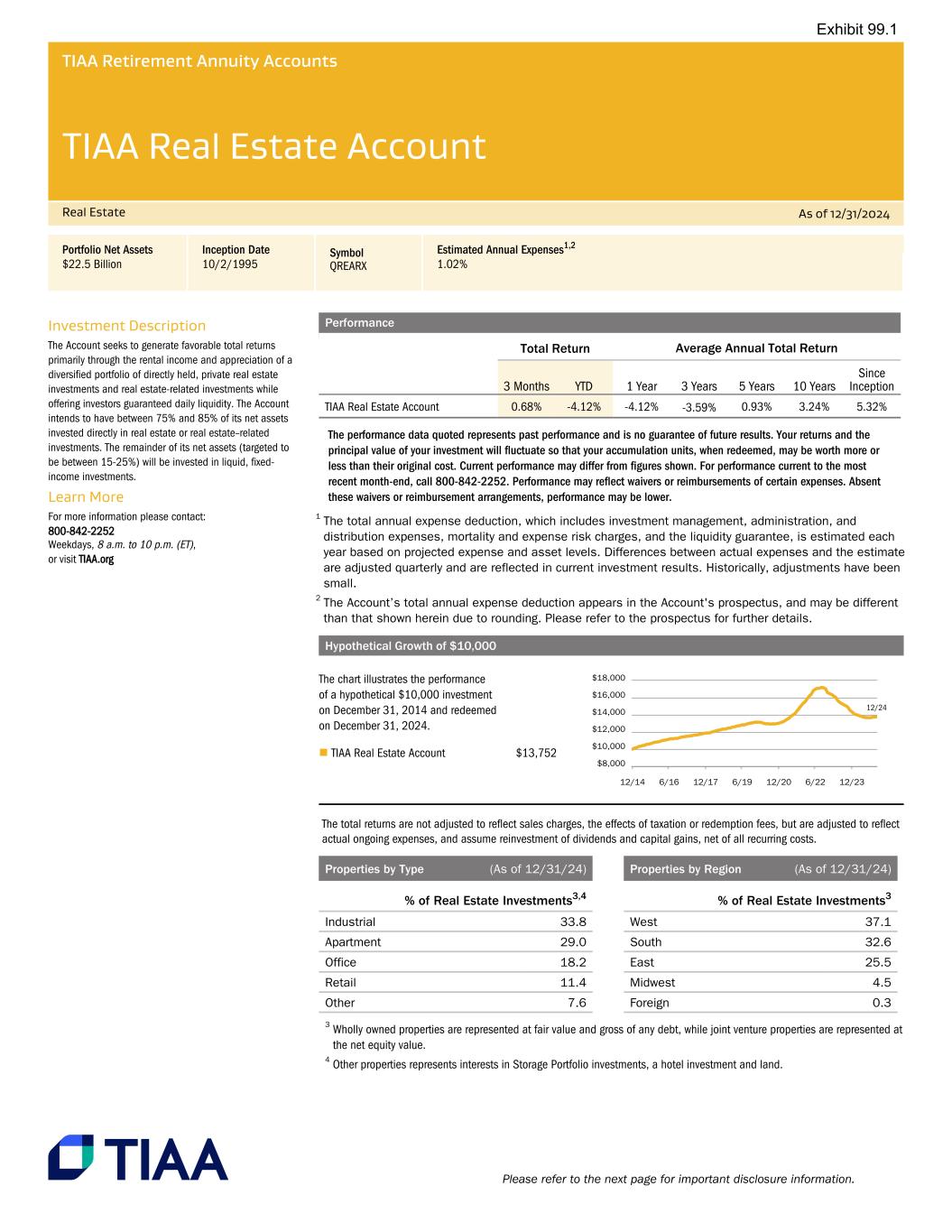

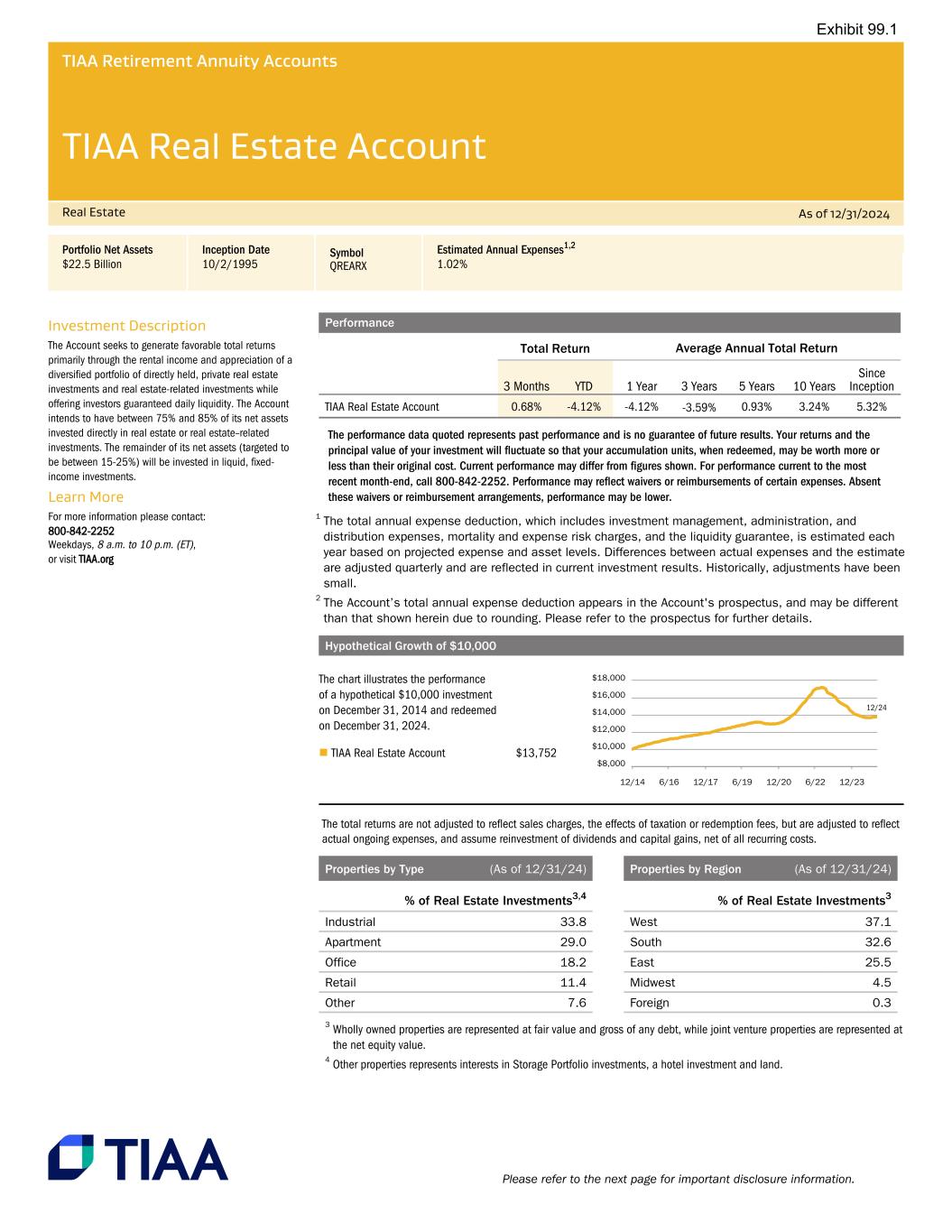

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 12/31/2024 Portfolio Net Assets Inception Date Symbol Estimated Annual Expenses1,2 $22.5 Billion 10/2/1995 QREARX 1.02% Investment Description The Account seeks to generate favorable total returns primarily through the rental income and appreciation of a diversified portfolio of directly held, private real estate investments and real estate-related investments while offering investors guaranteed daily liquidity. The Account intends to have between 75% and 85% of its net assets invested directly in real estate or real estate–related investments. The remainder of its net assets (targeted to be between 15-25%) will be invested in liquid, fixed- income investments. Learn More For more information please contact: 800-842-2252 Weekdays, 8 a.m. to 10 p.m. (ET), or visit TIAA.org Please refer to the next page for important disclosure information. Performance Total Return Average Annual Total Return 3 Months YTD 1 Year 3 Years 5 Years 10 Years Since Inception TIAA Real Estate Account 0.68% -4.12% -4.12% -3.59% 0.93% 3.24% 5.32% The performance data quoted represents past performance and is no guarantee of future results. Your returns and the principal value of your investment will fluctuate so that your accumulation units, when redeemed, may be worth more or less than their original cost. Current performance may differ from figures shown. For performance current to the most recent month-end, call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower. 1 The total annual expense deduction, which includes investment management, administration, and distribution expenses, mortality and expense risk charges, and the liquidity guarantee, is estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. 2 The Account’s total annual expense deduction appears in the Account's prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. Hypothetical Growth of $10,000 The chart illustrates the performance of a hypothetical $10,000 investment on December 31, 2014 and redeemed on December 31, 2024. n TIAA Real Estate Account $13,752 The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs. Properties by Type (As of 12/31/24) % of Real Estate Investments3,4 Industrial 33.8 Apartment 29.0 Office 18.2 Retail 11.4 Other 7.6 3 Wholly owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. 4 Other properties represents interests in Storage Portfolio investments, a hotel investment and land. Properties by Region (As of 12/31/24) % of Real Estate Investments3 West 37.1 South 32.6 East 25.5 Midwest 4.5 Foreign 0.3 Exhibit 99.1

