Exhibit 99.1

Financial Results for the Full Year Ended 30 June 2012

Sims Metal Management Limited

ASX Code: SGM NYSE Code: SMS

Supplemental Information

23 August 2012

Disclaimer

This presentation may contain forward-looking statements, including statements about Sims Metal Management’s financial condition, results of operations, earnings outlook and prospects. Forward looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions.

These forward-looking statements involve certain risks and uncertainties. Our ability to predict results or the actual effects of our plans and strategies is subject to inherent uncertainty. Factors that may cause actual results or earnings to differ materially from these forward looking statements include those discussed and identified in filings we make with the Australian Securities Exchange and the United States Securities and Exchange Commission (SEC), including the risk factors described in the Company’s Annual Report on Form 20F, which we filed with the SEC on 14 October 2011.

Because these forward-looking statements are subject to assumptions and uncertainties, actual results may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this release.

All subsequent written and oral forward-looking statements concerning the matters addressed in this release and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this release. Except to the extent required by applicable law or regulation, we undertake no obligation to update these forward looking statements to reflect events or circumstances after the date of this release. Please visit our website (www.simsmm.com) for more information on the Company.

Please note that all references to $ or dollars herein are references to Australian dollars, unless otherwise indicated.

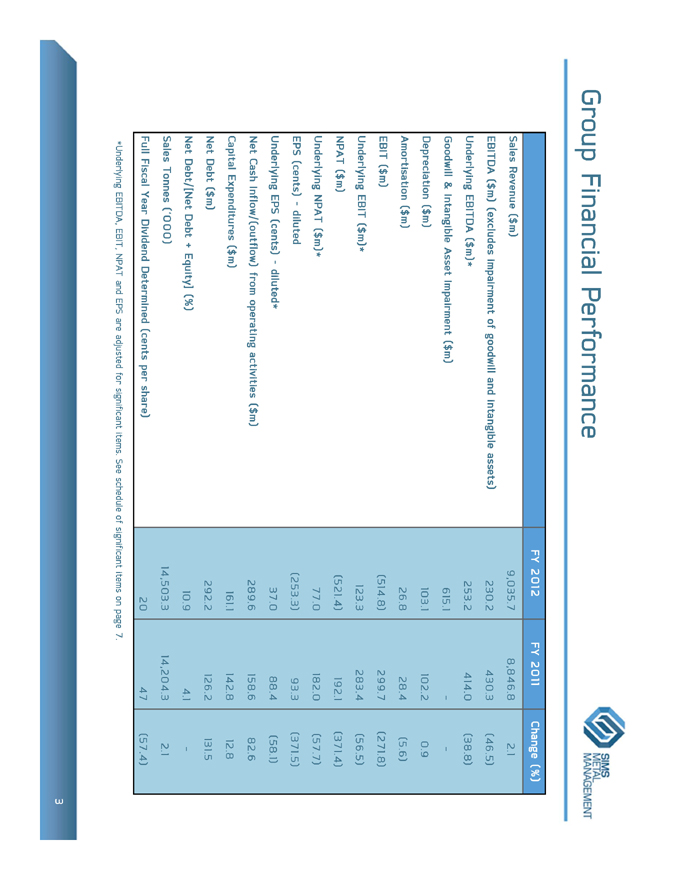

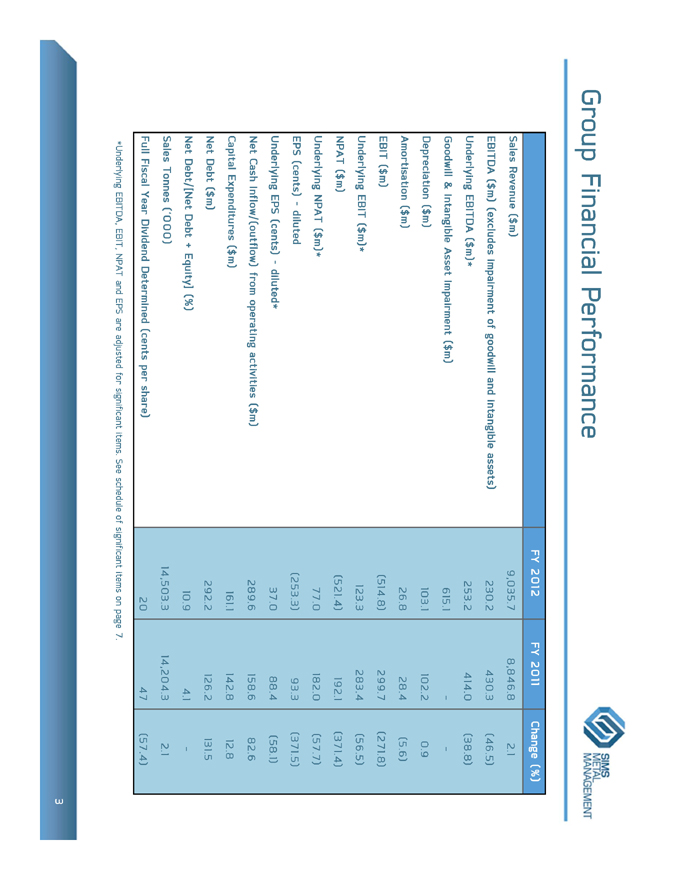

Group Financial Performance

FY 2012

FY 2011

Change (%)

Sales Revenue ($m)

9,035.7

8,846.8

2.1

EBITDA ($m) (excludes impairment of goodwill and intangible assets)

230.2

430.3

(46.5)

Underlying EBITDA ($m)*

253.2

414.0

(38.8)

Goodwill & Intangible Asset Impairment ($m)

615.1

—

—

Depreciation ($m)

103.1

102.2

0.9

Amortisation ($m)

26.8

28.4

(5.6)

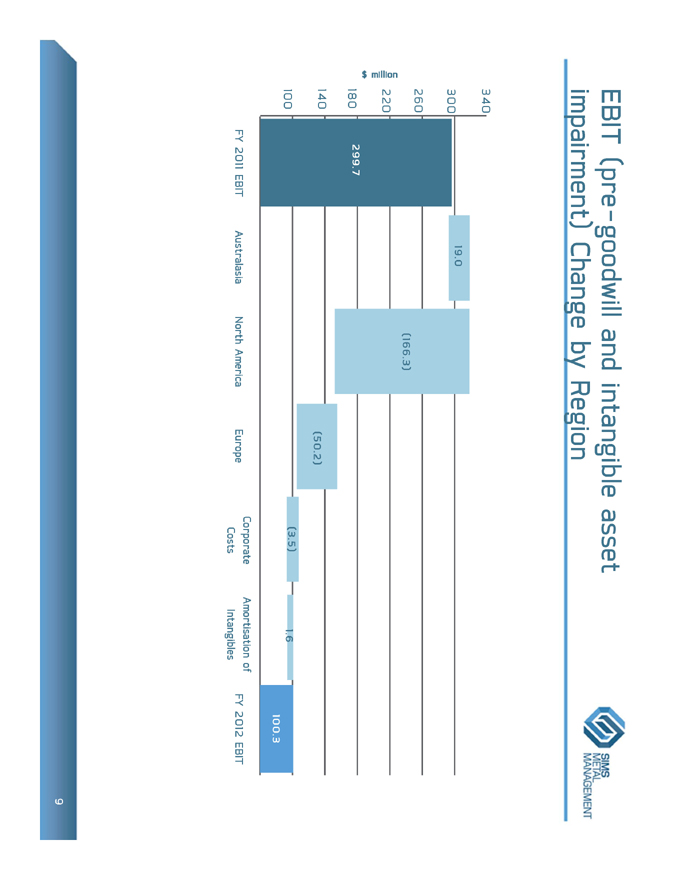

EBIT ($m)

(514.8)

299.7

(271.8)

Underlying EBIT ($m)*

123.3

283.4

(56.5)

NPAT ($m)

(521.4)

192.1

(371.4)

Underlying NPAT ($m)*

77.0

182.0

(57.7)

EPS (cents) – diluted

(253.3)

93.3

(371.5)

Underlying EPS (cents) – diluted*

37.0

88.4

(58.1)

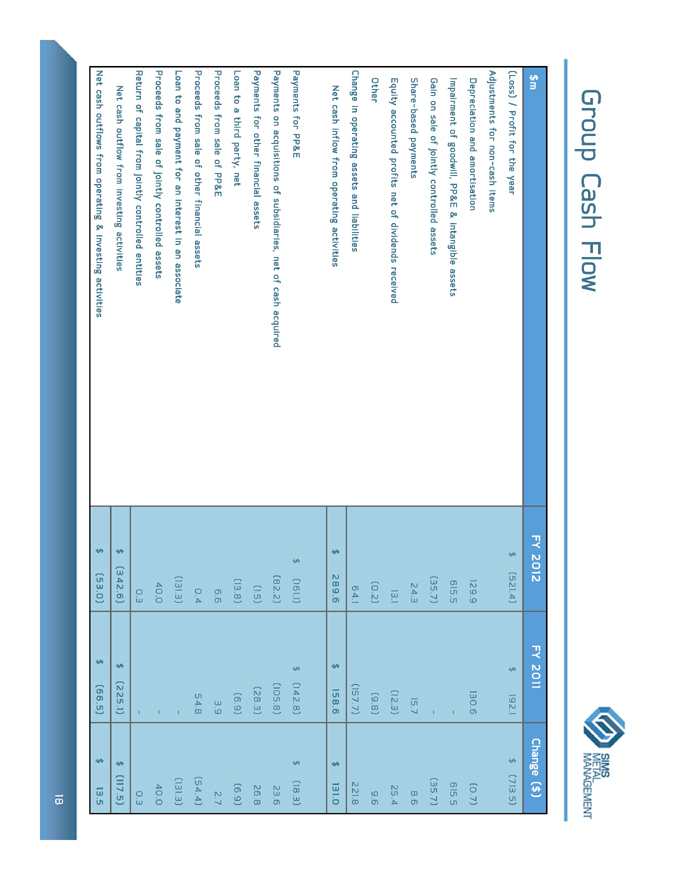

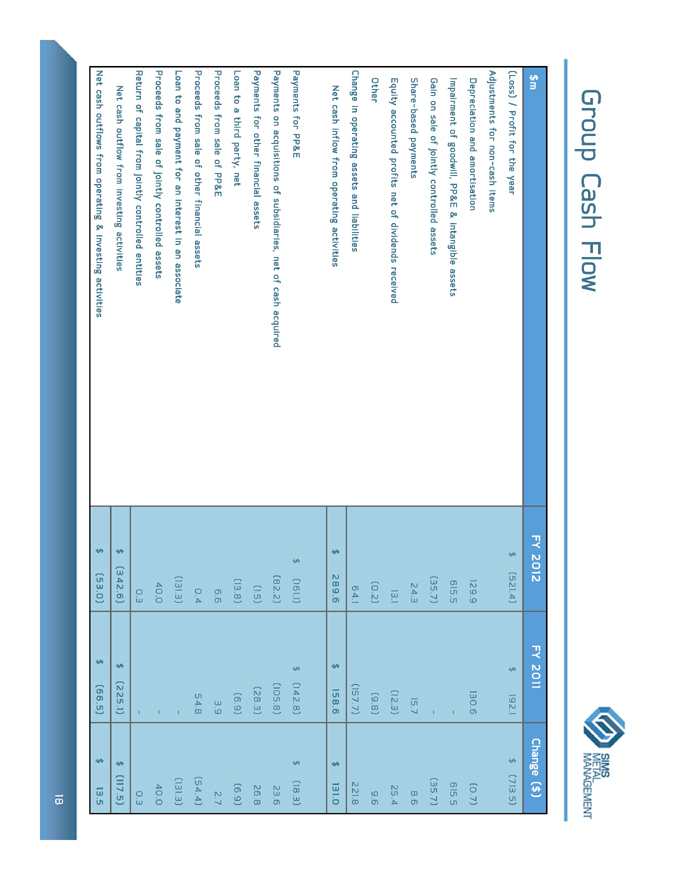

Net Cash Inflow/(outflow) from operating activities ($m)

289.6

158.6

82.6

Capital Expenditures ($m)

161.1

142.8

12.8

Net Debt ($m)

292.2

126.2

131.5

Net Debt/[Net Debt + Equity] (%)

10.9

4.1

—

Sales Tonnes (‘000)

14,503.3

14,204.3

2.1

Full Fiscal Year Dividend Determined (cents per share)

20

47

(57.4)

*Underlying EBITDA, EBIT, NPAT and EPS are adjusted for significant items. See schedule of significant items on page 7.

