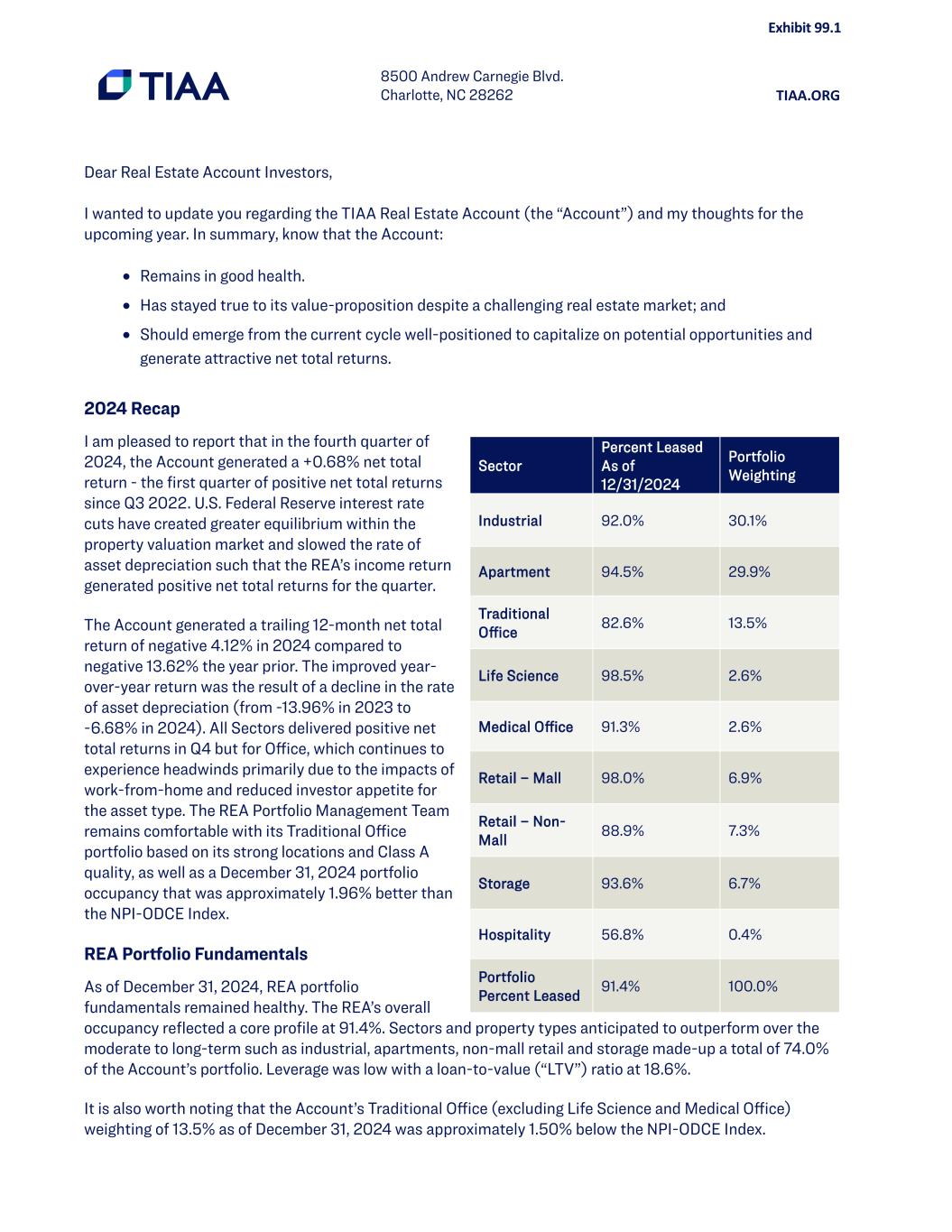

8500 Andrew Carnegie Blvd. Charlotte, NC 28262 TIAA.ORG Dear Real Estate Account Investors, I wanted to update you regarding the TIAA Real Estate Account (the “Account”) and my thoughts for the upcoming year. In summary, know that the Account: • Remains in good health. • Has stayed true to its value-proposition despite a challenging real estate market; and • Should emerge from the current cycle well-positioned to capitalize on potential opportunities and generate attractive net total returns. 2024 Recap I am pleased to report that in the fourth quarter of 2024, the Account generated a +0.68% net total return - the first quarter of positive net total returns since Q3 2022. U.S. Federal Reserve interest rate cuts have created greater equilibrium within the property valuation market and slowed the rate of asset depreciation such that the REA’s income return generated positive net total returns for the quarter. The Account generated a trailing 12-month net total return of negative 4.12% in 2024 compared to negative 13.62% the year prior. The improved year- over-year return was the result of a decline in the rate of asset depreciation (from -13.96% in 2023 to -6.68% in 2024). All Sectors delivered positive net total returns in Q4 but for Office, which continues to experience headwinds primarily due to the impacts of work-from-home and reduced investor appetite for the asset type. The REA Portfolio Management Team remains comfortable with its Traditional Office portfolio based on its strong locations and Class A quality, as well as a December 31, 2024 portfolio occupancy that was approximately 1.96% better than the NPI-ODCE Index. REA Portfolio Fundamentals As