| | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811-07237) | |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | 800 Boylston Street |

| | Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: April 30, 2011 | | |

| |

| Date of reporting period: May 1, 2010 — October 31, 2010 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam Capital

Opportunities

Fund

Semiannual report

10 | 31 | 10

| | |

| Message from the Trustees | 1 | |

| |

| About the fund | 2 | |

| |

| Performance snapshot | 4 | |

| |

| Interview with your fund’s portfolio manager | 5 | |

| |

| Your fund’s performance | 10 | |

| |

| Your fund’s expenses | 12 | |

| |

| Terms and definitions | 14 | |

| |

| Trustee approval of management contract | 15 | |

| |

| Other information for shareholders | 19 | |

| |

| Financial statements | 20 | |

| |

Message from the Trustees

Dear Fellow Shareholder:

Stock markets around the world rallied strongly over the past few months, riding a rising tide of strengthening investor confidence and slowly improving economic and corporate data. Indeed, U.S stocks delivered their best September in 71 years, and continued to add to those gains in October. Bond markets also have generated positive results for much of 2010 and continue to be a source of refuge for risk-averse investors.

It is important to recognize, however, that we may see periods of heightened market volatility as markets and economies seek more solid ground. The slow pace of the U.S. economic recovery and ongoing European sovereign debt concerns have made markets more susceptible to disappointing news. We believe, however, that Putnam’s research-intensive, actively managed investment approach is well suited for this environment.

In developments affecting oversight of your fund, Barbara M. Baumann has been elected to the Board of Trustees of the Putnam Funds, effective July 1, 2010. Ms. Baumann is president and owner of Cross Creek Energy Corporation of Denver, Colorado, a strategic consultant to domestic energy firms and direct investor in energy assets. We also want to thank Elizabeth T. Kennan, who has retired from the Board of Trustees, for her many years of dedicated and thoughtful leadership.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

Seeking overlooked, underpriced small and midsize companies

Every company, whatever its industry, growth rate, or size, has an underlying value. This value is based in part on the cash flows the company generates. The price of a company’s stock, however, may not accurately reflect this underlying value. A stock may be mispriced for different reasons, and is often the res ult of behavioral bias — when investors overreact to short-term factors.

Mispriced stocks can provide attractive opportunities for investors who have the expertise and insight to identify them. The managers of Putnam Capital Opportunities Fund look for stocks they believe are trading below their intrinsic value and can appreciate over time. It is up to the managers to uncover the reasons behind a stock’s valuation and to determine whether the market’s generally held assumptions are on target.

The fund focuses on stocks of small and midsize companies, which are typically covered by fewer analysts than large companies. With fewer analysts following these stocks, there may be more overlooked investment opportunities to pursue.

In seeking stocks with long-term growth potential, the managers draw on their own experience as well as that of the analysts in Putnam’s Global Equity Research organization. Because the fund is managed in the blend style, the managers are no t focused solely on either growth-or value-style stocks and can choose from thousands of small and midsize U.S. companies. This flexibility means the fund’s portfolio is broadly diversified, which can help reduce the risk of investing in a narrow range of sectors or stocks.

In all their decisions, the managers are guided by Putnam’s risk controls, which call for regular review of fund holdings and the discipline to sell stocks when they reach what is considered their true worth.

Consider these risks before investing: The fund invests some or all of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations.

Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. The market may not favor growth-or value-style investing.

Investor overreaction can mean investment opportunities

An important factor in the analysis for Putnam Capital Opportunities Fund is “behavioral insight. ” Investors frequently focus on short-term financial performance while ignoring the potential for a stock to outperform over the long term . For example, investors may overreact to a specific event, such as a management change, and either sell off the stock or buy it in large quantities. This overreaction can skew a stock’s price out of proportion to the real impact of the event. The result can develop into a buying or a selling opportunity for astute investment managers.

The portfolio managers for Putnam Capital Opportunities Fund determine behavioral rankings as part of their detailed stock-by-stock valuation process. Their process integrates behavioral insights and an in-depth analysis of each company’s fundamental worth.

Performance snapshot

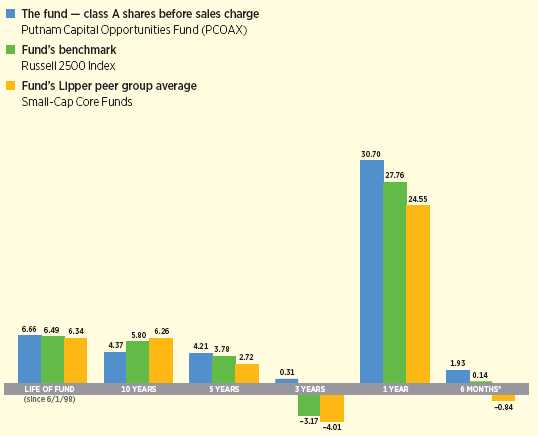

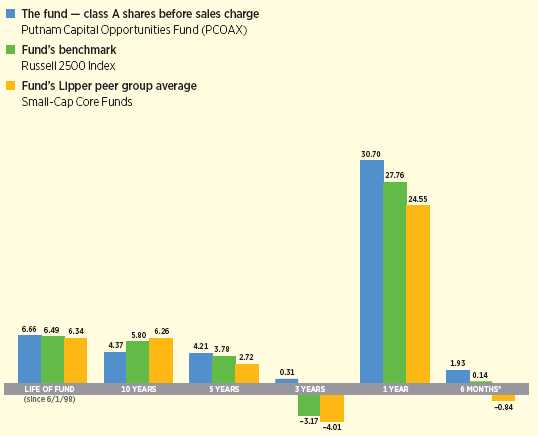

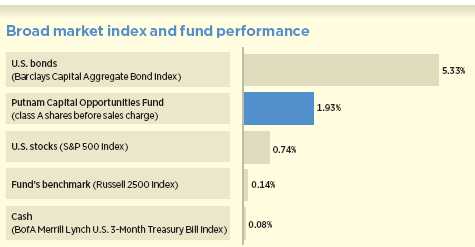

Annualized total return (%) comparison as of 10/31/10

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–11 for additional performance information. For a portion of the periods, the fund may have had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus. To obtain the most recent month-end performance, visit putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

4

Interview with your fund’s portfolio manager

Joseph Joseph

Joe, for the period we’re discussing, overall returns for stocks were flat. How did Putnam Capital Opportunities Fund perform?

Despite the fact that stock returns were flat, it was a fairly volatile six-month period for the markets overall.

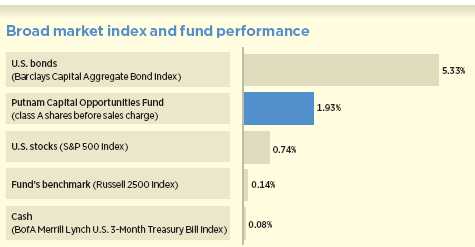

I’m pleased to report that the fund was able to deliver a positive return and outperform its benchmark and Lipper peer group. Class A shares of the fund gained 1.93% at net asset value, while its benchmark, the Russell 2500 Index, returned 0.14%. The average return for the fund’s peer group, Lipper Small-Cap Core Funds, was –0.84%.

Tell us more about market conditions over the six-month period.

