Exhibit 99.2

Appendix 4E

Sims Metal Management Limited

ABN 69 114 838 630

Preliminary Final Report

Results for announcement to the market

Year ended: 30 June 2012

Previous corresponding period: 30 June 2011

| | | | | | | | | | | | | | |

| Results | | | | | | | | | | A$m | |

| | | | | |

Revenue from ordinary activities | | Up | | | 2.1% | | | | to | | | | 9,035.7 | |

| | | | | |

Loss from ordinary activities after tax attributable to members* | | Down | | | 371.4 | % | | | to | | | | (521.4 | ) |

| | | | | |

Net loss for the period attributable to members* | | Down | | | 371.4 | % | | | to | | | | (521.4 | ) |

| | | | | |

| *Includes A$593.7 million non-cash goodwill impairment charge | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | |

| Dividends for the year ended 30 June 2012 | | Cents per | | | % Franked per |

| | | Security | | | Security |

| | | |

Interim dividend (1) | | | 10.0 | | | 0% |

Final dividend (2) | | | 10.0 | | | 0% |

| | |

Record date | | | 5 October 2012 |

Payment date | | | 19 October 2012 |

| |

| (1) The entire portion of the interim dividend was declared to be nil conduit foreign income. Accordingly, the entire interim dividend payable to non-residents was subject to a 15% non-resident shareholders’ withholding tax. |

| |

| (2) The entire portion of the final dividend is declared to be nil conduit foreign income. Accordingly, the entire final dividend payable to non-residents will be subject to a 15% non-resident shareholders’ withholding tax. |

| | | | | | | |

| | | | | | | | |

| Net tangible assets | | 30 June | | | 30 June | |

| | | 2012 | | | 2011 | |

| | | |

Net tangible asset per security | | | 8.59 | | | | 8.74 | |

| | | | | | | | | |

For further explanation of the above figures, please refer to the Directors’ Report, press release and market presentations filed with the Australian Securities Exchange Limited (“ASX”).

The remainder of the information required by Listing Rule 4.3A is contained in the attached additional information.

The consolidated financial statements are based on accounts that have been audited.

CONTENTS

| | | | |

| | | Page | |

| |

Directors’ Report | | | 1 | |

| |

Auditor’s Independence Declaration | | | 32 | |

| |

Consolidated Income Statements | | | 33 | |

| |

Consolidated Statements of Comprehensive Income | | | 34 | |

| |

Consolidated Statements of Financial Position | | | 35 | |

| |

Consolidated Statements of Changes in Equity | | | 36 | |

| |

Consolidated Statements of Cash Flows | | | 37 | |

| |

Notes to the Consolidated Financial Statements | | | 38 | |

| |

Directors’ Declaration | | | 110 | |

| |

Independent Auditor’s Report | | | 111 | |

Directors’ report

The directors present their report on the consolidated entity (the “Group”) consisting of Sims Metal Management Limited (the “Company”) and the entities it controlled at the end of, or during, the year ended 30 June 2012.

Names and particulars of directors

The names of the directors of the Company in office during the financial year and up to the date of this report together with their qualifications and experience are as follows:

Geoffrey N Brunsdon B Comm (age 54)

Chairperson and Independent non-executive director

Mr Brunsdon was appointed as a director in November 2009, appointed Deputy Chairperson in September 2011 and appointed Chairperson of the Company on 1 March 2012. He is the Chairperson of the Finance & Investment Committee and is a member of the Risk, Audit & Compliance Committee and the Remuneration Committee. Until June 2009, Mr Brunsdon was Managing Director and Head of Investment Banking of Merrill Lynch International (Australia) Limited. He is Chairman of ING Private Equity Access Limited (since 2004), a director of APN Funds Management Limited (since November 2009), a director of Macquarie University Hospital, Chairman of MetLife Insurance Limited (since April 2011) and a member of the Takeovers Panel. He was a member of the listing committee of the Australian Securities Exchange between 1993 and 1997 and was a director of Sims Group Limited between 1999 and 2007. He is a Fellow of the Institute of Chartered Accountants, a Fellow of the Financial Services Institute of Australia and a Fellow of the Institute of Company Directors. Mr Brunsdon is also a director of several non-profit organisations, including Redkite (supporting families who have children with cancer), the Wentworth Group of Concerned Scientists and Purves Environmental Custodians.

Daniel W Dienst JD (age 47)

Executive Director and Group Chief Executive Officer

Mr Dienst was appointed as an Executive Director and Group Chief Executive Officer in March 2008. He is a member of the Safety, Health, Environment & Community Committee, the Nomination/Governance Committee and the Finance & Investment Committee. Mr Dienst was formerly a director (since June 2001), Chairman (since April 2003), Chief Executive Officer (since January 2004) and President (since September 2004) of Metal Management, Inc which merged with the Company on 14 March 2008. From January 1999 to January 2004, Mr Dienst served in various capacities with CIBC World Markets Corp., lastly as Managing Director of the Corporate and Leveraged Finance Group. From 2002-2005, he was Chairman of the Board of Metals USA, Inc., a NASDAQ – listed steel service center company until its sale to a private entity. Mr Dienst is a director of other Sims Metal Management Limited subsidiaries and associated companies. He is a graduate of Washington University and received a Juris Doctorate from The Brooklyn Law School.

Norman R Bobins BS, MBA (age 69)

Independent non-executive director

Mr Bobins was appointed as a director in March 2008. He is Chairperson of the Nomination/Governance Committee and is a member of the Finance & Investment Committee. Mr Bobins was formerly a director of Metal Management, Inc (since 2006). He is the Chairman of Norman Bobins Consulting LLC (since 2008). From May 2007 until October 2007, Mr Bobins was the Chairman of the Board of LaSalle Bank Corporation. From 2002 to 2007, he was President and Chief Executive Officer of LaSalle Bank Corporation. From 2006-2007, he was President and Chief Executive Officer of ABN AMRO North America. From 2002-2007, Mr Bobins was Senior Executive Vice President at ABN AMRO Bank N.V., the Dutch parent of LaSalle Bank Corporation. He is the Non-Executive Chairman of The PrivateBank and Trust Company. Mr Bobins is also a director of AGL Resources, Inc. and AAR CORP. He earned his BS from the University of Wisconsin and his MBA from the University of Chicago.

1

John T DiLacqua MBA (age 60)

Independent non-executive director

Mr DiLacqua was appointed as a director on 1 September 2011. He is a member of the Risk, Audit & Compliance Committee and the Finance & Investment Committee. Mr DiLacqua was formerly a director of Metal Management, Inc (since June 2001), and was a director of Sims Metal Management Limited between March and November 2008. He was the Executive Chairman of Envirosource, Inc. from May 2004 to December 2004 and had served as President and Chief Executive Officer of Envirosource from January 1999 to May 2004. From October 1997 to December 1998, Mr DiLacqua served as President of the US Ferrous Operations of Philip Metals, Inc., and, prior to that, from May 1994, as the President of Luria Brothers. He is a graduate of Temple University and received an MBA from Carnegie Mellon University. Mr DiLacqua is a Certified Public Accountant.

J Michael Feeney B Comm (Marketing) (age 66)

Independent non-executive director

Mr Feeney was appointed as a director in September 1991. He is Chairperson of the Remuneration Committee and is a member of the Risk, Audit & Compliance Committee and the Nomination/Governance Committee. Mr Feeney was formerly an Executive Director of Collins Partners Corporate Advisory and prior to that Finance and Strategy Director for Philip Morris, Executive Director, Strategy & Corporate Affairs for Elders IXL and Executive Director, Corporate Strategy of Elders Resources NZFP.

Gerald E Morris BA (age 80)

Independent non-executive director

Mr Morris was appointed as a director in March 2008. He is Chairperson of the Risk, Audit & Compliance Committee and is a member of the Remuneration Committee and the Nomination/Governance Committee. Mr Morris was formerly a director (since January 2004) of Metal Management, Inc. He previously served as President and CEO of Intalite International N.V., as Chairman and director of Beacon Trust Company, and as a director of Metals USA, Inc., Rexel, Inc. and Tivoli Industries, Inc., and as trustee of the Blanchard Group of Funds. He earned his BA from the University of Connecticut. Mr Morris is a Certified Public Accountant.

Christopher J Renwick AM, FAIM, FAIE, FTSE - BA, LLB (age 69)

Independent non-executive director

Mr Renwick was appointed as a director in June 2007. He is Mitsui’s designated independent director. Mr Renwick is Chairperson of the Safety, Health, Environment & Community Committee and is a member of the Nomination/Governance Committee. Mr Renwick was employed with the Rio Tinto Group for over 35 years rising, in 1997, to Chief Executive, Rio Tinto Iron Ore, a position he held until his retirement in 2004. He has previously served as Chairman and director of Coal and Allied Industries Limited (2004 to 2011), Chairman of the Rio Tinto Aboriginal Fund (2004 to 2011) and director of Downer EDI Limited (2004 to 2010). Mr Renwick is a director of South East Regional Touring Opera Company Limited, a “not-for-profit” public company limited by guarantee, which operates as “Melbourne Opera”.

