UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | | |

¨ | | Definitive Additional Materials | | | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | | | |

CYMER, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

x | | No fee required. |

¨ | | Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

CYMER, INC.

17075 THORNMINT COURT

SAN DIEGO, CALIFORNIA 92127

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 19, 2011

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Cymer, Inc., a Nevada corporation, which will be held on Thursday, May 19, 2011 at 10:00 a.m. local time at our offices at 17075 Thornmint Court, San Diego, California 92127 for the following purposes:

| | 1. | To elect Charles J. Abbe, Robert P. Akins, Edward H. Braun, Michael R. Gaulke, William G. Oldham, Eric M. Ruttenberg, Peter J. Simone, Young K. Sohn and Jon D. Tompkins as directors to serve until the 2012 Annual Meeting of Stockholders. |

| | 2. | To approve our 2011 Equity Incentive Plan. |

| | 3. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2011. |

| | 4. | To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in this Proxy Statement. |

| | 5. | To indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of our named executive officers. |

| | 6. | To conduct any other business properly brought before the meeting. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

We have elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. This method of access facilitates getting the necessary information to stockholders while reducing the costs associated with printing and mailing proxy materials as well as reducing the environmental impact associated with our Annual Meeting. On April 8, 2011, we mailed to our stockholders a Notice containing instructions on how to access our 2011 Proxy Statement and Annual Report and vote online. The Notice contains instructions on how you can (i) receive a paper copy of the Proxy Statement and Annual Report, if you only received a Notice by mail, or (ii) elect to receive your Proxy Statement and Annual Report over the Internet, if you received them by mail this year.

Only stockholders of record at the close of business on March 21, 2011 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

Whether or not you expect to attend the Annual Meeting in person, we urge you to vote your shares in order to ensure your representation at the meeting. Promptly vote your shares by telephone, via the Internet, or by signing, dating, and returning the proxy card. If you are receiving these proxy materials by mail, an addressed return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience if you wish to vote by mail. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

|

By Order of the Board of Directors |

|

Paul B. Bowman |

Secretary |

San Diego, California

April 8, 2011

PROXY STATEMENT

TABLE OF CONTENTS

CYMER, INC.

17075 THORNMINT COURT

SAN DIEGO, CALIFORNIA 92127

PROXY STATEMENT

FOR THE 2010 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 19, 2011

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these proxy materials?

We have made these proxy materials available to you on the Internet, or, upon your request, delivered printed versions of these materials to you by mail, in connection with our Board of Directors’ solicitation of your proxy vote for use at our Annual Meeting of Stockholders to be held on May 19, 2011. We request that you cast your vote on each of the proposals described in this Proxy Statement. You are invited to attend the Annual Meeting, but you do not need to attend the meeting in person to vote your shares.

If you have received a printed copy of these proxy materials by mail, you may simply complete, sign and return your proxy card or vote by proxy over the telephone or the Internet as instructed below. If you did not receive a printed copy of these materials by mail and are accessing them on the Internet, you may simply follow the instructions below to submit your proxy on the Internet.

We intend to mail a printed copy of this Proxy Statement and proxy card to our stockholders who have requested them on or about April 8, 2011. All other stockholders will receive a Notice of Internet Availability of Proxy Materials (the “Notice”), which we also intend to mail on or about April 8, 2011.

What items will be voted on at the Annual Meeting?

There are five matters scheduled for a vote:

| | • | | Election of Charles J. Abbe, Robert P. Akins, Edward H. Braun, Michael R. Gaulke, William G. Oldham, Eric M. Ruttenberg, Peter J. Simone, Young K. Sohn and Jon D. Tompkins as directors to serve until the 2012 Annual Meeting of Stockholders; |

| | • | | Approval of our 2011 Equity Incentive Plan; |

| | • | | Ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2011; |

| | • | | Advisory approval of the compensation of our named executive officers, as disclosed in this Proxy Statement in accordance with the rules adopted by the Securities and Exchange Commission (“SEC”); and |

| | • | | Advisory indication of the preferred frequency of stockholder advisory votes on the compensation of our named executive officers. |

Who can vote at the Annual Meeting?

If you owned our common stock at the close of business on March 21, 2011 (the “Record Date”), then you will be entitled to attend and vote at the Annual Meeting. On the Record Date, we had 30,472,312 shares of our common stock outstanding.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least 15,236,157 shares, a majority of the shares outstanding on the Record Date, are represented at the meeting in

1

person or by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we provide stockholders access to our proxy materials via the Internet. On or about April 8, 2011, we are sending a Notice to our stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice. Stockholders may request to receive a full set of printed proxy materials by mail. Instructions on how to access the proxy materials on the Internet or request a printed copy may be found in the Notice.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after April 18, 2011. To receive a full set of printed proxy materials by mail, you must request them in accordance with the instructions in the Notice.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “FOR” and (with respect to proposals other than the election of directors and the advisory indication of the frequency of stockholder advisory votes on the compensation of our named executive officers) “AGAINST” votes, abstentions and broker non-votes. Abstentions and broker non-votes will be counted in determining whether a quorum is present. However, an abstention or broker non-vote will not constitute a vote cast and, accordingly, will not be counted in the vote total for any proposal.

If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

| | • | | For the election of directors in Proposal 1, you may vote “FOR” all nine of the nominees named herein, or you may withhold your vote from any nominee that you specify or all nine nominees. The nine nominees receiving the most “FOR” votes among votes properly cast will be elected. Only the nine nominees named herein have been properly nominated for election as directors. |

| | • | | You may vote “FOR” or “AGAINST” Proposal 2, to approve our 2011 Equity Incentive Plan, or you may “ABSTAIN” from voting on this proposal. To be approved, the number of votes “FOR” the proposal must exceed the number of votes “AGAINST” the proposal. |

| | • | | You may vote “FOR” or “AGAINST” Proposal 3, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2011, or you may “ABSTAIN” from voting on this proposal. To be approved, the number of votes “FOR” the proposal must exceed the number of votes “AGAINST” the proposal. |

2

| | • | | You may vote “FOR” or “AGAINST” Proposal 4, the advisory approval of the compensation of our named executive officers, or you may “ABSTAIN” from voting on this proposal. To be approved, the number of votes “FOR” the proposal must exceed the number of votes “AGAINST” the proposal. |

| | • | | With respect to Proposal 5, the advisory indication of the preferred frequency of stockholder advisory votes on the compensation of our named executive officers, you may vote “1 Year”, “2 Years”, “3 Years” or “ABSTAIN”. The frequency of voting receiving the most votes will be considered the frequency preferred by the stockholders. |

Broker non-votes and abstentions will not be counted towards the vote total for any proposal.

How many votes do I have?

On each proposal to be voted upon, you have one vote for each share of our common stock that you owned on the Record Date. In the election of directors, you may cast that vote “FOR” all of the nine nominees named herein, or you may withhold your vote from any nominee or all of the nominees.

What is the difference between holding shares as a stockholder of record and as a beneficial owner of shares held in street name?

