Item 2.Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain matters discussed in this Quarterly Report on Form 10-Q, in our other filings with the Securities and Exchange

Commission, in our press releases, and in oral statements made with the approval of an executive officer may constitute

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements

include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial

results, our liquidity and capital resources, and other non-historical statements, and may be prefaced with words such as

“outlook,” “guidance,” “believes,” “expects,” “potential,” “preliminary,” “continues,” “may,” “will,” “should,” “seeks,”

“approximately,” “predicts,” “projects,” “positioned,” “prospects,” “intends,” “plans,” “estimates,” “pending

investments,” “anticipates,” or the negative version of these words or other comparable words. Such statements are subject to

certain risks and uncertainties, including, among others, the factors discussed under the caption “Item 1A. Risk Factors” in our

Annual Report on Form 10-K for the year ended December 31, 2023, and from time to time, as applicable, our Quarterly

Reports on Form 10-Q . These factors (among others) could affect our financial condition, business activities, results of

operations, cash flows, or overall financial performance and cause actual results and business activities to differ materially

from historical periods and those presently anticipated and projected. Forward-looking statements speak only as of the date

they are made, and we will not undertake and we specifically disclaim any obligation to release publicly the result of any

revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such

statements or to reflect the occurrence of events, whether or not anticipated. In that respect, we caution readers not to place

undue reliance on any such forward-looking statements.

Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction

with our Consolidated Financial Statements and the notes thereto contained elsewhere in this Quarterly Report on Form 10-Q.

References throughout this report to “AMG,” “we,” “us,” “our,” the “Company,” and similar references refer to

Affiliated Managers Group, Inc., unless otherwise stated or the context otherwise requires.

Executive Overview

AMG is a strategic partner to leading independent investment firms globally. Our strategy is to generate long-term value

by investing in a diverse array of high-quality independent partner-owned firms, referred to as “Affiliates,” through a proven

partnership approach, and allocating resources across our unique opportunity set to the areas of highest growth and return.

With their entrepreneurial, investment-centric cultures and alignment of interests with clients through direct equity ownership

by firm principals, independent firms have fundamental competitive advantages in offering unique return streams to the

marketplace. Through AMG’s distinctive approach, we enhance these advantages to magnify the long-term success of our

Affiliates and actively support their independence. Our innovative model enables each Affiliate’s management team to retain

autonomy and significant equity ownership in their firm, while they leverage our strategic capabilities and insight, including

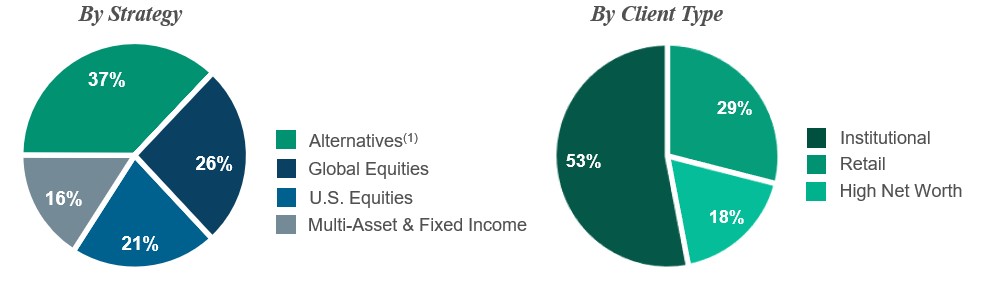

growth capital, product strategy and development, capital formation, and incentive alignment and succession planning. As of

June 30, 2024, our aggregate assets under management were approximately $701 billion across a diverse range of private

markets, liquid alternatives, and differentiated long-only investment strategies.

Operating Performance Measures

Under accounting principles generally accepted in the U.S. (“GAAP”), we are required to consolidate certain of our

Affiliates and use the equity method of accounting for others. Whether we consolidate an Affiliate or use the equity method of

accounting, we maintain the same innovative partnership approach and provide support and assistance in substantially the same

manner for all of our Affiliates. Furthermore, all of our Affiliates are investment managers and are impacted by similar

marketplace factors and industry trends. Therefore, our key aggregate operating performance measures are important in

providing management with a comprehensive view of the operating performance and material trends across our entire business.

The following table presents our key aggregate operating performance measures:

| | | | | | | | | | | | |

| | As of and for the Three Months Ended June 30, | | | | As of and for the Six Months Ended June 30, | | |

(in billions, except as noted) | | | | | | | | | | | | |

| | | | | | | | | | | | |

Average assets under management | | | | | | | | | | | | |

Aggregate fees (in millions) | | | | | | | | | | | | |