UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811- 07237)

Exact name of registrant as specified in charter: Putnam Investment Funds

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

Registrant’s telephone number, including area code: (617) 292-1000

Date of fiscal year end: April 30, 2008

Date of reporting period: May 1, 2007 — October 31, 2007

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right for investors

With a focus on investment performance, below-average expenses, and in-depth information about our funds, we put the interests of investors first and seek to set the standard for integrity and service.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

Putnam Capital

Opportunities

Fund

10| 31| 07

Semiannual Report

| |

| Message from the Trustees | 2 |

| About the fund | 4 |

| Performance snapshot | 6 |

| Report from the fund managers | 7 |

| Performance in depth | 12 |

| Expenses | 15 |

| Portfolio turnover | 17 |

| Risk | 18 |

| Your fund’s management | 19 |

| Terms and definitions | 21 |

| Trustee approval of management contract | 23 |

| Other information for shareholders | 28 |

| Financial statements | 29 |

| Shareholder meeting results | 59 |

| Brokerage commissions | 60 |

Cover photograph: © Marco Cristofori

Message from the Trustees

Dear Fellow Shareholder

In November, Putnam Investments celebrated its 70th anniversary. From modest beginnings in Boston, Massachusetts, Putnam has grown into a global asset manager that serves millions of investors worldwide. Coincident with this anniversary, we are pleased to announce that Great-West Lifeco Inc. recently completed its purchase of Putnam Investments from Marsh & McLennan Companies, Inc. Great-West Lifeco is a financial services holding company with operations in Canada, the United States, and Europe, and is a member of the Power Financial Corporation group of companies. With this change, Putnam becomes part of a successful organization with a long-standing commitment to high-quality investment management and financial services. The change in ownership is not expected to affect the Putnam funds, the way Putnam manages money, or the funds’ management teams.

We would also like to take this opportunity to announce that Putnam President and Chief Executive Officer Ed Haldeman, one of your fund’s Trustees since 2004, was named President of the Funds, assuming this role from George Putnam, III. This change, together with the completion of the transaction with Great-West Lifeco, has enabled George Putnam to become an independent Trustee of the funds. Both George and Ed will continue serving on the Board of Trustees in our collective role of overseeing the Putnam funds on your behalf.

Lastly, we are pleased to announce that a new independent Trustee, Robert J. Darretta, has joined your fund’s Board of Trustees. Mr. Darretta brings extensive leadership experience in corporate finance and accounting. He is a former Vice Chairman of the Board of Directors of Johnson & Johnson, one of the leading U.S. health-care and consumer products companies, where he also served as Chief Financial Officer, Executive Vice President, and Treasurer.

2

Although the mutual fund industry has undergone many changes since George Putnam introduced his innovative balanced fund in 1937, Putnam’s guiding principles have not. As we celebrate Putnam’s 70-year milestone, we look forward to Putnam continuing its long tradition of prudent money management and to the new chapter opened by its recent change in ownership. As always, we thank you for your support of the Putnam funds.

Putnam Capital Opportunities Fund: seeking

overlooked, underpriced small and midsize companies

Every company, whatever its industry, growth rate, or size, has an underlying value. This value can be based on the firm’s physical assets (factories, inventory, staff) or on less easily quantifiable measures (long-term competitive advantage, management team expertise, or research and development efforts). A stock’s price, however, may or may not accurately reflect the company’s underlying value.

A stock may be mispriced for many reasons, such as when the company has problems that concern its management, industry, or product line. Temporary factors, such as a cyclical industry downturn or a one-time inventory issue, may also cause a stock to be undervalued.

In addition, unlike the widely followed large, blue-chip companies, smaller companies are less likely to be covered by industry researchers. This lack of coverage can lead to the undervaluation of these stocks. It is up to the fund’s management team to uncover the reasons behind a stock’s valuation and to determine whether the market’s generally held assumptions are on target.

To uncover undervalued stocks with the long-term potential for growth, the members of Putnam Capital Opportunities Fund’s management team draw on their experience as well as on the expertise of Putnam’s equity analysts. Because the fund is managed in Putnam’s blend style, the team is not focused solely on either growth- or value-style stocks and can choose from thousands of U.S. small and midsize companies. This flexibility means the fund’s portfolio is broadly diversified, which can help reduce the risk of investing in these companies.

The fund invests some or all of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations.

Investor overreaction

can mean investment

opportunities

An important factor in the analysis performed by the management team of Putnam Capital Opportunities Fund is “behavioral insight.” When an event that negatively affects a company occurs, such as a temporary inventory shortage or a change in management, investors may overreact, either by selling off the stock or buying it in large quantities. This overreaction can skew a stock’s price out of proportion, resulting in a buying or a selling opportunity for astute investment managers.

The portfolio managers and analysts of Putnam Capital Opportunities Fund determine behavioral rankings as part of their detailed stock-by-stock valuation process. Their process integrates sophisticated quantitative models, behavioral insights, and an in-depth analysis of each company’s fundamental worth.

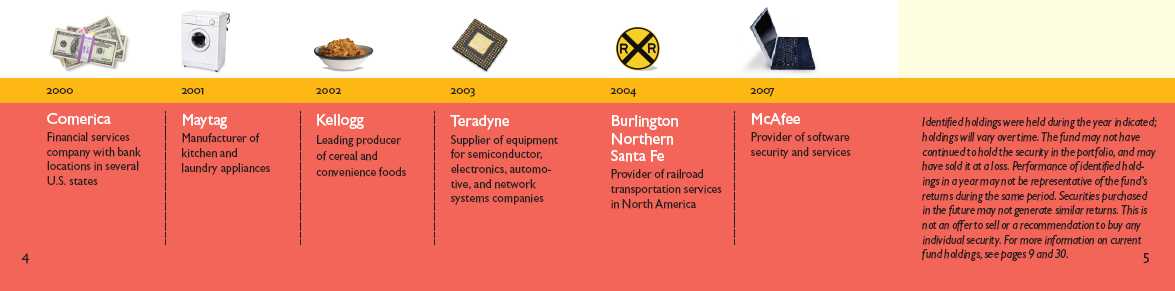

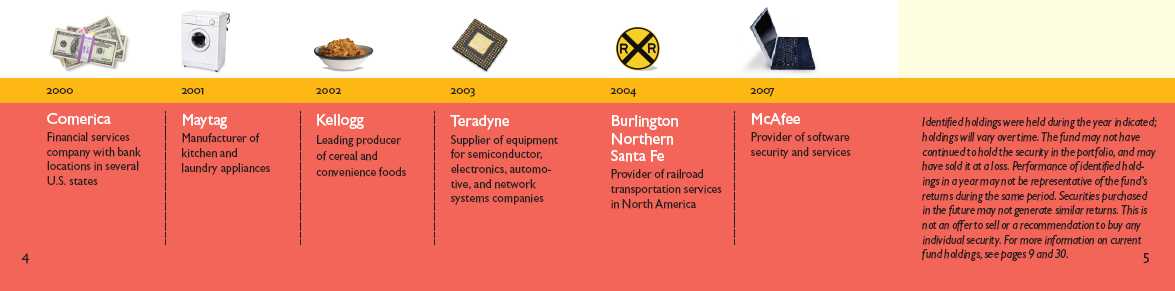

Putnam Capital Opportunities Fund holdings have spanned sectors and industries over time.

