CORPORATE STRUCTURE

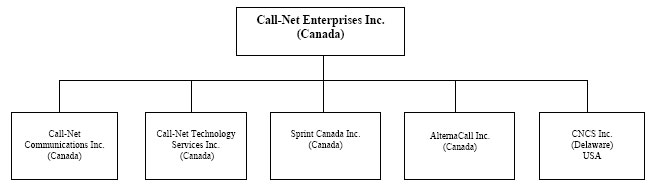

Call-Net Enterprises Inc. (Call-Net or the Corporation) with its head office at 2235 Sheppard Avenue East, Atria II, Suite 1800, Toronto, Ontario M2J 5G1 is a holding company that conducts its telecommunications business primarily through its wholly-owned operating subsidiaries: Call-Net Communications Inc. (CNCI), Call-Net Technology Services Inc. (CNTS), Sprint Canada Inc. (Sprint Canada), AlternaCall Inc. (AlternaCall), and CNCS Inc. (CNCS). All of the aforementioned subsidiaries are either incorporated or amalgamated under the laws of Canada except for CNCS, which is incorporated under the laws of Delaware, USA. The registered and principal offices of Call-Net and the aforementioned Call-Net subsidiaries are located at 2235 Sheppard Avenue East, Atria II, Suite 1800, Toronto, Ontario, Canada M2J 5G1, except that the address of the principal office of CNCS is 303 South Broadway, Suite 480, Tarrytown, New York, 10591. The Corporation owns and operates an extensive national fibre network and maintains network facilities in the United States and the United Kingdom. It also has switching centres in Vancouver, Calgary, Toronto and Montreal, and call centres in Montreal and Toronto. The Corporation operates a local services network in 33 municipalities through 151 ILEC switch co-location sites in five major urban areas. The Corporation has approximately 1,800 employees.

The following chart illustrates the organizational structure of Call-Net and its wholly owned operating subsidiaries, including their jurisdictions of incorporation.

GENERAL DEVELOPMENT OF THE BUSINESS

Introduction

The Corporation, primarily through its wholly-owned subsidiary Sprint Canada, is a leading Canadian integrated communications solutions provider of home phone, wireless, long distance (LD) and IP services to households, and local, long distance, toll free, enhanced voice, data and IP services to businesses and governments across Canada.

The Canadian Telecommunications Market

The total telecommunications market in Canada is estimated to be approximately $34 billion, and is currently segmented into long distance services, local services, wireless services and data services. Each of these market segments may be further divided into business and residential sub-segments.

Canadian Telecommunications Market

(Billions of Canadian dollars) | | Business | | Residential | | Total | |

| Long distance services | | | 2.8 | | | 15 | % | | 2.7 | | | 18 | % | | 5.5 | | | 16 | % |

| Local services | | | 4.3 | | | 23 | % | | 4.7 | | | 31 | % | | 9.0 | | | 27 | % |

| Data services | | | 7.9 | | | 43 | % | | 2.5 | | | 16 | % | | 10.4 | | | 30 | % |

| Wireless services | | | 3.6 | | | 19 | % | | 5.4 | | | 35 | % | | 9.0 | | | 27 | % |

TOTAL | | | 18.6 | | | | | | 15.3 | | | | | | 33.9 | | | | |

Call-Net, primarily through its wholly-owned subsidiary Sprint Canada, offers long distance, home phone, dial-up Internet, and wireless services to residential customers in Canada’s largest metropolitan areas, and long distance, local, enhanced voice, and wireless services, and data services and Internet Protocol (IP) solutions services to Canadian businesses and all levels of government. The Corporation estimates that it has approximately 3.3 per cent of the Canadian long distance, data and local services markets and 2.4 per cent of the total Canadian telecommunications market.

| Call-Net Enterprises Inc. | 1 |

Call-Net Market Share Estimate | | Business | | Residential | |

| Long distance services | | | 10.0 | % | | 5.5 | % |

| Local services | | | 1.2 | % | | 2.7 | % |

| Data services | | | 2.4 | % | | 0.5 | % |

| Wireless services | | | 0.0 | % | | 0.2 | % |

Call-Net's Share of Total Telecommunications Market Share | | | 2.4% | |

Significant Developments in 2004

Corporate Realignment

On September 29, 2004 the Corporation announced a realignment of its organizational structure designed to improve organizational effectiveness. The business solution and wholesale carrier services business units were consolidated into one organization. In addition, Call-Net consolidated its corporate, operations, marketing and provisioning functions, and eliminated the positions of chief operating officer, chief legal counsel and business unit presidents.

Broadband Phone Service Launch

On July 22, 2004 Sprint Canada launched Sprint Canada Internet Phone Service, its broadband phone service for households and small office home offices. Sprint Canada Internet Phone Service (IPS) uses voice over Internet protocol (VoIP) technology to transmit local and long distance calls over high-speed Internet networks and Sprint Canada's national local service network.

Local Telephone Service in Ontario and Quebec Expanded

On April 29, 2004 Sprint Canada opened 14 new wire centres in April 2004 and three new wire centres in October 2004 allowing it to offer local home and business telephone service to more communities in Southern Ontario and the Greater Montreal Area. The Corporation ended the year with 151 ILEC switch co-location sites serving 33 municipalities across Canada.

Repurchases Senior Secured Notes

On March 2, 2004 Call-Net repurchased for cancellation a total of U.S.$76.4 million of its 10.625 per cent senior secured notes, due December 31, 2008 leaving U.S.$223.1 million outstanding. The cost of these purchases was U.S.$79.5 million, including commissions. The purchases were funded from cash on hand. The purchase of these notes will reduce Call-Net's annual interest expense by U.S.$8.1 million.

Significant Developments - 2003 and 2002

IP Enabled Solutions

On September 24, 2003, Sprint Canada announced the launch of itsIP Enabled Solutions, a portfolio of integrated access services. The new technology allows businesses to easily establish new IP based services and to transition from existing networks to IP. For the first time in Canada, business customers were able to inter-operate a disparate network designed for different purposes or networks acquired through mergers and acquisitions, as one seamless network, without the need for additional capital outlay.IP Enabled Solutions offer highly reliable and secure connectivity and provide the opportunity for ongoing cost savings and more efficient management of resources, enabling businesses to more effectively re-deploy their information technology (IT) resources.

Sprint CanadaIP Enabled Solutions allow both asynchronous transfer mode (ATM) frame relay and customer provided equipment (CPE) based Virtual Private Network (VPN) networks to run on one seamless network. Furthermore, they offer business customers the flexibility to choose the most suitable access technology for connectivity to all sites from their head office, as well as to home and branch offices. Sprint CanadaIP Enabled Solutions deliver the benefits of IP networking with a simple and reliable architecture, preserving a customer's existing investment in its network while significantly enhancing network capabilities and bandwidth.

Share Offering

On September 9, 2003, the Corporation completed a share offering of 10,000,000 Class B Shares at a price of $3.75 per share for gross proceeds of $37.5 million. The offering was underwritten by a syndicate led by BMO Nesbitt Burns Inc. and CIBC World Markets Inc., and included TD Securities Inc. and National Bank Financial Inc. On September 30, 2003, the underwriters of its public offering exercised the over-allotment option granted to them purchasing an additional 1,500,000 Class B Shares at a price of $3.75 per Class B Non-Voting Share for aggregate gross proceeds of $5.625 million bringing the total proceeds to $43.125 million. The over-allotment option exercise transaction was completed on October 2, 2003.

| Call-Net Enterprises Inc. | 2 |

Securitization of Receivables

On July 23, 2003, the Corporation announced that its wholly-owned subsidiary, Sprint Canada, entered into an agreement with a securitization trust, which is arm’s length to the Corporation, under which Sprint Canada is able to sell an interest in certain accounts receivable. The five-year agreement provided cash proceeds to Call-Net of up to $55.0 million. Under the terms of the securitization agreement, Sprint Canada will sell a co-ownership interest in the accounts receivable of domestically originated and cross-border accounts of its residential and business units in exchange for cash. On August 12, 2003, Call-Net sold a co-ownership interest in certain accounts receivable and received $10.0 million under the securitization agreement. On February 13, 2004 and March 19, 2004, the Corporation sold additional receivables and received a further $33.7 million and $11.3 million, respectively.

