Exhibit 99.2

CALL-NET ENTERPRISES INC.

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR

MAY 4, 2005 11:00 A.M. (TORONTO TIME)

THE FAIRMONT ROYAL YORK HOTEL IMPERIAL ROOM 100 FRONT STREET WEST TORONTO, ONTARIO |

CALL-NET ENTERPRISES INC.

NOTICE OF ANNUAL AND SPECIAL MEETING

OF SHAREHOLDERS

NOTICE IS HEREBY GIVENthat the Annual and Special Meeting of Shareholders (the ‘Meeting’) of Call-Net Enterprises Inc. (the ‘Corporation’) will be held inThe Imperial Room, The Fairmont Royal York, 100 Front Street West, Toronto, Ontario on Wednesday, May 4, 2005 at 11:00 a.m. (Toronto time)for the following purposes, as further described in this circular:

| 1. | to receive the consolidated financial statements of the Corporation for the year ended December 31, 2004, together with the report of the auditors thereon; |

| | |

| 2. | to appoint KPMG LLP as the Corporation’s auditors and to authorize the directors to fix their remuneration; |

| | |

| 3. | to elect nine directors of the Corporation; |

| | |

| 4. | to consider, and, if thought advisable, pass a resolution authorizing certain amendments to the Corporation’s Incentive Stock Option Plan; |

| | |

| 5. | to consider, and, if thought advisable, pass a resolution authorizing certain amendments to the Corporation’s Restricted Stock Unit Plan ; and |

| | |

| 6. | to act upon such other matters, including amendments to the foregoing, as may properly come before the Meeting or any adjournment thereof. |

NOTES:

| 1. | The Corporation has fixed March 22, 2005 as the record date for determining those shareholders entitled to receive notice of the Meeting. |

| | |

| 2. | Enclosed is the annual report to shareholders for the year ended December 31, 2004. The annual report contains the consolidated financial statements for the fiscal year ended December 31, 2004, and the auditors’ report thereon. |

| | |

| 3. | Holders of sharesof the Corporation who are unable to be personally present at the Meeting may vote by proxy. Kindly date, complete, sign and return the applicable form of proxy in the envelope provided. |

| | |

| 4. | To be effective, proxies must be received before 5:00 p.m. (Toronto time) on May 3, 2005 (or the last business day preceding any adjournment of the Meeting), or be deposited with the Secretary of the Meeting prior to the commencement of the Meeting. |

| | |

| 5. | On peut obtenir le texte français de cette circulaire d’information en communiquant avec Janice Spencer, Secrétaire, bureau 1800, Atria II, 2235 Sheppard Avenue East, Toronto, Ontario, M2J 5G1 (416) 718-6111. Le texte français sera disponible à l’assemblée. |

DATEDat Toronto, Ontario, this 22nd day of March, 2005. | BY ORDER OF THE BOARD |

| | |

| |  |

| | |

| | Lawrence G. Tapp, Chair |

CALL-NET ENTERPRISES INC.

MANAGEMENT PROXY CIRCULAR

This circular is furnished in connection with the solicitation of proxies by or on behalf of the management of CALL-NET ENTERPRISES INC. (the ‘Corporation’) for use at the Annual and Special Meeting of Shareholders of the Corporation (the ‘Meeting’) to be held on Wednesday, May 4, 2005 at 11:00 a.m. (Toronto time) in the Imperial Room, The Fairmont Royal York Hotel, 100 Front Street West, Toronto, Ontario and at any adjournment or adjournments thereof for the purposes set forth in the Notice of Meeting.

PROXIES

SOLICITATION OF PROXIES

The enclosed proxy is being solicited by or on behalf of the management of the Corporationand the cost of such solicitation will be borne by the Corporation. The solicitation will be primarily by mail, but directors, officers, employees and agents of the Corporation may also solicit proxies by telephone or in person.

APPOINTMENT OF PROXYHOLDER

The persons named in the attached form of proxy are directors or officers of the Corporation. Each shareholder of the Corporation has the right to appoint as his or her proxyholder a person, who need not be ashareholder to attend and to act on his or her behalf at the Meeting other than the persons designated in the form of proxy accompanying this circular. Such right may be exercised by inserting the name of such other person in the blank space provided in the proxy or by completing another proper form of proxy and, in either case, by delivering the completed proxy to the Corporation’s registrar and transfer agent, CIBC Mellon Trust Company. For postal delivery, the completed proxy should be mailed by using the envelope provided. To deliver by facsimile, please send the proxy to the Proxy Department of CIBC Mellon Trust Company at (416) 368-2502. The completed proxy may also be delivered in person to CIBC Mellon Trust Company at 320 Bay Street, 6th Floor, Toronto, Ontario, M5H 4A6. Proxies delivered to CIBC Mellon Trust Company must be receivedno later than 5:00 p.m. (Toronto time) on the last business day preceding the Meeting, or any adjournment thereof. Otherwise, completed proxies may also be deposited with the Secretary of the Meeting prior to the commencement of the Meeting.

A holder (‘Shareholder’) of Common Shares (‘Shares’) should use the enclosed yellow form of proxy, and a holder (‘Class B Holder’) of Class B Non-Voting Shares (‘Class B Shares’) and the holder (‘Preferred Holder’) of the Preferred Share should use the enclosed blue form of proxy.

REVOCATION OF PROXY

Ashareholder who has executed a form of proxy has the right to revoke it under subsection 148(4) of theCanada Business Corporations Act (‘CBCA’). Ashareholder may revoke a proxy by depositing an instrument in writing executed by him or her, or by his or her attorney authorized in writing, at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the Chair of the Meeting on the day of the Meeting, or any adjournment thereof, or in any other manner permitted by law.

EXERCISE OF PROXY

Theshares represented by the proxy will be voted for or against or withheld from voting, as appropriate, in accordance with the instructions of theshareholder on any vote that may be called for and, if theshareholder specifies a choice with respect to any matter to be acted upon at the Meeting,shares represented by properly executed proxies will be voted accordingly.

| Call-Net Enterprises Inc. | 1 |

In the absence of any instructions to the contrary, the Shares represented by proxies received by management will be voted for: (i) the election of the persons to be nominated by management as directors of the Corporation; (ii) the appointment of auditors and the fixing of their remuneration; and (iii) the approval of the amendments to the Incentive Stock Option Plan(the ‘Stock Option Plan’)and Restricted Share Unit Plan (the ‘RSU Plan;); all as described in this circular. In the absence of any instructions to the contrary, the Class B Shares and Preferred Shares represented by proxies received by management will be voted for the approval of the amendments to the Stock Option Plan and the RSU Plan, as described in this circular.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters that may properly come before the Meeting or any adjournments thereof. At the date of this circular, management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice of Meeting accompanying this circular. If any other matters do properly come before the Meeting, it is intended that the person appointed as proxy shall vote on such other business in such manner as that person then considers to be proper.

EXPLANATION OF VOTING RIGHTS FOR BENEFICIAL OWNERS OF SHARES

Ifshares are not registered in ashareholder’s name but are held in the name of a nominee (a bank, trust company, securities broker, trustee or other similar entity), there are two ways theshareholder can vote theshares held on his or her behalf by the nominee.

As required by Canadian securities legislation, ashareholder will have received from his or her nominee either a request for voting instructions or a form of proxy for the number ofshares held by the nominee on his or her behalf.For such ashareholder’sshares to be voted, he or she should follow the voting instructions provided by his or her nominee.

Alternatively, if a shareholder wishes to vote in person at the Meeting, he or she should insert his or her own name in the space provided on the request for voting instructions or form of proxy to be appointed as proxyholder and return same in the envelope provided.

It is important that a shareholder inserts his or her name on the request for voting instructions or form of proxy.Since the Corporation has limited access to the names of its non-registeredshareholders,the Corporation may have no record of his or her shareholdings or of his or her entitlement to vote unlesshis or her nominee has appointed him or her as proxyholder.A Shareholder should not otherwise complete the form, as their vote will be taken at the Meeting. Such ashareholder should register with the transfer agent, CIBC Mellon Trust Company, upon arrival at the Meeting.

SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation has an authorized share capital consisting of an unlimited number of Shares, Class BShares and Preferred Shares.

As at March 21, 2005,4,235,857 Shares,31,548,419 Class B Shares, and one Preferred Share were issued and outstanding. Each Share entitles the holder thereof to onevote at all meetings of Shareholders. Class B Shares do not generally carry voting rights. The Preferred Share, which is currently held by Sprint Communications Company L.P. (‘Sprint’) or its affiliates and permitted associates, does not generally carry voting rights. However, the holder of the Preferred Share is entitled to elect twomembers of the Board of Directors (the ‘Board’) of the Corporation.

