2025 J.P. Morgan Healthcare Conference January 16, 2025

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 2 Safe Harbor Statement Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of federal securities laws, including, among others, statements about our expectations, plans, strategies or prospects. We generally use the words “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “project,” “assume,” “guide,” “target,” “forecast,” “see,” “seek,” “can,” “should,” “could,” “would,” “intend,” “predict,” “potential,” “strategy,” “is confident that,” “future,” “opportunity,” “work toward,” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are, or may be deemed to be, forward-looking statements. Such statements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. Forward-looking statements speak only as of the date they are made, and we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers of this presentation are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this presentation. The risks and uncertainties that may cause actual results to differ materially from Masimo’s current expectations are more fully described in Masimo’s reports filed with the U.S. Securities and Exchange Commission (SEC), including our most recent Form 10-K and Form 10-Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo.com or upon request. Non-GAAP Financial Measures: The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The non-GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on-going core operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non- GAAP financial measures used by other companies. The Company has presented the following non-GAAP financial measures to assist investors in understanding the Company’s core net operating results on an on- going basis: non-GAAP revenue (constant currency), pro-forma non-GAAP revenue (constant currency), pro-forma non-GAAP revenue growth (constant currency), non-GAAP gross profit/margin %, non-GAAP SG&A expense (prior definition and updated definition), non-GAAP R&D expense, non-GAAP litigation settlements and awards, non-GAAP impairment charge, non-GAAP operating expense % (prior definition and updated definition), non-GAAP operating profit/margin % (prior definition and updated definition), non-GAAP non-operating income (expense), non-GAAP provision for income taxes (prior definition and updated definition), non-GAAP net income (loss) (prior definition and updated definition), non-GAAP net income (loss) per share (prior definition and updated definition). These non-GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes these non-GAAP financial measures are important in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, including GAAP to non-GAAP reconciliations, please visit the Investor Relations section of the Company’s website at www.investor.masimo.com to access Supplementary Financial Information. Forward-Looking Non-GAAP Financial Measures: This presentation also includes certain forward-looking non-GAAP financial measures. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. For instance, we exclude the impact of certain charges related to acquisitions, integrations, divestitures and related costs; business transition and related costs; litigation related expenses and settlements; realized and unrealized gains or losses; tax related adjustments; and other adjustments. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable forward-looking GAAP financial measures because the excluded items are not available on a prospective basis without unreasonable efforts. For example, the timing of certain transactions is difficult to predict because management's plans may change. In addition, the Company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. It is probable that these forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures.

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 Ms. Brennan has served as a member of our Board since June 2023. Ms. Brennan currently serves on the boards of Cardinal Health, Inc. and Perosphere Technologies, Inc., where she sits on the Audit Committee and the Human Resources & Compensation Committee. Prior to her retirement in 2020, Ms. Brennan enjoyed a 30+ year career at Johnson & Johnson where she most recently served as Global Value Creation Leader and a member of the Medical Device Executive Leadership Team. Ms. Brennan earned a B.S. in Business Administration from the University of Kansas. 3 Michelle Brennan, Interim Chief Executive Officer

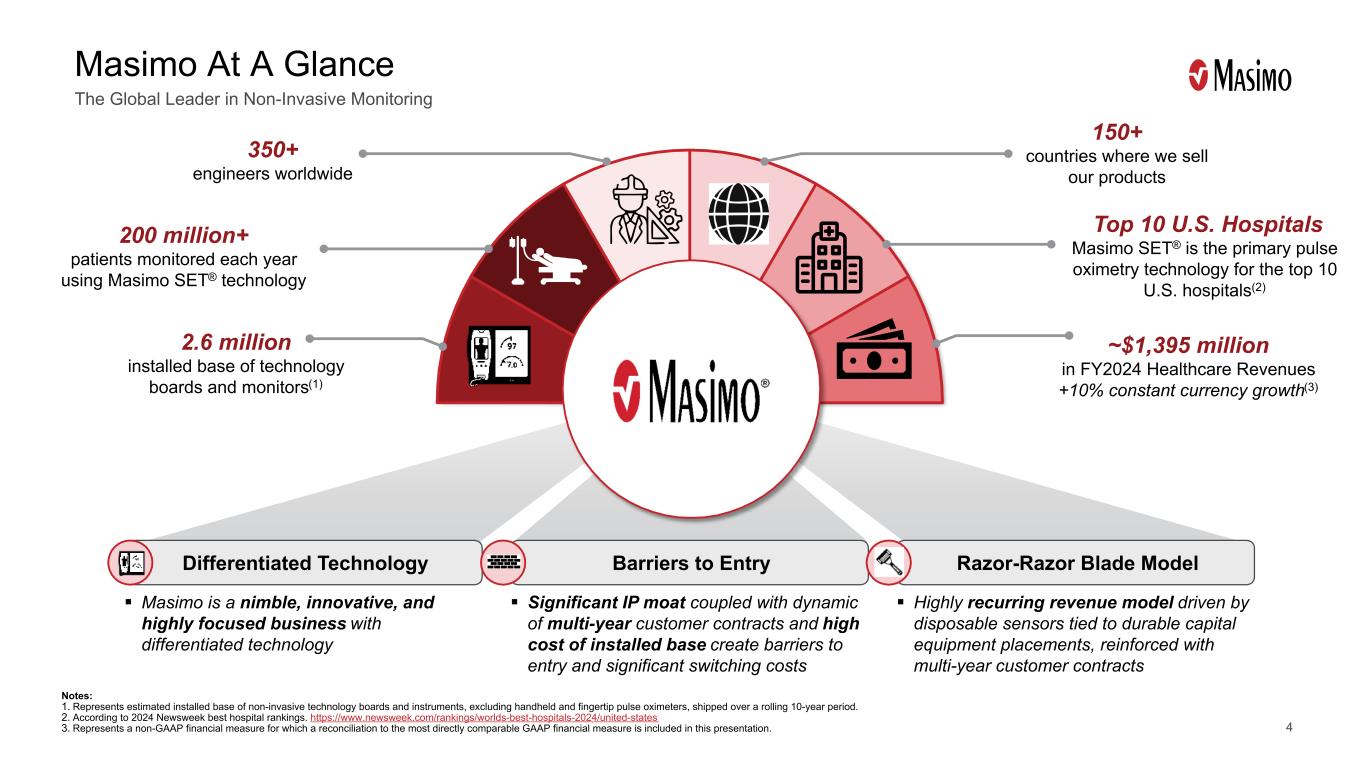

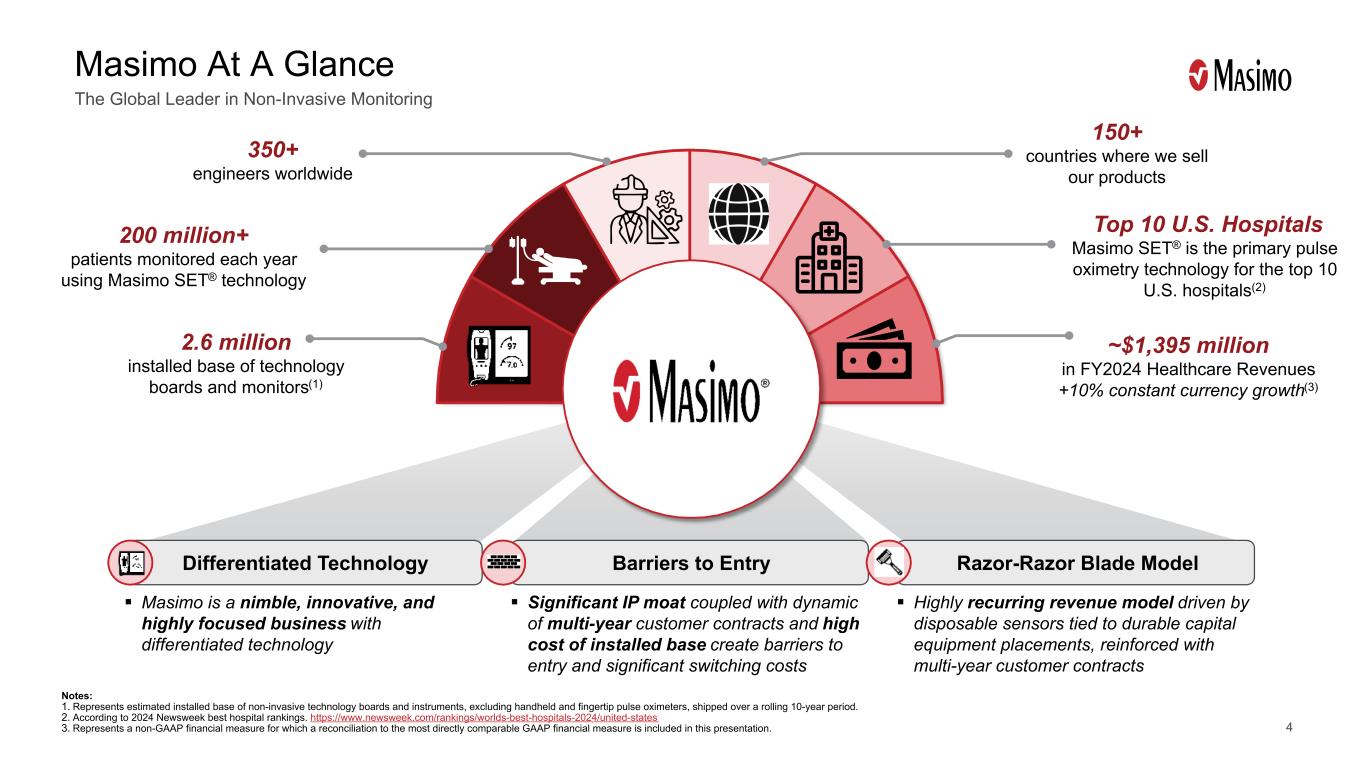

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 4 The Global Leader in Non-Invasive Monitoring Masimo At A Glance Notes: 1. Represents estimated installed base of non-invasive technology boards and instruments, excluding handheld and fingertip pulse oximeters, shipped over a rolling 10-year period. 2. According to 2024 Newsweek best hospital rankings. https://www.newsweek.com/rankings/worlds-best-hospitals-2024/united-states 3. Represents a non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is included in this presentation. 2.6 million installed base of technology boards and monitors(1) Top 10 U.S. Hospitals Masimo SET® is the primary pulse oximetry technology for the top 10 U.S. hospitals(2) 350+ engineers worldwide 200 million+ patients monitored each year using Masimo SET® technology 150+ countries where we sell our products Differentiated Technology Barriers to Entry Razor-Razor Blade Model Masimo is a nimble, innovative, and highly focused business with differentiated technology Significant IP moat coupled with dynamic of multi-year customer contracts and high cost of installed base create barriers to entry and significant switching costs Highly recurring revenue model driven by disposable sensors tied to durable capital equipment placements, reinforced with multi-year customer contracts ~$1,395 million in FY2024 Healthcare Revenues +10% constant currency growth(3)

