EXHIBIT 99.1 (i)

EXHIBIT 99.1(i)

Amedisys, Inc.

(Nasdaq: AMED)

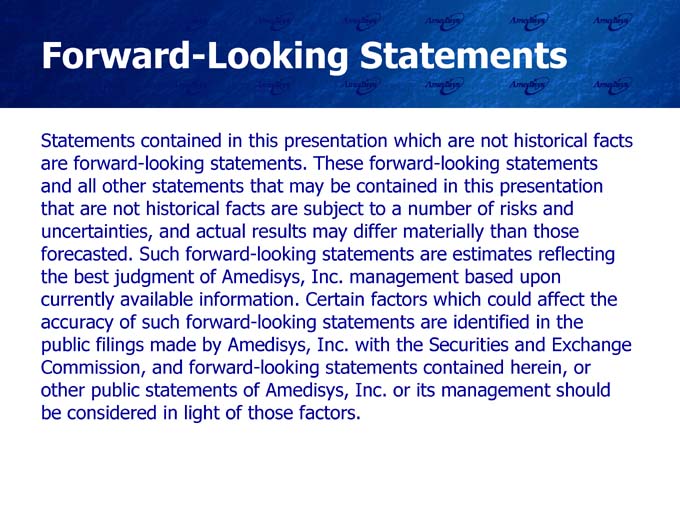

Forward-Looking Statements

Statements contained in this presentation which are not historical facts are forward-looking statements. These forward-looking statements and all other statements that may be contained in this presentation that are not historical facts are subject to a number of risks and uncertainties, and actual results may differ materially than those forecasted. Such forward-looking statements are estimates reflecting the best judgment of Amedisys, Inc. management based upon currently available information. Certain factors which could affect the accuracy of such forward-looking statements are identified in the public filings made by Amedisys, Inc. with the Securities and Exchange Commission, and forward-looking statements contained herein, or other public statements of Amedisys, Inc. or its management should be considered in light of those factors.

Investment Considerations

• Large and rapidly growing industry

• Focus on Medicare reimbursement

• Operating leverage

• Technology focus

• Regional growth strategy

• Successful acquisition record

Corporate Overview

Corporate Overview

• Amedisys is a leading provider of home health care nursing services

• Operates 90 home care locations in the southern and southeastern United States1

• Medicare accounts for 90% of revenue

1 As of May 2004

Corporate Overview

Our Purpose

To assist patients in maintaining and improving their quality of life

Our Strategy

To offer low-cost, outcome-driven health care at home

Our Mission

To provide cost-efficient, quality health care services to the patients entrusted to our care

