Exhibit 99.6

Exhibit 99.6 Investor Presentation September 2012 Daniel W. Dienst Group Chief Executive Officer Robert C. Larry Group Chief Financial Officer Prepared for Today, Positioned for Tomorrow

|

|

Disclaimer This presentation may contain forward-looking statements, including statements about Sims Metal Management’s financial condition, results of operations, earnings outlook and prospects. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions. These forward-looking statements involve certain risks and uncertainties. Our ability to predict results or the actual effects of our plans and strategies is subject to inherent uncertainty. Factors that may cause actual results or earnings to differ materially from these forward-looking statements include those discussed and identified in filings we make with the Australian Securities Exchange and the United States Securities and Exchange Commission (SEC), including the risk factors described in the Company’s Annual Report on Form 20F, which we filed with the SEC on 14 October 2011. Because these forward-looking statements are subject to assumptions and uncertainties, actual results may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this presentation. All subsequent written and oral forward-looking statements concerning the matters addressed in this presentation and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this presentation. Except to the extent required by applicable law or regulation, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this presentation. Please visit our website (www.simsmm.com) for more information on the Company. Please note that all references to $ or dollars herein are references to Australian dollars, unless otherwise indicated. 2

|

|

Agenda

Sims Metal Management

Company Overview

Our Vision and Mission

Financial Overview

Safety

Above Ground Mining

Our Operating Space

Drivers of Growth

Macroeconomic Factors

Competitive Advantages

Strategic Priorities

Challenges

North America Metals

U.K. Metals & SRS

Australia Metals

Sims Recycling Solutions

Global Growth Strategy

Financial Review

Outlook

Conclusion

Company Overview

Sims Metal Management Limited (SimsMM) is an industry leader and the world’s largest listed recycler of both metals and electronics, handling 14.4 million tonnes of recyclable material in FY 2012. In FY 2012, SimsMM had $9 billion in sales, total assets of $3.6 billion and 6,600+ employees at 270 locations on five continents.

We specialise in the following types of recyclable materials:

Ferrous metals

Non-ferrous metals

Industrial and obsolete grades of scrap metal

Specialty alloys

Waste electronics and electrical equipment

Increasingly non-metallics, i.e. plastics

Domiciled in Australia and headquartered in New York, we generate approximately 88% of revenues from operations outside of Australia — in North America, the U.K., Continental Europe, New Zealand and Asia.

As of 30 June 2012, the Company had a gearing level of 11% of net debt to total capital.

SimsMM is publicly listed on the ASX and NYSE

World’s largest listed recycler, a leader in safety, sustainability and commitment to shareholder return.

Sims Metal Management: Our Vision and Mission

Through our extensive global network of facilities, we provide end-of-life solutions for obsolete metals and electronics and refine these materials into quality products for downstream customers such as steel mills, smelters and foundries.

Our vision is to be the premier global metals and electronics recycling leader. And the SAFEST.

We will increase shareholder and stakeholder confidence by driving efficiency and recovery gains in our existing businesses, while executing on growth strategies that expand our reach into attractive source markets. We will strive to achieve significantly improved ROE/ROCCE and a total shareholder return in the top quartile, or better, of our peer group.

SimsMM has nearly 100 years experience in developing best-in-class operational and commercial practices and has leveraged this success as a foundation to build a global recycling company of unparalleled scope and size.

Our global footprint now includes significant metals/electronics recycling businesses and investments in North America, the U.K., Continental Europe, Australasia, China, India and South Africa, as well as ferrous and non-ferrous trading platforms in New York and Hong Kong, respectively.

We will continue to drive improvements in our operational and commercial practices through our 6,600+ employees worldwide.

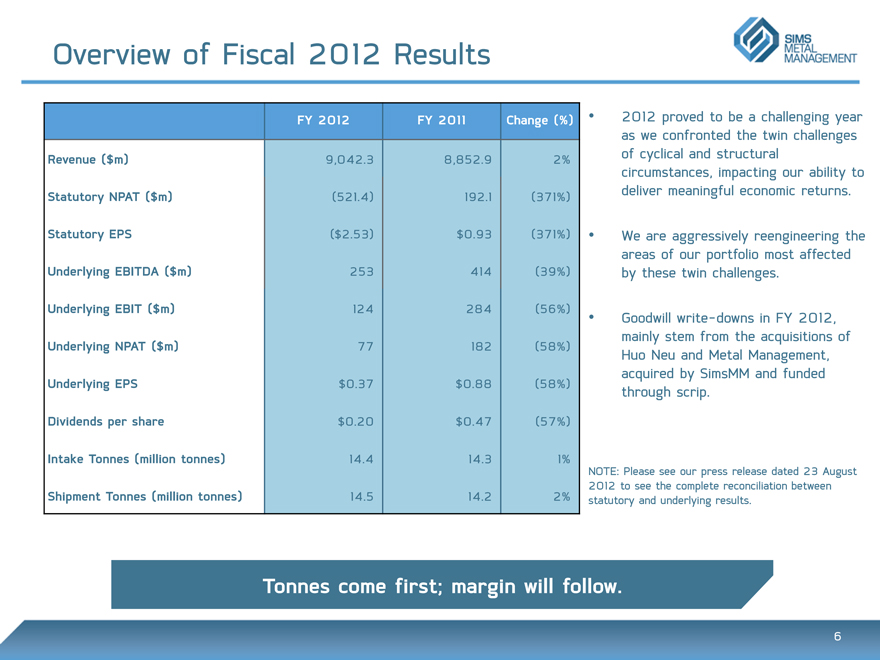

Overview of Fiscal 2012 Results

FY 2012 FY 2011 Change (%)

Revenue ($m) 9,042.3 8,852.9 2%

Statutory NPAT ($m) (521.4) 192.1 (371%)

Statutory EPS ($2.53) $0.93 (371%)

Underlying EBITDA ($m) 253 414 (39%)

Underlying EBIT ($m) 124 284 (56%)

Underlying NPAT ($m) 77 182 (58%)

Underlying EPS $0.37 $0.88 (58%)

Dividends per share $0.20 $0.47 (57%)

Intake Tonnes (million tonnes) 14.4 14.3 1%

Shipment Tonnes (million tonnes) 14.5 14.2 2%

2012 proved to be a challenging year as we confronted the twin challenges of cyclical and structural circumstances, impacting our ability to deliver meaningful economic returns.