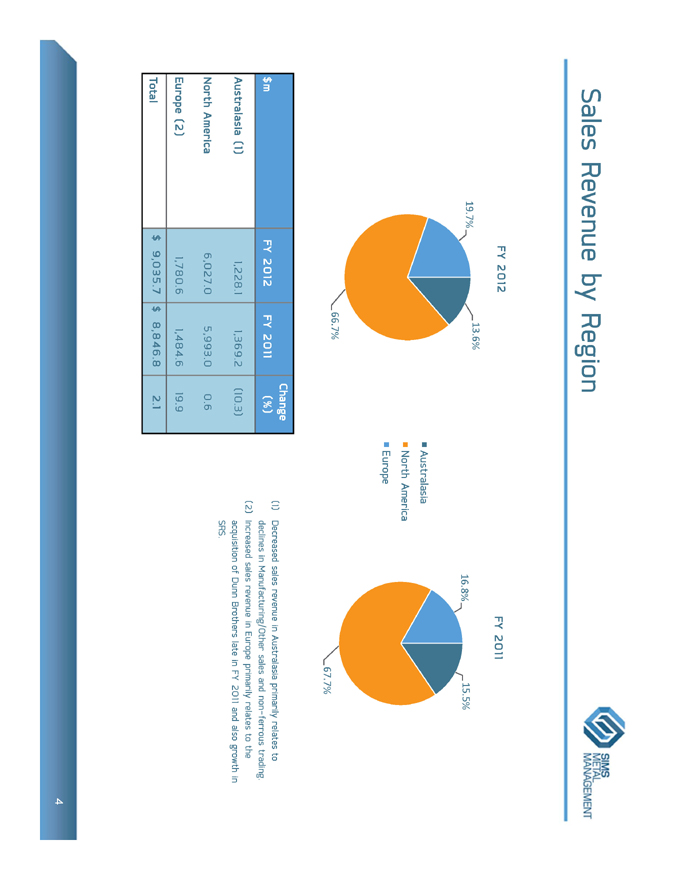

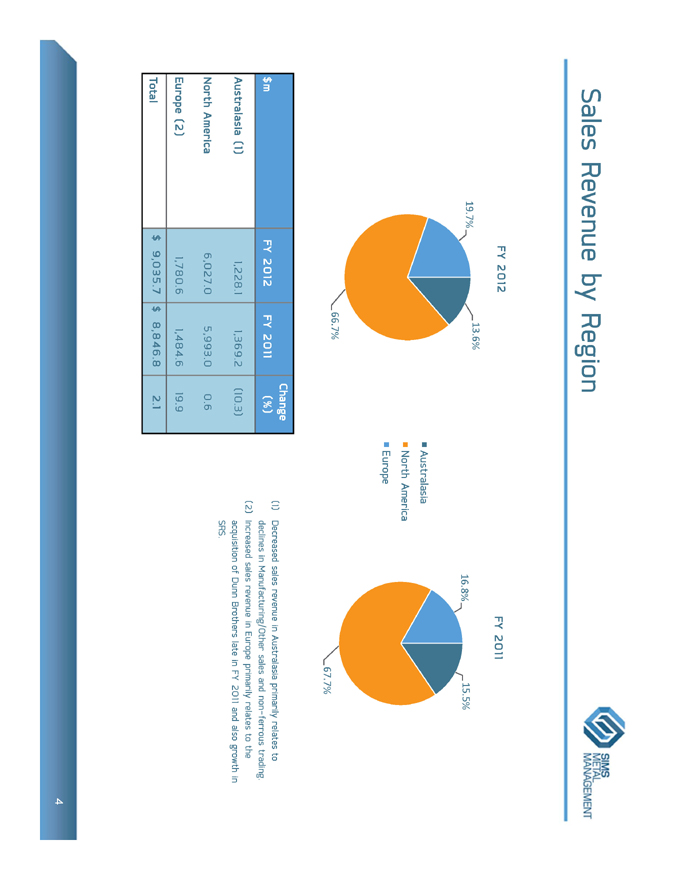

Sales Revenue by Region

Change

$m

FY 2012

FY 2011

(%)

Australasia (1)

1,228.1

1,369.2

(10.3)

North America

6,027.0

5,993.0

0.6

Europe (2)

1,780.6

1,484.6

19.9

Total

$9,035.7

$8,846.8

2.1

(1) Decreased sales revenue in Australasia primarily relates to declines in Manufacturing/Other sales and non-ferrous trading. (2) Increased sales revenue in Europe primarily relates to the acquisition of Dunn Brothers late in FY 2011 and also growth in SRS.

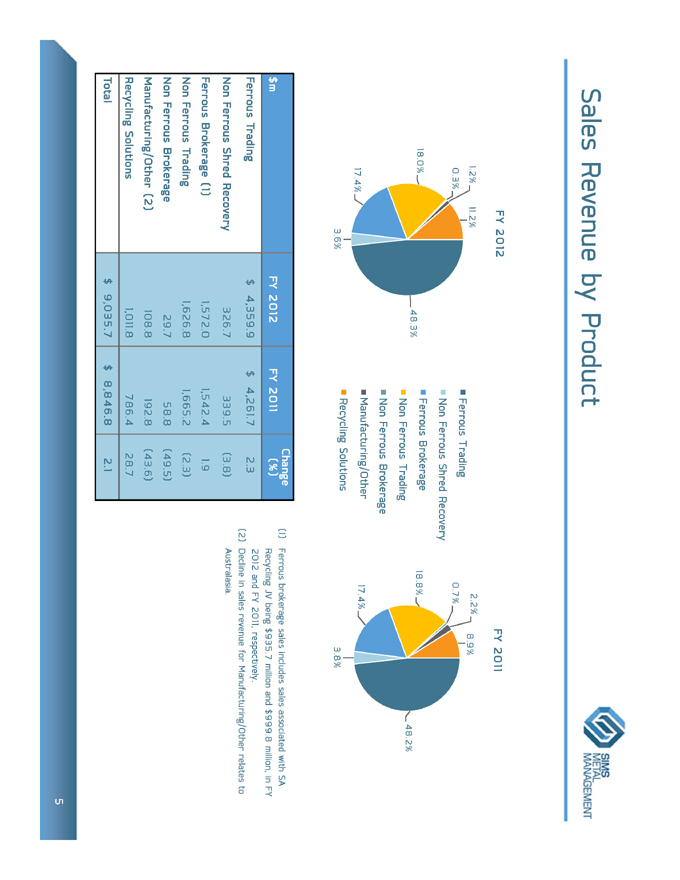

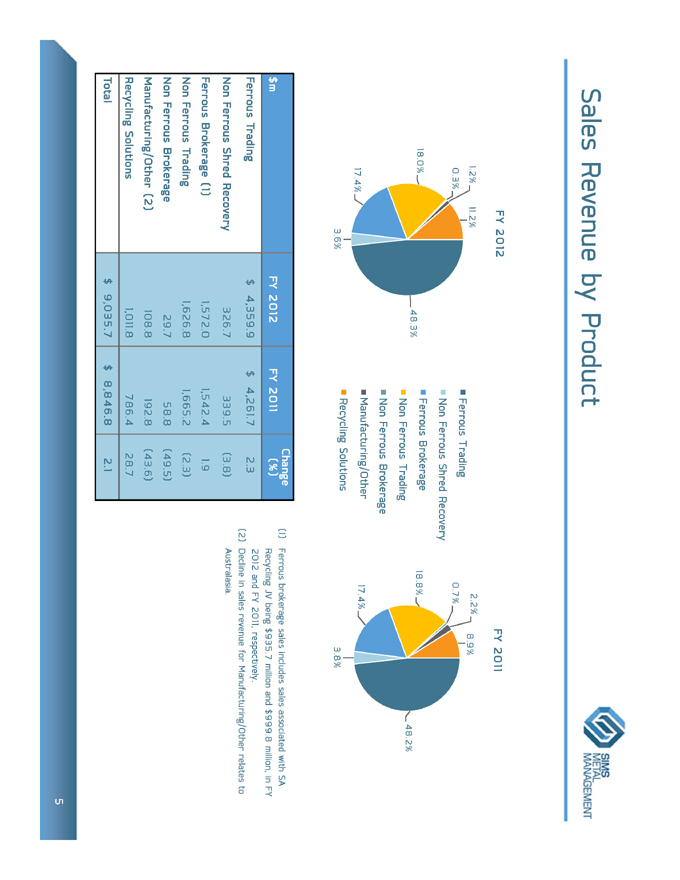

Sales Revenue by Product

Change

$m

FY 2012

FY 2011

(%)

Ferrous Trading

$4,359.9

$4,261.7

2.3

Non Ferrous Shred Recovery

326.7

339.5

(3.8)

Ferrous Brokerage (1)

1,572.0

1,542.4

1.9

Non Ferrous Trading

1,626.8

1,665.2

(2.3)

Non Ferrous Brokerage

29.7

58.8

(49.5)

Manufacturing/Other (2)

108.8

192.8

(43.6)

Recycling Solutions

1,011.8

786.4

28.7

Total

$9,035.7

$8,846.8

2.1

(1) Ferrous brokerage sales includes sales associated with SA Recycling JV being $935.7 million and $999.8 million, in FY 2012 and FY 2011, respectively.

