Investor Presentation

Gulf South Conference New Orleans

April 27, 2004

Presentation Outline

Strategic Direction

Our Markets

Quarterly Trends

Composition And Risk

Investment Perspective

Comparatives

Forward Looking Statements

Safe Harbor

Statements contained in this presentation which are not historical facts and which pertain to future operating results of IBERIABANK Corporation and its subsidiaries constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve significant risks and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the Company’s periodic filings with the SEC.

3

Strategic Direction

Strategic Direction

Brief History

One Of Oldest Banks In LA—March 12, 1887

Mutual Thrift Until IPO In 1995

Converted To Bank Charter in 1997

Acquired Branches From FCOM in 1998

New Leadership Team In Place In Late 1999

New Strategic Direction Set 4 Years Ago

Focus On Core Earnings And Performance

5

Strategic Direction

Our Current Position

$ 2.3 Billion One-Bank Holding Company

3rd Largest Independent BHC In Louisiana

Market Capitalization About $400 Million

42 Offices Serving Acadiana, New Orleans, Baton Rouge, Monroe, and Shreveport

Excellent Geographic Diversification

Commercial Bank With A Relationship Focus

6

Strategic Direction

Underlying Focus

Belief In The Power Of Progression

Shareholder Returns

Predictability – Clients, Associates And Shareholders

Remain Disciplined And Conservative

Critical Issues:

• Focus On People And Relationships, Less On Facilities And Products

• Make The Right Kind Of Investments

• Continuous Improvement—A Way Of Life

7

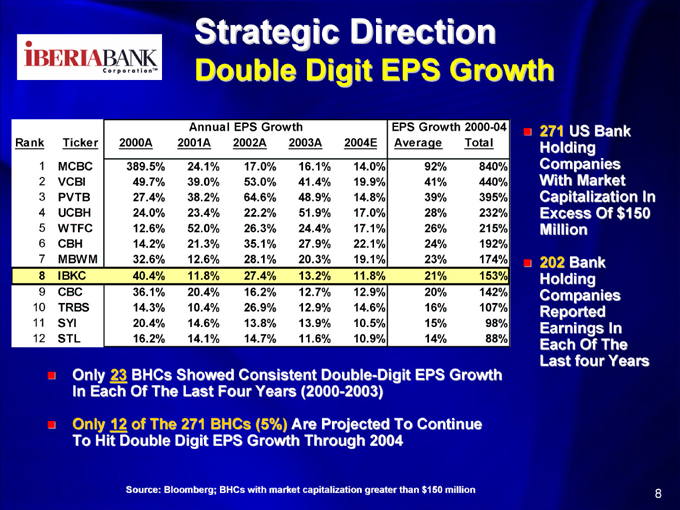

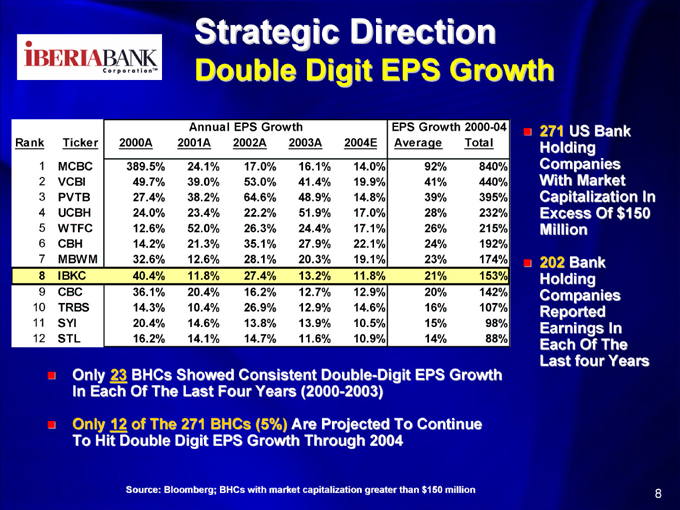

Strategic Direction

Double Digit EPS Growth

Annual EPS Growth EPS Growth 2000-04

Rank Ticker 2000A 2001A 2002A 2003A 2004E Average Total

1 MCBC 389.5% 24.1% 17.0% 16.1% 14.0% 92% 840%

2 VCBI 49.7% 39.0% 53.0% 41.4% 19.9% 41% 440%

3 PVTB 27.4% 38.2% 64.6% 48.9% 14.8% 39% 395%

4 UCBH 24.0% 23.4% 22.2% 51.9% 17.0% 28% 232%

5 WTFC 12.6% 52.0% 26.3% 24.4% 17.1% 26% 215%

6 CBH 14.2% 21.3% 35.1% 27.9% 22.1% 24% 192%

7 MBWM 32.6% 12.6% 28.1% 20.3% 19.1% 23% 174%

8 IBKC 40.4% 11.8% 27.4% 13.2% 11.8% 21% 153%

9 CBC 36.1% 20.4% 16.2% 12.7% 12.9% 20% 142%

10 TRBS 14.3% 10.4% 26.9% 12.9% 14.6% 16% 107%

11 SYI 20.4% 14.6% 13.8% 13.9% 10.5% 15% 98%

12 STL 16.2% 14.1% 14.7% 11.6% 10.9% 14% 88%

271 US Bank Holding Companies With Market Capitalization In Excess Of $150 Million

202 Bank Holding Companies Reported Earnings In Each Of The Last four Years

Only 23 BHCs Showed Consistent Double-Digit EPS Growth In Each Of The Last Four Years (2000-2003)

Only 12 of The 271 BHCs (5%) Are Projected To Continue To Hit Double Digit EPS Growth Through 2004

Source: Bloomberg; BHCs with market capitalization greater than $150 million

8

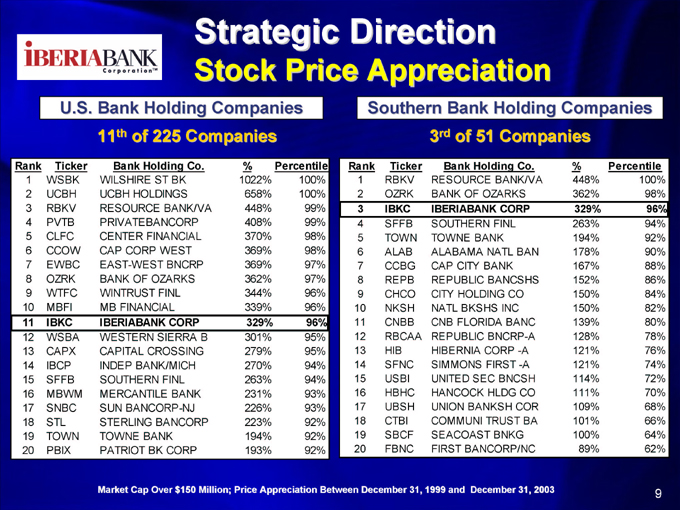

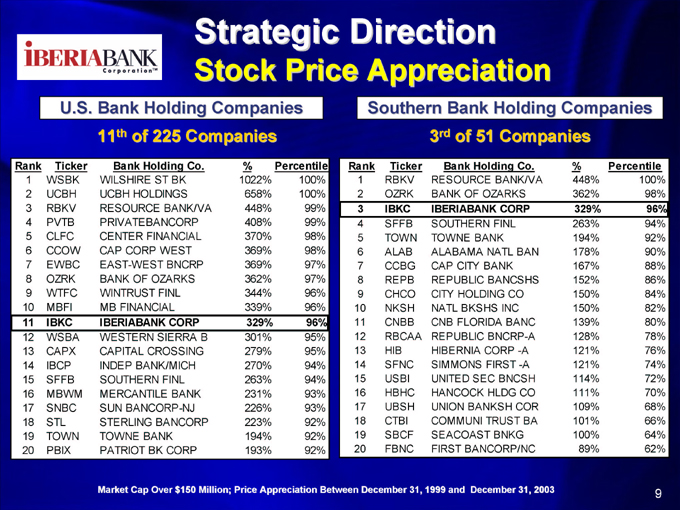

Strategic Direction

Stock Price Appreciation

U.S. Bank Holding Companies

11 of 225 Companies

Rank Ticker Bank Holding Co. % Percentile

1 WSBK WILSHIRE ST BK 1022% 100%

2 UCBH UCBH HOLDINGS 658% 100%

3 RBKV RESOURCE BANK/VA 448% 99%

4 PVTB PRIVATEBANCORP 408% 99%

5 CLFC CENTER FINANCIAL 370% 98%

6 CCOW CAP CORP WEST 369% 98%

7 EWBC EAST-WEST BNCRP 369% 97%

8 OZRK BANK OF OZARKS 362% 97%

9 WTFC WINTRUST FINL 344% 96%

10 MBFI MB FINANCIAL 339% 96%

11 IBKC IBERIABANK CORP 329% 96%

12 WSBA WESTERN SIERRA B 301% 95%

13 CAPX CAPITAL CROSSING 279% 95%

14 IBCP INDEP BANK/MICH 270% 94%

15 SFFB SOUTHERN FINL 263% 94%

16 MBWM MERCANTILE BANK 231% 93%

17 SNBC SUN BANCORP-NJ 226% 93%

18 STL STERLING BANCORP 223% 92%

19 TOWN TOWNE BANK 194% 92%

20 PBIX PATRIOT BK CORP 193% 92%

Southern Bank Holding Companies

3rd of 51 Companies

Rank Ticker Bank Holding Co. % Percentile

1 RBKV RESOURCE BANK/VA 448% 100%

2 OZRK BANK OF OZARKS 362% 98%

3 IBKC IBERIABANK CORP 329% 96%

4 SFFB SOUTHERN FINL 263% 94%

5 TOWN TOWNE BANK 194% 92%

6 ALAB ALABAMA NATL BAN 178% 90%

7 CCBG CAP CITY BANK 167% 88%

8 REPB REPUBLIC BANCSHS 152% 86%

9 CHCO CITY HOLDING CO 150% 84%

10 NKSH NATL BKSHS INC 150% 82%

11 CNBB CNB FLORIDA BANC 139% 80%

12 RBCAA REPUBLIC BNCRP-A 128% 78%

13 HIB HIBERNIA CORP -A 121% 76%

14 SFNC SIMMONS FIRST -A 121% 74%

15 USBI UNITED SEC BNCSH 114% 72%

16 HBHC HANCOCK HLDG CO 111% 70%

17 UBSH UNION BANKSH COR 109% 68%

18 CTBI COMMUNI TRUST BA 101% 66%

19 SBCF SEACOAST BNKG 100% 64%

20 FBNC FIRST BANCORP/NC 89% 62%

Market Cap Over $150 Million; Price Appreciation Between December 31, 1999 and December 31, 2003

9

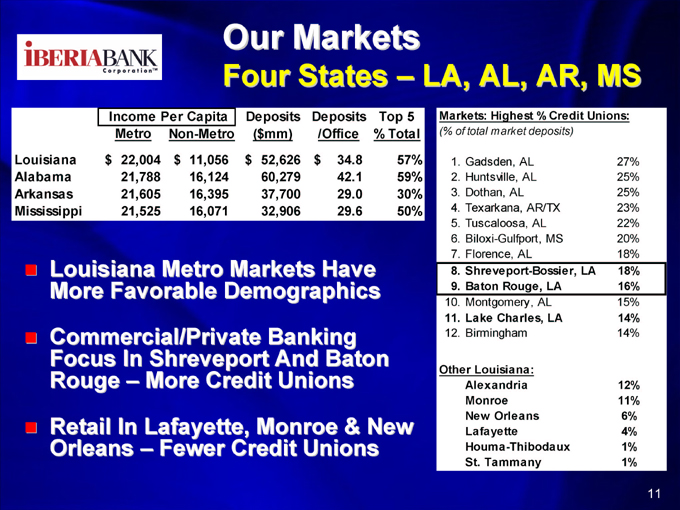

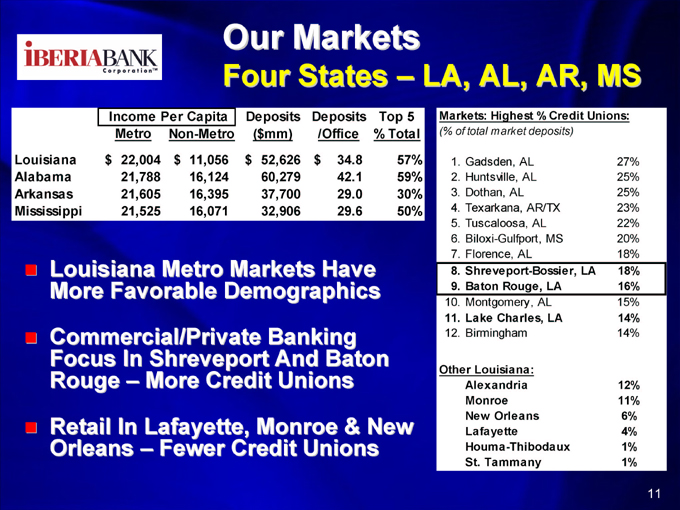

Our Markets

Our Markets

Four States – LA, AL, AR, MS

Income Per Capita Deposits Deposits Top 5

Metro Non-Metro ( $mm) /Office % Total

Louisiana $ 22,004 $ 11,056 $ 52,626 $ 34.8 57%

Alabama 21,788 16,124 60,279 42.1 59%

Arkansas 21,605 16,395 37,700 29.0 30%

Mississippi 21,525 16,071 32,906 29.6 50%

Markets: Highest % Credit Unions:

(% of total market deposits)

1. Gadsden, AL 27%

2. Huntsville, AL 25%

3. Dothan, AL 25%

4. Texarkana, AR/TX 23%

5. Tuscaloosa, AL 22%

6. Biloxi-Gulfport, MS 20%

7. Florence, AL 18%

8. Shreveport-Bossier, LA 18%

9. Baton Rouge, LA 16%

10. Montgomery, AL 15%

11. Lake Charles, LA 14%

12. Birmingham 14%

Other Louisiana:

Alexandria 12%

Monroe 11%

New Orleans 6%

Lafayette 4%

Houma-Thibodaux 1%

St. Tammany 1%

Louisiana Metro Markets Have More Favorable Demographics

Commercial/Private Banking Focus In Shreveport And Baton Rouge – More Credit Unions

Retail In Lafayette, Monroe & New Orleans – Fewer Credit Unions

11

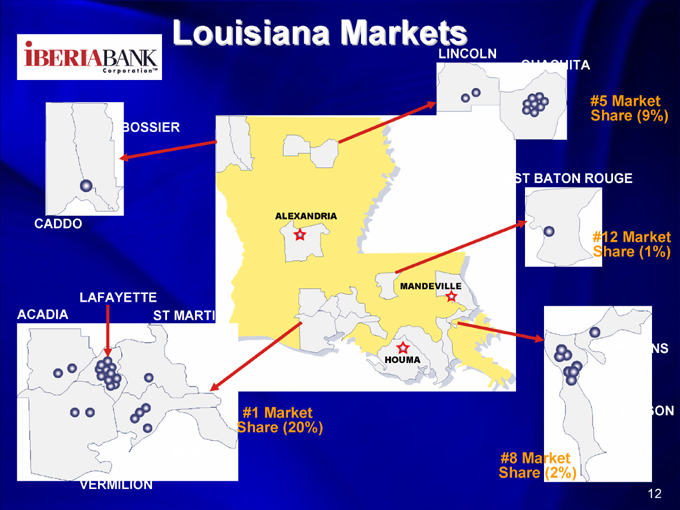

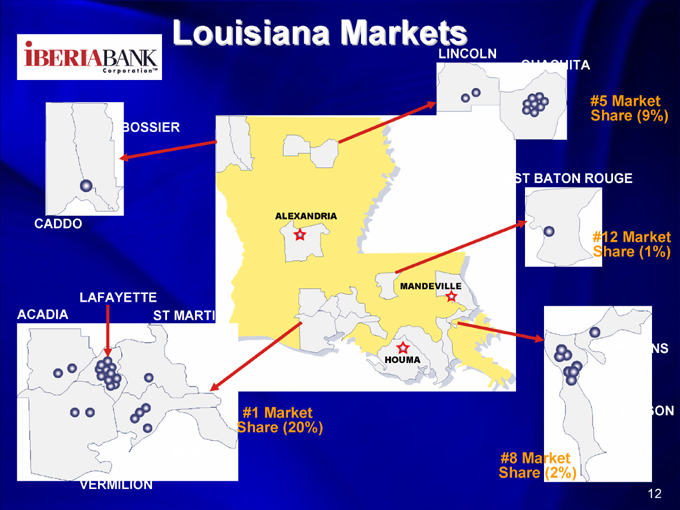

Louisiana Markets

LINCOLN

OUACHITA

BOSSIER

CADDO

LAFAYETTE

ACADIA

ST MARTIN

VERMILION

#1 Market Share (20%)

Market Share (9%)

BATON ROUGE

#12 Market Share (1%)

ORLEANS

JEFFERSON

#8 Market Share (2%)

ALEXANDRIA

MANDEVILLE

HOUMA

12

Our Markets

Strategic Markets

Focus On Markets With Greater

Population

Density, And

Income And

Population

Growth

Convenience-

Based

Distribution

Strategy

Metro Market

Credit

Underwriting

And Fee

Structures

13

Our Markets

Our Unique Position—Louisiana

LA ($mm) LA %Total

Hibernia $ 11,503 78%

Bank One/JPM 9,059 3%

Whitney 4,640 79%

Regions/UP 4,037 7%

IBERIABANK 1,595 100%

Amsouth 1,528 5%

Hancock 1,336 39%

Fidelity (Mutual) 586 100%

Louisiana BHCs:

Interested Elsewhere

Non-Louisiana BHCs:

Small Part of Franchise

IBKC:Uniquely Louisiana

Below $500mm:

Drops Off Significantly

Deposits On 6/30/03; Figures Include Pending Acquisitions

14

Our Markets

Market Competitiveness

Deposit Market Share Concentration

By Fed-Defined Market

Data and HHI on June 30, 2002

Fed Market

Market Deposit

Fed Banking Market Number HHI

IBERIABANK Corporation Target Markets:

Iberia, LA 2609 2,227

Lake Charles, LA 852 2,138

Baton Rouge, LA 95 1,819

Houma-Thibodaux, LA 711 1,751

Shreveport-Bossier City, LA 1455 1,747

Tangipahoa, LA 1546 1,726

Alexandria, LA 17 1,696

New Orleans, LA 1142 1,646

Monroe, LA 1073 1,269

Average (Ex-Lafayette) 1,780

Lafayette, LA 850 718

Peer Markets: Fed Market

Market Deposit

Fed Banking Market Number HHI

Jacksonville, FL 757 2,183

Mobile, AL 1061 1,999

Fredericksburg, VA 549 1,841

Savannah Area, GA 1420 1,714

Orlando, FL 1184 1,561

Raleigh, NC 1317 1,543

Asheville, NC 48 1,535

Gulf Shores, AL 638 1,479

Ocala, FL 1164 1,382

West Palm Beach, FL 1690 1,314

Tallahassee, FL 1540 1,297

Atlanta, GA 60 1,286

Birmingham, AL 132 1,284

Tampa Bay, FL 1544 1,276

Huntsville, AL 724 1,246

Roanoke, VA 1355 1,241

Dallas, TX 386 1,208

Beaumont-Port Arthur, TX 101 1,207

Baltimore, MD-PA 78 1,190

Decatur, AL 404 1,184

Knoxville, TN 837 1,182

Annapolis, MD 40 1,172

Gainesville, FL 559 1,164

Nashville, TN 1124 1,118

Naples, FL 1121 1,050

Pensacola, FL 1221 1,034

Athens, GA 55 939

Washington, DC-MD-VA-WV 1656 825

Average 1,338

Herfindahl-Hirschman Index Weightings Bank Deposits are weighted at 100% Savings Bank Deposits are weighted at 50% Thrift Deposits are weighted at 50%

15

Our Markets

Market Opportunities

Louisiana Market Deposits IBKC Mkt. # Large % Large Bank

(MSA Definition) ($ billion) Share (%) Banks** Deposits**

Baton Rouge $7.9 bill 0.9%* 7 88.4%

Shreveport-Bossier 3.9 0.0% 5 81.3

New Orleans 18.3 1.4% 7 73.6

Houma-Thibodaux 2.3 - 5 71.5

St. Tammany 2.2 - 7 68.3

Alexandria 1.4 - 4 64.5

Lake Charles 1.8 - 3 60.7

Monroe 1.8 8.8% 5 59.8

Lafayette 4.6 15.0% 5 30.7

* IBKC figures for Baton Rouge include Alliance Bank.

** “Large banks” are defined as FDIC-insured banks with headquarters outside

of Louisiana and/or deposits in excess of $5 billion.

Source: Deposits on June 30, 2003, adjusted for announced acquisitions; FDIC.

Source: FDIC Data; IBKC Analysis

16

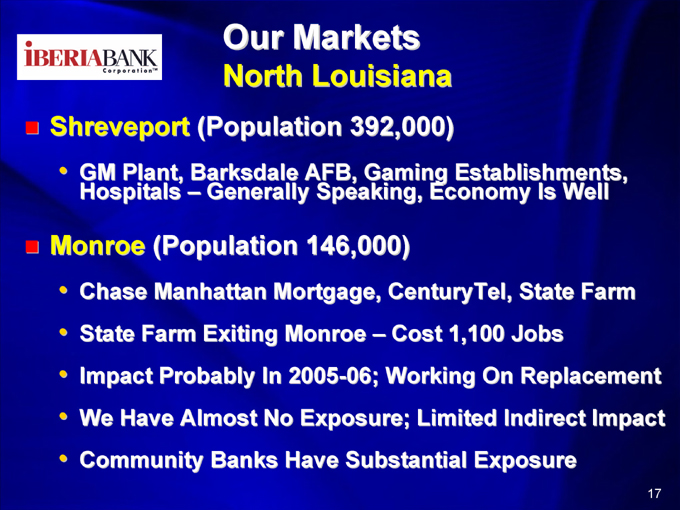

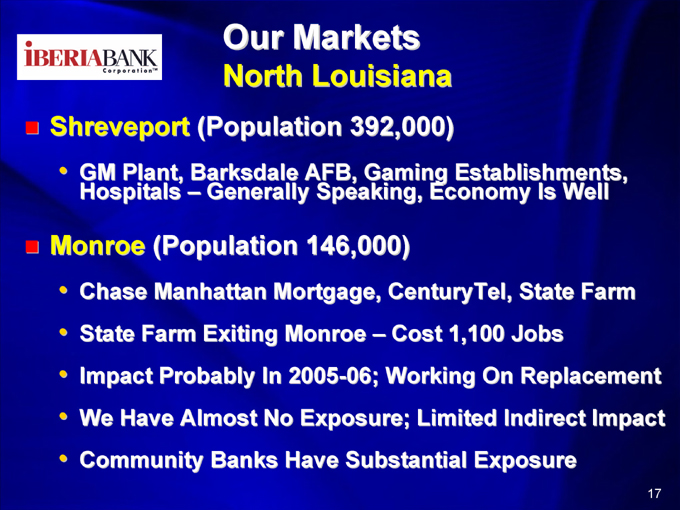

Our Markets

North Louisiana

Shreveport (Population 392,000)

• GM Plant, Barksdale AFB, Gaming Establishments, Hospitals – Generally Speaking, Economy Is Well

Monroe (Population 146,000)

• Chase Manhattan Mortgage, CenturyTel, State Farm

• State Farm Exiting Monroe – Cost 1,100 Jobs

• Impact Probably In 2005-06; Working On Replacement

• We Have Almost No Exposure; Limited Indirect Impact

• Community Banks Have Substantial Exposure

17

Our Markets

South Louisiana

Lafayette (Population 389,000)

• 2nd Lowest Unemployment In The State; Excellent Job Growth; Expansion In Medical Infrastructure; Very Entrepreneurial Area

Baton Rouge (Population 611,000)

