SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | |

| |

Filed by the Registrant x | | |

| |

Filed by a Party other than the Registrant ¨ | | |

| |

Check the appropriate box: | | |

| |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

| |

x Definitive Proxy Statement | | |

| |

¨ Definitive Additional Materials | | |

| |

¨ Soliciting Material Pursuant to Section 240.14a-12 | | |

NB&T Financial Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NB&T FINANCIAL GROUP, INC.

48 N. South Street

Wilmington, Ohio 45177

(937) 382-1441

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Notice is hereby given that the 2008 Annual Meeting of Shareholders of NB&T Financial Group, Inc. ("NBTF"), will be held at 48 N. South Street, Wilmington, Ohio, on April 22, 2008, at 9:00 a.m., Eastern Time (the "Annual Meeting"), for the following purposes:

| | 1. | To elect five directors of NBTF for terms expiring in 2010; and |

| | 2. | To transact such other business as may properly come before the Annual Meeting or any adjournments of the Annual Meeting. |

Such matters are more completely described in the accompanying Proxy Statement.

Only shareholders of NBTF of record at the close of business on March 3, 2008, will be entitled to receive notice of and to vote at the Annual Meeting and at any adjournments. Whether or not you expect to attend the Annual Meeting, we urge you to consider the accompanying Proxy Statement carefully and to SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND THE PRESENCE OF A QUORUM MAY BE ASSURED. If you submit a Proxy, you may still vote in person in the event you attend the Annual Meeting.

By Order of the Board of Directors

March 27, 2008 | Charles L. Dehner, Secretary |

NB&T FINANCIAL GROUP, INC.

48 N. South Street

Wilmington, Ohio 45177

(937) 382-1441

PROXY STATEMENT

PROXIES

The enclosed Proxy is being solicited by the Board of Directors of NB&T Financial Group, Inc. ("NBTF"), an Ohio Corporation, for use at the 2008 annual meeting of shareholders of NBTF and at any adjournments of the meeting. The annual meeting will held at 48 N. South Street, Wilmington, Ohio, on April 22, 2008, at 9:00 a.m., Eastern Time. Without affecting any vote previously taken, the Proxy may be revoked by a shareholder by a later dated proxy received by NBTF before the Proxy is exercised or by giving notice of revocation to NBTF in writing before the annual meeting or in open meeting. Attendance at the annual meeting will not, of itself, revoke a Proxy.

Each properly executed Proxy received prior to the annual meeting and not revoked will be voted as specified on the Proxy or, in the absence of specific instructions to the contrary, will be voted:

FOR the election of Charles L. Dehner, Daniel A DiBiasio, G. David Hawley, John J. Limbert and Timothy L. Smith as directors of NBTF for terms expiring in 2010.

Proxies may be solicited by the directors, officers and other employees of NBTF in person or by mail, telephone, facsimile or electronic mail only for use at the annual meeting. Such Proxies will not be used for any other meeting. The cost of soliciting Proxies will be paid by NBTF.

Only shareholders of record as of the close of business on March 3, 2008 are eligible to vote at the annual meeting and will be entitled to cast one vote for each share owned. NBTF's records disclose that, as of March 3, 2008, there were 3,175,051 votes entitled to be cast at the annual meeting.

This Proxy Statement is first being mailed to shareholders of NBTF on or about March 27, 2008.

1

VOTE REQUIRED

The presence, in person or by proxy, of a majority of the issued and outstanding shares entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Under Ohio law, shares held by a nominee for a beneficial owner which are represented in person or by proxy but which are not voted ("non-votes") are counted as present for purposes of establishing a quorum. Shares as to which the authority to vote is withheld and non-votes are not counted toward the election of directors or toward the election of the individual nominees specified on the form of proxy. The five nominees receiving the greatest number of votes will be elected as directors.

VOTING SECURITIES AND OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the only persons known to NBTF to own beneficially more than five percent of NBTF's outstanding common shares as of March 3, 2008:

| | | | | |

Name and Address Of Beneficial Owner

| | Amount Beneficially

Owned (1)

| | Percent of

Common Shares

Outstanding

| |

Janet M. Williams (2) B. Anthony Williams Trust 6172 U. S. 22 East Wilmington, Ohio 45177 | | 374,196 | | 11.79 | % |

| | |

Brooke W. James (3) 325 West Sixth Ave. Columbus, Ohio 43201 | | 183,241 | | 5.77 | |

| | |

Dana L. Williams 738 Kerr Street Columbus, Ohio 43215 | | 183,456 | | 5.78 | |

| | |

Lynn W. Cowan 166 Stanbery Avenue Bexley, Ohio 43209 | | 181,898 | | 5.73 | |

| | |

Beth Ellingwood 1127 Neil Ave. Columbus, Ohio 43201 | | 209,882 | | 6.61 | |

| | |

The National Bank and Trust Company (4) 48 N. South Street Wilmington, Ohio 45177 | | 633,897 | | 19.96 | |

| (1) | Except as indicated for the shares held by The National Bank and Trust Company (the "Bank"), the beneficial owner has sole voting and dispositive power. |

| (2) | Of the 374,196 shares, 188,826 are held in the name of Mrs. Williams, and 185,370 are held by the B. Anthony Williams Trust, of which Mrs. Williams is the trustee. |

| (3) | Includes 999 shares that may be acquired upon the exercise of an option within the next 60 days. |

| (4) | All of such shares are held by the Bank as Trustee, 528,617 of which are held as Trustee for the NB&T Financial Group, Inc., Employee Stock Ownership Plan (the "ESOP"). Pursuant to the ESOP, the Bank, as Trustee, has the power to vote in its sole discretion all ESOP shares that have not been allocated to the accounts of participants. At March 3, 2008, 48,830 shares had not been allocated. The Trustee may dispose of shares held in the ESOP Trust only under limited circumstances specified in the ESOP or by law. The Bank also has sole voting and sole dispositive power with respect to 143,916 and 105,480 shares, respectively, held as Trustee for various other trusts. |

2

The following table sets forth certain information with respect to the number of common shares of NBTF beneficially owned by each director of NBTF and each executive officer or former executive officer named in the Summary Compensation Table, and by all directors and executive officers of NBTF or the Bank as a group as of March 3, 2008:

| | | | | | | | | |

| | | Amount and Nature of

Beneficial Ownership

| | | Percent of Common

Shares Outstanding

| |

Name

| | Sole Voting and

Investment Power (1)

| | | Shared Voting and

Investment Power

| | |

S. Craig Beam | | 7,281 | | | 16,104 | | | 0.74 | % |

Charles L. Dehner | | 54,438 | (2) | | 38,761 | (3) | | 2.93 | |

Daniel A. DiBiasio | | 1,052 | | | -0- | | | 0.03 | |

G. David Hawley | | 7,984 | | | 2,414 | | | 0.33 | |

Brooke W. James | | 183,241 | | | -0- | | | 5.77 | |

John J. Limbert | | 23,595 | (4) | | -0- | | | 0.74 | |

D. Jeffery Lykins | | 1,589 | | | 1,610 | | | 0.10 | |

Darleen M. Myers | | 9,747 | | | -0- | | | 0.31 | |

Robert A. Raizk | | 15,467 | | | -0- | | | 0.49 | |

Timothy L. Smith | | 20,581 | | | 77,491 | (5) | | 3.09 | |

Craig F. Fortin | | 24,590 | (6) | | 587 | (7) | | 0.79 | |

Stephen G. Klumb | | 32,542 | (8) | | 3,968 | (9) | | 1.14 | |

All directors and executive officers of NBTF as a group (15 persons) | | 427,757 | (10) | | 196,528 | | | 19.03 | % |