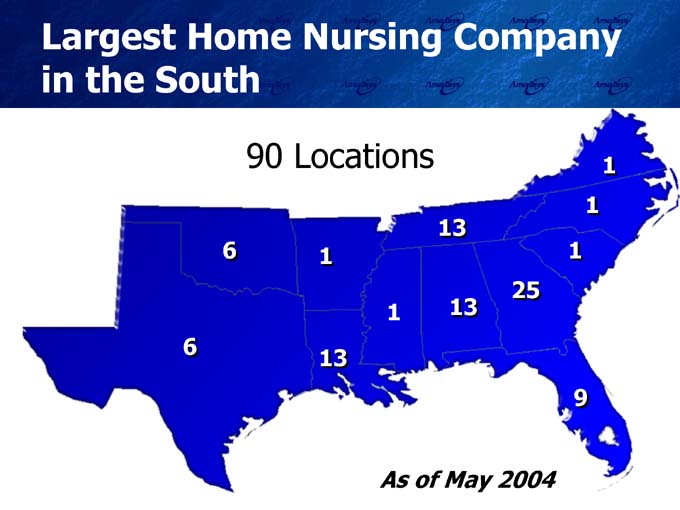

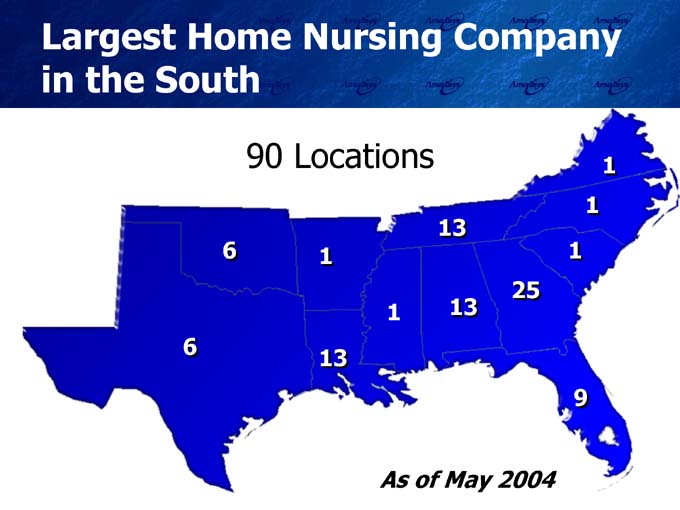

Largest Home Nursing Company in the South

90 Locations

As of May 2004

Leadership Team

Executive Team Board of Directors

William F. Borne William F. Borne, Chairman

Founder, Chief Executive Officer

Ronald A. LaBorde

Gregory H. Browne Jake L. Netterville

Chief Financial Officer

David R. Pitts

Larry R. Graham

Peter R. Ricchiuti

Chief Operating Officer

Market Opportunity

What is Home Health Care?

“Medical care delivered to a homebound patient by licensed professionals supervised by the patient’s physician.”