Wireless Services

In June 2003, Sprint Canada entered into a two-year agreement with Microcell Solutions Inc., a national provider of Personal Communications Services (PCS) under the Fido® brand to bring Canadian consumers a residential wireline-wireless bundled service. On November 8, 2004 Microcell was acquired by Rogers Wireless, a subsidiary of Rogers Communications Inc. Both parties have expressed an interest in renewing the terms of the agreement and have agreed to extend the term of the existing agreement until December 31, 2005 to allow sufficient time to negotiate a new agreement.

Under the terms of the agreement, Sprint Canada co-markets Fido service to current and potential home phone service customers across Canada in locations where Sprint Canada provides local service, including Vancouver, Calgary, Toronto, the Ottawa Region, Montreal and several cities in Southern Ontario, representing a total area of four million residential households. Microcell provides technical support service and Sprint Canada provides sales, marketing, customer support, billing and payment processing services. By year-end, Sprint Canada had more than 30,000 wireless lines and in the fourth quarter of 2004, revenue for wireless had grown to exceed revenue from the Corporation's dial-up Internet service.

Sales of Fido wireless bundled with Sprint Canada local and long distance residential plans began in late August 2003. The time from concept development, through to launch was three months, and the total first year capital commitment was less than $3.0 million. The wireless bundle is a good example of the benefits of a partnership with established operations in related categories. Such partnerships have the potential advantages of requiring an absolute minimum development time, capital commitment, brand development and permit instead a focus on the development of customer features and benefits.

The Sprint Canada home phone and wireless bundle is targeted at young, suburban families who are purchasing their first cell phone and at those families desiring to add a second or third wireless phone to their existing sets. Customers experience significant monthly savings over the cost of buying the lines separately, additional savings from wireless long distance plans priced at the same rates as wireline long distance plans, the convenience of a single call centre agent to resolve all customer needs, and the simplicity of one monthly statement for up to five lines of each type. Customers can also add The Most™ Online (TMO) residential Internet services to this offering for a four part bundle. Sprint Canada customers enter into a two-year contract for the bundle and this has had a positive impact in reducing Sprint Canada's customer churn.

Plan of Arrangement

On April 10, 2002, the Corporation completed a Plan of Arrangement pursuant to Section 192 of theCanada Business Corporations Actto surrender all of the Corporation’s $2.6 billion in principal amount of Senior Notes and Senior Discount Notes in exchange for U.S.$377.0 million of new 10.625 per cent Secured Notes due 2008, U.S.$81.9 million in cash, and 80 per cent of the equity in the recapitalized company. The Corporation’s existing shareholders retained 20 per cent of the re-capitalized equity. As part of the Plan of Arrangement the new Common Shares and new Class B Non-Voting Shares (Class B Shares) were immediately consolidated on a one for 20 basis.

Simultaneous with the announcement of the Plan of Arrangement, the Corporation announced an agreement in principle with Sprint Communications Company L.P. (Sprint) to enter into a new 10-year branding and technology services agreement (The New Sprint Agreement). Sprint also committed to invest $25.0 million to purchase a five per cent equity interest in the Corporation after the implementation of the Plan of Arrangement. The Sprint Agreement became effective as of April 1, 2002.

On April 3, 2002, the Corporation’s debt holders and shareholders voted overwhelmingly in favour of the Plan of Arrangement and related resolutions at two separate meetings. More than 97 per cent of votes cast by debt holders and more than 98 per cent of votes cast by shareholders were in favour of the Plan of Arrangement. On April 5, 2002, a Final Order of the Ontario Superior Court of Justice was received to implement the Plan of Arrangement effective April 10, 2002. On April 15, 2002, the Corporation’s Common and Class B Shares began trading on the Toronto Stock Exchange (TSX) under the symbols FON and FON.B (now FON.NV.B), respectively.

Repurchase of Debt

On September 26, 2002, the Corporation repurchased U.S.$77.5 million of Secured Notes, and on March 2, 2004, the Corporation purchased for cancellation a further U.S.$76.4 million, leaving U.S.$223.1 million outstanding.

| Call-Net Enterprises Inc. | 3 |

Various 360networks Inc. Fibre Transactions

In September 2002, the Corporation entered into a Global Settlement Agreement with360networks and360networks' former parent company, Ledcor Industries Limited, (Ledcor) in which, among other things,360networks and Ledcor paid the Corporation U.S.$2.5 million to be released from their obligations to the Corporation to make certain right-of-way payments and deliver certain fibre routes. The Corporation and360networks also terminated an escrow agreement resulting in the Corporation's receipt of an additional $1.7 million. Among other things, the Corporation: (a) paid360networks U.S.$600,000 for the delivery of a certain fibre route; and (b) committed to purchase U.S.$8.0 million in products and services from360networks and affiliates between September 2002 and December 2005.

The Sprint Alliance

Effective April 1, 2002, the Corporation entered into a new 10-year Technology and Services Provisioning Agreement (Sprint Agreement) with Sprint replacing the old agreement executed in October 1993. Sprint is a global integrated communications provider serving more than 26 million customers in over 100 countries. With approximately 60,000 employees worldwide and over U.S.$27 billion in annual revenues in 2004, Sprint is widely recognized for developing, engineering and deploying state-of-the-art network technologies, including the United States' first nationwide all-digital, fibre-optic network and an award-winning Tier 1 Internet backbone. Sprint provides local communications services in 39 states and the District of Columbia and operates the largest 100 per cent digital, nationwide PCS wireless network in the United States. In December 2004, Sprint announced a merger with Nextel, a U.S. wireless operator that focuses on wireless business applications. Both Sprint and Nextel announced that each would own 50 per cent of the new company to be called Sprint Nextel. Sprint intends to spin off its local business division to the shareholders of Sprint Nextel following closing of the merger deal. The Corporation does not expect the merger to have any negative impact on the Sprint Agreement. For more information on Sprint and the Sprint Nextel merger, visit www.sprint.com.

The Sprint Agreement provides the Corporation the rights to the Sprint brand, technology and know-how for wireline services in Canada. The Sprint Agreement also makes provision for the circumstances in which it will be extended to wireless services. The overarching objective of the Sprint Agreement is for both companies to create an integrated and seamless network in North America and a portfolio of commonly branded services. In addition both companies have committed to be the 'preferred supplier' to the other in each of their respective national markets and to jointly pursue and sell their commonly branded services to multi-national corporations.

In connection with the granting of the technology license and the trademark license, Call-Net pays a royalty to Sprint during the first five years of the agreement of 2.5 per cent of Call-Net’s consolidated gross revenue, following which the rate will be reduced to 2.0 per cent. There are limited exclusions to the application of the royalty, such as revenue for services provided to Sprint and non-Sprint-branded, non-telecommunications revenue.

Acquisitions

Acquisition of Customer Base of 360networks/Group Telecom in Eastern Canada

On November 20, 2004, the Corporation completed a transaction to acquire certain assets of360networks from Bell Canada, including significant portions of its business customer base and specific network facilities in Eastern Canada (Ontario, Quebec and Atlantic Canada). Taking acquisition costs into account, Call-Net's acquisition price for the business customer base is expected to be approximately $17.6 million and will be paid in installments over a two-year period. As part of the transaction, Call-Net entered into a two-year transitional services agreement with Bell Canada who will provide technical and operational services to the newly acquired customer base and in exchange will be paid approximately 70 per cent of the total retail revenue with a minimum monthly payment of approximately $2.0 million. In addition, Call-Net entered into an option agreement with Bell Canada to acquire CLEC network assets at the end of the transitional services agreement. The CLEC assets include access to over 1,000 office buildings. As consideration for the option, Call-Net will pay up to $2.3 million or 7.5 per cent of the expected $30 million maximum price payable for the CLEC network assets in the second quarter of fiscal 2005.

This new business customer base in Eastern Canada is expected to add $60 million annually, principally in local and data services, to the Corporation's business services revenue.