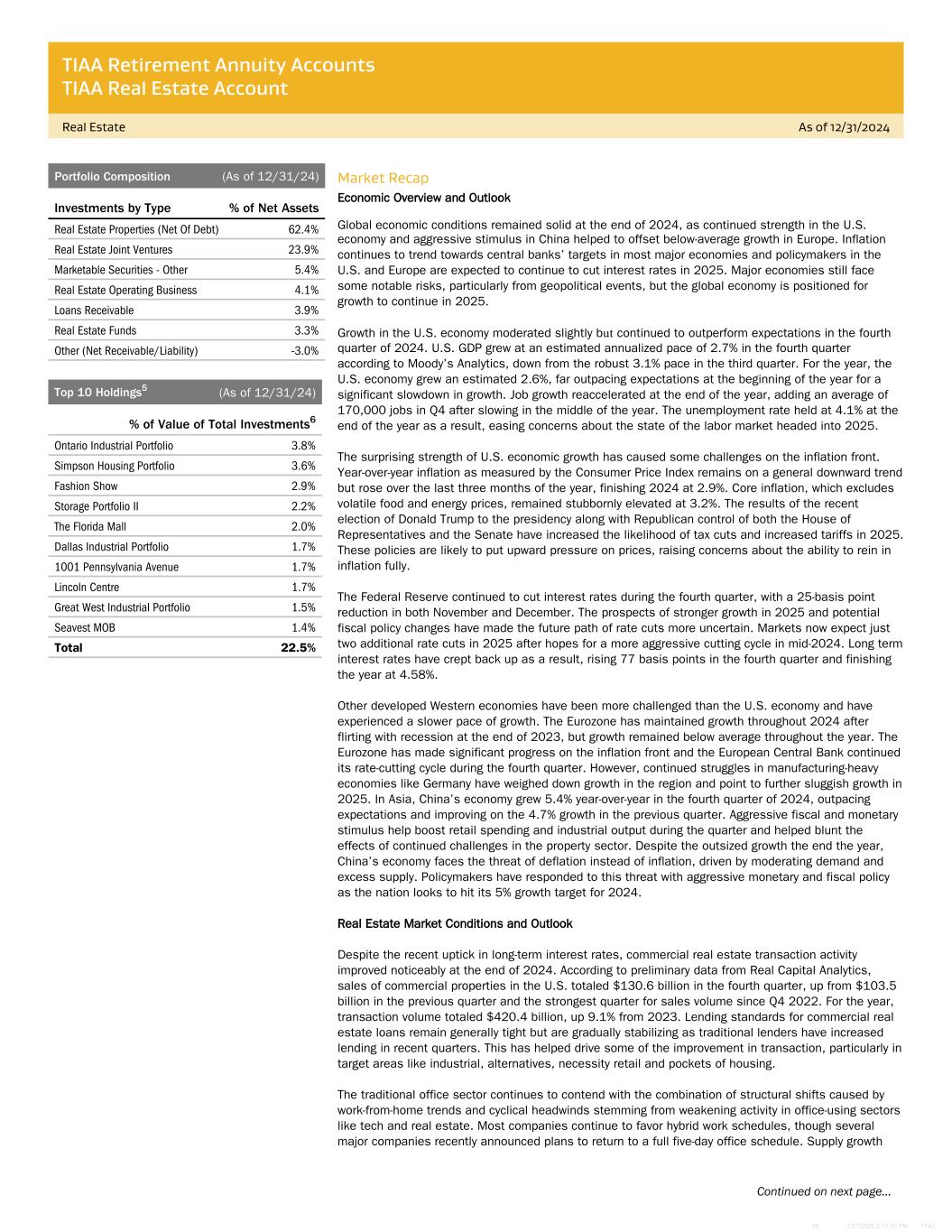

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 12/31/2024 Continued on next page... 39 1/27/2025 2:17:10 PM 7142 Portfolio Composition (As of 12/31/24) Investments by Type % of Net Assets Real Estate Properties (Net Of Debt) 62.4% Real Estate Joint Ventures 23.9% Marketable Securities - Other 5.4% Real Estate Operating Business 4.1% Loans Receivable 3.9% Real Estate Funds 3.3% Other (Net Receivable/Liability) -3.0% Top 10 Holdings5 (As of 12/31/24) % of Value of Total Investments6 Ontario Industrial Portfolio 3.8% Simpson Housing Portfolio 3.6% Fashion Show 2.9% Storage Portfolio II 2.2% The Florida Mall 2.0% Dallas Industrial Portfolio 1.7% 1001 Pennsylvania Avenue 1.7% Lincoln Centre 1.7% Great West Industrial Portfolio 1.5% Seavest MOB 1.4% Total 22.5% Market Recap Economic Overview and Outlook Global economic conditions remained solid at the end of 2024, as continued strength in the U.S. economy and aggressive stimulus in China helped to offset below-average growth in Europe. Inflation continues to trend towards central banks’ targets in most major economies and policymakers in the U.S. and Europe are expected to continue to cut interest rates in 2025. Major economies still face some notable risks, particularly from geopolitical events, but the global economy is positioned for growth to continue in 2025. Growth in the U.S. economy moderated slightly but continued to outperform expectations in the fourth quarter of 2024. U.S. GDP grew at an estimated annualized pace of 2.7% in the fourth quarter according to Moody’s Analytics, down from the robust 3.1% pace in the third quarter. For the year, the U.S. economy grew an estimated 2.6%, far outpacing expectations at the beginning of the year for a significant slowdown in growth. Job growth reaccelerated at the end of the year, adding an average of 170,000 jobs in Q4 after slowing in the middle of the year. The unemployment rate held at 4.1% at the end of the year as a result, easing concerns about the state of the labor market headed into 2025. The surprising strength of U.S. economic growth has caused some challenges on the inflation front. Year-over-year inflation as measured by the Consumer Price Index remains on a general downward trend but rose over the last three months of the year, finishing 2024 at 2.9%. Core inflation, which excludes volatile food and energy prices, remained stubbornly elevated at 3.2%. The results of the recent election of Donald Trump to the presidency along with Republican control of both