| (1) | Includes for each director other than Mr. Limbert 999 shares that may be acquired upon the exercise of an option within the next 60 days. |

| (2) | Includes 8,310 shares that are pledged as security. |

| (3) | Includes 38,705 shares allocated to Mr. Dehner's ESOP account, with respect to which Mr. Dehner has voting but not investment power. |

| (4) | Includes 12,000 shares that may be acquired upon the exercise of an option within the next 60 days. |

| (5) | Includes 49,005 shares allocated to Mr. Smith's ESOP account, with respect to which Mr. Smith has voting but not investment power. |

| (6) | Includes 22,233 shares that may be acquired currently upon the exercise of options. |

| (7) | Consists of shares allocated to Mr. Fortin’s ESOP account, with respect to which Mr. Fortin has voting but not investment power. |

| (8) | Includes 25,967 shares that may be acquired currently upon the exercise of options. |

| (9) | Includes 3,838 shares allocated to Mr. Klumb's ESOP account, with respect to which Mr. Klumb has voting but not investment power. |

| (10) | Includes 36,934 shares that may be acquired currently upon the exercise of options by executive officers of the Bank not named in this table who may be deemed to act as officers of NBTF. |

3

ELECTION OF DIRECTORS

Election of Directors

The Third Amended and Restated Articles of Incorporation of NBTF provide for a board of directors consisting of not less than seven nor more than eleven directors, such number to be fixed or changed by the board of directors or the shareholders. The board of directors has set the number of directors at ten. The directors are divided into two classes, each class serving for a two-year period. Five directors are to be elected at the annual meeting.

In accordance with Section 8.04 of the articles of incorporation, nominees for election as directors may be proposed only by the directors or by any shareholder entitled to vote for directors if such shareholder makes a timely notice to the Secretary of NBTF. To be timely, a shareholder's notice must be delivered to or mailed and received at the principal executive offices of NBTF on or before the later of (a) the February 15 immediately preceding the annual meeting of shareholders or (b) the sixtieth day before the first anniversary of the most recent annual meeting of shareholders; provided, however, that in the event that the annual meeting in any year is not held on or before the 31st day next following such anniversary, then the written notice shall be received by the Secretary within a reasonable time prior to the date of such meeting. In the case of a nominee proposed for election at a special meeting of shareholders at which directors are to be elected, such written notice of a proposed nominee by a shareholder must be received not later than the close of business on the seventh day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure was made. Such shareholder's notice shall set forth (a) as to each person who is not an incumbent director whom a shareholder proposes to nominate for election as a director (i) the name, age, business address and residence address of such person; (ii) the principal occupation or employment of such person; (iii) the class and number of shares of NBTF that are beneficially owned by such person; and (iv) any other information relating to such person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; and (b) as to the shareholder giving the notice, (i) the name and record address of such shareholder and (ii) the class and number of shares of NBTF that are beneficially owned by such shareholder. Such notice shall be accompanied by the written consent of each proposed nominee to serve as a director of NBTF, if elected.

The Nominating Committee will consider nominees for directors of NBTF recommended by a shareholder who submits the person's name and qualifications in writing. The Nominating Committee has no specific minimum qualifications for a recommended candidate, and the committee does not consider shareholder-recommended candidates differently from others. The Nominating Committee considers:

| | • | | personal qualities and characteristics, accomplishments and reputation in the business community; |

| | • | | relationships in the communities in which NBTF does business; |

| | • | | ability and willingness to commit adequate time to Board and committee responsibilities; |

| | • | | the individual's skills and experiences and how they fit with those of other directors and potential directors and satisfy the needs of NBTF; and |

| | • | | whether the potential nominees are shareholders of NBTF. |

The Nominating Committee makes its recommendation to the board of directors. Nominees are selected by vote of all of the directors of the board of directors.

4

The board of directors proposes the election of the following persons, all of whom were recommended by the Nominating Committee, to terms that will expire in 2010:

| | | | | | |

Name

| | Age

| | Position(s) Held

| | Director

Since

|

Charles L. Dehner | | 60 | | Director | | 1989 |

Daniel A. DiBiasio | | 58 | | Director | | 2001 |

G. David Hawley | | 60 | | Director | | 2000 |

John J. Limbert | | 60 | | Director, Chief Executive Officer and President of NBTF and the Bank | | 2006 |

Timothy L. Smith | | 57 | | Director and Chairman of the Board of NBTF and the Bank | | 1989 |

If any nominee is unable to stand for election, the Proxies will be voted for such substitute as the board of directors recommends.

The following directors will continue to serve after the annual meeting for the terms indicated:

| | | | | | | | |

Name

| | Age

| | Position Held

| | Director

Since

| | Term

Expires

|

S. Craig Beam | | 56 | | Director | | 1990 | | 2009 |

Brooke W. James | | 35 | | Director | | 2005 | | 2009 |

D. Jeffery Lykins | | 47 | | Director | | 2005 | | 2009 |

Darleen M. Myers | | 75 | | Director | | 1995 | | 2009 |

Robert A. Raizk | | 53 | | Director | | 1995 | | 2009 |

Charles L. Dehner was the Executive Vice President of NBTF from 1993 until January 2003, Treasurer of NBTF from 1984 until January 2003 and Executive Vice President of the Bank from 1991 until January 2003.

Daniel A. DiBiasio has been the President of Wilmington College since 1995. Dr. DiBiasio holds numerous leadership positions in statewide and national higher education organizations, including the Ohio Foundation of Independent Colleges, the Association of Independent Colleges and Universities of Ohio, the Greater Cincinnati Consortium of Colleges and Universities and the NCAA Division III President's Council.

G. David Hawley has been the Presbyterian Minister of the Indian Hill Episcopal/Presbyterian Church in Cincinnati since April 2003. Prior to that, Mr. Hawley was the Minister of the Presbyterian Church of Wilmington for 25 years. In addition, he is a member of the Wilmington College Board of Trustees.

John J. Limbert has been the President, Chief Executive Officer and a director of NBTF and the Bank since March 20, 2006. From 2003 until March 2006, Mr. Limbert was the President and CEO and a director of CSB Bancorp, Inc., and The Commercial & Savings Bank, located in Millersburg, Ohio. Mr. Limbert was the Vice President of Heartland Mortgage Corporation, a subsidiary of Heartland Community Bank in Gahanna, Ohio, from 2001 to 2003, and Chief Executive Officer of White Hat Group, LLC, in New Albany, Ohio, performing financial services consulting for financial institutions, prior to his employment with Heartland Mortgage Corporation.

Timothy L. Smith was the President and Chief Executive Officer of NBTF and the Bank from 1989 until March 20, 2006, and has been the Chairman of the Board of both NBTF and the Bank since May 2000.

S. Craig Beam has been a member of Thorobeam Farm, LLC., a thoroughbred horse business, since December 2006, and private investor since retirement in 1999. Mr. Beam is also a Trustee of Wilmington College.

5

Brooke W. James has been Business Administrator for WMSALL Farms, her family's farming operations, since 1999, and was a teacher at the Columbus School for Girls from 2002 through 2005.