• 7th Lowest Unemployment In The State, Weakness In Petrochemical Industry

New Orleans (Population 1.3 Million)

• Hospitality Segment Still Performing; Some Concern Regarding Belle Chasse Naval Air Station

18

Quarterly Trends

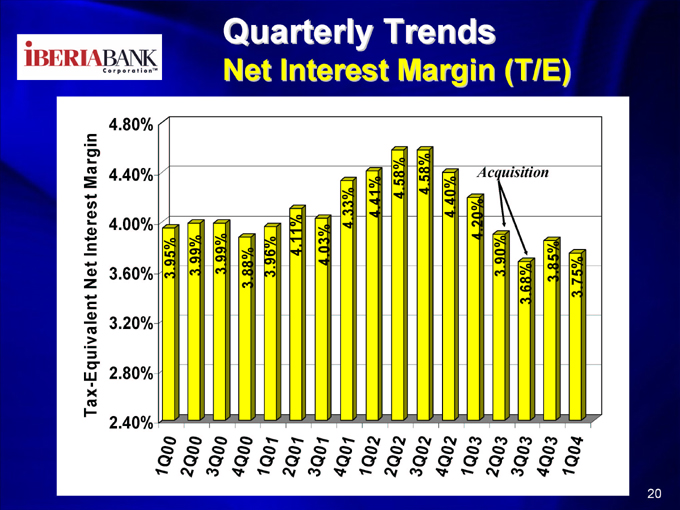

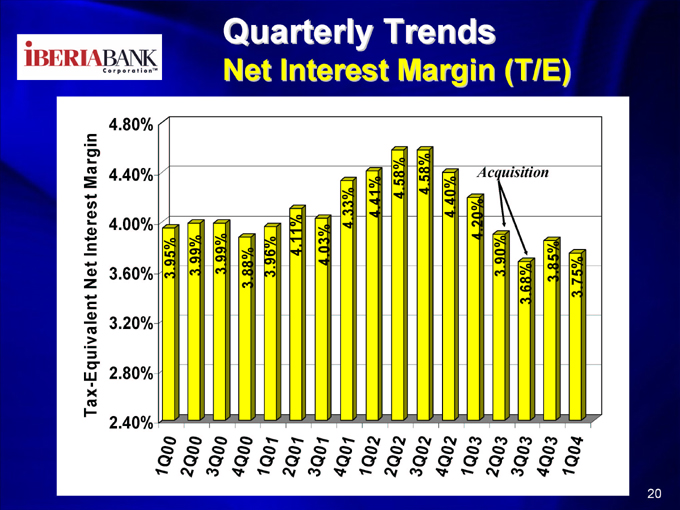

Quarterly Trends

Net Interest Margin (T/E)

Tax- Equivalent Net Interest Margin

2.40% 2.80% 3.20% 3.60% 4.00% 4.40% 4.80%

1Q00 3.95%

2Q00 3.99%

3Q00 3.99%

4Q0

0 3.88%

1Q01 3.96%

2Q01 4.11%

3Q0

1 4.03%

4Q01 4.33%

1Q0

2 4.41%

2Q02 4.58%

3Q02 4.58%

4Q02 4.40%

1Q03

4.20%

2Q03 3.90%

3Q03 3.68% Acquisition

4Q03

3.85%

1Q0

4 3.75%

20

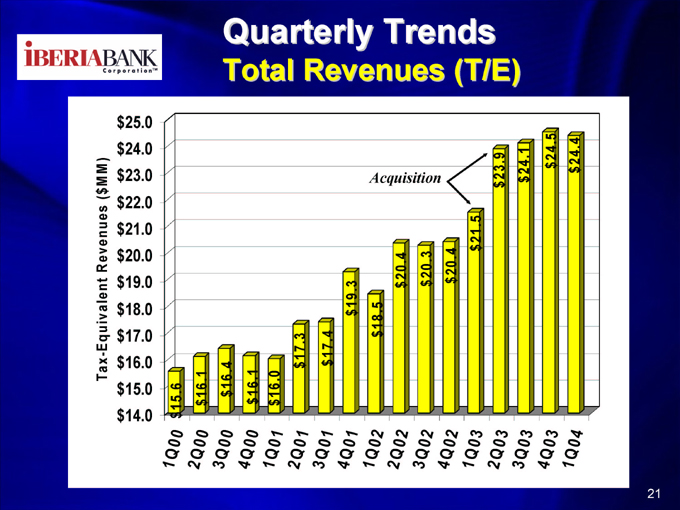

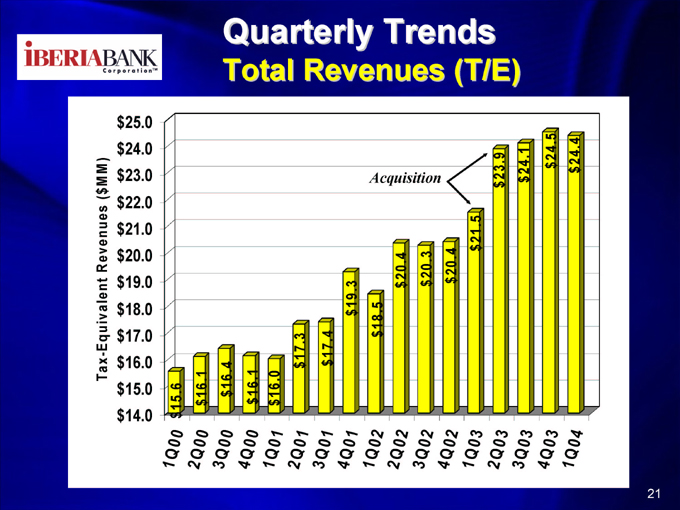

Quarterly Trends

Total Revenues (T/E)

Tax- Equivalent Revenues ($M M )

$ $ $ $ $ $ $ $ $ $ $ $

14.0 15.0 16.0 17.0 18.0 19.0 20.0 21.0 22.0 23.0 24.0 25.0

1Q00 $ 15.6

2Q00 $ 16.1

3Q00 $ 16.4

4Q0

0 $ 16.1

1Q01 $ 16.0

2Q01 $ 17.3

3Q0

1 $ 17.4

4Q01 $ 19.3

1Q0

2 $ 18.5

2Q02 $ 20.4

3Q02 $ 20.3 Acquisition

4Q02 $ 20.4

1Q03 $ 21.5

2Q03 $ 23.9

3Q03 $ 24.1

4Q03 $ 24.5

1Q04 $ 24.4

21

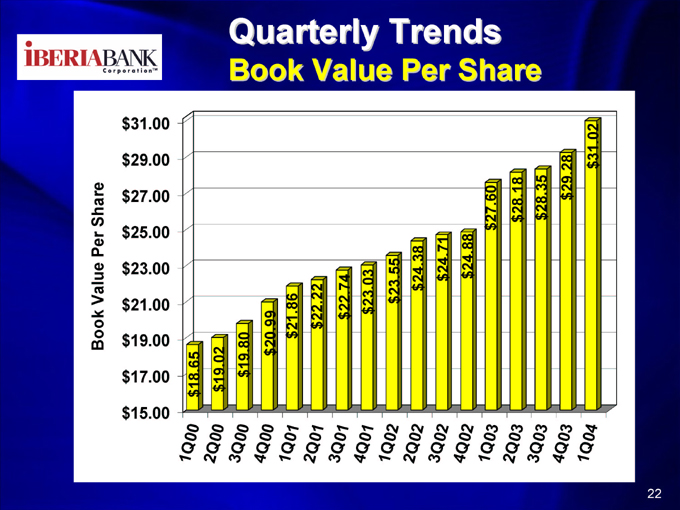

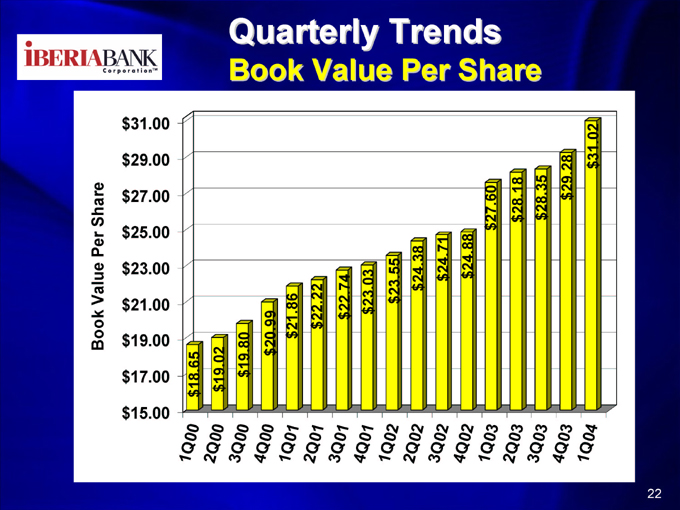

Quarterly Trends

Book Value Per Share

$ 31.00

$ 29.00

$ 27.00

$ 25.00

$ 23.00

$ 21.00

$ 19.00

$ 17.00

$ 15.00

Book Value Per Share

22

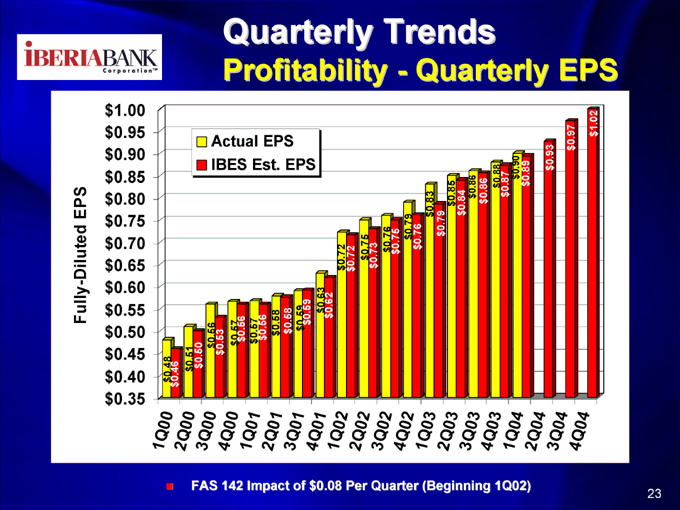

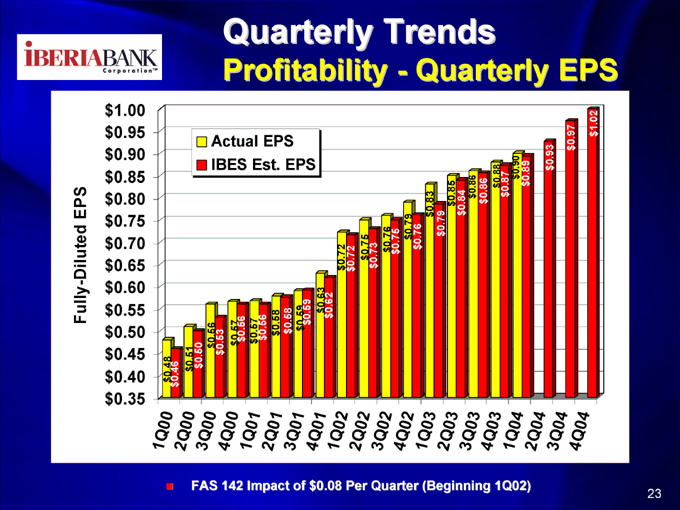

Quarterly Trends

Profitability—Quarterly EPS

$ 1.00

$ 0.95

$ 0.90

$ 0.85

$ 0.80

$ 0.75

$ 0.70

$ 0.65

$ 0.60

$ 0.55

$ 0.50

$ 0.45

$ 0.40

$ 0.35

Fully- Diluted EPS

Actual EPS IBES Est. EPS

FAS 142 Impact of $0.08 Per Quarter (Beginning 1Q02)

