SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ Confidential, Use of the |

| x | | Definitive Proxy Statement | | Commission Only (as permitted by |

| ¨ | | Definitive Additional Materials | | Rule 14a-6(e)(2) |

| ¨ | | Soliciting Material Pursuant to | | |

| | | (§)240.14a-I1(c) or (§)240.14a-12 | | |

MICROTEK MEDICAL HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

MICROTEK MEDICAL HOLDINGS, INC.

512 Lehmberg Road

Columbus, Mississippi 39702

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 19, 2004

To the Shareholders:

The Annual Meeting of Shareholders of Microtek Medical Holdings, Inc. (the “Company”) will be held at the Hilton Atlanta Northeast, 5993 Peachtree Industrial Boulevard, Norcross, GA 30092, on Wednesday, May 19, 2004 at 3:00 p.m. for the following purposes, all as set forth in the attached Proxy Statement:

1. To elect six directors to serve for one-year terms expiring at the annual meeting in 2005 and until their successors are elected and qualified. The Board of Directors’ nominees are named in the attached Proxy Statement.

2. To consider and act upon a proposed amendment to the Company’s 1999 Long-Term Incentive Plan.

3. To transact such other business as may properly come before the meeting, or any adjournment thereof.

Only shareholders of record on the books of the Company at the close of business on April 1, 2004, are entitled to receive notice of and to vote at the meeting.

Shareholders are cordially invited to attend the meeting in person. However, whether or not you expect to attend, we urge you to read the accompanying Proxy Statement and then complete, sign, date and return the enclosed proxy card in the enclosed postage-prepaid envelope. It is important that your shares be represented at the meeting, and your promptness will assist us to prepare for the meeting and to avoid the cost of a follow-up mailing. If you receive more than one proxy card because you own shares registered in different names or at different addresses, each proxy card should be completed and returned.

|

Sincerely, |

|

|

|

Dan R. Lee |

President and Chief Executive Officer |

Columbus, Mississippi

April 19, 2004

MICROTEK MEDICAL HOLDINGS, INC.

512 Lehmberg Road

Columbus, Mississippi 39702

PROXY STATEMENT

for

Annual Meeting of Shareholders To Be Held May 19, 2004

GENERAL INFORMATION

This Proxy Statement is furnished to shareholders of Microtek Medical Holdings, Inc., a Georgia corporation (the “Company”), in connection with the solicitation by the Board of Directors of the Company (the “Board of Directors” or “Board”) of proxies for use at the Annual Meeting of Shareholders (the “Meeting”) scheduled to be held on Wednesday, May 19, 2004, at 3:00 p.m., Atlanta time, at the Hilton Atlanta Northeast, 5993 Peachtree Industrial Boulevard, Norcross, GA 30092, and at any and all adjournments or postponements thereof. This Proxy Statement and the accompanying form of proxy were first mailed to shareholders on or about April 19, 2004.

At the Meeting, shareholders of the Company will vote upon: (1) the election of six directors, (2) an amendment to the Company’s 1999 Long-Term Incentive Plan, and (3) such other business as may properly come before the Meeting and any and all adjournments thereof.

Voting Rights and Votes Required

The close of business on April 1, 2004, has been fixed as the record date for the determination of shareholders entitled to receive notice of and to vote at the Meeting. As of the close of business on such date, the Company had outstanding and entitled to vote 42,915,912 shares of Common Stock, $.001 par value per share (“Common Stock”).

A majority of the outstanding shares of Common Stock on the record date must be represented in person or by proxy at the Meeting in order to constitute a quorum for the transaction of business. The record holder of each share of Common Stock entitled to vote at the Meeting will have one vote for each share so held. Abstentions will be treated as Common Stock present and entitled to vote for purposes of determining the presence of a quorum.

Directors are elected by a plurality of the votes cast. Shareholders may not cumulate their votes. The six candidates receiving the highest number of votes will be elected. In tabulating the votes, abstentions and broker non-votes will be disregarded and have no effect on the outcome of the vote for the election of directors.

The affirmative vote of the holders of the majority of the shares of common stock voting on the proposal will be required to approve the amendment to the Company’s 1999 Long-Term Incentive Plan. In determining whether the amendment has received the requisite number of affirmative votes, broker non-votes and abstentions will be disregarded and will have no effect on the outcome of the vote.

Voting of Proxies

Shares represented by all properly executed proxies will be voted at the Meeting in accordance with the instructions specified thereon. If no instructions are specified, the shares represented by any properly executed proxy will be voted FOR the election of the nominees listed below under “Election of Directors” and FOR the proposed amendment to the 1999 Long-Term Incentive Plan.

The Board of Directors is not aware of any matter that will come before the Meeting other than as described above. However, if any such other matter is duly presented, in the absence of instructions to the contrary, such proxies will be voted in accordance with the judgment of the proxy holders with respect to such matter properly coming before the Meeting. There are no rights of appraisal or similar dissenter’s rights with respect to any matter to be acted upon pursuant to this Proxy Statement.

Revocation of Proxies

Any proxy given pursuant to this solicitation may be revoked by a shareholder at any time before it is exercised. Any proxy may be revoked by a writing, by a valid proxy bearing a later date delivered to the Company or by attending the Meeting and voting in person.

Solicitation of Proxies

The expenses of this solicitation will be paid by the Company. To the extent necessary to ensure sufficient representation at the Meeting, proxies may be solicited by any appropriate means by officers, directors and regular employees of the Company, who will receive no additional compensation therefor. The Company will pay persons holding shares in their names or in the names of their nominees, but not owning such stock beneficially (such as brokerage houses, banks and other fiduciaries), for the expense of forwarding soliciting material to their principals.

PROPOSAL 1: ELECTION OF DIRECTORS

Proxies will be voted with respect to the election of the following six nominees as directors to serve until the 2005 Annual Meeting of Shareholders or until their successors are elected and qualified. The election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares cast in the election of directors. The Board of Directors has no reason to believe that any of the nominees will be unavailable for service if elected, but if any are unavailable, proxies will be voted for such substitute as the Board may designate. This Board has determined that each of the directors named below, other than Dan R. Lee, is an independent director within the meaning of NASD Rule 4200(a)(15).

| | | | |

Name

| | Age

| | Director

Since

|

Dan R. Lee | | 56 | | 1996 |

Kenneth F. Davis | | 52 | | 1996 |

Michael E. Glasscock, III | | 70 | | 2002 |

Rosdon Hendrix | | 64 | | 1994 |

Gene R. McGrevin | | 61 | | 1997 |

Ronald L. Smorada | | 56 | | 1999 |

Dan R. Lee(age 56) was appointed Chairman of the Board of Directors effective July 1, 2002, and was appointed to serve as President and Chief Executive Officer of the Company in December 2000. Additionally, he continues his role as the President of Microtek Medical, Inc., a subsidiary of the Company. He became an executive officer of the Company following the conclusion of the acquisition of Microtek Medical, Inc. in 1996, and became a director of the Company in December 1996. Prior to accepting such positions with the Company, Mr. Lee had served as the Vice President and Chief Operating and Financial Officer of Microtek Medical, Inc. since 1987. Previous to that time, he was engaged in the public accounting practice, including more than five years with KPMG LLP.

Kenneth F. Davis(age 52) was elected a director of the Company in January 1996. Dr. Davis was a practicing surgeon on the staff of the Harbin Clinic and Redmond Regional Medical Center in Rome, Georgia

2

from 1986 to 2000. Dr. Davis now serves as the Chief Executive Officer and President of the Harbin Clinic, the largest multi-specialty clinic in Georgia. In addition, Dr. Davis serves on the Board of AmSouth Bank of Georgia, Adams Product Management, Hydro Dynamics, Inc. and the Georgia Land Trust.

