SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under Rule 14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check the appropriate box):

x No fee required

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | Title of each class of securities to which transaction applies: |

| | | |

| | 2. | Aggregate number of securities to which transaction applies: |

| | | |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4. | Proposed maximum aggregate value of transaction: |

| | | |

¨ Fee paid previously with preliminary materials.

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | Amount Previously Paid: |

| | | |

| | 2. | Form, Schedule or Registration Statement No.: |

| | | |

PRELIMINARY COPY

SUBJECT TO COMPLETION DATED JANUARY 23, 2009

7840 Montgomery Road

Cincinnati, Ohio 45236

_________________, 2009

Dear Fellow Stockholder:

Stephen N. Joffe, Craig P.R. Joffe and Alan H. Buckey (collectively, the “Joffe Group”) have commenced a process seeking to remove, without cause, all members of your Board of Directors. The Joffe Group is also asking that you fill the vacancies created by such removals with individuals handpicked by the Joffe Group. In short, the Joffe Group is asking that you turn over control of LCA-Vision Inc. (the “Company”) to Stephen Joffe. In return, the Joffe Group is not providing you with a control premium nor a clear and concrete path to building value of your investment in the Company.

Your Board believes that the Joffe Group’s actions are not in the best interest of all of the Company’s stockholders. The Company’s directors and officers are committed to acting in the best interests of all of the stockholders. We believe that your current Board and management should be permitted to continue to pursue the Company’s business plan, which has been thoughtfully developed and refined. Accordingly, we strongly urge you to reject the Joffe Group’s efforts to remove your Board.

You can reject the Joffe Group’s efforts to hijack the Company. First, do not sign the Joffe Group’s WHITE consent card. Second, if you have previously signed a WHITE consent card, you may revoke that consent by signing, dating and mailing the enclosed GOLD Consent Revocation Card immediately. Finally, even if you have not signed the Joffe Group’s consent card, you can show your support for your Board by signing, dating and mailing the enclosed GOLD Consent Revocation Card. Regardless of the number of shares you own, your revocation of consent is important. Please act today. Thank you for your support.

| Very truly yours, |

| |

| E. Anthony Woods |

| Chairman of the Board |

| |

| Steven C. Straus |

| Chief Executive Officer |

If you have any questions about revoking any consent you may have previously granted or if you require assistance, please contact the Company’s consent revocation solicitor:

199 Water Street, 26th Floor

New York, NY 10038

Banks and Brokers Call 212.440.9800

All others call Toll-Free 1.800.457.0109

[Date]

CONSENT REVOCATION STATEMENT

BY THE BOARD OF DIRECTORS OF LCA-VISION INC.

IN OPPOSITION TO

A CONSENT SOLICITATION BY STEPHEN N. JOFFE,

CRAIG P.R. JOFFE AND ALAN H. BUCKEY

This Consent Revocation Statement is furnished by the Board of Directors (the “Board”) of LCA-Vision Inc., a Delaware corporation (the “Company”), to the holders of outstanding shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), in connection with your Board’s opposition to the solicitation of written stockholder consents by Stephen N. Joffe, Craig P.R. Joffe and Alan H. Buckey (collectively, the “Joffe Group”).

The Joffe Group is attempting to seize control of your Board and Company by asking you to remove the directors that you elected on May 12, 2008 at the 2008 Annual Meeting of Stockholders, and replace them with a slate of nominees handpicked by the Joffe Group. Specifically, the Joffe Group is asking you to: (i) repeal any amendments to the Company’s Bylaws (“Bylaws”) adopted after December 31, 2008; (ii) remove, without cause, all of the current directors of the Company; and (iii) elect as directors the Joffe Group’s own handpicked nominees: Stephen N. Joffe, Jason T. Mogel, Robert B. Probst, Edward J. VonderBrink and Robert H. Weisman (the “Joffe Group Nominees”). The Joffe Group has stated in its consent solicitation statement filed with the Securities and Exchange Commission (the “SEC”) that it will propose that its nominees, if elected, remove the Company’s current senior executive officers and replace them with Stephen Joffe, his son Craig Joffe and Alan Buckey.

Your directors were selected through processes designed by the Board to foster good corporate governance and representation of all stockholders. All but one of the current directors are “independent” as defined in the Marketplace Rules of the NASDAQ Stock Market, and all of them are experienced as directors of public companies.

For these reasons, among others, your Board unanimously opposes the consent solicitation by the Joffe Group. Your Board is comprised primarily of independent directors, and it is committed to acting in the best interests of all of the Company’s stockholders. Your Board believes that it is well positioned to recognize and act upon the Company’s strategic opportunities and to maximize the value to be extracted through the Company’s business plan.

This Consent Revocation Statement and the enclosed GOLD Consent Revocation Card are being mailed to stockholders on or about ____________, 2009.

Your Board urges you not to sign any WHITE consent card sent to you by the Joffe Group but instead to sign and return the GOLD card included with these materials.

If you have previously signed and returned the WHITE consent card, you have every right to change your mind and revoke your consent. Whether or not you have signed the WHITE consent card, we urge you to mark the “REVOKE CONSENT” boxes on the enclosed GOLD Consent Revocation Card and to sign and date and mail the card in the postage-paid envelope provided. Even if you have not submitted a WHITE consent card, we urge you to submit a GOLD Consent Revocation Card, as it will help us keep track of the progress of the consent process. Regardless of the number of shares you own, your consent revocation is important. Please act today.