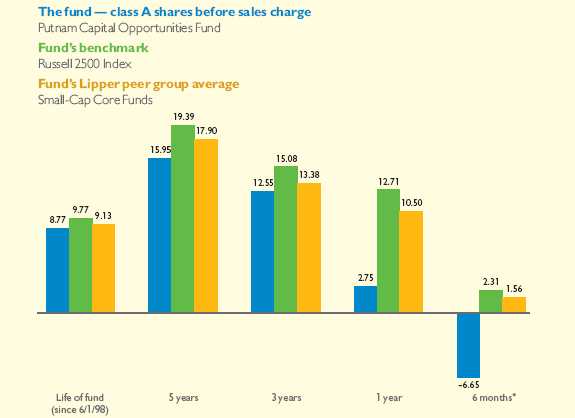

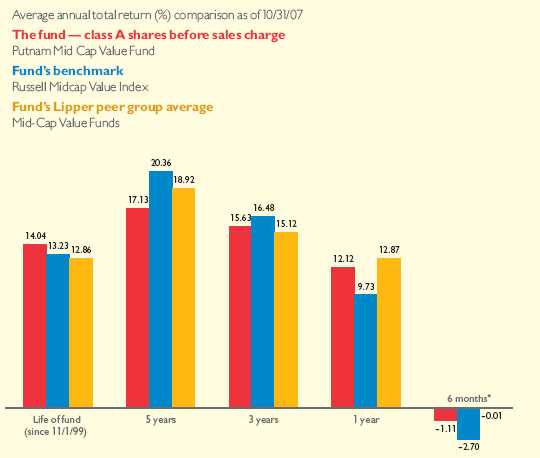

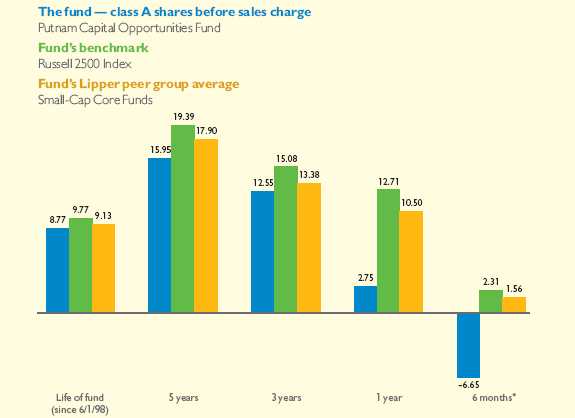

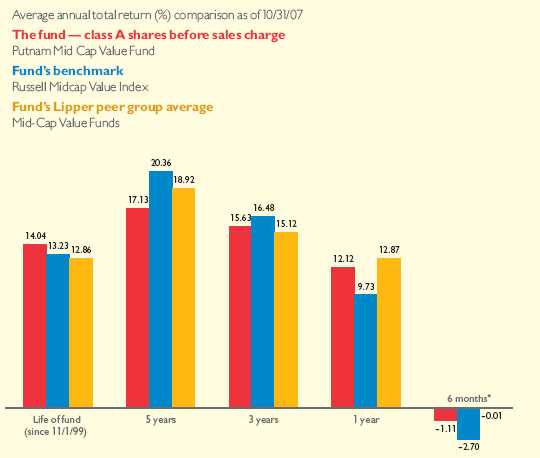

Performance snapshot

Putnam Capital

Opportunities Fund

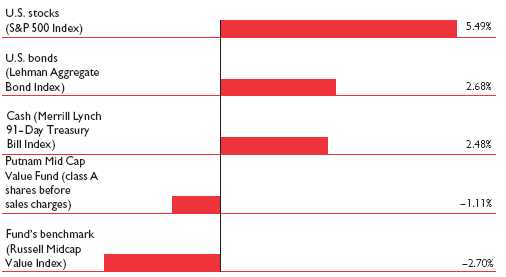

Average annual total return (%) comparison as of 10/31/07

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge. See pages 12–14 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit www.putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

6

Report from the fund managers

The period in review

In a challenging period for the U.S. stock market, your fund did not keep pace with its benchmark, the Russell 2500 Index, or the average return for funds in its Lipper peer group, Small-Cap Core Funds. During the first half of the fund’s fiscal year, the types of stocks we regularly target for the portfolio did not perform well. Throughout the period, we continued to employ our disciplined investment strategy, using a series of valuation factors to identify stocks that we believe are trading below their intrinsic value. Our goal is to find those that will appreciate over time as the market recognizes their value. Over the six months ended October 31, 2007, this stock selection discipline went unrewarded, as the market generally favored stocks we considered to be too expensive. Within the fund’s portfolio, stocks in the financial sector were among the top detractors, while holdings in steel-related industries contributed positively to returns. Despite the difficult ma rket environment, dominated by negative investor sentiment related to the housing market downturn, we continued to focus on our valuation discipline and took advantage of the fund’s flexibility to invest in both growth- and value-style stocks.

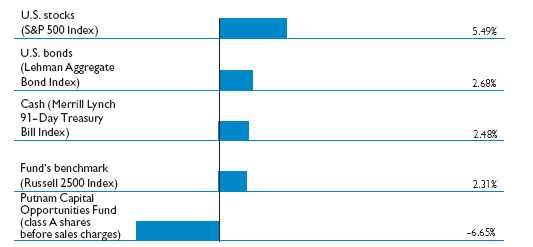

Market overview

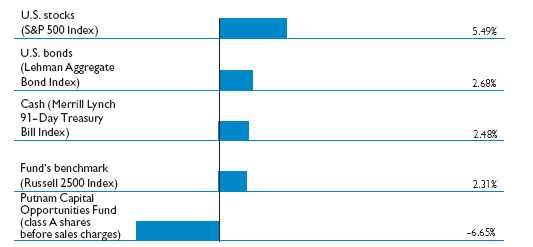

Although the broad stock market delivered gains for the six months ended October 31, 2007, it was a turbulent time for investors. The dominant theme was a wave of anxiety in response to a rising number of mortgage foreclosures, particularly among subprime mortgages, which are loans made to borrowers who, according to the lender, represent a higher risk. Stocks in the financial sector were hit particularly hard, and market volatility increased as investors grew more concerned about weakness spreading to other sectors and the overall economy. In response, the Federal Reserve (the Fed) took steps to restore calm by lowering key interest rates, a move that encouraged U.S. banks to borrow directly from the Fed as needed to support home-mortgage lending.

7

Issues related to the mortgage defaults caused mounting losses to several hedge funds and global financial institutions. At the same time, many blue-chip stocks dropped sharply as financial institutions, struggling to maintain liquidity, were in many cases compelled to sell high-quality stocks when they could not find buyers for low-quality bonds. After a swift and sharp decline in August, stocks recovered, but the market remained quite volatile throughout the final two months of the period.

