State Street has established three statutory business trusts, which collectively issued $650 million of cumulative semi-annual income and quarterly income preferred securities (“capital securities”). These securities qualify as Tier 1 capital under federal regulatory guidelines. The proceeds of these issuances, along with proceeds of related issuances of common securities of the trusts, were invested in junior subordinated debentures (“debentures”) of State Street. The debentures are the sole assets of the trusts. State Street owns all of the common securities of the trusts.

Payments to be made by the trusts on the capital securities are dependent on payments that State Street has committed to make, particularly the payments to be made by State Street on the debentures. Compliance by State Street would have the effect of providing a full, irrevocable and unconditional guarantee of the trusts’ obligations under the capital securities.

Distributions on the capital securities are included in interest expense and are payable from interest payments received on the debentures and are due semi-annually for Capital Securities A and B and quarterly for Capital Trust I, subject to deferral for up to five years under certain conditions. The capital securities are subject to mandatory redemption in whole at the stated maturity upon repayment of the debentures, with an option to redeem the debentures at any time by State Street upon the occurrence of certain tax events or changes to tax treatment, investment company regulation or capital treatment changes; or at any time after March 15, 2007 for the Capital Securities B, after December 30, 2006, for the Capital Securities A and after May 15, 2008, for the Capital Trust I securities.

For Capital Securities A and B, redemptions are based on declining redemption prices according to the terms of the trust agreements. All redemptions are subject to federal regulatory approval.

In connection with the sale of the floating rate capital securities issued by State Street Capital Trust I, State Street issued $150 million of floating rate junior subordinated deferrable interest debentures to State Street Capital Trust I due in May 2028. Subsequent to that issuance, two interest rate swaps were entered into in order to, in effect, modify the interest expense from a floating rate to a fixed rate of 6.58%.

The 7.65% subordinated notes due in 2010 qualify as Tier 2 capital under federal regulatory guidelines.

During 2002, State Street entered into various interest rate swap contracts to modify the interest expense on Capital Securities A and B and the 7.65% subordinated notes from a fixed rate to a floating rate. The swaps are accounted for as a fair value hedge, and at December 31, 2002, increased the reported value of long-term debt outstanding by $29 million, $17 million and $9 million for Capital Securities A and B and the 7.65% subordinated notes, respectively.

The 5.95% notes are unsecured obligations of State Street due September 15, 2003.

The 9.50% mortgage note was fully collateralized by property at December 31, 2002. The scheduled principal payments for the next five years are $2 million for each year 2003 through 2006 and $3 million for 2007.

The 7.75% debentures are convertible to common stock at a price of $1.4375 per share, subject to adjustment for certain events. The debentures are redeemable at par, at State Street’s option. During 2002 and 2001, debentures were converted into 243,000 and 286,000 shares of common stock, respectively. At December 31, 2002, 159,000 shares of common stock had been reserved for issuance upon conversion.

Note 10

Stockholders’ Equity

On December 21, 2000, State Street’s Board of Directors approved a 2-for-1 stock split in the form of a 100% stock dividend, subject to the approval of an increase in the authorized number of shares by stockholders. At the Annual Meeting in April 2001, a proposal to increase the authorized number of shares of common stock from 250 million to 500 million was approved. The stock dividend was distributed on May 30, 2001, to stockholders of record as of April 30, 2001. With the exception of State Street stock held by an external trustee, treasury stock did not receive the stock dividend.

State Street’s Board of Directors has authorized the purchase of State Street common stock for use in employee benefit programs and for general corporate purposes. As of December 31, 2002, cumulative actual shares purchased under the authorized stock purchase program were 20,565,000. These shares were reflected as treasury stock in the Consolidated Statement of Condition at the time of purchase. Reflecting comparable post-split activity, the total number of shares authorized for purchase within this program is 43 million shares, and the cumulative shares acquired as of December 31, 2002, is 34.7 million. At December 31, 2002, 8.3 million shares remained available for purchase within the program.

Additionally, shares may be acquired for other deferred compensation plans, held by an external trustee, that are not part of the stock purchase program. As of December 31, 2002, cumulative shares purchased and held in trust were 422,000. These shares are reflected as treasury stock in the Consolidated Statement of Condition.

During 2002, 2001 and 2000, total common stock purchased by State Street and recorded as treasury stock was 1,636,000 shares, 5,260,000 shares and 820,000 shares, respectively, at an average historical cost per share of $46, $48 and $103, respectively.

State Street Corporation| 67

State Street has a 1997 Equity Incentive Plan (“the 1997 Plan”) with 46,800,000 shares of common stock approved for issuance for stock and stock-based awards, including stock options, restricted stock, deferred stock and performance awards. Other award types are available under the plan, but are not currently utilized. All stock awards and stock options are awarded at the fair market value of State Street common stock at the date of grant. At December 31, 2002, 13,913,000 shares were available for future awards under the 1997 Plan. State Street has stock options outstanding from previous plans under which no further grants can be made.

Stock options can expire no longer than ten years from the date of grant, and the exercise price of non-qualified and incentive stock options may not be less than the fair value of such shares at the date of grant. Information on stock option activity is provided in the Stock Options table.

State Street has a restricted stock program under the 1997 Plan whereby stock certificates are issued at the time of grant, and recipients have dividend and voting rights. In general, these grants vest over three years. Awards, net of cancellations, were 334,000, 292,000 and 598,000 for the years ended December 31, 2002, 2001 and 2000, respectively. At December 31, 2002, a total of 1,101,000 restricted shares have been awarded but have not vested under this program.

State Street currently has deferred stock award programs under the 1997 Plan whereby no stock is issued at the time of grant. These grants vest over various time periods. Awards, net of cancellations, were 244,000, 528,000 and 385,000 for the years ended December 31, 2002, 2001 and 2000, respectively. At December 31, 2002, 1,124,000 awards were outstanding under these programs.

Performance awards granted under the 1997 Plan are earned over a performance period based on achievement of goals. Payment for performance awards is made in cash equal to the fair market value of State Street’s common stock after the conclusion of each performance period. There are currently 746,000 award units outstanding for the two-year performance period ending December 31, 2002. A total of 854,000 were granted and paid out for the two-year performance period ended December 31, 2000.

In addition to the deferred stock award programs above, State Street maintains one other deferred stock plan outside the 1997 Plan. Awards covering a total of 1,200,000 shares were originally granted in 1996. At December 31, 2002, awards covering a total of 986,000 were outstanding.

In June 2001, State Street’s Board of Directors approved a savings-related stock purchase plan for employees resident in the United Kingdom that is not part of the 1997 Plan. A total of 170,000 shares of common stock were approved for issuance under this plan. These awards vest in three to five years. Awards, net of cancellations, were 24,000 and 124,000 for the years ended December 31, 2002 and 2001, respectively. At December 31, 2002, 148,000 awards were outstanding under this program. Shares will be issued from treasury stock in 2004 through 2007 in accordance with plan provisions.

Compensation related to restricted stock awards, deferred stock awards and performance awards was $36 million, $42 million and $64 million for the years ended December 31, 2002, 2001 and 2000, respectively.

68 | State Street Corporation

S t o c k O p t i o n s

Options outstanding and activity for the years ended December 31 consisted of the following:

| | | | | Weighted | | | | | | |

| (Total dollars in millions, except per | | Option Price | | Average | | | | | | |

| share data; shares in thousands) | | Per Share | | Option Price | | Shares | | | Total | |

| | | | | | | | | | | | | |

| December 31, 1999 | $ | 1.40 – 42.58 | | | $ | 25.06 | | 17,864 | | $ | 448 | |

| Granted | | 33.65 – 60.74 | | | | 55.56 | | 5,194 | | | 288 | |

| Exercised | | 1.40 – 40.51 | | | | 15.05 | | (4,450 | ) | | (67 | ) |

| Canceled | | 8.12 – 59.39 | | | | 35.17 | | (576 | ) | | (20 | ) |

| | | | | | | | |

| |

| December 31, 2000 | | 1.40 – 60.74 | | | | 36.00 | | 18,032 | | | 649 | |

| Granted | | 39.56 – 52.57 | | | | 44.41 | | 5,568 | | | 247 | |

| Exercised | | 1.75 – 40.52 | | | | 21.22 | | (1,595 | ) | | (34 | ) |

| Canceled | | 8.12 – 60.74 | | | | 49.84 | | (245 | ) | | (12 | ) |

| | | | | | | | |

| |

| December 31, 2001 | | 1.40 – 60.74 | | | | 39.07 | | 21,760 | | | 850 | |

| Granted | | 38.85 – 55.84 | | | | 41.24 | | 7,148 | | | 294 | |

| Exercised | | 1.40 – 53.05 | | | | 28.15 | | (2,072 | ) | | (58 | ) |

| Canceled | | 8.12 – 60.74 | | | | 46.69 | | (522 | ) | | (24 | ) |

| | | | | | | | |

| |

| December 31, 2002 | | 1.40 – 60.74 | | | | 40.35 | | 26,314 | | $ | 1,062 | |

| | | | | | | | |

| |

The following table summarizes the weighted average remaining contractual life of stock options outstanding at December 31, 2002 (shares in thousands):

| | | Shares Outstanding | | Shares Exercisable | |

| | |

| |

| |

| | | | | Weighted | | | | | | | |

| | | | | Average | | | | | | | |

| | | Number of | | Remaining | | Weighted | | Number of | | Weighted | |

| | | Shares | | Contractual Life | | Average | | Shares | | Average | |

| Range of Exercise Prices | Outstanding | | (years) | | Exercise Price | | Exercisable | | Exercise Price | |

| $ | 1.40 – $14.99 | 1,651 | | 2.6 | | $10.30 | | 1,651 | | $10.30 | |

| $ | 15.88 – $34.77 | 5,221 | | 5.5 | | 30.56 | | 5,188 | | 30.55 | |

| $ | 38.38 – $45.72 | 12,699 | | 8.9 | | 46.62 | | 3,404 | | 40.20 | |

| $ | 51.10 – $60.74 | 6,743 | | 8.1 | | 54.87 | | 3,755 | | 55.43 | |

At December 31, 2002, 2001 and 2000, a total of 13,998,000, 11,388,000 and 7,414,000 shares under options, respectively, were exercisable.

