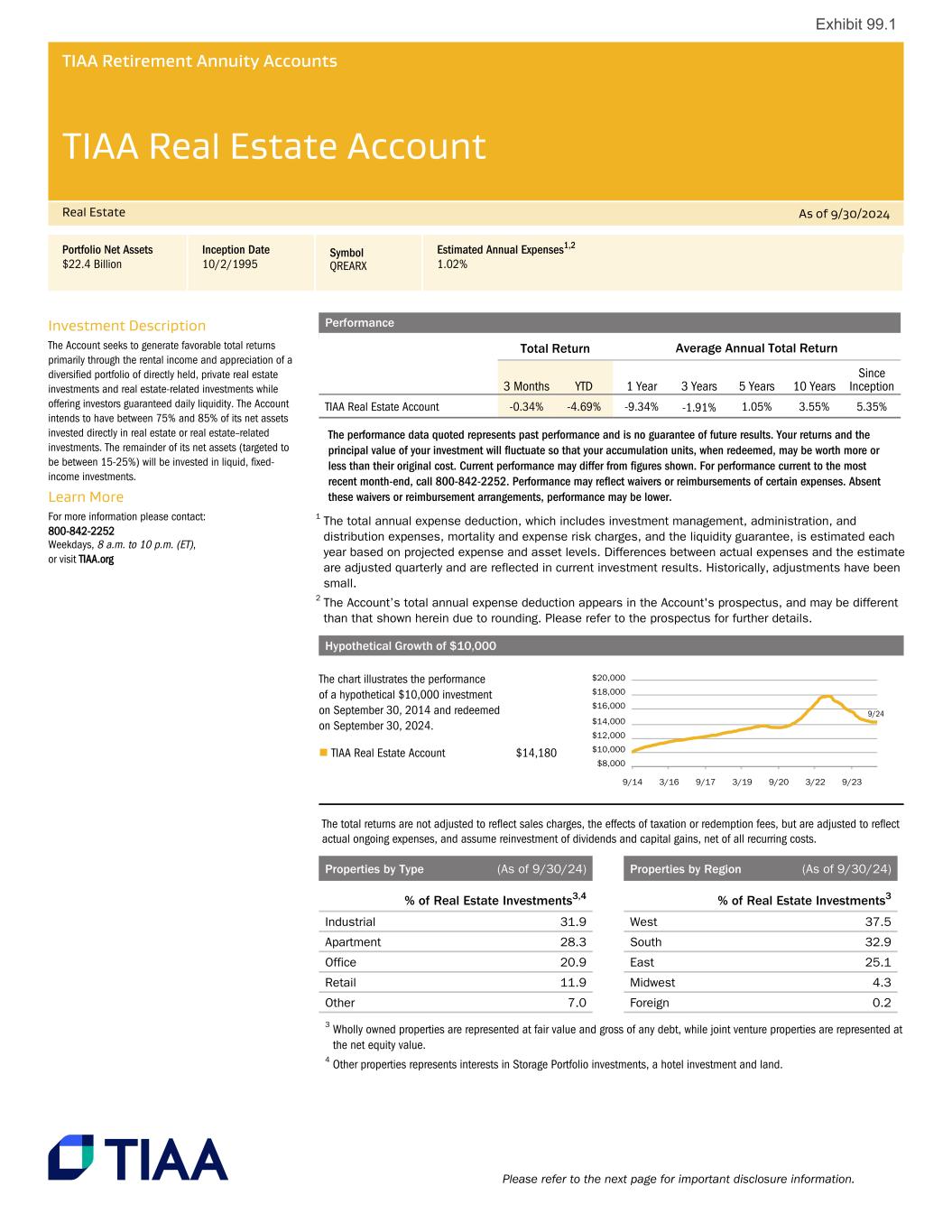

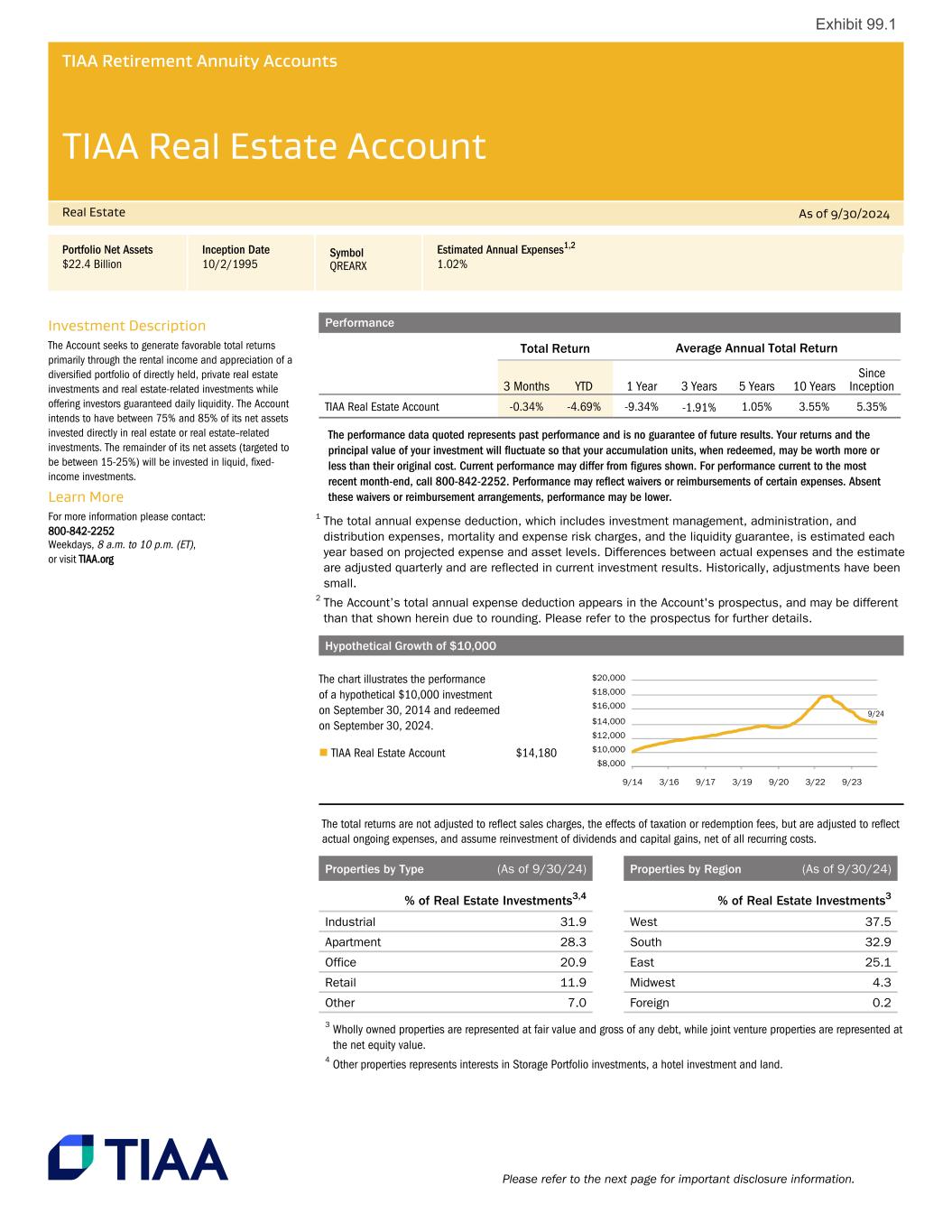

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 9/30/2024 Portfolio Net Assets Inception Date Symbol Estimated Annual Expenses1,2 $22.4 Billion 10/2/1995 QREARX 1.02% Investment Description The Account seeks to generate favorable total returns primarily through the rental income and appreciation of a diversified portfolio of directly held, private real estate investments and real estate-related investments while offering investors guaranteed daily liquidity. The Account intends to have between 75% and 85% of its net assets invested directly in real estate or real estate–related investments. The remainder of its net assets (targeted to be between 15-25%) will be invested in liquid, fixed- income investments. Learn More For more information please contact: 800-842-2252 Weekdays, 8 a.m. to 10 p.m. (ET), or visit TIAA.org Please refer to the next page for important disclosure information. Performance Total Return Average Annual Total Return 3 Months YTD 1 Year 3 Years 5 Years 10 Years Since Inception TIAA Real Estate Account -0.34% -4.69% -9.34% -1.91% 1.05% 3.55% 5.35% The performance data quoted represents past performance and is no guarantee of future results. Your returns and the principal value of your investment will fluctuate so that your accumulation units, when redeemed, may be worth more or less than their original cost. Current performance may differ from figures shown. For performance current to the most recent month-end, call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower. 1 The total annual expense deduction, which includes investment management, administration, and distribution expenses, mortality and expense risk charges, and the liquidity guarantee, is estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. 2 The Account’s total annual expense deduction appears in the Account's prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. Hypothetical Growth of $10,000 The chart illustrates the performance of a hypothetical $10,000 investment on September 30, 2014 and redeemed on September 30, 2024. n TIAA Real Estate Account $14,180 The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs. Properties by Type (As of 9/30/24) % of Real Estate Investments3,4 Industrial 31.9 Apartment 28.3 Office 20.9 Retail 11.9 Other 7.0 3 Wholly owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. 4 Other properties represents interests in Storage Portfolio investments, a hotel investment and land. Properties by Region (As of 9/30/24) % of Real Estate Investments3 West 37.5 South 32.9 East 25.1 Midwest 4.3 Foreign 0.2 Exhibit 99.1