We are aggressively reengineering the areas of our portfolio most affected by these twin challenges.

Goodwill write-downs in FY 2012, mainly stem from the acquisitions of Huo Neu and Metal Management, acquired by SimsMM and funded through scrip.

NOTE: Please see our press release dated 23 August 2012 to see the complete reconciliation between statutory and underlying results.

Tonnes come first; margin will follow.

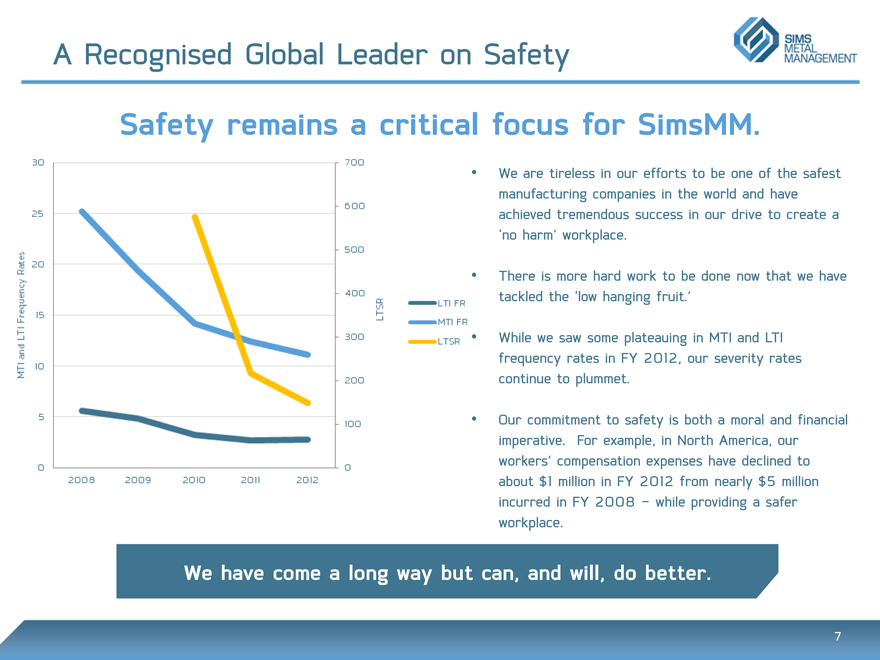

A Recognised Global Leader on Safety

Safety remains a critical focus for SimsMM.

We are tireless in our efforts to be one of the safest manufacturing companies in the world and have achieved tremendous success in our drive to create a ‘no harm’ workplace.

There is more hard work to be done now that we have tackled the ‘low hanging fruit.’

While we saw some plateauing in MTI and LTI frequency rates in FY 2012, our severity rates continue to plummet.

Our commitment to safety is both a moral and financial imperative. For example, in North America, our workers’ compensation expenses have declined to about $1 million in FY 2012 from nearly $5 million incurred in FY 2008 — while providing a safer workplace.

We have come a long way but can, and will, do better. .

An Above Ground Mining Company

At SimsMM, we believe in the increasing significance of total resource management for societies.

As countries continue to develop in the coming decades, the environmental and natural resource strains on our global society will be enormous, thereby increasing the importance of recyclable materials.

Societies’ demands on natural resources coupled with the increased awareness of the harmful effects of landfilling valuable recyclable materials will augment the relevance of companies like SimsMM.

We are an above ground mining company focused on (1) extracting recyclable materials from the communities in which we operate; (2) maximising value recovery; (3) delivering high quality, reliable raw materials to the downstream melting industry; (4) reselling e-components where appropriate; and (5) minimising waste.

SimsMM is well positioned as an ‘arbitrage’ agent to procure, process and ship scrap from developed economies to emerging markets that utilise scrap as a raw material. We are also poised to bring our expertise to ‘developing, developed’ emerging industrial and consumer economies.

Over the last several years we have invested $1 billion on improving our upstream, midstream and downstream capabilities in areas like source control, environmental & safety awareness, material recovery technology, information technology and access to premier consumer markets.

We are positioning to manage through the current depressed period, and our investments have positioned us to capture outsized margins as economic recovery takes hold.

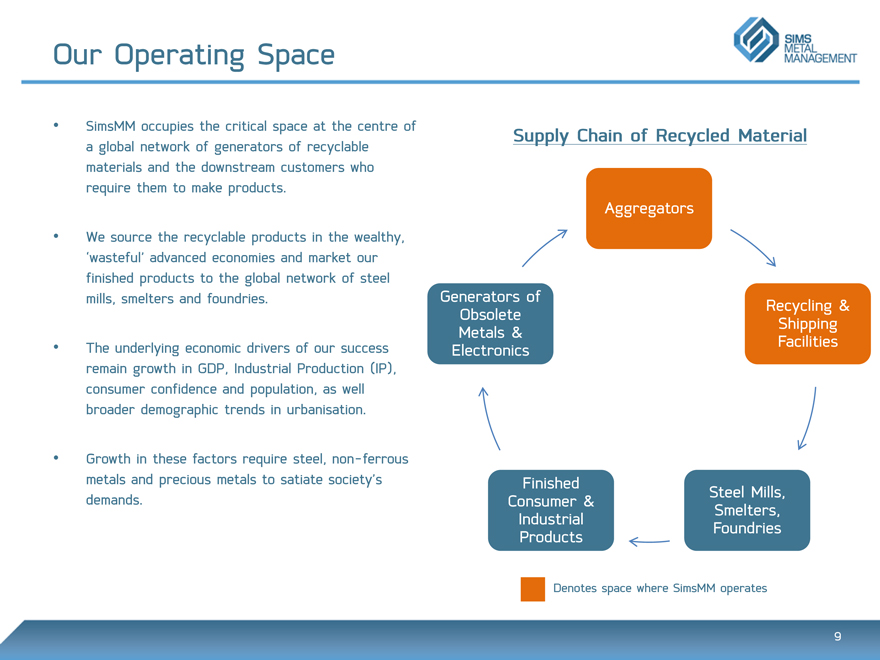

Our Operating Space

SimsMM occupies the critical space at the centre of a global network of generators of recyclable materials and the downstream customers who require them to make products.