23

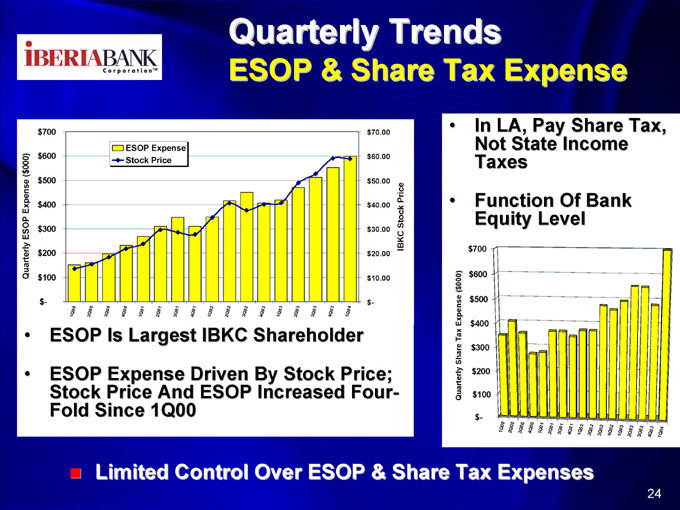

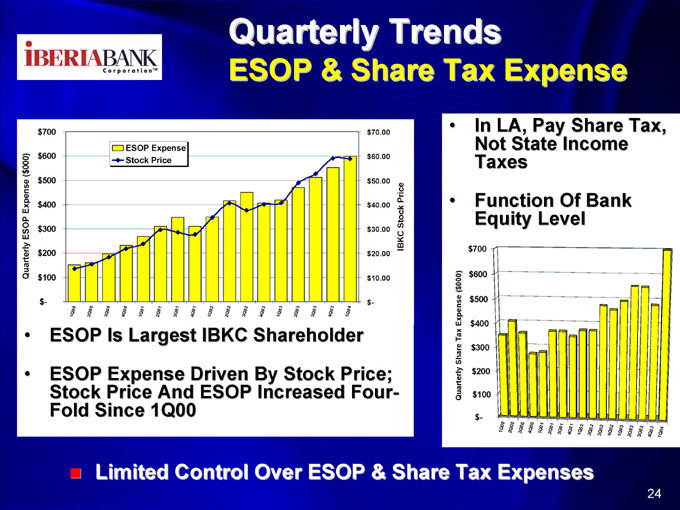

Quarterly Trends

ESOP & Share Tax Expense

ESOP Expense Stock Price

• ESOP Is Largest IBKC Shareholder

• ESOP Expense Driven By Stock Price; Stock Price And ESOP Increased FourFold Since 1Q

• In LA, Pay Share Tax, Not State Income Taxes

• Function Of Bank Equity Level $700 $600 $500 $400

Quarterly Share Tax Expense ($000) $300

Limited Control Over ESOP & Share Tax Expenses

24

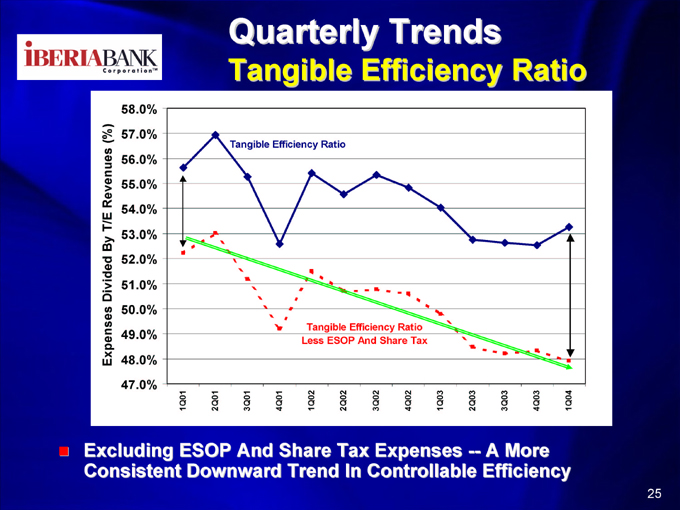

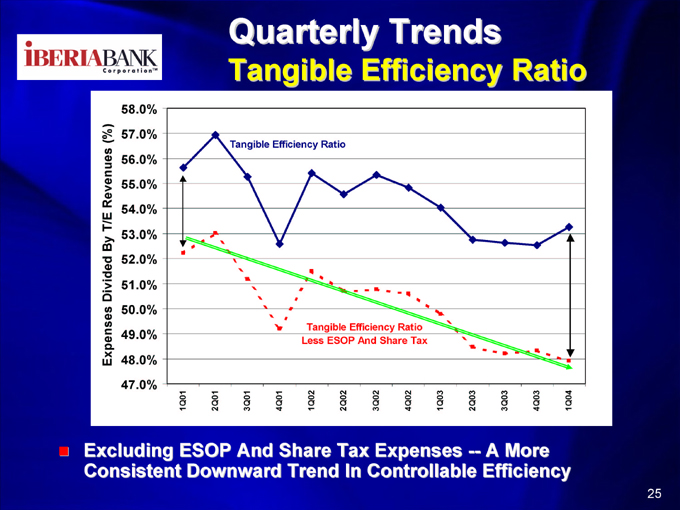

Quarterly Trends

Tangible Efficiency Ratio

(%) 57.0% Revenues 56.0% 55.0% 54.0% By T/E 53.0% 52.0%

Divided 51.0% 50.0%

Expenses 49.0% 48.0% 47.0%

Tangible Efficiency Ratio

Tangible Efficiency Ratio Less ESOP And Share Tax

Excluding ESOP And Share Tax Expenses — A More Consistent Downward Trend In Controllable Efficiency

