SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | |

| |

Filed by the Registrant x | | |

| |

Filed by a Party other than the Registrant ¨ | | |

| |

Check the appropriate box: | | |

| |

¨ Preliminary Proxy Statement | | |

|

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x Definitive Proxy Statement | | |

| |

¨ Definitive Additional Materials | | |

| |

¨ Soliciting Material Under Section 240.14a-12 | | |

NB&T Financial Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NB&T FINANCIAL GROUP, INC.

48 N. South Street

Wilmington, Ohio 45177

(937) 382-1441

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Notice is hereby given that the 2014 Annual Meeting of Shareholders of NB&T Financial Group, Inc. (“NBTF”), will be held at 48 N. South Street, Wilmington, Ohio, on April 22, 2014, at 9:00 a.m., Eastern Daylight Saving Time (the “Annual Meeting”), for the following purposes:

| | 1. | To elect four directors of NBTF for terms expiring in 2016; |

| | 2. | To ratify the selection of BKD, LLP as NBTF’s independent registered public accounting firm for fiscal year 2014; |

| | 3. | To consider and vote upon the NB&T Financial Group, Inc. 2014 Equity Plan; and |

| | 4. | To transact such other business as may properly come before the Annual Meeting or any adjournments of the Annual Meeting. |

Such matters are more completely described in the accompanying Proxy Statement.

Only shareholders of NBTF of record at the close of business on March 3, 2014, will be entitled to receive notice of and to vote at the Annual Meeting and at any adjournments. Whether or not you expect to attend the Annual Meeting, we urge you to consider the accompanying Proxy Statement carefully and to SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND THE PRESENCE OF A QUORUM MAY BE ASSURED. Alternatively, you may submit your proxy electronically by following the instructions for internet voting accompanying the enclosed Proxy. If you submit a Proxy, you may still vote in person in the event you attend the Annual Meeting.

To obtain directions to attend the Annual Meeting and vote in person, please call Kathy Hoschar at (937) 382-1441.

By Order of the Board of Directors

March 19, 2014 | Charles L. Dehner, Secretary |

NB&T FINANCIAL GROUP, INC.

48 N. South Street

Wilmington, Ohio 45177

(937) 382-1441

PROXY STATEMENT

PROXIES

The enclosed Proxy is being solicited by the Board of Directors of NB&T Financial Group, Inc. (“NBTF”), an Ohio Corporation, for use at the 2014 annual meeting of shareholders of NBTF and at any adjournments of the annual meeting. The annual meeting will be held at 48 N. South Street, Wilmington, Ohio, on April 22, 2014, at 9:00 a.m., Eastern Daylight Saving Time. Without affecting any vote previously taken, the Proxy may be revoked by a shareholder by a later dated proxy received by NBTF before the Proxy is exercised or by giving notice of revocation to NBTF in writing before the annual meeting or in open meeting. Attendance at the annual meeting will not, of itself, revoke a Proxy.

Each properly executed Proxy received prior to the annual meeting and not revoked will be voted as specified on the Proxy or, in the absence of specific instructions to the contrary, will be voted:

FOR the election of Charles L. Dehner, G. David Hawley, John J. Limbert and Timothy L. Smith as directors of NBTF for terms expiring in 2016;

FOR the ratification of BKD, LLP (“BKD”) as NBTF’s independent registered public accounting firm for fiscal year 2014; and

FOR the approval of the NB&T Financial Group, Inc. 2014 Equity Plan (the “2014 Equity Plan”)

Proxies may be solicited by the directors, officers and other employees of NBTF in person or by mail, telephone, facsimile or electronic mail only for use at the annual meeting. Such Proxies will not be used for any other meeting. The cost of soliciting Proxies will be paid by NBTF.

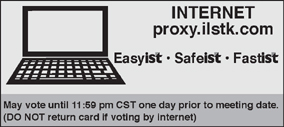

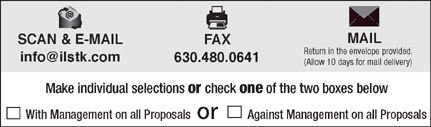

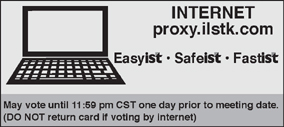

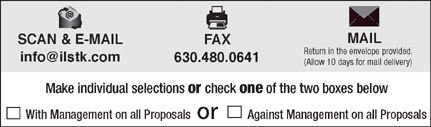

You may submit a Proxy by completing, signing, dating and promptly returning the enclosed Proxy in the envelope provided. Alternatively, you may submit a Proxy electronically by visiting the Internet voting site atproxy.ilstk.com and clicking on the “Internet Voting” tab. Enter your Voter Control Number printed on the front of the enclosed Proxy and the last four digits of your Tax Identification Number associated with the account with respect to which you are submitting a Proxy. The deadline for submitting your Proxy electronically is April 20, 2014, at 11:59 p.m. Central Daylight Saving Time. Shareholders who submit Proxies by the Internet will incur only their usual Internet access charges, if any.

Only shareholders of record as of the close of business on March 3, 2014 are eligible to vote at the annual meeting and will be entitled to cast one vote for each share owned. NBTF’s records disclose that, as of March 3, 2014, there were 3,429,560 votes entitled to be cast at the annual meeting.

This Proxy Statement is first being mailed to shareholders of NBTF on or about March 20, 2014.

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to be Held on April 22, 2014.

NBTF’s proxy statement for the 2014 annual meeting, NBTF’s 2013 Annual Report and a sample of the form of proxy card sent by NBTF are available by going to NBTF’s Internet website at www.nbtdirect.com/About-Us/Investor-Relations.

To obtain directions to attend the annual meeting and vote in person, please call Kathy Hoschar at (937) 382-1441.

1

VOTE REQUIRED

Quorum. Common shares represented by properly executed proxies returned to NBTF prior to the annual meeting will be counted toward the establishment of a quorum for the annual meeting. A majority of the outstanding common shares of NBTF must be represented in person or by proxy at the annual meeting to establish a quorum.

Director elections. The four nominees receiving the greatest number of votes for the class of directors whose terms expire in 2016 will be elected as directors for that term.

Ratification of selection of independent registered public accounting firm. The affirmative vote of a majority of the shares represented in person or by proxy at the annual meeting is required to ratify the selection of BKD, LLP as the independent registered public accounting firm.

Approval of the 2014 Equity Plan. The affirmative vote of a majority of the shares represented in person or by proxy at the annual meeting is required to approve the 2014 Equity Plan.

Effect of broker non-votes and abstentions. Brokers who hold common shares in street name may, under the applicable regulations of the Securities and Exchange Commission (the “SEC”) and the rules of exchanges and other self-regulatory organizations of which the brokers are members, sign and submit proxies for common shares of NBTF and may vote such common shares on certain matters. However, brokers who hold common shares in street name may not vote common shares on other matters without specific instruction from the customer who owns the common shares. Proxies that are signed and submitted by brokers that have not been voted on certain matters are referred to as representing “broker non-votes.”

Broker non-votes and abstentions count toward the establishment of a quorum for the annual meeting. Pursuant to rules of the New York Stock Exchange, member brokers are not permitted to vote without customer instruction with respect to the election of directors. Neither broker non-votes nor abstentions will have an effect on the election of directors. They will, though, count as shares present or represented at the annual meeting and therefore will have the effect of votes against the ratification of the selection of the independent registered public accounting firm and approval of the 2014 Equity Plan.