D. Jeffery Lykins has been the president of the Lykins Companies, a petroleum marketing company, since 2000. Mr. Lykins also serves on the Boards of the Ohio Petroleum Marketers and Convenience Store Association and Petroleum Marketers Associations of America. Mr. Lykins also serves as President of the Clermont County Improvement Corporation.

Darleen M. Myers was a Clinton County Commissioner from 1994 to 2006. Ms. Myers is also a member of the Wilmington College Board of Trustees.

Robert A. Raizk has been the President and Chief Executive Officer of The Wilmington Iron & Metal Co., Inc., since August 1990.

The board of directors of NBTF has determined that all of the directors except Messrs. Limbert and Smith are "independent" under the listing standards of The NASDAQ Stock Market, LLC ("NASDAQ"). In determining independence, the Board of Directors considered loan and deposit relationships with each director. The rules of NASDAQ do not deem such relationships to disqualify a director from being deemed independent. In addition, all loans and other extensions of credit were made and deposits accepted in the ordinary course of business and were made on substantially the same terms (including interest rates and collateral) as those prevailing at the time for comparable transactions with other persons. Further, in management’s opinion, the loans did not involve more than normal risk of collectibility or present other unfavorable features. The Board of Directors does not believe such relationships interfere with the directors’ exercise of independent judgment in carrying out their responsibilities as directors.

Meetings of Directors

The board of directors of NBTF met 13 times for regularly scheduled and special meetings during the year ended December 31, 2007. Each director attended at least 75% of the aggregate of the meetings of the Board of Directors and the meetings held by all committees of the Board on which the director served during 2007.

Each director of NBTF is also a director of the Bank. The board of directors of the Bank met 12 times for regularly scheduled and special meetings during the year ended December 31, 2007.

Committees of Directors

The board of directors of NBTF has an Audit Committee, a Nominating Committee and a Compensation Committee.

The Audit Committee is responsible for overseeing NBTF's and the Bank's accounting functions and controls, as well as selecting and retaining an accounting firm to audit NBTF's financial statements. For a more complete description of the Audit Committee's responsibilities, see "AUDIT COMMITTEE REPORT." The members of the Audit Committee are independent under the listing standards of NASDAQ. A copy of the Audit Committee Charter is available on NBTF’s website at www.nbtdirect.com.

The Nominating Committee's purpose is to identify and recommend individuals to the board of directors for nomination as members of the board and its committees and review the independence and other board memberships of directors. The members of the Nominating Committee are independent under the listing standards of NASDAQ. A copy of the Nominating Committee Charter is available on NBTF’s website at www.nbtdirect.com.

The Compensation Committee recommends annually to the full board of directors the compensation for NBTF's and the Bank's executive officers. The members of the Compensation Committee are independent under the listing standards of NASDAQ. The Compensation Committee does not have a charter.

6

The following table summarizes the membership of the board committees:

| | | | | | |

Name

| | Audit

Committee

Member

| | Compensation

Committee

Member

| | Nominating

Committee

Member

|

S. Craig Beam | | | | X (Chair) | | X (Chair) |

Charles L. Dehner | | X | | | | |

Daniel A. DiBiasio | | X | | X | | X |

G. David Hawley | | X (Chair) | | X | | X |

Brooke W. James | | X | | | | |

John J. Limbert | | | | | | |

D. Jeffery Lykins | | X | | X | | X |

Darleen M. Myers | | | | X | | X |

Robert A. Raizk | | X | | X | | X |

Timothy L. Smith | | | | | | |

Number of Meetings Held—2007 | | 5 | | 8 | | 0 |

7

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Processes and Procedures for Determining Director and Executive Officer Compensation

Annually, management develops a financial plan for the next year. During this planning process, management will review current salary levels along with incentive and other benefit plans. The Chief Executive Officer then meets with the Compensation Committee to provide compensation recommendations, including stock based awards, for all executive officers other than himself. With the assistance of the Bank’s Human Resource Department, he provides the Compensation Committee with peer information for comparison with the recommended salaries for executive officers and to assist the Compensation Committee in forming a recommendation for the Chief Executive’s compensation. The Compensation Committee reviews the information provided to it and determines officer salary recommendations for the year. The Compensation Committee does not delegate such authority. The Committee presents such recommendations to the full board of directors for its review and approval.

The Bank has an incentive compensation plan based on the Bank's achievement of predetermined goals established annually by the board of directors relating to earnings per share and operating income, and on the participant's achievement of goals relating to his or her individual contributions to the Bank. Awards are established as a percentage of each participant's base salary and differ due to the contribution of the individual to the Bank's success. Participants (except the Chief Executive Officer) earn awards by achieving individual goals and assisting in achieving the Bank's goals. The more control and influence a participant has on either individual goals or Bank goals, the greater the participant's weighting on that particular factor. The Chief Executive Officer's incentive plan awards are based solely on the achievement of the Bank's goals.

The Compensation Committee reviews the appropriateness of granting stock options and other equity awards to senior management. Awards are not based on any pre-determined formula or goals. Amounts realized by exercising prior options are not considered in future awards or in setting other compensation. The Committee makes recommendations to the board of directors based on an individual’s performance and contribution to the Bank's success.

Directors fees for both NBTF and the Bank are set by the full board of NBTF, with participation by the Chief Executive Officer. Each non-employee director also receives an option to purchase 1,000 common shares of NBTF on the date following each annual meeting during which the director serves as a director according to the 2006 Equity Plan approved by shareholders.

The Compensation Committee does have the authority to hire outside consultants for specific projects; however, it has not hired any outside consultants in the last two years.

Non-Employee Director Compensation

The following table describes the compensation arrangements with our non-employee directors for the 2007 and 2008 fiscal years:

| | | | | | | | | | | | |

| | | 2007

| | | | | 2008

| | | |

Annual Cash Retainers | | $ | 8,000 | | | | | $ | 8,000 | | | |

Attendance fee per meeting: | | | | | | | | | | | | |

NBTF Board Meeting | | | 600 | | | | | | 600 | | | |

Bank Board Meeting | | | 750 | | | | | | 750 | | | |

Committee Meetings | | | 0 | | | | | | 0 | | | |

Stock Options | | | 1,000 | | shares | (1) | | | 1,000 | | shares | (1) |

| (1) | Each non-employee director receives an option to purchase 1,000 common shares of NBTF on the date following each annual meeting during which the director serves as a director. The options have an exercise price equal to the closing price on the date of the grant, vest over a three-year period and expire ten years after date of grant. |

8

The following table shows the compensation paid to our non-employee directors for 2007:

2007 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | |

Name

| | Fees Earned or

Paid in Cash

($)

| | Option Awards

($) (1)

| | Nonqualified

Deferred

Compensation

Earnings

($) (2)

| | Total

($)

|

S. Craig Beam | | $ | 24,200 | | $ | 1,762 | | | | | $ | 25,962 |

Charles L. Dehner | | | 22,850 | | | 1,762 | | $ | 25,000 | | | 49,612 |

Daniel A. DiBiasio | | | 24,200 | | | 1,762 | | | | | | 25,962 |

G. David Hawley | | | 24,200 | | | 1,762 | | | | | | 25,962 |

Brooke W. James | | | 24,200 | | | 1,762 | | | | | | 25,962 |

D. Jeffery Lykins | | | 24,200 | | | 1,762 | | | | | | 25,962 |

Darleen M. Myers | | | 24,200 | | | 1,762 | | | | | | 25,962 |

Robert A. Raizk | | | 21,500 | | | 1,762 | | | | | | 23,262 |

Timothy L. Smith | | | 24,200 | | | 1,762 | | | 75,000 | | | 100,962 |

| (1) | The grant date present value was determined using a Black-Scholes option pricing model and does not necessarily reflect the value that may be realized upon the exercise of the options. Refer to Note 18 in NBTF’s financial statements included in Item 8 of Form 10-K for the year ended December 31, 2007, for the assumptions used in estimating the fair value. Each director had an outstanding option to purchase 2,000 shares at December 31, 2007. |

| (2) | In 2002, NBTF adopted the NB&T Financial Group, Inc., Supplemental Executive Retirement Plan, which provides retirement benefits for Mr. Smith and Mr. Dehner. Under the plan, Mr. Smith will be paid quarterly payments for a period of twenty years beginning in 2007. Mr. Smith will be entitled to payments equal to $75,000 each year. Mr. Dehner was entitled to annual payments of $25,000 for four years, with the final installment paid in 2007. |