Acquisition of eForce

On July 15, 2003, Call-Net’s wholly-owned subsidiary AlternaCall completed the acquisition of certain assets of Mosaic Performance Solutions Canada (MPS Canada), a private label consumer services company, from Mosaic Group Inc. (which was restructuring under theCompanies’ Creditors Arrangement Act (Canada) and United States Bankruptcy Code Chapter 11). The purchase price for the assets was $19.7 million including working capital. MPS Canada, renamed eForce, a division of AlternaCall, resells long distance service through consumer services companies who wish to complement their own product offerings to their existing customers. In addition, MPS Canada pioneered the 'rate and compare' billing technology that automatically selects the lowest long distance rates matched to a customer’s calling patterns.

| Call-Net Enterprises Inc. | 4 |

Acquisition of Time iCR Inc.

In September 2002, Call-Net acquired a 75 per cent interest in Time iCR Inc., a provider of customized, managed and hosted call processing solutions. Time iCR develops enhanced interactive voice response (IVR) applications for large call centre operations throughout Canada. Call-Net and Time iCR are jointly marketing a bundled offer into the major account market which includes Sprint Canada’s toll free services and Time iCR’s IVR applications. In December 2003, Call-Net gave notice of its intention to exercise its option to acquire the remaining 25 per cent interest of Time iCR. As a result, Time iCR became a wholly-owned subsidiary of Call-Net in February 2004.

BUSINESS DESCRIPTION

General

Over the past three years, the Corporation has been diversifying its revenue stream by building scale in local services and to a lesser extent data services to better balance the opportunities and risks inherent in long distance services.

Revenue Breakdown | | | 2004 | | | 2003 | | | 2002 | |

| Long distance service revenue | | | 52 | % | | 60 | % | | 63 | % |

| Local service revenue | | | 22 | % | | 15 | % | | 9 | % |

| Data service revenue | | | 25 | % | | 25 | % | | 28 | % |

| Wireless service revenue | | | 1 | % | | 0 | % | | 0 | % |

Total | | | 100 | % | | 100 | % | | 100 | % |

Operating Strategy

Primarily through Sprint Canada, Call-Net is one of Canada's leading national facilities based providers of local access, long distance, and data and Internet services to Canadian consumers and businesses. The Corporation plans to increase revenue by attaining a substantial share of the residential market and by exploiting niche markets focusing on small to medium sized enterprises (SME) and multi-national corporations (MNC) with differentiated products. Leveraging its existing network and customer base, Call-Net focuses its investments and resources on customers situated within its 'on-net' areas - areas where it provides facilities-based service. This on-net strategy has allowed Call-Net to grow local customers and revenue while maintaining cash flow self-sufficiency.

In 2004, Call-Net invested $55.4 million in capital assets in support of its strategy, as compared to $44.1 million in 2003, and $78.4 million in 2002. The 2004 investment program covered expanding capacity and increasing the capabilities of the Corporation's network to support its products and services; improving operational support systems; introducing new products such as the wireline-wireless bundle and IP-enabled services; and implementing customer related solutions. In 2004, Call-Net deployed 17 new co-locations to extend its addressable market to 4.4 million residential and 2.9 million business lines through 151 co-locations. In 2002 and 2003, Call-Net’s capital programs were targeted at the addition of new co-locations in areas contiguous to the co-location sites already in place and to enter into new local services market, such as Ottawa, and in the purchase and installation of asymmetrical digital subscriber line (ADSL) equipment in 50 co-location sites.

Within its on-net footprint, Call-Net is targeting residential, small office home office (SOHO) and SME business customers. It plans to meet the needs of these core customer segments by offering attractively priced simple bundles of products. These bundles include a combination of local services, long distance services and data and Internet services, including ADSL for business customers.

With regard to larger enterprises, the Corporation's focus is on providing voice, data, andIP Enabled Solutions to Canadian business customers in specific market segments. Sprint Canada is uniquely positioned to service business customers with North American and global networking requirements based on the long-term technology and business partnership with Sprint. In this marketplace, Sprint and Sprint Canada stand alone as the only branded North American solution with a long-term partnership in place and working - a significant advantage for North American based multi-national corporations. In order to leverage its position in this market, the Corporation is expanding its existing product suite for larger business customers with advanced

IP Enabled Solutions and value-added services developed by Sprint. Call-Net's goal is to provide ubiquitous and seamless North American telecommunication solutions to its large Canadian customers and American companies with operations in Canada.

For the broader business market segment, Call-Net is focused on niches, such as the contact centre market and has developed innovative solutions for customers with sophisticated contact centre requirements. Call-Net’s voice portfolio now includes new capabilities such as speech recognition, professional services, and other value added solutions along with network services to provide integrated solutions for customers. Call-Net has also expanded its IP-based data service offerings in the business market, providing its customers with products designed to allow them to benefit from the power and flexibility inherent in IP-based communications, without having to replace legacy data systems.

Telecommunications is a business with high capital and fixed costs. There are also significant servicing costs associated with each customer, particularly in the residential market. Furthermore, the cost associated with 'churn' (the movement of a customer from one telecommunications provider to another) has been a major issue for telecommunications providers. Call-Net's geographic focus and bundled product strategy addresses these key economic issues. By concentrating investment in areas where

| Call-Net Enterprises Inc. | 5 |

the Corporation already has a significant customer base, the incremental return on capital deployed is expected to be attractive and the payback period shortened. The Corporation's experience indicates that churn is substantially reduced when products and services are bundled. In addition, the net profit per customer for bundled telecommunications offerings, after provisioning and customer care costs, is higher than that for a one-product customer. Call-Net’s facilities-based approach, where it owns all of the switching intelligence also enables Call-Net to sell additional features to local customers that, on an incremental basis, produce relatively high profit margins.

A geographic focus also improves revenue opportunities from large business customers by reducing the cost structure and enhancing the competitiveness of Call-Net's data network solutions. This allows the Corporation to focus investment in areas that support both residential and business customers while focusing the organization on selling to the right accounts.

Call-Net's Network

To provide local service, Call-Net co-locates its equipment in the switch centres of the incumbent Local Exchange Carriers (incumbents or ILECs). At December 31, 2004, Call-Net was active in 151 co-locations in 33 municipalities in five of Canada's most populous urban areas around Vancouver, Calgary, Toronto, Ottawa, and Montreal. In Montreal, Vancouver, Ottawa, and Toronto, many of these co-locations are connected to Call-Net's local switches by metro area fibre networks (MANs).

In addition to operating a national Silver Certified Cisco IP network in Canada, Call-Net operates a North American transcontinental fibre optic network extending over 14,000 route kilometres (8,600 route miles). This network provides a significant North American geographic footprint connecting Canada's largest markets while also reaching key U.S. markets. In Canada, the network extends from Vancouver in the West to Quebec City in the East. Call-Net, through its Bell/360 acquisition, also has access to the GT CLEC network in Eastern Canada, allowing it access to network all the way to St. John’s, Newfoundland and Labrador. Call-Net is seamlessly interconnected to the network of Sprint through multiple interconnection points across the Canada/U.S. border. The Corporation’s network extends into the United States from Vancouver south to Seattle in the West, from the Manitoba-Minnesota border, through Minneapolis, Milwaukee and Chicago in the mid-West and from Toronto through Buffalo and Montreal through Albany to New York City in the East. Call-Net also has connected its North American network with Europe through international gateway switches in New York City, London and a leased trans-Atlantic fibre facility recently upgraded to synchronous transport module level 4 (STM4) capacity.

Call-Net’s network is characterized by:

| | • | Advanced technology. Call-Net has installed state-of-the-art switching technology and advanced fibre optic cable and electronic equipment offering dense wave division multiplexing (DWDM) and synchronous optical network (SONET) ring protection. The Corporation has an advanced network management system that gives it the ability to monitor network performance, access and utilization. The network is capable of high capacity transmission utilizing OC-48 and OC-192 technologies; |

| | | |

| | • | High security and reliability. Call-Net’s fibre optic network features physical route diversity with SONET protection thereby offering superior security and reliability due to its bi-directional SONET ring architecture (a 'self-healing' system that allows for instantaneous rerouting, virtually eliminating downtime in the event of a fibre cut); and |

| | | |

| | • | Additional capacity and flexibility. Call-Net has generally installed more fibre optic capacity than it expects to need for its own use. This will allow the Corporation to generate revenue from the sale of capacity to others or to increase the size and breadth of its network by swapping excess fibre for capacity on other routes. |

Call-Net believes that its fibre optic telecommunications network provides many benefits. First, the availability of a low cost, high capacity transmission source enables the Corporation to maintain low per unit carrier costs. Second, by having control over its network platform and infrastructure, the Corporation is able to design custom product offerings. Third, the Corporation has additional low cost network transmission capacity available to support data services products with high bandwidth requirements.