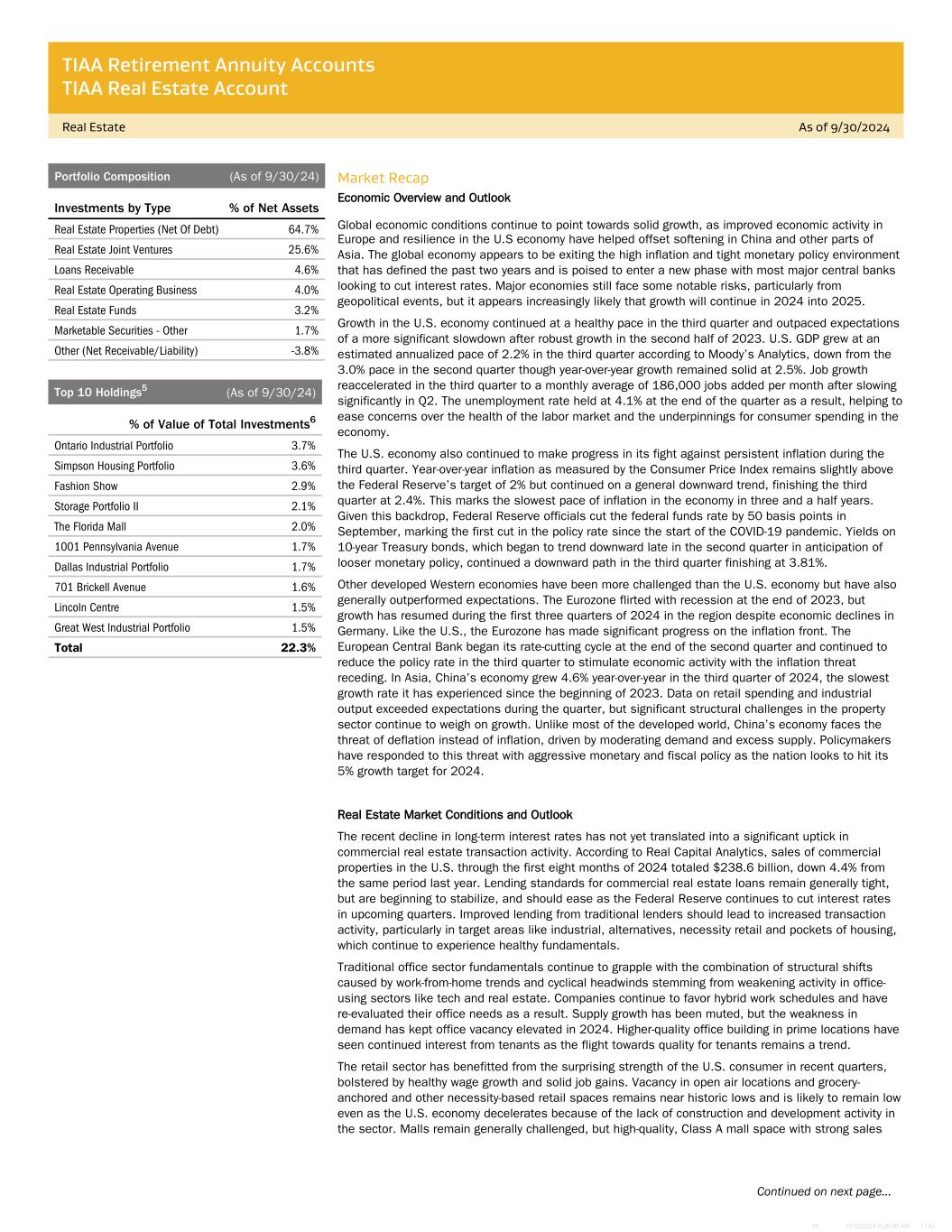

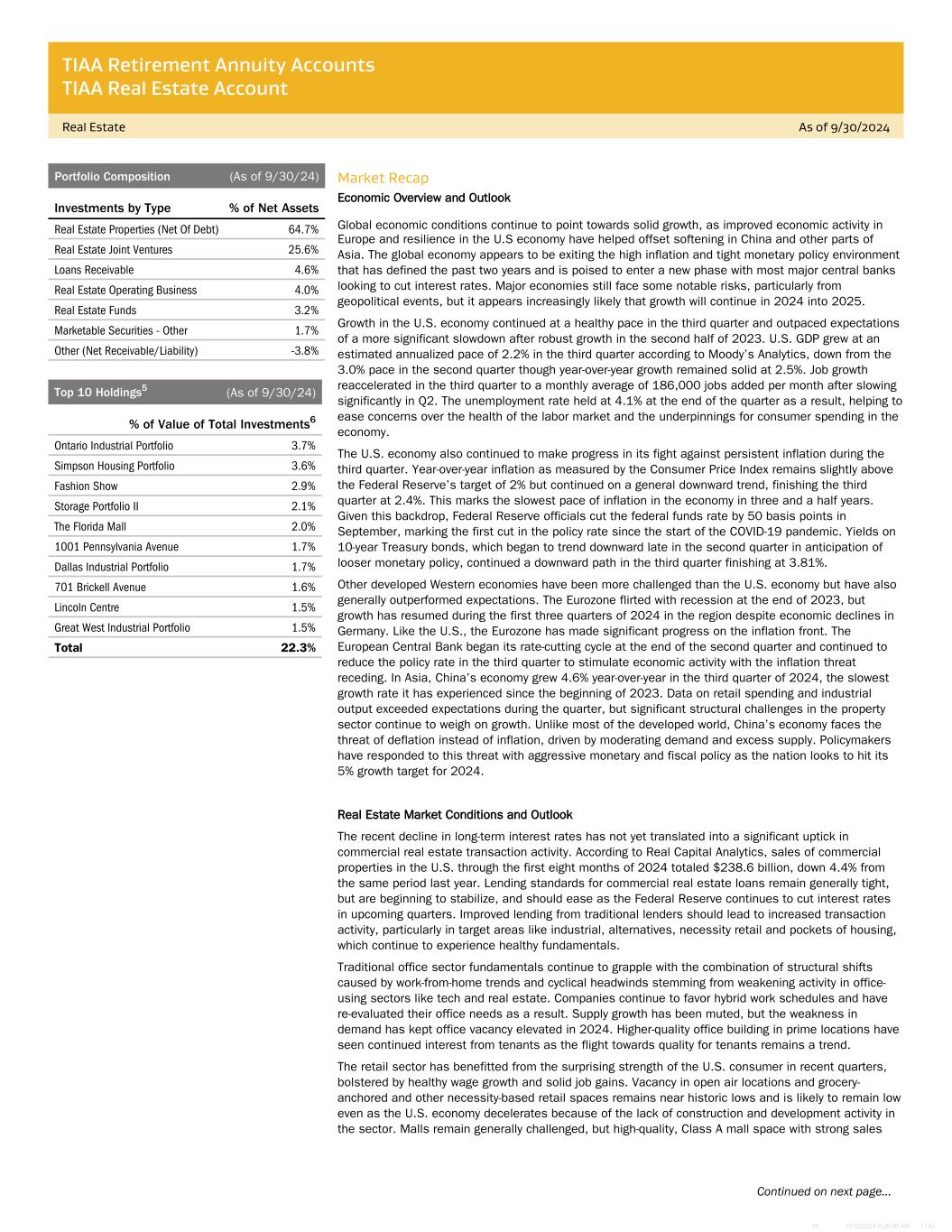

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 9/30/2024 Continued on next page... 39 10/22/2024 9:28:56 AM 7142 Portfolio Composition (As of 9/30/24) Investments by Type % of Net Assets Real Estate Properties (Net Of Debt) 64.7% Real Estate Joint Ventures 25.6% Loans Receivable 4.6% Real Estate Operating Business 4.0% Real Estate Funds 3.2% Marketable Securities - Other 1.7% Other (Net Receivable/Liability) -3.8% Top 10 Holdings5 (As of 9/30/24) % of Value of Total Investments6 Ontario Industrial Portfolio 3.7% Simpson Housing Portfolio 3.6% Fashion Show 2.9% Storage Portfolio II 2.1% The Florida Mall 2.0% 1001 Pennsylvania Avenue 1.7% Dallas Industrial Portfolio 1.7% 701 Brickell Avenue 1.6% Lincoln Centre 1.5% Great West Industrial Portfolio 1.5% Total 22.3% Market Recap Economic Overview and Outlook Global economic conditions continue to point towards solid growth, as improved economic activity in Europe and resilience in the U.S economy have helped offset softening in China and other parts of Asia. The global economy appears to be exiting the high inflation and tight monetary policy environment that has defined the past two years and is poised to enter a new phase with most major central banks looking to cut interest rates. Major economies still face some notable risks, particularly from geopolitical events, but it appears increasingly likely that growth will continue in 2024 into 2025. Growth in the U.S. economy continued at a healthy pace in the third quarter and outpaced expectations of a more significant slowdown after robust growth in the second half of 2023. U.S. GDP grew at an estimated annualized pace of 2.2% in the third quarter according to Moody’s Analytics, down from the 3.0% pace in the second quarter though year-over-year growth remained solid at 2.5%. Job growth reaccelerated in the third quarter to a monthly average of 186,000 jobs added per month after slowing significantly in Q2. The unemployment rate held at 4.1% at the end of the quarter as a result, helping to ease concerns over the health of the labor