the House of Representatives and the Senate have increased the likelihood of tax cuts and increased tariffs in 2025. These policies are likely to put upward pressure on prices, raising concerns about the ability to rein in inflation fully. The Federal Reserve continued to cut interest rates during the fourth quarter, with a 25-basis point reduction in both November and December. The prospects of stronger growth in 2025 and potential fiscal policy changes have made the future path of rate cuts more uncertain. Markets now expect just two additional rate cuts in 2025 after hopes for a more aggressive cutting cycle in mid-2024. Long term interest rates have crept back up as a result, rising 77 basis points in the fourth quarter and finishing the year at 4.58%. Other developed Western economies have been more challenged than the U.S. economy and have experienced a slower pace of growth. The Eurozone has maintained growth throughout 2024 after flirting with recession at the end of 2023, but growth remained below average throughout the year. The Eurozone has made significant progress on the inflation front and the European Central Bank continued its rate-cutting cycle during the fourth quarter. However, continued struggles in manufacturing-heavy economies like Germany have weighed down growth in the region and point to further sluggish growth in 2025. In Asia, China’s economy grew 5.4% year-over-year in the fourth quarter of 2024, outpacing expectations and improving on the 4.7% growth in the previous quarter. Aggressive fiscal and monetary stimulus help boost retail spending and industrial output during the quarter and helped blunt the effects of continued challenges in the property sector. Despite the outsized growth the end the year, China’s economy faces the threat of deflation instead of inflation, driven by moderating demand and excess supply. Policymakers have responded to this threat with aggressive monetary and fiscal policy as the nation looks to hit its 5% growth target for 2024. Real Estate Market Conditions and Outlook Despite the recent uptick in long-term interest rates, commercial real estate transaction activity improved noticeably at the end of 2024. According to preliminary data from Real Capital Analytics, sales of commercial properties in the U.S. totaled $130.6 billion in the fourth quarter, up from $103.5 billion in the previous quarter and the strongest quarter for sales volume since Q4 2022. For the year, transaction volume totaled $420.4 billion, up 9.1% from 2023. Lending standards for commercial real estate loans remain generally tight but are gradually