State Street Corporation| 69

A Black-Scholes option-pricing model was used for purposes of estimating the fair value of State Street’s employee stock options at the grant date under SFAS No. 123, “Accounting for Stock-Based Compensation.” The following were the weighted average assumptions for the years ended December 31, 2002, 2001 and 2000, respectively: risk-free interest rates of 3.14%, 3.99% and 5.75%; dividend yields of 1.45%, 1.08% and .73%; and volatility factors of the expected market price of State Street common stock of .30, .30 and .30. The estimated weighted average life of the stock options granted was 5.2 years for the year ended December 31, 2002 and 4.1 years for the years ended December 31, 2001 and 2000. For pro-forma expense information calculated under SFAS 123, see Note 1.

A c c u m u l a t e d O t h e r C o m p r e h e n s i v e I n c o m e ( L o s s )

At December 31, the components of accumulated other comprehensive income (loss), net of related taxes, were as follows:

| (Dollars in millions) | 2002 | | 2001 | | 2000 | |

| Unrealized gain on available-for-sale securities | $ | 100 | | $ | 96 | | $ | 19 | |

| Foreign currency translation | | 19 | | | (27 | ) | | (20 | ) |

| Unrealized (loss) gain on cash flow hedges | | (13 | ) | | 1 | | | | |

| |

| |

| Total | $ | 106 | | $ | 70 | | $ | (1 | ) |

| |

| |

For the year ended December 31, 2002, State Street realized gains of $58 million, $54 million of which were included in other comprehensive income as net unrealized gains at December 31, 2001, net of deferred taxes of $22 million.

Note 11

Shareholders’ Rights Plan

In 1988, State Street declared a dividend of one preferred share purchase right for each outstanding share of common stock. In 1998, the Rights Agreement was amended and restated. Accordingly, a right may be exercised, under certain conditions, to purchase one eight-hundredths share of a series of participating preferred stock at an exercise price of $132.50, subject to adjustment. The rights become exercisable if a party acquires or obtains the right to acquire 10% or more of State Street’s common stock or after commencement or public announcement of an offer for 10% or more of State Street’s common stock. When exercisable, under certain conditions, each right entitles the holder thereof to purchase shares of common stock, of either State Street or of the acquirer, having a market value of two times the then-current exercise price of that right.

The rights expire in September 2008, and may be redeemed at a price of $.00125 per right, subject to adjustment, at any time prior to expiration or the acquisition of 10% of State Street’s common stock. Under certain circumstances, the rights may be redeemed after they become exercisable and may be subject to automatic redemption.

70 | State Street Corporation

Note 12

Regulatory Matters

R e g u l a t o r y C a p i t a l

State Street is subject to various regulatory capital requirements administered by federal banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory and discretionary actions by regulators that, if undertaken, could have a direct material effect on State Street’s financial condition. Under capital adequacy guidelines, State Street must meet specific capital guidelines that involve quantitative measures of State Street’s assets, liabilities and off-balance sheet items as calculated under regulatory accounting practices. State Street’s capital amounts and classification are subject to qualitative judgments by the regulators about components, risk weightings and other factors.

Quantitative measures established by regulation to ensure capital adequacy require State Street and State Street Bank to maintain minimum risk-based capital and leverage ratios as set forth in the table that follows. The risk-based capital ratios are Tier 1 capital and total capital to total adjusted risk-weighted assets and market-risk equivalents, and the Tier 1 leverage ratio is Tier 1 capital to quarterly average adjusted assets.

As of December 31, 2002, State Street Bank was categorized as “well capitalized” under the regulatory framework for prompt corrective action. To be categorized as “well capitalized,” State Street Bank must exceed the “well capitalized” guideline ratios, as set forth in the table, and meet certain other requirements. State Street Bank exceeds all “well capitalized” requirements as of December 31, 2002.

The regulatory capital amounts and ratios were the following at December 31:

| | Regulatory Guidelines(1) | | State Street | | State Street Bank | |

| |

| |

| |

| |

| | | | Well | | | | | | | | | |

| (Dollars in millions) | Minimum | | Capitalized | | 2002 | | 2001 | | 2002 | | 2001 | |

| R i s k - b a s e d r a t i o s : | | | | | | | | | | | | | | | | |

| Tier 1 capital | 4 | % | 6 | % | | 17.1 | % | | 13.6 | % | | 16.4 | % | | 12.9 | % |

| Total capital | 8 | | 10 | | | 18.0 | | | 14.5 | | | 16.5 | | | 13.0 | |

| Tier 1 leverage ratio | 3 | | 5 | | | 5.6 | | | 5.4 | | | 5.7 | | | 5.3 | |

| Tier 1 capital | | | | | $ | 4,727 | | $ | 3,795 | | $ | 4,449 | | $ | 3,558 | |

| Total capital | | | | | | 4,975 | | | 4,050 | | | 4,476 | | | 3,587 | |

| | | | | | | | | | | | | | | | | |

A d j u s t e d r i s k - w e i g h t e d a s s e t s a n d

m a r k e t - r i s k e q u i v a l e n t s : | | | | | | | | | | | | | | | | |

| On-balance sheet | | | | | $ | 19,382 | | $ | 20,528 | | $ | 18,857 | | $ | 20,141 | |

| Off-balance sheet | | | | | | 7,925 | | | 6,708 | | | 7,930 | | | 6,710 | |

| Market-risk equivalents | | | | | | 342 | | | 706 | | | 317 | | | 679 | |

| | | | | |

| |

| Total | | | | | $ | 27,649 | | $ | 27,942 | | $ | 27,104 | | $ | 27,530 | |

| | | | | |

| |

| Quarterly average adjusted assets | | | | | $ | 84,031 | | $ | 70,922 | | $ | 77,563 | | $ | 67,496 | |

| | |

| (1) | State Street must meet the regulatory designation of “well capitalized” in order to maintain its status as a financial holding company. In addition, Regulation Y defines “well capitalized” for a bank holding company such as State Street for the purpose of determining eligibility for a streamlined review process for acquisition proposals. For such purposes, “well capitalized” requires State Street to maintain a minimum Tier 1 risk-based capital ratio of 6% and a minimum total risk-based capital ratio of 10%. |

State Street Corporation| 71

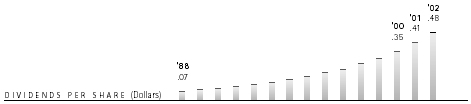

C a s h , D i v i d e n d , L o a n a n d O t h e r R e s t r i c t i o n s

During 2002, the subsidiary banks of State Street were required by the Federal Reserve Bank to maintain average reserve balances of $86 million. Federal and state banking regulations place certain restrictions on dividends paid by subsidiary banks to State Street. At December 31, 2002, State Street Bank had $1.8 billion of retained earnings available for distribution to State Street in the form of dividends.

The Federal Reserve Act requires that extensions of credit by State Street Bank to certain affiliates, including State Street, be secured by specific collateral, that the extension of credit to any one affiliate be limited to 10% of capital and surplus (as defined), and that extensions of credit to all such affiliates be limited to 20% of capital and surplus.

At December 31, 2002, consolidated retained earnings included $92 million representing undistributed earnings of affiliates that are accounted for using the equity method.

Note 13

Lines of Business

State Street reports two lines of business: Investment Servicing and Investment Management. Given the nature of State Street’s services and management organization, the results of operations for these lines of business are not necessarily comparable with those of other companies.

Revenue and expenses are directly charged or allocated to the lines of business through algorithm-based management information systems. State Street prices its products and services on total client relationships and other factors; therefore, revenue may not necessarily reflect market pricing on products within the business lines in the same way as it would for independent business entities. Assets and liabilities are allocated according to rules that support management’s strategic and tactical goals. Capital is allocated based on risk-weighted assets employed and management’s judgment. The capital allocations may not be representative of the capital that might be required if these lines of business were independent business entities.