Call-Net has a data networking infrastructure that provides IP, frame relay, and ATM services to Canadian businesses and consumers. Data networking equipment deployments are concentrated in the major switching facilities located in Toronto, Montreal, Calgary, and Vancouver. Smaller aggregation nodes are located in Halifax, Ottawa, Chicago, New York, Kitchener, Winnipeg and Quebec City. The IP, frame relay, and ATM services offer high availability as a result of the mated pair architecture of core network elements, multiple egress routes, and the use of SONET transport facilities for all on and off-net trunk routes. The fibre optic network is leveraged to extend on-net coverage for data networking products. Agreements with other carriers extend the product reach globally.

Call-Net operates digital switching centres located throughout North America including Vancouver, Calgary, Toronto, Montreal, Buffalo and New York City. The Corporation has connected its network with the United Kingdom through international gateway switches in New York City and London, United Kingdom. In New York City, the Corporation has connected its international gateway switch with leased capacity via an international undersea cable to a Corporation-owned switch in the United Kingdom. The Corporation has received appropriate authorizations in the United States and the United Kingdom to allow it to provide services using these facilities.

Call-Net offers local services through a hybrid carrier strategy. It has deployed its own scalable switching and intelligent services infrastructure while using connections between its co-located equipment and customer premises, provided largely by other carriers. The Corporation has expanded certain of its existing switch sites to accommodate local network infrastructure.

| Call-Net Enterprises Inc. | 6 |

Call-Net has deployed Lucent 5ESS switches in Vancouver, Calgary, Toronto, and Montreal. The Corporation also offers symmetrical DSL (SDSL) and ADSL for the business market in those same areas by co-locating DSL equipment in 50 ILEC central offices.

Product/Market Segments

Local and Long Distance Services

Call-Net offers local and long distance services across Canada, primarily using the Sprint Canada® brand, to residential customers, and small, medium and large businesses. Large businesses include financial institutions and national retailers as well as other large users of telecommunications services, such as other communications companies and various levels of government.

The Corporation is well positioned to leverage its legacy long distance customer base to deliver more value-added services and bundled local access, long distance and data products.

By optimizing the use of its existing capabilities, network and related assets, Sprint Canada has marketed profitable bundled products. It has continued its push into the residential local marketplace in 2004 by bundling local lines with innovative long distance service offerings and other products such as wireless and Internet access. These bundled solutions provide the customer with all services on one bill, offering a seamless communication solution.

Residential Local or Home Phone Service

Sprint Canada entered the local services market in 1999 through an initial launch in Calgary, Alberta. By that year’s end the Corporation had introduced local services in several other metropolitan areas. The Corporation’s local service offering provided businesses, SOHO and residential consumers with a simplified rate structure, enhanced calling features, and consolidated billing.

By December 31, 2004, Call-Net had a presence in 151 ILEC wire centres, passing 4.4 million households in major geographic centres such as, Vancouver, Calgary, Toronto and the Golden Horseshoe, Ottawa and Montreal. In 2004, Sprint Canada added over 100,000 net new residential lines to finish 2004 with about 311,000 residential and SOHO lines in service. In 2004 for the first time, revenue from home phone service exceeded revenue from residential long distance.

Process improvements in provisioning reduced service order intervals by as much as 50 per cent, meaning new customers could get activated in as little as four days. Additional focus on retention meant that the customer service channel became the second largest sales channel, just behind inbound sales driven by advertising. This improvement, coupled with strong sales via the Corporation's fully transactional website, enabled Sprint Canada to reduce the cost of acquiring new customers. Significant improvements were also made to local customer churn in 2004, with churn dropping by more than 10 per cent versus 2003.

Residential Long Distance Services

In the residential long distance market, efforts continue to be primarily aimed at adding customers bundled with local and other services to increase revenue per customer and total customer life through reduced churn. The Corporation’s experience is that bundled customers generate approximately three times the revenue per month of stand-alone long distance customers, and churn at a lower rate.

Sprint Canada’s long distance rates are in the mid-market range, offering better value than the best published ILEC rates, and seeking to match prices from other resellers. Sprint Canada attempts to differentiate its offerings with bundled service values, and avoids direct competition with lower priced competitors such as dial-around and prepaid phone card companies.

In 2004, Call-Net successfully developed a number of new plans that offer competitive per minute rates within North America and internationally.

In addition to traditional long distance services, Call-Net, through its wholly-owned subsidiary AlternaCall Inc., also offers 'dial-around' services using a separate brand, Buck-a-Call™, or 101-55-66™ as well as services provided by eForce, a long distance reseller with a unique ‘rate-and-compare’ strategy that is wholly-owned by AlternaCall.

Wireless Services

Through its unique partnership with Microcell, Sprint Canada continued to offer wireless phone services bundled with home phone service. By year-end, Sprint Canada had more than 30,000 wireless lines, and 28,900 customers and in the fourth quarter of 2004, revenue for wireless had grown to exceed revenue from the Corporation's dial-up Internet service. Wireless customers sign a two year contract and are billed on their Sprint Canada home phone bill.

Residential Data Services

Dial-up Internet service (The Most Online or TMO) continues to be a profitable niche in the residential portfolio, and services principally long distance customers living outside access zones of broadband, as well as urban dwellers with simple economical Internet access needs. More than 51,000 TMO customers will be good prospects for the Corporation's high-speed Internet product, expected to be launched in mid 2005.

| Call-Net Enterprises Inc. | 7 |

Business Local and Long Distance Services

In 2004, local and long distance bundles continued to play a key role in the mid-market success of the Corporation's business services group. The Corporation's value proposition behind these bundles - pricing, convenience of dealing with one provider, accountability from a single organization and enhanced usage reporting options - received a positive response from the SME market segment. Local and long distance services are also provided to the large business market although these bundles are delivered as more customized solutions including integrated services digital network primary rate interface (ISDN PRI) and Centrex services to meet the specific business requirements of large organizations.

Bill analysis software continues to be a popular value-added feature supporting Call-Net’s local and long distance services. Using this web-based application, customers can quickly and easily monitor, analyze and share their cost and usage information at a detailed or summary level facilitating allocation, capacity and business decision making. We believe that the Corporation continues to lead the Canadian market with its bill analysis software capability.

Enhanced voice services (EVS) was a key area of growth and driver of long distance and toll free minutes for the Business and Carrier Services division in 2004. EVS provides high value, customizable in and out-bound voice applications on a hosted basis including hosted IVR and speech recognition capabilities. The Corporation expects additional growth in this area in 2005.

Business Data Services and IP Services

The Corporation markets a full range of data and IP services, attractive to all business segments, for multi-site connectivity, remote access to corporate information resources and Internet access. Value-added services such as managed network services (MNS) and bundled applications such as video conferencing enable the Corporation to tailor solutions specifically to customers’ business needs.

The Corporation’s data services portfolio includes: basic transport services such as digital private line, frame relay and ATM; data services such as transparent LAN services (TLS), IP VPN for remote access service and IP VPN for multi-site networks; and MNS such as router management and reporting and frame relay management and reporting. The Corporation’s business Internet access portfolio (including ADSL, SDSL and dedicated Internet access) targets both the Internet service provider (ISP) market and the retail business market.

The Corporation was first in Canada to launch remote access IP VPN and is now growing its business IP VPN portfolio to support hybrid networks, providing a migration path from established services such as frame relay to services based on IP. This is an important consideration for businesses that are beginning to consider advanced applications on a converged wide area network.

