U.S. Securities and Exchange Commission

Washington, D.C. 20549

Form 20-F

[Mark One]

[ ] Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

or

[x] Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended March 31, 2004

or

[ ] Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _____________ to _______________

Commission File Number: 0-25872

____________Plaintree Systems Inc.____________

(Exact name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant's Name Into English)

Canada

(Jurisdiction of Incorporation or Organization)

110 DeCosta St. Arnprior,Ontario, K7S 3X1, Telephone (613) 623- 3434

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Securities Exchange Act of 1934.

| Title of each class | | Name of each exchange on which registered |

| | |

| | |

Securities registered or to be registered pursuant to Section 12(g) of the Securities Exchange Act of 1934.

Common Shares, without par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Securities Exchange Act of 1934.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

90,221,634 Common Shares, without par value

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes _X_No____

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 _X_ Item 18 ____

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes _ __ No___

Table of Contents

PART I

1

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

1

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

1

ITEM 3: KEY INFORMATION

2

ITEM 4: INFORMATION ON THE COMPANY

3

ITEM 5: OPERATING AND FINANCIAL REVIEW AND PROSPECTS

12

ITEM 6: DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

20

ITEM 7: MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

28

ITEM 8: FINANCIAL INFORMATION

30

ITEM 9: THE OFFER AND LISTING

31

ITEM 10: ADDITIONAL INFORMATION

32

ITEM 11: QUANTATIVE AND QUALITIVE DISCLOSURES ABOUT MARKET RISKS

33

ITEM 12: DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

33

PART II

33

ITEM 13: DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

33

ITEM 14: MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

33

ITEM 15: CONTROLS AND PROCEDURES

34

ITEM 16A: AUDIT COMMITTEE FINANCIAL EXPERT

34

ITEM 16B: CODE OF ETHICS

34

ITEM 16C: AUDIT FEES

34

PART III

34

ITEM 17: FINANCIAL STATEMENTS

34

ITEM 18: FINANCIAL STATEMENTS

34

ITEM 19: EXHIBITS

35

SIGNATURES

35

Caution Regarding Forward Looking Information

This Form 20-F ("20-F") of the Company contains certain statements that to the extent not based on historical events, are forward-looking statements based on certain assumptions and reflect Plaintree's current expectations. Forward-looking statements include, without limitation, statements evaluating market and general economic conditions in the preceding sections, and statements regarding growth strategy and future-oriented project revenue, costs and expenditures. Actual results could differ materially from those projected and should not be relied upon as a prediction of future events. A variety of inherent risks, uncertainties and factors, many of which are beyond Plaintree's control, affect the operations, performance and results of Plaintree and its business, and could cause actual results to differ materially from current expectations of estimated or anticipated events or results. Some of these risks, uncertainties and factors include the impact or unan ticipated impact of: companies evaluating Plaintree's products delaying purchase decisions; current, pending and proposed legislative or regulatory developments in the jurisdictions where Plaintree operates; change in tax laws; political conditions and developments; intensifying competition from established competitors and new entrants in the FSO industry; technological change; currency value fluctuation; general economic conditions worldwide, as well as in China; Plaintree's success in developing and introducing new products and services, expanding existing distribution channels, developing new distribution channels and realizing increased revenue from these channels. This list is not exhaustive of the factors that may affect any of Plaintree's forward-looking statements. Plaintree undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results otherwise. Readers are cautioned not to put undue reliance on forward-looking statements. Readers should also carefully review the risks concerning the business of the Company and the industries in which it operates generally described elsewhere in this 20-F and in the other documents filed from time to time with Canadian securities regulatory authorities and the United States Securities and Exchange Commission (SEC). All dollar amounts referred to herein, unless otherwise stated, are in Canadian dollars.

PART I

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

- 2 -

ITEM 3: KEY INFORMATION

A. Selected Financial Data

The selected consolidated financial data set forth below was derived from the Consolidated Financial Statements of Plaintree Systems Inc. (the "Company" or "Plaintree") presented in Canadian dollars, included elsewhere herein. All data presented below should be read in conjunction with, and is qualified in its entirety by, reference to the audited Consolidated Financial Statements and Notes thereto included in Item 17 of this Report. The Company's Consolidated Financial Statements are presented in accordance with accounting principles in Canada, which also conform in all material respects with principles generally accepted in the United States, except as disclosed in Note 19 to the audited Consolidated Financial Statements.

Summary of Financial Information |

| Year Ended March 31, |

| | 2000 | 2001 | 2002 | 2003 | 2004 |

Net Sales.... | $4,741,811 | $1,999,620 | $1,346,596 | $1,304,068 | $258,739 |

Loss from Operations | $(230,983) | $(5,077,381) | $(7,273,560) | $(3,282,886) | $(1,260,792) |

Earnings (losses) before extraordinary items.... | $1,262,440 | $(4,507,266) | $(7,322,926) | $(3,463,266) | $(710,451) |

Net assets (net book value)..... | $12,600,856 | $8,508,976 | $2,557,580 | $(905,686) | $(540,137) |

Total assets.... | $14,453,957 | $9,337,260 | $3,711,016 | $540,414 | $17,203,804 |

Capital Stock (excluding long term debt and redeemable preferred stock) | $87,839,496 | $96,189,610 | $97,561,140 | $97,561,140 | $97,561,140 |

Number of common shares outstanding | 73,216,732 | 86,059,869 | 90,221,634 | 90,221,634 | 90,221,634 |

Long term debt and capital leases.... | $7,710 | - | - | - | - |

Dividends per share.... | - | - | - | - | - |

Net earnings (loss) | $1,262,440 | $(4,507,266) | $(7,322,926) | $(3,463,266) | $(710,451) |

Net earnings (loss) per share... | $0.01 | $(0.06) | $(0.08) | $(0.04) | $(0.01) |

Net earnings (loss) per share on a fully diluted basis.... | $0.01 | $(0.06) | $(0.08) | $(0.04) | $(0.01) |

Foreign currency translation

Other monetary assets and liabilities, which are denominated in currencies other than Canadian funds, are converted into Canadian dollars at fiscal year-end exchange rates, and transactions included in earnings are converted at rates prevailing during the fiscal year. Exchange gains and losses resulting from the conversion of these amounts are included in net earnings.

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

- 3 -

D. Risk Factors

The risk factors that are specific to the Company include the absence of profitable operations, the financial position of the Company, the ability of the Company to raise sufficient capital to satisfy operational cash flow requirements, dependence of the Company on proprietary technology, the attraction and retention of highly skilled employees, the establishment and the maintenance of the Company's sales force and the Company's distribution channels, the market acceptance of the Company's new products, competition, the dependence of the Company on key personnel, potential dilution, fluctuations in exchange rates and the possible infringement of the Company's intellectual property rights by third parties.

ITEM 4: INFORMATION ON THE COMPANY

A. History and Development of the Company

Incorporation

Plaintree Systems Inc. ("Plaintree" or the "Company") is the continuing company resulting from the amalgamation of CANAI Computer and Network Architecture Inc. ("CANAI"), 2879484 Canada Limited and Plaintree Systems Inc. ("Old Plaintree") under the Canada Business Corporations Act pursuant to Articles of Amalgamation dated May 20, 1993. The Company's Articles of Amalgamation were amended: (i) on November 27, 1997, to create 7,000 Series I convertible preferred shares (the "Series I Shares"); (ii) on April 7, 1998, to permit the directors of the Company to determine, subject to the minimum and maximum numbers set out in its articles, the number of directors of the Company and to appoint one or more additional directors until the following annual meeting of shareholders provided the number so appointed does not exceed one third the number of directors elected at the previous annual meeting; and (iii ) on June 2, 1998, to create 9,000 Series II convertible preferred shares (the "Series II Shares"). The Company's head office is located at 110 Decosta St., Arnprior, Ontario K7S-3X1.

As of the date of this document, the Company has two wholly-owned subsidiaries: (i) Plaintree Systems Corporation, a wholly-owned inactive subsidiary incorporated under the laws of the State of Delaware in June 1993; and (ii) 4178611 Canada Inc., a wholly-owned subsidiary incorporated in July 2003 under the laws of Canada. Following the incorporation of 4178611 Canada Inc., the Company transferred all of its operational assets, business and related debt to 41786411 Canada Inc. Following the transfer, 41786411 Canada Inc. continued the business and operations of the Company. The only assets retained by the Company are: (a) Targa Group Debt; (b) the Partnership Interest; (c) the intellectual property of the Company; and (d) the ownership interest in the subsidiaries. The transfer was approved by the Shareholders of the Company at the annual and special shareholders meeting held on May 6, 2003. Other than these subsidiaries listed ab ove, the Company does not hold an equity interest in any other corporation. The Company also holds a 49% minority partnership interest in an unrelated manufacturing partnership (see Item 4: A "Investment in Partnership and Related Bank Loan" for further information).

Headquartered in Arnprior, Ontario, located just outside of Ottawa, Ontario, Plaintree designs, develops and manufactures a series of infrared optical wireless transmission links. The Company's mission is to become a global leader in the field of Free Space Optics (FSO), providing a solution for the broadband access bottleneck or "Last Mile" connection problems. The Company also continues to support and sell its legacy switching products.