market and the underpinnings for consumer spending in the economy. The U.S. economy also continued to make progress in its fight against persistent inflation during the third quarter. Year-over-year inflation as measured by the Consumer Price Index remains slightly above the Federal Reserve’s target of 2% but continued on a general downward trend, finishing the third quarter at 2.4%. This marks the slowest pace of inflation in the economy in three and a half years. Given this backdrop, Federal Reserve officials cut the federal funds rate by 50 basis points in September, marking the first cut in the policy rate since the start of the COVID-19 pandemic. Yields on 10-year Treasury bonds, which began to trend downward late in the second quarter in anticipation of looser monetary policy, continued a downward path in the third quarter finishing at 3.81%. Other developed Western economies have been more challenged than the U.S. economy but have also generally outperformed expectations. The Eurozone flirted with recession at the end of 2023, but growth has resumed during the first three quarters of 2024 in the region despite economic declines in Germany. Like the U.S., the Eurozone has made significant progress on the inflation front. The European Central Bank began its rate-cutting cycle at the end of the second quarter and continued to reduce the policy rate in the third quarter to stimulate economic activity with the inflation threat receding. In Asia, China’s economy grew 4.6% year-over-year in the third quarter of 2024, the slowest growth rate it has experienced since the beginning of 2023. Data on retail spending and industrial output exceeded expectations during the quarter, but significant structural challenges in the property sector continue to weigh on growth. Unlike most of the developed world, China’s economy faces the threat of deflation instead of inflation, driven by moderating demand and excess supply. Policymakers have responded to this threat with aggressive monetary and fiscal policy as the nation looks to hit its 5% growth target for 2024. Real Estate Market Conditions and Outlook The recent decline in long-term interest rates has not yet translated into a significant uptick in commercial real estate transaction activity. According to Real Capital Analytics, sales of commercial properties in the U.S. through the first eight months of 2024 totaled $238.6 