Investment Servicing includes custody, accounting, daily pricing and administration; master trust and master custody; trustee and recordkeeping; foreign exchange; securities lending; deposit and short-term investment facilities; lease financing; investment manager operations outsourcing; and performance, risk and compliance analytics to support institutional investors. State Street provides shareholder services, which includes mutual fund and collective fund shareholder accounting, through 50%-owned affiliates, Boston Financial Data Services, Inc. and the International Financial Data Services group of companies.

Investment Management offers a broad array of services for managing financial assets, including investment management, investment research and trading services for both institutions and individual investors worldwide. These services include active and passive U.S. and non-U.S. equity and fixed income strategies, and other related services, such as securities lending.

72 | State Street Corporation

State Street measures its line of business results on an operating basis because such non-GAAP financial information-assists management by providing them with financial information in a format that provides comparable financial trends of ongoing business activities. As such, the table below includes an “Other” category for the gain in 2002 for the sale of the corporate trust business of $495 million, the write-off in 2001 of State Street’s total investment in Bridge of $50 million and goodwill amortization expense in 2001 and 2000.

The following is a summary of the results for lines of business for the years ended December 31:

| | Investment Servicing | | Investment Management | | Other | | Total | |

| |

| |

| |

| |

| |

| (Dollars in millions) | 2002 | | | | 2001 | | | | 2000 | | | 2002 | | | 2001 | | | 2000 | | | 2002 | | 2001 | | 2000 | | 2002 | | 2001 | | 2000 | |

| F e e r e v e n u e : | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Servicing fees | $ | 1,716 | | | $ | 1,648 | | | $ | 1,447 | | | | | | | | | | | | | | | | | | | | | | | | $ | 1,716 | | $ | 1,648 | | $ | 1,447 | |

| Management fees | | | | | | | | | | | | | $ | 526 | | | $ | 516 | | | $ | 584 | | | | | | | | | | | | | 526 | | | 516 | | | 584 | |

| Foreign exchange trading | | 300 | | | | 368 | | | | 387 | | | | | | | | | | | | | | | | | | | | | | | | | 300 | | | 368 | | | 387 | |

| Brokerage fees | | 124 | | | | 89 | | | | 95 | | | | | | | | | | | | | | | | | | | | | | | | | 124 | | | 89 | | | 95 | |

| Processing fees and other | | 151 | | | | 174 | | | | 173 | | | | 33 | | | | 24 | | | | 4 | | | | | | $ | (50 | ) | | | | | 184 | | | 148 | | | 177 | |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total fee revenue | | 2,291 | | | | 2,279 | | | | 2,102 | | | | 559 | | | | 540 | | | | 588 | | | | | | | (50 | ) | | | | | 2,850 | | | 2,769 | | | 2,690 | |

| Net interest revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| after provision | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| for loan losses | | 936 | | | | 956 | | | | 800 | | | | 39 | | | | 59 | | | | 85 | | | | | | | | | | | | | 975 | | | 1,015 | | | 885 | |

| Gains on sales of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| available-for-sale | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| securities, net | | 76 | | | | 43 | | | | 2 | | | | | | | | | | | | | | | | | | | | | | | | | 76 | | | 43 | | | 2 | |

| Gain on sale of corporate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| trust business, net | | | | | | | | | | | | | | | | | | | | | | | | | $ | 495 | | | | | | | | | 495 | | | | | | | |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total revenue | | 3,303 | | | | 3,278 | | | | 2,904 | | | | 598 | | | | 599 | | | | 673 | | | | 495 | | | (50 | ) | | | | | 4,396 | | | 3,827 | | | 3,577 | |

| Operating expenses | | 2,330 | | | | 2,343 | | | | 2,120 | | | | 511 | | | | 516 | | | | 534 | | | | | | | 38 | | $ | 17 | | | 2,841 | | | 2,897 | | | 2,671 | |

| |

| |

| Income before income taxes | $ | 973 | | | $ | 935 | | | $ | 784 | | | $ | 87 | | | $ | 83 | | | $ | 139 | | | $ | 495 | | $ | (88 | ) | $ | (17 | ) | $ | 1,555 | | $ | 930 | | $ | 906 | |

| |

| |

| Pre-tax margin | | 29 | % | | | 29 | % | | | 27 | % | | | 15 | % | | | 14 | % | | | 21 | % | | | | | | | | | | | | | | | | | | | |

| Average assets (billions) | $ | 77.2 | | | $ | 69.5 | | | $ | 61.7 | | | $ | 1.9 | | | $ | 1.8 | | | $ | 1.2 | | | | | | | | | | | | $ | 79.1 | | $ | 71.3 | | $ | 62.9 | |

State Street Corporation| 73

Note 14

Net Interest Revenue

Net interest revenue consisted of the following for the years ended December 31:

| (Dollars in millions) | 2002 | | 2001 | | 2000 | |

| I n t e r e s t R e v e n u e : | | | | | | | | | |

| Deposits with banks | $ | 622 | | $ | 821 | | $ | 743 | |

| | | | | | | | | | |

| Investment securities: | | | | | | | | | |

| U.S. Treasury and federal agencies | | 404 | | | 447 | | | 520 | |

| State and political subdivisions (exempt from federal tax) | | 66 | | | 71 | | | 84 | |

| Other investments | | 287 | | | 380 | | | 324 | |

| | | | | | | | | | |

| Commercial and financial loans | | 82 | | | 143 | | | 186 | |

| Lease financing | | 104 | | | 115 | | | 106 | |

| Securities purchased under resale agreements, securities borrowed | | | | | | | | | |

| and federal funds sold | | 379 | | | 825 | | | 1,234 | |

| Trading account assets | | 30 | | | 53 | | | 59 | |

| |

| |

| Total interest revenue | | 1,974 | | | 2,855 | | | 3,256 | |

| | | | | | | | | | |

| I n t e r e s t E x p e n s e : | | | | | | | | | |

| Deposits | | 498 | | | 856 | | | 1,012 | |

| Other borrowings | | 426 | | | 881 | | | 1,268 | |

| Long-term debt | | 71 | | | 93 | | | 82 | |

| |

|

| Total interest expense | | 995 | | | 1,830 | | | 2,362 | |

| |

| |

| Net interest revenue | $ | 979 | | $ | 1,025 | | $ | 894 | |

| |

| |

Note 15

Processing Fees and Other Revenue

Processing fees and other revenue includes fees from software licensing and maintenance, loans, investment banking, structured products, trade banking, profits or losses from joint ventures, gains and losses on sales of leased equipment and other assets, other trading profits and losses, amortization of investments in tax-advantaged financings, and residual interest from a variable interest entity.

In March 2001, State Street recorded the write-off of $50 million for its total investment in Bridge Information Systems, Inc. (“Bridge”), upon the filing by Bridge of a Prepackaged Plan of Reorganization under Chapter 11 of the United States Bankruptcy Code. The write-off is reflected in processing fees and other revenue in 2001 and decreased after-tax net income by $33 million, equal to $.10 per basic and diluted share.

74 | State Street Corporation

Note 16

Employee Benefit Plans

State Street Bank and certain of its U.S. subsidiaries participate in a non-contributory defined benefit plan. In addition to the primary plan, State Street has non-qualified supplemental plans that provide certain officers with defined pension benefits in excess of allowable qualified plan limits. Non-U.S. employees participate in local plans.

State Street Bank and certain U.S. subsidiaries participate in a post-retirement plan that provides health care and insurance benefits for retired employees.

Information combined for the primary defined benefit plan and non-U.S. defined benefit plans, and information for the post-retirement plan as of December 31 is as follows:

| | Defined Benefit Plan | | Post-retirement Plan | |

| |

| |

| |

| (Dollars in millions) | 2002 | | 2001 | | 2002 | | 2001 | |

| | | | | | | | | | | | | |

| P r o j e c t e d B e n e f i t O b l i g a t i o n s : | | | | | | | | | | | | |

| Beginning of year | $ | 372 | | $ | 302 | | $ | 28 | | $ | 22 | |

| Current service cost | | 35 | | | 30 | | | 2 | | | 1 | |

| Interest cost | | 27 | | | 23 | | | 2 | | | 2 | |

| Amendment, acquisitions and transfers in | | 18 | | | | | | | | | | |

| Actuarial losses | | 49 | | | 47 | | | 15 | | | 5 | |

| Benefits paid | | (27 | ) | | (19 | ) | | (2 | ) | | (1 | ) |

| Divestitures | | | | | (9 | ) | | | | | (1 | ) |

| Foreign currency translation | | 7 | | | (2 | ) | | | | | | |

| |

| |

| End of year | $ | 481 | | $ | 372 | | $ | 45 | | $ | 28 | |

| |

| |

| | | | | | | | | | | | | |

| P l a n A s s e t s a t F a i r V a l u e : | | | | | | | | | | | | |

| Beginning of year | $ | 290 | | $ | 269 | | | | | | | |

| Actual return on plan assets | | (31 | ) | | (16 | ) | | | | | | |

| Divestitures | | | | | (9 | ) | | | | | | |

| Contributions and transfers in | | 142 | | | 66 | | | | | | | |

| Benefits paid | | (27 | ) | | (19 | ) | | | | | | |

| Foreign currency translation | | 5 | | | (1 | ) | | | | | | |

| |

| | | | | | | |

| End of year | $ | 379 | | $ | 290 | | | | | | | |

| |

| | | | | | | |

| | | | | | | | | | | | | |

| A c c r u e d B e n e f i t E x p e n s e : | | | | | | | | | | | | |

| Under funded status of the plans | $ | 102 | | $ | 82 | | $ | 45 | | $ | 28 | |