Stockholder of Record: If, on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record with respect to those shares.

Beneficial Owner of Shares Held in Street Name: If, on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct the stockholder of record on how to vote the shares held in your account. You are also invited to attend the Annual Meeting.

If I am a stockholder of record of Cymer shares, how do I vote?

If you are the stockholder of record, you may vote in person at the Annual Meeting or by proxy.

| | • | | To vote in person, come to the Annual Meeting, and we will give you a ballot when you arrive. |

| | • | | If you do not wish to vote in person or if you will not be attending the Annual Meeting, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice, or if you request a full set of printed copies of the proxy materials by mail, you may also vote by mail or by telephone. |

We provide Internet proxy voting to allow you to vote your shares on-line, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

If I am a beneficial owner of Cymer shares held in street name, how do I vote?

If you are a beneficial owner of shares registered in the name of your broker, bank, dealer or other similar organization, and you wish to vote in person at the Annual Meeting, you must obtain a valid proxy from the organization that holds your shares. If you do not wish to vote in person or you will not be attending the Annual Meeting, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Please follow the voting instructions provided by your broker, dealer or other similar organization to ensure that your vote is counted.

3

What happens if I do not make specific voting choices?

Stockholder of Record: If you are a stockholder of record and you:

| | • | | indicate when voting on the Internet or by telephone that you wish to vote as recommended by our Board of Directors; or |

| | • | | sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by our Board of Directors on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the meeting.

Beneficial Owner of Shares Held in Street Name: If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform our inspector of elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” When our inspector of elections tabulates the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the Notice.

Can I change my vote after I have voted?

Yes. You may revoke your proxy and change your vote at any time before the final vote at the meeting.

Stockholder of Record: If you are a stockholder of record, you may revoke your proxy in any one of the following ways:

| | • | | You may send a written notice that you are revoking your proxy to the Corporate Secretary of Cymer, Inc., 17075 Thornmint Court, San Diego, California 92127. |

| | • | | You may send a subsequent properly completed proxy card in accordance with the instructions in this Proxy Statement. |

| | • | | You may grant a subsequent proxy by telephone or through the Internet. |

| | • | | You may attend the Annual Meeting, revoke the proxy in writing and vote in person.Your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the meeting or specifically request in writing that your prior proxy be revoked. |

The most current proxy card or telephone or Internet proxy our inspector of elections receives is the one that is counted.

Beneficial Owner of Shares Held in Street Name: If you are a beneficial owner of shares held in street name, you will need to follow the instructions included on the proxy form provided to you by your broker regarding how to change your vote.

How can I find out the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by the inspector of elections after the Annual Meeting and will be reported on Form 8-K, which will be filed with the SEC within four business days after the Annual Meeting.

4

What is the deadline to propose actions for consideration at the 2012 annual meeting of stockholders?

For a stockholder proposal to be considered for inclusion in our Proxy Statement for our 2012 annual meeting of stockholders, your proposal must be received in writing by the Corporate Secretary of Cymer, Inc., 17075 Thornmint Court, San Diego, California 92127, no later than December 10, 2011. Stockholders wishing to submit proposals or director nominations that are not to be included in our proxy materials for that annual meeting of stockholders must do so no earlier than January 20, 2012 and no later than February 19, 2012.

You are advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. Our Bylaws are available on our website athttp://www.cymer.com under Investor Relations—Corporate Governance.

How can I communicate with Cymer’s Board of Directors?

Our Board of Directors has adopted a process for stockholder communication with the board. Stockholders wishing to communicate with the board may send a written communication addressed to the Corporate Secretary of Cymer, Inc. at 17075 Thornmint Court, San Diego California 92127 or by e-mail to the following address:board@cymer.com. The Corporate Secretary will screen all communications for spam, junk mail, mass mailings, product complaints, product inquiries, new product suggestions, resumes, job inquiries, surveys, business solicitations and advertisements, as well as unduly hostile, threatening, illegal, unsuitable, frivolous, patently offensive or otherwise inappropriate material before forwarding to the Board. The process regarding stockholder communications with the board is posted on our website athttp://www.cymer.com under Investor Relations—Contact Board.

Who is paying for this proxy solicitation?

We will pay for the entire cost of the solicitation of proxies. We have retained the services of Morrow & Co., LLC to aid in the solicitation of proxies from brokers, bank nominees and other institutions for a fee of $7,750, plus its reasonable out-of-pocket expenses. We will also reimburse brokers, banks, dealers and other similar organizations representing beneficial owners of shares held in street name for the cost of forwarding the Notice and printed proxy materials by mail to beneficial owners who specifically request them, and obtaining beneficial owners’ voting instructions. In addition to soliciting proxies by mail, our directors, officers and employees may solicit proxies on our behalf, in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies.

PROPOSAL 1

ELECTION OF DIRECTORS

Current Nominees

Listed below are our nine directors, each of whom is nominated for re-election at the Annual Meeting of stockholders. Each director to be elected at the Annual Meeting will serve a one-year term expiring at the next Annual Meeting of stockholders or until his respective successor is elected and qualified or, if sooner, until his death, resignation or removal. Each of the nominees listed below currently serves as one of our directors. All of the nominees were previously elected by our stockholders. Directors are elected by a plurality of the votes properly cast in person or by proxy. All of the nominees for election as a director at the 2010 Annual Meeting of Stockholders attended the 2010 Annual Meeting of Stockholders.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nine nominees named in this Proxy Statement. If any nominee becomes unavailable for election as a result of an unexpected occurrence, his shares will be voted for the election of a substitute nominee proposed by our Board of Directors. Each person nominated for election has agreed to be named in this Proxy Statement and to serve if elected. We have no reason to believe that any nominee will be unable to serve.

5

The following table lists the director nominees for election at the Annual Meeting and is followed by a brief biography of each of the nominees and a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the nominating and corporate governance committee to recommend that person as a nominee for director, as of the date of this Proxy Statement:

| | | | | | | | | | |

Name | | Age | | | Positions with the Company | | Director Since | |

Charles J. Abbe | | | 69 | | | Director | | | 2003 | |

Robert P. Akins | | | 59 | | | Chairman and Chief Executive Officer | | | 1986 | |

Edward H. Braun | | | 71 | | | Director | | | 2003 | |

Michael R. Gaulke | | | 65 | | | Director | | | 2000 | |

William G. Oldham | | | 72 | | | Director | | | 2001 | |

Eric M. Ruttenberg | | | 55 | | | Director | | | 2009 | |

Peter J. Simone | | | 63 | | | Director | | | 1993 | |

Young K. Sohn | | | 55 | | | Director | | | 2003 | |

Jon D. Tompkins | | | 70 | | | Director | | | 1999 | |

Charles J. Abbe has served as a director of Cymer since January 2003. Mr. Abbe served as president and chief operating officer and as director of JDS Uniphase Corporation from February 2000 until his retirement in June 2001. He was employed previously as president, chief executive officer and director at Optical Coating Laboratory, Inc. from 1996 until the company merged with JDS Uniphase in February 2000. From 1990 to 1996, he served in several positions of increasing responsibility, including senior vice president, electronics sector, at Raychem Corporation. Mr. Abbe practiced business consulting with McKinsey & Company from 1971 to 1989. Mr. Abbe also currently serves as director of Opnext, Inc., and CoSine Communications, Inc., both publicly held companies, and as director of several privately financed technology companies. Mr. Abbe received a B.S. and M.S. in chemical engineering from Cornell University and a M.B.A. from Stanford University.

