UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

Investment Company Act file number | 811-00816 |

| |

AMERICAN CENTURY MUTUAL FUNDS, INC. |

(Exact name of registrant as specified in charter) |

| |

4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

(Address of principal executive offices) | (Zip Code) |

| |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

(Name and address of agent for service) |

| |

Registrant’s telephone number, including area code: | 816-531-5575 |

| |

Date of fiscal year end: | 10-31 |

| |

Date of reporting period: | 10-31-2017 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| |

| Annual Report |

| |

| October 31, 2017 |

| |

| Adaptive Equity Fund |

|

| | |

President’s Letter | 2 |

|

Performance | 3 |

|

Portfolio Commentary | |

|

Fund Characteristics | |

|

Shareholder Fee Example | |

|

Schedule of Investments | |

|

Statement of Assets and Liabilities | |

|

Statement of Operations | |

|

Statement of Changes in Net Assets | |

|

Notes to Financial Statements | |

|

Financial Highlights | |

|

Report of Independent Registered Public Accounting Firm | |

|

Management | |

|

Approval of Management Agreement | |

|

Proxy Voting Results | |

|

Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended October 31, 2017. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

‘Risk-On’ Sentiment Sparked Strong Gains Among Stocks

U.S. stocks delivered robust double-digit gains for the reporting period. The “risk-on” rally began early in the period, following Donald Trump’s election victory in November 2016. Investor expectations for President Trump’s administration to usher in pro-growth policies and reforms drove stock prices higher. In addition, healthy corporate earnings growth and improving gross domestic product (GDP) and other economic data provided additional support for stocks. Against this backdrop, the S&P 500 Index reached several milestone levels during the period and returned 23.63%. In terms of equity styles, riskier and economically sensitive stocks generally remained in favor. For example, small-cap stocks generally outperformed their mid- and large-cap peers, while growth stocks broadly outperformed their value counterparts across the capitalization spectrum. Real estate investment trusts (REITs) advanced, but global property stocks significantly underperformed the broader stock market as interest rates increased, most notably in the U.S., where the Federal Reserve (Fed) raised rates three times during the period.

As stocks soared in the post-election environment, global bonds sold off sharply. President Trump’s policy agenda fueled inflation fears that sent global bond yields sharply higher in late 2016. However, broad bond market performance generally recovered beginning in early 2017, advancing on subdued inflation and continued central bank accommodation to post modest gains for the entire reporting period. Investor preferences for risk also extended to the global fixed-income market, where high-yield corporate and emerging markets bonds were top performers.

As Congress considers tax cuts and other pro-growth reforms and the Fed and other central banks pursue policy normalization, investors likely will face new opportunities and challenges in the months ahead. We continue to believe in a disciplined, diversified, and risk-aware approach, using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | | |

Total Returns as of October 31, 2017 |

| | | Average Annual Returns | |

| Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

Investor Class | AMVIX | 24.92% | 15.52% | 4.55% | — | 11/30/99 |

Russell 1000 Index | — | 23.67% | 15.17% | 7.60% | — | — |

I Class | AVDIX | 25.19% | 15.75% | 4.76% | — | 8/1/00 |

A Class | AVDAX | | | | | 12/1/16 |

No sales charge | | — | — | — | 19.50% | |

With sales charge | | — | — | — | 12.68% | |

R Class | AVDRX | — | — | — | 19.28% | 12/1/16 |

R6 Class | AVDMX | — | — | — | 20.17% | 12/1/16 |

Average annual returns since inception are presented when ten years of performance history is not available. Fund returns would have been lower if a portion of the fees had not been waived. Prior to April 10, 2017, the

I Class was referred to as the Institutional Class.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