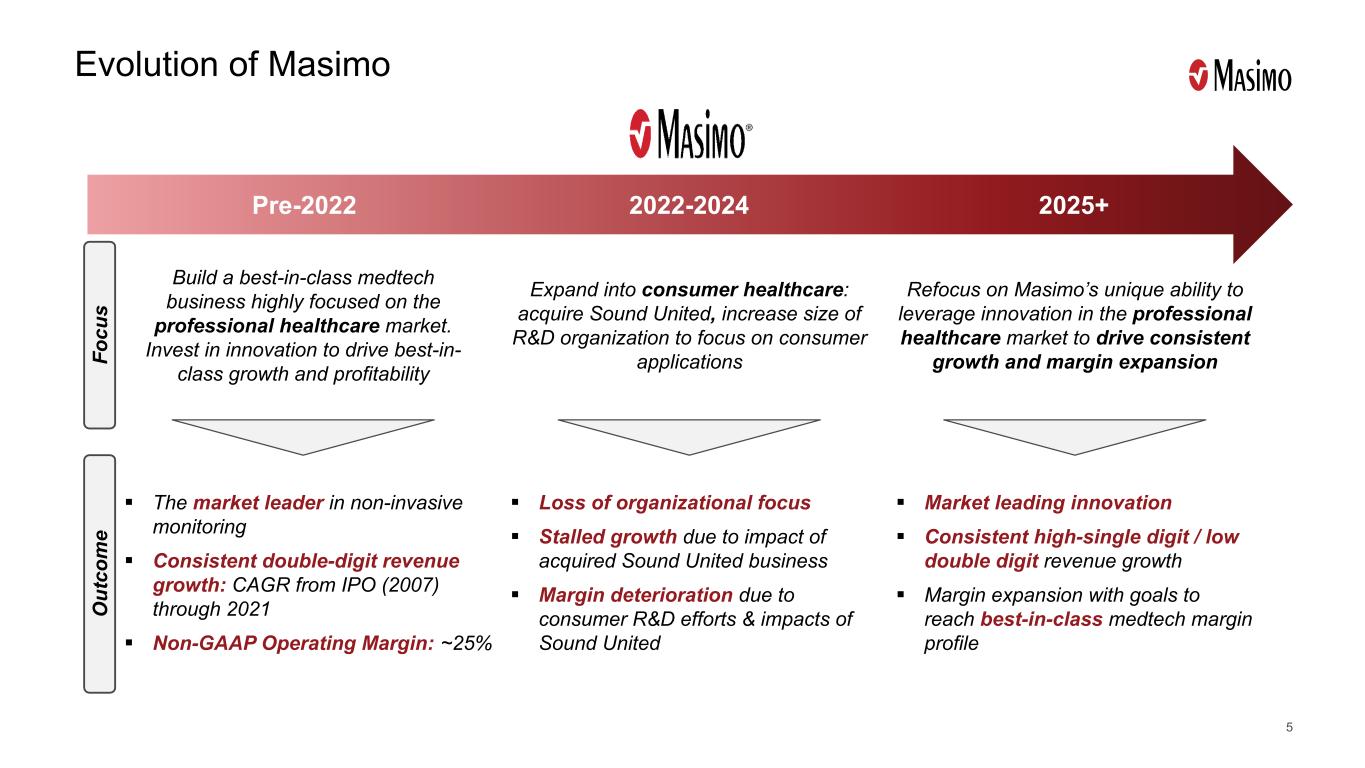

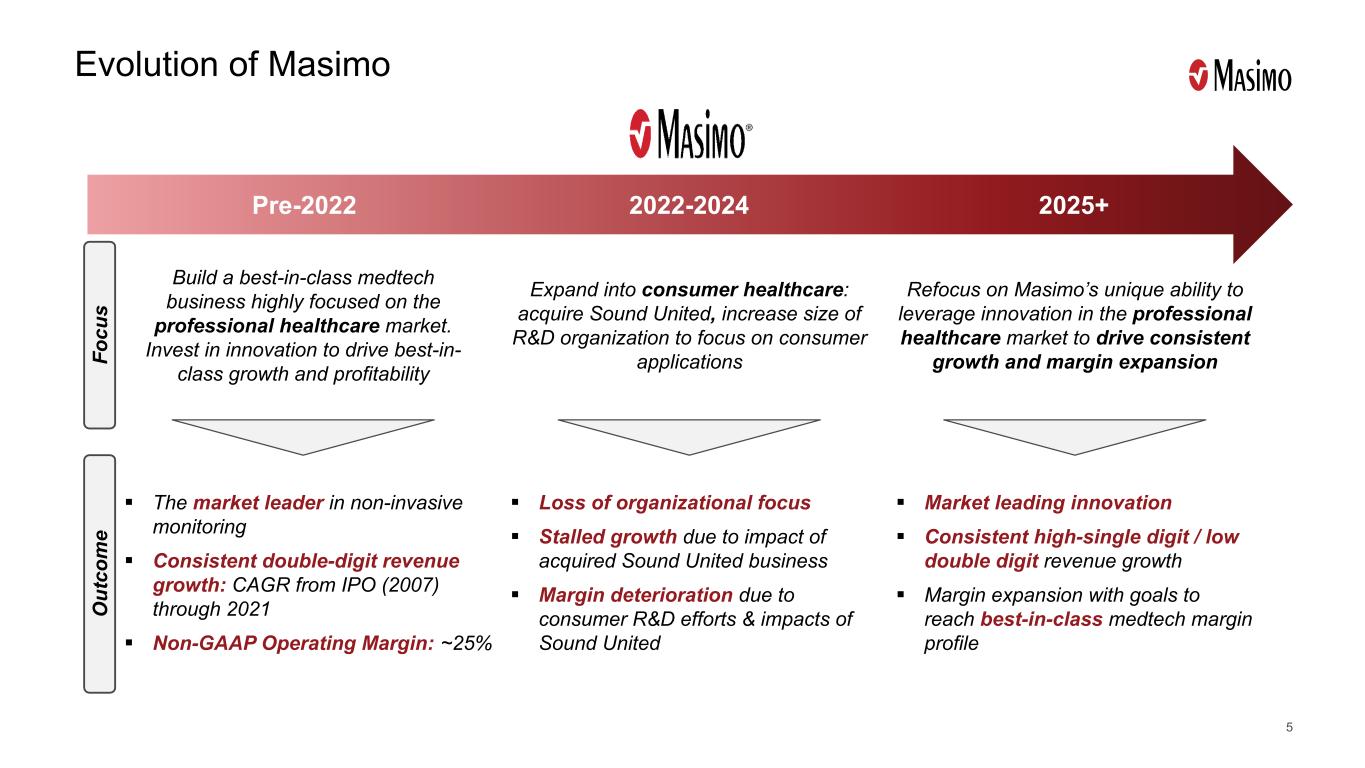

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 5 Evolution of Masimo Fo cu s O ut co m e Build a best-in-class medtech business highly focused on the professional healthcare market. Invest in innovation to drive best-in- class growth and profitability The market leader in non-invasive monitoring Consistent double-digit revenue growth: CAGR from IPO (2007) through 2021 Non-GAAP Operating Margin: ~25% Expand into consumer healthcare: acquire Sound United, increase size of R&D organization to focus on consumer applications Refocus on Masimo’s unique ability to leverage innovation in the professional healthcare market to drive consistent growth and margin expansion Market leading innovation Consistent high-single digit / low double digit revenue growth Margin expansion with goals to reach best-in-class medtech margin profile Loss of organizational focus Stalled growth due to impact of acquired Sound United business Margin deterioration due to consumer R&D efforts & impacts of Sound United Pre-2022 2022-2024 2025+

