UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

December 31, 2011 For the fiscal year ended December 31, 2011

Commission file number 0-23134

NB&T FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

| | |

| Ohio | | 31-1004998 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

48 N. South Street, Wilmington, Ohio 45177

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number: (937) 382-1441

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Shares, without par value | | The NASDAQ Stock Market LLC (NASDAQ Capital Market) |

Securities registered pursuant to 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and submitted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | x |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No x

Based on the closing sales price of $20.81 per share on June 30, 2011, the aggregate market value of the issuer’s shares held by nonaffiliates on such date was $50,442,670. For this purpose, shares held by nonaffiliates are all outstanding shares except those held by the directors and executive officers of the registrant and those held by The National Bank and Trust Company (the “Bank”) as trustee with respect to which the Bank has sole or shared voting or dispositive power. As of March 1, 2012, 3,423,252 common shares were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The following sections of the definitive Proxy Statement for the 2012 Annual Meeting of Shareholders of NB&T Financial Group, Inc. (the “Proxy Statement”), are incorporated by reference into Part III of this Form 10-K:

1. Proposal 1: Election of Directors;

2. Section 16(a) Beneficial Ownership Reporting Compliance;

3. Compensation of Executive Officers and Directors;

4. Voting Securities and Ownership of Certain Beneficial Owners and Management;

5. Certain Relationships and Related Transactions; and

6. Proposal 2: Ratification of Selection of BKD, LLP as the Independent Registered Public Accounting Firm

2

PART I

Item 1. Description of Business

GENERAL

NB&T Financial Group, Inc. (“NB&T Financial” or the “Company”), an Ohio corporation, is a financial holding company which owns all of the issued and outstanding common shares of The National Bank and Trust Company, chartered under the laws of the United States (the “Bank”). The Bank is engaged in the commercial banking business primarily in southwestern Ohio, providing a variety of consumer and commercial financial services. The primary business of the Bank consists of accepting deposits, through various consumer and commercial deposit products, and using such deposits to fund loans secured by residential and non-residential real estate, commercial and agricultural loans and consumer loans, including automobile loans. All of the foregoing deposit and lending services are available at each of the Bank’s full-service offices. The Bank also has a trust department with assets under management of approximately $197.3 million. As of December 31, 2011, the Bank had 211 employees.

On March 19, 2010, the Bank assumed all the deposits and acquired certain assets and other liabilities of American National Bank in Parma, Ohio, from the Federal Deposit Insurance Corporation (the “FDIC”), pursuant to the terms of a purchase and assumption agreement. As part of the acquisition, the Bank and the FDIC entered into loss-sharing agreements that collectively cover approximately $48.2 million of assets, consisting almost entirely of commercial real estate and commercial and industrial loans.

On January 8, 2010, the Bank sold its wholly-owned subsidiary, NB&T Insurance Agency, Inc. (“NB&T Insurance”), which had three locations, with its principal office in Wilmington, Ohio. NB&T Insurance sells a full line of insurance products, including property and casualty, life, health, and annuities. NB&T Insurance Group, Inc., another wholly-owned subsidiary of the Bank, then obtained a license to sell insurance. NB&T Insurance Group, Inc. offers annuities and, through a third-party, brokerage services to the Bank’s customers.

On December 31, 2009, Community National Corporation (“CNC”) merged into NB&T Financial and CNC’s subsidiary, Community National Bank (“CNB”), located in Franklin, Ohio, merged into the Bank. The merger added approximately $86 million to the Company’s assets and $76 million in deposits. CNB had five branches located in Warren, Montgomery and Butler counties in Ohio. NB&T Financial paid $3.6 million in cash and issued 237,582 shares of NB&T Financial in exchange for all of the outstanding common shares of CNC.

As a registered bank holding company and financial holding company under the Bank Holding Company Act, NB&T Financial is subject to regulation, examination and oversight by the Board of Governors of the Federal Reserve System (the “FRB”). The Bank, as a national bank, is subject to regulation, examination and oversight by the Office of the Comptroller of the Currency (the “OCC”) and special examination by the FRB. The Bank is a member of the Federal Reserve Bank of Cleveland. In addition, since its deposits are insured by the FDIC, the Bank is also subject to some regulation, oversight and special examination by the FDIC. The Bank must file periodic financial reports with the FDIC, the OCC and the Federal Reserve Bank of Cleveland. Examinations are conducted periodically by these federal regulators to determine whether the Bank and NB&T Financial are in compliance with various regulatory requirements and are operating in a safe and sound manner.

Since its incorporation in 1980, NB&T Financial’s activities have been limited primarily to holding the common shares of the Bank. Consequently, the following discussion focuses primarily on the business of the Bank.

3

Lending Activities

General. The Bank’s income consists primarily of interest income generated by lending activities, including the origination of loans secured by residential and nonresidential real estate, commercial and agricultural loans, and consumer loans. Please refer to Table 7 on page 24, which summarizes the loan portfolio mix.

Commercial and Industrial Lending. The Bank originates loans to businesses in its market area, including “floor plan” loans to automobile dealers and loans guaranteed by the Small Business Administration. The typical commercial borrower is a small to mid-sized company with annual sales under $5,000,000. The majority of commercial loans are made at adjustable rates of interest tied to the prime rate. Commercial loans typically have terms of up to five years. Commercial and industrial lending entails significant risks. Such loans are subject to greater risk of default during periods of adverse economic conditions. Because such loans are secured by equipment, inventory, accounts receivable and other non-real estate assets, the collateral may not be sufficient to ensure full payment of the loan in the event of a default.

Commercial Real Estate. The Bank makes loans secured by commercial real estate located in its market area. Such loans generally are adjustable-rate loans for terms of up to 20 years. The types of properties securing loans in the Bank’s portfolio include warehouses, retail outlets and general industrial use properties. Commercial real estate lending generally entails greater risks than residential real estate lending. Such loans typically involve larger balances and depend on the income of the property to service the debt. Consequently, the risk of default on such loans may be more sensitive to adverse economic conditions. The Bank attempts to minimize such risks through prudent underwriting practices.

Real Estate Construction. The Bank originates loans for the purpose of constructing both commercial and residential buildings. The Company offers both construction-phase-only and permanent financing.

Agricultural Loans. The Bank makes agricultural loans, which include loans to finance farm operations, equipment purchases, and land acquisition. The repayment of such loans is significantly dependent upon income from farm operations, which can be adversely affected by weather and other physical conditions, government policies and general economic conditions.

Residential Real Estate. The Bank makes loans secured by one- to four-family residential real estate and multi-family (over four units) real estate located in its market area. The Bank originates both fixed-rate mortgage loans and adjustable-rate mortgage loans (“ARMs”) to meet the needs of its customers. The Bank will sell loans in the secondary market it does not intend to hold for the foreseeable future.

Installment Loans. The Bank makes a variety of consumer installment loans, including home equity loans, automobile loans, recreational vehicle loans, and overdraft protection. Over the past five years, the Company has significantly reduced its indirect lending activities through automobile dealers. Consumer loans involve a higher risk of default than loans secured by one- to four-family residential real estate, particularly in the case of consumer loans which are unsecured or secured by rapidly depreciating assets, such as automobiles. Various federal and state laws, including federal and state bankruptcy and insolvency laws, may also limit the amount that can be recovered on such loans.

Credit Card Service. The Bank offers credit card services through a correspondent bank.

