SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | |

| |

Filed by the Registrant x | | |

| |

Filed by a Party other than the Registrant ¨ | | |

| |

Check the appropriate box: | | |

| |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

| |

x Definitive Proxy Statement | | |

| |

¨ Definitive Additional Materials | | |

| |

¨ Soliciting Material Pursuant to Section 240.14a-12 | | |

NB&T Financial Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NB&T FINANCIAL GROUP, INC.

48 N. South Street

Wilmington, Ohio 45177

(937) 382-1441

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Notice is hereby given that the 2006 Annual Meeting of Shareholders of NB&T Financial Group, Inc. (“NBTF”), will be held at 48 N. South Street, Wilmington, Ohio, on April 25, 2006, at 9:00 a.m., Eastern Time (the “Annual Meeting”), for the following purposes:

| | 1. | To elect five directors of NBTF for terms expiring in 2008; |

| | 2. | To consider and vote upon the NB&T Financial Group, Inc. 2006 Equity Plan; and |

| | 3. | To transact such other business as may properly come before the Annual Meeting or any adjournments of the annual meeting. |

Such matters are more completely set forth in the accompanying Proxy Statement.

Only shareholders of NBTF of record at the close of business on March 1, 2006, will be entitled to receive notice of and to vote at the Annual Meeting and at any adjournments. Whether or not you expect to attend the Annual Meeting, we urge you to consider the accompanying Proxy Statement carefully and to SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND THE PRESENCE OF A QUORUM MAY BE ASSURED. The giving of a Proxy does not affect your right to vote in person in the event you attend the Annual Meeting.

| | | | |

| | | | | By Order of the Board of Directors |

| | |

| | | | | |

March 21, 2006 | | | | Charles L. Dehner, Secretary |

NB&T FINANCIAL GROUP, INC.

48 N. South Street

Wilmington, Ohio 45177

(937) 382-1441

PROXY STATEMENT

PROXIES

The enclosed Proxy is being solicited by the Board of Directors of NB&T Financial Group, Inc. (“NBTF”), an Ohio Corporation, for use at the 2006 Annual Meeting of Shareholders of NBTF to be held at 48 N. South Street, Wilmington, Ohio, on April 25, 2006, at 9:00 a.m., Eastern Time, and at any adjournments of the meeting (the “Annual Meeting”). Without affecting any vote previously taken, the Proxy may be revoked by a shareholder by a later dated proxy received by NBTF before the Proxy is exercised or by giving notice of revocation to NBTF in writing before the Annual Meeting or in open meeting. Attendance at the Annual Meeting will not, of itself, revoke a Proxy.

Each properly executed Proxy received prior to the Annual Meeting and not revoked will be voted as specified on the proxy or, in the absence of specific instructions to the contrary, will be voted:

FOR the election of Charles L. Dehner, Daniel A. DiBiasio, G. David Hawley, John J. Limbert and Timothy L. Smith as directors of NBTF for terms expiring in 2008; and

FOR the approval of the NB&T Financial Group, Inc. 2006 Equity Plan (the “2006 Equity Plan”).

Proxies may be solicited by the directors, officers and other employees of NBTF in person or by telephone, telecopy, telegraph or mail only for use at the Annual Meeting. Such Proxies will not be used for any other meeting. The cost of soliciting Proxies will be paid by NBTF.

Only shareholders of record as of the close of business on March 1, 2006 (the “Voting Record Date”), are eligible to vote at the Annual Meeting and will be entitled to cast one vote for each share owned. NBTF’s records disclose that, as of the Voting Record Date, there were 3,232,513 votes entitled to be cast at the Annual Meeting.

This Proxy Statement is first being mailed to shareholders of NBTF on or about March 28, 2006.

1

VOTE REQUIRED

The presence, in person or by proxy, of a majority of the issued and outstanding shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Under Ohio law, shares held by a nominee for a beneficial owner which are represented in person or by proxy but which are not voted (“non-votes”) are counted as present for purposes of establishing a quorum. Shares as to which the authority to vote is withheld and non-votes are not counted toward the election of directors or toward the election of the individual nominees specified on the form of proxy. The five nominees receiving the greatest number of votes will be elected as directors.

The approval of the 2006 Equity Plan requires the approval of a majority of the votes present at the meeting in person or by proxy. Abstentions and non-votes will have the effect of a vote against the approval.

PROPOSAL ONE: ELECTION OF DIRECTORS

Voting Securities and Ownership of Certain Beneficial

Owners and Management

The following table sets forth certain information with respect to the only persons known to NBTF to own beneficially more than five percent of NBTF’s outstanding common shares as of March 1, 2006:

| | | | | |

Name and Address

Of Beneficial Owner

| | Amount Beneficially

Owned (1)

| | Percent of

Common Shares

Outstanding

| |

Janet M. Williams (2) B. Anthony Williams Trust 6172 U. S. 22 East Wilmington, Ohio 45177 | | 374,196 | | 11.58 | % |

| | |

Brooke Williams James 325 West Sixth Ave. Columbus, Ohio 43201 | | 182,242 | | 5.64 | |

| | |

Dana L. Williams 738 Kerr Street Columbus, Ohio 43215 | | 183,456 | | 5.68 | |

| | |

Lynn W. Cowan 4116 W. Franklin Street Richmond, Virginia 23221 | | 181,898 | | 5.63 | |

| | |

Beth Ellingwood 1127 Neil Ave. Columbus, Ohio 43201 | | 209,882 | | 6.49 | |

| | |

The National Bank and Trust Company (3) 48 N. South Street Wilmington, Ohio 45177 | | 708,560 | | 21.92 | |

| (1) | Except as indicated for the shares held by The National Bank and Trust Company (the “Bank”), the beneficial owner has sole voting and dispositive power. |

| (2) | Of the 374,196 shares, 188,826 are held in the name of Mrs. Williams, and 185,370 are held by the B. Anthony Williams Trust, of which Mrs. Williams is the trustee. |

| (3) | All of such shares are held by the Bank as Trustee, 583,457 of which are held as Trustee for the NB&T Financial Group, Inc., Employee Stock Ownership Plan (the “ESOP”). Pursuant to the ESOP, the Bank, as Trustee, has the power to vote in its sole discretion all ESOP shares that have not been allocated to the accounts of participants. At March 1, 2006, 68,062 shares had not been allocated. The Trustee may dispose of shares held in the ESOP Trust only under limited circumstances specified in the ESOP or by law. The Bank also has sole voting and sole dispositive power with respect to 125,103 and 89,855 shares, respectively, held as Trustee for various other trusts. |

2

The following table sets forth certain information with respect to the number of common shares of NBTF beneficially owned by each director of NBTF and each of the five highest paid executive officers of NBTF or the Bank whose cash compensation for 2005 exceeded $100,000, and by all directors and executive officers of NBTF or the Bank as a group as of March 1, 2006:

| | | | | | | | | |

| | | Amount and Nature of

Beneficial Ownership

| | | | |

Name

| | Sole Voting and

Investment Power

| | | Shared Voting and

Investment Power

| | | Percent of Common Shares Outstanding

| |

S. Craig Beam | | 3,282 | | | 18,396 | | | 0.67 | % |

Charles L. Dehner | | 53,439 | | | 38,610 | (1) | | 2.85 | |

Daniel A. DiBiasio | | 53 | | | -0- | | | — | |

G. David Hawley | | 3,985 | | | 2,414 | | | 0.20 | |

Brooke Williams James | | 182,242 | | | -0- | | | 5.64 | |

John J. Limbert | | -0- | | | -0- | | | — | |

D. Jeffery Lykins | | 200 | | | 1,610 | | | 0.06 | |

Darleen M. Myers | | 8,748 | | | -0- | | | 0.27 | |

Robert A. Raizk | | 14,468 | | | -0- | | | 0.45 | |

Timothy L. Smith | | 58,132 | (2) | | 52,018 | (3) | | 3.39 | |

Craig F. Fortin | | 15,550 | (4) | | 162 | (5) | | 0.48 | |

Stephen G. Klumb | | 26,450 | (6) | | 3,122 | (7) | | 0.91 | |

Andrew J. McCreanor | | 18,721 | (8) | | 19,674 | (9) | | 1.18 | |

Howard T. Witherby | | 18,058 | (10) | | 32,763 | (11) | | 1.57 | |

All directors and executive officers of NBTF as a group (14 persons) | | 418,562 | (12) | | 188,647 | | | 18.26 | % |