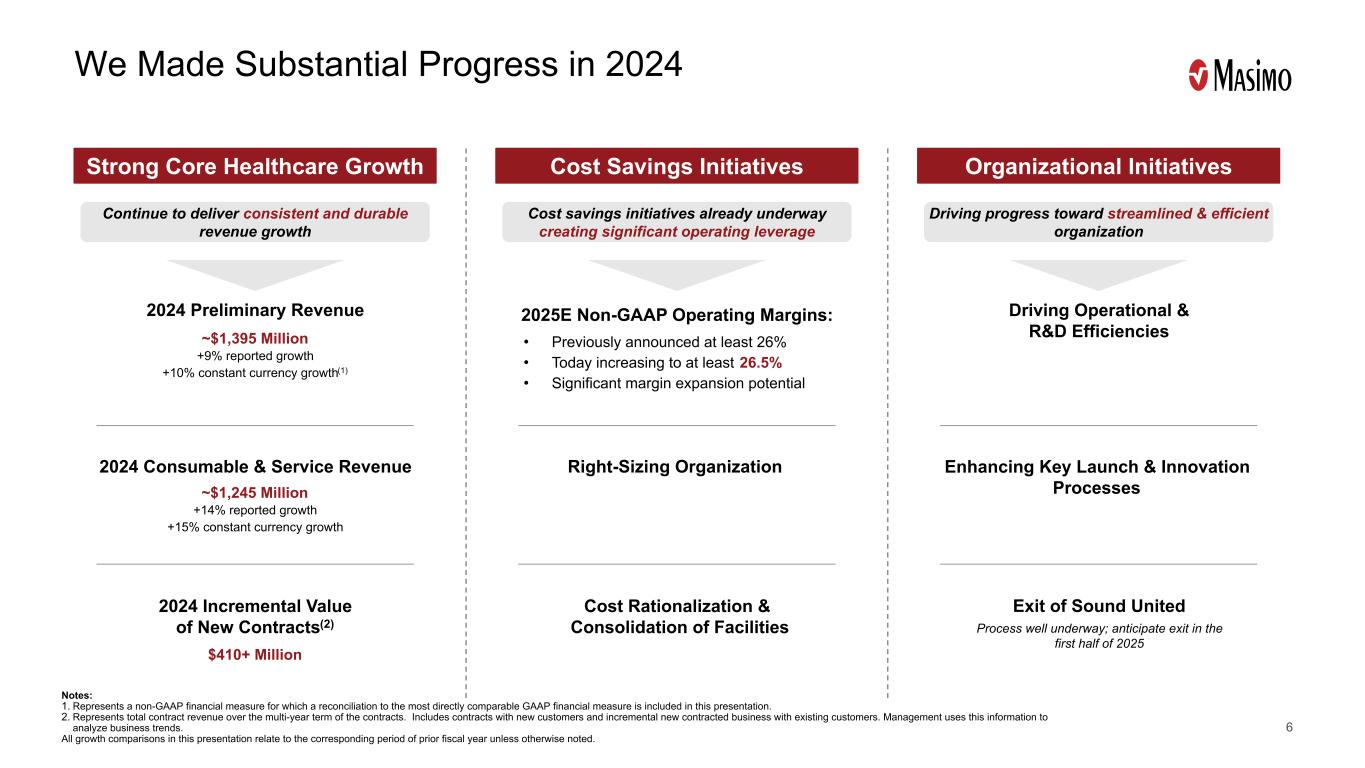

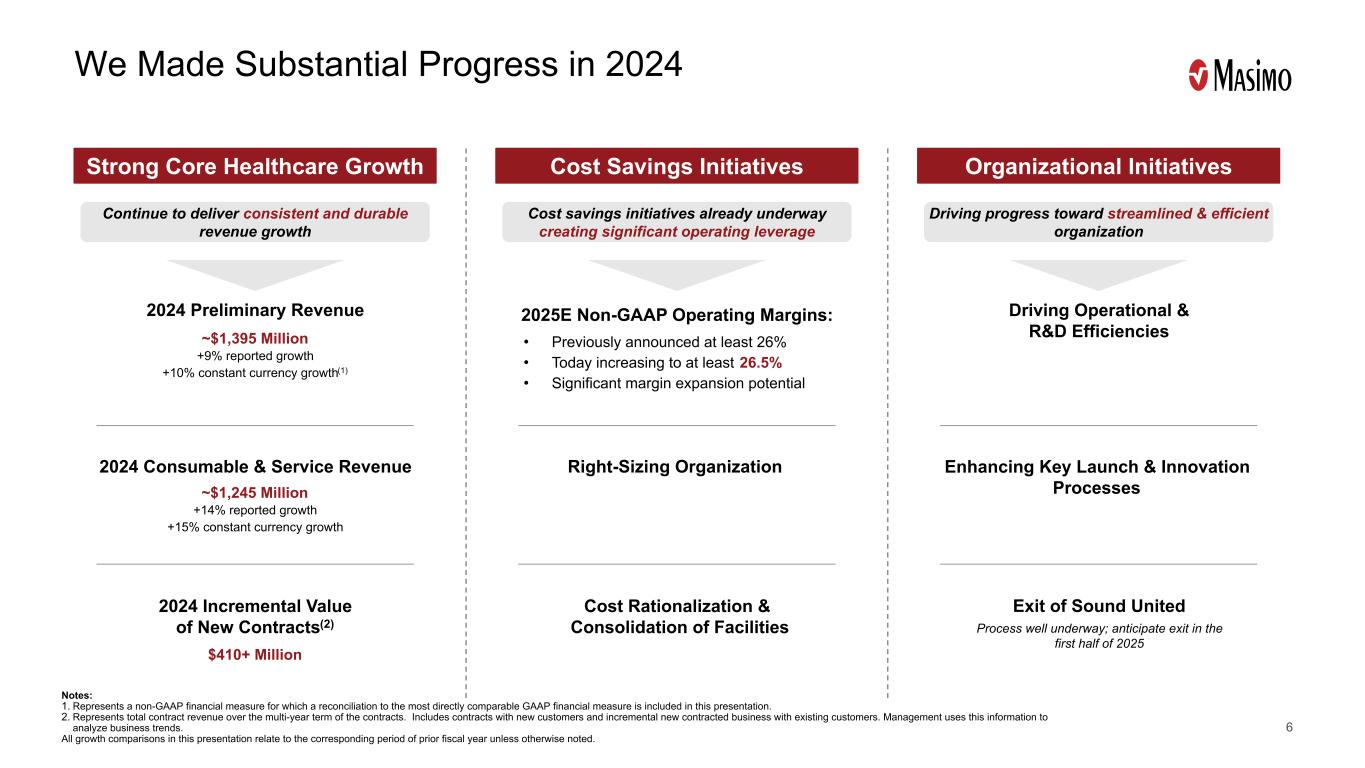

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 6 We Made Substantial Progress in 2024 Notes: 1. Represents a non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is included in this presentation. 2. Represents total contract revenue over the multi-year term of the contracts. Includes contracts with new customers and incremental new contracted business with existing customers. Management uses this information to analyze business trends. All growth comparisons in this presentation relate to the corresponding period of prior fiscal year unless otherwise noted. Cost Savings Initiatives Cost savings initiatives already underway creating significant operating leverage Right-Sizing Organization Cost Rationalization & Consolidation of Facilities Organizational Initiatives Driving progress toward streamlined & efficient organization Exit of Sound United Driving Operational & R&D Efficiencies Process well underway; anticipate exit in the first half of 2025 Enhancing Key Launch & Innovation Processes Strong Core Healthcare Growth Continue to deliver consistent and durable revenue growth 2024 Preliminary Revenue ~$1,395 Million +9% reported growth +10% constant currency growth(1) $410+ Million 2024 Consumable & Service Revenue 2024 Incremental Value of New Contracts(2) ~$1,245 Million +14% reported growth +15% constant currency growth 2025E Non-GAAP Operating Margins: • Previously announced at least 26% • Today increasing to at least 26.5% • Significant margin expansion potential

