SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Atlantic Coast Airlines Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

The following presentation was made to Institutional Shareholder Services on December 16, 2003.

December 16, 2003

1 ACA executives regarding its implementation available to it. A results to differ other factors listed in ACA related matters represent forward-looking presentation and by materially from these projected results, including the risks and the Company’s October 23, 2003 press release and recent 10-Q filing. undertakes no obligation to update any such forward-looking information, including as a result of any new information, future events, changed expectations or Safe Harbor Statement Statements in this of new business strategies and information that is based on management’s beliefs and assumptions that management believes to be reasonable in light of the information number of risks and uncertainties exist which could cause actual otherwise.

2 Chronology The Full Story Great Opportunity for ACA Stockholders Independence Air: New United Agreement Combination with Mesa Outline of Presentation ACA Overview Independence Air: Independence Air: A. B. Corporate Governance Comparison Analyst Comments I. II. III. IV. V. VI.

ACA Overview

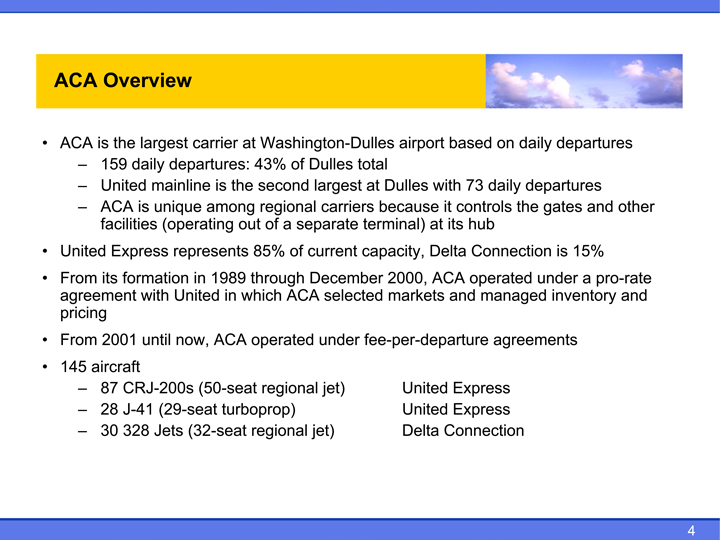

4 facilities (operating out of a separate terminal) at its hub United Express United Express Delta Connection 159 daily departures: 43% of Dulles total United mainline is the second largest at Dulles with 73 daily departures ACA is unique among regional carriers because it controls the gates and other 87 CRJ-200s (50-seat regional jet) 28 J-41 (29-seat turboprop) 30 328 Jets (32-seat regional jet) ACA Overview ACA is the largest carrier at Washington-Dulles airport based on daily departures – – – United Express represents 85% of current capacity, Delta Connection is 15% From its formation in 1989 through December 2000, ACA operated under a pro-rate agreement with United in which ACA selected markets and managed inventory and pricing From 2001 until now, ACA operated under fee-per-departure agreements 145 aircraft – – – • • • • •

5 (1) five years for last four years of pro-rate contracts (1997 for last two years (2001 and 2002) under safety) ACA stock price 7-year CAGR: 23.6% Regionals’ stock price 7-year CAGR: 14.2% (2) (3) October 21, 2003; regionals include ExpressJet, Mesa, Mesaba, Skywest Operating margin excluding turboprop retirement charges, averaged 12.5% including retirement charges. Operating margin excluding turboprop retirement charges, averaged 7.9% including retirement charges. Source: Factset, January 1, 1996 – ACA Overview: A Proven Track Record Management has solid track record in delivering long-term stockholder value – – Capacity growth (Available Seat Miles) of 38% CAGR over the last Operating margin averaged 14.1% to 2000): experience identifying markets, managing fares and controlling inventory Operating margin averaged 11.5% fee-per-departure contracts 3600+ energized employees with favorable labor relations over the years Opened 29 new markets on the East Coast and Mid-Atlantic from Washington Dulles over the past 10 years Extensive operational experience (maintenance, customer service, (1) (2) (3) • • • • • • • Notes:

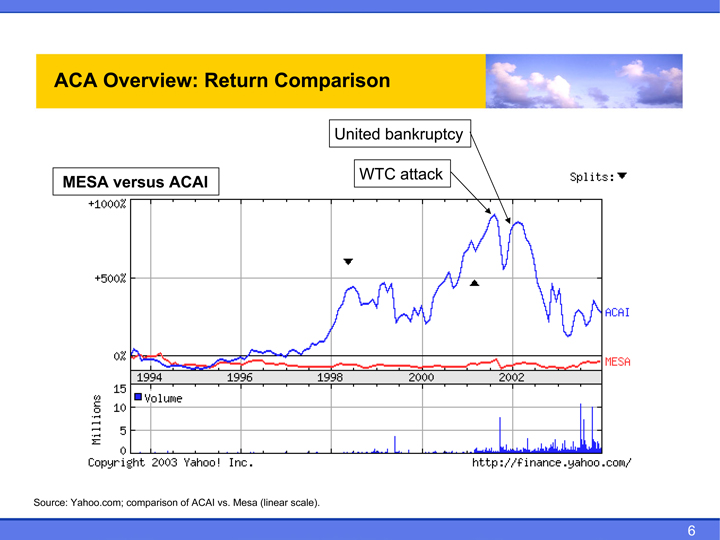

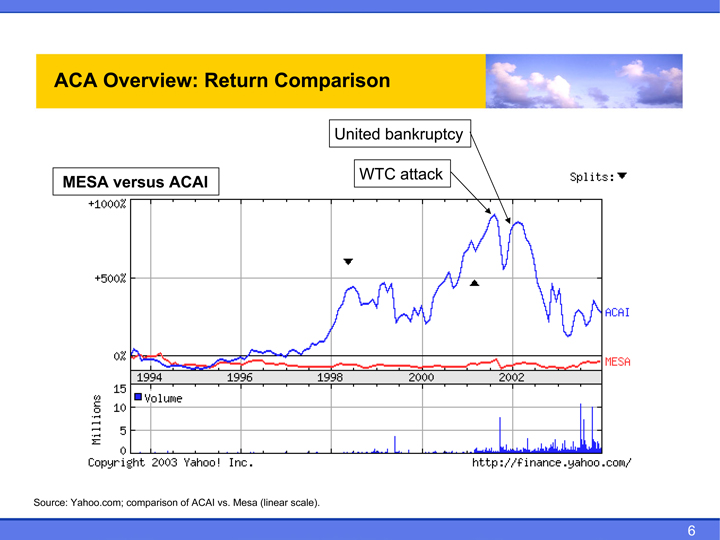

6 United bankruptcy WTC attack ACA Overview: Return Comparison MESA versus ACAI Source: Yahoo.com; comparison of ACAI vs. Mesa (linear scale).

Independence Air Chronology

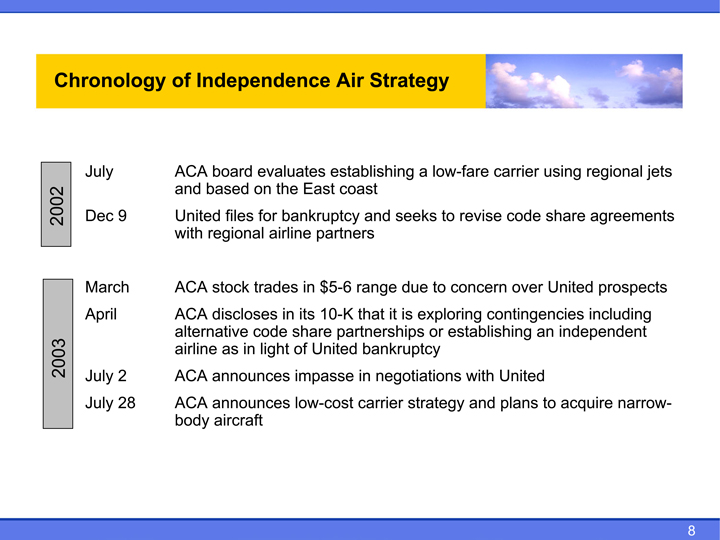

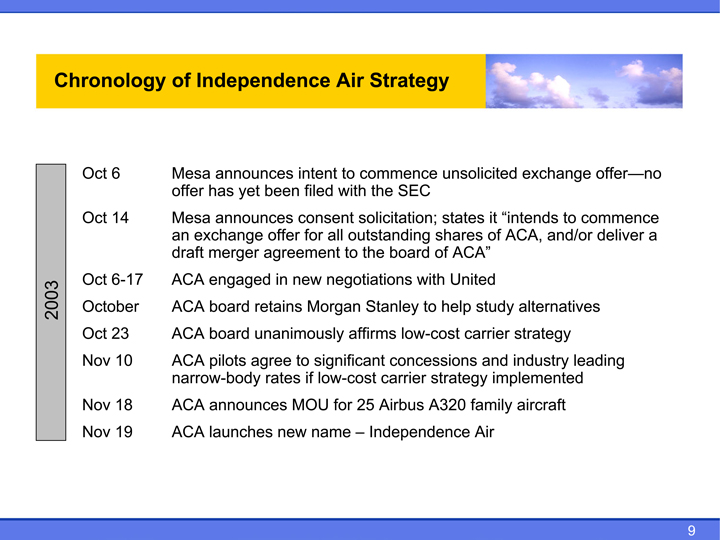

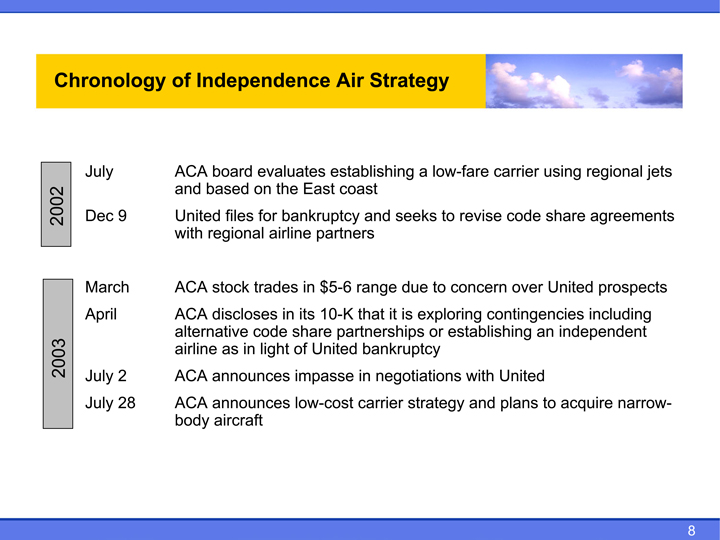

8 ACA board evaluates establishing a low-fare carrier using regional jets and based on the East coast United files for bankruptcy and seeks to revise code share agreements with regional airline partners ACA stock trades in $5-6 range due to concern over United prospects ACA discloses in its 10-K that it is exploring contingencies including alternative code share partnerships or establishing an independent airline as in light of United bankruptcy ACA announces impasse in negotiations with United ACA announces low-cost carrier strategy and plans to acquire narrow- body aircraft Chronology of Independence Air Strategy July Dec 9 March April July 2 July 28 2002 2003

