Filed by Oak Hill Financial, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Oak Hill Financial, Inc.

Commission File No.: 0-26876

Provided to Certain Associates of Oak Hill Financial, Inc. and its Affiliates.

| July 20, 2007 & "Strategic Expansion into Ohio Markets" |

| Forward Looking Statements Forward looking statements in this presentation relating to WesBanco's plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this presentation should be read in conjunction with WesBanco's 2006 Annual Report on Form 10K, as well as the 10Q for the prior quarter ended March 31, 2007, filed with the Securities and Exchange Commission ("SEC"), which are available at the SEC's website www.sec.gov or at WesBanco's website, www.wesbanco.com. Investors are cautioned that forward looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco's 2006 Annual Report on Form 10K filed with the SEC under the section "Risk Factors". Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements, including without limitation, the expected cost savings and any revenue synergies from the mergers may not be fully realized within the expected timeframes^ disruption from the mergers may make it more difficult to maintain relationships with clients, associates, or suppliers^ the effects of changing regional and national economic conditions^ changes in interest rates, spreads on earning assets and interest bearing liabilities, and associated interest rate sensitivity^ sources of liquidity available to the parent company and its related subsidiary operations^ potential future credit losses and the credit risk of commercial, real estate, and consumer loan customers and their borrowing activities^ actions of the Federal Reserve Board, Federal Deposit Insurance Corporation, the SEC, the National Association of Securities Dealers and other regulatory bodies^ potential legislative and federal and state regulatory actions and reform^ competitive conditions in the financial services industry^ rapidly changing technology affecting financial services and/or other external developments materially impacting WesBanco's operational and financial performance. WesBanco does not assume any duty to update forward looking statements. |

| James C. Gardill Chairman Paul M. Limbert President & CEO John D. Kidd Chairman Ralph E. Coffman, Jr. President & CEO Robert H. Young EVP, Chief Financial Officer Introductions |

| Combination Highlights Doubles WesBanco's Ohio Market Share Assists in developing existing markets Enhances Growth Profile of WesBanco's Footprint Financially Attractive Common Cultures Provides Additional Revenue Growth Opportunities |

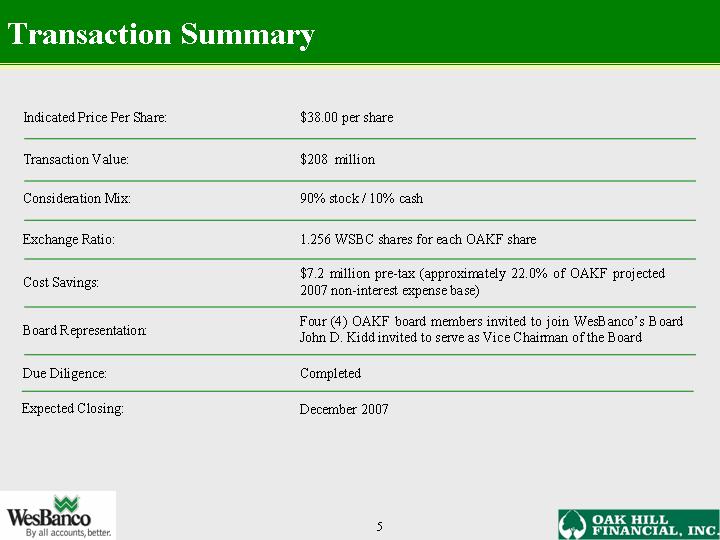

| Pricing Consistent with Recent Transactions Source: SNL Financial and company filings Comparable transactions do not include merger of equals (1) OAKF LTM earnings as of 6/30/2007 (2) Forward 2008 earnings estimates per First Call median of $2.15 (3) Excludes CDs greater than $100,000 (4) Based on OAKF 7/16/07 price per share Comparables Price / LTM Earnings (1) Price / Forward Earnings (2) Price / Tangible Book Value Core Deposit Premium (3) 1 Day Market Premium (4) 46.7 x 27.9 382 % 33.5 63.5 WSBC / OAKF High Median Low 14.2 x 15.4 193 % 11.6 15.0 24.3 x 21.0 272 % 22.7 31.9 19.9 x 17.7 241 % 14.6 63.1 |