2

VOTING SECURITIES AND OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the only persons known to NBTF to own beneficially more than five percent of NBTF’s outstanding common shares as of March 3, 2014:

| | | | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership (1) | | | Percent of

Common Shares

Outstanding | |

Janet M. Williams B. Anthony Williams Trust 6172 U. S. 22 East Wilmington, Ohio 45177 | | | 374,201 | (2) | | | 10.91 | % |

| | |

Brooke W. James 2431 Bexley Park Road Bexley, Ohio 43209 | | | 194,412 | (3) | | | 5.66 | |

| | |

Dana L. Williams 738 Kerr Street Columbus, Ohio 43215 | | | 185,456 | | | | 5.41 | |

| | |

Lynn W. Cowan 166 Stanbery Avenue Bexley, Ohio 43209 | | | 186,068 | | | | 5.43 | |

| | |

Beth Ellingwood 84 Moorland Street Williamstown, MA 01267 | | | 198,537 | | | | 5.79 | |

| | |

The National Bank and Trust Company 48 N. South Street Wilmington, Ohio 45177 | | | 453,971 | (4) | | | 13.24 | |

| (1) | Except as indicated for the shares held by The National Bank and Trust Company (the “Bank”), the beneficial owner has sole voting and dispositive power. |

| (2) | Of the 374,201 shares, 188,831 are held in the name of Mrs. Williams, and 185,370 are held by the B. Anthony Williams Trust, of which Mrs. Williams is the trustee. |

| (3) | Includes 7,000 shares that may be acquired upon the exercise of an option within the next 60 days. |

| (4) | All of such shares are held by the Bank as Trustee, 308,712 of which are held as Trustee for the NB&T Financial Group, Inc., Employee Stock Ownership Plan (the “ESOP”). Pursuant to the ESOP, the Bank, as Trustee, has the power to vote in its sole discretion all ESOP shares that have not been allocated to the accounts of participants. At March 3, 2014, all shares were allocated. The Trustee may dispose of shares held in the ESOP Trust only under limited circumstances specified in the ESOP or by law. The Bank also has sole voting and sole dispositive power with respect to 120,230 and 145,259 shares, respectively, held as Trustee for various other trusts. |

3

The following table sets forth certain information with respect to the number of common shares of NBTF beneficially owned by each director of NBTF and each executive officer named in the Summary Compensation Table, and by all directors and executive officers of NBTF or the Bank as a group as of March 3, 2014:

| | | | | | | | | | | | |

| | | Amount and Nature of

Beneficial Ownership | | | | |

Name | | Sole Voting and

Investment Power (1) | | | Shared Voting and

Investment Power | | | Percent of Common

Shares Outstanding | |

S. Craig Beam | | | 21,946 | | | | 12,890 | | | | 1.01 | % |

Charles L. Dehner | | | 105,213 | | | | 56 | | | | 3.06 | |

Daniel A. DiBiasio (10) | | | 7,053 | | | | -0- | | | | 0.21 | |

G. David Hawley | | | 16,985 | | | | 2,414 | | | | 0.56 | |

Brooke W. James | | | 194,412 | | | | -0- | | | | 5.66 | |

John J. Limbert | | | 88,170 | (2) | | | 1,940 | (3) | | | 2.57 | |

D. Jeffery Lykins | | | 8,590 | | | | 1,610 | | | | 0.30 | |

James M. Reynolds | | | 52 | | | | 0 | | | | >0.01 | |

Timothy L. Smith | | | 75,587 | | | | 28,486 | | | | 3.03 | |

W. Keith Argabright | | | 23,616 | (4) | | | 822 | (5) | | | 0.71 | |

Craig F. Fortin | | | 40,609 | (6) | | | 2,411 | (7) | | | 1.24 | |

All directors and executive officers of NBTF as a group (14 persons) | | | 639,585 | (8) | | | 126,590 | (9) | | | 20.98 | % |

| (1) | Includes for each director other than Mr. Limbert 7,000 shares that may be acquired upon the exercise of an option within the next 60 days. |

| (2) | Includes 72,600 shares that may be acquired upon the exercise of an option within the next 60 days. |

| (3) | Consists of shares allocated to Mr. Limbert’s ESOP account, with respect to which Mr. Limbert has voting and shared investment power. |

| (4) | Includes 21,166 shares that may be acquired upon the exercise of options within the next 60 days. |

| (5) | Consists of shares allocated to Mr. Argabright’s ESOP account, with respect to which Mr. Argabright has voting and shared investment power. |

| (6) | Includes 32,366 shares that may be acquired upon the exercise of options within the next 60 days. |

| (7) | Consists of shares allocated to Mr. Fortin’s ESOP account, with respect to which Mr. Fortin has voting and shared investment power. |

| (8) | Includes 47,748 shares that may be acquired within the next 60 days upon the exercise of options by executive officers of the Bank not named in this table who may be deemed to act as officers of NBTF. |

| (9) | Includes 75,961 shares allocated to the ESOP accounts of executive officers of the Bank not named in this table who may be deemed to act as officers of NBTF. Each has voting and shared investment power with respect to those shares. |

| (10) | Mr. DiBiasio resigned from the Boards of NBTF and the Bank effective with the conclusion of his term. |

4

PROXY ITEM 1: ELECTION OF DIRECTORS

Election of Directors

The Third Amended and Restated Articles of Incorporation of NBTF provide for a board of directors consisting of not less than seven nor more than eleven directors, such number to be fixed or changed by the board of directors or the shareholders. The board of directors has set the number of directors at nine. The directors are divided into two classes, each class serving for a two-year period. Four directors are to be elected at the annual meeting.

In accordance with Section 8.04 of the articles of incorporation, nominees for election as directors may be proposed only by the directors or by any shareholder entitled to vote for directors if such shareholder makes a timely notice to the Secretary of NBTF. To be timely, a shareholder’s notice must be delivered to or mailed and received at the principal executive offices of NBTF on or before the later of (a) the February 15 immediately preceding the annual meeting of shareholders or (b) the sixtieth day before the first anniversary of the most recent annual meeting of shareholders; provided, however, that in the event that the annual meeting in any year is not held on or before the 31st day next following such anniversary, then the written notice shall be received by the Secretary within a reasonable time prior to the date of such meeting. In the case of a nominee proposed for election at a special meeting of shareholders at which directors are to be elected, such written notice of a proposed nominee by a shareholder must be received not later than the close of business on the seventh day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure was made. Such shareholder’s notice shall set forth (a) as to each person who is not an incumbent director whom a shareholder proposes to nominate for election as a director (i) the name, age, business address and residence address of such person; (ii) the principal occupation or employment of such person; (iii) the class and number of shares of NBTF that are beneficially owned by such person; and (iv) any other information relating to such person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; and (b) as to the shareholder giving the notice, (i) the name and record address of such shareholder and (ii) the class and number of shares of NBTF that are beneficially owned by such shareholder. Such notice shall be accompanied by the written consent of each proposed nominee to serve as a director of NBTF, if elected.

The Nominating and Corporate Governance Committee will consider nominees for directors of NBTF recommended by a shareholder who submits the person’s name and qualifications in writing. The Nominating and Corporate Governance Committee has no specific minimum qualifications for a recommended candidate and no specific policy with respect to consideration of diversity, and the committee does not consider shareholder-recommended candidates differently from others. The Nominating and Corporate Governance Committee considers:

| | • | | personal qualities and characteristics, accomplishments and reputation in the business community; |

| | • | | relationships in the communities in which NBTF does business; |

| | • | | ability and willingness to commit adequate time to Board and committee responsibilities; |

| | • | | the individual’s skills and experiences and how they fit with those of other directors and potential directors and satisfy the needs of NBTF; and |

| | • | | whether the potential nominees are shareholders of NBTF. |

The Nominating and Corporate Governance Committee makes its recommendation to the board of directors. Nominees are selected by vote of all of the directors of the board of directors.

5

The board of directors proposes the election of the following persons, all of whom were recommended by the Nominating and Corporate Governance Committee, to terms that will expire in 2016:

| | | | | | | | | | | | |

Name | | Age | | | Position(s) Held | | Director

Since | | | |

Charles L. Dehner | | | 66 | | | Director, Secretary of NBTF | | | 1989 | | | |

G. David Hawley | | | 66 | | | Director | | | 2000 | | | |

John J. Limbert | | | 66 | | | Director, Chief Executive Officer and President of NBTF and the Bank | | | 2006 | | | |

Timothy L. Smith | | | 63 | | | Director and Chairman of the Board of NBTF and the Bank | | | 1989 | | | |

If any nominee is unable to stand for election, the Proxies will be voted for such substitute as the board of directors recommends.