Just as the period began in May, a prolonged, historically strong rally in the stock market came to an abrupt end, and volatility returned to the market in full force.

A major cause of concern for investors was a sovereign debt crisis in Greece that brought out broader worries about debt issues in other European Union countries. This resulted in anxiety across global markets and a market correction, with stocks declining sharply through June as investors also became discouraged about the slow pace of the U.S. economic recovery. Stocks staged a strong rebound in July, declined again in August, and then went on to rally considerably through September.

What strategies helped the fund outperform its benchmark and peers?

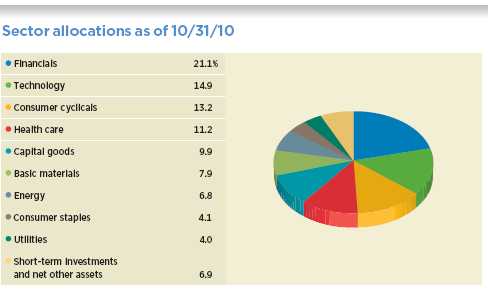

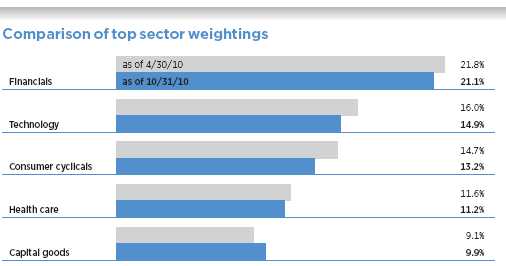

Our stock selection was beneficial during the period, particularly in the health-care, industrial, and consumer discretionary sectors. Also helping performance was our decision to maintain an overweight position in technology relative to the benchmark, as well as an underweight position in financials.

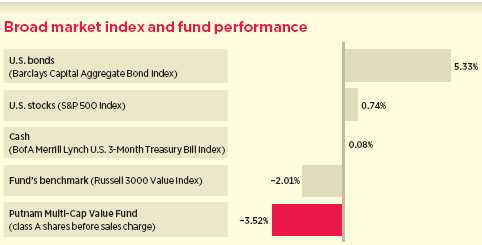

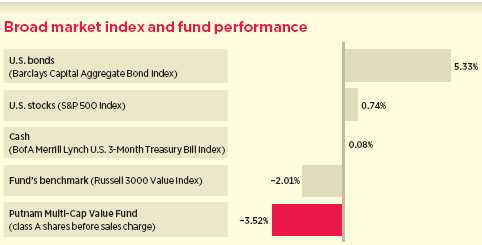

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 10/31/10. See pages 4 and 10–11 for additional fund performance information. Index descriptions can be found on page 14.

5

Which investments did well for the fund?

One of the biggest contributors to performance was the stock of Valeant Pharmaceuticals International, a specialty drug company headquartered in Canada. Valeant is now one of Canada’s largest publicly traded drug manufacturers, after completing its merger with Biovail Corporation in September.

The stock was a top performer as investors reacted favorably to news of the merger. In addition, we believe this stock remains attractive as the merger has resulted in an enhanced product line, financial strength, and cost-cutting initiatives that should enable Valeant to pursue more growth opportunities.

Another top-performing stock in the fund’s portfolio was that of WABCO Holdings, a provider of electronic and mechanical products for truck, bus, and car manufacturers. The company benefited from improved demand for trucks, particularly in Europe and emerging markets. Also during the period, investors reacted positively to the resolution of a lawsuit against the company.

Republic Airways Holdings was another portfolio highlight. The company includes several wholly owned airline subsidiaries, including recently acquired Frontier and Midwest, that offer service in the United States, Canada, Mexico, and Costa Rica. The company has reported improved profitability, due in part to significant traffic growth and improved industry pricing.

Another fund holding worth noting is F5 Networks, a networking appliances company that ensures the secure, reliable, and fast delivery of applications.

This stock was one of the top performers for the fund’s previous fiscal year, and it continued to make a positive contribution. The company was able to increase its market share during the severe economic downturn, which speaks to the competitiveness of its products. We sold F5 Networks from the portfolio when it exceeded our valuation target.

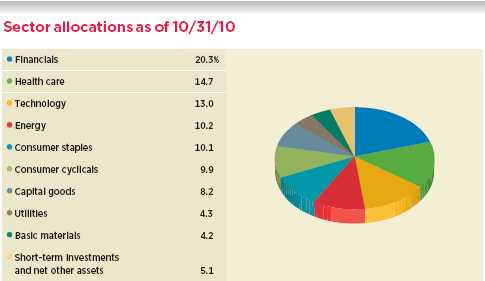

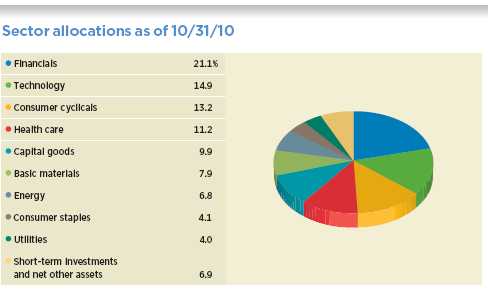

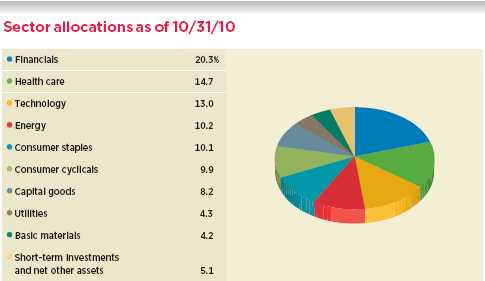

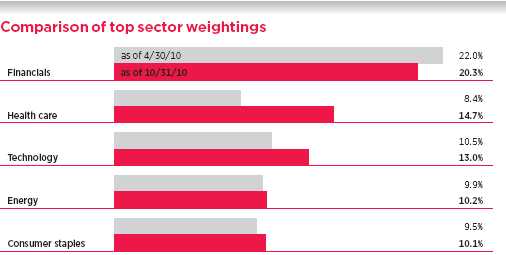

Allocations are represented as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

6

What are some stocks that had a negative impact on performance?

TradeStation Group was a detractor during the period. The stock of this company, which offers technology for traders of financial securities, underperformed as trading volumes were below expectations. In addition, investors were anticipating a long period of low interest rates. Because the company tends to benefit from rising rates, this market sentiment weighed on the stock price.

The stock of Career Education Corporation also dampened fund performance for the period. This company has schools on approximately 90 campuses in the United States and Europe.

The stock came under pressure as the government increased its scrutiny of business practices in the for-profit education industry. Investigations and inquiries have cast a negative cloud over Career Education and the industry as a whole.

The performance of Headwaters, a provider of building products and construction materials, was also a disappointment during the period. The stock was hurt by a weakening outlook for non-residential construction.

Can you tell us about your investment process?

We have a disciplined investment strategy that uses a series of valuation factors to identify stocks that we believe are trading below their intrinsic value. We look for stocks we believe will appreciate over time, and we seek to buy them for the portfolio before most investors recognize their value.

This table shows the fund’s top 10 holdings and the percentage of the fund’s net assets that each represented as of 10/31/10. Short-term holdings are excluded. Holdings will vary over time.