Recent Developments

The Company has undergone several changes over the past three years including a significant down-sizing of operations and the completion of a financial restructuring during the fiscal year ended March 31, 2004. The text set out below describes material events over the past three years of the Company.

Restructuring and Cost Cutting

In fiscal 2002, the Company anticipated the dramatic slow down in the telecommunication and wireless industries and proactively took decisive steps to ensure that it would be in a fiscal position to remain in business until the industries began to recover. Over the next following two years, these steps included the Company: reducingits work force by over 85%; completing a successful proposal toits creditors; and entering into a profitable

- 4 -

manufacturing partnership. These tough steps, combined with the critical financial support of the Company's largest shareholder, Targa Group Inc., have allowed Plaintree to survive to date.

In November of 2002, the Company filed a proposal to its creditors under theBankruptcy and Insolvency Act (Canada). This was approved by the Company's creditors on January 8, 2003, and the Company made its final payment under this arrangement in July 2003. The proposal entitled the creditors to be paid up to $0.30 on the dollar for their claims that existed on November 18, 2002. This proposal contained a basket clause that limited the amount of the total payment to creditors to $175,000, including administration fees. The Company has paid all amounts owing under the proposal and has satisfied all of its obligations thereunder.

During fiscal 2003, restructuring charges, primarily workforce reduction related, totaled $200,603. In total, 26 employees were terminated of which seven performed research and development, 10 were involved in manufacturing and nine were involved in sales and administration activities. Also, during the fiscal 2003 and 2002 time period, it became evident that the Company would not recover the cost of certain inventories reflected on its balance sheet. As a result, the Company wrote down these inventories to reflect their estimated recoverable value.

The Company also realized that in order for its FSO technology to be accepted by companies in the relevant industries, Plaintree would have to partner with a leading equipment provider. Towards the end of the fiscal year ended March 31, 2004, Plaintree was approached by a number of Multiple Service Operators (MSO) in North America that indicated serious interest in Plaintree's FSO product. These MSOs are actually the traditional Cable providers that are now moving to converge voice, video and data into one connection. At their request, Plaintree designed a specific FSO product to be mounted on the actual strand between telephone poles to allow the MSO to connect this strand to individual customer locations.

A key evaluation link installed for one of these MSOs has been operating at 350 meters for the past three months in an area prone to very high humidity, rain and fog. The link has been performing with over 99.99999% reliability and has surpassed customer expectations. The main decision point expressed by these MSOs is that Plaintree's FSO product is LED ensuring unconditional eye-safety, a wide beam and inexpensive price. To date, the Company has had limited success in selling its FSO product in this market as MSOs continue to evaluate the product.

The Company, despite its reduced work force, has continued to further develop its product lines and now offers lower priced modular FSO products that have increased performance over lastyear's offerings.

The Company continues to support its current customer base. During the past fiscal year, the Company has established new Value Added Resellers (VARs) in England, Japan and Korea, to name a few.

There were no restructuring or inventory write-downs in fiscal 2004.

Private Placement of Units

During the fiscal year ended March 31, 2002, pursuant to a subscription agreement dated December 19, 2001, the Company completed a private placement financing with Targa Group Inc. ("Targa"), the Company's principal shareholder, of 3,911,765 units of the Company at a subscription price of $0.34 per unit for aggregate gross proceeds of $1,330,000 less related issue costs of $35,970. Each unit was comprised of one common share and one warrant. Each warrant entitles the holder to acquire one common share at an exercise price of $0.51 per common share up to January 8, 2005. The financing was completed without the use of an agent and the Company has not undertaken to qualify any of the securities offered pursuant to the financing. As of the date of this document, all of the warrants remain outstanding.

Investment in Partnership and related Bank Loan

On July 15, 2003, the Company completed the acquisition of a 49% minority interest (the "Partnership Interest") for $20,000,000 in an unrelated manufacturing partnership doing business in Canada. Plaintree will not be involved in the day to day management of the Partnership. In a related transaction, Plaintree obtained a non-recourse credit facility (the "Credit Facility") from a Canadian chartered bank in the amount of $20,300,000 to fund its required $20,000,000 capital contribution to the Partnership, to cover related acquisition expenses and to fund its payment obligations under the bankruptcy and insolvency proposal approved by its creditors in July 2003. The only security

- 5 -

for the Credit Facility is the Partnership Interest itself and the Credit Facility is being repaid only from cash distributions received from the Partnership and not from Plaintree's general working capital. The Credit Facility is guaranteed by the Partnership. In order to secure the guarantee, Plaintree is required to pay 1% of cash distributions from its Partnership Interest up to a maximum of $200,000 to the Partnership. The Company anticipates generating approximately $1,100,000 of cash flow from this investment over a five year period, following which the Partnership Interest will be terminated. In the event that the partnership is unable to execute on its business plan, the availability of anticipated cash flow will be diminished. During fiscal 2004, as a result of distributions from the Partnership, Plaintree's investment in the Partnership was reduced by $4,000,000 and the Credit Facility was paid down by $4,000,000.

As part of the these transactions, Plaintree completed an internal restructuring of its operations, transferring primarily all of its business, its tangible assets (other than its intellectual property and its Partnership Interest) to a newly incorporated wholly-owned subsidiary of Plaintree, 4178611 Canada Inc. ("Newco"). Newco has also assumed all of the liabilities of Plaintree, except for its liabilities to Targa Electronics Systems Inc. (a related party of Targa) pursuant to various credit facilities and its liabilities under the Credit Facility. Newco will continue to carry on the former business of Plaintree. This transfer was approved by the shareholders of Plaintree at its annual and special meeting held on May 6, 2003.

During fiscal 2004, the Company reported a $845,730 income allocation from thePartnership. This amount is recorded as Other Income. Expenses which relate to this Partnership income allocation include Bank Loan interest ($491,392) as well as Other Partnership related expenses ($121,382) which is made up of Financing Expense ($59,217) and Guarantee Fees ($62,165).

As of March 31, 2004, a quarterly net Partnership income allocation of $69,283 was due and payable and recorded as a receivable on the Company's balance sheet.