For the purpose of the Meeting, Shareholders are entitled to one vote for each Share on all matters to be considered at the Meeting. Class B Holders are entitled to one vote for each Class B Share on (i) the resolution authorizing the amendments to the Stock Option Plan, and (ii) the resolution authorizing the amendments to the RSU Plan, but otherwise will have no right to vote as shareholders. The Preferred Holder is entitled to one vote for

| Call-Net Enterprises Inc. | 2 |

its Preferred Share on (i) the resolution authorizing the amendments to the Stock Option Plan, and (ii) the resolution authorizing the amendments to the RSU Plan, but otherwise will have no right to vote as a shareholder.

The presence, in person or by proxy, of two or more Shareholders is necessary for a quorum at the Meeting. The Board of the Corporation has fixed the close of business on March 22, 2005 as the record date for the purpose of determining theshareholders entitled to receive notice of the Meeting, but the failure of anyshareholder to receive notice of the Meeting does not deprive theshareholder of the right to vote at the Meeting.

For purposes of the Meeting, the Corporation has prepared a list ofshareholders who were registered on the records of the Corporation or its transfer agent, CIBC Mellon Trust Company, at the close of business on March 21, 2005. Eachshareholder named on the list is entitled, upon providing satisfactory identification to the scrutineers, to vote theshares shown on such list as being held by suchshareholder (other thanshares for which a proxy has been given and not revoked). Holders ofshares issued after March 21, 2005 will be entitled to vote suchshares at the Meeting, provided such holders are registered in the records of the Corporation or its transfer agent, CIBC Mellon Trust Company, prior to the time of the Meeting.

To the knowledge of the Corporation and its directors and officers, no person or company beneficially owns, directly or indirectly, or exercises control or direction over Shares of the Corporation carrying more than 10% of the voting rights attached to all Shares of the Corporation outstanding as of March 21, 2005. Other than as set out below, to the knowledge of the Corporation and its directors and officers, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, either Shares or Class B Shares of the Corporation representing more than 10%of the issued and outstanding Shares or Class B Shares, respectively, as of March 21, 2005:

| | | Shares | | % of Shares | | Class B | | % of Class B | | % of Issued & Outstanding | |

| Clearwater Capital Management Inc. | | | 492,000 | | | 11.63 | % | | 3,275,740 | | | 10.38 | % | | 10.53 | % |

| Harbert Distressed Investment Master Fund Ltd. | | | Nil | | | Nil | | | 5,936,200 | | | 18.82 | % | | 16.59 | % |

RESTRICTIONS ON THE TRANSFER, VOTING AND ISSUE OF SHARES

Telecommunications Legislation

In order to ensure that the Corporation and any Canadian corporation in which the Corporation has a direct or indirect interest remains qualified to own or operate as a telecommunications common carrier pursuant to theTelecommunications Act (Canada) and the Regulations made thereunder (‘Telecommunications Legislation’), and to ensure that the Corporation and any Canadian corporation in which the Corporation has an interest is not otherwise in breach of the Telecommunications Legislation or licences issued to it or to any Canadian subsidiary, associate or affiliate of it under the Telecommunications Legislation, the Articles of Arrangement of the Corporation impose certain restrictions on the issue and transfer of the Corporation’s Shares and the exercise of voting rights attached thereto (the ‘Conditions of Restriction’) as applicable to the Constrained Class, as defined below.

The Board of the Corporation has implemented Conditions of Restriction for any person who is not a Canadian or who is a member of the Constrained Class (the ‘Rules’).

| Call-Net Enterprises Inc. | 3 |

Pursuant to the Rules, the Board of the Corporation must not issue and shall refuse to register a transfer of, or allow the exercise of voting rights attached to Shares, in circumstances that would result in persons of the Constrained Class holding more than 33⅓% of the outstanding number of Shares (or such different percentage as may be prescribed from time to time under the Telecommunications Legislation).

‘Constrained Class’ means persons who are not Canadians within the meaning of that term intheTelecommunications Legislation.

Class B Shares

The holders of the Class B Shares are not entitled to vote at any meeting of shareholders of the Corporation except for votes affecting the Class B Shares. The Class B shares are convertible, at the option of the Class B Holders, at any time into Shares on a share-for-share basis, in the following circumstances: (a) upon the provision by a Class B Holder of a residency declaration to us and our transfer agent stating that the holder is a Canadian (as such term is defined in theTelecommunications Act); (b) upon the Board, by resolution, allowing the conversion, from time to time, of such number of Class B Shares as will not, in the sole discretion of the Board, place the Corporation at risk of non-compliance with the foreign ownership restrictions of theTelecommunications Act, provided that such conversion right is made available on a pro rata basis to all Class B Holders; (c) upon a take-over bid being made for the Shares for the purposes of allowing the Class B Shares to tender to such bid; or (d) without restriction, upon the foreign ownership restrictions in theTelecommunications Act being removed to the satisfaction of the Board. For the purposes of paragraph (b), the Board shall consider at least once in each calendar year whether to allow such conversion. Notwithstanding the foregoing, the Board shall only allow for such conversion if, at the time of conversion, at least 1% of the then outstanding Class B Shares can be converted.

Preferred Share

Sprint is the first and only Preferred Holder. The Preferred Shares are generally non-voting, except (a) as a class pursuant to any rights granted under the CBCA, (b) as a class in respect of amendments to the minimum or maximum number of directors and (c) with respect to the election of two directors. The Preferred Shares entitle the holder to nominate and elect two directors of the Corporation. The Preferred Shares have no rights to dividends. The Corporation may redeem all Preferred Shares for $1.00 per Preferred Share upon the sale, transfer or assignment of the Preferred Shares by the first holder to a third party that is not an affiliate of the first holder or the subsequent transfer by such affiliate, or any other affiliate of the first holder who holds the Preferred Shares no longer being an affiliate of the first holder, or in the event that the technology and service provisioning agreement with Sprint (the ‘Sprint Agreement’) is terminated for a reason other than the default of the Corporation, and where the termination of the agreement has been disputed by either party, the Sprint Agreement shall be deemed not to have been terminated until the parties agree that such termination shall have occurred or until the dispute has been resolved through a final, non-appealable decision.Holders of Preferred Shares have no right to participate if a take-over bid is made for the Corporation’s Shares.

Sprint beneficially owns or exercises control or direction over one Preferred Share, as well as Shares and Class B Shares, which together amount to approximately 6.63% of the issued and outstanding shares of the Corporation.

APPOINTMENT OF AUDITORS

Management of the Corporation proposes that the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation be approved and the directors be authorized to fix their remuneration. Upon the recommendation of the Audit Committee, the Board appointed KPMG LLP as the auditors of the Corporation effective March 22, 2004. KPMG was re-appointed auditors of the Corporation on May 6, 2004 at the 2004 annual and special meeting of shareholders of the Corporation.

The Shares represented by the proxies solicited in respect of the Meeting are intended to be VOTED FOR the appointment of KPMG LLP, as the Corporation’s auditors and the authorization of the directors to fix their remuneration, unless the authority to do so is withheld.

| Call-Net Enterprises Inc. | 4 |

The ordinary resolution must be passed by at least a majority of the votes cast at the Meeting by all Shareholders who vote in respect thereof in person or by proxy.

ELECTION OF DIRECTORS

Listed below are the names of the ninepersons who are proposed as nominees for election as directors of the Corporation by holders of the Shares.

As the holder of the Preferred Share, Sprint is entitled to nominate and elect two directors to the Board of the Corporation. Sprint has advised Call-Net that, for reasons internal to Sprint, it has decided that it will not exercise its right to nominate and elect two directors at this time.

The Shares represented by the proxies solicited in respect of the Meeting are intended to beVOTED FOR such nominees on any vote that may be called for, unless authority to do so is withheld. The term of office for each person so elected will be until the nextannual meeting of Shareholders of the Corporation or until a successor is elected or appointed following the resignation or removal of such director. If any of the proposed nominees should for any reason be unable to serve as a director of the Corporation, the persons named in the enclosed form of proxy reserve the right to nominate and vote for another nominee in their discretion.