The following directors will continue to serve after the annual meeting for the terms indicated:

| | | | | | | | | | | | | | |

Name | | Age | | | Position(s) Held | | Director

Since | | | Term

Expires | |

S. Craig Beam | | | 62 | | | Director | | | 1990 | | | | 2015 | |

Brooke W. James | | | 41 | | | Director | | | 2005 | | | | 2015 | |

D. Jeffery Lykins | | | 53 | | | Director | | | 2005 | | | | 2015 | |

James M. Reynolds | | | 56 | | | Director | | | 2014 | | | | 2015 | |

Charles L. Dehner was the Executive Vice President of NBTF from 1993 until January 2003, Treasurer of NBTF from 1984 until January 2003 and Executive Vice President of the Bank from 1991 until January 2003. Mr. Dehner provides the Board with over 25 years of experience with NBTF. As the former chief financial officer of NBTF, he is qualified to provide financial expertise to the board.

G. David Hawley was the Presbyterian Minister of the Indian Hill Episcopal/Presbyterian Church in Cincinnati from April 2003 until his retirement in December 2012. In addition, he was a member of the Wilmington College Board of Trustees and the Board of Ohio Presbyterian Retirement Services Foundation. Dr. Hawley provides insight and experience with philanthropic and non-profit organizations in the communities the Bank serves.

John J. Limbert has been the President, Chief Executive Officer and a director of NBTF and the Bank since March 20, 2006. Mr. Limbert provides the board with over 40 years of career experience working with financial institutions in the State of Ohio. This experience includes working with a large regional bank, small community banks and service companies to financial institutions.

Timothy L. Smith was the President and Chief Executive Officer of NBTF and the Bank from 1989 until March 20, 2006, and has been the Chairman of the Board of both NBTF and the Bank since May 2000. Mr. Smith provides the board with his experience as the former Chief Executive Officer of NBTF. He also continues to provide insight into continuing customer relationships based on this experience.

S. Craig Beam has been a member of Thorobeam Farm, LLC, a thoroughbred horse business, since December 2006, and private investor since retirement in 1999. Mr. Beam sold his business and has been active in the local community since his retirement. Mr. Beam provides the board insight regarding community activities and small business operations.

Brooke W. James has been Business Administrator for WMSALL Farms, her family’s farming operations, since 1999. Ms. James and family members own more than 30% of the shares of NBTF. Ms. James provides the board insight into the expectations of NBTF’s large shareholders.

6

D. Jeffery Lykins has been the president of the Lykins Companies, a petroleum marketing company, since 2000. Mr. Lykins also serves on the Boards of the Ohio Petroleum Marketers and Convenience Store Association and Petroleum Marketers Associations of America. Mr. Lykins also was appointed to the Milford City Council in October 2010, and was elected to the position in January 2012, and he serves as President of the Clermont County Improvement Corporation. Mr. Lykins provides the board with his experience as president of a medium-sized business operation and knowledge of Clermont County businesses and customers.

James M. Reynolds has been the President of Wilmington College since August 2011. Prior to that, he was Vice President for Academic Affairs at Wilmington College from July 2007 until August 2011. In addition, he is a member of the CMH Regional Health System Board of Trustees and the Clinton County Port Authority Board. As President of Wilmington College, Dr. Reynolds provides the board insight to one of Clinton County’s most influential and visible employers, as well as one of the Bank’s largest customers for both loans and deposits.

The board of directors of NBTF has determined that all of the directors except Mr. Limbert are “independent” under the listing standards of The NASDAQ Stock Market, LLC (“NASDAQ”). In determining independence, the board of directors considered loan and deposit relationships with each director. The rules of NASDAQ do not deem such relationships to disqualify a director from being deemed independent. In addition, all loans and other extensions of credit were made and deposits accepted in the ordinary course of business and were made on substantially the same terms (including interest rates and collateral) as those prevailing at the time for comparable transactions with persons not related to the Bank. Further, in management’s opinion, the loans did not involve more than normal risk of collectability or present other unfavorable features. The board of directors does not believe such relationships interfere with the directors’ exercise of independent judgment in carrying out their responsibilities as directors. None of the companies by which the directors are employed is a parent, subsidiary or other affiliate of NBTF, except the Bank.

Meetings of Directors

The board of directors of NBTF met 12 times for regularly scheduled and special meetings during the year ended December 31, 2013. Each director attended at least 75% of the aggregate of the meetings of the board of directors and the meetings held by all committees of the board on which the director served during 2013.

Each director of NBTF is also a director of the Bank. The board of directors of the Bank met 12 times for regularly scheduled and special meetings during the year ended December 31, 2013.

Board Leadership Structure and Role in Risk Oversight

The board provides risk oversight primarily through the full board and the Audit Committee. The Audit Committee meets quarterly and reviews the results of the Bank’s internal audit work, compliance with Sarbanes-Oxley Section 404 review, third-party loan review and financial reporting on Form 10-Q and Form 10-K. The Audit Committee meets with the Bank’s internal audit staff, the internal audit external co-source partner, and the external auditors both with and without the executive officers present.

The full board provides risk oversight through the Enterprise Risk Management Committee (“ERM”), the Asset/Liability Committee (“ALCO”) and a set of reports delivered to board members monthly. Both the ERM and ALCO are comprised of senior officers within the Bank. The ERM meets quarterly and reviews the Bank’s risk in areas including, but not limited to, security, insurance, compliance with regulations and disaster recovery. The ALCO meets monthly to review the bank’s interest rate and liquidity risk. Both committees provide the board with a report of their meetings. The board also receives monthly a set of reports reviewing the monthly financial results, retail branch results and loan performance. This reporting is accompanied by oral reports presented by executive officers.

The Compensation Committee reviews risks associated with our compensation polices, plans and practices and discusses such risks with the full board of directors. The Compensation Committee does not believe that NBTF’s compensation policies and practices for its employees are reasonably likely to have a material adverse effect on NBTF.

7

Mr. Smith currently serves as Chairman of the Board and Mr. Limbert as Chief Executive Officer. The board of directors believes that separating the roles of Chairman of the Board and Chief Executive Officer is appropriate for NBTF at this time. The roles were split in 2006 when NBTF appointed a new Chief Executive Officer, who had not previously been affiliated with NBTF. The separation facilitates the exercise of independent oversight of management by, and communication among, non-management directors when appropriate. The board’s role in risk oversight has not, to date, had any effect on the board’s leadership structure.

Committees of Directors

The board of directors of NBTF has an Audit Committee, a Nominating and Corporate Governance Committee, and a Compensation Committee.

The Audit Committee is responsible for overseeing NBTF’s and the Bank’s accounting functions and controls, as well as selecting and retaining an accounting firm to audit NBTF’s financial statements. For a more complete description of the Audit Committee’s responsibilities, see “AUDIT COMMITTEE REPORT.” The members of the Audit Committee are independent under the listing standards of NASDAQ. A copy of the Audit Committee Charter is available on NBTF’s website at www.nbtdirect.com.

The Nominating and Corporate Governance Committee is responsible for recommending to the board of directors the size and composition of the board of directors and recommending director nominees; making recommendations to the board on the assignment of directors to board committees; monitoring compliance with applicable corporate governance requirements, identifying governance issues and making recommendations to the board regarding governance matters; and working with the Chair of the Compensation Committee to conduct the annual performance review of the Chief Executive Officer. The members of the Nominating and Corporate Governance Committee are independent under the listing standards of NASDAQ. A copy of the Nominating and Corporate Governance Committee Charter is available on NBTF’s website at www.nbtdirect.com.