We source the recyclable products in the wealthy, ‘wasteful’ advanced economies and market our finished products to the global network of steel mills, smelters and foundries.

The underlying economic drivers of our success remain growth in GDP, Industrial Production (IP), consumer confidence and population, as well broader demographic trends in urbanisation.

Growth in these factors require steel, non- ferrous metals and precious metals to satiate society’s demands. Denotes space where SimsMM operates

Supply Chain of Recycled Material

9

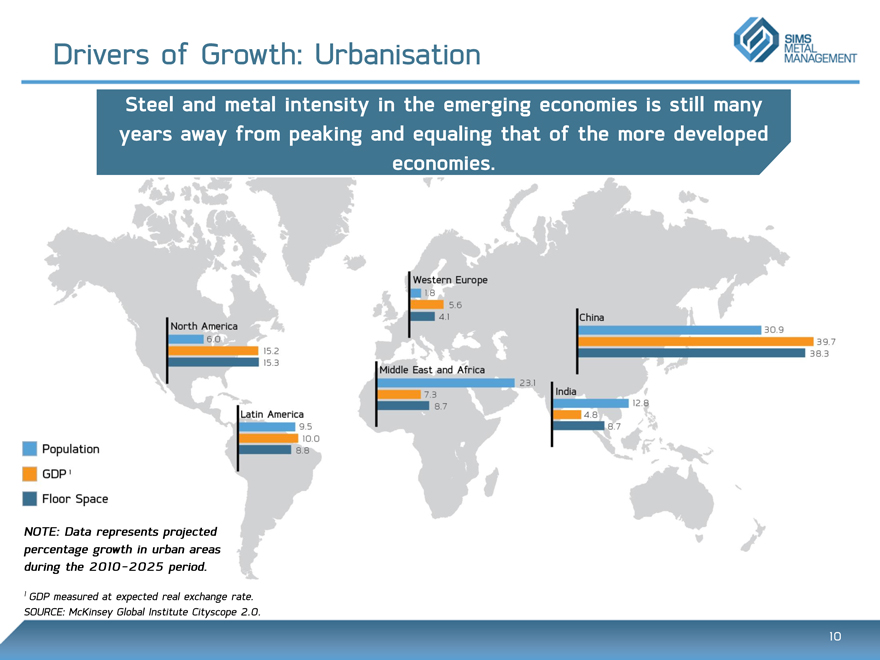

Drivers of Growth: Urbanisation

Steel and metal intensity in the emerging economies is still many years away from peaking and equaling that of the more developed economies.

NOTE: Data represents projected percentage growth in urban areas during the 2010-2025 period.

1 | | GDP measured at expected real exchange rate. SOURCE: McKinsey Global Institute Cityscope 2.0. |

10

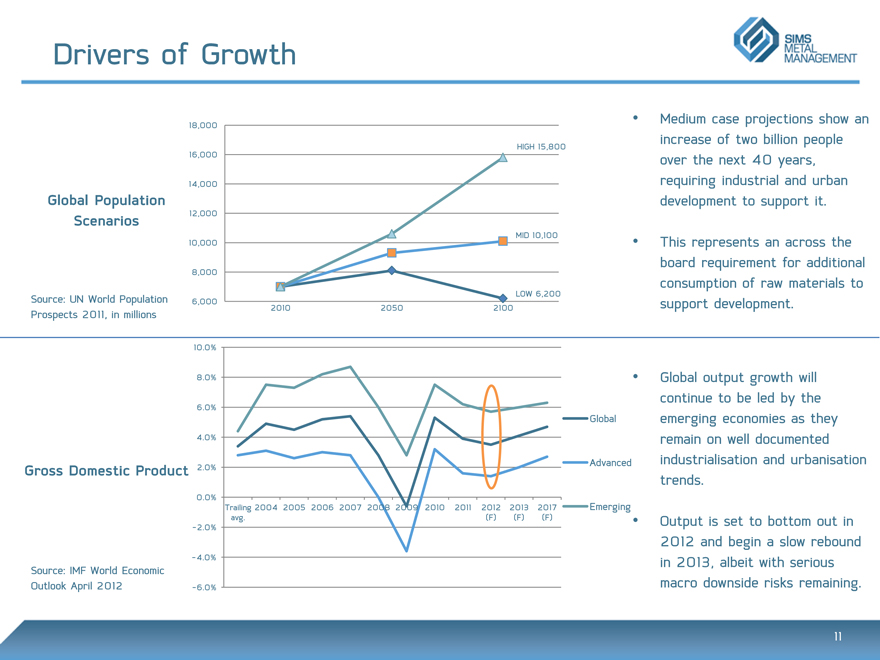

Drivers of Growth

Global Population Scenarios

Medium case projections show an increase of two billion people over the next 40 years, requiring industrial and urban development to support it.

This represents an across the board requirement for additional consumption of raw materials to support development.

Gross Domestic Product

Global output growth will continue to be led by the emerging economies as they remain on well documented industrialisation and urbanisation trends.

Output is set to bottom out in 2012 and begin a slow rebound in 2013, albeit with serious macro downside risks remaining.