Strategy overview

We continue to adhere to our disciplined strategy of targeting companies that we believe have sound business models and steadily growing cash flows. In selecting stocks for the portfolio, we carefully assess the underlying value of each company’s business. While a company’s stock price may fluctuate, this underlying value is crucial in determining its long-term growth potential. We target small and midsize U.S. companies across a wide range of industries, and we have the flexibility to invest in both growth- and value-style stocks. In seeking stocks whose current prices do not reflect the company’s fundamental, long-term value, we analyze factors such as future earnings-growth potential and the ability to generate cash over the long term. We look for situations where short-term factors cause a stock to become undervalued or overvalued, and strive

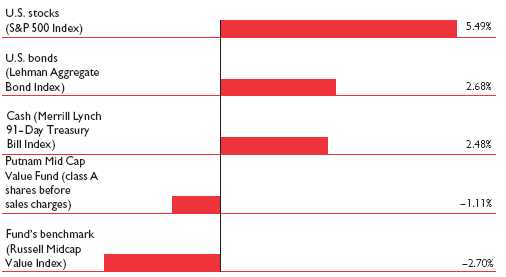

Market sector and fund performance

This comparison shows your fund’s performance in the context of different market sectors for the six months ended 10/31/07. See page 6 and pages 12–14 for additional fund performance information. Index descriptions can be found on page 22.

8

to take advantage of them. We also evaluate the attractiveness of a company compared with other firms in its industry. When our analysis indicates that a stock is being fairly priced by the market, we reduce or eliminate the fund’s position in that stock and reinvest the proceeds in securities that may have greater potential for long-term appreciation.

Your fund’s holdings

The rise in mortgage foreclosures took its biggest toll on stocks in the financial sector, particularly mortgage-related companies. Within the fund’s portfolio, the stocks of mortgage insurers Radian Group and Triad Guaranty were among the top detractors from returns. These companies provide insurance to cover residential first mortgage loans and expand home ownership opportunities by enabling people to purchase homes with down payments of less than 20%. By the close of the period, we had sold Triad from the portfolio. Another detractor for the period was FirstFed Financial, a Southern California bank that struggled with an increase in non-performing loans, which are loans that are close to being in default.

The slumping housing market also affected home builders such as fund holding NVR. As demand for homes has dropped, this Virginia-based company struggled with declining prices and a downturn in home sales.

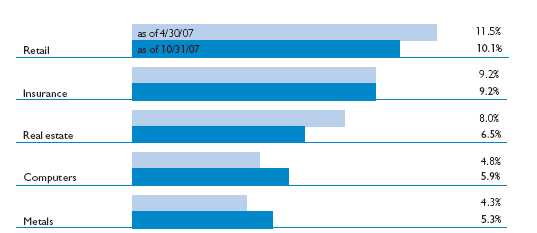

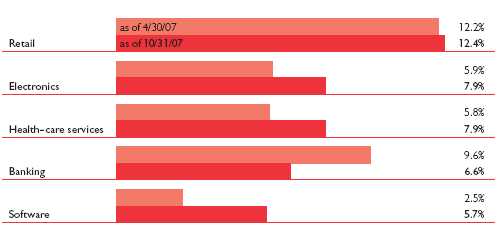

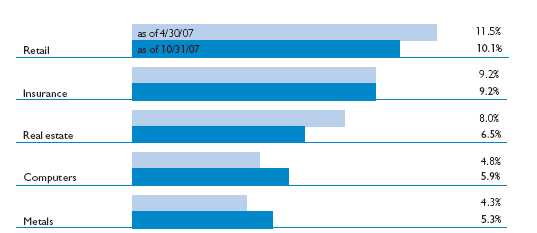

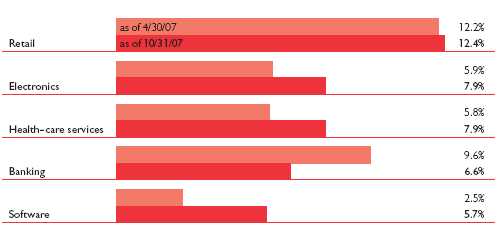

Comparison of top industry weightings

This chart shows how the fund’s top weightings have changed over the last six months.

Weightings are shown as a percentage of net assets. Holdings will vary over time.

9

In the pharmaceuticals sector, drug company King Pharmaceuticals lost patent protection for its largest drug, Altace. The company’s stock declined as investors realized this successful hypertension drug could face generic competition sooner than expected. In the retail sector, slowing sales hurt the stock of Rent-A-Center, while the stock of Select Comfort declined as demand slowed for its “sleep number” beds. By the close of the period, we had sold Rent-A-Center from the portfolio.

Contributing positively to performance for the period were stocks in steel-related industries. U.S. steel producer Steel Dynamics was a highlight, as the company’s scrap steel division benefited from rising steel prices, which have been almost twice as high as historical averages for the past two years. Valuations of steel companies have also increased with industry consolidation. Cleveland-Cliffs, which mines and supplies iron ore, saw strong demand from steel manufacturers and also benefited from price increases.

Also helping fund returns was United Online, a provider of Internet and media services. The growing popularity of social networking Web sites, such as this company’s classmates.com site, boosted the stock for the period. The stock of The Manitowoc Company, an industrial manufacturer, also experienced gains as demand increased for its cranes in the energy and construction markets. Real-estate investment trust

Top holdings

This table shows the fund’s top holdings, and the percentage of the fund’s net assets that each represented, as of 10/31/07. The fund’s holdings will change over time.

| | |

| Holding (Percent of fund’s net assets) | Industry |

|

| Watson Pharmaceuticals, Inc. (1.9%) | Pharmaceuticals |

|

| Steel Dynamics, Inc. (1.9%) | Metals |

|

| Brocade Communications Systems, Inc. (1.8%) | Computers |

|

| MicroStrategy, Inc. (1.8%) | Software |

|

| Hasbro, Inc. (1.8%) | Toys |

|

| Emulex Corp. (1.7%) | Computers |

|

| Cleveland-Cliffs, Inc. (1.7%) | Metals |

|

| Autoliv, Inc. (Sweden) (1.7%) | Trucks and parts |

|

| Overseas Shipholding Group (1.7%) | Shipping |

|

| Dollar Tree Stores, Inc. (1.6%) | Retail |

|

10

Equity Inns also delivered gains after it was acquired by a private equity group led by Goldman Sachs.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

Despite a turbulent market environment, dominated by the continued slump in the housing market and a wave of fear triggered by rising foreclosures, investors have also had positive news to consider. Economic expansion was sustained by solid growth in consumer spending and booming exports during the period, and although unemployment rose slightly during the year, it remained below 5%, and the economy continued to add jobs. The inflation story was also positive. Despite a falling dollar, the core inflation rate — consumer prices excluding food and energy — has generally drifted down. While corporate profits soared in the first half of 2007, they hit a road bump as many financial firms were forced to recognize the consequences of high-risk mortgage loans made in 2005 and 2006. At the close of the period, the short-term economic outlook remained uncertain as negative investor sentiment continued to weigh on the markets.

As always, we are more concerned with the long-term potential of individual companies than with short-term developments in the economy or the markets. While the market as a whole is affected by world events and economic cycles, we believe investors’ long-term goals are best served by our bottom-up approach to stock selection, which relies heavily on research and analysis. Regardless of the direction the market takes in the months ahead, our strategy and focus remain the same. We will continue to conduct intensive research to identify a wide array of companies with the potential to reward investors over time.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

The fund invests some or all of its assets in small and/or midsize companies. Such investments increase the risk of fluctuations in the value of your investment.