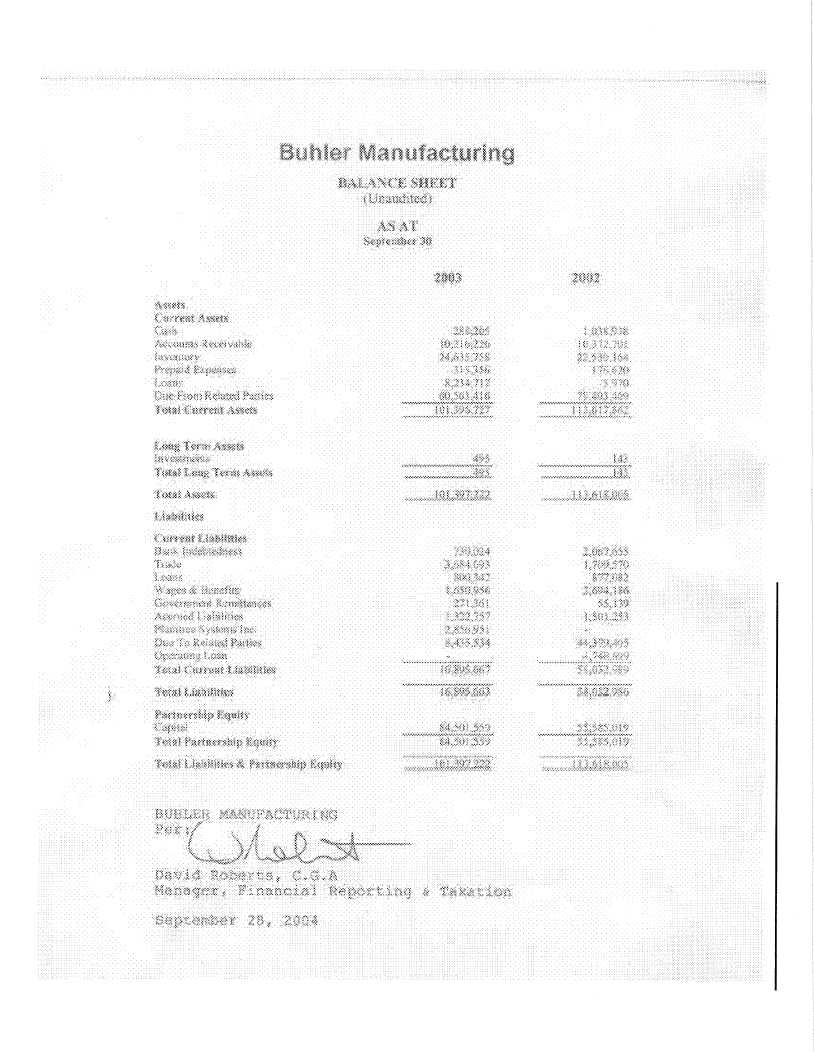

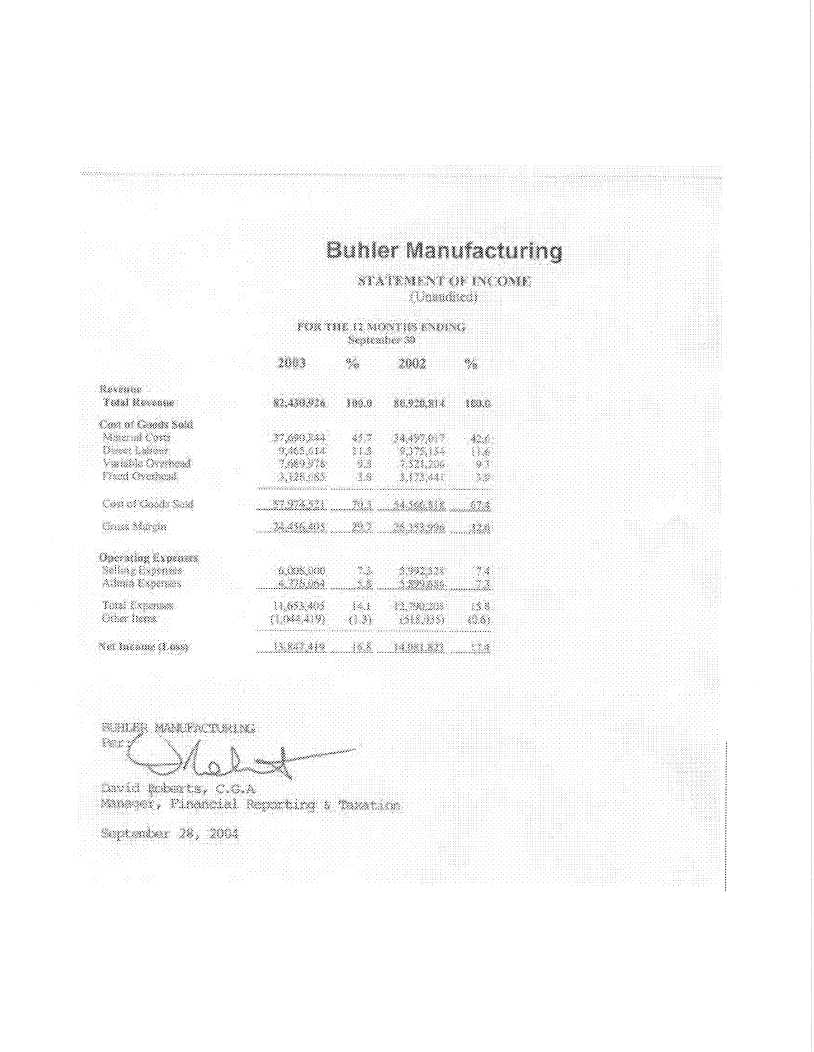

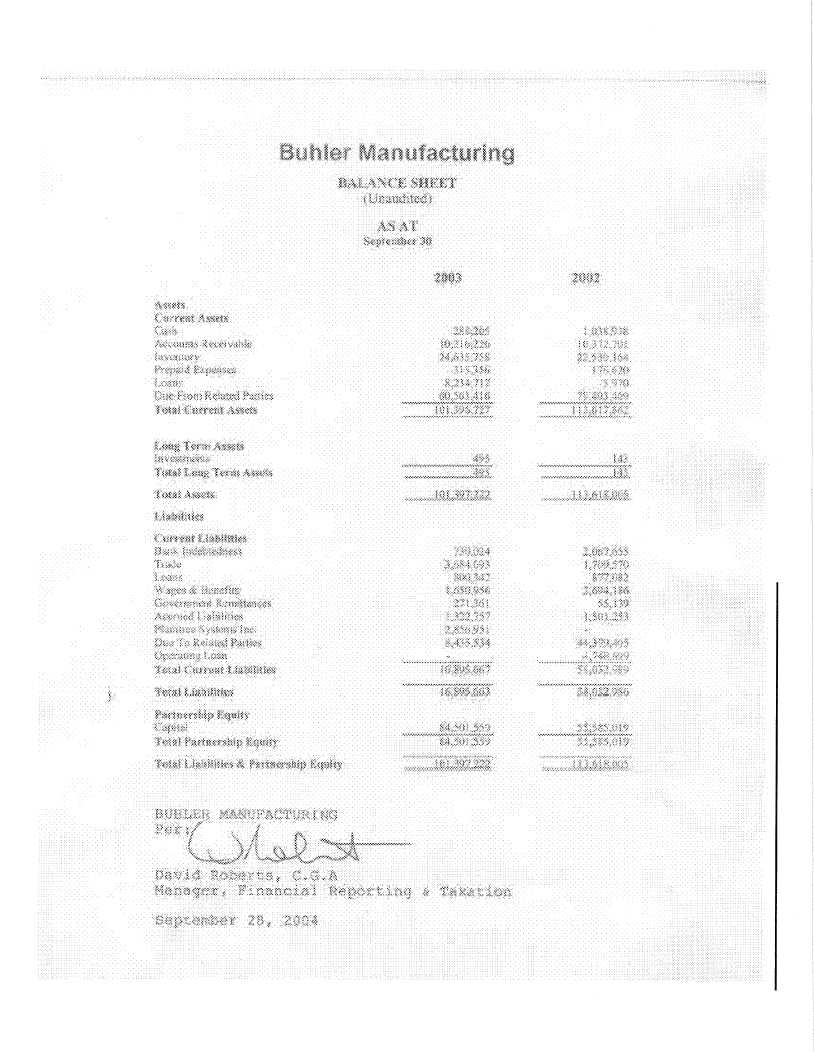

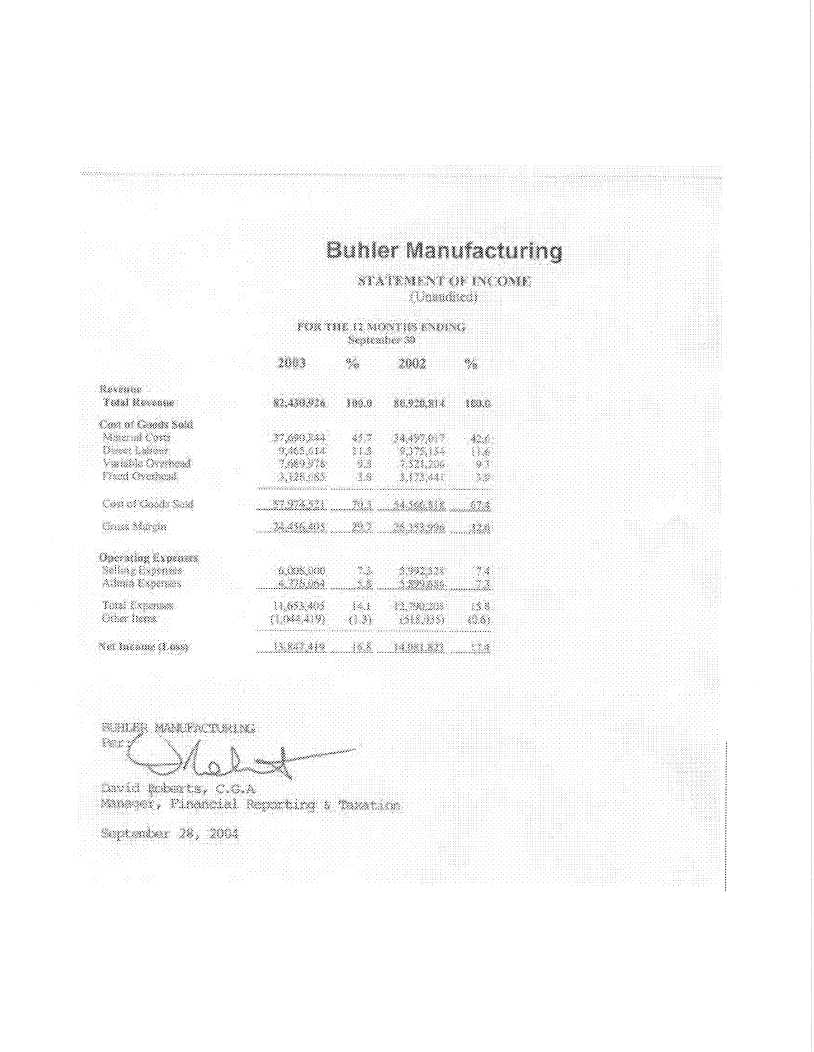

Financial information related to the Partnership for its last fiscal year ended September 30, 2003 is attached as Exhibit 2 to this 20-F.

Convertible Debenture with Related Party

On December 16, 2003, the Company completed a placement of secured convertible debentures ("Debentures") having a principal value of $900,000 to Targa. Of the $900,000 proceeds from the sale of the Debentures, $710,386 was utilized to retire outstanding credit facilities granted by Targa or its affiliates. The balance of the Debenture proceeds, $189,614, was satisfied by a cash payment by Targa to the Company. The due date for the payment of the Debentures is December 16, 2005. The Debentures are non-interest bearing until the due date and thereafter will bear 10% interest per annum until paid in full. The Debentures are secured by a general security agreement over the assets of the Company. At anytime while the Debentures are outstanding, Targa has the right to convert the amounts outstanding thereunder into Plaintree common shares at a conversion price of $0.115 per share. In the event that the full amount of the Debentures are converted, Targa will be issued 7,826,087 Plaintree common shares. The Company has the right to repay the Debenture at any time on 30 days prior notice, subject to Targa's right to convert the Debentures into Plaintree common shares.