Executive Officers

In addition to Mr. Limbert, the following persons are executive officers of NBTF or the Bank. Those who are executive officers only of the Bank may be deemed to participate in policy making for NBTF.

| | | | |

Name

| | Age

| | Positions Held During Last Five Years

|

W. Keith Argabright | | 36 | | Senior Vice President, Retail Bank Operations since July 2007; Regional Manager of Citizens Bank in Green Bay, Wisconsin, from April 2004 to July 2007; Senior Vice President, Retail Services of Monroe Bank in Bloomington, Indiana from May 2003 to March 2004; Vice President, Retail Sales of Monroe Bank in Bloomington, Indiana from October 2000 to May 2003. |

| | |

Craig F. Fortin | | 47 | | Senior Vice President, Chief Financial Officer of NBTF since January 2003; Senior Vice President, Chief Financial Officer and Cashier of the Bank since December 2002. |

| | |

Stephen G. Klumb | | 58 | | Senior Vice President, Senior Loan Officer of the Bank since June 1998. |

| | |

Walter H. Rowsey | | 59 | | Senior Vice President, Loan Operations Manager since August 2006; formerly Senior Vice President, Branch Administration of the Bank since 1993. |

| | |

Howard T. Witherby | | 52 | | Senior Vice President, Operations Division Manager of the Bank since October 1992. |

9

Executive Compensation

The following table presents certain information regarding the compensation received by our Chief Executive Officer and two other most highly compensated executive officers of NBTF or the Bank who served in such capacity during the fiscal year ended December 31, 2007 (the "Named Executive Officers"):

2007 SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Salary

($)(1)

| | Bonus

($)

| | | Option

Awards

($)(2)

| | Non-Equity

Incentive Plan

Compensation

($)

| | All

Other

Compensation

($)

| | Total

($)

|

John J. Limbert | | 2007 | | $ | 317,700 | | | — | | | | — | | $ | 118,422 | | $ | 24,484 | | $ | 460,606 |

Chief Executive Officer and President of NBTF and Bank | | 2006 | | | 240,819 | | $ | 50,000 | (3) | | $ | 17,959 | | | 77,885 | | | 37,163 | | | 423,826 |

Craig F. Fortin | | 2007 | | | 141,468 | | $ | 5,000 | | | | — | | | 31,830 | | | 7,678 | | | 185,976 |

Chief Financial Officer and Senior Vice President of NBTF and Bank | | 2006 | | | 137,347 | | | — | | | | 1,341 | | | 25,341 | | | 11,686 | | | 175,715 |

Stephen G. Klumb | | 2007 | | | 155,222 | | $ | 5,000 | | | | — | | | 30,424 | | | 8,586 | | | 199,231 |

Senior Vice President, Senior Loan Officer of Bank | | 2006 | | | 150,701 | | | — | | | | 853 | | | 29,839 | | | 15,125 | | | 196,518 |

| (1) | Includes director's fees of $11,700 in 2007 and $10,050 in 2006 for Mr. Limbert. |

| (2) | The grant date present value was determined using a Black-Scholes option pricing model and does not necessarily reflect the value that may be realized upon the exercise of the options. Refer to Note 18 in the Company’s financial statements included in Item 8 of Form 10-K for the year ended December 31, 2007, for the assumptions used in estimating the fair value. |

| (3) | A signing bonus paid to Mr. Limbert according to his employment agreement after accepting the position of President and Chief Executive Officer in March 2006. |

Employment and Severance Agreements.Only Mr. Limbert has an employment contract with the Company. The employment agreement between NBTF and the Bank and Mr. Limbert provides for a term commencing on November 20, 2007 and ending January 31, 2011, subject to annual renewal by the board of directors. The material terms of the employment agreement also include the following:

| | • | | Mr. Limbert will receive a base salary of $312,000 per year, subject to annual review and increase by the board of directors. |

| | • | | Mr. Limbert will receive an automobile allowance of $1,000 per month, plus reimbursement for all gasoline expenses for his primary vehicle. |

| | • | | Mr. Limbert will be eligible for participation in life, dental, disability and other benefit plans of the Bank available to other employees; consideration for participation in any equity benefit plans established by NBTF or the Bank; and reimbursement for country club dues. |

| | • | | If Mr. Limbert's employment is terminated following a change of control of the NBTF or the Bank, or if Mr. Limbert voluntarily terminates his employment within one year following a change of control due to certain changes in the conditions of Mr. Limbert's employment, Mr. Limbert will be entitled to receive approximately three times his annual salary at the time of the change of control and the highest bonus paid to Mr. Limbert during the five years preceding his termination, subject to adjustment to ensure that such payments do not constitute an "excess parachute payment" under Section 280G of the Internal Revenue Code of 1986, as amended, and continuation of health, life and disability coverage under the NBTF's and the Bank's plans, at the expense of the NBTF and the Bank for the time period allowed under COBRA or until the earlier date that Mr. Limbert is eligible to participate in similar plans |

10

| | of another employer. In addition, in the event of a change of control and termination of employment, Mr. Limbert would receive a lump sum payment of $200,000 in exchange for an agreement not to compete and not to solicit employees of customers for up to two years following termination. |

| | • | | If Mr. Limbert's employment is terminated due to his inability to perform his duties as a result of a medically diagnosable condition for a period of 180 consecutive days, Mr. Limbert will receive a payment equal to 50% of his annual salary and continued insurance coverage for 18 months. |

| | • | | If Mr. Limbert's employment is terminated by NBTF and the Bank other than in connection with a change of control and other than for just cause or due to a medically diagnosable condition and before the expiration of the term of the agreement, Mr. Limbert will be entitled to a payment in the amount of his annual salary and the continuation of health, life, disability and other benefits for 18 months or until the earlier date that Mr. Limbert is employed full-time by another employer. |

| | • | | NBTF and the Bank may terminate Mr. Limbert's employment at any time for just cause without further obligation to Mr. Limbert. |

The Bank has also entered into severance agreements with Messrs. Fortin and Klumb effective November 8, 2007, each with a term of three years, which term automatically renews each year unless the Bank provides six months’ notice of cancellation to the officer. Each agreement provides that the officer receives nothing if he is terminated for "just cause" or is terminated for any reason more than six months before a "change of control" or more than one year after a change of control.