If your shares are held in “street name,” only your broker or your banker can vote your shares. Please contact the person responsible for your account and instruct him or her to submit a GOLD Consent Revocation Card on your behalf today.

In accordance with Delaware law and the Company’s Bylaws, on ___________, 2009, the Board set _________, 2009 as the record date (the “Record Date”) for the determination of the Company’s stockholders who are entitled to execute, withhold or revoke consents relating to the Joffe Group’s consent solicitation. The Company will be soliciting consent revocations from stockholders of record as of the Record Date and only holders of record as of the close of business on the Record Date may execute, withhold or revoke consents with respect to the Joffe Group’s consent solicitation.

199 Water Street, 26th Floor

New York, NY 10038

Banks and Brokers Call 212.440.9800

All others call Toll-Free 1.800.457.0109

TABLE OF CONTENTS

| | PAGE |

| | |

| FORWARD-LOOKING STATEMENTS | 5 |

| DESCRIPTION OF THE JOFFE GROUP CONSENT SOLICITATION | 6 |

| REASONS TO REJECT THE JOFFE GROUP’S CONSENT SOLICITATION PROPOSALS | 6 |

| BACKGROUND OF THE JOFFE GROUP SOLICITATION | 15 |

| QUESTIONS AND ANSWERS ABOUT THIS CONSENT REVOCATION SOLICITATION | 19 |

| THE CONSENT PROCEDURE | 21 |

| SOLICITATION OF REVOCATION | 22 |

| PROFESSIONAL ADVISORS | 23 |

| APPRAISAL RIGHTS | 23 |

| CURRENT DIRECTORS OF LCA-VISION INC. | 23 |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 24 |

| MEETINGS OF THE BOARD OF DIRECTORS AND DIRECTOR INDEPENDENCE | 25 |

| COMMITTEES OF THE BOARD OF DIRECTORS | 25 |

| DIRECTOR COMPENSATION | 27 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 29 |

| EXECUTIVE OFFICERS | 30 |

| COMPENSATION COMMITTEE REPORT | 31 |

| COMPENSATION DISCUSSION AND ANALYSIS | 31 |

| EXECUTIVE COMPENSATION | 36 |

| AUDIT COMMITTEE REPORT | 42 |

| 2009 ANNUAL MEETING OF STOCKHOLDERS | 43 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 43 |

| STOCKHOLDER COMMUNICATIONS | 43 |

| HOUSEHOLDING PROXY MATERIALS | 43 |

| CERTAIN INFORMATION REGARDING PARTICIPANTS IN THIS CONSENT REVOCATION SOLICITATION | 45 |

| REQUESTS FOR CERTAIN DOCUMENTS | 45 |

FORWARD-LOOKING STATEMENTS

This Consent Revocation Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on information available to the Company as of the date hereof. Actual results could differ materially from those stated or implied in such forward-looking statements due to risks and uncertainties associated with the Company’s business, including, without limitation, those concerning economic, political and sociological conditions; the acceptance rate of new technology, and the Company’s ability to successfully implement new technology on a national basis; market acceptance of the Company’s services; the successful execution of marketing strategies to cost effectively drive patients to the Company’s vision centers; competition in the laser vision correction industry; an inability to attract new patients; the possibility of long-term side effects and adverse publicity regarding laser vision correction; operational and management instability; legal or regulatory action against the Company or others in the laser vision correction industry; the Company’s ability to operate profitably vision centers and retain qualified personnel during periods of lower procedure volumes; the relatively high fixed cost structure of the Company’s business; the continued availability of non-recourse third-party financing for the Company’s patients on terms similar to what the Company has paid historically; and the future value of revenues financed by the Company and its ability to collect on such financings which will depend on a number of factors, including the worsening consumer and credit environment and the Company’s ability to manage credit risk related to consumer debt, bankruptcies and other credit trends. In addition, an ongoing FDA study about post-Lasik quality of life matters could potentially impact negatively the acceptance of Lasik. Except to the extent required under the federal securities law and the rules and regulations promulgated by the Securities and Exchange Commission, the Company assumes no obligation to update the information included herein, whether as a result of new information, future events or circumstances, or otherwise. In addition to the information given herein, please refer to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2007 and its subsequent Quarterly Reports on Form 10-Q for discussion of important factors that could affect the Company’s results.

DESCRIPTION OF THE JOFFE GROUP CONSENT SOLICITATION

As set forth in its definitive consent solicitation materials filed with the SEC, the Joffe Group is asking you to consent to the following proposals:

Proposal No. 1 - Repeal any provision of the Bylaws in effect at the time the proposal becomes effective that were not included in the Bylaws that became effective on December 31, 2008 and were filed with the SEC on January 6, 2009;

Proposal No. 2 - Remove without cause William F. Bahl, John H. Gutfreund, John C. Hassan, Steven C. Straus and E. Anthony Woods and any person (other than those elected by the consent solicitation) elected or appointed to the Board to fill any vacancy on the Board by such directors or any newly-created directorships; and

Proposal No. 3 - Elect each of Stephen N. Joffe, Jason T. Mogel, Robert Probst, Edward J. VonderBrink and Robert H. Weisman to serve as directors of the Company (or, if any such nominee is unable or unwilling to serve as a director of the Company, any other person designated as a nominee by the remaining nominee or nominees).