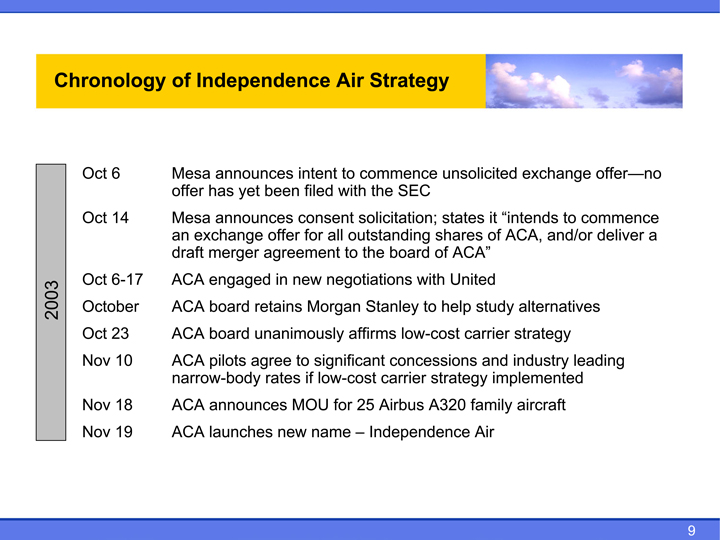

9 an exchange offer for all outstanding shares of ACA, and/or deliver a draft merger agreement to the board of ACA” ACA pilots agree to significant concessions and industry leading ACA announces MOU for 25 Airbus A320 family aircraft Independence Air Mesa announces intent to commence unsolicited exchange offer—no offer has yet been filed with the SEC Mesa announces consent solicitation; states it “intends to commence ACA engaged in new negotiations with United ACA board retains Morgan Stanley to help study alternatives ACA board unanimously affirms low-cost carrier strategy narrow-body rates if low-cost carrier strategy implemented ACA launches new name –Chronology of Independence Air Strategy Oct 6 Oct 14 Oct 6-17 October Oct 23 Nov 10 Nov 18 Nov 19 2003

Independence Air Overview

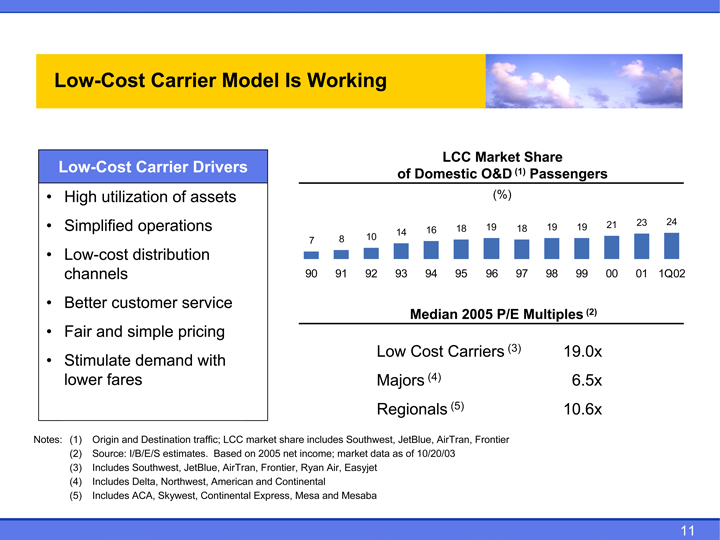

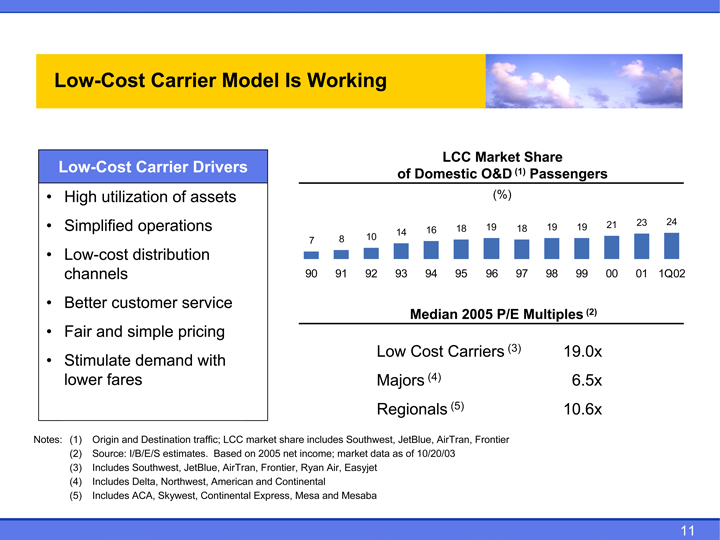

11 24 1Q02 23 01 21 00 (2) 19 99 19.0x 6.5x 10.6x Passengers 19 98 (1) 18 97 (3) (%) 19 96 LCC Market Share 18 95 (5) of Domestic O&D 16 94 Median 2005 P/E Multiples (4) 14 93 Low Cost Carriers Majors Regionals 10 92 8 91 7 90 Origin and Destination traffic; LCC market share includes Southwest, JetBlue, AirTran, Frontier Based on 2005 net income; market data as of 10/20/03 Includes Southwest, JetBlue, AirTran, Frontier, Ryan Air, Easyjet Includes Delta, Northwest, American and Continental Includes ACA, Skywest, Continental Express, Mesa and Mesaba Source: I/B/E/S estimates. Low-Cost Carrier Model Is Working Low-Cost Carrier Drivers High utilization of assets Simplified operations Low-cost distribution channels Better customer service Fair and simple pricing Stimulate demand with lower fares (1) (2) (3) (4) (5) • • • • • • Notes:

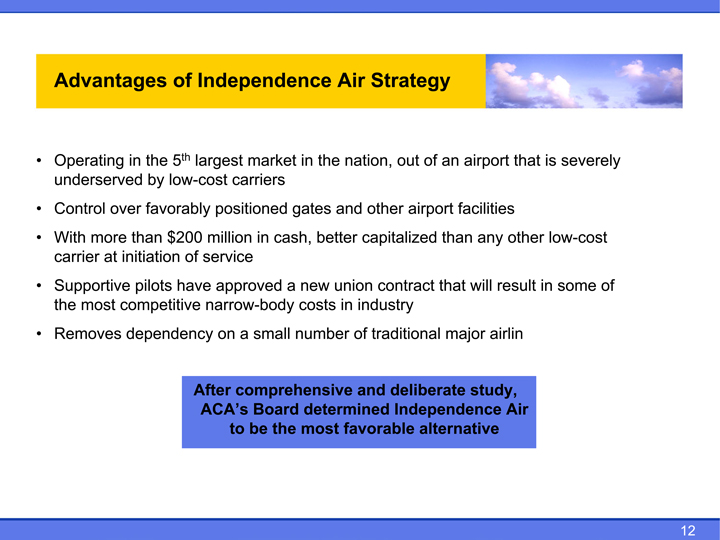

• 12 • severely of low-cost some is in that other result airlines Air airport facilities any will study, an than that major of airport alternative • Strategy out contract traditional deliberate Independence other capitalized industry and nation, of favorable Air and union in the better determined in gates new costs number most cash, a the market in small Board be carriers a comprehensive to • Independence largest positioned million service approved narrow-body on After ACA’s of th of have 5 low-cost $200 the by favorably

than pilots in over initiation competitive dependency more at most Advantages Operating underserved Control With carrier Supportive the Removes • • • •

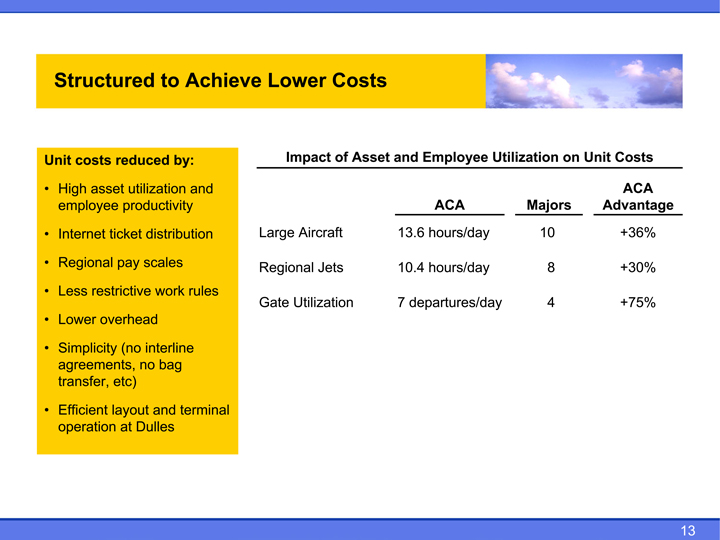

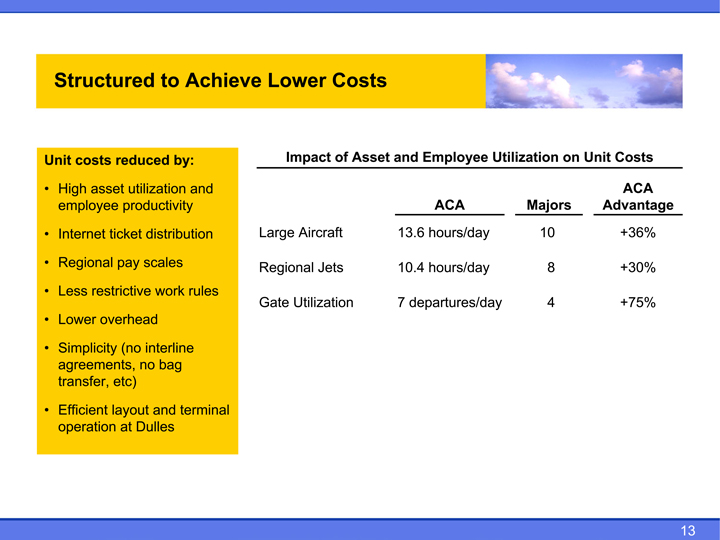

• 13 • Costs ACA Advantage +36% +30% +75% Unit on Utilization Majors 10 8 4 • Employee ACA hours/day hours/day departures/day and 13.6 10.4 7 • Asset • Costs of Aircraft Jets Utilization • Lower Impact • Large Regional Gate • Achieve and rules terminal by: to distribution scales work interline bag and utilization productivity no Dulles reduced ticket pay restrictive overhead (no etc) layout at costs asset employee agreements, transfer, operation Structured High Internet Regional Less Lower Simplicity Efficient Unit • • • • • •