Heather Ridout BEc (Hons) (age 58)

Independent non-executive director

Mrs Ridout was appointed as a director on 1 September 2011. She is a member of the Safety, Health, Environment & Community Committee. Mrs Ridout was formerly the Chief Executive Officer of the Australian Industry Group from 2004 until her retirement in April 2012. She is a Member of the Board of the Reserve Bank of Australia (since December 2011), and is a director of the AustralianSuper Trustee Board, the largest industry fund in Australia. Mrs Ridout also serves on the Boards of Skills Australia, a Federal Government body established to shape Australia’s strategy on skills development, and the Climate Change Authority, an independent body established to provide advice on the Australian Government’s policies for reducing carbon pollution. She has an economics degree with honours from the University of Sydney.

2

M Paul Sukagawa BA (age 61)

Non-independent non-executive director

Mr Sukagawa was appointed as a director in November 2009. He is Mitsui’s designated representative director. Mr Sukagawa is a member of the Finance & Investment Committee, the Nomination/Governance Committee and the Safety, Health, Environment & Community Committee. He joined Mitsui & Co., Ltd in 1973 and has held various positions within that company, including President & Managing Director of Mitsui Iron Ore Development (2004–2007), President & CEO of PT. Mitsui Indonesia (2007–2009) and, most recently, since April 2009, Senior Adviser of Mitsui Iron Ore Development.

James T Thompson BS (age 62)

Independent non-executive director

Mr Thompson was appointed as a director in November 2009. He is a member of the Finance & Investment Committee and the Remuneration Committee. Mr Thompson was, from 2004 until his retirement in 2007, Executive Vice President–Commercial for The Mosaic Company, one of the world’s largest fertiliser companies, with sales of US$11 billion and some 8,000 employees, which is publicly traded on the New York Stock Exchange. Prior to that, he was engaged for 30 years in the steel industry from 1974–2004 in various roles at Cargill, Inc of Minnesota, United States, leading to the position of President of Cargill Steel Group from 1996–2004. During that period, Mr Thompson also served for a time as Co-Chairman of the North Star BlueScope Steel joint venture, and was a member of various industry boards including AISI (American Iron and Steel Institute), SMA (Steel Manufacturers Institute) and MSCI (Metals Service Center Institute). He is currently a director of Hawkins, Inc. and serves on the Board of Visitors of the University of Wisconsin School of Education. Mr Thompson has a BS from the University of Wisconsin–Madison.

Paul J Varello BCE (Civil Engineering) (age 68)

Independent non-executive director

Mr Varello was appointed as a director in November 2005. He served as Chairperson of the Company from August 2009 until 1 March 2012. Mr Varello is a member of the Remuneration Committee and the Nomination/Governance Committee. He is Chairman of Commonwealth Engineering and Construction (CEC), located in Houston, Texas. Prior to founding CEC in 2003, he was Chairman and CEO of American Ref-Fuel Company. Mr Varello is a registered professional engineer and a member of the American Society of Civil Engineers and the American Institute of Chemical Engineers.

Robert Lewon BS (age 69)

Former Independent non-executive director

Mr Lewon retired on 10 November 2011 having served as an independent non-executive director since March 2008.

Company secretaries

Frank Moratti B Comm, LLB, MBA (Executive)

Mr Moratti was appointed to the position of Company Secretary in 1997. Before joining the Company, he held positions of assistant company secretary/legal counsel in a number of publicly listed companies over a period of some 12 years and, prior to that, worked as a solicitor with a major legal practice.

Scott Miller BS, MS, JD, PE

Mr Miller was appointed to the position of Company Secretary in 2008. Since joining the Company in 1997, Mr Miller has held positions as legal counsel and manager for environmental affairs for North American operations. Before joining the Company, he held positions at an environmental mediation firm, as an attorney with a major legal practice and as a consulting engineer.

3

Directors’ meetings

The following table shows the actual board and committee meetings held during the financial year and the number of meetings attended by each director.

| | | | | | | | | | | | |

| | | Board of

Directors | | Risk, Audit &

Compliance

Committee | | Safety, Health,

Environment

& Community

Committee | | Remuneration

Committee | | Finance &

Investment

Committee | | Nomination/

Governance

Committee |

Meetings held | | 8 | | 6 | | 4 | | 7 | | 7 | | 3 |

G Brunsdon1 | | 8 | | 6 | | | | 5 | | 7 | | |

D Dienst | | 8 | | | | 2 | | | | 6 | | 2 |

N Bobins2 | | 7 | | | | | | | | 6 | | 2 |

J DiLacqua3 | | 6 | | 5 | | | | | | 5 | | |

JM Feeney | | 8 | | 6 | | | | 7 | | | | 3 |

R Lewon4 | | 4 | | | | 2 | | | | 3 | | 2 |

G Morris | | 8 | | 6 | | | | 7 | | | | 3 |

C Renwick5 | | 8 | | | | 4 | | | | 2 | | 2 |

H Ridout6 | | 5 | | | | 3 | | | | | | |

M Sukagawa7 | | 8 | | | | 4 | | | | 7 | | 2 |

J Thompson8 | | 8 | | 1 | | 1 | | 5 | | 5 | | |

P Varello | | 7 | | | | | | 7 | | | | 3 |

1Mr Brunsdon was appointed to the Remuneration Committee on 1 September 2011.

2Mr Bobins was appointed to the Nomination/Governance Committee on 1 September 2011.

3Mr DiLacqua was appointed to the Board of Directors and to the Finance & Investment Committee and Risk, Audit & Compliance Committee on 1 September 2011.

4Mr Lewon retired from the Board of Directors and the Safety, Health, Environment & Community Committee, Finance & Investment Committee and Nomination/Governance Committee on 10 November 2011.

5Mr Renwick vacated the Finance & Investment Committee, and was appointed to the Nomination/Governance Committee, on 1 September 2011.

6Mrs Ridout was appointed to the Board of Directors and to the Safety, Health, Environment & Community Committee on 1 September 2011.

7Mr Sukagawa was appointed to the Nomination/Governance Committee on 1 September 2011.

8Mr Thompson vacated the Safety, Health, Environment & Community Committee and Risk, Audit & Compliance Committee and was appointed to the Remuneration Committee and Finance & Investment Committee on 1 September 2011.

Directors’ interests

As at the date of this report, the interests of the directors in the shares, options, or performance rights of the Company are set forth below. Shares owned by each director are either in the form of ordinary shares or American Depositary Shares (“ADS”).

| | | | | | | | | | | | |

| | | Shares | | | Options over

Shares | | | Performance

Rights | |

G Brunsdon | | | 4,057 | | | | - | | | | - | |

D Dienst (ADS) | | | 592,593 | | | | 1,075,640 | | | | 862,879 | |

N Bobins (ADS) | | | 54,600 | | | | - | | | | - | |

J DiLacqua | | | - | | | | - | | | | - | |

JM Feeney | | | 32,789 | | | | - | | | | - | |

G Morris (ADS) | | | 15,000 | | | | 82,000 | | | | - | |

C Renwick | | | 3,144 | | | | - | | | | - | |

H Ridout | | | - | | | | - | | | | - | |

M Sukagawa | | | 3,000 | | | | - | | | | - | |

J Thompson (ADS) | | | 12,000 | | | | - | | | | - | |

P Varello (ADS) | | | 97,625 | | | | - | | | | - | |

4

Review of operations

A review of the operations of the Group during the financial year and the results of those operations are set out in the Chairman’s and Group Chief Executive Officer’s Review in the annual report and in the press release announcing the results for the financial year as filed with the ASX.

Principal activities

The Group reports revenues by the following product groups:

| • | | Ferrous secondary recycling - comprising the collection, processing and trading of iron and steel secondary raw material. |

| • | | Non-ferrous secondary recycling - comprising the collection, processing and trading of other metal alloys and residues, principally aluminium, lead, copper, zinc and nickel bearing materials. |

| • | | Recycling solutions - comprising the provision of environmentally responsible solutions for the disposal of post-consumer electronic products, including IT assets recycled for commercial customers. The Group offers fee-for-service business opportunities in the environmentally responsible recycling of negative value materials including refrigerators, electrical and electronic equipment. |

| • | | Secondary processing and other services - comprising value-added processes involving the melting, refining and ingoting of certain non-ferrous metals and other service revenue. |

Dividends

The board determined a final dividend of 10.0 cents per share, unfranked, for the financial year to be paid on 19 October 2012. The interim dividend for the financial year was 10.0 cents per share, unfranked, and was paid on 10 April 2012.

Significant changes in the state of affairs

There were no significant changes in the state of affairs of the Group during the financial year not otherwise disclosed elsewhere in this report.

Significant events after the balance sheet date

The directors are not aware of any items, transactions or events of a material or unusual nature that have arisen since the end of the financial year which will significantly affect, or may significantly affect, the operations of the Group, the results of those operations or the state of affairs of the Group in subsequent financial years.

Likely developments

Information as to the likely developments in the operations of the Group is set out in the Chairman’s and Group Chief Executive Officer’s Review in the annual report.

Environmental regulation

The Group is subject to environmental regulations and reporting requirements in Australia and other countries in which it operates. The Group has licenses and consents in place at each of its operating sites as prescribed by environmental laws and regulations that apply in each respective location. Further information on the consolidated entity’s performance in relation to environmental regulation is set out in the annual report.

The Group’s Australian operations are subject to the reporting requirements of both theEnergy Efficiency Opportunities Act 2006and theNational Greenhouse and Energy Reporting Act 2007.The Group’s aluminium operation in Victoria also reports under that State’sEnvironment and Resource Efficiency Plan (EREP) as well as itsWater Management Action Plan (WaterMap).