In the event that the officer’s employment is terminated within six months before or within one year after a change of control, (i) the Bank will be required to pay to the officer or his dependents, beneficiaries or estate an amount equal to two times of (a) the higher of the officer’s base salary at the time of the change of control or the officer’s base salary at the time of termination of employment, plus (b) the highest bonus paid to the officer during the five years preceding this termination; and (ii) the officer and his dependents, beneficiaries and estate will be entitled to coverage under the health, life and disability plans of the Bank or its successor at the expenses of the Bank or its successor until the earliest of the expiration of the term of the agreement, the date the officer is included in another employer’s benefit plans as a full-time employee, or 18 months after the officer’s employment is terminated. The officer may also voluntarily terminate his employment with one year following a change of control upon a material decrease in base compensation or a material change in geographic location at which he is required to perform services and be entitled to the same compensation and benefits as if he were involuntarily terminated.

Incentive Plan.The Bank has an incentive compensation plan pursuant to which awards were based on the Bank's achievement of predetermined goals relating to earnings per share and operating income, and on the participant's achievement of goals relating to his or her individual contributions to the Bank. Mr. Limbert's incentive is solely based on the achievement of the Bank's goals, while 80% of Mr. Fortin's incentive and 60% of Mr. Klumb's incentive are based on the achievement of the Bank's goals. The remainder of the Mr. Fortin's and Mr. Klumb's incentive is based on their individual contributions to the Bank. The earnings per share and operating income goals are based on NBTF's financial plan for the year and may be adjusted by the Committee for strategic initiatives to enhance NBTF's competitive position in its market place. In 2007, after adjustment for certain one-time expenses approved by the board and permitted by the plan, NBTF achieved 100% of the total target incentive goal. The Compensation Committee and Board of Directors approved paying the target incentive goal at 100% for all employees except Mr. Limbert due to one-time expenses incurred by the Bank in connection with the purchase and sale of Mr. Limbert's home, as described in footnote 3 to the "2007 All Other Compensation Table."

Retirement Compensation and Life Insurance.Executive officers are eligible to participate in benefit plans available to all full-time employees. First, NBTF has a 401(k) plan to which it makes contributions matching a certain percentage of the contributions by each employee of NBTF or the Bank, including officers.

11

NBTF also has an employee stock ownership plan that allocates shares of NBTF to accounts of all employees proportionately on the basis of their other compensation. Finally, the Bank provides a group term life insurance benefit for all full-time employees. This group term life policy provides death benefits up to three times the employee’s salary up to a maximum death benefit of $250,000. In addition, the Bank offers senior officers an option to substitute their group term life insurance coverage over $50,000 for an individual life insurance policy or annuity owned by the employee. The annual premium for such an individual policy or annuity is limited to $2,800 per year.

The following table presents the components of All Other Compensation for the Named Executive Officers presented in the 2007 Summary Compensation Table.

2007 ALL OTHER COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position

| | Year

| | ESOP

Allocations

(1)

| | 401(k)

Matching

Contributions

| | Auto

Allowance

| | Whole

Life

Insurance

Benefit

| | Country

Club Dues

&

Membership

(2)

| | Housing

Allowance

and

Moving

Costs (3)

| | Total All

Other

Compensation

|

John J. Limbert | | 2007 | | | — | | $ | 5,741 | | $ | 12,621 | | — | | $ | 6,122 | | | — | | $ | 24,484 |

Chief Executive Officer, President of NBTF and Bank | | 2006 | | | — | | | — | | | 9,000 | | — | | | 12,615 | | $ | 15,548 | | | 37,163 |

| | | | | | | | |

Craig F. Fortin | | 2007 | | | — | | | 5,238 | | | — | | 2,440 | | | — | | | — | | | 7,678 |

Chief Financial Officer, Senior Vice President of NBTF and Bank | | 2006 | | $ | 4,361 | | | 4,885 | | | — | | 2,440 | | | — | | | — | | | 11,686 |

| | | | | | | | |

Stephen G. Klumb | | 2007 | | | — | | | 5,786 | | | — | | 2,800 | | | — | | | — | | | 8,586 |

Senior Vice President, Senior Loan Officer of Bank | | 2006 | | | 4,820 | | | 5,405 | | | — | | 2,800 | | | 2,100 | | | — | | | 15,125 |

| (1) | Allocations to ESOP accounts for 2007 have not yet been determined; however, the compensation associated with this allocation is not expected to exceed $10,000 for any Named Executive Officer. |

| (2) | Amounts for actual reimbursements during the year to Named Executive Officers for monthly dues and initiation fees. None of the reimbursements were grossed-up to compensate for additional income taxes. |

| (3) | Under Mr. Limbert's employment agreement, the Bank paid or reimbursed Mr. Limbert for certain relocation expenses, including (a) moving expenses, (b) costs incurred during house-hunting trips, (c) temporary housing expenses until Mr. Limbert moved into permanent housing and (d) an agreement with a relocation company for the marketing of Mr. Limbert's home. None of these reimbursements were grossed-up to compensate for additional income taxes. As part of such arrangement, the Bank agreed to purchase Mr. Limbert's home if it were not sold at an appraised price within 90 days. Because the home was not sold within that time, the Bank purchased Mr. Limbert's home in Millersburg, Ohio, on December 19, 2006, for $745,000. The Bank sold the home in November 2007, realizing $526,943 after all costs. |

12

The following table sets forth information regarding all outstanding grants of options to purchase NBTF common shares made to the Named Executive Officers at December 31, 2007, along with the exercise price and expiration date. We have awarded no other equity awards. Awards are not based on any pre-determined formula or goals. All options granted to date have a term of 10 years. The grant date is the date an award is determined by the board of directors. The exercise price is the closing price of an NBTF share on NASDAQ on the grant date.

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2007

| | | | | | | | | | |

| | | Option Awards

|

| | | Number of

Securities

Underlying

Unexercised

Options

(#)

| | Number of

Securities

Underlying

Unexercised

Options

(#)

| | | Option

Exercise

Price

($)

| | Option

Expiration

Date

|

Name

| | Exercisable

| | Unexercisable

| | | | | |

John J. Limbert President and CEO of NBTF and Bank | | 6,000 | | 24,000 | (1) | | $ | 20.88 | | 03/19/2016 |

| | | | |

Craig F. Fortin Chief Financial Officer, Senior Vice President of NBTF and Bank | | 7,500 2,400 3,300 5,500 1,833 | | — 600 2,200 — 3,667 | (2) (3) (4) (5) (6) | | | 22.00 24.50 30.50 23.00 20.50 | | 12/16/2012 03/17/2013 02/16/2014 05/16/2015 10/16/2016 |

| | | | |

Stephen G. Klumb Senior Vice President Senior Loan Officer of Bank | | 6,000 1,500 2,500 3,000 3,000 2,000 2,100 3,500 1,167 | | — — — — — 500 1,400 — 2,333 | (2) (2) (2) (2) (2) (3) (4) (5) (6) | | | 23.25 28.00 24.50 17.25 20.50 24.50 30.50 23.00 20.50 | | 05/31/2008 03/15/2009 02/14/2010 01/22/2011 03/18/2012 03/17/2013 02/16/2014 05/16/2015 10/16/2016 |

| (1) | Stock options vest at a rate of 20% per year with remaining vesting dates of 03/20/2008, 03/20/2009,03/20/2010 and 03/20/2011. |

| (2) | Stock options fully vested five years prior to option expiration date. |

| (3) | Stock options vest at a rate of 20% per year with remaining vesting date of 03/17/2008. |

| (4) | Stock options vest at a rate of 20% per year with remaining vesting dates of 02/16/2008 and 02/16/2009. |

| (5) | Stock options fully vested on grant date of 05/17/2005. |

| (6) | Stock options vest at a rate of 33 1/3% per year with remaining vesting dates of 10/17/2008 and 10/17/2009. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Bank occasionally makes loans of various types to directors, officers and employees of the Bank. Adjustable-rate loans are offered to all employees of the Bank, including executive officers, at an interest rate that is 25 basis points less than the rate offered on similar loans to others. All loans outstanding to executive officers during 2007 were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other Bank customers and did not involve more than the normal risk of collectibility or present other unfavorable features.

