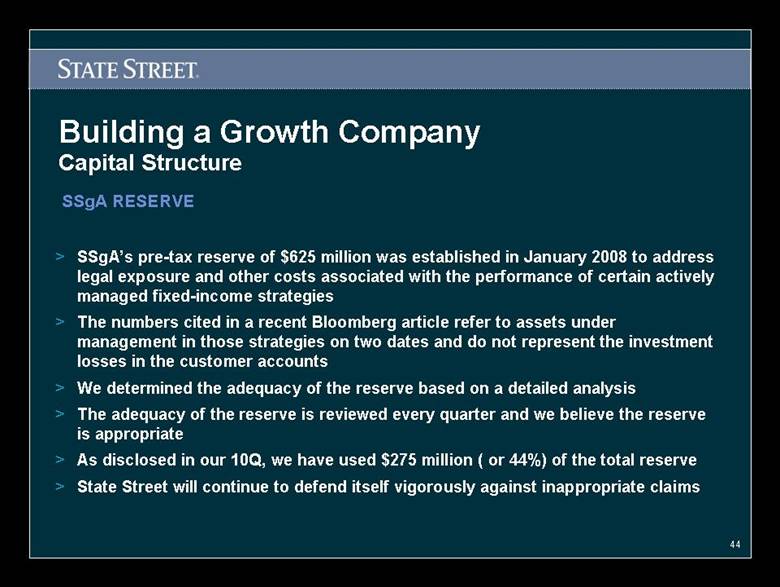

| 2 This presentation contains forward-looking statements as defined by United States securities laws, including statements about our financial goals and expectations, strategic objectives, financial and industry outlook and business environment, as well as about integration, cost savings and other results and benefits of our July 2007 acquisition of Investors Financial Services Corp. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing State Street’s expectations or beliefs as of any date subsequent to the date of this presentation. Important factors that may affect future results and outcomes include: State Street’s ability to integrate acquisitions into its business, including the acquisition of Investors Financial Services Corp.; the level and volatility of interest rates, particularly in the U.S., Europe, and Asia-Pacific region; the performance and volatility of securities, currency and other markets in the U.S. and internationally; and economic conditions and monetary and other governmental actions designed to address those conditions; the liquidity of the US and International securities markets, particularly the markets for fixed-income securities, including asset-backed commercial paper, and the liquidity requirements of State Street’s customers; State Street’s ability to estimate the fair value for securities in its investment securities portfolio, particularly given the current market conditions for many of these securities; the credit quality and credit agency ratings of the securities in State Steet’s investment securities portfolio, a deterioration or downgrade of which could lead to other-than- temporary impairment of the respective securities and the recognition of an impairment loss; State Street’s ability to attract non-interest bearing deposits and other low-cost funds; the possibility that changes in market conditions or asset performance may require any off-balance sheet activities, including our asset-backed commercial conduits, to be consolidated into our financial statements, requiring the recognition of associated losses, if any; the results of litigation and similar disputes and, in particular, the effect that any current or potential results may have on the reputation of State Street or of State Street Global Advisors (“SSgA”) and State Street’s ability to attract and retain customers, and the possibility that the ultimate costs of the legal exposure associated with certain of SSgA’s actively managed fixed-income strategies may exceed or be below the level of the related reserve, in view of the uncertainties of the timing and outcome of litigation, and the amounts involved; the possibility of further developments of that nature that previously gave rise to the legal exposure associated with SSgA’s actively managed fixed-income and other investment strategies; the performance of, and demand for, the products State Street offers; the competitive environment in which State Street operates; the enactment of legislation and changes in regulation and enforcement that impact State Street and its customers, as well as the effects of legal and regulatory proceedings, including litigation; State Street’s ability to continue to grow revenue, control expenses and attract the capital necessary to achieve its business goals and comply with regulatory requirements; State Street’s ability to manage systemic risks and control operating risks; State Street’s ability to obtain quality and timely services from third parties with which it contracts; trends in the globalization of investment activity and the growth on a worldwide basis in financial assets; trends in governmental and corporate pension plans and savings rates; changes in accounting standards and practices, including changes in the interpretation of existing standards, that impact State Street’s consolidated financial statements; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that impact the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in State Street’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2008 and its subsequent SEC filings. State Street encourages investors to read these filings, particularly the sections on Risk Factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation speak only as of the date hereof, May 13, 2008, and State Street will not undertake efforts to revise those forward-looking statements to reflect events after this date. Reminder |