Source: IMF World Economic Outlook April 2012

Source: UN World Population Prospects 2011, in millions

11

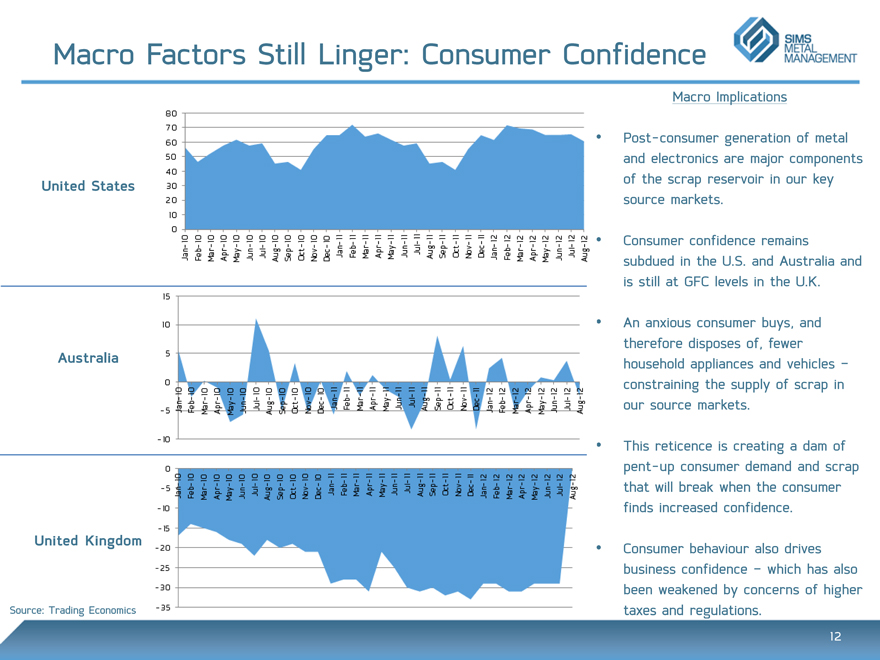

Macro Factors Still Linger: Consumer Confidence

United States

Australia

United Kingdom

Macro Implications

Post-consumer generation of metal and electronics are major components of the scrap reservoir in our key source markets.

Consumer confidence remains subdued in the U.S. and Australia and is still at GFC levels in the U.K.

An anxious consumer buys, and therefore disposes of, fewer household appliances and vehicles — constraining the supply of scrap in our source markets.

This reticence is creating a dam of pent-up consumer demand and scrap that will break when the consumer finds increased confidence.

Consumer behaviour also drives business confidence — which has also been weakened by concerns of higher taxes and regulations.

Source: Trading Economics

12

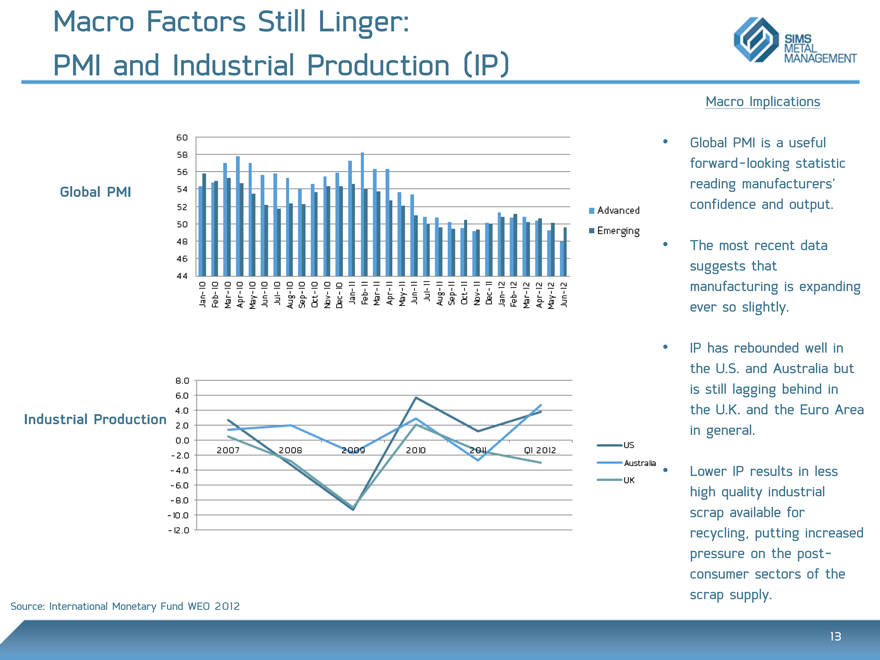

Macro Factors Still Linger: PMI and Industrial Production (IP)

Global PMI

Industrial Production

Macro Implications

Global PMI is a useful forward-looking statistic reading manufacturers’ confidence and output.

The most recent data suggests that manufacturing is expanding ever so slightly.

IP has rebounded well in the U.S. and Australia but is still lagging behind in the U.K. and the Euro Area in general.

Lower IP results in less high quality industrial scrap available for recycling, putting increased pressure on the post-consumer sectors of the scrap supply.

Source: International Monetary Fund WEO 2012

13

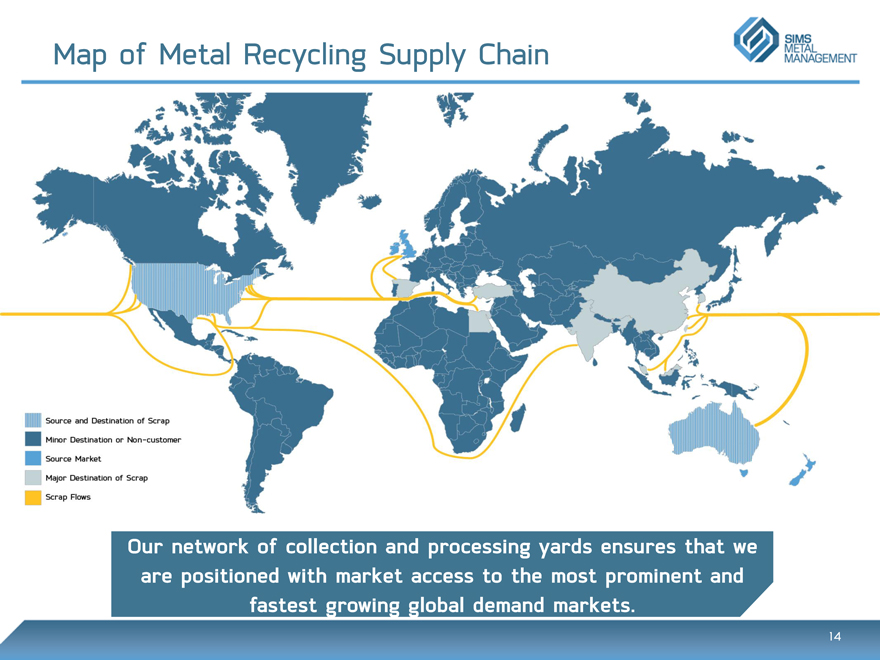

Map of Metal Recycling Supply Chain

Our network of collection and processing yards ensures that we are positioned with market access to the most prominent and fastest growing global demand markets.