Loans to non-employee directors outstanding during the last year were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time

13

for comparable transactions with other Bank customers and did not involve more than the normal risk of collectibility or present other unfavorable features.

Each loan made to a director or executive officer since January 1, 2007, has been ratified by the Audit Committee.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the federal securities laws, NBTF's directors and executive officers and persons holding more than ten percent of the common shares of NBTF are required to report their ownership of common shares and changes in such ownership to the Securities and Exchange Commission and NBTF. The Securities and Exchange Commission has established specific due dates for such reports. Based upon a review of such reports, NBTF must disclose any failures to file such reports timely in Proxy Statements used in connection with annual meetings of shareholders. No such failures occurred during 2007.

AUDIT COMMITTEE REPORT

The Audit Committee of the board of directors of NBTF is comprised of six directors, all of whom are considered "independent" under Rule 4200(a)(14) of NASDAQ's listing standards. The Audit Committee is responsible for overseeing NBTF's accounting functions and controls, as well as selecting and retaining an accounting firm to audit NBTF's financial statements. The Board of Directors has adopted a Charter to set forth the responsibilities of the Audit Committee.

The Audit Committee received and reviewed the report of BKD, LLP ("BKD") regarding the results of their audit, as well as the written disclosures and the letter from BKD required by Independence Standards Board Standard No. 1. The Audit Committee reviewed the audited financial statements with the management of NBTF. A representative of BKD also discussed with the Audit Committee the independence of BKD from NBTF, as well as the matters required to be discussed by Statement of Auditing Standards 61, as amended and supplemented. Discussions between the Audit Committee and the representative of BKD included the following:

| | • | | BKD's responsibilities in accordance with generally accepted auditing standards |

| | • | | The initial selection of, and whether there were any changes in, significant accounting policies or their application |

| | • | | Management's judgments and accounting estimates |

| | • | | Whether there were any significant audit adjustments or uncorrected misstatements determined by management to be immaterial |

| | • | | Whether there were any disagreements with management |

| | • | | Whether there was any consultation with other accountants |

| | • | | Whether there were any major issues discussed with management prior to BKD's retention |

| | • | | Whether BKD encountered any difficulties in performing the audit |

| | • | | BKD's judgments about the quality of NBTF's accounting principles |

| | • | | BKD's responsibilities for information prepared by management that is included in documents containing audited financial statements |

Based on its review of the financial statements and its discussions with management and the representative of BKD, the Audit Committee did not become aware of any material misstatements or omissions in the financial

14

statements. Accordingly, the Audit Committee recommended to the board of directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2007, to be filed with the SEC.

Submitted by the Audit Committee:

| | |

Charles L. Dehner | | Brooke Williams James |

Daniel A. DiBiasio | | D. Jeffery Lykins |

G. David Hawley | | Robert A. Raizk |

AUDITORS

NBTF engaged BKD as NBTF's independent certified public accountants effective March 19, 2002.

Management of NBTF expects that a representative of BKD will be present at the Annual Meeting, will have the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Audit Fees

BKD billed NBTF $101,030 and $98,255 for professional services in connection with the audit of NBTF's annual financial statements and the review of financial statements included in NBTF's Forms 10-Q during 2007 and 2006.

Audit Related Fees

During 2007 and 2006, BKD billed NBTF $19,540 and $19,280 for assurance and related services concerning financial accounting and audits of two employee benefit plans and not included under "Audit Fees."

Tax Fees

During 2007 and 2006, BKD billed NBTF $12,390 and $12,000 for tax compliance, tax planning and tax advice services,including preparation of tax returns.

All Other Fees

During 2007 and 2006, BKD performed no services for NBTF and the Bank other than the services discussed in "Audit Fees", "Audit Related Fees" or "Tax Fees."

The Audit Committee of NBTF pre-approves all services to be performed by its independent auditor for NBTF, and during 2007, all services provided by BKD for NBTF were approved in advance by NBTF's Audit Committee.

15

PROPOSALS OF SECURITY HOLDERS AND OTHER MATTERS

Any proposals of shareholders intended to be included in NBTF's proxy statement for the 2009 annual meeting of shareholders should be sent to NBTF by certified mail and must be received by NBTF not later than November 27, 2008. In addition, if a shareholder intends to present a proposal at the 2009 annual meeting without including the proposal in the proxy materials related to that meeting, and if the proposal is not received by February 10, 2009, then the proxies designated by the board of directors of NBTF for the 2009 annual meeting of shareholders of NBTF may vote in their discretion on any such proposal any shares for which they have been appointed proxies without mention of such matter in the proxy statement or on the proxy card for such meeting.

Management knows of no other business that may be brought before the annual meeting. The persons named in the enclosed Proxy intend to vote such Proxy in accordance with their best judgment on any other matters that may be brought before the annual meeting.

The board of directors expects all directors to make every effort to attend meetings of the shareholders of NBTF. All directors attended the 2007 annual meeting of shareholders. All written communications addressed to an individual director at the address of NBTF or one of the offices of a subsidiary of NBTF, except those clearly of a marketing nature, will be forwarded directly to the director. All written communications addressed to the board of directors at the address of NBTF or one of the offices of a subsidiary of NBTF will be presented to the full board of directors at a meeting of the board of directors.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING IN PERSON, WE URGE YOU TO FILL IN, SIGN AND RETURN THE PROXY IN THE ENCLOSED SELF-ADDRESSED ENVELOPE.

By Order of the Board of Directors

March 27, 2008

Charles L. Dehner, Secretary

16

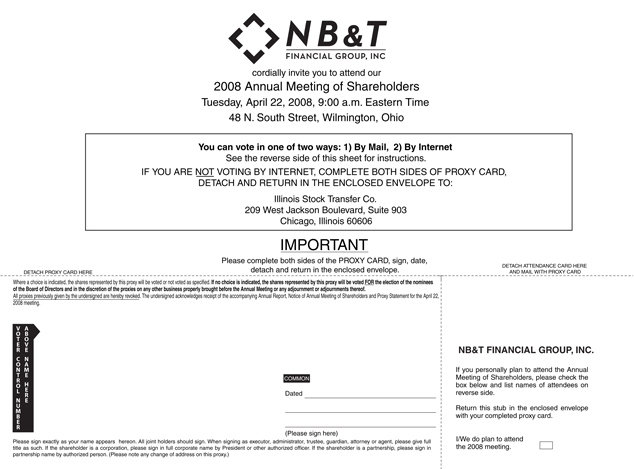

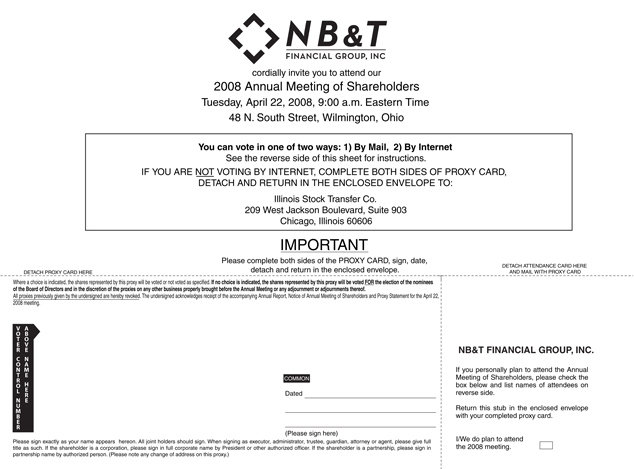

NB & T FINANCIAL GROUP, INC

cordially invite you to attend our2008 Annual Meeting of ShareholdersTuesday, April 22, 2008, 900 a.m. Eastern Time48 N. South Street, Wilmington, Ohio