| (1) | Includes 38,554 allocated to Mr. Dehner’s ESOP account, with respect to which Mr. Dehner has voting but not investment power. |

| (2) | Includes 13,500 shares that may be acquired currently upon the exercise of options. |

| (3) | Includes 48,532 shares allocated to Mr. Smith’s ESOP account, with respect to which Mr. Smith has voting but not investment power. |

| (4) | Includes 13,400 shares that may be acquired currently upon the exercise of options. |

| (5) | Consists of shares allocated to Mr. Fortin’s ESOP account, with respect to which Mr. Fortin has voting but not investment power. |

| (6) | Includes 20,700 shares that may be acquired currently upon the exercise of options. |

| (7) | Includes 2,992 shares allocated to Mr. Klumb’s ESOP account, with respect to which Mr. Klumb has voting but not investment power. |

| (8) | Includes 17,000 shares that may be acquired currently upon the exercise of options. |

| (9) | Includes 19,330 shares allocated to Mr. McCreanor’s ESOP account, with respect to which Mr. McCreanor has voting but not investment power. |

| (10) | Includes 12,900 shares that may be acquired currently upon the exercise of options. |

| (11) | Includes 32,143 shares allocated to Mr. Witherby’s ESOP account, with respect to which Mr. Witherby has voting but not investment power. |

| (12) | Includes 14,700 shares that may be acquired currently upon the exercise of options by an executive officer of the Bank not named in this table who may be deemed to act as an officer of NBTF. |

3

BOARD OF DIRECTORS

Election of Directors

The Third Amended and Restated Articles of Incorporation of NBTF (the “Articles”) provide for a Board of Directors consisting of not less than seven nor more than eleven directors, such number to be fixed or changed by the Board of Directors or the shareholders. Upon the appointment of Mr. Limbert as Chief Executive Officer and President of NBTF and the Bankas of March 20, 2006, the Board of Directors set the number of directors at ten and appointed Mr. Limbert to fill the newly created vacancy. The directors are divided into two classes, each class serving for a two-year period. Five directors are to be elected at the Annual Meeting.

In accordance with Section 8.04 of the Articles, nominees for election as directors may be proposed only by the directors or by any shareholder entitled to vote for directors if such shareholder makes a timely notice to the Secretary of NBTF. To be timely, a shareholder’s notice shall be delivered to or mailed and received at the principal executive offices of NBTF on or before the later of (a) the February 15 immediately preceding the annual meeting of shareholders or (b) the sixtieth day before the first anniversary of the most recent annual meeting of shareholders; provided, however, that in the event that the annual meeting in any year is not held on or before the 31st day next following such anniversary, then the written notice shall be received by the Secretary within a reasonable time prior to the date of such meeting. In the case of a nominee proposed for election at a special meeting of shareholders at which directors are to be elected, such written notice of a proposed nominee by a shareholder must be received not later than the close of business on the seventh day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure was made. Such shareholder’s notice shall set forth (a) as to each person who is not an incumbent director whom a shareholder proposes to nominate for election as a director (i) the name, age, business address and residence address of such person; (ii) the principal occupation or employment of such person; (iii) the class and number of shares of NBTF that are beneficially owned by such person; and (iv) any other information relating to such person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; and (b) as to the shareholder giving the notice, (i) the name and record address of such shareholder and (ii) the class and number of shares of NBTF that are beneficially owned by such shareholder. Such notice shall be accompanied by the written consent of each proposed nominee to serve as a director of NBTF, if elected.

The Nominating Committee will consider nominees for directors of NBTF recommended by a shareholder who submits the person’s name and qualifications in writing. The Nominating Committee has no specific minimum qualifications for a recommended candidate, and the committee does not consider shareholder-recommended candidates differently from others. The Nominating Committee considers:

| | • | | personal qualities and characteristics, accomplishments and reputation in the business community; |

| | • | | relationships in the communities in which NBTF does business; |

| | • | | ability and willingness to commit adequate time to Board and committee responsibilities; |

| | • | | the individual’s skills and experiences and how they fit with those of other directors and potential directors and satisfy the needs of NBTF; and |

| | • | | whether the potential nominees are shareholders of NBTF. |

The Nominating Committee makes its recommendation to the Board of Directors, and nominees are selected by vote of all of the directors of the Board of Directors.

4

The Board of Directors proposes the election of the following persons, all of whom were recommended by the Nominating Committee, to terms that will expire in 2008:

| | | | | | |

Name

| | Age

| | Position(s) Held

| | Director

Since

|

Charles L. Dehner | | 58 | | Director | | 1989 |

Daniel A. DiBiasio | | 56 | | Director | | 2001 |

G. David Hawley | | 58 | | Director | | 2000 |

John J. Limbert | | 58 | | Director, Chief Executive Officer and President of NBTF and the Bank | | 2006 |

Timothy L. Smith | | 55 | | Director and Chairman of the Board of NBTF and the Bank | | 1989 |

If any nominee is unable to stand for election, the Proxies will be voted for such substitute as the Board of Directors recommends.

The following directors will continue to serve after the Annual Meeting for the terms indicated:

| | | | | | | | |

Name

| | Age

| | Position(s) Held

| | Director Since

| | Term Expires

|

S. Craig Beam | | 54 | | Director | | 1990 | | 2007 |

Brooke W. James | | 33 | | Director | | 2005 | | 2007 |

D. Jeffery Lykins | | 44 | | Director | | 2005 | | 2007 |

Darleen M. Myers | | 73 | | Director | | 1995 | | 2007 |

Robert A. Raizk | | 51 | | Director | | 1995 | | 2007 |

Charles L. Dehner was the Executive Vice President of NBTF from 1993 until January 2003, Treasurer of NBTF from 1984 until January 2003 and Executive Vice President of the Bank from 1991 until January 2003. Mr. Dehner was Senior Vice President and Controller of the Bank from 1988 to 1991.

Daniel A. DiBiasio has been the President of Wilmington College since 1995. Dr. DiBiasio holds numerous leadership positions in statewide and national higher education organizations, including the Ohio Foundation of Independent Colleges, the Association of Independent Colleges and Universities of Ohio, the Greater Cincinnati Consortium of Colleges and Universities and the NCAA Division III President’s Council.

G. David Hawley has been the Presbyterian Minister of the Indian Hill Episcopal/Presbyterian Church in Cincinnati since April 2003. Prior to that, Mr. Hawley was the Minister of the Presbyterian Church of Wilmington for 25 years. In addition, he has been a director and the Secretary of Hutchins-Rhodes Corporation, a real estate development company in Wilmington, for six years, and he served on the Board of Directors of Liberty Savings Bank in Wilmington from 1991 until 2000.

John J. Limbert was elected by the Board of Directors of NBTF and the Bank as the President, the Chief Executive Officer and a director of each of NBTF and the Bank effective March 20, 2006. From 2003 until March 2006, Mr. Limbert was the President and CEO and a director of CSB Bancorp, Inc., and The Commercial & Savings Bank, located in Millersburg, Ohio. CSB Bancorp is a public company with approximately $320 million in assets. Mr. Limbert was the Vice President of Heartland Mortgage Corporation, a subsidiary of Heartland Community Bank in Gahana, Ohio, from 2001 to 2003, and Chief Executive Officer of White Hat Group, LLC, in New Albany, Ohio, performing financial services consulting for financial institutions, prior to his employment with Heartland Mortgage Corporation.

Timothy L. Smith was the President and Chief Executive Officer of NBTF and the Bank from 1989 until March 20, 2006, and has been the Chairman of the Board of both NBTF and the Bank since May 2000. From 1988 until 1989, Mr. Smith was a Senior Vice President and Senior Loan Officer of the Bank. He is also Chairperson of Chatfield College. Effective March 21, 2006, Mr. Smith is serving as a consultant to the Bank.

5

S. Craig Beam has been the President of Six-B, Inc. since 1999. Prior to that, he was President of Melvin Stone Company from 1989 to 1999 and served as General Manager before being elected President. Mr. Beam is also a Trustee of Wilmington College, and is involved in the thoroughbred horse business.