NOMINEES TO THE BOARD

| | | | | |

| | | | | Number of securities of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised as at March 21, 2005 |

Name and Position and/or Office with the Corporation and Significant Affiliates | | Principal Occupation, Business or Employment and Name and Principal Business of Employer | | Year First Became Director | Shares | Class B Shares | Deferred Share Units(4) | Unvested RSUs |

WILLIAM W. LINTON Toronto, ON Canada | | President and Chief Executive Officer Call-Net Enterprises Inc. (telecommunications) • previously President and Chief Executive Officer, Prior Data Sciences, Inc. (1999-2000); Executive VP and CFO, SHL Systemhouse Inc. (1994-1999) | | 2000 | 258,883 | 17,000 | 26,102 | 72,667 |

S. DENNIS BELCHER(1) (7) Oakville, ON Canada | | Corporate Director, Foamex International Inc.; Viatel Holdings (Bermuda) Ltd.; Rand McNally & Company and Care Canada (Global Development Group) • previously Executive Vice President, The Bank of Nova Scotia | | 2002 | NIL | NIL | 10,266 | |

ROBERT M. FRANKLIN(2) (3) Toronto, ON Canada | | Chairman and Corporate Director, Placer Dome Inc., (mining); Director, Toromont Industries and Great Lakes Carbon Income Fund • previously Chairman, Eli Eco Logic Inc. | | 2002 | 25,000 | 15,000 | 2,566 | |

ROBERT T.E. GILLESPIE(2) (5) Mississauga, ON Canada | | President, Gilvest Inc., Chairman and Corporate Director of Husky Injection Molding Systems Ltd. and Spinrite Inc. (consumer goods), Corporate Director, Genworth Canada (insurance) • previously Chairman and Chief Executive Officer, General Electric Canada Inc. (manufacturing, technology) | | 1999 | NIL | 10,000 | 10,266 | |

ARTHUR B. KRAUSE(1) Naples, Florida, U.S.A. | | Corporate Director, Westar Energy (electric power) and Inergy GP MLP (propane distribution) • previously Executive Vice President, Chief Financial Officer, Sprint Corp. (telecommunications) | | 1999 | NIL | NIL | 0 | 0 |

WENDY A. LEANEY(1) (3) Toronto, ON Canada | | President, Wyoming Associates Ltd., (investment and consulting),; Corporate Director, Corus Entertainment Inc. (media, broadcasting) and Canadian Western Bank (commercial banking) • previously Managing Director of the Communications Group, TD Securities Inc. | | 2002 | 20,000 | 2,000 | 0 | 0 |

| Call-Net Enterprises Inc. | 5 |

| | | | | | |

Name and Position and/or Office with the Corporation and Significant Affiliates | | Principal Occupation, Business or Employment and Name and Principal Business of Employer | | Year First Became Director | Number of securities of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised as at March 21, 2005 |

DAVID A. RATTEE(1) (6) Toronto, ON Canada | | Chairman, President & Chief Executive Officer, CIGL Holdings Ltd.; President and Chief Executive Officer, MICC Investments Limited (investment); Corporate Director, Bank of New York Trust Company of Canada; Northstar Aerospace Inc.; Pet Value Inc. and Open Access Limited | | 2002 | 750 | NIL | 10,266 | |

LAWRENCE G. TAPP Langley, BC Canada | | Chairman, Call-Net Enterprises Inc. (telecommunications), Chairman and director, Automation Tooling Systems Inc. and Talisman Energy; Director, CCL Industries, Mainstreet Equities, and Wescast Industries • previously Dean, Richard Ivey School of Business, University of Western Ontario (business education) | | 1996 | NIL | 10,294 | 5,133 | |

JOSEPH H. WRIGHT(2) (3) Toronto, ON Canada | | Corporate Director, Loblaw Companies Limited; President’s Choice Bank; Chairman & Trustee, O&Y REIT; Director, ROC Capital Corp., Trustee: BFI Canada Income Fund and CSH Reit; Board of Advisors, CC&L Tigers Trust and CC&L Prints Trust (investment) • previously President and Chief Executive Officer, Swiss Bank (Canada); Managing Partner, Crosbie & Company Inc. | | 2002 | 1,000 | 10,000 | 5,133 | |

| | NOTES: |

| | (1) | Denotes member of the Audit Committee of the Board of the Corporation. |

| | (2) | Denotes member of the Corporate Governance and Nominating Committee of the Board of the Corporation. |

| | (3) | Denotes member of the Compensation and Human Resources Committee of the Board of the Corporation. |

| | (4) | Directors may elect to take up to 100% of their annual retainer in the form of Deferred Share Units pursuant to the Deferred Share Unit Plan adopted in 2003. |

| | (5) | Mr. Gillespie was a director of Bramalea Inc. at the time it filed for protection under theCompanies Creditors Arrangement Act(Canada) (the ‘CCAA’) on April 1, 1995. Mr. Gillespie was a director of Atlas Cold Storage Income Trust in December 2003 at which time all of the directors and officers were subject to a cease trade order, which is no longer in effect, as a result of failing to file quarterly financial reports and Management's Discussion and Analysis within the time requirements mandated by Canadian securities laws. |

| | (6) | Mr. Rattee was a director of TDZ Holdings Inc. from April 1999 to August 2001. On July 21, 2001, various provincial securities commissions issued orders ceasing the trading of TDZ Holdings Inc.’s shares as a result of a failure to file December 31, 2000 and March 31, 2001 financial statements within the prescribed filing periods. Such financial statements were subsequently filed and the order was lifted. On February 26, 1997 CIGL Holdings Ltd., a company of which Mr. Rattee was a director and officer, obtained court approval in respect of a proposal filed under theBankruptcy and Insolvency Act(Canada) (the ‘BIA’). |

| | (7) | Mr. Belcher was a director of Slater Steel Inc., which filed for protection under the CCAA on June 2, 2003. Mr. Belcher was also a director of Consumers Packaging Inc. at the time it filed for protection under the CCAA on May 23, 2001. On January 20, 2003, various provincial securities commissions issued orders ceasing the trading of Consumers Packaging Inc.’s shares as a result of a failure to file December 31, 2001 and September 30, 2001, March 31, 2002, June 30, 2002 and September 30, 2002 financial statements within the prescribed filing periods. In addition, Mr. Belcher was a director of White Rose Crafts and Nursery Sales Ltd. immediately prior to its voluntary assignment into bankruptcy under the BIA on June 20, 2002. Finally, Mr. Belcher was a director of Richtree Inc. which was subject to a cease trade order in 2003. On February 26, 2004, the cease trade order was lifted. This company filed for protection under the CCAA on October 18, 2004. |

AMENDMENT TO THE INCENTIVE STOCK OPTION PLAN

GENERAL

We currently havea Stock Option Plan under which options to purchase Shares or Class B Shares (collectively, the ‘Option Shares’) are granted to individuals. Stock option grants are designed to align executive compensation with the interests of the Corporation’s shareholders and to provide long-term additional compensation directly related to the improvement of the Corporation’s share price.

| Call-Net Enterprises Inc. | 6 |

As at March 21, 2005, there are1,949,084 outstanding options to purchaseOptionShares. Options granted pursuant to the Stock Option Plan will not exceed a term of tenyears and are granted at an option price and on terms that the Board determines is necessary to achieve the goals of the Stock Option Plan and in accordance with regulatory policies. Options are granted at the closing price of the Sharesor Class B Shares, as the case may be,on the day prior to the day on which such options are granted. All awards for executives are subject to vesting over periods of threeyears.

The number ofshares allocated to the Stock Option Plan is determined by the Board from time to time. In addition, the aggregate number ofOptionShares so reserved for issuance to any one person cannot exceed5% of the Corporation’s issued and outstandingshares. Optionholders have90 days from cessation of employmentwith the Corporation to exercise any options that have vested as of their last day of employment.

