UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 1-11921

E*TRADE Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 94-2844166 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

1271 Avenue of the Americas, 14th Floor, New York, New York 10020

(Address of principal executive offices and Zip Code)

(646) 521-4300

(Registrant’s telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer x | | Accelerated filer | | ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

At June 30, 2010, the aggregate market value of voting stock held by non-affiliates of the registrant was approximately $2.3 billion (based upon the closing price per share of the registrant’s common stock as reported by the NASDAQ Global Select Market on that date). Shares of common stock held by each officer, director and holder of 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of February 17, 2011, there were 221,247,848 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive Proxy Statement related to the Company’s 2011 Annual Meeting of Shareholders, to be filed hereafter (incorporated into Part III hereof).

E*TRADE FINANCIAL CORPORATION

FORM 10-K ANNUAL REPORT

For the Year Ended December 31, 2010

TABLE OF CONTENTS

i

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “E*TRADE” mean E*TRADE Financial Corporation and its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank, Equity Edge, OptionsLink and the Converging Arrows logo are registered trademarks of E*TRADE Financial Corporation in the United States and in other countries.

ii

REVERSE STOCK SPLIT

In June 2010, we completed a 1-for-10 reverse stock split and a corresponding decrease to our authorized shares of common stock to a total of 400 million shares. All prior periods presented have been adjusted to reflect the impact of this reverse stock split, including the impact on basic and diluted weighted-average shares and shares issued and outstanding.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements involving risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “expect,” “may,” “anticipate,” “intend,” “plan” and similar expressions. Our actual results could differ materially from those discussed in these forward-looking statements, and we caution that we do not undertake to update these statements. Factors that could contribute to our actual results differing from any forward-looking statements include those discussed under Risk Factors, Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report. The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report. We further caution that there may be risks associated with owning our securities other than those discussed in such filings.

OVERVIEW

E*TRADE Financial Corporation is a financial services company that provides online brokerage and related products and services primarily to individual retail investors, under the brand “E*TRADE Financial.” Our primary focus is to profitably grow our online brokerage business, which includes our active trader and long-term investing customers. We also provide investor-focused banking products, primarily sweep deposits and savings products, to retail investors. Our competitive strategy is to attract and retain customers by emphasizing low-cost, ease of use and innovation, with delivery of our products and services primarily through online and technology-intensive channels.

Our corporate offices are located at 1271 Avenue of the Americas, 14th Floor, New York, New York 10020. We were incorporated in California in 1982 and reincorporated in Delaware in July 1996. We have approximately 3,000 employees. We operate directly and through numerous subsidiaries many of which are overseen by governmental and self-regulatory organizations. Our most significant subsidiaries are described below:

| | • | | E*TRADE Bank is a federally chartered savings bank that provides investor-focused banking products to retail customers nationwide and deposit accounts insured by the Federal Deposit Insurance Corporation (“FDIC”); |

| | • | | E*TRADE Capital Markets, LLC is a registered broker-dealer and market maker; |

| | • | | E*TRADE Clearing LLC is the clearing firm for our brokerage subsidiaries and is a wholly-owned operating subsidiary of E*TRADE Bank. Its main purpose is to transfer securities from one party to another; and |

| | • | | E*TRADE Securities LLC is a registered broker-dealer and is a wholly-owned operating subsidiary of E*TRADE Bank. It is the primary provider of brokerage products and services to our customers. |

A complete list of our subsidiaries can be found in Exhibit 21.1.

1

We provide services to customers in the U.S. through our website at www.etrade.com. In addition to our website, we also provide services through our network of customer service representatives, relationship managers and investment advisors. We also provide these services over the phone or in person through our 28 E*TRADE Branches. Information on our website is not a part of this report.

STRATEGY

Our core business is our trading and investing customer franchise. Building on the strengths of this franchise, our growth strategy is focused on four areas: retail brokerage, corporate services and market making, wealth management, and banking.

| | • | | Our retail brokerage business is our foundation. We believe a focus on these key factors will position us for future growth in this business: growing our sales force with a focus on long-term investing, optimizing our marketing spend, continuing to develop innovative products and services and minimizing account attrition. |

| | • | | Our corporate services and market making businesses enhance our strategy by allowing us to realize additional economic benefit from our retail brokerage business. Our corporate services business is a leading provider of software and services for managing equity compensation plans and is an important source of new retail brokerage accounts. Our market making business allows us to increase the economic benefit on the order flow from the retail brokerage business as well as generate additional revenues through external order flow. |

| | • | | We also plan to expand our wealth management offerings. Our vision is to provide wealth management services that are enabled by innovative technology and supported by guidance from professionals when needed. |

| | • | | Our retail brokerage business generates a significant amount of customer cash and we plan to continue to utilize our bank to optimize the value of these customer deposits. |

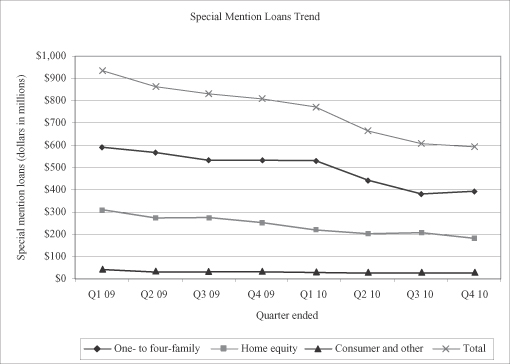

Our strategy also includes an intense focus on mitigating the credit losses in our legacy loan portfolio and maintaining disciplined expense management. We remain focused on strengthening our overall capital structure and positioning the Company for future growth.