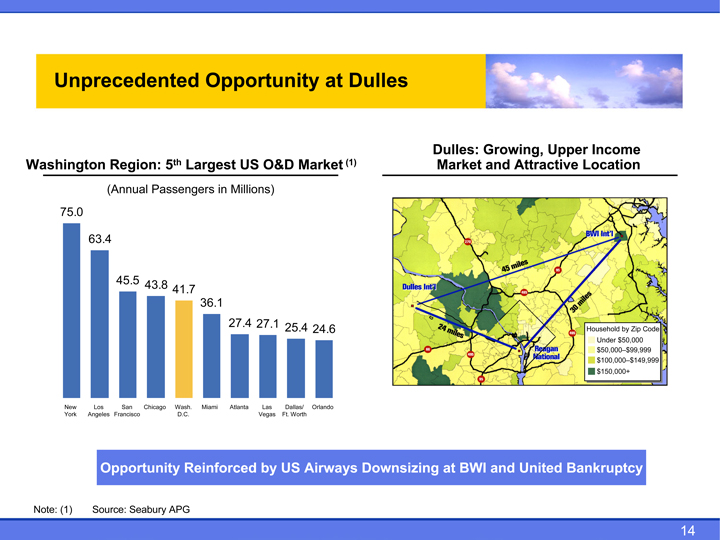

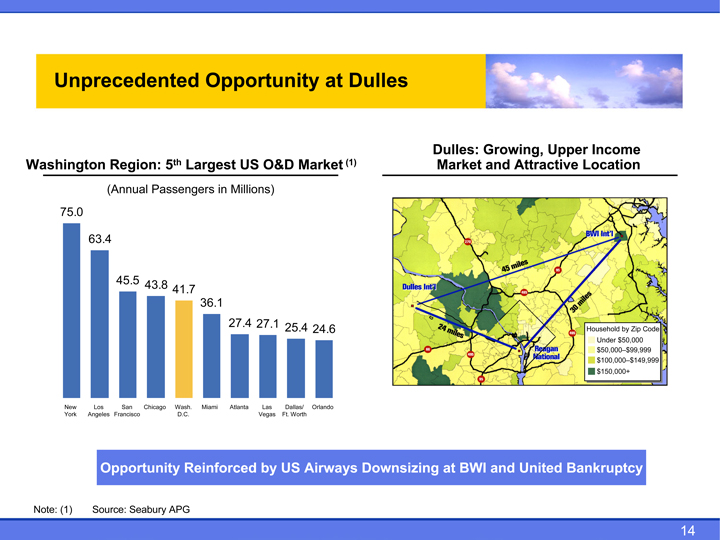

14 Dulles: Growing, Upper Income Market and Attractive Location Household by Zip Code Under $50,000 $50,000–$99,999 $100,000–$149,999 $150,000+ (1) 24.6 Orlando 25.4 Dallas/ Ft. Worth 27.1 Las Vegas 27.4 Atlanta Largest US O&D Market 36.1 Miami Wash. D.C. th 41.7 43.8 Chicago (Annual Passengers in Millions) 45.5 San Francisco Opportunity Reinforced by US Airways Downsizing at BWI and United Bankruptcy 63.4 Los Angeles Source: Seabury APG Unprecedented Opportunity at Dulles Washington Region: 5 75.0 New York Note: (1)

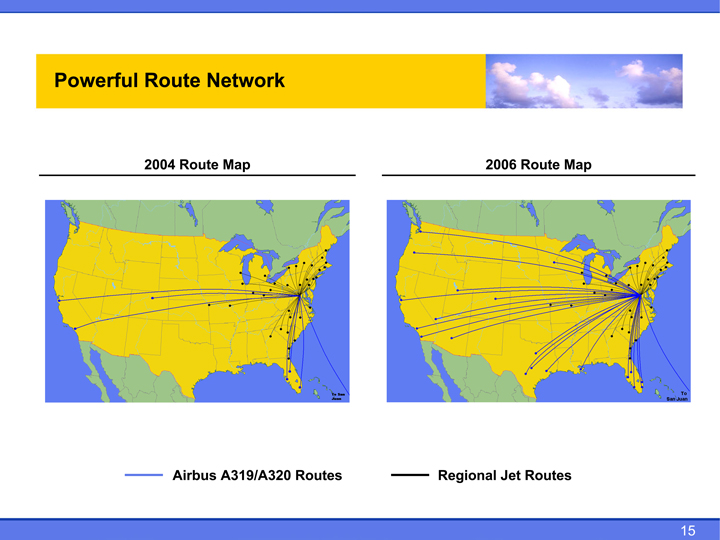

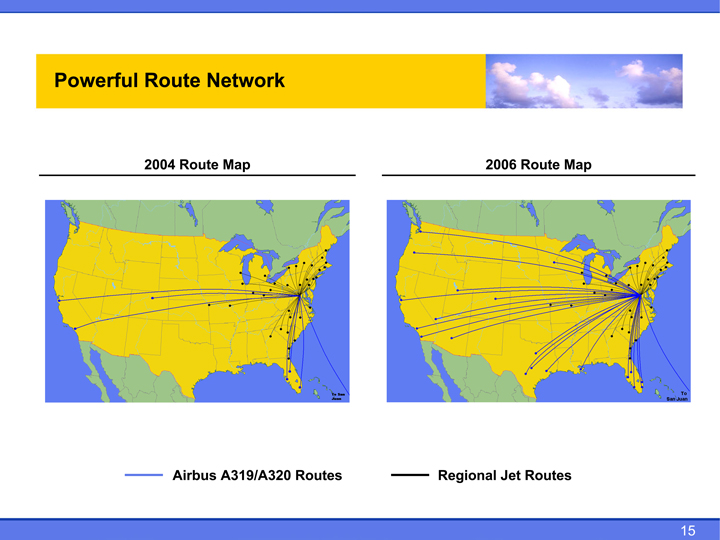

15 2006 Route Map Regional Jet Routes Powerful Route Network 2004 Route Map Airbus A319/A320 Routes

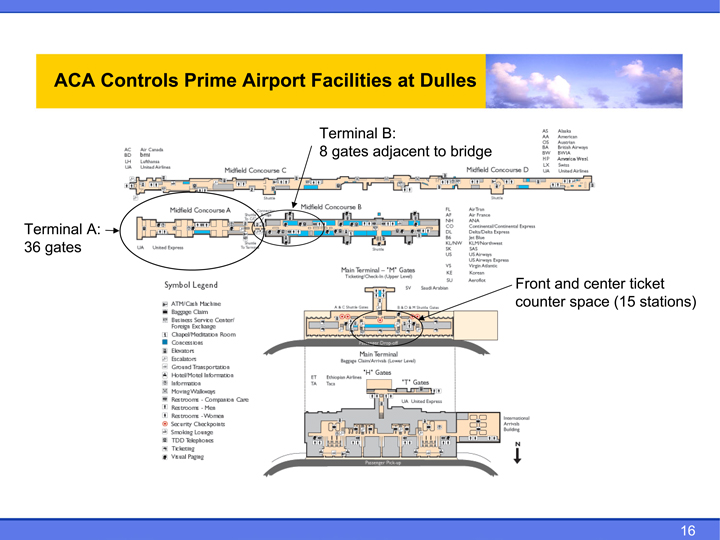

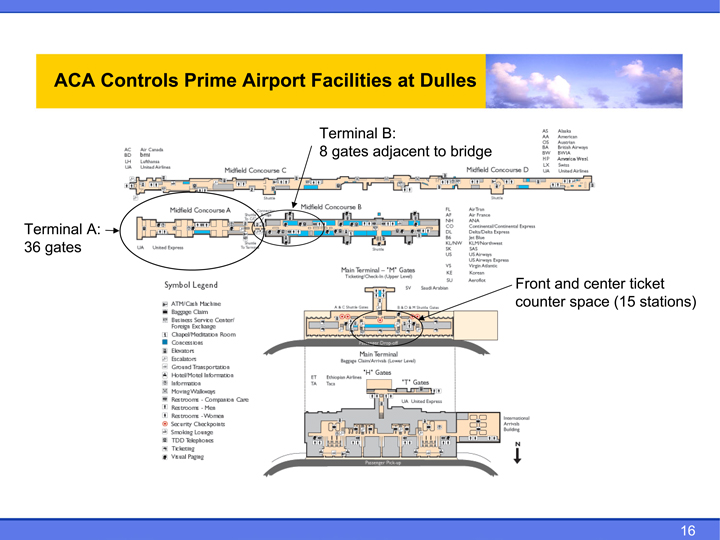

counter space (15 stations) 16 Front and center ticket ACA Controls Prime Airport Facilities at Dulles Terminal B: 8 gates adjacent to bridge Terminal A: 36 gates

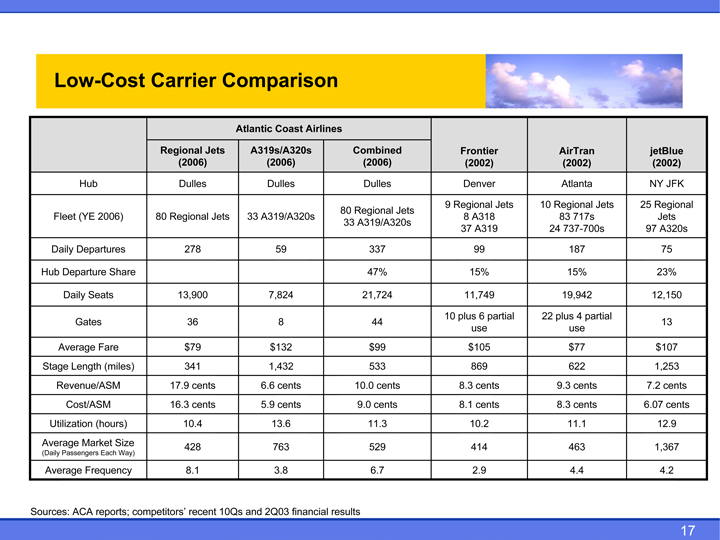

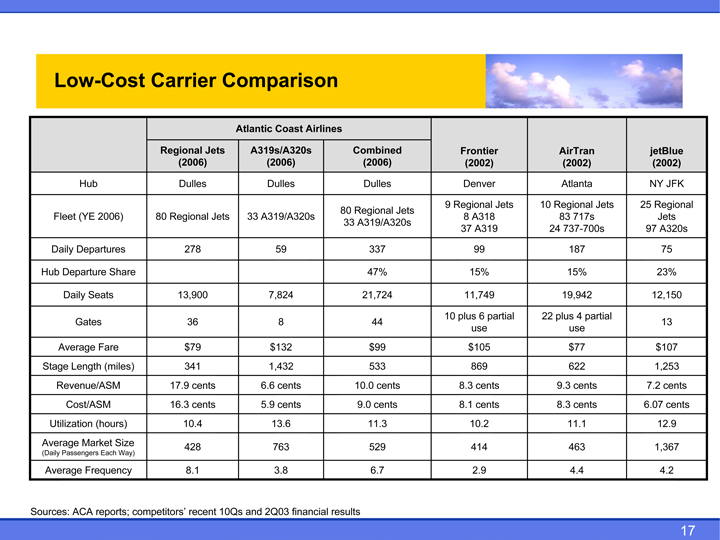

17 jetBlue (2002) NY JFK 25 Regional Jets 97 A320s 75 23% 12,150 13 $107 1,253 7.2 cents 6.07 cents 12.9 1,367 4.2 AirTran (2002) Atlanta 10 Regional Jets 83 717s 24 737-700s 187 15% 19,942 22 plus 4 partial use $77 622 9.3 cents 8.3 cents 11.1 463 4.4 Frontier (2002) Denver 9 Regional Jets 8 A318 37 A319 99 15% 11,749 10 plus 6 partial use $105 869 8.3 cents 8.1 cents 10.2 414 2.9 Combined (2006) Dulles 80 Regional Jets 33 A319/A320s 337 47% 21,724 44 $99 533 10.0 cents 9.0 cents 11.3 529 6.7 Atlantic Coast Airlines A319s/A320s (2006) Dulles 33 A319/A320s 59 7,824 8 $132 1,432 6.6 cents 5.9 cents 13.6 763 3.8 Regional Jets (2006) Dulles 80 Regional Jets 278 13,900 36 $79 341 17.9 cents 16.3 cents 10.4 428 8.1 Low-Cost Carrier Comparison Hub Fleet (YE 2006) Daily Departures Hub Departure Share Daily Seats Gates Average Fare Stage Length (miles) Revenue/ASM Cost/ASM Utilization (hours) Average Market Size (Daily Passengers Each Way) Average Frequency Sources: ACA reports; competitors’ recent 10Qs and 2Q03 financial results