The responsibilities of the Compensation Committee include establishing the general compensation philosophy of NBTF and overseeing compensation programs; evaluating and making recommendations to the boards of directors of NBTF and the Bank regarding all compensation plans, policies and programs as they affect executive officers; reviewing and recommending to the boards of directors of NBTF and the Bank the performance criteria, targets, payout criteria and payment amounts for incentive compensation plans; reviewing and making recommendations to the board of directors of NBTF regarding equity plans and awards; recommending the terms of all employment and severance agreements; conducting an annual performance review of the Chief Executive Officer; participating in risk assessments with respect to NBTF’s and the Bank’s compensation plans and policies; approving disclosures regarding compensation in NBTF’s proxy statements and other public filings; and making recommendations to the board of directors regarding director compensation. The members of the Compensation Committee are independent under the listing standards of NASDAQ. A copy of the Compensation Committee Charter is available on NBTF’s website at www.nbtdirect.com.

8

The following table summarizes the membership of the board committees:

| | | | | | |

Name | | Audit

Committee

Member | | Compensation

Committee

Member | | Nominating and

Corporate

Governance

Committee

Member |

S. Craig Beam | | | | X (Chair) | | X (Chair) |

Charles L. Dehner | | X | | | | |

Daniel A. DiBiasio | | X | | | | |

G. David Hawley | | X (Chair) | | X | | X |

Brooke W. James | | X | | | | |

John J. Limbert | | | | | | |

D. Jeffery Lykins | | X | | X | | X |

James M. Reynolds | | | | | | |

Timothy L. Smith | | | | X | | X |

Number of Meetings Held—2013 | | 5 | | 2 | | 1 |

9

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Processes and Procedures for Determining Director and Executive Officer Compensation

Annually, management develops a financial plan for the next year. During this planning process, management reviews current salary levels along with incentive and other benefit plans. The Chief Executive Officer then meets with the Compensation Committee to provide compensation recommendations, including stock based awards, for all executive officers other than himself. With the assistance of the Bank’s Human Resource Department, he provides the Compensation Committee with peer information for comparison with the recommended salaries for executive officers and to assist the Compensation Committee in forming a recommendation for the Chief Executive Officer’s compensation. The Compensation Committee reviews the information provided to it and determines officer salary recommendations for the year. The Compensation Committee does not delegate such authority. The Compensation Committee does have the authority to hire outside consultants for specific projects, but has not hired any outside consultants over the last two years. The Committee presents its recommendations to the full board of directors for its review and approval.

The Bank has an incentive compensation plan based on the Bank’s achievement of predetermined goals established annually by the board of directors relating to operating income, credit quality and noninterest expense to revenue, and on the participant’s achievement of goals relating to his or her individual contributions to the Bank. Awards are established as a percentage of each participant’s base salary and differ due to the contribution of the individual to the Bank’s success. Participants (except the Chief Executive Officer) earn awards by achieving individual goals and assisting in achieving the Bank’s goals. The more control and influence a participant has on individual goals or Bank goals, the greater the participant’s weighting on that particular factor. The Chief Executive Officer’s incentive plan awards are based solely on the achievement of the Bank’s goals.

The Compensation Committee reviews the appropriateness of granting stock options and other equity awards to senior management. Awards are not based on any pre-determined formula or goals. Amounts realized by exercising prior options are not considered in future awards or in setting other compensation. The Committee makes recommendations to the board of directors based on an individual’s performance and contribution to the Bank’s success.

Director’s fees for both NBTF and the Bank are set by the full board of NBTF, with participation by the Chief Executive Officer. Each non-employee director also receives an option to purchase 1,000 common shares of NBTF on the date following each annual meeting during which the director serves as a director according to the 2006 Equity Plan approved by shareholders.

10

Non-Employee Director Compensation

The following table describes the compensation arrangements with our non-employee directors for the 2013 and 2014 fiscal years:

| | | | | | | | |

| | | 2013 | | | 2014 | |

Annual Cash Retainers | | | $10,000 | | | | $10,000 | |

Attendance fee per meeting: | | | | | | | | |

NBTF Board Meeting | | | 600 | | | | 600 | |

Bank Board Meeting | | | 750 | | | | 750 | |

Committee Meetings | | | 0 | | | | 0 | |

Bank Loan Committee | | | 150/per month | | | | 150/per meeting | |

Chairman of the Board Stipend | | | 4,000 | | | | 4,000 | |

Audit Committee Chair Stipend | | | 2,000 | | | | 2,000 | |

Compensation Committee Chair Stipend | | | 2,000 | | | | 2,000 | |

Nominating and Corporate Governance Committee Chair Stipend | | | 2,000 | | | | 2,000 | |

Stock Options | | | 1,000 | shares (1) | | | 1,000 | shares (1) |

| (1) | Each non-employee director receives an option to purchase 1,000 common shares of NBTF on the date following each annual meeting during which the director serves as a director. The options have an exercise price equal to the closing price on the date of the grant, vest over a three-year period, and expire ten years after date of grant. |

The following table shows the compensation paid to our non-employee directors for 2013:

2013 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash | | | Option

Awards

(1) | | | Nonqualified

Deferred

Compensation

Earnings (2) | | | Total | |

S. Craig Beam | | $ | 31,850 | | | $ | 4,883 | | | | | | | $ | 36,733 | |

Charles L. Dehner | | | 24,850 | | | | 4,883 | | | | | | | | 29,733 | |

Daniel A. DiBiasio (3) | | | 26,200 | | | | 4,883 | | | | | | | | 31,083 | |

G. David Hawley | | | 28,200 | | | | 4,883 | | | | | | | | 33,083 | |

Brooke W. James | | | 26,200 | | | | 4,883 | | | | | | | | 31,083 | |

D. Jeffery Lykins | | | 26,200 | | | | 4,883 | | | | | | | | 31,083 | |

James M. Reynolds (4) | | | 0 | | | | 0 | | | | | | | | 0 | |

Timothy L. Smith | | | 30,200 | | | | 4,883 | | | $ | 75,000 | | | | 110,083 | |

| (1) | The aggregate grant date present value was determined using a Black-Scholes option pricing model and does not necessarily reflect the value that may be realized upon the exercise of the options. Refer to Note 18 in NBTF’s financial statements included in Item 8 of Form 10-K for the year ended December 31, 2013, for the assumptions used in estimating the fair value. Each director had outstanding options to purchase 7,000 shares at December 31, 2013. |

| (2) | In 2002, NBTF adopted the NB&T Financial Group, Inc., Supplemental Executive Retirement Plan, which provides retirement benefits for Mr. Smith. Under the plan, Mr. Smith is paid quarterly payments for a period of twenty years, beginning in 2007, equal to $75,000 each year. |

| (3) | Mr. DiBiasio resigned from the Boards of NBTF and the Bank effective with the conclusion of his term. |

| (4) | Mr. Reynolds did not become a member of the Boards of NBTF and the Bank until February 2014. |

11

Executive Officers

In addition to Mr. Limbert, the following persons are executive officers of NBTF or the Bank. Those who are executive officers only of the Bank may be deemed to participate in policy making for NBTF.

| | | | | | |

Name | | Age | | | Positions Held During Last Five Years |

| W. Keith Argabright | | | 42 | | | Senior Vice President, Retail Bank Operations of the Bank since July 2007. |

| | |

Craig F. Fortin | | | 53 | | | Senior Vice President, Chief Financial Officer of NBTF since January 2003; Senior Vice President, Chief Financial Officer and Cashier of the Bank since December 2002. |

| | |

Keith A. Kral | | | 42 | | | Senior Vice President, Senior Loan Officer of the Bank since December 2012; Vice President-Business Banker of PNC Bank, N.A. in Cincinnati, Ohio from March 2006 to November 2012. (PNC Bank, N.A. is not a parent, subsidiary or other affiliate of NBTF.) |

| | |

Walter H. Rowsey | | | 65 | | | Senior Vice President, Loan Operations Manager since August 2006; formerly Senior Vice President, Branch Administration of the Bank since 1993. |

| | |

Howard T. Witherby | | | 58 | | | Senior Vice President, Operations Division Manager of the Bank since October 1992. |

Executive Compensation

The following table presents certain information regarding the compensation received by our Chief Executive Officer and two other most highly compensated executive officers of NBTF or the Bank who served in such capacity during the fiscal year ended December 31, 2013 (the “Named Executive Officers”):