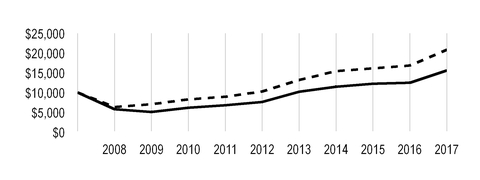

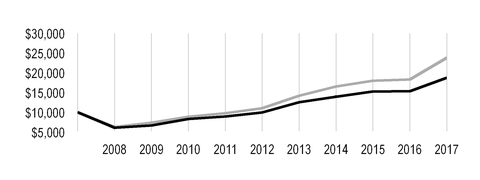

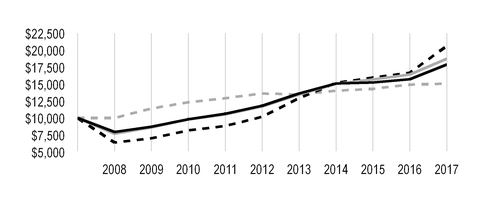

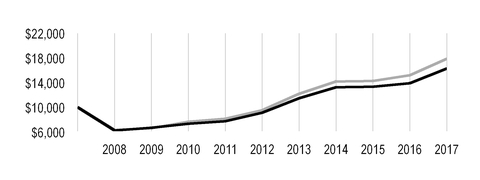

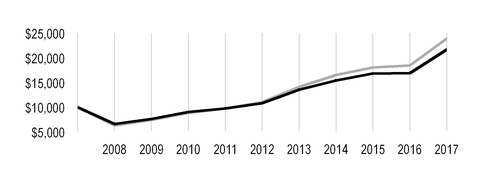

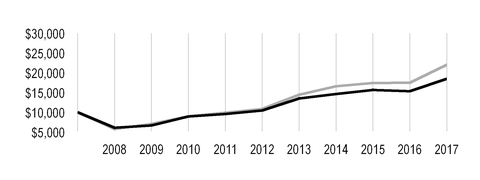

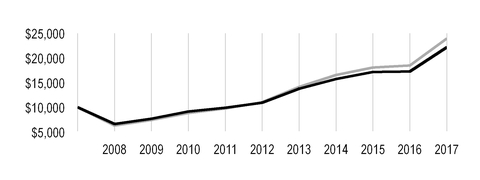

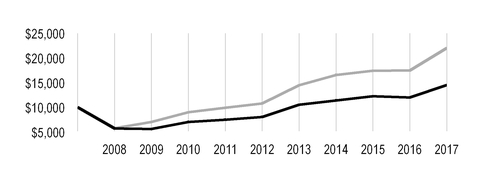

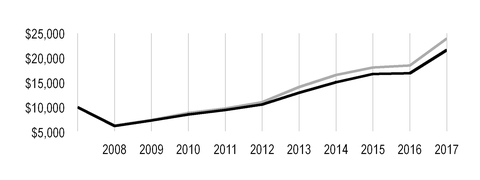

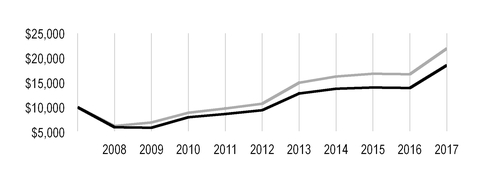

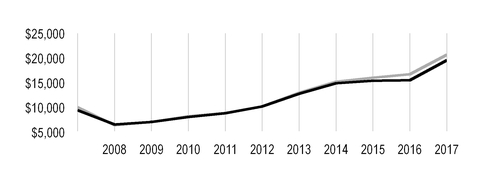

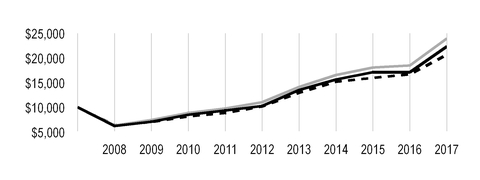

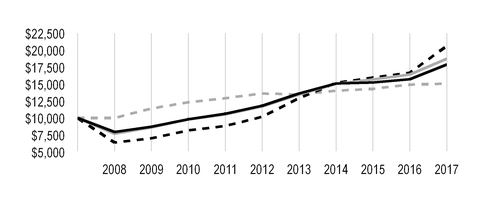

Growth of $10,000 Over 10 Years |

$10,000 investment made October 31, 2007 |

Performance for other share classes will vary due to differences in fee structure. |

|

| |

Value on October 31, 2017 |

| Investor Class — $15,604 |

|

| Russell 1000 Index — $20,818 |

|

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

|

| | | | |

Total Annual Fund Operating Expenses |

Investor Class | I Class | A Class | R Class | R6 Class |

1.25% | 1.05% | 1.50% | 1.75% | 0.90% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Stephen Pool and Joe Reiland

In January 2017, portfolio manager Don Owen retired from American Century Investments and portfolio manager Joe Reiland was added to the fund’s management team.

Performance Summary

Adaptive Equity returned 24.92%* for the 12 months ended October 31, 2017, outpacing the 23.67% return of the portfolio’s benchmark, the Russell 1000 Index.

U.S. stock indices posted positive returns during the reporting period. Growth stocks outperformed value stocks by a wide margin across the capitalization spectrum. Within the Russell 1000 Index, all sectors except telecommunication services posted gains. Information technology, financials, materials, and industrials all recorded total returns greater than the index average.

In this environment, Adaptive Equity’s highly systematic investment process delivered positive portfolio returns and outperformed its benchmark, the Russell 1000 Index. The fund received the best absolute contributions from information technology and financials stocks, while only our energy holdings generated a modest negative contribution. Relative to the Russell benchmark, stock selection in the real estate sector led results, and stock choices in materials, financials, consumer staples, and consumer discretionary were also positive. Stock selection in the energy, health care, and information technology sectors hampered performance.

Real Estate Led Contributors

Stock selection among equity real estate investment trusts was a significant contributor to fund performance in the real estate sector. Although none of our holdings were top-10 contributors, data center real estate trust DuPont Fabros Technology was a solid contributor in the sector, benefiting from a merger that brought shareholders a premium for their shares. As a result of the merger, the holding was eliminated.

Stock decisions in the chemicals industry boosted performance in the materials sector. Titanium dioxide producer Tronox was a significant contributor. Titanium dioxide is used in a variety of products including paint and food coloring, and the company benefited from strong demand and cost-cutting initiatives.

In financials, exposure to Green Dot was a strong contributor. The company, which provides prepaid credit cards through various retail stores and offers other banking services, posted strong quarterly results, and it recently signed deals with Apple and Uber. Mobile payment firm Square reported very good results in topline growth. The company has historically focused on smaller merchants but it is successfully moving up to larger businesses. Although energy was a detractor overall, Resolute Energy was a top contributor, aided by positive investor sentiment regarding a major acquisition. Resolute Energy was eliminated.

*All fund returns referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

Energy Holdings Hampered Performance

Clean Energy Fuels was a major detractor in the energy sector. The supplier of fuel for natural gas-fueled vehicles fell on increased costs and lower revenue. The holding was eliminated. EP Energy, an exploration and production company, fell sharply early in 2017 on concerns about the firm’s balance sheet.

Among other significant detractors, shares of life sciences company Cambrex declined as investors became concerned about its reliance on one customer, Gilead Sciences, whose hepatitis C drug has come under competitive pressure and lower demand. Information technology software and services company Unisys detracted after reporting disappointing earnings. The consumer credit reporting company Equifax fell sharply after it revealed that hackers had breached its data, compromising the information of as many as 143 million people. The holding was eliminated.

Outlook

Using a systematic and quantitatively driven process, Adaptive Equity combines market factors and company-specific information in a unique model to underpin its stock selection process. Looking ahead, we remain confident that this systematic process will continue to successfully identify risk-adjusted opportunities across investment styles and industry sectors.

|

| |

OCTOBER 31, 2017 | |

Top Ten Holdings | % of net assets |

Microsoft Corp. | 2.5% |

Apple, Inc. | 2.2% |

Amazon.com, Inc. | 2.1% |

Tronox Ltd., Class A | 2.0% |

Essent Group Ltd. | 1.9% |

RealPage, Inc. | 1.9% |

Alphabet, Inc., Class A | 1.9% |

Monster Beverage Corp. | 1.9% |

Corning, Inc. | 1.7% |

Intel Corp. | 1.6% |

| |

Top Five Industries | % of net assets |

Equity Real Estate Investment Trusts (REITs) | 5.8% |

Oil, Gas and Consumable Fuels | 5.8% |

IT Services | 5.6% |

Software | 5.5% |

Internet Software and Services | 5.3% |

| |

Types of Investments in Portfolio | % of net assets |

Common Stocks | 99.0% |

Temporary Cash Investments | 1.0% |

Other Assets and Liabilities | —* |

*Category is less than 0.05% of total net assets.