The Corporation is proposing amendments to the Stock Option Plan, as set out below:

| | (i) | Currently, there is a maximum of 2,261,000 Shares issuable under the Stock Option Plan. Our Board has approved increasing the maximum number ofOptionShares available for issuance under the Stock Option Plan by 1,000,000, to a total of 3,261,000 Shares, beingapproximately 9.12% of 35,784,277, the current number of outstandingshares; |

| | | |

| | (ii) | Currently, the Stock Option Plan does not limit the number ofOptionShares that may be issued tonon -employeemembers of the Board pursuant to the exercise of options under the Stock Option Plan. Our Board has approved amending the Stock Option Plan toprohibit the granting of options to non-employeemembers of theBoard pursuant to the Stock Option Plan; |

| | | |

| | (iii) | Currently, the Stock Option Plan does not require that the Board seek shareholder approval before the Board re-sets the option price of any options. Our Board has approved amending the Stock Option Plan to require that the Board seek shareholder approval before re-setting the option price of any options; |

| | | |

| | (iv) | Currently, the Stock Option Planprovides the Board with the right to grant incentive awards (in addition to options) to certain individuals pursuant to the Stock Option Plan in accordance with applicable laws and regulations. Our Board has approved amending the Stock Option Plan toremove the right to grant such incentive awards under the Stock Option Plan; and |

| | | |

| | (v) | Currently, the Stock Option Plan provides that the period for which an option is exercisable shall not exceed ten years. Our Board has approved amending the Stock Option Plan to limit the period for which an option is exercisable to seven years. |

Shareholders, Class B Holders and Preferred Holders will be asked at the Meeting to consider and, if deemed advisable, to approve, by a simple majority of votes cast at the Meeting, a resolution, the text of which is set forth in Schedule ‘B’ attached hereto (the ‘Stock Option Plan Resolution’), to approve the proposed amendments to the Stock Option Plan. If the Stock Option Plan Resolution is not passed, the Stock Option Plan will continue on the same terms in existence prior to the amendments. The Toronto Stock Exchange (the ‘TSX’) requires that the proposed amendments be approved by a majority of the votes cast at the Meeting, other than votes attaching to shares owned by insiders to whom options may be issued pursuant to the Stock Option Plan and associates of such persons (‘Option Plan Disinterested Holders’). To the knowledge of management, the number of shares as at March 21, 2005 that will be excluded for the purposes of the Option Plan Disinterested Holder vote is approximately 768,500. In order to be effective, the Stock Option Plan Resolution requires approval by a simple majority of the votes cast by Option Plan Disinterested Holders in person or by proxy who vote in respect of this resolution.

RECOMMENDATION OF THE BOARD

The Board has determined that the proposed amendments to the Stock Option Plan are in the best interests of our Corporation and ourshareholders. Our Board unanimously recommends that Shareholders, Class B Holders and Preferred Holders VOTE FOR the adoption of the Stock Option Plan Resolution, to amend the Stock Option Plan. The persons named in the enclosed form of proxy intend to vote at the Meeting in favour of the Stock Option

| Call-Net Enterprises Inc. | 7 |

��

Plan Resolution, unless theshareholder has specified in the form of proxy that his or hershares are to be voted against this resolution. The Stock Option Plan Resolution must be passed by at least a majority of the votes cast at the Meeting by allOption Plan Disinterested Holders who vote in respect thereof in person or by proxy.

AMENDMENT TO THE RESTRICTED STOCK UNIT PLAN

GENERAL

We currently have aRSU Plan. The RSU Plan is an incentive plan designed to promote the long-term success of the Corporation by providing for the payment of bonuses to key executives in the form of Shares. The plan is designed to encourage Designated Employees (as defined below under ‘Long-Term Incentive Compensation’) to acquire an interest in the Corporation through the ownership of Shares, to provide them with an incentive to furtherthegrowth and development of the Corporation and to encourage them to remain in the employment of the Corporation. The Board, or a committee thereof, administers the RSU Plan.RSUs will be settled by the delivery of Shares to theindividual that has been granted the RSUs (the ‘Participant’) or, at theParticipant’s option, the delivery of the cash equivalent market value of the Shares based on the five trading day average of the closing price of the Shares on the TSX. If Shares are to be delivered, the Corporation shall have the option to deliver Shares issued from treasury or Shares purchased on the TSX by an independent administrator. The RSU Plan provides that the maximum number of Shares deliverable to Designated Employees shall be 678,000 Shares. The maximum term for any RSU is threeyears.

As at March 21, 2005, there are104,667 outstanding RSUs.

The number of Shares allocated to the RSU Plan is determined byour Board from time to time.RSU grants, subject to limited exceptions, must be exercised while the optioneeis a director, officer or employee of the Corporation. The RSUs are not transferable or assignable.

The Corporation is proposing to amend the RSU Planas set out below:

| | (i) | Currently, there is a maximum of 678,000 Shares issuable under the RSU Plan.Our Board has approved increasing the maximum number of Shares available for issuance under the RSU Plan by 1,000,000, to a total of 1,678,000 Shares, beingapproximately 4.69% of 35,784,277, the current number of outstandingshares as at March 21, 2005; and |

| | | |

| | (ii) | Currently, the RSU Plan does not specifically prohibit non-employee members of the Board from participating in the RSU Plan. Our Board has approved amending the RSU Plan to specifically state that non-employee members of the Board are not eligible to participate in the RSU Plan. |

Shareholders, Class B Holders and Preferred Holders will be asked at the Meeting to consider and, if deemed advisable, to approve, by a simple majority of votes cast at the Meeting, a resolution, the text of which is set forth in Schedule ‘C’ attached hereto (the ‘RSU Plan Resolution’), to approve the proposedamendments to the RSU Plan. If the RSU Plan Resolution is not passed, the RSU Plan will continue on the same terms in existence prior to theamendments. The TSX has required that the proposed amendments be approved by a majority of the votes cast at the Meeting, other than votes attaching to shares owned by insiders to whom RSUs may be issued pursuant to the RSU Plan and associates of such persons (the ‘RSU Plan Disinterested Holders’). To the knowledge of management, the number of shares as at March 21, 2005 that will be excluded for the purposes of the RSU Plan Disinterested Holder vote is approximately768,500. In order to be effective, the RSU Plan Resolution requires approval by a simple majority of the votes cast by RSU Plan Disinterested Holders in person or by proxy who vote in respect of this resolution.

RECOMMENDATION OF THE BOARD

Our Board has determined that the proposed amendment to the RSU Plan is in the best interests of our Corporation and ourshareholders. Our Board unanimously recommends that Shareholders, Class B Holders and Preferred Holders VOTE FOR the adoption of the RSU Plan Resolution, to amend the RSU Plan. The persons named in the enclosed form of proxy intend to vote at the Meeting in favour of the RSU Plan Resolution, unless the

| Call-Net Enterprises Inc. | 8 |

shareholder has specified in the form of proxy that his or hershares are to be voted against this resolution. The RSU Plan Resolution must be passed by at least a majority of the votes cast at the Meeting by allRSU Plan Disinterested Holders who vote in respect thereof in person or by proxy.

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following table sets forth compensation earned during the last three financial years by the current Chief Executive Officer, the Chief Financial Officer, and the Corporation’s threemost highly compensated executive officers other than the Chief Executive Officer and the Chief Financial Officer who were serving as executive officers at the end of 2004, and anyone else who, were it not for the fact that they were not serving in their role as an executive officer at the end of 2004, would have been one of the Corporation’s three most highly compensated executives (the ‘Named Executives’).

| | | | | | | | |

| | | | Annual Compensation | | Long Term Compensation | All Other Compensation(5)($) |

| | | | | | | Awards | | Payouts | |

Name and Principal Position | | Year | | Salary ($) | | Bonus(1) ($) | | Other Annual Compensation(2) ($) | | Securities Under Options/SARs Granted(3) (#) | | Restricted Stock Units(4) ($) | | LTIP Payouts ($) | |

| WILLIAM LINTON | | 2004 | | 450,000 | | 250,678 | | - | | 67,800 | | - | | - | 323,992 |

| President and CEO | | 2003 | | 450,000 | | 630,900 | | 2,456,850 | | 67,800 | | - | | - | 221,456 |

| | | 2002 | | 450,000 | | 241,650 | | - | | 141,000 | | 1,962,000 | | - | 18,000 |

| ROY GRAYDON | | 2004 | | 325,000 | | 227,663 | | - | | 33,900 | | - | | - | 13,095 |

| Executive Vice President | | 2003 | | 182,292 | | 199,335 | | - | | 75,000 | | - | | - | 8,538 |

Chief Financial Officer(8) | | 2002 | | - | | - | | - | | - | | - | | - | - |

| DUNCAN MCEWAN | | 2004 | | 375,000 | | 262,688 | | - | | 33,900 | | - | | - | 202,719 |

Executive Vice President Chief Strategy Officer(6) | | 2003 2002 | | 375,000 375,000 | | 394,313 151,031 | | 1,344,450 - | | 33,900 71,000 | | - 1,197,000 | | - | 137,332 13,200 |

| GREG MCCAMUS | | 2004 | | 325,000 | | 232,781 | | - | | 14,000 | | - | | - | 544,040 |

| President, Enterprise | | 2003 | | 325,000 | | 342,713 | | - | | 14,000 | | - | | - | 42,600 |

Communications Solutions(7) | | 2002 | | 325,000 | | 139,669 | | 412,500 | | 45,000 | | 216,000 | | - | 13,200 |

| ERIC DOBSON | | 2004 | | 300,000 | | 163,350 | | - | | 14,000 | | - | | - | 49,731 |

| Senior Vice President | | 2003 | | 300,000 | | 224,528 | | - | | 14,000 | | - | | - | 35,600 |

| Business and Carrier Services | | 2002 | | 300,000 | | 57,600 | | - | | 24,000 | | 216,000 | | - | 13,200 |