Home Care Nursing Services

Cardiac Orthopedics

Diabetes Wound Care

Psychiatric Cancer

Pain Management Post-Surgical

Hydration Antibiotic Therapy

Malnutrition Rehabilitation

Neurology Respiratory

Home Care Growth Drivers

• Trend from facility to non-facility based care

– Lower cost

– Consumer preference

– Technology

• Aging population

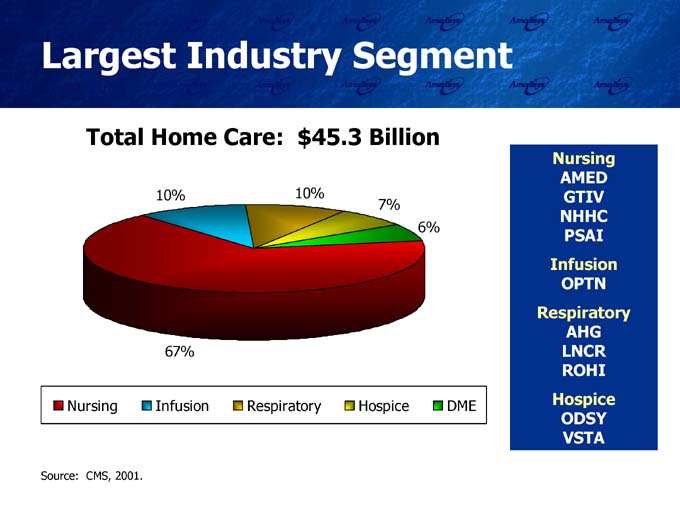

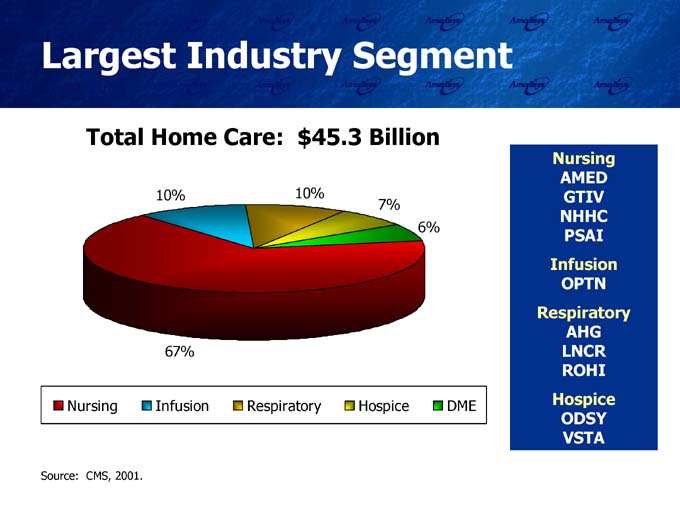

Largest Industry Segment

Total Home Care: $45.3 Billion

Nursing AMED

GTIV NHHC PSAI

Infusion OPTN

Respiratory AHG

LNCR ROHI Hospice ODSY

VSTA

Nursing Infusion Respiratory Hospice DME

Source: CMS, 2001.

Medicare Overview

Prospective Payment System (PPS)