billion, down 4.4% from the same period last year. Lending standards for commercial real estate loans remain generally tight, but are beginning to stabilize, and should ease as the Federal Reserve continues to cut interest rates in upcoming quarters. Improved lending from traditional lenders should lead to increased transaction activity, particularly in target areas like industrial, alternatives, necessity retail and pockets of housing, which continue to experience healthy fundamentals. Traditional office sector fundamentals continue to grapple with the combination of structural shifts caused by work-from-home trends and cyclical headwinds stemming from weakening activity in office- using sectors like tech and real estate. Companies continue to favor hybrid work schedules and have re-evaluated their office needs as a result. Supply growth has been muted, but the weakness in demand has kept office vacancy elevated in 2024. Higher-quality office building in prime locations have seen continued interest from tenants as the flight towards quality for tenants remains a trend. The retail sector has benefitted from the surprising strength of the U.S. consumer in recent quarters, bolstered by healthy wage growth and solid job gains. Vacancy in open air locations and grocery- anchored and other necessity-based retail spaces remains near historic lows and is likely to remain low even as the U.S. economy decelerates because of the lack of construction and development activity in the sector. Malls remain generally challenged, but high-quality, Class A mall space with strong sales

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 9/30/2024 Continued on next page... 39 10/22/2024 9:28:56 AM 7142 density still attracts desirable tenants and outperforms the broader mall subsegment. The multifamily sector continues to experience strong demand in 2024, helping to absorb the record level of supply growth that caused vacancy rates in the sector to increase in 2023 and the first half of 2024. Elevated home prices and high mortgage rates remain impedances to home ownership and have stimulated the demand for alternatives like traditional apartments and single-family rentals. Like other sectors, construction starts for multifamily projects have slowed significantly in recent quarters, and supply growth will peak in 2024. This should translate to firming multifamily fundamentals going forward. Demand