After the launch ofIP Enabled Solutions in late 2003, the Corporation saw growth in this area in 2004 as it began to focus on IP as a dominant networking solution. This technology allows our customers to leverage the benefits of IP technology through hybrid networks. The Corporation’s solution offers several advantages:

| | • | a single flexible network that encompasses a range of access types from xDSL to Ethernet allowing a customer to tailor a solution to precisely match the requirements of each site; |

| | | |

| | • | a migration path from legacy frame relay services, which delivers more bandwidth, more flexibility and a platform for emerging converged IP applications; and |

| | | |

| | • | an opportunity to simplify customers’ data solutions, moving from disparate services to a single IP platform. |

In 2004, the Corporation further expanded its North American data and Internet services portfolio in partnership with Sprint. This joint effort targets North American MNCs through a proposition that includes seamless technical interworking and single North American point of contact, or local in-country account management, billing and contract options. The Corporation is unique in the Canadian market with a single branded cross-border service and intends to further develop this competitive advantage in 2005 with further expansion of the cross-border product offerings and joint sales efforts with Sprint in the U.S.

Risk Factors

The international telecommunications industry is changing rapidly due to deregulation, privatization, technological improvements, expansion of infrastructure and the globalization of the world's economies. In order to compete effectively, the Corporation must adjust its contemplated plan of development to meet changing market conditions.

Operational Risks

Operational risks inherent in executing Call-Net's strategy include:

| | • | a continuing or accelerated erosion in average revenue per long distance minute. Each 10 per cent decline in average revenue per minute reduces Call-Net's revenue by approximately $43 million; |

| | | |

| | • | acquiring and retaining local customers at an economically viable cost; |

| | | |

| | • | competing effectively with competitors, many of whom have larger operational and financial resources than Call-Net, including the risk that Call-Net will not be able to effectively participate in the consolidation of the industry; |

| Call-Net Enterprises Inc. | 8 |

| | • | profitably developing, marketing and provisioning new products on a timely basis that are acceptable to its target markets; |

| | | |

| | • | hiring and retaining qualified management and staff; |

| | | |

| | • | maintaining and protecting the key assets of Call-Net, including both its network and the Sprint® brand from damage or loss; |

| | | |

| | • | Call-Net’s reliance on its agreement with Sprint in respect of its Sprint™ trademark as well as certain long distance and data services technology and know how; |

| | | |

| | • | Call-Net's ability to execute its strategy depends on the effective implementation of its relationship with Sprint and on Sprint's ability to overcome its own operational risks; and |

| | | |

| | • | Call-Net's reliance on other competitive carriers to access its customers or to deliver its data and voice traffic. |

| | | |

| | Call-Net uses a variety of strategies to mitigate these operational risks where possible including: |

| | |

| | • | transitioning its marketing focus away from long distance and towards its local, data and IP offerings; |

| | | |

| | • | launching a variety of new long distance residential products to meet the needs of a broad range of consumers, as well as transitioning the majority of its marketing and advertising budget to promote its bundled local offering; |

| | | |

| | • | entering into an expanded technological agreement with Sprint to improve its access to new technology on a timely and cost-effective basis; |

| | | |

| | • | developing and sustaining a strong operational relationship with Sprint; |

| | | |

| | • | improving its demographic market information by obtaining information on the specific needs and wants of its target markets; |

| | | |

| | • | designing a competitive compensation package and training programs, as well as other human resource related strategies, to maintain Call-Net's ability to hire and retain qualified management and staff; and |

| | | |

| | • | designing and implementing an effective risk management program, including purchasing an appropriate level of general and business interruption insurance. |

However, investors should recognize that a number of the operating risks are not within Call-Net's control and such risks could adversely affect its financial condition and operating results.

Technology Risks

One of the biggest forces for potential change in the telecommunications industry is the threat of substitution of the traditional wireline telephone by new technologies.

Wireless is often cited as an eventual replacement for the standard home telephone, although experience shows that mobile phones are used primarily as second lines. The popularity of mobile phones among younger generations has resulted in some abandonment of wireline service, but these preferences are not likely to challenge the prominence of the traditional wireline phone for many years, if at all. To benefit from the popularity of mobile phones as a second line, Call-Net introduced a bundled wireline-wireless service in 2003.

A more recently cited threat to the standard wireline home telephone is telephone service over the Internet, commonly referred to as 'voice over IP' (VoIP). This service is generally less reliable than the standard telephone, though there may be potential cost savings for users. To meet the demands of those who want Internet telephony, Call-Net introduced VoIP service for consumers in July 2004. In 2005, cable television companies are also expected to begin to offer local and long distance services to Canadian consumers on their own networks using a version of VoIP. Cable telephony, will have advantages over other forms of IP telephony in that it will be able to provide a higher quality of service, in general, than other VoIP competitors, although not as high as traditional wireline telephony.

In the business market, there is a continuing shift from ATM and frame relay (two common data networks) to IP delivered through VPN services. This transition results in lower costs for both users and carriers. Call-Net is well positioned to benefit from this trend with one of the most advanced IP networking solutions available.

Financial Risks

Availability of Capital Resources: Call-Net currently has a significant risk associated with the level of debt on its consolidated balance sheet and the debt servicing costs associated with the debt. In spite of extinguishing $2.6 billion of debt by way of the Plan of Arrangement, if Call-Net's plans change or its projections prove inaccurate and the funds currently available as cash, cash equivalents and short-term investments prove insufficient to fully fund its business plan, then Call-Net may be required to seek additional financing sooner than it currently expects. Additional sources of financing may include public or private equity or debt financing, capital and operating leases and other financing arrangements. To the extent sufficient funding is not available, Call-Net may be required to limit the markets it enters and the degree to which it penetrates a particular market.

| Call-Net Enterprises Inc. | 9 |

Call-Net can give no assurance that such additional financing will be available to it or, if available, that it can be obtained on a timely basis and on acceptable terms or within the limitations contained in Call-Net's financing arrangements. Failure to obtain such financing could result in the delay or abandonment of some or all of Call-Net's business plans, or limit its ability to make principal and interest payments on its indebtedness.

Currency Risks

Call-Net's revenue is generated primarily in Canadian dollars, while substantial amounts of its current and future liabilities, including interest and principal obligations on its long-term debt, are and will be payable in U.S. dollars. As at December 31, 2004, Call-Net had no cross-currency swaps on its outstanding U.S. dollar denominated debt. Based on its December 31, 2004 balances, a one cent change in the foreign currency exchange rate between the Canadian and U.S. dollar would have an impact of approximately $3.3 million on its long-term debt. Any substantial increase in the U.S. dollar relative to the Canadian dollar could affect Call-Net's financial condition and operating results and its ability to meet its future payment obligations on its long-term debt.

Regulatory Risks

Call-Net's retail and wholesale services have been deregulated by the CRTC. Nevertheless, the CRTC continues to retain broad regulatory powers over Call-Net under theTelecommunications Act (Canada), in particular with respect to interconnection to Call-Net’s networks. However, Call-Net’s major competitors, the ILECs, remain subject to CRTC regulation with respect to many of their services. How the ILECs comply with regulation as well as how the CRTC enforces its regulation against the ILECs could impact Call-Net’s operations and financial condition. Because neither the CRTC nor the courts have interpreted certain aspects of theTelecommunications Act (Canada) and its regulations, it is impossible to predict what impact, if any, these provisions will have on Call-Net. Moreover, any change in policy, regulations or interpretations could have a material adverse effect on Call-Net's operations and financial condition and operating results. In addition, the CRTC's decisions are subject to review under theTelecommunications Act (Canada) at any time and may be appealed to the Federal Court of Appeal (Canada) within 30 days of a decision or challenged by a petition to the Federal Cabinet of Canada within 90 days of a decision. The CRTC's decisions necessary to implement competition in the long distance and local services markets may be appealed or challenged or changed upon review.

Overview of the Regulation of Canadian Telecommunications Industry

The CRTC and Legislation

The CRTC is an agency of the Canadian federal government charged under theTelecommunications Actwith the regulation of companies, such as Call-Net, that offer telecommunications services crossing provincial or international borders and that own or operate transmission facilities. TheTelecommunications Actrequires that rates charged by carriers must be 'just and reasonable' and that services must not be unjustly discriminatory or unduly preferential.

Under the Telecommunications Act, the CRTC has the power to exempt any class of Canadian carrier from the application of the legislation if the CRTC is satisfied that such an exemption is consistent with Canadian telecommunications policy objectives. The CRTC also has the power to forbear from regulating certain services or classes of services provided by individual carriers. If the CRTC finds that a service or class of services provided by a carrier is subject to a degree of competition that is sufficient to protect the interests of users, the CRTC is required to forbear from regulating those services unless such an order would be likely to unduly impair the establishment or continuance of a competitive market for those services.