The nominating and corporate governance committee believes that Mr. Abbe’s prior history in financial and senior executive positions, along with his current role as a director for several technology companies, including two other public companies, provides him with operational and industry expertise, as well as leadership skills, that are valuable to his role as a director of Cymer and its audit committee chairman.

Robert P. Akins is one of Cymer’s co-founders, has served as its chairman and chief executive officer since Cymer’s inception in 1986, and served as president of Cymer from its inception until May 2000. Mr. Akins currently serves on the boards of directors of KLA-Tencor Corporation, and Semiconductor Equipment and Materials International (“SEMI”) North America, and is chairman of the board of SEMI. He is also a member of the council of advisors to the Irwin and Joan Jacobs School of Engineering at the University of California, San Diego (“UCSD”), and has served on the board of the UC San Diego Foundation. Mr. Akins received the Ernst & Young Entrepreneur of the Year Award for San Diego County in 1997, and with fellow Cymer co-founder Rick Sandstrom, received the outstanding alumnus award from UCSD, and the prestigious SEMI Award for North America, the highest honor conferred by SEMI, in 1996 for contributions to the field of deep ultraviolet (“DUV”) lithography. Mr. Akins received a B.S. in physics, a B.A. in literature, and a Ph.D. in applied physics from UCSD.

The nominating and corporate governance committee believes that Mr. Akins’ scientific and industry background and extensive history with the Company brings valuable historic knowledge and continuity to the Board of Directors, along with a thorough understanding of our operations, investors, customers and technology.

Edward H. Braun has served as a director of Cymer since March 2003. Mr. Braun has been chairman of the board of Veeco Instruments, Inc since January 1990. In addition, he was Veeco’s chief executive officer from January 1990 to July 2007. Mr. Braun is a director emeritus of the board of directors of SEMI, of which he was chairman of the board in 1993. Mr. Braun also serves as a director of Axcelis Technologies and QD Vision, Inc. Mr. Braun received a BSME from Clarkson College of Technology.

6

The nominating and corporate governance committee believes that Mr. Braun’s extensive experience managing Veeco, a provider of metrology and process equipment solutions for the semiconductor, magnetic memory media, and flat panel display industries, provide him with broad industry, operational, and manufacturing expertise, and general leadership skills, which are important to the Board of Directors.

Michael R. Gaulke has served as a director of Cymer since August 2000. Mr. Gaulke has served on the board of directors of Exponent, Inc., a nationally recognized engineering and scientific consulting firm that performs in-depth investigations in more than 90 technical disciplines to analyze failures and accidents to determine their causes, since 1994. Mr. Gaulke served as Exponent’s executive chairman from May 2009 to June 2010 and as its chief executive officer from June 1996 to May 2009. Mr. Gaulke first joined Exponent in September 1992, as executive vice president and chief financial officer. In March 1993, he was named Exponent’s president and was appointed as a member of its board of directors in January 1994. Prior to 1992, Mr. Gaulke served as executive vice president and chief financial officer of Raynet Corporation, which pioneered a fiber-to-the-curb architecture for telecommunications. Before that, he served as executive vice president and chief financial officer of Spectra-Physics, a leading manufacturer of a broad range of lasers and laser-related products. Mr. Gaulke served as a director of LECG Corporation from June 2003 to 2007. Mr. Gaulke serves on the board of Sutter Health and is also a member of the board of trustees of the Palo Alto Medical Foundation. Mr. Gaulke received a B.S. in electrical engineering from Oregon State University and a M.B.A. from Stanford University.

The nominating and corporate governance committee believes that, as a result of his extensive experience in financial and executive leadership positions, Mr. Gaulke brings to the Board of Directors and its audit committee valuable insights into the financial and operational requirements of a large company. The committee also believes that Mr. Gaulke’s lengthy tenure at Exponent provides him with a unique perspective into understanding and managing risk.

William G. Oldham, Ph.D. has served as a director of Cymer since January 2001. He is the Robert S. Pepper Professor of Electrical Engineering and Computer Science, emeritus, at the University of California, Berkeley, where he has been on the faculty since 1964. Dr. Oldham’s research interest is in semiconductor materials and process technology, including optical and extreme ultraviolet lithography. He has published more than 200 articles and holds 13 patents. He also served as an outside consultant on our scientific advisory board from its inception in 1999 until August 2002. He also served as program manager for dynamic RAM technology development and circuit design at Intel Corporation from 1974 to 1976. In 2003, he was awarded the Semiconductor Industry Association’s University Research Award for his career contributions to the semiconductor industry, and he is a member of the National Academy of Engineering. He also serves on the board of directors of Nanometrics Inc. He received B.S., M.S. and Ph.D. degrees from the Carnegie Institute of Technology.

The nominating and corporate governance committee believes that Dr. Oldham brings an invaluable, deep understanding of the technology, science and engineering of the semiconductor industry to our Board of Directors, including current state of the art developments in extreme ultraviolet lithography.

Eric M. Ruttenberghas served as director of Cymer since October 1, 2009. Mr. Ruttenberg serves as Co-Managing Member of the General Partner of Tinicum Capital Partners II, L.P., a New York based investment firm since 1998. Mr. Ruttenberg also currently serves as a director of several of Tinicum’s privately held portfolio companies. Mr. Ruttenberg has previously served on the boards of SPS Technologies and Kollmorgen Corporation. Mr. Ruttenberg received a B.A. from Hampshire College, where he concentrated in mathematics and business.

The nominating and corporate governance committee believes that, as a result of his extensive experience as an investor in a broad array of private and public companies, Mr. Ruttenberg provides our Board of Directors with valuable perspective as an individual and institutional stockholder, along with the benefit of his experience with manufacturing companies and financial markets.

7

Peter J. Simone has served as a director of Cymer since July 1993. Mr. Simone is an independent consultant to the investment community and serves on the boards of directors of Inphi Corporation, Newport Corporation, Monotype Imaging, Inc. and Veeco Instruments, Inc., as well as several private companies. Mr. Simone was executive chairman of SpeedFam-IPEC, Inc., a semiconductor equipment company, from June 2001 to December 2002, when it was acquired by Novellus Systems, Inc. Mr. Simone served as a director of Sanmina-SCI Corp from 2003 to 2008. Mr. Simone’s previous experience includes 17 years with GCA Corporation, a manufacturer of semiconductor photolithography capital equipment, holding various management positions, including president and director. Mr. Simone received a B.S. in accounting from Bentley University and a M.B.A. from Babson College.