5

TheEnergy Efficiency Opportunities Act 2006 requires the Group to assess the energy usage of its Australian operations, including the identification, investigation and evaluation of energy saving opportunities, and to report publicly on the assessments undertaken, including what action the Group intends to take as a result. The Group continues to meet its obligations under this Act.

TheNational Greenhouse and Energy Reporting Act 2007 requires the Group to report its annual greenhouse gas emissions and energy use of its Australian operations. The Group has implemented systems and processes for the collection and calculation of the data required to enable it to prepare and submit its report to the Greenhouse and Energy Data Officer by 31 October 2012.

EREP is a regulatory program in Victoria that requires the reporting of major energy, water and waste activities, with the aim of better management of those activities. WaterMap is a Victoria based initiative that aims to improve the utilisation of water sources.

There have been no significant known breaches of the Group’s license conditions or any environmental regulations to which it is subject.

Insurance and indemnification of officers

During the financial year, the Company had contracts in place insuring all directors and executives of the Company (and/or any subsidiary companies in which it holds greater than 50% of the voting shares), including directors in office at the date of this report and those who served on the board during the year, against liabilities that may arise from their positions within the Company and its controlled entities, except where the liabilities arise out of conduct involving a lack of good faith. The directors have not included details of the nature of the liabilities covered or the amount of the premium paid as such disclosure is prohibited under the terms of the contracts.

Share option and rights

Unissued shares

As of the date of this report, there are 5,191,263 share options outstanding and 3,483,123 rights outstanding in relation to the Company’s ordinary shares. Refer to Note 24 of the consolidated financial statements for further details of the options and rights outstanding as at 30 June 2012. Option and right holders do not have any right, by virtue of the option or right, to participate in any share issue of the Company.

Shares issued as a result of the exercise of options and vesting of rights

During the financial year, there were 181,654 ordinary shares issued upon the exercise of share options and 531,787 ordinary shares issued in connection with the vesting of rights. Refer to Note 24 of the consolidated financial statements for further details of shares issued pursuant to share-based awards. Subsequent to the end of the financial year and up to the date of this report, 13,251 ordinary shares were issued in connection with vesting of rights.

Non-audit services

The Company may decide to employ its external auditor (PricewaterhouseCoopers) on assignments additional to their statutory audit duties where the auditor’s expertise and experience with the Company and/or the Group are important.

Details of the amounts paid or payable to the auditor for audit and non-audit services provided during the financial year are set out in Note 26 of the consolidated financial statements.

The Board has considered the position and, in accordance with advice received from the Risk, Audit & Compliance Committee, is satisfied that the provision of the non-audit services is compatible with the general standard of independence for auditors imposed by theCorporations Act 2001. The directors are satisfied that the provision of non-audit services by the auditor, as set forth in Note 26 of the consolidated financial statements, did not compromise the auditor independence requirements of theCorporations Act 2001 for the following reasons:

6

| • | | All non-audit services have been reviewed by the Risk, Audit & Compliance Committee to ensure they do not impact the impartiality and objectivity of the auditor; and |

| • | | None of the services undermine the general principles relating to auditor independence as set out inAPES 110 Code of Ethics for Professional Accountants. |

A copy of the auditor’s independence declaration as required under section307C of the Corporations Act 2001 is set out on page 32.

Rounding of amounts

The Company is of a kind referred to in Class Order 98/100, issued by the Australian Securities and Investments Commission, relating to the “rounding off” of amounts in the financial statements. Amounts in the financial statements have been rounded off in accordance with that Class Order to the nearest tenth of a million dollars, unless otherwise indicated.

7

REMARKS BY THE CHAIRMAN OF THE REMUNERATION COMMITTEE

Dear Shareholder,

We are pleased to present your Company’s 2012 Remuneration Report and hope that you will find it to be clear, informative and easy to comprehend.

Our executive remuneration framework, including incentive plan design, has remained consistent between the 2011 and 2012 financial years. It reflects our global scale and consists of fixed remuneration, a short-term incentive plan (‘STI Plan’) that is subject to the achievement of challenging Company financial targets and personal performance goals and a long-term incentive plan (‘LTI Plan’) that is aligned to the creation of shareholder value.

Each year, we continue to strive to make our Remuneration Report more readable and relevant, and, in enhancing this year’s Report, we have:

| • | | provided an ‘executive remuneration snapshot,’ which provides an overview of our remuneration approach; and |

| • | | explained in further detail how actual remuneration outcomes are correlated to Company performance, as well as the difference between actual remuneration outcomes, targeted remuneration and the statutory remuneration table. |

With respect to the Company’s LTI Plan, the Committee commissioned its remuneration consultant, Mercer (US) Inc.(‘Mercer’), to review the Plan and recommend possible changes. These recommendations are being considered by management and the Committee and may lead to changes being put into effect for the LTI Plan in the 2014 financial year.

The negotiation of a new employment agreement for the Executive Director was postponed until the 2013 financial year. In exchange for an agreement to extend his existing contract through 30 June 2013, the Executive Director received a one-off payment of US$500,000. He also received an approximate five percent increase in base salary effective 1 July 2012 which was in line with our compensation philosophy and benchmarking against our compensation comparator group. In addition, effective 1 July 2012, the Executives received base salary increases ranging from zero to three percent. The average salary increase for all other global employees was approximately three percent.

We will keep our remuneration policy and practices under constant review as we continue to strive to achieve ‘best practice’ in the alignment of remuneration with corporate strategy and shareholder wealth.

We welcome and value your feedback as we continue to find ways to improve communications with our shareholders.

Yours sincerely,

Michael Feeney

Remuneration Committee Chair

RemCoChair@simsmm.com

REMUNERATION REPORT

The Directors of Sims Metal Management Limited present the Remuneration Report for the Company and the Group for the 2012 financial year. The information provided in this Remuneration Report has been audited.

The Remuneration Report is set out as follows:

| | | | |

Section | | Description | | Page # |

| | |

| A | | Executive Remuneration Snapshot | | 9 |

| | |

| B | | Our Remuneration Governance Framework | | 12 |

| | |

| C | | Executive Remuneration Policy | | 13 |

| | |

| D | | Executive Remuneration Framework | | 14 |

| | |

| E | | Remuneration Outcomes For Executives During The 2012 Financial Year, Including Discussion Of The Linkage Between ‘At-Risk’ Remuneration And Company Performance | | 20 |

| | |

| F | | Executive Contracts | | 25 |

| | |

| G | | Share-based Payment Disclosures | | 26 |

| | |

| H | | Non-Executive Director Remuneration | | 30 |

8

A. EXECUTIVE REMUNERATION SNAPSHOT

Due to our global scale, our remuneration practices must take into account local market practice, particularly in our largest jurisdiction of the United States where we compete for much of our talent and business. Our executive remuneration framework consists of fixed remuneration, short-term incentives and long-term incentives.

The Company’s remuneration philosophy is designed to provide a remuneration program that:

| | • | | attracts, motivates and retains the best and brightest of its senior executive, leadership and staff positions; |

| | • | | drives the Company’s business strategy of continued growth and success as a major global corporation; and |

| | • | | aligns reward opportunities with shareholder interests. |

Sims Metal Management Limited and its joint ventures operate in more than 270 locations across five continents. Given our global scale, it is imperative that our remuneration practices take into account local market practice, particularly in our largest jurisdiction of the United States where we compete for much of our talent and business. Of the five members of your current senior management team, three are based in the United States, one is based in the United Kingdom, and one is based in Australia.

Fixed Remuneration

Our Executive fixed remuneration levels are benchmarked against a comparator group by Mercer (the Board’s external remuneration adviser). In light of our global operations, the comparator group includes industry-related companies of a relative size, footprint and complexity. Adjustments with respect to fixed remuneration were made in the 2012 financial year, factoring in appropriate benchmarks, role and Executive performance.

Variable Pay

Our variable pay plans use demanding financial and individual performance criteria focused on delivering short-term and long-term value to our shareholders. The Company endeavours to achieve simplicity and transparency in remuneration design, whilst also balancing competitive market practice in the United States, the United Kingdom and Australia.

Our STI Plan is a global plan and the 2012 financial year metrics were in alignment with the Company’s strategic plan and factored in its cost of capital. The STI Plan for the Executive Director and Executives is weighted 80% on financial measures and, in order to drive and reinforce desired individual behaviours and outcomes, 20% on individual measures. The STI Plan performance in respect of financial measures came in below threshold on a Group-wide basis and, as such, only ‘personal priority’ portions of the STI were earned by the Executive Director and Executives as measured against Group performance. However, some regions did achieve partial accomplishments against target. As such, bonuses were paid to those Executives in line with the respective performance of their region as applicable, in conjunction with their performance against their individual objectives.

Under our LTI Plan, performance rights and options are granted to select Company executives consistent with the framework of the awards made to the Executive Director, as approved by shareholders at the Company’s Annual General Meeting in November. These awards provide meaningful remuneration opportunities that are aligned with the Company’s share price performance and reflect the importance of retaining the Company’s world-class management team.

The performance rights are nil exercise price options and vest subject to relative total shareholder return (TSR) performance against an industry peer group over a three-to-five-year period. This is consistent with competitive market practice in Australia and the United Kingdom. The options have an exercise price which is equal to the average share price for the five days preceding the grant date. They vest in three equal instalments over a three-year period subject to continued service. The options reward executives for share price growth and only deliver value if the share price exceeds the exercise price subsequent to vesting. This is consistent with competitive market practice in the United States.