PRODUCTS AND SERVICES

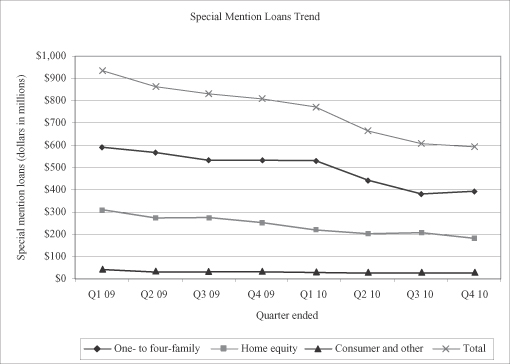

We assess the performance of our business based on our segments, trading and investing and balance sheet management. We consider multiple factors, including the competitiveness of our pricing compared to similar products and services in the market, the overall profitability of our businesses and customer relationships when pricing our various products and services. We manage the performance of our business using various customer activity and financial metrics, including daily average revenue trades (“DARTs”), average commission per trade, margin receivables, end of period brokerage accounts, net new brokerage accounts, customer assets, net new brokerage assets, brokerage related cash, corporate cash, E*TRADE Bank excess risk-based capital, special mention loan delinquencies, allowance for loan losses, enterprise net interest spread and average enterprise interest-earning assets. Costs associated with certain functions that are centrally managed are separately reported in a “Corporate/Other” category.

Trading and Investing

Our trading and investing segment offers a full suite of financial products and services to individual retail investors. The most significant of these products and services are described below:

Trading Products and Services

| | • | | automated order placement and execution of U.S. equities, futures, options, exchange-traded funds and bond orders; |

2

| | • | | FDIC insured sweep deposit accounts that automatically transfer funds to and from customer brokerage accounts; |

| | • | | access to E*TRADE Mobile Pro, which allows customers to trade stocks and transfer funds between accounts via a Blackberry®, the Apple iPhoneTM, the Apple iPod® Touch, the Apple iPadTM or the AndroidTM device as well as the ability to monitor real-time investment, market and account information; |

| | • | | use of Power E*TRADE Pro, our desktop trading software for qualified active traders, which includes CNBC Plus, providing customers with customization capabilities, an expanded feature set and more news and information; |

| | • | | an open applications programming interface (“Open API”) for third-party and independent software developers, which allows customers to have access to technical information and documentation, reference guides, and other resources to help network external applications and programs with our active trader platform; |

| | • | | two-second execution guarantee on all qualified market orders for Standard & Poor’s (“S&P”) 500 stocks and exchange-traded funds; |

| | • | | margin accounts allowing customers to borrow against their securities; |

| | • | | cross-border trading, which allows customers residing outside of the U.S. to trade in U.S. securities; |

| | • | | access to international equities in Canada, France, Germany, Hong Kong, Japan and the United Kingdom and foreign currencies, including the Canadian dollar, Euro, Hong Kong dollar, Yen and Sterling; and |

| | • | | research and trade idea generation tools that assist customers with identifying investment opportunities to make informed decisions; these tools include market commentary from Dreyfus and Minyanville’s Buzz & Banter, a business and finance site. |

Long-Term Investing Products and Services

| | • | | use of the Investor Resource Center, which provides an aggregated view of our investing tools, market insights, independent research, education and other investing resources; |

| | • | | flexible advisory services through Online Advisor, our investment advice tool designed to provide investors with actionable investment guidance, including recommended asset allocations ranging from fully self-directed investing to 100 percent discretionary portfolio management from an affiliated registered investment advisor; |

| | • | | fixed income tools in our Bond Resource Center aimed at helping customers identify, evaluate and implement fixed income investment strategies; |

| | • | | access to Retirement QuickPlan, which is an easy-to-use, four-step retirement planning tool that provides a quick assessment of an individual’s or a family’s retirement savings and investing plan as well as tips to help get on track with personal retirement savings goals; |

| | • | | managed investment portfolio advisory services with an investment of $25,000 or more from an affiliated registered investment advisor, which provides one-on-one professional portfolio management; |

| | • | | unified managed account advisory services with an investment of $250,000 or more from an affiliated registered investment advisor, which provides customers the opportunity to work with a dedicated investment professional to obtain a comprehensive, integrated approach to asset allocation, investments, portfolio rebalancing and tax management; |

| | • | | no fee and no minimum individual retirement accounts; |

| | • | | access to more than 1,000 non-proprietary exchange-traded funds and over 8,000 non-proprietary mutual funds; |

3

| | • | | investing and trading educational services via online videos, web seminars and web tutorials; and |

| | • | | FDIC insured deposit accounts, including checking, savings and money market accounts. |

Corporate Services

We offer software and services for managing equity compensation plans for corporate customers. Our Equity Edge platform facilitates the management of employee option plans, employee stock purchase plans and restricted stock plans, including necessary accounting and reporting functions. This is a product of the trading and investing segment since it serves as an introduction to E*TRADE for many employees of our corporate customers who conduct equity option and restricted stock transactions, with our goal being that these individuals will also use our other products and services. Our corporate services business rated highest in overall satisfaction and loyalty among broker plan administrators for full and partial outsourced stock plan administration by GROUP FIVE, an independent consulting and research firm, in their 2010 Stock Plan Administration Benchmarking Study.