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from May 1, 2017 to October 31, 2017.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| Beginning

Account Value

5/1/17 | Ending

Account Value

10/31/17 | Expenses Paid

During Period(1)

5/1/17 - 10/31/17 | Annualized

Expense Ratio(1) |

Actual | | | | |

Investor Class | $1,000 | $1,088.70 | $6.11 | 1.16% |

I Class | $1,000 | $1,090.30 | $5.06 | 0.96% |

A Class | $1,000 | $1,087.10 | $7.42 | 1.41% |

R Class | $1,000 | $1,086.30 | $8.73 | 1.66% |

R6 Class | $1,000 | $1,091.10 | $4.27 | 0.81% |

Hypothetical | | | | |

Investor Class | $1,000 | $1,019.36 | $5.90 | 1.16% |

I Class | $1,000 | $1,020.37 | $4.89 | 0.96% |

A Class | $1,000 | $1,018.10 | $7.17 | 1.41% |

R Class | $1,000 | $1,016.84 | $8.44 | 1.66% |

R6 Class | $1,000 | $1,021.12 | $4.13 | 0.81% |

| |

(1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

OCTOBER 31, 2017

|

| | | | | |

| Shares | Value |

COMMON STOCKS — 99.0% | | |

Aerospace and Defense — 2.2% | | |

Aerojet Rocketdyne Holdings, Inc.(1) | 10,909 |

| $ | 344,506 |

|

Boeing Co. (The) | 2,822 |

| 728,019 |

|

Curtiss-Wright Corp. | 2,259 |

| 267,127 |

|

General Dynamics Corp. | 4,766 |

| 967,403 |

|

| | 2,307,055 |

|

Airlines — 1.5% | | |

Hawaiian Holdings, Inc.(1) | 15,958 |

| 534,593 |

|

Southwest Airlines Co. | 18,319 |

| 986,661 |

|

| | 1,521,254 |

|

Automobiles — 0.4% | | |

Ford Motor Co. | 33,102 |

| 406,162 |

|

Banks — 0.6% | | |

1st Source Corp. | 554 |

| 28,426 |

|

U.S. Bancorp | 11,151 |

| 606,391 |

|

| | 634,817 |

|

Beverages — 1.9% | | |

Monster Beverage Corp.(1) | 33,184 |

| 1,922,349 |

|

Biotechnology — 2.9% | | |

AbbVie, Inc. | 10,569 |

| 953,852 |

|

Amgen, Inc. | 6,574 |

| 1,151,897 |

|

Gilead Sciences, Inc. | 11,474 |

| 860,091 |

|

| | 2,965,840 |

|

Building Products — 0.4% | | |

Simpson Manufacturing Co., Inc. | 7,317 |

| 407,850 |

|

Capital Markets — 1.7% | | |

Janus Henderson Group plc | 37,256 |

| 1,294,646 |

|

Moelis & Co., Class A | 11,722 |

| 501,116 |

|

| | 1,795,762 |

|

Chemicals — 2.2% | | |

AgroFresh Solutions, Inc.(1) | 42,967 |

| 253,505 |

|

Tronox Ltd., Class A | 76,931 |

| 2,036,364 |

|

| | 2,289,869 |

|

Communications Equipment — 1.7% | | |

Cisco Systems, Inc. | 35,049 |

| 1,196,923 |

|

Palo Alto Networks, Inc.(1) | 3,577 |

| 526,535 |

|

| | 1,723,458 |

|

Consumer Finance — 2.8% | | |

American Express Co. | 15,385 |

| 1,469,575 |

|

Green Dot Corp., Class A(1) | 24,700 |

| 1,398,514 |

|

| | 2,868,089 |

|

|

| | | | | |

| Shares | Value |

Diversified Financial Services — 1.1% | | |

Berkshire Hathaway, Inc., Class B(1) | 5,837 |

| $ | 1,091,169 |

|

Diversified Telecommunication Services — 1.2% | | |

AT&T, Inc. | 37,179 |

| 1,251,073 |

|

Electric Utilities — 2.0% | | |

Exelon Corp. | 32,515 |

| 1,307,428 |

|

Great Plains Energy, Inc. | 24,157 |

| 793,074 |

|

| | 2,100,502 |

|

Electrical Equipment — 1.0% | | |

Rockwell Automation, Inc. | 5,128 |

| 1,029,805 |

|

Electronic Equipment, Instruments and Components — 1.7% | | |

Corning, Inc. | 55,108 |

| 1,725,431 |

|

Energy Equipment and Services — 0.6% | | |

Oceaneering International, Inc. | 31,973 |

| 646,494 |

|

Equity Real Estate Investment Trusts (REITs) — 5.8% | | |

American Tower Corp. | 11,595 |

| 1,665,854 |

|

Apple Hospitality REIT, Inc. | 68,926 |

| 1,305,458 |

|

Ashford Hospitality Prime, Inc. | 34,908 |

| 339,306 |

|

Brixmor Property Group, Inc. | 8,766 |

| 153,142 |

|

CareTrust REIT, Inc. | 36,003 |

| 680,457 |

|

CBL & Associates Properties, Inc. | 24,794 |

| 194,385 |

|

InfraREIT, Inc.(1) | 60,563 |

| 1,356,611 |

|

LaSalle Hotel Properties | 11,245 |

| 317,221 |

|

| | 6,012,434 |

|

Food and Staples Retailing — 2.6% | | |

CVS Health Corp. | 15,617 |

| 1,070,233 |

|

Wal-Mart Stores, Inc. | 18,473 |

| 1,612,878 |

|

| | 2,683,111 |

|

Food Products — 1.3% | | |

Blue Buffalo Pet Products, Inc.(1) | 29,290 |

| 847,360 |

|

General Mills, Inc. | 5,319 |

| 276,162 |

|

Post Holdings, Inc.(1) | 2,134 |

| 176,973 |

|

| | 1,300,495 |

|

Gas Utilities — 0.6% | | |

ONE Gas, Inc. | 7,595 |

| 584,663 |

|

Health Care Equipment and Supplies — 1.2% | | |

Haemonetics Corp.(1) | 25,078 |

| 1,192,710 |

|

Health Care Providers and Services — 3.7% | | |

Anthem, Inc. | 7,700 |

| 1,610,917 |

|

Cardinal Health, Inc. | 9,473 |

| 586,379 |

|

HCA Healthcare, Inc.(1) | 8,287 |

| 626,912 |

|

Premier, Inc., Class A(1) | 9,139 |

| 298,571 |

|

UnitedHealth Group, Inc. | 3,242 |

| 681,533 |

|

| | 3,804,312 |

|

Hotels, Restaurants and Leisure — 1.6% | | |

Buffalo Wild Wings, Inc.(1) | 10,366 |

| 1,225,261 |

|

|

| | | | | |

| Shares | Value |

Wynn Resorts Ltd. | 3,081 |

| $ | 454,417 |

|

| | 1,679,678 |

|

Independent Power and Renewable Electricity Producers — 1.3% | | |

Ormat Technologies, Inc. | 20,040 |

| 1,301,197 |

|

Industrial Conglomerates — 1.2% | | |