• PPS is a capitated payment system

• PPS is based on per episode payments

• CMS expenditures were $11.4 billion in 2002

• CMS projects expenditures of $21.9 billion in 2012

• Requires careful episode management

Reimbursement Outlook

• Inflation adjustments

– 3.0% on October 1, 2003

– Estimated 2.0-3.0% on January 1, 2005

• Impact of Prescription-Drug Bill

– Effective April 1, 2004

– 5.0% increase for rural patients for 12 months

– 0.8% reduction in inflation adjustment for 33 months

Strategic Focus

Internal Growth

Strategic Approach

• Enhance physician relationships

• Develop strategic hospital partnerships

• Expand service area with start-ups

Increased admissions 10% Q4

External Growth

• Expand within geographic footprint

• Disciplined acquisitions

• Target hospital-based and multi-site agencies

– Compatible payor mix

– Underperforming agencies

– Reasonable pricing

• Target size: $2M—$20M in revenues

Successful Record of Acquisitions

1998 November Columbia HCA Southern States

2000 October Northwest Home Health Georgia

November Mid-Florida Home Health Florida

2001 April Seton Home Health Services Alabama

June HealthCalls South Carolina

2002 April Christus Spohn Home Health Texas

August Baylor All Saints Home Care Texas

2003 August Metro Home Health Louisiana

November St Luke’s Episcopal Texas

2004 Mar/May Tenet Home Health Southern States

Technology

Drives Integration

• Scanning technology for assessments

• Automatic scheduling

• Real time episode analysis

• Centralized review of quality indicators

• Web-based HR system

Financial Performance

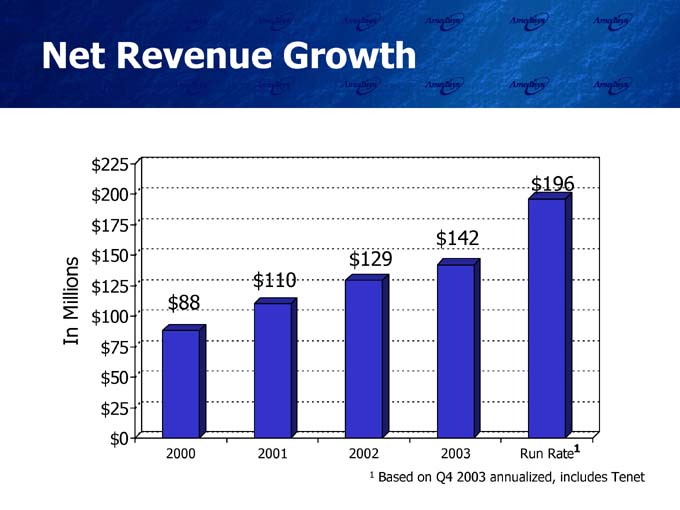

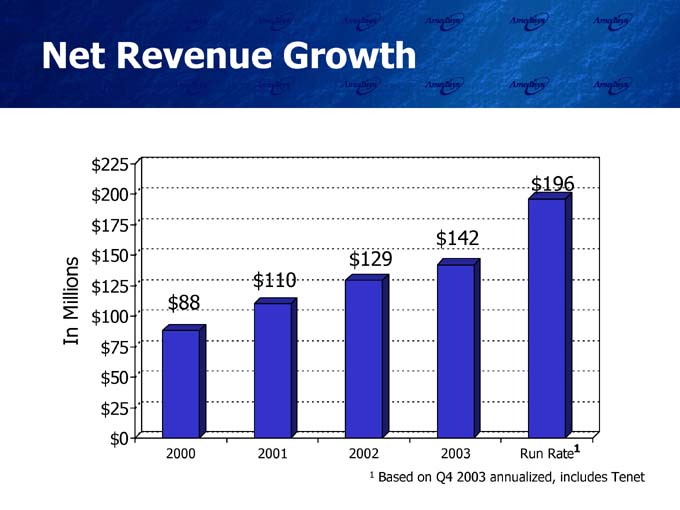

Net Revenue Growth

In Millions

$ 225

$ 196

$ 200

$ 175

$ 142

$ 150 $ 129

$ 125 $ 110

$ 88

$ 100

$ 75

$ 50

$ 25

$ 0

2000 2001 2002 2003 Run Rate1

1 Based on Q4 2003 annualized, includes Tenet

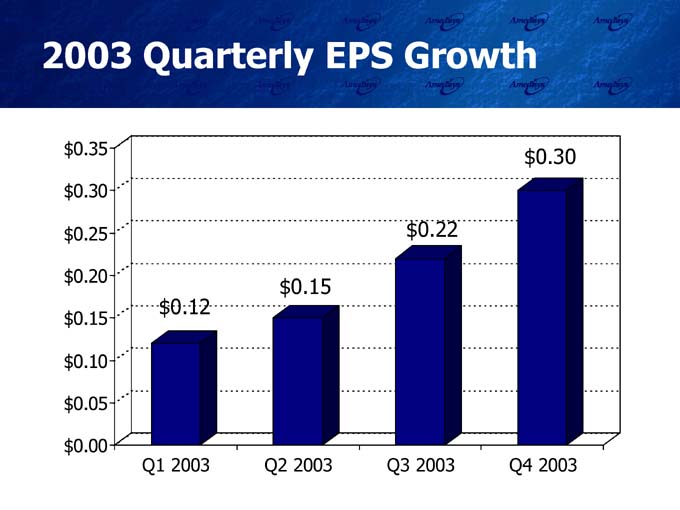

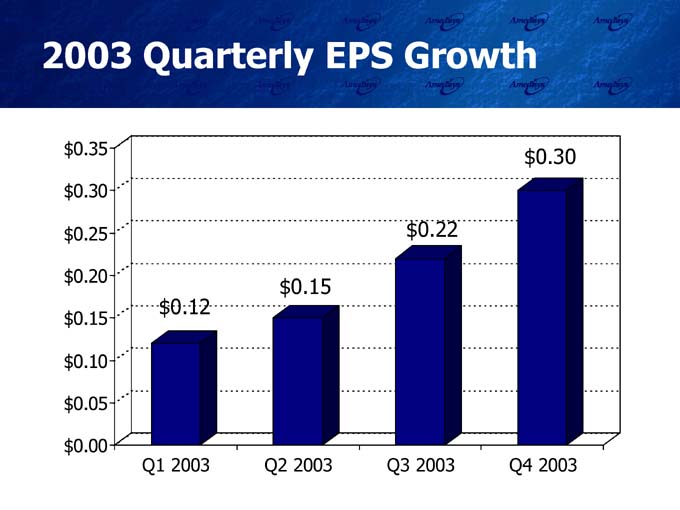

2003 Quarterly EPS Growth

$ 0.35 $ 0.30

$ 0.30

$ 0.25 $ 0.22

$ 0.20 $ 0.15

$ 0.12

$ 0.15

