| | | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811-07237) | |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: August 31, 2010 | | |

| |

| Date of reporting period: September 1, 2009 — February 28, 2010 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

A BALANCED APPROACH

Since 1937, when George Putnam created a diverse mix of stocks and bonds in a single, professionally managed portfolio, Putnam has championed the balanced approach.

A WORLD OF INVESTING

Today, we offer investors a world of equity, fixed-income, multi-asset, and absolute-return portfolios to suit a range of financial goals.

A COMMITMENT TO EXCELLENCE

Our portfolio managers seek superior results over time, backed by original, fundamental research on a global scale. We believe in the value of experienced financial advice, in providing exemplary service, and in putting clients first in all we do.

Putnam

International Capital

Opportunities Fund

Semiannual report

2 | 28 | 10

| |

| Message from the Trustees | 2 |

|

| About the fund | 4 |

|

| Performance snapshot | 6 |

|

| Interview with your fund’s portfolio managers | 7 |

|

| Your fund’s performance | 12 |

|

| Your fund’s expenses | 14 |

|

| Terms and definitions | 16 |

|

| Trustee approval of management contract | 17 |

|

| Other information for shareholders | 28 |

|

| Financial statements | 29 |

|

| Shareholder meeting results | 57 |

|

Message from the Trustees

Dear Fellow Shareholder:

What a difference a year makes. The rebound that followed the market lows in early March 2009 turned out to be one of the strongest in generations. After a slow start, the markets have continued to rise during the first few months of 2010.

It is unlikely that this year will be a repeat performance of 2009. Still, based on an encouraging earnings outlook and evidence of an improving but fragile global economic recovery, today’s markets offer opportunities for active money management, which is Putnam’s core strength.

If there is any lesson to be learned from the extraordinary volatility of the past two years, it is the importance of positioning one’s portfolio to limit downside risk.It is our belief that the best way to achieve this is by diversifying across all asset classes and investment strategies, and by adhering to your plan in every type of market environment.

Diversification and downside protection are worthwhile endeavors — and not just from a psychological standpoint. A portfolio diversified across all asset classes has been shown in the past to conserve wealth better during downturns and to benefit in a rising market environment.

2

Lastly, we would like to thank all shareholders who took the time to vote by proxy on a number of issues, including shareholder-friendly management fee changes, which went into effect earlier this year. We would also like to welcome new shareholders to the fund and thank all of our investors for your continued confidence in Putnam.

About the fund

Targeting smaller international companies

In international economies, as in the United States, small and midsize companies can offer attractive long-term investment potential. Such companies can seize new opportunities quickly or occupy profitable business niches. International markets may be particularly fertile ground compared with the United States, because relatively fewer research analysts cover smaller companies overseas.

Putnam International Capital Opportunities Fund has invested in stocks of small and midsize international companies since late 1995. While investing in companies located in other countries involves risk, including the possibility of currency fluctuations, economic instability, and political developments, it may also give your money a chance to grow, even during a downturn in the U.S. economy. That’s because international economies generally follow a different business cycle than that of the United States. In foreign markets, interest rates are managed by institutions such as the European

Central Bank or the Bank of Japan. Also, while foreign currencies such as the euro, the yen, and the pound fluctuate in value, your investment may benefit if these currencies strengthen against the U.S. dollar.

With thousands of smaller-company securities around the world to choose from, the fund’s managers rely on the proprietary research and extensive capabilities of analysts in Putnam’s Global Equity Research group.

Reflecting Putnam’s blend strategy, the portfolio can hold both value and growth stocks without a bias toward either style. This flexibility may help keep the fund diversified given the risks of changing market conditions. In addition to developed markets, including Europe, Japan, Australia, and Canada, the fund can invest in emerging markets, which may offer faster rates of economic growth despite greater risk of volatility and illiquid securities. In all their decisions, the portfolio managers are guided by Putnam’s risk controls, which call for regular review of fund holdings and the discipline to sell stocks when they reach what the managers consider their true worth.

Consider these risks before investing: Interna tional investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. The fund invests some or all of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations. The use of derivatives involves special risks and may result in losses. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound.

In-depth analysis is key to

successful stock selection.

Drawing on the expertise of a dedicated group of stock analysts, the fund’s portfolio managers seek stocks that are believed to be mispriced by the market. Once a stock is selected for the portfolio, it is regularly assessed by the managers to ensure that it continues to meet their criteria, including:

Quality The managers look for high-quality companies, seeking characteristics such as solid management teams, sound business models , and strong balance sheets.

Valuation The managers carefully consider how each stock is valued, seeking stocks whose valuations are attractive relative to the company’s growth potential.

Cash flow The managers examine each company’s financials, particularly the amount of cash a company generates relative to the earnings that it reports, and target those believed to offer attractive and sustainable cash flow.