Market Making

Our trading and investing segment also includes market making activities which match buyers and sellers of securities from our retail brokerage business and unrelated third parties. As a market maker, we take positions in securities and function as a wholesale trader by combining trading lots to match buyers and sellers of securities. Trading gains and losses result from these activities. Our revenues are influenced by overall trading volumes, the number of stocks for which we act as a market maker and the trading volumes and volatility of those specific stocks.

Balance Sheet Management

The balance sheet management segment consists of the management of our balance sheet, focusing on asset allocation and managing credit, liquidity and interest rate risks. The balance sheet management segment manages loans previously originated or purchased from third parties as well as our customer cash and deposits, which originate in the trading and investing segment.

For additional statistical information regarding products and customers, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) beginning on page 28. Three years of segment financial performance and data can be found in the MD&A beginning on page 45 and in Note 23—Segment and Geographic Information of Item 8. Financial Statements and Supplementary Data beginning on page 160.

SALES AND CUSTOMER SERVICE

We believe providing superior sales and customer service is fundamental to our business. Growing our sales force with a focus on long-term investing is one of the key factors in our growth strategy. We also strive to maintain a high standard of customer service by staffing the customer support team with appropriately trained personnel who are equipped to handle customer inquiries in a prompt yet thorough manner. Our customer service representatives utilize our proprietary web-based platform to provide customers with answers to their inquiries. We also have specialized customer service programs that are tailored to the needs of each customer group.

We provide sales and customer support through the following channels of our registered broker-dealer and investment advisory subsidiaries:

| | • | | Branches—we have 28 branches located in the U.S. where retail investors can go to service any of their needs while receiving face to face customer support. Financial consultants are also available on-site to help customers assess their current asset allocation. |

4

| | • | | Online—we have an Online Advisor tool available that provides asset allocation and a range of investment solutions that can be managed online or through a dedicated investment professional. We also have an online service center where customers can request services on their accounts and obtain answers to frequently asked questions. The online service center also provides customers with the ability to send a secure message to one of our customer service representatives. |

| | • | | Telephonic—we have a toll free number that connects customers to an automated phone system which will help ensure that they are directed to the appropriate department where a financial consultant or licensed customer service representative can assist with their inquiry. |

TECHNOLOGY

We believe our focus on being a technological leader in the financial services industry enhances our competitive position. This focus allows us to deploy a secure, scalable technology and back office platform that promotes innovative product development and delivery. We continued to increase our investments in these critical platforms in 2010, helping to drive significant efficiencies as well as enhancing our service and operational support capabilities. Our technology platform also enabled us to deliver trading and investing functionality with the introduction of Open API, mobile offerings across new devices and the Equity Edge Online platform.

COMPETITION

The online financial services market continues to evolve rapidly and we expect it to remain highly competitive. Our trading and investing segment competes with full commission brokerage firms, discount brokerage firms, online brokerage firms, Internet banks, traditional “brick & mortar” retail banks and thrifts and market making firms. Some of these competitors provide Internet trading and banking services, investment advisor services, touchtone telephone and voice response banking services, electronic bill payment services and a host of other financial products. Our balance sheet management segment competes with investment banking firms and other users of market liquidity, in addition to the competitors above, in its quest for the least expensive source of funding.

The financial services industry has become more concentrated as companies involved in a broad range of financial services have been acquired, merged or have declared bankruptcy. During the past three years, this trend accelerated considerably as a significant number of U.S. financial institutions consolidated, were forced to merge, or received substantial government assistance. We believe we can continue to attract customers by appealing to retail investors within large established financial institutions by providing them with easy to use and innovative financial products and services.

We also face competition in attracting and retaining qualified employees. Our ability to compete effectively in financial services will depend upon our ability to attract new employees and retain and motivate our existing employees while efficiently managing compensation related costs.

REGULATION

Our business is subject to regulation by U.S. federal and state regulatory and self-regulatory agencies and securities exchanges and by various non-U.S. governmental agencies or regulatory or self-regulatory bodies, securities exchanges and central banks, each of which has been charged with the protection of the financial markets and the protection of the interests of those participating in those markets.

Our regulators, rulemaking agencies and primary securities exchanges in the U.S. include, among others, the Securities and Exchange Commission (“SEC”), the Financial Industry Regulatory Authority (“FINRA”), the New York Stock Exchange (“NYSE”), the National Association of Securities Dealers Automated Quotations (“NASDAQ”), the FDIC, the Federal Reserve, the Municipal Securities Rulemaking Board and the Office of Thrift Supervision (“OTS”).

5

Both our brokerage and banking entities are subject to the Bank Secrecy Act, as amended by the USA PATRIOT ACT of 2001 (“BSA/USA PATRIOT Act”), which contains anti-money laundering and financial transparency laws. In order to comply with the BSA/USA PATRIOT Act, we have established an Anti-Money Laundering (“AML”) unit which is responsible for developing and implementing enterprise-wide programs for compliance with the various anti-money laundering and counter-terrorist financing laws and regulations.