TheTelecommunications Actalso implements the Canadian government's policy of promoting Canadian ownership and control of the country's telecommunications infrastructure. Specifically, 80 per cent of the voting shares of a carrier subject to theTelecommunications Actmust be owned and controlled by Canadians. In the case of a company that wholly owns a carrier, not less than 66 2/3 per cent of the voting shares of that company must be owned and controlled by Canadians. In addition, carriers may not 'otherwise be controlled' by non-Canadians and not less than 80 per cent of the board of directors of a company operating as a carrier must be Canadian. The Corporation must report to the CRTC annually with respect to its compliance with these foreign ownership requirements. Sprint owns approximately 6.63 per cent of the equity of Call-Net. The Corporation believes that it is currently in compliance with such restrictions.

Canadian Regulatory Overview

Competition in the long distance services and local services markets is guided to a large extent by the principles set out in Telecom Decision CRTC 92-12, Telecom Decision CRTC 94-19, and Telecom Decision CRTC 97-8. This latter decision, along with certain other decisions issued concurrently or shortly after May 1, 1997 (collectively the 'local decisions'), set out the terms and conditions for competitive entry into the market for local services. Three other key local decisions that impacted the Corporation's local business plans were Telecom Decision CRTC 97-15, which enabled competitors to co-locate transmission equipment in the incumbents' local central switching offices, Telecom Decision CRTC 98-22, which established the rate that competitive local exchange carriers (CLECs) must pay to the incumbents to lease the incumbents' unbundled local loops, and Telecom Decision CRTC 99-20, which modified one of the local loop price components set out in Telecom Decision CRTC 98-22 referred to above. Another key decision was Telecom Decision CRTC 2000-745, in which the CRTC ordered that the existing per-minute contribution regime be replaced by a revenue tax applicable to all telecommunications service providers (TSPs) in

| Call-Net Enterprises Inc. | 10 |

Canada effective January 1, 2001. This decision had far-reaching implications for all service providers in Canada. In May 2002, the CRTC issued Telecom Decision 2002-34 after completing its review of the price cap regulatory regime that it established for the ILECs in 1998. In Telecom Decision 2002-34, the Commission established a separate basket consisting of carrier services purchased by competitors from the ILECs, and ordered that they be priced at incremental cost plus a 15 per cent mark-up. Telecom Decision 2002-34 and associated follow-up proceedings had significant immediate and potential impact on competitors, especially in reducing competitors’ carrier costs. Starting in late 2002, the CRTC issued a series of decisions that were intended to enforce competitive safeguards in the market in relation to the ILECs. These decisions limited the manner in which the ILECs can target competitors’ local customers for winback (Telecom Decision 2002-73), strengthens the rules regulating the manner in which they can bundle tariffed services with untariffed services (Telecom Decision 2002-58), suspended the ILECs’ rights to offer price promotions in respect of local services (PN 2003-1.1) and constrain the ability of the ILECs to use unregulated affiliates to avoid the competitive safeguards (Telecom Decision 2002-76).

The CRTC also released certain decisions in 2004 that were intended to further facilitate competition in the market. These include Telecom Decision CRTC 2004-4 in which the Commission granted Call-Net’s request to extend the ILECs’ winback restrictions from three months to 12 months and approved an education program to inform consumers of the existence of local competition; Telecom Decision CRTC 2004-5 in which the Commission directed the major ILECs to file ethernet access and transport tariffs for use by competitors; and Telecom Decisions 2004-21 and 2004-22 in which the CRTC directed Aliant and Bell Canada respectively to cease and desist violating the service bundling rules.

The CRTC continues to emphasize its commitment to ensuring sustainable facilities-based competition in the Canadian telecommunications sector. It also continues to engage the public in dialogue to determine the most efficient regulatory framework to reach that goal. In 2004 the CRTC conducted two key public proceedings that may impact the Corporation’s operations in the future. First, in Telecom Public Notice 2003-10, the CRTC initiated a proceeding to impose new or modified price floor regulation on the ILECs with the view to limit or prevent predatory pricing behaviour. Second, in Telecom Public Notice 2004-2 the CRTC conducted a proceeding to determine how VoIP should be regulated. This proceeding raises the crucial issue of whether and how the ILECs’ VoIP services should be regulated.

In late 2004, the CRTC released its fourth annual report to Cabinet on the state of competition in the Canadian telecommunications sector. This is pursuant to the CRTC’s mandate to assess and report on the state of competition in the industry on an annual basis. The CRTC’s conclusion is that overall, competition remains much further behind where it expects it to be at this stage, and that the Commission will continue to remove obstacles to fair and sustainable competition, including barriers to access and assuring regulatory compliance.

On February 3, 2005, the CRTC released Telecom Decision CRTC 2005-6 (Decision 2005-6) with respect to the ILECs’ Competitive Digital Network services (CDN). The decision concludes the process that was initiated by the second Price Cap decision. In Decision 2005-6, the CRTC set the terms and conditions, as well as the rates that competitors will pay the incumbent telephone companies (ILECs) for digital network services they rely on to provide services to their customers. In arriving at the decision, the Commission took into account: a) the competitors’ reliance on the telephone companies’ network facilities and services; b) the competitive supply that exists in the market place; c) the constraints competitors face in building their own networks; and d) the state of competition in the local market. Rates for access to low-speed services, which are legacy copper-based, were set at cost plus 15 per cent, while rates for high-speed services, which are generally fibre-based and easier to replicate, were reduced from their prior market level to cost plus a margin above 15 per cent. The CRTC found that competitors still rely heavily on the facilities of the telephone companies and that by reducing the prices for underlying facilities, competitors will be able to offer services to more customers and in more regions and growth in their customer base and revenues will facilitate the expansion of their own networks.

Canadian Regulation of International Traffic

On January 1, 1999, the CRTC instituted a new regulatory regime for international telecommunications. Under this regime, any carrier that transports international telecommunications traffic over a Canadian border requires a Class A license from the CRTC. Any domestic carrier that originates or terminates, but does not carry over the border, international telecommunications traffic requires a Class B license from the CRTC. Both types of licensees are subject to minimal reporting requirements and are prevented from acting in an anti-competitive manner. The Corporation has obtained three Class B licenses (for Sprint Canada, Call-Net and AlternaCall) as well as one Class A license (for CNTS).

United States Regulatory Environment

The Federal Communications Commission (FCC) is an independent agency of the United States (U.S.) federal government charged under theCommunications Act of 1934, as amended, and theTelecommunications Act (U.S.) (collectively 'Communications Act') with regulation of carriers providing interstate or international telecommunications services in the United States. TheCommunications Act requires that rates charged by long distance telephone companies must be 'just and reasonable' and may not be unreasonably discriminatory or unduly preferential. Consumers or other carriers may file complaints with the FCC regarding any unjust or unreasonable practices by common carriers.

Carriers seeking to provide international services must obtain authorization from the FCC pursuant to Section 214 of theTelecommunications Act (U.S.) prior to offering international services.

| Call-Net Enterprises Inc. | 11 |

Telecommunications services providers in the United States are also regulated at the state level by state public utilities commissions (PUCs) and/or other authorities. State regulations apply only to intra-state services and not to international or inter-state services.

The Corporation believes that it operates in full compliance with all rules, regulations and policies of the FCC, the state regulators and other communications regulatory agencies in the United States. Some of these rules, regulations and policies are extremely complex and are rapidly changing. While the Corporation is making its best efforts to fully comply, it can give no assurance that the FCC or other agencies, and reviewing courts, will agree with its good faith interpretations of certain complex rules, regulations and policies. Moreover, as noted above, the Corporation can give no assurance that these rules, regulations and policies will not change in the future in a manner that would have a material adverse effect on the Corporation.

International Regulatory Environment

The Corporation originally obtained an International Facilities Licence (IFL) in the United Kingdom that allows it to operate as a facilities-based carrier or a reseller of international telecommunications. In 2004, the new U.K. regulatory agency - OfCom - introduced a new regime under which carriers are no longer required to be licensed in order to operate. The Corporation will obtain other licenses to serve other foreign jurisdictions, as needed, if it expands its foreign operations.