The nominating and corporate governance committee believes that Mr. Simone’s lithography background and long tenure as a director of Cymer brings necessary historic knowledge and continuity to the Board of Directors. The committee also believes that Mr. Simone’s extensive financial and management experience, along with his current role as a director for several technology companies, provides him with operational, manufacturing and inventory management expertise that are valuable to our audit committee and our Board of Directors.

Young K. Sohn has served as a director of Cymer since March 2003. Mr. Sohn currently serves as president, chief executive officer and director of Inphi Corporation, a semiconductor company. From May 2005 through December 2007, Sohn was an independent consultant to the high technology industry. He served as president of the Semiconductor Products Group (SPG) at Agilent Technologies Inc. from October 2003 through April 2005. Prior to joining Agilent, he served as president and chief executive officer and chairman of the board of directors of Oak Technology, Inc. which was acquired by Zoran Corporation in August 2003. Prior to joining Oak Technology, Inc. in 1999, Mr. Sohn was employed by Quantum Corporation for six years, serving most recently as president of its Hard Drive Business. From August 1983 to January 1993, he was director of marketing at Intel Corporation. Mr. Sohn also serves on the board of directors of Arm Holdings, PLC. He received a B.S. in electrical engineering from the University of Pennsylvania and a M.S. and M.B.A. from the Massachusetts Institute of Technology’s Sloan School of Management.

The nominating and corporate governance committee believes that Mr. Sohn’s extensive experience in the semiconductor industry provides our Board of Directors with valuable insight into the business of our chipmaker customers. The committee also believes that Mr. Sohn’s extensive involvement with overseas operations bring valuable international insights to the Board of Directors, particularly with respect to our business and relationships in Japan, Korea, Singapore, China and Taiwan.

Jon D. Tompkins has served as a director of Cymer since May 1999. Mr. Tompkins served as chief executive officer of KLA-Tencor Corporation from April 1997 until June 1998 and served as chairman of the board of KLA-Tencor from July 1998 until his retirement in 1999. He served as president and chief executive officer of Tencor Instruments from April 1991 until its merger with KLA Instruments in April 1997 and chairman of the board from November 1993 until the merger. He has also previously served as president and chief executive officer of Spectra-Physics. Mr. Tompkins served as director of Credence Systems Corporation from September 1999 to April 2008 and also served as its lead independent director. Since April 2003, Mr. Tompkins has served as chairman of the board of Electro Scientific Industries. Mr. Tompkins received a B.S. in electrical engineering from the University of Washington and a M.B.A. from Stanford University with an emphasis in finance and accounting.

The nominating and corporate governance committee believes that Mr. Tompkins’ significant experience in executive leadership roles at Tencor and KLA-Tencor, suppliers of metrology and yield management solutions for the semiconductor industry, provides our Board of Directors with unique insights into the businesses of our lithography equipment manufacturing customers, as well as our chipmaker customers.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR EACH NAMED NOMINEE

FOR ELECTION TO THE BOARD OF DIRECTORS

8

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

During 2010, our Board of Directors held six meetings. Each director attended 75% or more of the aggregate number of the meetings of the board and the committees on which he served, held during the portion of the last fiscal year for which he was a director or committee member, respectively.

The following table lists the chairman and members of each committee and the number of meetings held by each committee during 2010:

| | | | | | | | |

Name | | Audit | | Compensation | | Nominating and

Corporate

Governance | | Scientific

Advisory |

Charles J. Abbe | | Chairman | | — | | — | | — |

Edward H. Braun | | — | | Chairman | | — | | — |

Michael R. Gaulke | | Member | | — | | Member | | — |

William G. Oldham | | — | | Member | | — | | Chairman |

Eric M. Ruttenberg | | — | | Member | | — | | — |

Peter J. Simone | | Member | | — | | Member | | — |

Young K. Sohn | | — | | — | | Member(1) | | — |

Jon D. Tompkins | | — | | Member | | Chairman | | — |

| | | | | | | | |

Total meetings in 2010 | | 12 | | 7 | | 4 | | 3 |

| | | | | | | | |

| (1) | Mr. Sohn served on the compensation committee until May 2010. He was appointed to the nominating and corporate governance committee in May 2010. |

Independence of the Board of Directors

As required under the NASDAQ Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. Our Board of Directors consults with our legal counsel to ensure that the Board of Directors’ determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent Nasdaq listing standards, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his family members, and Cymer, our senior management and our independent registered public accounting firm, our Board of Directors affirmatively has determined that all of our directors are independent directors within the meaning of the applicable Nasdaq listing standards, except for Mr. Akins, our chief executive officer and chairman of the Board of Directors. As required under Nasdaq listing standards, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present and the executive session chairman presides.

Board Leadership Structure and Risk Oversight

Since Cymer’s inception in 1986, Mr. Akins has served as our chief executive officer and chairman of the board. Our Board of Directors is comprised of Mr. Akins and eight independent directors. The Board of Directors established the position of executive session chairman in 2004. Our Board of Director policy requires that independent directors who have served on our board for at least one year, other than those who are active chief executive officers or the chairman of the audit committee, serve as chair of the executive sessions at our board meetings for a two year term on a rotating basis.

The executive session chairman:

| | • | | reviews and approves the meeting agenda for our Board of Directors; |

| | • | | sets the agenda for the executive session after consultation with the other independent directors; |

9

| | • | | presides during the executive session; |

| | • | | conveys any messages from the executive session to the chief executive officer; |

| | ��� | | is available to discuss with the other directors any concerns they may have about Cymer and its performance and to relay those concerns, where appropriate, to the full Board of Directors; |

| | • | | is available to consult with the chief executive officer regarding the concerns of the directors; and |

| | • | | is available to be consulted by any of our senior executives as to any concerns the executive might have. |

During 2009 and 2010 Mr. Braun served as executive session chairman. Mr. Gaulke has been appointed by the Board of Directors to serve as executive session chairman for 2011 and 2012.

The Board of Directors has four standing committees: the audit committee, the compensation committee, the nominating and corporate governance committee and the scientific advisory committee. Each of the committees is comprised of independent directors, with each of the four committees having a separate chair. Our audit committee is responsible for overseeing and monitoring financial risk and our nominating and corporate governance committee is responsible for the oversight of enterprise risk management.

Mr. Akins is seen by our customers and investors as providing strong leadership for the company and the semiconductor industry. In light of the considerations discussed above, we believe that having Mr. Akins as our chief executive officer and chairman of the Board of Directors, combined with independent chairs for each of our board committees and an independent executive session chair, has been effective and provides the right form of leadership for us.