| Unrecognized net asset (obligation) at transition | | 3 | | | 4 | | | (11 | ) | | (12 | ) |

| Unrecognized net (losses) gains | | (227 | ) | | (128 | ) | | (9 | ) | | 7 | |

| Unrecognized prior service costs | | (16 | ) | | (13 | ) | | | | | | |

| |

| |

| Total (prepaid) accrued benefit expense | $ | (138 | ) | $ | (55 | ) | $ | 25 | | $ | 23 | |

| |

| |

| | | | | | | | | | | | | |

| A c t u a r i a l A s s u m p t i o n s : | | | | | | | | | | | | |

| Discount rate used to determine benefit obligation | | 6.75 | % | | 7.50 | % | | 6.75 | % | | 7.50 | % |

| Rate of increase for future compensation | | 4.50 | | | 4.50 | | | | | | | |

| Expected long-term rate of return on assets | | 8.00 | | | 9.00 | | | | | | | |

The assumed health care cost trend rate used in measuring the post-retirement plan benefit obligation was 10% for 2003, gradually decreasing to 5% in 2013, and remaining level thereafter.

State Street has unfunded, non-qualified supplemental employee retirement plans (SERPs) that provide certain officers with defined pension benefits in excess of limits imposed by U.S. federal tax law.

State Street Corporation| 75

Information combined for the SERPs as of and for the years ended December 31, is as follows:

| (Dollars in millions) | 2002 | | 2001 | |

| C h a n g e i n b e n e f i t o b l i g a t i o n : | | | | | | |

| Benefit obligation at beginning of year | $ | 58 | | $ | 44 | |

| Service cost | | 3 | | | 2 | |

| Interest cost | | 4 | | | 3 | |

| Settlement loss | | 2 | | | 8 | |

| Actuarial loss | | 14 | | | 17 | |

| Benefits paid | | (2 | ) | | (16 | ) |

| Plan settlements | | (7 | ) | | | |

| |

| |

| Benefit obligation at end of year | $ | 72 | | $ | 58 | |

| |

| |

| | | | | | | |

| F u n d e d s t a t u s o f p l a n : | | | | | | |

| Under funded status of the plans | $ | 72 | | $ | 58 | |

| Unrecognized actuarial loss | | (34 | ) | | (23 | ) |

| Unrecognized prior service cost | | (10 | ) | | (14 | ) |

| |

| |

| Accrued pension cost | $ | 28 | | $ | 21 | |

| |

| |

| | | | | | | |

| A c t u a r i a l a s s u m p t i o n s : | | | | | | |

| Discount rate used to determine benefit obligation | | 6.75 | % | | 7.50 | % |

| Rate of increase for future compensation | | 4.75 | | | 4.75 | |

| |

| |

For those plans that have accumulated benefit obligations in excess of plan assets as of December 31, 2002 and 2001, the aggregate benefit obligations are $139 million and $64 million, respectively, the plan assets are $46 million and $1 million, respectively, and the accumulated benefit obligations are $109 million and $44 million, respectively.

If the health care cost trend rates were increased by 1%, the post-retirement benefit obligation as of December 31, 2002, would have increased 8%, and the aggregate expense for service and interest costs for 2002 would have increased by 10%. Conversely, if the health care cost trend rates were decreased by 1%, the post-retirement benefit obligation as of December 31, 2002, would have decreased 7%, and the aggregate expense for service and interest costs for 2002 would have decreased by 8%.

76 | State Street Corporation

The following table sets forth the actuarially determined expenses (benefits) for State Street’s primary and non-U.S. defined benefit plans, SERPs and post-retirement plan for the years ended December 31:

| (Dollars in millions) | 2002 | | 2001 | | 2000 | |

| P r i m a r y a n d n o n - U . S . D e f i n e d B e n e f i t P l a n s : | | | | | | | | | |

| Service cost | $ | 35 | | $ | 30 | | $ | 23 | |

| Interest cost | | 27 | | | 23 | | | 20 | |

| Assumed return on plan assets | | (28 | ) | | (25 | ) | | (23 | ) |

| Net amortization and deferral | | 4 | | | 1 | | | (1 | ) |

| |

| |

| Total expense | $ | 38 | | $ | 29 | | $ | 19 | |

| |

| |

| | | | | | | | | | |

| S E R P s : | | | | | | | | | |

| Service cost | $ | 3 | | $ | 2 | | $ | 3 | |

| Interest cost | | 4 | | | 3 | | | 3 | |

| Assumed return on plan assets | | | | | | | | | |

| Net amortization and deferral | | 8 | | | 8 | | | 2 | |

| |

| |

| Total expense | $ | 15 | | $ | 13 | | $ | 8 | |

| |

| |

| | | | | | | | | | |

| Po s t - r e t i r e m e n t P l a n : | | | | | | | | | |

| Service cost | $ | 2 | | $ | 1 | | $ | 1 | |

| Interest cost | | 2 | | | 2 | | | 2 | |

| Assumed return on plan assets | | | | | | | | | |

| Net amortization and deferral | | 1 | | | | | | | |

| |

| |

| Total expense | $ | 5 | | $ | 3 | | $ | 3 | |

| |

| |

Employees of State Street and certain subsidiaries are eligible to contribute a portion of their pre-tax salary to a 401(k) savings plan and an Employee Stock Ownership Plan (ESOP). State Street’s matching portion of these contributions is made in cash, and the related expense for the years ended December 31, was $17 million for 2002, $21 million for 2001 and $16 million for 2000. Further, employees in certain non-U.S. offices participate in other local plans. Expenses for these plans were $19 million, $17 million and $10 million for 2002, 2001 and 2000, respectively.

The ESOP is a non-leveraged plan. Compensation cost is equal to the contribution called for by the plan formula and is equal to the cash contributed for the purchase of shares on the open market or the fair value of the shares contributed from treasury stock. Dividends on shares held by the ESOP are charged to retained earnings and are treated as outstanding for purposes of calculating earnings per share.

State Street Corporation| 77

Note 17

Operating Expenses — Other

The other category of operating expenses consisted of the following for the years ended December 31:

| (Dollars in millions) | 2002 | | 2001 | | 2000 | |

| Professional services | $ | 96 | | $ | 119 | | $ | 124 | |

| Advertising and sales promotion | | 46 | | | 57 | | | 60 | |

| Goodwill amortization | | | | | 38 | | | 17 | |

| Other | | 164 | | | 179 | | | 172 | |

| |

| |

| Total operating expenses — other | $ | 306 | | $ | 393 | | $ | 373 | |

| |

| |

Note 18

Income Taxes

Current and deferred income taxes for 2001 and 2000 have been reclassified to reflect the tax returns as actually filed. The provision for income taxes included in the Consolidated Statement of Income consisted of the following for the years ended December 31:

| (Dollars in millions) | 2002 | | 2001 | | 2000 | |

| C u r r e n t : | | | | | | | | | |

| Federal | $ | 139 | | $ | 44 | | $ | 47 | |

| State | | 65 | | | 29 | | | 23 | |

| Non-U.S. | | 37 | | | 58 | | | 60 | |

| |

| |

| Total current | | 241 | | | 131 | | | 130 | |

| | | | | | | | | | |

| D e f e r r e d : | | | | | | | | | |

| Federal | | 235 | | | 115 | | | 155 | |

| State | | 56 | | | 26 | | | 25 | |

| Non-U.S. | | 8 | | | 30 | | | 1 | |

| |

| |

| Total deferred | | 299 | | | 171 | | | 181 | |

| |

| |

| Total income taxes | $ | 540 | | $ | 302 | | $ | 311 | |

| |

| |

The income tax expense related to net realized securities gains was $31 million, $17 million and $1 million for 2002, 2001 and 2000, respectively. Pre-tax income attributable to operations located outside the United States was $147 million, $201 million and $181 million in 2002, 2001 and 2000, respectively.