11

Your fund’s performance

This section shows your fund’s performance for periods ended October 31, 2007, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and definitions section in this report for definiti ons of the share classes offered by your fund.

Fund performance

Total return for periods ended 10/31/07

| | | | | | | | | | |

| | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | (6/1/98) | | (6/29/98) | | (7/26/99) | | (6/29/98) | | (1/21/03) | (10/2/00) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Life of fund | 120.71% | 109.15% | 105.96% | 105.96% | 105.92% | 105.92% | 110.44% | 103.49% | 115.60% | 124.95% |

| Annual average | 8.77 | 8.15 | 7.97 | 7.97 | 7.97 | 7.97 | 8.22 | 7.83 | 8.50 | 8.99 |

|

| 5 years | 109.60 | 98.49 | 101.82 | 99.82 | 101.65 | 101.65 | 104.33 | 97.59 | 106.88 | 112.22 |

| Annual average | 15.95 | 14.70 | 15.08 | 14.85 | 15.06 | 15.06 | 15.36 | 14.59 | 15.65 | 16.24 |

|

| 3 years | 42.59 | 35.10 | 39.39 | 36.39 | 39.36 | 39.36 | 40.33 | 35.80 | 41.41 | 43.63 |

| Annual average | 12.55 | 10.55 | 11.71 | 10.90 | 11.70 | 11.70 | 11.96 | 10.74 | 12.24 | 12.83 |

|

| 1 year | 2.75 | -2.66 | 1.93 | -2.56 | 1.90 | 1.00 | 2.15 | -1.17 | 2.42 | 2.95 |

|

| 6 months | -6.65 | -11.53 | -7.02 | -11.67 | -7.03 | -7.96 | -6.93 | -9.97 | -6.81 | -6.60 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After sales charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.25% and 3.25% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year and is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund may have limited expenses, without which returns would have been lower.

A 1% short-term trading fee may be applied to shares exchanged or sold within 90 days of purchase.

12

Comparative index returns

For periods ended 10/31/07

| | |

| | | Lipper Small-Cap |

| | | Core Funds |

| | Russell 2500 Index | category average* |

|

| Life of fund | 140.67% | 136.43% |

| Annual average | 9.77 | 9.13 |

|

| 5 years | 142.59 | 130.01 |

| Annual average | 19.39 | 17.90 |

|

| 3 years | 52.41 | 46.19 |

| Annual average | 15.08 | 13.38 |

|

| 1 year | 12.71 | 10.50 |

|

| 6 months | 2.31 | 1.56 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, and life-of-fund periods ended 10/31/07, there were 806, 757, 580, 458, and 191 funds, respectively, in this Lipper category.

Fund price and distribution* information

For the six-month period ended 10/31/07

| | | | | | | | |

| | Class A | | Class B | Class C | Class M | | Class R | Class Y |

| Share value: | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 4/30/07 | $12.49 | $13.18 | $11.54 | $11.66 | $11.84 | $12.24 | $12.34 | $12.72 |

|

| 10/31/07 | 11.66 | 12.31 | 10.73 | 10.84 | 11.02 | 11.39 | 11.50 | 11.88 |

|

* The fund made no distributions during the period.

13

Fund performance as of most recent calendar quarter

Total return for periods ended 9/30/07

| | | | | | | | | | |

| | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | (6/1/98) | | (6/29/98) | | (7/26/99) | | (6/29/98) | | (1/21/03) | (10/2/00) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Life of fund | 119.58% | 108.07% | 105.00% | 105.00% | 105.16% | 105.16% | 109.48% | 102.57% | 114.67% | 123.82% |

| Annual average | 8.79 | 8.16 | 7.99 | 7.99 | 8.00 | 8.00 | 8.24 | 7.85 | 8.53 | 9.01 |

|

| 5 years | 116.61 | 105.24 | 108.64 | 106.64 | 108.89 | 108.89 | 111.49 | 104.52 | 113.96 | 119.58 |

| Annual average | 16.72 | 15.47 | 15.85 | 15.62 | 15.87 | 15.87 | 16.16 | 15.38 | 16.43 | 17.04 |

|

| 3 years | 45.07 | 37.41 | 41.77 | 38.77 | 41.85 | 41.85 | 42.84 | 38.25 | 44.01 | 46.11 |

| Annual average | 13.20 | 11.17 | 12.34 | 11.54 | 12.36 | 12.36 | 12.62 | 11.40 | 12.93 | 13.47 |

|

| 1 year | 7.25 | 1.58 | 6.43 | 1.75 | 6.46 | 5.52 | 6.66 | 3.20 | 7.04 | 7.56 |

|

| 6 months | -4.29 | -9.30 | -4.73 | -9.49 | -4.68 | -5.63 | -4.61 | -7.74 | -4.43 | -4.21 |

|

Fund’s annual operating expenses

For the fiscal year ended 4/30/07

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual fund | | | | | | |

| operating expenses | 1.23% | 1.98% | 1.98% | 1.73% | 1.48% | 0.98% |

|

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

14

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam Capital Opportunities Fund from May 1, 2007, to October 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | $ 6.03 | $ 9.65 | $ 9.65 | $ 8.44 | $ 7.24 | $ 4.81 |

|

| Ending value (after expenses) | $933.50 | $929.80 | $929.70 | $930.70 | $931.90 | $934.00 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/07. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

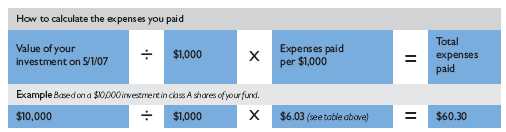

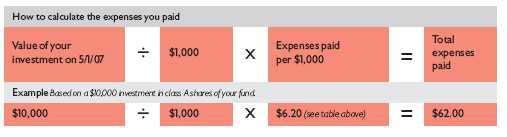

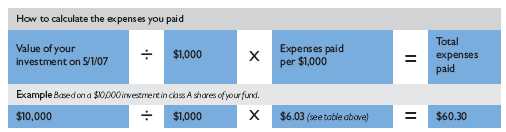

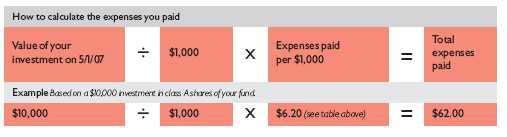

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended October 31, 2007, use the calculation method below. To find the value of your investment on May 1, 2007, call Putnam at 1-800-225-1581.

15

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | $ 6.29 | $ 10.08 | $ 10.08 | $ 8.82 | $ 7.56 | $ 5.03 |

|

| Ending value (after expenses) | $1,018.90 | $1,015.13 | $1,015.13 | $1,016.39 | $1,017.65 | $1,020.16 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/07. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Your fund’s annualized | | | | | | |

| expense ratio | 1.24% | 1.99% | 1.99% | 1.74% | 1.49% | 0.99% |

|

| Average annualized expense | | | | | | |

| ratio for Lipper peer group* | 1.49% | 2.24% | 2.24% | 1.99% | 1.74% | 1.24% |

|

* Putnam is committed to keeping fund expenses below the Lipper peer group average expense ratio and will limit fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times and for different periods. The fund’s expense ratio shown here is annualized data for the most rec ent six-month period, while the quarterly updated Lipper average is based on the most recent fiscal year-end data available for the peer group funds as of 9/30/07.