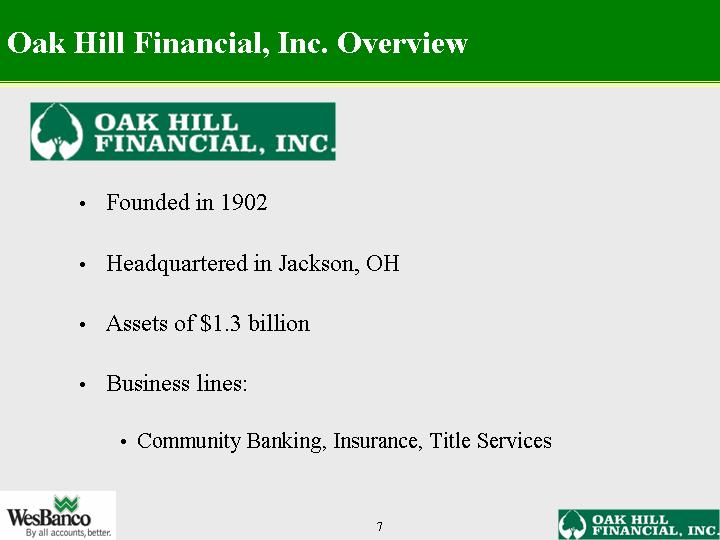

| Oak Hill Financial, Inc. Overview Founded in 1902 Headquartered in Jackson, OH Assets of $1.3 billion Business lines: Community Banking, Insurance, Title Services |

| Markets 36 branches over 15 counties Central and Southern Ohio Key Counties (1) : Jackson, Scioto, Lawrence, Hamilton Financial Highlights (2) Net Loans ($M) Deposits ($M) ROAA: ROAE: NPAs/Assets: Reserves / Loans: NCO's / Avg. Loans: Tang. Equity / Tang. Assets: Oak Hill Financial, Inc. Overview (1) Represent 58% of Total Deposits (2) Financial Highlights as of or for the three months ended June 30, 2007 Source: SNL Financial $ 1,025 $ 958 1.43% 19.61% 1.29% 1.23% 0.23% 6.60% |