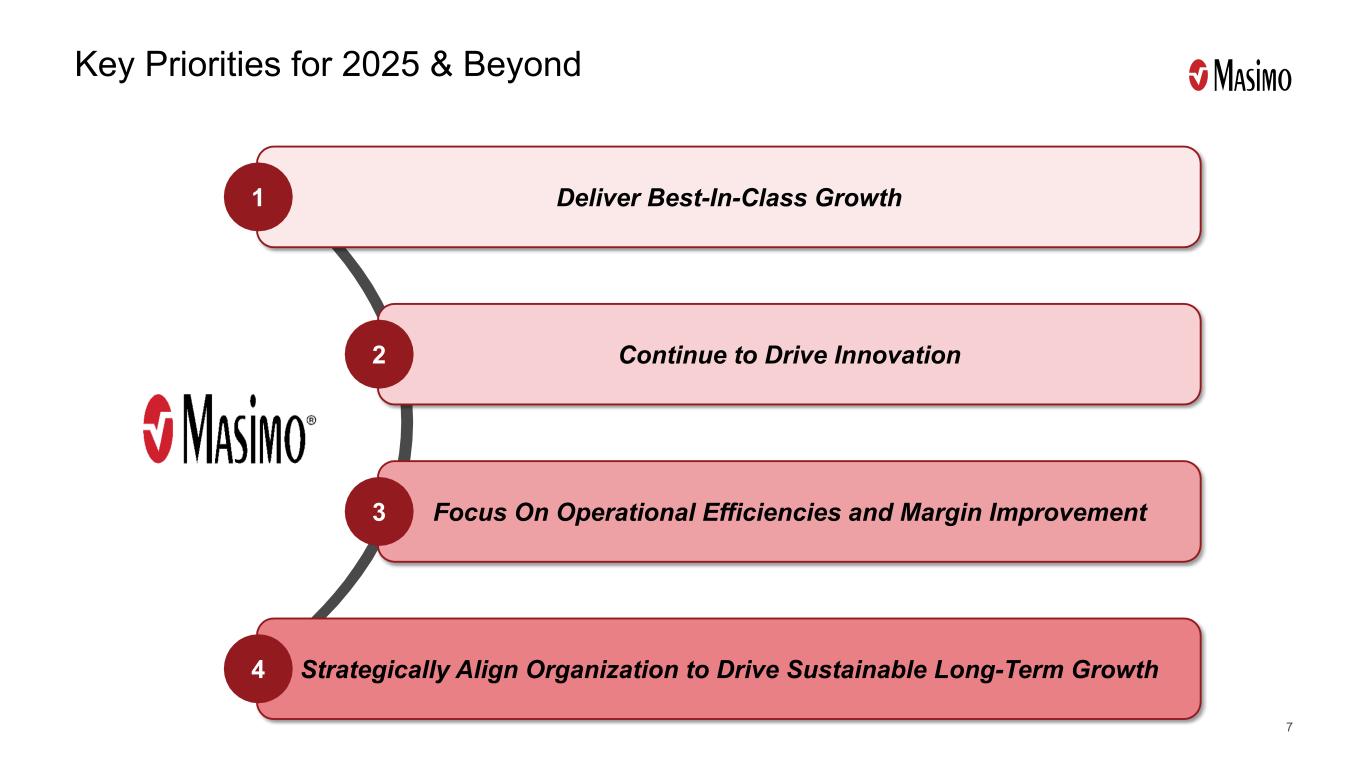

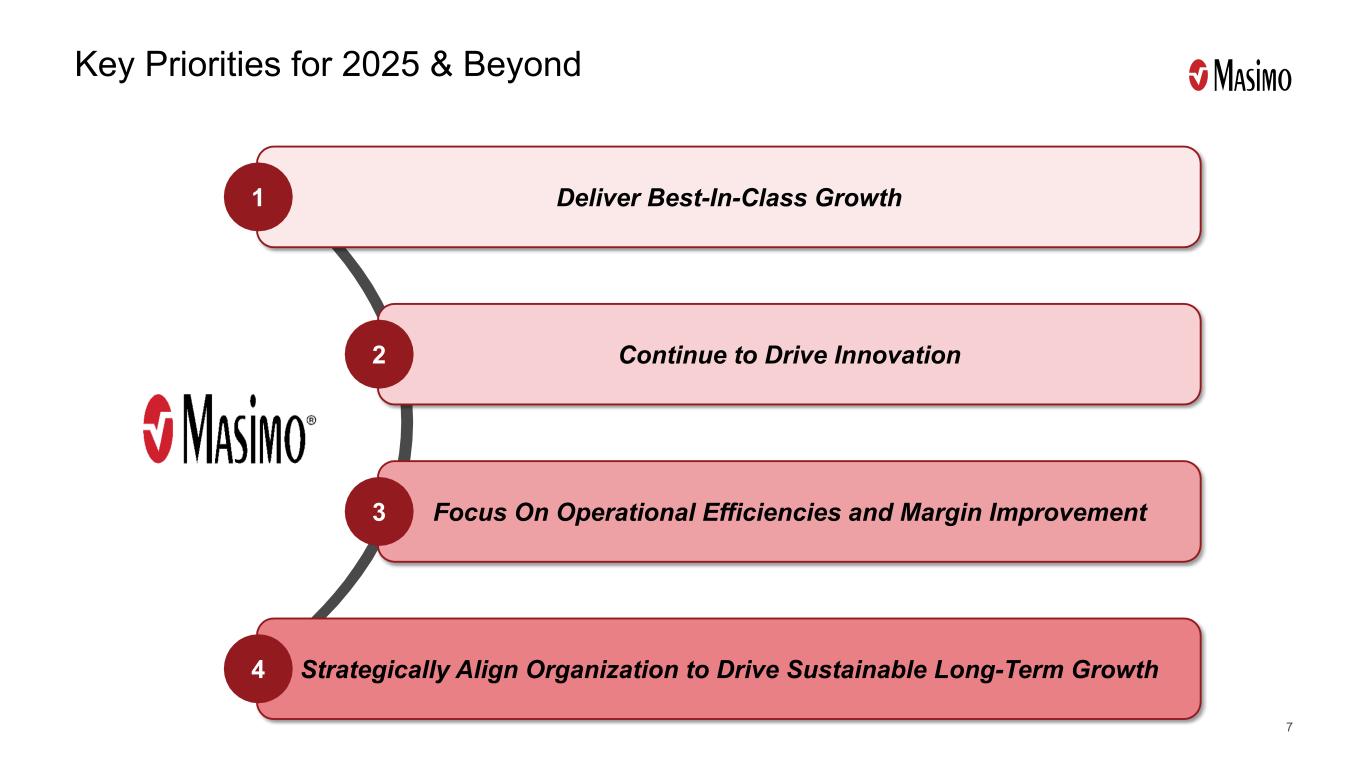

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 7 Key Priorities for 2025 & Beyond Deliver Best-In-Class Growth1 Continue to Drive Innovation2 Focus On Operational Efficiencies and Margin Improvement3 Strategically Align Organization to Drive Sustainable Long-Term Growth4

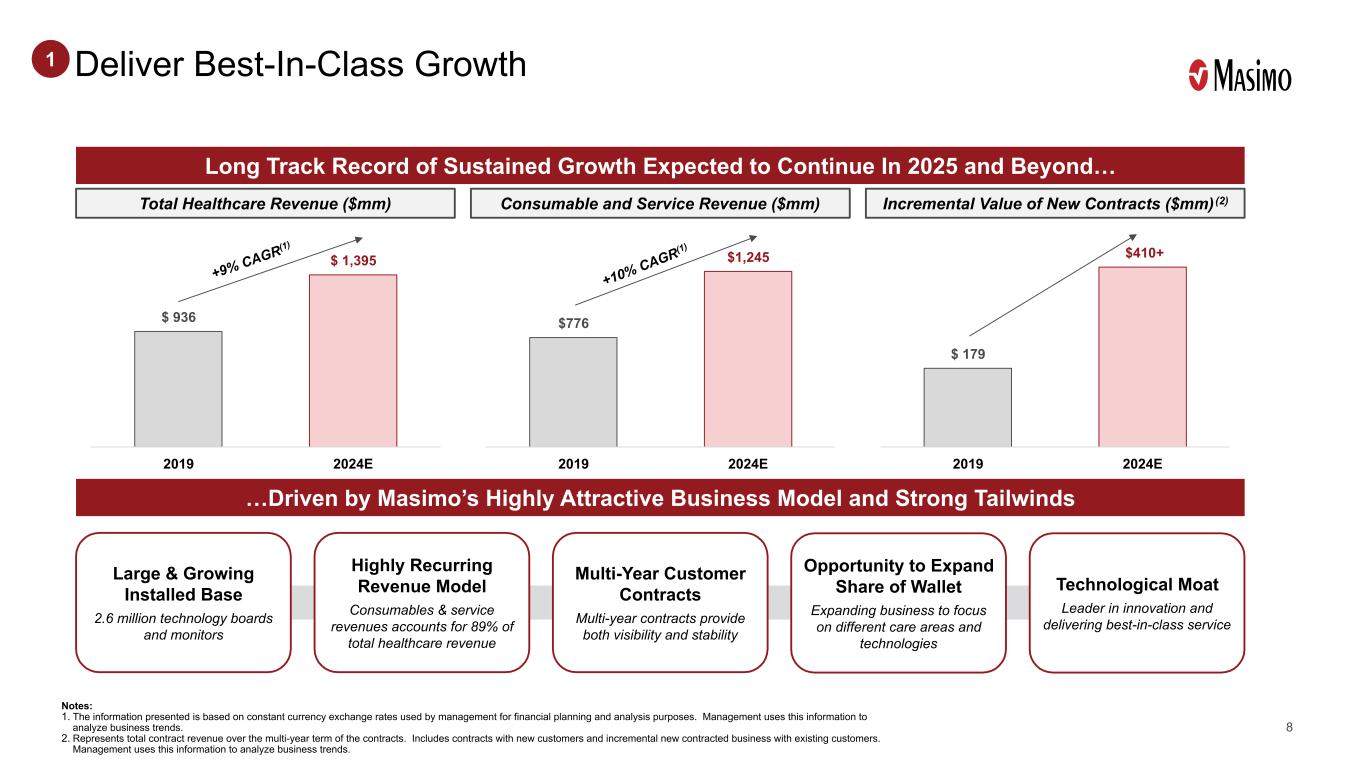

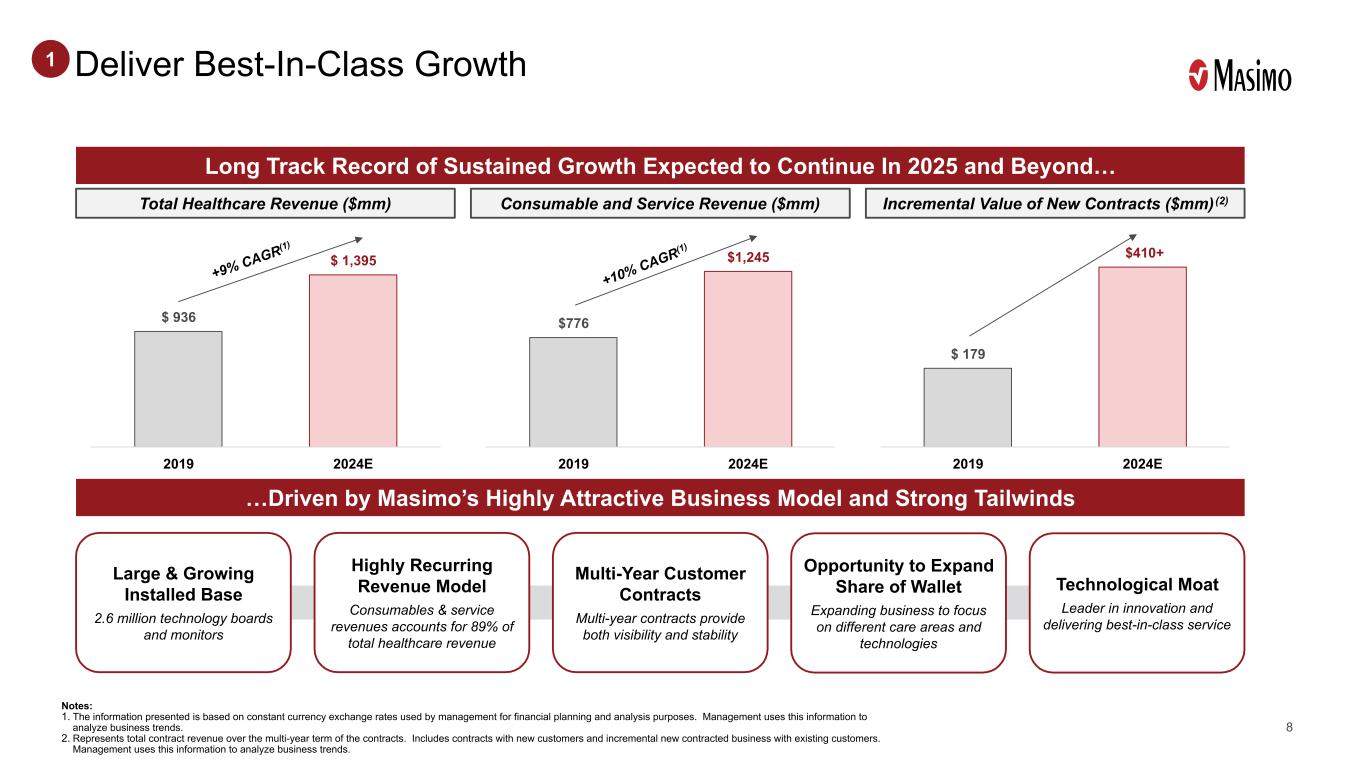

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 8 Deliver Best-In-Class Growth1 Notes: 1. The information presented is based on constant currency exchange rates used by management for financial planning and analysis purposes. Management uses this information to analyze business trends. 2. Represents total contract revenue over the multi-year term of the contracts. Includes contracts with new customers and incremental new contracted business with existing customers. Management uses this information to analyze business trends. 2019 2024E $776 $1,245 2019 2024E $ 179 $410+ 2019 2024E $ 936 $ 1,395 Long Track Record of Sustained Growth Expected to Continue In 2025 and Beyond… …Driven by Masimo’s Highly Attractive Business Model and Strong Tailwinds Total Healthcare Revenue ($mm) Consumable and Service Revenue ($mm) Incremental Value of New Contracts ($mm) (2) +9% CAGR(1) Large & Growing Installed Base 2.6 million technology boards and monitors Highly Recurring Revenue Model Consumables & service revenues accounts for 89% of total healthcare revenue Technological Moat Leader in innovation and delivering best-in-class service Multi-Year Customer Contracts Multi-year contracts provide both visibility and stability Opportunity to Expand Share of Wallet Expanding business to focus on different care areas and technologies +10% CAGR(1)