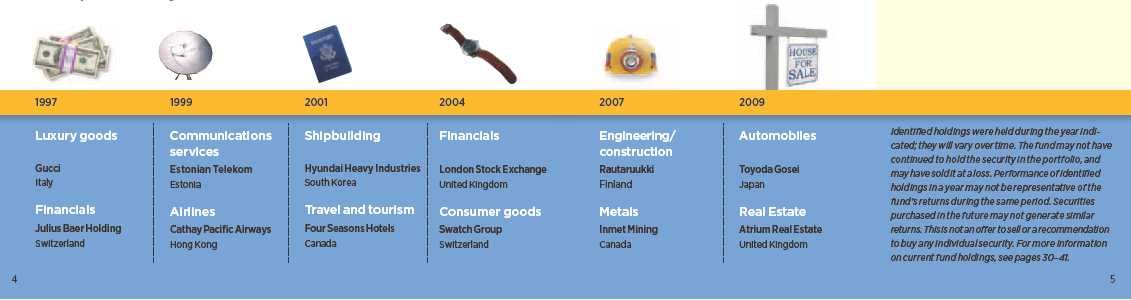

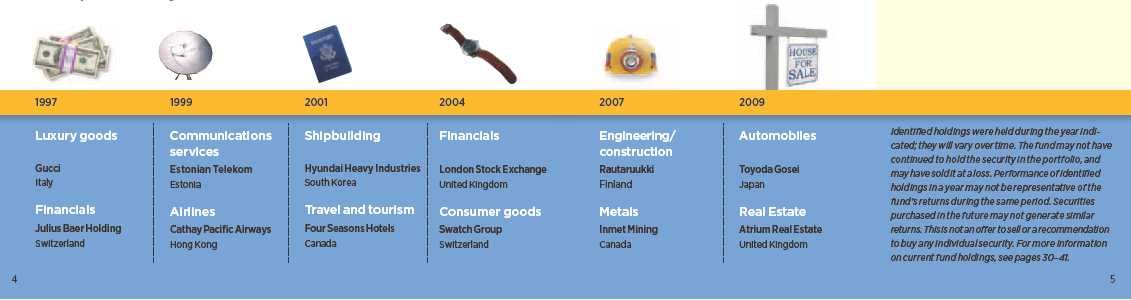

Putnam International Capital Opportunities Fund’s holdings

have spanned many sectors and international markets.

Performance

snapshot

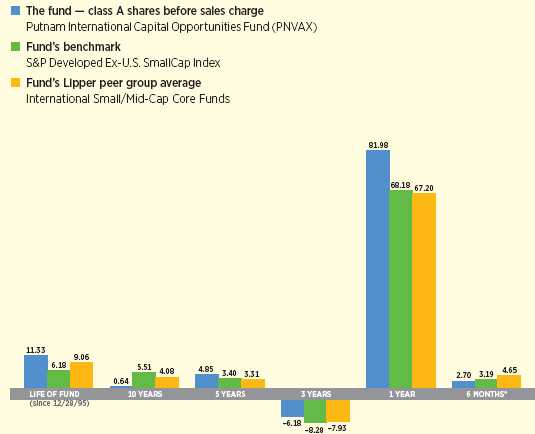

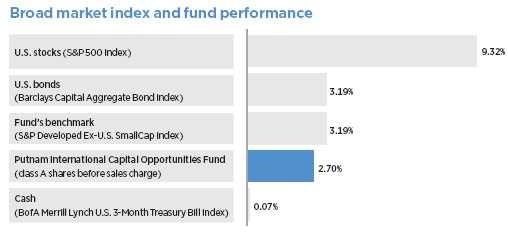

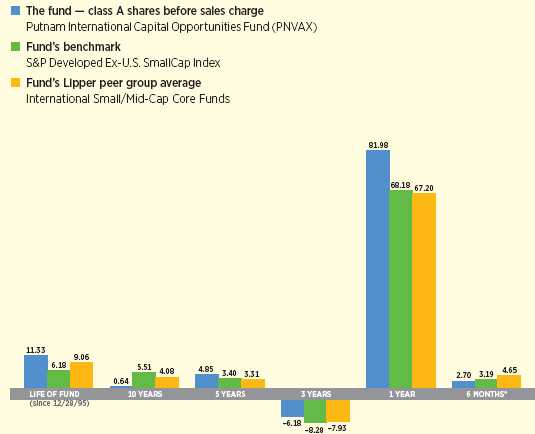

Annualized total return (%) comparison as of 2/28/10

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 7 and 12–13 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

6

Interview with your

fund’s portfolio managers

Joe Joseph and Randy Farina

There were signs of recovery in the global economy during the period. How did Putnam International Capital Opportunities Fund perform?

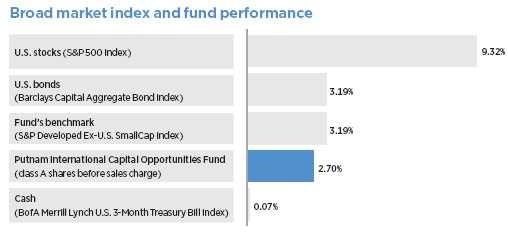

Joe: Early in the six-month period markets were generally positive, but they retraced some gains in November and December, followed by a bit more turbulence in February. Over the full six months, the fund’s class A shares rose 2.70%. The fund’s Lipper peer group of International Small/ Mid-Cap Core Funds on average posted a better result of 4.65%. The fund’s benchmark index, the S&P Developed Ex-U.S. SmallCap Index, also performed better than the fund, advancing3.19%. International markets lagged U.S. stocks. Several currencies weakened versus the dollar, including the euro and the British pound, which had a negative effect on the fund’s performance.

Worries about the sovereign debt levels of Greece, Spain, and other countries caused turmoil in European financial markets. Did this have an impact on the fund?

Joe: The fund does not own banks in the European markets most directly influenced by the debt crisis, such as Greece, Spain, and Ireland, and so the turmoil did not have a direct impact on the portfolio. The fund also has an underweight position in the banking industry relative to the benchmark index. The

This comparison shows your fund’s performance in the context of broad market indexes for the sixmonths ended 2/28/10. See pages 6 and 12–13 for additional fund performance information. Index descriptions can be found on page 16.

7

banks we hold in the portfolio are generally well capitalized and have strong balance sheets. As a result, although the financials sector underperformed during this period, the financial holdings in the fund were actually a source of relative strength.

What stocks contributed positively to the fund’s performance during the period?

Randy: Among the top contributors was Shire, a pharmaceuticals company headquartered in Ireland, and whose stock trades in the United Kingdom. We believe that it performed better than the benchmark index because the market recognized that it was undervalued — there was no significant change in its earnings. We believe Shire is still undervalued, and we continue to hold it.

Wotif.com Holdings of Australia is an Internet travel company that has benefited from rising travel bookings. Among developed markets, Australia has one of the strongest rates of economic growth and solid consumer demand. This demonstrates one of the benefits of owning a fund that can invest in international markets.