3M Co. | 5,577 |

| 1,283,770 |

|

Insurance — 3.3% | | |

Aon plc | 8,036 |

| 1,152,603 |

|

Chubb Ltd. | 10,782 |

| 1,626,141 |

|

Kemper Corp. | 10,597 |

| 679,268 |

|

| | 3,458,012 |

|

Internet and Direct Marketing Retail — 2.8% | | |

Amazon.com, Inc.(1) | 1,932 |

| 2,135,401 |

|

Liberty TripAdvisor Holdings, Inc., Class A(1) | 8,630 |

| 93,204 |

|

Netflix, Inc.(1) | 3,321 |

| 652,344 |

|

| | 2,880,949 |

|

Internet Software and Services — 5.3% | | |

Alphabet, Inc., Class A(1) | 1,896 |

| 1,958,644 |

|

Facebook, Inc., Class A(1) | 7,443 |

| 1,340,186 |

|

GoDaddy, Inc., Class A(1) | 7,908 |

| 369,304 |

|

NIC, Inc. | 37,001 |

| 629,017 |

|

Yelp, Inc.(1) | 24,838 |

| 1,160,431 |

|

| | 5,457,582 |

|

IT Services — 5.6% | | |

Alliance Data Systems Corp. | 168 |

| 37,587 |

|

Conduent, Inc.(1) | 32,741 |

| 506,831 |

|

CoreLogic, Inc.(1) | 21,828 |

| 1,023,733 |

|

EVERTEC, Inc. | 38,642 |

| 579,630 |

|

FleetCor Technologies, Inc.(1) | 1,632 |

| 269,721 |

|

PayPal Holdings, Inc.(1) | 21,522 |

| 1,561,636 |

|

Square, Inc., Class A(1) | 14,838 |

| 551,825 |

|

Unisys Corp.(1) | 100,591 |

| 880,171 |

|

Visa, Inc., Class A | 3,941 |

| 433,431 |

|

| | 5,844,565 |

|

Leisure Products — 0.6% | | |

Callaway Golf Co. | 45,172 |

| 651,832 |

|

Life Sciences Tools and Services — 2.2% | | |

Cambrex Corp.(1) | 24,743 |

| 1,070,135 |

|

Quintiles IMS Holdings, Inc.(1) | 11,656 |

| 1,260,013 |

|

| | 2,330,148 |

|

Machinery — 0.7% | | |

IDEX Corp. | 1,295 |

| 166,032 |

|

Xylem Inc. | 9,048 |

| 601,963 |

|

| | 767,995 |

|

Marine — 0.1% | | |

Costamare, Inc. | 15,137 |

| 94,001 |

|

|

| | | | | |

| Shares | Value |

Media — 2.7% | | |

Comcast Corp., Class A | 30,632 |

| $ | 1,103,671 |

|

Omnicom Group, Inc. | 10,765 |

| 723,300 |

|

Walt Disney Co. (The) | 9,666 |

| 945,432 |

|

| | 2,772,403 |

|

Metals and Mining — 0.1% | | |

Newmont Mining Corp. | 3,512 |

| 126,994 |

|

Multi-Utilities — 0.3% | | |

Consolidated Edison, Inc. | 3,872 |

| 333,186 |

|

Oil, Gas and Consumable Fuels — 5.8% | | |

EP Energy Corp., Class A(1) | 175,652 |

| 474,261 |

|

Exxon Mobil Corp. | 14,432 |

| 1,202,907 |

|

Laredo Petroleum, Inc.(1) | 74,233 |

| 884,857 |

|

Marathon Petroleum Corp. | 8,460 |

| 505,401 |

|

Occidental Petroleum Corp. | 9,472 |

| 611,607 |

|

Williams Cos., Inc. (The) | 40,512 |

| 1,154,592 |

|

Williams Partners LP | 31,529 |

| 1,167,834 |

|

| | 6,001,459 |

|

Paper and Forest Products — 1.1% | | |

Domtar Corp. | 24,377 |

| 1,153,520 |

|

Personal Products — 0.4% | | |

Estee Lauder Cos., Inc. (The), Class A | 4,157 |

| 464,794 |

|

Pharmaceuticals — 3.3% | | |

Merck & Co., Inc. | 7,453 |

| 410,586 |

|

Mylan NV(1) | 9,564 |

| 341,530 |

|

Pfizer, Inc. | 40,955 |

| 1,435,882 |

|

Phibro Animal Health Corp., Class A | 18,324 |

| 689,899 |

|

Prestige Brands Holdings, Inc.(1) | 11,864 |

| 556,422 |

|

| | 3,434,319 |

|

Professional Services — 0.6% | | |

Exponent, Inc. | 8,286 |

| 611,921 |

|

Road and Rail — 1.6% | | |

Genesee & Wyoming, Inc., Class A(1) | 12,006 |

| 861,790 |

|

Saia, Inc.(1) | 11,626 |

| 753,365 |

|

| | 1,615,155 |

|

Semiconductors and Semiconductor Equipment — 2.7% | | |

Diodes, Inc.(1) | 3,537 |

| 121,461 |

|

First Solar, Inc.(1) | 5,622 |

| 308,198 |

|

Intel Corp. | 36,852 |

| 1,676,397 |

|

QUALCOMM, Inc. | 5,390 |

| 274,944 |

|

Texas Instruments, Inc. | 4,281 |

| 413,930 |

|

| | 2,794,930 |

|

Software — 5.5% | | |

Intuit, Inc. | 3,224 |

| 486,888 |

|

Manhattan Associates, Inc.(1) | 10,460 |

| 437,856 |

|

Microsoft Corp. | 31,545 |

| 2,623,913 |

|

Nuance Communications, Inc.(1) | 8,059 |

| 118,790 |

|

|

| | | | | |

| Shares | Value |

RealPage, Inc.(1) | 45,887 |

| $ | 1,986,907 |

|

| | 5,654,354 |

|

Specialty Retail — 1.8% | | |

Home Depot, Inc. (The) | 6,721 |

| 1,114,208 |

|

L Brands, Inc. | 928 |

| 39,941 |

|

Lowe's Cos., Inc. | 9,013 |

| 720,589 |

|

| | 1,874,738 |

|

Technology Hardware, Storage and Peripherals — 2.4% | | |

Apple, Inc. | 13,509 |

| 2,283,562 |

|

Hewlett Packard Enterprise Co. | 13,573 |

| 188,936 |

|

| | 2,472,498 |

|

Thrifts and Mortgage Finance — 3.5% | | |

Essent Group Ltd.(1) | 47,198 |

| 2,011,579 |

|

Federal Agricultural Mortgage Corp., Class C | 1,358 |

| 100,818 |

|

Northwest Bancshares, Inc. | 90,841 |

| 1,532,487 |

|

| | 3,644,884 |

|

Tobacco — 0.9% | | |

Altria Group, Inc. | 14,774 |

| 948,786 |

|

Wireless Telecommunication Services — 0.5% | | |

T-Mobile US, Inc.(1) | 8,737 |

| 522,210 |

|

TOTAL COMMON STOCKS

(Cost $82,095,525) | | 102,440,584 |

|

TEMPORARY CASH INVESTMENTS — 1.0% | | |

Repurchase Agreement, BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 0.375% - 1.375%, 1/15/27 - 2/15/45, valued at $565,107), in a joint trading account at 0.88%, dated 10/31/17, due 11/1/17 (Delivery value $552,771) | | 552,757 |