Audit Committee

The audit committee of the Board of Directors oversees our corporate accounting and financial reporting process. For this purpose, the audit committee performs the following functions, among other things:

| | • | | appoints our independent registered public accounting firm and determines the funding for audit and review by them of our consolidated financial statements and internal controls over financial reporting; |

| | • | | evaluates and oversees our independent registered public accounting firm’s independence and performance; |

| | • | | determines in advance whether to engage our independent registered public accounting firm to provide any non-audit services and pre-approves these engagements; |

| | • | | oversees and monitors our management and independent registered public accounting firm and their activities with respect to our financial reporting and compliance with our disclosure policies; |

| | • | | discusses and reviews our financial statements, the results of our annual integrated audit and all press releases containing financial information with management and our independent registered public accounting firm; |

| | • | | approves the disclosures in and filing of our periodic reports on Form 10-K and Form 10-Q to be filed with the SEC; |

| | • | | establishes procedures to receive and address complaints regarding accounting and auditing matters; |

| | • | | reviews and approves the internal audit function; |

| | • | | considers periodically whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; |

| | • | | reviews with our management and independent registered public accounting firm the effectiveness of internal controls over financial reporting; and |

10

| | • | | performs such other duties of an audit committee specified in the Sarbanes-Oxley Act of 2002 and rules and regulations implemented by the SEC and Nasdaq. |

During 2010, the audit committee was comprised of three independent directors, Messrs. Abbe, Gaulke and Simone. Our audit committee charter is available on our website athttp://www.cymer.com under Investor Relations—Corporate Governance.

The Board of Directors annually reviews the Nasdaq listing standards definition of independence for audit committee members and has determined that all members of the audit committee are independent (as currently defined in the Nasdaq listing standards and SEC rules). The Board of Directors has also determined that Messrs. Abbe, Gaulke and Simone qualify as “audit committee financial experts,” as defined in the applicable SEC rules.

Compensation Committee

The compensation committee acts on behalf of the Board of Directors to oversee and determine executive compensation. The compensation committee, among other things:

| | • | | reviews, evaluates and approves our compensation policy for executive officers; |

| | • | | approves all forms of compensation to be provided to our executive officers; |

| | • | | reviews, modifies and approves our overall compensation strategy, philosophy and programs; |

| | • | | establishes policies with respect to equity compensation arrangements and evaluates the efficacy of our compensation policies and programs; |

| | • | | acts as administrator of our equity incentive and employee stock purchase plans; and |

| | • | | performs such other functions regarding compensation as the board may delegate. |

The compensation committee also reviews with management the information set forth in the “Executive Compensation—Compensation Discussion and Analysis” and considers whether to recommend that it be included in Proxy Statements and other filings.

During 2010, the compensation committee was comprised of five independent directors. Messrs. Braun, Tompkins, Ruttenberg and Dr. Oldham served on the compensation committee for the entire year, and Mr. Sohn served until May 2010. Our compensation committee charter is available on our website athttp://www.cymer.com under Investor Relations—Corporate Governance.

For specific details about the determination of executive compensation for 2010, see the section titled “Executive Compensation—Compensation Discussion and Analysis.”

Nominating and Corporate Governance Committee

During 2010, the nominating and corporate governance committee was comprised of four independent directors. Messrs. Gaulke, Simone and Tompkins served on the nominating and corporate governance committee for the entire year and Mr. Sohn served since his appointment in May 2010. The nominating and corporate governance committee, among other things:

| | • | | acts on behalf of the board identifying individuals qualified to become directors and recommending that the board select the candidates for all directorships to be filled by the board or by the stockholders; |

| | • | | oversees the composition, structure and evaluation of the board and each of its committees; |

11

| | • | | oversees board compensation; and |

| | • | | develops and recommends to the board for its approval a set of corporate governance principles applicable to us. |

Our corporate governance principles and our nominating and corporate governance committee charter are available on our website athttp://www.cymer.com under Investor Relations—Corporate Governance.

The nominating and corporate governance committee is responsible for reviewing from time to time the specific experience, qualifications, attributes and skills necessary and appropriate for our directors in the context of the board’s composition. These include such factors as business experience, international background, and knowledge of technology, manufacturing, operations, finance and/or marketing, and other skills that would enhance the board’s effectiveness.

The nominating and corporate governance committee believes that directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our stockholders. The nominating and corporate governance committee evaluates candidates based on qualities such as inquisitiveness, objectivity and possession of practical wisdom and mature judgment. The nominating and corporate governance committee believes the board should represent diverse experience at policy-making levels in business, education and technology, and in areas that are relevant to our global activities.

Our directors who also serve as chief executive officers, or in equivalent positions, at other companies may serve on the boards of no more than three public companies, including Cymer’s. Directors who are not chief executive officers, or in equivalent positions, may serve on the boards of no more than four public companies, including Cymer’s. The Board of Directors may approve requests for waivers of this policy with the approval of at least two- thirds of the directors (other than the director requesting the waiver); provided that each such waiver shall be subject to annual review and re-approval by at least two-thirds of the directors then in office (other than the director requesting the waiver). In November 2010, the Board of Directors approved a waiver with respect to Mr. Simone for his service on the boards of directors of five public companies.

In order to further align the economic interests of directors with those of stockholders, the Board of Directors has adopted a policy requiring that within one year after the date on which an individual becomes a director, each director shall be required to hold not less than 2,500 shares of our common stock.

Because of the significant time investment and energy required to become familiar with the intricacies of the semiconductor capital equipment industry, the Board of Directors does not believe that arbitrary term limits on directors’ service are appropriate, nor does it believe that directors should expect to be re-nominated annually. Additionally, the Board of Directors has determined that there should be no arbitrary age limit or mandatory retirement age for board members. Each board committee’s performance review and assessment, and the nominating and corporate governance committee’s review and assessment of the Board of Directors’ performance will help determine each director’s tenure.

The nominating and corporate governance committee will consider director candidates recommended by stockholders. The committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder or not. Stockholders who wish to recommend individuals for consideration by the nominating and corporate governance committee to become nominees for election to the Board of Directors may do so by delivering a written recommendation to the nominating and corporate governance committee at the following address: Cymer, Inc., 17075 Thornmint Court, San Diego, California 92127 at least 120 days prior to the anniversary date of the mailing of our proxy statement for the last annual meeting of stockholders. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as

12

a director and a representation that the nominating stockholder is a beneficial or record owner of our stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Our Bylaws authorize nine members for the Board of Directors and authorize the Board of Directors to change the number of directors from time to time. Between annual meetings of stockholders, the Board of Directors may elect directors to serve until the next annual meeting. The Board of Directors believes the current size of the board is appropriate and adequate to properly oversee our business, but will reassess as our size as circumstances require.

Scientific Advisory Committee

The scientific advisory committee was formed in August 2002, and charged with interacting with and attending meetings of our scientific advisory board. The scientific advisory committee currently consists solely of Dr. Oldham. The scientific advisory board met three times during 2010 and Dr. Oldham was in attendance at all scientific advisory board meetings.