16

Your fund’s

portfolio turnover

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s average portfolio value within a given period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Turnover comparisons

Percentage of holdings that change every year

| | | | | |

| | 2007 | 2006 | 2005 | 2004 | 2003 |

|

| Putnam Capital | | | | | |

| Opportunities Fund | 59% | 60% | 71% | 135% | 91% |

|

| Lipper Small-Cap Core Funds | | | | | |

| category average | 82% | 83% | 86% | 86% | 88% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on April 30. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2007 is based on information available as of 10/31/07.

17

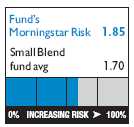

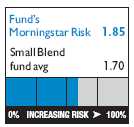

Your fund’s risk

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Morningstar Risk.

Your fund’s Morningstar® Risk

Your fund’s Morningstar Risk is shown alongside that of the average fund in its Morningstar category. The risk bar broadens the comparison by translating the fund’s Morningstar Risk into a percentile, which is based on the fund’s ranking among all funds rated by Morningstar as of September 30, 2007. A higher Morningstar Risk generally indicates that a fund’s monthly returns have varied more widely.

Morningstar determines a fund’s Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over a 3-year period, if available. Those measures are weighted and averaged to produce the fund’s Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2007 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

18

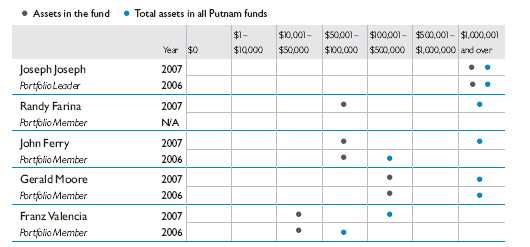

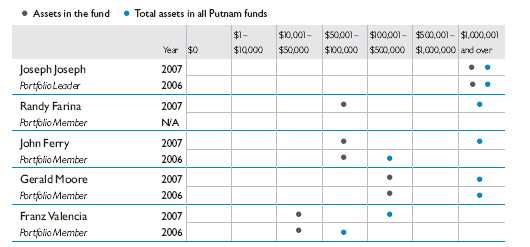

Your fund’s management

Your fund is managed by the members of the Putnam U.S. Small- and Mid-Cap Core Team. Joseph Joseph is the Portfolio Leader of the fund. Randy Farina, John Ferry, Gerald Moore, and Franz Valencia are Portfolio Members. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam U.S. Small- and Mid-Cap Core Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

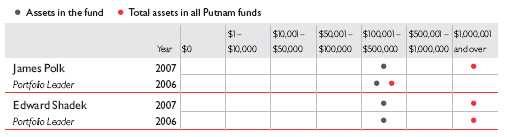

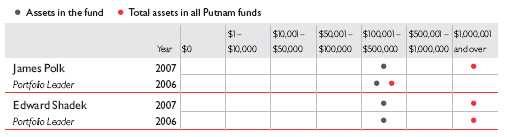

Investment team fund ownership

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of October 31, 2007, and October 31, 2006.

N/A indicates the individual was not a Portfolio Leader or Portfolio Member as of 10/31/06.

Trustee and Putnam employee fund ownership

As of October 31, 2007, all of the Trustees of the Putnam funds owned fund shares. The table below shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | |

| | | Total assets in |

| | Assets in the fund | all Putnam funds |

|

| Trustees | $ 326,000 | $ 92,000,000 |

|

| Putnam employees | $7,306,000 | $777,000,000 |

|

19

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

Joseph Joseph is also a Portfolio Leader of Putnam International Capital Opportunities Fund and a Portfolio Member of Putnam Capital Appreciation Fund.

Randy Farina is also a Portfolio Member of Putnam International Capital Opportunities Fund.

John Ferry is also a Portfolio Member of Putnam International Capital Opportunities Fund.

Franz Valencia is also a Portfolio Member of Putnam International Capital Opportunities Fund.

Joseph Joseph, Randy Farina, John Ferry, Gerald Moore, and Franz Valencia may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

During the year ended October 31, 2007, Portfolio Member Randy Farina joined your fund’s management team.

20

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.25% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

21

Comparative indexes

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Merrill Lynch 91-Day Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell 2500 Index is an unmanaged index of the 2,500 small and midsize companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

22

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”). In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2007, the Contract Committee met several times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract, effective July 1, 2007.

In addition, in anticipation of the sale of Putnam Investments to Great-West Lifeco, at a series of meetings ending in March 2007, the Trustees reviewed and approved new management and distribution arrangements to take effect upon the change of control. Shareholders of all funds approved the management contracts in May 2007, and the change of control transaction was completed on August 3, 2007. Upon the change of control, the management contracts that were approved by the Trustees in June 2007 automatically terminated and were replaced by new contracts that had been approved by shareholders. In connection with their review for the June 2007 continuance of the Putnam funds’ management contracts, the Trustees did not identify any facts or circumstances that would alter the substance of the conclusions and recommendations they made in their review of the contracts to take effect upon the change of control.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that

23

certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 1st percentile in management fees and in the 17th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2006 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, ha d been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management had committed to maintain at least through 2007. In anticipation of the change of control of Putnam Investments, the Trustees requested, and received a commitment from Putnam Management and Great-West Lifeco, to extend this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2007, an additional expense limitation for certain funds at an

24

amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2006. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract Committee’s stated intent to con tinue to work with Putnam Management to plan for an eventual resumption in the growth of assets, and to consider the potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investm ent results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods

25

and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Small-Cap Core Funds) for the one-, three- and five-year periods ended March 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | |

| One-year period | Three-year period | Five-year period |

|

| 20th | 14th | 87th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2007, there were 711, 546, and 435 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.)

The Trustees noted the disappointing performance for your fund for the five-year period ended March 31, 2007. In this regard, the Trustees considered that Putnam Management had implemented management team changes that it believed would clarify and strengthen the fund’s investment philosophy and process by focusing on a blend of quantitative techniques and fundamental analysis.

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Small-Cap Core Funds category for the one- and five-year periods ended September 30, 2007 were 86% and 74%, respectively. Over the one- and five-year periods ended September 30, 2007, the fund ranked 640th out of 744 and 331st out of 451 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

26

Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of which provides benefits to affiliates of Putnam Management. In the case of the custodian agreement, the Trustees considered that, effective January 1, 2007, the Putnam funds had engaged State Street Bank and Trust Company as custodian and began to transition the responsibility for providing custody services away from PFTC.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for funds than for institutional cli ents, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