14

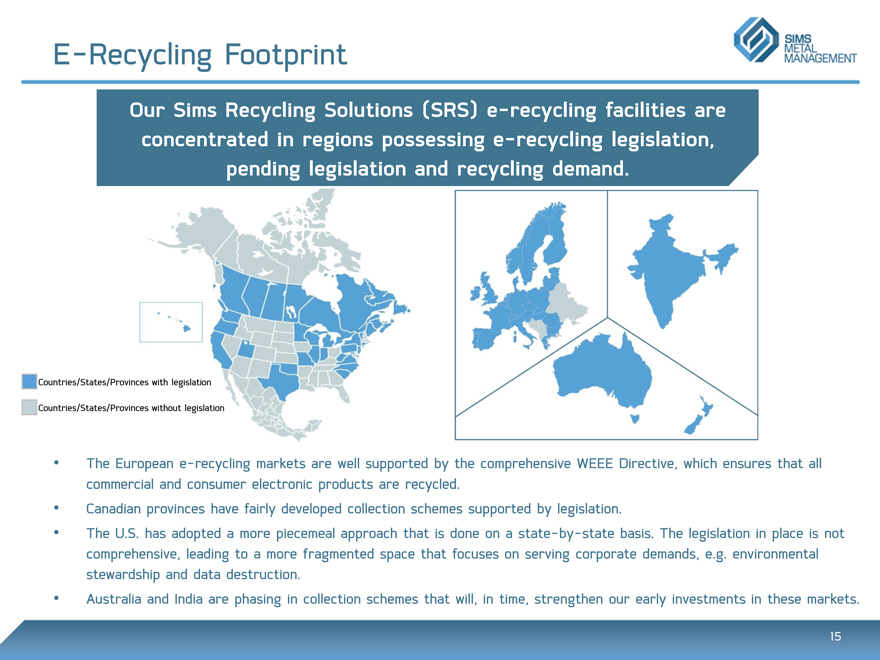

E-Recycling Footprint

Our Sims Recycling Solutions (SRS) e-recycling facilities are concentrated in regions possessing e-recycling legislation, pending legislation and recycling demand.

The European e-recycling markets are well supported by the comprehensive WEEE Directive, which ensures that all commercial and consumer electronic products are recycled.

Canadian provinces have fairly developed collection schemes supported by legislation.

The U.S. has adopted a more piecemeal approach that is done on a state-by-state basis. The legislation in place is not comprehensive, leading to a more fragmented space that focuses on serving corporate demands, e.g. environmental stewardship and data destruction.

Australia and India are phasing in collection schemes that will, in time, strengthen our early investments in these markets.

Countries/States/Provinces with legislation

Countries/States/Provinces without legislation

15

SimsMM Competitive Advantages

Our commitment to recruiting, training and employee engagement ensures that we have the best and most diverse workforce in the industry.

SimsMM is the world’s largest listed scrap metal and e-recycling company.

Separate divisions for stainless steel, brokerage, municipal recycling and aerospace metals.

| | 3. | | Financial Strength and Financial Opportunities |

We possess solid capitalisation with an abundance of opportunities for expansion and development/implementation of material recovery technology.

Facilities are located in premier material generation regions with maximum logistical flexibility to ensure access to the most lucrative downstream markets.

Global network ensures that SimsMM has access to first hand knowledge of developments in every corner of the industry.

| | 5. | | Technologically Advanced & Low Cost Operations |

SimsMM operates the most advanced material recovery operations in the industry with a focus on being the low cost producer while providing a safe environment for our employees, visitors and communities.

| | 6. | | Commitment to Corporate Environmental & Social Responsibility |

At the World Economic Forum in Davos, Switzerland, Corporate Knights named SimsMM #11 on the 2012 Global 100 Most Sustainable Corporations List – the fourth year in a row and our highest ranking to date.

16

FY 2013 Strategic Priorities

Build on the momentum of our business improvement efforts in North America Metals (NAM) and U.K. Metals and achieve meaningful increases in profit and higher returns for our shareholders.

Optimise current portfolio of assets.

Targeted Group-wide cost reductions of 75 bps (against FY 2012 sales) – phased in throughout H1 2013.

Widen gross margins.

Continue the development and implementation of industry leading material recovery technology.

Expand our position in the Australia and New Zealand scrap metal businesses.

Build on our first mover advantage in e-recycling business globally.

Advance SimsMM positioning in emerging economies, including the People’s Republic of China (PRC).

Nurture, invest, attract and retain the best and brightest in our industry.

Retain an unwavering commitment to a safe workplace.

17

Challenges

SimsMM’s global expansion strategy for the past 20 years focused on developing a recycling business in key source countries, principally in the large markets of North America and Europe. These large scrap generating markets were ripe for investment because they were highly fragmented and subject to powerful consolidation forces. SimsMM’s investments over the past decade were successful at increasing revenue and market position while delivering historically high returns on shareholder capital.

The scrap metal supply surge in the U.S. peaked in 2008 and came mainly from increased amounts of post-consumer goods like vehicles and appliances, causing the industry to expand capacity.

In the aftermath of the GFC, the strength of consumers in the U.S. and U.K. has been dulled, resulting in capacity increases that have outstripped supply increases.

We believe that the resulting weakness in the consumer sector is creating a massive backlog for new products, which, when met, will unleash a commensurate wave of supply to the scrap processors. At the same time, marginal capacity is being culled.

In FY 2013, we will improve earnings by reducing operating costs and improving gross margins, without sacrificing the operating leverage that we have built to allow maximum margin expansion when the economic climate improves.