Brooke W. James has been Business Administrator of her family’s farming operations, WMSALL Farms, since 1999. Ms. James also was a teacher at the Columbus School For Girls from 2002-2005. Ms. James was appointed to the Board of Directors of NBTF by the Board in July 2005 to fill a vacancy.

D. Jeffery Lykins has been the president of the Lykins Companies, a petroleum marketing company, since 2000. Prior to 2000, Mr. Lykins worked for the Lykins Companies in various capacities since 1981. Mr. Lykins also serves on the Boards of the Ohio Petroleum Marketers and Convenience Store Association, Petroleum Marketers Associations of America and National Oilheat Research Alliance. Mr. Lykins also serves as secretary of the Clermont County Improvement Corporation.

Darleen M. Myers has been a Clinton County Commissioner since 1994. From 1993 to 1994, Ms. Myers served as the Director of the Rainbow Village Child Day Care Center, and from 1976 to 1993, she was an Extension Agent for The Ohio Cooperative Extension Services. Ms. Myers is also a member of the Wilmington College Board of Trustees.

Robert A. Raizk has been the President and Chief Executive Officer of The Wilmington Iron & Metal Co., Inc., since August 1990. From 1985 to 1990, Mr. Raizk was a commercial real estate broker with The Tipton Group, Inc.

The Board of Directors of NBTF has determined that all of the directors except Messrs. Limbert and Smith are “independent” under the listing standards of The Nasdaq Stock Market, Inc. (“Nasdaq”).

Meetings of Directors

The Board of Directors of NBTF met 13 times for regularly scheduled and special meetings during the year ended December 31, 2005. Each director attended at least 75% of the aggregate of the meetings of the Board of Directors and the meetings held by all committees of the Board on which the director served during 2005.

Each director of NBTF is also a director of the Bank. The Board of Directors of the Bank met 12 times for regularly scheduled and special meetings during the year ended December 31, 2005.

Committees of Directors

The Board of Directors of NBTF has an Audit Committee, a Nominating Committee and an Executive Compensation Committee. The Board of Directors of the Bank has a Trust Policy Committee. Prior to April 2005, the Board of Directors of NBTF did not have an compensation committee and the functions of the current Executive Compensation Committee were performed by the the compensation committee of the Board of Directors of the Bank.

The Audit Committee is responsible for overseeing NBTF’s and the Bank’s accounting functions and controls, as well as selecting and retaining an accounting firm to audit NBTF’s financial statements. For a more complete description of the Audit Committee’s responsibilities, see “AUDIT COMMITTEE REPORT.” The members of the Audit Committee are Messrs. DiBiasio, Hawley, Lykins and Raizk and Ms. Myers, all of whom are independent under the listing standards of Nasdaq. The Audit Committee met five times in 2005.

The Nominating Committee’s purpose is to identify and recommend individuals to the Board of Directors for nomination as members of the Board and its committees and review the independence and other board memberships of directors. The committee consists of Messrs. Beam, DiBiasio, Hawley, Lykins and Raizk and Ms. Myers, all of whom are independent under the listing standards of Nasdaq. The Nominating Committee met

6

two times in 2005. A copy of the Nominating Committee Charter is available on the Company’s website at www.nbtdirect.com. The Bank paid a fee to an executive search firm to assist the Bank and NBTF in identifying potential candidates for the position of President and Chief Executive Officer, and NBTF received from such search firm information regarding Mr. Limbert’s qualifications for such executive positions and for his appointment as a director.

The Executive Compensation Committee recommends annually to the full Board of Directors the compensation for NBTF’s and the Bank’s executive officers. The members of the Executive Compensation Committee are Messrs. Beam, DiBiasio, Hawley and Raizk and Ms. Myers. The Compensation Committee met four times in 2005.

The Trust Policy Committee is responsible for the review of the administration, policies, investment holdings, investment performance, operating results, earnings, conduct and reports of examinations and audits of the Trust Department. The members of such committee are Messrs. Beam, Dehner and Smith and Ms. James. The Trust Policy Committee met 10 times during 2005.

7

EXECUTIVE OFFICERS

In addition to Mr. Limbert, the following persons are executive officers of the Bank. Those who are executive officers only of the Bank may be deemed to participate in policy making for NBTF.

| | | | |

Name

| | Age

| | Positions Held During Last Five Years

|

| | |

Craig F. Fortin | | 45 | | Senior Vice President, Chief Financial Officer of NBTF since January 2003; Senior Vice President, Chief Financial Officer and Cashier of the Bank since December 2002; Chief Financial Officer of Cornerstone Bank in Springfield, Ohio, from February 1999 to December 2002. |

| | |

Stephen G. Klumb | | 56 | | Senior Vice President, Senior Loan Officer of the Bank since June 1998. |

| | |

Andrew J. McCreanor | | 56 | | Executive Vice President of the Bank since November 2002; formerly Senior Vice President, Customer Relations of the Bank from January 1997 to November 2002. |

| | |

Walter H. Rowsey | | 57 | | Senior Vice President, Branch Administrator of the Bank since September 1993. |

| | |

Howard T. Witherby | | 50 | | Senior Vice President, Operations Division Manager of the Bank since October 1992. |

8

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Executive Compensation

The following table presents certain information regarding the compensation received by the five executive officers of NBTF or the Bank whose cash compensation was the highest and exceeded $100,000 during the fiscal years ended December 31, 2005, 2004 and 2003:

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | |

| | | | | | | | | | Long-Term

Compensation

| | All Other

Compensation (3)

|

| | | Annual Compensation (1)

| | Awards

| |

Name and Principal Position

| | Year

| | Salary($)

| | | Bonus($)

| | Securities

Underlying

Options/SARs(#)

| |

Timothy L. Smith Chief Executive Officer, President of NBTF

and Bank (until March 2006) | | 2005

2004

2003 | | $

| 274,364

268,182

264,052 | (2)

(2)

(2) | | $

| 89,786

60,798

— | | 6,000/-0-

6,000/-0-

3,000/-0- | | $

| 5,771

12,342

22,589 |

| | | | | |

Craig F. Fortin Chief Financial Officer,

Senior Vice President of NBTF and Bank | | 2005

2004

2003 | | $

| 133,347

128,281

125,000 |

| | $

| 23,601

17,959

— | | 5,500/-0-

5,500/-0-

3,000/-0- | | $

| 7,216

9,817

657 |

| | | | | |

Stephen G. Klumb Senior Vice President,

Senior Loan Officer of Bank | | 2005

2004

2003 | | $

| 146,668

140,098

137,820 |

| | $

| 27,483

21,855

— | | 3,500/-0-

3,500/-0-

2,500/-0- | | $

| 8,139

11,406

22,666 |

| | | | | |

Andrew J. McCreanor Executive Vice President of Bank | | 2005

2004

2003 | | $

| 144,014

138,543

135,000 |

| | $

| 25,881

24,938

— | | 5,400/-0-

5,000/-0-

3,000/-0- | | $

| 6,936

8,051

21,833 |

| | | | | |

Howard T. Witherby Senior Vice President of Bank | | 2005

2004

2003 | | $

| 115,534

110,627

108,828 |

| | $

| 23,720

20,962

— | | 3,500/-0-

3,500/-0-

2,500/-0- | | $

| 6,961

10,257

18,363 |

| (1) | As Mr. Limbert did not become employed by NBTF or the Bank until 2006, he received no compensation in 2005. Cash compensation does not include amounts attributable to other miscellaneous benefits received by executive officers, which consisted of the use of a Bank automobile by Mr. Smith. The cost to NBTF and the Bank of providing such benefits to each of the executive officers listed above during the years ended December 31, 2005, 2004 and 2003, was less than the lesser of $50,000 or 10% of the officer’s cash compensation. |

| (2) | Includes director’s fees of $11,700, $12,900, and $11,400 for Mr. Smith. |

9

| (3) | All other compensation is detailed in the following table: |

| | | | | | | | | | | |

Name and Principal Position

| | Year

| | ESOP

Allocations (a)

| | 401(k) Matching

Contributions

| | Whole Life

Insurance Benefit

|

Timothy L. Smith Chief Executive Officer, President of NBTF and Bank (until March 2006) | | 2005