Two other contributors were Norwegian companies TGS Nopec and Petroleum Geo-Services, which specialize in seismic exploration for energy resources. As small companies in a specialized niche, their stock prices tend to be more volatile than prices of large, diversified oil companies. The stocks sank to attractive levels during the recession, but have performed well in the recovery.

What stocks lagged and accounted for the fund’s relative underperformance?

Randy: Several Japanese REITs [real estate investment trusts] underperformed the index, in part because Japan was one of the weakest markets in the world. REITs are stocks of trusts or corporations that invest in properties or mortgages. Examples included

Top 10 holdings

| | |

| HOLDING (percentage of fund’s net assets) | COUNTRY | SECTOR/INDUSTRY |

|

| Banque Cantonale Vaudoise (BCV) (0.9%) | Switzerland | Financials/Banking |

| Shire PLC (0.9%) | Ireland | Health care/Pharmaceuticals |

| Partners Group Holding AG (0.8%) | Switzerland | Financials/Investment banking/ |

| | | Brokerage |

| Wotif.com Holdings, Ltd. (0.8%) | Australia | Consumer staples/Consumer services |

| Next PLC (0.8%) | United Kingdom | Consumer cyclicals/Retail |

| Publicis Group SA (0.8%) | France | Consumer cyclicals/Advertising |

| | | and marketing services |

| Dassault Systemes SA (0.7%) | France | Technology/Software |

| Andritz AG (0.7%) | Austria | Capital goods/Machinery |

| Recordati SpA (0.7%) | Italy | Health care/Pharmaceuticals |

| Methanex Corp. (0.6%) | Canada | Basic materials/Chemicals |

This table shows the fund’s top 10 holdings and the percentage of the fund’s net assets that each represented as of 2/28/10. Short-term holdings are excluded. Holdings will vary over time.

8

“Our comparative equity research indi-

cates that the stocks of international

small companies offer attractive valu-

ations, particularly when compared

with U.S.largecaps.”

Joe Joseph

Leopalace21 and Tokyu Land Corporation, which lease and manage commercial and residential properties. As in most countries, this industry is depressed in Japan. We continue to hold the stocks because they are attractively valued.

In Mexico, the fund owned Cemex, a major cement and basic materials company. While emerging markets in general have begun to rebound, there is concern that construction of new infrastructure projects in Mexico might not be as robust as in other markets. We continue to own Cemex because we believe it has potential to perform well if these doubts are erased.

What changes did you make to the portfolio during the period?

Joe: We reduced positions in consumer staples stocks, which increased the portfolio’s underweight relative to the benchmark index. In our view, stocks in this sector have generally become more expensive. To offset this change, we increased positions in financial stocks, particularly in REITs, because we found that many of them were very attractively valued, following steep declines during the real estate crisis. This helped to bring the financials sector in the portfolio to a neutral weighting relative to the benchmark. Earlier, we had built an overweight in the asset management and capital market industries. Stocks in these industries fell to attractive valuations and stand to benefit from an improvement in the financial markets, but in

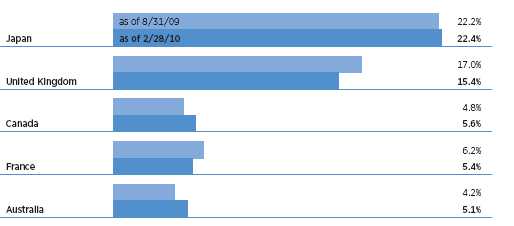

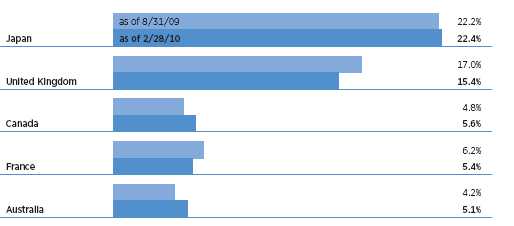

Comparison of top country weightings

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Holdings will vary over time.

9

our view they do not have the same negative credit risks that banks have.

IN THE NEWS

After two straight years of stagnation, the global economy is recovering faster than previously thought. In its World Economic Outlook, the International Monetary Fund (IMF) upgraded its view on global growth —predicting that world economies will expand 3.9% in 2010, up from –0.8% last year. The recovery, according to the IMF, will not be consistent across the board, with emerging markets leading more advanced economies, which continue to remain dependent on government stimulus for growth. Asia, in particular, is expected to lead the pack, with strong growth coming from China and India. Meanwhile, the United States is already showing signs of growth, with gross domestic product (GDP) increasing by 5.6% in the fourth quarter of 2009, up from 2.2% in the third quarter.

Would you say that the fund now favors stocks that can benefit from a recoveringeconomy?

Randy: The fund now has more exposure to sectors that can benefit from an economic upturn because this is where we find attractive valuations. It is important to note that our investment strategy is not based on economic forecasts, and we did not make these adjustments because of strong confidence that the economy will improve. Instead, cyclical stocks are relatively cheap, we believe, perhaps because many investors are still reluctant to believe the recovery is solid. We think that some of our competitors are more defensively positioned, which might be why the fund has lagged the peer group a bit lately.

We have an overweight to advertisers, auto components companies, and homebuilders. We believe these industries are improving, and they have substantial potential for growth. One of the portfolio’s biggest overweights continues to be in information technology. Our research indicates many of these companies have three attractive features in this environment: less debt on their balance sheets relative to other sectors; strong free cash flow; and relatively low valuations, which we believe give them greater performance potential. The fund is neutral to the benchmark in defensive sectors such as health care and consumer staples. We have increased the underweight in utilities.

What is your outlook for the coming sixmonths?

Joe: We do not invest the fund based on market forecasts, just as we do not invest based on economic forecasts. What we can say is that our comparative equity research indicates that the stocks of international small companies offer attractive valuations, particularly when compared with U.S. large caps. We also believe they are very attractive compared with emerging-market stocks. Within our investment universe, we have favored companies we consider undervalued relative to their ability to generate cash flow. This is the source of long-term investment performance, in our view.

Joe and Randy, thanks for discussing the fund today.