2013 SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary ($) | | | Bonus

($) | | | Option

Awards

($)(1) | | | Non-Equity

Incentive Plan

Compensation

($) | | | All

Other

Compensation

($) | | | Total

($) | |

John J. Limbert | | | 2013 | | | $ | 329,700 | | | $ | 0 | | | $ | 36,623 | | | $ | 0 | | | $ | 29,807 | | | $ | 396,130 | |

Chief Executive Officer and President of NBTF and Bank | | | 2012 | | | | 329,700 | | | | 0 | | | | 0 | | | | 0 | | | | 27,034 | | | | 356,734 | |

| | | | | | | |

W. Keith Argabright | | | 2013 | | | | 169,800 | | | | 0 | | | | 24,415 | | | | 0 | | | | 12,983 | | | | 207,198 | |

Senior Vice President, Retail Bank Operations | | | 2012 | | | | 169,800 | | | | 0 | | | | 0 | | | | 0 | | | | 10,580 | | | | 180,380 | |

| | | | | | | |

Craig F. Fortin | | | 2013 | | | | 166,000 | | | | 0 | | | | 24,415 | | | | 0 | | | | 9,200 | | | | 199,615 | |

Senior Vice President, Chief Financial Officer of NBTF and Bank | | | 2012 | | | | 166,000 | | | | 0 | | | | 0 | | | | 0 | | | | 8,264 | | | | 174,264 | |

| (1) | The grant date present value was determined using a Black-Scholes option pricing model and does not necessarily reflect the value that may be realized upon the exercise of the options. The options granted in 2013 have an exercise price of $19.30, vest over a three-year period and expire ten years after date of grant. Refer to Note 18 in NBTF’s financial statements included in Item 8 of Form 10-K for the year ended December 31, 2013, for the assumptions used in estimating the fair value. |

12

Employment and Severance Agreements. Only Mr. Limbert has an employment contract with NBTF and the Bank. The employment agreement between NBTF and the Bank and Mr. Limbert provides for a term currently ending on January 31, 2017, automatically extending each year for another year unless either the employer or Mr. Limbert provides notice at least 60 days in advance of the next extension date of an intention not to extend the term. The material terms of the employment agreement also include the following:

| | • | | Mr. Limbert is entitled to receive a base salary of $312,000 per year, subject to annual review and increase by the board of directors. |

| | • | | Mr. Limbert is entitled to receive an automobile allowance of $1,000 per month, plus reimbursement for all gasoline expenses for his primary vehicle. |

| | • | | Mr. Limbert is eligible for participation in life, dental, disability and other benefit plans of the Bank available to other employees; consideration for participation in any equity benefit plans established by NBTF or the Bank; and reimbursement for country club dues. |

| | • | | If Mr. Limbert’s employment is terminated following a change of control of NBTF or the Bank, or if Mr. Limbert voluntarily terminates his employment within one year following a change of control due to certain changes in the conditions of Mr. Limbert’s employment, Mr. Limbert will be entitled to receive approximately three times his annual salary at the time of the change of control and the highest bonus paid to Mr. Limbert during the five years preceding his termination, subject to adjustment to ensure that such payments do not constitute an “excess parachute payment” under Section 280G of the Internal Revenue Code of 1986, as amended, and continuation of health, life and disability coverage under the NBTF’s and the Bank’s plans, at the expense of the NBTF and the Bank for the time period allowed under COBRA or until the earlier date that Mr. Limbert is eligible to participate in similar plans of another employer. In addition, in the event of a change of control and termination of employment, Mr. Limbert would receive a lump sum payment of $200,000 in exchange for an agreement not to compete and not to solicit employees of customers for up to two years following termination. |

| | • | | If Mr. Limbert’s employment is terminated due to his inability to perform his duties as a result of a medically diagnosable condition for a period of 180 consecutive days, Mr. Limbert will receive a payment equal to 50% of his annual salary and continued insurance coverage for 18 months. |

| | • | | If Mr. Limbert’s employment is terminated by NBTF and the Bank other than in connection with a change of control and other than for just cause or due to a medically diagnosable condition and before the expiration of the term of the agreement, Mr. Limbert will be entitled to a payment in the amount of his annual salary and the continuation of health, life, disability and other benefits for 18 months or until the earlier date that Mr. Limbert is employed full-time by another employer. |

| | • | | NBTF and the Bank may terminate Mr. Limbert’s employment at any time for just cause without further obligation to Mr. Limbert. |

The Bank has also entered into severance agreements with Messrs. Argabright and Fortin effective November 8, 2007, each with a term of three years, which term automatically renews each year unless the Bank provides six months’ notice of cancellation to the officer. Each agreement provides that the officer receives nothing if he is terminated for “just cause” or is terminated for any reason more than six months before a “change of control” or more than one year after a change of control.

In the event that the officer’s employment is terminated within six months before or within one year after a change of control, (i) the Bank will be required to pay to the officer or his dependents, beneficiaries or estate an amount equal to two times (a) the higher of the officer’s base salary at the time of the change of control or the officer’s base salary at the time of termination of employment, plus (b) the highest bonus paid to the officer during the five years preceding this termination; and (ii) the officer and his dependents, beneficiaries and estate will be entitled to coverage under the health, life and disability plans of the Bank or its successor at the expense of the Bank or its successor until the earliest of the expiration of the term of the agreement, the date the officer is

13

included in another employer’s benefit plans as a full-time employee, or 18 months after the officer’s employment is terminated. The officer may also voluntarily terminate his employment within one year following a change of control upon a material decrease in base compensation or a material change in geographic location at which he is required to perform services and be entitled to the same compensation and benefits as if he were involuntarily terminated.

Incentive Plan. The Bank has an incentive compensation plan pursuant to which awards were based on the Bank’s achievement of predetermined goals relating to earnings per share and operating income, and on the participant’s achievement of goals relating to his or her individual contributions to the Bank. Mr. Limbert’s incentive is solely based on the achievement of the Bank’s goals, while 60% of Mr. Argabright’s incentive and 80% of Mr. Fortin’s incentive are based on the achievement of the Bank’s goals. The remainder of Mr. Argabright’s and Mr. Fortin’s incentive is based on their individual contributions to the Bank. The board of directors may, in its discretion, exclude any extraordinary or significant items in determining the level of achievement of the Bank’s goals. In 2013, the Bank targeted goals of pre-tax operating income for the Bank (after deducting net charge-offs and securities gains and adding back bonus and loan loss provisions) of $5.9 million (60% weighting), a Texas Ratio asset quality measure of 18.6% (20% weighting), and noninterest expense to revenue (excluding securities gains) of 74% (20% weighting) to be eligible for incentive compensation. The Bank failed to achieve its net operating income goal; therefore, no incentive compensation was paid to executive officers for 2013.

Retirement Compensation and Life Insurance. Executive officers are eligible to participate in benefit plans available to all full-time employees. First, NBTF has a 401(k) plan to which it makes contributions matching a certain percentage of the contributions by each employee of NBTF or the Bank, including officers. Employees are fully vested in the employer contribution after 3 years of service. NBTF also has an employee stock ownership plan that allocates shares of NBTF to accounts of all employees proportionately on the basis of their other compensation. Employees are fully vested in the shares allocated to their account by NBTF after 5 years of service. Although the employee stock ownership plan has not been terminated, NBTF made no contributions to the plan and allocated no shares to participant accounts in 2013 or 2012. Finally, the Bank provides a group term life insurance benefit for all full-time employees. This group term life policy provides death benefits up to three times the employee’s salary up to a maximum death benefit of $250,000. In addition, the Bank offers senior officers an option to substitute their group term life insurance coverage over $50,000 for an individual life insurance policy or annuity owned by the employee. The annual premium for such an individual policy or annuity is limited to $2,800 per year.

The following table presents the components of All Other Compensation for the Named Executive Officers presented in the 2013 Summary Compensation Table.