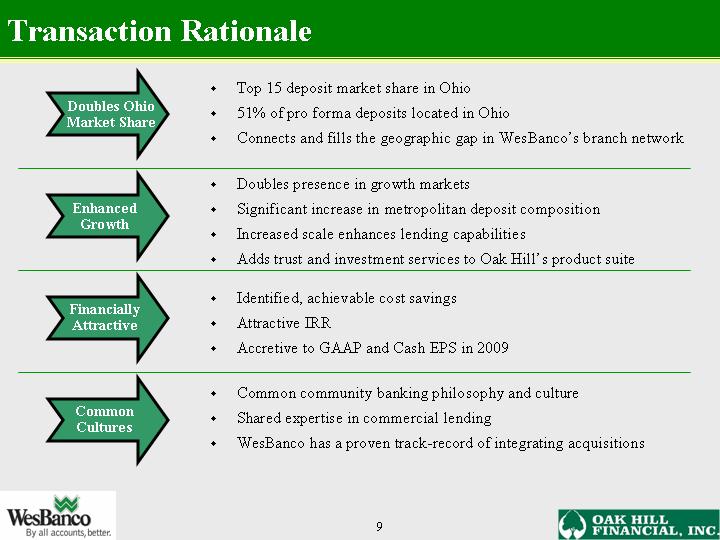

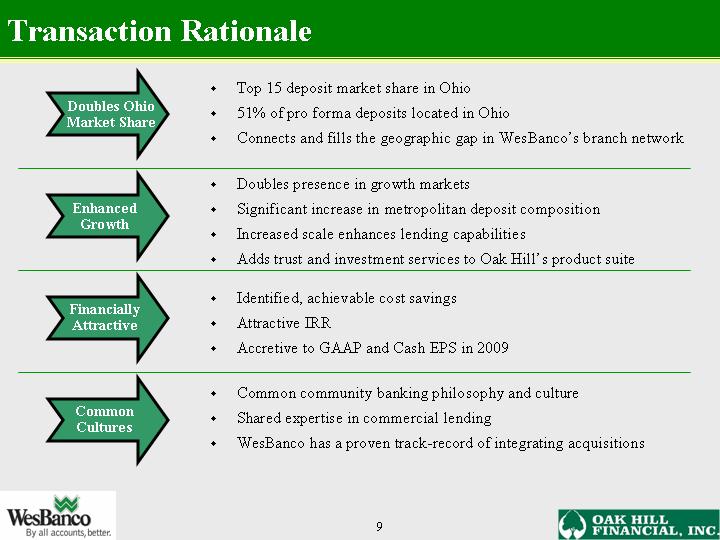

| Transaction Rationale Top 15 deposit market share in Ohio 51% of pro forma deposits located in Ohio Connects and fills the geographic gap in WesBanco's branch network Doubles presence in growth markets Significant increase in metropolitan deposit composition Increased scale enhances lending capabilities Adds trust and investment services to Oak Hill's product suite Identified, achievable cost savings Attractive IRR Accretive to GAAP and Cash EPS in 2009 Common community banking philosophy and culture Shared expertise in commercial lending WesBanco has a proven track-record of integrating acquisitions Doubles Ohio Market Share Enhanced Growth Financially Attractive Common Cultures |

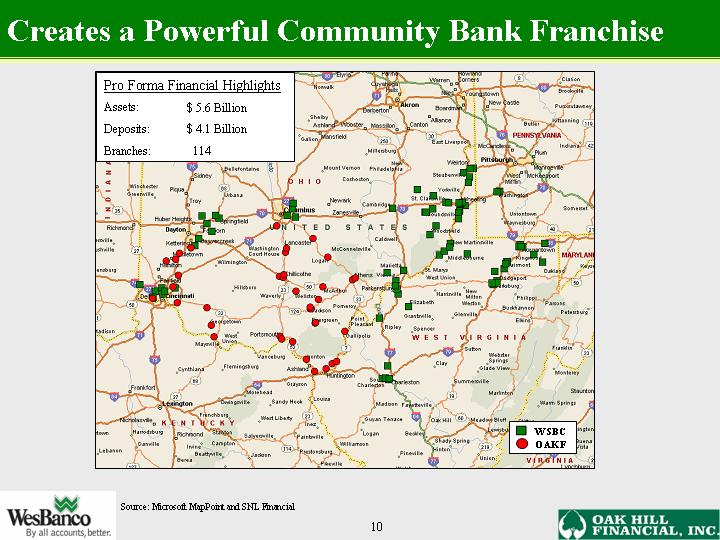

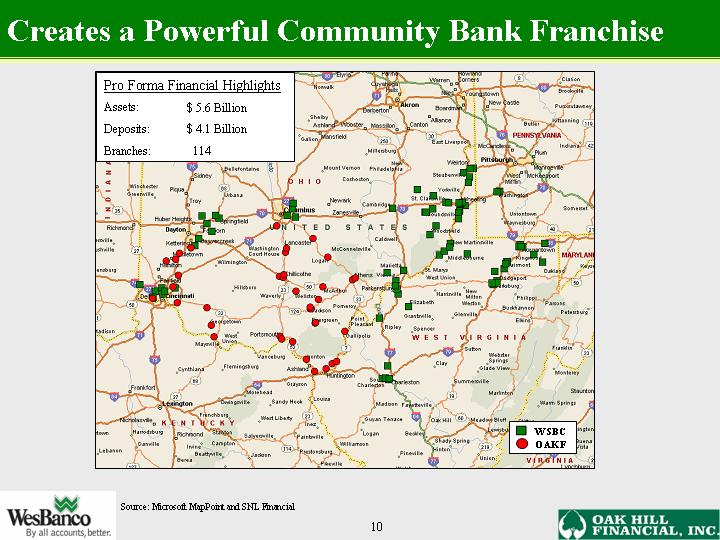

| Creates a Powerful Community Bank Franchise Pro Forma Financial Highlights Assets: Deposits: Branches: $ 5.6 Billion $ 4.1 Billion 114 Source: Microsoft MapPoint and SNL Financial |