10

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Joseph Joseph has an M.B.A. from the Stern School of Business at New York University and a B.A. from Loyola College. A Certified Public Accountant, he joined Putnam in 1994 and has been in the investment industry since1987.

Portfolio Manager Randy Farina has an M.S. in Finance from Boston College and a B.S. from the University of Massachusetts Lowell. A CFA charterholder, he joined Putnam in 1997 and has been in the investment industry since 1995.

11

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 28, 2010, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at put nam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 2/28/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (12/28/95) | (10/30/96) | (7/26/99) | (10/30/96) | (1/21/03) | (2/1/00) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 11.33% | 10.86% | 10.49% | 10.49% | 10.50% | 10.50% | 10.77% | 10.49% | 11.07% | 11.52% |

|

| 10 years | 6.59 | 0.45 | –1.20 | –1.20 | –1.13 | –1.13 | 1.40 | –2.15 | 4.23 | 9.25 |

| Annual average | 0.64 | 0.04 | –0.12 | –0.12 | –0.11 | –0.11 | 0.14 | –0.22 | 0.42 | 0.89 |

|

| 5 years | 26.72 | 19.43 | 22.00 | 20.00 | 22.08 | 22.08 | 23.60 | 19.26 | 25.20 | 28.33 |

| Annual average | 4.85 | 3.62 | 4.06 | 3.71 | 4.07 | 4.07 | 4.33 | 3.59 | 4.60 | 5.12 |

|

| 3 years | –17.42 | –22.16 | –19.27 | –21.60 | –19.22 | –19.22 | –18.65 | –21.50 | –18.02 | –16.80 |

| Annual average | –6.18 | –8.01 | –6.89 | –7.79 | –6.87 | –6.87 | –6.65 | –7.75 | –6.41 | –5.95 |

|

| 1 year | 81.98 | 71.50 | 80.62 | 75.62 | 80.72 | 79.72 | 81.14 | 74.85 | 81.50 | 82.49 |

|

| 6 months | 2.70 | –3.21 | 2.32 | –2.68 | 2.35 | 1.35 | 2.46 | –1.12 | 2.59 | 2.84 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.75% and 3.50% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for classB, C, M, R, and Y shares before their inception is derived from the historical performance of classA shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund may have limited expenses, without which returns would have been lower.

A 1% short-term trading fee may be applied to shares exchanged or sold within 90 days of purchase.

12

Comparative index returns For periods ended 2/28/10

| | |

| | S&P Developed Ex-U.S. | Lipper International Small/Mid-Cap |

| | SmallCap Index | Core Funds category average* |

|

| Annual average (life of fund) | 6.18% | 9.06% |

|

| 10 years | 70.95 | 56.65 |

| Annual average | 5.51 | 4.08 |

|

| 5 years | 18.18 | 17.79 |

| Annual average | 3.40 | 3.31 |

|

| 3 years | –22.83 | –21.84 |

| Annual average | –8.28 | –7.93 |

|

| 1 year | 68.18 | 67.20 |

|

| 6 months | 3.19 | 4.65 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 2/28/10, there were 43, 43, 26, 20, 13, and 3 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 2/28/10

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | — | — | — | 1 | 1 |

|

| Income | $0.115 | — | — | — | $0.094 | $0.178 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.115 | — | — | — | $0.094 | $0.178 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 8/31/09 | $28.69 | $30.44 | $28.42 | $28.48 | $28.50 | $29.53 | $28.29 | $28.73 |

|

| 2/28/10 | 29.35 | 31.14 | 29.08 | 29.15 | 29.20 | 30.26 | 28.93 | 29.37 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (12/28/95) | (10/30/96) | (7/26/99) | (10/30/96) | (1/21/03) | (2/1/00) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 11.89% | 11.42% | 11.05% | 11.05% | 11.06% | 11.06% | 11.33% | 11.05% | 11.63% | 12.09% |

|

| 10 years | 23.18 | 16.10 | 14.20 | 14.20 | 14.24 | 14.24 | 17.14 | 13.04 | 20.51 | 26.26 |

| Annual average | 2.11 | 1.50 | 1.34 | 1.34 | 1.34 | 1.34 | 1.59 | 1.23 | 1.88 | 2.36 |

|

| 5 years | 41.52 | 33.40 | 36.27 | 34.27 | 36.33 | 36.33 | 38.00 | 33.18 | 39.87 | 43.30 |

| Annual average | 7.19 | 5.93 | 6.38 | 6.07 | 6.39 | 6.39 | 6.65 | 5.90 | 6.94 | 7.46 |

|

| 3 years | –12.93 | –17.94 | –14.88 | –17.33 | –14.86 | –14.86 | –14.23 | –17.22 | –13.52 | –12.27 |

| Annual average | –4.51 | –6.38 | –5.23 | –6.15 | –5.22 | –5.22 | –4.99 | –6.11 | –4.73 | –4.27 |

|

| 1 year | 80.07 | 69.75 | 78.74 | 73.74 | 78.73 | 77.73 | 79.17 | 72.91 | 79.74 | 80.52 |

|

| 6 months | 5.73 | –0.33 | 5.35 | 0.35 | 5.33 | 4.33 | 5.46 | 1.77 | 5.64 | 5.88 |

|

13

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total fund annual operating expenses for the fiscal | | | | | | |

| year ended 8/31/09* | 1.67% | 2.42% | 2.42% | 2.17% | 1.92% | 1.42% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 2/28/10 | 1.67% | 2.42% | 2.42% | 2.17% | 1.92% | 1.42% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Reflects projected expenses based on a new expense arrangement.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in Putnam International Capital Opportunities Fund from September 1, 2009, to February 28, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $8.39 | $12.14 | $12.14 | $10.89 | $9.64 | $7.14 |

|

| Ending value (after expenses) | $1,027.00 | $1,023.20 | $1,023.50 | $1,024.60 | $1,025.90 | $1,028.40 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in theyear.