78 | State Street Corporation

Components of the deferred tax liabilities and assets at December 31 were as follows:

| (Dollars in millions) | 2002 | | 2001 | |

| D e f e r r e d t a x l i a b i l i t i e s : | | | | | | |

| Lease financing transactions | $ | 1,358 | | $ | 1,176 | |

| Unrealized gain on available-for-sale securities | | 71 | | | 68 | |

| Other | | 59 | | | 30 | |

| |

| |

| Total deferred tax liabilities | | 1,488 | | | 1,274 | |

| | | | | | | |

| D e f e r r e d t a x a s s e t s : | | | | | | |

| Operating expenses not currently deductible | | 66 | | | 63 | |

| Deferred compensation | | 48 | | | 89 | |

| Allowance for loan losses | | 23 | | | 23 | |

| Tax carryforwards | | 36 | | | 82 | |

| Other | | 66 | | | 57 | |

| |

| |

| Total deferred tax assets | | 239 | | | 314 | |

| Valuation allowance for deferred tax assets | | 5 | | | 2 | |

| |

| |

| Net deferred tax assets | | 234 | | | 312 | |

| |

| |

| Net deferred tax liabilities | $ | 1,254 | | $ | 962 | |

| |

| |

At December 31, 2002, State Street had minimum tax credit carryforwards of $30 million and non-U.S. federal tax loss carryforwards of $5 million. Non-U.S. federal tax loss carryforwards expire in years 2003 to 2022. Remaining tax losses carry forward indefinitely.

A reconciliation of the U.S. statutory income tax rate to the effective tax rate based on income before income taxes is as follows for the years ended December 31:

| (Dollars in millions) | 2002 | | | 2001 | | | 2000 | |

| U.S. federal income tax rate | 35.0 | % | | 35.0 | % | | 35.0 | % |

| Changes from statutory rate: | | | | | | | | |

| State taxes, net of federal benefit | 4.1 | | | 3.9 | | | 4.2 | |

| Tax-exempt interest revenue, net of disallowed interest | (3.0 | ) | | (3.2 | ) | | (3.0 | ) |

| Tax credits | (3.1 | ) | | (3.6 | ) | | (2.7 | ) |

| Other, net | (.9 | ) | | .5 | | | .8 | |

| Non-operating item(1) | 2.6 | | | (.2 | ) | | | |

| |

| |

| Effective tax rate | 34.7 | % | | 32.4 | % | | 34.3 | % |

| |

| |

| (1) | The adjustment for the non-operating item reported in 2002 above includes the increase in the effective rate resulting from the gain on the sale of State Street’s corporate trust business. The adjustment for the non-operating item in 2001 above includes the decrease in the effective rate resulting from the write-off of State Street’s investment in Bridge. Accordingly, other changes from the statutory rate are computed without regard to these items. |

State Street Corporation| 79

Note 19

Earnings Per Share

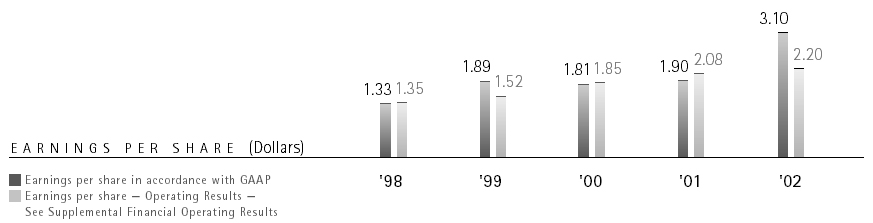

The following table sets forth the computation of basic and diluted earnings per share for the years ended December 31:

| (Dollars in millions, except per share data) | 2002 | | 2001 | | 2000 | |

| Net Income | $1,015 | | $628 | | $595 | |

| | | | | | | | | | |

| E a r n i n g s p e r s h a r e : | | | | | | | | | |

| Basic | $ | 3.14 | | $ | 1.94 | | $ | 1.85 | |

| Diluted | | 3.10 | | | 1.90 | | | 1.81 | |

| | | | | | | | | | |

| A v e r a g e s h a r e s o u t s t a n d i n g ( t h o u s a n d s ) : | | | | | | | | | |

| Basic average shares | 323,520 | | 325,030 | | 321,678 | |

| Effect of dilutive securities: | | | | | | | | | |

| Stock options and stock awards | | 3,631 | | | 4,849 | | | 5,281 | |

| 7.75% convertible subordinated debentures | | 326 | | | 613 | | | 1,129 | |

| |

| |

| Dilutive average shares | 327,477 | | 330,492 | | 328,088 | |

| |

| |

Note 20

Contingent Liabilities

State Street provides custody, accounting, daily pricing and administration; master trust and master custody; investment management; trustee and recordkeeping; foreign exchange; securities lending; cash management; trading; and information services to clients worldwide. Assets under custody and assets under management are held by State Street in a fiduciary or custodial capacity and are not included in the Consolidated Statement of Condition because such items are not assets of State Street. Management conducts regular reviews of its responsibilities for these services and considers the results in preparing its financial statements. In the opinion of management, there are no contingent liabilities at December 31, 2002 that would have a material adverse effect on State Street’s financial position or results of operations.

State Street is subject to pending and threatened legal actions that arise in the normal course of business. In the opinion of management, after discussion with counsel, these actions can be successfully defended or resolved without a material adverse effect on State Street’s financial position or results of operations.

80 | State Street Corporation

Note 21

Off-balance Sheet Financial Instruments, Including Derivatives

D e r i v a t i v e F i n a n c i a l I n s t r u m e n t s

State Street uses derivatives to support clients’ needs, conduct trading activities, and manage its interest rate and currency risk. The Corporation assumes positions in both the foreign exchange and interest rate markets by buying and selling cash instruments and using financial derivatives, including foreign exchange forward contracts, foreign exchange and interest rate options, and interest rate swaps.

An off-balance sheet derivative instrument is a financial instrument or other contract which has one or more underlying and one or more notional amounts, no initial net investment, or a smaller initial net investment than would be expected for similar types of contracts, and which requires or permits net settlement. Derivative instruments include forwards, futures, swaps, options and other instruments with similar characteristics. The use of these instruments generates fee or interest revenue.

Interest rate contracts involve an agreement with a counterparty to exchange cash flows based on the movement of an underlying interest rate index. An interest rate swap agreement involves the exchange of a series of interest payments, either at a fixed or variable rate, based upon the notional amount without the exchange of the underlying principal amount. An interest rate option contract provides the purchaser, for a premium, the right, but not the obligation, to buy or sell the underlying financial instrument at a set price at or during a specified period. An interest rate futures contract is a commitment to buy or sell, at a future date, a financial instrument at a contracted price; it may be settled in cash or through the delivery of the contracted instrument.

Foreign exchange contracts involve an agreement to exchange one currency for another currency at an agreed-upon rate and settlement date. Foreign exchange contracts consist of swap agreements and forward and spot contracts.

The following table summarizes the contractual or notional amounts of derivative financial instruments held or issued for trading and balance sheet management at December 31:

| (Dollars in millions) | 2002 | | 2001 | |

| | | | | | | |

| T r a d i n g : | | | | | | |

| Interest rate contracts: | | | | | | |

| Swap agreements | $ | 3,847 | | $ | 2,385 | |

| Options and caps purchased | | 351 | | | 281 | |

| Options and caps written | | 483 | | | 418 | |

| Futures — short position | | 15,078 | | | 7,395 | |

| Options on futures purchased | | | | | 235 | |

| Options on futures written | | | | | 285 | |

| | | | | | | |

| Foreign exchange contracts: | | | | | | |

| Forward, swap and spot | | 227,782 | | 167,415 | |

| Options purchased | | 350 | | | 1,097 | |

| Options written | | 136 | | | 1,095 | |

| Futures | | 409 | | | | |

| | | | | | | |

| B a l a n c e s h e e t m a n a g e m e n t : | | | | | | |

| Interest rate contracts: | | | | | | |

| Swap agreements | | 2,020 | | | 1,299 | |

State Street Corporation| 81

In connection with its interest rate risk management strategies, State Street has executed interest rate swap agreements with a notional value of $1.3 billion and $1.1 billion at December 31, 2002 and 2001, respectively, designated as fair value hedges to hedge the changes in the fair value of certain securities. For the years ended December 31, 2002 and 2001, State Street recognized net pre-tax losses of approximately $5 million and $2 million, respectively, which represented the ineffective portion of the hedge reported in processing fees and other revenue.

State Street has designated interest rate swaps with a notional value of $150 million as cash flow hedges to its floating rate debt. These interest rate swaps constitute a fully effective hedge. In addition, State Street entered into interest rate swaps with a notional value of $500 million effective February 20, 2002, a notional value of $50 million effective June 11, 2002, and a notional value of $50 million effective July 9, 2002, designated as fair value hedges to hedge certain of its fixed rate debt issuances. The fair value hedge swaps increased the value of long-term debt presented in the Statement of Condition by $55 million. For the year ended December 31, 2002, the Corporation’s overall weighted average interest rate for long-term debt was 7.12% on a contractual basis and 5.68% including the effects of derivative contracts.