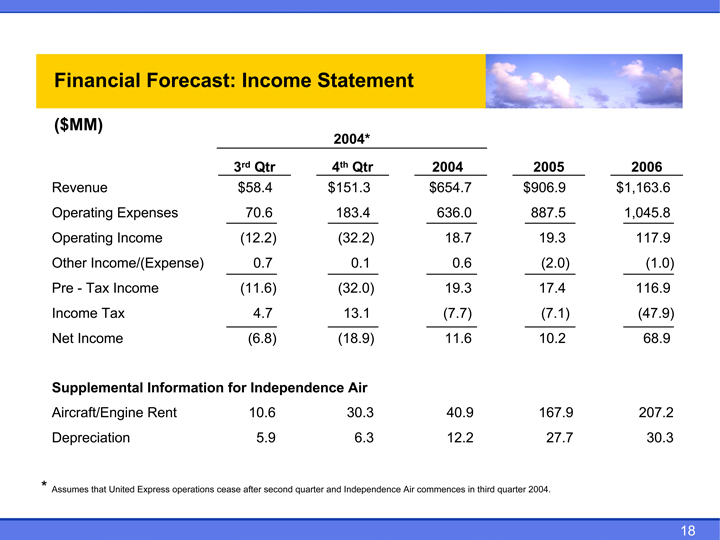

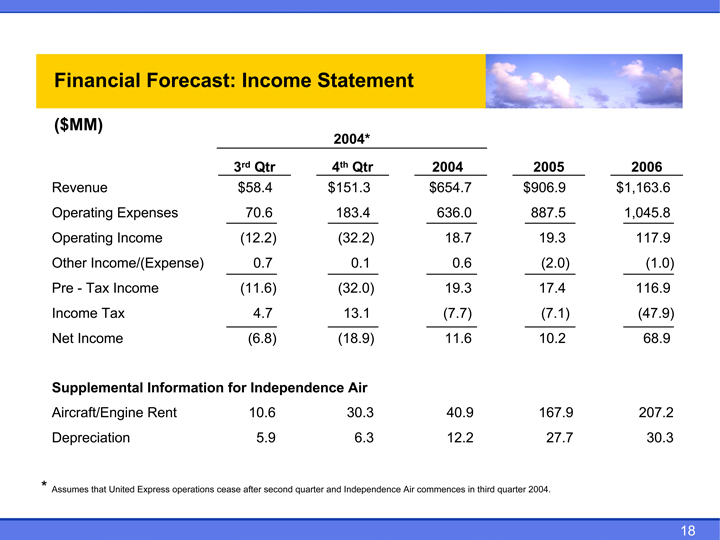

18 2006 $1,163.6 1,045.8 117.9 (1.0) 116.9 (47.9) 68.9 207.2 30.3 2005 $906.9 887.5 19.3 (2.0) 17.4 (7.1) 10.2 167.9 27.7 636.0 18.7 0.6 19.3 (7.7) 11.6 40.9 12.2 2004 $654.7 Qtr 0.1 13.1 30.3 6.3 2004* th 183.4 (32.2) (32.0) (18.9) 4 $151.3 Qtr 70.6 0.7 4.7 (6.8) 10.6 5.9 rd $58.4 (12.2) (11.6) 3 Financial Forecast: Income Statement Tax Income ($MM) Revenue Operating Expenses Operating Income Other Income/(Expense) Pre—Income Tax Net Income Supplemental Information for Independence Air Aircraft/Engine Rent Depreciation Assumes that United Express

operations cease after second quarter and Independence Air commences in third quarter 2004. *

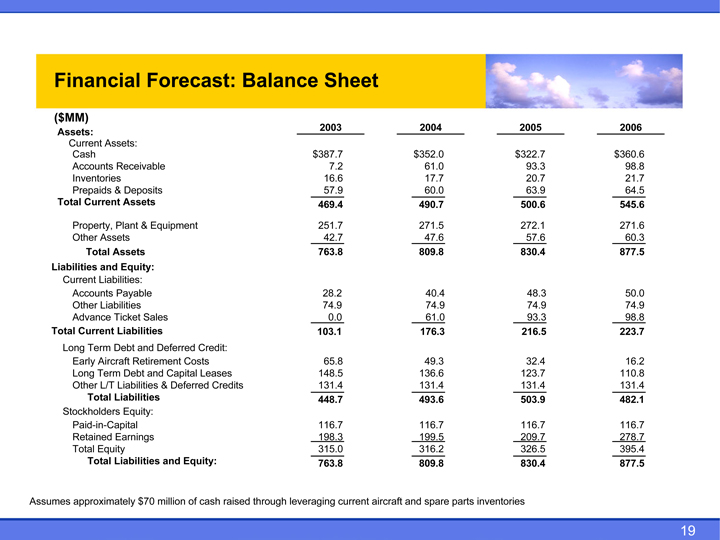

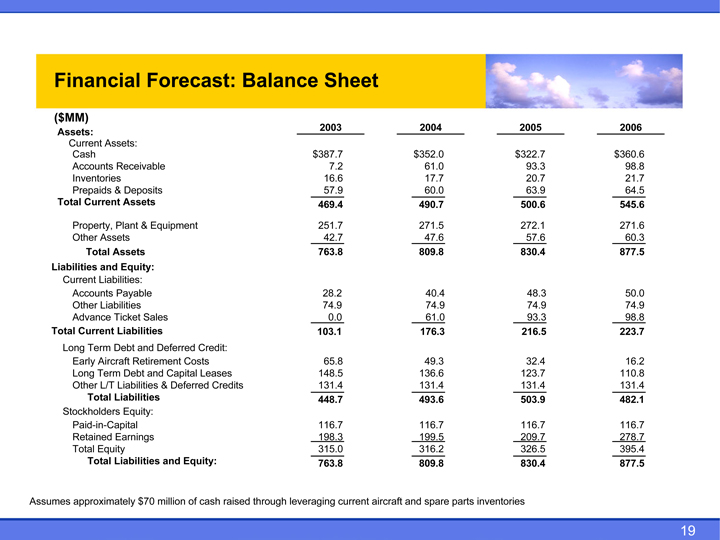

19 2006 $360.6 98.8 21.7 64.5 545.6 271.6 60.3 877.5 50.0 74.9 98.8 223.7 16.2 110.8 131.4 482.1 116.7 278.7 395.4 877.5 2005 $322.7 93.3 20.7 63.9 500.6 272.1 57.6 830.4 48.3 74.9 93.3 216.5 32.4 123.7 131.4 503.9 116.7 209.7 326.5 830.4 2004 $352.0 61.0 17.7 60.0 490.7 271.5 47.6 809.8 40.4 74.9 61.0 176.3 49.3 136.6 131.4 493.6 116.7 199.5 316.2 809.8 2003 $387.7 7.2 16.6 57.9 469.4 251.7 42.7 763.8 28.2 74.9 0.0 103.1 65.8 148.5 131.4 448.7 116.7 198.3 315.0 763.8 Total Assets Long Term Debt and Capital Leases Total Liabilities Total Liabilities and Equity: Financial Forecast: Balance Sheet ($MM) Assets: Current Assets: Cash Accounts Receivable Inventories Prepaids & Deposits Total Current Assets Property, Plant & Equipment Other Assets Liabilities and Equity: Current Liabilities: Accounts Payable Other Liabilities Advance Ticket Sales Total Current Liabilities Long Term Debt and Deferred Credit: Early Aircraft Retirement Costs Other L/T Liabilities & Deferred Credits Stockholders Equity: Paid-in-Capital Retained Earnings Total Equity Assumes approximately $70 million of cash raised through leveraging current aircraft and spare parts inventories

Independence Air The Full Story

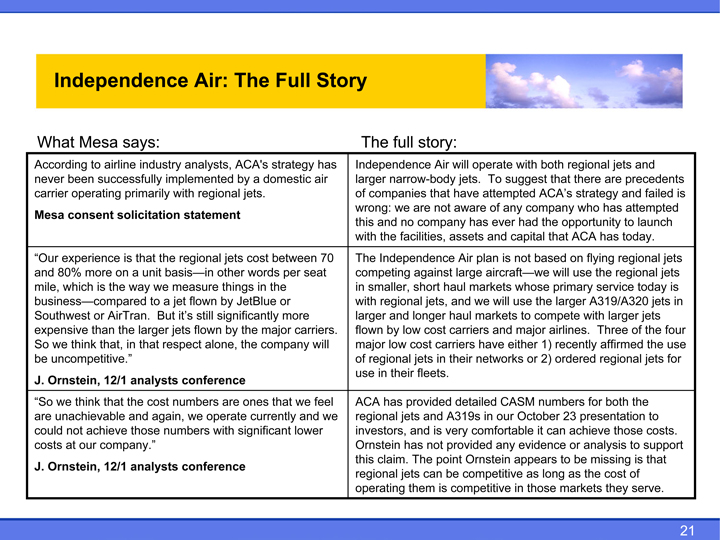

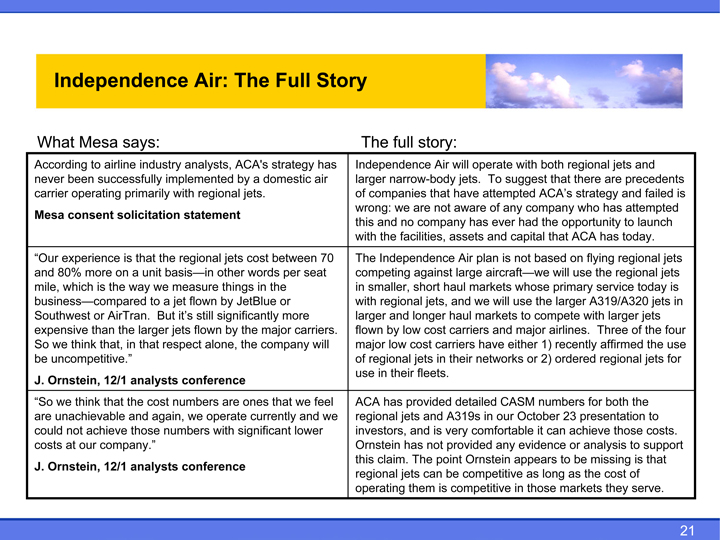

four 21 To suggest that there are precedents Three of the The full story: Independence Air will operate with both regional jets and larger narrow-body jets. of companies that have attempted ACA’s strategy and failed is wrong: we are not aware of any company who has attempted this and no company has ever had the opportunity to launch with the facilities, assets and capital that ACA has today. The Independence Air plan is not based on flying regional jets competing against large aircraft—we will use the regional jets in smaller, short haul markets whose primary service today is with regional jets, and we will use the larger A319/A320 jets in larger and longer haul markets to compete with larger jets flown by low cost carriers and major airlines. major low cost carriers have either 1) recently affirmed the use of regional jets in their networks or 2) ordered regional jets for use in their fleets. ACA has provided detailed CASM numbers for both the regional jets and A319s in our October 23 presentation to investors, and is very comfortable it can achieve those costs. Ornstein has not provided any evidence or analysis to support this claim. The point Ornstein appears to be missing is that regional jets can be competitive as long as the cost of operating them is competitive in those markets they serve. Independence Air: The Full Story But it’s still significantly more What Mesa says: According to airline industry analysts, ACA’s strategy has never been successfully implemented by a domestic air carrier operating primarily with regional jets. Mesa consent solicitation statement “Our experience is that the regional jets cost between 70 and 80% more on a unit basis—in other words per seat mile, which is the way we measure things in the business—compared to a jet flown by JetBlue or Southwest or AirTran. expensive than the larger jets flown by the major carriers. So we think that, in that respect alone, the company will be uncompetitive.” J. Ornstein, 12/1 analysts conference “So we think that the cost numbers are ones that we feel are unachievable and again, we operate currently and we could not achieve those numbers with significant lower costs at our company.” J. Ornstein, 12/1 analysts conference