14

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended February 28, 2010, use the following calculation method. To find the value of your investment on September 1, 2009, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $8.35 | $12.08 | $12.08 | $10.84 | $9.59 | $7.10 |

|

| Ending value (after expenses) | $1,016.51 | $1,012.79 | $1,012.79 | $1,014.03 | $1,015.27 | $1,017.75 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in theyear.

15

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approvedprograms.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S.

3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

S&P Developed Ex-U.S. SmallCap Index is an unmanaged index of small-cap stocks from developed countries, excluding the UnitedStates.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

16

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract, with respect to your fund, between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2009, the Contract Committee met several times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. At the Trustees’ June12, 2009 meeting, the Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management and sub-management contract s, effective July 1, 2009. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That such fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees, were subject to the continued application of certain expense reductions and waivers pending other considerations noted below, and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these sam e arrangements in prior years.

Consideration of strategic

pricing proposal

The Trustees considered that the Contract Committee had been engaged in a detailed review of Putnam Management’s strategic pricing proposal that was first presented

17

to the Committee at its May 2009 meeting. The proposal included proposed changes to the basic structure of the management fees in place for all open-end funds (except the Putnam RetirementReady® Funds and Putnam Money Market Liquidity Fund), including implementation of a breakpoint structure based on the aggregate net assets of all such funds in lieu of the individual breakpoint structures in place for each fund, as well as implementation of performance fees for certain funds. In addition, the proposal recommended substituting separate expense limitations on investor servicing fees and on other expenses as a group in lieu of the total expense limitations in place for many funds.

While the Contract Committee noted the likelihood that the Trustees and Putnam Management would reach agreement on the strategic pricing matters in later months, the terms of the management contracts required that the Trustees approve the continuance of the contracts in order to prevent their expiration at June 30, 2009. The Contract Committee’s recommendations in June reflect its conclusion that the terms of the contractual arrangements for your fund continued to be appropriate for the upcoming term, absent any possible agreement with respect to the matters addressed in Putnam Management’s proposal.

The Trustees were mindful of the significant changes that had occurred at Putnam Management in the past two years, including a change of ownership, the installation of a new senior management team at Putnam Management, the substantial decline in assets under management resulting from extraordinary market forces as well as continued net redemptions in many funds, the introduction of new fund products representing novel investment strategies and the introduction of performance fees for certain new funds. The Trustees were also mindful that many other leading firms in the industry had also been experiencing significant challenges due to the changing financial and competitive environment. For these reasons, even though the Trustees believed that the current contractual arrangements in place between the funds and Putnam Management and its affiliates have served shareholders well and continued to be appropriate for the nea r term, the Trustees believed that it was an appropriate time to reconsider the current structure of the funds’ contractual arrangements with Putnam Management with a view to possible changes that might better serve the interests of shareholders in this new environment. The Trustees concluded their review of Putnam Management’s strategic pricing proposal in July 2009, and their considerations regarding the proposal are discussed below under the heading “Subsequent approval of strategic pricing proposal.” With the exception of the discussion under this heading, the following discussion generally addresses only the Trustees’ reasons for recommending the continuance of the current contractual arrangements as, at the time the Trustees determined to make this recommendation, the Trustees had not yet reached any conclusions with respect to the strategic pricing proposal.

Management fee schedules and

categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. The general fee structure has been carefully developed over the years and re-examined on many occasions and adjusted where appropriate. In this regard, the Trustees noted that shareholders of all funds voted by overwhelming majorities in 2007 to approve new management contracts containing identical fee schedules.

In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example,

18

changes in a fund’s size or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund at that time but, as indicated above, based on their detailed review of the current fee structure, were prepared to consider possible changes to this arrangement that might better serve the interests of shareholders in the future. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 34th percentile in management fees and in the 21st percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2008 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds).

The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees (as applicable) and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints. The Trustees expressed their intention to monitor the funds’ percentile rankings in management fees and in total expenses to ensure that fees and expenses of the funds continue to meet evolving competitive standards.

The Trustees noted that the expense ratio increases described above were being controlled by expense limitations initially implemented in January 2004. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception and, while the Contract Committee was reviewing proposed alternative expense limitation arrangements as noted above, the Trustees received a commitment from Putnam Management and its parent company to continue this program through at least June30, 2010, or such earlier time as the Trustees and Putnam Management reach agreement on alternative arrangements.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2009, or until such earlier time as the Trustees and Putnam Management reach agreement on alternative expense limitation arrangements, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation is applicable to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2007. This additional expense limitation was not applied to your fund because it had a below-average expense ratio relative to its custom peergroup.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of the fund (as

19

a percentage of fund assets) declines as the fund grows in size and crosses specified asset thresholds. Conversely, as the fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedule in effect for your fund represented an appropriate sharing of economies of scale at that time but, as noted above, were in the process of reviewing a proposal to eliminate individual fund breakpoints for all of the open-end funds (except for the Putnam RetirementReady® Funds and Putnam Money Market Liquidity Fund) in favor of a breakpoint structure based on the aggregate net assets of all such funds.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process— as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — bu t also recognized that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the disappointing investment performance of many of the funds for periods ended March 31, 2009. They discussed with senior management of Putnam Management the factors contributing to such underperformance and the actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has taken steps to strengthen its investment personnel and processes to address areas of underperformance, including Putnam Management’s continuing efforts to strengthen the equity research function, recent changes in portfolio managers including increased accountability of individual managers rather than teams, recent changes in Putnam Management’s approach to incentive compensation, including emphasis on top quartile performance over a rolling three-year period, and the recent arrival of a new chief investment officer. The Trustees also recognized the substantial improvement in performance of many funds si nce the implementation of those changes. The Trustees indicated their intention to continue

20

to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper International Small/ Mid-Cap Core Funds) for the one-year, three-year and five-year periods ended March 31, 2009 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | | |

| One-year period | 55th | | |

| | |

| Three-year period | 34th | | |

| | |

| Five-year period | 30th | | |

| | |

Over the one-year, three-year and five-year periods ended March 31, 2009, there were 67, 41 and 39 funds, respectively, in your fund’s Lipper peer group. Past performance is no guarantee of future results.