stabilizing as traditional lenders have increased lending in recent quarters. This has helped drive some of the improvement in transaction, particularly in target areas like industrial, alternatives, necessity retail and pockets of housing. The traditional office sector continues to contend with the combination of structural shifts caused by work-from-home trends and cyclical headwinds stemming from weakening activity in office-using sectors like tech and real estate. Most companies continue to favor hybrid work schedules, though several major companies recently announced plans to return to a full five-day office schedule. Supply growth

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 12/31/2024 Continued on next page... 39 1/27/2025 2:17:10 PM 7142 continued to weaken from already low levels at the end of 2024, but office vacancy remains elevated because of muted demand. Higher-quality office building in prime locations have seen continued interest from tenants as the flight towards quality for tenants remains a trend. In addition, alternatives in the office sector, such as medical office and life science properties, face less of a threat from work- from-home shifts and benefit from significant demographic tailwinds. The retail sector remained well-positioned at the end of 2024, driven by limited new supply and healthy levels of demand. Vacancy rates for open-air retail continued to trend at historic lows, and vacancy in the mall sector showed improvement from recent highs. Class A malls remain primed for outperformance and will continue to attract desirable tenants and a larger share of retail sales. Construction activity remains subdued across all retail subtypes, which will help keep retail vacancy rates low even if demand does not continue at its recent pace. Tenants in necessity-based and grocery- anchored retail are likely to remain resilient should the U.S. economy slow, and well-located mixed used opportunities represent attractive investment targets over the medium to long term. The multifamily sector continued to experience strong demand at the end of 2024, helping to absorb the record level of supply growth that caused vacancy rates in the sector to increase in 2023 and the first half of 2024. Elevated home prices and mortgage rates have pressured home affordability throughout 2023 and 2024, and the cost premium for owning vs renting has never been higher. As a result, households have opted increasingly for multifamily options, helping to support demand trends. Like other sectors, multifamily has seen a significant slowdown in construction activity in