(2) | | Decline in sales revenue for Manufacturing/Other relates to Australasia. |

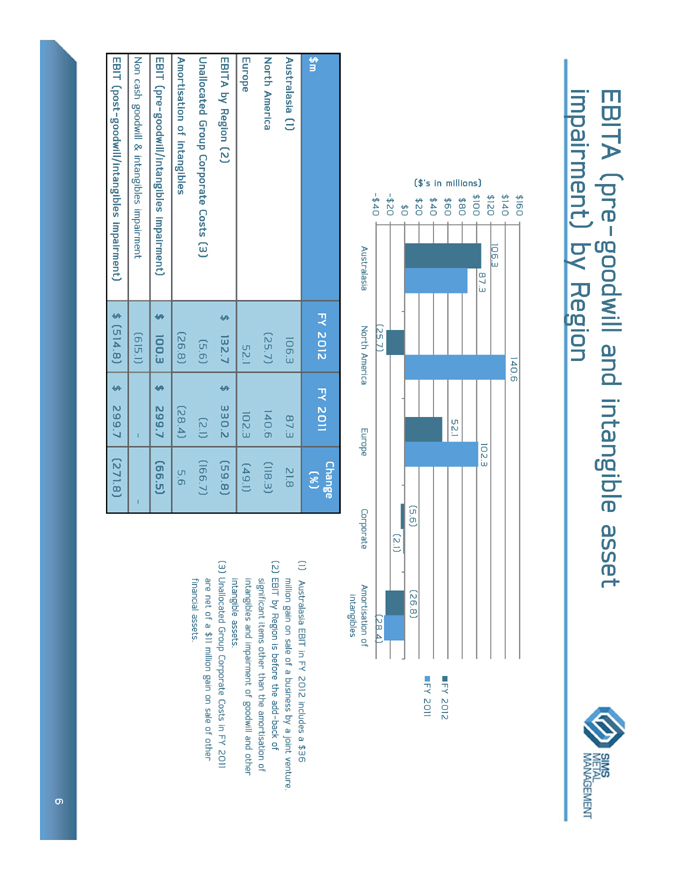

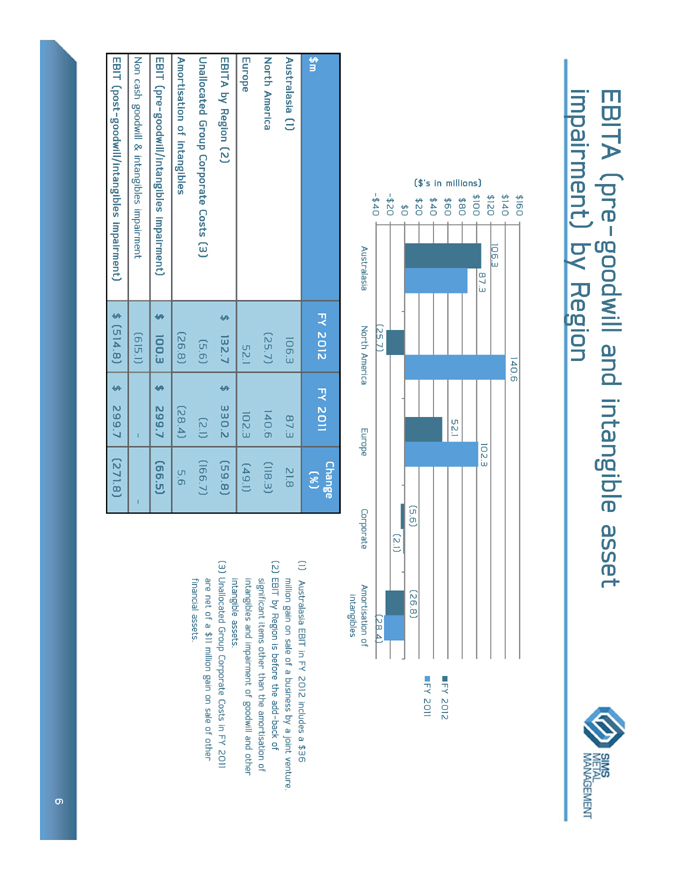

EBITA (pre-goodwill and intangible asset impairment) by Region

FY 2012

FY 2011

Change

$m

(%)

Australasia (1)

106.3

87.3

21.8

North America

(25.7)

140.6

(118.3)

Europe

52.1

102.3

(49.1)

EBITA by Region (2)

$132.7

$330.2

(59.8)

Unallocated Group Corporate Costs (3)

(5.6)

(2.1)

(166.7)

Amortisation of intangibles

(26.8)

(28.4)

5.6

EBIT (pre-goodwill/intangibles impairment)

$100.3

$299.7

(66.5)

Non cash goodwill & intangibles impairment

(615.1)

—

—

EBIT (post-goodwill/intangibles impairment)

$(514.8)

$299.7

(271.8)

(1) Australasia EBIT in FY 2012 includes a $36 million gain on sale of a business by a joint venture. (2) EBIT by Region is before the add-back of significant items other than the amortisation of intangibles and impairment of goodwill and other intangible assets.

(3) | | Unallocated Group Corporate Costs in FY 2011 are net of a $11 million gain on sale of other financial assets. |

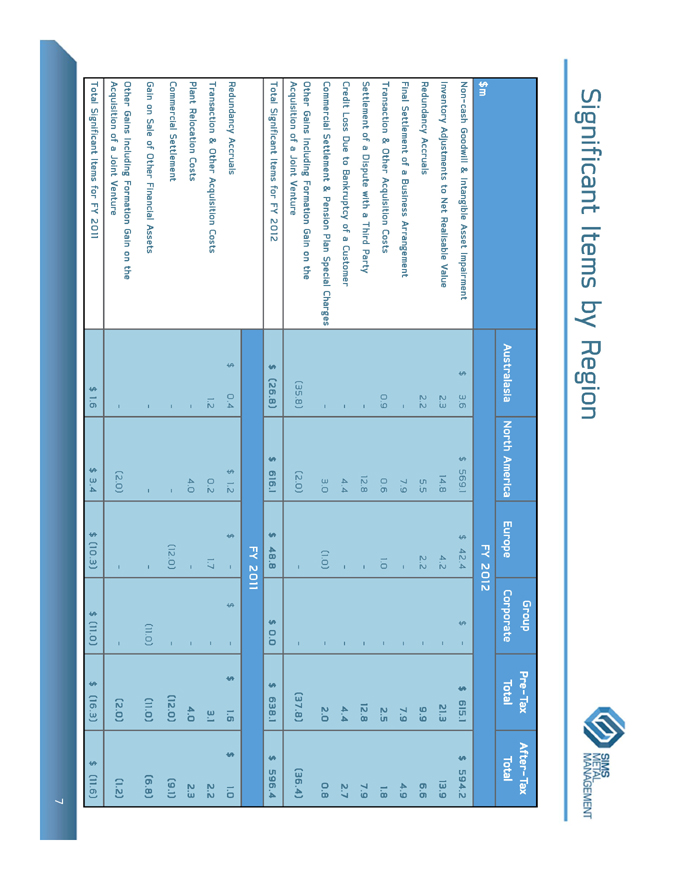

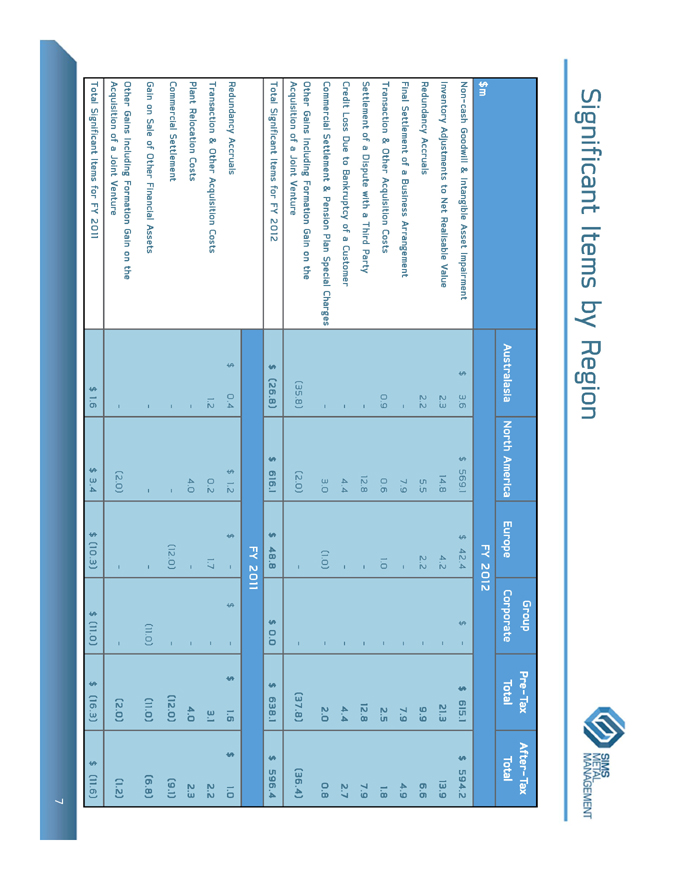

Significant Items by Region

Group

Pre-Tax

After-Tax

Australasia North America

Europe

Corporate

Total

Total

$m

FY 2012

Non-cash Goodwill & Intangible Asset Impairment

$

3.6

$569.1

$42.4

$

—

$

615.1

$

594.2

Inventory Adjustments to Net Realisable Value

2.3

14.8

4.2

—

21.3

13.9

Redundancy Accruals

2.2

5.5

2.2

—

9.9

6.6

Final Settlement of a Business Arrangement

—

7.9

—

—

7.9

4.9

Transaction & Other Acquisition Costs

0.9

0.6

1.0

—

2.5

1.8

Settlement of a Dispute with a Third Party

—

12.8

—

—

12.8

7.9

Credit Loss Due to Bankruptcy of a Customer

—

4.4

—

—

4.4

2.7

Commercial Settlement & Pension Plan Special Charges

—

3.0

(1.0)

—

2.0

0.8

Other Gains Including Formation Gain on the

Acquisition of a Joint Venture

(35.8)

(2.0)

—

—

(37.8)

(36.4)

Total Significant Items for FY 2012

$

(26.8)

$616.1

$48.8

$0.0

$638.1

$

596.4

FY 2011

Redundancy Accruals

$

0.4

$1.2

$—

$

—

$

1.6

$

1.0

Transaction & Other Acquisition Costs

1.2

0.2

1.7

—

3.1

2.2

Plant Relocation Costs

—

4.0

—

—

4.0

2.3

Commercial Settlement

—

—

(12.0)

—

(12.0)

(9.1)

Gain on Sale of Other Financial Assets

—

—

—

(11.0

)

(11.0

)

(6.8

)

Other Gains Including Formation Gain on the

Acquisition of a Joint Venture

—

(2.0)

—

—

(2.0)

(1.2)

Total Significant Items for FY 2011

$1.6

$3.4

$(10.3)

$(11.0

)

$(16.3

)$

(11.6

)