18

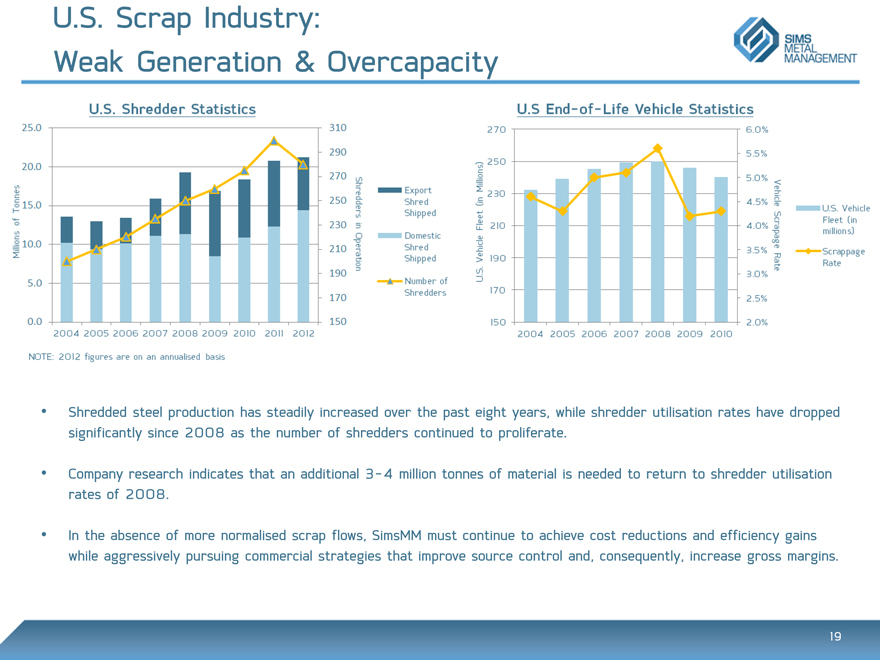

U.S. Scrap Industry: Weak Generation & Overcapacity

Shredded steel production has steadily increased over the past eight years, while shredder utilisation rates have dropped significantly since 2008 as the number of shredders continued to proliferate.

Company research indicates that an additional 3-4 million tonnes of material is needed to return to shredder utilisation rates of 2008.

In the absence of more normalised scrap flows, SimsMM must continue to achieve cost reductions and efficiency gains while aggressively pursuing commercial strategies that improve source control and, consequently, increase gross margins.

19

North America Metals: Our Largest Opportunity

H2 2012 marked a realignment of management and the start of our aggressive improvement efforts in NAM.

We repositioned the business to be a lower cost, flatter organisation – able to navigate the operating climate more nimbly.

We have made good progress on our goals in the last six months:

Implemented strategies that will save circa $50M in annualised operating costs in FY 2013.

Realigned leadership under one president.

Created smaller, more strategically aligned business units.

Established more rigorous and uniform cost measurement and recovery standards.

With the proper organisational framework and cost structures in place, we are positioned to accelerate the turnaround efforts in FY 2013 with the goal of becoming the lowest cost producer of scrap with the logistical flexibility to ship our products to the most lucrative markets.

FY 2013 initiatives include:

Aggressive source control strategies to improve gross margin and recoveries.

Reductions in operating and administrative costs.

Targeted capital reallocation among business units.

Regional expansion into scrap rich markets, unencumbered by overcapacity issues.

Installation of material recovery equipment in existing facilities.

Success on these fronts will result in a more cohesive, strategically aligned business that is able to capitalise on SimsMM’s competitive strengths and generate meaningfully higher return characteristics.

20

Reengineer U.K. Metals and U.K. SRS

Improving our competitive and technological positioning in the U.K. has been a top priority for management.

FY 2012 marked the culmination of many of these efforts with the acquisition/integration of Dunn Brothers (400K tonnes per annum) and the recent commissioning of our centralised third generation non-ferrous recovery plant and the world’s largest plastics recovery plant.

Our twin initiatives for FY 2013 are as follows:

Optimise assets

Phasing in significant cost reductions.

Targeted reductions of $18M per annum (anticipated to be in place by the end of H1 2013).

Capitalise on technology advancements.

Non-ferrous and plastics recovery plants to be significant contributors in FY 2013.

Ensure the right flow of materials to appropriate processing facilities.

Temporarily idle underutilised facilities.

Organisational realignment to improve accountability and business agility.

Improve source control

More feeder yards.

Improved commercial organisational structures – getting even flatter.

21

Expand Australia Metals

Our strategic focus has been, and continues to be, expanding Australia Metals as a distinct growth entity, investing in it as more than just a ‘high returning, mature’ asset.

We will build on our sustainable competitive advantages in the following areas:

Improve source control to ensure that we have the highest quality raw materials purchased from first phase generators of scrap metal.

Install advanced material recovery technology to maximise the value of existing material flows and reduce landfill costs.

Establish facilities to capture increasing flows of post-consumer and post-industrial materials in growing regions.

Leverage our ability to handle electronic materials to provide comprehensive end-of-life solutions for our communities and suppliers.

Continue to strategically evaluate divestiture of assets deemed ‘secondary’ or ‘non-core’ – the proceeds of which will be reinvested into businesses that are more integral to our portfolio or returned to shareholders.

22

Accelerate Growth for Sims Recycling Solutions

Our goal for SRS has been to develop and deliver innovative e-recycling services for communities, corporations and individuals.

We have been successful in establishing SRS as a global brand, operating on five continents, capable of providing these services to a growing customer and client list, which includes some of the world’s largest corporations and municipalities.

Our first mover status has been a major competitive advantage – one which is important to nurture and expand.

Our strategic foci include:

Continued development and installation of industry leading material recovery technology focused on complex, post-industrial materials (B2B recycling).

Continued regional expansion of current footprint in the North America and Europe, both organically and through acquisitions.

Low capitalised entry into emerging market countries with high per capita concentrations of electronic consumption.

Continued export of best-in-class technology and business practices from high developed e- recycling markets (U.K., Europe) to less developed ones (U.S., Australasia).

While we expect new competition to continue to emerge, we feel that our investments and growth will strengthen our advantages as we deploy technologies and business practices (developed in mature markets) to markets that are still developing.

We have developed a cohesive global strategy, tailored to local customs, that will ensure that we maintain our market leadership position in the rapidly growing e-recycling space.

23

Global Growth Strategy: Go to the Scrap!

In an effort to maintain our standing as the world’s leading recycling company, we diligently evaluate emerging markets that are, or will become, major generators of recyclable materials

Our global approach identifies attractive markets for entry and develops appropriate entry strategies.