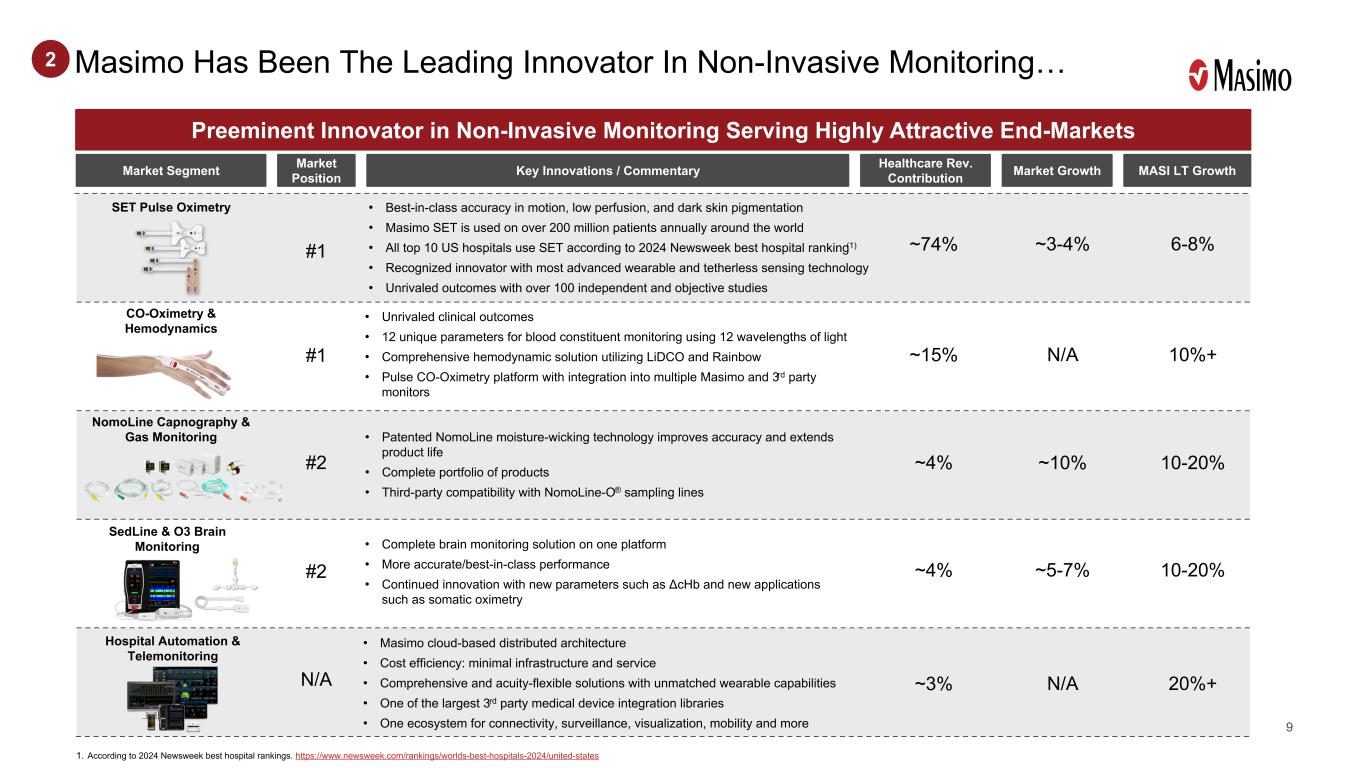

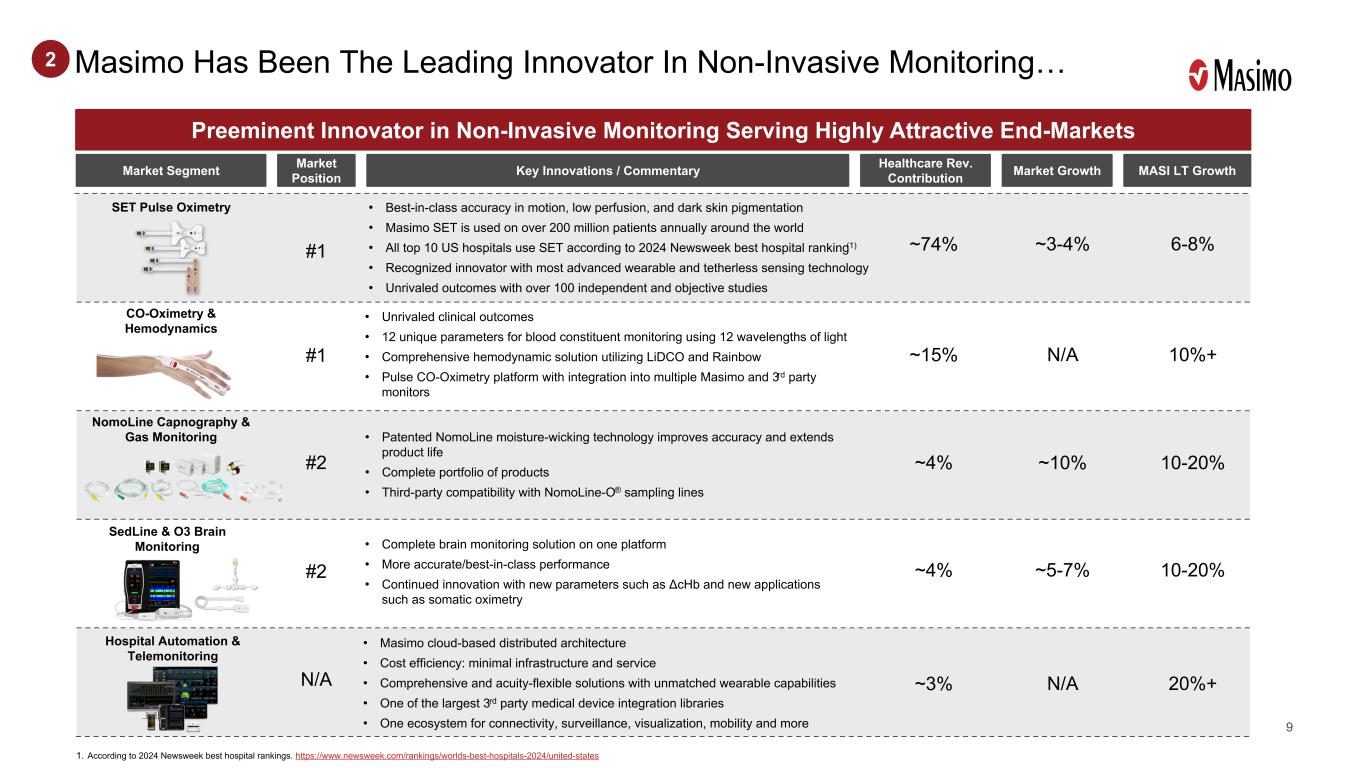

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 9 Masimo Has Been The Leading Innovator In Non-Invasive Monitoring… Preeminent Innovator in Non-Invasive Patient Monitoring Serving Highly Attractive End-Markets Market Segment Healthcare Rev. Contribution Market GrowthMarket Position SET Pulse Oximetry ~74% ~3-4%#1 CO-Oximetry & Hemodynamics ~15% N/A#1 NomoLine Capnography & Gas Monitoring ~4% ~10%#2 ~4% ~5-7%#2 Hospital Automation & Telemonitoring ~3% N/AN/A Preeminent Innovator in Non-Invasive Monitoring Serving Highly Attractive End-Markets Key Innovations / Commentary • Best-in-class accuracy in motion, low perfusion, and dark skin pigmentation • Masimo SET is used on over 200 million patients annually around the world • All top 10 US hospitals use SET according to 2024 Newsweek best hospital ranking(1) • Recognized innovator with most advanced wearable and tetherless sensing technology • Unrivaled outcomes with over 100 independent and objective studies MASI LT Growth 6-8% 10%+ 10-20% 10-20% 20%+ 2 • Unrivaled clinical outcomes • 12 unique parameters for blood constituent monitoring using 12 wavelengths of light • Comprehensive hemodynamic solution utilizing LiDCO and Rainbow • Pulse CO-Oximetry platform with integration into multiple Masimo and 3rd party monitors • Patented NomoLine moisture-wicking technology improves accuracy and extends product life • Complete portfolio of products • Third-party compatibility with NomoLine-O® sampling lines • Complete brain monitoring solution on one platform • More accurate/best-in-class performance • Continued innovation with new parameters such as ΔcHb and new applications such as somatic oximetry • Masimo cloud-based distributed architecture • Cost efficiency: minimal infrastructure and service • Comprehensive and acuity-flexible solutions with unmatched wearable capabilities • One of the largest 3rd party medical device integration libraries • One ecosystem for connectivity, surveillance, visualization, mobility and more SedLine & O3 Brain Monitoring 1. According to 2024 Newsweek best hospital rankings. https://www.newsweek.com/rankings/worlds-best-hospitals-2024/united-states

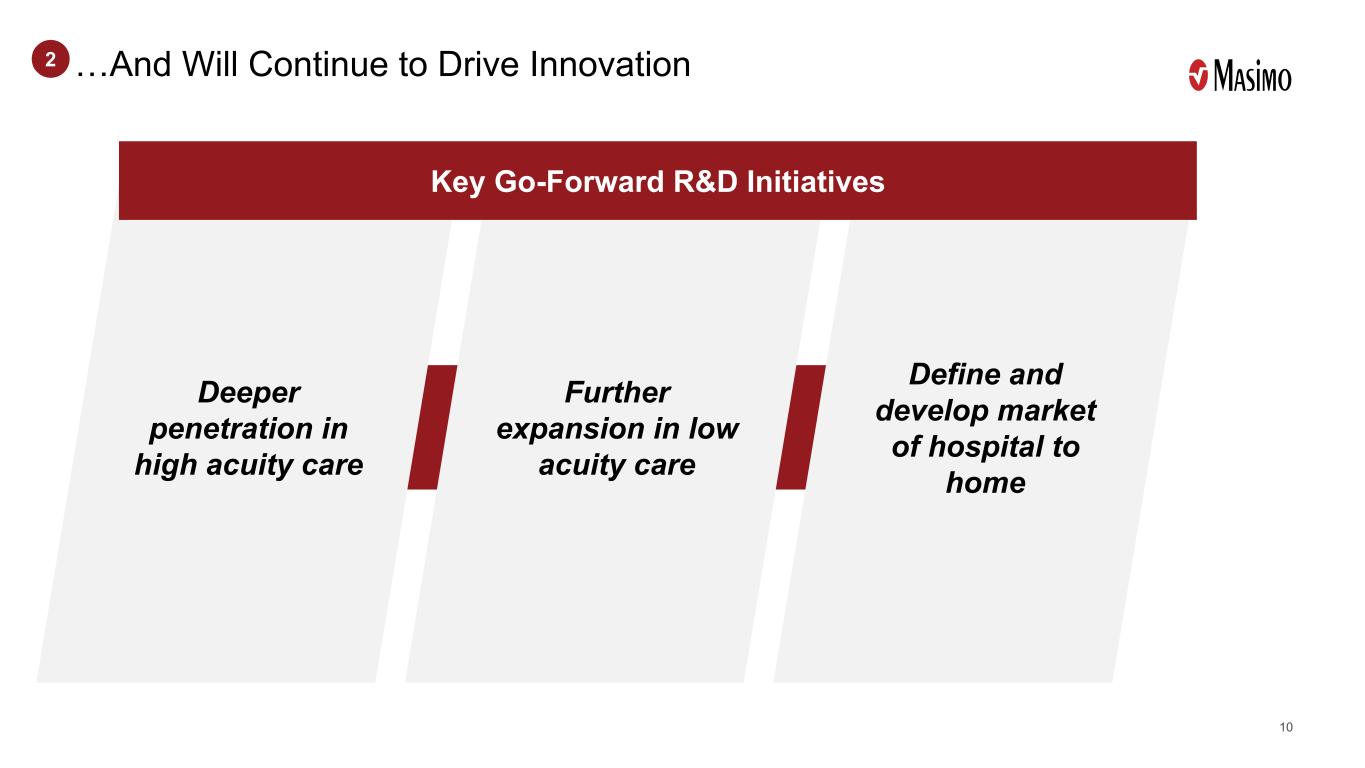

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 10 …And Will Continue to Drive Innovation Deeper penetration in high acuity care Further expansion in low acuity care Define and develop market of hospital to home Key Go-Forward R&D Initiatives 2