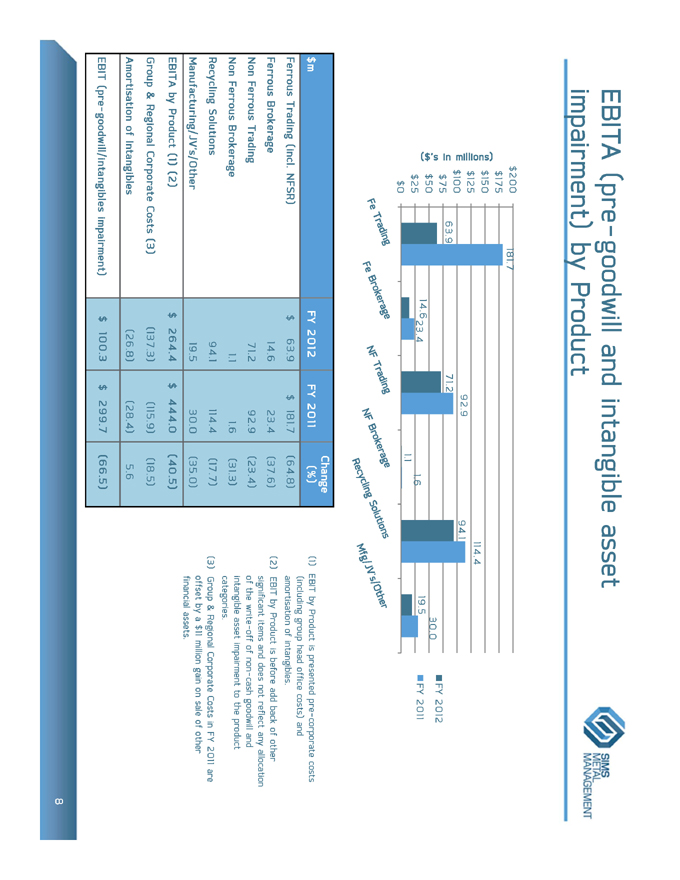

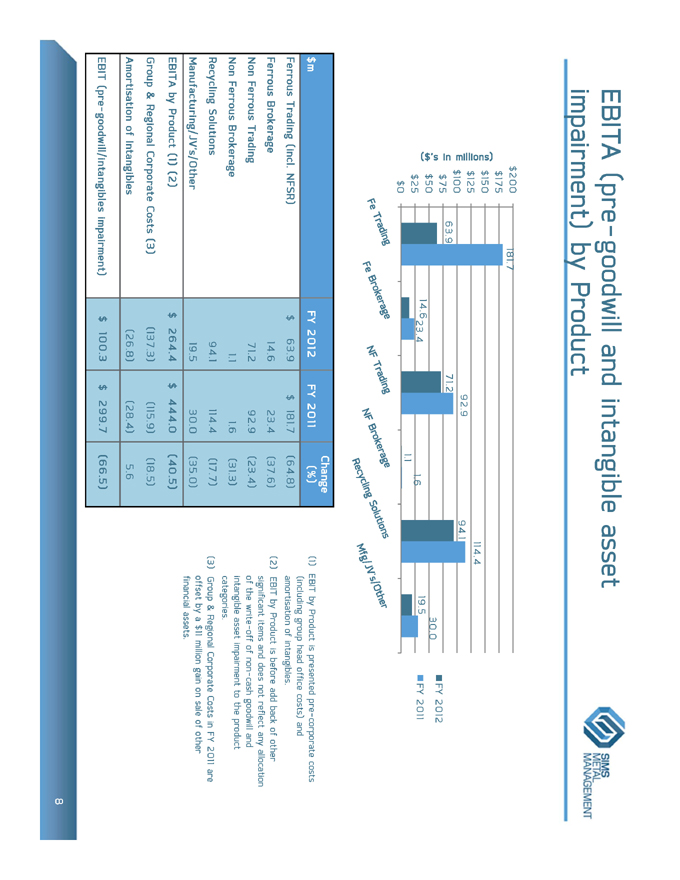

EBITA (pre-goodwill and intangible asset impairment) by Product

Change

$m

FY 2012

FY 2011

(%)

Ferrous Trading (incl. NFSR)

$63.9

$181.7

(64.8)

Ferrous Brokerage

14.6

23.4

(37.6)

Non Ferrous Trading

71.2

92.9

(23.4)

Non Ferrous Brokerage

1.1

1.6

(31.3)

Recycling Solutions

94.1

114.4

(17.7)

Manufacturing/JV’s/Other

19.5

30.0

(35.0)

EBITA by Product (1) (2)

$264.4

$

444.0

(40.5)

Group & Regional Corporate Costs (3)

(137.3)

(115.9)

(18.5)

Amortisation of Intangibles

(26.8)

(28.4)

5.6

EBIT (pre-goodwill/intangibles impairment)

$100.3

$

299.7

(66.5)

(1) EBIT by Product is presented pre-corporate costs (including group head office costs) and amortisation of intangibles.

(2) EBIT by Product is before add back of other significant items and does not reflect any allocation of the write-off of non-cash goodwill and intangible asset impairment to the product categories.

(3) | | Group & Regional Corporate Costs in FY 2011 are offset by a $11 million gain on sale of other financial assets. |