Loan Processing. Loan officers are authorized by the Board of Directors to approve loans up to specified limits. Loans exceeding the loan officers’ approval authority are referred to the Bank’s Senior Loan Committee. Any loans made by the Bank in excess of the limits established for the Senior Loan Committee must be approved by the Chairman of the Board and the President of the Bank as representatives of the Board of Directors. All loans in excess of $50,000 are reported to the Board on a monthly basis.

4

Loan Originations, Purchases and Sales. Although the Bank generally does not purchase loans, purchases could occur in the future. Residential real estate loans are originated for sale in the secondary market. From time to time, the Bank sells participation interests in loans it originates.

Allowance for Loan Losses. Federal regulations require that the Bank establish prudent general allowances for loan losses. Senior management, with oversight responsibility provided by the Board of Directors, reviews on a monthly basis the allowance for loan losses as it relates to a number of relevant factors, including but not limited to, historical trends in the level of non-performing assets and classified loans, current charge-offs and the amount of the allowance as a percent of the total loan portfolio. While management believes that it uses the best information available to determine the allowance for loan losses, unforeseen market conditions could result in adjustments, and net earnings could be significantly affected if circumstances differ substantially from the assumptions used in making the final determination.

Investment Activities

Funds not used in the Bank’s lending or banking function are dedicated to the investment portfolio. Those funds will be placed in investment programs approved by the Asset/Liability Management Committee (ALCO). The deployment of these funds will be consistent with the overall strategy and risk profile of the Bank. The Bank primarily invests in high-quality securities to provide sufficient liquidity, secure pledged deposits, minimize current tax liability, and increase earnings.

Trust Services

The Bank received trust powers in 1922 and had approximately $197.3 million in assets under management at December 31, 2011 in the Trust Department. These assets are not included in the Bank’s balance sheet because, under federal law, neither the Bank nor its creditors can assert any claim against funds held by the Bank in its fiduciary capacity. In addition to administering trusts, the services offered by the Trust Department include investment purchase and management, estate planning and administration, tax and financial planning and employee benefit plan administration.

Deposits and Borrowings

General. Deposits have traditionally been the primary source of the Bank’s funds for use in lending and other investment activities. In addition to deposits, the Bank derives funds from interest payments and principal repayments on loans and income on earning assets. Loan payments are a relatively stable source of funds, while deposit inflows and outflows fluctuate more in response to general interest rates and money market conditions.

Deposits. Deposits are attracted principally from within the Bank’s market area through the offering of numerous deposit instruments, including checking accounts, savings accounts, money market deposit accounts, and term certificate accounts. Interest rates paid, maturity terms, service fees and withdrawal penalties for the various types of accounts are established periodically by the Bank’s Asset/Liability Committee and the Executive Committee based on the Bank’s liquidity requirements, growth goals and market trends. The Company has also used brokers, on a limited basis, to obtain deposits. Currently the amount of deposits from outside the Bank’s market area is not significant.

Borrowings. The Federal Reserve System functions as a central reserve bank providing credit for its member banks and certain other financial institutions. As a member in good standing of the Federal Reserve Bank of Cleveland, the Bank is authorized to apply for advances, provided certain standards of credit-worthiness have been met. The Bank is also a member of the Federal Home Loan Bank system. Short-term borrowings include federal funds purchased and U.S Treasury demand notes.

5

Competition

The Bank competes for deposits with other commercial banks, savings associations and credit unions and with the issuers of commercial paper and other securities, such as shares in money market mutual funds. The primary factors in competing for deposits are interest rates and convenience of office location. In making loans, the Bank competes with other commercial banks, savings associations, mortgage bankers, consumer finance companies, credit unions, leasing companies, insurance companies and other lenders. The Bank competes for loan originations primarily through the interest rates and loan fees it charges and through the efficiency and quality of services it provides to borrowers. Competition is affected by, among other things, the general availability of lendable funds, general and local economic conditions, current interest rate levels and other factors which are not readily predictable. For years the Bank has competed within its market area with several regional bank holding companies, each with assets far exceeding those of the Bank.

REGULATION

General

Because of its ownership of all the outstanding stock of the Bank, NB&T Financial is subject to regulation, examination and oversight by the FRB as a bank holding company and financial holding company under the Bank Holding Company Act. The FRB has extensive enforcement authority over financial holding companies. The FRB may assess civil money penalties, issue cease and desist or removal orders and require that a financial holding company divest subsidiaries. The Bank, as a national bank, is subject to regulation, examination and oversight by the OCC and special examination by the FRB. The Bank is a member of the Federal Reserve Bank of Cleveland and a member of the Federal Home Loan Bank of Cincinnati. In addition, since its deposits are insured by the FDIC, the Bank is also subject to some regulation, oversight and special examination by the FDIC. The Bank must file periodic financial reports with the FDIC, the OCC and the Federal Reserve Bank of Cleveland. Examinations are conducted periodically by these federal regulators to determine whether the Bank and NB&T Financial are in compliance with various regulatory requirements and are operating in a safe and sound manner. In general, the FRB may initiate enforcement actions for violations of law and regulations.

Bank Holding Company Regulation

The FRB has adopted capital adequacy guidelines for bank holding companies, pursuant to which, on a consolidated basis, NB&T Financial must maintain total capital of at least 8% of risk-weighted assets. Risk-weighted assets consist of all assets, plus credit equivalent amounts of certain off- balance sheet items, which are weighted at percentage levels ranging from 0% to 100%, based on the relative credit risk of the asset. At least half of the total capital to meet this risk-based requirement must consist of core or “Tier 1” capital, which includes common stockholders’ equity, qualifying perpetual preferred stock (up to 25% of Tier 1 capital) and minority interests in the equity accounts of consolidated subsidiaries, less goodwill, certain other intangibles, and portions of certain non-financial equity investments. The remainder of total capital may consist of supplementary or “Tier 2 capital.” In addition to this risk-based capital requirement, the FRB requires bank holding companies to meet a leverage ratio of a minimum level of Tier 1 capital to average total consolidated assets of 3%, if they have the highest regulatory examination rating, well-diversified risk and minimal anticipated growth or expansion. All other bank holding companies are expected to maintain a leverage ratio of at least 4% of average total consolidated assets. NB&T Financial was in compliance with these capital requirements at December 31, 2011. For NB&T Financial’s capital ratios, see Note 17 to the Consolidated Financial Statements in Item 8. The current capital requirements are based on the 1998 capital accord of the Basel Committee on Banking supervision (the “Basel Committee”). In December 2010, the Basel Committee released a new framework, referred to as “Basel III.” The banking regulators are considering the extent to which they will apply the Basel III principles to smaller financial institutions, such as NB&T Financial and the Bank.

6

A bank holding company is required by law to guarantee the compliance of any insured depository institution subsidiary that may become “undercapitalized” (defined in the regulations as not meeting minimum capital requirements) with the terms of the capital restoration plan filed by such subsidiary with its appropriate federal banking agency.

The Bank Holding Company Act restricts NB&T Financial’s ownership or control of the outstanding shares of any class of voting stock of any company engaged in a nonbanking business, other than companies engaged in certain activities determined by the FRB to be closely related to banking. In addition, the FRB has the authority to require a bank holding company to terminate any activity or relinquish control of any nonbank subsidiary (other than a nonbank subsidiary of a bank) upon the determination by the FRB that such activity or control constitutes a serious risk to the financial soundness and stability of any bank subsidiary of the bank holding company. NB&T Financial currently has no nonbank subsidiaries, except subsidiaries of the Bank. The ownership of subsidiaries of the Bank is regulated by the OCC, rather than the FRB.