You can vote in one of two ways: 1) By Mail, 2) By InternetSee the reverse side of this sheet for instructions.IF YOU ARE NOT VOTING BY INTERNET, COMPLETE BOTH SIDES OF PROXY CARD,DETACH AND RETURN IN THE ENCLOSED ENVELOPE TO:Illinois Stock Transfer Co.209 West Jackson Boulevard, Suite 903Chicago, Illinois 60606

DETACH PROXY CARD

IMPORTANTPlease complete both sides of the PROXY CARD, sign, date,detach and return in the enclosed envelope.

DETACH ATTENDANCE CARD HEREAND MAIL WITH PROXY CARD

Where a choice is indicated, the shares represented by this proxy will be voted or not voted as specified. If no choice is indicated, the shares represented by this proxy will be voted FOR the election of the nominees of the Board of Directors and in the discretion of the proxies on any other business properly brought before the Annual Meeting or any adjournment or adjournments thereof.All proxies previously given by the undersigned are hereby revoked. The undersigned acknowledges receipt of the accompanying Annual Report, Notice of Annual Meeting of Shareholders and Proxy Statement for the April 22, 2008 meeting.

VOTERCONTROLNUMBERABOVENAMEHERE

COMMON Dated (Please sign here)

Please sign exactly as your name appears hereon. All joint holders should sign. When signing as executor, administrator, trustee, guardian, attorney or agent, please give full title as such. If the shareholder is a corporation, please sign in full corporate name by President or other authorized officer. If the shareholder is a partnership, please sign in partnership name by authorized person. (Please note any change of address on this proxy.)

NB&T FINANCIAL GROUP, INC.

If you personally plan to attend the Annual Meeting of Shareholders, please check the box below and list names of attendees on reverse side.Return this stub in the enclosed envelope with your completed proxy card.

I/We do plan to attendthe 2008 meeting.

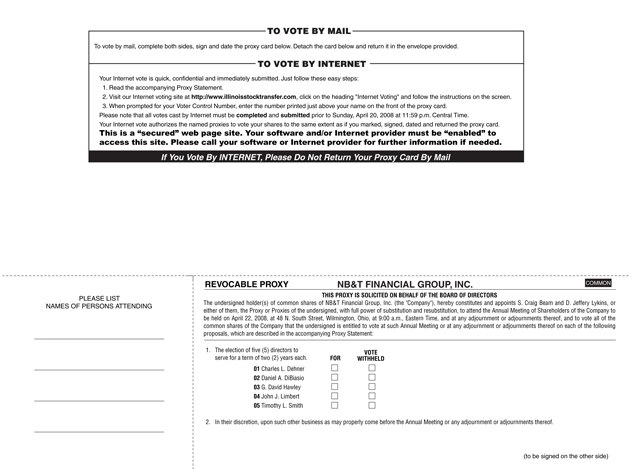

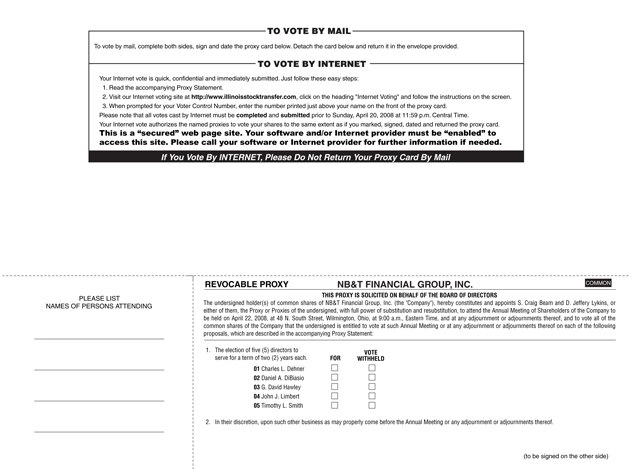

TO VOTE BY MAIL

To vote by mail, complete both sides, sign and date the proxy card below. Detach the card below and return it in the envelope provided.

TO VOTE BY INTERNET

Your Internet vote is quick, confidential and immediately submitted. Just follow these easy steps: 1. Read the accompanying Proxy Statement. 2. Visit our Internet voting site at http://www.illinoisstocktransfer.com, click on the heading “Internet Voting” and follow the instructions on the screen. 3. When prompted for your Voter Control Number, enter the number printed just above your name on the front of the proxy card.Please note that all votes cast by Internet must be completed and submitted prior to Sunday, April 20, 2008 at 11:59 p.m. Central Time.Your Internet vote authorizes the named proxies to vote your shares to the same extent as if you marked, signed, dated and returned the proxy card.This is a “secured” web page site. Your software and/or Internet provider must be “enabled” to access this site. Please call your software or Internet provider for further information if needed.

If You Vote By INTERNET, Please Do Not Return Your Proxy Card By Mail

PLEASE LISTNAMES OF PERSONS ATTENDING

REVOCABLE PROXY

NB&T FINANCIAL GROUP, INC.

COMMON

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORSThe undersigned holder(s) of common shares of NB&T Financial Group, Inc. (the “Company”), hereby constitutes and appoints S. Craig Beam and D. Jeffery Lykins, or either of them, the Proxy or Proxies of the undersigned, with full power of substitution and resubstitution, to attend the Annual Meeting of Shareholders of the Company to be held on April 22, 2008, at 48 N. South Street, Wilmington, Ohio, at 9:00 a.m., Eastern Time, and at any adjournment or adjournments thereof, and to vote all of the common shares of the Company that the undersigned is entitled to vote at such Annual Meeting or at any adjournment or adjournments thereof on each of the following proposals, which are described in the accompanying Proxy Statement:

1... The election of five (5) directors to serve for a term of two (2) years each.

01 Charles L. Dehner02 Daniel A. DiBiasio03 G. David Hawley04 John J. Limbert05 Timothy L. Smith

FOR VOTE WITHHELD

2. In their discretion, upon such other business as may properly come before the Annual Meeting or any adjournment or adjournments thereof.