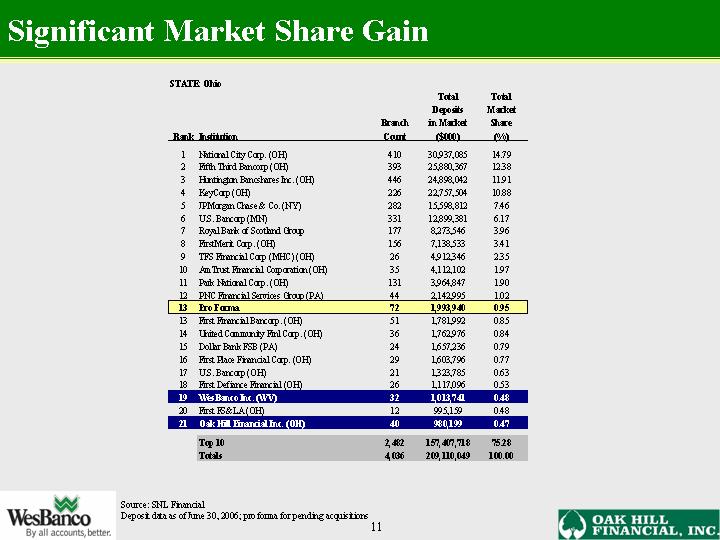

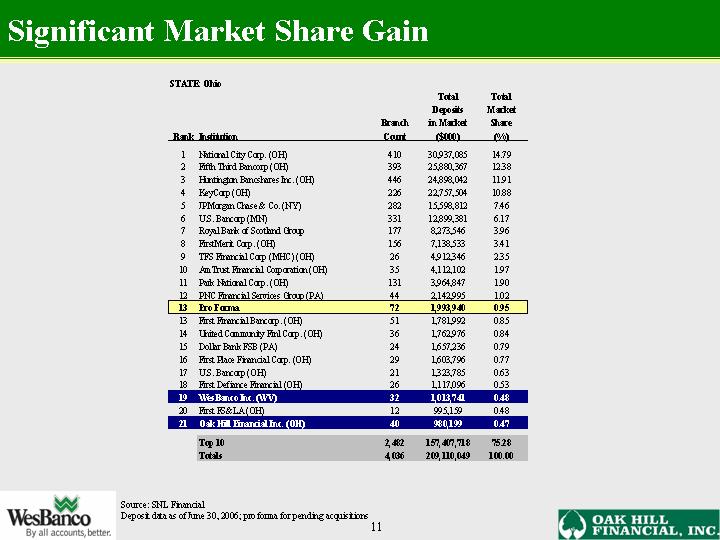

| Significant Market Share Gain Source: SNL Financial Deposit data as of June 30, 2006; pro forma for pending acquisitions |

| West Virginia Ohio Pennsylvania East 1906737 1013741 49318 Deposit Composition By State WesBanco Pro Forma Pennsylvania Ohio West Virginia Source: SNL Financial |

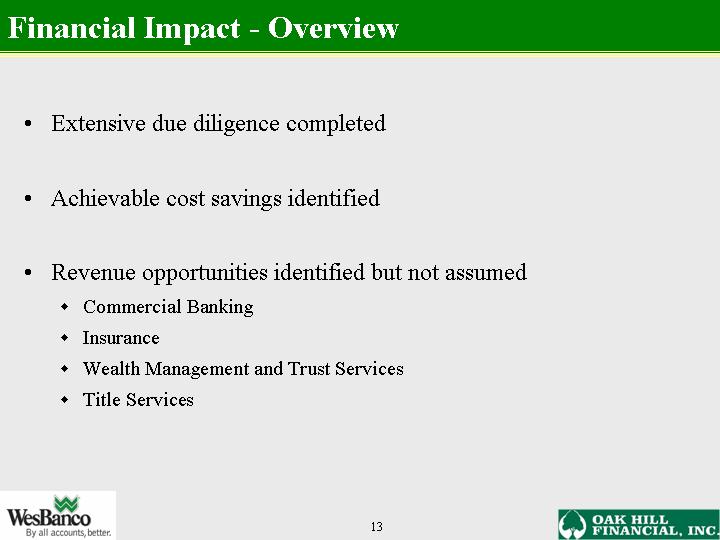

| Financial Impact - Overview Extensive due diligence completed Achievable cost savings identified Revenue opportunities identified but not assumed Commercial Banking Insurance Wealth Management and Trust Services Title Services |