Notes:

| (1) | Bonuses shown above were earned in the relevant year but some portion was paid in the following year. Mr. Linton chose to be paid a portion of his bonus in deferred share units, as set out under ‘Deferred Share Unit Plan’ on page13. |

| (2) | For Mr. Linton and Mr. McEwan, the amounts shown for 2003 represent the total value of amid-term incentive plan, based on performance during 2003, and paid out in thirds in three successive years. The payment made to Mr. McCamus represents a negotiated payment pursuant to a change in control provision in his employment contract with NorthPoint Canada Enterprises Inc. |

| (3) | No SARs were granted to any of the individuals listed in the chart. Options grantedare as set out. |

| (4) | Amounts shown for 2002 represent the value of allRSUs granted on April 10, 2002, whether vested or unvested. The value is based on a stock unit price of $9.00, which was the closing price of the Shares on that day. Aggregate holdings of RSUs granted under this plan were valued as at December 31, 2004. Their value is based on a Share price of $3.10, which was the average closing price of theSharesfor thefive trading days ending December 31, 2004. The number of RSUsgrantedareas follows: Mr. Linton, 218,000RSUs, Mr. McEwan, 133,000RSUs, Mr. McCamus, 24,000RSUs, Mr. Dobson, 24,000RSUs. One third of the RSUs vested in 2004. Based upon this Share price, the value of the RSUs as at December 31, 2004 wasforMr. Linton, $675,800, Mr. McEwan, $412,300, Mr. McCamus, $74,400 and Mr. Dobson, $74,400. RSUs vest over a three year period in 1/3 increments on each anniversary date. |

| (5) | Represents certain operating allowances. Amounts shown in 2004 also include the taxable benefit incurred in April 2004 upon the vesting of one-third of vested RSUs. The value was as follows: Mr. Linton $304,475, Mr. McEwan $185,755, Mr. McCamus $33,520, Mr. Dobson $33,520. |

| (6) | Mr. McEwan assumed the title of Executive Vice President and Chief Strategy Officer on October 1, 2004. Prior to that, he was President and Chief Operating Officer of Sprint Canada Inc.Mr. McEwan ceased to be Executive Vice President & Chief Strategy Officer on February 28, 2005 but will remain in an advisory capacity for a period of six months to further develop the Corporation's strategy. |

| (7) | Mr. McCamus assumed the title of President, Enterprise Communications Solutions on June 25, 2001. Prior to that, he was Senior Vice President, New Product Development of Sprint Canada Inc. and prior to that he was Senior Vice President, Sales and Marketing of NorthPoint Canada Enterprises Inc., which became a wholly-owned subsidiary of the Corporation on January 10, 2001. Mr. McCamus ceased acting as an executive officer on October 1, 2004 and the payment made to him under the column, ‘All Other Compensation’ includes the amount paid or payable on account of his termination. |

| (8) | Mr. Graydon was hired on June 9, 2003 as Executive Vice President and Chief Financial Officer. |

| Call-Net Enterprises Inc. | 9 |

The following tables set forth individual grants of stock options by the Corporation and the exercise of employee options during the last financial year for the Named Executives.

OPTION/SAR GRANTS DURING THE MOST RECENTLY COMPLETED FINANCIAL YEAR

| Named Executive | | Securities Under Options/SARs Granted(1) (#Shares) | | % of Total Options/ SARs Granted to Employees in Financial Year (Shares) | | Exercise or Base Price ($/Security) (Shares) | | Market Value of Securities Underlying Options/SAR’s on the Date of Grant (Shares) | | Expiration Date (Shares) | |

| W. Linton | | | 67,800 | | | 13.9% | | | | | | | | | Feb 24/11 | |

| R. Graydon | | | 33,900 | | | 6.9% | | | | | | | | | Feb 24/11 | |

| D. McEwan | | | 33,900 | | | 6.9% | | | | | | | | | Feb 24/11 | |

| G. McCamus | | | 14,000 | | | 2.9% | | | | | | | | | Feb 24/11 | |

| E. Dobson | | | 14,000 | | | 2.9% | | | | | | | | | Feb 24/11 | |

Notes:

| (1) | Options granted are exercisable for Shares. None of the individuals listed hold options for Class B Shares. The options granted to Named Executives have a three-year vesting schedule as follows: 331/3% after the first year, 331/3% after the second year and 331/3% after the third year. |

AGGREGATED OPTIONS/SARS EXERCISED DURING THE

MOST RECENTLY COMPLETED

FINANCIAL YEAR AND FINANCIAL YEAR-END OPTION/SAR VALUES

| Named Executive | | Securities Acquired on Exercise (# Shares) | | Aggregated Value Realized ($ Shares) | | Unexercised Options/SARs at the Financial Year-end Exercisable/ Unexercisable(1) (# Shares) | | Value of Unexercised in-the-Money Options/SARs at the Financial Year-end Exercisable/ Unexercisable(3) ($ Shares) | |

| W. Linton | | | 0 | | | 0 | | | 22,600 / 254,000(2) | | | | |

| R. Graydon | | | 0 | | | 0 | | | 25,000 / 83,900(2) | | | | |

| D. McEwan | | | 0 | | | 0 | | | 11,300 / 127,500(2) | | | | |

| G. McCamus | | | 0 | | | 0 | | | 4,666 / 68,334(2) | | | | |

| E. Dobson | | | 0 | | | 0 | | | 4,666 / 58,334(2) | | | | |

Notes:

| (1) | Options granted are exercisable for Shares. None of the individuals listed above hold options for Class B Shares. |

| (2) | All options granted to Named Executives have a three-year vesting schedule as follows: 331/3% for the first year, 331/3% for the second year and 331/3% for the third year. In addition, for 2002 grants only, in order for the options to vest, the market value of the shares must reach certain performance criteria. The price of the Shares must reach 120% of the exercise price for the first third to vest, 140% of the exercise price for the second third to vest, and 150% for the remaining third to vest. |

| (3) | Based on a year-end close price of the shares of $3.04 less the exercise price of $1.80. |

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information with respect to compensation plans under which equity securities of the Corporation are authorized for issuance as atDecember 31, 2004 and approved by the Shareholders of the Corporation.

| Call-Net Enterprises Inc. | 10 |

| | | Number of Securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)(1) | |

Plan Category | | (a) | | (b) | | (c) | |

| Equity compensation plans approved by Shareholders | | | | | | | | | | |

• Incentive Stock Option Plan | | | 1,596,750 Shares 0 Class B Shares | | | | | | 647,269 | |

• Restricted Stock Unit Plan | | | 104,667(2) | | | 0 | | | 160,834 | |

Total | | | | | | | | | | |

Notes:

| (1) | Numbers listed are not adjusted to reflect the proposed amendments to the Stock Option Plan or the RSU Plan. |

| (2) | Participants have the right to receive a cash payment in lieu of Shares. See ‘Long-Term Incentive Compensation’ on page12. |

OPTIONS, GRANTS AND EXERCISES

Our Stock Option Plan provides for the grant of options to purchase Shares to eligible directors, officers, key employees and consultants of the Corporation and its subsidiaries (the ‘Eligible Persons’). Our Stock Option Plan currently permits a maximum of 2,261,000 Shares to be issued to holders of options granted thereunder. If any options granted under our Stock Option Plan expire, terminate or, with the consent of the optionee, are cancelled without having been exercised, then new options may thereafter be granted covering such Option Shares. Accordingly, since our Stock Option Plan was adopted, 2,389,950 options have been granted since the Stock Option Plan was adopted. As of March 21, 2005, the Corporation has outstanding 1,949,084 options to purchaseOptionShares, representingapproximately 5.45% of ourissued andoutstandingshares. As of March 21, 2005, 32,147 Shares have been purchased pursuant to an exercise of options since the Stock Option Plan was adopted,representing 0.09% of our issued and outstanding shares. The number of Shares issuable under the Stock Option Plan amounts to2,228,853 Option Shares, representing approximately 6.23% of our issued and outstandingshares, as of March 21, 2005. If the proposed amendment to increase the number ofOptionShares that may be granted under the Stock Option Plan is approved, the number ofOptionShares that may be issued under the Stock Option Plan to holders of options will increaseby 1,000,000from 2,261,000OptionShares to 3,261,000Option Shares, representing approximately 9.11% of our issued and outstanding shares. Accordingly, if the proposed amendments are approved, we will have 3,228,853 Option Shares reserved for issuance, representing approximately 9.02% of our issued and outstanding shares.