2004

2003 | | $

| —

7,213

17,031 | | $

| 5,771

5,129

5,558 | | $

| —

—

— |

| | | | |

Craig F. Fortin Chief Financial Officer,

Senior Vice President of NBTF and Bank | | 2005

2004

2003 | |

| —

4,552

— | |

| 4,776

2,825

— | |

| 2,440

2,440

657 |

| | | | |

Stephen G. Klumb Senior Vice President,

Senior Loan Officer of Bank | | 2005

2004

2003 | |

| —

4,934

15,009 | |

| 5,339

3,672

4,857 | |

| 2,800

2,800

2,800 |

| | | | |

Andrew J. McCreanor Executive Vice President of Bank | | 2005

2004

2003 | |

| —

4,880

14,182 | |

| 4,136

371

4,851 | |

| 2,800

2,800

2,800 |

| | | | |

Howard T. Witherby Senior Vice President of Bank | | 2005

2004

2003 | |

| —

4,084

11,994 | |

| 4,161

3,373

3,569 | |

| 2,800

2,800

2,800 |

| (a) | Allocations to ESOP accounts for 2005 have not yet been determined. |

The following table sets forth information regarding all grants of options to purchase NBTF common shares made to Messrs. Smith, Fortin, Klumb, McCreanor and Witherby during 2005. Each of such options, which are not intended to qualify as incentive stock options under the Internal Revenue Code of 1986, has a term of 10 years and are immediately exercisable.

| | | | | | | | | | | | | |

Aggregated Option/SAR Grants in Last Fiscal Year

|

Individual Grants

| | Alternative to (f) and (g) Grant Date Value

(#) (1)

|

Name

| | Number of Securities

Underlying Options/SARs

Granted (#)

| | % of Total Options/

SARs Granted to Employees in

Fiscal Year

| | | Exercise or

Base Price

($/share)

| | Expiration Date

| | Grant Date

Present Value

|

Timothy L. Smith | | 6,000/-0- | | 16 | % | | $ | 23.00 | | 5/17/2015 | | $ | 20,580 |

Craig F. Fortin | | 5,500/-0- | | 15 | | | | 23.00 | | 5/17/2015 | | | 18,865 |

Stephen G. Klumb | | 3,500/-0- | | 9 | | | | 23.00 | | 5/17/2015 | | | 12,005 |

Andrew J. McCreanor | | 5,000/-0- | | 14 | | | | 23.00 | | 5/17/2015 | | | 17,150 |

Howard T. Witherby | | 3,500/-0- | | 9 | | | | 23.00 | | 5/17/2015 | | | 12,005 |

| (1) | The grant date present value was determined using a Black-Scholes option pricing model and does not necessarily reflect the value that may be realized upon the exercise of the options. The assumptions used for the model include: |

| | a. | Volatility of expected market price of common stock = 20.2% |

| | b. | Risk free interest rate = 4.12% |

| | d. | Expected life of options = 9 years |

10

The following table sets forth information regarding the number and value of unexercised options held at December 31, 2005 by Messrs. Smith, Fortin, Klumb, McCreanor and Witherby:

| | | | | | | | | | |

Aggregated Option/SAR Exercises In Last Fiscal Year and 12/31/05 Option/SAR Values

|

| | | Shares Acquired on Exercise (#)

| | Value Realized($)

| | Number of Securities

Underlying

Unexercised

Options/SARs at

12/31/05 (#)

| | Value of Unexercised

In-the-Money

Options/SARs at

12/31/05 ($) (1)

|

Name

| | | | Exercisable/

Unexercisable

| | Exercisable/

Unexercisable

|

Timothy L. Smith | | 21,400 | | $ | 121,450 | | 11,100/10,200 | | $ | -0- /4,980 |

Craig F. Fortin | | -0- | | | -0- | | 12,300/9,200 | | | -0- / -0- |

Stephen G. Klumb | | 3,000 | | | -0- | | 19,400/6,100 | | | 9,060/2,490 |

Andrew J. McCreanor | | 1,200 | | | 12,792 | | 15,400/7,600 | | | 9,060/2,490 |

Howard T. Witherby | | -0- | | | -0- | | 11,600/6,100 | | | 2,670/2,490 |

| (1) | An option is “in-the-money” if the fair market value of the underlying stock exceeds the exercise price of the option. The figure represents the value of such options, determined by multiplying the number of shares subject to unexercised options by the difference between the exercise price and the fair market value of NBTF’s common shares on December 31, 2005, of $20.80 per share. |

Option Award for Mr. Limbert

In connection with Mr.Limbert’s employment, the Board of Directors of NBTF awarded to Mr. Limbert an option to purchase 30,000 common shares of NBTF at an exercise price equal to the fair market value of a common share of NBTF on the March 20, 2006, grant date (which amount was not yet determined when this Proxy Statement was delivered to the printer). The option is exercisable one-fifth each year for five years and has a term of ten years. To the extent the option has not been exercised at the time Mr. Limbert’s employment terminates for any reason other than death, Mr. Limbert forfeits any portion of the option that has not been exercised within 90 days after termination of employment. In the event of Mr. Limbert’s death, the executor or administrator of his estate may exercise Mr. Limbert’s rights under the agreement until 180 days after Mr. Limbert’s death. Upon a “change of control” of NBTF, as defined in the Option Award Agreement, the option shall become fully exercisable. The option will not be assignable or transferable except by will or the laws of descent and distribution.

Employment and Severance Agreements

The Bank has entered into a severance agreement with each of Messrs. Fortin, Klumb, McCreanor and Witherby, which are described in this Proxy Statement within the Compensation Committee Report.

On March 3, 2006, NBTF and the Bank entered into an employment agreement with Mr. Limbert. The employment agreement provides for a three-year term commencing on March 20, 2006, subject to annual renewal by the Boards of Directors. The material terms of the employment agreement are as follows:

| | • | | Mr. Limbert will receive a base salary of $300,000 per year, subject to annual review and increase by the Board of Directors. |

| | • | | Mr. Limbert will receive a $50,000 bonus with his first paycheck. |

| | • | | Mr. Limbert will be awarded on his first day of employment a nonqualified option to purchase 30,000 common shares of NBTF at an exercise price equal to the fair market value of a common share of NBTF on the date of grant, which option is exercisable one-fifth each year for five years and has a term of ten years. |

| | • | | Mr. Limbert will be eligible for participation in life, dental, disability and other benefit plans of the Bank available to other senior management personnel; consideration for participation in any equity |

11

| | benefit plans established by NBTF or the Bank; an automobile allowance of $1,000 per month; and reimbursement for country club dues and initiation fees of not more than $50,000. |

| | • | | The Bank will pay Mr. Limbert’s temporary housing expenses for up to six months and moving expenses. |

| | • | | If Mr. Limbert’s employment is terminated following a change of control of NBTF or the Bank, Mr. Limbert will be entitled to receive approximately three times his annual compensation at the time of the change of control, subject to adjustment to ensure that such payments do not constitute an “excess parachute payment” under Section 280G of the Internal Revenue Code of 1986, as amended, and continuation of health, life and disability coverage under NBTF’s and the Bank’s plans, at the expense of NBTF and the Bank for up to 24 months. |

| | • | | If Mr. Limbert’s employment is terminated by NBTF and the Bank other than in connection with a change of control and other than for just cause, or by Mr. Limbert due to certain changes in the conditions of his employment, and before the expiration of the term of the agreement, Mr. Limbert will be entitled to a payment in the amount of his annual salary and the continuation of health, life, disability and other benefits for 18 months or until the earlier date that Mr. Limbert is employed full-time by another employer. |

| | • | | NBTF and the Bank may terminate Mr. Limbert’s employment at any time for just cause without further obligation to Mr. Limbert. |

Director Compensation

Each director of NBTF who is not a full-time employee of the Bank currently receives $600 for each meeting of the Board of Directors attended. Directors who are full-time employees of the Bank are not paid fees by NBTF. In addition, each director of NBTF who is not a full-time employee of the Bank currently receives for services as a director of the Bank a fee of $8,000 each year and $750 for each meeting of the Board of Directors attended. Directors of the Bank who are full-time employees of the Bank receive $4,500 each year and $600 for each meeting of the Board of Directors attended.