This LTI structure ensures that executives focus on shareholder value creation relative to companies within the Company’s industry, as well as the creation of absolute shareholder value. Under this structure, executives cannot receive their full LTI opportunity unless the Company’s share price has grown in absolute terms and its TSR is above the median against its industry peer group. This structure is more rigorous than other structures typically seen in the Australian market where, in difficult economic conditions, 100% of the LTI opportunity can still vest even if relative TSR performance is strong but no shareholder value has been created.

9

Non-Executive Directors and Executives covered in this report

The Remuneration Report is focused on the Company’s Key Management Personnel (‘KMP’) consisting of the below Non-Executive Directors and Executives.

| | |

| Name | | Position |

| Non-Executive Directors |

| Geoffrey N Brunsdon | | Chairman and Independent Non-Executive Director |

| Norman R Bobins | | Independent Non-Executive Director |

| John T DiLacqua | | Independent Non-Executive Director (commenced on 1 September 2011) |

| J Michael Feeney | | Independent Non-Executive Director |

| Robert Lewon | | Independent Non-Executive Director (retired 10 November 2011) |

| Gerald E Morris | | Independent Non-Executive Director |

| Chris J Renwick | | Independent Non-Executive Director |

| Heather Ridout | | Independent Non-Executive Director (commenced on 1 September 2011) |

| M Paul Sukagawa | | Non-Independent Non-Executive Director |

| James T Thompson | | Independent Non-Executive Director |

| Paul J Varello | | Independent Non-Executive Director |

| | |

| Executives | | |

| Daniel W Dienst | | Executive Director and Group Chief Executive Officer |

| Graham Davy | | Chief Executive Officer – European Metals and Sims Recycling Solutions (SRS), Global Operations |

| Robert Kelman | | President – Commercial North America (1 July 2011 to 31 January 2012) |

| | President – North America Metals (effective 1 February 2012) |

| Robert C Larry | | Group Chief Financial Officer |

| Darron McGree | | Managing Director Australia and New Zealand Metals |

| Alan D Ratner1 | | President – Operations North America (1 July 2011 to 31 January 2012) Group Executive Vice President – Operations & SHEC (Safety, Health, Environment & Community) (effective 1 February 2012) |

| 1 | As at 1 February 2012, Mr Ratner, due to a change in responsibilities, is no longer considered to be a KMP. |

10

Actual Remuneration Outcomes

There is a strong correlation between incentive pay and Company performance, with cash bonuses being significantly lower than target and significantly lower than the prior year due to Company performance against ROCCE targets. No performance rights vested since the Company’s TSR performance was below the median when measured against its peer group.

In order to provide additional transparency, outlined below is the actual remuneration received by the Executives during the 2012 financial year. For comparative purposes, the targeted remuneration is also shown. Targeted remuneration is consistent with the Company’s remuneration philosophy and is supported by Mercer’s competitive benchmarking data.

The statutory remuneration tables, which are prepared consistent with Australian Accounting Standards and theCorporations Act 2001 (Cth), are outlined later in this report.

By providing this table below, the strong correlation between actual remuneration received and Company performance can be more clearly demonstrated. Actual cash bonuses were significantly lower than the previous financial year (as noted in the statutory remuneration table in Section E) as well as significantly lower than targeted incentives because the Return on Controlled Capital Employed (ROCCE) performance against target at the Group and business unit level was not met. Actual cash bonus figures reflect the figures in the statutory remuneration table.

In the 2008 financial year, there were three tranches of performance rights granted, with vesting subject to Relative TSR, EPS and EBITDA respectively. 43.8% of the performance rights subject to EBITDA vested during the 2012 financial year, meaning that 100% of this allocation has now vested. There was no vesting in relation to the 2008 performance rights that were subject to relative TSR and EPS. Accordingly, in the 2013 financial year, 40.4% of the 2008 performance rights subject to relative TSR will be forfeited (because the Company’s relative TSR performance was below the median against its peer group) and 100% of the 2008 performance rights subject to EPS will be forfeited (because the threshold EPS level was not achieved). There was also no vesting of the 2009 and 2010 financial year performance rights subject to relative TSR.

The actual value of LTI awards is different from the targeted LTI awards noted below, as well as the statutory remuneration table in Section E. This is because the actual LTI figures reflect the value of the LTI awards that actually vested on the vesting date (i.e., the actual amount that Executives received) whereas the value of the LTI figures in the statutory remuneration table reflects the amortised value of the entire LTI award (that may or may not vest) in accordance with accounting standards. By comparing the two tables, it can be seen that the actual remuneration of the Executives during the 2012 financial year was significantly lower than their targeted incentives, as well as the remuneration that is required to be disclosed in the statutory remuneration table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Executives (A$) | | Fixed remuneration1 | | | Actual cash bonus2 | | | Target cash bonus | | | Actual long-term incentives3 | | | Target long-term incentives | | | Total actual remuneration | | | Total target remuneration | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

D Dienst4 | | | 1,435,952 | | | | 819,653 | | | | 1,675,550 | | | | 449,490 | | | | 3,866,654 | | | | 2,705,095 | | | | 6,978,156 | |

G Davy4 | | | 583,821 | | | | 244,274 | | | | 526,691 | | | | 43,867 | | | | 526,691 | | | | 871,962 | | | | 1,637,203 | |

R Kelman4 | | | 790,754 | | | | 133,686 | | | | 668,669 | | | | 109,306 | | | | 668,669 | | | | 1,033,746 | | | | 2,128,092 | |

R Larry4 | | | 806,174 | | | | 128,888 | | | | 644,442 | | | | 256,847 | | | | 805,553 | | | | 1,191,909 | | | | 2,256,169 | |

D McGree | | | 732,692 | | | | 244,923 | | | | 621,557 | | | | - | | | | 621,557 | | | | 977,615 | | | | 1,975,806 | |

A Ratner4 | | | 713,522 | | | | 128,888 | | | | 644,442 | | | | 109,306 | | | | 644,442 | | | | 951,716 | | | | 2,002,406 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 1. | Fixed remuneration includes cash salary, other benefits, pension and superannuation, and leave accruals in line with statutory remuneration disclosures. Effective 1 February 2012, commensurate with the assumption of his new role and expanded responsibilities, Mr Kelman received a nine percent increase to his base salary. |

| | 2. | Actual cash bonus refers to the Executive’s total bonus that was earned in the 2012 financial year and will be paid to the Executive in September 2012 following the finalisation of the audited financial results. For Mr Dienst, the actual cash bonus also includes a one-off payment of US$500,000 in exchange for an agreement to extend his existing contract through 30 June 2013. |

| | 3. | LTI refers to equity allocations granted in prior years that vested during the 2012 financial year. The value has been calculated using the closing share price of the Company’s shares on the vesting date (less any exercise price). It also includes amounts paid out under the deferred compensation plan. |

| | 4. | Messrs Dienst, Kelman, Larry and Ratner receive their cash payments in United States dollars. Mr Davy receives his cash payments in pounds sterling. |

11

B: OUR REMUNERATION GOVERNANCE FRAMEWORK

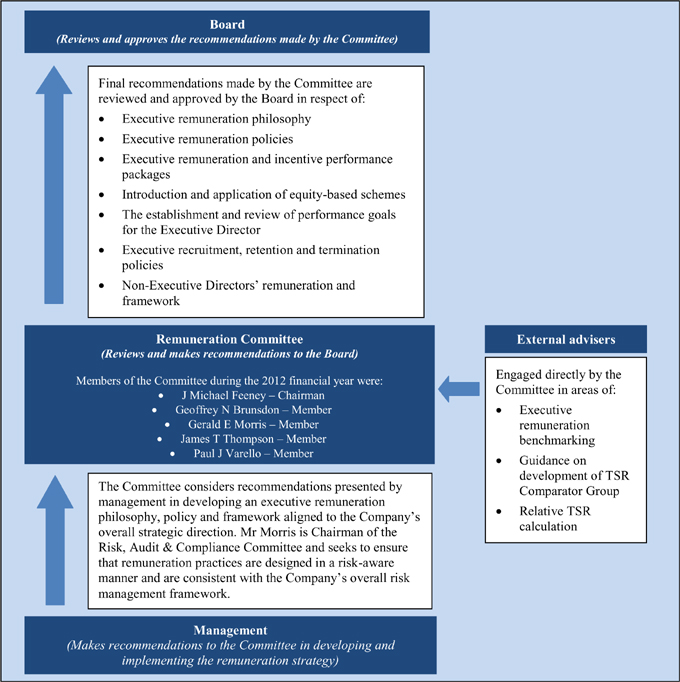

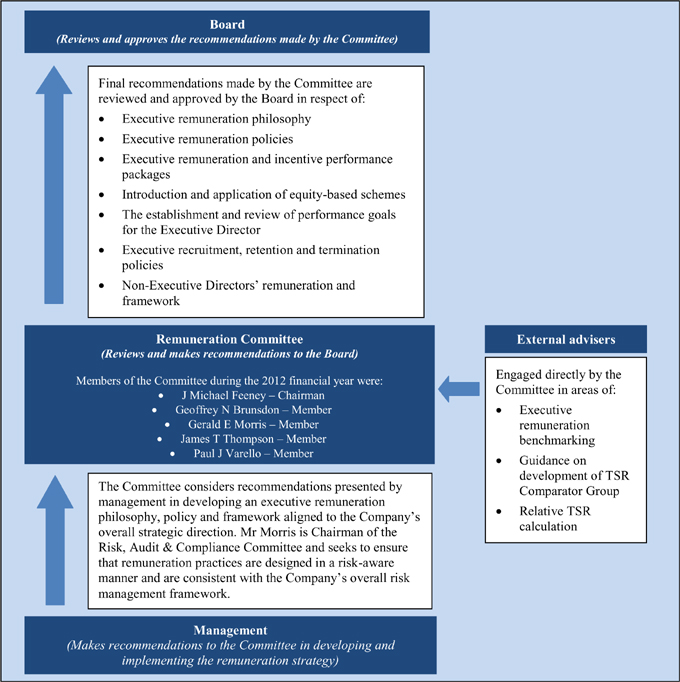

We have a strong remuneration governance framework, with the Board being ultimately responsible for the Company’s executive remuneration practices. The Remuneration Committee (Committee) supports the Board The in making remuneration decisions.