|

Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 2.50%, 5/15/46, valued at $473,090), at 0.34%, dated 10/31/17, due 11/1/17 (Delivery value $460,004) | | 460,000 |

|

State Street Institutional U.S. Government Money Market Fund, Premier Class | 1,325 |

| 1,325 |

|

TOTAL TEMPORARY CASH INVESTMENTS

(Cost $1,014,082) | | 1,014,082 |

|

TOTAL INVESTMENT SECURITIES — 100.0%

(Cost $83,109,607) | | 103,454,666 |

|

OTHER ASSETS AND LIABILITIES† | | (10,385 | ) |

TOTAL NET ASSETS — 100.0% | | $ | 103,444,281 |

|

|

| | |

NOTES TO SCHEDULE OF INVESTMENTS |

† Category is less than 0.05% of total net assets.

See Notes to Financial Statements.

|

|

Statement of Assets and Liabilities |

|

| | | |

OCTOBER 31, 2017 | |

Assets | |

Investment securities, at value (cost of $83,109,607) | $ | 103,454,666 |

|

Receivable for investments sold | 1,859,937 |

|

Receivable for capital shares sold | 1,005 |

|

Dividends and interest receivable | 58,396 |

|

| 105,374,004 |

|

| |

Liabilities | |

Payable for investments purchased | 1,795,959 |

|

Payable for capital shares redeemed | 33,463 |

|

Accrued management fees | 99,112 |

|

Distribution and service fees payable | 31 |

|

Accrued other expenses | 1,158 |

|

| 1,929,723 |

|

| |

Net Assets | $ | 103,444,281 |

|

| |

Net Assets Consist of: | |

Capital (par value and paid-in surplus) | $ | 76,141,033 |

|

Undistributed net investment income | 271,903 |

|

Undistributed net realized gain | 6,686,286 |

|

Net unrealized appreciation | 20,345,059 |

|

| $ | 103,444,281 |

|

|

| | | | |

| Net Assets | Shares Outstanding | Net Asset Value Per Share |

Investor Class, $0.01 Par Value | $98,584,706 | 8,113,332 |

| $12.15 |

I Class, $0.01 Par Value | $4,568,217 | 367,247 |

| $12.44 |

A Class, $0.01 Par Value | $29,882 | 2,443 |

| $12.23* |

R Class, $0.01 Par Value | $60,930 | 4,992 |

| $12.21 |

R6 Class, $0.01 Par Value | $200,546 | 15,940 |

| $12.58 |

*Maximum offering price $12.98 (net asset value divided by 0.9425).

See Notes to Financial Statements.

|

| | | |

YEAR ENDED OCTOBER 31, 2017 | |

Investment Income (Loss) | |

Income: | |

Dividends (net of foreign taxes withheld of $6,307) | $ | 1,718,163 |

|

Interest | 2,246 |

|

| 1,720,409 |

|

| |

Expenses: | |

Management fees | 1,223,807 |

|

Distribution and service fees: | |

A Class | 63 |

|

R Class | 190 |

|

Directors' fees and expenses | 3,029 |

|

Other expenses | 3,276 |

|

| 1,230,365 |

|

Fees waived(1) | (98,454 | ) |

| 1,131,911 |

|

| |

Net investment income (loss) | 588,498 |

|

| |

Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) on: | |

Investment transactions | 8,029,881 |

|

Forward foreign currency exchange contract transactions | (37,666 | ) |

Foreign currency translation transactions | 34 |

|

| 7,992,249 |

|

| |

Change in net unrealized appreciation (depreciation) on: | |

Investments | 13,194,971 |

|

Forward foreign currency exchange contracts | (36,235 | ) |

| 13,158,736 |

|

| |

Net realized and unrealized gain (loss) | 21,150,985 |

|

| |

Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 21,739,483 |

|

| |

(1) | Amount consists of $95,048, $3,219, $25, $38 and $124 for the Investor Class, I Class, A Class, R Class and R6 Class, respectively. |

See Notes to Financial Statements.

|

|

Statement of Changes in Net Assets |

|

| | | | | | |

YEARS ENDED OCTOBER 31, 2017 AND OCTOBER 31, 2016 |

Increase (Decrease) in Net Assets | October 31, 2017 | October 31, 2016 |

Operations | | |

Net investment income (loss) | $ | 588,498 |

| $ | 993,300 |

|

Net realized gain (loss) | 7,992,249 |

| (1,249,801 | ) |

Change in net unrealized appreciation (depreciation) | 13,158,736 |

| 2,029,647 |

|

Net increase (decrease) in net assets resulting from operations | 21,739,483 |

| 1,773,146 |

|

| | |

Distributions to Shareholders | | |

From net investment income: | | |

Investor Class | (897,365 | ) | (1,053,460 | ) |

I Class | (33,360 | ) | (32,985 | ) |

A Class | (15 | ) | — |

|

R Class | (10 | ) | — |

|

R6 Class | (28 | ) | — |

|

From net realized gains: | | |

Investor Class | — |

| (9,000,208 | ) |

I Class | — |

| (238,821 | ) |

Decrease in net assets from distributions | (930,778 | ) | (10,325,474 | ) |

| | |

Capital Share Transactions | | |

Net increase (decrease) in net assets from capital share transactions (Note 5) | (7,982,654 | ) | (2,638,765 | ) |

| | |

Redemption Fees | | |

Increase in net assets from redemption fees | 1,332 |

| 2,101 |

|

| | |

Net increase (decrease) in net assets | 12,827,383 |

| (11,188,992 | ) |

| | |

Net Assets | | |

Beginning of period | 90,616,898 |

| 101,805,890 |

|

End of period | $ | 103,444,281 |

| $ | 90,616,898 |

|

| | |

Undistributed net investment income | $ | 271,903 |

| $ | 702,891 |

|

See Notes to Financial Statements.

|

|

Notes to Financial Statements |

OCTOBER 31, 2017

1. Organization

American Century Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Adaptive Equity Fund (the fund) is one fund in a series issued by the corporation. The fund's investment objective is to seek long-term capital growth.