Compensation Committee Report

NBTF is a bank holding company which directly owns all of the outstanding capital stock of the Bank. NBTF’s business consists primarily of the business of the Bank. The financial results of NBTF depend primarily upon the Bank’s financial results. Executive officers of NBTF receive no compensation from NBTF. Prior to April 2005, the Executive Compensation Committee of the Bank made recommendations of compensation for executive officers of NBTF and the Bank to the Board of Directors of the Bank. In April 2005, the Board of Directors of NBTF, composed of the same individuals who constitute the Board of Directors of the Bank, appointed an Executive Compensation Committee of the NBTF Board of Directors. Since April 2005, the NBTF Executive Compensation makes executive compensation recommendations to the Boards of Directors of NBTF and the Bank. The Executive Compensation Committee of the Bank and of NBTF (the “Committee”) has always been composed of directors who are deemed independent under the rules of The Nasdaq Stock Market.

The Committee’s philosophy is to tie executive compensation to the achievement of the Bank’s goals and the resulting performance of NBTF.

The Committee’s goal is to accomplish the following specific objectives through the use of base salary and incentive plans:

(1) Motivate personnel to perform and succeed according to the goals outlined in the Bank’s annual business plan;

(2) Retain key personnel critical to the long-term success of the Bank; and

(3) Utilize incentive plans, such as stock options, that reward executives for corporate success and align the interests of management with those of the shareholders.

12

Base Salary.Base Salary is the foundation of the Bank’s compensation program, providing income on which the executive can rely, but which is not so large as to eliminate the executive’s motivation to work hard to increase shareholder value. An executive’s base salary is directly related to his or her position, job responsibilities, performance and contribution to the Bank’s success. The Committee reviews peer group information with respect to compensation and company performance on a regional and national basis to ensure salaries are competitive and in line with the industry.

Incentive Plan.The Bank also had an incentive compensation plan pursuant to which awards were based on the Bank’s achievement of predetermined goals relating to return on average equity and return on average assets, and on the participant’s achievement of goals relating to his or her individual contributions to the Bank. Threshold, target and maximum goals for corporate performance are generally established at the beginning of each fiscal year.

All awards were established as a percentage of each participant’s base salary. Awards differed due to the contribution of the individual to the Bank’s success. Participants (except the Chief Executive Officer) earned awards by achieving individual goals and assisting in achieving the Bank’s goals. The more control and influence a participant had on either individual goals or Bank goals, the greater the participant’s weighting on that particular factor. The Chief Executive Officer’s incentive plan awards were based solely on the achievement of the Bank’s goals.

If individual goals were achieved but the Bank failed to achieve its goals, no incentive award would be made to any participant. For the year ended December 31, 2005, bonuses, including the Chief Executive Officer’s, were paid below the target level, but above the minimum threshold level.

Stock Options.The Committee annually reviews the appropriateness of granting stock options to senior management. The purposes of this long-term incentive compensation are to provide an incentive to officers and key employees to promote the success of the business and thereby increase shareholder value, and to attract and retain the best available personnel. The Committee grants options based on an individual’s performance and contribution to the Bank’s success. All options granted to date have a term of 10 years.

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), prohibits a publicly-held corporation, such as NBTF, from claiming a deduction on its federal income tax return for compensation in excess of $1 million paid for a given fiscal year to the chief executive officer and the four most highly compensated officers of the corporation other than the chief executive officer at the close of the corporation’s fiscal year. The $1 million compensation deduction limitation does not apply to “performance-based compensation.”

An option award must meet several requirements to qualify as “performance-based compensation.” NBTF has determined that the options to purchase NBTF currently outstanding will not qualify for exemption from the $1 million limit. Neither NBTF nor the Bank has a policy requiring that all compensation payable in 2005 and thereafter to the covered officers be deductible under Section 162(m). The Board of Directors of both companies will, however, continue to consider carefully the after-tax cost and value to NBTF and the Bank of all compensation.

Retirement Compensation and Life Insurance.NBTF has adopted a number of benefit plans designed to protect the income of officers of NBTF or the Bank upon their retirement or death or a termination of employment in connection with a change in control of NBTF. First, NBTF has a 401(k) plan to which it makes contributions matching a certain percentage of the contributions by each employee of NBTF or the Bank, including officers. NBTF also has an employee stock ownership plan that allocates shares of NBTF to accounts of all employees proportionately on the basis of their other compensation. Finally, in 2002, NBTF adopted the NB&T Financial Group, Inc., Supplemental Executive Retirement Plan (the “SERP”), which provides benefits for certain executive officers of NBTF in the event of the termination of their employment with NBTF and the Bank for any reason other than termination by NBTF or the Bank for cause, as defined in the SERP.

13

An agreement pursuant to the SERP has been executed with Mr. Smith. Under the agreement with Mr. Smith, if his employment is terminated on or after reaching the age of 55, Mr. Smith will be paid quarterly payments for a period of twenty years after he terminates employment with NBTF. If he terminates employment after the age of 55 but before the age of 57, Mr. Smith will be entitled to payments equal to $75,000 each year. If Mr. Smith’s employment were to terminate after he reaches the age of 57, he would be entitled to payments equal to $85,000 each year. Upon a change in control of NBTF after Mr. Smith reaches age 55 but before he reaches age 57, Mr. Smith’s benefits would become vested as if he had reached age 57. Mr. Smith has retired as of March 20, 2006, at the age of 55. During 2005, 2004 and 2003, $241,733 was accrued each year for Mr. Smith’s benefit. The SERP is designed to provide incentive for the covered officer to remain with NBTF and to act in the best interests of NBTF and its shareholders with the knowledge that their income will be protected in the case of certain life-changing events.

The Bank provides a group term life insurance benefit for all full-time employees. This group term life policy provides death benefits up to three times the employee’s salary up to a maximum death benefit of $250,000. In addition, the Bank offers senior officers an option to substitute their group term life insurance coverage over $50,000 for an individual life insurance policy or annuity owned by the employee. The annual premium for such an individual policy or annuity is limited to $2,800 per year.

Severance Agreements. The Bank has also entered into a severance agreement with each of Messrs. Fortin, Klumb, McCreanor and Witherby, effective April 19, 2004, and with a term of three years, which term automatically renews each year unless the Bank provides six months’ notice of cancellation to the officer. Each agreement provides that the officer receives nothing if he is terminated for “just cause” or is terminated for any reason more than six months before a “change of control” or more than one year after a change of control.

In the event that the officer’s employment is terminated within six months before or within one year after a change of control, (i) the Bank will be required to pay to the officer or his dependents, beneficiaries or estate an amount equal to a multiple (two times for Messrs. Fortin and McCreanor, one time for Messrs. Klumb and Witherby) of (a) the higher of the officer’s base salary at the time of the change of control or the officer’s base salary at the time of termination of employment, plus (b) the highest bonus paid to the officer during the five years preceding this termination; and (ii) the officer and his dependents, beneficiaries and estate will be entitled to coverage under the health, life and disability plans of the Bank or its successor at the expenses of the Bank or its successor until the earliest of the expiration of the term of the agreement, the date the officer is included in another employer’s benefit plans as a full-time employee, or either 24 months (in the case of Messrs. Fortin and McCreanor) or 18 months (in the case of Messrs. Klumb and Witherby) after the officer’s employment is terminated. As an alternative to providing such insurance coverage, the Bank or its successor may choose to pay to the officer cash in an amount sufficient for the officer to purchase equivalent coverage until the earlier of the expiration of the term or for the stated number of months after the termination of employment. Under each of the severance agreements, the officer will also be entitled to the same payments and benefits in connection with a change of control if the officer voluntarily terminates his employment within one year following a change of control upon the occurrence of any one of certain events within six months before or one year after a change of control, including a material change in the capacity or circumstance in which the officer is employed, a change in title of the officer, a requirement that the officer move his residence or perform his principal executive functions more than 35 miles from his present primary office, or the Bank otherwise breaches the agreement.