7

Typically, we try to avoid companies with excessive leverage. We try to own companies with high returns on capital or those whose returns on capital we expect to improve over time. We also seek companies that generate significant free cash flow and where management has a history of deploying that cash in a shareholder-friendly manner.

Your analysis includes “behavioral insight” — finding buying or selling opportunities based on investor sentiment. Can you cite a recent example?

Recently, investors have become enthusiastic —and, in our opinion, over-exuberant — about the investment opportunities around “cloud” computing. This refers to the storing and management of data over the Internet rather than on an individual computer.

Investor sentiment drove up the valuations of companies in this field and, in many cases, these valuations exceeded our estimates of the companies’ fair value. As a result, we sold the fund’s positions in several of these stocks shortly after the close of the period.

What is your outlook for the markets, and are there particular sectors on which you are focusing?

Our investment process is grounded in fundamental, bottom-up research, meaning we focus on individual stock selection rather than trying to predict the direction of the economy or the broader market. That said, we are starting to see some signs of a gradual improvement in the economy.

As of the close of the period, we were finding the most attractive opportunities in the information technology, industrial, and health-care sectors, while consumer staples, utilities, and telecommunications stocks appeared to be closer to fair value.

Thank you for this update, Joe.

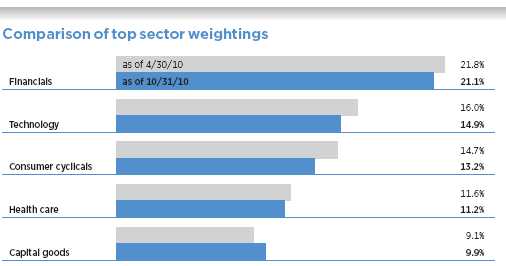

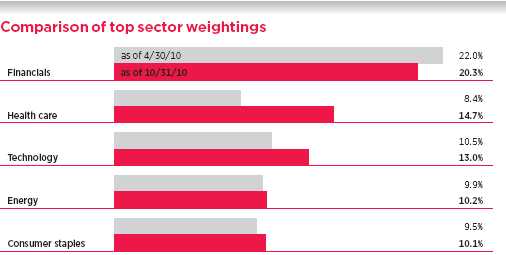

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

Data in the chart reflect a new calculation methodology placed in effect within the past six months.

8

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Joseph Joseph has an M.B.A. from the Stern School of Business at New York University and a B.A. from Loyola College. A Certified Public Accountant, he joined Putnam in 1994 and has been in the investment industry since 1987.

In addition to Joe, your fund’s portfolio managers are Randy Farina and John McLanahan.

IN THE NEWS

U.S. corporate profits soared in the first 10 months of 2010, despite the slow economic recovery. Earnings rose 10.5% in the first quarter and 3.0% in the second quarter, and are on track for a positive third quarter. The profit picture is remarkable because it occurred during a period of decelerating growth, with the nation’s gross domestic product slowing to 1.7% in the second quarter. There are several factors behind the rosy profit picture. The recession forced many companies to cut costs, and this year’s slow growth environment has helped further reduce wage pressure. Corporate borrowing rates are also low. Although sluggish economic growth remains a threat to profits, the consensus estimate for S&P 500 companies is for near-record earnings in 2011.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended October 31, 2010, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putn am.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 10/31/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (6/1/98) | (6/29/98) | (7/26/99) | (6/29/98) | (1/21/03) | (10/2/00) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 6.66% | 6.15% | 5.88% | 5.88% | 5.88% | 5.88% | 6.13% | 5.83% | 6.40% | 6.90% |

|

| 10 years | 53.31 | 44.51 | 42.29 | 42.29 | 42.22 | 42.22 | 45.75 | 40.68 | 49.52 | 57.48 |

| Annual average | 4.37 | 3.75 | 3.59 | 3.59 | 3.58 | 3.58 | 3.84 | 3.47 | 4.10 | 4.65 |

|

| 5 years | 22.92 | 15.88 | 18.44 | 16.84 | 18.35 | 18.35 | 19.97 | 15.79 | 21.35 | 24.52 |

| Annual average | 4.21 | 2.99 | 3.44 | 3.16 | 3.43 | 3.43 | 3.71 | 2.98 | 3.95 | 4.48 |

|

| 3 years | 0.94 | –4.85 | –1.27 | –3.95 | –1.26 | –1.26 | –0.47 | –3.96 | 0.22 | 1.82 |

| Annual average | 0.31 | –1.64 | –0.43 | –1.33 | –0.42 | –0.42 | –0.16 | –1.34 | 0.07 | 0.60 |

|

| 1 year | 30.70 | 23.25 | 29.77 | 24.77 | 29.85 | 28.85 | 30.07 | 25.47 | 30.32 | 31.16 |

|

| 6 months | 1.93 | –3.92 | 1.70 | –3.30 | 1.57 | 0.57 | 1.74 | –1.78 | 1.86 | 2.18 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.75% and 3.50% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund may have had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus.

10

| | |

| Comparative index returns For periods ended 10/31/10 | |

| |

| | | Lipper Small-Cap Core Funds |

| | Russell 2500 Index | category average* |

|

| Annual average (life of fund) | 6.49% | 6.34% |

|

| 10 years | 75.76 | 90.42 |

| Annual average | 5.80 | 6.26 |

|

| 5 years | 20.41 | 15.27 |

| Annual average | 3.78 | 2.72 |

|

| 3 years | –9.22 | –11.20 |

| Annual average | –3.17 | –4.01 |

|

| 1 year | 27.76 | 24.55 |

|

| 6 months | 0.14 | –0.84 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 10/31/10, there were 827, 814, 710, 578, 308, and 203 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 10/31/10

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 4/30/10 | $10.35 | $10.98 | $9.43 | $9.55 | $9.78 | $10.13 | $10.19 | $10.53 |

|

| 10/31/10 | 10.55 | 11.19 | 9.59 | 9.70 | 9.95 | 10.31 | 10.38 | 10.76 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

The fund made no distributions during the period.

Fund performance as of most recent calendar quarter

Total return for periods ended 9/30/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (6/1/98) | (6/29/98) | (7/26/99) | (6/29/98) | (1/21/03) | (10/2/00) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 6.32% | 5.81% | 5.53% | 5.53% | 5.53% | 5.53% | 5.78% | 5.47% | 6.05% | 6.55% |

|

| 10 years | 45.18 | 36.81 | 34.68 | 34.68 | 34.70 | 34.70 | 38.03 | 33.15 | 41.64 | 49.10 |

| Annual average | 3.80 | 3.18 | 3.02 | 3.02 | 3.02 | 3.02 | 3.28 | 2.90 | 3.54 | 4.08 |

|

| 5 years | 15.44 | 8.77 | 11.18 | 9.67 | 11.17 | 11.17 | 12.51 | 8.57 | 14.07 | 16.94 |

| Annual average | 2.91 | 1.70 | 2.14 | 1.86 | 2.14 | 2.14 | 2.39 | 1.66 | 2.67 | 3.18 |

|

| 3 years | –3.06 | –8.65 | –5.25 | –7.83 | –5.29 | –5.29 | –4.54 | –7.90 | –3.80 | –2.32 |

| Annual average | –1.03 | –2.97 | –1.78 | –2.68 | –1.80 | –1.80 | –1.54 | –2.71 | –1.28 | –0.78 |

|

| 1 year | 19.71 | 12.77 | 18.81 | 13.81 | 18.85 | 17.85 | 19.05 | 14.87 | 19.46 | 20.09 |

|

| 6 months | 1.82 | –4.00 | 1.44 | –3.56 | 1.42 | 0.42 | 1.50 | –2.06 | 1.64 | 1.99 |

|

11

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 4/30/10* | 1.34% | 2.09% | 2.09% | 1.84% | 1.59% | 1.09% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 10/31/10 | 1.31% | 2.06% | 2.06% | 1.81% | 1.56% | 1.06% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Restated to reflect projected expenses under a new management contract effective 1/1/10 and a new expense arrangement.