of December 31, 2024, REA portfolio fundamentals remained healthy. The REA’s overall occupancy reflected a core profile at 91.4%. Sectors and property types anticipated to outperform over the moderate to long-term such as industrial, apartments, non-mall retail and storage made-up a total of 74.0% of the Account’s portfolio. Leverage was low with a loan-to-value (“LTV”) ratio at 18.6%. It is also worth noting that the Account’s Traditional Office (excluding Life Science and Medical Office) weighting of 13.5% as of December 31, 2024 was approximately 1.50% below the NPI-ODCE Index. Sector Percent Leased As of 12/31/2024 Portfolio Weighting Industrial 92.0% 30.1% Apartment 94.5% 29.9% Traditional Office 82.6% 13.5% Life Science 98.5% 2.6% Medical Office 91.3% 2.6% Retail – Mall 98.0% 6.9% Retail – Non- Mall 88.9% 7.3% Storage 93.6% 6.7% Hospitality 56.8% 0.4% Portfolio Percent Leased 91.4% 100.0% Exhibit 99.1

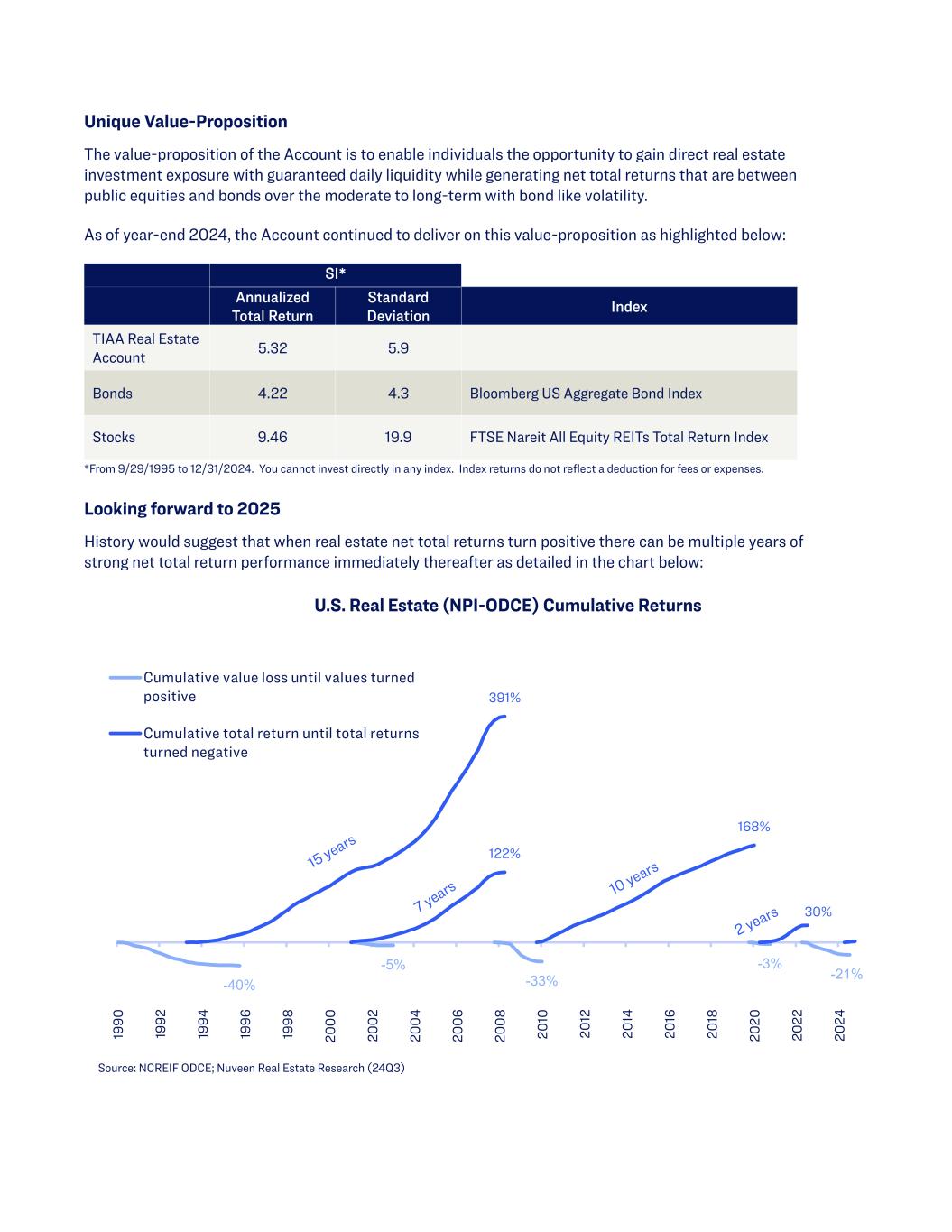

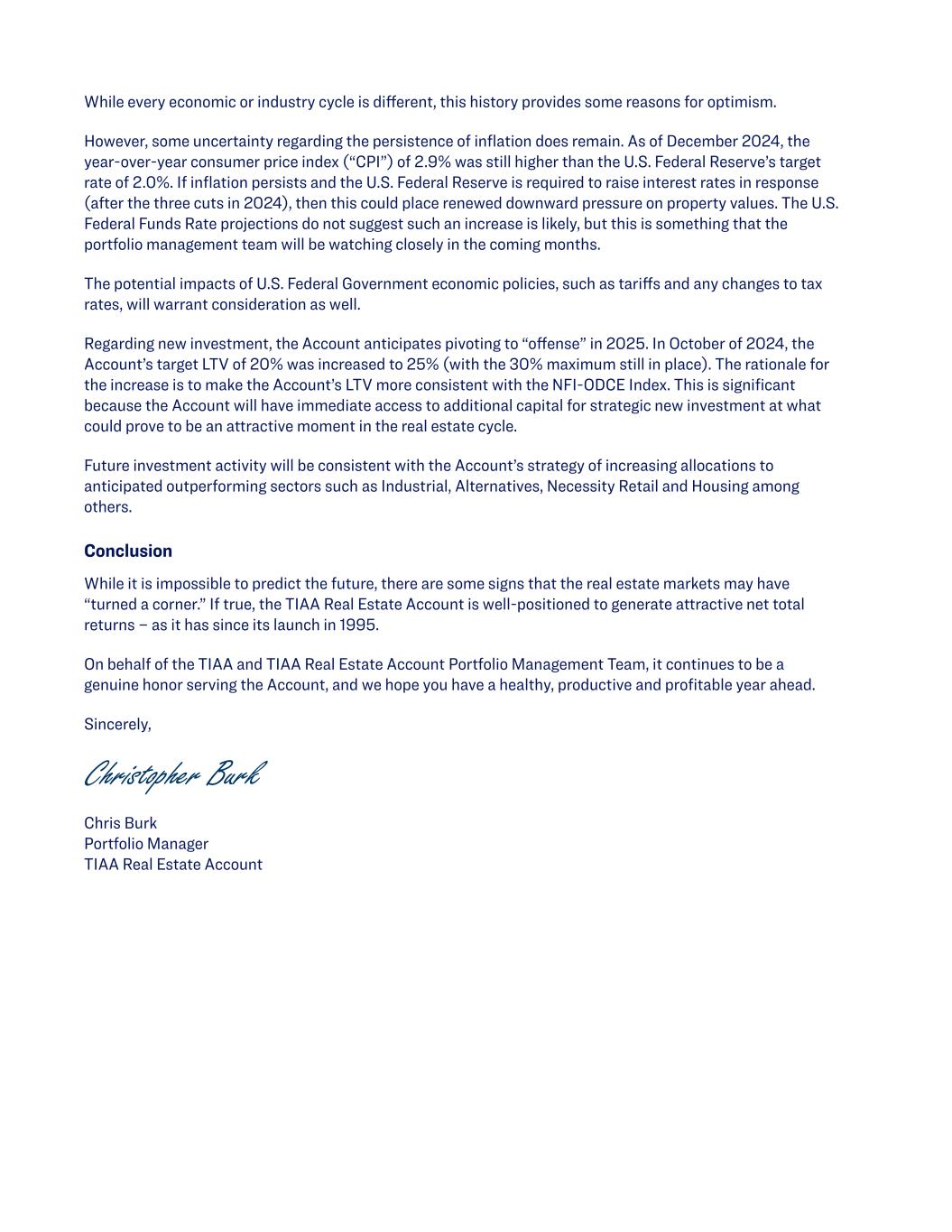

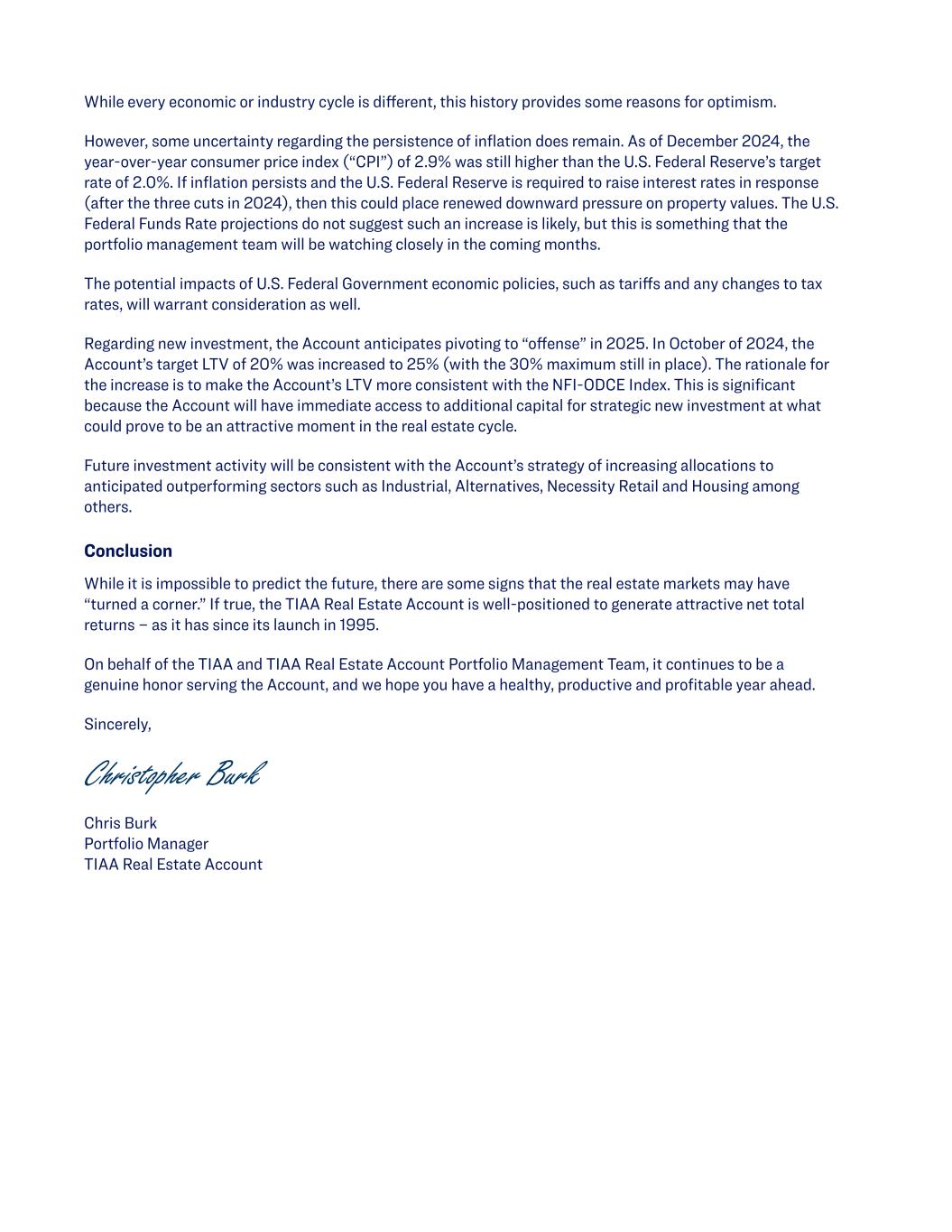

Unique Value-Proposition The value-proposition of the Account is to enable individuals the opportunity to gain direct real estate investment exposure with guaranteed daily liquidity while generating net total returns that are between public equities and bonds over the moderate to long-term with bond like volatility. As of year-end 2024, the Account continued to deliver on this value-proposition as highlighted below: SI* Annualized Total Return Standard Deviation Index TIAA Real Estate Account 5.32 5.9 Bonds 4.22 4.3 Bloomberg US Aggregate Bond Index Stocks 9.46 19.9 FTSE Nareit All Equity REITs Total Return Index *From 9/29/1995 to 12/31/2024. You cannot invest