COMPENSATION OF DIRECTORS

Each of our non-employee directors received an annual retainer of $25,000 prior to April 2010, payable quarterly, a fee of $2,500 for each board meeting attended and $1,000 for each committee meeting attended, with the exception of the chairman. In February 2010, our Board of Directors approved an increase in the annual retainer to $30,000, payable quarterly, and beginning in April 2010. The chairman of the audit committee receives $3,000 for each meeting attended and the chairman of the compensation committee, the nominating and corporate governance committee, and the scientific advisory committee each receive $2,000 for each meeting attended. The executive session chairman receives an annual retainer of $10,000, payable quarterly. In addition, all members of the audit committee, including the chairman, receive a separate quarterly fee of $1,000 for their service on the audit committee. Total cash compensation paid to outside directors in 2010 was $422,500. No fees are paid for telephonic meetings scheduled to last less than one hour. The members of the Board of Directors are also eligible for reimbursement for their expenses incurred to attend board meetings, in accordance with our policy.

Newly elected non-employee directors are granted an initial restricted stock unit (“RSU”) award for the number of shares determined by dividing $200,000 by the closing sales price per share of our common stock as reported on the Nasdaq Global Select Market as of the date of the first regular quarterly meeting of the compensation committee following the non-employee directors’ initial election. Each RSU award shall vest 25% on each of the next four anniversaries of the date the non-employee director is first elected to the Board of Directors. On the first trading day of each fiscal year each non-employee director then in office who has served for at least one year will be granted an RSU award pursuant to the Amended and Restated 2005 Equity Incentive Plan. If our stockholders approve Proposal 2, the award will instead be granted under the 2011 Equity Incentive Plan. This discussion refers to whichever of the two equity incentive plans is in force as the “Incentive Plan”. The number of shares issued under the RSU award shall be determined by dividing $100,000 by the closing sales price per share of our common stock as reported on the Nasdaq Global Select Market as of the date of grant. Each RSU award vests 100% one year from the date of grant.

The vesting of “stock awards” (which include RSU awards and other equity incentives that may be granted under the Incentive Plan) may be accelerated in full in the event of a Corporate Transaction. The term “Corporate Transaction” is defined in the Incentive Plan and includes transactions such as a sale of all of our assets, a sale of at least 90% of our outstanding stock or a merger, consolidation or similar transaction following which we are not the surviving corporation or following which we are the surviving corporation but the shares of our common stock outstanding immediately preceding the merger, consolidation or similar transaction are converted or exchanged into other securities, cash or other property.

13

According to the terms of the Incentive Plan, in the event of a Corporate Transaction, any surviving corporation or acquiring corporation may assume or continue any or all stock awards outstanding under the Incentive Plan. A surviving corporation or acquiring corporation may choose to assume or continue only a portion of a stock award or substitute a similar stock award for only a portion of a stock award. With respect to stock awards that have not been assumed, continued or substituted and are held by non-employee directors whose continuous service has not terminated prior to the effective date of the Corporate Transaction, the vesting of stock awards shall be accelerated in full to a date prior to the effective date of the Corporate Transaction as determined by our Board of Directors (or, if our Board of Directors did not determine a date, to the date that is five days prior to the effective date of the Corporate Transaction), and the stock awards shall not terminate.

For outstanding options that were granted under our 1996 Stock Option Plan, in the event of any change-in-control transaction involving us, each outstanding option would be assumed or an equivalent option substituted by the successor corporation. If the successor corporation refuses to assume or substitute the options, the non-employee director would have the right to exercise all of the option shares, including shares not otherwise exercisable. In such event, the plan administrator would notify the non-employee director that the option is fully exercisable for 15 days from the date of such notice and the option terminates upon expiration of such period.

DIRECTOR COMPENSATION FOR 2010

The table below summarizes the compensation paid to our non-employee directors during 2010:

| | | | | | | | | | | | |

Name | | Paid in Cash

($)(1) | | | Awards

($)(2) | | | Total

($) | |

Charles J. Abbe | | | 57,250 | | | | 99,987 | | | | 157,237 | |

Edward H. Braun | | | 61,250 | | | | 99,987 | | | | 161,237 | |

Michael R. Gaulke | | | 53,250 | | | | 99,987 | | | | 153,237 | |

William G. Oldham | | | 52,250 | | | | 99,987 | | | | 152,237 | |

Eric M. Ruttenberg | | | 46,250 | | | | — | | | | 46,250 | |

Peter J. Simone | | | 53,250 | | | | 99,987 | | | | 153,237 | |

Young K. Sohn | | | 44,750 | | | | 99,987 | | | | 144,737 | |

Jon D. Tompkins | | | 54,250 | | | | 99,987 | | | | 154,237 | |

| (1) | Amounts shown include an annual retainer and fees for meetings held and attended by each non-employee director during 2010 |

| (2) | The number of RSUs awarded, in whole shares, was determined by dividing $100,000 by the closing price per share of our common stock as of the date of grant. In January 2010, each non-employee director was awarded 2,552 RSUs with a grant date fair value of $39.18 per share. Each RSU award vests 100% one year from the date of grant. Mr. Ruttenberg was not eligible to receive an annual RSU grant in 2010 because he had not served on the Board of Directors for at least one year as of the date of grant. |

14

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion and Analysis (“CD&A”) provides information regarding the 2010 compensation program for the principal executive officer, the principal financial officer, and the two other executive officers of Cymer, Inc (the “named executive officers”). During 2010, our named executive officers were:

| | • | | Robert P. Akins, our Chairman of the Board and Chief Executive Officer; |

| | • | | Edward J. Brown, Jr., our President and Chief Operating Officer; |

| | • | | Paul B. Bowman, our Senior Vice President, Chief Financial Officer, and Secretary; and |

| | • | | Karen K. McGinnis, our Vice President, Corporate Controller, and Chief Accounting Officer. |

We design and operate our executive compensation program to achieve specific objectives including: market competitiveness to attract, retain, and motivate our executive officers; pay-for-performance; and incentive compensation representing a large portion of an executive officer’s total compensation. These objectives are further described in the section entitled“Executive Compensation Philosophy” below.

In the cyclical environment in which we operate, applying these objectives leads to changes in our programs from time to time. For example, in response to the downturn in late 2008 and early 2009, we reduced the annual base salaries of Messrs. Akins and Brown by 15% for the first six months of 2009; suspended the Short-Term Incentive Plan for 2009; and reduced the target award values for long-term equity incentive awards by 35%. Effective July 2009, the salaries were restored to 2008 levels and a cash incentive plan was implemented for the second half of 2009. As business results improved during 2010, cash and equity incentive targets were restored. As the business climate changes, we will continue to adjust our programs to reward the management behaviors that we believe will deliver the best results for our stockholders over the long-term.

Though the semiconductor industry has long been acknowledged as being a very cyclical industry, full cycles have recently been measured in terms of four to six years. In the past two years alone, however, we have witnessed dramatic swings in demand in our industry, with equipment demand in 2010 recovering significantly compared to the multi-cycle low recorded in 2009.