recent quarters. This signals that supply pressure in the sector should subside by the end of 2025, with fewer deliveries in 2026 and 2027. Demand for industrial space continued to soften at the end of 2024, as weakness in both manufacturing and housing activity in the U.S. economy have weighed on tenants need for additional space. Healthy consumer spending growth, particularly through e-commerce channels, and improved international trade volume has helped sustain industrial sector demand in recent quarters, but the pace of demand growth remained well below historical norms. The sector still benefits from structural demand tailwinds, such as e-commerce growth and efforts towards supply chain modernization and diversification. In addition, supply growth eased considerably in Q3 and Q4 2024 after a record amount of new supply was delivered in the previous eight quarters, and will slow further as the current construction pipeline continues to normalize. As a result, vacancy rates in the sector will continue to stabilize near historic norms in 2025. The Account returned 0.68% in the fourth quarter of 2024 and -4.12% since December 31st, 2023. The fourth quarter net return was positive for the first quarter since Q3 2022. The Account had slight appreciation in property values in Q4 and property fundamentals remain strong. Future investment activity will be consistent with the Account’s multi-year strategy of reducing exposure to segments characterized by high capital expenditures and anticipated underperformance, such as traditional office and regional mall, and increasing allocations to lower capex and anticipated outperforming sectors like industrial, housing, necessity retail and alternatives. The REA will recycle capital into sectors that are anticipated to outperform while addressing areas of allocation divergence with benchmark. The Account’s Portfolio Management Team is particularly interested in increasing exposure to the alternatives sector, which includes property types such as self-storage, data centers, medical office, senior and manufactured housing. Important Information 5 The commercial real property holdings listed are subject to change and may not be representative of the Account’s current or future investments. The property holdings listed are part of the Account’s long-term investments and exclude liquid, fixed-income investments and other securities held by the Account. The property holdings do not include the Account’s entire investment portfolio and should not be considered a recommendation to buy, sell or hold a particular security or other investment.