directly in any index. Index returns do not reflect a deduction for fees or expenses. Looking forward to 2025 History would suggest that when real estate net total returns turn positive there can be multiple years of strong net total return performance immediately thereafter as detailed in the chart below: Source: NCREIF ODCE; Nuveen Real Estate Research (24Q3) -40% -5% -33% -3% -21% 391% 168% 122% 30% 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 20 08 20 10 20 12 20 14 20 16 20 18 20 20 20 22 20 24 U.S. Real Estate (NPI-ODCE) Cumulative Returns Cumulative value loss until values turned positive Cumulative total return until total returns turned negative

While every economic or industry cycle is different, this history provides some reasons for optimism. However, some uncertainty regarding the persistence of inflation does remain. As of December 2024, the year-over-year consumer price index (“CPI”) of 2.9% was still higher than the U.S. Federal Reserve’s target rate of 2.0%. If inflation persists and the U.S. Federal Reserve is required to raise interest rates in response (after the three cuts in 2024), then this could place renewed downward pressure on property values. The U.S. Federal Funds Rate projections do not suggest such an increase is likely, but this is something that the portfolio management team will be watching closely in the coming months. The potential impacts of U.S. Federal Government economic policies, such as tariffs and any changes to tax rates, will warrant consideration as well. Regarding new investment, the Account anticipates pivoting to “offense” in 2025. In October of 2024, the Account’s target LTV of 20% was increased to 25% (with the 30% maximum still in place). The