This trend was reflected in our operating results for 2010:

| | • | | 74% increase in revenues; $534.2 million in 2010 compared to revenue of $307.7 million in 2009 |

| | • | | 51% gross margin, with gross profit totaling $272.8 million |

| | • | | 23% operating margin, with operating income totaling $121.1 million |

| | • | | 658% increase in net income; net income totaled $91.0 million, equal to $3.02 per share (diluted) in 2010, compared to net income of $12.0 million, equal to $0.40 per share (diluted) for 2009 |

| | • | | 17% increase in cash and investments, totaling approximately $217 million, an increase of $31 million from December 31, 2009. |

In general, our compensation programs address this cyclicality through a mix of short and long-term incentives, including both cash and equity, as well as through grants of performance-based restricted stock units that allow our Board of Directors and compensation committee to tailor the incentives to the goal of delivering the best results for our stockholders over the long term.

15

2010 Compensation Program Highlights:

The following compensation actions were taken with respect to the compensation of our executive officers in 2010. Each of these items is discussed in greater detail under the section titled “Elements of Executive Compensation”.

| | • | | Base Salaries. Salaries were reviewed and adjusted, effective April 1, 2010. Both Messrs. Akins and Brown received increases of 3.0%, less than the typical increase being given to other Cymer U.S. employees and consistent with increases given by our peer companies. Neither Mr. Bowman nor Ms. McGinnis received increases in 2010 as Mr. Bowman accepted the role of our Chief Financial Officer and Ms. McGinnis was hired in late 2009. |

| | • | | Short-Term Incentive Program ( “STIP”) |

| | • | | The compensation committee structured the STIP for 2010 to emphasize achievement based on two measures: revenue and operating margin. We believe these metrics drive the results necessary to increase shareholder value. The compensation committee established a funding pool with a maximum aggregate value of two times the aggregate target payout levels, with actual payouts to each executive officer based on achievement of corporate and individual performance goals. In 2010, we exceeded our financial plan, resulting in the funding of the STIP pool at 184.77% of target levels. This resulted in the following 2010 STIP awards to our executive officers: |

| | | | |

| | | Actual 2010 Cash Incentive | |

Robert P. Akins | | $ | 1,421,540 | |

Edward J. Brown, Jr. | | $ | 918,219 | |

Paul B. Bowman | | $ | 517,356 | |

Karen K. McGinnis | | $ | 233,388 | |

| | • | | Long-Term Incentive Program (“LTIP”). |

| | • | | In 2010, two-thirds of the equity awards granted to our executive officers was in the form of performance-based restricted stock units (“PRSUs”) with a one-year performance period and a three-year vesting period from date of grant. The remaining one-third of the equity awards granted to our executive officers was in the form of restricted stock units (“RSUs”) with a three-year vesting period from date of grant. The PRSUs were granted subject to two different performance measures: relative financial performance against our peer companies and achievement against a pre-defined market share goal. We believe that use of multiple performance metrics in our LTIP leads to better alignment of pay and performance, while this design also promotes the achievement of results that are not directly rewarded under the STIP. |

The actual number of shares issued under the PRSU award based on relative financial performance against our peer companies was 65% of the target award levels, and the actual number of shares issued under the PRSU award based on the market share goal was 81.25% of the target awards levels. As a result, the actual number of shares earned by our executive officers under these PRSU awards were as follows:

| | | | | | | | | | | | | | | | |

| | | Financial

Performance PRSUs | | | Market Share

PRSUs | |

| | | Target

Award | | | Actual

Award | | | Target

Award | | | Actual

Award | |

Robert P. Akins | | | 28,667 | | | | 18,633 | | | | 28,666 | | | | 23,291 | |

Edward J. Brown, Jr. | | | 17,334 | | | | 11,267 | | | | 17,333 | | | | 14,083 | |

Paul B. Bowman | | | 10,800 | | | | 7,020 | | | | 10,800 | | | | 8,775 | |

Ms. McGinnis did not receive an equity award from the 2010 LTIP as she was not eligible for this program.

16

| | • | | We continued to manage our equity compensation program conservatively as shown in the table below: |

| | | | | | | | | | | | |

Parameter(1) | | 3-Year

Average

Burn

Rate(2) | | | Issued

Overhang(3)

Fiscal Year End | | | Total

Overhang(4)

Fiscal Year End | |

Core Peer Group 50th Percentile | | | 4.2 | % | | | 11.4 | % | | | 18.5 | % |

Core Peer Group 75th Percentile | | | 4.7 | % | | | 14.1 | % | | | 29.1 | % |

Cymer | | | 3.5 | % | | | 5.9 | % | | | 9.9 | % |

Percent Rank within Peer Group | | | 36.0 | % | | | 7.0 | % | | | 1.0 | % |

| (1) | Reflects Core Peer Group data filed with the SEC through January 27, 2011 and Cymer’s data as of December 31, 2010. |

| (2) | ‘Burn Rate’ is defined as total equity (stock options and full-value shares) granted within the latest fiscal year, as a percentage of shares outstanding. |

| (3) | ‘Issued Overhang’ is defined as outstanding total equity (stock options and full-value shares), as a percentage of shares outstanding. |

| (4) | ‘Total Overhang’ is defined as the sum of outstanding equity (stock options and full-value shares), as well as shares available for future issuance, as a percentage of shares outstanding. |

Executive Compensation Philosophy

We operate in an industry that is both highly competitive and undergoing significant globalization. As a result, we have a high demand for qualified and experienced executives. Through our executive compensation program, we seek to attract and retain executives with the requisite knowledge, skills, experience, and integrity to manage our business, and to motivate and reward these individuals to achieve our strategic, operational, and financial objectives, while supporting our core values and culture. In so doing, we provide our executive officers with total compensation that we believe is competitive with other leading companies in our industry and rewards performance as measured against the achievement of challenging business objectives. We also seek to align our executive officers’ business objectives and, thereby, their financial interests, with the long-term interests of our stockholders.

We have designed a compensation program which puts a substantial percentage of executive pay at-risk, subject to increase when corporate targets are overachieved and subject to reduction when corporate targets are not achieved. This provides us with a more variable expense structure, allowing us to reduce our compensation costs in challenging times and reward performance when business conditions warrant. Consistent with our goal of linking pay and performance, approximately 87% of the targeted total compensation awarded to Mr. Akins in 2010 was comprised of incentive compensation tied to the achievement of specific performance objectives.

Further, to achieve our executive compensation objectives, our executive compensation decisions are influenced by the following principles:

Each year, we evaluate the various elements of our executive compensation program, relative to the compensation paid to the executives of the companies within our peer groups, as identified below, as well as against compensation survey data of companies in our industry sector with comparable annual revenues. This analysis is intended to assess the competitiveness of the compensation that we offer to our executive officers as compared to that offered to executives at companies with which we compete for talent. Due to the difficulty in identifying a suitable number of comparable executive positions at the companies within our peer groups, typically we use the peer group data along with the

17

survey data to analyze the competitive market for our chief executive officer and chief financial officer positions, and use only the industry sector survey data to analyze the competitive market for our other executive officer positions.

The peer groups consists of 18 semiconductor capital equipment companies either comparable to or larger than Cymer as measured by revenue, market capitalization, business maturity, and general growth opportunities. For analytical purposes, these companies were broken into two groups.