25

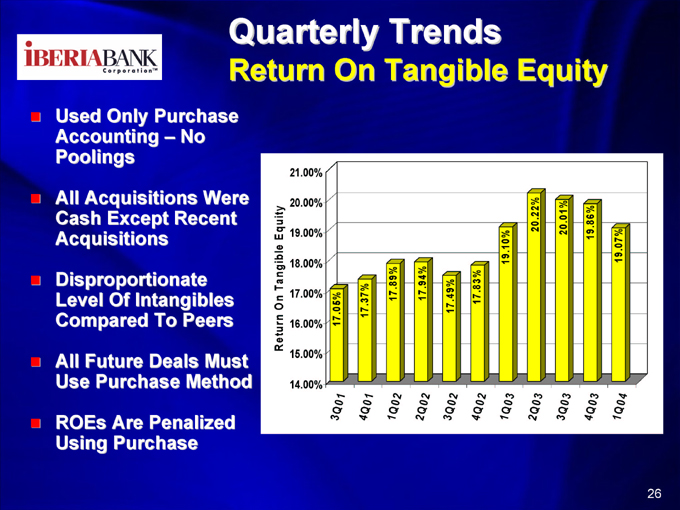

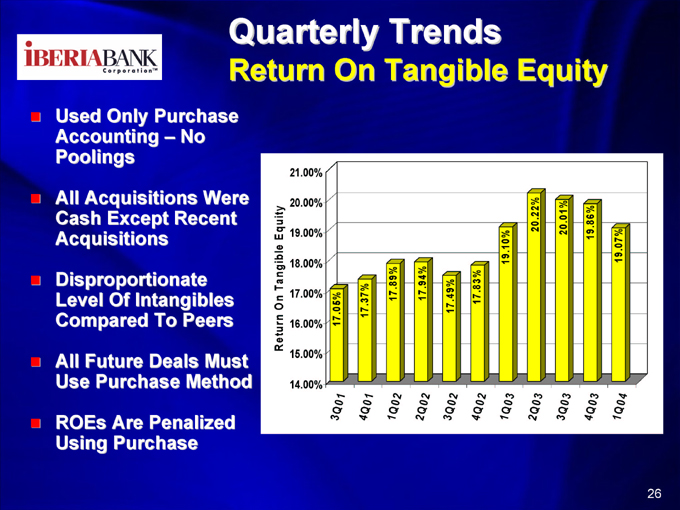

Quarterly Trends

Return On Tangible Equity

Used Only Purchase Accounting – No Poolings

All Acquisitions Were Cash Except Recent Acquisitions

Disproportionate Level Of Intangibles Compared To Peers

All Future Deals Must Use Purchase Method

ROEs Are Penalized Using Purchase

21.00%

20.00%

19.00%

18.00%

17.00%

16.00%

15.00%

14.00%

26

Composition And Risk

27

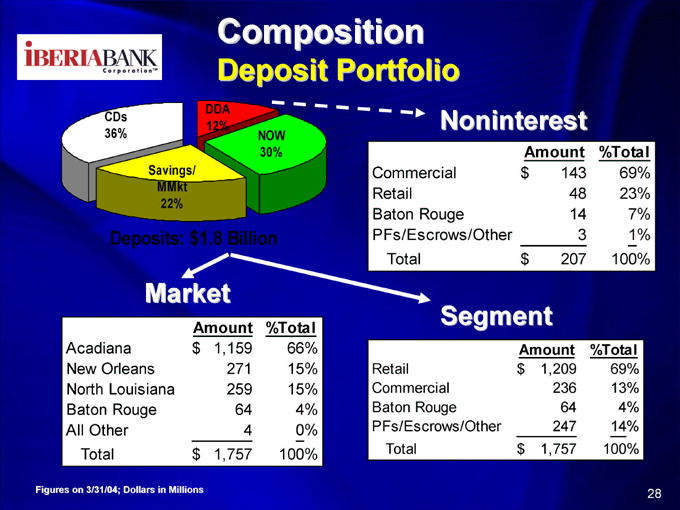

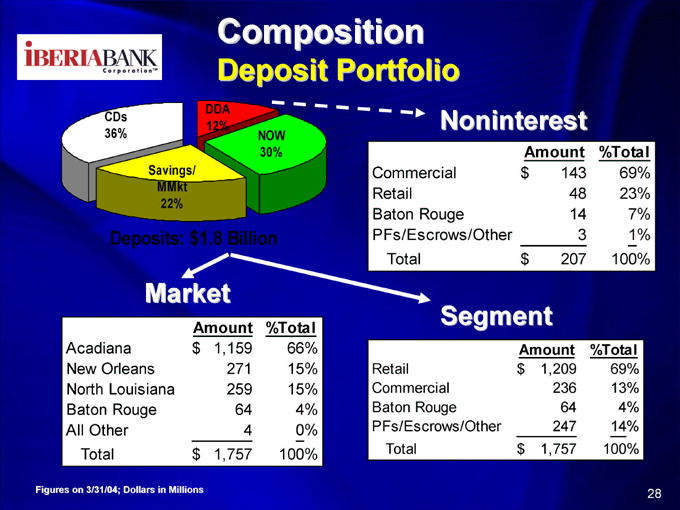

Composition

Deposit Portfolio

CDs 36%

DDA 12%

NOW 30%

Savings/ MMkt 22%

Deposits: $1.8 Billion

Market

Amount %Total

Acadiana $ 1,159 66%

New Orleans 271 15%

North Louisiana 259 15%

Baton Rouge 64 4%

All Other 4 0%

Total $ 1,757 100%

Noninterest

Amount %Total

Commercial $ 143 69%

Retail 48 23%

Baton Rouge 14 7%

PFs/Escrows/Other 3 1%

Total $ 207 100%

Segment

Amount %Total

Retail $ 1,209 69%

Commercial 236 13%

Baton Rouge 64 4%

PFs/Escrows/Other 247 14%

Total $ 1,757 100%

Figures on 3/31/04; Dollars in Millions

28

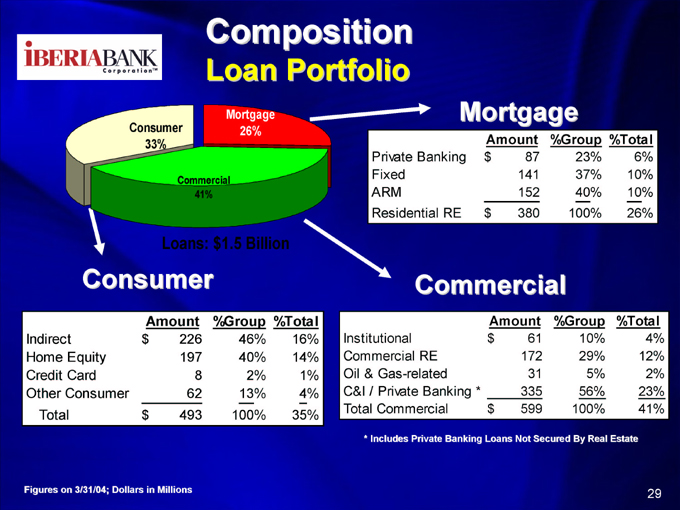

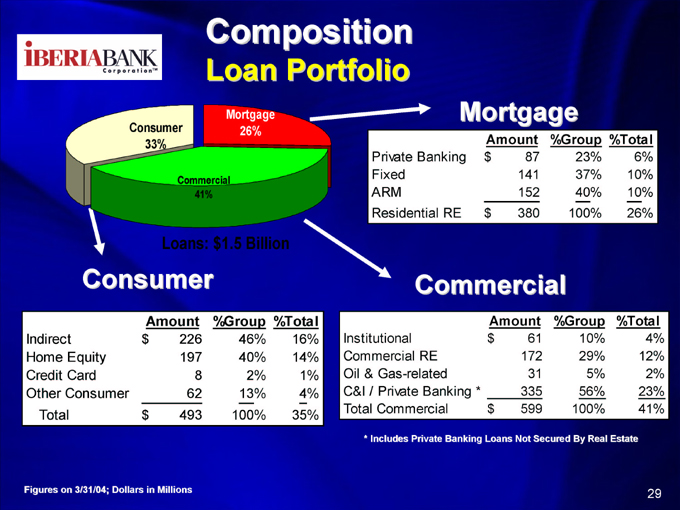

Composition

Loan Portfolio

Consumer 33%

Mortgage 26%

Commercial 41%

Loans: $1.5 Billion

Consumer

Amount %Group %Total

Indirect $ 226 46% 16%

Home Equity 197 40% 14%

Credit Card 8 2% 1%

Other Consumer 62 13% 4%

Total $ 493 100% 35%

Mortgage

Private Banking $ 87 23% 6%

Fixed 141 37% 10%

ARM 152 40% 10%

Residential RE $ 380 100% 26%

Commercial

Amount %Group %Total

Institutional $ 61 10% 4%

Commercial RE 172 29% 12%

Oil & Gas-related 31 5% 2%

C&I / Private Banking * 335 56% 23%

Total Commercial $ 599 100% 41%

* Includes Private Banking Loans Not Secured By Real Estate

Figures on 3/31/04; Dollars in Millions

29

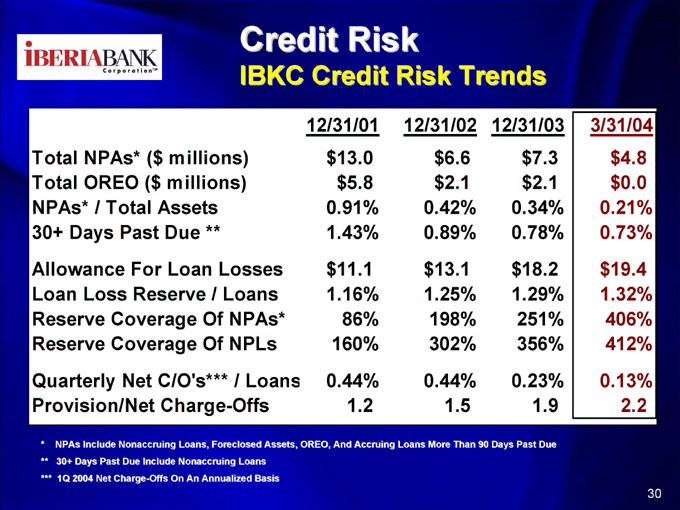

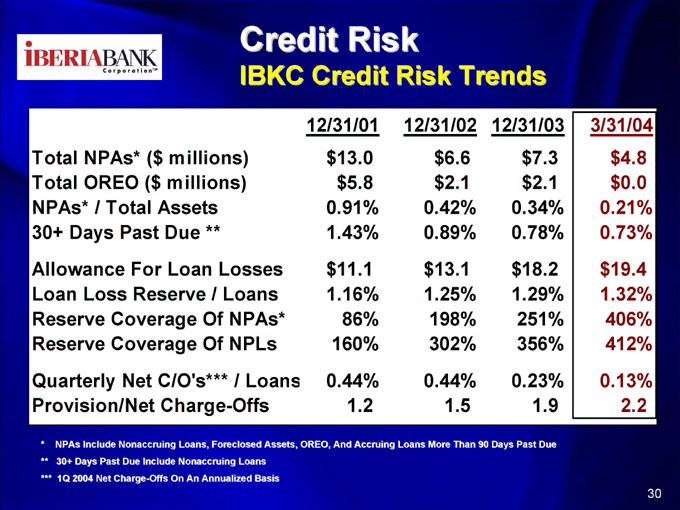

Credit Risk

IBKC Credit Risk Trends

12/31/01 12/31/02 12/31/03 3/31/04

Total NPAs* ($ millions) $ 13.0 $6.6 $ 7.3 $ 4.8

Total OREO ($ millions) $5.8 $2.1 $ 2.1 $ 0.0

NPAs* / Total Assets 0.91% 0.42% 0.34% 0.21%

30+ Days Past Due ** 1.43% 0.89% 0.78% 0.73%

Allowance For Loan Losses $ 11.1 $ 13.1 $ 18.2 $ 19.4

Loan Loss Reserve / Loans 1.16% 1.25% 1.29% 1.32%

Reserve Coverage Of NPAs* 86% 198% 251% 406%

Reserve Coverage Of NPLs 160% 302% 356% 412%

Quarterly Net C/O’s*** / Loans 0.44% 0.44% 0.23% 0.13%

Provision/Net Charge-Offs 1.2 1.5 1.9 2.2

* NPAs Include Nonaccruing Loans, Foreclosed Assets, OREO, And Accruing Loans More Than 90 Days Past Due

** 30+ Days Past Due Include Nonaccruing Loans *** 1Q 2004 Net Charge-Offs On An Annualized Basis

30

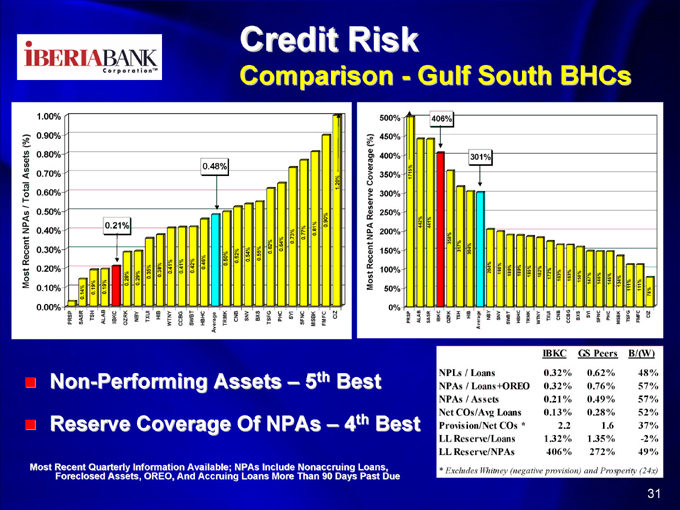

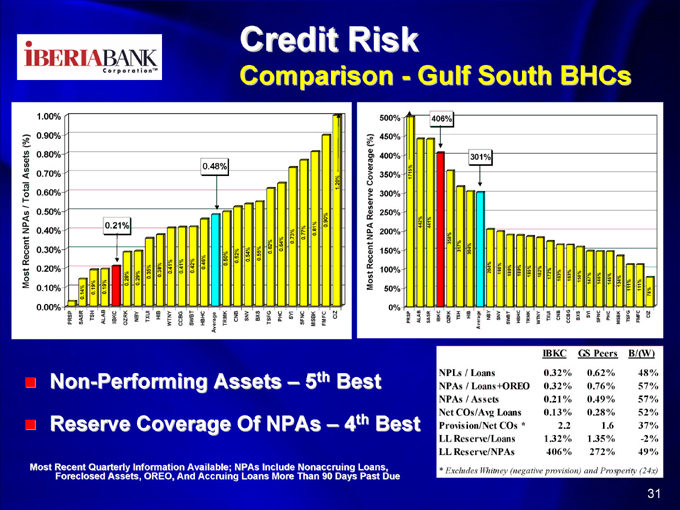

Credit Risk

Comparison—Gulf South BHCs

1.00%

(%) 0.90% Assets 0.80% 0.70%

0.60%

0.50% NPAs / Total 0.40% Recent 0.30%

Most 0.20% 0.10%

0.00%

Most Recent NPA Reserve Coverage (%)

0% 50% 100% 150% 200% 250% 300% 350% 400% 450% 500%

Non-Performing Assets – 5th Best

Reserve Coverage Of NPAs – 4th Best

IBKC GS Peers B/(W)

NPLs / Loans 0.32% 0.62% 48%

NPAs / Loans+OREO 0.32% 0.76% 57%

NPAs / Assets 0.21% 0.49% 57%

Net COs/Avg Loans 0.13% 0.28% 52%

Provision/Net COs * 2.2 1.6 37%

LL Reserve/Loans 1.32% 1.35% -2%

LL Reserve/NPAs 406% 272% 49%

* Excludes Whitney (negative provision) and Prosperity (24x)

Most Recent Quarterly Information Available; NPAs Include Nonaccruing Loans, Foreclosed Assets, OREO, And Accruing Loans More Than 90 Days Past Due

31

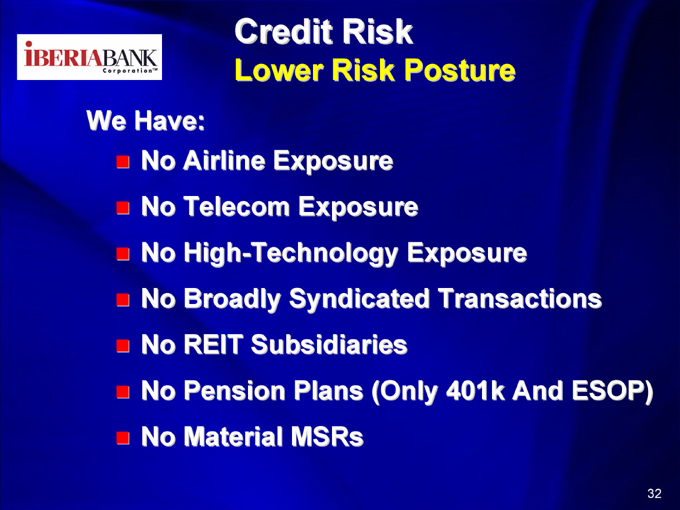

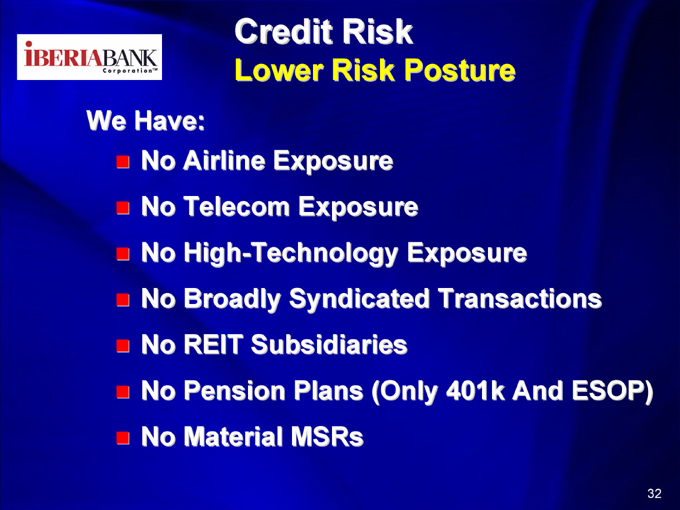

Credit Risk

Lower Risk Posture

We Have:

No Airline Exposure

No Telecom Exposure

No High-Technology Exposure

No Broadly Syndicated Transactions

No REIT Subsidiaries

No Pension Plans (Only 401k And ESOP)