27

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

28

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

29

The fund’s portfolio 10/31/07 (Unaudited)

| | | |

| COMMON STOCKS (93.6%)* | | | |

|

| | Shares | | Value |

| |

| Advertising and Marketing Services (0.1%) | | | |

| Greenfield Online, Inc. † | 53,400 | $ | 814,884 |

| Nu Skin Enterprises, Inc. Class A | 15,047 | | 259,862 |

| ValueClick, Inc. † | 8,600 | | 233,834 |

| | | | 1,308,580 |

|

| |

| Aerospace and Defense (0.6%) | | | |

| Alliant Techsystems, Inc. † | 3,900 | | 430,521 |

| Teledyne Technologies, Inc. † | 5,300 | | 277,243 |

| United Industrial Corp. | 67,086 | | 5,421,891 |

| | | | 6,129,655 |

|

| |

| Airlines (0.8%) | | | |

| Continental Airlines, Inc. Class B † (S) | 89,831 | | 3,085,695 |

| ExpressJet Holdings, Inc. † (S) | 934,471 | | 3,102,444 |

| Midwest Express Holdings, Inc. † | 148,900 | | 2,415,158 |

| | | | 8,603,297 |

|

| |

| Automotive (0.7%) | | | |

| Group 1 Automotive, Inc. | 9,200 | | 285,660 |

| Lear Corp. † | 2,606 | | 92,591 |

| Tenneco Automotive, Inc. † (S) | 207,395 | | 6,348,361 |

| | | | 6,726,612 |

|

| |

| Banking (1.9%) | | | |

| Bank of Hawaii Corp. | 2,751 | | 146,243 |

| BankUnited Financial Corp. Class A | 39,900 | | 344,337 |

| Center Financial Corp. | 10,450 | | 133,656 |

| City Bank | 35,387 | | 847,519 |

| City Holding Co. | 26,003 | | 983,173 |

| Community Bancorp † | 16,400 | | 332,428 |

| Corus Bankshares, Inc. # | 431,400 | | 4,754,028 |

| Cullen/Frost Bankers, Inc. | 4,166 | | 221,548 |

| First Citizens BancShares, Inc. Class A | 925 | | 150,618 |

| First Regional Bancorp † | 4,980 | | 117,030 |

| FirstFed Financial Corp. † | 230,999 | | 9,882,137 |

| Frontier Financial Corp. | 2,179 | | 48,352 |

| Great Southern Bancorp, Inc. | 4,472 | | 104,645 |

| Imperial Capital Bancorp, Inc. | 1,590 | | 34,328 |

| International Bancshares Corp. | 10,827 | | 236,678 |

| Lakeland Financial Corp. | 4,200 | | 87,822 |

| PFF Bancorp, Inc. | 1,361 | | 14,495 |

| Republic Bancorp, Inc. Class A | 9,350 | | 144,458 |

| Southwest Bancorp, Inc. | 18,096 | | 342,557 |

| SVB Financial Group † | 6,861 | | 355,331 |

| Wilmington Trust Corp. | 9,024 | | 328,203 |

| | | | 19,609,586 |

30

| | | |

| COMMON STOCKS (93.6%)* continued | | | |

|

| | Shares | | Value |

| |

| Basic Materials (0.1%) | | | |

| Ameron International Corp. | 2,000 | $ | 215,740 |

| Foamex International, Inc. † | 55,548 | | 455,494 |

| | | | 671,234 |

|

| |

| Biotechnology (2.2%) | | | |

| Albany Molecular Research, Inc. † | 126,141 | | 2,281,891 |

| Applera Corp. — Applied Biosystems Group | 89,762 | | 3,333,761 |

| Immunomedics, Inc. † (S) | 206,300 | | 474,490 |

| Invitrogen Corp. † | 114,500 | | 10,404,615 |

| Quidel Corp. † | 181,810 | | 3,754,377 |

| Savient Pharmaceuticals, Inc. † | 145,057 | | 2,042,403 |

| | | | 22,291,537 |

|

| |

| Broadcasting (0.2%) | | | |

| Sinclair Broadcast Group, Inc. Class A | 151,700 | | 1,826,468 |

|

| |

| Building Materials (—%) | | | |

| Genlyte Group, Inc. (The) † | 1,470 | | 95,697 |

| Lennox International, Inc. | 7,300 | | 260,610 |

| | | | 356,307 |

|

| |

| Chemicals (1.7%) | | | |

| Arch Chemicals, Inc. | 17,651 | | 805,239 |

| Cambrex Corp. | 115,648 | | 1,317,231 |

| Celanese Corp. (Ser. A) | 7,900 | | 331,484 |

| FMC Corp. | 102,186 | | 5,875,695 |

| Georgia Gulf Corp. (S) | 29,689 | | 359,237 |

| Hercules, Inc. | 13,380 | | 251,678 |

| Huntsman Corp. | 7,480 | | 197,098 |

| Innospec, Inc. (United Kingdom) | 7,546 | | 160,654 |

| Lubrizol Corp. (The) | 5,400 | | 366,552 |

| NewMarket Corp. | 75,839 | | 4,077,105 |

| Olin Corp. | 14,603 | | 332,656 |

| OM Group, Inc. † | 48,800 | | 2,585,424 |

| PolyOne Corp. † | 66,900 | | 534,531 |

| Spartech Corp. | 10,260 | | 157,696 |

| Valspar Corp. | 10,840 | | 271,325 |

| Westlake Chemical Corp. | 7,280 | | 178,651 |

| | | | 17,802,256 |

|

| |

| Coal (—%) | | | |

| Foundation Coal Holdings, Inc. | 5,200 | | 222,144 |

|

| |

| Commercial and Consumer Services (2.5%) | | | |

| ABM Industries, Inc. | 6,800 | | 159,936 |

| Bowne & Co., Inc. | 100,562 | | 1,747,768 |

| Brink’s Co. (The) | 1,968 | | 123,295 |

| Chemed Corp. | 110,327 | | 6,323,944 |

| CPI Corp. | 47,318 | | 1,571,431 |

| ICT Group, Inc. † | 29,800 | | 325,416 |

31

| | | |

| COMMON STOCKS (93.6%)* continued | | | |

|

| | Shares | | Value |

| |

| Commercial and Consumer Services continued | | | |

| Jackson Hewitt Tax Service, Inc. | 155,812 | $ | 4,869,125 |

| Landauer, Inc. | 21,200 | | 1,044,524 |

| MoneyGram International, Inc. | 13,464 | | 214,751 |

| Spherion Corp. † | 131,143 | | 1,143,567 |

| Tech Data Corp. † | 201,500 | | 7,924,995 |

| URS Corp. † | 8,440 | | 521,676 |

| Viad Corp. | 5,080 | | 180,035 |

| | | | 26,150,463 |

|

| |

| Communications Equipment (—%) | | | |

| F5 Networks, Inc. † | 5,828 | | 209,983 |

| Foundry Networks, Inc. † | 9,400 | | 198,716 |

| | | | 408,699 |

|

| |

| Computers (5.9%) | | | |

| Actuate Corp. † | 256,000 | | 2,250,240 |

| ANSYS, Inc. † (S) | 166,795 | | 6,473,314 |

| Blackbaud, Inc. | 14,337 | | 386,382 |

| Brocade Communications Systems, Inc. † | 1,960,128 | | 18,640,817 |