Brokerage Regulation

Our broker-dealers are registered with the SEC and are subject to regulation by the SEC and by self-regulatory organizations, such as FINRA and the securities exchanges of which each is a member, as well as various state regulators. Such regulation covers all aspects of the brokerage business, including, but not limited to, client protection, net capital requirements, required books and records, safekeeping of funds and securities, trading, prohibited transactions, public offerings, margin lending, customer qualifications for margin and options transactions, registration of personnel and transactions with affiliates. Our international broker-dealers are regulated by their respective local regulators such as the United Kingdom Financial Services Authority (“FSA”) and Hong Kong Securities & Futures Commission.

Banking Regulation

Our banking entities are subject to regulation, supervision and examination by the OTS, the Federal Reserve and the FDIC. Such regulation covers all aspects of the banking business, including lending practices, safeguarding deposits, customer privacy and information security, capital structure, transactions with affiliates and conduct and qualifications of personnel.

Under safeguarding deposits, each of our banking entities, as an insured depository institution, is a member of the Deposit Insurance Fund (“DIF”), maintained by the FDIC. All members of the DIF are required to pay assessed premiums, based on their institutional risk category and the amount of insured deposits held, to fund the DIF. On December 31, 2009 the FDIC required all insured depository institutions to prepay deposit insurance premiums for the fourth quarter of 2009 and for 2010, 2011, and 2012.

For customer privacy and information security, under the rules of the Gramm-Leach-Bliley Act, our banking entities are required to disclose their privacy policies and practices related to sharing customer information with affiliates and non-affiliates. The rules also give customers the ability to “opt-out” of having non-public information disclosed to third parties or receiving marketing solicitations from affiliates and non-affiliates based on non-public information received from our banking entities.

Financial Regulatory Reform Legislation and Basel III Accords

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was signed into law on July 21, 2010 and includes comprehensive changes to the financial services industry. Under the Dodd-Frank Act, our primary regulator, the OTS, will be abolished and its functions and personnel distributed among the Office of the Comptroller of the Currency (the “OCC”), FDIC and the Federal Reserve. Although the Dodd-Frank Act maintains the federal thrift charter, it eliminates certain benefits of the charter and imposes new penalties for failure to comply with the qualified thrift lender test. The Dodd-Frank Act also requires all companies, including savings and loan holding companies, that directly or indirectly control an insured depository institution to serve as a source of strength for the institution.

We believe the majority of the changes in the Dodd-Frank Act will have no material impact on our business. We believe, however, that the implementation of holding company capital requirements is relevant to us as the parent company is not currently subject to capital requirements. We fully expect that our holding company capital ratios will exceed the “well capitalized” minimums well in advance of the effective date and we have no plans to raise additional capital as a result of this new law. Our confidence in our ability to meet these requirements is reinforced by: our trajectory toward sustainable profitability; anticipated additional conversions of our convertible debt; and the utilization of our deferred tax asset as we deliver profitable results.

6

The current risk-based capital guidelines that apply to E*TRADE Bank are based upon the 1988 capital accord of the International Basel Committee on Banking Supervision (“BCBS”), a committee of central banks and bank supervisors, as implemented by the U.S. federal banking agencies, including the OTS. On September 12, 2010, the Group of Governors and Heads of Supervision (“GHOS”), the oversight body of the BCBS, announced agreement on the calibration and phase-in arrangements for a strengthened set of capital requirements, known as the Basel III Accords. The final Basel III Accords were released on December 16, 2010 and are subject to individual adoption by member nations, including the U.S. beginning January 1, 2013. The GHOS agreement is intended to strengthen the prudential standards for large and internationally active banks and is not directly applicable to us; however, it may impact how the U.S. regulators implement the Dodd-Frank Act for other banking institutions, including the possibility of higher capital requirements. The full impact of the GHOS agreement on the regulatory requirements to which we will be subject is unclear, and will remain unknown for at least some time until implementing capital regulations are proposed and adopted. We will continue to monitor the ongoing rule-making process to assess both the timing and the impact of the Dodd-Frank Act and Basel III Accords on our business.

For additional regulatory information on our brokerage and banking regulations, see Note 20—Regulatory Requirements of Item 8. Financial Statements and Supplementary Data beginning on page 154.

AVAILABLE INFORMATION

We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, available free of charge at our website as soon as reasonably practicable after they have been filed with the SEC. Our website address is www.etrade.com.

The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains the materials we file with the SEC at www.sec.gov.

7

The following factors which could materially affect our business, financial condition and results of operations should be carefully considered in addition to the other information set forth in this report. Although the risks described below are those that management believes are the most significant, these are not the only risks facing our company. Additional risks and uncertainties not currently known to us or that we currently do not deem to be material may also materially affect our business, financial condition and results of operations.

Risks Relating to the Nature and Operation of Our Business

We have incurred significant losses in recent years and cannot assure that we will be profitable in the future.

We incurred a net loss of $28.5 million, or $0.13 loss per share, for the year ended December 31, 2010 and net losses of $1.3 billion and $512 million for the years ended December 31, 2009 and 2008, respectively. These losses were due primarily to the credit losses in our loan portfolio and, in 2009, the loss on the Debt Exchange in which $1.7 billion aggregate principal amount of interest-bearing debt was exchanged for an equal principal amount of non-interest-bearing convertible debentures. Although we have taken a significant number of steps to reduce our credit exposure, we likely will continue to suffer credit losses in 2011. In late 2007, we experienced a substantial diminution of customer assets and accounts as a result of customer concerns regarding our credit related exposures. While we were able to stabilize our retail franchise during 2008, 2009 and 2010, it could take additional time to fully mitigate the credit issues in our loan portfolio and return to profitability.