rationale for the increase is to make the Account’s LTV more consistent with the NFI-ODCE Index. This is significant because the Account will have immediate access to additional capital for strategic new investment at what could prove to be an attractive moment in the real estate cycle. Future investment activity will be consistent with the Account’s strategy of increasing allocations to anticipated outperforming sectors such as Industrial, Alternatives, Necessity Retail and Housing among others. Conclusion While it is impossible to predict the future, there are some signs that the real estate markets may have “turned a corner.” If true, the TIAA Real Estate Account is well-positioned to generate attractive net total returns – as it has since its launch in 1995. On behalf of the TIAA and TIAA Real Estate Account Portfolio Management Team, it continues to be a genuine honor serving the Account, and we hope you have a healthy, productive and profitable year ahead. Sincerely, Christopher Burk Chris Burk Portfolio Manager TIAA Real Estate Account

Consumer Price Index (CPI) – measure of change in consumer prices, as determined by a monthly survey of the U.S. Bureau of Labor Statistics. Loan-To-Value (LTV) – the portion of the amount borrowed compared to the cost or value of the property purchased. NPI-ODCE Index – property performance returns index maintained by the National Council of Real Estate Investment Fiduciaries (NCREIF). Bloomberg US Aggregate Bond Index – broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds in the United States. FTSE Nareit All Equity REITs Total Return Index – a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. The real estate industry is subject to various risks including fluctuations in underlying property values, expenses and income, and potential environmental liabilities. The real estate industry is subject to various risks including fluctuations in underlying property values, expenses and income, and potential environmental liabilities. There are risks associated with investing in securities including possible loss of principal. In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including, among other things, fluctuations in underlying property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. Please consider all risks carefully prior to investing. You should consider the investment objectives, risks, charges, and expenses carefully before investing. Please call 800-842- 2252 or go to TIAA Real Estate Account Prospectus for copies that contain this information. Please read the TIAA Real Estate Account prospectus carefully before investing. This material is for informational or educational purposes only and is not fiduciary investment advice, or a securiites, investment strategy, or insurance product recommendation. This material does not consider an individual’s own objectives or circumstances which should be the basis of any investment decision. The views expressed in this material may change in response to changing economic and market conditions. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value. Past performance does not guarantee future results. The TIAA Real Estate Account is an insurance separate account of Teachers Insurance and Annuity Association of America, New York, NY. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributes securities ©2025 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 4216913 (02/25)