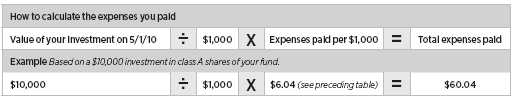

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in Putnam Capital Opportunities Fund from May 1, 2010, to October 31, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.67 | $10.47 | $10.47 | $9.20 | $7.94 | $5.40 |

|

| Ending value (after expenses) | $1,019.30 | $1,017.00 | $1,015.70 | $1,017.40 | $1,018.60 | $1,021.80 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

12

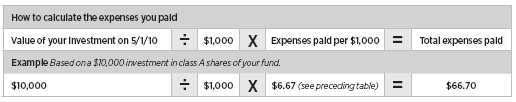

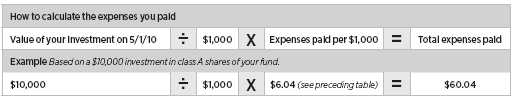

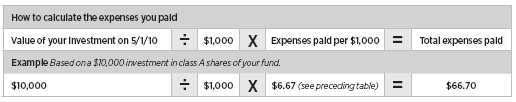

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended October 31, 2010, use the following calculation method. To find the value of your investment on May 1, 2010, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.67 | $10.46 | $10.46 | $9.20 | $7.93 | $5.40 |

|

| Ending value (after expenses) | $1,018.60 | $1,014.82 | $1,014.82 | $1,016.08 | $1,017.34 | $1,019.86 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell 2500 Index is an unmanaged index of the 2,500 small and midsize companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

14

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract with respect to your fund, between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2010, the Contract Committee met on a number of occasions with representatives of Putnam Management and in executive session to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. At the Trustees’ June 11, 2010 meeting, the Contract Committee recommended, and the Independent Trustees appro ved, the continuance of your fund’s management contract, and sub-management contracts, effective July 1, 2010. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing such services, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in prior years.

Consideration of implementation of strategic pricing initiative

The Trustees were mindful that new management contracts had been implemented for all but a few funds at the beginning of 2010 as part of Putnam Management’s strategic pricing initiative. These new management contracts reflected the implementation of more competitive fee levels for many funds, complex-wide breakpoints for the open-end funds and performance fees for some funds.

15

The Trustees had approved these new management contracts on July 10, 2009 and submitted them to shareholder meetings of the affected funds in late 2009, where the contracts were in all cases approved by overwhelming majorities of the shares voted.

Because the management contracts had been implemented only recently, the Contract Committee had limited practical experience with the operation of the new fee structures. The financial data available to the Committee reflected actual operations under the prior contracts; information was also available on a pro forma basis, adjusted to reflect the fees payable under the new management contracts. In light of the limited information available regarding operations under the new management contracts, in recommending the continuation of the new management contracts in June 2010, the Contract Committee relied to a considerable extent on its review of the financial information and analysis that formed the basis of the Board’s approval of the new management contracts on July 10, 2009.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

As in the past, the Trustees continued to focus on the competitiveness of the total expense ratio of each fund. In order to ensure that expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management agreed in 2009 to implement certain expense limitations. Most funds had sufficiently low expenses that these expense limitations did not apply. However, in the case of your fund, the first of the expense limitations applied. The expense limitations were (i) a contractual expense limitation applicable to all retail open-end funds of 37.5 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, taxes, brokerage commissions and extraordinary expenses) . These expense limitations serve in particular to maintain competitive expense levels for funds with large numbers of small shareholder accounts and funds with relatively small net assets.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fee), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the 1st quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 2nd quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2009 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The Trustees also considered that your fund ranked in the 1st quintile in effective management fees, on a pro forma basis adjusted to reflect the impact of the strategic pricing initiative discussed above, as of December 31, 2009.

Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Contract Committee

16

observed that the complex-wide breakpoints of the open-end funds have only been in place for a short while, and the Trustees will examine the operation of this new breakpoint structure in future years in light of actual experience.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at c urrent asset levels, the fee schedules currently in place represented an appropriate sharing of economies of scale at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of such fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different asset clas ses are typically higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients, and did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which met on a regular basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable invest ment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Committee noted the substantial improvement in the performance of most Putnam funds during 2009. The Committee also noted the disappointing investment performance of a number of the funds for periods ended December 31, 2009 and considered information provided by Putnam Management regarding the factors contributing to the

17

underperformance and actions being taken to improve performance. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following quartiles of its Lipper Inc. peer group (Lipper Small-Cap Core Funds) for the one-year, three-year and five-year periods ended December 31, 2009 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds):

| | | |

| One-year period | 1st | | |

| | |

| Three-year period | 2nd | | |

| | |

| Five-year period | 2nd | | |

| | |

Over the one-year, three-year and five-year periods ended December 31, 2009, there were 756, 631 and 522 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered a change made, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policies commencing in 2010, which increased the permitted soft dollar allocation to third-party services over what had been authorized in previous years. The Trustees noted that a portion of available soft dollars continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management contract, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services.

18

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2010, are available in the Individual Investors section of putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of October 31, 2010, Putnam employees had approximately $324,000,000 and the Trustees had approximately $68,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