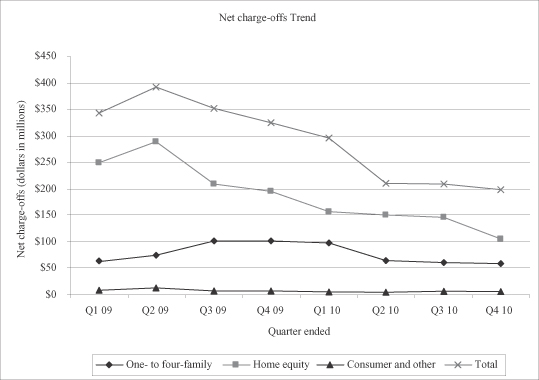

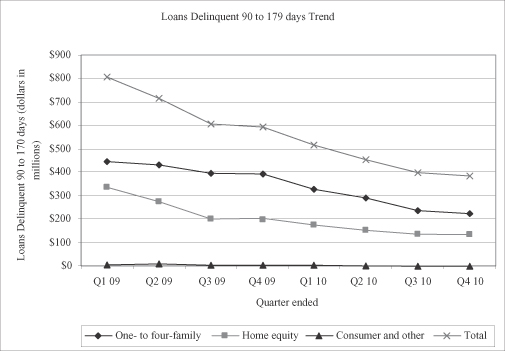

We will continue to experience losses in our mortgage loan portfolio.

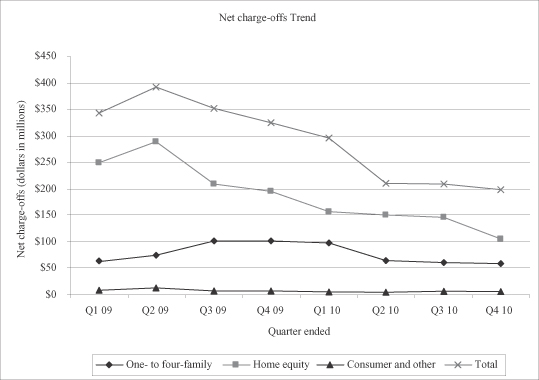

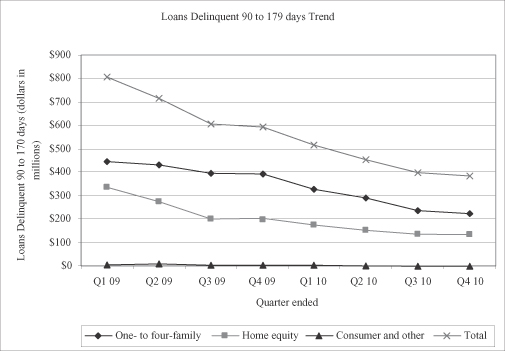

At December 31, 2010, the principal balance of our home equity loan portfolio was $6.4 billion and the allowance for loan losses for this portfolio was $576.1 million. At December 31, 2010, the principal balance of our one- to four-family loan portfolio was $8.2 billion and the allowance for loan losses for this portfolio was $389.6 million. Although the provision for loan losses has improved in recent periods, performance is subject to variability in any given quarter and we cannot state with certainty that the declining loan loss trend will continue. In particular, a significant portion of our mortgage loan portfolio is collateralized by properties in which the value is now estimated to be less than the outstanding balance of the loan. There can be no assurance that our allowance for loan losses will be adequate if the residential real estate and credit markets deteriorate beyond our expectations. We may be required under such circumstances to further increase our allowance for loan losses, which could have an adverse effect on our regulatory capital position and our results of operations in future periods.

The carrying value of our home equity and one- to four-family loan portfolios was $5.9 billion and $7.8 billion, respectively, at December 31, 2010. Our home equity and one- to four-family loan portfolios are held on the consolidated balance sheet at carrying value because they are classified as held for investment, which indicates that we have the intent and ability to hold them for the foreseeable future or until maturity. The fair value of our home equity and one- to four-family loan portfolios was estimated to be $4.7 billion and $7.3 billion, respectively, at December 31, 2010, in accordance with the fair value measurements accounting guidance, as disclosed in Note 5—Fair Value Disclosures of Item 8. Financial Statements and Supplementary Data on page 110. The fair value of our home equity and one- to four-family loan portfolios was estimated using a modeling technique that discounted future cash flows based on estimated principal and interest payments over the life of the loans, including expected losses and prepayments. There was limited or no observable market data for our home equity and one- to four-family loan portfolios, which indicates that the market for these types of loans is considered to be inactive. Given the limited market data, the fair value measurements cannot be determined with precision and the amount that would be realized in a forced liquidation, an actual sale or immediate settlement could be significantly lower than both the carrying value and the estimated fair value of the portfolio. In addition, changes in the underlying assumptions used, including discount rates and estimates of future cash flows, could significantly affect the results of current or future fair value estimates.

8

We could experience significant losses on other securities held on the balance sheet.