$ 0.10

$ 0.05

$ 0.00

Q1 2003 Q2 2003 Q3 2003 Q4 2003

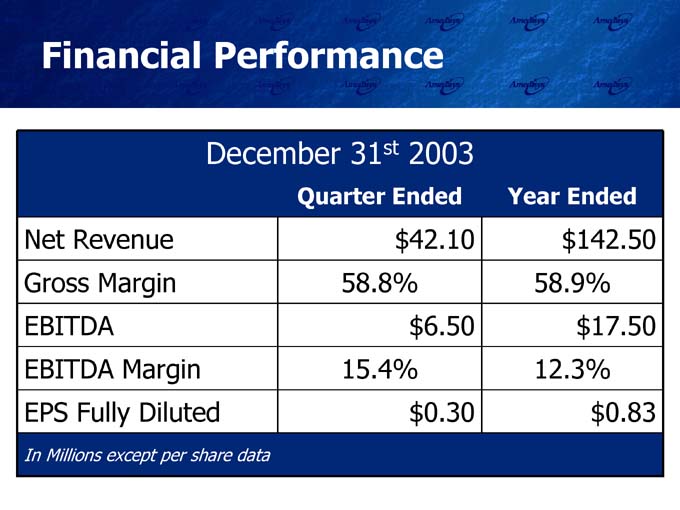

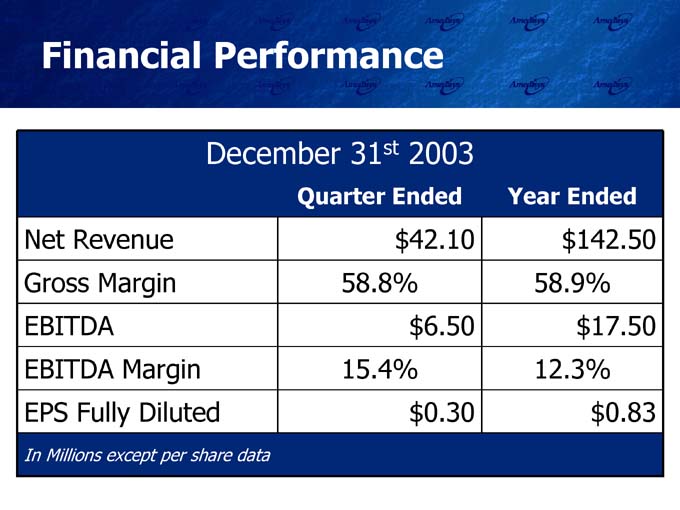

Financial Performance

December 31st 2003

Quarter Ended Year Ended

Net Revenue $ 42.10 $ 142.50

Gross Margin 58.8% 58.9%

EBITDA $ 6.50 $17.50

EBITDA Margin 15.4% 12.3%

EPS Fully Diluted $ 0.30 $0.83

In Millions except per share data

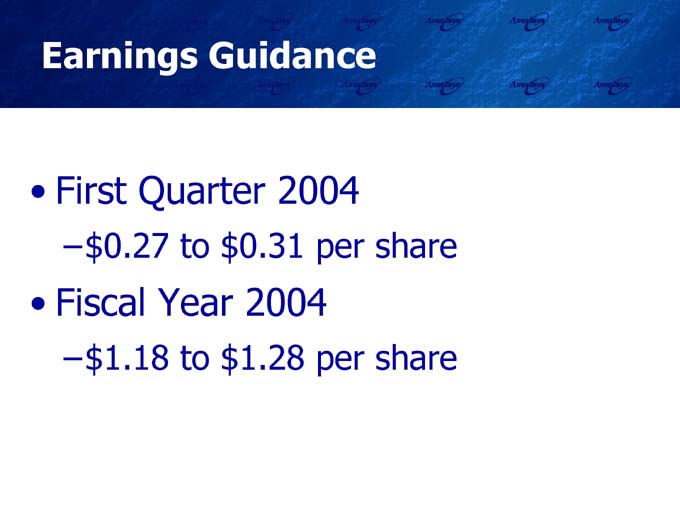

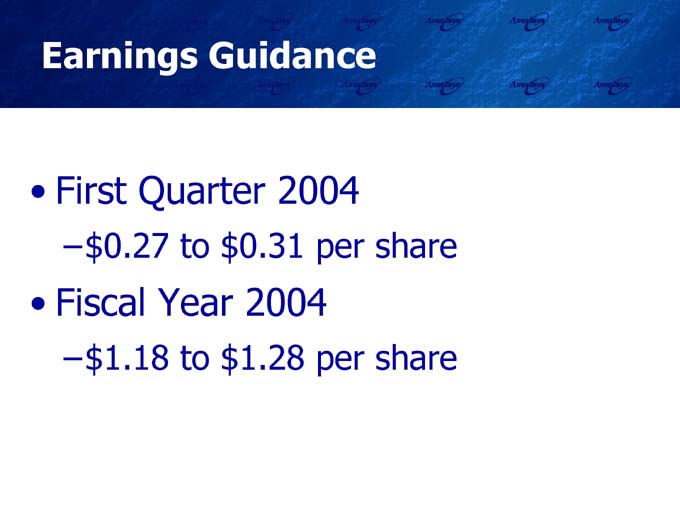

Earnings Guidance

• First Quarter 2004

–$ 0.27 to $0.31 per share

• Fiscal Year 2004

–$ 1.18 to $1.28 per share

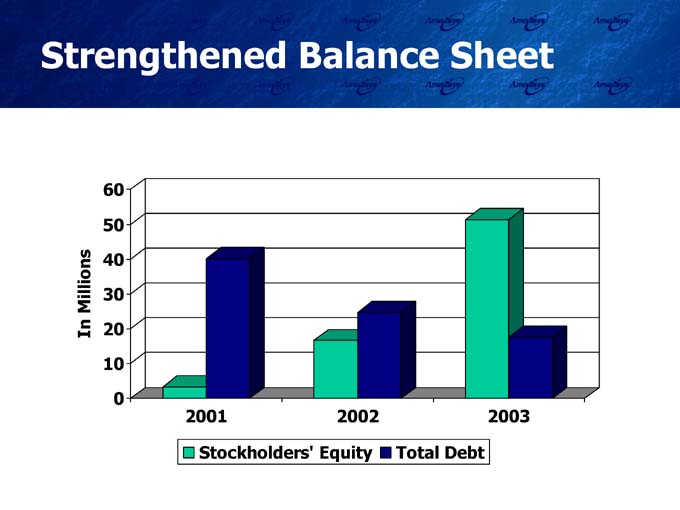

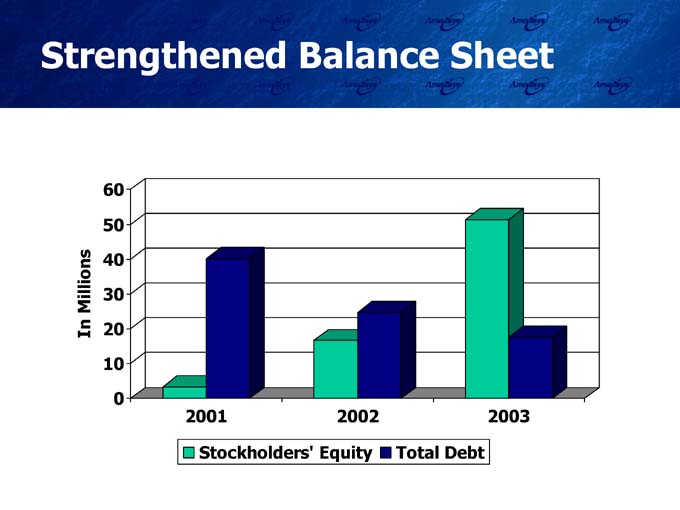

Strengthened Balance Sheet

In Millions

60

50

40

30

20

10

0

2001 2002 2003

Stockholders’ Equity Total Debt

Investment Considerations

Investment Considerations

• Large and rapidly growing industry

• Focus on Medicare reimbursement

• Operating leverage

• Technology focus

• Regional growth strategy

• Successful acquisition record

Amedisys, Inc.

(Nasdaq: AMED)