The Company has assigned carrying amounts to the liability and equity elements of the Convertible Debenture in accordance with the substance of the contractual agreement. The Company has determined the carrying amount of the equity component based on the application of the Black-Scholes pricing model. The carrying amount of the equity component of the Convertible Debentures is $625,000 and is recorded in additional paid in capital. As at March 31, 2004, the Debentures are recorded net of a discount of $534,000 which reflects the unamortized portion of the value attributed to the equity component. The Company is amortizing this discount over the two-year term to maturity and $91,000 of amortization is included in finance and administration expenses in fiscal 2004.

November 19, 2003 Credit facility

On November 19, 2003, the board of the Company agreed to accept a loan ("Loan") from Targa of $500,000 (net of related fees). The funds advanced by Targa were the proceeds (net of related fees) received by Targa from the sale of a portion of its shares in Plaintree. The Loan is payable on demand and earns interest at a rate of prime plus 5% per annum. As a condition of the Loan, Plaintree agreed to pay for any agency fees incurred by Targa as a result of the sale of the Plaintree shares. The Loan is also secured by an already existing general security agreement over Plaintree's assets.

- 6 -

As part of the $500,000 demand loan arrangement with Targa, key shareholders of Targa, William and David Watson, who are also directors and officers of the Company, each received a total of 2,500,000 options exercisable at a share price of $0.105. The options expire on November 19, 2008. The fair value of this option grant was recorded as a financing cost and is being amortized over one year. In June 2004, David Watson agreed to return to the Company for cancellation 300,000 of the 2,500,000 options granted to him as noted above.

On December 4, 2003, the Loan was reduced by a cash payment of $189,614 from Targa in settlement of the purchase of Debentures referred to in Note 8 of the Fiscal 2004 Financial Statements. As of March 31, 2004, the total Loan amount outstanding was $318,781 ($310,386principal plus $8,395 in accumulated interest).

Leased facilities with related party

Until March 31, 2003, the Company leased facilities from a company controlled by Targa. Lease arrears, including interest of $35,705, owing to this related party amounted to $254,513. In 2003, this related party entered into a forbearance agreement with the Company whereby the Company agreed to repay the amounts owing and the related party was provided with a security interest in the form of a mortgage on the property owned by the Company. As a result of theBankruptcy and Insolvency Act proposal to creditors, the forbearance agreement is now in default and the amounts owing are due and payable, however, no enforcement proceedings have been threatened or commenced.

Salary deferrals by senior officers

Since April 1, 2002, the Company'ssenior officers havedeferred their consulting fees and salaries payable. As of March 31, 2004, these fees and salaries to senior officers of the Company, who are also majority shareholders of Targa, amounted to $383,847, plus interest charges of $21,880 for a total payable of $405,727.

Rental fees payable to Targa

During thefiscal year ended March 31, 2004, total rentexpenses of $17,000were paid to companies controlled by Targa for storage services.

Credit Facility With Related Party

Prior to the issuance of the Debentures referenced above, the Company had in place an operating credit facility with acompany controlled by Targa. This facility was secured by a general security agreement covering all assets of the Company and expired on March 25, 2003, at which time theprincipal and interest accrued was due and payable. Subsequent to March 31, 2003, a new $225,000 additional credit line was extended by Targa to the Company at 2% above the prime rate charged by the Company's bank and secured by all of the assets of the Company. Both of these credit facilities were replaced by the Debentures.

B. Business Overview

Pursuant to the Canadian Institute of Chartered Accounts' Handbook Section 1701, operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker, or decision making group, in making decisions regarding how to allocate resources and assess performance. The Company's chief operating decision maker is the Chief Executive Officer.

To date, the Chief Executive Officer has viewed the Company's operations as principally one business segment: (i) the design, development, manufacture, marketing and support of FSO products and (ii) the support of the Company's legacy computer networking products.

Overview

Plaintree designs, develops, manufactures, markets and supports infrared optical wireless transmission links and continue to support the Company's legacy switching equipment to its customers. The Company's goal is to become a global leader in the field of FSO, which is becoming the accepted terminology for optical wireless. This is based on the combined attributes of the Company's optical wireless engineering expertise with its specialization in LED (Light Emitting Diode) technology, and the solution that the optical wireless links provide to the broadband access bottleneck or the 'last mile' connection problem that currently exists.

- 7 -

Key elements of the Company's strategy to achieve this goal include developing and manufacturing a broad range of the WAVEBRIDGE FSO links to provide high-speed network connections for a variety of customers. The Company intends to continue to build a global sales presence through a network of VARs (Value Added Resellers) and VAIs (Value Added Integrators) strategically positioned around the world.

The Company's WAVEBRIDGE links send information (voice, video and data) on a beam of infrared light. These links act as a replacement for cable or fiber, thus avoiding the delay and expense of the planning and installation of wireline connections. Simplicity of installation of the WAVEBRIDGE links ensures they can be up and running in a matter of hours thus avoiding costly network downtime. These links are also an alternative to Microwave or Radio Frequency (RF) systems as they require no licensing. The high deployment densities of RF and Microwave systems are causing frequency interference and overlap problems that are not experienced by FSO systems. Optical wireless can also carry a bigger payload than RF systems, making it a very attractive solution.

Plaintree specializes in LED technology. Although FSO refers to both laser and LED technologies, laser and LED differ in many respects including eye-safety, reliability and atmospheric attenuation.

The WAVEBRIDGE links have a Class 1 eye hazard rating from the IEC (International Electrotechnical Commission) and the American National Standards Institute (ANSI), the most eye-safe rating possible. The Class 1 rating means that the WAVEBRIDGE LED links can be viewed for any length of time, with or without binoculars under all foreseeable circumstances. This is of tremendous importance as binoculars or other viewing aids are often used in the initial alignment of optical wireless equipment.

Background

Founded in 1988, Plaintree's original focus was engineering and manufacturing intelligent network switches that quickly gained a reputation for their robustness and reliability. Many of these switches continue to be in use as network backbones around the world.

As part ofa business arrangement with Targain 2000, Plaintree hired key members of Targa's management team. Shortly after the Targa Business Arrangement, Plaintree completed a strategic acquisition that positioned the Company to become a leader in the optical wireless networking market. Plaintree purchased the assets of ATS, an early entrant into the field of optical wireless communication. Established in 1985, ATS introduced its first wireless LANs in 1991, under the name FiRLAN.

Plaintree was to remain a switching manufacturer with a secondary line of optical wireless. However, the markets for Plaintree's products have changed dramatically since fiscal 2001. Switching supply has grown and demand has fallen, leading to the predictable fall in margins. Optical wireless on the other hand has a market that appears ready to grow. Plaintree decided that the interests of its shareholders would be best served by focusing management, marketing, sales, and manufacturing efforts, and financial resources in serving the optical wireless market rather than on the lower margin, highly competitive network switching market. Although Plaintree's market focus has shifted from switching to optical wireless, it continues to provide ongoing support to all of its switching customers.

Products

Plaintree offers a series of optical wireless links to meet a broad range of customer requirements. All FSO communications systems need line-of-sight for connectivity. The only factor limiting the reliability of these systems is fog. Installation planning can reduce this factor by calculating the fade margin to measure optimum distance between the links.

WAVEBRIDGE 300 Series

The 300 Series is a lightweight, easily transported design, intended for indoor use such as a small office. This is an ideal application for LEDs in particular as the units can be located near people without any concerns regarding eye hazards. It is also ideal for special events or emergency applications as set-up time is minimal and the equipment can be moved easily. This very cost-effective unit offers speeds of 10Mbps (megabits per second), covering distances

- 8 -

from 27 meters to 500 meters. The 300 Series also offers a Multiplex unit that provides a E1/T1 line in addition to the 10 Mbps line.

WAVEBRIDGE 400 Series

The 400 series is an indoor/outdoor Optical Wireless link that provides connection speeds from E1/T1 through to OC3 (155Mbps). The 400 is fully modular and has a list price of under USD $10,000, one of the most competitively priced products currently on the market.

WAVEBRIDGE 500 Series

The 500 Series is primarily an outdoor system but can also easily be mounted indoors to operate through windows. It provides a variety of connection speeds from E1/T1 through to OC3 155 (Mbps) Ethernet or a combination of both. With a range of up to 2000 meters, businesses can now eliminate the hassles of last mile connectivity and obtain high speed network connections in just a few hours. This solution is favored by Internet Service Providers (ISPs), cellular operators and information technology (IT) managers due to its reliability and rapid installation. Businesses can connect offices or create their own backbone across rivers, highways, streets or courtyards.

WAVEBRIDGE 600 Series

The 600 Series is an open protocol, full duplex system, offering speeds up to 100 Mbps Fast Ethernet/155 Mbps Asynchronous Transfer Mode (ATM) up to a range of 500 meters. This product meets the requirements of customers such as ISPs, cellular operators and enterprise customers who require bandwidth greater than 10 Mbps. This product has largely been replaced by the new higher performance 400 and 500 series.