The fund offers the Investor Class, I Class (formerly Institutional Class), A Class, R Class and R6 Class. The A Class may incur an initial sales charge and may be subject to a contingent deferred sales charge. Sale of the A Class, R Class and R6 Class commenced on December 1, 2016.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value. Forward foreign currency exchange contracts are valued at the mean of the appropriate forward exchange rate at the close of the NYSE as provided by an independent pricing service.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between

domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. If significant fluctuations in foreign markets are identified, the fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income and net realized gains, if any, are generally declared and paid annually.

Redemption Fees — Prior to October 9, 2017, the fund may have imposed a 2.00% redemption fee on shares held less than 60 days. The fee was not applicable to all classes. The redemption fee was retained by the fund to help cover transaction costs that long-term investors may bear when the fund sells securities to meet investor redemptions.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class's daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class. The rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as well as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that use very similar investment teams and strategies (strategy assets). During the period ended October 31, 2017, the investment advisor agreed to waive 0.10% of the fund's management fee. The investment advisor expects this waiver to continue until July 31, 2018 and cannot terminate it prior to such date without the approval of the Board of Directors.

The management fee schedule range and the effective annual management fee before and after waiver for each class for the period ended October 31, 2017 are as follows:

|

| | | |

| | Effective Annual Management Fee |

| Management Fee Schedule Range | Before Waiver | After Waiver |

Investor Class | 1.000% to 1.250% | 1.25% | 1.15% |

I Class | 0.800% to 1.050% | 1.05% | 0.95% |

A Class | 1.000% to 1.250% | 1.25% | 1.15% |

R Class | 1.000% to 1.250% | 1.25% | 1.15% |

R6 Class | 0.650% to 0.900% | 0.90% | 0.80% |

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the period ended October 31, 2017 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund purchases and sales were $1,711,956 and $1,041,089, respectively. The effect of interfund transactions on the Statement of Operations was $304,785 in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the period ended October 31, 2017 were $82,548,437 and $91,085,314, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

|

| | | | | | | | | | |

| Year ended October 31, 2017(1) | Year ended

October 31, 2016 |

| Shares | Amount | Shares | Amount |

Investor Class/Shares Authorized | 140,000,000 |

| | 200,000,000 |

| |

Sold | 423,033 |

| $ | 4,625,253 |

| 611,237 |

| $ | 5,868,811 |

|

Issued in reinvestment of distributions | 82,377 |

| 870,726 |

| 1,052,445 |

| 9,808,781 |

|

Redeemed | (1,345,235 | ) | (14,879,140 | ) | (1,942,395 | ) | (18,588,341 | ) |

| (839,825 | ) | (9,383,161 | ) | (278,713 | ) | (2,910,749 | ) |

I Class/Shares Authorized | 70,000,000 |

| | 90,000,000 |

| |

Sold | 119,781 |

| 1,416,036 |

| 19,452 |

| 191,524 |

|

Issued in reinvestment of distributions | 3,089 |

| 33,360 |

| 28,551 |

| 271,806 |

|

Redeemed | (27,307 | ) | (304,458 | ) | (19,365 | ) | (191,346 | ) |

| 95,563 |

| 1,144,938 |

| 28,638 |

| 271,984 |

|

A Class/Shares Authorized | 40,000,000 |

| | N/A |

| |

Sold | 2,442 |

| 25,000 |

| | |

Issued in reinvestment of distributions | 1 |

| 15 |

| | |

| 2,443 |

| 25,015 |

| | |

R Class/Shares Authorized | 40,000,000 |

| | N/A |

| |

Sold | 4,992 |

| 53,749 |

| | |

Issued in reinvestment of distributions | 1 |

| 10 |

| | |

Redeemed | (1 | ) | (15 | ) | | |

| 4,992 |

| 53,744 |

| | |

R6 Class/Shares Authorized | 40,000,000 |

| | N/A |

| |

Sold | 26,971 |

| 304,642 |

| | |

Issued in reinvestment of distributions | 3 |

| 28 |

| | |

Redeemed | (11,034 | ) | (127,860 | ) | | |

| 15,940 |

| 176,810 |

| | |

Net increase (decrease) | (720,887 | ) | $ | (7,982,654 | ) | (250,075 | ) | $ | (2,638,765 | ) |

| |

(1) | December 1, 2016 (commencement of sale) through October 31, 2017 for the A Class, R Class and R6 Class. |

6. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

• Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments.

• Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for

comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds,

credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in

local currencies that are adjusted through translation into U.S. dollars.

• Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments. There were no significant transfers between levels during the period.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

|

| | | | | | | | |

| Level 1 | Level 2 | Level 3 |

Assets | | | |

Investment Securities | | | |

Common Stocks | $ | 102,440,584 |

| — |

| — |

|

Temporary Cash Investments | 1,325 |

| $ | 1,012,757 |

| — |

|

| $ | 102,441,909 |

| $ | 1,012,757 |

| — |

|

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund's exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on forward foreign currency exchange contract transactions and change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The fund's average U.S. dollar exposure to foreign currency risk derivative instruments held during the period was $2,270,205.

At period end, the fund did not have any derivative instruments disclosed on the Statement of Assets and Liabilities. For the year ended October 31, 2017, the effect of foreign currency risk derivative instruments on the Statement of Operations was $(37,666) in net realized gain (loss) on forward foreign currency exchange contract transactions and $(36,235) in change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts.