Michael E. Glasscock(age 70) was appointed a director of the Company in December 2002. Dr. Glasscock, a physician, practiced otology and neurotology for 35 years and retired from the active practice of medicine in 1997. From 1997 to 1998, Dr. Glasscock served as Chairman of St. Cloud Medical, a physician practice management company, from 1998 to 2001 he served as Chairman of TrueSound, Inc., a hearing aid dispensing company, and since 2001 he has served as Chairman of Tympany, a start-up company that has developed an automated hearing test. Dr. Glasscock has published in excess of 250 scientific articles and founded the American Journal of Otology and the E.A.R. Foundation, was the past president of the American Otologic Society, and has been an active entrepreneur with several medical related companies.

Rosdon Hendrix(age 64) was elected a director of the Company in December 1994. Until he retired in June 1992, Mr. Hendrix served for approximately 30 years in various financial positions for General Motors Corporation, including serving as Resident Comptroller from 1975 until his retirement. Since June 1992, Mr. Hendrix has engaged in consulting for and efficiency consulting studies and other consulting services with various governmental authorities and businesses. In addition, since June 1997, Mr. Hendrix has performed information technology consulting services for Lockheed Martin. On December 1, 2003, Lockheed Martin’s Commercial Division was acquired by Affiliated Computer Services, Inc. (“ACS”), and Mr. Hendrix has been retained by ACS as a consultant.

Gene R. McGrevin(age 61) was appointed Chairman of the Board of Directors and acting President of the Company in April 1997, and currently serves as a director of the Company. Mr. McGrevin served as chairman of P.E.T.Net Pharmaceutical Services, LLC, a manufacturer and distributor of radiopharmaceuticals, from May 1997 until January 2001. Mr. McGrevin previously served as Vice Chairman and Chief Executive Officer of Syncor International Corp., a public company in the nuclear medicine industry, with which Mr. McGrevin was associated since 1989. Prior to managing Syncor, Mr. McGrevin served in executive positions with various healthcare businesses including President of the Healthcare Products Group of Kimberly-Clark Corporation, founder and President of a consulting firm specializing in the healthcare industry and an executive officer of VHA Enterprises, Inc. Mr. McGrevin is currently chairman of the executive committee of Hydro Dynamics, Inc. and serves as Chairman of the Board of Real Time Medical Data, LLC.

Ronald L. Smorada(age 57) was elected a director of the Company in May 1999. Dr. Smorada has been an active participant in the nonwovens industry. From 1995 to 1999, Dr. Smorada held senior management positions at Reemay, Fiberweb and BBA US Holdings, the latter being the parent of the former two with nonwoven sales in excess of $800 million, where he worked in the development, acquisition and integration of new and existing businesses, both domestic and international. Since 1999, Dr. Smorada has been involved with establishing new businesses which develop new technologies and markets. A major focus for Dr. Smorada has been the application and conversion of science and technical concepts into meaningful businesses.

Listed below is information regarding the executive officers of the Company who are not also directors.

J. Michael Mabry(age 41) was appointed Executive Vice President in October 1998 after serving as Vice President of Operations of the Company since May 1997. Mr. Mabry is currently serving as Chief Operating Officer of the Company. Additionally, he serves as Chairman of MindHarbor, Inc., a technology services provider, and as a director of Global Resources, Inc. (“GRI”), a material sourcing and manufacturing company. Prior to accepting the position of Executive Vice President, Mr. Mabry served in various positions with the Company (including Chief Information Officer) since his joining the Company in September 1995. From 1984 to 1995, Mr. Mabry was employed by DeRoyal Industries where his career advanced from software engineer to vice president of information systems and operations. He also serves as Secretary of the Company.

3

Roger G. “Jerry” Wilson(age 59) was appointed Chief Financial Officer, Treasurer and Assistant Secretary of the Company in December 2000. In addition to serving since July 1998 in the position of Vice President and Chief Financial Officer of Microtek Medical, Inc., Mr. Wilson served as Vice President of Finance for the Company’s former White Knight Healthcare subsidiary after its acquisition by the Company in 1995. Prior to accepting such positions, Mr. Wilson had served as corporate controller of White Knight Healthcare, Inc. since 1987. Mr. Wilson was also employed by Akzo America, Inc. for twelve years in various accounting and income tax management positions. Prior to that, Mr. Wilson, who is a Certified Public Accountant, practiced public accounting for seven years.

PROPOSAL 2: AMENDMENT OF STOCK OPTION PLAN

In March 1999, the Board of Directors approved and in May 1999 the Company’s shareholders adopted the 1999 Long-Term Incentive Plan (the “1999 Stock Option Plan”). In May 2002, the Company’s shareholders approved an amendment of the 1999 Stock Option Plan to add shares to the Plan. As of April 1, 2004, approximately 189,250 shares of Common Stock were available for future awards under the 1999 Stock Option Plan and options to purchase approximately 2,745,750 shares of Common Stock were outstanding under the 1999 Stock Option Plan. As of April 1, 2004, options to purchase 996,128 shares of Common Stock were outstanding under the 1992 Stock Option Plan. No additional awards may be made under the 1992 Plan. Accordingly, the Board of Directors has approved and recommended to the shareholders an amendment of the 1999 Stock Option Plan to add 2,145,000 shares to the 1999 Stock Option Plan. The following summarizes the terms and provisions of the 1999 Stock Option Plan as proposed to be amended.

Options and other stock awards may be granted under the 1999 Stock Option Plan to employees of the Company and certain subsidiaries and affiliated businesses (“Related Companies”), and directors, consultants and other persons providing key services to the Company. The Company estimates that, as of the date of this Proxy Statement, approximately 1,800 employees (including officers) and the five non-officer directors are eligible to participate in the 1999 Stock Option Plan. The following discussion summarizes the 1999 Stock Option Plan as proposed to be amended. Such discussion is qualified in its entirety by reference to the 1999 Stock Option Plan as proposed to be amended.

Shares Reserved for the Amended Plan

The Company’s 1999 Stock Option Plan provides for the grant of options (“Options”), stock appreciation rights (“SARs”) and other stock awards (“Stock Awards”) (collectively “Awards”) to acquire shares of Common Stock up to a maximum (“Plan Maximum”) of 5,345,000 shares (an increase from 3,200,000 shares as in effect before the proposed amendment) of Common Stock. In addition, the following limitations are imposed under the 1999 Stock Option Plan, as proposed to be amended: (1) a maximum of 5,345,000 shares (an increase from 3,200,000 shares as in effect before the proposed amendment) issued under Options intended to be Incentive Stock Options (“ISOs”) under Section 422 of the Internal Revenue Code (the “Code”), (ii) a maximum of 500,000 shares issued under Options and SARs to any one individual during any consecutive twelve month period, (iii) a maximum number of shares under other Awards of 5,345,000 shares (an increase from 3,200,000 shares as in effect before the proposed amendment), and (iv) a maximum payment under other Awards of $500,000 to any one individual for any performance goals established for any fiscal year (including the fair market value of stock subject to Awards denominated in shares). These maximums are subject to adjustment in the event of stock dividends, stock splits, combination of shares, recapitalization, reorganization, merger, consolidation, split-up, spin-off, exchange of shares or other changes in the outstanding Common Stock (“Corporate Transactions”). Any such adjustment will be made by the Committee (as defined below). The Plan Maximum shall not be reduced for shares subject to plans assumed by the Company in an acquisition of an interest in another company. Shares subject to Awards that are forfeited or canceled shall again be available for new Awards under the 1999 Stock Option Plan. Shares issued under the 1999 Stock Option Plan may consist, in whole or in part, of authorized and unissued shares or treasury shares.

4

The 1999 Stock Option Plan permits the grant of ISOs, non-qualified stock options (“NSOs”), SARs and other Stock Awards. The Compensation Committee will determine the terms and conditions of options granted under the 1999 Stock Option Plan, including the exercise price (“Exercise Price”), which may not be less than the fair market value of the Company’s Common Stock on the date of grant, all subject to certain limitations provided under the 1999 Stock Option Plan.

Awards may be settled through cash payments, the delivery of shares of Common Stock, or a combination thereof as the Committee shall determine. Any Award settlement, including payment deferrals, may be subject to such rules and procedures as it may establish, which may include provisions for the payment or crediting of interest, or dividend equivalents, including converting such credits into deferred Common Stock equivalents.