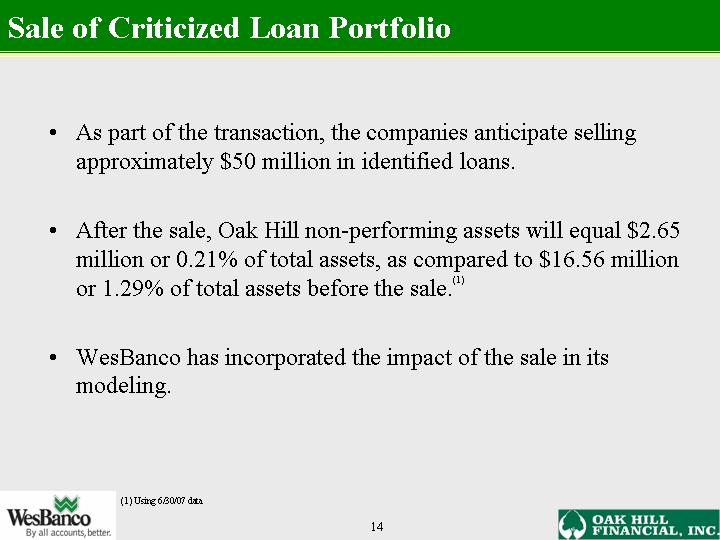

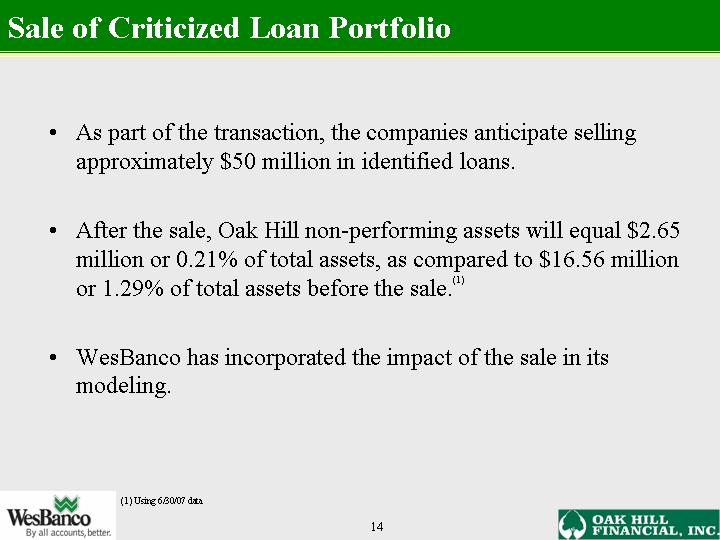

| As part of the transaction, the companies anticipate selling approximately $50 million in identified loans. After the sale, Oak Hill non-performing assets will equal $2.65 million or 0.21% of total assets, as compared to $16.56 million or 1.29% of total assets before the sale.(1) WesBanco has incorporated the impact of the sale in its modeling. Sale of Criticized Loan Portfolio (1) Using 6/30/07 data |