19

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

20

| | |

| The fund’s portfolio 10/31/10 (Unaudited) | | |

| |

| COMMON STOCKS (97.7%)* | Shares | Value |

|

| Advertising and marketing services (0.3%) | | |

| ValueClick, Inc. † | 58,937 | $810,973 |

|

| | | 810,973 |

| Aerospace and defense (0.6%) | | |

| Alliant Techsystems, Inc. † | 9,144 | 697,139 |

|

| Teledyne Technologies, Inc. † | 26,951 | 1,120,353 |

|

| | | 1,817,492 |

| Airlines (0.9%) | | |

| Republic Airways Holdings, Inc. † S | 299,700 | 2,784,213 |

|

| | | 2,784,213 |

| Automotive (0.4%) | | |

| BorgWarner, Inc. † | 21,563 | 1,209,900 |

|

| | | 1,209,900 |

| Banking (6.5%) | | |

| Bancorp, Inc. † | 239,200 | 1,791,608 |

|

| Bond Street Holdings, LLC 144A Class A † F | 38,819 | 795,790 |

|

| Brookline Bancorp, Inc. | 23,630 | 230,156 |

|

| City Holding Co. S | 8,399 | 266,248 |

|

| City National Corp. | 22,718 | 1,171,567 |

|

| Commerce Bancshares, Inc. | 6,458 | 237,913 |

|

| Cullen/Frost Bankers, Inc. | 7,174 | 376,205 |

|

| Danvers Bancorp, Inc. | 123,641 | 1,858,324 |

|

| East West Bancorp, Inc. | 109,627 | 1,932,724 |

|

| First Citizens BancShares, Inc. Class A | 5,335 | 996,471 |

|

| IBERIABANK Corp. | 14,400 | 749,520 |

|

| International Bancshares Corp. | 21,112 | 361,649 |

|

| NBH Holdings Corp. 144A Class A † | 66,250 | 1,291,875 |

|

| OmniAmerican Bancorp, Inc. † | 46,500 | 544,515 |

|

| PacWest Bancorp S | 24,849 | 433,118 |

|

| Popular, Inc. (Puerto Rico) † | 166,900 | 455,637 |

|

| Provident New York Bancorp | 197,498 | 1,751,807 |

|

| Seacoast Banking Corp. of Florida † S | 181,559 | 226,949 |

|

| SVB Financial Group † | 41,277 | 1,788,945 |

|

| Union First Market Bankshares Corp. | 20,645 | 265,495 |

|

| Webster Financial Corp. | 49,290 | 843,845 |

|

| Whitney Holding Corp. | 64,213 | 531,684 |

|

| Wilmington Trust Corp. | 44,268 | 314,745 |

|

| | | 19,216,790 |

| Biotechnology (0.3%) | | |

| Cubist Pharmaceuticals, Inc. † | 36,161 | 841,828 |

|

| | | 841,828 |

| Broadcasting (0.2%) | | |

| Clear Channel Outdoor Holdings, Inc. Class A † | 42,500 | 504,900 |

|

| | | 504,900 |

| Building materials (0.9%) | | |

| AAON, Inc. S | 23,064 | 566,221 |

|

| Apogee Enterprises, Inc. | 37,699 | 395,463 |

|

| Mohawk Industries, Inc. † | 31,600 | 1,811,944 |

|

| | | 2,773,628 |

| Cable television (0.3%) | | |

| IAC/InterActiveCorp. † | 34,700 | 968,130 |

|

| | | 968,130 |

21

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Chemicals (4.2%) | | |

| American Vanguard Corp. | 16,600 | $122,342 |

|

| Ashland, Inc. | 17,519 | 904,506 |

|

| CF Industries Holdings, Inc. | 3,005 | 368,203 |

|

| Compass Minerals International, Inc. | 11,751 | 926,801 |

|

| Cytec Industries, Inc. | 18,988 | 940,286 |

|

| Eastman Chemical Co. | 12,319 | 967,904 |

|

| FMC Corp. | 10,303 | 753,149 |

|

| Georgia Gulf Corp. † | 30,800 | 623,084 |

|

| Innophos Holdings, Inc. | 28,700 | 1,053,864 |

|

| International Flavors & Fragrances, Inc. | 16,762 | 840,782 |

|

| Lubrizol Corp. (The) | 8,902 | 912,366 |

|

| Methanex Corp. (Canada) | 42,900 | 1,191,333 |

|

| Olin Corp. | 38,202 | 763,658 |

|

| OM Group, Inc. † | 18,979 | 631,431 |

|

| Valspar Corp. | 44,254 | 1,420,553 |

|

| | | 12,420,262 |

| Coal (0.6%) | | |

| James River Coal Co. † S | 16,000 | 276,960 |

|

| Massey Energy Co. | 23,600 | 992,852 |

|

| Penn Virginia Corp. | 29,400 | 435,708 |

|

| | | 1,705,520 |

| Commercial and consumer services (1.5%) | | |

| Alliance Data Systems Corp. † S | 19,159 | 1,163,334 |

|

| Deluxe Corp. | 33,446 | 683,636 |

|

| Dun & Bradstreet Corp. (The) | 12,128 | 902,444 |

|

| Ennis Inc. | 41,522 | 749,057 |

|

| Global Cash Access, Inc. † | 97,328 | 354,274 |

|

| Sotheby’s Holdings, Inc. Class A | 15,900 | 697,056 |

|

| | | 4,549,801 |

| Communications equipment (0.4%) | | |

| Netgear, Inc. † | 40,700 | 1,253,967 |

|

| | | 1,253,967 |

| Computers (4.0%) | | |

| ANSYS, Inc. † | 31,035 | 1,404,334 |

|

| Blackbaud, Inc. | 47,893 | 1,216,003 |

|

| Brocade Communications Systems, Inc. † | 194,008 | 1,226,131 |

|

| Emulex Corp. † | 175,160 | 1,996,824 |

|

| Lexmark International, Inc. Class A † | 24,600 | 935,538 |

|

| Logitech International SA (NASDAQ) (Switzerland) † | 80,651 | 1,515,432 |

|

| Logitech International SA (Virt-X Exchange) (Switzerland) † S | 11,617 | 219,974 |