At December 31, 2010, we held $490.3 million in amortized cost of non-agency collateralized mortgage obligations (“CMO”) on our consolidated balance sheet. We incurred net impairment charges of $37.7 million during 2010, which was a result of the deterioration in the expected credit performance of the underlying loans in the securities. If the credit quality of these securities further deteriorates, we may incur additional impairment charges which would have an adverse effect on our regulatory capital position and our results of operations in future periods.

Loss of customers and assets could destabilize the Company or result in lower revenues in future periods.

During November 2007, well-publicized concerns about E*TRADE Bank’s holdings of asset-backed securities led to widespread concerns about our continued viability. From the beginning of this crisis through December 31, 2007, when the situation stabilized, customers withdrew approximately $5.6 billion of net cash and approximately $12.2 billion of net assets from our bank and brokerage businesses. Many of the accounts that were closed belonged to sophisticated and active customers with large cash and securities balances. While we were able to stabilize our retail franchise in 2008, 2009 and 2010, concerns about our viability may recur, which could lead to destabilization and asset and customer attrition. If such destabilization should occur, there can be no assurance that we will be able to successfully rebuild our franchise by reclaiming customers and growing assets. If we are unable to sustain or, if necessary, rebuild our franchise, in future periods our revenues will be lower and our losses will be greater than we have experienced.

We have a large amount of debt.

We have issued a substantial amount of high-yield debt, with restrictive financial and other covenants. Following the completion of the Debt Exchange in 2009, in which $1.7 billion aggregate principal amount of interest-bearing corporate debt was exchanged for an equal principal amount of non-interest-bearing convertible debentures, our expected annual interest cash outlay decreased to approximately $166 million. Our ratio of debt (our corporate debt) to equity (expressed as a percentage) was 53% at December 31, 2010. The degree to which we are leveraged could have important consequences, including: 1) a substantial portion of our cash flow from operations is dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available for other purposes; 2) our ability to obtain additional financing for working capital, capital expenditures, acquisitions and other corporate needs is significantly limited; and 3) our substantial leverage may place us at a competitive disadvantage, hinder our ability to adjust rapidly to changing market conditions and make us more vulnerable in the event of a further downturn in general economic conditions or our business. In addition, a significant reduction in revenues could have a material adverse effect on our ability to meet our obligations under our debt securities.

We depend on payments from our subsidiaries.

We depend on dividends, distributions and other payments from our subsidiaries to fund payments on our obligations, including our debt obligations. Regulatory and other legal restrictions limit our ability to transfer funds to or from our subsidiaries. In addition, many of our subsidiaries are subject to laws and regulations that authorize regulatory bodies to block or reduce the flow of funds to us, or that prohibit such transfers altogether in certain circumstances. These laws and regulations may hinder our ability to access funds that we may need to make payments on our obligations. The majority of our capital is invested in our banking subsidiary E*TRADE Bank, which may not pay dividends to us without approval from the OTS. Our primary brokerage subsidiaries, E*TRADE Securities LLC and E*TRADE Clearing LLC, are both subsidiaries of E*TRADE Bank; therefore, as our primary banking regulator and as a result of the memoranda of understanding with the OTS under which we continue to operate, the OTS controls our ability to receive dividend payments from our brokerage business as well. Furthermore, even if we receive the approval of the OTS to receive dividend payments from our brokerage business, in the event of our bankruptcy or liquidation or E*TRADE Bank’s receivership, we would not be entitled to receive any cash or other property or assets from our subsidiaries (including E*TRADE Bank,

9

E*TRADE Clearing LLC and E*TRADE Securities LLC) until those subsidiaries pay in full their respective creditors, including customers of those subsidiaries and, as applicable, the FDIC and the Securities Investor Protection Corporation.

We are subject to investigations and lawsuits as a result of our losses from mortgage loans and asset-backed securities.

In 2007, we recognized an increased provision expense totaling $640 million and asset losses and impairments of $2.45 billion, including the sale of our asset-backed securities portfolio to Citadel. As a result, various plaintiffs filed class actions and derivative lawsuits, which have subsequently been consolidated into one class action and one derivative lawsuit, alleging disclosure violations regarding our home equity, mortgage and securities portfolios during 2007. In addition, the SEC initiated an informal inquiry into matters related to our loan and securities portfolios. The defense of these matters has and will continue to entail considerable cost and will be time-consuming for our management. Unfavorable outcomes in any of these matters could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Many of our competitors have greater financial, technical, marketing and other resources.

The financial services industry is highly competitive, with multiple industry participants competing for the same customers. Many of our competitors have longer operating histories and greater resources than we have and offer a wider range of financial products and services. Other of our competitors offer a more narrow range of financial products and services and have not been as susceptible to the disruptions in the credit markets that have impacted our Company, and therefore have not suffered the losses we have. The impact of competitors with superior name recognition, greater market acceptance, larger customer bases or stronger capital positions could adversely affect our revenue growth and customer retention. Our competitors may also be able to respond more quickly to new or changing opportunities and demands and withstand changing market conditions better than we can. Competitors may conduct extensive promotional activities, offering better terms, lower prices and/or different products and services or combination of products and services that could attract current E*TRADE customers and potentially result in price wars within the industry. Some of our competitors may also benefit from established relationships among themselves or with third parties enhancing their products and services.

Turmoil in the global financial markets could reduce trade volumes and margin borrowing and increase our dependence on our more active customers who receive lower pricing.