Purpose of Plan

The Company desires to (i) attract and retain persons eligible to participate in the 1999 Stock Option Plan (“Participants”); (ii) motivate Participants, by means of appropriate incentives, to achieve long-range goals; (iii) provide incentive compensation opportunities that are competitive with those of other similar companies; and (iv) further identify Participants’ interests with those of the Company’s other shareholders through compensation that is based on the Company’s Common Stock; and thereby promote the long-term financial interest of the Company and the Related Companies, including the growth in value of the Company’s equity and enhancement of long-term shareholder return. A portion of the options issued pursuant to the 1999 Stock Option Plan may constitute ISOs within the meaning of Section 422 of the Code, or any succeeding provisions. The 1999 Stock Option Plan is not qualified under Section 401(a) of the Code and is not subject to the provisions of the Employee Retirement Income Security Act of 1974.

Administration of the Plan

The 1999 Stock Option Plan is administered by the Compensation Committee (the “Committee”) appointed by the Board of Directors of the Company. Subject to the terms of the 1999 Stock Option Plan, in administering the 1999 Stock Option Plan and the Awards granted under the 1999 Stock Option Plan, the Committee will have the authority to (1) determine the directors, officers and employees of the Company and its subsidiaries and the consultants and advisors to whom Awards may be granted and the types of Awards; (2) determine the time or times at which Awards may be granted; (3) determine the option price for shares subject to each Option and establish the terms, conditions, performance criteria, restrictions and other provisions of each Award; (4) determine the extent to which Awards will be structured to conform to Section 162(m) of the Code; (5) establish terms and conditions of Awards to conform to requirements of jurisdictions outside the United States; and (6) interpret the 1999 Stock Option Plan and prescribe and rescind rules and regulations, if any, relating to and consistent with the 1999 Stock Option Plan.

Amendment of the Plan

The 1999 Stock Option Plan may be terminated or amended by the Board of Directors at any time, except that the following actions may not be taken without shareholder approval: (a) increasing the number of shares that may be issued under the 1999 Stock Option Plan (except by certain conforming adjustments provided for under the 1999 Stock Option Plan related to Corporate Transactions); or (b) amending the 1999 Stock Option Plan provisions regarding the limitations on the Exercise Price. Subject to modifications of Options to make equitable adjustments related to Corporate Transactions, Options which have been granted and remain outstanding under the 1999 Stock Option Plan may not be amended to reduce the Exercise Price of such Options without obtaining shareholder approval. In addition, no amendment or termination may, in the absence of written consent to the change by the affected Participant (or, if the Participant is not then living, the affected beneficiary), adversely affect the rights of any Participant or beneficiary under any Award granted under the 1999 Stock Option Plan prior to the date such amendment is adopted by the Board. Options may not be granted under the 1999 Stock Option Plan after the date of termination of the 1999 Stock Option Plan, but Options granted prior to that date shall continue to be exercisable according to their terms.

5

Eligibility for Participation

Each person who is serving as an officer, director, or employee of the Company or any of its subsidiaries is eligible to participate in the 1999 Stock Option Plan. Furthermore, certain consultants and advisors to the Company may also be eligible to participate in the 1999 Stock Option Plan.

Nothing contained in the 1999 Stock Option Plan or in any Option agreement may confer upon any person any right to continue as director, officer or employee of the Company or its subsidiaries or as a consultant or advisor, or limit in any way any right of shareholders or of the Board, as applicable, to remove such person.

New Plan Benefits

Options to purchase 2,745,750 shares of Common Stock are outstanding as of April 1, 2004 under the 1999 Stock Option Plan. Except as described below, no determination has been made by the Board or the Committee regarding the number of Awards to be granted to any executive officer, executive officers as a group, non-executive directors or non-executive employees. Beginning in 2002, in connection with the implementation of a multi-component compensation strategy, the Committee adopted a policy (which can be modified at any time at the discretion of the Committee) to grant to the Company’s Chief Executive Officer, Chief Financial Officer and Chief Operating Officer 100,000, 75,000 and 75,000 fully vested Options, respectively, as of each of February 1 and August 1 beginning in August 2002 and continuing through August 2005 having an exercise price set at the closing price of the Company’s shares on The Nasdaq Stock Market on their respective grant date and being exercisable over a ten year term (subject to earlier termination upon certain events) from their respective grant date. The Company has followed certain policies to regularly award Options to Nonemployee Directors on an annual basis as part of director compensation. See “Director Compensation” below. The following Options have been granted pursuant to the Company’s 1999 Stock Option Plan:

| | |

Dan R. Lee, President and Chief Executive Officer | | 450,000 |

J. Michael Mabry, Executive Vice President and Secretary | | 300,000 |

Roger G. Wilson, Chief Financial Officer | | 450,000 |

Current executive officers, as a group | | 1,200,000 |

Current non-employee directors | | 440,000 |

Employees, excluding current executive officers | | 1,735,000 |

Associates of Directors or Executive Officers | | 0 |

Other persons receiving 5% of such options | | 185,000 |

Option Exercise Price and Vesting

The Exercise Price per share for the shares subject to NSOs shall be at whatever price is approved by the Committee, but not less than the greater of the fair market value or par value per share of the Common Stock on the Pricing Date (as defined below). The Exercise Price per share for the shares subject to ISOs shall be not less than the fair market value per share of Common Stock on the Pricing Date, except that in the case of an ISO to be granted to an employee owning more than 10% of the total combined voting power of all classes of stock of the Company, the Exercise Price per share shall be not less than 110% of the fair market value per share of Common Stock on the Pricing Date. The “fair market value” shall generally be the closing sale price of the Common Stock on the date in question. The “Pricing Date” is the date on which the Option or SAR is granted, except that the Committee may provide that the Pricing Date is the date on which the recipient is hired or promoted (or similar event), if the grant of the Option or SAR occurs not more than 90 days after the date of such hiring, promotion or other event. The Committee determines the vesting provisions for each Option. On April 1, 2004, the closing sales price for the Common Stock as reported by The Nasdaq Stock Market was $4.57 per share.

Adjustments to Exercise Price and Number of Shares; Change of Control

In the event of a Corporate Transaction, the Committee may adjust Awards to preserve the benefits or potential benefits of the Awards. Action by the Committee may include adjustment of: (i) the number and kind of

6

shares which may be delivered under the 1999 Stock Option Plan; (ii) the number and kind of shares subject to outstanding Awards; and (iii) the Exercise Price of outstanding Options and SARs; as well as any other adjustments that the Committee determines to be equitable.

In the event of a Change of Control (as defined generally to include the acquisition by an individual entity or group of more than 15% of the outstanding Common Stock of the Company, a merger or consolidation of the Company or a sale by the Company of all or substantially all of the Company’s assets), any Award granted under the 1999 Stock Option Plan shall become exercisable except to the extent (a) the Award otherwise provides or (b) the exercisibility of such Award will result in an “excess parachute payment” within the meaning of the Code.

Duration and Termination of 1999 Stock Option Plan and Options

The 1999 Stock Option Plan shall be unlimited in duration and, in the event of 1999 Stock Option Plan termination, shall remain in effect as long as any Awards under it are outstanding; provided, however, that, to the extent required by the Code, no ISOs may be granted under the 1999 Stock Option Plan on a date that is more than ten years from the date the 1999 Stock Option Plan is approved by shareholders.

Each Option expires on the Expiration Date specified by the Committee. The “Expiration Date” with respect to an Option means the date established as the Expiration Date by the Committee at the time of the grant; provided, however, that the Expiration Date with respect to any Option shall not be later than the earliest to occur of: (a) the ten-year anniversary of the date on which the Option is granted; (b) if the Participant’s date of termination occurs for reasons other than retirement or early retirement, the one year anniversary of such date of termination; or (c) if the Participant’s date of termination occurs by reason of retirement or early retirement, the three year anniversary of such date of termination.