No Material MSRs

32

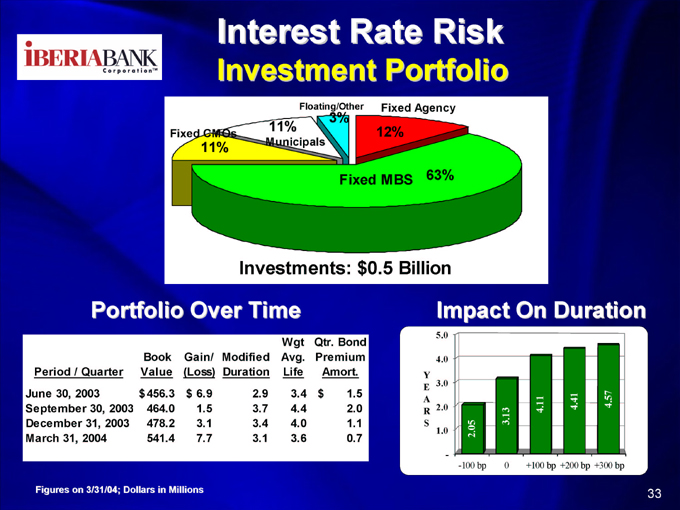

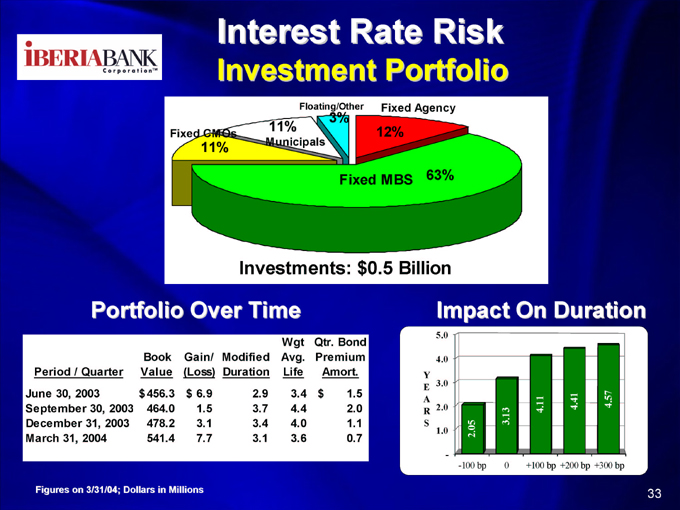

Interest Rate Risk

Investment Portfolio

Fixed CMOs

11%

11%

Municipals

Floating/Other

3%

Fixed Agency

12%

Fixed MBS 63%

Investments: $0.5 Billion

Portfolio Over Time

Book Gain/ Modified Avg. Premium

Period / Quarter Value (Loss) Duration Life Amort.

June 30, 2003 $ 456.3 $ 6.9 2.9 3.4 $ 1.5

September 30, 2003 464.0 1.5 3.7 4.4 2.0

December 31, 2003 478.2 3.1 3.4 4.0 1.1

March 31, 2004 541.4 7.7 3.1 3.6 0.7

Impact On Duration

5.0

4.0 Y E 3.0 A R 2.0 S

1.0

-

Figures on 3/31/04; Dollars in Millions

33

Interest Rate Risk

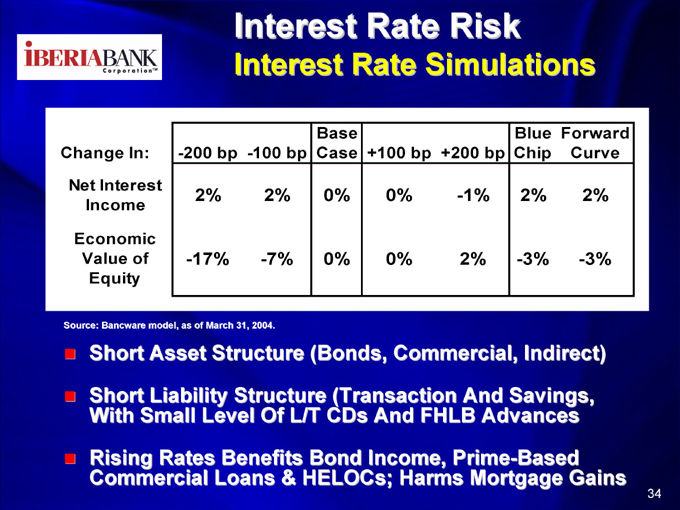

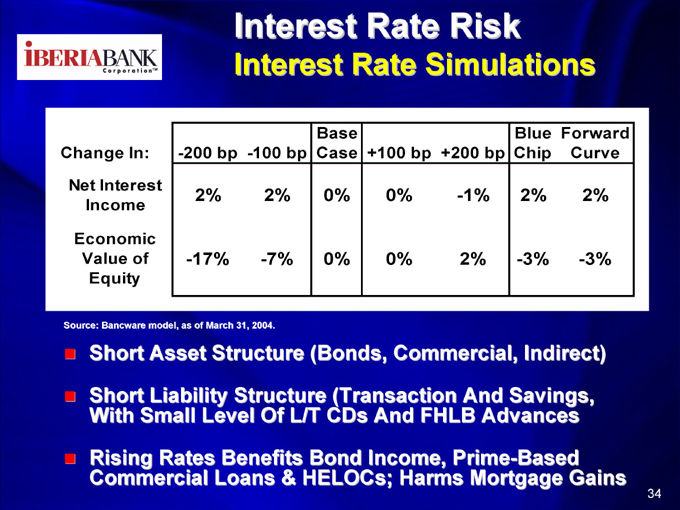

Interest Rate Simulations

Base Blue Forward Change In: -200 bp -100 bp Case +100 bp +200 bp Chip Curve

Net Interest

2% 2% 0% 0% -1% 2% 2%

Income

Economic

Value of -17% -7% 0% 0% 2% -3% -3%

Equity

Source: Bancware model, as of March 31, 2004.

Short Asset Structure (Bonds, Commercial, Indirect)

Short Liability Structure (Transaction And Savings, With Small Level Of L/T CDs And FHLB Advances

Rising Rates Benefits Bond Income, Prime-Based Commercial Loans & HELOCs; Harms Mortgage Gains

34

Investment Perspective

Investment Perspective

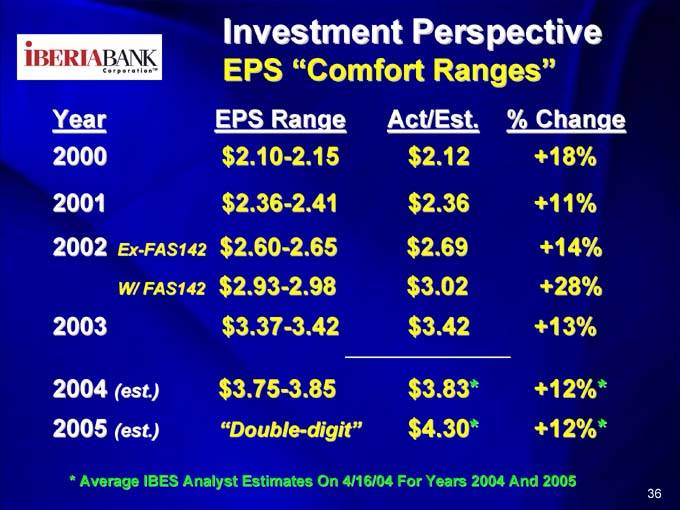

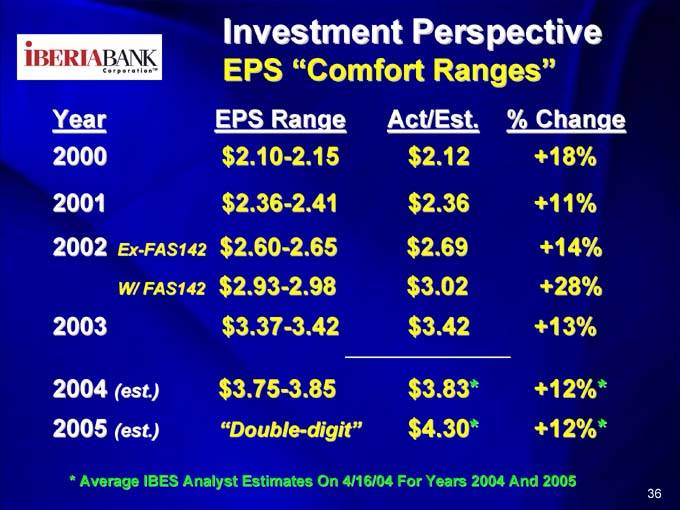

EPS “Comfort Ranges”

Year EPS Range Act/Est. % Change

2000 $2.10-2.15 $ 2.12 +18%

2001 $2.36-2.41 $ 2.36 +11%

2002 Ex-FAS142 $2.60-2.65 $ 2.69 +14%

W/ FAS142 $2.93-2.98 $ 3.02 +28%

2003 $3.37-3.42 $ 3.42 +13%

2004 (est.) $3.75-3.85 $3.83* +12%*

2005 (est.) “Double-digit” $4.30* +12%*

* Average IBES Analyst Estimates On 4/16/04 For Years 2004 And 2005

36

Investment Perspective

Price-To-Earnings Ratio

Source: Bloomberg on April 16, 2004

37

Investment Perspective

Market-To-Book Ratio

Source: Bloomberg on April 16, 2004

38

Investment Perspective

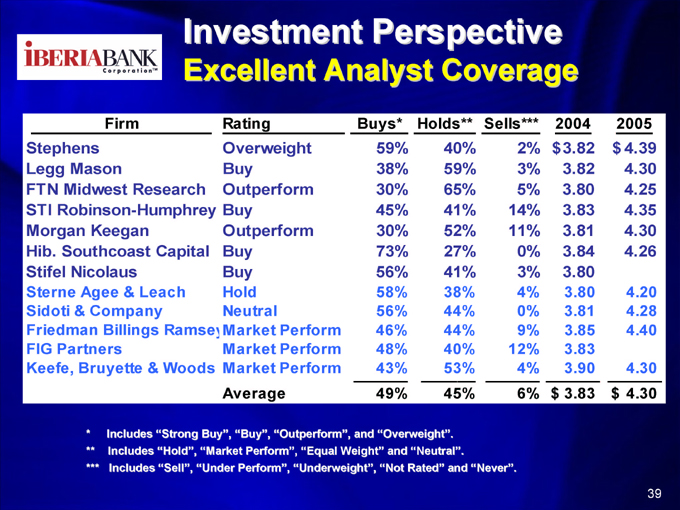

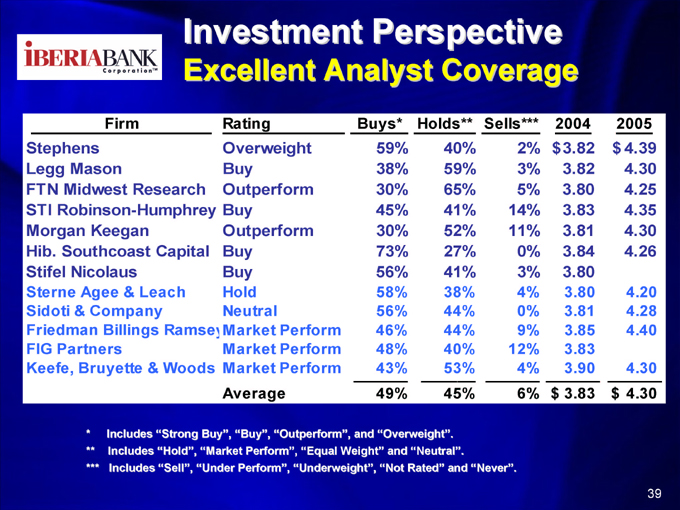

Excellent Analyst Coverage

Firm Rating Buys* Holds** Sells*** 2004 2005

Stephens Overweight 59% 40% 2% $ 3.82 $ 4.39

Legg Mason Buy 38% 59% 3% 3.82 4.30

FTN Midwest Research Outperform 30% 65% 5% 3.80 4.25

STI Robinson-Humphrey Buy 45% 41% 14% 3.83 4.35

Morgan Keegan Outperform 30% 52% 11% 3.81 4.30

Hib. Southcoast Capital Buy 73% 27% 0% 3.84 4.26

Stifel Nicolaus Buy 56% 41% 3% 3.80

Sterne Agee & Leach Hold 58% 38% 4% 3.80 4.20

Sidoti & Company Neutral 56% 44% 0% 3.81 4.28

Friedman Billings Ramse Market Perform 46% 44% 9% 3.85 4.40

FIG Partners Market Perform 48% 40% 12% 3.83

Keefe, Bruyette & Woods Market Perform ______ 43% ______ 53% ______ 4% ______ 3.90 ______ 4.30

Average 49% 45% 6% $ 3.83 $ 4.30

* Includes “Strong Buy”, “Buy”, “Outperform”, and “Overweight”.