**********

In its consent solicitation materials, the Joffe Group has also stated that, if successful in obtaining control of the Board, it will propose that the Board:

| | · | remove the senior executive officers of the Company; |

| | · | appoint Stephen Joffe, his son Craig Joffe, and Alan Buckey as the senior executive officers of the Company; and |

| | · | cause the Company, without seeking stockholder approval, to reimburse the expenses of its consent solicitation, which the Joffe Group estimates to be approximately $_______________. |

REASONS TO REJECT THE JOFFE GROUP’S

CONSENT SOLICITATION PROPOSALS

Your Board urges you to reject the Joffe Group’s consent solicitation for the following reasons, each of which is explained in greater detail below:

| | · | Your Board believes it is not in the best interests of all stockholders to turn over control of the Company to the Joffe Group. |

| | · | Your Board believes that Stephen Joffe’s past history indicates that he exhibits unfettered concern for his own personal benefits. |

| | · | Your Board and management have a thoughtful plan for the Company and are implementing it. |

| | · | By contrast, the Joffe Group has not presented a concrete plan for the Company. |

| | · | Your Board believes the principal reasons for the Company’s recent financial results are the declines in consumer confidence and discretionary spending. |

| | · | The Joffe Group’s allegations contain inconsistencies, omissions and inaccuracies. |

| | · | If the Joffe Group’s consent solicitation is successful, the resulting change in control of the Company may have a material adverse effect on the Company’s financial condition. |

Your Board Believes it is Not in the Best Interests of All Stockholders to Turn Over Control of the Company to the Joffe Group.

The Joffe Group is asking you to remove all of your directors, without cause, and replace them with individuals handpicked by the Joffe Group. In effect, the Joffe Group is asking you to give it control without providing you with a control premium. Your Board believes that it is not in the best interests of all stockholders to turn over control of the Company to any individual stockholders or group of stockholders. Your Board is firmly committed to acting in the best interests of the Company and all of its stockholders.

All but one of the Company’s current directors are independent, that is, not also a member of the Company’s management. The Joffe Group seeks to replace these independent directors with persons handpicked by Stephen Joffe.

Your Board Believes that Stephen Joffe’s Past History Indicates that He Exhibits Unfettered Concern for his Own Personal Benefits.

As described in more detail below, in “Background of the Joffe Group Solicitation”:

| | · | In 2006, while serving as Chief Executive Officer of the Company, Stephen Joffe rejected a substantially increased compensation package offered by the Company as inadequate and resigned his executive position. Although in its consent solicitation statement the Joffe Group criticizes Mr. Straus’ compensation, Mr. Straus’ compensation for 2008 (including equity awards and perquisites) is substantially less than 50% of the compensation package Stephen Joffe rejected, which included a base salary of $750,000, a bonus of up to 150% of base salary and up to 170,000 shares of Common Stock, and is less than Stephen Joffe’s 2006 base salary of $600,000. |

| | · | While negotiating his compensation with the Board and still serving as Company Chairman and CEO, Stephen Joffe began acquiring without the Company’s knowledge approximately 7.2% of the common stock of the Company’s largest competitor, TLC Vision Corporation, which the Board determined was a violation of the Company’s ethics policy. |

| | · | When Stephen Joffe refused to divest his interest in TLC Vision on terms acceptable to the Board, the Board replaced him as Chairman of the Company and declined to nominate him for re-election as a director. |

| | · | Stephen Joffe then sought, unsuccessfully, at various times to acquire TLC Vision, to become CEO of TLC Vision with substantial cash and equity compensation for himself and to gain election for himself and two designees to the TLC Board. |

Rebuffed in his attempts to acquire TLC Vision, Stephen Joffe returned his focus to your Company.

Before and during the current consent solicitation, Stephen Joffe and the Joffe Group have repeatedly contacted the Company’s surgeons, employees and outside consultants to seek support for their solicitation and to undermine confidence in your Board and management. Your Board has been advised that members of the Joffe Group have threatened to terminate surgeons and Company employees who do not support their takeover bid if their consent solicitation is successful. Your Board believes that these tactics are divisive, undermine surgeon and employee morale and seek to benefit the Joffe Group at the expense of other stockholders.

In 2007 and 2008, Stephen Joffe and Craig Joffe launched private clinics called Joffe MediCenter operating in Minneapolis, Minnesota and Louisville, Kentucky, respectively, which offer LASIK surgery and aesthetic laser enhancement procedures. The Joffes’ clinics compete directly with the Company, which operates LASIK centers in the same markets. The Board believes that Stephen Joffe should be forthcoming with the Company’s stockholders as to what he and his son intend to do with their latest refractive surgery investment if the Joffe Group’s consent solicitation is successful. In their December 17, 2008 letter to stockholders, Stephen Joffe and Craig Joffe said they would explore selling the Joffe MediCenter to the Company, but did not commit to doing so or disclose what terms they would seek for the transaction.

The Board believes that Stephen Joffe’s pursuit of his personal objectives at the Company’s expense is not new. In July 1999, the Company first revealed it had formed a joint venture with Cole National Corporation, a traditional eyeglass retailer, to manage a referral network. According to a press release, Cole was to market the Company’s LASIK centers to plan sponsors and employees. In August 1999, while Chairman and Chief Executive Officer of the Company, Stephen Joffe and his wife revealed that they purchased a 6.7% interest in Cole National for investment purposes.

Then on February 22, 2000, Stephen Joffe wrote an open letter to Cole National’s management stating he was “very disappointed in the performance of the Company over the last several years. I think it is reasonable to assume that most of the investors share my belief.” On December 31, 2001, Stephen Joffe reported that he had liquidated his position in Cole National.