The first group, which is our core group of peer companies (“core peer group”), represents the companies against which the compensation committee believes our executive compensation program should be competitive for our chief executive officer and chief financial officer positions. These companies are similar to us in terms of scope and general business complexity and operations. Compensia, Inc. (“Compensia”), our compensation committee’s independent compensation consultant, conducted an analysis using publicly-available compensation information from these companies to determine the base salary, annual cash incentive compensation, aggregate equity award values, and overall compensation provided by the core peer group to their chief executive and chief financial officers.

For 2010, our core peer group consisted of:

| | | | |

Advanced Energy Industries | | FormFactor | | Teradyne |

Brooks Automation | | MKS Instruments | | Ultratech |

Coherent | | Newport | | Varian Semiconductor Equipment |

FEI | | Novellus Systems | | Veeco Instruments |

The second group consists of our aspirational peer companies (“aspirational peer group”). This group represents companies with which we aggressively compete for senior executive talent. These companies are much larger than us in terms of both revenue and market capitalization and are considered mature bellwethers for our industry. Therefore, this peer group is only used to analyze long-term incentive plan design (but not individual award levels) for our executive officers.

For 2010, our aspirational peer group consisted of:

| | | | |

Agilent Technologies | | KLA-Tencor | | Leap Wireless International |

Applied Materials | | Lam Research | | Microchip Technology |

In addition, for all of our executive officers, Compensia performed a compensation analysis using survey data for base salary, annual cash incentive compensation, aggregate equity award values, and total overall compensation at companies in our industry sector with comparable annual revenues to determine competitive pay levels for each executive position.

Using this analysis, the compensation committee sought to target each individual compensation element for our executive officers for 2010 at approximately the 60thpercentile of the competitive market. The compensation committee determined that this positioning provided a greater incentive compensation opportunity for strong performance and enabled total compensation to be competitive with the companies in our peer groups. The compensation committee also evaluated the total compensation of our executive officers to ensure that it appropriately recognized each individual’s position and role, scope of responsibility, experience, performance, and contributions. The compensation committee has discretion to set compensation at a level that may be higher or lower than the percentiles of the market data.

| | • | | Pay for performance.We believe that a significant portion of an executive officer’s total compensation should be tied not only to individual performance, but also to overall corporate performance as measured against strategic, operational, and financial objectives. During periods when our performance meets or exceeds established objectives, executive officers should be paid at or above target levels. When our performance does not meet key objectives, incentive award payments, if any, should be less than target levels. |

18

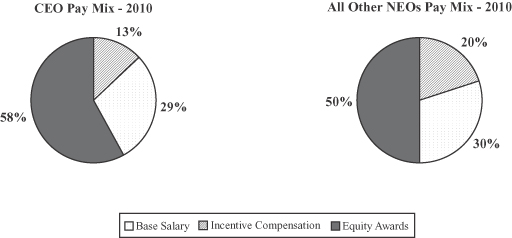

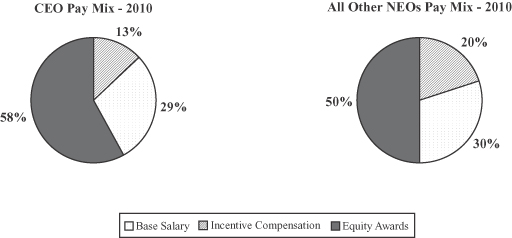

| | • | | Incentive compensation should represent a large portion of an executive officer’s total compensation.We minimize the amount of fixed compensation paid to executive officers to reduce costs when our performance does not meet or exceed target levels. Further, we believe the majority of an executive officer’s total compensation should be in the form of short-term and long-term incentives, which are based primarily on our level of revenue and profitability. As shown in the charts below, Mr. Akins receives approximately 87% of his total target compensation in performance-based compensation, while our other executive officers receive approximately 80% of their total target compensation in performance-based compensation. Accordingly, we believe our executive officers are motivated to increase our profitability and stockholder return to earn their target compensation. |

Where appropriate, the compensation committee includes multiple measures of performance in our incentive plan design. However, to mitigate the potential risks of incentive payments, we have incorporated appropriate maximums of between 1.25x – 2.0x target payments for both our STIP and LTIP, with the compensation committee having oversight and approval on both plans to ensure that there continues to be the appropriate balance of short-term financial results and long-term strategic vision.

Compensation Process

Role of the Compensation Committee

The compensation committee oversees and determines executive compensation on behalf of our Board of Directors. Among its duties, the compensation committee establishes our compensation philosophy and the framework for determining the compensation of our executive officers and, within that philosophy and framework, reviews, evaluates, and approves base salaries, short-term and long-term incentives, and all other forms of compensation for these individuals.

The compensation committee receives compensation recommendations and supporting data, as described below, on the compensation of our executive officers from its compensation consultant as well as performance evaluations and compensation recommendations for our executive officers from Mr. Akins (other than for himself). In addition, the compensation committee members rely on their own personal experience with compensation practices through their involvement as either executives or directors of other companies. Historically, the compensation committee has made adjustments to our executive officers’ base salaries, determined annual cash incentive payments, granted equity awards, and established new annual and long-term performance objectives in the first quarter of the year, as part of our formal annual executive compensation review process. Generally, the compensation committee’s process comprises two related elements: (i) the determination of compensation levels and (ii) the establishment of performance objectives for the current year.

19

In the case of Mr. Akins, the evaluation of his performance is conducted by the compensation committee, which determines any adjustments to his base salary, as well as any annual cash incentive payments and equity awards, and establishes the performance objectives required to earn those awards. Mr. Akins is not permitted to participate in or be present during any deliberations or determinations of the compensation committee regarding his compensation or individual performance objectives. The compensation committee also meets at every regularly scheduled compensation committee meeting in executive sessions without management present.

As part of its evaluation process, the compensation committee solicits the opinions of all members of our Board of Directors. As part of its considerations and deliberations on the compensation for our executive officers the compensation committee may review and consider such materials as it deems appropriate, as well as recommendations from the compensation committee’s compensation consultant. Each executive officer performs an annual self-assessment to measure his or her performance against his or her pre-established individual performance objectives. This self-assessment is then reviewed with the executive officers who are ranked at least one level higher and who have authority to approve and/or modify the self-assessment. Mr. Akins’ self-assessment is reviewed by the compensation committee and other members of our Board of Directors.

For more information on the compensation committee, please see “Information Regarding the Board of Directors and its Committees.”

Role of the Independent Compensation Consultant

The compensation committee has the sole authority to retain compensation consultants to assist in its evaluation of executive compensation, including the authority to approve the consultant’s fees and the other terms of its engagement. The compensation committee has engaged Compensia, an independent, nationally-recognized executive compensation consulting firm, which does not provide any other services to us and works with our management only on matters for which the compensation committee is responsible.

Compensia performed the following services during 2010:

| | • | | advised the compensation committee on current compensation market trends and the specifics of new legislation affecting executive compensation; |