DIVIDEND POLICY

Under the indenture governing the Corporation's 10.625 per cent Secured Notes due in December 31, 2008, there are certain limitations and restrictions on the payment of dividends and corporate distributions. The Corporation has never paid dividends on any of its issued shares and does not currently contemplate paying dividends on any of its issued shares for the foreseeable future.

DESCRIPTION OF CAPITAL STRUCTURE

General Description of Capital Structure

The authorized share capital of the Corporation consists of Common Shares, Class B Shares and Preferred Shares. The following summary describes the rights, privileges, restrictions and conditions that attach to the Common Shares, the Class B Shares and the Preferred Shares.

Common Shares

The Corporation is authorized to issue an unlimited number of its Common Shares. The holders of the Common Shares are entitled to one vote for each share held at any meeting of the shareholders of the Corporation. The Common Shares are convertible, at the option of the Common Shareholders, at any time into Class B Shares on a share-for-share basis. The Common Shares rankpari passu with the Class B Shares on a per share basis with respect to payment of dividends and the right to participate in a distribution of assets of the Corporation on winding up, dissolution or otherwise.

Class B Non-Voting Shares

The Corporation is authorized to issue an unlimited number of Class B Non-Voting Shares. The holders of the Class B Shares are not entitled to vote at any meeting of shareholders of the Corporation except for votes affecting the Class B Non-Voting Shares. The Class B Shares are convertible, at the option of the Class B Shareholders, at any time into Common Shares on a share-for-share basis, in the following circumstances: (a) upon the provision by a Class B Shareholder of a Residency Declaration to the Corporation and the Transfer Agent stating that the holder is a Canadian (as such term is defined in theTelecommunications Act); (b) upon the Board of Directors, by resolution, allowing the conversion, from time to time, of such number of Class B Shares as will not, in the sole discretion of the Board of Directors, place the Corporation at risk of non-compliance with the foreign ownership restrictions of theTelecommunications Act, provided that such conversion right is made available on a pro rata basis to all Class B Shareholders; (c) upon a take-over bid being made for the Common Shares for the purposes of allowing the Class B Shares to tender to such bid; or (d) without restriction, upon the foreign ownership restrictions in theTelecommunications Act (Canada) being removed to the satisfaction of the Board of Directors. For the purposes of paragraph (b), the Board of Directors shall consider at least once in each calendar year whether to allow such conversion. Notwithstanding the foregoing, the Board of Directors shall only allow for such conversion if, at the time of conversion, at least 1 per cent of the then outstanding Class B Shares can be converted. The Class B Shares rankpari passu with the Common Shares on a per share basis with respect to the payment of dividends and the right to participate in a winding up, dissolution or otherwise.

Preferred Shares

The Corporation is authorized to issue an unlimited number of the Preferred Shares. As part of the consideration for entering into the Sprint Agreement, Sprint was issued one Preferred Share (for a value of $1.00) and is the first and only holder of Preferred Shares at December 31, 2004. The Preferred Shares are generally non-voting, except (i) as a class pursuant to any rights granted under the CBCA, (ii) as a class in respect of amendments to the minimum or maximum number of directors and (iii) with respect to the election of two directors. The Preferred Shares entitle the holder to nominate and elect two directors of the Corporation. The Preferred Shares have no rights to dividends. The Preferred Shares have a priority right over all other

| Call-Net Enterprises Inc. | 12 |

classes of shares to receive a return of capital equal to $1.00 per Preferred Share upon the liquidation, dissolution or winding up of the Corporation. The Corporation may redeem all Preferred Shares for $1.00 per Preferred Share upon the sale, transfer or assignment of the Preferred Shares by the first holder to a third party that is not an affiliate of the first holder or the subsequent transfer by such affiliate, or any other affiliate of the first holder who from time to time holds the Preferred Shares, to a non-affiliate of the first holder, or upon any affiliate of the first holder who holds the Preferred Shares no longer being an affiliate of the first holder, or in the event that the Sprint Agreement is Terminated. ‘‘Terminated’’ for this purpose, means terminated for a reason other than the default of the Corporation, and where the termination of the agreement has been disputed by either party, the Sprint Agreement shall be deemed not to have been terminated until the parties agree that such termination shall have occurred or until the dispute has been resolved through a final, non-appealable decision.

Constraints

Compliance with the Telecommunications Act (Canada)

To ensure compliance with the foreign ownership restrictions contained in theTelecommunications Act, for so long as theTelecommunications Act applies to the Corporation, the Corporation has the right, in addition to any other rights under theTelecommunications Act, to sell the Common Shares of a Common shareholder who is not a Canadian (as such term is defined in theTelecommunications Act), subject to the provisions of the CBCA and theTelecommunications Act. In addition, the directors of the Corporation may refuse to issue a Common Share, or register the transfer of a Common Share, in a circumstance where to do so otherwise would result in the Corporation’s non-compliance with the foreign ownership restrictions of theTelecommunications Act.

Ratings

Secured Notes

As at December 31, 2004, there was outstanding U.S.$223.1 million 10.625 per cent Secured Notes due in 2008 issued pursuant to a note indenture (the 'Indenture') between Call-Net, CIBC Mellon Trust Company and The Bankers Trust Company (now Deutsche Bank Trust Company Americas) dated April 5, 2002. There was initially U.S.$377.0 million of Secured Notes issued under the Indenture. On September 26, 2002, the Corporation repurchased U.S.$77.5 million of Secured Notes and on March 2, 2004, the Corporation purchased for cancellation a further U.S.$76.4 million, leaving U.S.$223.1 million outstanding.

The Corporation's Secured Notes have received the following ratings:

Approved Rating Organization | | Long Term Debt | |

| Dominion Bond Rating Service Limited | | | B | |

| Moody's Investors Service | | | Caa3 | |

| Standard & Poor's | | | B (minus | ) |

On March 10, 2005 the Dominion Bond Rating Service Limited (DBRS) upgraded the rating of the Corporation’s Secured Notes from B (low) to B. As a result of the upgrade, the trend has been moved to ‘Stable’ from ‘Positive’. DBRS’ rating scale consists of the following categories: AAA - Highest Credit Quality, AA - Superior Credit Quality, A - Satisfactory Credit Quality, BBB - Adequate Credit Quality, BB - Speculative, B - Highly Speculative, CCC, CC and C are all rated Very Highly Speculative. ‘High’ and ‘Low’ grades are used to indicate the relative standing within a particular rating. A B rating is defined as highly speculative and there is a reasonably high level of uncertainty which exists as to the ability of the entity to pay interest and principal on a continuing basis in the future, especially in periods of economic recession or industry adversity.

In its rating considerations DBRS identifies the following strengths: (1) revenue gains through increases in the Corporation’s residential access line base has resulted in a better revenue mix by customer segment and product; (2) the recent acquisition of the 360networks’s eastern Canadian business has improved economies of scale; (3) the recent CRTC decision to be implemented will decrease network charges by $25M on an annual basis, thus increase cash flow from operations in the future; and (4) with the Corporation maintaining its low capital intensity hybrid network strategy, Call-Net has a greater likelihood of maintaining its self-funding model going forward.

DBRS identifies the following challenges facing the Corporation: (1) Call-Net still operates in a highly competitive environment and has relatively small market share; (2) susceptibility to pressure in the long-distance market where pricing continues to decline; (3) aggressive competitor offerings along with the introduction of VoIP will put further pressure on long distance pricing and negatively impact Call-Net’s future local access line growth; and (4) the carrier services segment will still be subject to the oversupply conditions that exist in the wholesale market, with further revenue and margin pressure expected.

On June 17, 2004, Moody’s Investors Service (Moody’s) affirmed its previous rating for the Corporation’s Secured Notes at Caa3, and the outlook has been changed to 'stable' from 'negative'. Moody’s rating scale consists of the following categories: Aaa, Aa, A, Baa, Ba, B, Caa, Ca and C. The numbers 1, 2 and 3 are used to indicate the relative standing within a particular rating with 1 indicating a ranking at the higher end of the particular category, 2 indicating a mid-range ranking and 3 a ranking in the lower end of the category. Moody’s judges obligations rated as Caa to be of poor standing and subject to very high credit risk.

| Call-Net Enterprises Inc. | 13 |

The stable outlook reflects Moody’s expectation that (1) in the near term, improvements in local customer revenues will continue to offset reductions in the carrier segment, allowing Call-Net to generate near break-even free cash flow; (2) debt level will remain relatively constant; and (3) liquidity will remain adequate to fund the company’s business plan over the next 12 to 18 months.