The primary role of the Committee is to support and advise the Board on the implementation and maintenance of coherent, fair and responsible remuneration policies and practices that are observed by the Company and enable it to attract and retain executives and directors who will create value for shareholders. The Committee’s charter, which is available on the Company’s website at www.simsmm.com, provides further information on the role of the Committee.

The diagram below illustrates the role of the Board, the Committee, management and external advisers (including remuneration consultants) in relation to remuneration.

In addition to the above, in recognition of the value and advantages of having a diversified workforce and consistent with the Company’s Workforce Diversity Policy (which has been posted on the Company’s website atwww.simsmm.com), the Committee is responsible for reviewing and approving the measureable objectives for achieving diversity as noted in the Company’s Corporate Governance Statement.

12

C: EXECUTIVE REMUNERATION POLICY

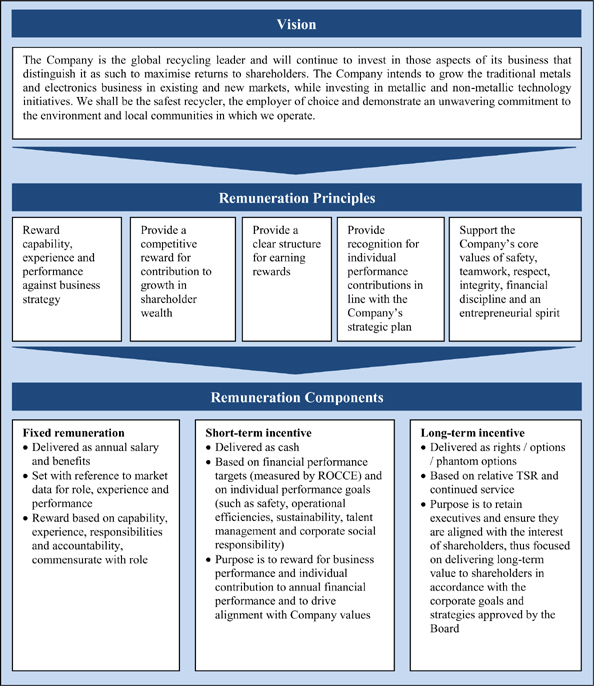

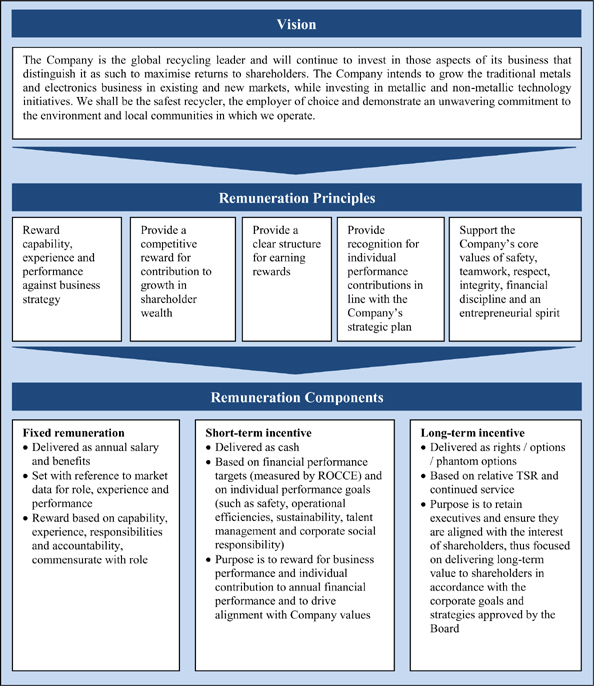

Our executive remuneration policy supports our vision and aligns executive incentive pay with the achievement of Company strategic and business priorities and the creation of shareholder value.

Executive remuneration policy

The executive remuneration policy recognises that the Company operates in a global environment and that the Company’s performance depends on the quality of its people.

The policy seeks to ensure alignment between the Company’s remuneration philosophy, its business strategy and the best interest of its shareholders.

The primary aim of the Company’s remuneration policy is to attract, motivate and retain high calibre executives. To do so, the Company provides executive remuneration packages that are competitive (referencing market data) and commensurate with employee responsibilities and accountabilities. The diagram below provides a snapshot of the Company’s remuneration principles and its components, and how they support the Company’s overall vision.

13

D: EXECUTIVE REMUNERATION FRAMEWORK

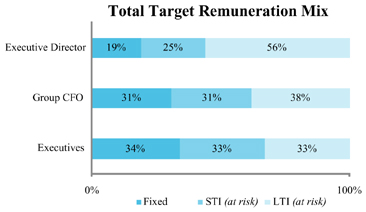

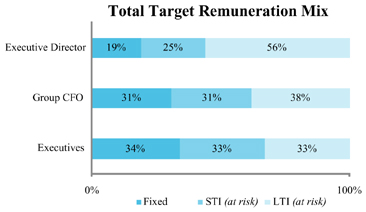

Our executive remuneration framework is heavily skewed towards variable pay, with 81% of the Executive Director’s target pay being at-risk, subject to challenging short-term and long-term hurdles.

The executive remuneration framework reflects the international nature of the Company and the fact that we employ executives based throughout the world.

The framework is continually reviewed by the Committee to ensure best practices are followed. The Company also undertakes an annual remuneration review to determine the total remuneration positioning of its executives against the market.

Use of External Remuneration Advisor

The Committee retains Mercer, a remuneration consultant, to serve as its external advisor. In its capacity as advisor to the Committee, Mercer performs competitive compensation research and provides guidance on executive remuneration issues. The activity includes providing guidance on appropriate comparator group companies, which includes industry-related companies of similar sized revenue and market capitalisation (i.e., from approximately half the Company’s size to twice the Company’s size) with similar geographic footprints and complexity. Mercer also assesses competitive executive base salary, annual incentive, and long-term incentive levels for the Committee’s consideration as it approves base salary adjustments and sets target incentive opportunities for Executives. During the 2012 financial year, Mercer also reviewed the Company’s LTI Plan and provided the Committee with potential alternatives, provided guidance on competitive practices with regard to executive contracts, provided valuations of awards under the LTI Plan and assessed the Company’s cumulative TSR against the comparator group. In addition, Mercer provided the Committee with a remuneration recommendation as defined under theCorporations Act 2001(Cth) during the 2012 financial year. Mercer has not provided any other advice to the Committee during the 2012 financial year.

The Mercer fees for the above remuneration recommendation approximated A$109,000. The Committee has implemented protocols around the appointment and use of remuneration consultants to ensure compliance with theCorporations Act 2001(Cth). Michael Feeney, Chairman of the Committee, directly engaged Mercer to perform the above work and Mercer did not provide their report to any member of Company management. The Committee also had direct access to Mercer during executive sessions (sans Company management) throughout the 2012 financial year. Mercer has declared to the Committee that their remuneration recommendations were not unduly influenced by any of the Company’s KMP throughout the course of their engagement. Based on the protocols followed, and Mercer’s declaration, the Board is satisfied that the remuneration recommendation from Mercer was made free from undue influence by any of the KMP.

Fixed and variable (‘at-risk’) remuneration mix

In line with the Company’s intent to ensure the executive remuneration framework is aligned to the Company’s performance, a significant portion of an Executive’s remuneration is ‘at-risk’. The following chart sets out the target remuneration mix; that is, fixed remuneration (salary/package), target short-term incentive, and long-term incentive for the Executives.

14

Fixed remuneration

Fixed remuneration comprises base salary and benefits.

| • | | Base salary is determined on an individual basis, taking into consideration the individual’s capability, experience, responsibilities and accountability, as well as external market factors and benchmark data. |

| • | | Benefits programs vary by market and may include health insurance, life and disability insurance, retirement programs (depending on national government and tax regulations) and automobile allowances. |

Remuneration packages (including fixed components of base salaries and benefits) are reviewed annually. In reviewing any changes to executive remuneration, the Committee references individual performance, as well as market-based comparable positions in public surveys and obtains advice from its external remuneration consultant where necessary.

There are no guaranteed increases to any components of fixed remuneration for any Executives.

‘At-risk’ remuneration

‘At-risk’ remuneration comprises both short-term and long-term incentives. ‘At-risk’ means an absence of certainty regarding the payment of a particular component of remuneration in the event agreed-upon performance hurdles or employment conditions are not met during the performance period. The remuneration of Executives is linked to performance through short- and long-term incentives. Details on each of these plans are outlined below.