|

| Polycom, Inc. † S | 27,927 | 943,374 |

|

| Progress Software Corp. † | 14,500 | 541,865 |

|

| Quest Software, Inc. † | 45,200 | 1,182,884 |

|

| Satyam Computer Services., Ltd. ADR (India) † | 190,000 | 665,000 |

|

| | | 11,847,359 |

| Conglomerates (0.9%) | | |

| AMETEK, Inc. | 38,760 | 2,094,978 |

|

| Harsco Corp. | 27,400 | 635,132 |

|

| | | 2,730,110 |

22

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Construction (1.0%) | | |

| Chicago Bridge & Iron Co., NV (Netherlands) † | 54,139 | $1,364,844 |

|

| Tutor Perini Corp. † | 67,854 | 1,574,891 |

|

| | | 2,939,735 |

| Consumer (0.7%) | | |

| CSS Industries, Inc. | 21,777 | 364,329 |

|

| Helen of Troy, Ltd. (Bermuda) † | 63,916 | 1,639,445 |

|

| Hooker Furniture Corp. | 19,534 | 206,474 |

|

| | | 2,210,248 |

| Consumer goods (1.1%) | | |

| Blyth, Inc. | 10,128 | 406,335 |

|

| Church & Dwight Co., Inc. | 15,863 | 1,044,579 |

|

| Weight Watchers International, Inc. S | 58,500 | 1,959,165 |

|

| | | 3,410,079 |

| Consumer services (0.9%) | | |

| Brink’s Co. (The) | 23,026 | 543,414 |

|

| TrueBlue, Inc. † | 159,854 | 2,245,949 |

|

| | | 2,789,363 |

| Electric utilities (3.3%) | | |

| Allegheny Energy, Inc. | 38,100 | 883,920 |

|

| Alliant Energy Corp. | 23,872 | 872,044 |

|

| Black Hills Corp. | 31,100 | 990,224 |

|

| El Paso Electric Co. † | 54,900 | 1,350,540 |

|

| Integrys Energy Group, Inc. | 14,400 | 765,936 |

|

| NSTAR | 24,300 | 1,013,553 |

|

| Pepco Holdings, Inc. | 51,700 | 995,742 |

|

| Pinnacle West Capital Corp. | 27,100 | 1,115,436 |

|

| PNM Resources, Inc. | 62,600 | 738,054 |

|

| Westar Energy, Inc. | 45,200 | 1,143,560 |

|

| | | 9,869,009 |

| Electrical equipment (0.6%) | | |

| Hubbell, Inc. Class B | 34,315 | 1,853,696 |

|

| | | 1,853,696 |

| Electronics (3.1%) | | |

| Diodes, Inc. † | 24,100 | 529,718 |

|

| Fairchild Semiconductor Intl., Inc. † | 47,400 | 534,198 |

|

| International Rectifier Corp. † | 55,700 | 1,293,911 |

|

| Intersil Corp. Class A | 76,307 | 998,859 |

|

| Multi-Fineline Electronix, Inc. † | 18,600 | 455,328 |

|

| Omnivision Technologies, Inc. † | 40,100 | 1,087,913 |

|

| QLogic Corp. † | 69,642 | 1,223,610 |

|

| Silicon Laboratories, Inc. † S | 28,500 | 1,137,150 |

|

| Synopsys, Inc. † | 53,831 | 1,376,997 |

|

| Zoran Corp. † | 90,000 | 637,200 |

|

| | | 9,274,884 |

| Energy (oil field) (2.1%) | | |

| Basic Energy Services, Inc. † | 54,481 | 602,560 |

|

| Cal Dive International, Inc. † | 39,500 | 199,870 |

|

| Complete Production Services, Inc. † | 28,100 | 658,383 |

|

| Global Industries, Ltd. † | 67,900 | 393,141 |

|

| Helix Energy Solutions Group, Inc. † | 58,400 | 741,096 |

|

23

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Energy (oil field) cont. | | |

| Hercules Offshore, Inc. † | 157,200 | $370,992 |

|

| ION Geophysical Corp. † | 59,307 | 290,011 |

|

| Key Energy Services, Inc. † | 81,958 | 807,286 |

|

| Rowan Cos., Inc. † | 14,400 | 473,760 |

|

| Superior Energy Services † | 23,900 | 660,118 |

|

| TETRA Technologies, Inc. † | 42,800 | 417,728 |

|

| Tidewater, Inc. S | 11,300 | 521,269 |

|

| | | 6,136,214 |

| Energy (other) (0.2%) | | |

| Headwaters, Inc. † | 190,264 | 646,898 |

|

| | | 646,898 |

| Financial (0.9%) | | |

| Broadridge Financial Solutions, Inc. | 31,300 | 688,600 |

|

| GATX Corp. | 41,278 | 1,306,861 |

|

| MGIC Investment Corp. † S | 69,301 | 611,235 |

|

| | | 2,606,696 |

| Forest products and packaging (0.9%) | | |

| Packaging Corp. of America | 25,851 | 631,540 |

|

| Sealed Air Corp. | 51,714 | 1,197,179 |

|

| Sonoco Products Co. | 22,948 | 768,758 |

|

| | | 2,597,477 |

| Health-care services (4.8%) | | |

| Amedisys, Inc. † S | 15,300 | 389,538 |

|

| AMERIGROUP Corp. † | 52,572 | 2,193,830 |

|

| AMN Healthcare Services, Inc. † | 99,400 | 526,820 |

|

| Centene Corp. † | 28,100 | 627,192 |

|

| Coventry Health Care, Inc. † | 44,800 | 1,049,216 |

|

| Cross Country Healthcare, Inc. † | 53,100 | 387,630 |

|

| Gentiva Health Services, Inc. † | 39,700 | 924,216 |

|

| Health Net, Inc. † | 41,900 | 1,126,691 |

|

| Healthways, Inc. † | 64,200 | 672,816 |

|

| Kindred Healthcare, Inc. † | 45,700 | 627,004 |

|

| LifePoint Hospitals, Inc. † | 24,300 | 824,256 |

|

| Medcath Corp. † | 41,957 | 415,794 |

|

| Molina Healthcare, Inc. † | 41,845 | 1,084,622 |

|

| Omnicare, Inc. | 34,800 | 839,376 |

|

| Parexel International Corp. † | 60,500 | 1,300,750 |

|

| Res-Care, Inc. † | 88,200 | 1,166,886 |

|

| | | 14,156,637 |

| Homebuilding (0.3%) | | |

| NVR, Inc. † | 1,369 | 858,924 |

|

| | | 858,924 |

| Household furniture and appliances (0.7%) | | |

| American Woodmark Corp. | 13,851 | 245,163 |

|

| Whirlpool Corp. | 24,000 | 1,819,920 |

|

| | | 2,065,083 |

| Insurance (4.8%) | | |

| American Financial Group, Inc. | 25,183 | 770,096 |

|

| Amerisafe, Inc. † | 14,696 | 280,547 |

|

| Aspen Insurance Holdings, Ltd. | 23,375 | 663,149 |

|

24

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Insurance cont. | | |

| CNA Surety Corp. † | 40,764 | $784,707 |

|

| Delphi Financial Group Class A | 36,025 | 975,197 |

|

| Endurance Specialty Holdings, Ltd. (Bermuda) | 25,479 | 1,054,831 |

|

| Hanover Insurance Group, Inc. (The) | 21,401 | 968,395 |

|

| Harleysville Group, Inc. | 10,435 | 358,234 |

|

| HCC Insurance Holdings, Inc. | 30,207 | 799,881 |

|

| RenaissanceRe Holdings, Ltd. | 14,437 | 869,974 |

|

| Safety Insurance Group, Inc. | 27,945 | 1,298,325 |

|

| SeaBright Insurance Holdings, Inc. | 39,045 | 326,807 |

|

| Selective Insurance Group | 62,373 | 1,055,351 |

|

| Stancorp Financial Group | 28,722 | 1,232,174 |

|

| Universal American Financial Corp. | 75,300 | 1,210,824 |

|

| Validus Holdings, Ltd. | 23,151 | 656,562 |

|

| W.R. Berkley Corp. | 33,189 | 913,361 |

|

| | | 14,218,415 |

| Investment banking/Brokerage (3.8%) | | |

| Calamos Asset Management, Inc. Class A | 21,600 | 258,984 |

|

| Eaton Vance Corp. | 21,142 | 608,255 |

|

| Federated Investors, Inc. S | 73,713 | 1,836,191 |

|

| Jefferies Group, Inc. S | 29,606 | 708,472 |

|

| Legg Mason, Inc. | 26,300 | 816,089 |

|

| optionsXpress Holdings, Inc. † | 71,100 | 1,135,467 |

|

| SEI Investments Co. | 97,400 | 2,157,410 |

|

| TradeStation Group, Inc. † | 386,000 | 2,119,140 |

|

| Waddell & Reed Financial, Inc. Class A | 54,922 | 1,596,583 |

|

| | | 11,236,591 |

| Leisure (0.5%) | | |

| Polaris Industries, Inc. | 22,100 | 1,571,089 |

|

| | | 1,571,089 |

| Machinery (2.7%) | | |

| AGCO Corp. † | 18,419 | 782,255 |

|

| Applied Industrial Technologies, Inc. | 67,606 | 2,055,898 |

|

| Gardner Denver, Inc. | 18,034 | 1,042,726 |

|

| Kennametal, Inc. | 42,300 | 1,444,122 |

|

| Manitowoc Co., Inc. (The) | 137,768 | 1,534,736 |

|

| Regal-Beloit Corp. | 6,496 | 374,884 |

|

| Terex Corp. † | 37,200 | 835,140 |

|

| | | 8,069,761 |

| Manufacturing (3.2%) | | |

| Actuant Corp. Class A | 231,900 | 5,210,793 |

|

| EnPro Industries, Inc. † | 34,585 | 1,215,317 |

|

| LSB Industries, Inc. † | 29,100 | 650,385 |

|

| Oshkosh Corp. † | 43,900 | 1,295,489 |

|

| Roper Industries, Inc. | 15,450 | 1,072,694 |

|

| | | 9,444,678 |

| Medical technology (1.8%) | | |

| Conmed Corp. † | 54,072 | 1,190,125 |

|

| Hill-Rom Holdings, Inc. | 47,600 | 1,844,500 |

|

| Hologic, Inc. † | 57,700 | 924,354 |

|

25

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Medical technology cont. | | |