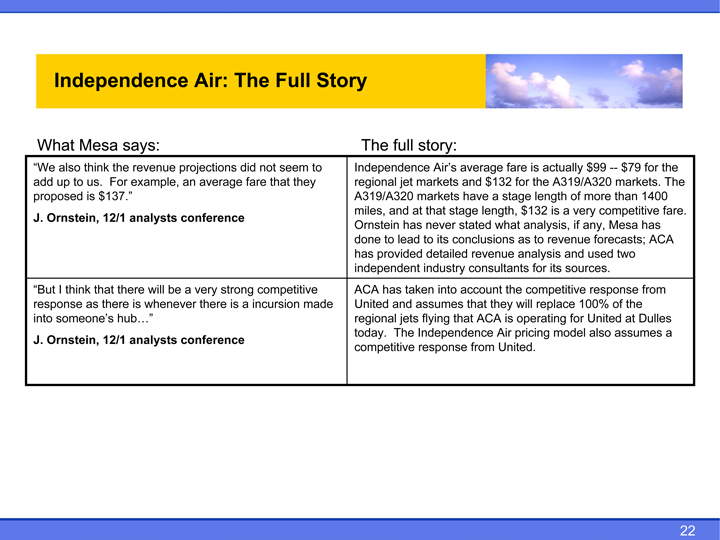

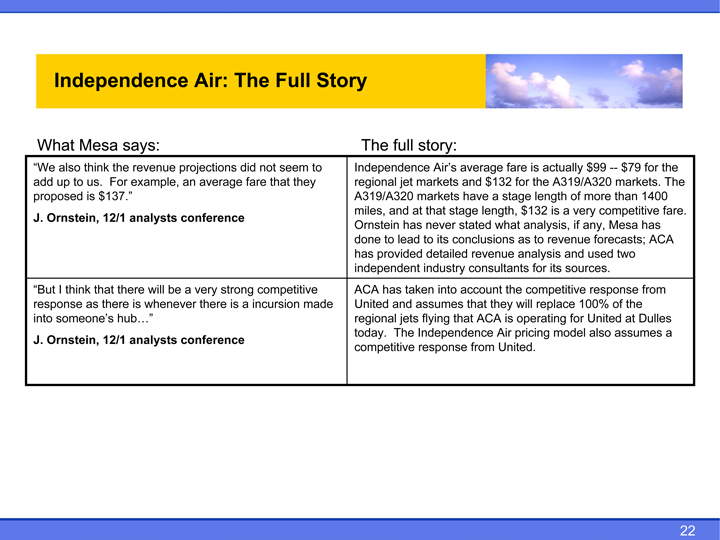

22 $79 for the The Independence Air pricing model also assumes a from United. The full story: Independence Air’s average fare is actually $99 — regional jet markets and $132 for the A319/A320 markets. The A319/A320 markets have a stage length of more than 1400 miles, and at that stage length, $132 is a very competitive fare. Ornstein has never stated what analysis, if any, Mesa has done to lead to its conclusions as to revenue forecasts; ACA has provided detailed revenue analysis and used two independent industry consultants for its sources. ACA has taken into account the competitive response from United and assumes that they will replace 100% of the regional jets flying that ACA is operating for United at Dulles today. competitive response Independence Air: The Full Story For example, an average fare that they What Mesa says: “We also think the revenue projections did not seem to add up to us. proposed is $137.” J. Ornstein, 12/1 analysts conference “But I think that there will be a very strong competitive response as there is whenever there is a incursion made into someone’s hub…” J. Ornstein, 12/1 analysts conference

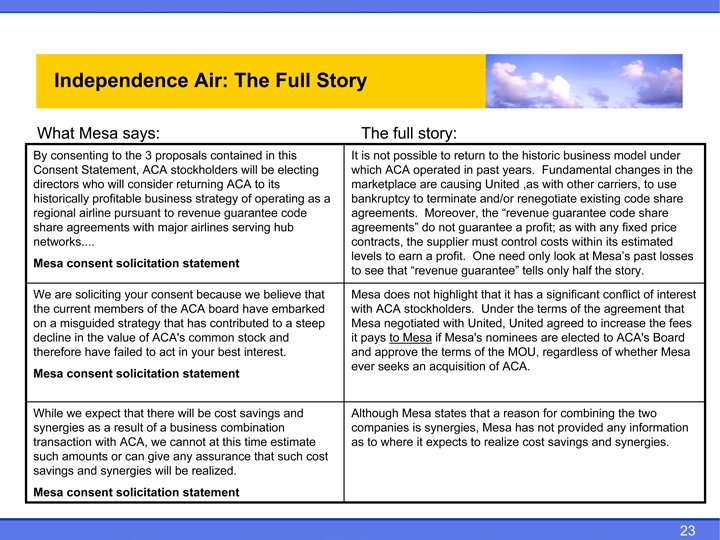

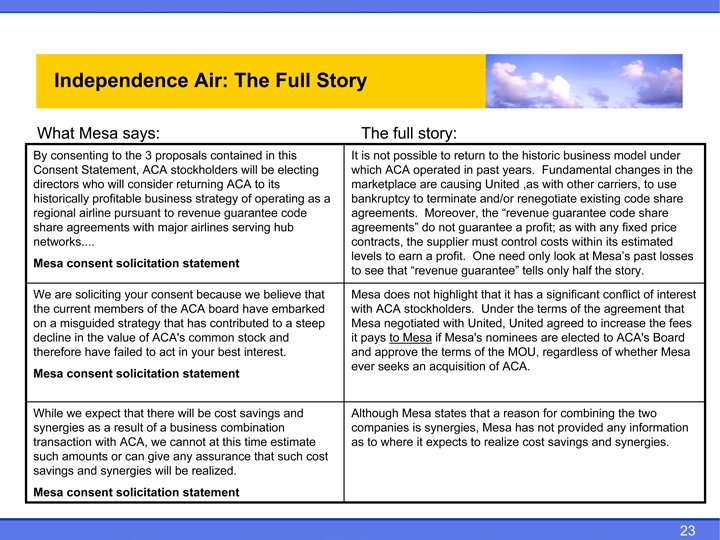

Fundamental changes in the 23 Moreover, the “revenue guarantee code share One need only look at Mesa’s past losses Under the terms of the agreement that if Mesa’s nominees are elected to ACA’s Board Mesa The full story: Mesa does not highlight that it has a significant conflict of interest with ACA stockholders. Mesa negotiated with United, United agreed to increase the fees to Although Mesa states that a reason for combining the two companies is synergies, Mesa has not provided any information as to where it expects to realize cost savings and synergies. It is not possible to return to the historic business model under which ACA operated in past years. marketplace are causing United ,as with other carriers, to use bankruptcy to terminate and/or renegotiate existing code share agreements. agreements” do not guarantee a profit; as with any fixed price contracts, the supplier must control costs within its estimated levels to earn a profit. to see that “revenue guarantee” tells only half the story. it pays and approve the terms of the MOU, regardless of whether Mesa ever seeks an acquisition of ACA. Independence Air: The Full Story What Mesa says: By consenting to the 3 proposals contained in this Consent Statement, ACA stockholders will be electing directors who will consider returning ACA to its historically profitable business strategy of operating as a regional airline pursuant to revenue guarantee code share agreements with major airlines serving hub networks Mesa consent solicitation statement We are soliciting your consent because we believe that the current members of the ACA board have embarked on a misguided strategy that has contributed to a steep decline in the value of ACA’s common stock and therefore have failed to act in your best interest. Mesa consent solicitation statement While we expect that there will be cost savings and synergies as a result of a business combination transaction with ACA, we cannot at this time estimate such amounts or can give any assurance that such cost savings and synergies will be realized. Mesa consent solicitation statement

Independence Air Great Opportunity for ACA Stockholders

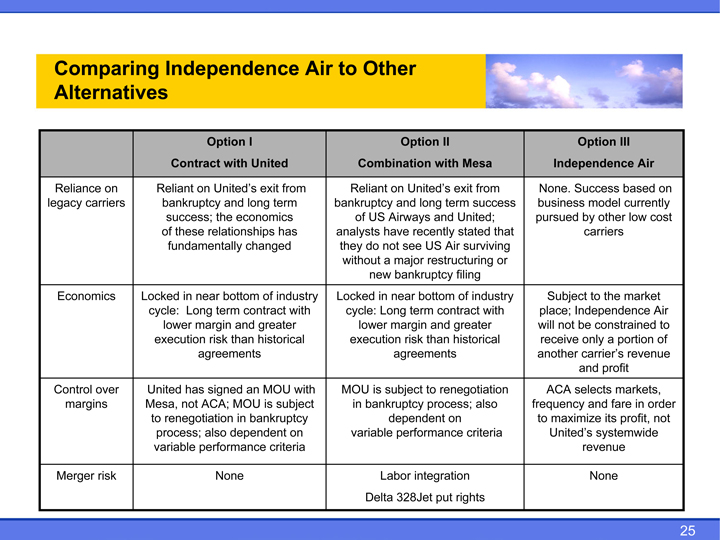

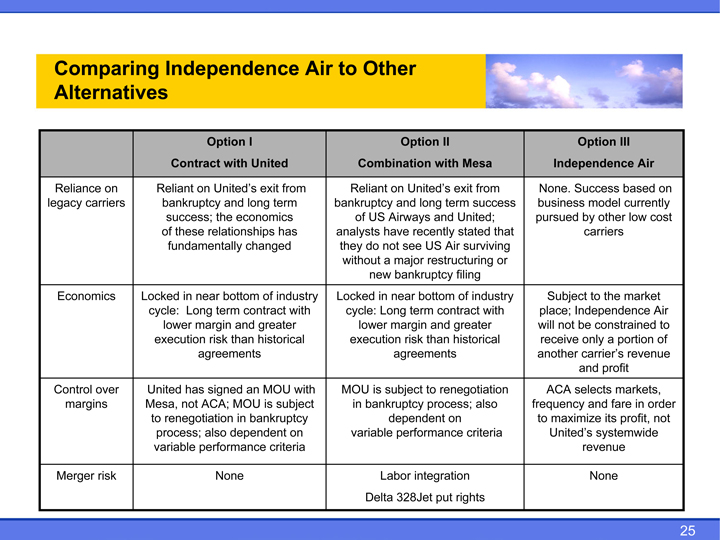

25 Option III Independence Air None. Success based on business model currently pursued by other low cost carriers Subject to the market place; Independence Air will not

be constrained to receive only a portion of another carrier’s revenue and profit ACA selects markets, frequency and fare in order to maximize its profit, not United’s systemwide revenue None Option II Combination with Mesa Reliant on United’s exit from bankruptcy and long term success of US Airways and United; analysts have recently stated that they do not see US Air surviving without a major restructuring or new bankruptcy filing Locked in near bottom of industry cycle: Long term contract with lower margin and greater execution risk than historical agreements MOU is subject to renegotiation in bankruptcy process; also dependent on variable performance criteria Labor integration Delta 328Jet put rights Option I Contract with United Reliant on United’s exit from bankruptcy and long term success; the economics of these relationships has fundamentally changed Long term contract with lower margin and greater execution risk than historical agreements to renegotiation in bankruptcy process; also dependent on variable performance criteria None Locked in near bottom of industry cycle: United has signed an MOU with Mesa, not ACA; MOU is subject Comparing Independence Air to Other Alternatives Reliance on legacy carriers Economics Control over margins Merger risk