Your Board views Stephen Joffe’s tactics with Cole National as questionable given that he was publicly criticizing the Company’s new joint venture partner. The Board believes Stephen Joffe’s actions were not in the best interests of the Company and its stockholders.

Your Board believes that these prior actions raise valid questions as to Stephen Joffe’s judgment and motives, as well as showing a pattern of conflicts of interest that could distract from his duties as a director and officer.

The Company’s stockholders deserve a management team and Board that are focused on creating value for all stockholders. By inserting himself and his nominees on the Board, Stephen Joffe is looking to advance his own agenda, which is to install himself as Chief Executive Officer and his son as Chief Operating Officer and to gain control of your Company without paying anything to the Company’s stockholders. Stockholders should ask themselves, where is Stephen Joffe’s loyalty? What are his true motives? What are his plans for the Company? What are his plans for the Joffe MediCenter?

Your Board and Management Have a Thoughtful Plan for the Company and Are Implementing It.

The Company owns and operates 75 vision centers in 32 states under the LasikPlus® brand. The Company’s management firmly believes that the core strength of the Company resides in its knowledge of and ability to treat conditions of the eye.

Since Steven C. Straus became the Company’s Chief Executive Officer in November 2006, the Company’s management has rapidly implemented processes and procedures which were sorely lacking under the prior management led by Stephen Joffe and Craig Joffe. In doing so, management has professionalized the operations of the Company from a start-up enterprise to an industry leader poised for future success.

After joining the Company, Mr. Straus assembled a leadership team with expertise in healthcare, expense and cash management, multi-site operational management, consumer marketing and human resources development. The Company then embarked on parallel paths of professionalizing the management of the Company, which had been a family led, start-up enterprise, and preparing the Company for the next stage of profitable growth.

The Company operated since inception with neither detailed annual vision center-level operating budgets nor a formal strategic plan. Starting in July 2007, under the leadership of Mr. Straus, the Company’s new management has engaged in a dedicated ongoing strategic planning process to address all aspects of the Company’s business. The strategic process has enabled the Company to understand better its market, its competitors and its competencies. The operational changes and results to date of this strategic planning process are far too numerous to identify, but the following are some of the more significant achievements:

● in the area of patient experience, management has upgraded the laser technology in all of its vision centers and empowered decision-making at the vision center level to be more responsive to patient needs in individual markets;

● in the area of staff development, the Company has implemented various training, recruitment and succession planning programs for surgeons, optometrists and staff, which has resulted in improvements in exam show-rate, patient conversion and treatment show-rate;

● in the area of operations, management has reorganized and strengthened the organizational structure, including the hiring of senior executives in the areas of operations, human resources and call center management, opened state-of-the-art national call and data centers, and evaluated the Company’s laser platforms to streamline operational and clinical processes;

● in the area of financial/accounting management, management has created the first-ever detailed annual operating budget process and improved the timeliness of financial reporting;

● in the area of leadership, management has created the Optometric Advisory Board, which complements the previously established Medical Advisory Board, and has created strong partnerships between field staff and corporate support departments, and increased and improved communications across the entire Company, which helps all members say connected and improve morale.

The impact of these initiatives started to pay dividends in 2008, including:

● the Company performed over 115,000 successful laser vision correction procedures;

● the Company expanded its relationships with major managed care health and vision plans, and now has exclusive or preferred agreements with seven of the eight top U.S. health and vision plans and signed agreements with an additional five insurers;

● the Company has in place aggressive cash management initiatives, such as improved management of vendor terms, that generated approximately $3.0 million in cash flow;

● the Company reduced expenses, such as labor cost reductions, that generated approximately $14.0 million of annualized savings;

● the Company reduced marketing spend from approximately $66.5 million in 2007 to approximately $52.4 million in 2008;

● the Company reduced general and administrative overhead expense from approximately $22.7 million in 2007 to approximately $20.3 million in 2008;

● the Company reduced capital expenditures from approximately $28.9 million in 2007 to approximately $14.9 million in 2008;

● the Company negotiated a five-year even-payment $20 million term loan with a fixed interest rate below 5%; and

● the Company ended 2008 with a cash and investment balance of nearly $60 million.

As a result of these initiatives, in 2009, the Company expects to be cash flow positive at 2008 procedure levels and to have a three-year cash reserve position at a 90,000 annual procedures level.

Ongoing initiatives to strengthen further the Company’s balance sheet and financial performance include negotiations to rationalize the number of excimer lasers in each vision center to reduce costs while maintaining clinical outcomes and patient satisfaction, further improvement in collection results from internally financed patients using FICO scores to qualify patients for appropriate financing options, and continued migration toward part-time workforce to complement a core work group of full-time employees.

In addition to the reduction of marketing costs in 2008, the Company has aggressively refocused its marketing efforts on local marketing and advertising. These efforts include: local market pricing, a disciplined approach to individual market planning and budgeting as well as in depth use of analytics to evaluate marketing efficiency. Following research and a segmentation study, we developed cost-effective, market-specific plans that deliver a message that clearly differentiates LasikPlus® to targeted audiences, while building brand awareness through integrated marketing materials. The Company’s test of this new concept in 13 markets over a three-week period resulted in a 34% increase in eye procedures performed compared with a control group of 46 markets over a four-week period.