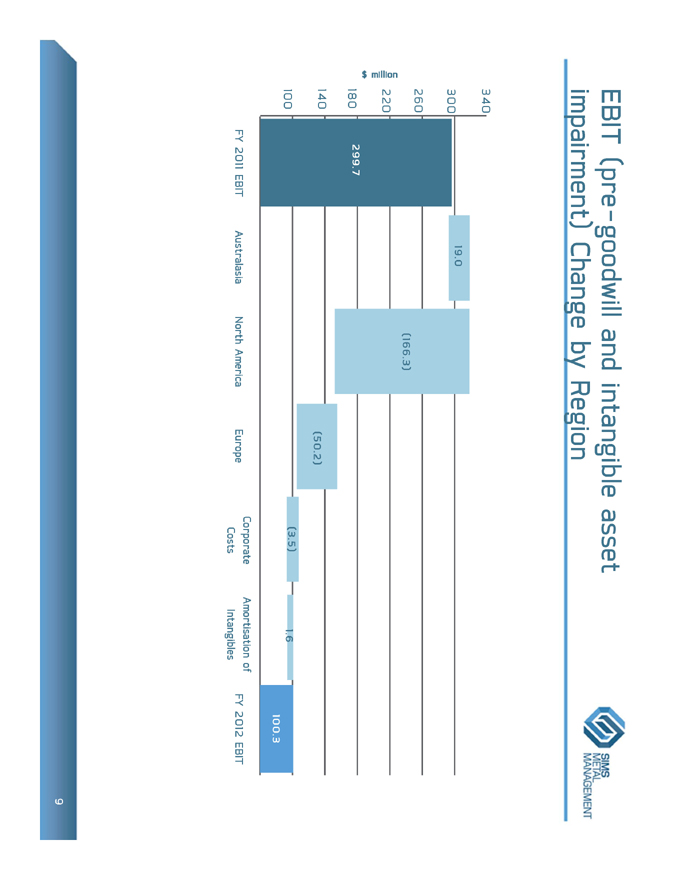

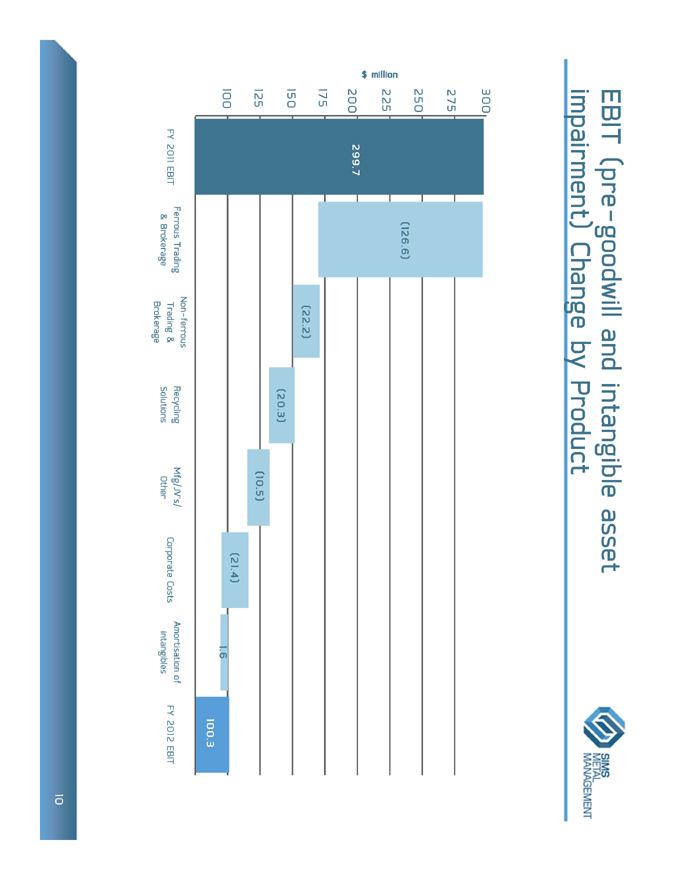

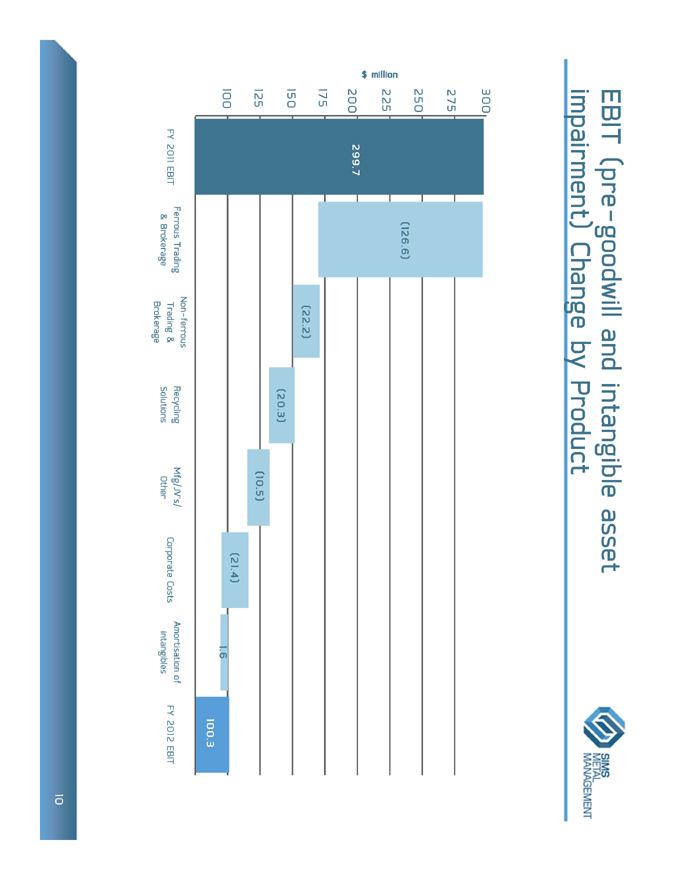

EBIT (pre-goodwill and intangible asset impairment) Change by Region

EBIT (pre-goodwill and intangible asset impairment) Change by Product

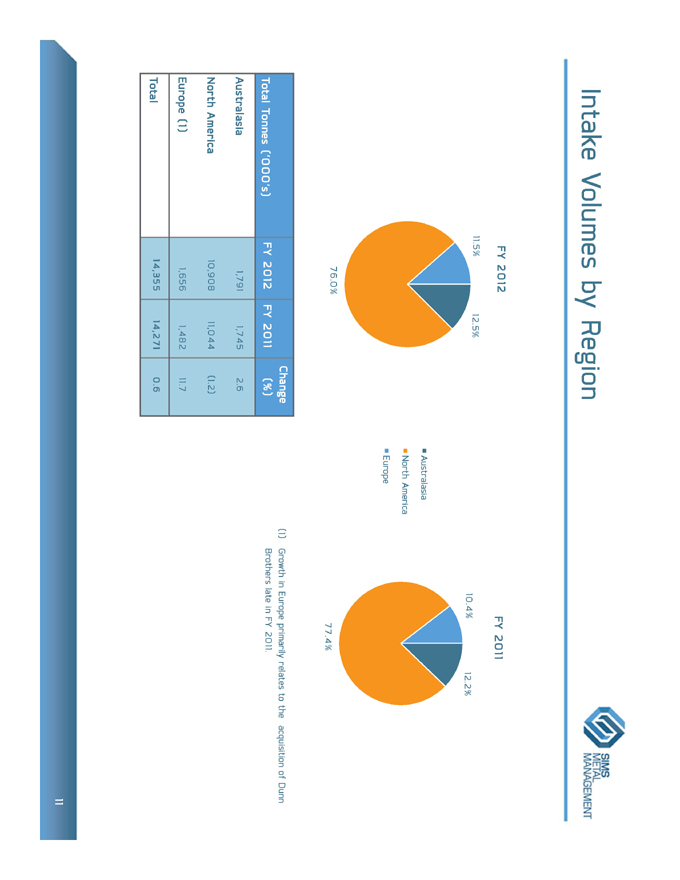

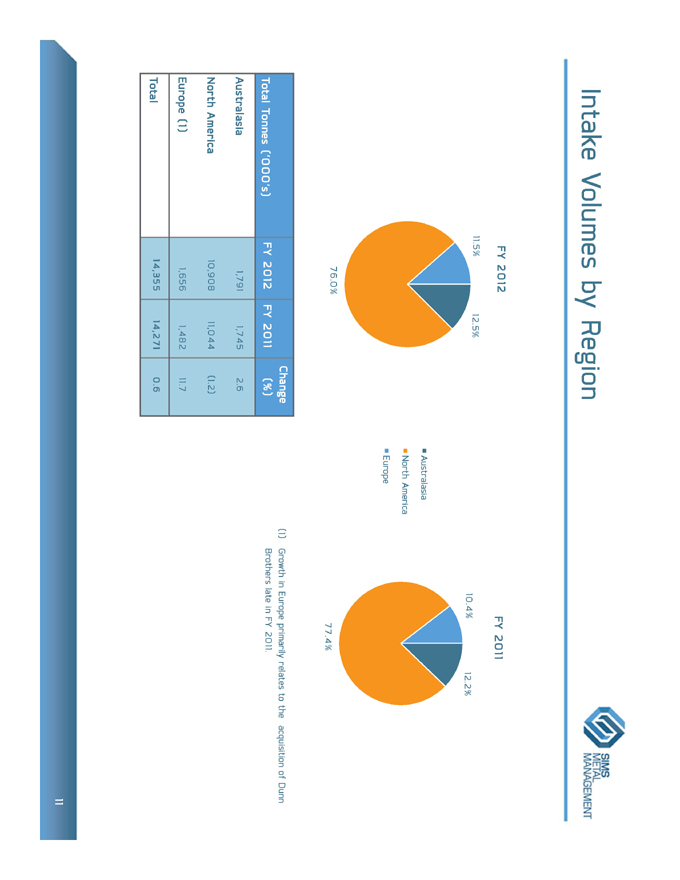

Intake Volumes by Region

Change

Total Tonnes (‘000’s)

FY 2012

FY 2011

(%)

Australasia

1,791

1,745

2.6

North America

10,908

11,044

(1.2)

Europe (1)

1,656

1,482

11.7

Total

14,355

14,271

0.6

(1) | | Growth in Europe primarily relates to the acquisition of Dunn Brothers late in FY 2011. |

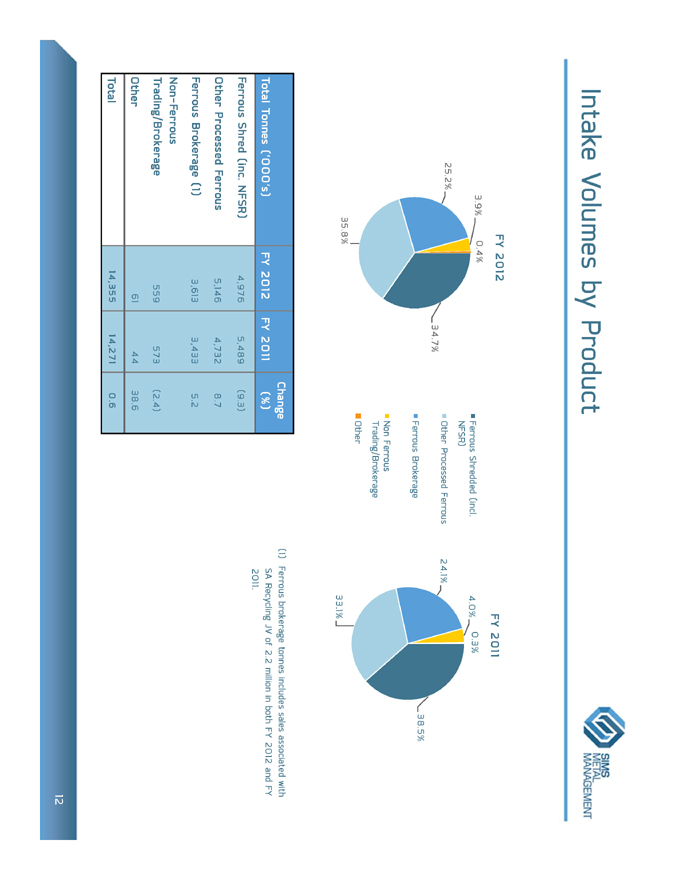

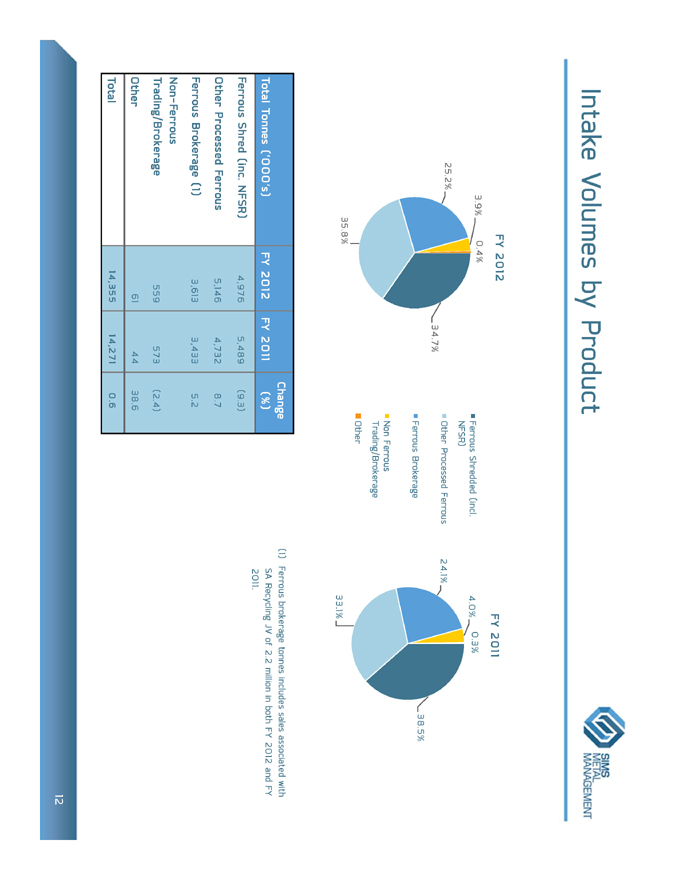

Intake Volumes by Product

Change

Total Tonnes (‘000’s)

FY 2012

FY 2011

(%)

Ferrous Shred (inc. NFSR)

4,976

5,489

(9.3)

Other Processed Ferrous

5,146

4,732

8.7

Ferrous Brokerage (1)

3,613

3,433

5.2

Non-Ferrous

Trading/Brokerage

559

573

(2.4)

Other

61

44

38.6

Total

14,355

14,271

0.6

(1) | | Ferrous brokerage tonnes includes sales associated with SA Recycling JV of 2.2 million in both FY 2012 and FY 2011. |

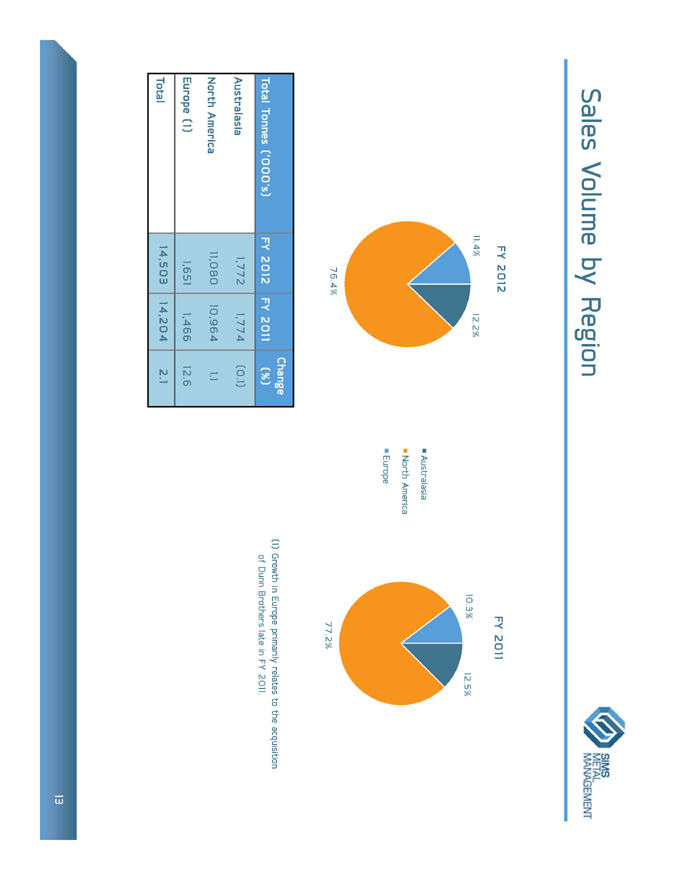

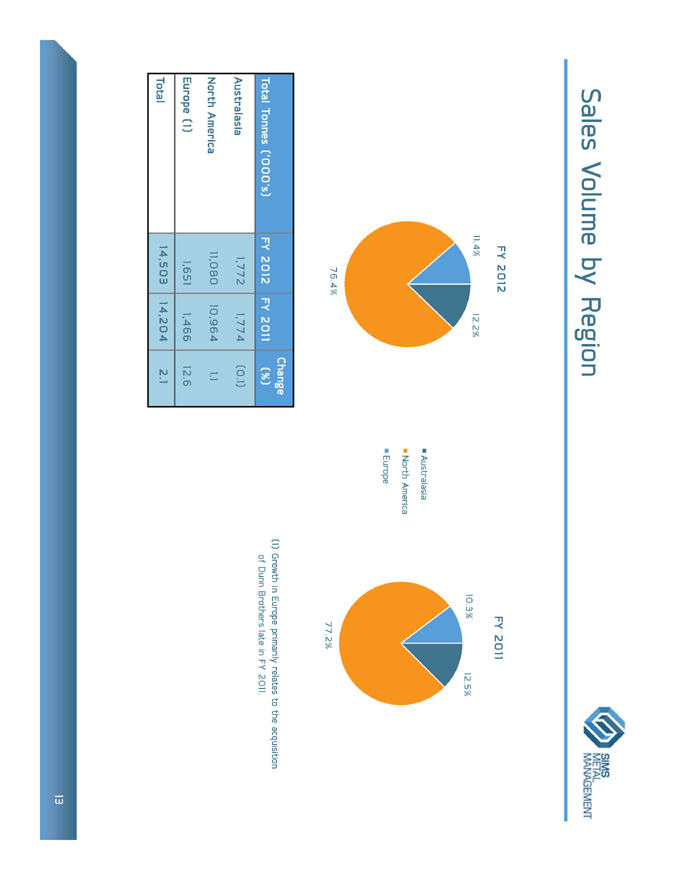

Sales Volume by Region

Change

Total Tonnes (‘000’s)