The Financial Services Modernization Act of 1999 permits bank holding companies to become financial holding companies and thereby affiliate with securities firms and insurance companies and engage in other activities that are financial in nature. A bank holding company may become a financial holding company if each of its subsidiary banks is well capitalized under the Federal Deposit Insurance Corporation Act of 1991 prompt corrective action provisions, is well managed, and has at least a satisfactory rating under the Community Reinvestment Act, by filing a declaration that the bank holding company wishes to become a financial holding company. In October 2006, NB&T Financial Group, Inc. became a financial holding company. No regulatory approval is required for a financial holding company to acquire a company, other than a bank or savings association, engaged in activities that are financial in nature or incidental to activities that are financial in nature, as determined by the Federal Reserve Board.

The Financial Services Modernization Act defines “financial in nature” to include:

| | • | | securities underwriting, dealing and market making; |

| | • | | sponsoring mutual funds and investment companies; |

| | • | | insurance underwriting and agency; |

| | • | | activities that the Federal Reserve Board has determined to be closely related to banking. |

A national bank also may engage, subject to limitations on investment, in activities that are financial in nature, other than insurance underwriting, insurance company portfolio investment, real estate development and real estate investment, through a financial subsidiary of the bank, if the bank is well capitalized, well managed and has at least a satisfactory Community Reinvestment Act rating. Subsidiary banks of a financial holding company or national banks with financial subsidiaries must continue to be well capitalized and well managed in order to continue to engage in activities that are financial in nature without regulatory actions or restrictions, which could include divestiture of the financial in nature subsidiary or subsidiaries. In addition, a financial holding company or a bank may not acquire a company that is engaged in activities that are financial in nature unless each of the subsidiary banks of the financial holding company or the bank has a Community Reinvestment Act rating of satisfactory or better. NB&T Insurance Group, Inc. is a financial subsidiary.

Transactions between NB&T Financial and the Bank are subject to statutory limits in Sections 23A and 23B of the Federal Reserve Act, which limit the amounts of such transactions and require that the terms of the transactions be at least as favorable to the Bank as the terms would be of a similar transaction between the Bank and an unrelated party. NB&T Financial and the Bank were in compliance with these requirements and restrictions at December 31, 2011.

The FRB must approve the application of a bank holding company to acquire any bank or savings association. The Company’s ability to pay dividends to its shareholders may be restricted. Current FRB policy

7

requires bank holding companies to act as a source of financial strength to its banking subsidiaries. Under this policy, the FRB may require the Company to commit resources or contribute additional capital to the Bank, which could restrict the amount of cash available for dividends to the Company’s shareholders. The FRB has issued guidance on the payment of dividends by bank holding companies, which includes conditions under which bank holding companies must provide advance notification of their intentions to declare and pay dividends.

National Bank Regulation

Office of the Comptroller of the Currency. The OCC is an office in the Department of the Treasury and is subject to the general oversight of the Secretary of the Treasury. The OCC is responsible for the regulation and supervision of all national banks, including the Bank. The OCC issues regulations governing the operation of national banks and, in accordance with federal law, prescribes the permissible investments and activities of national banks. The Bank is authorized to exercise trust powers in accordance with OCC guidelines. National banks are subject to regulatory oversight under various consumer protection and fair lending laws. These laws govern, among other things, truth-in-lending disclosure, equal credit opportunity, fair credit reporting and community reinvestment. The OCC has the authority to impose sanctions on the Bank and, under certain circumstances, may appoint a receiver for the Bank.

The Bank is required to meet certain minimum capital requirements set by the OCC. These requirements consist of risk-based capital guidelines and a leverage ratio, which are substantially the same as the capital requirements imposed on NB&T Financial. The Bank was in compliance with those capital requirements at December 31, 2011. For the Bank capital ratios, see Note 17 to the Consolidated Financial Statements in Item 8. The OCC may adjust the risk-based capital requirement of a national bank on an individualized basis to take into account risks due to concentrations of credit or nontraditional activities.

The OCC has adopted regulations governing prompt corrective action to resolve the problems of capital deficient and otherwise troubled national banks. At each successively lower defined capital category, a national bank is subject to more restrictive and numerous mandatory or discretionary regulatory actions or limits, and the OCC has less flexibility in determining how to resolve the problems of the institution. In addition, the OCC generally can downgrade a national bank’s capital category, notwithstanding its capital level, if, after notice and opportunity for hearing, the national bank is deemed to be engaging in an unsafe or unsound practice, because it has not corrected deficiencies that resulted in it receiving a less than satisfactory examination rating on matters other than capital or it is deemed to be in an unsafe or unsound condition. The Bank’s capital at December 31, 2011, met the standards for the highest capital category, a well-capitalized bank.

A national bank is subject to restrictions on the payment of dividends, including dividends to a holding company. The Bank may not pay a dividend if it would cause the Bank not to meet its capital requirements. In addition, the dividends that a Bank subsidiary can pay to its holding company without prior approval of regulatory agencies is limited to net income plus its retained net income for the preceding two years. Based on the current financial condition of the Bank, the Bank does not expect these provisions to affect the current ability of the Bank to pay dividends to NB&T Financial in an amount customary for the Bank.

OCC regulations generally limit the aggregate amount that a national bank can lend to one borrower or aggregated groups of related borrowers to an amount equal to 15% of the bank’s unimpaired capital and surplus. A national bank may loan to one borrower an additional amount not to exceed 10% of the association’s unimpaired capital and surplus, if the additional amount is fully secured by certain forms of “readily marketable collateral”. Loans to executive officers, directors and principal shareholders and their related interests must conform to the OCC lending limits. All transactions between national banks and their affiliates, including NB&T Financial, must comply with Sections 23A and 23B of the Federal Reserve Act.

Federal Deposit Insurance Corporation. The FDIC is an independent federal agency that insures the deposits, up to prescribed statutory limits, of federally insured banks and thrifts and safeguards the safety and

8

soundness of the banking and thrift industries. The FDIC is authorized to establish annual assessment rates for deposit insurance. The FDIC has established a risk-based assessment system for members. Under this system, assessments vary based on the risk the institution poses to its deposit insurance fund. The risk level is determined based on the institution’s capital level and the FDIC’s level of supervisory concern about the institution. Insurance of deposits may be terminated by the FDIC if it finds that the institution has engaged in unsafe or unsound practices, is in an unsafe or unsound condition to continue operations, or has violated any applicable law, regulation, rule, order or condition enacted or imposed by the institution’s regulatory agency. On February 7, 2011, the FDIC issued final regulations, effective April 1, 2011, as required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), to change the deposit insurance assessment base from total domestic deposits to average total assets minus average tangible equity, as well as changing the assessment for larger institutions and the assessment rate schedules.

Federal Reserve Board. The Federal Reserve Act requires national banks to maintain reserves against their net transaction accounts (primarily checking and NOW accounts). The amounts are subject to adjustment by the FRB. At December 31, 2011, the Bank was in compliance with its reserve requirements.

Federal Home Loan Banks. The Federal Home Loan Banks (the “FHLBs”) provide credit to their members in the form of advances. As a member, the Bank must maintain an investment in the capital stock of the FHLB of Cincinnati in an amount equal to the greater of 1% of the aggregate outstanding principal amount of the Bank’s residential real estate loans, home purchase contracts and similar obligations at the beginning of each year, or 5% of its advances from the FHLB. The Bank is in compliance with this requirement with an investment in FHLB of Cincinnati stock having a book value of $9.1 million at December 31, 2011. The FHLB advances are secured by collateral in one or more specified categories. The amount a member may borrow from the FHLB is limited based upon the amounts of various assets held by the member.