A “change of control” includes (i) a change in ownership or power to vote of 50% of the voting stock of NBTF; (ii) the merger or consolidation of NBTF or the Bank resulting in more than 50% of the voting power of the resulting entity being owned by persons who were not formerly shareholders of NBTF; (iii) the acquisition of the ability to control the election of a majority of the directors of NBTF or the Bank; (iv) a change of a majority of the directors of NBTF or the Bank within two years, unless approved by the continuing directors; (v) the acquisition by any person of the power to direct NBTF’s management or policies, if the Board has determined that such acquisition of power constitutes a change of control under applicable banking laws; or (vi) a sale of substantially all of the Bank’s assets.

14

CEO Compensation.Timothy L. Smith was the President and the Chief Executive Officer (“CEO”) of NBTF from October 1989 until March 2006. The Committee used the executive compensation policy described above to determine Mr. Smith’s recommended compensation. All of Mr. Smith’s compensation , including retirement benefits, were considered. In setting the base salary, the Committee made an overall assessment of Mr. Smith’s leadership in achieving the Bank’s long-term strategic and business goals. In addition, the Committee used peer group information obtained from Watson Wyatt Data Services for Independent Financial Companies with average assets from $500 million to $1.9 billion.

In January 2005, the Board established target goals for return on average assets and return on average equity. In addition, threshold and maximum goals were established for the bonus plan. Mr. Smith’s percentage of salary attainable at target was 45%. The Company exceeded the threshold goals, but did not meet targeted goals. As a result, Mr. Smith’s bonus was 33% of salary.

| | |

Compensation Committee |

| |

| S. Craig Beam | | Darleen M. Myers |

| G. David Hawley | | Robert A. Raizk |

| Daniel A. DiBiasio | | |

Compensation Committee Interlocks and Insider Participation

The Board of Directors of NBTF has a Compensation Committee whose members are Messrs. Beam, DiBiasio, Hawley and Raizk and Ms. Myers. None of such persons are employees of the Bank or NBTF, none was formerly an officer of NBTF or a subsidiary of NBTF, and none had any business relationship required to be disclosed in this Proxy Statement.

15

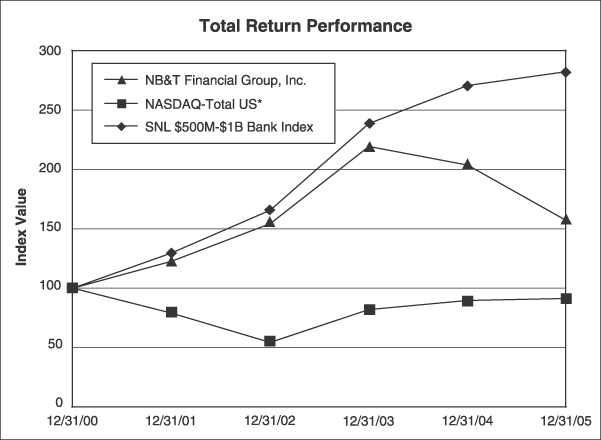

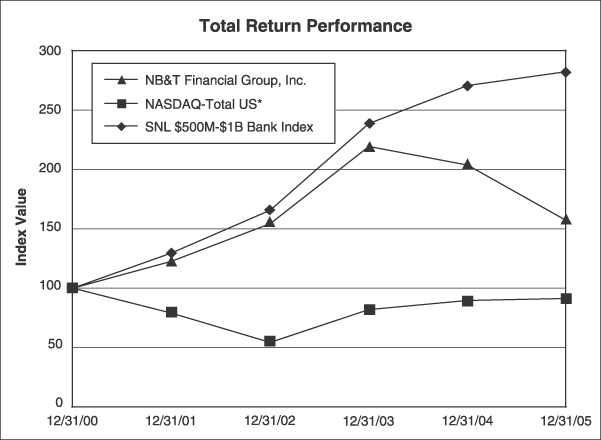

Performance Graph

The following line graph compares the yearly percentage change in NBTF’s cumulative total shareholder return against the cumulative return of The Nasdaq National Market, and an index of banks with total assets of $500 million to $1 billion. The graph assumes the investment of $100 on December 31, 2000. Cumulative total shareholder return is measured by dividing (i) the sum of (A) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (B) the difference between the price of NBTF’s common shares at the end and at the beginning of the measurement period; by (ii) the price of NBTF’s common shares at the beginning of the measurement period.

NB&T Financial Group, Inc.

| | | | | | | | | | | | |

Index

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

| | 12/31/05

|

NB&T Financial Group, Inc. | | 100.00 | | 122.91 | | 154.47 | | 219.38 | | 203.76 | | 157.14 |

NASDAQ—Total US* | | 100.00 | | 79.18 | | 54.44 | | 82.09 | | 89.59 | | 91.54 |

SNL $500M-$1B Bank Index | | 100.00 | | 129.74 | | 165.63 | | 238.84 | | 270.66 | | 282.26 |

* Source: SNL Financial LC, Charlottesville, VA. (434) 977-1600 2006

16

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Bank occasionally makes loans of various types to directors, officers and employees of the Bank. Loans are offered to all employees of the Bank, including executive officers, at an interest rate that is 25 basis points less than the rate offered on similar loans to others. All loans outstanding to executive officers during 2005 were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other Bank customers and did not involve more than the normal risk of collectibility or present other unfavorable features.

Loans to non-employee directors outstanding during the last year were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other Bank customers and did not involve more than the normal risk of collectibility or present other unfavorable features.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the federal securities laws, NBTF’s directors and executive officers and persons holding more than ten percent of the common shares of NBTF are required to report their ownership of common shares and changes in such ownership to the Securities and Exchange Commission (the “SEC”) and NBTF. The SEC has established specific due dates for such reports. Based upon a review of such reports, NBTF must disclose any failures to file such reports timely in Proxy Statements used in connection with annual meetings of shareholders. No such failures occurred during 2005.

17

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors of NBTF is comprised of five directors, all of whom are considered “independent” under Rule 4200(a)(14) of the National Association of Securities Dealers’ listing standards. The Audit Committee is responsible for overseeing NBTF’s accounting functions and controls, as well as selecting and retaining an accounting firm to audit NBTF’s financial statements. The Board of Directors has adopted a Charter to set forth the responsibilities of the Audit Committee.

The Audit Committee received and reviewed the report of BKD, LLP (“BKD”) regarding the results of their audit, as well as the written disclosures and the letter from BKD required by Independence Standards Board Standard No. 1. The Audit Committee reviewed the audited financial statements with the management of NBTF. A representative of BKD also discussed with the Audit Committee the independence of BKD from NBTF, as well as the matters required to be discussed by Statement of Auditing Standards 61, as amended and supplemented. Discussions between the Audit Committee and the representative of BKD included the following:

| | • | | BKD’s responsibilities in accordance with generally accepted auditing standards |

| | • | | The initial selection of, and whether there were any changes in, significant accounting policies or their application |

| | • | | Management’s judgments and accounting estimates |

| | • | | Whether there were any significant audit adjustments or uncorrected misstatements determined by management to be immaterial |

| | • | | Whether there were any disagreements with management |

| | • | | Whether there was any consultation with other accountants |

| | • | | Whether there were any major issues discussed with management prior to BKD’s retention |

| | • | | Whether BKD encountered any difficulties in performing the audit |

| | • | | BKD’s judgments about the quality of NBTF’s accounting principles |

| | • | | BKD’s responsibilities for information prepared by management that is included in documents containing audited financial statements |

Based on its review of the financial statements and its discussions with management and the representative of BKD, the Audit Committee did not become aware of any material misstatements or omissions in the financial statements. Accordingly, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2005, to be filed with the SEC.

Submitted by the Audit Committee:

| | |

| Daniel A. DiBiasio | | Darleen M. Myers |

| G. David Hawley | | Robert A. Raizk |

| D. Jeffery Lykins | | |

18

AUDITORS

NBTF engaged BKD as NBTF’s independent certified public accountants effective March 19, 2002.

Management of NBTF expects that a representative of BKD will be present at the Annual Meeting, will have the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Audit Fees

BKD billed NBTF $91,300 and $84,450 for professional services in connection with the audit of NBTF’s annual financial statements and the review of financial statements included in NBTF’s Forms 10-Q during 2005 and 2004.