Means of Exercise of Options

An Option or an SAR shall be exercisable in accordance with such terms and conditions and during such periods as may be established by the Committee. The payment of the Exercise Price of an Option granted under the 1999 Stock Option Plan shall be subject to the following:

(a) The full Exercise Price for shares of Common Stock purchased upon the exercise of any Option shall be paid at the time of such exercise (except that, in the case of an exercise arrangement approved by the Committee and described below, payment may be made as soon as practicable after the exercise).

(b) The Exercise Price shall be payable in cash or by tendering shares of Common Stock (by either actual delivery of shares or by attestation, with such shares valued at fair value as of the day of exercise), or in any combination thereof, as determined by the Committee.

(c) The Committee may permit a Participant to elect to pay the Exercise Price upon the exercise of an Option by authorizing a third party to sell shares of Common Stock (or a sufficient portion of the shares) acquired upon exercise of the Option and remit to the Company a sufficient portion of the sale proceeds to pay the entire Exercise Price and any tax withholding resulting from such exercise, or the Company may choose to retain sufficient shares from the Option Exercise in satisfaction of the Exercise Price and tax withholding.

Non-transferability of Options

Except as provided by the Committee, no Option is transferable except by will or by the laws of descent and distribution. Shares subject to Options granted under the 1999 Stock Option Plan that have lapsed or terminated may again be subject to Options granted under the 1999 Stock Option Plan.

Restrictions on Stock Awards

Each Stock Award shall be subject to such conditions, restrictions and contingencies as the Committee shall determine. These may include continuous service and/or the achievement of performance measures designated by

7

the Committee. The performance measures that may be used by the Committee for such Awards shall be measured by revenues, income, or such other criteria as the Committee may specify. Subject to acceleration of vesting in the event of a Change of Control, each Stock Award shall be subject to forfeiture in the event the Participant’s date of termination occurs within the one year anniversary of the date on which the Stock Award is granted.

Tax Treatment

The following discussion addresses certain anticipated federal income tax consequences to recipients of Awards made under the 1999 Stock Option Plan as currently in effect and as proposed to be amended. It is based on the Code and interpretations thereof as in effect on the date of this Proxy Statement. This summary is not intended to be exhaustive and, among other things, does not describe state, local or foreign tax consequences.

A company, such as the Company, for which an individual is performing services will generally be allowed to claim as a deduction amounts that are includable in the income of such person as compensation income in the Company’s taxable year in which the employee’s taxable year of inclusion ends, provided that such amounts qualify as reasonable compensation for the services rendered. This general rule will apply to the deductibility of a Participant’s compensation income resulting from participation in the 1999 Stock Option Plan. The timing and amount of deductions available to the Company as a result of the 1999 Stock Option Plan will, therefore, depend upon the timing and amount of compensation income recognized by a Participant as a result of participation in the 1999 Stock Option Plan. The following discusses the timing and amount of compensation income which will be recognized by Participants and the accompanying deduction that may be available to the Company.

ISOs. A Participant to whom an ISO which qualifies under Section 422 of the Code is granted generally will not recognize compensation income (and the Company will not be entitled to a deduction) upon the grant or the exercise of the Option. To obtain nonrecognition treatment on exercise of an ISO, however, the Participant must be an employee of the Company or a subsidiary continuously from the date of grant of the option until three months prior to the exercise of the Option. (If termination of employment is due to disability of the Participant, ISO treatment will be available if the option is exercised within one year of termination). If an Option originally designated as an ISO is exercised after those periods, the option will be treated as an NSO for income tax purposes and compensation income will be recognized by the Participant (and a deduction will be available to the Company) in accordance with the rules discussed below concerning NSOs.

The Code provides that ISO treatment will not be available to the extent that the fair market value of shares subject to ISOs (determined as of the date of grant of the ISOs) which become exercisable for the first time during any calendar year exceeds $100,000. If the $100,000 limitation is exceeded, the Options in excess of the limitation are treated as NSOs when exercised.

While a Participant may not recognize compensation income upon exercise of an ISO, the excess of the fair market value of the shares of Common Stock received over the exercise price for the option is an adjustment for alternative minimum tax purposes and can affect the optionee’s alternative minimum tax liability under applicable provisions of the Code. The increase, if any, in an optionee’s alternative minimum tax liability resulting from exercise of an ISO will not, however, create a deductible compensation expense for the Company.

When a Participant sells shares of Common Stock received upon exercise of an ISO more than one year after the exercise of the Option and more than two years after the grant of the Option, the Participant will normally not recognize any compensation income, but will instead recognize capital gain or loss from the sale in an amount equal to the difference between the sales price for the shares of Common Stock and the option exercise price. If, however, a Participant sells the shares of Common Stock within one year after exercising the ISO or within two years after the grant of the ISO (an “Early Disposition”), the Participant will recognize compensation income (and the Company generally will be entitled to a deduction) in an amount equal to the lesser of (i) the excess, if any, of the fair market value of the shares of Common Stock on the date of exercise of

8

the Option over the option exercise price, and (ii) the excess, if any, of the sale price for the shares over the option exercise price. Any other gain or loss on such sales (in addition to the compensation income mentioned previously) will normally be capital gain or loss.

NSOs. A Participant to whom an NSO is granted will not normally recognize income at the time of grant of the Option. When a Participant exercises an NSO, the Participant will generally recognize compensation income (and the Company will be entitled to a deduction) in an amount equal to the excess, if any, of the fair market value of the shares of Common Stock when acquired over the option exercise price. The amount of gain or loss recognized by a Participant from a subsequent sale of shares of Common Stock acquired from the exercise of an NSO will be equal to the difference between the sales price for the shares of Common Stock and the sum of the exercise price of the Option plus the amount of compensation income recognized by the Participant upon exercise of the Option.

SARs. The recipient of an SAR generally will not recognize any compensation income (and the Company generally will be entitled to a deduction) upon grant of the SAR. At the time of exercise of an SAR, however, the recipient should recognize compensation income in an amount equal to the amount of cash, or the fair market value of the shares, received.

Restricted Stock Awards. If stock received pursuant to a Stock Award made through the 1999 Stock Option Plan is subject to a substantial restriction on continued ownership which is dependent upon the recipient continuing to perform services for the Company or its affiliated companies (a “risk of forfeiture”), the Participant should not recognize compensation income upon receipt of the shares of Common Stock unless he/she makes a so-called “83(b) election” as discussed below. Instead, the Participant will recognize compensation income (and the Company generally will be entitled to a deduction) when the shares of Common Stock are no longer subject to a risk of forfeiture, in an amount equal to the fair market value of the stock at that time. Absent a Participant making an 83(b) election, dividends paid with respect to shares of Common Stock which are subject to a risk of forfeiture will be treated as compensation income for the Participant (and a compensation deduction will be available to the Company for the dividend) until the shares of Common Stock are no longer subject to a risk of forfeiture.

Different tax rules will apply to a Participant who receives shares of Common Stock subject to a risk of forfeiture if the Participant files an election pursuant to Section 83(b) of the Code (an “83(b) election”). If, within 30 days of receipt of the shares of Common Stock, a Participant files an 83(b) election with the Internal Revenue Service and the Company, then, notwithstanding that the shares of Common Stock are subject to a risk of forfeiture, the Participant will recognize compensation income upon receipt of the shares of Common Stock (and the Company will be entitled to a deduction) in an amount equal to the fair market value of the stock at the time of the award. If the 83(b) election is made, any dividends paid with respect to the shares of Common Stock will not result in compensation income for the Participant (and will not entitle the Company to a deduction). Rather, the dividends paid will be treated as any other dividends paid with respect to Common Stock, as ordinary income which is not compensation.

Tax Withholding

Whenever the Company proposes, or is required, to distribute shares under the 1999 Stock Option Plan, the Company may require the recipient to satisfy any Federal, state and local tax withholding requirements prior to the delivery of any certificate for such shares or, in the discretion of the Committee, the Company may withhold from the shares to be delivered shares sufficient to satisfy all or a portion of such tax withholding requirements.