Insurance Agency Regulation

The Bank’s insurance agency subsidiary is subject to insurance laws and regulations of the State of Ohio and the Ohio Department of Insurance. The insurance laws and regulations require education and licensing of agencies and individual agents, require reports and impose business conduct rules.

Recent Legislation

On July 21, 2010, President Obama signed into law the Dodd-Frank Act. This new law is significantly changing the regulation of financial institutions and the financial services industry. Because the Dodd-Frank Act requires various federal agencies to adopt a broad range of regulations with significant discretion, many of the details of the new law and the effects they will have on our company will not be known for months and even years. For further information about the Dodd-Frank Act, see “Item 1.A. Risk Factors—The enactment of new legislation and increased regulatory oversight may significantly affect our financial condition and results of operations.”

Item 1A. Risk Factors

Like all financial companies, NB&T Financial’s business and results of operations are subject to a number of risks, many of which are outside of our control. In addition to the other information in this report, readers should carefully consider that the following important factors could materially impact our business and future results of operations.

Our business may be adversely affected by current conditions in the financial markets, the real estate market and economic conditions generally.

Beginning in the latter half of 2007, negative developments in the capital markets resulted in uncertainty in the financial markets and an economic downturn. The housing market declined, resulting in decreasing home

9

prices and increasing delinquencies and foreclosures. The credit performance of mortgage and construction loans resulted in significant write-downs of asset values by financial institutions, including government-sponsored entities and major commercial and investment banks. The declines in the performance and value of mortgage assets encompassed all mortgage and real estate asset types, leveraged bank loans and nearly all other asset classes, including equity securities. These write-downs have caused many financial institutions to seek additional capital or to merge with larger and stronger institutions. Some financial institutions have failed. Although some improvements in the U.S. economy have occurred, housing prices are still depressed and continue to decline in some markets and unemployment remains high compared to levels prior to the recession. Debt concerns in Europe have added to volatility in the capital markets and concerns over whether such improvements in the U.S. economy will continue.

In addition to the increases in delinquencies and foreclosures on existing loans and the reductions in the value of collateral, the slowing of business activity and the high unemployment rates have had an adverse effect on loan demand from both businesses and consumers. A worsening of current conditions would likely adversely affect our business and results of operations, as well as those of our customers. As a result, we may experience increased foreclosures, delinquencies and customer bankruptcies, as well as decreased loan demand.

The enactment of new legislation and increased regulatory oversight may significantly affect our financial condition and results of operations.

The Federal Reserve Board, Congress, the Treasury, the FDIC and others have taken numerous actions to address the current liquidity and credit situation in the financial markets. These measures include actions to encourage loan restructuring and modification for homeowners; the establishment of significant liquidity and credit facilities for financial institutions and investment banks; the lowering of the federal funds rate; and coordinated efforts to address liquidity and other weaknesses in the banking sector. The long-term effect of actions already taken as well as new legislation is unknown. Continued or renewed instability in the financial markets could weaken public confidence in financial institutions and adversely affect our ability to attract and retain new customers.

Further, legislation has been proposed that would reduce the amount that our customers are required to pay under existing loan contracts or limit our ability to foreclose on collateral. There can be no assurance that future legislation will not significantly impact our ability to collect on our current loans or foreclose on collateral.

On July 21, 2010, President Obama signed into law the Dodd-Frank Act. This new law is significantly changing the regulation of financial institutions and the financial services industry. Because the Dodd-Frank Act requires various federal agencies to adopt a broad range of regulations with significant discretion, many of the details of the new law and the effects they will have on our company will not be known for months and even years.

Many of the provisions of the Dodd-Frank Act apply directly only to institutions much larger than ours, and some will affect only institutions with different charters than ours or institutions that engage in activities in which we do not engage. Among the changes to occur pursuant to the Dodd-Frank Act that can be expected to have an effect on our business are the following:

| | • | | the Dodd-Frank Act creates a Consumer Financial Protection Bureau with broad powers to adopt and enforce consumer protection regulations; |

| | • | | new capital regulations for bank holding companies will be adopted, which may impose stricter requirements, and any new trust preferred securities will no longer count toward Tier I capital; |

| | • | | the federal law prohibition on the payment of interest on commercial demand deposit accounts was eliminated effective in July 2011; |

| | • | | the standard maximum amount of deposit insurance per customer is permanently increased to $250,000, and non-interest bearing transaction accounts will have unlimited insurance through December 31, 2012; |

10

| | • | | the assessment base for determining deposit insurance premiums has been expanded to include liabilities other than just deposits; |

| | • | | new corporate governance requirements applicable generally to all public companies in all industries will require new compensation practices, including requiring companies to “claw back” incentive compensation under certain circumstances, to provide shareholders the opportunity to cast a non-binding vote on executive compensation, and to consider the independence of compensation advisers, and new executive compensation disclosure requirements. |

New regulations pertaining to debit card fees were enacted by the Federal Reserve in October 2011. The new rules cap debit interchange fees for banks with more than $10 billion in assets. Although there is no cap for smaller banks, including the Bank, it is still unclear what other market changes may impact debit card fees as the debit cards with higher fees become less competitive and larger banks take steps to recover income lost due to the caps on their debit card interchange fees.

In addition, the FDIC has recently issued guidance prescribing the order in which Banks may process customer debit items and imposing limits on the overdraft fees Banks may charge. Currently, these limits only apply to banks governed by the FDIC but may eventually impact all banks. These limitations could negatively impact the Company’s earnings.

Although it is impossible for us to predict at this time all the effects the Dodd-Frank Act will have on us and the rest of our industry, it is possible that our non-interest income could decrease, both our interest expense and our non-interest expense could increase, deposit insurance premiums could change, and steps may need to be taken to increase qualifying capital. We expect that our operating and compliance costs will increase and could adversely affect our financial condition and results of operations.

Adverse changes in the financial markets may adversely impact our results of operations.

The global financial markets have experienced increased volatility and an overall loss of investor confidence in recent years. While we generally invest in securities issued by U.S. government agencies and sponsored entities and U.S. state and local governments with limited credit risk, certain investment securities we hold possess higher credit risk since they represent beneficial interests in structured investments collateralized by residential mortgages, debt obligations and other similar asset-backed assets. Regardless of the level of credit risk, all investment securities are subject to changes in market value due to changing interest rates, implied credit spreads and credit ratings.

Over the last few years, structured investments, like our collateralized debt obligations, have been subject to significant market volatility due to the uncertainty of the credit ratings, deterioration in credit losses occurring within certain types of residential mortgages, changes in prepayments of the underlying collateral and the lack of transparency related to the investment structures and the collateral underlying the structured investment vehicles. These conditions have resulted in our recognizing impairment charges on certain investment securities during 2010 and 2009. Given recent market conditions and changing economic factors, we may be required to recognize additional impairment changes on securities held in our investment portfolio in the future.

We may not be able to access capital when needed.

We are required by regulatory authorities to maintain specified levels of capital. Should we experience significant loan losses, we may need additional capital. In addition, we may elect to raise additional capital to support our business, to finance acquisitions, if any, or for other purposes. Our ability to raise additional capital, if needed, will depend on our financial performance, conditions in the capital markets, economic conditions and a number of other factors, many of which are outside of our control. There can be no assurance, therefore, that we can raise additional capital at all or on terms acceptable to us. If we cannot raise additional capital when needed or desired, it may have a material adverse effect on our financial condition, results of operations and prospects.

11

A default by another larger financial institution could adversely affect financial markets generally.