Audit Related Fees

During 2005 and 2004, BKD billed NBTF $24,965 and $18,335 for assurance and related services concerning financial accounting and audits of two employee benefit plans and not included under “Audit Fees.”

Tax Fees

During 2005 and 2004, BKD billed NBTF $13,950 and $11,785 for tax compliance, tax planning and tax advice services,including preparation of tax returns.

All Other Fees

During 2005 and 2004, BKD performed no services for NBTF and the Bank other than the services discussed in “Audit Fees”, “Audit Related Fees” or “Tax Fees.”

The Audit Committee of NBTF pre-approves all services to be performed by its independent auditor for NBTF, and during 2005, all services provided by BKD for NBTF were approved in advance by NBTF’s Audit Committee.

19

PROPOSAL TWO: APPROVAL OF NB&T FINANCIAL GROUP, INC. 2006 EQUITY PLAN

General

In 1992, the shareholders of NBTF approved a nonqualified stock option plan (the “1992 Plan”), pursuant to which the only type of equity award authorized is a nonqualified stock option and which permitted awards only to employees, not to non-employee directors. The 1992 Plan has no termination date. There are currently outstanding options to purchase 146,500 common shares of NBTF.

The Board of Directors proposes to replace the 1992 Plan with the 2006 Equity Plan, which will permit additional types of equity awards and will permit option awards to non-employee directors. The Board of Directors of NBTF has voted to terminate the 1992 Plan effective upon the approval by the shareholders of NBTF of the 2006 Equity Plan. The termination of the 1992 Plan would not affect outstanding awards under the 1992 Plan, but no awards would be granted after the awards made in May 2005.

We are asking shareholders to approve the 2006 Equity Plan.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE 2006 EQUITY PLAN.

The 2006 Equity Plan is intended to foster and promote the long-term financial success of NBTF and its subsidiaries and to increase shareholder value by:

| | • | | Providing employees and directors an opportunity to acquire an ownership interest in NBTF. Under the 2006 Equity Plan, NBTF will have authority to grant stock options, stock appreciation rights and restricted stock awards to employees and non-employee directors of NBTF and its subsidiaries. |

| | • | | Enabling NBTF and its subsidiaries to attract and obtain the services of outstanding employees and directors upon whose judgment, interest and special efforts the successful conduct of the business of NBTF and its subsidiaries is largely dependent. The various types of equity awards available under the 2006 Equity Plan will give NBTF flexibility to respond to market-competitive changes in equity compensation practices. |

Summary of the 2006 Equity Plan

The principal features of the 2006 Equity Plan are summarized below. The complete text is set forth in Appendix A to this Proxy Statement.

Plan Administration. The Compensation Committee of the Board of Directors of NBTF (the “Committee”), is responsible for administering the 2006 Equity Plan, and will have all powers appropriate and necessary for that purpose. The amount and terms of all equity awards will be determined by the entire Board of Directors, except that the amounts and vesting schedule of awards to non-employee directors are set forth under the 2006 Equity Plan.

The Committee has the authority to, among other things:

| | • | | interpret the 2006 Equity Plan; |

| | • | | adopt, amend and rescind rules and regulations relating to the administration of the 2006 Equity Plan; and |

| | • | | make recommendations as to which employees of NBTF or any subsidiary of NBTF (“Employees”) will be granted awards, the type of awards to be granted and the terms and conditions of the awards. |

The Board of Directors has the final authority to decide which Employees will be granted awards, the types of award to be granted to each Employee, and the terms and conditions of each award to both Employees and non-employee directors, subject to certain limitations set forth in the 2006 Equity Plan.

20

None of NBTF, the Board or the Committee, however, may reprice any award without the approval of NBTF’s shareholders.

So long as permitted by law, the Committee may delegate to any individual (including Employees) or entity that it deems appropriate any of its ministerial duties and authority, but not the discretionary aspects of its duties and authority.

Eligibility for Awards. The 2006 Equity Plan permits the Board of Directors to grant awards to any Employee, although it is anticipated that only executives and key managers generally will be considered for discretionary awards. Currently, there are approximately eight executives and key managers of NBTF and its subsidiaries who would be eligible for an award under the 2006 Equity Plan. The selection of Employee participants and the nature and size of their awards are within the discretion of the Board of Directors. A total of nine non-employee directors currently would receive awards as set forth in the 2006 Equity Plan.

Awards. The 2006 Equity Plan provides for the grant of non-qualified stock options, incentive stock options that qualify under Section 422 of the Code, stock appreciation rights, and restricted stock, each as defined in the 2006 Equity Plan.

Authorized Shares and Limitations on Grants.The 2006 Equity Plan authorizes the issuance of 270,000 common shares of NBTF. If shares subject to an award granted under the 2006 Equity Plan are forfeited, terminated, exchanged or otherwise settled without the issuance of shares or the payment of cash, the shares associated with that award will be available for future grants. The shares issued pursuant to the 2006 Equity Plan may consist, in whole or in part, of authorized and unissued shares not reserved for any other purpose or treasury shares.

During any fiscal year, no Employee whose compensation is (or likely will be) subject to limited deductibility under Section 162(m) of the Code (a “Covered Employee”) may receive options and stock appreciation rights covering more than 12,000 common shares of NBTF in the aggregate (including any shares in respect of awards that have been cancelled) and restricted stock awards covering more than 2,000 shares, in each case subject to later adjustment as described below under the heading “Adjustments.”

Adjustments. If a corporate transaction affects NBTF’s outstanding shares, such as a stock dividend, stock split, recapitalization, merger or other similar corporate change, the Committee will make such adjustments as it deems necessary or appropriate to the number of shares authorized for issuance pursuant to the 2006 Equity Plan and to the individual limitations described in this discussion. The Committee also will make adjustments to outstanding awards previously granted under the 2006 Equity Plan as it deems necessary or appropriate. Any such decision by the Committee will be final and binding on all participants.

Options. Options to purchase common shares of NBTF may be in the form of a non-qualified stock option or an incentive stock option. Incentive stock options may be granted only to Employees and may not be issued to non-employee directors.

The price at which a share may be purchased under an option (the exercise price) will be determined by the Committee, but may not be less than the fair market value (as defined in the 2006 Equity Plan) of a common share on the date the option is granted (subject to later adjustment as described above under the heading “Adjustments”). The exercise price of an incentive stock option granted to an Employee who owns (as defined in the Code) shares of NBTF possessing more than 10 percent of the voting power of NBTF (a “10% Holder”), determined under rules issued by the Internal Revenue Service (“IRS”), may not be less than 110 percent of the fair market value of a common share of NBTF on the date the option is granted.

The Committee may establish the term of each option, but no incentive stock option may be exercised after 10 years from the grant date (5 years if the Employee is a 10% Holder). Options granted to non-employee

21

directors will become exercisable at the rate of one third each year beginning on and after the grant date. Options awarded to Employees will become exercisable according to a schedule determined by the Board of Directors at the time the award is made, but no Employee option will become exercisable at a rate of less than one third each year on and after the grant date.

The number of incentive stock options that become exercisable for the first time in any year cannot relate to shares of common shares of NBTF having a fair market value (determined on the date of grant) of more than $100,000 per Employee.

The exercise price of any option must be paid in the manner specified in the associated award agreement, which may include payment in cash (or a cash equivalent), a cashless exercise and tendering common shares of NBTF the participant already has owned for at least six months as partial or full payment of the exercise price.

Director Option Grants. The 2006 Equity Plan provides for automatic grants of non-qualified stock options to non-employee directors. During any fiscal year, the Board will grant to NBTF’s non-employee directors non-qualified stock options to purchase 1,000 shares. In addition, the Board will grant to each of NBTF’s non-employee directors a non-qualified stock option to purchase 1,000 shares on the date immediately following the director’s initially becoming a director. The number of awards granted to NBTF’s non-employee directors is subject to later adjustment as described under the heading “Adjustments.”

Stock Appreciation Rights. Stock appreciation rights (“SARs”) may be granted under the Plan. The exercise price of an SAR must be equal to or greater than the fair market value of the NBTF’s common shares on the date of grant (subject to later adjustment as described above under the heading “Adjustments”). An Employee exercising an SAR receives the number of whole shares equal to the difference between the fair market value of a common share of NBTF on the exercise date and the exercise price, multiplied by the number of shares with respect to which the SAR is exercised. The value of any fractional shares of Common Stock otherwise receivable upon the exercise of an SAR will be settled in cash.