The PRC has been a large area of focus for our global strategy because of its insatiable appetite for raw materials and its developing consumer economy; we engaged in a detailed market entry evaluation over a multiyear period.

In January 2012, we executed the first leg of our PRC entry plans by acquiring a significant minority holding (up to circa 20%) of publicly listed and fast-growing Chiho-Tiande Group (CTG).

We have targeted and are working to execute on SRS recycling opportunities in the Middle East, India and Africa, which have the ability to showcase the full recycling capability of SimsMM in these regions.

Our global non-ferrous/ferrous marketing prowess, traditional metals & e-recycling processing ‘know- how’ and high sustainability & safety profiles are key to acceptance in these markets.

24

Global Growth Strategy: CTG Investment

CTG Locations

The CTG investment provides upside exposure in a young, publicly listed company with immense growth potential, which shares SimsMM’s core values of returns, growth, safety and sustainability.

Upon completion of this investment, SimsMM and CTG executives have been working on the development of recycling opportunities that draw on each party’s respective abilities.

Through this investment we will gain unique insight into the PRC recycling industry that will inform how and when we continue to invest in this key obsolete metals and electronics producing market.

Additional investment will further leverage our leading supplier position to the PRC.

We believe in the sustainability of the PRC’s development. As fixed asset investment growth slows, domestic consumer spending will strengthen – supported by significant increases in real wages – producing increased volumes of obsolete post-consumer goods that will require end-of-life solutions.

The PRC will be a major force in the international recycling industry, and SimsMM will participate in it as the consumer market strengthens and becomes a major generator of scrap.

25

Financial Review

Our financial strength is a source of important advantages relative to our competition in every market in which we operate.

Despite the challenging operating climate in the post-GFC period, we have successfully invested in major facility and business improvements – from both free cash flow and financing activities – aggressively positioning ourselves for a better operating climate.

Our dividend policy remains 45%-55% of NPAT.

Despite our aggressive growth strategies of the last several years our net debt to total capital remains 11%.

We will continue to be opportunistic with the buy-back.

In the context of the historical volatility and uncertainty in the space, we believe that the disciplined, conservative approach to our capitalisation strategies is prudent.

26

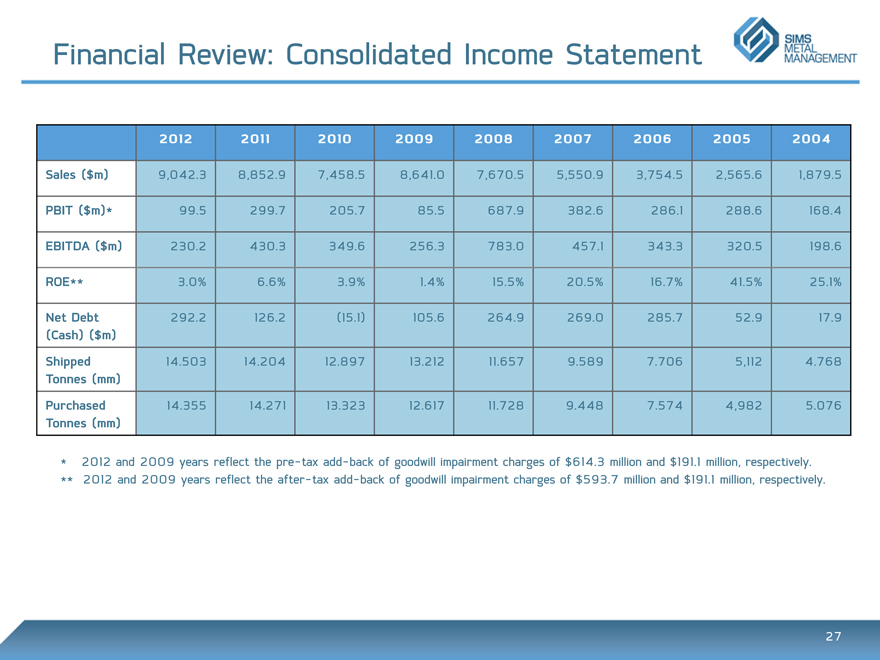

Financial Review: Consolidated Income Statement

2012 2011 2010 2009 2008 2007 2006 2005 2004

Sales ($m) 9,042.3 8,852.9 7,458.5 8,641.0 7,670.5 5,550.9 3,754.5 2,565.6 1,879.5

PBIT ($m)* 99.5 299.7 205.7 85.5 687.9 382.6 286.1 288.6 168.4

EBITDA ($m) 230.2 430.3 349.6 256.3 783.0 457.1 343.3 320.5 198.6

ROE** 3.0% 6.6% 3.9% 1.4% 15.5% 20.5% 16.7% 41.5% 25.1%

Net Debt (Cash) ($m) 292.2 126.2 (15.1) 105.6 264.9 269.0 285.7 52.9 17.9

Shipped Tonnes (mm) 14.503 14.204 12.897 13.212 11.657 9.589 7.706 5,112 4.768

Purchased Tonnes (mm) 14.355 14.271 13.323 12.617 11.728 9.448 7.574 4,982 5.076

* 2012 and 2009 years reflect the pre-tax add-back of goodwill impairment charges of $614.3 million and $191.1 million, respectively.

** 2012 and 2009 years reflect the after-tax add-back of goodwill impairment charges of $593.7 million and $191.1 million, respectively.