WAVEBRIDGE WBLS

The WBLS is the newest addition to Plaintree's Free Space Optics product line. This new product line is an industry unique solution that has been designed specifically for the Multi System Operator (typically cable companies) to address the small to medium business customer. Plaintree is presently the only company in the world that has a solution for this market. The key attributes for this product are: speeds from 1 to 155Mbps, 100% eye-safe, and a wide beam for sway and vibration protection. The wide beam allows unique flexible mount options including towers, poles and cable strands. Due to the unique attributes of WBLS and its low cost, this wireless device will help establish FSO in the market.

Applications

Plaintree's range of WAVEBRIDGE optical wireless links are designed for a variety of applications and customers.

Cellular and Global System for Mobile communications (GSM) operators can connect their base stations to micro-cells using Plaintree's WAVEBRIDGE optical wireless links. The use of FSO in this application helps the cellular companies avoid the frequency interference problems in areas of high congestion. They can also avoid the expense and delay of installing a fiber line to connect a micro-cell to a base station.

ISP customers are demanding more bandwidth and the capacity to carry rich media. ISPs can use the WAVEBRIDGE links to deliver high bandwidth to business parks, MTUs (multi-tenant units), MDU (multi-dwelling units), hotels and strip malls and avoid the monthly cost of leased lines.

Businesses can connect remote buildings and create their own VPN (virtual private network). This is of particular interest to government agencies that are looking for a high degree of channel security in their network. Interception of the beam is immediately detectable by network management as it would cause interruption of the signal, immediately notifying IT managers.

Other applications include mining, manufacturing, tele-health and avionics. The abundant use of RF systems in wireless applications will continue to cause frequency interference in some areas. FSO does not require spectrum licensing and does not experience RF overlap and interference. This is of great importance in areas where frequencies are highly regulated such as airports or hospitals.

- 9 -

Marketing; Sales and Customer Support

The Company markets its products world-wide through direct sales, value added resellers (VARs), distributors and systems integrators. Notwithstanding the layoff of certain of its staff following fiscal 2002, the Company intends to re-engage and to increase the size of its marketing and sales force and revitalize distribution channels, as expected sales begin to materialize and Company resources become available. During fiscal 2004, Plaintree hired two new sales professionals to manage the growing volume of product inquiries the Company has been receiving. Plaintree's business plan includes global representation for all its optical wireless products.

Value Added Resellers (VAR's)

The Plaintree reseller program has established close working relationships with a limited number of solution providers to serve as an extended sales and support force in Canada, United States and around the world. These programs combine a selective recruitment process with a comprehensive partnering methodology, allowing Plaintree authorized resellers to promote, sell and support the WAVEBRIDGE products. The authorized Plaintree reseller program ensures that resellers are carefully selected to offer focused value-added services or solutions. They share Plaintree's commitment to customer satisfaction, and undergo extensive training to ensure they have the same world class selling and support skills as those required internally by the Company. The Company has signed contracts with greater than 40 VAR's throughout the world. Several of these VAR's have offices in multiple countries and regions.

Value Added Integrators (VAI's)

Plaintree has established a network of systems integrators who include WAVEBRIDGE products in total solutions for customers. VAI's enjoy VAR purchasing privileges, and provide increased market exposure for Plaintree.

Customer Support

The Company believes that high-quality customer service and support is essential to developing long-term relationships with its customers. Notwithstanding the layoff of 70% of its workforce following fiscal 2002, the Company continues to provide support to their customers for all of its products. This includes technical advice, trouble diagnosis and repair. Except for repair, such services are usually provided by telephone. Since replacement of failed equipment is crucial to most customers, the Company provides overnight replacements (where possible) to its customers. The Company's products typically have warranties of up to 12 months, with extended warranties also available. To date, the Company has not experienced any significant warranty claims.

Research and Product Development

The market for the Company's products is characterized by uncertain conditions in the telecommunications market, rapidly changing technology, evolving industry standards and frequent new product introductions as well as product modifications. As a result, the Company believes that its future success depends upon its ability to continue to enhance its product line and to develop new products complementary to its WAVEBRIDGE product line. As with all research and developments projects, it is difficult for the Company to predict with certainty the capital requirements or the time that will be required to bring any new products to market. The Company is presently exploring several alternative areas of research and development and the ongoing emphasis will be determined over the next few months by analysis of the potential market and the Company's available resources.

Operations

The Company's manufacturing operations are located in Arnprior, Ontario within the Ottawa region near a substantial community of high technology companies.

The Company's manufacturing operations consist primarily of quality control, final assembly and testing. The Company generally purchases components, many of which are prepared to the Company's specifications, and sorts these components into kits for subcontractors to assemble according to the Company's specifications. The final assembly of major manufactured subcomponents, quality control testing, packing and shipping to the customer are

- 10 -

performed by the Company at its manufacturing premises. Most of the Company's subcontractors and component suppliers also have their offices in the Ottawa area. These companies provide an infrastructure of services and a local pool of skilled workers and professionals.

The Company currently purchases its components and materials from a vendor base of approximately 50 different suppliers. Most of the components and materials are available from more than one supplier. Certain components such as diodes and optical chip sets, however, are available from only a single source or from limited sources, some of which require order lead times of up to 20 weeks. In general, the Company has been able to obtain adequate supplies of all components by scheduling orders over specified periods of time. In order to avoid late shipments due to delays in the manufacturing process, the Company's policy is to maintain an inventory of components, materials and assembled products in quantities sufficient to meet approximately three months of expected sales. Although the Company seeks to develop alternative sources of supply for products that are available from only one supplier, it expects that it will continue to be dependent on single or limited source supplier relationships in the future. These suppliers are generally major manufacturers.

The Company determines the geographic location of revenues based on the location of its customers. All of the Company's assets are primarily located in Canada. Product revenue in excess of 10 percent of the Company's total revenue was earned from five customers during the year ended March 31, 2004, accounting for 70% of the total. In 2003, two customers accounted for 59% of total revenue and in 2002, one customer located in the US accounted for 27 percent of total revenue.

Competition

The competitors for Plaintree are companies that produce short-haul wireless connectivity products which include RF, Microwave and FSO companies. FSO has significant advantages over radio-based systems for certain markets, defined by range, bandwidth, flexibility, ease of installation and environmental requirements. As FSO addresses some of the problems that are created by the abundant use of RF and Microwave systems, the discussion set out herein will focus on and address competing FSO companies.

The competitive landscape for FSO has approximately 18 companies that target various segments of the FSO market. Almost all of Plaintree's known FSO competition relies on laser-based transmitters, with eye-damage risks and signal degradation problems inherent in the technology. Only Plaintree's WAVEBRIDGE LED solution is certified to be the highest eye-safe Class 1 by the International Electrotechnical Commission. Some customers have eliminated all laser-based systems for safety concerns alone, and eye safety will become a major concern for residential and all indoor use.

The companies listed below use laser technology as opposed to Plaintree's LED technology.

Two of the larger FSO companies, AirFiber Inc. and Terabeam Corp., did focus on mesh network applications, involving several device installations and the cost of acquisition, installation and maintenance make these systems more appropriate to large carriers, and very large enterprises. Airfibre has ceased to exist and Terrabeam is now changing its product line. The systems are high-end (622 Mbps and higher), short range products.

fSONA Communications Corporation, a Canadian competitor, has laser equipment that provides data rates up to 1.25 Gbps (Gigabit Ethernet, OC-24).

Optical Access Inc. of Denver, Colorado, supplies optical wireless and IP switching and routing solutions using a mesh topology.

LightPointe Communications Inc. of San Diego, California, provides a range of scaleable FSO products including 10 Mbps, 20 Mbps, 155 Mbps, 622 Mbps and 1.25 Gbps.

Other competitors include PAV Data Systems Ltd. in the United Kingdom and Canon Europa, of Amsterdam, Netherlands.

Management of Plaintree, through discussions with customers and VARs, believes that the largest market segment in the FSO market is for units capable of speeds of E1/T1 (i.e. 2 Mbps), with migration to 10 Mbps and 100/155

- 11 -

Mbps. Plaintree appears to be the one of few FSO companies that has targeted the high-volume, lower-cost, lower bandwidth market.

The Company believes its WAVEBRIDGE LED optical wireless links offer a very competitive alternative to the laser products offered by its competitors. However, there can be no assurance that the Company's competitors will not succeed in developing products which are more effective than any that are being developed by the Company, or which would render the Company's technologies and products obsolete and non-competitive. In addition, many of the Company's competitors are significantly larger and have longer operating histories, greater name recognition and substantially greater financial, technical, personnel, research and development, marketing and other resources than the Company. The Company expects competition to persist, intensify and increase results or financial condition. As well, such companies may have a better ability to withstand a prolonged downturn in the telecommunications market than the Company.

Intellectual Property

The Company principally relies on copyright, trade secret and contract law to protect its proprietary technologies. It may be possible for a third party to copy or otherwise obtain and use the Company's products or technologies without authorization, or to develop similar technologies independently and there can be no assurance that such measures are adequate to protect the Company's proprietary technologies. In addition, the Company's products may be licensed in foreign countries and the laws of such foreign countries may treat the protection of proprietary rights differently than, and may not protect the Company's proprietary rights to the same extent as do, the laws of Canada.

Although the Company appreciates the benefits of patent protection, it believes that the rapid pace of technological change in this industry makes patent protection less significant than factors such as the knowledge, ability and experience of the Company's employees, frequent product enhancements, and the timeliness and quality of support services provided by the Company. The Company also has registered trademarks in Canada and the United States.