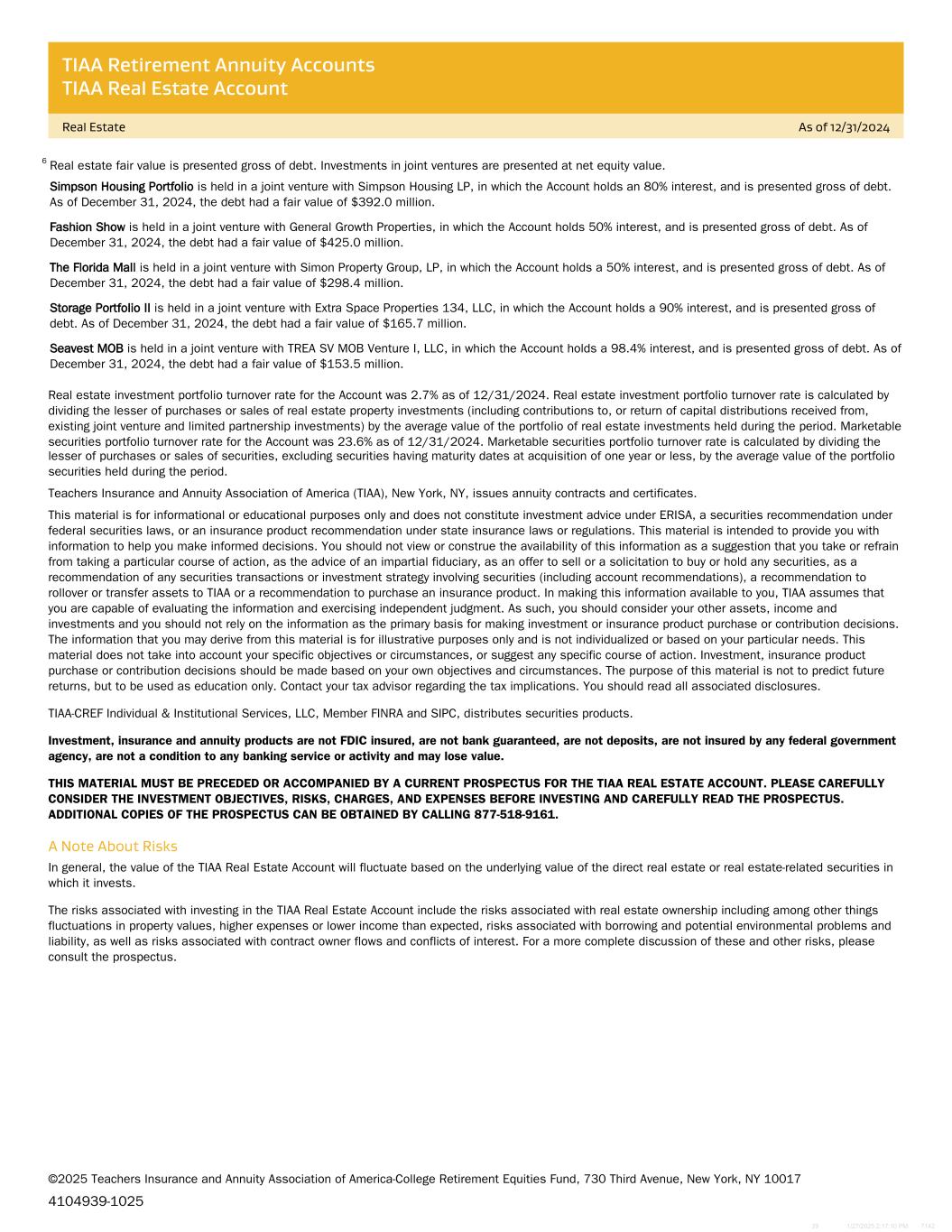

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 12/31/2024 Continued on next page... 39 1/27/2025 2:17:10 PM 7142 6 Real estate fair value is presented gross of debt. Investments in joint ventures are presented at net equity value. Simpson Housing Portfolio is held in a joint venture with Simpson Housing LP, in which the Account holds an 80% interest, and is presented gross of debt. As of December 31, 2024, the debt had a fair value of $392.0 million. Fashion Show is held in a joint venture with General Growth Properties, in which the Account holds 50% interest, and is presented gross of debt. As of December 31, 2024, the debt had a fair value of $425.0 million. The Florida Mall is held in a joint venture with Simon Property Group, LP, in which the Account holds a 50% interest, and is presented gross of debt. As of December 31, 2024, the debt had a fair value of $298.4 million. Storage Portfolio II is held in a joint venture with Extra Space Properties 134, LLC, in which the Account holds a 90% interest, and is presented gross of debt. As of December 31, 2024, the debt had a fair value of $165.7 million. Seavest MOB is held in a joint venture with TREA SV MOB Venture I, LLC, in which the Account holds a 98.4% interest, and is presented gross of debt. As of December 31, 2024, the debt had a fair value of $153.5 million. Real estate investment portfolio turnover rate for the Account was 2.7% as of 12/31/2024. Real estate investment portfolio turnover rate is calculated by dividing the lesser of purchases or sales of real estate property investments (including contributions to, or return of capital distributions received from, existing joint venture and limited partnership investments) by the average value of the portfolio of real estate investments held during the period. Marketable securities portfolio turnover rate for the Account was 23.6% as of 12/31/2024. Marketable securities portfolio turnover rate is calculated by dividing the lesser of purchases or sales of securities, excluding securities having maturity dates at acquisition of one year or less, by the average value of the portfolio securities held during the period. Teachers Insurance and Annuity Association of America (TIAA), New York, NY, issues annuity contracts and certificates. This material is for informational or educational purposes only and does not constitute investment advice under ERISA, a securities recommendation