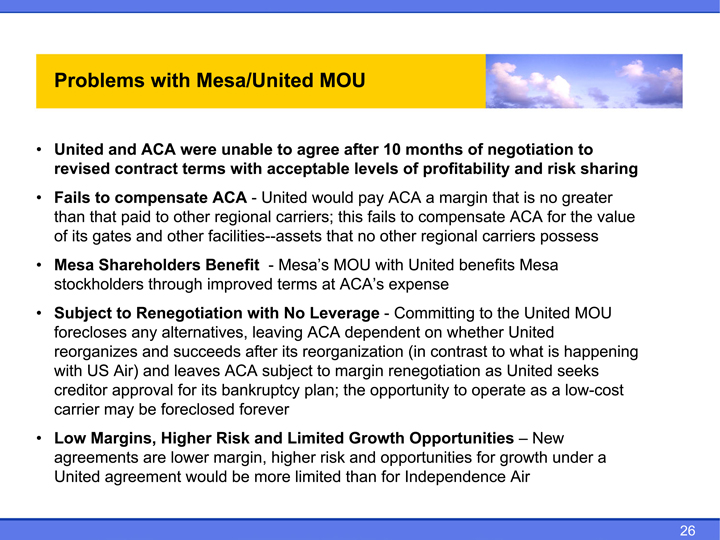

• 26 • sharing value a to greater the MOU happening seeks low-cost under risk no for possess is a New United as is Mesa and ACA United what United – growth Air negotiation that the to carriers to as operate for of benefits margin whether contrast to profitability a compensate regional United on Opportunities months of (in Independence ACA to expense Committing renegotiation 10 fails other with—opportunity opportunities for after levels pay no dependent Growth and than this MOU ACA’s margin the MOU that at risk agree would Leverage ACA reorganization to plan; Limited limited to carriers; Mesa’s terms No its higher acceptable United—leaving subject and more—with after forever unable with ACA regional facilities—assets Benefit improved ACA bankruptcy Risk margin, be • Mesa/United were terms its would • other other alternatives, succeeds leaves for foreclosed Higher lower with ACA to through and and are paid and Renegotiation any be and contract compensate Shareholders to Air) approval may agreement to that gates US Margins, • Problems United revised its agreements • Fails than of Mesa stockholders Subject forecloses reorganizes with creditor carrier Low United • • • •

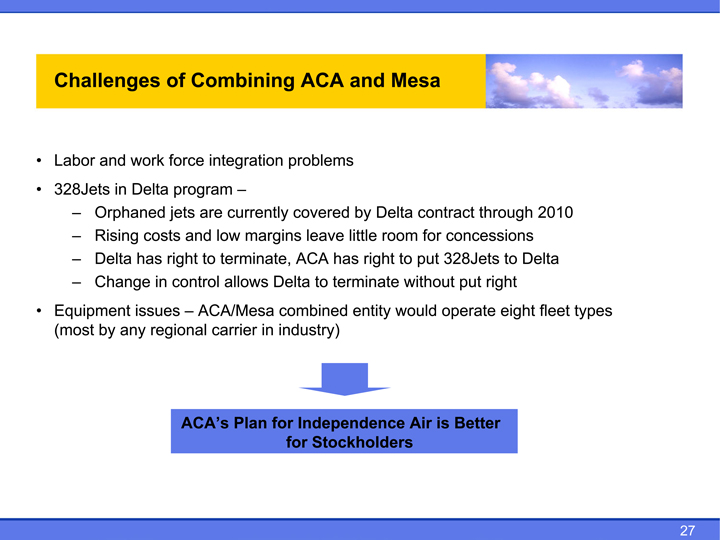

27 Orphaned jets are currently covered by Delta contract through 2010 Rising costs and low margins leave little room for concessions Delta has right to terminate, ACA has right to put 328Jets to Delta Change in control allows Delta to terminate without put right ACA/Mesa combined entity would operate eight fleet types ACA’s Plan for Independence Air is Better for Stockholders Challenges of Combining ACA and Mesa Labor and work force integration problems 328Jets in Delta program – – – – – Equipment issues – (most by any regional carrier in industry) • • •

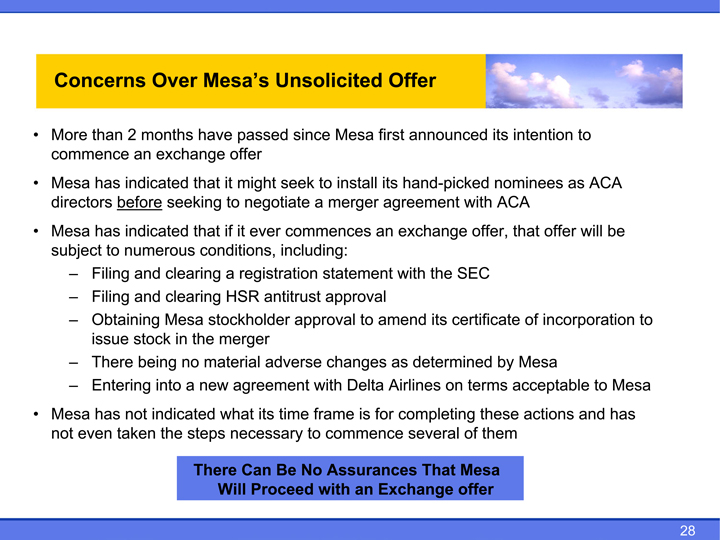

28 seeking to negotiate a merger agreement with ACA There Can Be No Assurances That Mesa Will Proceed with an Exchange offer before Filing and clearing a registration statement with the SEC Filing and clearing HSR antitrust approval Obtaining Mesa stockholder approval to amend its certificate of incorporation to issue stock in the merger There being no material adverse changes as determined by Mesa Entering into a new

agreement with Delta Airlines on terms acceptable to Mesa Concerns Over Mesa’s Unsolicited Offer More than 2 months have passed since Mesa first announced its intention to commence an exchange offer Mesa has indicated that it might seek to install its hand-picked nominees as ACA directors Mesa has indicated that if it ever commences an exchange offer, that offer will be subject to numerous conditions, including: – – – – – Mesa has not indicated what its time frame is for completing these actions and has not even taken the steps necessary to commence several of them • • • •

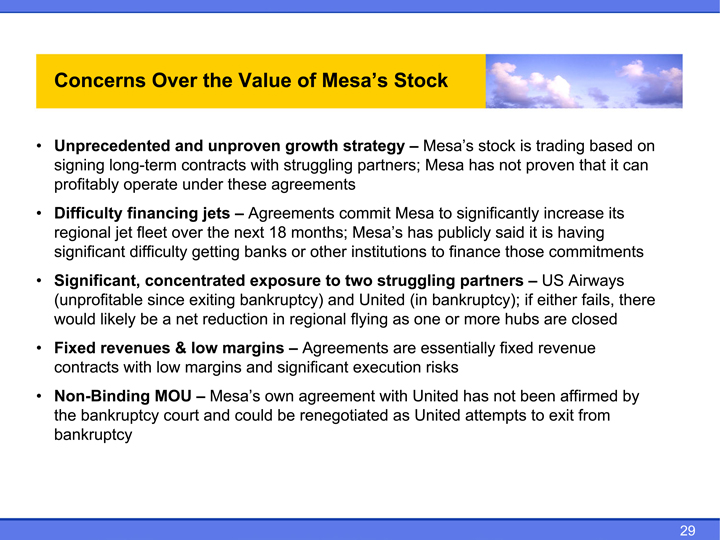

• 29 • on can there by based it its fails, that having Airways closed affirmed from increase commitments US are exit trading is either revenue proven it – to is those if hubs fixed been stock not said not has significantly finance partners more has attempts to publicly bankruptcy); or Mesa’s Mesa to one essentially risks United United Stock – Mesa has (in partners; struggling United as are execution with as strategy commit Mesa’s institutions two flying Mesa’s other to and Agreements agreement renegotiated of months; or regional growth struggling – significant be with agreements Agreements 18 exposure in own Value banks bankruptcy) and unproven these – next margins Mesa’s could the jets the reduction and contracts under getting exiting low margins –and over net & court • Over concentrated since a low MOU operate financing fleet difficulty be with long-term jet likely revenues bankruptcy Concerns Unprecedented signing profitably Difficulty regional significant Significant, (unprofitable would Fixed contracts Non-Binding the bankruptcy • • • •

Corporate Governance Comparison

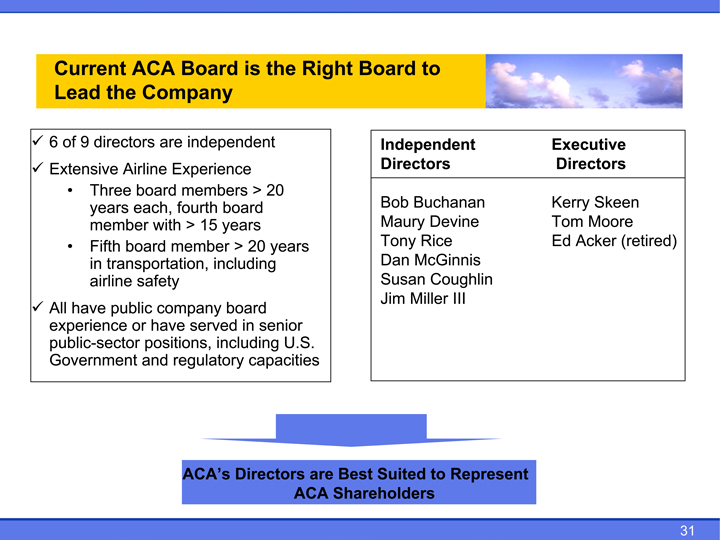

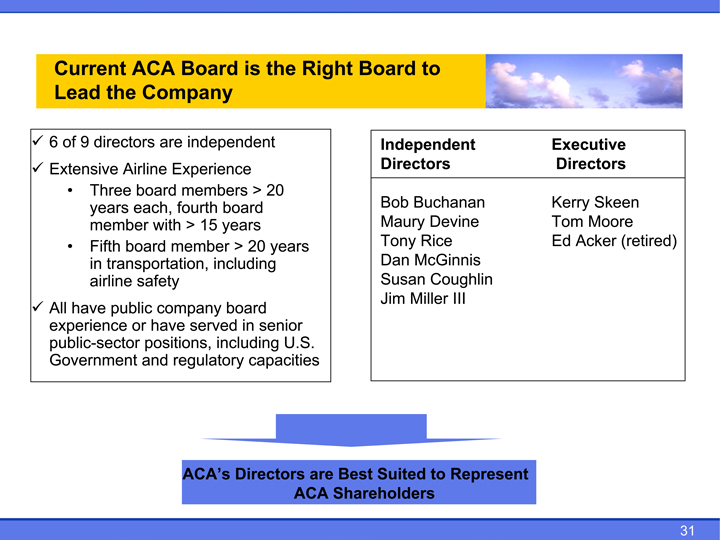

• 31 • (retired) Directors Skeen Moore Acker Executive Kerry Tom Ed • III Represent to Buchanan Devine Rice McGinnis Coughlin Miller to • Board Independent Directors Bob Maury Tony Dan Susan Jim Suited Best Shareholders Right are ACA years U.S. the 20 senior is > 20 capacities in Directors board years > including board including independent 15 served Board Experience members fourth > member regulatory ACA’s Company are with company have positions, ACA board each, safety and Airline board transportation, public or the directors Three years member Fifth in airline 9 have • Current Lead of • • Extensive All experience public-sector Government • 9 9