for industrial space remains subdued in 2024, driven by weakness in both manufacturing and housing activity in the U.S. economy. Solid growth in consumer spending, long-term shifts towards e- commerce, and improved import activity have helped sustain demand since the start of 2023, albeit at a pace that is well below the strength seen in 2021 and 2022. On the supply side, the amount of new industrial space completed hit a three-year low in the third quarter after record setting supply growth over the past two years. Supply growth is likely to moderate further at the end of 2024 into 2025, which should translate to stabilization in industrial vacancy rates and improved prospects for rental growth. The Account returned -0.34% in the third quarter of 2024 and -9.34% since September 30th, 2023. As a result of interest rate increases and decreased commercial property transaction volume for the reporting period, property values have been adjusted downward. The third quarter net return was negative for the eighth consecutive quarter and reflects the impact of these broader economic conditions on property valuations. While the Account has experienced valuation declines, property fundamentals remain strong and the properties within the Account are generally well positioned. Potential future investment activity will be consistent with the Account’s multi-year strategy of reducing exposure to segments characterized by high capital expenditures and anticipated underperformance, such as traditional office and retail, and increasing allocations to lower capex and anticipated outperforming sectors like industrial, housing, and alternatives. The Account’s Portfolio Management Team is particularly interested in increasing exposure to the alternatives sector, which includes property types such as self-storage, data centers, life science, medical office, and senior and student housing. Important Information 5 The commercial real property holdings listed are subject to change and may not be representative of the Account’s current or future investments. The property holdings listed are part of the Account’s long-term investments and exclude liquid, fixed-income investments and other securities held by the Account. The property holdings do not include the Account’s entire investment portfolio and should not be considered a recommendation to buy, sell or hold a particular security or other investment. 