Human Resources

As at the date of this document, the Company's total work force (including service providers) is 10 persons. All employees and service providers execute confidentiality agreements with the Company and assignments of intellectual property rights to the Company. The Company's employees are not unionized.

Facilities

The Company's manufacturing, research and development and administrative operations currently occupy approximately 6,000 square feet in the plant owned by the Company, located in Arnprior, Ontario in the Ottawa area. The Company is of the view that its premises are currently adequate for its needs.

Legal Proceedings

There currently are no known legal claims or proceedings against the Company or to which the Company is a party to.

C. Organizational Structure

See "ITEM 4, Section A. History and Development of the Company".

D. Property, Plants and Equipment

The Company's property, plant and equipment includes the land and building as stated under "Facilities" above, as well as computer and office equipment, software and furniture and fixtures (see Note 6 to he Fiscal 2004 Financial Statements).

- 12 -

ITEM 5: OPERATING AND FINANCIAL REVIEW AND PROSPECTS

A. Operating Results

The following discussion of the financial condition, changes in financial condition and results of operations of Plaintree Systems Inc. ("Plaintree" or the "Company") for the years ended March 31, 2004, 2003 and 2002 should be read in conjunction with its audited Consolidated Financial Statements and Notes for the year ended March 31, 2004 ("Fiscal 2004 Statements"). Historical results of operations, percentage relationships and any trends that may be inferred therefrom are not necessarily indicative of the operating results of any future period.All amounts are stated in Canadian dollars and are prepared in accordance with Canadian generally accepted accounting principles, which also conform in all material respects with accounting principles generally accepted in the United States, except as disclosed in Note 19 to the Fiscal 2004 Financial Statements.

About Plaintree

Located in Arnprior, Ontario, Plaintree develops and manufactures the WAVEBRIDGE series of Free Space Optical wireless links using Class 1, eye-safe LED technology providing high-speed network connections for Cable companies, ISPs, traditional Telco's, GSM or cellular operators, airports and campus networks. Acting as a replacement for cable, fiber or radio frequency systems, the WAVEBRIDGE links offer broadband access with no spectrum interference problems, and same day installation for rapid network deployment. Plaintree also supports and manufactures its existing lines of robust and user friendly network switches.

Overview

There was limited growth potential in the telecommunications and wireless industry during the fiscal year ended March 31, 2004 ("fiscal 2004"). However, interest in Plaintree's technology by potential users has continued to grow since the spring of 2003.

In the subsequent events section of the management's discussion and analysis of the Company for the year ended March 31, 2003 ("fiscal 2003"), Plaintree indicated serious interest by parties from Japan, England and Korea. To date the Ministry of Defence (UK) and Phi Co Ltd (Japan) both have ordered evaluation units, the evaluations have gone very well and their interest level remains high.

During fiscal 2004, a number of new customers began evaluating Plaintree's products, including Associated Press, Metropark Communications and Avaya Networks, (Lucent's IP Telephone and Enterprise switching company). These companies have reported excellent test results.

The largest wireless integrator in Poland has purchased Plaintree's FSO equipment and has successfully promoted the product and Plaintree has received an indication that there may be additional customer orders to follow in the near future. Orascom (the largest Middle Eastern GSM Company) is in the final product testing stages with Plaintree's FSO equipment and has indicated that a large volume order may follow in the future. Other companies evaluating our product are located in Serbia, Czech Republic and the US.

Towards the end of fiscal 2004, Plaintree was approached by a number of Multiple Service Operators (MSO) in North America that indicated serious interest in Plaintree's FSO product. These MSOs are actually the traditional Cable providers that are now moving to converge voice, video and data into one connection. At their request, Plaintree designed a specific FSO product to be mounted on the actual strand between telephone poles to allow the MSO to connect this strand to individual customers locations.

A key evaluation link installed for one of these MSOs has been operating at 350 Meters for the past three months in an area prone to very high humidity, rain and fog. The link has been performing with over 99.99999% reliability and has surpassed customer expectations. The main decision point expressed by these MSOs is that Plaintree's FSO product uses LED technology, ensuring unconditional eye-safety, a wide beam and inexpensive price.

- 13 -

Plaintree cautions readers that an expression of interest from a customer does not necessarily lead to a firm order for products.

Throughout fiscal 2004, Plaintree has continued its policy of fiscal conservatism maintaining its streamlined workforce while recruiting two sales professionals to manage the growing volume of product inquiries Plaintree is now receiving.

Current Products and Market Overview

The WAVEBRIDGE series of optical wireless systems uses LED (light-emitting diode) technology to provide a local and wide area networking alternative to wire line, fiber, leased circuits, and radio wave (RF) data solutions. A WAVEBRIDGE link is transparent, replicating at the remote site the exact signal it receives from the network. The WAVEBRIDGE series of products can be used as a bridge to extend, overbuild, or replace conventional cabling systems. The WAVEBRIDGE system can also be used to transport data, voice, and video information among computer workstations, file servers, PBX's, and printers either in the same office or between office buildings. Implementing the WAVEBRIDGE series technology offers various advantages including seamless replacement for cables or fiber, IEC (International Electrotechnical Commission) Class 1, eye safety under all reasonably foreseeable conditions, ease of installation and relocation, currently no regulatory licensing required and an estimated MTTF (Mean Time To Failure) in excess of 17 years.

Very few FSO companies specialise in LED systems, the vast majority have chosen Laser Systems. The Company has based its decision to go LED on the fact that only LED systems are 100% eye safe under any condition and they feel that this is going to become a major decision for customers of FSO. The Company feels that the other advantages of LED, such as ease of installation and low cost, offset the one disadvantage, that the fastest speeds you can drive an LED Diode is 155Mbps. It is the Company's view that the largest market for FSO is at speeds of 155Mbps or less and will be for a number of years to come.

After the recent period of retraction in the telecommunication markets, it is the Company's belief that the demand for wireless access and bandwidth is about to increase. The popularity of Wi-Fi, internet high speed and increases in cell phone functions will drive this growth.

The risk the Company faces, along with most other telecommunication companies, is ensuring that cash flows are sufficient to allow the company to continue and remain competitive until the markets begin this expected growth phase. To this end, as described below, the Company has lowered its operating costs dramatically and will strive to keep these costs low until the sales level warrants operating increases.

Selected Financial Information

The Company's consolidated financial statements are stated in Canadian dollars and are prepared in accordance with Canadian generally accepted accounting principles, which also conform in all material respects with accounting principles generally accepted in the United States, except as disclosed in note 19 to the Fiscal 2004 Financial Statements.

As stated in Note 1 to the Fiscal 2004 Financial Statements, the financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. However, there is substantial doubt about the Company's ability to continue as a going concern because of the Company's losses during the past year of $710,451, a working capital deficit, and an accumulated deficit of $98,730,202 as at March 31, 2004. The Company's continued existence is dependent upon its ability to raise additional capital, to increase sales and ultimately become profitable.

The Company believes that future funding and certain sales-related efforts will provide sufficient cash flow for it to continue as a going concern in its present form. However, there can be no assurances that the Company will achieve such results and to date, the Company has not secured such funding either through an equity investment or strategic partnership.

The following table sets forth selected financial information from the Company's Fiscal 2004 Financial Statements.

- 14 -

Statement of Operations Data |

($000s, except per share data) | | | | |

| | Fiscal Year 2004 | Fiscal Year 2003 | Fiscal Year 2002 |

Revenue | | $259 | $1,304 | $1,347 |

Operating loss | | (1,261) | (3,283) | (7,273) |

Net loss | | (711) | (3,463) | (7,323) |

Basic and diluted loss per share | | $(0.01) | $(0.04) | $(0.08) |

|

Balance Sheet Data |

($000s) | | | | |

| | At Mar 31, 2004 | At Mar 31, 2003 | At Mar 31, 2002 |

Total assets | | $17,204 | $540 | $3,711 |

Total liabilities | | 17,744 | 1,446 | 1,153 |

Long-term liabilities | | nil | nil | nil |

Cash dividends declared per share | | nil | nil | nil |

In July, 2003 the Company acquired a 49% interest in a general manufacturing partnership ("Partnership") for $20,000,000. The acquisition was financed through the credit facility (bank loan) referred to in Note 7 to the Fiscal 2004 Statements. This Partnership interest was reduced to $16,000,000 by March 31, 2004, as a result of distributions from the Partnership during fiscal 2004. The Company is required to pay to the bank as loan repayments, 94.5% of the cash distributions it receives from the Partnership until the bank loan is paid in full. In fiscal 2004, the Company reported $845,730 of Partnership income from distributions received from the Partnership. Also recorded was Bank loan interest of $491,392 and Other Partnership related expenses of $121,382, which is made up of Financing expense ($59,217) and Guarantee fees ($62,165). As of March 31, 2004, a quarterly net Partnership income allocation of $69,283 was due and payable and recorded as a rec eivable on the Company's balance sheet. See also Exhibit 2 to this 20-F for further information regarding the Partnership.