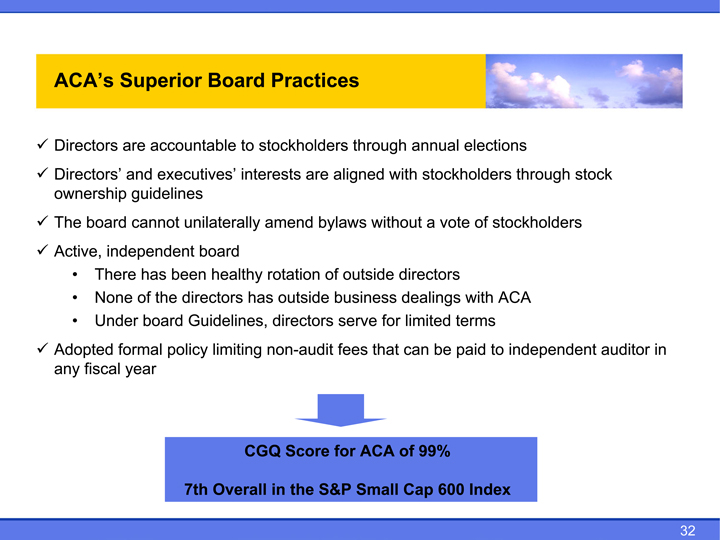

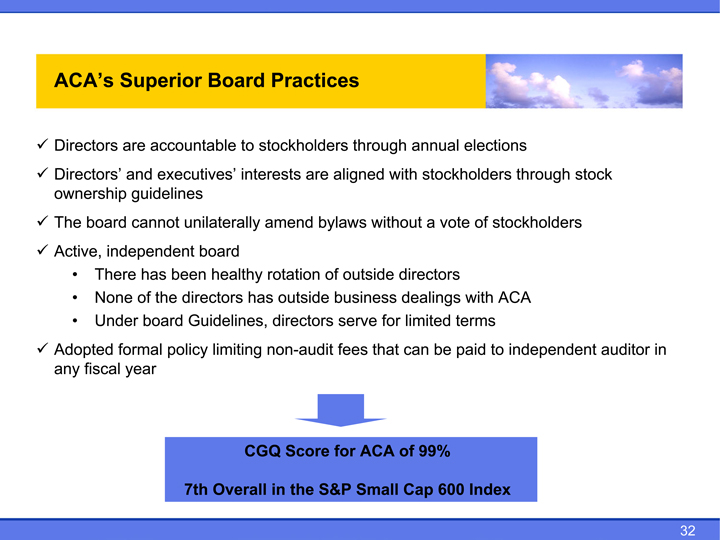

• 32 • in auditor stock through independent stockholders ACA to elections of with terms paid Index vote be 600 annual stockholders a limited 99% with directors dealings can of Cap through without outside for that ACA Small aligned business serve fees for bylaws of S&P are outside directors Score the Practices stockholders amend rotation non-audit in has CGQ Board to interests healthy limiting Overall board Guidelines, executives’ unilaterally been directors policy 7th accountable has the board Superior are and guidelines cannot independent of formal year board There None Under fiscal ACA’s Directors Directors’ ownership The Active, • • Adopted any • 9 9 9 9

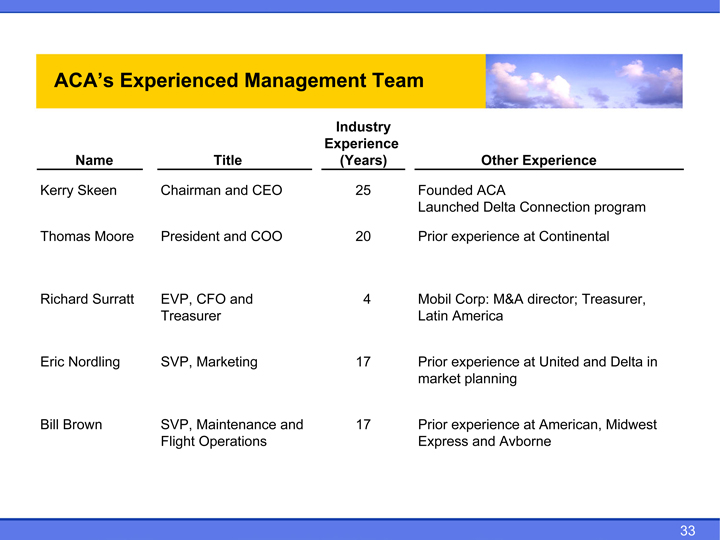

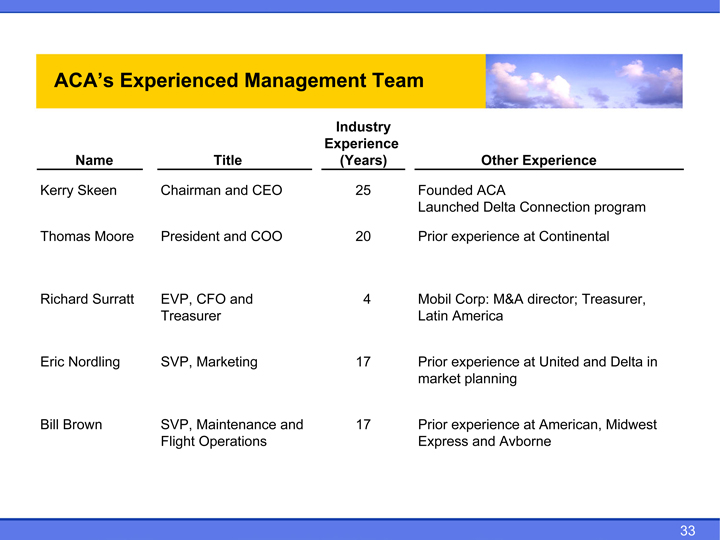

33 Other Experience Launched Delta Connection program Prior experience at American, Midwest Founded ACA Prior experience at Continental Mobil Corp: M&A director; Treasurer, Latin America Prior experience at United and Delta in market planning Express and Avborne Industry Experience (Years) 25 20 4 17 17 Title

President and COO EVP, CFO and SVP, Marketing Chairman and CEO Treasurer SVP, Maintenance and Flight Operations ACA’s Experienced Management Team Name Kerry Skeen Thomas Moore Richard Surratt Eric Nordling Bill Brown

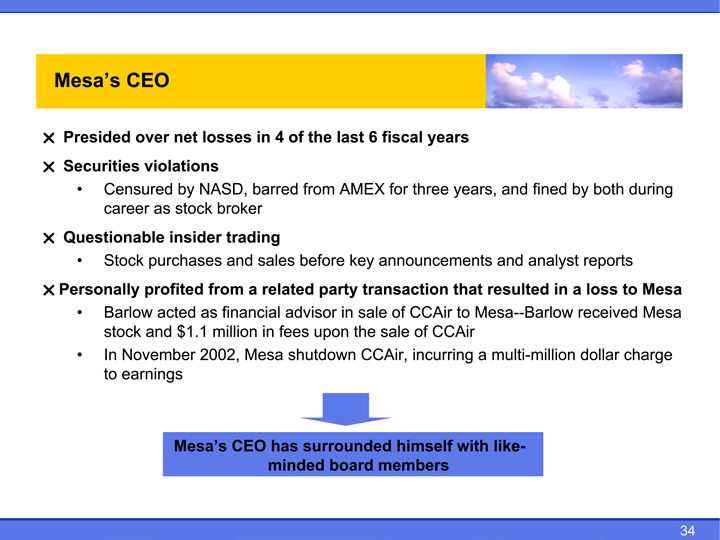

• 34 • during Mesa Mesa charge to both reports loss received dollar by a fined analyst in and and resulted multi-million like-Mesa—Barlow a with years years, that to CCAir three CCAir of incurring himself fiscal for announcements of sale members 6 key transaction sale the CCAir, last AMEX party in upon board the from before surrounded of advisor fees shutdown • 4 has minded in barred sales related in broker trading and a financial million Mesa CEO losses NASD, from as 2002, net by stock insider acted $1.1 Mesa’s • CEO over violations as purchases profited and November earnings Censured career Stock Barlow stock In to • Mesa’s Presided Securities Questionable • Personally • • • U U U U

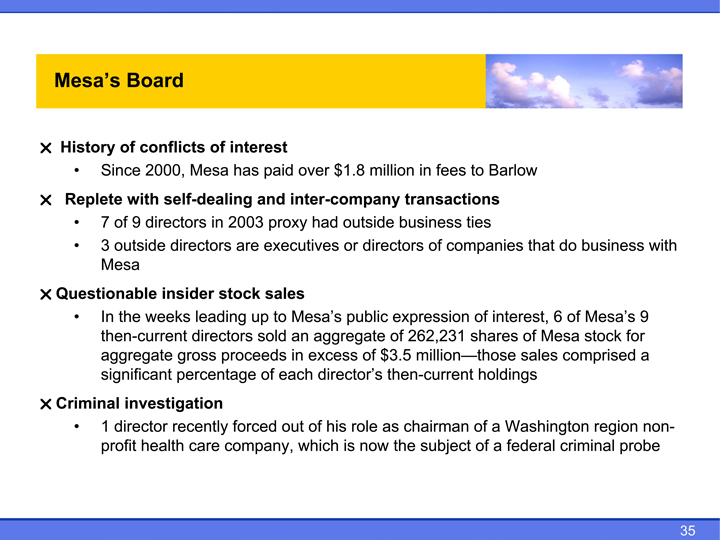

35 6 of Mesa’s 9 Since 2000, Mesa has paid over $1.8 million in fees to Barlow 7 of 9 directors in 2003 proxy had outside business ties 3 outside directors are executives or directors of companies that do business with Mesa In the weeks leading up to Mesa’s public expression of interest, then-current directors sold an aggregate of 262,231 shares of Mesa stock for aggregate gross proceeds in excess of $3.5 million—those sales comprised a significant percentage of each director’s then-current holdings 1 director recently forced out of his role as chairman of a Washington region non- profit health care company, which is now the subject of a federal criminal probe Mesa’s Board History of conflicts of interest • Replete with self-dealing and inter-company transactions • • Questionable insider stock sales • Criminal investigation • U U U U