2013 ALL OTHER COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | 401(k)

Matching

Contributions | | | Auto

Allowance | | | Whole

Life

Insurance

Benefit | | | Country

Club Dues

&

Membership

(1) | | | Total All

Other

Compensation | |

John J. Limbert | | | 2013 | | | $ | 10,200 | | | $ | 13,230 | | | $ | 0 | | | $ | 6,377 | | | $ | 29,807 | |

Chief Executive Officer, President of NBTF and Bank | | | 2012 | | | | 6,950 | | | | 13,706 | | | | 0 | | | | 6,377 | | | | 27,034 | |

W. Keith Argabright | | | 2013 | | | | 7,040 | | | | 0 | | | | 0 | | | | 5,943 | | | | 12,983 | |

Senior Vice President, Retail Bank Operations | | | 2012 | | | | 4,893 | | | | 0 | | | | 0 | | | | 5,687 | | | | 10,580 | |

Craig F. Fortin | | | 2013 | | | | 6,760 | | | | 0 | | | | 2,440 | | | | 0 | | | | 9,200 | |

Senior Vice President, Chief Financial Officer of NBTF and Bank | | | 2012 | | | | 5,824 | | | | 0 | | | | 2,440 | | | | 0 | | | | 8,264 | |

| (1) | Amounts for actual reimbursements during the year to Named Executive Officers for monthly dues and initiation fees. None of the reimbursements were grossed-up to compensate for additional income taxes. |

14

The following table sets forth information regarding all outstanding grants of options to purchase NBTF common shares made to the Named Executive Officers at December 31, 2013, along with the exercise price and expiration date. We have awarded no other equity awards. Awards are not based on any pre-determined formula or goals. All options granted to date have a term of 10 years. The grant date is the date an award is determined by the board of directors. The exercise price is the closing price of an NBTF share on NASDAQ on the grant date.

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2013

| | | | | | | | | | | | | | | | |

| | | Option Awards | |

| | | Number of

Securities

Underlying

Unexercised

Options

(#) | | | Number of

Securities

Underlying

Unexercised

Options

(#) | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | |

Name | | Exercisable | | | Unexercisable | | | | | | | |

John J. Limbert | |

| 30,000

7,500 15,000 11,733 — |

| |

| — (1)

— (2) — (2) 5,867(4) 7,500(5) |

| |

| $20.88

19.00 15.80 21.12 19.30 |

| |

| 03/19/2016

04/25/2018 11/17/2019 04/27/2021 04/24/2023 |

|

| | | | |

W. Keith Argabright | |

| 5,000

3,500

5,000

4,000

— |

| |

| — (1)

— (2)

— (2)

2,000(4)

5,000(5) |

| |

| 20.50

19.00

15.80

21.12

19.30 |

| |

| 07/30/2017

04/25/2018

11/17/2019

04/27/2021

04/24/2023 |

|

| | | | |

Craig F. Fortin | |

| 5,500

5,500 5,500 5,500 3,000 3,800

— |

| |

| (1)

— (3) — (2) — (2) — (4) 1,900(4)

5,000(5) |

| |

| 30.50

23.00 20.50 19.00 15.80 21.12

19.30 |

| |

| 02/16/2014

05/16/2015 10/16/2016 04/25/2018 11/17/2019 04/27/2021

04/24/2023 |

|

| (1) | Stock options fully vested five years prior to option expiration date. |

| (2) | Stock options fully vested seven years prior to option expiration date. |

| (3) | Stock options fully vested on grant date of 05/17/2005. |

| (4) | Stock options vest at a rate of 33 1/3% per year with remaining vesting date of 04/28/2014. |

| (5) | Stock options vest at a rate of 33 1/3% per year with remaining vesting dates of 04/25/2014, 04/25/2015 and 04/25/2016. |

15

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Bank occasionally makes loans of various types to directors and executive officers of the Bank, their immediate family members, persons sharing their households and corporations and organizations in which such persons have a material interest. All loans outstanding to any of such related persons since January 1, 2012 were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to the Bank and did not involve more than the normal risk of collectability or present other unfavorable features.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the federal securities laws, NBTF’s directors and executive officers and persons holding more than ten percent of the common shares of NBTF are required to report their ownership of common shares and changes in such ownership to the Securities and Exchange Commission and NBTF. The Securities and Exchange Commission has established specific due dates for such reports. Based upon a review of such reports, NBTF must disclose any failures to file such reports timely in Proxy Statements used in connection with annual meetings of shareholders. No such failures occurred during 2013.

AUDIT COMMITTEE REPORT

The Audit Committee of the board of directors of NBTF is comprised of five directors, all of whom are considered “independent” under Rule 4200(a) (14) of NASDAQ’s listing standards. The Audit Committee is responsible for overseeing NBTF’s accounting functions and controls, as well as selecting and retaining an accounting firm to audit NBTF’s financial statements. The board of directors has adopted a Charter to set forth the responsibilities of the Audit Committee.

The Audit Committee received and reviewed the report of BKD, LLP (“BKD”) regarding the results of their audit, as well as the written disclosures and the letter from BKD required by applicable requirements of the Public Company Accounting Oversight Board regarding BKD’s communications with the Audit Committee concerning independence, and has discussed BKD’s independence with a representative of BKD. The Audit Committee reviewed and discussed the audited financial statements with the management of NBTF. A representative of BKD also discussed with the Audit Committee the matters required to be discussed by Statement of Auditing Standards 61, as amended and as adopted by the Public Company Accounting Oversight Board in Rule 3200T. Discussions between the Audit Committee and the representative of BKD included the following:

| | • | | BKD’s responsibilities in accordance with generally accepted auditing standards |

| | • | | The initial selection of, and whether there were any changes in, significant accounting policies or their application |

| | • | | Management’s judgments and accounting estimates |

| | • | | Whether there were any significant audit adjustments or uncorrected misstatements determined by management to be immaterial |

| | • | | Whether there were any disagreements with management |

| | • | | Whether there was any consultation with other accountants |

| | • | | Whether there were any major issues discussed with management prior to BKD’s retention |

| | • | | Whether BKD encountered any difficulties in performing the audit |

| | • | | BKD’s judgments about the quality of NBTF’s accounting principles |

| | • | | BKD’s responsibilities for information prepared by management that is included in documents containing audited financial statements |

16

Based on its review of the financial statements and its discussions with management and the representative of BKD, the Audit Committee did not become aware of any material misstatements or omissions in the financial statements. Accordingly, the Audit Committee recommended to the board of directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2013, to be filed with the SEC.

Submitted by the Audit Committee:

| | |

Charles L. Dehner Daniel A. DiBiasio G. David Hawley | | Brooke Williams James D. Jeffery Lykins |

PROXY ITEM 2: RATIFICATION OF THE SELECTION OF BKD, LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected BKD, LLP as NBTF’s independent registered public accounting firm for fiscal year 2014. BKD has served as NBTF’s independent registered public accounting firm since 2002. Although not required, shareholders are being asked to ratify the appointment of BKD as NBTF’s independent public accounting firm for fiscal year 2014 as a matter of good corporate practice and to determine shareholder confidence in the firm that reviews the quality of NBTF’s financial statements. The vote will not be binding on the Audit Committee. If the selection of BKD is not ratified, the Audit Committee will reconsider but may decide to maintain the appointment of BKD. Even if the selection is ratified by the shareholders, the Audit Committee may, in its discretion, retain a different independent registered public accounting firm at any time if such change would be in the best interests of NBTF and its shareholders.

Management of NBTF expects that a representative of BKD will be present at the Annual Meeting, will have the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

The board of directors recommends a vote “FOR” the ratification of the selection of BKD, LLP as NBTF’s independent registered public accounting firm for fiscal year 2014.

Audit Fees

BKD billed NBTF $124,800 and $120,200 for professional services in connection with the audit of NBTF’s annual financial statements and the review of financial statements included in NBTF’s Forms 10-Q during 2013 and 2012.

Audit-Related Fees

During 2013 and 2012, BKD billed NBTF $3,700 and $3,500 for fees not included under “Audit Fees” for FDIC Loss Share negative assurance reporting.