F a i r V a l u e o f D e r i v a t i v e F i n a n c i a l I n s t r u m e n t s

State Street’s risk exposure from interest rate and foreign exchange contracts results from the possibility that one party may default on its contractual obligation or from movements in exchange or interest rates. Credit risk is limited to the positive market value of the derivative financial instrument, which is significantly less than the notional value. The notional value provides the basis for determining the exchange of contractual cash flows. The exposure to credit loss can be estimated by calculating the cost, on a present-value basis, to replace at current market rates all profitable contracts at year-end. The estimated aggregate replacement cost of derivative financial instruments in a net positive position was $3.6 billion at December 31, 2002, and $1.8 billion at December 31, 2001.

The foreign exchange contracts have been reduced by offsetting balances with the same counterparty where a master netting agreement exists.

82 | State Street Corporation

The following table represents the fair value as of December 31, and average fair value for the years ended December 31, of financial derivative instruments held or issued for trading purposes:

| | | | Average | |

| (Dollars in millions) | Fair Value | | Fair Value | |

| 2002: | | | | | | | | |

| Foreign exchange contracts: | | | | | | | | |

| Contracts in a receivable position | | $ | 2,451 | | | $ | 1,376 | |

| Contracts in a payable position | | | 2,373 | | | | 1,361 | |

| | | | | | | | | |

| Other financial instrument contracts: | | | | | | | | |

| Contracts in a receivable position | | | 91 | | | | 68 | |

| Contracts in a payable position | | | 165 | | | | 80 | |

| | | | | | | | | |

| 2001: | | | | | | | | |

| Foreign exchange contracts: | | | | | | | | |

| Contracts in a receivable position | | $ | 1,098 | | | $ | 1,483 | |

| Contracts in a payable position | | | 1,060 | | | | 1,425 | |

| | | | | | | | | |

| Other financial instrument contracts: | | | | | | | | |

| Contracts in a receivable position | | | 52 | | | | 51 | |

| Contracts in a payable position | | | 48 | | | | 70 | |

Net foreign exchange trading revenue related to foreign exchange contracts was $300 million; $368 million and $387 million for the years ended December 31, 2002, 2001 and 2000, respectively. For other financial instrument contracts, there were losses of $38 million in 2002, $22 million in 2001 and $29 million in 2000. Future cash requirements, if any, related to foreign currency contracts are represented by the gross amount of currencies to be exchanged under each contract unless State Street and the counterparty have agreed to pay or receive the net contractual settlement amount on the settlement date. Future cash requirements on other financial instruments are limited to the net amounts payable under the agreements.

State Street Corporation| 83

C r e d i t - R e l a t e d , O f f - B a l a n c e S h e e t F i n a n c i a l I n s t r u m e n t s

Credit-related financial instruments include indemnified securities on loan, commitments to extend credit or purchase assets, standby letters of credit, and letters of credit. The maximum credit risk associated with credit-related financial instruments is measured by the contractual amounts of these instruments.

The following is a summary of the contractual amount of credit-related, off-balance sheet financial instruments at December 31:

| (Dollars in millions) | | 2002 | | | 2001 | |

| Indemnified securities on loan | $ | 131,991 | | $ | 113,047 | |

| Liquidity asset purchase agreements | | 14,044 | | | 10,588 | |

| Loan commitments | | 12,499 | | | 12,962 | |

| Standby letters of credit | | 3,252 | | | 3,918 | |

| Letters of credit | | 106 | | | 164 | |

On behalf of its clients, State Street lends their securities to creditworthy brokers and other institutions. In certain circumstances, State Street may indemnify its clients for the fair market value of those securities against a failure of the borrower to return such securities. Collateral funds resulting from State Street’s securities lending services are held by State Street as agent; therefore, under accounting principles generally accepted in the United States, these assets are not assets of the Corporation. State Street requires the borrowers to provide collateral in an amount equal to or in excess of 102% of the fair market value of the securities borrowed. The borrowed securities are revalued daily to determine if additional collateral is necessary. State Street held, as collateral, cash and U.S. government securities totaling $134.6 billion and $117.2 billion for indemnified securities on loan at December 31, 2002 and 2001, respectively.

Loan commitments (unfunded loans and unused lines of credit), asset purchase agreements, standby letters of credit and letters of credit are issued to accommodate the financing needs of State Street’s clients and to provide credit enhancements to variable interest entities. Loan commitments are agreements by State Street to lend monies at a future date. Asset purchase agreements are commitments to purchase receivables or securities, subject to conditions established in the agreements.

These loan, asset purchase and letter of credit commitments are subject to the same credit policies and reviews as loans. The amount and nature of collateral are obtained based upon management’s assessment of the credit risk. Approximately 87% of the loan commitments and asset purchase agreements expire within one year from the date of issue. Since many of the commitments are expected to expire or renew without being drawn, the total commitment amounts do not necessarily represent future cash requirements.

State Street provides liquidity and credit enhancements facilities in the forms of liquidity asset purchase agreements, lines of credit, and standby letters of credit to two types of variable interest entities (“VIEs”). One type, which State Street administers, issues asset-backed commercial paper (“ABCP”). At December 31, 2002 and 2001, State Street’s commitments under liquidity asset purchase agreements and lines of credit to these VIEs were $10.0 billion and $6.6 billion, respectively, and standby letters of credit were $590 million and $616 million, respectively, none of which were utilized. Amounts committed, but unused, under the liquidity asset purchase agreements, lines of credit and standby letters of credit that State Street provides to these VIEs are included in the table above. Asset performance deterioration may cause the asset risk to shift from the ABCP investors to State Street as the liquidity provider for the asset as the VIE may need to repay maturing commercial paper by drawing the liquidity facilities.

For a second type of VIE, structured as a qualified special purpose entity in accordance with accounting principles generally accepted in the United States, State Street distributes and sells equity interests in tax-exempt investment-grade assets that are primarily sold to mutual fund clients. State Street provides liquidity asset purchase agreements to these entities. These liquidity asset purchase agreements obligate State Street to buy

84 | State Street Corporation

the equity interests in the underlying portfolio at par, which approximates market value, in the event that the re-marketing agent is unable to place the equity interests of the VIE with investors. The liquidity asset purchase agreements are subject to early termination by State Street in the event of payment default, bankruptcy of issuer or credit enhancement provider, taxability, or downgrade of an asset below investment grade. State Street’s liquidity asset purchase agreements to these VIEs were $1.3 billion and $1.6 billion at December 31, 2002 and 2001, respectively, none of which were utilized, and are included in the preceding table.

Note 22

Fair Value of Financial Instruments

State Street uses the following methods to estimate the fair value of financial instruments.

For financial instruments that have quoted market prices, those quotes are used to determine fair value. Financial instruments that have no defined maturity, have a remaining maturity of 180 days or less, or reprice frequently to a market rate are assumed to have a fair value that approximates reported book value, after taking into consideration any applicable credit risk. If no market quotes are available, financial instruments are valued by discounting the expected cash flow(s) using an estimated current market interest rate for the financial instrument. For off-balance sheet derivative instruments, fair value is estimated as the amount at which an asset or liability could be bought or sold in a current transaction between willing parties, other than in a forced or liquidation sale.

The short maturity of State Street’s assets and liabilities results in a significant number of financial instruments whose fair value equals or closely approximates reported balance sheet value. Such financial instruments are reported in the following balance sheet captions: cash and due from banks, interest-bearing deposits with banks, securities purchased under resale agreements and securities borrowed, federal funds sold, deposits, securities sold under repurchase agreements, federal funds purchased and other short-term borrowings. The fair value of trading account assets equals the carrying value. As of December 31, 2002 and 2001, the net fair value of interest rate contracts used for balance sheet management was a liability of $76 million and a liability of $35 million, respectively. There is no reported cost for loan commitments since terms are at prevailing market rates.

The reported value and fair value for other balance sheet captions at December 31 are as follows:

| | Reported | | Fair | |

| (Dollars in millions) | Value | | Value | |

| 2002: | | | | | | |

| Investment securities: | | | | | | |

| Available for sale | $ | 26,528 | | $ | 26,528 | |

| Held to maturity | | 1,543 | | | 1,556 | |

| | | | | | | |

| Net loans (excluding leases) | | 1,991 | | | 1,991 | |

| Long-term debt | | 1,270 | | | 1,337 | |

| | | | | | | |

| 2001: | | | | | | |

| Investment securities: | | | | | | |

| Available for sale | $ | 19,338 | | $ | 19,338 | |

| Held to maturity | | 1,443 | | | 1,455 | |

| | | | | | | |

| Net loans (excluding leases) | | 3,231 | | | 3,231 | |

| Long-term debt | | 1,217 | | | 1,331 | |

State Street Corporation| 85

Note 23

Non-U.S. Activities

Non-U.S. activities, as defined by the Securities and Exchange Commission, are considered to be those revenue-producing assets and transactions that arise from clients domiciled outside the United States.

Due to the nature of State Street’s business, it is not possible to segregate precisely U.S. and non-U.S. activities. Subjective judgments have been used to arrive at the operating results for non-U.S. activities, including the application of tax transfer pricing and asset-liability management policies. Interest expense allocations are based on the average cost of short-term borrowed funds. State Street does not allocate costs related to resources common to non-U.S. and U.S. activities. Certain previously reported amounts have been restated to conform to the current method of presentation.