Another key component of the Company’s strategy is to institute a “Lifetime Vision” model, which allows the Company to leverage its currently installed fixed asset base and to fully utilize the highly trained and skilled ophthalmic surgeons and optometrists associated with the LCA family. The “Lifetime Vision” model is based on the concept that an individual should be a patient of the Company for life and rejects the old “Catch & Release” model that does not allow for repeat sources of revenue. The Company believes that with a phased approach, there is a potential annual revenue increase of $30.0 million by instituting Intra Ocular Lens (IOL) replacement alone. The advancement and development of the “Lifetime Vision” model will be the primary focus of the Company’s management in 2009.

In addition, the Company has also completed the first funded LASIK insurance program in the industry, underwritten by Standard Security Life Insurance Company of New York. This funded LASIK program provides partially funded Lasik insurance coverage and will be available through vision and health care plans and employer and labor union benefit plans. The Company believes that this new program will further strengthen and broaden its ability to penetrate its targeted market segments.

The Joffe Group Has Not Presented a Concrete Plan for the Company.

The Joffe Group makes a number of bold statements about the shortcomings of the current Board and management and about its ability to improve the Company’s performance. In particular, the Joffe Group says it has a “plan to right the ship,” but has failed to disclose it. By comparison, as described above, your Board and management have articulated a concrete, thoughtful plan for the future of the Company, and the Company has invested heavily in that plan.

Stephen Joffe has criticized the Company’s strategy but has not offered any concrete plan of his own. Instead, it appears he has the following intentions: (1) to install himself as Chief Executive Officer, with his son Craig Joffe as Chief Operating Officer and Alan Buckey as Chief Financial Officer, and (2) to step in and take credit for the Company’s turn-around just as current management’s strategy begins to bear fruit and financial performance begins to improve, or to change the Company’s direction and disrupt all of the progress the Company has made implementing its new strategy before stockholders have had an opportunity to benefit from the Company’s investment in that strategy. Your Board believes that the Joffe Group’s plans will not benefit you as a stockholder and are disruptive and damaging to the Company and its current strategy.

Your Board believes that the “plan” proposed by the Joffe Group in its consent solicitation statement is vague, conclusory and contradictory. For example:

| | · | It proposes to “restore positive physician relationships and confidence,” which the Board believes the Joffe Group itself has sought to undermine. |

| | · | It proposes to implement “aggressive cost reduction,” while hiring “key operational employees” but at the same time it is criticizing the Company’s current management for closing underperforming centers and reducing staff. The Joffe Group does not describe how it will accomplish this. |

| | · | It proposes to “restore patient quality” without presenting any convincing evidence that patient quality has declined. |

The Joffe Group states that it can not assure you that its “plan” will be implemented if its nominees are elected or that the election of its nominees will improve the Company or enhance your stockholder value.

Your Board and management have a business plan and are implementing it. Stephen Joffe has made only vague proclamations with no specifics whatsoever as to how or what he intends to deliver on these proclamations. If the Joffe Group’s consent solicitation is successful, the progress that has already been made with respect to the new strategy will be disrupted. Your Board urges you not to take that risk.

Your Board believes that the Principal Reasons for the Company’s Recent Financial Results are the Declines in Consumer Confidence and Discretionary Spending.

An October 28, 2008 research report on the Company by Maxim Group stated, “[w]e believe that it is too soon to call a bottom in the refractive market due to continued erosion in many key economic indicators, particularly rising unemployment and declining consumer spending…On the expense side of the equation, we applaud management’s effort to rein in expenditures across all operations during the present softening market conditions.”

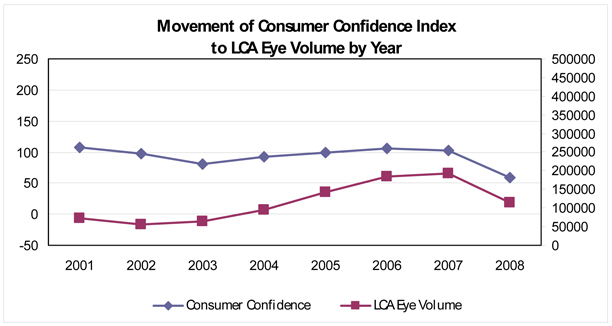

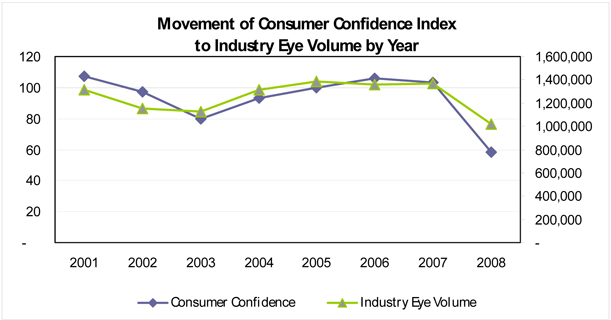

As shown below, the operating metrics of the laser vision correction industry are closely correlated to consumer confidence. Furthermore, the Company experienced a similar downturn in 2001 when Stephen Joffe was its CEO.

Although today the Company is a market leader in laser vision correction and operates 75 LasikPlus vision centers across the U.S., 10 years ago the Company operated only 22 centers, including 19 in the United States, two in Canada and one in Finland. The four-fold increase in domestic centers coincided with growth in consumer confidence and was accomplished by strategic de novo center openings, meaning each center was "built” and not "bought." The Company's growth was facilitated by then-innovative consumer marketing, including a heavy emphasis on direct-response mail and local advertising.

As shown in the following tables, the Company’s business and industry are extremely sensitive to adverse changes in the economy and especially to declines in consumer confidence.