** Includes “Hold”, “Market Perform”, “Equal Weight” and “Neutral”.

*** Includes “Sell”, “Under Perform”, “Underweight”, “Not Rated” and “Never”.

39

Comparatives

40

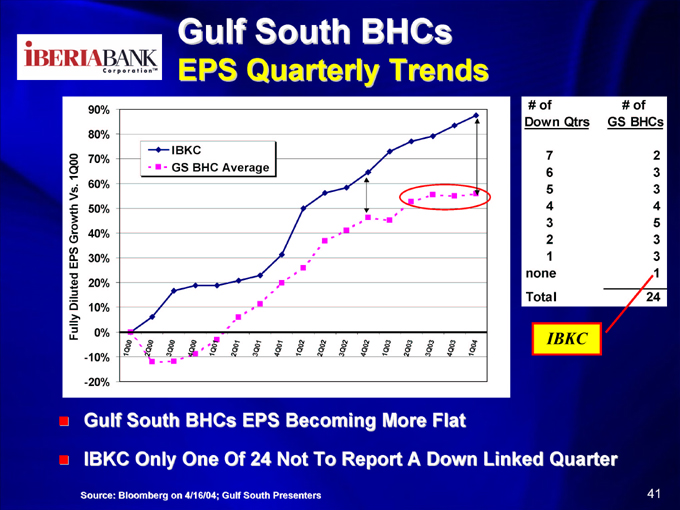

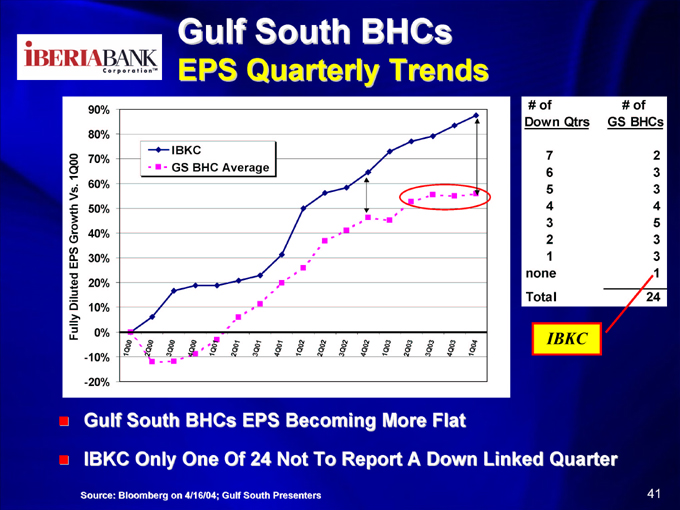

Gulf South BHCs

EPS Quarterly Trends

90%

80%

70% Vs. 1Q00 60% Growth 50% 40% EPS 30% Diluted 20% 10% Fully 0% -10%

-20%

IBKC

GS BHC Average

# of # of

Down Qtrs GS BHCs

7 2

6 3

5 3

4 4

3 5

2 3

1 3

none 1

Total 24

IBKC

Gulf South BHCs EPS Becoming More Flat

IBKC Only One Of 24 Not To Report A Down Linked Quarter

Source: Bloomberg on 4/16/04; Gulf South Presenters

41

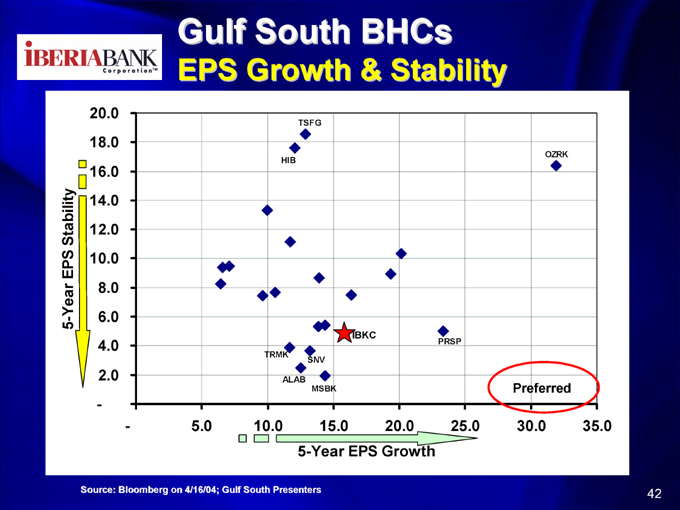

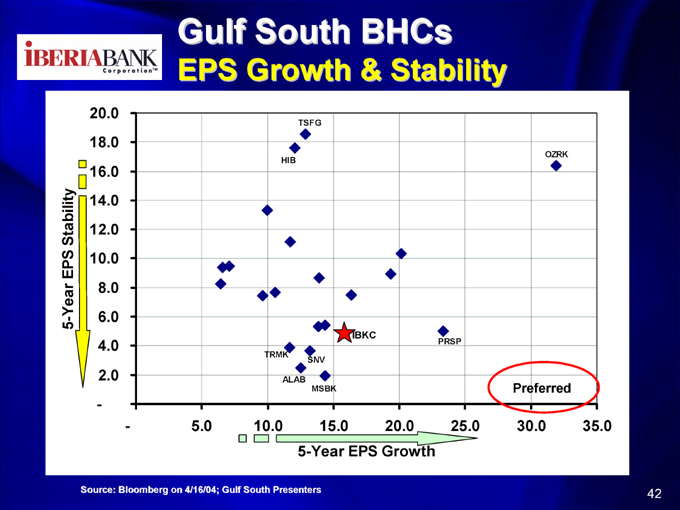

Gulf South BHCs

EPS Growth & Stability

20.0 18.0 16.0 Stability 14.0 12.0 10.0 8.0 5-Year EPS 6.0 4.0 2.0

5.0 10.0 15.0 20.0 25.0 30.0 35.0 5-Year EPS Growth

Source: Bloomberg on 4/16/04; Gulf South Presenters

42

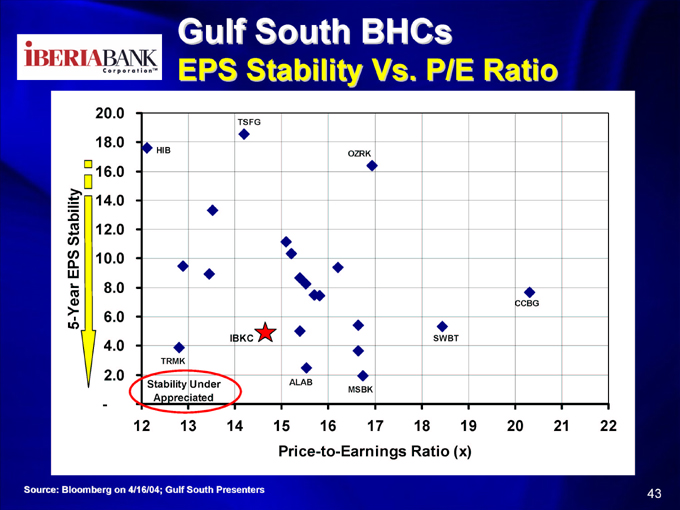

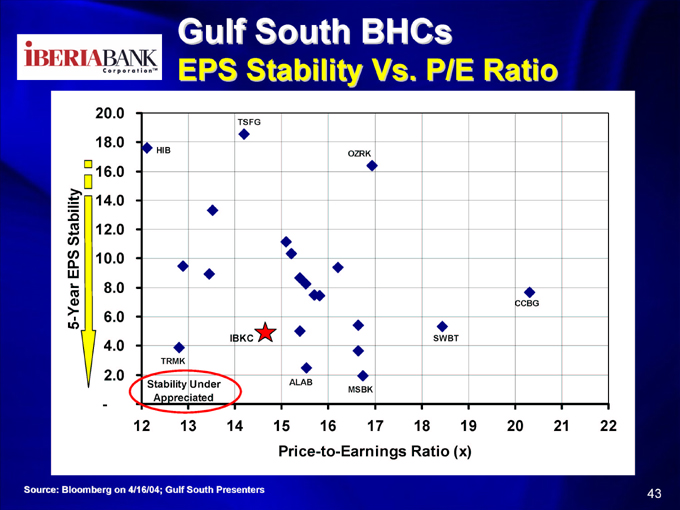

Gulf South BHCs

EPS Stability Vs. P/E Ratio

20.0 18.0 16.0 Stability 14.0 12.0 10.0 8.0 5-Year EPS 6.0 4.0 2.0 -

Source: Bloomberg on 4/16/04; Gulf South Presenters

43

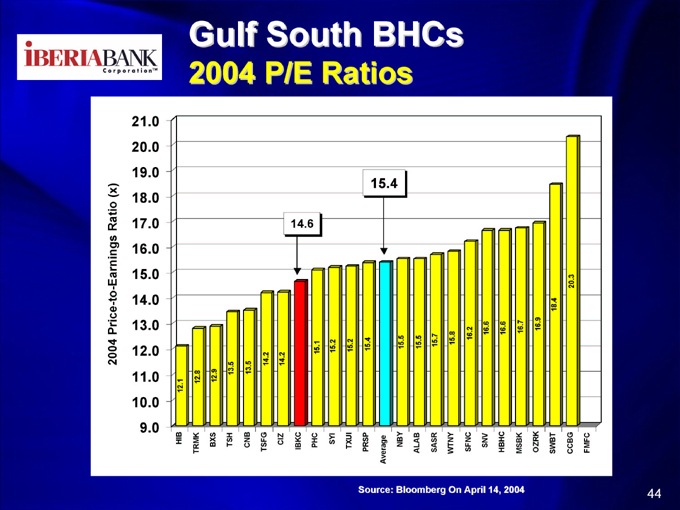

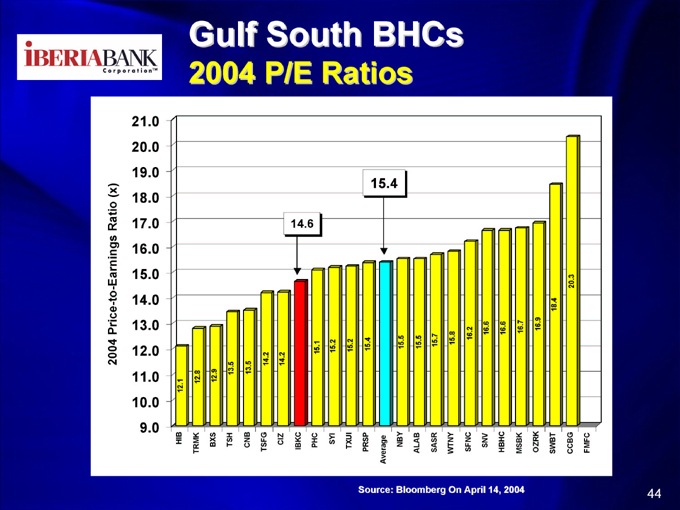

Gulf South BHCs

2004 P/E Ratios

21.0 20.0 19.0 18.0

Ratio (x) 17.0 Earnings 16.0

15.0 14.0 13.0

2004 Price-to- 12.0

11.0 10.0 9.0

Source: Bloomberg On April 14, 2004

44

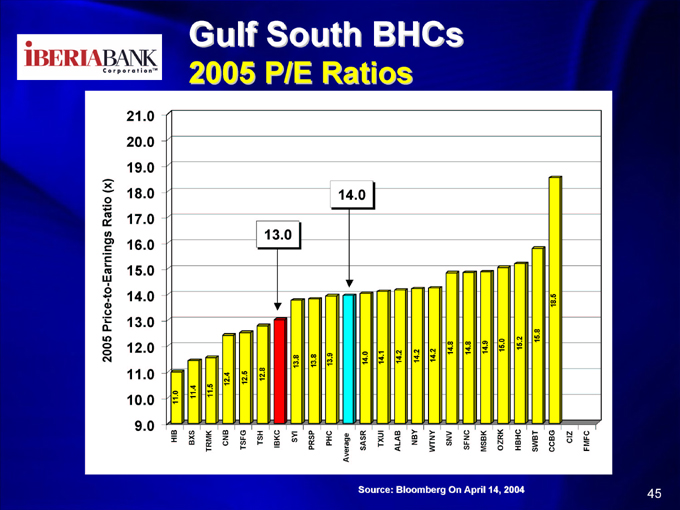

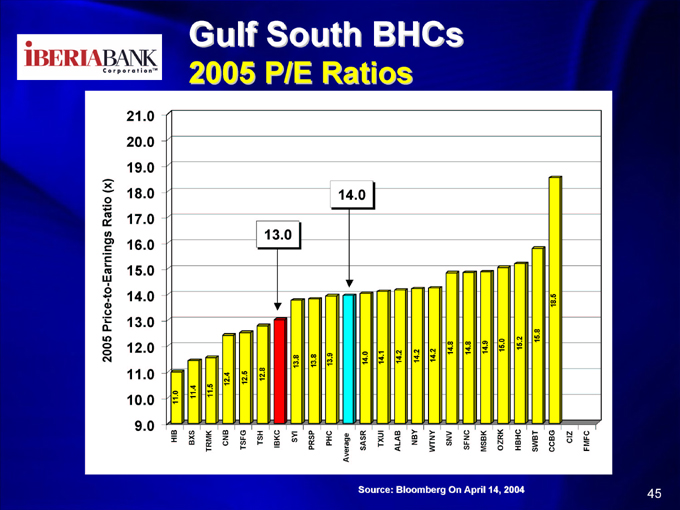

Gulf South BHCs

2005 P/E Ratios

21.0 20.0 19.0 18.0

Ratio (x) 17.0 Earnings 16.0

15.0 14.0 13.0

2005 Price-to- 12.0

11.0 10.0 9.0

Source: Bloomberg On April 14, 2004

45

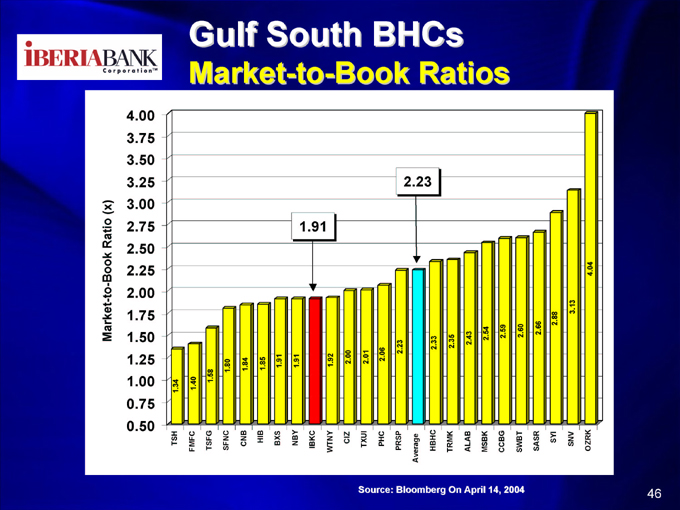

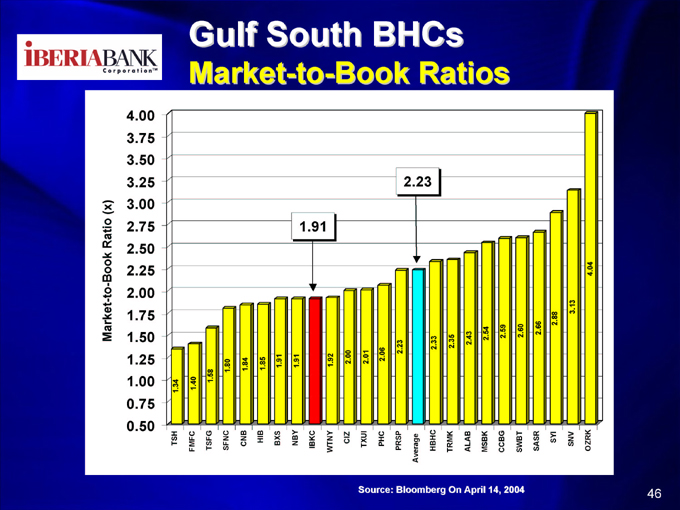

Gulf South BHCs

Market-to-Book Ratios

4.00 3.75 3.50 3.25 3.00 2.75 2.50 2.25 2.00

Market-to-Book Ratio (x) 1.75

1.50 1.25 1.00 0.75 0.50

Source: Bloomberg On April 14, 2004

46

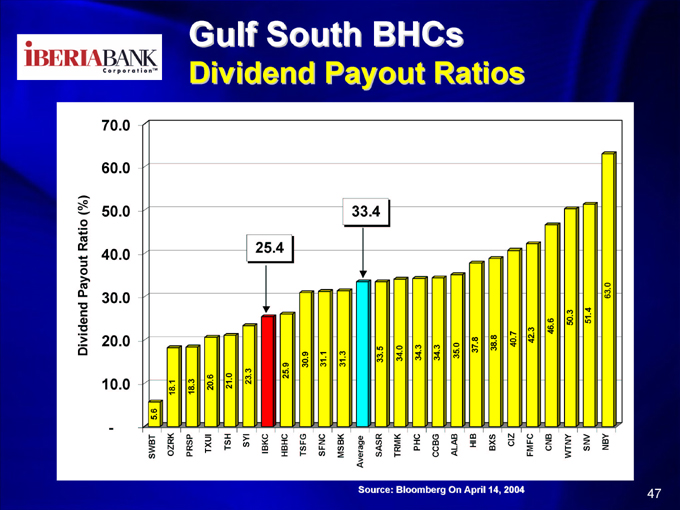

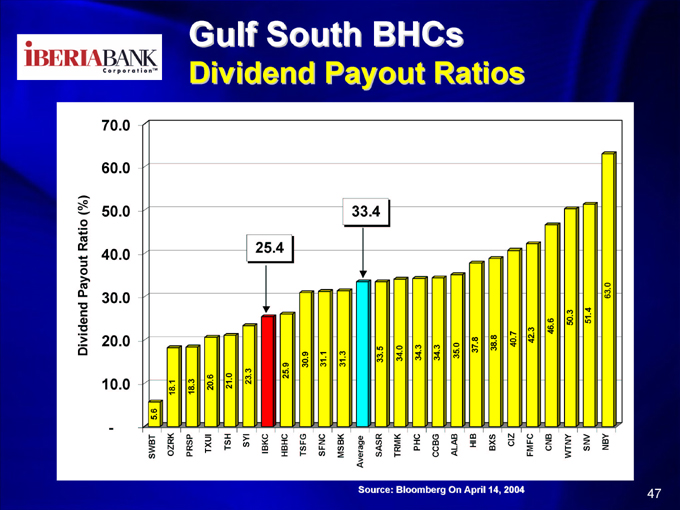

Gulf South BHCs

Dividend Payout Ratios

70.0

60.0

50.0

Payout Ratio (%) 40.0

30.0

Dividend

20.0 10.0 -

Source: Bloomberg On April 14, 2004

47

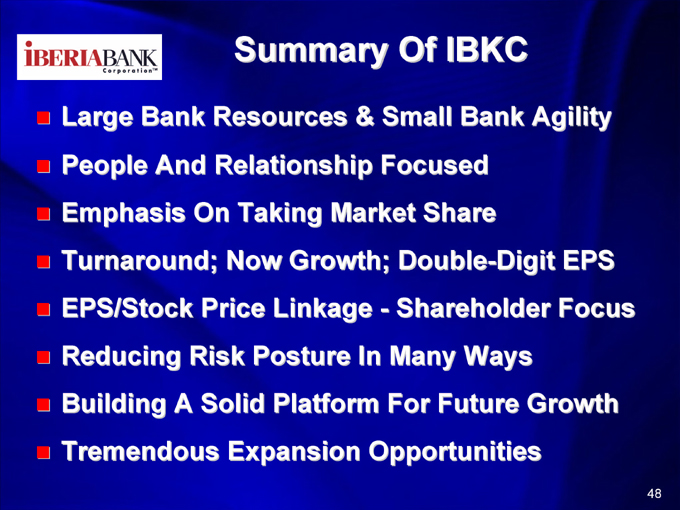

Summary Of IBKC

Large Bank Resources & Small Bank Agility

People And Relationship Focused

Emphasis On Taking Market Share

Turnaround; Now Growth; Double-Digit EPS

EPS/Stock Price Linkage—Shareholder Focus

Reducing Risk Posture In Many Ways

Building A Solid Platform For Future Growth

Tremendous Expansion Opportunities

48

Iberiabank

An Independent Louisiana Bank

Appendix A

50

DARYL BYRD

President & Chief Executive Officer

1981 • Trust Company Bank, Atlanta

Banking Officer, Corporate Banking

1983 • First National Bank of South Carolina

Vice President, Commercial Lending Officer