Short-Term Incentive Plan (STI Plan)

The STI Plan is based 80% on financial performance (ROCCE) and 20% on individual goals that are critical to the overall success of the Company.

Executives are eligible to participate in the Company’s STI Plan. The table below summarises the key aspects of the STI Plan.

| | | | | | | | | | |

| Frequency, timing and form of award | | | | - Executives have an opportunity to earn an annual cash-based incentive based on the achievement of pre-defined targets over the financial year. - Individual goals and targets are set on an annual basis. - Payment is made in September following the finalisation of the audited financial results. | | |

| Target and maximum STI opportunities | | | | - The STI target opportunity is 130% of fixed remuneration for the Executive Director and 100% of fixed remuneration for Executives. - The STI opportunity ranges from a minimum of nil payment to a maximum opportunity of 200% of the target opportunity for all Executives. | | |

Performance measures for the Executive Director and Executives | | | | | | |

| | | | | | Financial measures | | Individual measures | | |

| | | Weighting | | • 80% | | • 20% | |

| | | Metrics | | • Based on ROCCE targets1,

taking into account Group or business unit cost of capital. • Group Executives–

ROCCE is based wholly on overall Group performance. • Regional Executives–

ROCCE is based wholly on the results of their own business units. | | • Individual goals are set in several key performance areas which focus on individual initiatives that are critical to the overall success of the Company. They may include: - Safety (i.e., reduction in certain safety metrics) - Implementation of certain aspects of the Company strategic plan - Talent Management

(i.e., succession planning, management development, etc.) - Sustainability - Shareholder and community relations | |

| | | 1. ROCCE is computed as Profit Before Interest and Taxes (PBIT) divided by Average Controlled Capital Employed (CCE). | |

15

| | |

| | | - The Company understands the desire for greater transparency of specific targets. However, given the Company’s size and position in the industry, we believe disclosing precise financial / individual performance targets would put us at a competitive disadvantage due to commercial sensitivity. Performance against the financial targets is set out in Section E. |

Rationale for performance measures | | - ROCCE has been approved by the Committee as the appropriate financial measure as the Committee believes that ROCCE is a key performance driver of the Group. ROCCE focuses on the effective management of invested capital while encouraging maximisation of operating profits. - The Company has chosen relevant individual performance measures to drive and reinforce the desired individual behaviours and outcomes, even in difficult economic and financial times. |

| Determination of performance measures | | - The financial targets for Executives are recommended each year by the Executive Director and reviewed by the Committee for recommendation to the Board for approval. The financial targets for the Executive Director are recommended by the Committee and approved by the Board. The financial targets are determined by taking into consideration stretch performance targets in the context of the economic cycle. - Individual goals and targets for Executives are established on an annual basis by the Executive Director, taking into consideration the Executive’s required goals to support the Company’s strategic plan. The individual goals and targets for the Executive Director are recommended by the Committee for approval by the Board. |

Assessment of performance against measures | | - Threshold, target and maximum individual award opportunities have been established and vary by position. - A minimum ROCCE threshold and individual level of performance must be met for executives to be eligible for payment. Payment between threshold and maximum is then determined by reference to ROCCE and individual performance outcomes against pre-defined targets. Once the threshold hurdle is met, awards are linear in calculation until the maximum hurdle is reached. - At the end of the financial year, each executive’s individual performance is assessed based on appropriate ROCCE performance (e.g., overall Group performance or the relevant business unit) and a review of individual performance achievement against pre-defined key performance areas. - The individual’s performance is rated on a scale of 0 to 4. Participants must receive a weighted average rating of at least 2.0 (meets expectations) in order to receive target payment based on the individual performance component. A rating below 1.75 results in no award with regard to the individual performance component. - Executive performance is assessed by the Executive Director, and recommended payments are considered and, if appropriate, approved by the Committee. For the Executive Director, performance is assessed by the Committee and a recommended payment is approved by the Board. - Performance against the financial targets is set out in Section E. |

| Termination provisions | | - A voluntary termination or termination for cause prior to the last calendar day of the financial year will result in no STI being paid for the year unless the Committee determines otherwise. - Upon a qualifying cessation (i.e., termination due to death, disability or redundancy), STI performance for the relevant period will be assessed and paid. |

Long-Term Incentive Plan (LTI Plan)

The LTI Plan aligns executive rewards with the shareholder experience through the use of relative TSR and absolute share price.

The Committee believes that executive participation in equity-based incentive plans is a key element which aligns executive and shareholder objectives. The Company’s LTI Plan is the principal means of allowing executives the opportunity to be rewarded for the Company’s growth in share price and total shareholder return. The LTI Plan provides a direct link between the value created for shareholders, and the reward earned by executives. It also assists in the retention of executives.

The LTI Plan allows for grants of performance rights (rights), options and phantom options. The LTI Plan structure is designed to focus on two key aspects of future performance. First, rights recognise shareholder value

16

creation relative to companies either within the Company’s industry or of a similar nature, as measured by TSR. Second, options (and phantom options where applicable) reflect creation of absolute shareholder value, as recognised by absolute growth in the Company’s share price.

| | |

Performance Rights | | - A right is a contractual right to acquire an ordinary share for nil consideration. United States participants have their rights settled in American Depositary Shares (ADSs). - Rights reward executives for relative performance as a relative total shareholder return (TSR) hurdle must be satisfied in order for the rights to vest. Accordingly, for participants to receive any value from the plan, the Company’s TSR performance must be above the median against the peer group. |

| Options | | - An option is a contract that gives the holder the right, but not the obligation, to acquire an ordinary share at a fixed price over a specified period of time. United States participants have their options settled in ADSs. - Options reward executives for absolute share price performance. This is because the options only have value if the share price exceeds the exercise price at the end of the vesting period. The options are also subject to a continuous service vesting condition. This reflects common market practice in the United States, where the Company competes for much of its talent and business. |

| Phantom Options | | - Phantom options operate in the same manner as options; however, they are cash-settled rather than equity-settled. Accordingly, rather than receiving one fully paid ordinary share in the Company upon exercise, the executive receives the value of one fully paid ordinary share in the Company in cash. - Phantom options (as opposed to equity-settled options) have been offered to participants in Australia and India from 1 July 2010 onwards because of the differing securities laws and taxation treatments in those jurisdictions. |

The Board believes that the combined rights / options structure provides an appropriate balance in terms of ensuring that rewards for executives are competitive, aligned to the Company’s global business and its shareholders, and reflect market practice in Australia, the United States and the United Kingdom. In addition, this structure is more rigorous than other structures commonly seen in the Australian market where, in difficult economic conditions, 100% of the LTI opportunity can vest if relative TSR performance is strong but no shareholder value has been created.

The following table summarises the LTI Plan as it relates to grants made in the 2012 financial year.

| | | | | | |

| | | Options / Phantom Options | | Rights |

| Frequency and timing of awards | | - The Company’s shareholders approved an LTI award for the Executive Director at the Company’s 2011 Annual General Meeting. In conjunction with that meeting, the Committee approved and granted LTI awards for the Executives. - Awards are typically made on an annual basis. |

| Valuation of grants | | - The fair value of rights and options is calculated by Mercer, the Company’s external valuation consultant, at their grant date using a Black-Scholes, Binomial or Monte Carlo simulation option pricing model as appropriate. See Note 24 of the financial report for assumptions used in determining the fair value. |

| Treatment of dividends | | - Holders of rights and options are not entitled to dividends over the term of the relevant vesting period (and in the case of options, until exercised). |

| Performance conditions | | Performance measure and rationale | | - In order for options to deliver value to participants, the Company’s share price must increase above the exercise price. This aligns the award’s value to absolute growth in shareholder wealth, as measured by share price. | | - In order for rights to vest, the Company’s TSR must be at the 51stpercentile or higher against a comparator group of companies. Above the 51st percentile,vesting is prorated, with full vesting occurring at the 75thpercentile. TSR aligns the vesting of executive awards to relative shareholder wealth creation. |

| | Performance period | | - Options generally vest in three equal instalments over a three-year period. This vesting schedule reflects common United States practice.1 - Options expire seven | | - Performance is measured over an initial three-year period starting 1 July 2011 through 30 June 2014, with two potential annual re-tests at Year 4 (30 June 2015) and Year 5 (30 June 2016). - The potential tests at Year 4 and Year 5 will be measured over the extended four-year and five-year periods respectively. |