FY 2012

FY 2011

(%)

Australasia

1,772

1,774

(0.1)

North America

11,080

10,964

1.1

Europe (1)

1,651

1,466

12.6

Total

14,503

14,204

2.1

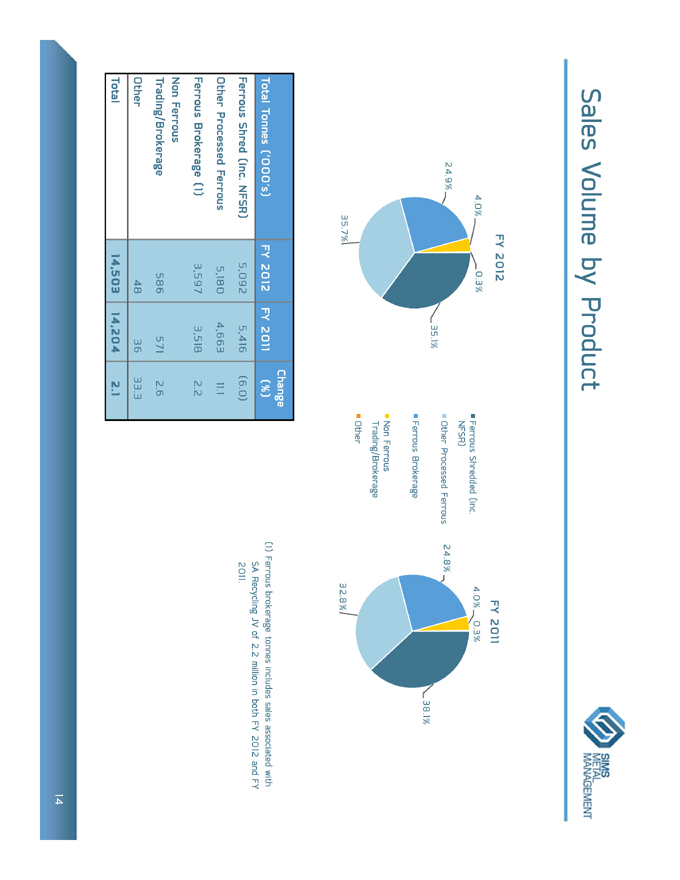

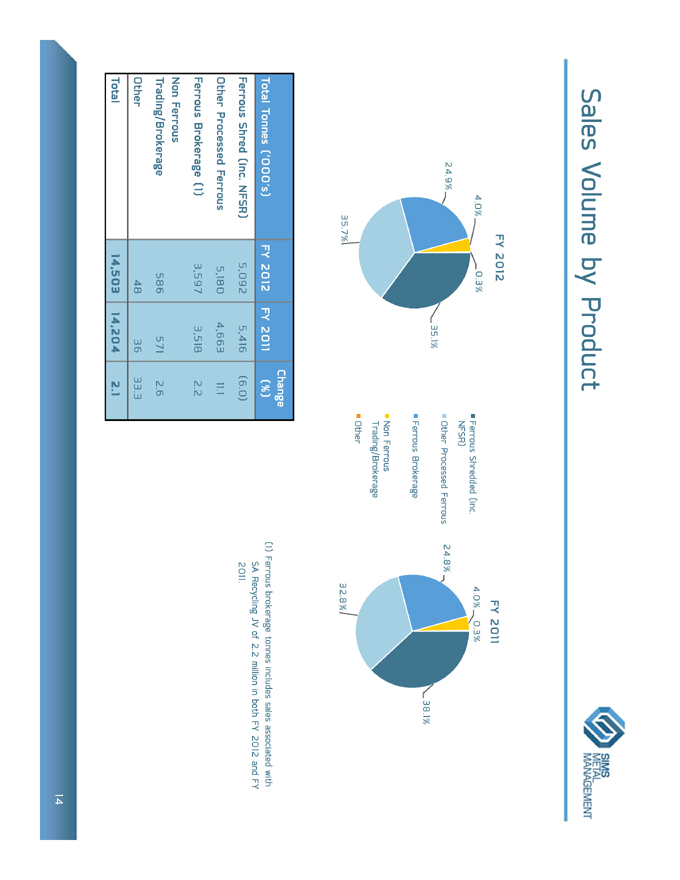

Sales Volume by Product

Change

Total Tonnes (‘000’s)

FY 2012

FY 2011

(%)

Ferrous Shred (inc. NFSR)

5,092

5,416

(6.0)

Other Processed Ferrous

5,180

4,663

11.1

Ferrous Brokerage (1)

3,597

3,518

2.2

Non Ferrous

Trading/Brokerage

586

571

2.6

Other

48

36

33.3

Total

14,503

14,204

2.1

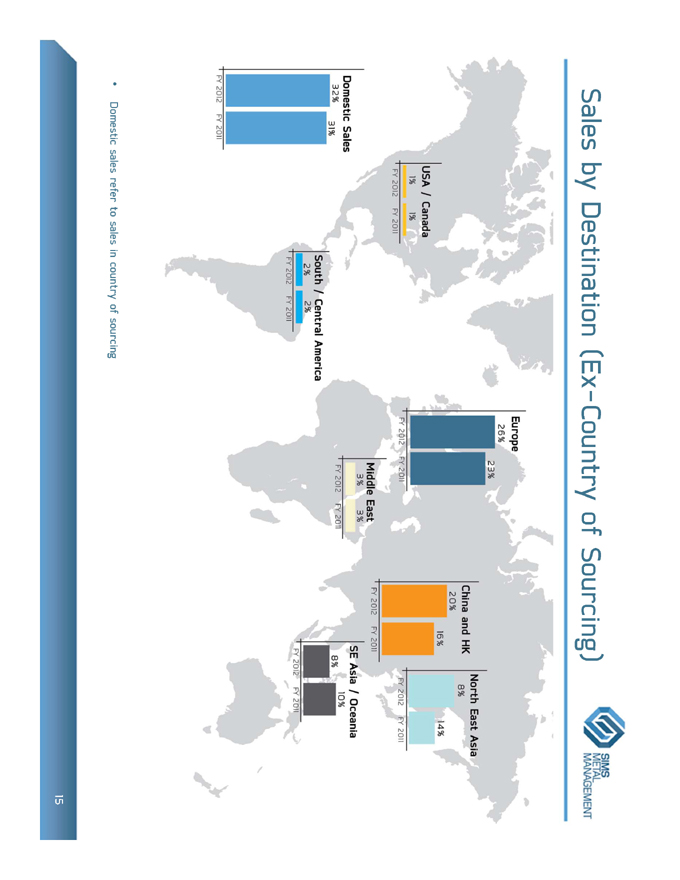

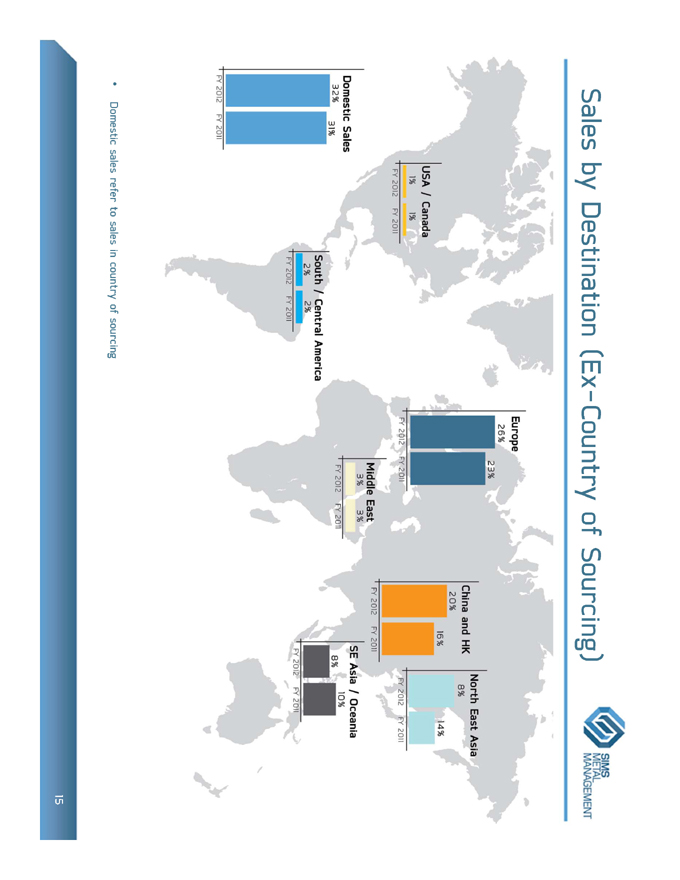

Sales by Destination (Ex-Country of Sourcing)