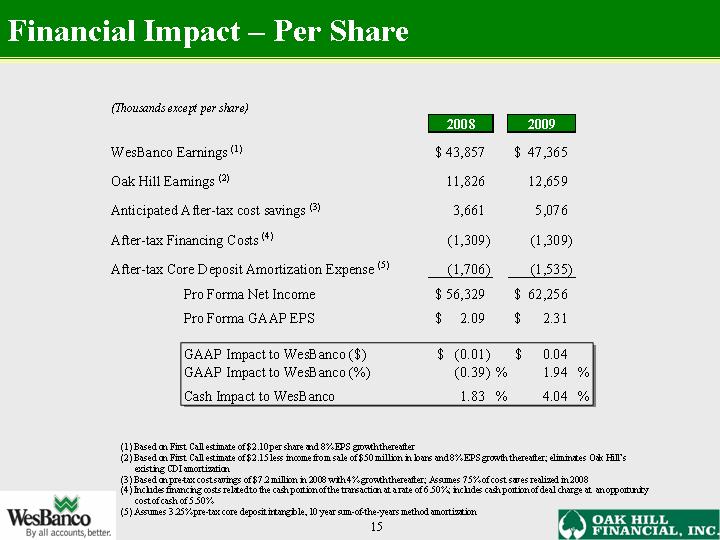

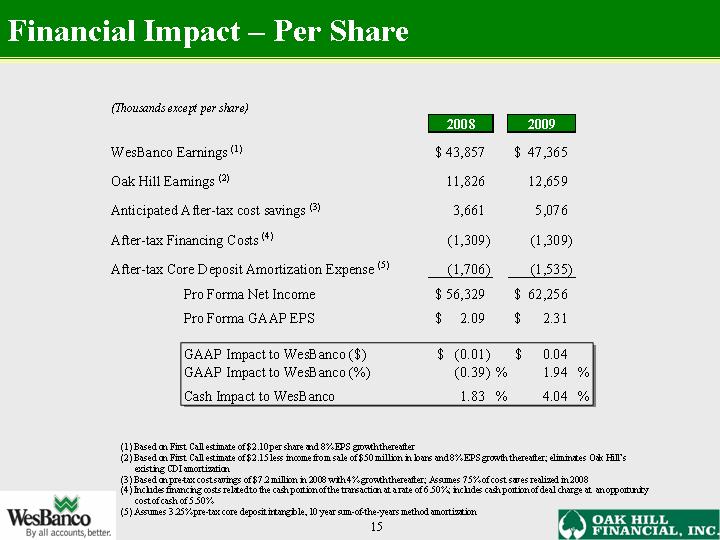

| Financial Impact - Per Share (1) Based on First Call estimate of $2.10 per share and 8% EPS growth thereafter (2) Based on First Call estimate of $2.15 less income from sale of $50 million in loans and 8% EPS growth thereafter; eliminates Oak Hill's existing CDI amortization (3) Based on pre-tax cost savings of $7.2 million in 2008 with 4% growth thereafter; Assumes 75% of cost saves realized in 2008 (4) Includes financing costs related to the cash portion of the transaction at a rate of 6.50%; includes cash portion of deal charge at an opportunity cost of cash of 5.50% (5) Assumes 3.25% pre-tax core deposit intangible, 10 year sum-of-the-years method amortization |