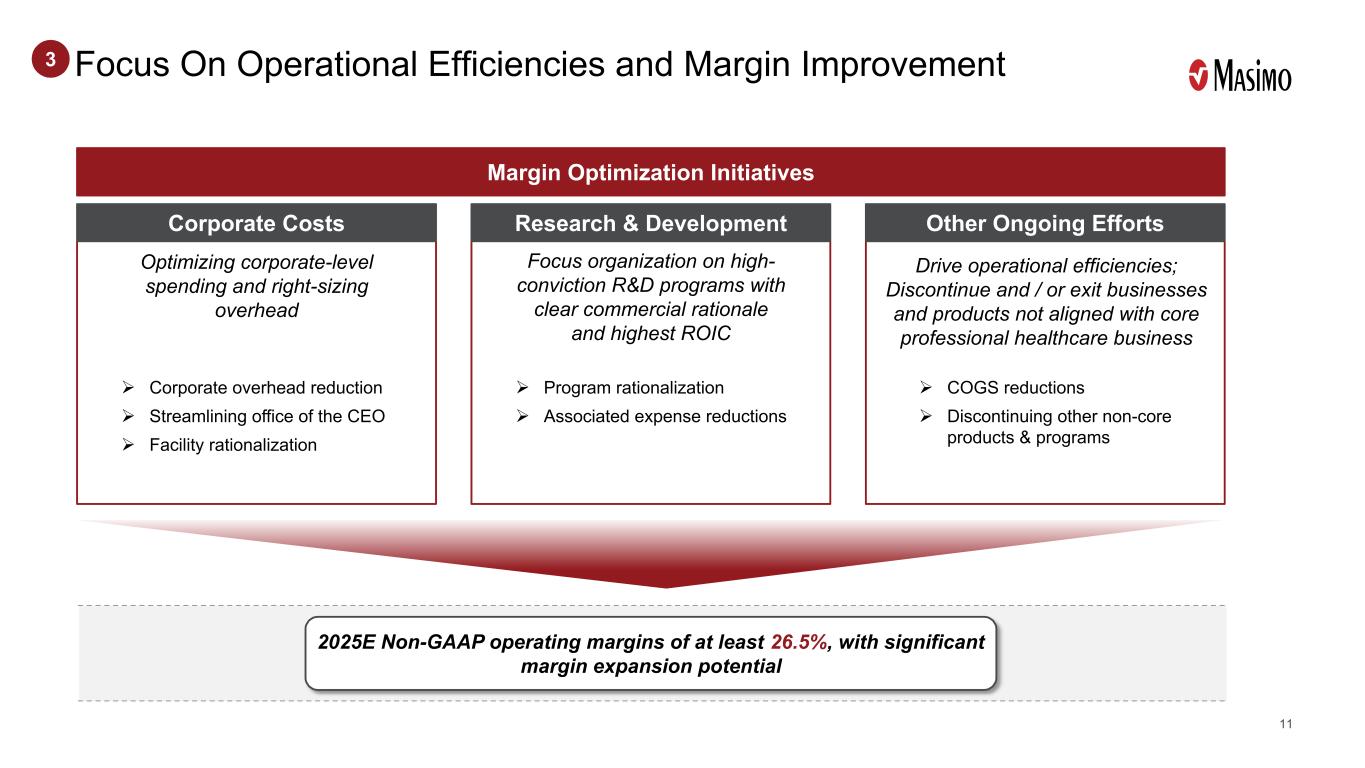

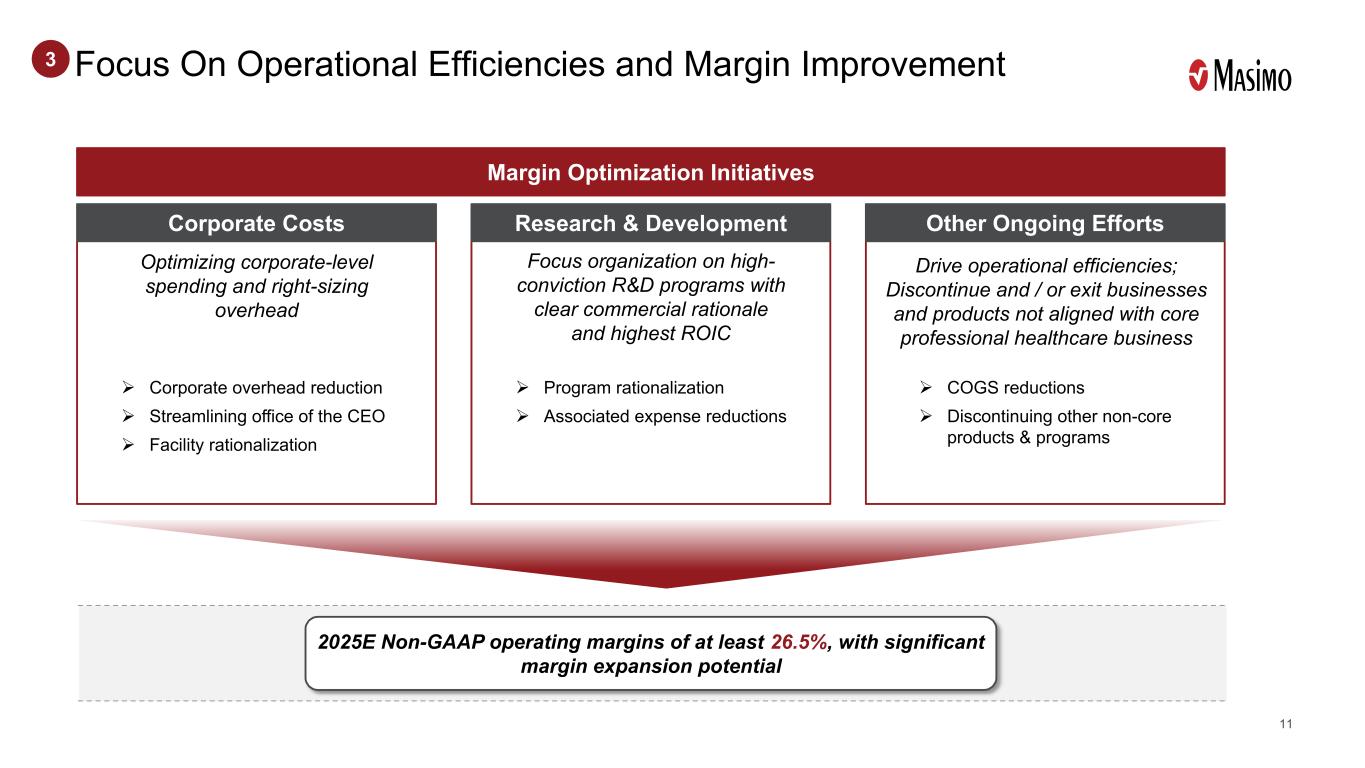

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 11 Focus On Operational Efficiencies and Margin Improvement3 2025E Non-GAAP operating margins of at least 26.5%, with significant margin expansion potential Corporate overhead reduction Streamlining office of the CEO Facility rationalization Program rationalization Associated expense reductions COGS reductions Discontinuing other non-core products & programs Focus organization on high- conviction R&D programs with clear commercial rationale and highest ROIC Drive operational efficiencies; Discontinue and / or exit businesses and products not aligned with core professional healthcare business Optimizing corporate-level spending and right-sizing overhead Corporate Costs Research & Development Other Ongoing Efforts Margin Optimization Initiatives