The aggregate number of Option Shares reserved for issuance pursuant to all options granted to any one optionee cannot exceed 5% of the number ofshares outstanding immediately prior to the share issuance in question. Any grants of options to an optionee who is a Canadian for the purpose of theTelecommunications Act shall only be grants of options to purchaseShares. If the proposed amendmentprohibiting the granting of options to non-employeemembers of the Board is approved, then options shall not be granted to non-employee members of the Board.

The exercise price of options granted by us is determined by the Board at the time any option is granted (or at the time any option is re-priced), but in no event shall such price be less than the closing price of the Shares, or Class B Shares, as the case may be, on the TSX on the day prior to the grant or re-pricing, as the case may be.The Corporation has never re-priced options. If the proposed amendment is approved, any re-pricing of options must have the prior approval of shareholders.

Although the Board, in its discretion, may determine the term and vesting provisions of options granted under the Stock Option Plan, all options that have been granted to date to management have had a three-year vesting schedule as follows: 331/3% after the first year, 331/3% after the second year and 331/3% after the third year. Notwithstanding the vesting of the options as determined by the Board, all of the Option Shares under options granted to optionees shall vest immediately prior to the happening of certain transactions pursuant to which, directly or indirectly, the Corporation undergoes a change of control or transfers all or substantially all of its assets to any person (other than a wholly-owned subsidiary), subject to certain exceptions. We do not provide financial assistance to Eligible Persons in connection with their participation in the Stock Option Plan. Options issued under the Stock Option Plan have a maximum term of ten years and if the proposed amendment is approved, options will have a maximum term of seven years.

| Call-Net Enterprises Inc. | 11 |

Options are non-assignable. In the event of an optionee’s death, the optionee’s legal personal representative has three months from the date of death to exercise the options that had vested at the date of death but had not yet been exercised by the optionee. In the event an optionee’s employment, directorshipor consultancy is terminated for any reason whatsoever, the optionee has three months from the date of termination to exercise the option, but only to the extent that the optionee’s right to exercise the option had vested at the date of termination.

Pursuant to the Stock Option Plan, the Boardhas the right to grant other incentive awards to Eligible Persons in accordance with applicable laws and regulations and subject to regulatory approval, including the TSX, based uponOptionShares having such terms and conditions as the Board may determine, including the grant of shares based upon certain conditions, the grant of securities convertible intoOptionShares and the grant of stock appreciation rights. If the proposed amendment is approved, the right to grant such other incentive awards pursuant to the Stock Option Plan shall be removed.

The Board may amend or terminate the Stock Option Plan, provided that no such amendment may alter or impair any option previously granted under the Stock Option Plan without the written consent of the optionee, or permit the granting of options that expire beyond ten years from the date of grant or at an option price less than that determined at the time the option was granted. Any amendment to the Stock Option Plan is subject to appropriate governmental, regulatory or shareholder approval, including approval of the TSX. As discussed above, if the proposed amendment to the Stock Option Plan that would require shareholder approval for any re-pricing of options is approved, then no options may be re-priced without shareholder approval.

LONG-TERM INCENTIVE COMPENSATION

OurRSU Plan provides for the grant ofRSUs to employees of the Corporation or any of its subsidiaries, as designated by the Board of the Corporation (the ‘Designated Employees’). If the proposed amendments are approved, non-employee members of the Board will not be eligible to participate in the RSU Plan. Under the RSU Plan, Designated Employees do not receive Shares at the date of grant, but instead are awarded RSUs that represent the right to receive Shares if certain vesting requirements are met. If those requirements are met within the term, theParticipant in the RSU Plan would be entitled to receive, without any additional payment, a specified number of Shares at the end of the term or, at theParticipant’s option, a cash payment based upon the then current trading price of such Shares. If the requirements are not met within the term, then theParticipant forfeits the RSUs, including any rights to receive the underlying Shares.

The RSU Plan currently permits a maximum of 678,000 Shares to be issued under the plan.652,000 RSUs have been granted since the RSU Plan was adopted and, as of March 21, 2005, the Corporation has104,667 RSUs outstanding, each of which, provided certain conditions are met, represents the right to be issued one Share. As of March 21, 2005, 412,499 Shares have been issued pursuant to the RSU Plan since its adoption, 134,834 have been cancelled and265,501 Shares are available to be issued under the RSU Plan. The number of Shares issued and issuable underthe RSU Plan amounts to1.15% and0.74% of our outstandingshares, respectively, as ofMarch 21, 2005. If the proposed amendment to increase the number of Shares that may be granted under the RSU Plan is approved, the number of RSUs that may be granted will increase from 678,000 to 1,678,000,representing approximately 4.69% of our issued and outstanding shares. Accordingly, if the proposed amendments are approved, we will have 1,265,501 shares issuable under the RSU Plan, representing approximately 3.54% of our issued and outstanding shares.

The Board, in its discretion, shall determine which Designated Employees will be granted RSUs, based on that employee’s current and potential contribution to the success of the Corporation.At such time, the Board shall also determine (i) the effective date of the RSU grant and the number of RSUs to be allocated, (ii) the term applicable thereto and any applicable vesting terms, (iii) the performance criteria, if any, to be achieved during the term in order for RSUs to be issued to the participant, and (iv) all other terms and conditions of RSUs covered by any grant (which may include non-competition or change in control provisions). RSUs issued under the RSU Plan have a maximum term of three years.

Subject to compliance with applicable laws and regulations, the Board may authorize from time to time the issuance by the Corporation of Shares or the purchase of Shares for the benefit ofParticipants on the open market or by private transactions as required in order to administer the RSU Plan.

| Call-Net Enterprises Inc. | 12 |

Unless the Board provides for another term (provided however, that such term shall not exceed three years), at the time a grant is made, subject to the level of achievement of performance criteria, if any, determined by the Board, theParticipant shall be issued RSUs covered by a grant, settled in the form of Shares on each release date, provided theParticipant remains employed with the Corporation or any of its affiliated companies from the effective date of such grant until such release date. RSUs are not assignable or transferable.

In the event of the death of aParticipant, the deceasedParticipant’s estate shall elect, within 120 days of the date of death, with respect to each grant for which the term has not ended and for which RSUs have not otherwise been issued prior to the date of death, to receive, subject to the provisions of the RSU Plan, RSUs issued in the form of Shares to the estate:(i) as if the term had ended and the performance criteria had been met (but not exceeded) on the day preceding the date of death, in which case, receipt of the election shall give rise to the issuance of the RSUs; or (ii) on the release date on which all or a portion of the RSUs would otherwise be issued, if at all, in accordance with the RSU Plan, had theParticipant not died and continued inthe employment until such release date.

In the event of the death of aParticipant following the end of the term, but prior to the release date with respect to such grant, the number of such RSUs that would otherwise be issued to suchParticipant shall be issued in the form of Shares and delivered to the estate as if theParticipant had continued in the employment until the release date.

Subject to applicable change in control provisions and the terms upon which the grant was made, in the event aParticipant’s employment terminates for any cause other than death, the RSUs covered by any grant to suchParticipant with respect to which the release date has not occurred and for which RSUs have not been issued prior to such termination, shall be forfeited without compensation as of such termination.

Upon the occurrence of a change in control (as such term may be defined in theParticipant’s change in control agreement or in the terms upon which the RSUs are allocated to theParticipant), with respect to all grants outstanding onthe date of the change in control, all performance criteria, if any, applicable to the outstanding grant, shall be waived as of such date and, except as may otherwise be provided under any other employee benefit plan approved by the Board, eachParticipant who has received any such grants shall be entitled to receive a cash payment based upon the market value of the underlying Shares.

In the event of certain alterations to the Corporation’s share capital, the Board shall, in its sole discretion, be entitled to determine whether such alteration equitably requires any adjustment in the number of (i) RSUs issuable pursuant to the RSU Plan, (ii) RSUs then covered by grants, (iii) RSUs generally available for grants under the RSU Plan, and (iv) RSUs available for grant under theRSU Plan in any calendar year.

The Board may amend, suspend or terminate the RSU Plan. The Board may amend the terms of grants made under the RSU Plan, subject to obtaining any required regulatory or other approvals. If anyamendment will materially adversely affect the rights of aParticipant with respect to a grant, the Board must obtain the written consent of theParticipant tothe amendment, unless such amendment is required to comply with applicable law or regulations. Furthermore, no amendments may be made to the change in control provision of theRSU Plan after the date of a change in control.