6 Real estate fair value is presented gross of debt. Investments in joint ventures are presented at net equity value. Simpson Housing Portfolio is held in a joint venture with Simpson Housing LP, in which the Account holds an 80% interest, and is presented gross of debt. As of September 30, 2024, the debt had a fair value of $384.7 million. Fashion Show is held in a joint venture with General Growth Properties, in which the Account holds 50% interest, and is presented gross of debt. As of September 30, 2024, the debt had a fair value of $417.5 million. The Florida Mall is held in a joint venture with Simon Property Group, LP, in which the Account holds a 50% interest, and is presented gross of debt. As of September 30, 2024, the debt had a fair value of $296.5 million. Storage Portfolio II is held in a joint venture with Extra Space Properties 134, LLC, in which the Account holds a 90% interest, and is presented gross of debt. As of September 30, 2024, the debt had a fair value of $165.8 million. 701 Brickell Avenue is presented gross of debt. As of September 30, 2024, the debt had a fair value of $172.0 million. Real estate investment portfolio turnover rate for the Account was 2.1% as of 9/30/2024. Real estate investment portfolio turnover rate is calculated by dividing the lesser of purchases or sales of real estate property investments (including contributions to, or return of capital distributions received from, existing joint venture and limited partnership investments) by the average value of the portfolio of real estate investments held during the period. Marketable securities portfolio turnover rate for the Account was 0.0% as of 9/30/2024. Marketable securities portfolio turnover rate is calculated by dividing the lesser of purchases or sales of securities, excluding securities having maturity dates at acquisition of one year or less, by the average value of the portfolio securities held during the period. Teachers Insurance and Annuity Association of America (TIAA), New York, NY, issues annuity contracts and certificates. This material is for informational or educational purposes only and does not constitute investment advice under ERISA, a securities recommendation under federal securities laws, or an insurance product recommendation under state insurance laws or regulations. This material is intended to provide you with information to help you make