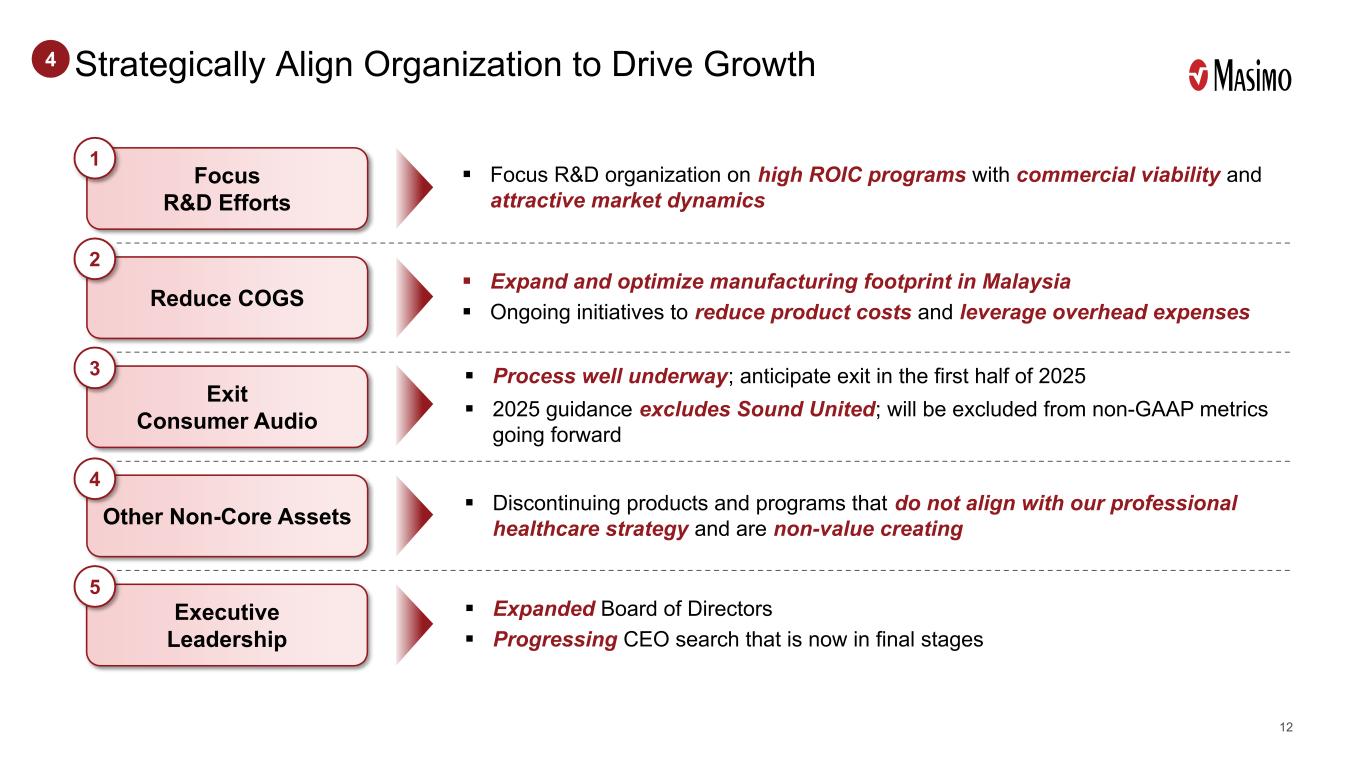

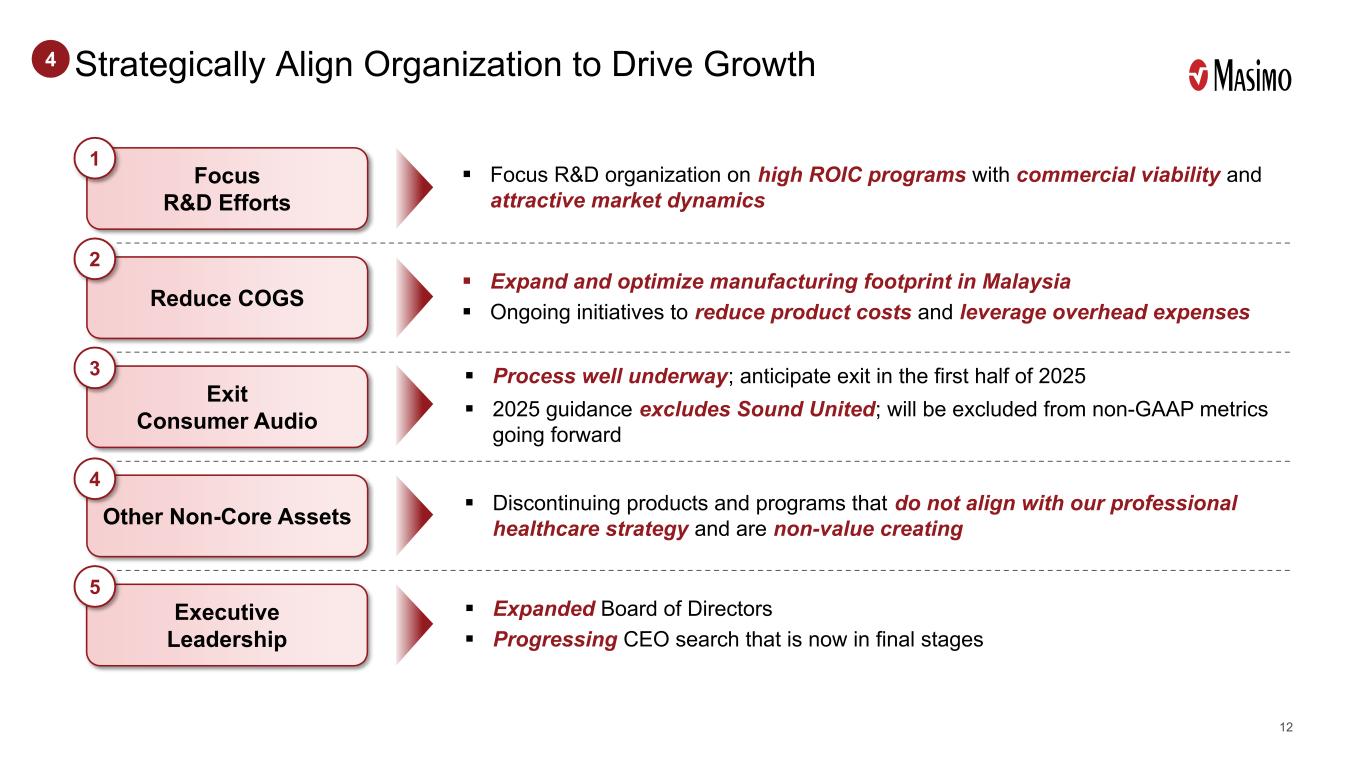

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 12 Strategically Align Organization to Drive Growth Expanded Board of Directors Progressing CEO search that is now in final stages Discontinuing products and programs that do not align with our professional healthcare strategy and are non-value creating Focus R&D organization on high ROIC programs with commercial viability and attractive market dynamics Process well underway; anticipate exit in the first half of 2025 2025 guidance excludes Sound United; will be excluded from non-GAAP metrics going forward Expand and optimize manufacturing footprint in Malaysia Ongoing initiatives to reduce product costs and leverage overhead expenses 4 Focus R&D Efforts Executive Leadership Exit Consumer Audio 1 Other Non-Core Assets Reduce COGS 3 4 5 2