DEFERRED SHARE UNIT PLAN

Deferred share units may be granted each year to certain senior executives in lieu of all or part of their annual cash bonus awards as describedin the ‘Summary Compensation Table’ on page9.Each executive officer may elect, twice each calendar year, to be paid a percentage of his or her bonus entitlements, not to exceed 25% of his or her annual base salary, in the form of deferred share units with the balance being paid in cash. The number of units owned by theNamed Executives and the value of the deferred share units for each of the Named Executives as of December 31, 2004 were as follows:

| Call-Net Enterprises Inc. | 13 |

Name | | Units owned in Deferred Share Unit Plan (# Common) | | Value of Units as of December 31, 2004 (based on year endmarketprice per Share of $3.04) | |

| W. Linton | | | 26,102 | | | | |

| R. Graydon | | | 0 | | | | |

| D. McEwan | | | 0 | | | | |

| G. McCamus | | | 0 | | | | |

| E. Dobson | | | 0 | | | | |

PENSION BENEFITS

The Corporation does not sponsor any pension plans for its executive officers.

EMPLOYMENT CONTRACTS

Each of the Named Executiveshas entered into an employmentagreement with the Corporation providing for, among other things, industry standard covenants in favour of the Corporation, including covenants not to compete with the Corporation for a period of three months after departure, as well as confidentiality covenants. These agreements provide for the executive’s annual base salary and bonus, and for certain other benefits, all as set forth in the ‘Summary Compensation Table’ on page9.Messrs. McEwan’s and Graydon’s agreements provide that if their employment is terminated without cause, they are entitled to a severance payment of 100% of base salary. Additionally, the employment agreements for Messrs. Linton and McEwan provide that, upon achange ofcontrol of the Corporation (as defined therein) they may become entitled to up to 24 months’ salary and bonus as well as an immediate vesting of their outstanding options andRSUs. The employment agreement for Mr. Graydon provides that upon achange incontrol of the Corporation (as defined therein), he may become entitled to up to 24 months’ salary and bonus as well as an immediate vesting of his outstanding options.

COMPENSATION COMMITTEE

The following members of theBoard comprise the Compensation and Human Resources Committee, which meets periodically to determine the compensation and compensation policies for the executives of the Corporation: Robert Franklin (Chair), Wendy A. Leaney, Leslie M. Meredith and Joseph Wright. None of these directors are, or ever have been, an executive officer of the Corporation or any of its subsidiaries.

2004 REPORT ON EXECUTIVE COMPENSATION

The Corporation’s executive compensation policies are designed to recognize and reward individual performance as well as to provide a competitive level of compensation. The overriding objective of these policies is to provide a total compensation package that will attract and retain the most capable individuals possible.

The Corporation’s compensation policies are heavily performance-based and consist of three primary components: base salary, an annual incentive bonus program and a long-term incentive program. Base salaries are set at a level that is considered to be slightly above the median level for other similar executive positions for public companies of similar size but slightly below median on a total compensation perspective when compared to direct competitors in the telecommunications industry. The annual incentive bonus program is designed to provide the executive officers with an opportunity to earn an above-average level of compensation based upon meeting certain performance targets. The target level of annual incentive bonus compensation for most executives is 50% to 100% of base salary, and is awarded as a function of the attainment of pre-determined departmental targets. However, the program allows this level to be exceeded for exceptional performance against objectives. Performance targets consist of overall corporate performance metrics that are specific, quantifiable measures of corporate and business unit performance such as revenue, earnings before interest, taxes, depreciation and amortization (‘EBITDA’) and cash (measured by taking EBITDA and subtracting capital expenditures and other factors). At the executive level, as part of the compensation determination, the Board reviews a comprehensive overview of the executive’s compensation history, including equity grants and terms.

| Call-Net Enterprises Inc. | 14 |

In 2003, the Board approved a medium term incentive plan for theCorporation’sChief Executive Officer and Chief Operating Officer in order to bring the total compensation package for these individuals more in line with market. The Board established criteria against which awards under this plan would be payable. For the Chief Executive Officer, these criteria included increased cross-border sales resulting in incremental annualized revenue, regulatory relief, gross margin improvement, growth in local markets and an increase in the enterprise value of the Corporation. For the Chief Operating Officer, the criteria included gross margin improvement, growth in local markets, an increase in the enterprise value of the Corporation, as well as growth in the enterprise and consumer divisions of the business, and the betterment of a target operating costs to revenue ratio. Amounts earned under this plan were payable over three years provided the executive officer’s employment continues with the Corporation. Upon termination of employment, any unpaid amounts may be awarded to the individual at the discretion of the Board. Amounts earned in 2003, but payable over the next three years are reflected in the Summary Compensation Table on page9 of this circular.

A significant component of the executive compensation program is the long-term incentive program, under which stock options are awarded. Stock options are designed to align executive compensation with the interests of the Corporation’s shareholders and to provide long-term additional compensation directly related to improvement of the Corporation’sshare price. Options are granted at the closing price of the Shares or Class B Shares, as the case may be, on the day prior to the day on which such options are granted. All awards for executives are subject to vesting over periods of three years. Optionholders have90 days from cessation of employment by the Corporation to exercise any options that have vested as of their last day of employment.

The Corporation’sRSU Plan is an incentive plan designed to promote the long term success of the Corporation by providing for the payment of bonuses to key executives in the form of Shares. The RSU Plan is designed to encourage Designated Employees to acquire an interest in the Corporation through the ownership of Shares, to provide them with an incentive to furtherthegrowth and development of the Corporation and to encourage them to remainemployed with the Corporation. The Board or a committee thereof, administers the RSU Plan.RSUs will be settled by the delivery of Shares to the participant or, at the participant’s option, the delivery of the cash equivalent market value of the Shares based on the five trading day average of the closing price of the Shares on the TSX. If Shares are to be delivered, the Corporation shall have the option to deliver Shares issued from treasury or Shares purchased on the TSX by an independent administrator. The RSU Plan currently provides that the maximum number of Shares deliverable to Designated Employees shall be 678,000 Shares. The maximum term for any RSU is three years. Further, pursuant to the RSU Plan, all Named Executives elected to settle their stock unit grants in the form of Shares in 2004.

In order to further align executive compensation with the interests of shareholders, the Board instituted share ownership guidelines for directors and officers in 2003.For executives the number of shares required to be held ranges from one half of the executive’s base salary to two times base salary, based on the market value of the shares held and the position that the executive holds. To further this ownership goal, in 2003 the Corporation adopted a Deferred Share Unit Plan that permits executive officers to invest up to 25% of their annual bonus in share equivalents. DSUs can be redeemed only upon the cessation of the executive’s employment, either as Shares or a cash equivalent value.

Certain benefits and perquisites are also provided to officers based upon their cost effectiveness and their value in assisting the officers to carry out their duties effectively. The total value of such benefits and perquisites is relatively minimal in comparison to each individual’s total compensation, and is therefore a secondary consideration.

| Call-Net Enterprises Inc. | 15 |

The Chief Executive Officer’s compensation is established separately by the Board. The annual compensation of the current Chief Executive Officer was established by an employment agreement with the Corporation dated September 27, 2000 and amended on May 1, 2002. This compensation package consists of a combination of base salary, cash bonuses, related allowances and benefits, stock option grants and RSUs. A substantial portion of the Chief Executive Officer’s incentive compensation is based upon the Corporation’s financial performance (such as revenue targets, cash flow and equity gains) as well as the achievement of strategic and organizational goals. The Board is of the view that this structure aligns the Chief Executive Officer’s personal interests with those of the shareholders.

ROBERT FRANKLIN (CHAIR)

WENDY LEANEY

LESLIE MEREDITH

JOSEPH WRIGHT

COMPENSATION AND HUMAN RESOURCES COMMITTEE

| Call-Net Enterprises Inc. | 16 |

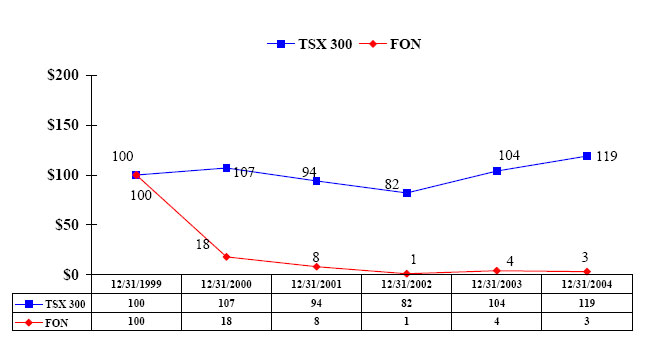

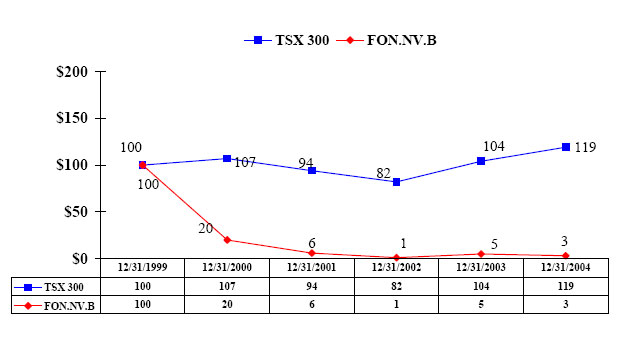

PERFORMANCE GRAPHS

The performance graphs below set out the performance of the Corporation’sShares and Class BShares versus the TSX 300 Index for the previous five years, beginning December 31, 1999.