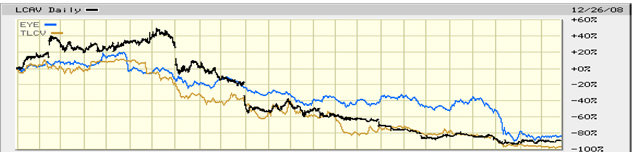

The resulting decline in procedure volume has been felt consistently across the industry, including by the two major service providers (the Company and TLC Vision), as well as the dominant technology manufacturer (AMO). Over the past two years, each of these companies lost approximately 90% of its market valuation.

The Company’s management and the Board take no comfort in the argument that the impact on Company performance by declining consumer confidence is “outside its control.” Rather, it serves as a sharp catalyst to review decisions recently made and to test and implement changes that promote future success.

As the sole (albeit loose) period of comparison to current economic times when the Company was operating at meaningful scale, the U.S. economy was in an economic down cycle for eight months as of March 2001. During this period of economic decline, which was less severe in magnitude and duration than the current recession, our country experienced a significant drop in consumer confidence, which correlated to a drop in LASIK vision correction procedure volume. Beginning then, under the leadership of Stephen Joffe, the Company reported five consecutive quarters of year-over-year revenue declines, reported a loss (excluding one-time items) for five of six consecutive quarters, postponed new center openings and restructured operations. From the first quarter of 2001 to the third quarter of 2002, the Company closed five of 31 LasikPlus vision centers (16% of its total). As a result, the Company’s estimated market share declined 40% from 6.5% in the first quarter of 2001 to 3.9% in fourth quarter of 2001.

In response to the decline, Stephen Joffe took limited actions by reducing the number of centers and decreasing operating expenses. No major initiatives were undertaken to change the marketing strategy or marketing messages, or to strengthen field or corporate leadership. Management maintained its sole dependence on elective, self-pay laser vision correction service, rather than diversifying the business model. The Company reported pre-tax operating losses in 2001 and 2002, and indeed in five of the most recent 10 years (1996 to 2005) under Stephen Joffe’s management.

The Joffe Group’s Allegations Contain Inconsistencies, Omissions and Inaccuracies

The Board believes the Joffe Group’s consent solicitation statement contains many inconsistencies, omissions and inaccuracies, including the following:

· The Joffe Group expresses “concerns” over the compensation of the Company’s senior management. Yet Mr. Straus’s compensation is substantially less than Stephen Joffe’s $600,000 base salary in 2006 and the $750,000 base salary he rejected when he resigned as CEO in 2006. The Joffe Group does not disclose the compensation arrangements it will propose for Stephen Joffe, his son Craig Joffe, and Alan Buckey if it is successful in gaining control of the Company.

· Similarly, the Joffe Group alleges that the Board's compensation is excessive without disclosing the compensation arrangements it will propose for the Board if it is successful in obtaining control of the Company. Furthermore, the Joffe Group does not tell you that the compensation arrangements for the Board which it criticizes were adopted in 2006 when Craig Joffe was a director and acting CEO of the Company and Alan Buckey was CFO of the Company.

· The Joffe Group states that Craig Joffe resigned “over concerns about the strategic direction of the Company under the leadership of the Board and the recently appointed CEO” and that Alan Buckey resigned from the Company over disappointment with the CEO and the Board. The Joffe Group does not tell you that both of them resigned after the Board declined to appoint them as CEO. The Joffe Group does not disclose why Stephen Joffe resigned as CEO. The Board believes he resigned because the Board would not meet his compensation demands, which substantially exceeded the compensation paid to the Company's current CEO and that recommended by the Company's independent compensation consultant.

· The Joffe Groups states part of its plan is to “appoint new members of the Board of Directors with the relevant experience and expertise to turn around the Company” but:

| | · | Other than Stephen Joffe, none of its nominees have any apparent expertise in healthcare. Two are lawyers, one is an accountant and the fourth is a professor of graphic design. |

| | · | The Joffe Group’s consent solicitation materials do not disclose whether its nominees (other than Stephen Joffe and Mr. VonderBrink), have any experience as a director of a public company. Mr. VonderBrink is a director of Streamline Health Solutions. Since 2006, when Mr. VonderBrink became a director of Streamline Health Solutions, its stock price has declined by approximately 66% percent. |

| | · | The Joffe Group complains that the members of the Board do not own enough shares of Common Stock, while ignoring the fact that four of its five nominees for director do not own a single share of Common Stock. |

| | · | The Joffe Group criticizes the current Board, without acknowledging that Stephen Joffe participated in the recruitment of, and approved the nomination and election of, all of the independent directors. |

If the Joffe Group’s consent solicitation is successful, the resulting change-in-control of the Company may have a material adverse effect on the Company’s financial conditios.

· If the Joffe Group’s consent solicitation is successful, a material change in the Company’s executive management will result in an “Event of Default” under the Company’s Loan and Security Agreement dated as of April 24, 2008 with PNC Equipment Finance, LLC. An Event of Default would permit the lender to require immediate repayment of the approximately $16.6 million currently outstanding under the Loan Agreement. The Joffe Group had not informed you that such acceleration could occur or how it would repay the debt and replace this financing, which bears interest at less than 5% per annum. The Board believes that doing so under current economic conditions would be very difficult at best, and that the loss of this financing could have a material adverse effect on the Company.