The commercial soundness of many financial institutions may be closely interrelated as a result of relationships between the institutions. As a result, concerns about, or a default or threatened default by, one institution could lead to significant market-wide liquidity and credit problems, losses or defaults by other institutions. This “systemic risk” may adversely affect our business.

Changes in national and local economic and political conditions could adversely affect our earnings, as our borrowers’ ability to repay loans and the value of the collateral securing our loans decline and as loans and deposits decline.

There are inherent risks associated with our lending activities, including credit risk, which is the risk that borrowers may not repay outstanding loans or the value of the collateral securing loans will decrease. Conditions such as inflation, recession, unemployment, changes in interest rates and money supply and other factors beyond our control may adversely affect the ability of our borrowers to repay their loans and the value of collateral securing the loans, which could adversely affect our earnings. Because we have a significant amount of real estate loans, a decline in the value of real estate could have a material adverse affect on us. As of December 31, 2011, 69% of our loan portfolio consisted of commercial and industrial, commercial real estate, real estate construction, installment and agricultural loans, all of which are generally viewed as having more risk of default than residential real estate loans and all of which, with the exception of installment loans, are typically larger than residential real estate loans. Residential real estate loans held in the portfolio are typically originated using conservative underwriting standards that does not include sub-prime lending. We attempt to manage credit risk through a program of underwriting standards, the review of certain credit decisions and an on-going process of assessment of the quality of the credit already extended. Economic and political changes could also adversely affect our deposits and loan demand, which could adversely affect our earnings and financial condition. Since substantially all of our loans are to individuals and businesses in Ohio, any decline in the economy of this market area could have a materially adverse effect on our credit risk and on our deposit and loan levels.

Changes in our local economy resulting from the departure of a large employer may adversely affect our financial condition and results of operations.

Although the Company has branch offices in several counties, the departure of a large employer in any of these communities could adversely affect our market area. This occurred with the departure of DHL Express (USA), Inc. and DHL Network Operations (USA), Inc. (collectively, “DHL”) and ABX Air, Inc. (“ABX Air”), which employed more people in Clinton County than any other employer. Although this departure had a significant short-term, negative impact on the local economy, the long-term effects are still not completely known.

Changes in interest rates could adversely affect our financial condition and results of operations.

Our results of operations depend substantially on our net interest income, which is the difference between (i) the interest earned on loans, securities and other interest-earning assets and (ii) the interest paid on deposits and borrowings. These rates are highly sensitive to many factors beyond our control, including general economic conditions, inflation, recession, unemployment, money supply and the policies of various governmental and regulatory authorities. If the interest we pay on deposits and other borrowings increases at a faster rate than the interest we receive on loans and other investments, our net interest income and therefore earnings, could be adversely affected. Earnings could also be adversely affected if the interest we receive on loans and other investments falls more quickly than the interest we pay on deposits and borrowings. While we have taken measures intended to manage the risks of operating in a changing interest rate environment, there can be no assurance that these measures will be effective in avoiding undue interest rate risk.

Increases in interest rates also can affect the value of loans and other assets, including our ability to realize gains on the sale of assets. We originate loans for sale and for our portfolio. Increasing interest rates may reduce

12

the origination of loans for sale and consequently the fee income we earn on such sales. Further, increasing interest rates may adversely affect the ability of borrowers to pay the principal or interest on loans and leases, resulting in an increase in non-performing assets and a reduction of income recognized.

Increases in FDIC insurance premiums may have a material adverse effect on our earnings.

During the last few years, there have been higher levels of bank failures, which dramatically increased resolution costs of the FDIC and depleted the deposit insurance fund. In order to maintain a strong funding position and restore reserve ratios of the deposit insurance fund, the FDIC increased assessment rates of insured institutions uniformly by 7 basis points (7 cents for every $100 of deposits) for 2009 and 2010. Additional changes were also made to require riskier institutions to pay a larger share of premiums by factoring in rate adjustments based on secured liabilities and unsecured debt levels.

The Emergency Economic Stabilization Act of 2008 (the “EESA”) instituted two temporary programs to further insure customer deposits at FDIC-member banks: deposit accounts became insured up to $250,000 per customer (up from $100,000) and noninterest bearing transactional accounts became fully insured (unlimited coverage). Since then, the Dodd-Frank Act made the increase in the standard maximum insurance amount permanent, and the unlimited coverage of non-interest bearing transactions accounts has been extended until December 31, 2012.

On May 22, 2009, the FDIC adopted a rule that imposed a special assessment for the second quarter of 2009 of 5 basis points on each insured depository institution’s assets minus its Tier 1 capital as of June 30, 2009, which was collected on September 30, 2009. We paid $241,000.

On November 12, 2009, the FDIC adopted a rule requiring insured institutions to prepay their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. The prepaid assessments for these periods were collected on December 30, 2009, along with the regular quarterly risk-based deposit insurance assessment for the third quarter of 2009. For the fourth quarter of 2009 and for all of 2010, the prepaid assessment rate was based on each institution’s total base assessment rate in effect on September 30, 2009, modified to assume that the assessment rate in effect for the institution on September 30, 2009, was in effect for the entire third quarter of 2009. On September 29, 2009, the FDIC increased annual assessment rates uniformly by 3 basis points beginning in 2011. As a result, an institution’s total base assessment rate for purposes estimating an institution’s assessment for 2011 and 2012 was increased by 3 basis points. Each institution’s prepaid assessment base was calculated using its third quarter 2009 assessment base, adjusted quarterly for an estimated five percent annual growth rate in the assessment base through the end of 2012. The three-year prepayment was $3.1 million for us, of which $1.5 million has been expensed through 2011.

On February 7, 2011, the FDIC issued final regulations, effective April 1, 2011, as required by the Dodd-Frank Act to change the deposit insurance assessment base from total domestic deposits to average total assets minus average tangible equity, as well as changing the assessment for larger institutions and the assessment rate schedules. These changes have reduced the Bank’s FDIC premiums due to a lower assessment rate.

We are generally unable to control the amount of premiums that we are required to pay for FDIC insurance. If there are additional financial institution failures, we may be required to pay higher FDIC premiums. Increases in FDIC insurance premiums may materially adversely affect our results of operations and our ability to continue to pay dividends on our common shares at the current rate or at all.

Our allowance for loan losses may be insufficient.

We maintain an allowance for loan losses to provide for probable loan losses based on management’s quarterly analysis of the loan portfolio. The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”) requires management to make significant estimates that affect the financial statements. One of our most critical estimates is the level of the

13

allowance for loan losses. Due to the inherent nature of these estimates, we cannot provide absolute assurance that we will not be required to charge earnings for significant unexpected loan losses. For more information on the sensitivity of these estimates, refer to the discussion of our “Critical Accounting Policies” on pages 31 and 32.

We maintain an allowance for loan losses that we believe is a reasonable estimate of known and inherent losses within the loan portfolio. We make various assumptions and judgments about the collectability of our loan portfolio, including the creditworthiness of our borrowers and the value of the real estate and other assets serving as collateral for the repayment of loans. In deciding whether to extend credit or enter into other transactions with customers and counterparties, we may rely on information provided to us by customers and counterparties, including financial statements and other financial information. We may also rely on representations of customers and counterparties as to the accuracy and completeness of that information and, with respect to financial statements, on reports of independent auditors. For example, in deciding whether to extend credit to a business, we may assume that the customer’s audited financial statements conform with GAAP and present fairly, in all material respects, the financial condition, results of operations and cash flows of the customer. We may also rely on the audit report covering those financial statements. Our financial condition, results of operations and cash flows could be negatively impacted to the extent that we rely on financial statements that do not comply with GAAP or on financial statements and other financial information that are materially misleading.