27

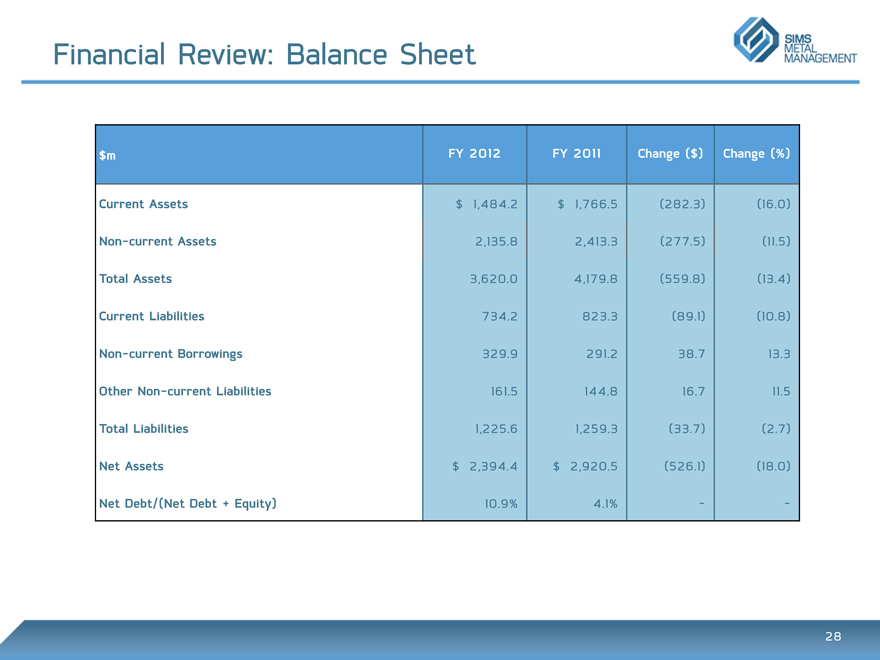

Financial Review: Balance Sheet

$m FY 2012 FY 2011 Change ($) Change (%)

Current Assets $ 1,484.2 $ 1,766.5 (282.3) (16.0)

Non-current Assets 2,135.8 2,413.3 (277.5) (11.5)

Total Assets 3,620.0 4,179.8 (559.8) (13.4)

Current Liabilities 734.2 823.3 (89.1) (10.8)

Non-current Borrowings 329.9 291.2 38.7 13.3

Other Non-current Liabilities 161.5 144.8 16.7 11.5

Total Liabilities 1,225.6 1,259.3 (33.7) (2.7)

Net Assets $ 2,394.4 $ 2,920.5 (526.1) (18.0)

Net Debt/(Net Debt + Equity) 10.9% 4.1%—-

28

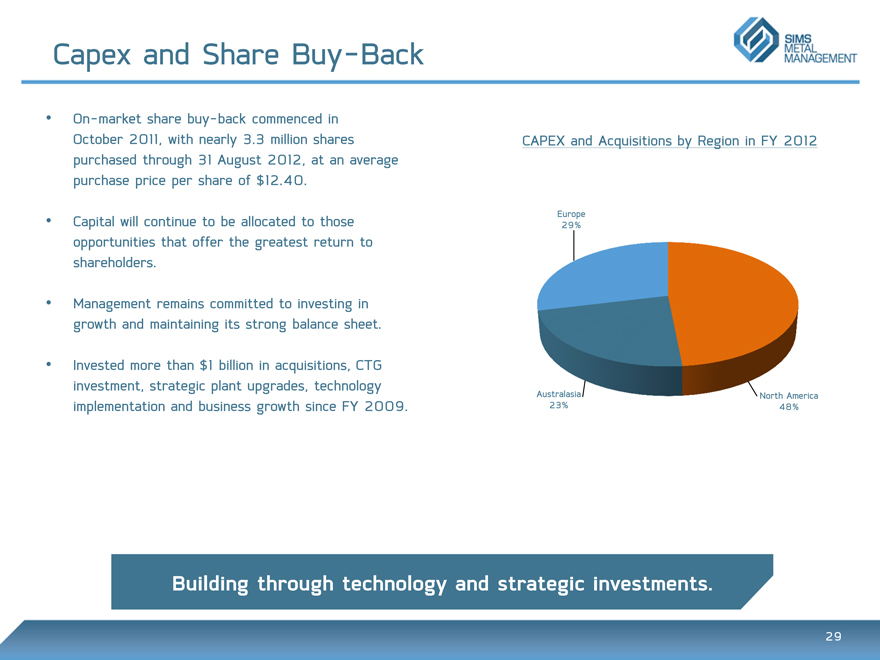

Capex and Share Buy-Back

On-market share buy-back commenced in October 2011, with nearly 3.3 million shares purchased through 31 August 2012, at an average purchase price per share of $12.40.

Capital will continue to be allocated to those opportunities that offer the greatest return to shareholders.

Management remains committed to investing in growth and maintaining its strong balance sheet.

Invested more than $1 billion in acquisitions, CTG investment, strategic plant upgrades, technology implementation and business growth since FY 2009.

CAPEX and Acquisitions by Region in FY 2012

Building through technology and strategic investment Building through technology and strategic investments.

29

Outlook

The last several years have presented an unprecedented series of challenges to recyclers.

We have taken many aggressive steps to optimise, improve and grow our businesses in order to produce meaningful returns on shareholder capital in the current and future fiscal years.

At the same time, we have executed, and will continue to execute, a growth strategy focused on regional/international expansion, facility improvement and technological development that has put SimsMM on the path to sustained success.

While we expect FY 2013 to present additional challenges as global macro uncertainty remains, we will rise and meet them – providing confidence to our shareholders and stakeholders that SimsMM is the premier recycling company in the world.

Our belief in the increased relevance of recycled materials as a major part of society’s total resource management is undiminished.

SimsMM’s ability to provide end-of-life solutions for obsolete metals and electronics is crucial for ‘our’ continued sustainable development.

Prepared for Today, Positioned for Tomorrow.

30

Conclusion

The last several years have been marked by extreme volatility and global/national economic recoveries that have had a number of false starts – significantly affecting our operating performance.

Throughout this period, we have accomplished the following:

Returned capital to shareholders.

Markedly improved the safety of our operations.

Aggressively repositioned the NAM, U.K. Metals and SRS businesses to succeed in a climate of increased competition and lower arisings.

Significantly enhanced our collection footprint and material recovery capabilities in North America, the U.K. and Continental Europe.

Invested in Australia Metals to expand its reach and deliver technological innovation in that market.

Expanded Global SRS to a $1 billion business in FY 2012 – with more growth ahead.

Developed and executed a global growth strategy that ensures that we will be scaleable players in significant new source markets for recyclable materials.

In FY 2013, we will build on these accomplishments and achieve higher returns for our shareholders while striving to consolidate our standing as the premier global recycler of metals and electronics.

31

Questions?

32