Restricted Stock.Restricted stock consists of common shares of NBTF that are issued to a participant but which are subject to restrictions on transfer and the risk of forfeiture if certain specified conditions are not met. Restricted stock may not be sold or otherwise transferred or hypothecated until the end of the transfer restriction period established by the Committee, which will lapse as described in the associated award agreement. Unless otherwise specified in the award agreement, the restriction period will lapse no later than three years after the grant date. During the restriction period, restricted stock granted to a participant will be held by NBTF as escrow agent. Restricted stock will vest, with the associated restrictions on transfer lapsing, if time-based conditions are met.

Restricted stock will be forfeited if all conditions to the lapse of transfer restrictions and risk of forfeiture have not been met. Restricted stock held in escrow will not be released until all restrictions have been met at the end of the applicable restriction period. Restricted stock that has been forfeited will again become available under the 2006 Equity Plan for future awards.

Unless the associated award agreement specifies otherwise, a participant who has been granted restricted stock will have the right to receive dividends on such shares and will have the right to vote such shares during the restriction period.

Award Agreements.By accepting an award, a participant will have agreed to be bound by the terms of the 2006 Equity Plan and the award agreement between the participant and NBTF that sets forth the terms and conditions of the award.

22

Effect of Termination of Service on Awards

Unless the associated award agreement provides otherwise, the following rules apply to all awards granted under the 2006 Equity Plan when a participant terminates service as an employee or non-employee director, as the case may be:

Death or Disability.Unless the associated award agreement provides otherwise, if a participant’s employment (or, in the case of a non-employee director, his or her board service) terminates because of death or disability (as defined in the 2006 Equity Plan):

| | • | | all restricted stock held by the participant that is unvested at the time of termination of employment (or board service in the case of a non-employee director) will become fully vested; |

| | • | | all non-qualified stock options and SARs (whether or not then exercisable) held by the participant at the time of termination of employment (or board service in the case of a non-employee director) will be exercisable by the participant’s beneficiaries at any time before the earlier of the normal expiration date of the award or one year after the participant’s death or disability; and |

| | • | | all incentive stock options held by the Employee at the time of termination of employment will be exercisable by the Employee’s beneficiaries at any time before the earlier of the normal expiration date of the award and one year after the Employee’s death or disability, with any incentive stock option not exercised within three months of death or disability being treated as a non-qualified stock option. |

Retirement. Unless the associated award agreement provides otherwise, if a participating Employee’s employment terminates because of retirement:

| | • | | all restricted stock (whether or not then vested) held by the participant when the participant retires will become fully vested; |

| | • | | all non-qualified stock options and SARs (whether or not then exercisable) held by the participant when the participant retires will be exercisable by the participant at any time before the earlier of the normal expiration date of the award and one year after the retirement date; and |

| | • | | all incentive stock options held by the Employee when the employee retires will be exercisable by the Employee at any time before the earlier of the normal expiration date of the award and one year after the retirement date; except that any incentive stock option not exercised within three months after the Employee retires will be treated as a non-qualified stock option. |

For purposes of the 2006 Equity Plan, “retirement” is defined as any termination of employment on or after reaching age 55 and after qualifying to receive benefits under any defined benefit type deferred compensation arrangement maintained by NBTF or any subsidiary.

Involuntary Termination of Service for Cause. Unless the associated award agreement provides otherwise, all outstanding awards will be forfeited if an Employee’s employment is terminated for cause (as defined in the 2006 Equity Plan) as of the date of termination of service.

Termination for any Other Reason. Unless otherwise specified in the associated award agreement, any awards that are exercisable when a participant terminates for any reason other than death, disability, retirement or cause may be exercised at any time before the earlier of the normal expiration date of the award and 90 days after the termination date. All options and SARs not exercisable on the termination date and all unvested restricted stock will terminate on the termination date unless otherwise specified in the award agreement.

Buy-out of Awards.At any time before a change in control, the Committee, in its sole discretion, may offer to buy for cash or by substitution of another award any or all outstanding awards held by any participant, whether or not exercisable, by providing to the participant written notice of its intention to exercise its right. If NBTF makes an offer to buy outstanding awards, it will transfer to each participant accepting the offer the value of the award to be purchased or exchanged, or determined by the Committee, as soon as administratively possible.

23

Merger, Consolidation or Similar Events.If NBTF undergoes a Change in Control (as defined in the 2006 Equity Plan), all of a participant’s awards will be treated as provided in the associated award agreement or in a separate written change in control or similar agreement between the participant and NBTF or any subsidiary.

Amendment, Modification and Termination of Plan. The 2006 Equity Plan was adopted by NBTF’s Board of Directors on March 21, 2006, and will become effective upon the approval by the shareholders at the 2006 Annual Meeting. If approved by NBTF’s shareholders, the 2006 Equity Plan will remain in effect until March 21, 2016.

NBTF may terminate, suspend or amend the 2006 Equity Plan at any time without shareholder approval except to the extent that shareholder approval is required to satisfy applicable requirements imposed by Rule 16b-3 under the Securities Exchange Act of 1934, or any successor rule or regulation, applicable requirements of the Code or applicable requirements of any securities exchange, market or other quotation system on which NBTF’s securities are listed or traded. No amendment of the 2006 Equity Plan may (i) result in the loss of a Committee member’s status as a “non-employee director” as defined in Rule 16b-3 under the Securities Exhange Act of 1934 or any successor rule or regulation, (ii) cause the 2006 Equity Plan to fail to meet the requirements of Rule 16b-3 or (iii) except as otherwise provided in the 2006 Equity Plan or in the participant’s award agreement, without the consent of the participant, adversely affect any award held by such participant.

U.S. Federal Income Tax Consequences

The following is a brief summary of the general U.S. federal income and employment tax consequences relating to the 2006 Equity Plan. This summary is based on U.S. federal tax laws and regulations in effect on the date of this proxy statement and does not purport to be a complete description of the U.S. federal income or employment tax laws.

Section 409A of the Internal Revenue Code. In 2004, the Internal Revenue Code was amended to add Section 409A, which creates new rules for amounts deferred under “nonqualified deferred compensation plans.” Section 409A includes a broad definition of nonqualified deferred compensation plans which may extend to various types of awards granted under the 2006 Equity Plan. The proceeds of any grant that is subject to Section 409A are subject to a 20 percent excise tax if those proceeds are distributed before the recipient separates from service or before the occurrence of other specified events, such as death, disability or a change of control, all as defined in Section 409A. The IRS has not finalized regulations describing the effect of Section 409A on the types of awards issuable pursuant to the 2006 Equity Plan. The Committee intends to administer the 2006 Equity Plan to avoid or minimize the effect of Section 409A and, if necessary, will amend the 2006 Plan to comply with Section 409A before December 31, 2006 (or a later date specified by the IRS).

ISOs. ISOs are intended to qualify for special treatment available under Section 422 of the Internal Revenue Code. A participant will not recognize any income when an ISO is granted or exercised, and NBTF will not receive a deduction at either of those times. Also, ISOs are not subject to employment taxes.

If a participant acquires common shares of NBTF by exercising an ISO and continues to hold those common shares for one year or, if longer, until the second anniversary of the grant date (each of these periods is called an “ISO Holding Period”), the amount the participant receives when he or she disposes of the common shares minus the exercise price will be taxable at long-term capital gain or loss rates (this is referred to as a “qualifying disposition”), depending on whether the amount the participant receives when he or she disposes of the common shares is larger or smaller than the exercise price he or she paid. Upon a qualifying disposition, NBTF is not entitled to a deduction.

If a participant disposes of the common shares before the end of either ISO Holding Period (this is referred to as a “disqualifying disposition”), the participant will recognize compensation income equal to the excess, if any, of (1) the fair market value of the common shares on the date the ISO was exercised, or, if less, the amount

24

received on the disposition, over (2) the exercise price. NBTF will be entitled to a deduction equal to the income that the participant recognizes. The participant’s additional gain will be taxable at long-term or short-term capital gain rates (depending on whether he or she held the common shares for more than one year).