Unfunded Status of the 1999 Stock Option Plan

The 1999 Stock Option Plan is intended to constitute an “unfunded” plan for incentive and deferred compensation. With respect to any payments not yet made to a Participant or optionee by the Company, nothing contained in the 1999 Stock Option Plan shall give any such Participant or optionee any rights that are greater than those of a general creditor of the Company.

9

Equity Compensation Plan Information.

The following table provides information as of December 31, 2003 with respect to shares of the Company’s common stock that may be issued under existing equity compensation plans:

Equity Compensation Plan Information

| | | | | | | |

Plan Category

| | Number of securities

to be issued upon

exercise of outstanding options,

warrants and rights (a)

| | Weighted-average

exercise price of

outstanding options, warrants and rights (b)

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)) (c)

|

Equity compensation plans approved by security holders: | | | | | | | |

Stock Option Plans | | 3,235,128 | | $ | 2.15 | | 943,250 |

Employee Stock Purchase Plan | | N/A | | | N/A | | 300,033 |

Equity compensation plans not approved by security holders | | 0 | | | N/A | | 0 |

Total | | 3,235,128 | | $ | 2.15 | | 1,243,283 |

The Board of Directors recommends a vote “FOR” the amendment of the 1999 Stock Option Plan. Proxies solicited by the Board of Directors will be so voted unless shareholders specify otherwise.

CORPORATE GOVERNANCE

Information Regarding the Board of Directors and Its Committees

The Board of Directors maintains standing Nominating, Audit and Compensation Committees.

Nominating Committee. The Board recently formed a Nominating Committee consisting of Rosdon Hendrix and Gene R. McGrevin, each of whom is an “independent director” as defined by the Nasdaq Stock Market. The Nominating Committee assists the Board in establishing qualification criteria for the Company’s non-employee directors, identifying and evaluating candidates for nomination to the shareholders for election to the Board of Directors, and developing and recommending to the Board corporate governance guidelines and procedures applicable to the Company. A copy of the Nominating Committee’s charter is included on the Company’s web site atwww.microtekmed.com.

The Nominating Committee has established the following general qualifications criteria for the Company’s directors:

| | • | | At least a majority of the directors shall be independent; |

| | • | | Each director must be an individual of the highest character and integrity, with an inquiring mind, vision, a willingness to ask hard questions and the ability to work well with others; |

| | • | | Each director must be willing and able to devote sufficient time to the affairs of the Company and be diligent in fulfilling the responsibilities of a director and Board committee member; and |

| | • | | Each director must have the capacity and desire to represent the balanced, best interests of the shareholders as a whole and not primarily a special interest group or constituency. |

In addition, the Nominating Committee from time to time establishes and modifies specific criteria desirable to be represented on the Board including knowledge and experience in business strategy, leadership, industry experience, finance and audit, and other skills beneficial to the business objectives of the Company.

10

The Board is responsible for selecting director nominees on behalf of the Company, with the assistance of the Nominating Committee. The Nominating Committee will consider nominees for directors properly proposed by shareholders. Any shareholder who desires to propose a candidate for consideration by the Nominating Committee should submit a written proposal which includes at a minimum the nominee’s name and qualifications for Board membership. These proposals should be addressed to:

Corporate Secretary

Microtek Medical Holdings, Inc.

512 Lehmberg Road

Columbus, Mississippi 39702

In addition, the Company permits shareholders who comply with the procedures set forth in the Company’s bylaws to nominate directors for consideration at an annual shareholders meeting. The Company’s bylaws provide that shareholders intending to nominate candidates for election as directors at an annual meeting of shareholders must give notice in writing to the Company’s secretary not less than 90 or no more than 120 days prior to the first anniversary of the date the Company mailed its proxy materials for the preceding year’s annual meeting. That notice is required to set forth (1) as to each nominee, all information relating to such person as would be required to be disclosed in solicitations of proxies for the election of directors pursuant to Regulation 14A of the Securities and Exchange Act of 1934, and the nominee’s written consent to serve as a director if elected, and (2) as to the shareholder making a nomination and the beneficial owner, if any, on whose behalf the nomination is made, the name and address of such shareholder and beneficial owner, the number of shares that are owned beneficially and of record by such shareholder and beneficial owner and whether such shareholder or beneficial owner has delivered or intends to deliver a proxy statement and form of proxy to holders of a sufficient number of the Company’s voting shares to elect such nominee or nominees. Shareholders desiring to use the procedures of the Company’s bylaws to nominate candidates for election as directors should review Section 2.13 of the Company’s bylaws.

The Nominating Committee may from time to time use a variety of methods for identifying and evaluating nominees for director. In the past, the Company’s Board of Directors has assessed and in the future the Company’s Nominating Committee is expected to assess the appropriate size of the Board, expected vacancies on the Board and the availability of desirable candidates for appointment to the Board. Candidates may come to the attention of the Nominating Committee through current Board members, management, professional search firms, shareholders and other persons.

Audit Committee. The Audit Committee, which consists of Rosdon Hendrix, Kenneth F. Davis and Michael E. Glasscock, III, serves as an independent and objective party to, among other things, review the Company’s financial statements and annual report, review and appraise the audit efforts of the Company’s auditors and pre-approve permissible services to be performed for the Company by its auditors, and is responsible for the appointment, compensation and oversight of the work of the independent public accountants which audit the Company’s financial statements. The primary function of the Audit Committee involves oversight functions to support the quality and integrity of the Company’s accounting and financial reporting processes generally. It should be noted, however, that the members of the Committee are not necessarily experts in the fields of auditing and accounting and do not provide special assurances on such matters. The Audit Committee met four times during 2003. In addition to these meetings, the Chair and other members of the Audit Committee met several times with management and the Company’s independent accountants. The Board of Directors has determined that Rosdon Hendrix is an “audit committee financial expert” as that term is defined by applicable rules of the Securities and Exchange Commission. The report of the Audit Committee begins at page 12 of this Proxy Statement.

Compensation Committee. The Compensation Committee, consisting of Rosdon Hendrix and Kenneth F. Davis, makes recommendations to the Board regarding the compensation of executive officers and administers

11

the Company’s incentive plans, including the Company’s Stock Option Plans and Employee Stock Purchase Plan. The Compensation Committee’s report on executive compensation begins at page 20 of this Proxy Statement. The Compensation Committee met four times during 2003.

Meetings and Attendance. The Board of Directors held four meetings during 2003. Each incumbent director attended at least 75 percent of the aggregate of the meetings of the Board of Directors and of the committees of which he was a member. The Company strongly encourages each Board member to attend the Company’s annual meeting of shareholders. All Board members attended the 2003 annual meeting of shareholders.

Communications to the Board

The Board of Directors requests that any shareholders who desire to send communications to the Board mail those communications to:

Vice President of Legal Affairs

Microtek Medical Holdings, Inc.

512 Lehmberg Road

Columbus, Mississippi 39702

All mail addressed in this manner will be delivered to the chair or chairs of the committees with responsibilities touching most directly on the matters addressed in the communication.

Code of Conduct

All employees and directors of the Company, including the Company’s Chief Executive Officer, Chief Financial Officer and principal accounting officer or controller, are required to comply with the Microtek Medical Holdings, Inc. Code of Conduct. This Code .is available on the Company’s web site atwww.microtekmed.com. The Company will disclose on its web site any amendments to or waivers from provisions of the Code as required by the rules of the Securities and Exchange Commission. The Board of Directors has also established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. Complaints regarding these matters will be reviewed under Audit Committee direction and oversight.

Report of the Audit Committee

The following Report of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission (the “Commission”) or subject to Regulations 14A or 14C of the Commission or to the liabilities of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, notwithstanding any general incorporation by reference of this Proxy Statement into any other document.