Through a periodic review and consideration of the loan portfolio, management determines the amount of the allowance for loan losses by considering general market conditions, credit quality of the loan portfolio, the collateral supporting the loans and performance of customers relative to their financial obligations with us. The amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates, which may be beyond our control, and these losses may exceed current estimates. We cannot fully predict the amount or timing of losses or whether the loss allowance will be adequate in the future. If our assumptions prove to be incorrect, our allowance for loan losses may not be sufficient to cover losses inherent in our loan portfolio, resulting in additions could have a material adverse impact on our financial condition and results of operations. In addition, federal and state regulators periodically review our allowance for loan losses as part of their examination process and may require management to increase the allowance or recognize further loan charge-offs based on judgments different than those of management. Any increase in the provision for loan losses would decrease our pretax and net income.

We operate in an extremely competitive market, and our business will suffer if we are unable to compete effectively.

In our market area, we encounter significant competition from other banks, savings and loan associations, credit unions, mortgage banking firms, securities brokerage firms, asset management firms and insurance companies. The increasingly competitive environment is a result primarily of changes in regulation and the accelerating pace of consolidation among financial service providers. NB&T Financial is smaller than many of our competitors. Many of our competitors have substantially greater resources and lending limits than we do and may offer services that we do not or cannot provide.

Our ability to pay cash dividends is limited.

We are dependent primarily upon the earnings of our operating subsidiaries for funds to pay dividends on our common shares. The payment of dividends by us and our subsidiaries is subject to certain regulatory restrictions. As a result, any payment of dividends in the future will be dependent, in large part, on our ability to satisfy these regulatory restrictions and our subsidiaries’ earnings, capital requirements, financial condition and other factors. Although our financial earnings and financial condition have allowed us to declare and pay periodic cash dividends to our shareholders, there can be no assurance that our dividend policy or size of dividend distribution will continue in the future.

14

The preparation of financial statements requires management to make estimates about matters that are inherently uncertain.

Management’s accounting policies and methods are fundamental to how we record and report our financial condition and results of operations. Our management must exercise judgment in selecting and applying many of these accounting policies and methods in order to ensure that they comply with generally accepted accounting principles and reflect management’s judgment as to the most appropriate manner in which to record and report our financial condition and results of operations. One of the most critical estimates is the level of the allowance of loan losses. Due to the inherent nature of these estimates, we cannot provide absolute assurance that we will not significantly increase the allowance for loan losses or sustain loan losses that are significantly higher than the provided allowance.

Material breaches in security of our systems may have a significant effect on our business.

We collect, process and store sensitive consumer data by utilizing computer systems and telecommunications networks operated by both us and third party service providers. We have security and backup and recovery systems in place, as well as a business continuity plan, to ensure the computer systems will not be inoperable, to the extent possible. We also have implemented security controls to prevent unauthorized access to the computer systems and requires its third party service providers to maintain similar controls. However, management cannot be certain that these measures will be successful. A security breach of the computer systems and loss of confidential information, such as customer account numbers and related information, could result in a loss of customers’ confidence and, thus, loss of business.

Trading in our common shares is very limited, which may adversely affect the time and the price at which you can sell your NB&T Financial common shares.

Although the common shares of NB&T Financial are quoted on The NASDAQ Capital Market, trading in NB&T Financial’s common shares is not active, and the spread between the bid and the asked price is often wide. As a result, you may not be able to sell your shares on short notice, and the sale of a large number of shares at one time could temporarily depress the market price. The price at which you may be able to sell your common shares may be significantly lower than the price at which you could buy NB&T Financial common shares at that time.

Our organizational documents and the large percentage of shares controlled by management and family members of management may have the effect of discouraging a third party from acquiring us.

Our articles of incorporation and code of regulations contain provisions, including a staggered board of directors and a supermajority vote requirement, that make it more difficult for a third party to gain control or acquire us without the consent of the board of directors. These provisions could also discourage proxy contests and may make it more difficult for dissident shareholders to elect representatives as directors and take other corporate actions. Moreover, as of March 1, 2012, directors and executive officers controlled the vote of 6.3% of the outstanding common shares of NB&T Financial in addition to the 4.0% of the outstanding shares with respect to which the Bank controls the vote as trustee and an additional 27.6% owned by relatives of a director. The provisions in our articles and code of regulations and the percentage of voting control by NB&T Financial affiliates and relatives could have the effect of delaying or preventing a transaction or a change in control that a shareholder might deem to be in the best interests of that shareholder.

Future expansion may adversely affect our financial condition and results of operations.

We may acquire other financial institutions or parts of institutions in the future and may open new branches. We also may consider and enter into new lines of business or offer new products or services. Expansions of our business involve a number of expenses and risks, including:

| | • | | the time and costs associated with identifying and evaluating potential acquisitions; |

15

| | • | | the potential inaccuracy of estimates and judgments used to evaluate credit, operations, management and market risk with respect to the target institutions; |

| | • | | the time and costs of evaluating new markets, hiring local management and opening new offices, and the delay between commencing these activities and the generation of profits from the expansion; |

| | • | | our ability to finance an acquisition or other expansion and the possible dilution to our existing shareholders; |

| | • | | the diversion of management’s attention to the negotiation of a transaction and the integration of the operations and personnel of the combining businesses; |

| | • | | entry into unfamiliar markets; |

| | • | | the introduction of new products and services into our existing business; |

| | • | | the incurrence and possible impairment of goodwill associated with an acquisition and possible adverse short-term effects on our results of operations; and |

| | • | | the risk of loss of key employees and customers. |

We may incur substantial costs to expand, and we can give no assurance that such expansion will result in the levels of profits we expect. Neither can we assure that integration efforts for any future acquisitions will be successful. We may issue equity securities in connection with acquisitions, which could dilute the economic and voting interests of our existing shareholders.

The Company undertakes no obligation and disclaims any intention to publish revised information or updates to forward-looking statements contained in the above risk factors or in any other statement made at any time by any director, officer, employee or other representative of the Company unless and until any such revisions or updates are required to be disclosed by applicable securities laws or regulations.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

NB&T Financial and the Bank own and occupy their main offices located at 48 North South Street, Wilmington, Ohio. The Bank also owns or leases 23 full-service branch offices and one remote drive-through ATM facility, all of which are located in Brown, Clermont, Clinton, Highland, Montgomery, Warren and Cuyahoga counties in Ohio. The Bank owns a building at 1600 West Main Street, Wilmington, Ohio, which serves as an operation center for the Bank and is leased in part to the insurance agency sold by the Bank in early 2010.

Item 3. Legal Proceedings

Neither NB&T Financial nor the Bank is presently involved in any legal proceedings of a material nature. From time to time, the Bank is a party to legal proceedings incidental to its business to enforce its security interest in collateral pledged to secure loans made by the Bank.

Item 4. Mine Safety Disclosures

Not applicable.

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

There were 3,423,252 common shares of the Company outstanding on December 31, 2011 held by approximately 431 shareholders of record.