(to be signed on the other side)

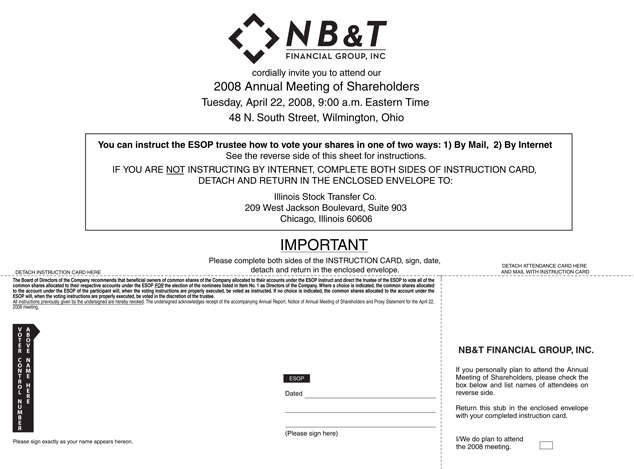

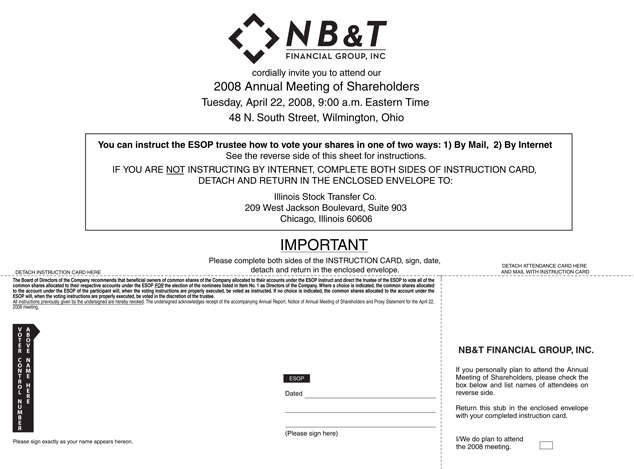

NB&T FINANCIAL GROUP, INC

cordially invite you to attend our2008 Annual Meeting of ShareholdersTuesday, April 22, 2008, 9:00 a.m. Eastern Time48 N. South Street, Wilmington, Ohio

You can instruct the ESOP trustee how to vote your shares in one of two ways: 1) By Mail, 2) By InternetSee the reverse side of this sheet for instructions.IF YOU ARE NOT INSTRUCTING BY INTERNET, COMPLETE BOTH SIDES OF INSTRUCTION CARD,DETACH AND RETURN IN THE ENCLOSED ENVELOPE TO:Illinois Stock Transfer Co.209 West Jackson Boulevard, Suite 903Chicago, Illinois 60606

DETACH INSTRUCTION CARD HERE

IMPORTANTPlease complete both sides of the INSTRUCTION CARD, sign, date,detach and return in the enclosed envelope.

DETACH ATTENDANCE CARD HEREAND MAIL WITH INSTRUCTION CARD

The Board of Directors of the Company recommends that beneficial owners of common shares of the Company allocated to their accounts under the ESOP instruct and direct the trustee of the ESOP to vote all of the common shares allocated to their respective accounts under the ESOP FOR the election of the nominees listed in Item No. 1 as Directors of the Company. Where a choice is indicated, the common shares allocated to the account under the ESOP of the participant will, when the voting instructions are properly executed, be voted as instructed. If no choice is indicated, the common shares allocated to the account under the ESOP will, when the voting instructions are properly executed, be voted in the discretion of the trustee.All instructions previously given by the undersigned are hereby revoked. The undersigned acknowledges receipt of the accompanying Annual Report, Notice of Annual Meeting of Shareholders and Proxy Statement for the April 22, 2008 meeting.

VOTER CONTROL NUMBER ABOVE NAME HERE

Please sign exactly as your name appears hereon.

ESOP

Dated (Please sign here)

NB&T FINANCIAL GROUP, INC.

If you personally plan to attend the Annual Meeting of Shareholders, please check the box below and list names of attendees on reverse side.Return this stub in the enclosed envelope with your completed instruction card.

I/We do plan to attendthe 2008 meeting.

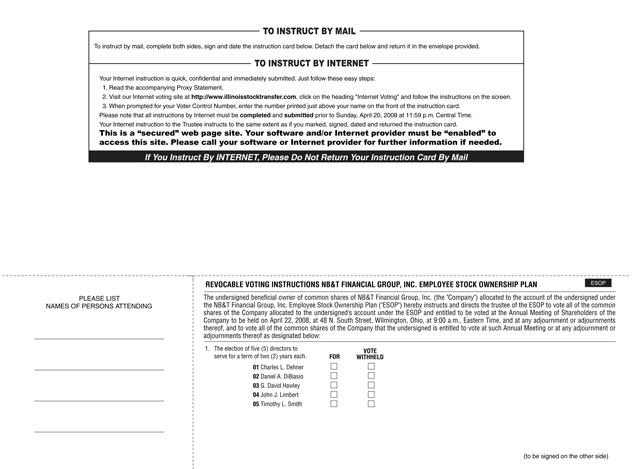

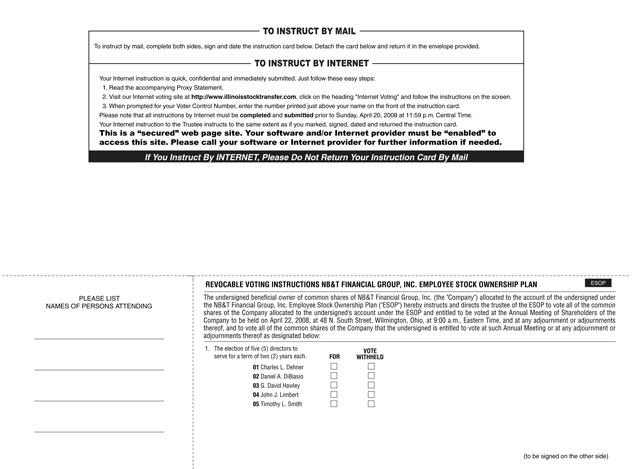

TO INSTRUCT BY MAIL

To instruct by mail, complete both sides, sign and date the instruction card below. Detach the card below and return it in the envelope provided.

TO INSTRUCT BY INTERNET

Your Internet instruction is quick, confidential and immediately submitted. Just follow these easy steps: 1. Read the accompanying Proxy Statement. 2. Visit our Internet voting site at http://www.illinoisstocktransfer.com, click on the heading “Internet Voting” and follow the instructions on the screen. 3. When prompted for your Voter Control Number, enter the number printed just above your name on the front of the instruction card.Please note that all instructions by Internet must be completed and submitted prior to Sunday, April 20, 2008 at 11:59 p.m. Central Time.Your Internet instruction to the Trustee instructs to the same extent as if you marked, signed, dated and returned the instruction card.This is a “secured” web page site. Your software and/or Internet provider must be “enabled” to access this site. Please call your software or Internet provider for further information if needed.

PLEASE LIST NAMES OF PERSONS

REVOCABLE VOTING INSTRUCTIONS NB&T FINANCIAL GROUP, INC. EMPLOYEE STOCK OWNERSHIP PLAN (ESOP)

The undersigned beneficial owner of common shares of NB&T Financial Group, Inc. (the “Company”) allocated to the account of the undersigned under the NB&T Financial Group, Inc. Employee Stock Ownership Plan (“ESOP”) hereby instructs and directs the trustee of the ESOP to vote all of the common shares of the Company allocated to the undersigned’s account under the ESOP and entitled to be voted at the Annual Meeting of Shareholders of the Company to be held on April 22, 2008, at 48 N. South Street, Wilmington, Ohio, at 9:00 a.m., Eastern Time, and at any adjournment or adjournments thereof, and to vote all of the common shares of the Company that the undersigned is entitled to vote at such Annual Meeting or at any adjournment or adjournments thereof as designated below:

1. The election of five (5) directors to serve for a term FORof VOTE WITHHELD two (2) years each.01 Charles L. Dehner02 Daniel A. DiBiasio03 G. David Hawley04 John J. Limbert05 Timothy L. Smith(to be signed on