The following table summarizes non-U.S. operating results for the years ended December 31, and assets as of December 31, based on the domicile location of clients:

| (Dollars in millions) | 2002 | | 2001 | | 2000 | |

| Fee revenue | $ | 654 | | $ | 642 | | $ | 636 | |

| Interest revenue | 786 | | 1,023 | | 949 | |

| Interest expense | 375 | | 622 | | 648 | |

| |

| |

| Net interest revenue | 411 | | 401 | | 301 | |

| Provision for loan losses | | | | | 2 | |

| Total revenue | 1,065 | | 1,043 | | 935 | |

| Operating expenses | 704 | | 648 | | 629 | |

| |

| |

| Income before income taxes | 361 | | 395 | | 306 | |

| Income taxes | 145 | | 158 | | 120 | |

| |

| |

| Net Income | $ | 216 | | $ | 237 | | $ | 186 | |

| |

| |

| A s s e t s : | | | | | | | | | |

| Interest-bearing deposits with banks | $ | 28,143 | | $ | 20,317 | | $ | 21,295 | |

| Loans and other assets | | 4,851 | | | 4,525 | | | 3,709 | |

| |

| |

| Total Assets | $ | 32,994 | | $ | 24,842 | | $ | 25,004 | |

| |

| |

86 | State Street Corporation

Note 24

Financial Statements of State Street Corporation (Parent only)

S T A T E M E N T O F I N C O M E

| (Dollars in millions) Years ended December 31, | | 2002 | | 2001 | | 2000 | |

| Interest on securities purchased under resale agreements | $ | 87 | | $ | 201 | | $ | 308 | |

| Cash dividends from consolidated bank subsidiary | | 200 | | | 175 | | | 144 | |

| Cash dividends from consolidated non-bank subsidiaries | | 5 | | | 8 | | | 6 | |

| Other, net | | 29 | | | 29 | | | 37 | |

| |

| |

| Total revenue | | 321 | | | 413 | | | 495 | |

| Interest on securities sold under repurchase agreements | | 73 | | | 172 | | | 285 | |

| Other interest expense | | 79 | | | 111 | | | 94 | |

| Other expenses | | 14 | | | 10 | | | 5 | |

| |

| |

| Total expenses | | 166 | | | 293 | | | 384 | |

| Income tax (benefit) expense | | (8 | ) | | (20 | ) | | 1 | |

| |

| |

| Income before equity in undistributed income of subsidiaries | | | | | | | | | |

| and affiliates | | 163 | | | 140 | | | 110 | |

| Equity in undistributed income (loss) of subsidiaries and | | | | | | | | | |

| affiliates: | | | | | | | | | |

| Consolidated bank subsidiary | | 813 | | | 513 | | | 465 | |

| Consolidated non-bank subsidiaries and unconsolidated | | | | | | | | | |

| affiliates | | 39 | | | (25 | ) | | 20 | |

| |

| |

| Net Income | $ | 1,015 | | $ | 628 | | $ | 595 | |

| |

| |

State Street Corporation| 87

S T A T E M E N T O F C O N D I T I O N

| (Dollars in millions) As of December 31, | 2002 | | 2001 | |

| A s s e t s : | | | | | | |

| Interest-bearing deposits with bank subsidiary | $ | 517 | | $ | 150 | |

| Securities purchased under resale agreements from: | | | | | | |

| Consolidated bank subsidiary | | 414 | | | 145 | |

| Consolidated non-bank subsidiary | | 354 | | | 250 | |

| External parties | | 5,111 | | | 3,678 | |

| |

| Available-for-sale securities | | 67 | | | 37 | |

| Investments in subsidiaries: | | | | | | |

| Consolidated bank subsidiary | | 5,074 | | | 4,188 | |

| Consolidated non-bank subsidiaries | | 479 | | | 392 | |

| Unconsolidated affiliates | | 125 | | | 117 | |

| |

| Notes and other receivables from: | | | | | | |

| Consolidated bank subsidiary | | 200 | | | 31 | |

| Consolidated non-bank subsidiaries and affiliates | | 170 | | | 142 | |

| |

| Other assets | | 57 | | | 59 | |

| |

| |

| Total Assets | $ | 12,568 | | $ | 9,189 | |

| |

| |

| | | | | | | |

| L i a b i l i t i e s : | | | | | | |

| Securities sold under repurchase agreements | $ | 5,277 | | $ | 3,495 | |

| Commercial paper | | 998 | | | 499 | |

| Accrued taxes, expenses and other liabilities due to: | | | | | | |

| Consolidated bank subsidiary | | 78 | | | 36 | |

| Consolidated non-bank subsidiaries | | 7 | | | 11 | |

| External parties | | 201 | | | 102 | |

| |

| Long-term debt | | 1,220 | | | 1,201 | |

| |

| |

| Total Liabilities | | 7,781 | | | 5,344 | |

| Stockholders’ Equity | | 4,787 | | | 3,845 | |

| |

| |

| Total Liabilities and Stockholders’ Equity | $ | 12,568 | | $ | 9,189 | |

| |

| |

88 | State Street Corporation

S T A T E M E N T O F C A S H F L O W S

| (Dollars in millions) Years ended December 31, | 2002 | | 2001 | | 2000 | |

| Net Cash Provided by Operating Activities | $ | 126 | | $ | 226 | | $ | 138 | |

| I n v e s t i n g A c t i v i t i e s : | | | | | | | | | |

| N e t ( p a y m e n t s f o r ) p r o c e e d s f r o m : | | | | | | | | | |

| Investments in non-bank subsidiaries and affiliates | | (54 | ) | | (190 | ) | | (39 | ) |

| Securities purchased under resale agreements | | (1,806 | ) | | 1,161 | | | 6 | |

| Purchase of available-for-sale securities | | (43 | ) | | (19 | ) | | (24 | ) |

| Interest-bearing deposits with bank subsidiary | | (367 | ) | | 201 | | | (236 | ) |

| Notes receivable from subsidiaries | | (30 | ) | | 1 | | | (111 | ) |

| Other | | 19 | | | 11 | | | 10 | |

| |

| |

| Net Cash (Used) Provided by Investing Activities | | (2,281 | ) | | 1,165 | | | (394 | ) |

| | | | | | | | | | |

| F i n a n c i n g A c t i v i t i e s : | | | | | | | | | |

| Net proceeds from commercial paper | | 499 | | | 12 | | | 352 | |

| Proceeds from issuance of long-term debt | | | | | | | | 300 | |

| Proceeds from issuance of common and treasury stock | | 98 | | | 247 | | | 89 | |

| Payments for cash dividends | | (149 | ) | | (127 | ) | | (106 | ) |

| Payments for purchase of common stock | | (75 | ) | | (252 | ) | | (84 | ) |

| Net proceeds from (payments for) short-term borrowing | | 1,782 | | | (1,271 | ) | | (295 | ) |

| |

| |

| Net Cash Provided (Used) by Financing Activities | | 2,155 | | | (1,391 | ) | | 256 | |

| |

| |

| Net Change | | | | | | | | | |

| Cash and Due from Banks at Beginning of Year | | | | | | | | | |

| Cash and Due from Banks at End of Year | $ | 0 | | $ | 0 | | $ | 0 | |

| |

| |

State Street Corporation | 89

Note 25

Subsequent Event

A c q u i s i t i o n o f S u b s t a n t i a l P a r t s o f t h e G l o b a l S e c u r i t i e s

S e r v i c e s B u s i n e s s o f D e u t s c h e B a n k A G

On January 31, 2003, State Street completed the primary closing of its acquisition of a substantial part of the global securities services business (“GSS”) of Deutsche Bank AG. Under the terms of the definitive agreements, first announced on November 5, 2002, State Street’s initial payment to Deutsche Bank for all business units to be acquired was approximately $1.1 billion. A separate closing will be held in the near future for business units in Italy and Austria, upon receipt of applicable regulatory approvals. In the period ending on the one-year anniversary of the closing, State Street will make additional payments of up to an estimated €360 million, based upon performance of the acquired business. The restructuring costs associated with the acquisition are expected to be $90–$110 million on a pre-tax basis, approximately half of which will be recorded in the first quarter of 2003 and the balance recorded over the next three quarters. GSS had approximately $2.2 trillion of assets under custody.