| Catapult Communications Corp. † | 33,710 | | 250,465 |

| Checkpoint Systems, Inc. † | 13,700 | | 414,425 |

| Cognos, Inc. (Canada) † | 39,800 | | 2,003,134 |

| Emulex Corp. † | 831,898 | | 18,018,911 |

| Logitech International SA (Switzerland) † | 6,218 | | 216,517 |

| Magma Design Automation, Inc. † | 167,557 | | 2,494,924 |

| Micros Systems, Inc. † | 82,391 | | 5,917,322 |

| MTS Systems Corp. | 6,400 | | 284,736 |

| Polycom, Inc. † | 6,925 | | 193,762 |

| Red Hat, Inc. † | 8,927 | | 192,734 |

| SPSS, Inc. † (S) | 46,844 | | 1,780,072 |

| Trident Microsystems, Inc. † | 178,610 | | 1,344,933 |

| | | | 60,862,688 |

|

| |

| Conglomerates (0.1%) | | | |

| AMETEK, Inc. | 11,820 | | 555,540 |

| SPX Corp. | 1,330 | | 134,729 |

| | | | 690,269 |

|

| |

| Construction (0.6%) | | | |

| Builders FirstSource, Inc. † (S) | 18,462 | | 133,850 |

| Chicago Bridge & Iron Co., NV (Netherlands) | 110,468 | | 5,523,400 |

| Eagle Materials, Inc. | 3,820 | | 150,928 |

| | | | 5,808,178 |

|

| |

| Consumer (0.8%) | | | |

| CSS Industries, Inc. | 58,458 | | 2,314,937 |

| Helen of Troy, Ltd. (Bermuda) † | 156,200 | | 2,811,600 |

| Hooker Furniture Corp. (S) | 138,844 | | 2,990,700 |

| Tupperware Brands Corp. | 5,140 | | 185,554 |

| | | | 8,302,791 |

32

| | | |

| COMMON STOCKS (93.6%)* continued | | | |

|

| | Shares | | Value |

| |

| Consumer Finance (0.5%) | | | |

| AmeriCredit Corp. † | 79,300 | $ | 1,118,923 |

| Asta Funding, Inc. | 53,995 | | 1,918,982 |

| Encore Capital Group, Inc. † | 4,500 | | 51,345 |

| World Acceptance Corp. † | 57,289 | | 1,848,143 |

| | | | 4,937,393 |

|

| |

| Consumer Goods (1.7%) | | | |

| American Greetings Corp. Class A | 6,530 | | 172,000 |

| Blyth Industries, Inc. | 186,587 | | 3,561,946 |

| Chattem, Inc. † (S) | 183,700 | | 13,648,910 |

| Jarden Corp. † | 1,308 | | 46,460 |

| Scotts Miracle-Gro Co. (The) Class A | 4,600 | | 211,094 |

| | | | 17,640,410 |

|

| |

| Consumer Services (1.0%) | | | |

| Labor Ready, Inc. † | 557,778 | | 9,805,737 |

| Visual Sciences, Inc. † | 17,400 | | 316,680 |

| | | | 10,122,417 |

|

| |

| Distribution (—%) | | | |

| Huttig Building Products, Inc. † | 6,308 | | 26,178 |

|

| |

| Electric Utilities (0.7%) | | | |

| Alliant Energy Corp. | 2,967 | | 118,680 |

| Black Hills Corp. | 12,680 | | 563,246 |

| CenterPoint Energy, Inc. | 3,110 | | 52,124 |

| OGE Energy Corp. | 6,720 | | 257,376 |

| Puget Energy, Inc. | 12,000 | | 339,000 |

| UniSource Energy Corp. (S) | 181,796 | | 5,766,569 |

| Westar Energy, Inc. | 23,390 | | 622,642 |

| | | | 7,719,637 |

|

| |

| Electrical Equipment (0.3%) | | | |

| GrafTech International, Ltd. † | 42,925 | | 811,283 |

| Insteel Industries, Inc. | 37,348 | | 433,237 |

| LoJack Corp. † | 86,400 | | 1,518,048 |

| Rofin-Sinar Technologies, Inc. † | 4,660 | | 366,369 |

| | | | 3,128,937 |

|

| |

| Electronics (2.2%) | | | |

| Ansoft Corp. † | 56,098 | | 1,687,428 |

| ASE Test, Ltd. (Taiwan) † | 205,700 | | 2,982,650 |

| DSP Group, Inc. † | 6,570 | | 103,740 |

| General Cable Corp. † (S) | 12,504 | | 900,163 |

| Greatbatch, Inc. † | 41,000 | | 1,019,260 |

| LSI Logic Corp. † | 133,000 | | 877,800 |

| Methode Electronics, Inc. Class A | 107,269 | | 1,345,153 |

| Nam Tai Electronics, Inc. (Hong Kong) | 144,900 | | 1,746,045 |

| QLogic Corp. † | 16,569 | | 257,317 |

| Stoneridge, Inc. † | 51,403 | | 528,937 |

33

| | | |

| COMMON STOCKS (93.6%)* continued | | | |

|

| | Shares | | Value |

| |

| Electronics continued | | | |

| Synopsys, Inc. † | 190,263 | $ | 5,376,832 |

| TriQuint Semiconductor, Inc. † | 325,487 | | 2,040,803 |

| TTM Technologies, Inc. † (S) | 99,727 | | 1,279,497 |

| Varian, Inc. † | 5,310 | | 392,356 |

| Zoran Corp. † | 91,800 | | 2,340,900 |

| | | | 22,878,881 |

|

| |

| Energy (2.9%) | | | |

| Cal Dive International, Inc. † (S) | 15,900 | | 210,357 |

| Grey Wolf, Inc. † | 742,200 | | 4,178,586 |

| Hercules Offshore, Inc. † (S) | 8,656 | | 234,058 |

| Markwest Hydrocarbon, Inc. | 5,600 | | 338,688 |

| NATCO Group, Inc. † | 46,143 | | 2,459,883 |

| Parker Drilling Co. † (S) | 1,026,805 | | 8,666,234 |

| Tidewater, Inc. (S) | 120,316 | | 6,577,676 |

| Trico Marine Services, Inc. † (S) | 207,100 | | 6,720,395 |

| | | | 29,385,877 |

|

| |

| Energy (Other) (—%) | | | |

| Verenium Corp. † (S) | 39,797 | | 211,720 |

|

| |

| Entertainment (—%) | | | |

| Audiovox Corp. Class A † | 300 | | 3,600 |

|

| |

| Financial (0.3%) | | | |

| Advanta Corp. Class B | 14,355 | | 226,809 |

| Asset Acceptance Capital Corp. | 36,962 | | 397,711 |

| PMI Group, Inc. (The) | 3,600 | | 57,708 |

| Radian Group, Inc. | 190,768 | | 2,401,769 |

| | | | 3,083,997 |

|

| |

| Food (—%) | | | |

| Arden Group, Inc. | 553 | | 78,758 |

| Overhill Farms, Inc. † | 23,200 | | 80,272 |

| Village Super Market, Inc. Class A | 3,196 | | 174,470 |

| | | | 333,500 |

|

| |

| Forest Products and Packaging (0.2%) | | | |

| Buckeye Technologies, Inc. † | 72,107 | | 1,292,157 |

| Neenah Paper, Inc. | 9,400 | | 319,600 |

| Packaging Corp. of America | 5,250 | | 167,160 |

| Sonoco Products Co. | 4,380 | | 135,430 |

| | | | 1,914,347 |

|

| |

| Gaming & Lottery (—%) | | | |

| Dover Downs Gaming & Entertainment, Inc. | 2,047 | | 22,374 |