- 15 -

Results of Operations

| | | | |

($000s, except per share and % amounts) | Fiscal Year | | Change from Fiscal |

| | 2004 | 2003 | 2002 | | 2003 to 2004 | 2002 to 2003 |

Revenue | | $259 | $1,304 | $1,347 | | $(1,045) | $(43) |

Cost of revenue | | 36 | 199 | 656 | | (163) | (457) |

Gross margin | | 223 | 1,105 | 691 | | (882) | 414 |

| | 86.2% | 84.7% | 51.3% | | | |

Operating expenses: | | | | | | | |

Sales & marketing | | 454 | 756 | 2,794 | | (302) | (2,038) |

Finance & administration | | 606 | 583 | 970 | | 23 | (387) |

Research & development | | 424 | 766 | 2,095 | | (342) | (1,329) |

Restructuring | | - | 201 | | | (201) | 201 |

Write-down of inventory | | - | 2,082 | 1,363 | | (2,082) | 719 |

Write-down of intangibles | | - | - | 742 | | - | (742) |

| | 1,484 | 4,388 | 7,965 | | (2,904) | (3,576) |

Loss from operations | | (1,261) | (3,283) | (7,273) | | 2,022 | 3,990 |

Interest (expense) income | | (68) | (55) | 65 | | (13) | (120) |

Other income (loss) | | 385 | (125) | (115) | | 510 | (10) |

Partnership income | | 846 | | | | 846 | |

Other partnership expenses | | (121) | | | | (121) | |

Bank loan interest | | (492) | | | | (492) | |

Net loss | | $(711) | $(3,463) | $(7,323) | | $2,752 | $3,860 |

| | | | | | | |

Basic and diluted loss per share | | $(0.01) | $(0.04) | $(0.08) | | $0.03 | $0.04 |

Revenues

Product and service revenue

Total product and service revenue for fiscal 2004 was $258,739 as compared to $1,304,068 in fiscal 2003 and $1,071,596 in fiscal 2002. Product and service revenue decreased from fiscal 2003 to fiscal 2004 by $1,045,329 primarily due to continued weak demand for telecommunications and wireless products resulting in revenues being below expectations. It is important to note that the majority of fiscal 2004 revenues were the result of the sale of evaluation units to potential repeat customers such as Rapid IR, PHI CO and Gesto. There was no Management service revenue in fiscal 2004 or fiscal 2003 due to the expiration of the contract with Targa entered into in fiscal 2000. $275,000 of Management service revenue was recorded in fiscal 2002.

Gross Margin

Gross margin from product and service revenue for fiscal 2004 was 86.2% compared to 84.7% in fiscal 2003 and 51.3% in fiscal 2002. In fiscal 2004 and 2003, the high gross margin was a result of the sale of legacy products that had been previously written off from inventory. The Company expects that its current and future WAVEBRIDGE high speed optical wireless products will represent a greater portion of the Company's revenues in the future and that gross margins will return to the range of 30-50% as experienced in fiscal 2002.

Operating Expenses

Sales and marketing expenses

Sales and marketing expenses were $453,718, $756,414 and $2,794,261 in fiscal 2004, 2003 and 2002, respectively. These expenses consisted primarily of personnel and related costs associated with the Company's sales and

- 16 -

marketing departments, which include sales commissions, advertising, travel, trade shows and other promotional activities.

The decrease of $302,696 in sales and marketing expenses from fiscal 2003 to fiscal 2004 and the decrease of $2,037,847 from fiscal 2002 to fiscal 2003 were due to major cutbacks in the international sales force and marketing initiatives in response to the decreased revenue levels experienced by the Company.

Finance and administration expenses

Finance and administrative expenses were $605,764, $583,303 and $970,440, in fiscal 2004, 2003 and 2002, respectively. Finance and administration expenses consist primarily of costs associated with managing the Company's finances, which include financial staff, legal and audit activities as well as the amortization of capital assets. During fiscal 2004, finance and administrative expenses also included the amortization of deferred charges of $164,368 and amortization of the fair value assigned to the equity component of convertible debentures of $91,000 (see Note 5 and Note 8 to the fiscal 2004 financial statements). These additional amortization costs totaling $255,358 mainly related to the fair value of stock options granted and the fair value assigned to the equity component of convertible debentures, based on the application of the Black-Scholes pricing model.

Finance and administrative expense increased by $22,461 during fiscal 2004 as compared to fiscal 2003. Prior to the amortization charge of $255,358 stated above, finance and administration expenses decreased from fiscal 2003 to fiscal 2004 by $232,897 which was due to the reduction in personnel and other finance and administrative expenses. The decrease of $387,137 in finance and administration expenses from $970,440 in fiscal 2002 to 583,303 in fiscal 2003 was primarily attributable to a reduction in personnel.

Research and development expenses

Research and development expenses were $424,431, $765,472 and $2,094,823, in fiscal 2004, 2003 and 2002, respectively. Research and development expenditures consist primarily of software and hardware engineering personnel expenses, subcontracted research and development costs and costs associated with equipment and facilities.

The decrease in research and development expenses by $341,041 from fiscal 2003 to fiscal 2004 and the decrease of $1,329,351 from fiscal 2002 to fiscal 2003 were predominately related to the reduction in personnel.

Write-down of Inventory

There was no inventory write-down during fiscal 2004. During fiscal 2003, after reviewing the remaining switch and certain WAVEBRIDGE product inventory, management determined this inventory should be written down to reflect its estimated recoverable values resulting from the extensive redesign of the product line. This resulted in a $2,081,792 charge against income in fiscal 2003. Accordingly, the revised WAVEBRIDGE product line represents 100% of the inventory as at March 31, 2003. During fiscal 2002, there was a similar write-down of obsolete inventory in the amount of $1,362,840.

Write-down of Intangible assets

During fiscal 2002, the Company wrote off intangible assets in the amount of $742,538.

Interest Income (Expense) and Other

Combined Interest and Other Income went from a loss of $180,380 in fiscal 2003 to an income gain of $317,385 in fiscal 2004. This $497,765 positive change in Interest Income and Other was primarily due to the $371,395 gain realized during fiscal 2004 on the settlement of claims and debts of the unsecured creditors of the Company pursuant to the BIA proposal completed. Also, no loss on disposal of capital assets was recorded during fiscal 2004 as compared to the loss recorded during fiscal 2003 of $113,805.

- 17 -

Combined Interest and Other Income increased from a loss in fiscal 2002 of $49,366 to a loss in fiscal 2003 of $180,380. This increase was primarily due to the loss on disposal of capital assets, the effect of lower cash balances and an increase in interest expense incurred on lease arrears and credit facilities

Partnership income, Other partnership related expenses and Bank loan interest

In fiscal 2004, the Company recorded Partnership income allocations of $845,730. Also recorded was Bank loan interest of $491,392 and Other Partnership related expenses of $121,382, which is made up of Financing expense ($59,217) and Guarantee fees ($62,165). See also Exhibit 2 to this 20-F for further information regarding the Partnership.

Net Loss

The net loss for fiscal 2004 was $710,451 or $0.01 per share as compared to a net loss of $3,463,266 or $0.04 per share in fiscal 2003 and $7,322,926 or $0.08 per share in fiscal 2002.

The fiscal 2004 net loss was significantly lower than experienced in fiscal 2003 largely due to the one time restructuring and inventory write-down expenses recorded in 2003 as well as management's aggressive cost cutting measures which have reduced Sales and Marketing and Research and Development expenses.

Similar cost cutting occurred in fiscal 2002 which resulted in the decrease in the net loss experienced from fiscal 2002 to fiscal 2003.

Quarterly Results

The following table sets out selected unaudited consolidated financial information for each quarter in fiscal 2004 and fiscal 2003.

| Fiscal 2004 | | Fiscal 2003 |

Quarters ended (unaudited, in $000s except per share amounts) | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | | First Quarter | Second Quarter | Third Quarter | Fourth Quarter |

Revenue | $122 | $52 | $82 | $3 | | $528 | $584 | $114 | $78 |

Operating loss | (219) | (190) | (342) | (510) | | (283) | (100) | (388) | (2,512) |

Net inc (loss) | (229) | 272 | (301) | (453) | | (285) | (1,592) | (972) | (614) |

Basic and diluted loss per share | $(0.00) | $0.00 | $(0.00) | $(0.01) | | $(0.00) | $(0.02) | $(0.01) | $(0.01) |

Fourth quarter of fiscal 2004

During the fourth quarter of fiscal 2004 revenue was $2,620 and the net loss was $452,310. Expenses increased in the fourth quarter of fiscal 2004 as compared to the third quarter mainly as a result of the amortization of deferred charges of $164,368 and amortization of the fair value assigned to the equity component of convertible debentures of $91,000 (see Note 5 and Note 8 to the fiscal 2004 statements). These additional amortization costs totaling $255,358 mainly related to the fair value of stock options granted and the fair value assigned to the equity component of convertible debentures, based on the application of the Black-Scholes pricing model.

- 18 -

B. Liquidity and Capital Resources

($000s) | Fiscal Year | | Change from Fiscal |

| 2004 | 2003 | | 2003 to 2004 |

Cash | $396 | $42 | | $354 |

Working Capital | (16,737) | (1,169) | | (15,568) |

Net cash provided by (used in): | | | | |

Operating activities | (1,043) | (626) | | (417) |

Investing activities | (16,107) | 35 | | (16,142) |

Financing activities | 17,503 | 200 | | 17,303 |

Cash

As at March 31, 2004, the Company held $395,536 in cash, an increase of $353,388 from March 31, 2003.