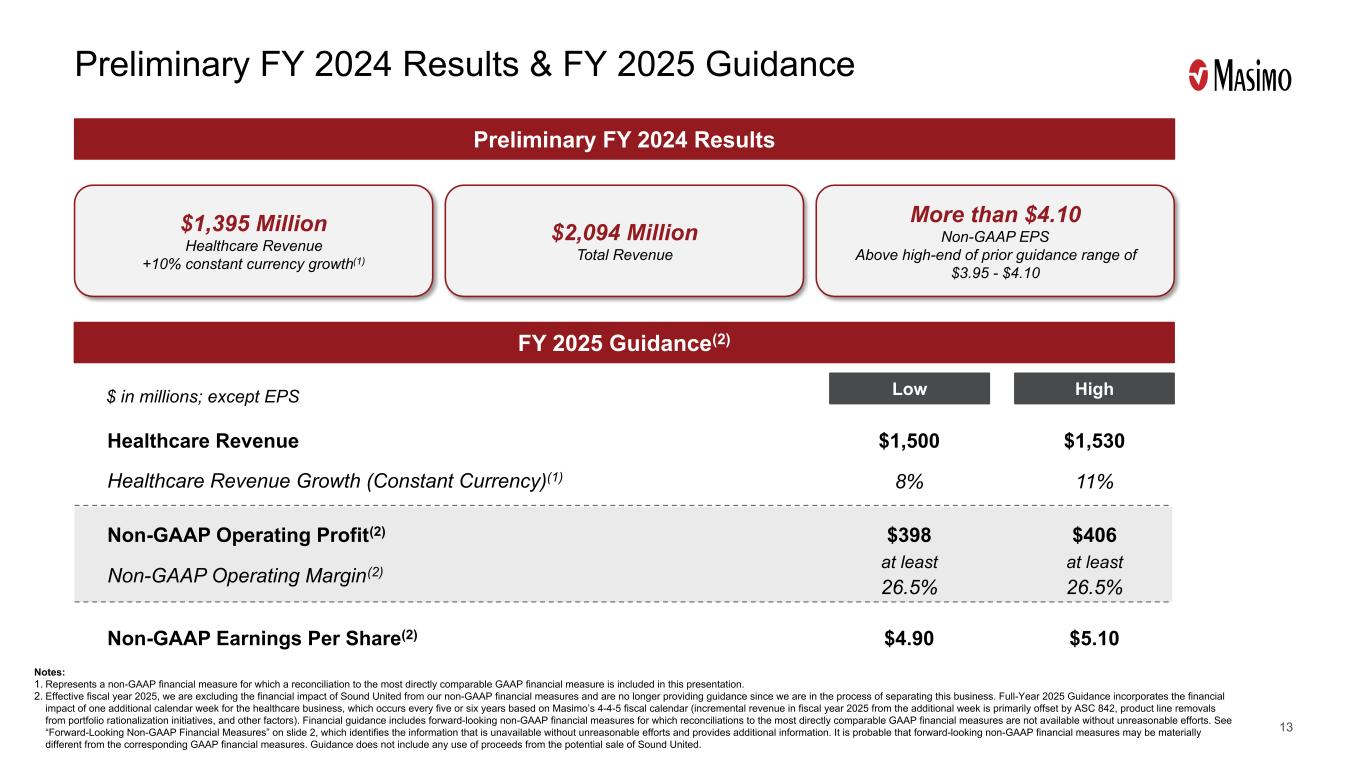

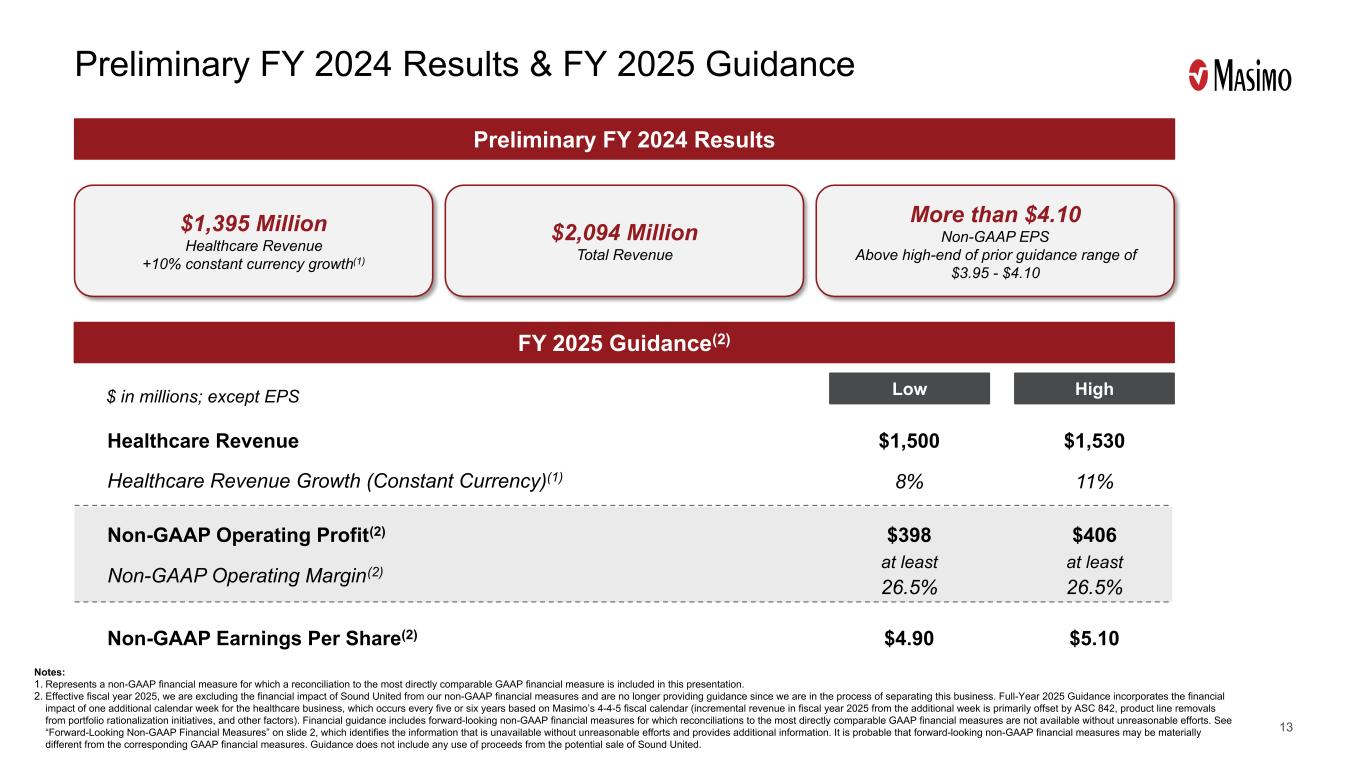

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 13 Preliminary FY 2024 Results & FY 2025 Guidance FY 2025 Guidance(2) Low High Healthcare Revenue Healthcare Revenue Growth (Constant Currency)(1) Non-GAAP Operating Profit(2) Non-GAAP Operating Margin(2) Non-GAAP Earnings Per Share(2) $1,500 8% $398 at least 26.5% $4.90 $1,530 11% $406 at least 26.5% $5.10 Preliminary FY 2024 Results $1,395 Million Healthcare Revenue +10% constant currency growth(1) $2,094 Million Total Revenue More than $4.10 Non-GAAP EPS Above high-end of prior guidance range of $3.95 - $4.10 $ in millions; except EPS Notes: 1. Represents a non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is included in this presentation. 2. Effective fiscal year 2025, we are excluding the financial impact of Sound United from our non-GAAP financial measures and are no longer providing guidance since we are in the process of separating this business. Full-Year 2025 Guidance incorporates the financial impact of one additional calendar week for the healthcare business, which occurs every five or six years based on Masimo’s 4-4-5 fiscal calendar (incremental revenue in fiscal year 2025 from the additional week is primarily offset by ASC 842, product line removals from portfolio rationalization initiatives, and other factors). Financial guidance includes forward-looking non-GAAP financial measures for which reconciliations to the most directly comparable GAAP financial measures are not available without unreasonable efforts. See “Forward-Looking Non-GAAP Financial Measures” on slide 2, which identifies the information that is unavailable without unreasonable efforts and provides additional information. It is probable that forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures. Guidance does not include any use of proceeds from the potential sale of Sound United.

Appendix GAAP to Non-GAAP Reconciliations 14

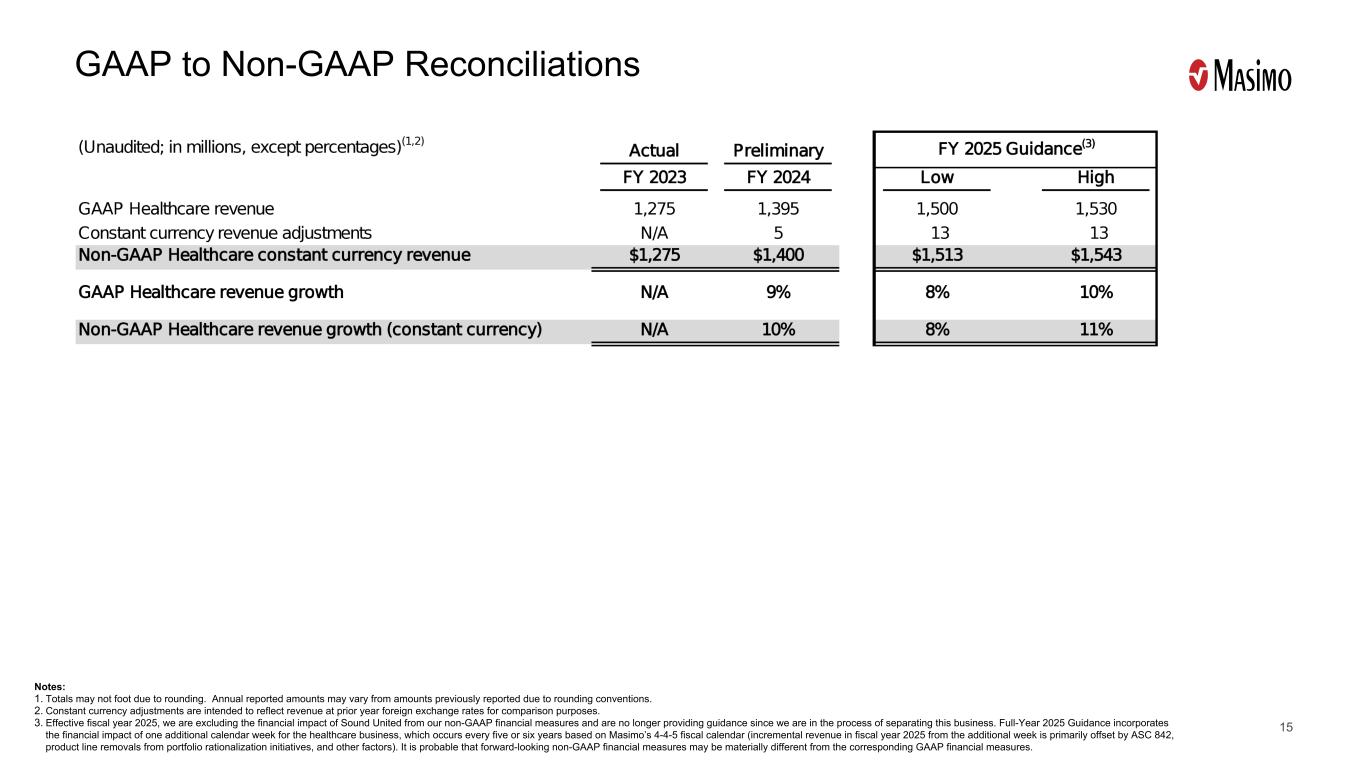

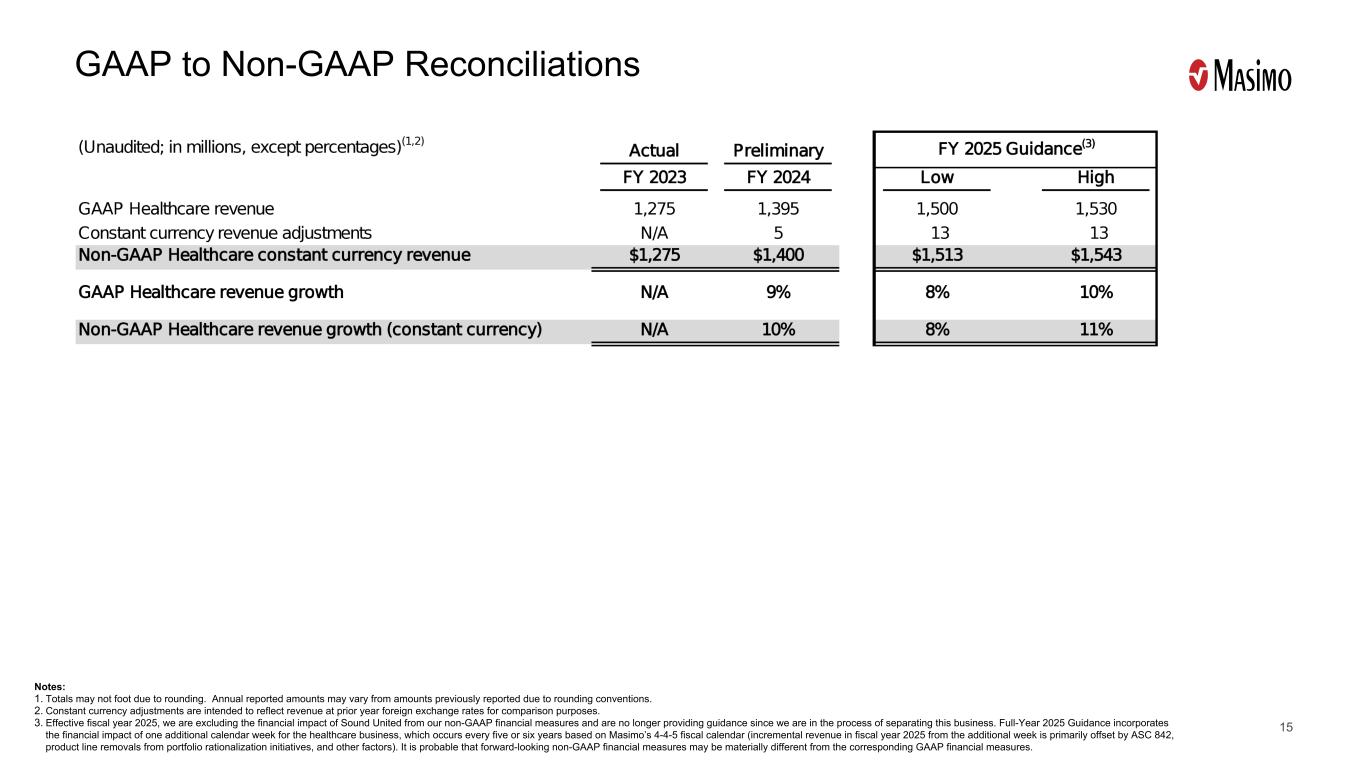

146 26 31 73 74 76 246 208 209 16520 9164 197 36 42 148 149 152 GAAP to Non-GAAP Reconciliations Notes: 1. Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conventions. 2. Constant currency adjustments are intended to reflect revenue at prior year foreign exchange rates for comparison purposes. 3. Effective fiscal year 2025, we are excluding the financial impact of Sound United from our non-GAAP financial measures and are no longer providing guidance since we are in the process of separating this business. Full-Year 2025 Guidance incorporates the financial impact of one additional calendar week for the healthcare business, which occurs every five or six years based on Masimo’s 4-4-5 fiscal calendar (incremental revenue in fiscal year 2025 from the additional week is primarily offset by ASC 842, product line removals from portfolio rationalization initiatives, and other factors). It is probable that forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures. 15