informed decisions. You should not view or construe the availability of this information as a suggestion that you take or refrain from taking a particular course of action, as the advice of an impartial fiduciary, as an offer to sell or a solicitation to buy or hold any securities, as a recommendation of any securities transactions or investment strategy involving securities (including account recommendations), a recommendation to rollover or transfer assets to TIAA or a recommendation to purchase an insurance product. In making this information available to you, TIAA assumes that

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 9/30/2024 Continued on next page... 39 10/22/2024 9:28:56 AM 7142 you are capable of evaluating the information and exercising independent judgment. As such, you should consider your other assets, income and investments and you should not rely on the information as the primary basis for making investment or insurance product purchase or contribution decisions. The information that you may derive from this material is for illustrative purposes only and is not individualized or based on your particular needs. This material does not take into account your specific objectives or circumstances, or suggest any specific course of action. Investment, insurance product purchase or contribution decisions should be made based on your own objectives and circumstances. The purpose of this material is not to predict future returns, but to be used as education only. Contact your tax advisor regarding the tax implications. You should read all associated disclosures. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC, distributes securities products. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS FOR THE TIAA REAL ESTATE ACCOUNT. PLEASE CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES, AND EXPENSES BEFORE INVESTING AND CAREFULLY READ THE PROSPECTUS. ADDITIONAL COPIES OF THE PROSPECTUS CAN BE OBTAINED BY CALLING 877-518-9161. A Note About Risks In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the TIAA Real Estate Account include the risks associated with real estate ownership including among other things fluctuations in property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with contract owner flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. ©2024 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 MFS-3418478CR-Y1223W