17

| | | | | | | | | | |

| | | Options / Phantom Options | | Rights |

| | | | | years after the date of grant. | | . | | - Respectful of the feedback from shareholders and shareholder advisory groups, the Board and the Committee continue to maintain a firm belief that re-testing motivates executives to exert an extra level of effort in the years subsequent to the original performance period to bring performance above the median of (or higher than) the comparator group. Where executives receive value from the re-test, shareholders will also have experienced enhanced relative shareholder returns in those subsequent years. Accordingly, re-testing has been maintained for the 2012 financial year. - Any unvested rights outstanding at the end of Year 5 will immediately lapse. |

| | Exercise price | | - The exercise price of options is set at grant, and is equal to the average closing share price for the five days preceding the grant date2. | | | | - Nil |

| | Comparator group | | - N/A | | | | - The following companies comprise the current comparator group, chosen from comparable industry sectors: |

| | | | | | Peer companies |

| | | | | | AK Steel | | Arrium (formerly OneSteel) |

| | | | | | Alcoa | | Posco |

| | | | | | Allegheny Technologies | | Reliance Steel |

| | | | | | ArcelorMittal | | Schnitzer Steel |

| | | | | | BlueScope Steel | | Steel Dynamics |

| | | | | | Commercial Metals | | Tokyo Steel |

| | | | | | Gerdau | | U.S. Steel |

| | | | | | Nucor | | |

| | Vesting schedule | | - N/A | | | | The vesting schedule against the relative TSR hurdle is: |

| | | | | | TSR growth relative to the comparator group | | Proportion of TSR grant vesting |

| | | | | | Less than 51stpercentile | | 0% |

| | | | | | 51stpercentile | | 50% |

| | | | | | 51stpercentile to 75thpercentile | | Pro-rata straight line |

| | | | | | 75thpercentile or higher | | 100% |

| Treatment of awards on termination of employment | | - Where participants resign, or are terminated for cause, awards are forfeited. - Where termination of employment is the result of a qualifying cessation (i.e., death, total or permanent disablement, or other circumstances at the discretion of the Board), participants will be entitled to unvested awards in accordance with the original vesting schedule. - Any unvested awards will continue to be held by eligible terminated participants and will be tested at the end of the initial performance period. However, no additional re-testing will be permitted. Any unvested awards lapse at the end of the initial performance period, subject to the Board’s discretion. |

| Treatment of awards on change of control | | - A change in control of the Company may trigger full vesting of awards, subject to Board discretion in certain circumstances. |

| | 1. | Each instalment vests following the date the Company announces its annual financial results to the Australian Securities Exchange (ASX) for its 2012, 2013 and 2014 financial years. |

| | 2. | For United States executives, option awards are not Incentive Stock Options for the purposes of section 422 of the United States Internal Revenue Code. |

18

Guidelines for Group CEO approval of Discretionary Awards

In the 2011 financial year, the Committee implemented clearly defined Group CEO approval authority limits for individual discretionary cash awards and aggregate discretionary cash and/or equity awards.

With regard to individual awards, any individual discretionary cash award in excess of US$500,000 must be presented to the Committee for approval. With regard to aggregate awards, if the aggregate sum of the cash and/or equity award per occurrence is in excess of the Group CEO Discretionary Capital Expenditure authority (currently US$1,000,000), then it must be presented to the Committee for approval.

Securities Trading Policy

The trading of securities issued to participants pursuant to the Company’s LTI Plan is subject to, and conditional upon, compliance with the terms of the Company’s policy titledDealingsin SimsMetalManagementLimited Securities (a copy of which is available on the Company’s website atwww.simsmm.com). Executives are prohibited from entering into any hedging arrangements over unvested awards under the Company’s LTI Plan. The Company would consider a breach of the insider securities trading policy as serious misconduct, which may lead to disciplinary action up to and including dismissal.

19

E: REMUNERATION OUTCOMES FOR EXECUTIVES DURING THE 2012 FINANCIAL YEAR, INCLUDING DISCUSSION OF THE LINKAGE BETWEEN ‘AT-RISK’ REMUNERATION AND COMPANY PERFORMANCE

Overview of the link between remuneration and performance

In accounting for the Group’s performance and benefits for shareholder wealth, the Committee considers the following indices in respect of the current financial year and the previous four financial years.

| | | | | | | | | | | | | | | | | | | | |

| | | 20121 | | | 2011 | | | 2010 | | | 20091 | | | 2008 | |

(Loss)/Profit Before Interest and Tax (A$m)2 | | | (514.8) | | | | 299.7 | | | | 205.7 | | | | (105.6) | | | | 687.9 | |

Diluted EPS (cents)3 | | | (253.3) | | | | 93.3 | | | | 64.5 | | | | (82.5) | | | | 306.3 | |

Return on Shareholders’ Equity | | | (21.8)% | | | | 6.6% | | | | 3.9% | | | | (5.3)% | | | | 15.5% | |

Total dividends (cents) | | | 20.0 | | | | 47.0 | | | | 33.0 | | | | 38.0 | | | | 130.0 | |

Share price at 30 June A$ | | | 9.61 | | | | 17.65 | | | | 17.11 | | | | 26.51 | | | | 41.69 | |

1 2012 and 2009 financial years reflect non-cash goodwill and other intangible impairment charges of A$615.1 million and A$191.1 million, respectively.

2Profit/(loss) before interest and tax for the 2008 to 2011 financial years have been adjusted to reflect a reclassification of income tax expense for equity accounted investments which were previously included within income tax expense. See Note 1(b) of the financial report.

3 Diluted EPS for the 2008 to 2010 financial years have been adjusted to reflect the shares issued in connection with the institutional placement and share purchase program in November and December 2009. See Note 4 of the financial report.

PBIT is used as one of the financial performance metrics in setting the STI Plan hurdles, as it is this figure divided by Average Controlled Capital Employed that determines ROCCE.

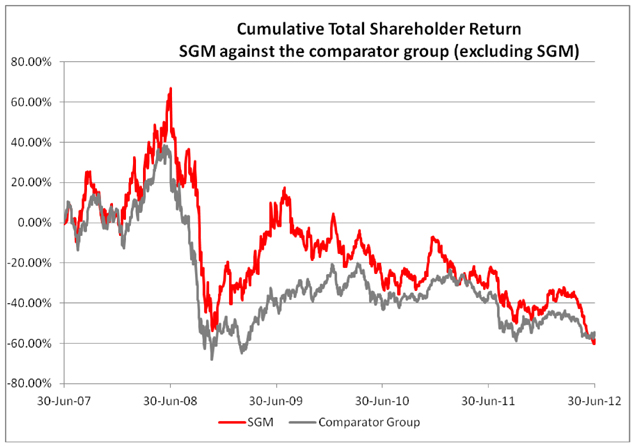

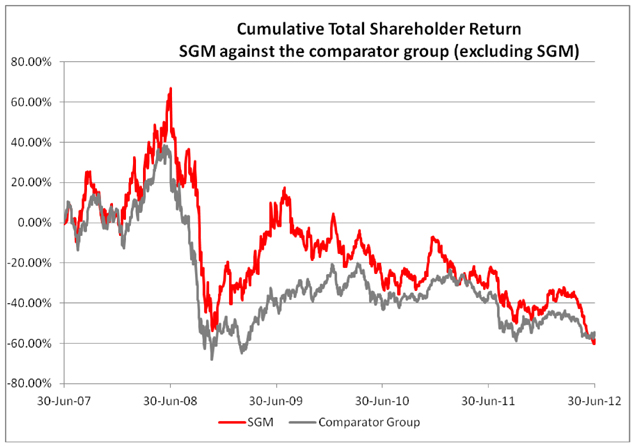

Dividends, share price and return on shareholders’ equity are included in the TSR calculation, which is the performance criteria assessed for the LTI Plan. The TSR graph below compares the Company (‘SGM’)’s TSR against the LTI comparator group (as referenced above) for the five-year period ending 30 June 2012. TSR is the return to shareholders provided by share price appreciation plus dividends (which are assumed to be reinvested in the Company’s shares) expressed as a percentage of the share price at the beginning of the measurement period, adjusted where appropriate for bonus issues, capital consolidation or equivalents.

20

Short-term incentives

As noted previously, STI Plan measures are based on financial performance (ROCCE) and individual performance measures. The table below outlines 2012 financial year Group and business unit performance against STI Plan ROCCE targets.

| | | | | | |

| Name | | Business Unit | | ROCCE Performance | | |

D Dienst | | Group | | Below Threshold | | |

G Davy | | Global SRS (less United Kingdom SRS) | | Above Threshold | | |

G Davy | | United Kingdom Metals/United Kingdom SRS | | Below Threshold | | |

R Kelman | | North America Metals | | Below Threshold | | |

R Larry | | Group | | Below Threshold | | |

D McGree | | Australia Metals | | Below Threshold | | |

D McGree | | New Zealand Metals | | Above Threshold | | |

A Ratner | | Group | | Below Threshold | | |

The following table outlines the proportion of the target STI that was earned and forfeited in relation to the 2012 financial year. Both ROCCE and individual performance influences individual STI payments.

| | | | | | | | |

| Name | | Proportion of target STI earned during the 2011 financial year | | Proportion of target STI

forfeited during the 2011 financial year | | Proportion of target STI

earned during the 2012 financial year | | Proportion of target STI

forfeited during the 2012 financial year |

D Dienst | | 95% | | 5% | | 20% | | 80% |

G Davy | | 148% | | 0% | | 41% | | 59% |

R Kelman | | 20% | | 80% | | 20% | | 80% |

R Larry | | 95% | | 5% | | 20% | | 80% |

D McGree | | 102% | | 0% | | 34% | | 66% |

A Ratner | | 20% | | 80% | | 20% | | 80% |

21

Long-term incentives

Actual vesting outcomes of the rights granted in the 2008, 2009 and 2010 financial years, as a result of the Company’s performance, are outlined in the table below.