8. Federal Tax Information

The tax character of distributions paid during the years ended October 31, 2017 and October 31, 2016 were as follows:

|

| | | | | | |

| 2017 | 2016 |

Distributions Paid From | | |

Ordinary income | $ | 930,778 |

| $ | 3,902,759 |

|

Long-term capital gains | — |

| $ | 6,422,715 |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of period end, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

|

| | | |

Federal tax cost of investments | $ | 83,318,944 |

|

Gross tax appreciation of investments | $ | 22,724,011 |

|

Gross tax depreciation of investments | (2,588,289 | ) |

Net tax appreciation (depreciation) of investments | $ | 20,135,722 |

|

Undistributed ordinary income | $ | 2,960,432 |

|

Accumulated long-term gains | $ | 4,207,094 |

|

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

|

| | | | | | | | | | | | | | | | | |

For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | | | | | |

Per-Share Data | | | | | | | | | Ratios and Supplemental Data |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Net

Investment

Income

(Loss) | Net

Investment

Income

(Loss)

(before

expense

waiver) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

Investor Class | | | | | | | | | | | | | | |

2017 | $9.82 | 0.07 | 2.36 | 2.43 | (0.10) | — | (0.10) | $12.15 | 24.92% | 1.16% | 1.26% | 0.58% | 0.48% | 85% |

| $98,585 |

|

2016 | $10.74 | 0.10 | 0.08 | 0.18 | (0.12) | (0.98) | (1.10) | $9.82 | 2.20% | 1.23% | 1.25% | 1.04% | 1.02% | 116% |

| $87,888 |

|

2015 | $10.15 | 0.06 | 0.59 | 0.65 | (0.06) | — | (0.06) | $10.74 | 6.40% | 1.26% | 1.26% | 0.54% | 0.54% | 185% |

| $99,141 |

|

2014 | $9.08 | 0.06 | 1.11 | 1.17 | (0.10) | — | (0.10) | $10.15 | 12.96% | 1.25% | 1.25% | 0.59% | 0.59% | 184% |

| $91,093 |

|

2013 | $6.90 | 0.06 | 2.25 | 2.31 | (0.13) | — | (0.13) | $9.08 | 34.11% | 1.25% | 1.25% | 0.80% | 0.80% | 158% |

| $88,256 |

|

I Class(3) | | | | | | | | | | | | | | |

2017 | $10.05 | 0.09 | 2.42 | 2.51 | (0.12) | — | (0.12) | $12.44 | 25.19% | 0.96% | 1.06% | 0.78% | 0.68% | 85% |

| $4,568 |

|

2016 | $10.96 | 0.12 | 0.09 | 0.21 | (0.14) | (0.98) | (1.12) | $10.05 | 2.47% | 1.03% | 1.05% | 1.24% | 1.22% | 116% |

| $2,729 |

|

2015 | $10.36 | 0.08 | 0.60 | 0.68 | (0.08) | — | (0.08) | $10.96 | 6.58% | 1.06% | 1.06% | 0.74% | 0.74% | 185% |

| $2,665 |

|

2014 | $9.27 | 0.09 | 1.11 | 1.20 | (0.11) | — | (0.11) | $10.36 | 13.13% | 1.05% | 1.05% | 0.79% | 0.79% | 184% |

| $2,501 |

|

2013 | $7.03 | 0.07 | 2.31 | 2.38 | (0.14) | — | (0.14) | $9.27 | 34.41% | 1.05% | 1.05% | 1.00% | 1.00% | 158% |

| $317 |

|

A Class | | | | | | | | | | | | | | |

2017(4) | $10.24 | 0.03 | 1.97 | 2.00 | (0.01) | — | (0.01) | $12.23 | 19.50% | 1.41%(6) | 1.51%(6) | 0.26%(6) | 0.16%(6) | 85%(7) |

| $30 |

|

|

| | | | | | | | | | | | | | | | | |

For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | | | | | |

Per-Share Data | | | | | | | | | Ratios and Supplemental Data |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Net

Investment

Income

(Loss) | Net

Investment

Income

(Loss)

(before

expense

waiver) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

R Class | | | | | | | | | | | | | | |

2017(4) | $10.24 | —(5) | 1.97 | 1.97 | —(5) | — | —(5) | $12.21 | 19.28% | 1.66%(6) | 1.76%(6) | (0.01)%(6) | (0.11)%(6) | 85%(7) |

| $61 |

|

R6 Class | | | | | | | | | | | | | | |

2017(4) | $10.48 | 0.09 | 2.02 | 2.11 | (0.01) | — | (0.01) | $12.58 | 20.17% | 0.81%(6) | 0.91%(6) | 0.82%(6) | 0.72%(6) | 85%(7) |

| $201 |

|

|

|

Notes to Financial Highlights |

| |

(1) | Computed using average shares outstanding throughout the period. |

| |

(2) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized. |

| |

(3) | Prior to April 10, 2017, the I Class was referred to as the Institutional Class. |

| |

(4) | December 1, 2016 (commencement of sale) through October 31, 2017. |

| |

(5) | Per share amount was less than $0.005. |

| |

(7) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2017. |

See Notes to Financial Statements.

|

|

Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of American Century Mutual Funds, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Adaptive Equity Fund (the “Fund”), one of the funds constituting American Century Mutual Funds, Inc., as of October 31, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2017, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Adaptive Equity Fund of American Century Mutual Funds, Inc. as of October 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Kansas City, Missouri

December 15, 2017

The Board of Directors

The individuals listed below serve as directors of the funds. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The board has adopted a mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors). Independent directors shall retire by December 31 of the year in which they reach their 75th birthday.

Mr. Thomas is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor). The other directors (more than three-fourths of the total number) are independent. They are not employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS), and they do not have any other affiliations, positions or relationships that would cause them to be considered “interested persons” under the Investment Company Act. The directors serve in this capacity for seven (in the case of Mr. Thomas, 15) registered investment companies in the American Century Investments family of funds.

The following table presents additional information about the directors. The mailing address for each director is 4500 Main Street, Kansas City, Missouri 64111.

|

| | | | | |

Name

(Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Director | Other Directorships Held During Past 5 Years |

Independent Directors |

|

|

Thomas W. Bunn (1953) | Director | Since 2017 | Retired | 69 | SquareTwo Financial; Barings (formerly Babson Capital Funds Trust) (2013 to 2016) |

Barry Fink

(1955) | Director | Since 2012 (independent since 2016) | Retired; Executive Vice President, ACC (2007 to 2013); President, ACS (2007 to 2013); Chief Operating Officer, ACC (2007 to 2012) | 69 | None |

Andrea C. Hall

(1945) | Director | Since 1997 | Retired | 69 | None |

Jan M. Lewis

(1957) | Director | Since 2011 | Retired; President and Chief Executive Officer, Catholic Charities of Northeast Kansas (human services organization) (2006 to 2013) | 69 | None |

James A. Olson

(1942) | Director and Chairman of the Board | Since 2007 (Chairman since 2014) | Member, Plaza Belmont LLC (private equity fund manager) (1999 to present) | 69 | Saia, Inc. (2002 to 2012) and EPR Properties (2003 to 2013) |

|

| | | | | |

Name

(Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Director | Other Directorships Held During Past 5 Years |

Independent Directors |

|

|

M. Jeannine Strandjord

(1945) | Director | Since 1994 | Retired | 69 | Euronet Worldwide Inc.; MGP Ingredients, Inc.; and DST Systems Inc. (1996 to 2012) |

John R. Whitten

(1946) | Director | Since 2008 | Retired | 69 | Rudolph Technologies, Inc. |

Stephen E. Yates

(1948) | Director | Since 2012 | Retired | 69 | None |

Interested Director |

|

|

Jonathan S. Thomas

(1963) | Director and President | Since 2007 | President and Chief Executive Officer, ACC (2007 to present). Also serves as Chief Executive Officer, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries | 114 | BioMed Valley Discoveries, Inc. |

The Statement of Additional Information has additional information about the fund's directors and is available without charge, upon request, by calling 1-800-345-2021.