Online investing services to the retail customer, including trading and margin lending, account for a significant portion of our revenues. Turmoil in the global financial markets could lead to changes in volume and price levels of securities and futures transactions which may, in turn, result in lower trading volumes and margin lending. For example, in the months following the abnormal intraday volatility (or so-called “flash crash”) of May 6, 2010, retail trading levels declined significantly; our DARTs for the third quarter of 2010 declined by 26% over the preceding quarter and 30% over the same quarter in the prior year. In particular, a decrease in trading activity within our lower activity accounts could impact revenues and increase dependence on more active trading customers who receive more favorable pricing based on their trade volume. A decrease in trading activity or securities prices would also typically be expected to result in a decrease in margin borrowing, which would reduce the revenue that we generate from interest charged on margin borrowing. More broadly, any reduction in overall transaction volumes would likely result in lower revenues and may harm our operating results because many of our overhead costs are fixed.

We rely heavily on technology, and technology can be subject to interruption and instability.

We rely on technology, particularly the Internet, to conduct much of our activity. Our technology operations are vulnerable to disruptions from human error, natural disasters, power loss, computer viruses, spam attacks, unauthorized access and other similar events. Disruptions to or instability of our technology or external technology that allows our customers to use our products and services could harm our business and our reputation. In addition, technology systems, whether they be our own proprietary systems or the systems of third

10

parties on whom we rely to conduct portions of our operations, are potentially vulnerable to security breaches and unauthorized usage. An actual or perceived breach of the security of our technology could harm our business and our reputation.

Vulnerability of our customers’ computers and mobile devices could lead to significant losses related to identity theft or other fraud and harm our reputation and financial performance.

Because our business model relies heavily on our customers’ use of their own personal computers, mobile devices and the Internet, our business and reputation could be harmed by security breaches of our customers and third parties. Computer viruses and other attacks on our customers’ personal computer systems and mobile devices could create losses for our customers even without any breach in the security of our systems, and could thereby harm our business and our reputation. As part of our E*TRADE Complete Protection Guarantee, we reimburse our customers for losses caused by a breach of security of the customers’ own personal systems. Such reimbursements could have a material impact on our financial performance.

We rely on third party service providers to perform certain functions.

We rely on third party service providers for certain technology, processing, servicing and support functions. These third party service providers are also subject to operational and technology vulnerabilities, which may impact our business. An interruption in or the cessation of service by any third party service provider and our inability to make alternative arrangements in a timely manner could have a material impact on our business and financial performance.

Downturns in the securities markets increase the credit risk associated with margin lending or securities loaned transactions.

We permit customers to purchase securities on margin. A downturn in securities markets may impact the value of collateral held in connection with margin receivables and may reduce its value below the amount borrowed, potentially creating collections issues with our margin receivables. In addition, we frequently borrow securities from and lend securities to other broker-dealers. Under regulatory guidelines, when we borrow or lend securities, we must simultaneously disburse or receive cash deposits. A sharp change in security market values may result in losses if counterparties to the borrowing and lending transactions fail to honor their commitments.

We may be unsuccessful in managing the effects of changes in interest rates and the enterprise interest-earning assets in our portfolio.

Net operating interest income is an important source of our revenue. Our results of operations depend, in part, on our level of net operating interest income and our effective management of the impact of changing interest rates and varying asset and liability maturities. Our ability to manage interest rate risk could impact our financial condition. We use derivatives to help manage interest rate risk. However, the derivatives we utilize may not be completely effective at managing this risk and changes in market interest rates and the yield curve could reduce the value of our financial assets and reduce net operating interest income. Among other items, we periodically enter into repurchase agreements to support the funding and liquidity requirements of E*TRADE Bank. If we are unsuccessful in maintaining our relationships with counterparties, we could recognize substantial losses on the derivatives we utilized to hedge repurchase agreements.

If we do not successfully manage consolidation opportunities, we could be at a competitive disadvantage.

There has recently been significant consolidation in the financial services industry and this consolidation is likely to continue in the future. Should we be excluded from or fail to take advantage of viable consolidation opportunities, our competitors may be able to capitalize on those opportunities and create greater scale and cost efficiencies to our detriment.

11

We have acquired a number of businesses and, although we are currently constrained by the terms of our corporate debt and the memoranda of understanding we and E*TRADE Bank entered into with the OTS, may continue to acquire businesses in the future. The primary assets of these businesses are their customer accounts. Our retention of these assets and the customers of businesses we acquire may be impacted by our ability to successfully continue to integrate the acquired operations, products (including pricing) and personnel. Diversion of management attention from other business concerns could have a negative impact. If we are not successful in our integration efforts, we may experience significant attrition in the acquired accounts or experience other issues that would prevent us from achieving the level of revenue enhancements and cost savings that we expect with respect to an acquisition.

Risks associated with principal trading transactions could result in trading losses.

A majority of our market making revenues are derived from trading as a principal. We may incur trading losses relating to the purchase, sale or short sale of securities for our own account, as well as trading losses in our market maker stocks. We carry equity security positions on a daily basis and from time to time, we may carry large positions in securities of a single issuer or issuers engaged in a specific industry. Sudden changes in the value of these positions could impact our financial results.

Reduced spreads in securities pricing, levels of trading activity and trading through market makers could harm our market maker business.