Approximately half of the initial payment was financed using existing resources including the net proceeds from the sale of the corporate trust business mentioned in Note 2. State Street financed $595 million of the purchase price by issuance of equity, equity-related and capital securities to the public under an existing shelf registration statement. In January 2003, State Street issued $345 million, or 7.2 million shares of common stock, $345 million, or 1.7 million units of SPACES(SM), and $345 million of floating-rate, medium-term capital securities due 2008. SPACES are collateralized, forward purchase contract units for additional shares of common stock of State Street. Each SPACES has a stated amount of $200 and consists of PACES(SM), a fixed-share purchase contract and treasury securities, and COVERS(SM), a variable-share repurchase contract. The SPACES investors will receive total annual payments of 6.75% on the units, payable quarterly, consisting of an annual 2.75% coupon on the PACES and an annual 4.00% contract payment on the COVERS. State Street did not receive the proceeds from the SPACES at closing, but will receive proceeds of $345 million and issue common stock upon the settlement of the fixed share purchase contracts underlying the SPACES units on November 15, 2005. The floating rate capital securities were issued at LIBOR plus 50 basis points, and are subject to mandatory redemption on December 15, 2005, provided certain regulatory requirements are met, and otherwise are due on February 15, 2008. After the close of the financing transactions in January 2003, $469 million of State Street’s shelf registration was available for further issuance.

90 | State Street Corporation

Note 26

Quarterly Results of Operations, Share and Per Share Data (unaudited)

The following is a tabulation of the unaudited quarterly results:

| | 2002 Quarters | | 2001 Quarters(3) | |

| |

| |

| |

| (Dollars and shares in millions, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| except per share data) | Fourth(1) | | Third | | Second | | First | | Fourth | | Third | | Second | | First(2) | |

| Fee revenue | | $ | 706 | | $ | 702 | | | $ | 745 | | $ | 697 | | | $ | 709 | | $ | 701 | | | $ | 722 | | | $ | 637 | |

| Interest revenue | | | 465 | | | 475 | | | | 510 | | | 524 | | | | 563 | | | 705 | | | | 732 | | | | 855 | |

| Interest expense | | | 240 | | | 251 | | | | 261 | | | 243 | | | | 278 | | | 451 | | | | 493 | | | | 608 | |

| |

| |

| Net interest revenue | | | 225 | | | 224 | | | | 249 | | | 281 | | | | 285 | | | 254 | | | | 239 | | | | 247 | |

| Provision for loan losses | | | 1 | | | 1 | | | | 1 | | | 1 | | | | 3 | | | 3 | | | | 3 | | | | 1 | |

| |

| |

| Net interest revenue after | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| provision for loan losses | | | 224 | | | 223 | | | | 248 | | | 280 | | | | 282 | | | 251 | | | | 236 | | | | 246 | |

| Net gains on sales of securities, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| included in fee revenue above | | | 31 | | | 31 | | | | 10 | | | 4 | | | | 7 | | | 15 | | | | 15 | | | | 6 | |

| Net gains on the sale of Corp. Trust | | | 495 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| Total revenue | | | 1,456 | | | 956 | | | | 1,003 | | | 981 | | | | 998 | | | 967 | | | | 973 | | | | 889 | |

| Operating expenses | | | 704 | | | 684 | | | | 738 | | | 715 | | | | 746 | | | 720 | | | | 725 | | | | 706 | |

| |

| |

| Income before income taxes | | | 752 | | | 272 | | | | 265 | | | 266 | | | | 252 | | | 247 | | | | 248 | | | | 183 | |

| Income taxes | | | 275 | | | 90 | | | | 87 | | | 88 | | | | 81 | | | 77 | | | | 81 | | | | 62 | |

| |

| |

| Net income | | $ | 477 | | $ | 182 | | | $ | 178 | | $ | 178 | | | $ | 171 | | $ | 170 | | | $ | 167 | | | $ | 121 | |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| E a r n i n g s Pe r S h a r e : | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.47 | | $ | .57 | | | $ | .55 | | $ | .55 | | | $ | .53 | | $ | .52 | | | $ | .51 | | | $ | .38 | |

| Diluted | | | 1.46 | | | .56 | | | | .54 | | | .54 | | | | .52 | | | .51 | | | | .50 | | | | .37 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| A v e r a g e S h a r e s O u t s t a n d i n g : | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 324 | | | 323 | | | | 324 | | | 324 | | | | 323 | | | 327 | | | | 325 | | | | 325 | |

| Diluted | | | 326 | | | 326 | | | | 328 | | | 329 | | | | 329 | | | 332 | | | | 331 | | | | 330 | |

| | |

| (1) | Results for the fourth quarter of 2002 include the gain on the sale of the corporate trust business of $495 million, equal to $296 million after tax, or $.90 per diluted share.

|

| (2) | Results for the first quarter of 2001 include the write-off of State Street’s total investment in Bridge of $50 million, equal to $33 million after tax, or $.10 per diluted share.

|

| (3) | Results for 2001 include goodwill amortization expense of $10 million, $10 million, $10 million and $8 million for the fourth, third, second and first quarters, respectively. Effective January 1, 2002, in accordance with new accounting guidance, goodwill is no longer amortized.

|

State Street Corporation | 91

I T E M 9 . Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

None

Part III

I T E M 1 0 . Directors and Executive Officers of the Registrant

Information concerning State Street’s directors will appear in State Street’s Proxy Statement for the 2003 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A on or before April 30, 2003, under the caption “Election of Directors.” Such information is incorporated herein by reference.

Information concerning State Street’s executive officers appears under the caption “Executive Officers of the Registrant” in Item 4A of this Report.

Information concerning compliance with Section 16(a) of the Securities Exchange Act will appear in State Street’s Proxy Statement for the 2003 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A on or before April 30, 2003, under the caption “Section 16(a) Beneficial Ownership Reporting Compliance.” Such information is incorporated herein by reference.

I T E M 11 . Executive Compensation

Information in response to this item will appear in State Street’s Proxy Statement for the 2003 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A on or before April 30, 2003, under the captions “Executive Compensation,” “Compensation of Directors,” “Retirement Benefits,” “Committees of the Board of Directors — Executive Compensation Committee,” “Report of the Executive Compensation Committee,” and “Stockholder Return Performance Presentation.” Such information is incorporated herein by reference.

92 | State Street Corporation

I T E M 1 2 . Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Information concerning security ownership of certain beneficial owners and management will appear in State Street’s Proxy Statement for the 2003 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A on or before April 30, 2003, under the caption “Beneficial Ownership of Shares.” Such information is incorporated herein by reference.

The following table discloses the number of outstanding options, warrants and rights granted by the Corporation to participants in equity compensation plans, as well as the number of securities remaining available for future issuance under these plans. The table provides this information separately for equity compensation plans that have and have not been approved by security holders.

| (Share data in thousands) | (a)

Number of securities to

be issued upon

exercise of outstanding

options, warrants and

rights | | (b)

Weighted-average

exercise price of

outstanding options,

warrants and rights | | (c)

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)) | |

| Plan Category: | | | | | | |

| Equity compensation plans approved | | | | | | |

| by stockholders | 26,166 | | $40.33 | | 15,037 | |

| Equity compensation plans not | | | | | | |

| approved by stockholders | 148 | | 44.52 | | 1,097 | |

| |

| | | |

| |

| Total | 26,314 | | 40.35 | | 16,134 | |

| |

| | | |

| |

Two compensation plans under which equity securities of the Registrant are authorized for issuance have been adopted without the approval of stockholders.

In 1996, the Board of Directors adopted the State Street Global Advisors Equity Compensation Plan, pursuant to which senior officers of SSgA were eligible to be selected for participation in the plan, and to receive at that time awards providing for the deferred delivery of shares of common stock. The awards vest as to 20% of the total award of each participant after five years, and as to an additional 20% in each year thereafter. Special vesting rules apply in the case of death, disability or retirement. Shares are deliverable under the plan on December 31, 2005 or upon earlier death, disability or retirement. Upon termination of a participant’s employment, unvested portions are forfeited. Award participants are subject to a non-competition and non-solicitation of business covenant during a period of 18 months following termination of employment. The awards are non-transferable. Awards providing for the deferred delivery of an aggregate of 986,000 shares of common stock were outstanding as of December 31, 2002.

In 2001, the Board of Directors adopted the State Street Corporation Savings-Related Stock Plan (“SAYE Plan”), for employees in the United Kingdom. Under the SAYE Plan, employee-participants could commit to save a specified amount from after-tax pay for a fixed period (either three or five years). Savings are deducted automatically. At the end of the period chosen, a tax-free bonus is added by the Registrant to the savings amount (the level of the bonus depends on the length of the fixed period of savings), and participants have the option to receive the savings and bonus amount in cash, or to use the amount to purchase common stock from the Registrant at an exercise price equal to the market price of the stock as of the date of joining the SAYE Plan less a discount fixed by the Registrant at the date of joining. For participants joining the SAYE Plan in 2001, the discount was 15%. There was no discount for participants joining in 2002. Options granted under the SAYE Plan are non-transferable. If a participant withdraws from participation before the end of the fixed period, the options to purchase stock are forfeited. If a participant terminates during the period due to retirement, disability, redundancy or sale of the employer from the Registrant’s group, the options may be exercised within six months of the occurrence, or one year if by reason of death. Under the SAYE Plan, an aggregate of 170,000 shares of

State Street Corporation | 93

common stock was authorized for issuance. The SAYE Plan has been discontinued and no new participations under the SAYE Plan are permitted. At December 31, 2002, a total of 148,000 shares of common stock are eligible to be purchased under outstanding options.

|