| Invacare Corp. S | 26,279 | $709,533 |

|

| Kinetic Concepts, Inc. † | 13,800 | 524,814 |

|

| SurModics, Inc. † S | 23,500 | 281,060 |

|

| | | 5,474,386 |

| Metals (1.9%) | | |

| Century Aluminum Co. † | 51,202 | 692,251 |

|

| Cliffs Natural Resources, Inc. S | 2,800 | 182,560 |

|

| Coeur d’Alene Mines Corp. † S | 44,200 | 910,962 |

|

| Commercial Metals Co. | 47,600 | 660,688 |

|

| Contango Ore, Inc. F | 1,330 | 599 |

|

| Reliance Steel & Aluminum Co. | 26,220 | 1,097,307 |

|

| Schnitzer Steel Industries, Inc. Class A | 8,400 | 434,196 |

|

| Steel Dynamics, Inc. | 62,600 | 908,952 |

|

| U.S. Steel Corp. S | 14,400 | 616,176 |

|

| | | 5,503,691 |

| Natural gas utilities (0.7%) | | |

| NiSource, Inc. S | 55,400 | 958,974 |

|

| Southwest Gas Corp. | 30,862 | 1,072,763 |

|

| | | 2,031,737 |

| Office equipment and supplies (0.2%) | | |

| Steelcase, Inc. | 59,649 | 501,648 |

|

| | | 501,648 |

| Oil and gas (3.9%) | | |

| Atwood Oceanics, Inc. † | 26,600 | 864,766 |

|

| Berry Petroleum Co. Class A | 24,605 | 841,737 |

|

| Cabot Oil & Gas Corp. Class A | 16,814 | 487,270 |

|

| Clayton Williams Energy, Inc. † | 14,600 | 871,912 |

|

| Contango Oil & Gas Co. † | 13,300 | 699,447 |

|

| Oil States International, Inc. † | 19,800 | 1,012,176 |

|

| Patterson-UTI Energy, Inc. S | 47,500 | 921,975 |

|

| Petroleum Development Corp. † | 30,945 | 965,793 |

|

| SM Energy Co. | 15,000 | 625,200 |

|

| Stone Energy Corp. † S | 32,800 | 512,664 |

|

| Swift Energy Co. † | 29,516 | 940,085 |

|

| Unit Corp. † | 22,251 | 872,907 |

|

| Vaalco Energy, Inc. † | 41,900 | 246,372 |

|

| W&T Offshore, Inc. S | 62,600 | 681,088 |

|

| Whiting Petroleum Corp. † | 11,014 | 1,106,246 |

|

| | | 11,649,638 |

| Pharmaceuticals (4.4%) | | |

| Cephalon, Inc. † | 13,800 | 916,872 |

|

| Endo Pharmaceuticals Holdings, Inc. † | 45,444 | 1,669,613 |

|

| Medicis Pharmaceutical Corp. Class A | 77,843 | 2,315,829 |

|

| Par Pharmaceutical Cos., Inc. † | 44,700 | 1,453,197 |

|

| Valeant Pharmaceuticals International, Inc. (Canada) S | 129,024 | 3,562,353 |

|

| Watson Pharmaceuticals, Inc. † | 64,972 | 3,030,944 |

|

| | | 12,948,808 |

| Publishing (0.6%) | | |

| Gannett Co., Inc. | 149,000 | 1,765,650 |

|

| | | 1,765,650 |

26

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Real estate (5.5%) | | |

| DiamondRock Hospitality Co. R | 96,611 | $1,022,144 |

|

| Entertainment Properties Trust R | 9,264 | 428,275 |

|

| Hospitality Properties Trust R | 81,394 | 1,856,597 |

|

| Kimco Realty Corp. R | 32,022 | 551,739 |

|

| LaSalle Hotel Properties R S | 68,394 | 1,620,254 |

|

| LTC Properties, Inc. R | 33,757 | 940,132 |

|

| Macerich Co. (The) R | 18,913 | 843,709 |

|

| National Health Investors, Inc. R | 52,562 | 2,433,621 |

|

| National Retail Properties, Inc. R S | 84,178 | 2,281,224 |

|

| Nationwide Health Properties, Inc. R | 23,762 | 970,202 |

|

| Omega Healthcare Investors, Inc. R | 69,642 | 1,601,766 |

|

| Taubman Centers, Inc. R | 38,439 | 1,784,338 |

|

| | | 16,334,001 |

| Restaurants (0.5%) | | |

| Red Robin Gourmet Burgers, Inc. † | 52,900 | 1,073,870 |

|

| Sonic Corp. † | 43,500 | 386,280 |

|

| | | 1,460,150 |

| Retail (5.8%) | | |

| Abercrombie & Fitch Co. Class A | 34,970 | 1,498,814 |

|

| Aeropostale, Inc. † | 39,003 | 950,893 |

|

| AnnTaylor Stores Corp. † | 100,942 | 2,351,949 |

|

| Books-A-Million, Inc. | 89,778 | 570,090 |

|

| Brown Shoe Co., Inc. | 32,777 | 385,130 |

|

| Buckle, Inc. (The) S | 19,411 | 564,666 |

|

| Cabela’s, Inc. † S | 88,500 | 1,640,790 |

|

| Cato Corp. (The) Class A | 16,085 | 425,448 |

|

| Dollar Tree, Inc. † | 31,101 | 1,595,792 |

|

| Jos. A. Bank Clothiers, Inc. † | 20,937 | 912,853 |

|

| Kenneth Cole Productions, Inc. Class A † | 47,560 | 639,682 |

|

| Nash Finch Co. | 28,523 | 1,195,114 |

|

| Saks, Inc. † S | 94,767 | 1,055,704 |

|

| Systemax, Inc. | 60,046 | 777,596 |

|

| Timberland Co. (The) Class A † | 89,555 | 1,878,864 |

|

| Toro Co. (The) | 5,411 | 307,128 |

|

| Wolverine World Wide, Inc. | 21,083 | 613,937 |

|

| | | 17,364,450 |

| Schools (0.3%) | | |

| Career Education Corp. † | 51,427 | 902,030 |

|

| | | 902,030 |

| Semiconductor (2.1%) | | |

| Hittite Microwave Corp. † | 7,365 | 380,550 |

|

| KLA-Tencor Corp. | 20,726 | 740,333 |

|

| Lam Research Corp. † | 19,372 | 887,044 |

|

| MKS Instruments, Inc. † | 39,900 | 823,935 |

|

| Novellus Systems, Inc. † | 33,227 | 970,561 |

|

| Teradyne, Inc. † | 51,400 | 577,736 |

|

| Tessera Technologies, Inc. † | 58,400 | 1,152,232 |

|

| Verigy, Ltd. (Singapore) † | 93,400 | 855,544 |

|

| | | 6,387,935 |

27

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Shipping (0.9%) | | |

| Arkansas Best Corp. | 43,867 | $1,111,151 |

|

| Con-way, Inc. | 12,000 | 396,120 |

|

| Overseas Shipholding Group S | 9,516 | 318,120 |

|

| Ship Finance International, Ltd. (Norway) S | 46,917 | 943,501 |

|

| | | 2,768,892 |

| Software (1.8%) | | |

| AsiaInfo-Linkage, Inc. (China) † S | 36,500 | 811,030 |

|

| Autodesk, Inc. † | 22,100 | 799,578 |

|

| MicroStrategy, Inc. † | 16,297 | 1,476,997 |

|

| Shanda Interactive Entertainment, Ltd. ADR (China) † S | 10,600 | 428,346 |

|