Tax Fees

During 2013 and 2012, BKD billed NBTF $16,100 and $15,315 for tax compliance, tax planning and tax advice services,including preparation of tax returns.

All Other Fees

During 2013 and 2012, BKD performed no services for NBTF and the Bank other than the services discussed in “Audit Fees,” “Audit Related Fees” or “Tax Fees.”

The Audit Committee of NBTF pre-approves all services to be performed by its independent auditor for NBTF, and during 2013, all services provided by BKD for NBTF were approved in advance by NBTF’s Audit Committee.

17

PROXY ITEM 3: APPROVAL OF NB&T FINANCIAL GROUP, INC. 2014 EQUITY PLAN

General

In 2006, the shareholders of NBTF approved the NB&T Financial Group, Inc. 2006 Equity Plan (the “2006 Equity Plan”) and the board of directors terminated a nonqualified stock option plan adopted in 1992. The 2006 Equity Plan authorizes the issuance of 270,000 common shares of NBTF and, at December 31, 2013, only 30,067 remained available for awards. The 2006 Equity Plan terminates in March 2016. There are currently outstanding options to purchase 212,622 common shares of NBTF.

The board of directors proposes to terminate the 2006 Equity Plan and recommends the shareholders approve the 2014 Equity Plan, which will permit the same types of equity awards as the 2006 Equity Plan and authorize the issuance of another 270,000 common shares of NBTF. The board of directors of NBTF has voted to terminate the 2006 Equity Plan effective upon the approval by the shareholders of NBTF of the 2014 Equity Plan. The termination of the 2006 Equity Plan would not affect outstanding awards under the 2006 Equity Plan, but no further awards would be granted under the 2006 Equity Plan.

The 2014 Equity Plan is intended to foster and promote the long-term financial success of NBTF and its subsidiaries and to increase shareholder value by:

| | • | | Providing employees and directors an opportunity to acquire an ownership interest in NBTF. Under the 2014 Equity Plan, NBTF will have authority to grant stock options, stock appreciation rights and restricted stock awards to employees and non-employee directors of NBTF and its subsidiaries. |

| | • | | Enabling NBTF and its subsidiaries to attract and obtain the services of outstanding employees and directors upon whose judgment, interest and special efforts the successful conduct of the business of NBTF and its subsidiaries is largely dependent. The various types of equity awards available under the 2014 Equity Plan will give NBTF flexibility to respond to market-competitive changes in equity compensation practices. |

Summary of the 2014 Equity Plan

The principal features of the 2014 Equity Plan are summarized below. The complete text is set forth in Appendix A to this Proxy Statement.

Plan Administration. The Compensation Committee of the board of directors of NBTF (the “Committee”), is responsible for administering the 2014 Equity Plan, and will have all powers appropriate and necessary for that purpose. The amount and terms of all equity awards will be determined by the entire board of directors, except that the amounts and vesting schedule of awards to non-employee directors are set forth under the 2014 Equity Plan.

The Committee has the authority to, among other things:

| | • | | interpret the 2014 Equity Plan; |

| | • | | adopt, amend and rescind rules and regulations relating to the administration of the 2014 Equity Plan; and |

| | • | | make recommendations as to which employees of NBTF or any subsidiary of NBTF (“Employees”) will be granted awards, the type of awards to be granted and the terms and conditions of the awards. |

The board of directors has the final authority to decide which Employees will be granted awards, the types of award to be granted to each Employee, and the terms and conditions of each award to both Employees and non-employee directors, subject to certain limitations set forth in the 2014 Equity Plan.

None of NBTF, the board or the Committee, however, may reprice any award without the approval of NBTF’s shareholders.

18

So long as permitted by law, the Committee may delegate to any individual (including Employees) or entity that it deems appropriate any of its ministerial duties and authority, but not the discretionary aspects of its duties and authority.

Eligibility for Awards. The 2014 Equity Plan permits the board of directors to grant awards to any Employee, although it is anticipated that only executives and key managers generally will be considered for discretionary awards. Currently, there are approximately eight executives and key managers of NBTF and its subsidiaries who would be eligible for an award under the 2014 Equity Plan. The selection of Employee participants and the nature and size of their awards are within the discretion of the board of directors. A total of seven non-employee directors currently would receive awards as set forth in the 2014 Equity Plan.

Awards. The 2014 Equity Plan provides for the grant of non-qualified stock options, incentive stock options that qualify under Section 422 of the Code, stock appreciation rights, and restricted stock, each as defined in the 2014 Equity Plan.

Authorized Shares and Limitations on Grants. The 2014 Equity Plan authorizes the issuance of 270,000 common shares of NBTF. If shares subject to an award granted under the 2014 Equity Plan are forfeited, terminated, exchanged or otherwise settled without the issuance of shares or the payment of cash, the shares associated with that award will be available for future grants. The shares issued pursuant to the 2014 Equity Plan may consist, in whole or in part, of authorized and unissued shares not reserved for any other purpose or treasury shares.

During any fiscal year, no Employee whose compensation is (or likely will be) subject to limited deductibility under Section 162(m) of the Code (a “Covered Employee”) may receive options and stock appreciation rights covering more than 12,000 common shares of NBTF in the aggregate (including any shares in respect of awards that have been cancelled) and restricted stock awards covering more than 2,000 shares, in each case subject to later adjustment as described below under the heading “Adjustments.”

Adjustments. If a corporate transaction affects NBTF’s outstanding shares, such as a stock dividend, stock split, recapitalization, merger or other similar corporate change, the Committee will make such adjustments as it deems necessary or appropriate to the number of shares authorized for issuance pursuant to the 2014 Equity Plan and to the individual limitations described in this discussion. The Committee also will make adjustments to outstanding awards previously granted under the 2014 Equity Plan as it deems necessary or appropriate. Any such decision by the Committee will be final and binding on all participants.

Options. Options to purchase common shares of NBTF may be in the form of a non-qualified stock option or an incentive stock option. Incentive stock options may be granted only to Employees and may not be issued to non-employee directors.

The price at which a share may be purchased under an option (the exercise price) will be determined by the board, but may not be less than the fair market value (as defined in the 2014 Equity Plan) of a common share on the date the option is granted (subject to later adjustment as described above under the heading “Adjustments”). The exercise price of an incentive stock option granted to an Employee who owns (as defined in the Code) shares of NBTF possessing more than 10 percent of the voting power of NBTF (a “10% Holder”), determined under rules issued by the Internal Revenue Service (“IRS”), may not be less than 110 percent of the fair market value of a common share of NBTF on the date the option is granted.

The board of directors may establish the term of each option, but no incentive stock option may be exercised after 10 years from the grant date (5 years if the Employee is a 10% Holder). Options granted to non-employee directors will become exercisable at the rate of one third each year beginning on and after the grant date. Options awarded to Employees will become exercisable according to a schedule determined by the board of directors at the time the award is made, but no Employee option will become exercisable at a rate of less than one third each year on and after the grant date.

19

The number of incentive stock options that become exercisable for the first time in any year cannot relate to shares of common shares of NBTF having a fair market value (determined on the date of grant) of more than $100,000 per Employee.

The exercise price of any option must be paid in the manner specified in the associated award agreement, which may include payment in cash (or a cash equivalent), a cashless exercise and tendering common shares of NBTF the participant already has owned for at least six months as partial or full payment of the exercise price.

Director Option Grants. The 2014 Equity Plan provides for automatic grants of non-qualified stock options to non-employee directors. During any fiscal year, the board will grant to each of NBTF’s non-employee directors a non-qualified stock option to purchase 1,000 shares. In addition, the board will grant to each of NBTF’s non-employee directors a non-qualified stock option to purchase 1,000 shares on the date immediately following the director’s initially becoming a director. The number of awards granted to NBTF’s non-employee directors is subject to later adjustment as described under the heading “Adjustments.”