The Company’s shares trade on the NASDAQ Capital Market under the symbol NBTF. The following table summarizes the quarterly common stock prices and dividends declared for the last two years.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2010 | |

| | | High | | | Low | | | Dividend | | | High | | | Low | | | Dividend | |

Fourth Quarter | | $ | 20.00 | | | $ | 16.70 | | | $ | 0.30 | | | $ | 27.06 | | | $ | 18.72 | | | $ | 0.30 | |

Third Quarter | | | 20.81 | | | | 17.85 | | | | 0.30 | | | | 20.25 | | | | 16.50 | | | | 0.29 | |

Second Quarter | | | 22.00 | | | | 19.55 | | | | 0.30 | | | | 18.50 | | | | 17.00 | | | | 0.29 | |

First Quarter | | | 27.06 | | | | 20.00 | | | | 0.30 | | | | 18.00 | | | | 15.00 | | | | 0.29 | |

As a national bank, the Bank is subject to restrictions on the payment of dividends to the Company, which could restrict the ability of the Company to pay dividends. The Bank may not pay a dividend if it would cause the Bank not to meet its capital requirements. In addition, without regulatory approval, the Bank is limited to paying dividends equal to net income to date in the fiscal year plus its retained net income for the preceding two years. The Company’s ability to pay dividends to its shareholders may be restricted. Current FRB policy requires bank holding companies to act as a source of financial strength to its banking subsidiaries. Under this policy, the FRB may require the Company to commit resources or contribute additional capital to the Bank, which could restrict the amount of cash available for dividends to the Company’s shareholders. The FRB has issued guidance on the payment of dividends by bank holding companies, which includes conditions under which bank holding companies must provide advance notification of their intentions to declare and pay dividends.

The Company has an equity plan under which the Company may grant options, restricted stock and stock appreciation rights to selected directors and employees for up to 270,000 common shares of the Company. The Company also has a stock option plan that has been terminated but under which options to purchase shares remain exercisable. Finally, an option to purchase 30,000 shares was awarded to Mr. Limbert upon his employment. These options may be exercised at $20.88, vested over five years and expire in 2016. The following table summarizes the securities authorized for issuance at December 31, 2011 under all equity compensation plans in existence at that date:

| | | | | | | | | | | | |

Plan Category | | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a) | | | Weighted-average

exercise price of

outstanding

options, warrants

and rights

(b) | | | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column

(a)) (c) | |

Equity compensation plans approved by security holders: | | | | | | | | | | | | |

2006 Equity Plan | | | 198,602 | | | $ | 19.22 | | | | 47,567 | |

1992 Nonqualified Stock Option Plan (Terminated 2006) | | | 59,000 | | | | 24.79 | | | | 0 | |

Equity compensation plans not approved by security holders | | | 30,000 | | | | 20.88 | | | | 0 | |

| | | | | | | | | | | | |

Total | | | 248,502 | | | $ | 20.50 | | | | 47,567 | |

| | | | | | | | | | | | |

17

Unregistered Sales of Equity Securities and Use of Proceeds

None.

Issuer Purchases of Equity Securities

| | | | | | | | | | | | | | | | |

Period | | (a) Total

Number of

Shares

Purchased | | | (b) Average

Price Paid per

Share | | | (c) Total Number of Shares

Purchased as Part of Publicly

Announced Plans or Programs | | | (d) Maximum Number

(or Approximate

Dollar Value) of Shares

that May Yet Be

Purchased Under the

Plans or Programs | |

10/1/11 to 10/31/11 | | | 910 | | | $ | 17.49 | | | | — | | | | — | |

11/1/11 to 11/30/11 | | | — | | | | — | | | | — | | | | — | |

12/1/11 to 12/31/11 | | | — | | | | — | | | | — | | | | — | |

Total | | | 910 | | | $ | 17.49 | | | | — | | | | — | |

The 910 shares were repurchased to facilitate distributions from the Company’s Employee Stock Ownership plan.

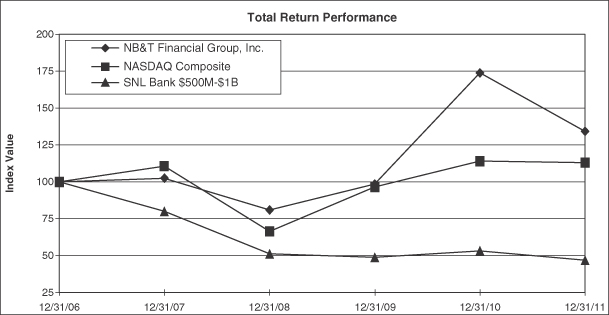

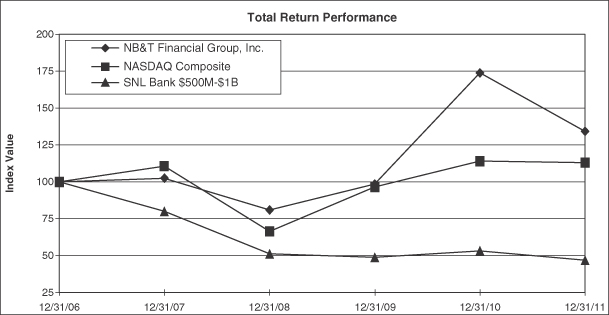

Performance Graph

The following line graph compares the yearly percentage change in NB&T Financial’s cumulative total shareholder return against the cumulative return of The NASDAQ Composite Index, which includes all Nasdaq domestic and international based common type stocks listed on The NASDAQ Stock Market, and an index of banks with total assets of $500 million to $1 billion. The graph assumes the investment of $100 on December 31, 2006. Cumulative total shareholder return is measured by dividing (i) the sum of (A) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (B) the difference between the price of NB&T Financial’s common shares at the end and at the beginning of the measurement period; by (ii) the price of NB&T Financial’s common shares at the beginning of the measurement period.

NB&T Financial Group, Inc.

18

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Period Ending | |

Index | | 12/31/06 | | | 12/31/07 | | | 12/31/08 | | | 12/31/09 | | | 12/31/10 | | | 12/31/11 | |

NB&T Financial Group, Inc. | | | 100.00 | | | | 102.55 | | | | 81.05 | | | | 98.64 | | | | 173.88 | | | | 134.34 | |

NASDAQ Composite | | | 100.00 | | | | 110.66 | | | | 66.42 | | | | 96.54 | | | | 114.06 | | | | 113.16 | |

SNL Bank $500M-$1B | | | 100.00 | | | | 80.13 | | | | 51.35 | | | | 48.90 | | | | 53.38 | | | | 46.96 | |

Item 6. Selected Financial Data

(Dollars and shares in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Consolidated Statements of Income | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 28,172 | | | $ | 31,613 | | | $ | 25,916 | | | $ | 28,828 | | | $ | 32,947 | |

Interest expense | | | 4,734 | | | | 7,333 | | | | 7,475 | | | | 10,353 | | | | 14,276 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 23,438 | | | | 24,280 | | | | 18,441 | | | | 18,475 | | | | 18,671 | |

Provision for loan losses | | | 2,935 | | | | 1,610 | | | | 1,550 | | | | 400 | | | | 135 | |

Non-interest income | | | 9,724 | | | | 16,397 | | | | 9,924 | | | | 8,236 | | | | 8,240 | |

Non-interest expense | | | 25,123 | | | | 26,458 | | | | 22,481 | | | | 21,679 | | | | 21,316 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 5,104 | | | | 12,609 | | | | 4,334 | | | | 4,632 | | | | 5,460 | |

Income taxes | | | 1,303 | | | | 3,800 | | | | 297 | | | | 801 | | | | 1,028 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 3,801 | | | $ | 8,809 | | | $ | 4,037 | | | $ | 3,831 | | | $ | 4,432 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Basic earnings per share | | $ | 1.11 | | | $ | 2.58 | | | $ | 1.28 | | | $ | 1.22 | | | $ | 1.39 | |