In its review, Moody's states that the rating is supported by factors such as the Corporation's relationship with Sprint and associated brand recognition, and an improvement in free cash flow over the last several quarters. Moody's believes that the Corporation’s rating is constrained by the following factors: (1) Call-Net’s customer value proposition is not very strong compared to the incumbents; (2) the entrance of new competitors into the local and long distance telephony markets will further erode Call-Net’s competitive stance; (3) the long distance segment may face an accelerated decline; (4) the Corporation has very limited alternative funding prospects; (5) returns will be limited by the fact Call-Net rents the local loop connection to its customers; and (6) the Corporation's relatively limited liquidity.

On December 1, 2004 Standard & Poor’s rated the Corporation’s long term debt at B (minus). Standard & Poor’s rating scheme consists of: AAA, AA, A, BBB, BB, B, CCC, CC and C. A 'B' minus rating means to Standard & Poor’s that the obligor currently has the capacity to meet its financial commitments on its obligations, but adverse business, financial or economic conditions would likely impair capacity or willingness of the obligor to meet its financial commitments on the obligation.

Standard & Poor's points out that its outlook reflects its view that the Corporation will continue to be negatively affected by continued pricing pressure in long distance services and expectations for increased competition in residential local services in 2005.

These ratings should be construed solely as statements of opinion by the respective rating organization and not statements of fact or recommendations to buy, sell or hold securities. The ratings may be subject to revision or withdrawal by the rating organization at any time.

MARKET FOR SECURITIES

Trading Price and Volume

The outstanding common shares of the Corporation (the Common Shares) and Class B Shares are listed for trading on the TSX under the symbols 'FON' and 'FON.NV.B', respectively.

FON - - Monthly trading activity for 2004

| Date | | Open | | High | | Low | | Close | | Volume | |

| Dec 04 | | | 2.98 | | | 3.65 | | | 2.88 | | | 3.04 | | | 6,957 | |

| Nov 04 | | | 2.41 | | | 3.15 | | | 2.40 | | | 2.94 | | | 7,163 | |

| Oct 04 | | | 2.79 | | | 3.00 | | | 2.31 | | | 2.50 | | | 4,860 | |

| Sep 04 | | | 2.50 | | | 2.90 | | | 2.45 | | | 2.84 | | | 2,466 | |

| Aug 04 | | | 2.90 | | | 2.90 | | | 2.13 | | | 2.70 | | | 7,190 | |

| Jul 04 | | | 4.00 | | | 4.24 | | | 2.63 | | | 2.63 | | | 12,119 | |

| Jun 04 | | | 4.50 | | | 4.60 | | | 3.97 | | | 4.05 | | | 6,522 | |

| May 04 | | | 4.15 | | | 4.65 | | | 3.65 | | | 4.50 | | | 11,340 | |

| Apr 04 | | | 4.30 | | | 4.59 | | | 3.85 | | | 4.02 | | | 5,266 | |

| Mar 04 | | | 4.45 | | | 4.90 | | | 3.91 | | | 4.30 | | | 13,030 | |

| Feb 04 | | | 5.50 | | | 5.50 | | | 4.25 | | | 4.60 | | | 15,640 | |

| Jan 04 | | | 4.95 | | | 5.98 | | | 4.81 | | | 5.45 | | | 24,571 | |

FON.NV.B - - Monthly trading activity for 2004

| Date | | Open | | High | | Low | | Close | | Volume | |

| Dec 04 | | | 2.90 | | | 3.49 | | | 2.81 | | | 3.03 | | | 41,590 | |

| Nov 04 | | | 2.54 | | | 3.15 | | | 2.40 | | | 2.95 | | | 69,150 | |

| Oct 04 | | | 2.86 | | | 2.95 | | | 2.10 | | | 2.50 | | | 56,410 | |

| Sep 04 | | | 2.80 | | | 2.92 | | | 2.35 | | | 2.86 | | | 106,695 | |

| Aug 04 | | | 2.80 | | | 2.94 | | | 2.25 | | | 2.80 | | | 72,895 | |

| Jul 04 | | | 3.95 | | | 4.00 | | | 2.60 | | | 2.60 | | | 248,528 | |

| Jun 04 | | | 4.50 | | | 4.61 | | | 3.95 | | | 4.00 | | | 163,486 | |

| May 04 | | | 4.00 | | | 4.70 | | | 3.76 | | | 4.45 | | | 246,935 | |

| Apr 04 | | | 4.20 | | | 4.58 | | | 3.85 | | | 4.00 | | | 279,538 | |

| Mar 04 | | | 4.40 | | | 4.70 | | | 3.85 | | | 4.35 | | | 218,934 | |

| Feb 04 | | | 5.25 | | | 5.40 | | | 4.25 | | | 4.59 | | | 396,665 | |

| Jan 04 | | | 5.05 | | | 6.00 | | | 4.73 | | | 5.35 | | | 625,885 | |

* Average daily volume

| Call-Net Enterprises Inc. | 14 |

DIRECTORS AND EXECUTIVE OFFICERS Directors The name, municipality of residence, position with the Corporation and principal occupation for the last five years of each of the current directors and executive officers of the Corporation are as follows: |

Name and Position and/or Office with the Corporation and Significant Affiliates | Principal Occupation, Business or Employment and Name and Principal Business of Employer | Period* Served as a Director | Number of shares of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised as at March 22, 2005 |

| | | | Common Shares | Class B Shares | DSUs(**) | Unvested RSU's |

WILLIAM W. LINTON Toronto, ON Canada | President and Chief Executive Officer Call-Net Enterprises Inc. (telecommunications) • previously President and Chief Executive Officer, Prior Data Sciences, Inc.; Executive VP and CFO, SHL Systemhouse Inc. | 2000 | 258,883 | 17,000 | 43,790 | 72,667 |

S. DENNIS BELCHER(1) (7) Oakville,ON Canada | Corporate Director, Foamex International Inc.; Viatel Holdings (Bermuda) Ltd., Rand McNally & Company and Care Canada (Global Development Group) • previously Executive Vice President, The Bank of Nova Scotia | 2002 | 0 | 0 | 10,266 | 0 |

ROBERT M. FRANKLIN(2) (3) Toronto, ON Canada | Chairman and Corporate Director Placer Dome Inc. (mining); Director, Torment Industries and Great Lakes Carbon Income Fund | 2002 | 25,000 | 15,000 | 2,565 | 0 |

ROBERT T.E. GILLESPIE(2) (5) Mississauga,ON Canada | President, Gilvest Inc., Chairman and Corporate Director of Husky Injection Molding Systems Ltd. and Spinrite Inc. (consumer goods), Corporate Director, Genworth Canada (insurance) • previously Chairman and Chief Executive Officer, General Electric Canada Inc. (manufacturing, technology) | 1999 | 0 | 10,000 | 10,266 | 0 |

WENDY A. LEANEY(1) (3) Toronto,ON Canada | President, Wyoming Associates Ltd., (investment and consulting), Corporate Director of Corus Entertainment Inc. (media, broadcasting) and Canadian Western Bank (commercial banking) • previously Managing Director of the Communications Group for TD Securities Inc. | 2002 | 20,000 | 2,000 | 0 | 0 |

DAVID A. RATTEE(1)(6) Toronto,ON Canada | Chairman, President & Chief Executive Officer, CIGL Holdings Ltd.; President and Chief Executive Officer MICC Investments Limited (investment), Corporate Director of Bank of New York Trust Company of Canada, Northstar Aerospace Inc., Pet Value Inc. and Open Access Limited | 2002 | 750 | 0 | 10,266 | 0 |

LAWRENCE G. TAPP Langley, BCCanada | Chairman, Call-Net Enterprises Inc. (telecommunications), Chairman and director of Automation Tooling Systems Inc., Talisman Energy, Director, CCL Industries, Mainstreet Equities and Wescast Industries • previously Dean,Richard Ivey School of Business, University of Western Ontario (business education) | 1996 | 0 | 10,294 | 5,133 | 0 |