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations;

other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered a change made, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policy commencing in 2009, which increased the permitted soft dollar allocation to third-party services over what had been authorized in previous years. The Trustees noted that a portion of available soft dollars continue to be allocated to the payment of fund expenses, although the amount allocated for this purpose has declined in recent years. The Trustees indicated their continued int ent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage and trends in industry practice to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of the investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”), which agreement provides benefits to an affiliate of Putnam Management. The Trustees considered that effective January 1, 2009, the Trustees, PSERV and Putnam Management entered into a new fee schedule that includes for the open-end funds (other than funds of Putnam Variable Trust and Putnam Money Market Liquidity Fund) an expense limitation

21

but, as noted above, also considered that this expense limitation is subject to review as part of the Trustees’ pending review of Putnam’s strategic pricing proposal.

In the case of your fund, the Trustees’ annual review of the fund’s management contract also included the review of the fund’s distributor’s contract and distribution plans with Putnam Retail Management Limited Partnership, which contract and plans also provide benefits to an affiliate of Putnam Management.

Comparison of retail and institutional

fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparisons of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different asset classes are typically higher on average fo r mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Subsequent approval of strategic

pricing proposal

As mentioned above, at a series of meetings beginning in May 2009 and ending on July 10, 2009, the Contract Committee and the Trustees engaged in a detailed review of Putnam Management’s strategic pricing proposal. Following this review, the Trustees of each fund, including all of the Independent Trustees, voted unanimously on July 10, 2009 to approve proposed management contracts reflecting the proposal, as modified based on discussions between the Independent Trustees and Putnam Management, for each fund. In considering the proposed contracts, the Independent Trustees focused largely on the specific proposed changes described below relating to management fees. They also took into account the factors that they considered in connection with their most recent annual approval on June 12, 2009 of the continuance of the funds’ current management contracts and the extensive materials that they had reviewed in connection with that approval process, as described above.

On December 18, 2009, shareholders approved the proposed management contract for your fund. The new management contract was implemented on January 1, 2010.

• Considerations relating to Fund Family fee rate calculations. The Independent Trustees considered that the proposed management contracts would change the manner in which fund shareholders share in potential economies of scale associated with the management of the funds. Under the current management contracts, shareholders of a fund (other than Putnam Money Market Liquidity Fund and the Putnam RetirementReady® Funds, which do not pay management fees to Putnam Management) benefit from increased fund size through reductions in the effective management fee paid to Putnam Management once the fund’s net assets exceed the first breakpoint in

22

the fund’s fee schedule ($500 million for most funds). Conversely, in the case of funds with net assets above the level of the first breakpoint, the effective management fee increases as the fund’s average net assets decline below a breakpoint. These breakpoints are measured solely by the net assets of each individual fund and are not affected by possible growth (or decline) of net assets of other funds in the Fund Family. (“Fund Family” for purposes of this discussion refers to all open-end mutual funds sponsored by Putnam Management, except for the Putnam RetirementReady® Funds and Putnam Money Market Liquidity Fund.) Under the proposed management contracts, potential economies of scale would be shared ratably among shareholders of all funds, regardless of their size. The management fees paid by a fund (and indirectly by shareholders) would no longer be affected by the growth (or decline) o f assets of the particular fund, but rather would be affected solely by the growth (or decline) of the aggregate net assets of all funds in the Fund Family, regardless of whether the net assets of the particular fund are growing or declining.

The table below shows the proposed effective management fee rate for your fund, based on June 30, 2009 net assets of the Fund Family ($52.3 billion). This table also shows the effective management fee rate payable by your fund under its current management contract, based on the net assets of the fund as of June30, 2009. Finally, this table shows the difference in the effective management fees, based on net assets as of June 30, 2009, between the proposed management contract and the current contract.

| | | |

| | Proposed Effective | Current Effective | |

| Name of Fund | Contractual Rate | Contractual Rate | Difference |

|

| Putnam International Capital Opportunities Fund | 0.942% | 0.948% | (0.006)% |

As shown in the foregoing table, based on June 30, 2009 net asset levels, the proposed management contract would provide for payment of a management fee rate that is lower for your fund than the management fee rate payable under the current management contract. For a small number of funds (although not your fund), the management fee rate would be slightly higher under the proposed contract at these asset levels, but by only immaterial amounts. In the aggregate, the financial impact on Putnam Management of implementing this proposed change for all funds at June 30, 2009 net asset levels is a reduction in annual management fee revenue of approximately $24.0 million. (Putnam Management has already incurred a significant portion of this revenue reduction through the waiver of a portion of its current management fees for certain funds pending shareholder consideration of the proposed management contracts. Putnam is not ob liged to continue such waivers beyond July 31, 2010 in the event that the proposed contracts are not approved by shareholders.) The Independent Trustees carefully considered the implications of this proposed change under a variety of economic circumstances. They considered the fact that at current asset levels the management fees paid by the funds under the proposed contract would be lower for almost all funds, and would not be materially higher for any fund. They considered the possibility that under some circumstances, the current management contract could result in a lower fee for a particular fund than the proposed management contract. Such circumstances might occur, for example, if the aggregate net assets of the Fund Family remain largely unchanged and the net assets of an individual fund grew substantially, or if the net assets of an individual fund remain largely unchanged and

23

the aggregate net assets of the Fund Family declined substantially.

The Independent Trustees noted that future changes in the net assets of individual funds are inherently unpredictable and that experience has shown that funds often grow in size and decline in size over time depending on market conditions and the changing popularity of particular investment styles and asset classes. They noted that, while the aggregate net assets of the Fund Family have changed substantially over time, basing a management fee on the aggregate level of assets of the Fund Family would likely reduce fluctuations in costs paid by individual funds and lead to greater stability and predictability of fund operating costs over time.