The Board of Directors maintains an Audit Committee comprised of three of the Company’s outside directors. The Board of Directors and the Audit Committee believe that the Audit Committee’s current member composition satisfies the rule of the National Association of Securities Dealers, Inc. (“NASD”) that governs audit committee composition as currently in effect, including the requirement that audit committee members all be “independent directors” as that term is defined by NASD Rule 4200(a)(15) and Rule 10A-3(b)(1) of the Exchange Act. The Board has adopted a written Charter of the Audit Committee.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process

12

including the systems of internal controls. The independent auditors are responsible for expressing an opinion on the conformity of the financial statements with United States generally accepted accounting principles. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in the Annual Report on Form 10-K for the year ended December 31, 2003 with management and the independent auditors, including without limitation, a discussion with the independent auditors of the matters required to be discussed with the Audit Committee under Statement on Auditing Standards No. 61.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors the written disclosures required by the Independence Standards Board Standard No. 1 and discussed with the independent auditors their independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003 for filing with Securities and Exchange Commission.

AUDIT COMMITTEE

Rosdon Hendrix

Kenneth F. Davis

Michael E. Glasscock, III

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Securities Exchange Act of 1934 and the rules issued thereunder, the Company’s executive officers and directors and any persons holding more than ten percent of the Company’s common stock are required to file with the Securities and Exchange Commission and The Nasdaq Stock Market reports of their initial ownership of the Company’s common stock and any changes in ownership of such common stock. Specific due dates have been established and the Company is required to disclose in its Annual Report on Form 10-K and Proxy Statement any failure to file such reports by these dates. Copies of such reports are required to be furnished to the Company. Based solely on its review of the copies of such reports furnished to the Company, or written representations that no reports were required, the Company believes that, during 2003, all of its executive officers, directors and persons owning more than 10% of its common stock complied with the Section 16(a) requirements.

Certain Relationships and Related Transactions

In May 2000, the Company and certain of its affiliates and employees organized GRI to provide supply-chain management and material sourcing services for products manufactured in China. The Company and J. Michael Mabry (an executive officer of the Company) own 19.5% and 30%, respectively, of GRI, and Mr. Mabry currently serves on the Board of Directors of GRI. In accordance with a Services Agreement dated June 1, 2000, between the Company and GRI, GRI agreed to provide the Company with supply-chain management services addressing the sourcing of PVA fiber and manufacturing and shipping of products by contract manufacturers of the Company located in China, and agreed to protect the Company’s confidential information and to certain other covenants protecting the Company against competition. For these services, the Company agreed to pay an annual fee of $338,000 (plus certain salary and benefits of certain employees) for the first year of the Agreement and $250,000 for each of the second and third year of the Agreement. This Agreement expired during 2003. In addition, the Company loaned $200,000 to GRI to finance startup costs. The loan accrued interest at 6% (with all accrued and unpaid interest added to principal at the end of year one), and thereafter the loan was repayable in equal quarterly installments of principal plus accrued and unpaid interest, and matured on May 31, 2003. This loan was paid in accordance with its terms. The Board of Directors of the Company approved these various agreements with GRI after full consideration of the terms and provisions of these agreements.

13

During 2001, Microtek Medical, Inc. began sourcing manufacturing of various of its products through GRI where such supply arrangements were advantageous to Microtek Medical, Inc. based on favorable pricing and other considerations. During 2003, 2002 and 2001, the Company paid a total of $6,576,509, $2,379,822 and $927,482, respectively, for products supplied, services rendered and expenses incurred by GRI for the benefit of the Company. The Company has implemented systems and procedures to exclude Mr. Mabry from participating in purchase decisions or other business dealings between the Company and GRI. The Audit Committee has received a report from the Company concerning the relationship between the Company and GRI and the structures and systems in place to deal with conflicts of interest posed by Mr. Mabry’s relationship with GRI and the Company. After consideration of the relevant facts and circumstances, the Audit Committee approved the structures and systems which the Company has implemented to govern its relationship with GRI.

In August 2000, the Company entered into an agreement with VersaCore Industrial Corporation to purchase from VersaCore certain equipment used for novel applications of nonwoven materials. Ron Smorada, one of the directors of the Company, is an owner and the president of VersaCore. The purchase price for such equipment was to be $350,000, and the equipment was to be custom manufactured by a third party at a cost to VersaCore which VersaCore has estimated at approximately $280,000. In accordance with the terms of the agreement, the Company advanced to VersaCore $225,000 in connection with and following the ordering of such equipment. By agreement with VersaCore, such order was subsequently cancelled, and it was agreed that the Company would not be required to make further payments for such equipment and would not receive delivery of such equipment. In addition, the Company would be repaid its advance for the equipment at the time of VersaCore’s sale of the equipment to a third party.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth, as of April 1, 2004, certain information regarding the beneficial ownership of common stock by (i) each person known by the Company to be the beneficial owner of more than five percent of the outstanding shares of common stock, (ii) each director and Named Executive Officer identified under “Executive Compensation” below, and (iii) all directors and executive officers as a group:

| | | | | |

Name of Beneficial Owner

| | Shares

Beneficially Owned

| | Percentage of

Common Stock

Beneficially

Owned

| |

Dan R. Lee(1) | | 775,298 | | 2 | % |

J. Michael Mabry(2) | | 518,739 | | 1 | % |

Roger G. Wilson(3) | | 445,283 | | 1 | % |

Kenneth F. Davis(4) | | 88,243 | | * | |

Michael E. Glasscock, III(5) | | 30,000 | | * | |

Rosdon Hendrix(6) | | 130,000 | | * | |

Gene R. McGrevin(7) | | 205,000 | | * | |

Ronald L. Smorada(8) | | 75,000 | | * | |

Dimensional Fund Advisors Inc.(9) | | 2,456,490 | | 6 | % |

All directors and executive officers as a group (8 persons)(10) | | 2,267,563 | | 5 | % |

| * | | Represents less than 1% of the common stock |

| (1) | | Includes options to acquire 701,331 shares exercisable within 60 days. |

| (2) | | Includes options to acquire 480,261 shares exercisable within 60 days. |

| (3) | | Includes options to acquire 383,750 shares exercisable within 60 days. |

| (4) | | Includes options to acquire 55,000 shares exercisable within 60 days. |

| (5) | | Includes options to acquire 30,000 shares exercisable within 60 days. |

| (6) | | Includes options to acquire 100,000 shares exercisable within 60 days. |

14

| (7) | | Includes options to acquire 185,000 shares exercisable within 60 days. |

| (8) | | Includes options to acquire 75,000 shares exercisable within 60 days. |

| (9) | | As reported by Dimensional Fund Advisors, Inc. in a Statement on Form 13G filed with the Securities and Exchange Commission. Dimensional Fund Advisors, Inc. address is 1299 Ocean Avenue, 11th Floor, Santa Monica, California 90401. |

| (10) | | Includes options to acquire 2,010,342 shares exercisable within 60 days. |

EXECUTIVE COMPENSATION

Compensation Tables

The following table sets forth the cash and non-cash compensation paid by the Company to the Company’s chief executive officer and each of the other executive officers of the Company (collectively, the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation

| | Long-Term Compensation Awards Options (#)

| | All Other Compensation

| |

| | | Salary

| | Bonus

| | Other Annual Compensation

| | |

Dan R. Lee Chairman, President and Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 296,154

250,000

248,558 | | $

$

$ | 225,000

130,000

209,156 | | —

—

— | | 200,000

100,000

250,000 | | $

$

$ | 24,340

18,294

18,116 | (1)

(2)

(3) |

| | | | | | |

J. Michael Mabry Chief Operating Officer, Executive Vice President and Secretary | | 2003

2002

2001 | | $

$

$ | 170,096

150,000

150,000 | | $

$

$ | 85,000

52,000

83,663 | | —

—

— | | 150,000

75,000

50,000 | | $

$

$ | 12,864

6,060

5,877 | (4)

(5)