34

| | | |

| COMMON STOCKS (93.6%)* continued | | | |

|

| | Shares | | Value |

| |

| Health Care Services (1.5%) | | | |

| AMN Healthcare Services, Inc. † | 6,455 | $ | 122,710 |

| Healthspring, Inc. † | 89,800 | | 1,885,800 |

| Lincare Holdings, Inc. † (S) | 311,710 | | 10,838,157 |

| Medcath Corp. † | 60,100 | | 1,666,573 |

| Molina Healthcare, Inc. † | 1,960 | | 74,696 |

| Odyssey Healthcare, Inc. † | 59,398 | | 608,830 |

| Pediatrix Medical Group, Inc. † | 6,290 | | 411,995 |

| | | | 15,608,761 |

|

| |

| Homebuilding (0.8%) | | | |

| NVR, Inc. † (S) | 16,387 | | 7,796,115 |

| Winnebago Industries, Inc. | 4,100 | | 105,698 |

| | | | 7,901,813 |

|

| |

| Household Furniture and Appliances (0.9%) | | | |

| American Woodmark Corp. (S) | 89,300 | | 2,264,648 |

| Conn’s, Inc. † (S) | 4,985 | | 127,466 |

| Select Comfort Corp. † (S) | 528,928 | | 6,045,647 |

| Tempur-Pedic International, Inc. (S) | 12,942 | | 465,912 |

| | | | 8,903,673 |

|

| |

| Insurance (9.2%) | | | |

| American Financial Group, Inc. | 36,625 | | 1,095,088 |

| American Physicians Capital, Inc. | 76,919 | | 3,350,592 |

| Amerisafe, Inc. † | 166,167 | | 2,686,920 |

| Aspen Insurance Holdings, Ltd. (Bermuda) | 157,505 | | 4,309,337 |

| CNA Surety Corp. † | 116,517 | | 2,305,871 |

| Commerce Group, Inc. (S) | 135,650 | | 4,949,869 |

| Delphi Financial Group Class A | 93,550 | | 3,625,063 |

| EMC Insurance Group, Inc. | 33,799 | | 889,928 |

| Employers Holdings, Inc. | 1,180 | | 22,609 |

| Endurance Specialty Holdings, Ltd. (Bermuda) | 57,369 | | 2,249,438 |

| FBL Financial Group, Inc. Class A | 5,400 | | 218,592 |

| First Mercury Financial Corp. † | 28,775 | | 637,366 |

| FPIC Insurance Group, Inc. † | 25,800 | | 1,077,924 |

| Hanover Insurance Group, Inc. (The) | 29,295 | | 1,349,621 |

| Harleysville Group, Inc. | 63,622 | | 1,983,098 |

| HCC Insurance Holdings, Inc. | 549,626 | | 16,428,321 |

| Hilb, Rogal & Hamilton Co. | 7,899 | | 348,109 |

| Horace Mann Educators Corp. | 25,109 | | 519,505 |

| IPC Holdings, Ltd. (Bermuda) | 58,950 | | 1,763,195 |

| Mercury General Corp. | 897 | | 46,025 |

| Midland Co. (The) | 15,843 | | 1,007,932 |

| National Interstate Corp. | 24,239 | | 775,648 |

| Odyssey Re Holdings Corp. | 45,400 | | 1,687,972 |

| Phoenix Companies, Inc. (The) | 17,400 | | 239,772 |

| Platinum Underwriters Holdings, Ltd. (Bermuda) | 1,440 | | 51,840 |

| RenaissanceRe Holdings, Ltd. (Bermuda) | 103,586 | | 6,043,207 |

| Safety Insurance Group, Inc. | 85,744 | | 3,083,354 |

35

| | | |

| COMMON STOCKS (93.6%)* continued | | | |

|

| | Shares | | Value |

| |

| Insurance continued | | | |

| SeaBright Insurance Holdings, Inc. † | 84,000 | $ | 1,401,120 |

| Selective Insurance Group | 153,872 | | 3,740,628 |

| Stancorp Financial Group | 85,174 | | 4,695,643 |

| State Auto Financial Corp. | 2,625 | | 72,240 |

| W.R. Berkley Corp. | 504,174 | | 15,170,596 |

| Zenith National Insurance Corp. | 167,052 | | 6,712,149 |

| | | | 94,538,572 |

|

| |

| Investment Banking/Brokerage (0.5%) | | | |

| Affiliated Managers Group † | 25,335 | | 3,332,819 |

| Eaton Vance Corp. | 4,162 | | 208,225 |

| FBR Capital Markets Corp. † | 12,940 | | 165,632 |

| Federated Investors, Inc. | 11,429 | | 491,447 |

| Investment Technology Group, Inc. † | 9,067 | | 379,907 |

| Jefferies Group, Inc. | 14,410 | | 385,179 |

| Pzena Investment Management, Inc. Class A † | 480 | | 9,302 |

| Raymond James Financial, Inc. | 8,300 | | 309,175 |

| Waddell & Reed Financial, Inc. Class A | 5,539 | | 184,006 |

| | | | 5,465,692 |

|

| |

| Leisure (0.1%) | | | |

| Polaris Industries, Inc. | 633 | | 31,131 |

| Steinway Musical Instruments, Inc. | 9,144 | | 273,863 |

| Thor Industries, Inc. | 5,500 | | 264,000 |

| | | | 568,994 |

|

| |

| Machinery (2.5%) | | | |

| Applied Industrial Technologies, Inc. | 65,943 | | 2,337,679 |

| Cascade Corp. | 92,064 | | 5,798,191 |

| Gardner Denver, Inc. † | 76,700 | | 2,771,171 |

| Manitowoc Co., Inc. (The) | 215,300 | | 10,605,678 |

| NACCO Industries, Inc. Class A | 11,300 | | 1,170,567 |

| Regal-Beloit Corp. | 38,400 | | 1,883,136 |

| Terex Corp. † | 3,026 | | 224,590 |

| Wabtec Corp. | 39,900 | | 1,497,447 |

| | | | 26,288,459 |

|

| |

| Manufacturing (1.0%) | | | |

| Acuity Brands, Inc. | 6,200 | | 296,360 |

| Knoll, Inc. | 7,200 | | 136,728 |

| Teleflex, Inc. | 125,610 | | 9,195,908 |

| Thomas & Betts Corp. † | 8,140 | | 455,921 |

| | | | 10,084,917 |

|

| |

| Medical Technology (2.3%) | | | |

| Edwards Lifesciences Corp. † (S) | 76,644 | | 3,849,062 |

| Immucor, Inc. † (S) | 263,851 | | 8,509,195 |

| LCA-Vision, Inc. (S) | 10,270 | | 175,309 |

| Mentor Corp. | 258,732 | | 11,014,221 |

36

| | | |

| COMMON STOCKS (93.6%)* continued | | | |

|

| | Shares | | Value |

| |

| Medical Technology continued | | | |

| PerkinElmer, Inc. | 3,860 | $ | 106,227 |

| Steris Corp. | 1,424 | | 41,353 |

| | | | 23,695,367 |

|

| |

| Metal Fabricators (0.1%) | | | |

| USEC, Inc. † (S) | 82,689 | | 727,663 |

|

| |

| Metals (5.3%) | | | |

| AK Steel Holding Corp. † | 55,674 | | 2,790,938 |

| Cleveland-Cliffs, Inc. (S) | 186,358 | | 17,825,143 |

| North American Galvanizing & Coatings, Inc. † (S) | 462,191 | | 4,011,818 |