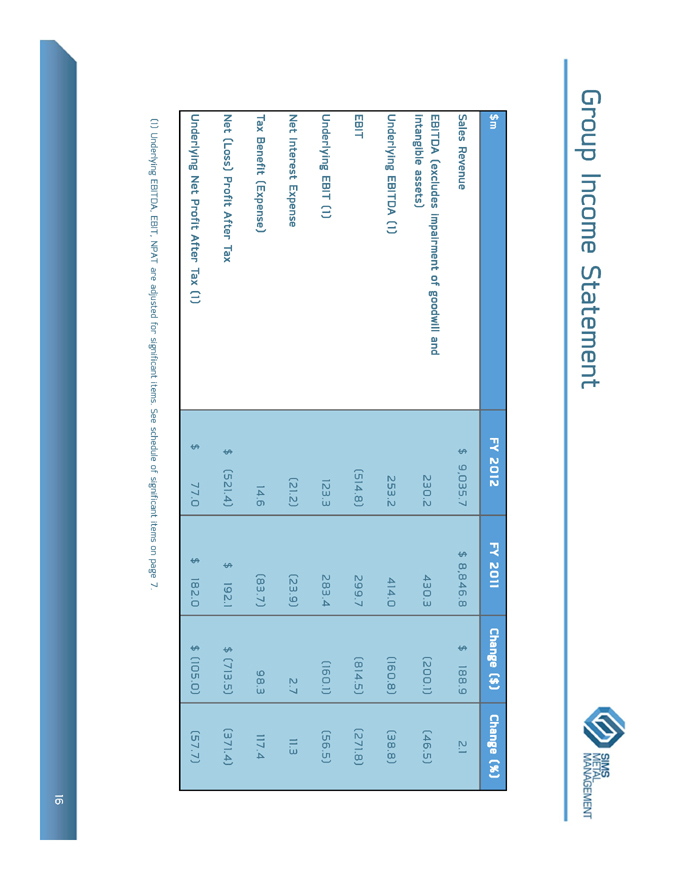

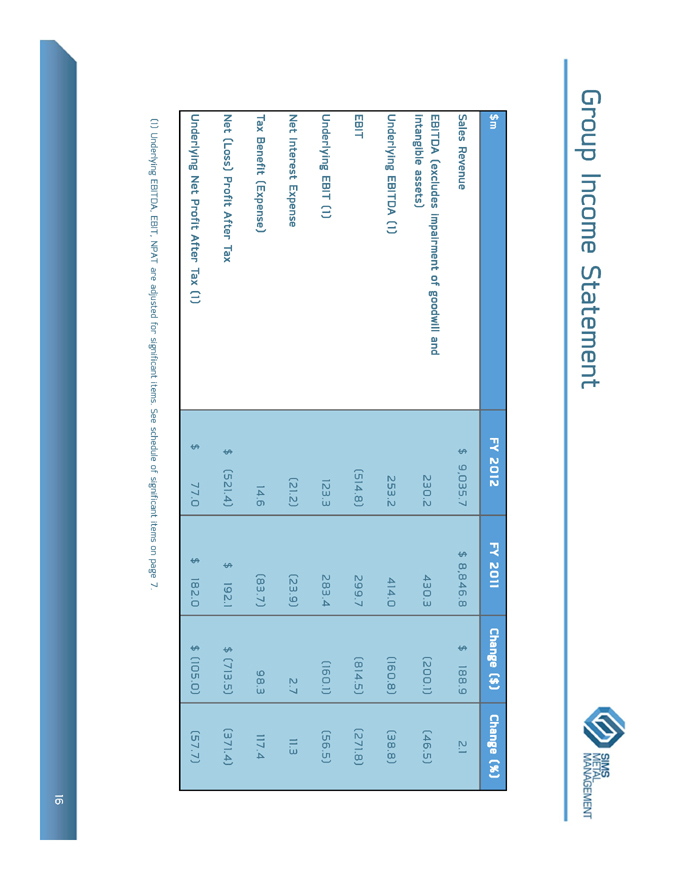

Group Income Statement

$m

FY 2012

FY 2011

Change ($)

Change (%)

Sales Revenue

$9,035.7

$8,846.8

$188.9

2.1

EBITDA (excludes impairment of goodwill andintangible assets)

230.2

430.3

(200.1)

(46.5)

Underlying EBITDA (1)

253.2

414.0

(160.8)

(38.8)

EBIT

(514.8)

299.7

(814.5)

(271.8)

Underlying EBIT (1)

123.3

283.4

(160.1)

(56.5)

Net Interest Expense

(21.2)

(23.9)

2.7

11.3

Tax Benefit (Expense)

14.6

(83.7)

98.3

117.4

Net (Loss) Profit After Tax

$(521.4)

$192.1

$(713.5)

(371.4)

Underlying Net Profit After Tax (1)

$77.0

$182.0

$(105.0)

(57.7)

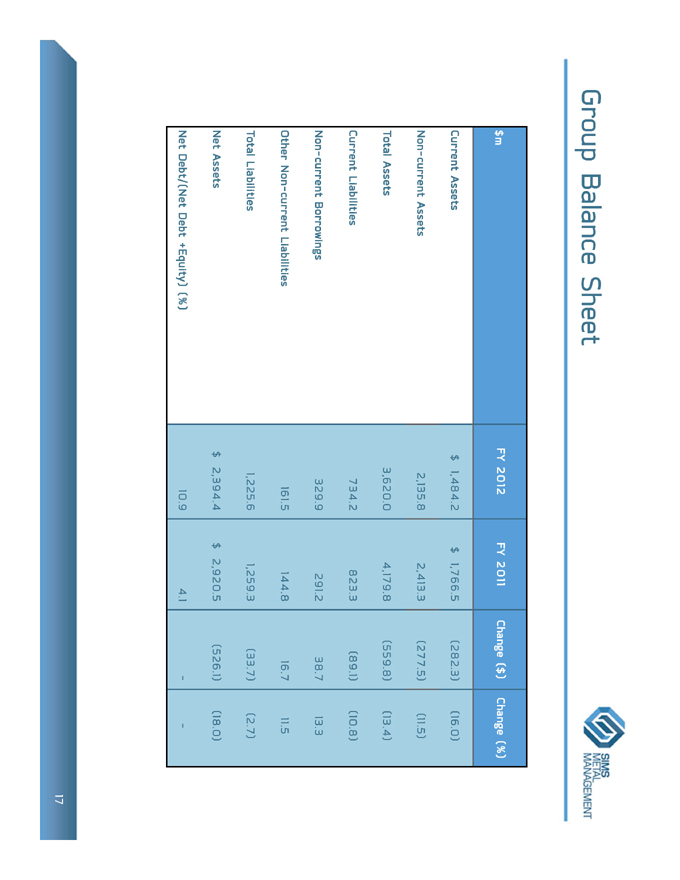

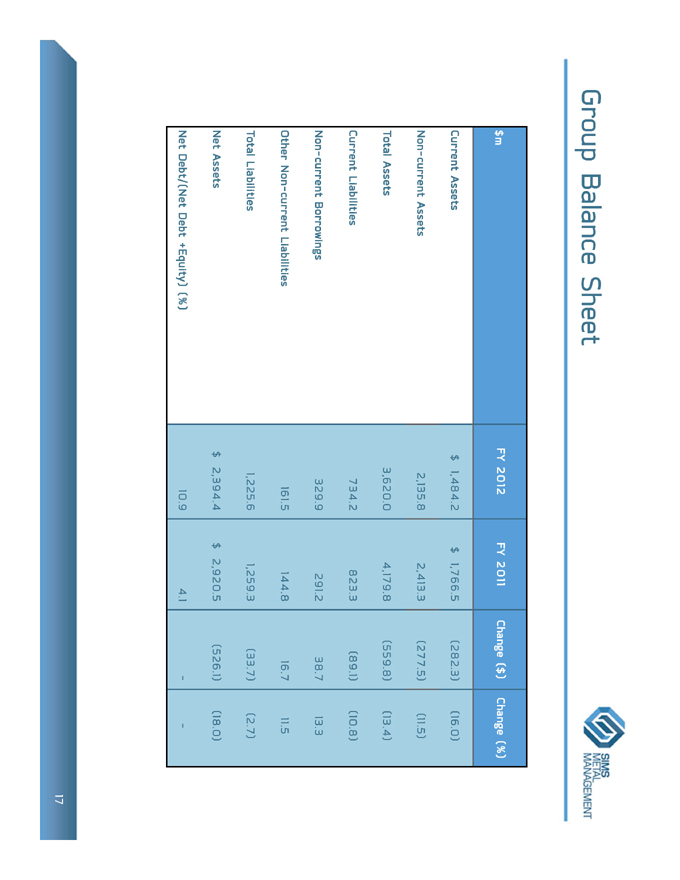

Group Balance Sheet

Group Cash Flow

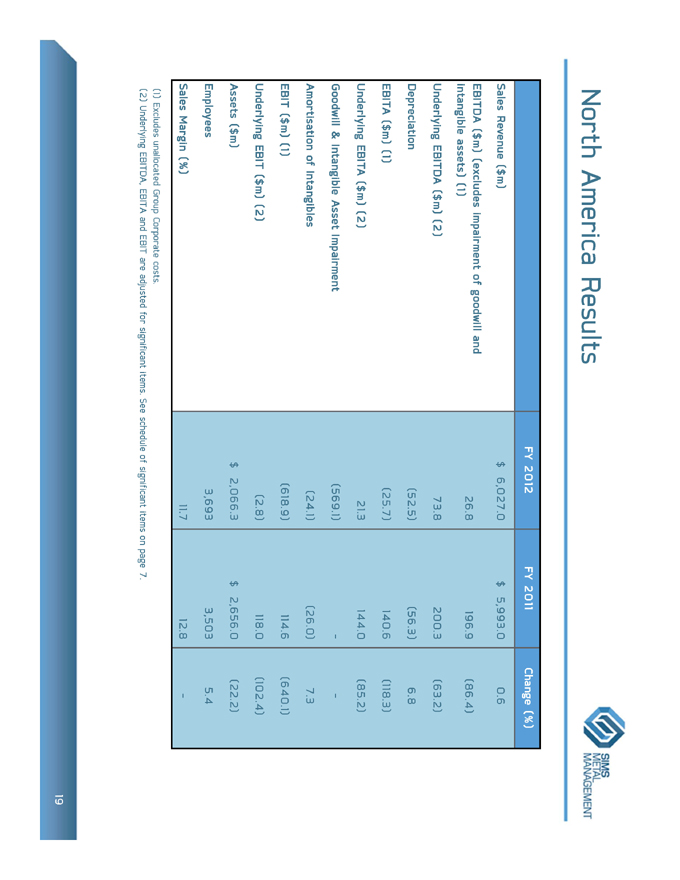

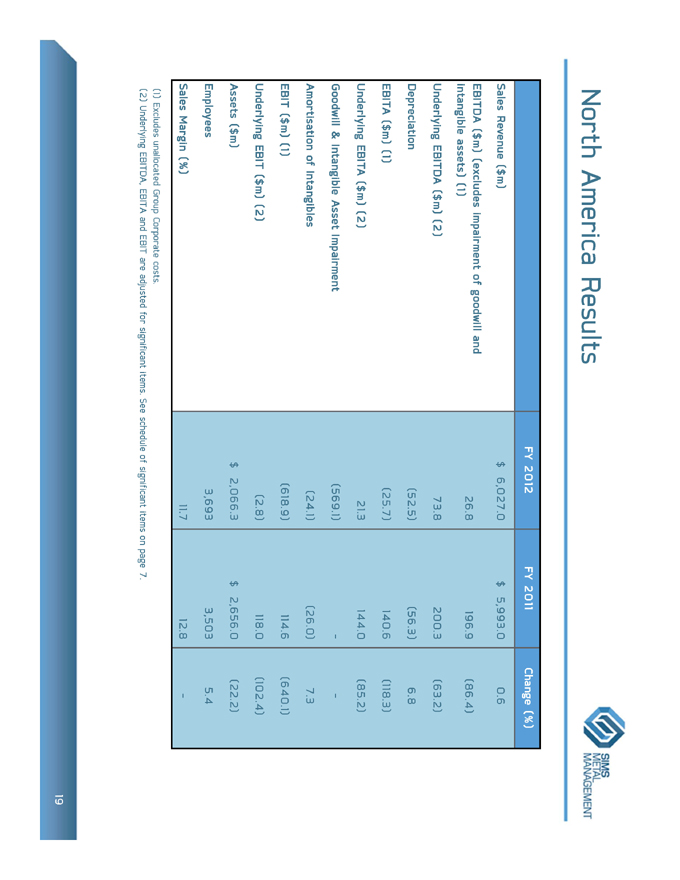

North America Results

FY 2012

FY 2011

Change (%)