(6) |

| | | | | | |

Roger G. Wilson Chief Financial Officer and Treasurer | | 2003

2002

2001 | | $

$

$ | 161,154

150,000

149,519 | | $

$

$ | 75,000

50,000

83,663 | | —

—

— | | 150,000

75,000

125,000 | | $

$

$ | 12,704

6,258

6,239 | (7)

(8)

(9) |

| (1) | | This amount represents $11,846 in contributions to a 401(k) plan, $2,036 for a $250,000 term life insurance policy, $258 for a $100,000 term life insurance policy, and a $10,200 automobile allowance. |

| (2) | | This amount represents $10,000 in contributions to a 401(k) plan, $2,036 for a $250,000 term life insurance policy, $258 for a $100,000 term life insurance policy, and a $6,000 automobile allowance. |

| (3) | | This amount represents $9,942 in contributions to a 401(k) plan, $2,036 for a $250,000 term life insurance policy, $138 for a $100,000 term life insurance policy and a $6,000 automobile allowance. |

| (4) | | This amount represents $6,804 in contributions to a 401(k) plan, $60 for a $100,000 term life insurance policy, and a $6,000 automobile allowance. |

| (5) | | This amount represents $6,000 in contributions to a 401(k) plan and $60 for a $100,000 term life insurance policy. |

| (6) | | This amount represents $5,769 in contributions to a 401(k) plan and $108 for a $100,000 term life insurance policy. |

| (7) | | This amount represents $6,446 in contributions to a 401(k) plan, $258 for a $100,000 term life insurance policy, and a $6,000 automobile allowance. |

| (8) | | This amount represents $6,000 in contributions to a 401(k) plan and $258 for a $100,000 term life insurance policy. |

| (9) | | This amount represents $5,981 in contributions to a 401(k) plan and $258 for a $100,000 term life insurance policy. |

15

Employment Arrangements

Messrs. Lee, Mabry and Wilson are each a party to a three-year employment agreement with the Company which commenced on October 20, 2002. Pursuant to each such respective employment agreement, Mr. Lee will serve as President and Chief Executive Officer of the Company, Mr. Mabry will serve as Executive Vice President and Chief Operating Officer of the Company, and Mr. Wilson will serve as Chief Financial Officer of the Company. Each employment agreement specifies a minimum salary and benefits payable during the term of the employment agreement, and contains restrictive covenants including covenants relating to the protection of confidential information and restricting competition against the Company. Each employment agreement is terminable by the Company or the employee with or without cause. In the event of a termination of the employment agreement by the Company without cause, or by the employee for good reason (as the terms “cause” and “good reason” are defined), the employee will generally be entitled to severance equal to the employee’s salary and annual performance bonus for the unexpired portion of the remaining term of the employment agreement and continued welfare benefits (such as health insurance) for the unexpired term of the employment agreement. In the event of any termination of the employee’s employment following a change of control (as defined) of the Company, other than a termination of employment as a result of death or disability or cause, the Company is obligated to pay the employee an amount equal to three times the largest of the employee’s annual salary and annual performance bonus over the current or the prior two years plus certain other amounts primarily involving the continuation of welfare benefits following the date of such termination of employment. In the event that any payments to the employee will be subject to excise taxes imposed under the Internal Revenue Code, then the payments to the employee would be increased by an amount (i.e., a tax gross-up payment) sufficient to pay all of the employee’s excise taxes on such payments and any income, excise or other taxes on the gross-up payment to the employee.

In connection with the completion of the aforementioned employment agreements, the Company adopted a Sale of Business Bonus Program designed to increase the value of the Company to shareholders upon and in the event of a change of control of the Company. The Sale of Business Bonus Program establishes a bonus pool determined as a percentage of appreciation in the price of the Company’s common stock from a pre-established base amount (which is currently $1.90 per share) to the price of a share of the Company’s common stock at which the event constituting a change of control (as defined) of the Company occurs. As currently adopted, the bonus pool uses the following levels of share appreciation and percentage participation in such share appreciation to fund the bonus pool:

| | | | | | | | | |

Share Appreciation

| | Market Capitalization

(Share Appreciation

multiplied by 42M*)

| | Bonus

Percentage

| | | Bonus Pool

|

$ 0.00 to $ 1.90 | | $ | 80,598,000.00 | | 0.00 | % | | $ | 0.00 |

$ 1.90 to $ 5.00 | | $ | 130,200,000.00 | | 3.00 | % | | $ | 3,906,000.00 |

$ 5.00 to $10.00 | | $ | 210,000,000.00 | | 3.50 | % | | $ | 7,350,000.00 |

$10.00 to $11.00 | | $ | 42,000,000.00 | | 4.00 | % | | $ | 1,680,000.00 |

| | | |

| | | | | | | | |

|

|

Total Bonus Pool | | | | | | | | $ | 12,936,000.00 |

| | | | | | | | |

|

|

| * | | The market capitalization column assumes 42 million shares outstanding for purposes of illustration. |

The bonus pool may be allocated among employees of the Company as from time-to-time determined by the Compensation Committee of the Board of Directors, and the bonus program may be modified from time-to-time as determined by the Board of Directors.

Employee Benefit Plans

1992 Stock Option Plan. In April 1992, the Board of Directors and shareholders of the Company adopted a Stock Option Plan (the “1992 Stock Option Plan”). The 1992 Stock Option Plan provided for the issuance of options to purchase up to 4,800,000 shares of common stock (subject to appropriate adjustments in the event of stock splits, stock dividends and similar dilutive events). Options were granted under the 1992 Stock Option Plan to employees, officers or directors of, and consultants and advisors to, the Company who, in the opinion of the

16

Compensation Committee, were in a position to contribute materially to the Company’s continued growth and development and to its long-term financial success. The 1992 Stock Option Plan was administered by a committee appointed by the Board of Directors. The Compensation Committee was designated by the Board of Directors as the committee to administer the 1992 Stock Option Plan. The purposes of the 1992 Stock Option Plan were to ensure the retention of existing executive personnel, key employees and consultants of the Company, to attract and retain new executive personnel, key employees and consultants and to provide additional incentives by permitting such individuals to participate in the ownership of the Company. The 1992 Stock Option Plan terminated on April 27, 2002.

Options granted to employees were either incentive stock options (as defined in the Code) or nonqualified stock options. The exercise price of the options were determined by the Board of Directors or the committee at the time of grant, provided that the exercise price was not less than the fair market value of the Company’s common stock on the date of grant as determined in accordance with the limitations set forth in the Code. The terms of each option and the period over which it vested were determined by the committee, although no option could be exercised more than ten years after the date of grant and all options were to become exercisable upon certain events defined to constitute a change of control. To the extent that the aggregate fair market value, as of the date of grant, of shares with respect to which incentive stock options became exercisable for the first time by an optionee during the calendar year exceeded $100,000, the portion of such option in excess of the $100,000 limitation was be treated as a nonqualified stock option. In addition, if an optionee owned more than 10% of the total voting power of all classes of the Company’s stock at the time the individual was granted an incentive stock option, the purchase price per share could not be less than 110% of the fair market value on the date of grant and the term of the incentive stock option could not exceed five years from the date of grant. Upon the exercise of an option, payment may be made by cash, check or, if provided in the option agreement, by delivery of shares of the Company’s common stock having a fair market value equal to the exercise price of the options, or any other means that the Board or the committee determines. Options are non-transferable during the life of the option holder. The 1992 Stock Option Plan also permitted the grant of alternate rights defined as the right to receive an amount of cash or shares of common stock having an aggregate fair market value equal to the appreciation in the fair market value of a stated number of shares of common stock from the grant date to the date of exercise. No alternate rights were granted under the 1992 Stock Option Plan.

As of April 1, 2004, options to purchase 996,128 shares of common stock were outstanding under the 1992 Stock Option Plan. The expiration of the 1992 Stock Option Plan on April 27, 2002 does not affect options outstanding under that Plan.