| | | | | | | | | | | | | | | | |

| | | | | | | 2008 grant1 | | | | | | | | | | |

| | | % of Rights | | % of Rights | | Additional % of | | | | Total % of | | | | Total % of | | |

| | | that | | that | | Rights that will | | | | Rights that | | | | Rights that | | |

| | | vested in 2011 | | vested in 2012 | | vest in 2013 | | | | vested | | | | will be | | |

| | | (based on | | (based on | | (based on | | | | | | | | forfeited | | |

| | | performance | | performance | | performance | | | | | | | | | | |

| | | over initial | | over extended | | over extended | | | | | | | | | | |

| | | three-year | | four-year period | | five-year period | | | | | | | | | | |

| | | period to 30 | | to 30 June 2011) | | to 30 June 2012) | | | | | | | | | | |

| | | June 2010) | | | | | | | | | | | | | | |

Relative TSR | | 59.6%2 | | 0%3 | | 0%3 | | | | 59.6% | | | | 40.4%3 | | |

| | | | | | | | | | | | | | | | | |

Earnings per | | 0% | | 0% | | 0% | | | | 0% | | | | 100% | | |

share (EPS) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Earnings | | 56.2% | | 43.8% (i.e., the | | n/a | | | | 100% | | | | 0% | | |

before | | | | full 100% of | | | | | | | | | | | | |

interest, tax, | | | | EBITDA rights | | | | | | | | | | | | |

depreciation | | | | became vested) | | | | | | | | | | | | |

and amortisation | | | | | | | | | | | | | | | | |

(EBITDA) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | 1. | The 2008 rights had an initial performance period from 1 July 2007 to 30 June 2010. They had re-tests on 30 June 2011 and 30 June 2012. Any rights that did not vest as of the end of the final performance period (30 June 2012) will be forfeited. |

| | 2. | This equated to a TSR percentile rank of 55.6%. |

| | 3. | No additional rights vested in the 2012 financial year or will vest in the 2013 financial year as the TSR performance ranks over the extended four-year and five-year periods were 54.2% and 45.8% respectively. These were below the initial performance rank of 55.6%. The remaining 40.4% of outstanding rights will be forfeited in August 2012. |

| | | | | | | | | | |

| | | 2009 grant1 | | | | | | 2010 grant3 |

| | | % of Rights that | | Additional % of Rights | | | | | | % of Rights that |

| | | vested in 2012 | | that will vest in 2013 | | | | | | will vest in 2013 |

| | | (based on performance | | (based on performance | | | | | | (based on performance |

| | | over initial three-year | | over extended four-year | | | | | | over the initial three-year |

| | | period to 30 June 2011) | | period to 30 June 2012) | | | | | | period to 30 June 2012) |

| | | | | | | | | | | |

Relative TSR | | 0%2 | | 0%2 | | | | | | 0%4 |

| | | | | |

| | | | | | | | | | | |

| | 1. | The 2009 rights had an initial performance period from 1 July 2008 to 30 June 2011. They had one re-test on 30 June 2012, and will have a final re-test on 30 June 2013. |

| | 2. | No rights vested in the 2012 financial year, and no additional rights will vest in the 2013 financial year, as the Company’s TSR percentile ranks were 43.8% and 43.8% respectively. |

| | 3. | The 2010 rights had an initial performance period from 1 July 2009 to 30 June 2012. They have two potential further test dates, one on 30 June 2013 and one on 30 June 2014. |

| | 4. | No rights vested as the Company’s TSR percentile rank was 25%. |

22

Statutory Executive Remuneration Disclosures

Certain Executives (as disclosed below) are not residents of Australia. Their respective remuneration paid in foreign currency has been converted to Australian dollars at an average exchange rate for the year. Both the amount of any remuneration and any movement in comparison to the prior year may be influenced by changes in the respective currency exchange rates.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | Short-term benefits | | Post-

employment

benefits | | Other | | Share- | | |

| (A$) | | Location | | Year | | Cash salary1 | | | Cash

bonus2 | | Other

benefits3 | | Pension and superannuation | | long-term

benefits4 | | based

payments5 | | Total |

| | | | | | | | | | | | | | | | | | | | |

Executive Director | | | | | | | | | | | | | | | | | | |

D Dienst6 | | USA | | 2012 | | | 1,288,885 | | | 819,653 | | 109,473 | | 37,594 | | - | | 4,281,770 | | 6,537,375 |

| | | | 2011 | | | 1,305,536 | | | 1,603,851 | | 44,043 | | 37,166 | | - | | 3,473,987 | | 6,464,583 |

Executives | | | | | | | | | | | | | | | | | | | | |

G Davy6 | | UK | | 2012 | | | 526,691 | | | 244,274 | | 32,107 | | 25,023 | | - | | 701,230 | | 1,529,325 |

| | | | | 2011 | | | 449,905 | | | 772,880 | | 32,780 | | 26,256 | | - | | 603,437 | | 1,885,258 |

R Kelman6 | | USA | | 2012 | | | 668,669 | | | 133,686 | | 92,863 | | 29,222 | | 4,845 | | 638,123 | | 1,567,408 |

| | | | | 2011 | | | 652,768 | | | 130,554 | | 36,972 | | 29,482 | | 5,060 | | 661,570 | | 1,516,406 |

R Larry6 | | USA | | 2012 | | | 644,442 | | | 128,888 | | 131,998 | | 29,734 | | 4,845 | | 852,834 | | 1,792,741 |

| | | | | 2011 | | | 652,768 | | | 616,866 | | 36,100 | | 31,731 | | 5,060 | | 959,237 | | 2,301,762 |

D McGree | | Australia | | 2012 | | | 621,557 | | | 244,923 | | 2,362 | | 108,773 | | 19,430 | | 393,231 | | 1,390,276 |

| | | | | 2011 | | | 605,611 | | | 720,391 | | 4,401 | | 105,603 | | 21,703 | | 575,638 | | 2,033,347 |

A Ratner6,7 | | USA | | 2012 | | | 644,442 | | | 128,888 | | 51,065 | | 18,015 | | - | | 638,123 | | 1,480,533 |

| | | | | 2011 | | | 652,768 | | | 130,554 | | 22,221 | | 18,236 | | - | | 714,755 | | 1,538,534 |

Total Executive Director & Executives | | 2012 | | | 4,394,686 | | | 1,700,312 | | 419,868 | | 248,361 | | 29,120 | | 7,505,311 | | 14,297,658 |

| | 2011 | | | 4,319,356 | | | 3,975,096 | | 176,517 | | 248,474 | | 31,823 | | 6,988,624 | | 15,739,890 |

1 Cash salary includes amounts sacrificed in lieu of other benefits at the discretion of the individual. Effective 1 February 2012, commensurate with the assumption of his new role and expanded responsibilities, Mr Kelman received a nine percent increase to his base salary.

2 Cash bonus amounts for 2012 and 2011 reflect the amounts accrued for all Executives under the 2012 and 2011 STI Plans respectively. The Company agreed to make a one-off payment to Mr Dienst of US$500,000 in exchange for an agreement to extend his existing contract through 30 June 2013.

3 Other short-term benefits include auto allowances, health and life insurance benefits, amounts accrued for annual leave during the period and personal security payments (for Mr Dienst). Effective for the 2011 financial year, the Company instituted a Paid Time Off policy for U.S. employees which included a carryover feature of up to two weeks. The amount for Mr Larry in 2012 also includes a one-time reimbursement (plus related gross-up) of expenses incurred arising from a medical injury that occurred while travelling internationally on Company business.

4 Other long-term benefits include amounts accrued for cash-based long-term incentive plans, long-service leave and deferred compensation plans.

5 Share-based payments represent the accounting expense (as computed pursuant to AASB 2 (IFRS 2), ‘Share-based Payments’) recognised by the Company for share-based awards.

6 Messrs Dienst, Larry, Ratner and Kelman receive their cash payments in United States dollars. Mr Davy receives his cash payments in pounds sterling.

7 Mr Ratner received an overpayment of his car allowance in prior years, which resulted in a repayment of A$14,169 in the 2011 financial year. The amounts reflected in the table above represent the actual amounts paid to Mr Ratner in the respective years. No adjustment has been made to reflect the related repayment. Mr Ratner’s 2012 remuneration disclosed above reflects his remuneration for the entire year. He ceased being classified as a KMP as of 31 January 2012.

23

Fixed and actual ‘at-risk’ remuneration for the 2012 financial year

Outlined below is the percentage of the Executives’ 2012 financial year remuneration that was fixed and ‘at-risk’ based upon the statutory remuneration table. The percentage of the value of their actual total remuneration that consisted of rights and options is also disclosed.

| | | | | | | | | | |

| | | Fixed

Remuneration

% | | ‘At-Risk’

Remuneration

% | | | | Remuneration

consisting of

Rights % | | Remuneration

consisting of

Options % |

| | | | | | | | | | | |

Executives | | | | | | | | | | |

D Dienst | | 22 | | 78 | | | | 46 | | 19 |

G Davy | | 38 | | 62 | | | | 27 | | 18 |

R Kelman | | 50 | | 50 | | | | 20 | | 20 |

R Larry | | 45 | | 55 | | | | 25 | | 22 |

D McGree | | 54 | | 46 | | | | 25 | | 3 |

A Ratner | | 48 | | 52 | | | | 21 | | 22 |

| | | | | | | | | | | |

24

F: EXECUTIVE CONTRACTS

Executive Director

The Executive Director’s contract with Metal Management, Inc. (MMI), entered into as of 26 July 2007, was amended as of 1 August 2009 and was due to expire on 30 June 2012. The Company and Executive Director have agreed that such contract will continue until 30 June 2013. The Company agreed to make a one-off payment to the Executive Director of US$500,000 in exchange for an agreement to extend the expiry / term of his existing contract through 30 June 2013.