Sales Revenue ($m)

$6,027.0

$5,993.0

0.6

EBITDA ($m) (excludes impairment of goodwill andintangible assets) (1)

26.8

196.9

(86.4)

Underlying EBITDA ($m) (2)

73.8

200.3

(63.2)

Depreciation

(52.5)

(56.3)

6.8

EBITA ($m) (1)

(25.7)

140.6

(118.3)

Underlying EBITA ($m) (2)

21.3

144.0

(85.2)

Goodwill & Intangible Asset Impairment

(569.1)

—

—

Amortisation of Intangibles

(24.1)

(26.0)

7.3

EBIT ($m) (1)

(618.9)

114.6

(640.1)

Underlying EBIT ($m) (2)

(2.8)

118.0

(102.4)

Assets ($m)

$2,066.3

$2,656.0

(22.2)

Employees

3,693

3,503

5.4

Sales Margin (%)

11.7

12.8

—

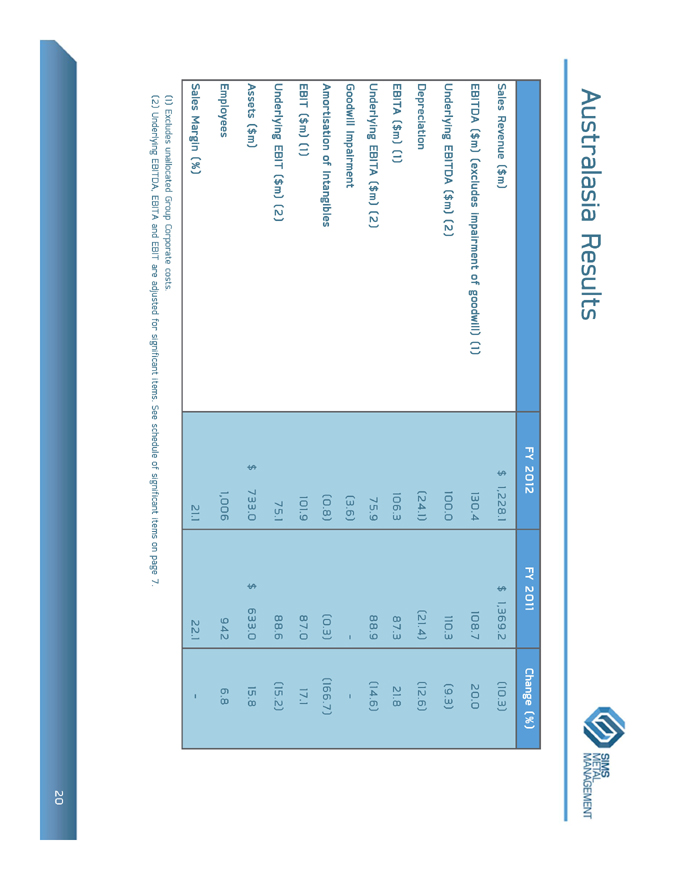

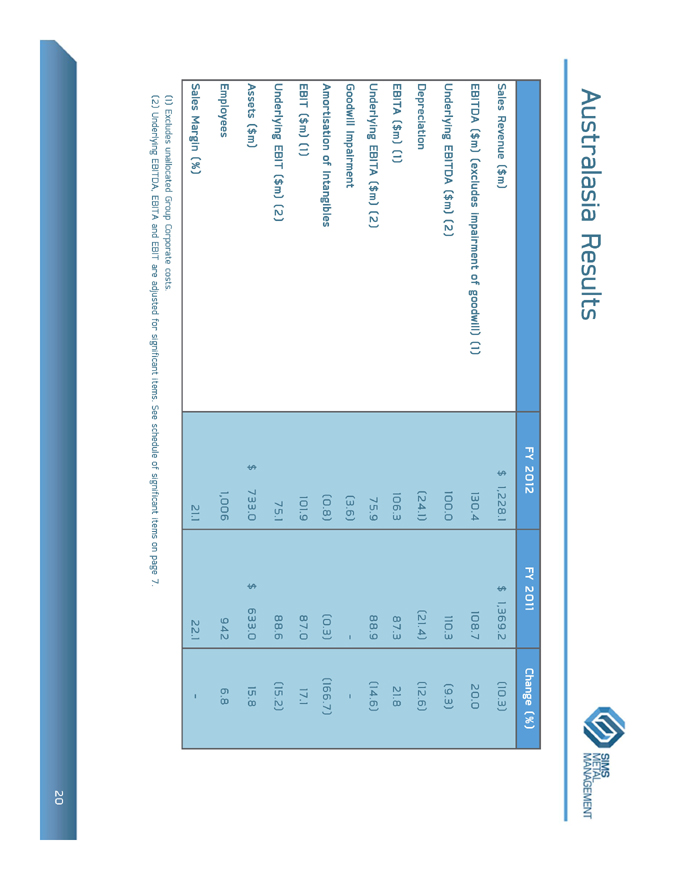

Australasia Results

FY 2012

FY 2011

Change (%)

Sales Revenue ($m)

$1,228.1

$1,369.2

(10.3)

EBITDA ($m) (excludes impairment of goodwill) (1)

130.4

108.7

20.0

Underlying EBITDA ($m) (2)

100.0

110.3

(9.3)

Depreciation

(24.1)

(21.4)

(12.6)

EBITA ($m) (1)

106.3

87.3

21.8

Underlying EBITA ($m) (2)

75.9

88.9

(14.6)

Goodwill Impairment

(3.6)

—

—

Amortisation of Intangibles

(0.8)

(0.3)

(166.7)

EBIT ($m) (1)

101.9

87.0

17.1

Underlying EBIT ($m) (2)

75.1

88.6

(15.2)

Assets ($m)

$733.0

$633.0

15.8

Employees

1,006

942

6.8

Sales Margin (%)

21.1

22.1

—

(1) | | Excludes unallocated Group Corporate costs. |

(2) | | Underlying EBITDA, EBITA and EBIT are adjusted for significant items. See schedule of significant items on page 7. |

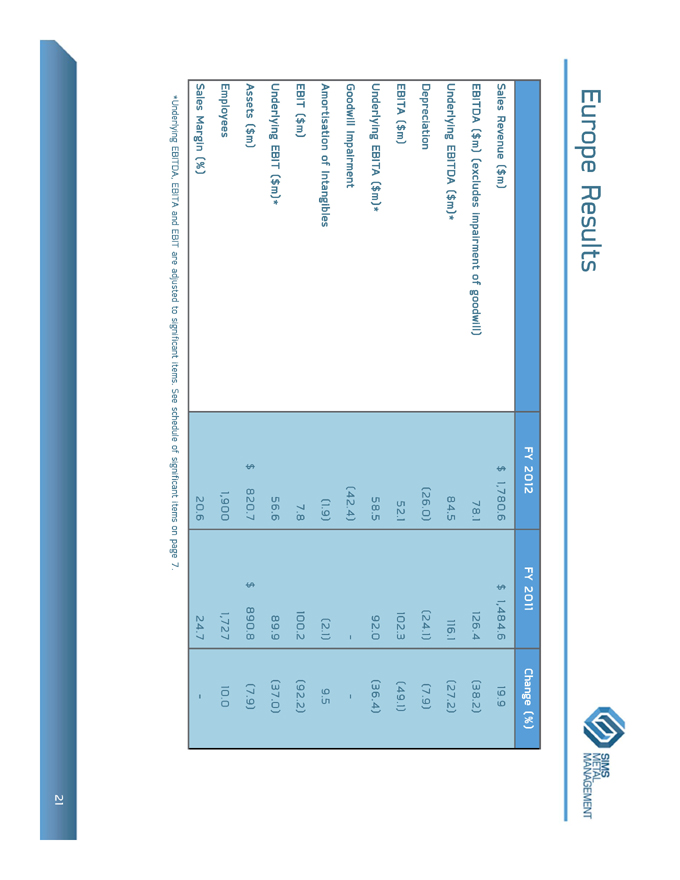

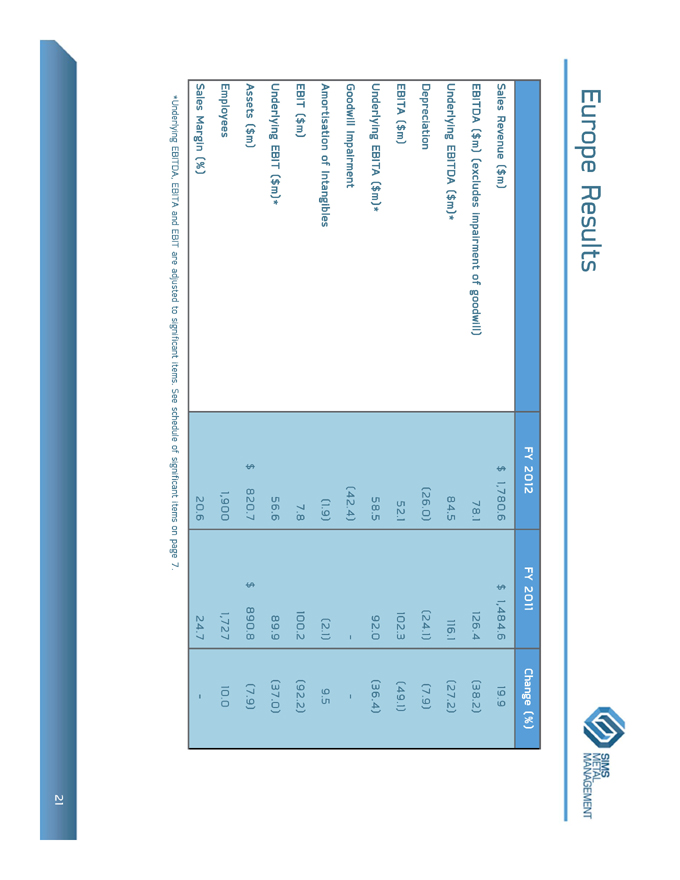

Europe Results

FY 2012

FY 2011

Change (%)

Sales Revenue ($m)

$1,780.6

$1,484.6

19.9

EBITDA ($m) (excludes impairment of goodwill)

78.1

126.4

(38.2)

Underlying EBITDA ($m)*

84.5

116.1

(27.2)

Depreciation

(26.0)

(24.1)

(7.9)

EBITA ($m)

52.1

102.3

(49.1)

Underlying EBITA ($m)*

58.5

92.0

(36.4)

Goodwill Impairment

(42.4)

—

—

Amortisation of Intangibles

(1.9)

(2.1)

9.5

EBIT ($m)

7.8

100.2

(92.2)

Underlying EBIT ($m)*

56.6

89.9

(37.0)

Assets ($m)

$820.7

$890.8

(7.9)

Employees

1,900

1,727

10.0

Sales Margin (%)

20.6

24.7

—