Officers

The following table presents certain information about the executive officers of the funds. Each officer serves as an officer for each of the 15 investment companies in the American Century family of funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the funds. The listed officers are interested persons of the funds and are appointed or re-appointed on an annual basis. The mailing address for each officer listed below is 4500 Main Street, Kansas City, Missouri 64111.

|

| | |

Name

(Year of Birth) | Offices with the Funds | Principal Occupation(s) During the Past Five Years |

Jonathan S. Thomas

(1963) | Director and President since 2007 | President and Chief Executive Officer, ACC (2007 to present). Also serves as Chief Executive Officer, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries |

Amy D. Shelton

(1964) | Chief Compliance Officer and Vice President since 2014 | Chief Compliance Officer, American Century funds, (2014 to present); Chief Compliance Officer, ACIM (2014 to present); Chief Compliance Officer, ACIS (2009 to present); Vice President, Client Interactions and Marketing, ACIS (2013 to 2014); Director, Client Interactions and Marketing, ACIS (2007 to 2013). Also serves as Vice President, ACIS |

Charles A. Etherington

(1957) | General Counsel since 2007 and Senior Vice President since 2006 | Attorney, ACC (1994 to present); Vice President, ACC (2005 to present); General Counsel, ACC (2007 to present). Also serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; and Senior Vice President, ACIM and ACS |

C. Jean Wade

(1964) | Vice President,Treasurer and Chief Financial Officer since 2012 | Vice President, ACS (2000 to present) |

Robert J. Leach

(1966) | Vice President since 2006 and Assistant Treasurer since 2012 | Vice President, ACS (2000 to present) |

David H. Reinmiller

(1963) | Vice President since 2000 | Attorney, ACC (1994 to present); Associate General Counsel, ACC (2001 to present). Also serves as Vice President, ACIM and ACS |

Ward D. Stauffer

(1960) | Secretary since 2005 | Attorney, ACC (2003 to present) |

|

|

Approval of Management Agreement |

At a meeting held on June 29, 2017, the Fund’s Board of Directors (the "Board") unanimously approved the renewal of the management agreement pursuant to which American Century Investment Management, Inc. (the “Advisor”) acts as the investment advisor for the Fund. Under Section 15(c) of the Investment Company Act, contracts for investment advisory services are required to be reviewed, evaluated, and approved by a majority of a fund’s directors (the “Directors”), including a majority of the independent Directors, each year.

Prior to its consideration of the renewal of the management agreement, the Directors requested and reviewed extensive data and information compiled by the Advisor and certain independent providers of evaluation data concerning the Fund and the services provided to the Fund by the Advisor. This review was in addition to the oversight and evaluation undertaken by the Board and its committees on a continual basis and the information received was supplemental to the extensive information that the Board and its committees receive and consider throughout the year.

In connection with its consideration of the renewal of the management agreement, the Board’s review and evaluation of the services provided by the Advisor included, but was not limited to, the following:

| |

• | the nature, extent, and quality of investment management, shareholder services, and other services provided and to be provided to the Fund; |

| |

• | the wide range of other programs and services provided and to be provided to the Fund and its shareholders on a routine and non-routine basis; |

| |

• | the investment performance of the Fund, including data comparing the Fund's performance to appropriate benchmarks and/or a peer group of other mutual funds with similar investment objectives and strategies; |

| |

• | the cost of owning the Fund compared to the cost of owning similar funds; |

| |

• | the compliance policies, procedures, and regulatory experience of the Advisor and the Fund's service providers; |

| |

• | financial data showing the cost of services provided to the Fund, the profitability of the Fund to the Advisor, and the overall profitability of the Advisor; |

| |

• | strategic plans of the Advisor |

| |

• | possible economies of scale associated with the Advisor’s management of the Fund and other accounts under its management; |

| |

• | data comparing services provided and charges to the Advisor's other investment management clients; |

| |

• | acquired fund fees and expenses; |

| |

• | payments and practices by the Fund and the Advisor regarding financial intermediaries, the nature of services provided by intermediaries, and the terms of share classes utilized; and |

| |

• | any collateral benefits derived by the Advisor from the management of the Fund. |

The Directors held three in-person meetings and one telephonic meeting to review and discuss the information provided. The independent Directors also reviewed responses to supplemental information requests and held active discussions with the Advisor regarding the renewal of the management agreement. The independent Directors had the benefit of the advice of their independent counsel throughout the process.

Factors Considered

The Directors considered all of the information provided by the Advisor, the independent data providers, and independent counsel in connection with the approval. They determined that the

information was sufficient for them to evaluate the management agreement for the Fund. In connection with their review, the Directors did not identify any single factor as being all-important or controlling, and each Director may have attributed different levels of importance to different factors. In deciding to renew the management agreement, the Board based its decision on a number of factors, including without limitation the following:

Nature, Extent and Quality of Services - Generally. Under the management agreement, the Advisor is responsible for providing or arranging for all services necessary for the operation of the Fund. The Board noted that the Advisor provides or arranges at its own expense a wide variety of services including without limitation the following:

| |

• | portfolio research and security selection |

| |

• | daily valuation of the Fund’s portfolio |

| |

• | shareholder servicing and transfer agency, including shareholder confirmations, recordkeeping, and communications |

| |

• | legal services (except the independent Directors’ counsel) |

| |

• | regulatory and portfolio compliance |

| |

• | marketing and distribution (except amounts paid by the Fund under Rule 12b-1 plans) |

The Board noted that many of these services have expanded over time in terms of both quantity and complexity in response to shareholder demands, competition in the industry, changing distribution channels, and the changing regulatory environment. The Board noted specifically the resources the Advisor has committed during the year to compliance with the Department of Labor fiduciary rule and share class modernization.