Stock Appreciation Rights. Stock appreciation rights (“SARs”) may be granted under the Plan. The exercise price of an SAR must be equal to or greater than the fair market value of the NBTF’s common shares on the date of grant (subject to later adjustment as described above under the heading “Adjustments”). An Employee exercising an SAR receives the number of whole shares equal to the difference between the fair market value of a common share of NBTF on the exercise date and the exercise price, multiplied by the number of shares with respect to which the SAR is exercised. The value of any fractional shares otherwise receivable upon the exercise of an SAR will be settled in cash.

Restricted Stock. Restricted stock consists of common shares of NBTF that are issued to a participant but which are subject to restrictions on transfer and the risk of forfeiture if certain specified conditions are not met. Restricted stock may not be sold or otherwise transferred or hypothecated until the end of the transfer restriction period established by the board, which will lapse as described in the associated award agreement. Unless otherwise specified in the award agreement, the restriction period will lapse no later than three years after the grant date. During the restriction period, restricted stock granted to a participant will be held by NBTF as escrow agent. Restricted stock will vest, with the associated restrictions on transfer lapsing, if time-based conditions are met.

Restricted stock will be forfeited if all conditions to the lapse of transfer restrictions and risk of forfeiture have not been met. Restricted stock held in escrow will not be released until all restrictions have been met at the end of the applicable restriction period. Restricted stock that has been forfeited will again become available under the 2014 Equity Plan for future awards.

Unless the associated award agreement specifies otherwise, a participant who has been granted restricted stock will have the right to receive dividends on such shares and will have the right to vote such shares during the restriction period.

Award Agreements. By accepting an award, a participant will have agreed to be bound by the terms of the 2014 Equity Plan and the award agreement between the participant and NBTF that sets forth the terms and conditions of the award.

20

Effect of Termination of Service on Awards

Unless the associated award agreement provides otherwise, the following rules apply to all awards granted under the 2014 Equity Plan when a participant terminates service as an employee or non-employee director, as the case may be:

Death or Disability. Unless the associated award agreement provides otherwise, if a participant’s employment (or, in the case of a non-employee director, his or her board service) terminates because of death or disability (as defined in the 2014 Equity Plan):

| | • | | all restricted stock held by the participant that is unvested at the time of termination of employment (or board service in the case of a non-employee director) will become fully vested; |

| | • | | all non-qualified stock options and SARs (whether or not then exercisable) held by the participant at the time of termination of employment (or board service in the case of a non-employee director) will be exercisable by the participant’s beneficiaries at any time before the earlier of the normal expiration date of the award or one year after the participant’s death or disability; and |

| | • | | all incentive stock options held by the Employee at the time of termination of employment will be exercisable by the Employee’s beneficiaries at any time before the earlier of the normal expiration date of the award and one year after the Employee’s death or disability, with any incentive stock option not exercised within three months of death or disability being treated as a non-qualified stock option. |

Retirement. Unless the associated award agreement provides otherwise, if a participating Employee’s employment terminates because of retirement:

| | • | | all restricted stock (whether or not then vested) held by the participant when the participant retires will become fully vested; |

| | • | | all non-qualified stock options and SARs (whether or not then exercisable) held by the participant when the participant retires will be exercisable by the participant at any time before the earlier of the normal expiration date of the award and one year after the retirement date; and |

| | • | | all incentive stock options held by the Employee when the Employee retires will be exercisable by the Employee at any time before the earlier of the normal expiration date of the award and one year after the retirement date, except that any incentive stock option not exercised within three months after the Employee retires will be treated as a non-qualified stock option. |

For purposes of the 2014 Equity Plan, “retirement” is defined as any termination of employment on or after reaching age 55 and after qualifying to receive benefits under any defined benefit type deferred compensation arrangement maintained by NBTF or any subsidiary.

Involuntary Termination of Service for Cause. Unless the associated award agreement provides otherwise, all outstanding awards will be forfeited if an Employee’s employment is terminated for cause (as defined in the 2014 Equity Plan) as of the date of termination of service.

Termination for any Other Reason. Unless otherwise specified in the associated award agreement, any awards that are exercisable when a participant terminates for any reason other than death, disability, retirement or cause may be exercised at any time before the earlier of the normal expiration date of the award and three months after the termination date. All options and SARs not exercisable on the termination date and all unvested restricted stock will terminate on the termination date unless otherwise specified in the award agreement.

Buy-out of Awards. At any time before a change in control, the Compensation Committee, in its sole discretion, may offer to buy for cash or by substitution of another award any or all outstanding awards held by any participant, whether or not exercisable, by providing to the participant written notice of its intention to exercise its right. If NBTF makes an offer to buy outstanding awards, it will transfer to each participant accepting

21

the offer, as soon as administratively possible, the value (equal to the difference between the aggregate fair market value of the award on the date of the buy-out offer over the aggregate exercise price, if any) of the award to be purchased or exchanged, or a substitute award whose value is equal to the difference between the aggregate fair market value on the date of the buy-out offer over the aggregate exercise price, if any, of the award to be exchanged.

Merger, Consolidation or Similar Events. If NBTF undergoes a Change in Control (as defined in the Plan), all of a participant’s awards will be treated as provided in a written change in control agreement. If there is no such agreement, (1) each option or SAR will be cancelled in exchange for cash or shares with a value equal to the excess of the change in control price over the exercise price of the award, and (2) all restrictions on restricted stock will lapse and the committee will elect to distribute either a lump sum payment of cash or the restricted shares and dividends held in escrow. The cash payment in lieu of stock will be based on the change in control price.

Amendment, Modification and Termination of Plan. The 2014 Equity Plan was adopted by NBTF’s board of directors on January 21, 2014, and will become effective upon the approval by the shareholders at the 2014 annual meeting. If approved by NBTF’s shareholders, the 2014 Equity Plan will remain in effect until January 21, 2024.

NBTF may terminate, suspend or amend the 2014 Equity Plan at any time without shareholder approval except to the extent that shareholder approval is required to satisfy applicable requirements imposed by Rule 16b-3 under the Securities Exchange Act of 1934, or any successor rule or regulation, applicable requirements of the Code or applicable requirements of any securities exchange, market or other quotation system on which NBTF’s securities are listed or traded. No amendment of the 2014 Equity Plan may (i) result in the loss of a Committee member’s status as a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934 or any successor rule or regulation, (ii) cause the 2014 Equity Plan to fail to meet the requirements of Rule 16b-3 or (iii) except as otherwise provided in the 2014 Equity Plan or in the participant’s award agreement, without the consent of the participant, adversely affect any award held by such participant.

U.S. Federal Income Tax Consequences

The following is a brief summary of the general U.S. federal income tax consequences relating to the 2014 Equity Plan. This summary is based on U.S. federal tax laws and regulations in effect on the date of this proxy statement and does not purport to be a complete description of the U.S. federal income or employment tax laws.

Section 409A of the Internal Revenue Code. Internal Revenue Code Section 409A regulates “nonqualified deferred compensation plans.” Section 409A includes a broad definition of nonqualified deferred compensation plans which may extend to various types of awards granted under the 2014 Equity Plan. The proceeds of any grant that is subject to Section 409A are subject to a 20 percent excise tax if those proceeds are distributed before the recipient separates from service or before the occurrence of other specified events, such as death, disability or a change of control, all as defined in Section 409A.

ISOs. ISOs are intended to qualify for special treatment available under Section 422 of the Internal Revenue Code. A participant will not recognize any income when an ISO is granted or exercised, and NBTF will not receive a deduction at either of those times. Also, ISOs are not subject to employment taxes.

If a participant acquires common shares of NBTF by exercising an ISO and continues to hold those common shares for one year or, if longer, until the second anniversary of the grant date (each of these periods is called an “ISO Holding Period”), the amount the participant receives when he or she disposes of the common shares minus the exercise price will be taxable at long-term capital gain or loss rates (this is referred to as a “qualifying disposition”), depending on whether the amount the participant receives when he or she disposes of the common shares is larger or smaller than the exercise price he or she paid. Upon a qualifying disposition, NBTF is not entitled to a deduction.

22