The Independent Trustees considered that the proposed management contract would likely be advantageous for newly organized funds that have yet to attract significant assets and for funds in specialty asset classes that are unlikely to grow to a significant size. In each case, such funds would participate in the benefits of scale made possible by the aggregate size of the Fund Family to an extent that would not be possible based solely on their individual size.

The Independent Trustees also considered that for funds that have achieved or are likely to achieve considerable scale on their own, the proposed management contract could result in sharing of economies which might lead to slightly higher costs under some circumstances, but they noted that any such increases are immaterial at current asset levels and that over time such funds are likely to realize offsetting benefits from their opportunity to participate, both through the exchange privilege and through the Fund Family breakpoint fee structure, in the improved growth prospects of a diversified Fund Family able to offer competitively priced products.

The Independent Trustees noted that the implementation of the proposed management contracts would result in a reduction in aggregate fee revenues for Putnam Management at current asset levels. They also noted that applying various projections of growth equally to the aggregate net assets of the Fund Family and to the net assets of individual funds also showed revenue reductions for Putnam Management. They recognized, however, the possibility that under some scenarios Putnam Management might realize greater future revenues, with respect to certain funds, under the proposed contracts than under the current contracts, but considered such circumstances to be both less likely and inherently unpredictable.

The Independent Trustees considered the extent to which Putnam Management may realize economies of scale in connection with the management of the funds. In this regard, they considered the possibility that such economies of scale as may exist in the management of mutual funds may be associated more closely with the size of the aggregate assets of the mutual fund complex than with the size of any individual fund. In this regard the Independent Trustees considered the financial information provided to them by Putnam Management over a period of many years regarding the allocation of costs involved in calculating the profitability of its mutual fund business as a whole and the profitability of individual funds. The Independent Trustees noted that the methodologies for such cost allocations had been reviewed on a number of occasions in the past by independent financial consultants engaged by the Independent Trustees. The Independent Trustees noted that thes e methodologies support Putnam Management’s assertion that many of its operating costs and any associated economies of scale are related more to the aggregate net assets under management in various sectors of its business than to the size of individual funds. They noted that on a number of occasions in the past the Independent Trustees had separately considered the possibility of

24

calculating management fees in whole or in part based on aggregate net assets of the Putnam funds.

The Independent Trustees considered the fact that the proposed contracts would result in a sharing among the affected funds of economies of scale that for the most part are now enjoyed by the larger funds, without materially increasing the current costs of any of the larger funds. They concluded that this sharing of economies among funds was appropriate in light of the diverse investment opportunities available to shareholders of all funds through the existence of the exchange privilege. They also considered that the proposed change in management fee structure would allow Putnam Management to introduce new investment products at more attractive pricing levels than may currently be the case.

After considering all of the foregoing, the Independent Trustees concluded that the proposed calculation of management fees based on the aggregate net assets of the Fund Family represented a fair and reasonable means of sharing possible economies of scale among the shareholders of all funds.

• Considerations relating to addition of fee rate adjustments based on investment performance for certain funds. The Independent Trustees considered that Putnam’s proposal to add fee rate adjustments based on investment performance to the management contracts of certain funds reflected a desire by Putnam Management to align its fee revenues more closely with investment performance in the case of certain funds. They noted that Putnam Management already has a significant financial interest in achieving good performance results for the funds it manages. Putnam Management’s fees are based on the assets under its management (whether calculated on an individual fund or complex-wide basis). Good performance results in higher asset levels and therefore higher revenues to Putnam Management. Moreove r, good performance also tends to attract additional investors to particular funds or the complex generally, also resulting in higher revenues. Nevertheless, the Independent Trustees concluded that adjusting management fees based on performance for certain selected funds could provide additional benefits to shareholders.

The Independent Trustees noted that Putnam Management proposed the addition of performance adjustments only for certain of the funds and considered whether similar adjustments might be appropriate for other funds. In this regard, they considered Putnam Management’s belief that the addition of performance adjustments would be most appropriate for shareholders of U.S. growth funds, international equity funds, including your fund, and Putnam Global Equity Fund. They also considered Putnam Management’s view that it would continue to monitor whether performance fees would be appropriate for other funds. Accordingly, the Independent Trustees concluded that it would be desirable to gain further experience with the operation of performance adjustments for certain funds and the market’s receptivity to such fee structures before giving further consideration to whether similar performance adjustments would be appropriate for other funds as well.

• Considerations relating to standardization of payment terms. The proposed management contracts for all funds provide thatmanagement fees will be computed and paid monthly within 15 days after the end of each month. The current contracts of the funds contain quarterly computation and payment terms in some cases. These differences largely reflect practices in place at earlier times when many of the funds were first organized. Under the proposed contract, certain funds would make payments to Putnam Management earlier than they do under their current contract. This would reduce a fund’s opportunity to earn income on accrued but

25

unpaid management fees by a small amount, but would not have a material effect on a fund’s operating costs.

The Independent Trustees considered the fact that standardizing the payment terms for all funds would involve an acceleration in the timing of payments to Putnam Management for some funds and a corresponding loss of a potential opportunity for such funds to earn income on accrued but unpaid management fees. The Independent Trustees did not view this change as having a material impact on shareholders of any fund. In this regard, the Independent Trustees noted that the proposed contracts conform to the payment terms included in management contracts for all Putnam funds organized in recent years and that standardizing payment terms across all funds would reduce administrative burdens for both the funds and Putnam Management.