| TIBCO Software, Inc. † | 41,198 | 791,826 |

|

| Websense, Inc. † | 58,414 | 1,175,290 |

|

| | | 5,483,067 |

| Staffing (0.6%) | | |

| Administaff, Inc. | 20,149 | 528,105 |

|

| CDI Corp. | 24,070 | 344,923 |

|

| Heidrick & Struggles International, Inc. | 36,700 | 788,316 |

|

| | | 1,661,344 |

| Technology (0.5%) | | |

| Amkor Technologies, Inc. † S | 63,100 | 454,951 |

|

| ON Semiconductor Corp. † | 146,100 | 1,120,587 |

|

| | | 1,575,538 |

| Technology services (2.9%) | | |

| Acxiom Corp. † | 55,987 | 982,572 |

|

| CSG Systems International, Inc. † | 48,700 | 946,728 |

|

| DST Systems, Inc. | 22,900 | 990,883 |

|

| FactSet Research Systems, Inc. | 8,708 | 764,388 |

|

| Fair Isaac Corp. S | 40,201 | 966,432 |

|

| Global Payments, Inc. | 22,654 | 882,600 |

|

| IHS, Inc. Class A † | 19,949 | 1,441,116 |

|

| Perfect World Co., Ltd. ADR (China) † S | 38,400 | 1,244,160 |

|

| Unisys Corp. † | 21,400 | 493,270 |

|

| | | 8,712,149 |

| Telecommunications (0.9%) | | |

| ADTRAN, Inc. | 27,396 | 884,069 |

|

| NeuStar, Inc. Class A † | 74,326 | 1,918,354 |

|

| | | 2,802,423 |

| Textiles (0.7%) | | |

| Jones Group, Inc. (The) | 53,700 | 776,502 |

|

| Maidenform Brands, Inc. † | 33,808 | 904,702 |

|

| Perry Ellis International, Inc. † | 23,807 | 535,181 |

|

| | | 2,216,385 |

| Tobacco (0.2%) | | |

| Universal Corp. | 16,994 | 704,231 |

|

| | | 704,231 |

| Toys (0.9%) | | |

| Hasbro, Inc. | 48,584 | 2,247,010 |

|

| Jakks Pacific, Inc. † | 17,913 | 337,660 |

|

| | | 2,584,670 |

| Transportation services (0.3%) | | |

| HUB Group, Inc. Class A † | 19,119 | 620,794 |

|

| Pacer International, Inc. † | 46,825 | 260,815 |

|

| | | 881,609 |

28

| | |

| COMMON STOCKS (97.7%)* cont. | Shares | Value |

|

| Trucks and parts (2.7%) | | |

| Autoliv, Inc. (Sweden) S | 45,343 | $3,232,956 |

|

| Superior Industries International, Inc. | 40,683 | 730,260 |

|

| WABCO Holdings, Inc. † | 85,700 | 3,978,191 |

|

| | | 7,941,407 |

| | | |

| Total common stocks (cost $237,281,595) | | $291,046,189 |

| |

| |

| SHORT-TERM INVESTMENTS (11.6%)* | Principal amount/shares | Value |

|

| Putnam Cash Collateral Pool, LLC 0.21% d | 29,288,328 | $29,288,328 |

|

| Putnam Money Market Liquidity Fund 0.16% e | 4,718,704 | 4,718,704 |

|

| U.S. Treasury Bills, for an effective yield of 0.27%, | | |

| June 2, 2011 # | $279,000 | 278,555 |

|

| U.S. Treasury Bills, for effective yields ranging from | | |

| 0.19% to 0.23%, March 10, 2011 # | 211,000 | 210,892 |

|

| Total short-term investments (cost $34,496,442) | | $34,496,479 |

|

| |

| TOTAL INVESTMENTS | | |

|

| Total investments (cost $271,778,037) | | $325,542,668 |

Key to holding’s abbreviations

ADR American Depository Receipts

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from May 1, 2010 through October 31, 2010 (the reporting period).

* Percentages indicated are based on net assets of $297,945,004.

† Non-income-producing security.

# These securities, in part or in entirety, were pledged and segregated with the broker to cover margin requirements for futures contracts at the close of the reporting period.

d See Note 1 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

F Is valued at fair value following procedures approved by the Trustees. Securities may be classified as Level 2 or Level 3 for Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures (ASC 820) based on the securities’ valuation inputs.

R Real Estate Investment Trust.

S Securities on loan, in part or in entirety, at the close of the reporting period.

144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

ADR after the name of a foreign holding represents ownership of foreign securities on deposit with a custodian bank.

29

| | | | | |

| FUTURES CONTRACTS OUTSTANDING at 10/31/10 (Unaudited) | | | |

| |

| | | | | | Unrealized |

| Number of | | | Expiration | appreciation/ |

| | contracts | Value | | date | (depreciation) |

|

| Russell 2000 Index Mini (Long) | 28 | $1,966,160 | | Dec-10 | $(3,116) |

|

| S&P 500 Index (Long) | 1 | 294,925 | | Dec-10 | (579) |

|

| S&P Mid Cap 400 Index E-Mini (Long) | 22 | 1,820,500 | | Dec-10 | 1,571 |

|

| Total | | | | | $(2,124) |

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1 — Valuations based on quoted prices for identical securities in active markets.

Level 2 — Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 — Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | |

| | | Valuation inputs | |

|

| Investments in securities: | Level 1 | Level 2 | Level 3 |

|

| Common stocks: | | | |

|

| Basic materials | $23,460,566 | $— | $599 |

|

| Capital goods | 29,628,682 | — | — |

|

| Communication services | 3,770,553 | — | — |

|

| Conglomerates | 2,730,110 | — | — |

|

| Consumer cyclicals | 39,290,587 | — | — |

|

| Consumer staples | 12,122,311 | — | — |

|

| Energy | 20,138,270 | — | — |

|

| Financial | 61,524,828 | 1,291,875 | 795,790 |

|

| Health care | 33,421,659 | — | — |

|

| Technology | 44,534,899 | — | — |

|

| Transportation | 6,434,714 | — | — |

|

| Utilities and power | 11,900,746 | — | — |

|

| Total common stocks | 288,957,925 | 1,291,875 | 796,389 |

| Short-term investments | 4,718,704 | 29,777,775 | — |

|