· A change in control of the Company also will permit GE Money Bank to terminate the open-end patient financing program for the Company’s customers under the CareCredit Program and Card Acceptance Agreement dated as of October 30, 2007. During 2008, approximately 50% of the Company’s revenues were financed through this program. The Board believes that a termination would also have a material adverse effect on the Company.

· In addition, if the Joffe Group’s solicitation is successful, and the Joffe Group’s designated directors discharge the Company’s current executive officers, their employment agreements would require the Company to pay them approximately $1.5 million in lump sum severance payments plus benefit continuation.

· Finally, in its consent solicitation the Joffe Group stated that, if successful, it would ask the new Board to reimburse its expenses in connection with the solicitation of approximately $_______.

BACKGROUND OF THE JOFFE GROUP

SOLICITATION

From 2006 to the present, the members of the Joffe Group abruptly resigned their respective positions with the Company to pursue alternative objectives. By early 2005, then Company CEO/Chairman Stephen Joffe, who had been the Company’s largest stockholder, had divested virtually all of his holdings in the Company. SEC filings indicate that he transferred approximately 1 million shares to his son Craig Joffe in early 2005. He did not advise the Board in advance of his intent to do so.

Stephen Joffe’s annual monetary compensation as CEO of the Company increased from $325,000 in 2004 to $600,000 in 2005, substantially more than Steven Straus is paid today. In 2005, Stephen Joffe hired an outside compensation consultant to assist him in negotiating his compensation for the 2006 to 2008 period. The Board’s Compensation Committee, on the advice of its independent compensation consultant, was willing to increase Stephen Joffe’s compensation substantially. However, the Committee’s proposed increase (to $750,000, with a bonus of up to 150% of salary, 95,000 restricted shares of Common Stock and up to 75,000 additional shares of Common Stock on the achievement of specified performance targets) did not reach the level Stephen Joffe was seeking – a level the Committee deemed excessive – and Stephen Joffe resigned his CEO position as of March 1, 2006.

In connection with his resignation, Stephen Joffe negotiated an arrangement that would pay him $1.0 million to remain as Chairman of the Company until the end of 2006. While negotiating with the Board and still serving as Company Chairman and CEO, Stephen Joffe, without the Company’s knowledge, began acquiring 4.3 million shares of common stock of the Company’s largest competitor, TLC Vision Corporation. The Board believed that his sizable equity stake in TLC Vision violated the Company’s business code of ethical conduct. In March 2006, when Stephen Joffe refused to concur with the Board’s proposal for divesting his interest in TLC Vision, the Board replaced Stephen Joffe as Company Chairman and decided not to nominate him for reelection as a director at the 2006 Annual Meeting of Stockholders. Stephen Joffe was paid a lump sum severance of $1.0 million in cash.

With no succession plan in place, the Board immediately named as interim CEO Stephen Joffe’s son Craig Joffe, who had been serving as Chief Operating Officer and General Counsel. The Board hired an industry-leading national recruitment firm, SpencerStuart, to seek a permanent CEO with Craig Joffe among the candidates under consideration for the position. In November 2006, Steven Straus was named Company CEO and a member of the Board. Craig Joffe remained with the Company as Chief Operating Officer and General Counsel and a member of the Board for five additional months until he unexpectedly resigned in late March 2007.

In January 2007, Stephen Joffe engaged in discussions to acquire TLC Vision. According to TLC Vision:

“[TLC Vision] engaged in good faith negotiations with [Stephen Joffe] over several months, including negotiating the terms of an acquisition agreement. Late in the process, however, [Stephen] Joffe and his advisors became unresponsive for a period of time and then presented the [TLC Vision] board of directors with a list of new demands, many of which related to significant issues that had been the subject of previous negotiations and which the board of directors and its advisors thought had been agreed upon. Based on [Stephen] Joffe’s new demands, [the TLC Vision] board of directors concluded that [Stephen] Joffe’s offer was not bona fide and requested that he make a firm offer or discussions would be terminated. [Stephen] Joffe was unwilling to present a firm bona fide offer [and] discussions were terminated…”

TLC Vision also reported that in May 2007, Stephen Joffe approached TLC Vision’s board of directors about joining TLC Vision’s board and taking an executive position with TLC Vision. Over the course of approximately four weeks of discussions, Stephen Joffe made clear to the TLC Vision board that he would require a compensation package including stock options for himself and his management team exercisable for approximately 15% of TLC Vision’s outstanding shares. TLC Vision and Stephen Joffe were unable to reach agreement.

Stephen Joffe then proposed in early 2008 that TLC Vision shareholders elect himself and two of his designees to the TLC Vision board of directors. Stephen Joffe stated that he intended to solicit proxies to elect his nominees at the TLC Vision 2008 annual meeting, but TLC Vision’s board opposed his proposal, and, on May 7, 2008, he announced he had abandoned this effort.

After eight years of service to the Company, Alan Buckey resigned abruptly in June 2008 from his position as Executive Vice President and Chief Financial Officer and promptly joined the Joffe Group.

Beginning in October 2008, when the Company’s Common Stock was trading at historic lows, the Joffe Group began to purchase Common Stock. On November 5, 2008, the Joffe Group filed a Schedule 13D with the SEC reporting that they had purchased an aggregate of 2,115,320 shares of Common Stock at prices ranging from $2.29 to $3.20 per share between October 6, 2008 and November 4, 2008. In the filing, the Joffe Group stated that its intent in purchasing the shares was investment and that it had no present plan or proposal relating to changing the management of the Company.