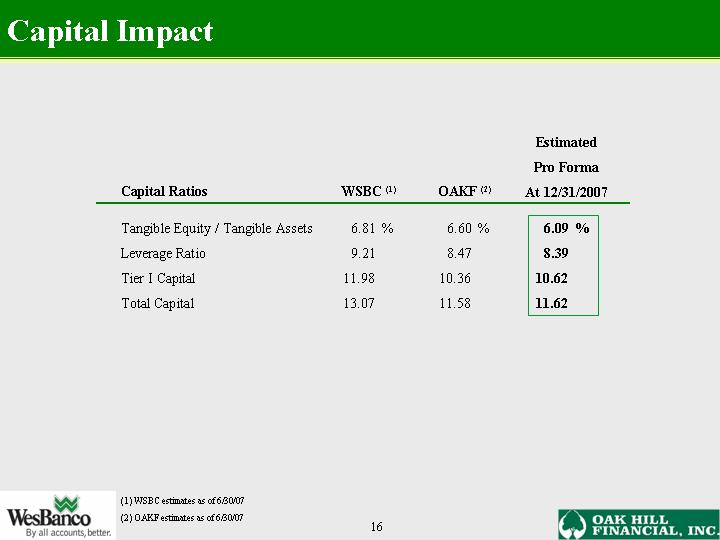

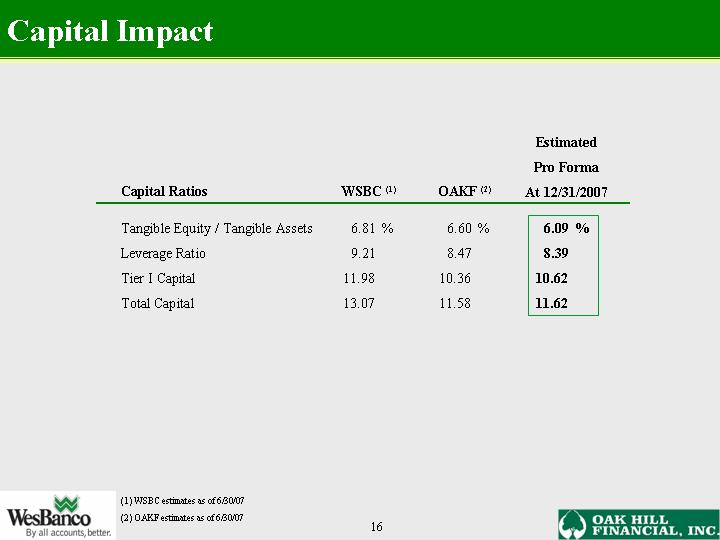

| Capital Impact 6.60 % 8.47 10.36 11.58 6.09 % 8.39 10.62 11.62 6.81 % 9.21 11.98 13.07 WSBC (1) OAKF (2) Estimated Pro Forma At 12/31/2007 Tangible Equity / Tangible Assets Leverage Ratio Tier I Capital Total Capital Capital Ratios (1) WSBC estimates as of 6/30/07 (2) OAKF estimates as of 6/30/07 |

| Low Execution Risk Consistent with WesBanco's expansion strategy Common community banking philosophy and culture Shared expertise in commercial lending Proven track-record integrating acquisitions Key Oak Hill management to be retained |

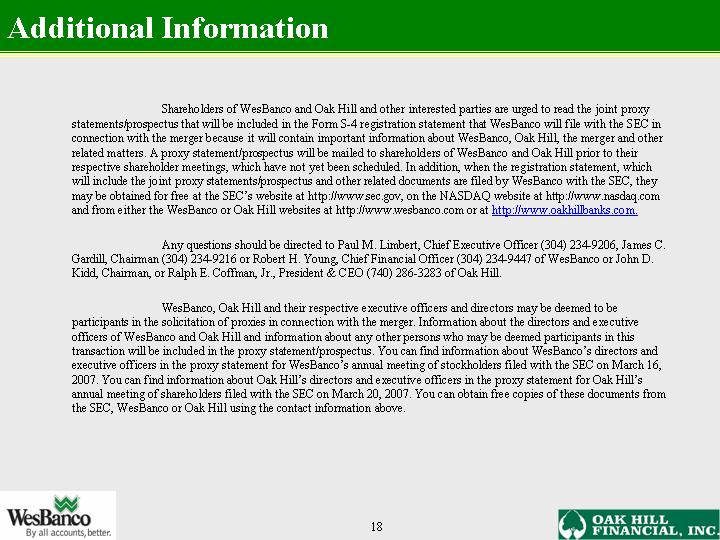

| Additional Information Shareholders of WesBanco and Oak Hill and other interested parties are urged to read the joint proxy statements/prospectus that will be included in the Form S-4 registration statement that WesBanco will file with the SEC in connection with the merger because it will contain important information about WesBanco, Oak Hill, the merger and other related matters. A proxy statement/prospectus will be mailed to shareholders of WesBanco and Oak Hill prior to their respective shareholder meetings, which have not yet been scheduled. In addition, when the registration statement, which will include the joint proxy statements/prospectus and other related documents are filed by WesBanco with the SEC, they may be obtained for free at the SEC's website at http://www.sec.gov, on the NASDAQ website at http://www.nasdaq.com and from either the WesBanco or Oak Hill websites at http://www.wesbanco.com or at http://www.oakhillbanks.com. Any questions should be directed to Paul M. Limbert, Chief Executive Officer (304) 234-9206, James C. Gardill, Chairman (304) 234-9216 or Robert H. Young, Chief Financial Officer (304) 234-9447 of WesBanco or John D. Kidd, Chairman, or Ralph E. Coffman, Jr., President & CEO (740) 286-3283 of Oak Hill. WesBanco, Oak Hill and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies in connection with the merger. Information about the directors and executive officers of WesBanco and Oak Hill and information about any other persons who may be deemed participants in this transaction will be included in the proxy statement/prospectus. You can find information about WesBanco's directors and executive officers in the proxy statement for WesBanco's annual meeting of stockholders filed with the SEC on March 16, 2007. You can find information about Oak Hill's directors and executive officers in the proxy statement for Oak Hill's annual meeting of shareholders filed with the SEC on March 20, 2007. You can obtain free copies of these documents from the SEC, WesBanco or Oak Hill using the contact information above. |