under federal securities laws, or an insurance product recommendation under state insurance laws or regulations. This material is intended to provide you with information to help you make informed decisions. You should not view or construe the availability of this information as a suggestion that you take or refrain from taking a particular course of action, as the advice of an impartial fiduciary, as an offer to sell or a solicitation to buy or hold any securities, as a recommendation of any securities transactions or investment strategy involving securities (including account recommendations), a recommendation to rollover or transfer assets to TIAA or a recommendation to purchase an insurance product. In making this information available to you, TIAA assumes that you are capable of evaluating the information and exercising independent judgment. As such, you should consider your other assets, income and investments and you should not rely on the information as the primary basis for making investment or insurance product purchase or contribution decisions. The information that you may derive from this material is for illustrative purposes only and is not individualized or based on your particular needs. This material does not take into account your specific objectives or circumstances, or suggest any specific course of action. Investment, insurance product purchase or contribution decisions should be made based on your own objectives and circumstances. The purpose of this material is not to predict future returns, but to be used as education only. Contact your tax advisor regarding the tax implications. You should read all associated disclosures. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC, distributes securities products. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS FOR THE TIAA REAL ESTATE ACCOUNT. PLEASE CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES, AND EXPENSES BEFORE INVESTING AND CAREFULLY READ THE PROSPECTUS. ADDITIONAL COPIES OF THE PROSPECTUS CAN BE OBTAINED BY CALLING 877-518-9161. A Note About Risks In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the TIAA Real Estate Account include the risks associated with real estate ownership including among other things fluctuations in property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with contract owner flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. ©2025 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 4104939-1025