SHARES

CLASS B SHARES

| Call-Net Enterprises Inc. | 17 |

CORPORATE GOVERNANCE

The Board believes that sound corporate governance practices are in the interest of shareholders and contribute to prudent and effective decision-making and as such the Board is committed to thorough and effective corporate governance arrangements. TheTSX has issued guidelines for effective corporate governance (‘Guidelines’) and requires listed companies to disclose their corporate governance practices on an annual basis with reference to the Guidelines. The Board believes that the Corporation’s corporate governance policies and practices, outlined in Schedule ‘A’ attached to this circular, are comprehensive and consistent with the Guidelines.

Recently, the Ontario Securities Commission issued draft corporate governance rules intended to outline ‘best practices’. These rules, when implemented, would replace the Guidelines. The Board is carefully monitoring the draft rule as well as other developments in recommended corporate governance ‘best practices’ with reference to its own corporate governance practices with a view to continually augmenting and improving its own practices and procedures. The Board’s objective is to meet and, where appropriate, exceed all relevant corporate governance guidelines.

INDEBTEDNESS OF DIRECTORS AND OFFICERS

Other than routine indebtedness to the Corporation, none of the directors, officers and nominee directors of the Corporation were indebted to the Corporation in 2004 or are at present indebted to the Corporation.

COMPENSATION OF DIRECTORS

During the financial year ended December 31, 2004, all directors of the Corporation, except the CEO, were paid an annual fee of $25,000, except the Chair who was paid an annual fee of $50,000. Attendance fees were $1,500 per meeting. Chairs of committees of the Board were paid an annual fee of $10,000. Attendance fees of $1,500 per meeting were paid to each committee member. In July 2004, the Board approved an increase in the annual retainer of the chair of the audit committee to $15,000 and in the meeting fees for all audit committee members to $2,000 to reflect the increased workload of that committee prompted by legislative change. Directors are also separately reimbursed for travel and other out-of-pocket expenses incurred in attending board or committee meetings.

DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE

In2004, the Corporation purchased primary and excess directors’ and officers’ liability and indemnification insurance coverage in the amount of U.S. $30,000,000 for the benefit of the Corporation and its subsidiaries. The 2004 annual total premium for the coverage was $701,564.00. The premium was not allocated as between directors as a group or officers as a group. The Corporation retained a deductible of U.S. $1,000,000 per claim for securities related claims and U.S. $250,000 per claim for all other losses under the directors’ and officers’ liability coverage. The Corporation expects it will be renewing this policy in 2005 subject to market availability and pricing. The policy insures directors and officers, in their capacity as directors and officers of the Corporation, against certain liabilities incurred by them, except where the liability relates to the failure of the director or officer to act honestly, in good faith and with a view to the bestinterests of the Corporation.

PARTICULARS OF OTHER MATTERS

Management knows of no matters to come before the Meeting other than the matters referred to in the Notice of Meeting accompanying this circular. However, if any other matters that are not now known to management should properly come before the Meeting, the proxy (unless amended) will be voted upon such matters in accordance with the best judgment of the person voting the proxy.

| Call-Net Enterprises Inc. | 18 |

SHAREHOLDERS PROPOSALS FOR NEXT YEAR’S ANNUAL MEETING

TheCBCA permits certain eligible Shareholders of the Corporation to submit shareholder proposals to the Corporation for inclusion in a management proxy circular for an annual meeting of Shareholders. The final date by which the Corporation must receive shareholder proposals for the annual meeting of Shareholders of the Corporation to be held in 2006 is December 23, 2005.

ADDITIONAL INFORMATION

The Corporation will provide to any person or company, upon receipt of a request by the Secretary of the Corporation, a copy of:

| | (i) | the most recent Annual Information Form (‘AIF’), together with one copy of any document, or the pertinent pages of any document, incorporated by reference in the AIF; |

| | | |

| | (ii) | the most recently filed comparative annual financial statements, together with the accompanying report of the auditor, and any interim financial statements that have been filed for any period after the end of its most recently completed financial year; and |

| | | |

| | (iii) | the information circular in respect of its most recent annual meeting of shareholders. |

Copies of these documents can also be found atwww.sedar.com. Additional information relating to the Corporation is also available atwww.sedar.com. Financial information is provided in our comparative financial statements and Management’s Discussion and Analysis.

APPROVAL OF BOARD

The contents of this Management Proxy Circular and the sending of it toshareholders of the Corporation, to each director of the Corporation, to the auditors of the Corporation and to the appropriate governmental agencies, have been approved by the directors of the Corporation.

DATEDat Toronto, Ontario, this 22nd day of March, 2005.

| | BY ORDER OF THE BOARD |

| | |

| | Lawrence G. Tapp, Chair |

| Call-Net Enterprises Inc. | 19 |

SCHEDULE ‘A’

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

| | | |

TSX Corporate Governance Guidelines | | 2004 Disclosure Statement |

| 1. The Board as stewards of the Corporation | | The Corporation’s corporate governance practices are designed to protect and enhance shareholder value. The Board is guided by and acts in accordance with the Canada Business Corporations Act, the Corporation’s articles and by-laws, its mandate and those of its committees, the Corporation’s code of conduct and applicable laws, regulations and policies. The Corporation’s Governance Manual includes a mandate for the Board, which formally sets out the responsibilities of the Board. The Board’s mandate includes the supervision of management of the Corporation in the conduct of the business. The Corporation’s planning, forecasting and review process enables directors to assume effective stewardship of the Corporation and to oversee the performance of management. The Board reviews and approves all significant decisions facing the Corporation, including all business agreements that meet certain thresholds (generally, those that exceed $10 million in value or that have terms in excess of five years), all equity investments, strategic alliances, changes in business focus, as well as any corporate financing or debt issuance. The Board met nine times in 2004 with a total attendance of 94%. |

(a) Adoption of a Strategic planning process | | The Board holds special sessions at least annually to review, discuss and approve the Corporation’s strategic plan and regularly monitors the progress of the Corporation against its plan at board meetings. In the fourth quarter, budgets and performance targets are set for the coming year and are updated for major strategic changes as and when required. The directors analyze variances to the business plan and budgets at regularly scheduled Board meetings. The Board also reviews any transaction that may have a material impact on the strategic plan. |

(b) Risk Management | | The strategic planning process followed by the Board includes the identification and evaluation of the Corporation’s principal risks, which include the telecommunications and regulatory environment, currency and interest rate risks and the competitive landscape. Through itsaudit committeethe Board also reviews with its internal and external auditors the Corporation’s risk management policies and systems, such as internal audit and information management systems. |

(c) Succession planning | | The Board is responsible for selecting the CEO, appointing senior management and assessing their performance. A senior management succession plan has been adopted by the Board and is reviewed by thecompensation and human resources committeeannually. This committee identifies, with the help of the CEO, the management needs to ensure that executive leadership skills are of the highest standards to keep pace with the Corporation’s diversification into new telecommunications sectors and geographic markets. |

(d) Communications policy | | The Corporation has a formal communications policy for dealing with governments, regulators, analysts and investors in Canada and the United States. Senior executives are involved on a continuous basis in making presentations to stakeholders and other parties, and the Corporation is committed to full and timely disclosure of material events and financial results through a number of channels including its website. The Corporation employs a Vice President to address investor questions and concerns on a day-to-day basis and a Corporate Communications Specialist who assists senior management and the Board in their review of the Corporation’s public disclosure and press relations. |

(e) Internal control and management information systems | | Theaudit committeereviews and approves methods of controlling corporate assets and the effectiveness of information systems in conjunction with the internal auditors and oversees the financial reporting process in accordance with generally accepted accounting principles. An internal audit unit, which reports to theaudit committeeon a regular basis, is mandated to independently assess and report on the state of internal controls. |

| Call-Net Enterprises Inc. | 1 |

| | | |

TSX Corporate Governance Guidelines | | 2004 Disclosure Statement |