• Considerations relating to comparisons with management fees and total expenses of competitive funds. As part of their evaluation of the proposed management contracts, the Independent Trustees also reviewed the general approach taken by Putnam Management and the Independent Trustees in recent years in imposing appropriate limits on total fund expenses. As part of the annual contract review process in recent years, Putnam Management agreed to waive fees as needed to limit total fund expenses to a maximum level equal to the average total expenses of comparable competitive funds in the mutual fund industry. In connection with its proposal to implement new management contracts, Putnam Management also proposed, and the Independent Trustees approved, certain changes in this approach that shift the focus from controlling total expenses to imposing separate limits on certain c ategories of expenses, as required. As a general matter, Putnam Management and the Independent Trustees concluded that management fees for the Putnam funds are competitive with the fees charged by comparable funds in the industry. Nevertheless, the Independent Trustees considered specific management fee waivers proposed to be implemented as of August 1, 2009 by Putnam Management with respect to the current management fees of certain funds, as well as projected reductions in management fees for almost all funds that would result under the proposed contracts. Putnam Management and the Independent Trustees also agreed to impose separate expense limitations of 37.5 basis points on the general category of shareholder servicing expenses and 20 basis points on the general category of other ordinary operating expenses. These new expense limitations, as well as the fee waivers, were implemented for all funds effective as of August 1, 2009, replacing the expense limitation referred to above.

These changes resulted in lower total expenses for many funds, but in the case of some funds total expenses increased after application of the new waivers and expense limitations (as compared with the results obtained using the expense limitation method previously in place). In this regard, the Independent Trustees considered the likelihood that total expenses for most of these funds would have increased in any event in the normal course under the previous expense limitation arrangement, as the reported total expense levels of many competitive funds increased in response to the major decline in asset values that began in September 2008. These new waivers and expense limitations will continue in effect until at least July 31, 2010 and will be re-evaluated by the Independent Trustees as part of the annual contract review process prior to their scheduled expiration. However, the management fee waivers referred to above would largely become permanent reduc tions in fees as a result of the implementation of the proposed management contracts.

26

Under these new expense limitation arrangements effective August 1, 2009, your fund is subject to expense limitations of 37.5 basis points on the category of shareholder servicing fees and 20 basis points on the general category of other ordinary operating expenses.

27

Other information for shareholders

Important notice regarding delivery

of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2009, are available in the Individual Investors section of putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

Trustee and employee

fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2010, Putnam employees had approximately $323,000,000 and the Trustees had approximately $46,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

28

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

29

The fund’s portfolio 2/28/10 (Unaudited)

| | |

| COMMON STOCKS (99.3%)* | Shares | Value |

|

| Australia (5.1%) | | |

| Abacus Property Group R | 9,468,822 | $3,566,091 |

|

| Alesco Corp., Ltd. | 632,868 | 2,479,943 |

|

| Beach Petroleum, Ltd. | 3,007,404 | 1,793,332 |

|

| BlueScope Steel, Ltd. | 1,844,235 | 4,002,016 |

|

| Corporate Express Australia, Ltd. | 689,262 | 2,645,302 |

|

| Crane Group, Ltd. S | 256,608 | 1,932,843 |

|

| Flight Centre, Ltd. S | 305,618 | 5,171,279 |

|

| Iluka Resources, Ltd. † | 1,033,034 | 3,316,231 |

|

| Incitec Pivot, Ltd. | 1,771,200 | 5,145,882 |

|

| ING Industrial Fund † | 6,817,552 | 2,598,152 |

|

| Kagara Zinc, Ltd. † | 3,457,985 | 2,573,643 |

|

| Macquarie Office Trust | 12,908,400 | 3,240,989 |

|

| Pacific Brands, Ltd. † | 5,203,903 | 5,319,627 |

|

| Sigma Pharmaceuticals, Ltd. | 3,028,332 | 2,443,955 |

|

| Sims Group, Ltd. | 216,116 | 3,765,363 |

|

| Valad Property Group † R | 31,562,741 | 2,971,743 |

|

| Wotif.com Holdings, Ltd. | 1,462,007 | 9,622,606 |

|

| | | 62,588,997 |

| Austria (1.0%) | | |

| Andritz AG | 141,449 | 8,033,063 |

|

| Bank Austria Creditanstalt AG † F | 471 | — |

|

| CA Immobilien Anlagen AG † | 198,642 | 1,964,052 |

|

| EVN AG | 146,458 | 2,561,081 |

|

| | | 12,558,196 |

| Belgium (1.0%) | | |

| Euronav NV S | 167,367 | 3,398,542 |

|

| Gimv NV | 13,677 | 682,669 |

|

| Omega Pharma SA | 81,458 | 4,011,505 |

|

| UCB SA | 100,765 | 4,460,035 |

|

| | | 12,552,751 |

| Bermuda (1.2%) | | |

| Aspen Insurance Holdings, Ltd. | 216,714 | 6,124,338 |

|

| Hiscox, Ltd. | 856,535 | 4,643,685 |

|

| Ship Finance International, Ltd. | 253,071 | 4,023,829 |

|

| | | 14,791,852 |

| Canada (5.6%) | | |

| Atco, Ltd. Class I | 40,300 | 1,843,315 |

|

| Biovail Corp. | 328,600 | 4,865,255 |

|

| Canaccord Capital, Inc. | 976,143 | 7,862,240 |

|

| Dorel Industries, Inc. Class B | 92,400 | 2,663,222 |

|

| Ensign Energy Services, Inc. | 321,224 | 4,600,260 |

|

| Forzani Group, Ltd. (The) | 309,940 | 4,250,033 |

|

| Industrial Alliance Insurance and Financial Services, Inc. | 90,000 | 2,838,817 |

|

| Inmet Mining Corp. | 107,793 | 5,879,618 |

|

| InnVest Real Estate Investment Trust R | 904,500 | 4,851,065 |

|

| Lundin Mining Corp. † | 1,312,500 | 5,554,037 |

|

| Methanex Corp. | 332,491 | 7,875,952 |

|

30

| | |

| COMMON STOCKS (99.3%)* cont. | Shares | Value |

|

| Canada cont. | | |

| Pason Systems, Inc. | 380,100 | $4,662,695 |

|

| Precision Drilling Trust (Units) † | 585,000 | 4,511,554 |

|

| Sherritt International Corp. | 829,000 | 5,857,237 |

|

| | | 68,115,300 |

| Cayman Islands (0.2%) | | |

| Herbalife, Ltd. | 51,400 | 2,058,570 |

|