Working Capital

Working capital represents current assets less current liabilities. As at March 31, 2004, the Company had a working capital deficit of $16,736,693 as compared to a working capital deficit of $1,169,341 at March 31, 2003. The increase in the working capital deficit was primarily a result of the bank loan of $20,300,000 obtained by the Company in July, 2003 to fund its investment in the Partnership less $4,000,000 paid back on the loan during the year. Distributions from the partnership are being used to repay the Bank loan.

Cash used in Operating activities

Cash used in operating activities for fiscal 2004 was $1,042,958, an increase of $416,841 compared to the prior fiscal year. This increase was mainly attributable to the cash used to reduce accounts payable and accrued liabilities during fiscal 2004 relating to restructuring and relating to the payment to settle claims and debts of the unsecured creditors of the Company pursuant to the BIA proposal.

Cash used in Investing activities

Cash used in investing activities for fiscal 2004 was $16,107,011, an increase of $16,142,582 compared to the prior fiscal year. This increase was due to the Company's investment in the Partnership of $20,000,000 partially offset by Partnership distributions of $4,000,000 repaid by Plaintree during fiscal 2004.

Cash provided by Financing activities

Cash provided by financing activities for fiscal 2004 was $17,503,357, an increase of $17,303,494 compared to the prior fiscal year. This increase was due to the bank loan of $20,300,000 for the Partnership investment, partially offset by a payment of $4,000,000 from the Partnership distribution which was used to reduce the bank loan by $4,000,000. This was partially offset by the Convertible Debentures and the loan financing provided by Targa during the year in the amounts of $900,000 and $500,000, respectively. See also Item 7.B "Related Party Transactions" for further information.

Despite the financing obtained during fiscal 2004, the Company will require an additional capital infusion in order to continue to operate in its present form and continue to develop its business. In this regard, Management continues to investigate other sources of financing. There can be no assurances that the Company will be successful in obtaining required financing.

C. Research and Development and Licenses, etc.

Research and development expenditures consist primarily of software and hardware engineering personnel expenses, subcontracted research and development costs and costs associated with equipment and facilities. Research and development expenditures decreased to $424,431 for fiscal 2004 as compared to $765,472 for fiscal 2003 and

- 19 -

$2,094,823 for fiscal 2002. This decrease in expenses was predominately related to the Company's employee cuts backs and the result of reduced engineering consulting rates now available to the Company.

D. Trend Information

There was limited growth potential in the telecommunications and wireless industry during the fiscal year ended March 31, 2004 ("fiscal 2004"). However, interest in Plaintree's technology by potential users has continued to grow since the spring of 2003.

In the subsequent events section of the management's discussion and analysis of the Company for the year ended March 31, 2003 ("fiscal 2003"), Plaintree indicated serious interest by parties from Japan, England and Korea. To date the Ministry of Defence (UK) and Phi Co Ltd (Japan) both have ordered evaluation units, the evaluations have gone very well and their interest level remains high.

During fiscal 2004, a number of new customers began evaluating Plaintree's products, including Associated Press, Metropark Communications and Avaya Networks, (Lucent's IP Telephone and Enterprise switching company). These companies have reported excellent test results.

The largest wireless integrator in Poland has purchased Plaintree's FSO equipment and has successfully promoted the product and Plaintree has received an indication that there may be additional customer orders to follow in the near future. Orascom (the largest Middle Eastern GSM Company) is in the final product testing stages with Plaintree's FSO equipment and has indicated that a large volume order may follow in the future. Other companies evaluating our product are located in Serbia, Czech Republic and the US.

Towards the end of fiscal 2004, Plaintree was approached by a number of Multiple Service Operators (MSO) in North America that indicated serious interest in Plaintree's FSO product. These MSOs are actually the traditional Cable providers that are now moving to converge voice, video and data into one connection. At their request, Plaintree designed a specific FSO product to be mounted on the actual strand between telephone poles to allow the MSO to connect this strand to individual customers locations.

A key evaluation link installed for one of these MSOs has been operating at 350 Meters for the past three months in an area prone to very high humidity, rain and fog. The link has been performing with over 99.99999% reliability and has surpassed customer expectations. The main decision point expressed by these MSOs is that Plaintree's FSO product is LED ensuring unconditional eye-safety, a wide beam and inexpensive price.

Plaintree cautions readers that an expression of interest from a customer does not necessarily lead to a firm order for products.

Throughout fiscal 2004, Plaintree has continued its policy of fiscal conservatism maintaining its streamlined workforce while recruiting two sales professionals to manage the growing volume of product inquiries Plaintree is now receiving.

E. Off-Balance Sheet Arrangement

Investment in Partnership and related Bank Loan

On July 15, 2003, the Company completed the acquisition of a 49% minority interest (the "Partnership Interest") for $20,000,000 in an unrelated manufacturing partnership doing business in Canada. Plaintree will not be involved in the day to day management of the partnership. In a related transaction, Plaintree obtained a non-recourse credit facility (the "Credit Facility") from a Canadian chartered bank in the amount of $20,300,000 to fund its required $20,000,000 capital contribution to the Partnership, to cover related acquisition expenses and to fund its payment obligations under the proposal approved by its creditors in July 2003. The only security for the Credit Facility will be the Partnership Interest itself and the Credit Facility will be repaid only from cash distributions received from the Partnership and not from Plaintree's general working capital. The credit facility is guaranteed by the Partnership. In order to secure the gua rantee, Plaintree is required to pay 1% of cash distributions from its Partnership interest up to a maximum of $200,000 to the Partnership. The Company anticipates generating approximately $1,100,000 of cash flow from this investment over a five year period, following which the Partnership Interest will be terminated. In

- 20 -

the event that the Partnership is unable to execute on its business plan, the availability of anticipated cash flow will be diminished. During fiscal 2004, Partnership distributions in the amount of $4,000,000 were received, resulting in the credit facility being paid down by the same amount. See also Exhibit 2 to this 20-F for further information regarding the Partnership.

As part of the these transactions, Plaintree completed an internal restructuring of its operations, transferring primarily all of its business, its tangible assets (other than its intellectual property and its Partnership Interest) to a newly incorporated wholly-owned subsidiary of Plaintree, 4178611 Canada Inc. ("Newco"). Newco has also assumed all of the liabilities of Plaintree, except for its liabilities to Targa Electronics Systems Inc. pursuant to various credit facilities and its liabilities under the Credit Facility. Newco will continue to carry on the former business of Plaintree. This transfer was approved by the shareholders of Plaintree at its Annual and Special Meeting held on May 6, 2003.

F. Tabular disclosure of contractual obligations

Not Applicable.

ITEM 6: DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

A. Directors and Senior Management

Name | Position(s) with the Company | Date of Election or Appointment |

William David Watson | Director, Chairman of the Board of the Company, Vice President - - Mergers and Acquisitions | 1999 |

W. David Watson II(1)(3) | Director, Chief Executive Officer and President | 1999 |

Robert G. Shea(2) | Director | 2000 |

Jerry Vickers(1) (2) | Director | 2003 |

John Buchanan | Director | 2003 |

Girvan L. Patterson(1) (2) | Director | 2000 |

Lynn E. Saunders | Vice President of Operations | 2000 |

Jason Lee | Vice President of Business Development | 2002 |

(1) Member of the Compensation and Corporate Governance Committee.

(2) Member of the Audit Committee.

(3) David Watson II is the son of William David Watson

Set out below are profiles of the directors and officers of the Company including particulars of their principal occupations for the past five years:

WILLIAM DAVID WATSON,Chairman of the Board of Directors and Vice President, Mergers and Acquisitions. Mr. Watson was appointed Chairman of the board of directors of the Company on February 9, 2000 and Vice President, Mergers and Acquisitions, effective November 1, 1999. Since November 4, 1999, Mr. Watson has been acting as a special advisor to the Company. From October 1993 to November 1999, Mr. Watson was special advisor to Targa Group Inc., a company founded in 1993 as a vehicle for acquiring troubled companies and turning them around with a primary interest in avionics and high technology. Prior to 1993, Mr. Watson was a self-employed businessman involved with a number of corporations. Mr. Watson attended Ryerson Polytechnical Institute.

- 21 -

WILLIAM DAVID WATSON II,President, Chief Executive Officer and Director. Mr. Watson became President and Chief Executive Officer of the Company on November 4, 1999 and was appointed a director of the Company on February 9, 2000. From October 1993 to November 1999, Mr. Watson was President and Chief Executive Officer of Targa Group Inc. Prior to 1993, Mr. Watson was a tax specialist in public and private practice. Mr. Watson holds a Bachelor of Management Economics from the University of Guelph.

ROBERT E. SHEA,Director. Mr. Shea was appointed a director of the Company on May 1, 2000. Mr. Shea is currently, and for the past thirty seven years has been, Chairman of Shea Financial Group, a company engaged in the design and funding of executive compensation plans. He is also a director of Highliner Foods, Inc., SolutionInc Technologies, Ltd., New England Canada Business Council, and American Manor Enterprises Inc.; and has served on numerous boards in the past.