1999 Stock Option Plan. In March 1999, the Board approved and in May 1999 the Company’s shareholders ratified, the adoption of the Company’s 1999 Long-Term Incentive Plan (the “1999 Stock Option Plan”). As amended to date, the 1999 Stock Option Plan currently provides for the issuance of options and other stock awards to acquire shares of common stock up to a maximum of 3,200,000 shares (subject to appropriate adjustment in the event of stock splits, stock dividends and other similar dilutive events). Options and other stock awards may be granted under the 1999 Stock Option Plan to employees of the Company and certain subsidiaries and affiliated businesses, and to directors, consultants and other persons providing key services to the Company.

The Compensation Committee of the Board of Directors determines the terms and conditions of options granted under the 1999 Stock Option Plan, including the exercise price, which generally may not be less than the fair market value of the Company’s common stock on the date of grant. Awards under the 1999 Stock Option Plan may be settled through cash payments, the delivery of shares of common stock, or a combination thereof as the Committee shall determine. Stock options awarded under the 1999 Stock Option Plan which are intended to be incentive stock options are subject to the same restrictions described above with respect to the 1992 Stock Option Plan.

The 1999 Stock Option Plan may be terminated or amended by the Board of Directors at any time, except that the following actions may not be taken without shareholder approval: (a) increasing the number of shares that may be issued under the 1999 Stock Option Plan (except for certain adjustments provided for under the 1999 Stock Option Plan), or (b) amending the 1999 Stock Option Plan provisions regarding the limitations on the

17

exercise price. In the event of a change of control (as defined generally to include the acquisition by an individual, entity or group of more than 15% of the outstanding common stock of the Company, a merger or consolidation of the Company or a sale by the Company of all or substantially all of the Company’s assets), any award granted under the 1999 Stock Option Plan shall become exercisable except to the extent (a) the award otherwise provides or (b) the exerciseability of such award will result in an “excess parachute payment” within the meaning of the Code. The 1999 Stock Option Plan is unlimited in duration and, in the event of 1999 Stock Option Plan termination, shall remain in effect as long as any awards under it are outstanding, except no incentive stock options may be granted under the 1999 Stock Option Plan on a date that is more than ten years from the date the 1999 Stock Option Plan is approved by shareholders. Each option expires on the date established by the Compensation Committee at the time of the grant, except the expiration cannot be later than the earliest of ten years from the date on which the option was granted, if the participant’s date of termination occurs for reasons other than retirement or early retirement, the one year anniversary of such date of termination, or if the participant’s date of termination occurs by reason of retirement or early retirement, the three year anniversary of such date of termination.

As of April 1, 2004, options to purchase 2,745,750 shares of common stock were outstanding under the 1999 Stock Option Plan and 189,250 shares of common stock were available for future awards under the 1999 Stock Option Plan. In March 2004, the Board of Directors approved and recommended to the shareholders an amendment of the 1999 Stock Option Plan to add 2,145,000 shares to the Plan. For a complete description of that proposal, see “Amendment of Stock Option Plan” above.

Employee Stock Purchase Plan. In March 1999 the Board approved and in May 1999 the Company’s shareholders ratified, the adoption of the Company’s Employee Stock Purchase Plan for employees of the Company and its subsidiaries (the “1999 Stock Purchase Plan”). The 1999 Stock Purchase Plan was established pursuant to the provisions of Section 423 of the Code to provide a method whereby all eligible employees of the Company may acquire a proprietary interest in the Company through the purchase of common stock. Under the 1999 Stock Purchase Plan, payroll deductions are used to purchase the Company’s common stock. An aggregate of 700,000 shares of common stock of the Company were reserved for issuance under the 1999 Stock Purchase Plan. Through December 31, 2003, a total of 399,967 shares of common stock had been purchased under such plan, leaving 300,033 shares of common stock available for issuance under such plan in the future.

Stock Options

The Company granted options to its Named Executive Officers in 2003 as set forth in the following table. The Company has no stock appreciation rights (“SARs”) outstanding.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value

at Assumed Annual rates

of Stock Price Appreciation for Option

Term (1)

|

Name

| | Number of

Securities

Underlying

Options/SARs

Granted(#)

| | Percent of Total

Options/SARs

Granted to

Employees in

Fiscal Year

| | | Exercise or

Base Price

($/Sh)

| | Expiration

Date

| |

| | | | | | 5%($)

| | 10%($)

|

Dan R. Lee | | 100,000

100,000 | | 15.2

15.2 | %

% | | $

$ | 2.25

3.59 | | 02/01/13

08/01/13 | | $

$ | 141,501

225,773 | | $

$ | 358,592

572,154 |

J. Michael Mabry | | 75,000

75,000 | | 11.4

11.4 | %

% | | $

$ | 2.25

3.59 | | 02/01/13

08/01/13 | | $

$ | 106,126

169,330 | | $

$ | 268,944

429,115 |

Roger G. Wilson | | 75,000

75,000 | | 11.4

11.4 | %

% | | $

$ | 2.25

3.59 | | 02/01/13

08/01/13 | | $

$ | 106,126

169,330 | | $

$ | 268,944

429,115 |

| (1) | | These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock and overall market conditions. |

18

The following table sets forth the value of options exercised during 2003 and of unexercised options held by the Company’s Named Executive Officers at December 31, 2003.

AGGREGATED OPTION/SAR EXERCISES IN THE LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

| | | | | | | | | |

Name

| | Shares Acquired On Exercise(#)

| | Value

Realized($)

| | Number of Securities Underlying Unexercised Options/SARs at FY-End(#) Exercisable/ Unexercisable

| | Value of Unexercised In-the-Money Options/SARs At FY-End($) Exercisable/ Unexercisable

|

Dan R. Lee | | — | | — | | 538,831/137,500 | | $ | 1,244,541/$222,344(1) |

J. Michael Mabry | | — | | — | | 477,761/25,000 | | $ | 1,074,047/$41,500(2) |

Roger G. Wilson | | — | | — | | 326,250/68,750 | | $ | 751,360/$111,172(3) |

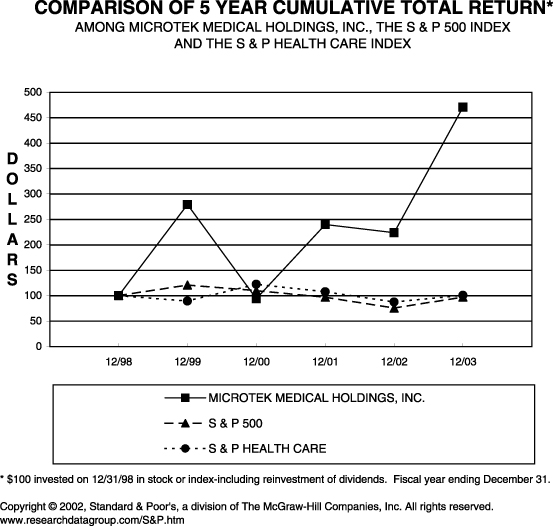

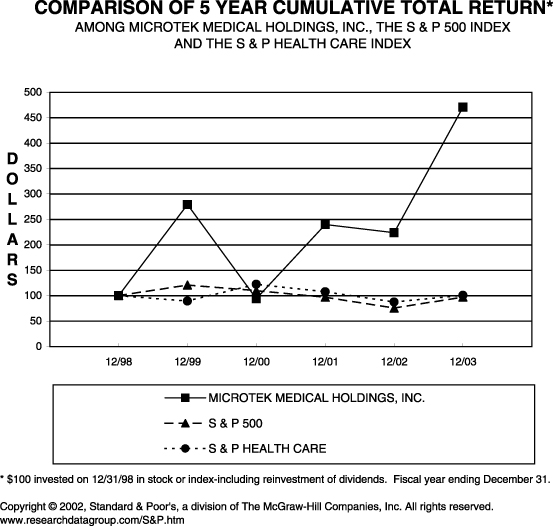

| (1) | | The indicated value is based on exercise prices ranging from $1.1875 to $3.59 per share on 538,831 exercisable options and exercise prices ranging from $1.1875 to $1.66 on 137,500 unexercisable options, and a value per share on December 31, 2003 of $5.00. |