1984 • BB&T (North Carolina)

Vice President, Business Services Manager Commercial Lending Officer

1985 • FNB-Lafayette (First Commerce Corp.)

Executive Vice President, Corporate Banking Manager

1990 • Rapides Bank & Trust (First Commerce Corp.)

President & CEO

1992 • First National Bank of Commerce, New Orleans

Executive Vice President in charge of the commercial bank and mortgage banking groups.

Managed the strategic development for multiple businesses and had responsibility for other business lines and support functions.

1998 • Bank One Louisiana

President and CEO New Orleans Region

51

MIKE NAQUIN

North Louisiana; Administration

1984 • First City National Bank, Houston

Banking Officer – Energy Division.

1987 • SunTrust Bank, Tampa

Senior Vice President-Commercial Sales and Credit Manager; Also business and private banking groups.

1991 • First Commerce Corporation, New Orleans

Senior Vice President-Strategic Support.

1996 • First Commerce Corporation, Monroe

Executive Vice President-Commercial Banking Group for Central Bank and Senior Credit Officer for Central bank (Monroe) and Rapides Bank & Trust (Alexandria).

1998 • Bank One, Louisiana

Market President & CEO – Northeast Louisiana Market.

2002 • Bank One, Arizona

Senior Vice President-Commercial Market Manager for Arizona and California (3rd largest commercial banking market for Bank One).

52

MICHAEL BROWN

South Louisiana; Chief Credit Officer

1987 • Wachovia Bank

Treasury Services Representative and Assistant Vice President Vice President and Relationship Manager—Managed all aspects of bank relationships with Fortune 500 clients in Texas and Louisiana.

Loan Administration Manager—Managed the loan administration and credit policy functions for the Midwest and Chicago credit portfolios.

1996 • First Commerce Corporation, New Orleans

Senior Vice President, Manager of Credit and Client Services -Re-engineered and managed consumer and commercial credit processes.

1998 • Bank One Louisiana

Chief Credit Officer for the Commercial Line of Business in Louisiana Capital Markets Specialist—Responsible for the sale of capital market products and served as corporate finance advisor to the bank’s client base.

Chartered Financial Analyst (CFA)

53

JOHN DAVIS

Finance And Strategy

1983 • BB&T (NC)

Senior Vice President and Manager of the Financial Planning Department Responsible for mergers and acquisitions, strategic planning, and budgeting.

1993 • First Commerce Corporation, New Orleans

Senior Vice President

Responsibilities included mergers and acquisitions, corporate finance, and President of Marquis Insurance Agency.

1997 • Crestar Financial Corporation (VA)

Corporate Senior Vice President

Responsibilities included strategic planning, forecasting, and budgeting for the corporation.

Chartered Financial Analyst (CFA)

54