Diluted earnings per share | | | 1.11 | | | | 2.58 | | | | 1.28 | | | | 1.22 | | | | 1.39 | |

Dividends per share | | | 1.20 | | | | 1.17 | | | | 1.16 | | | | 1.16 | | | | 1.12 | |

Book value at year end | | | 20.68 | | | | 20.74 | | | | 18.91 | | | | 18.52 | | | | 18.52 | |

Weighted average shares outstanding—basic | | | 3,424 | | | | 3,411 | | | | 3,154 | | | | 3,143 | | | | 3,188 | |

Weighted average shares outstanding—diluted | | | 3,436 | | | | 3,414 | | | | 3,154 | | | | 3,143 | | | | 3,190 | |

| | | | | |

Consolidated Balance Sheets (Year End) | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 675,588 | | | $ | 690,618 | | | $ | 649,340 | | | $ | 524,841 | | | $ | 518,922 | |

Securities | | | 139,744 | | | | 133,855 | | | | 142,424 | | | | 87,908 | | | | 89,285 | |

Loans, including loans held for sale | | | 404,469 | | | | 414,978 | | | | 395,548 | | | | 336,184 | | | | 357,763 | |

Allowance for loan losses | | | 4,668 | | | | 3,714 | | | | 3,776 | | | | 3,411 | | | | 3,594 | |

Deposits | | | 581,383 | | | | 584,373 | | | | 541,422 | | | | 420,728 | | | | 420,254 | |

Long-term debt | | | 15,310 | | | | 15,310 | | | | 39,810 | | | | 39,810 | | | | 34,810 | |

Total shareholders’ equity | | | 70,790 | | | | 71,019 | | | | 64,485 | | | | 58,791 | | | | 58,883 | |

| | | | | |

Selected Financial Ratios | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.56 | % | | | 1.27 | % | | | 0.74 | % | | | 0.73 | % | | | 0.82 | % |

Return on average equity | | | 5.33 | | | | 12.65 | | | | 6.76 | | | | 6.49 | | | | 7.53 | |

Dividend payout ratio | | | 108.11 | | | | 45.35 | | | | 90.63 | | | | 95.08 | | | | 80.58 | |

Net interest margin | | | 3.77 | | | | 3.83 | | | | 3.70 | | | | 3.84 | | | | 3.78 | |

Non-interest expense to total revenue | | | 75.66 | | | | 65.04 | | | | 79.26 | | | | 81.16 | | | | 79.21 | |

Average loans to average total assets | | | 59.62 | | | | 60.53 | | | | 60.83 | | | | 65.19 | | | | 71.62 | |

Average equity to average total assets | | | 10.47 | | | | 10.04 | | | | 10.93 | | | | 11.21 | | | | 10.94 | |

Total risk-based capital ratio (at year end) | | | 19.15 | | | | 18.36 | | | | 16.87 | | | | 18.80 | | | | 17.69 | |

Ratio of non-performing loans to total loans | | | 3.00 | | | | 2.65 | | | | 1.74 | | | | 0.95 | | | | 0.55 | |

Ratio of loan loss allowance to total loans | | | 1.15 | | | | 0.89 | | | | 0.95 | | | | 1.01 | | | | 1.00 | |

Ratio of loan loss allowance to non-performing loans | | | 38 | | | | 34 | | | | 55 | | | | 107 | | | | 181 | |

Net charge-offs to average loans | | | 0.49 | | | | 0.40 | | | | 0.36 | | | | 0.17 | | | | 0.34 | |

19

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis comparing 2011 to prior years should be read in conjunction with the audited consolidated financial statements at December 31, 2011 and 2010 and for the three years ended December 31, 2011.

FORWARD-LOOKING STATEMENTS

Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plans,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” and “could” are generally forward-looking in nature and not historical facts. Results could differ materially from those expressed in such forward-looking statements due to a number of factors, including (1) changes in interest rates; (2) changes in national and local economic and political conditions; (3) competitive pressures in the retail banking, financial services, insurance and other industries; (4) changes in laws and regulations, including changes in accounting standards; (5) changes in policy by regulatory agencies; and (6) changes in the securities markets. Any forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions, and actual results could differ materially from those contemplated by those forward-looking statements. Many of the factors that will determine these results are beyond the Company’s ability to control or predict. The Company disclaims any duty to update any forward-looking statements, all of which are qualified by the statements in this section. See Item 1.A. “Risk Factors” in this annual report for further discussion of the risks affecting the business of the Company and the value of an investment in its shares.

RESULTS OF OPERATIONS

PURCHASE AND ASSUMPTION OF AMERICAN NATIONAL BANK

On March 19, 2010, the Company acquired, through the Bank, the banking operations of American National Bank (“ANB”), based in Parma, Ohio, under a Purchase and Assumption agreement with the FDIC. The Office of the Comptroller of the Currency declared ANB closed and appointed the FDIC as receiver. The Bank did not pay the FDIC a premium for the deposits of ANB. In addition to assuming all of the deposits of the failed bank, the Bank agreed to purchase essentially all of the assets. The book value of the net assets of ANB were acquired from the FDIC at a $10.0 million discount. The acquisition did not include the mortgage servicing business conducted by ANB by its division Leader Financial Services. The FDIC and the Bank entered into a loss-share transaction on $48.2 million of ANB assets. The Bank will share in the losses on the asset pools covered under the loss-share agreement. Under the loss-share agreement, the Bank shares in 20% of losses for the first $8.0 million in losses and 5% for any losses in excess of $8.0 million.

The transaction resulted in a gain on bargain purchase of $7.6 million for the year ended December 31, 2010. The more significant fair value adjustments in our purchase accounting for the purchase and assumption of ANB’s business were to loans and the FDIC loss share receivable. Certain of the loans acquired from ANB have evidence of deterioration since origination, and it is probable that we will not collect all contractually required principal and interest payments. Such credit-impaired loans are recorded at fair value, and the related allowance for loan losses is not carried forward. Of the $42.2 million in loans purchased, $4.2 million were determined to be credit-impaired. The estimation of fair value of credit-impaired loans involves estimating the principal and interest cash flows expected to be collected on the loans and discounting those cash flows at market rates of interest. The difference between contractually required payments at acquisition and the cash flows expected to be collected at acquisition is referred to as the nonaccretable difference. Subsequent decreases to the expected cash flows will generally result in a charge to the provision for loan losses resulting in an increase to the allowance for loan losses. Subsequent increases in cash flows result in reversal of any nonaccretable difference (or allowance for loan losses to the extent any has been recorded) with a positive impact on interest income. Disposals of loans, which may include sales of loans, receipt of payments in full by the borrower, foreclosure or troubled debt restructurings, result in removal of the loan from the acquired credit-impaired portfolio at its carrying amount.

20

Because acquired credit-impaired loans are written down to an amount estimated to be collectible, such loans are no longer classified as nonaccrual even though they may be contractually past due. We expect to fully collect the new carrying values of such loans (that is the new cost basis arising out of our acquisition accounting). Acquired credit-impaired loans are also excluded from the disclosure of loans 90 days or more past due and still accruing interest even though substantially all of them are 90 days or more contractually past due. Under accounting standards, such loans are considered to be accruing because the interest income on these loans relates to the establishment of an accretable yield. Loans acquired from ANB but not considered credit impaired are recorded net of an adjustment to reflect market rates and an estimate of potential credit losses for the pool of loans. The allowance for loan losses was not carried forward. The FDIC loss share receivable was estimated based on a review of the credit quality of the loan portfolio and expected losses.