At a meeting held on November 11, 2008, the Board approved a Stockholders Rights Plan (the “Plan”), which was later finalized and announced on November 24, 2008. The Board had been considering the adoption of the Plan for more than six months. The Board determined that the Plan was desirable to preserve the long-term value for the Company in the event of a takeover. The Plan is not intended, and will not, prevent a takeover of the Company, but is intended to ensure that all Company stockholders receive equal treatment in a takeover and to guard against tactics that could impair the Board’s ability to represent stockholders’ interests fully. Contrary to assertions by the Joffe Group in its letter of November 24, 2008 and in its consent solicitation materials, the Plan’s terms, including the “adverse person” provisions, are similar to those adopted by many other public companies. Furthermore, the Board has not invoked, and has no current intention to invoke, the “adverse person” provision against the Joffe Group.

On November 13, 2008, at his request, the Joffe Group met with Anthony Woods and William Bahl, independent directors of the Company. In that meeting, Stephen Joffe expressed concern about the business and management of the Company but declined to offer any concrete proposals to improve the Company’s results of operations.

On November 18, 2008, the Board discussed the meeting with Stephen Joffe. On November 19, 2008, Mr. Woods advised Stephen Joffe that the Board had discussed the November 13 meeting, but the Board was not prepared to replace its current management team with the Joffe Group.

On November 21, November 24, December 4 and December 9, 2008, the Joffe Group sent letters to Mr. Woods and the Board criticizing the Board and management, criticizing the adoption of the Plan, requesting Board representation and calling for a special meeting of stockholders to approve the Plan.

On December 10, 2008, the Board responded in writing to the Joffe Group, as follows:

December 10, 2008

VIA EMAIL & CERTIFIED MAIL

Stephen N. Joffe

Craig P. Joffe

Alan H. Buckey

9650 Montgomery Road

Cincinnati, Ohio 45242

Gentlemen:

The Board of Directors of LCA-Vision has received and reviewed each of your letters.

The Board is, of course, concerned about the Company's recent operating results and aware of the business challenges the Company faces, although it does not agree with your description of the Company's condition as "dire" or its prognosis as "poor." As in prior economic downturns, a decline in consumer confidence and discretionary spending has adversely affected the Company's performance. The Company has adopted and is implementing a business plan, including the actions described in its recent SEC filings, which the Board believes are appropriate during the current difficult economic situation. The Board is confident in the ability of its current management team to execute this business plan.

With respect to your recent request for Board representation and appointment to management positions at the Company, as you have noted repeatedly, each of you has previously served as an executive officer of LCA-Vision and, in the case of Steve and Craig, also as a Director. Each of you voluntarily resigned from those positions of trust to pursue alternative personal or business objectives. It seems to the Board for you to request such appointments is disingenuous after previously abandoning the Company.

Finally, the Board's rationale for taking certain recent actions has been adequately explained in the Company's public announcements regarding those actions. In particular, the stockholders' rights plan is designed to benefit all stockholders by ensuring that all stockholders receive equal treatment in the event of any proposed takeover, and to guard against tactics that could impair the Board's ability to represent stockholders' interests fully and independently. Under the Company's policies, the Board is authorized to adopt a rights plan without prior approval if the plan is submitted for stockholder approval within 12 months of adoption. Accordingly, the plan provides that it will expire if its adoption is not ratified by the stockholders within 12 months. Consequently, the Board does not believe that it is necessary or prudent to call an immediate special meeting of stockholders for this purpose.

The Board is certainly open to hearing the suggestions of the Company's stockholders, as evidenced by our arranging a meeting between you and certain members of the Board. However, your recent letter writing campaign has become a distraction to executing our strategic plan. Thus, we do not intend to respond to your letters individually, as they tend to repeat certain themes with which we don't agree.

|

| |

| /s/ E. Anthony Woods |

|

| Chairman of the Board |

The Joffe Group continued to criticize publicly and privately the Company’s Board and management, without offering any concrete suggestions for changing the Company’s strategic plan, culminating in the publication, on December 17, 2008, of a letter to stockholders demanding the ouster of the entire Board and its replacement with members and designees of the Joffe Group and announcing the proposed consent solicitation.

In private conversations with representatives of the Company, Stephen Joffe rejected any solution that did not include the Joffe Group’s obtaining control of the Board, the ouster of the Company’s current senior management and their replacement by the Joffe Group.

On December 22, 2008, Craig Joffe delivered a letter to the Company requesting a complete list of the Company’s stockholders and other corporate records. The Company promptly supplied him with all information required by law.

On December 29, 2008, the Company issued the following press release:

CINCINNATI, Dec 29, 2008 — The LCA-Vision Inc. (Nasdaq: LCAV) Board of Directors strongly opposes the consent solicitation threatened by the Joffe group. The Board believes that the Company has undertaken a prudent and achievable strategic plan to return the Company to profitability and that the Joffe intervention is a poorly designed effort to take control of your Company. The Board further believes that the Joffe effort is an undue distraction to the Company that would damage shareholder value. The Board of Directors strongly encourages stockholders to refrain from taking any action regarding the Joffe group's consent solicitation until they have had the benefit of the Board's recommendation and accompanying explanation.

On December 31, 2008, the Board adopted amendments to the Bylaws to ensure that all stockholders have advance notice of nominations of directors and the proposal of other business, as applicable, to be brought before stockholders at an annual meeting. The Joffe Group is not seeking the repeal of these amendments.

On January 16, 2009, the Joffe Group filed its preliminary consent solicitation statement with the SEC.