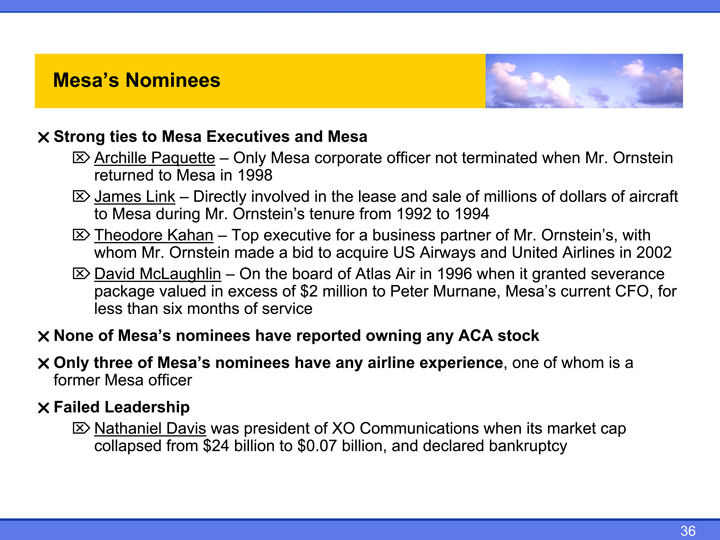

• 36 • aircraft 2002 for • Ornstein with in CFO, a of severance is cap Mr. dollars Airlines current whom when of Ornstein’s, granted of market Mr. United it Mesa’s one its millions of and when stock , when bankruptcy terminated of 1994 partner ACA not sale to Airways 1996 Murnane, any declared and 1992 in experience officer business US Air Peter and from to owning airline communications lease a Atlas billion, Mesa the for acquire of million any XO corporate in tenure to of and bid board $2 reported have $0.04 Mesa a of to involved executive the service have Only 1998 Ornstein’s Top made On excess of president billion in – • – nominees • Executives Directly Mr. in months was $20 Mesa – Kahan Ornstein nominees Davis from Mesa Paquette to Link during valued six Mesa’s officer Nominees to Mesa Mr. McLaughlin than Mesa’s of ties Mesa Leadership • Archille returned James to Theodore whom David package less of three Nathaniel collapsed • Mesa’s Strong None Only former Failed • U U U U

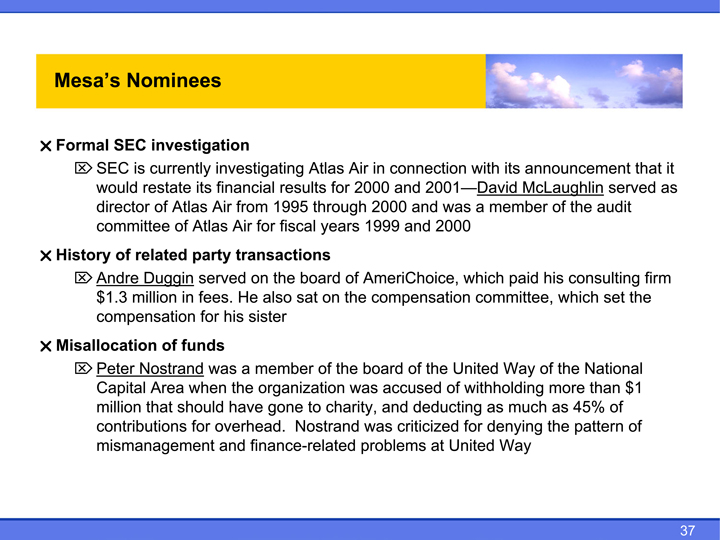

• 37 • it as firm that the $1 of served audit set National than of pattern the consulting which 45% of the more as the announcement McLaughlin his of its member paid Way much denying Way • David as with a which committee, United withholding for United was 2000 of 2001— and the deducting at connection and and of accused criticized and in 2000 2000 1999 AmeriChoice, compensation board was problems Air of the was for the charity, Atlas through years on of results fiscal board sat to Nostrand 1995 the also organization gone for on sister member finance-related from Air transactions He a the have investigating financial his overhead. and Air was its Atlas party served fees. for when for Atlas of in funds should of investigation currently restate of related Duggin

Nostrand Area that Nominees is million SEC SEC would director committee of Andre $1.3 compensation Peter Capital million contributions mismanagement • Mesa’s Formal History Misallocation • U U U

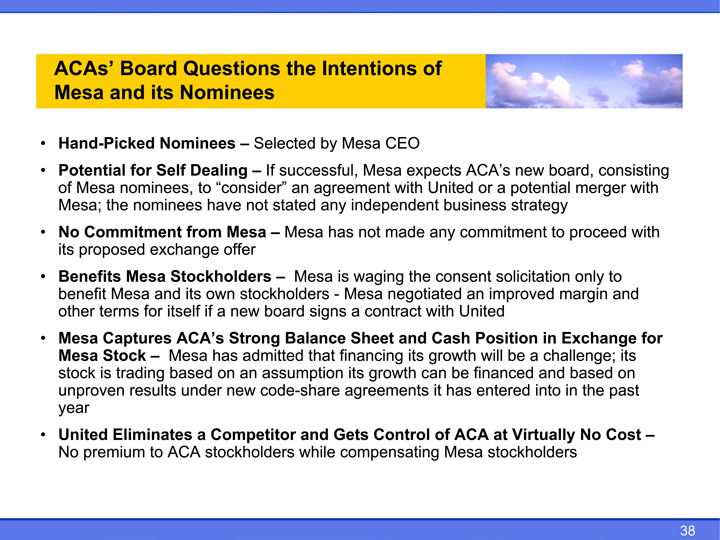

• 38 • with with for –and its on past consisting to Cost merger proceed only based the No margin Exchange in board, to challenge; in and into new potential strategy a Virtually be a solicitation improved will at stockholders or Position financed entered ACA’s commitment an United ACA business consent be has Mesa United any with Cash growth it of of can CEO expects with made the negotiated and its Control Mesa not waging contract growth Mesa independent Mesa a Sheet financing its agreements compensating is Intentions by agreement any has—signs Gets Mesa that and while the successful, an Mesa Balance stated – • – • Selected If board assumption code-share – not admitted • Mesa offer stockholders new Strong an new • “consider” have own a has on Competitor stockholders to if • Dealing from a • Questions Nominees Nominees Stockholders its itself ACA’s Mesa based under ACA its Self and nominees exchange for – to Board and for nominees, Mesa Mesa trading results Eliminates the Captures Stock • Mesa Commitment proposed terms is unproven premium • ACAs’ Mesa Hand-Picked Potential of Mesa; No its Benefits benefit other Mesa Mesa stock year United No • • • • •

Independence Air Analyst Comments

40 from or then i.e. a major network carrier – for the views expressed by these authors. i.e. the domestic U.S. market – Merrill Lynch (August 5, 2003) Mike Linenberg – ACA has not paid any amount to the authors of these quotations and has not obtained the authors’ ACA is not responsible Analyst Comments ACA’s announcement of becoming a low fare operator has been met with much skepticism – industry pundits, other airline management, investors, etc. However, if one ascribes to the view that low fare carriers are basically taking over the world – one must ask the following question? Should ACA continue to closely align itself with a business model that has yet to prove itself financially over the long term – should ACA try to regain control of its own destiny? The latter may be the preferred course for Atlantic Coast. Additionally, the timing couldn’t be better for ACA to utilize its industry know-how and resources (cash, aircraft, airport facilities, etc.) in the formation of a low fare carrier given the weakened financial state of the majors. Note: permission to duplicate these materials.

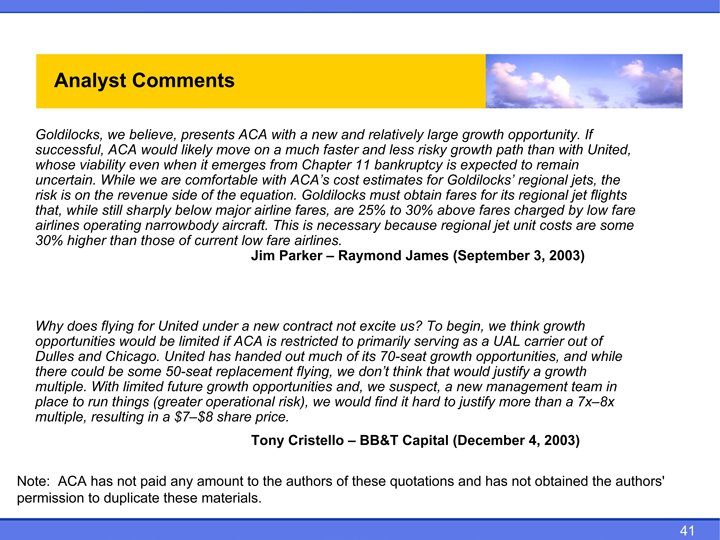

41 Raymond James (September 3, 2003) serving as a UAL carrier out of hard to justify more than a 7x–8x BB&T Capital (December 4, 2003) for the views expressed by these authors. Jim Parker – Tony Cristello – ACA has not paid any amount to the authors of these quotations and has not obtained the authors’ ACA is not responsible Analyst Comments Goldilocks, we believe, presents ACA with a new and relatively large growth opportunity. If successful, ACA would likely move on a much faster and less risky growth path than with United, whose viability even when it emerges from Chapter 11 bankruptcy is expected to remain uncertain. While we are comfortable with ACA’s cost estimates for Goldilocks’ regional jets, the risk is on the revenue side of the equation. Goldilocks must obtain fares for its regional jet flights that, while still sharply below major airline fares, are 25% to 30% above fares charged by low fare airlines operating

narrowbody aircraft. This is necessary because regional jet unit costs are some 30% higher than those of current low fare airlines. Why does flying for United under a new contract not excite us? To begin, we think growth opportunities would be limited if ACA is restricted to primarily Dulles and Chicago. United has handed out much of its 70-seat growth opportunities, and while there could be some 50-seat replacement flying, we don’t think that would justify a growth multiple. With limited future growth opportunities and, we suspect, a new management team in place to run things (greater operational risk), we would find it multiple, resulting in a $7–$8 share price. Note: permission to duplicate these materials.

• 42 authors’ authors. are (LCC)) the the these and planners bad by carrier believe a its of airline obtained cost advantage, and 2003) we 2003) not expressed low 15, segment major 15, has cost stupid, reminder, much) and views not a worst without the not relative she’s As the for of (December even likely (December quotations but right. UBS airline. scarce UBS matter airlines, (i.e. • “Goldilocks”—ACAI’s it – – these a responsible is perfect, get regional legacy contracts, majors of to not a of becomes Air ain’t Ashcroft great: the Ashcroft authors is success being not change existing of ACA enough) to by growth the LCC Robert to fortunes Robert Goldilocks time term, as terms to ACAI the unlikely the Independence tweaks. that. have long business to protection on amount materials. have return is, tied especially any these opinion, minor should to something scant Comments with mostly business commodity consolidate paid (and not popular will a completely offered will duplicate to works determined airline It’s It’s industry, It’s bankruptcies, It has to enough is • Analyst – – – ACA • Contrary probably Goldilocks smart MESA regional Note: permission

43 Prior to any request for the stockholders of ACA to take any action in the event that SEC at Additional information Mesa commences an exchange offer, appropriate filings shall be made with the SEC by both Mesa and ACA, which filings may include a Schedule TO and/or a Schedule 14D-9. These filings will contain important information. You are urged to read them carefully before taking any action or making any decision with respect to any Mesa exchange offer. You will be able to obtain the documents if and when they become available free of charge at the website maintained by the www.sec.gov. The common stock of parent company Atlantic Coast Airlines Holdings, Inc. is traded on the Nasdaq National Market under the symbol ACAI. For more information about Atlantic Coast Airlines, visit our website at www.atlanticcoast.com.