Technological advances, competition and regulatory changes in the marketplace may continue to tighten securities spreads. Tighter spreads could reduce revenue capture per share by our market maker, thus reducing revenues for this line of business.

Advisory services subject us to additional risks.

We provide advisory services to investors to aid them in their decision making and also provide full service portfolio management. Investment decisions and suggestions are based on publicly available documents and communications with investors regarding investment preferences and risk tolerances. Publicly available documents may be inaccurate and misleading, resulting in recommendations or transactions that are inconsistent with the investors’ intended results. In addition, advisors may not understand investor needs or risk tolerances, failures that may result in the recommendation or purchase of a portfolio of assets that may not be suitable for the investor. To the extent that we fail to know our customers or improperly advise them, we could be found liable for losses suffered by such customers, which could harm our reputation and business.

Our international operations subject us to additional risks and regulation, which could impair our business growth.

We conduct business in a number of international locations. Action or inaction in any of these operations, including the failure to follow proper practices with respect to regulatory compliance and/or corporate governance, could harm our operations and/or our reputation.

We have a significant deferred tax asset and cannot assure it will be fully realized.

We had net deferred tax assets of $1.5 billion as of December 31, 2010. We did not establish a valuation allowance against our federal net deferred tax assets as of December 31, 2010 as we believe that it is more likely than not that all of these assets will be realized. In evaluating the need for a valuation allowance, we estimated future taxable income based on management approved forecasts. This process required significant judgment by management about matters that are by nature uncertain. If future events differ significantly from our current forecasts, a valuation allowance may need to be established, which would have a material adverse effect on our results of operations and our financial condition.

12

As a result of the Public Equity Offering, the Debt Exchange and related transactions in 2009, we believe that we experienced an “ownership change” for tax purposes that could cause us to permanently lose a significant portion of our U.S. federal and state deferred tax assets.

As a result of the Public Equity Offering, the Debt Exchange and related transactions in 2009, we believe that we experienced an “ownership change” as defined under Section 382 of the Internal Revenue Code of 1986, as amended (“Section 382”) (which is generally a greater than 50 percentage point increase by certain “5% shareholders” over a rolling three year period). Section 382 imposes an annual limitation on the utilization of deferred tax assets, such as net operating loss carryforwards and other tax attributes, once an ownership change has occurred. Depending on the size of the annual limitation (which is in part a function of our market capitalization at the time of the ownership change) and the remaining carryforward period of the tax assets (U.S. federal net operating losses generally may be carried forward for a period of 20 years), we could realize a permanent loss of a portion of our U.S. federal and state deferred tax assets and certain built-in losses that have not been recognized for tax purposes. We believe the tax ownership change will extend the period of time it will take to fully utilize our pre-ownership change net operating losses (“NOLs”), but will not limit the total amount of pre-ownership change NOLs we can utilize. This is a complex analysis and requires the Company to make certain judgments in determining the annual limitation. As a result, it is possible that we could ultimately lose a significant portion of our deferred tax assets, which could have a material adverse effect on our results of operations and financial condition.

Risks Relating to the Regulation of Our Business

We are subject to extensive government regulation, including banking and securities rules and regulations, which could restrict our business practices.

The securities and banking industries are subject to extensive regulation. All of our broker-dealer subsidiaries have to comply with many laws and rules, including rules relating to sales practices and the suitability of recommendations to customers, possession and control of customer funds and securities, margin lending, execution and settlement of transactions and anti money-laundering. We are also subject to additional laws and rules as a result of our market maker operations.

Similarly, E*TRADE Financial Corporation and ETB Holdings, Inc., as savings and loan holding companies, and E*TRADE Bank, E*TRADE Savings Bank and E*TRADE United Bank, as federally chartered savings banks, are subject to extensive regulation, supervision and examination by the OTS (including pursuant to the terms of the memoranda of understanding that E*TRADE Financial Corporation and E*TRADE Bank entered into with the OTS) and, in the case of the savings banks, also the FDIC. Such regulation covers all banking business, including lending practices, safeguarding deposits, capital structure, recordkeeping, transactions with affiliates and conduct and qualifications of personnel.

Recently enacted regulatory reform legislation may have a material impact on our operations. In addition, if we are unable to meet the new requirements, we could face negative regulatory consequences. Any such actions could have a material negative effect on our business.

On July 21, 2010, the President signed into law the Dodd-Frank Act. This new law contains various provisions designed to enhance financial stability and to reduce the likelihood of another financial crisis and will significantly change the current bank regulatory structure for our Company and its thrift subsidiaries. The key effects of the Dodd-Frank Act on our business are:

| | • | | changes to the thrift supervisory structure; |

| | • | | changes to regulatory capital requirements; |

| | • | | increases in the FDIC assessment for depository institutions with assets of $10 billion or more; |

13

| | • | | establishment of a Consumer Financial Protection Bureau with broad authority to implement new consumer protection regulations and, for banks and thrifts with $10 billion or more in assets, to examine and enforce compliance with federal consumer laws; and |

| | • | | increases in the minimum reserve ratio for the FDIC’s deposit insurance fund to 1.35%. |

Under the legislation, the OTS will be abolished by April 2012 and its functions and personnel distributed among the OCC, FDIC and the Federal Reserve. Primary jurisdiction for the supervision and regulation of federal thrifts, such as the Company’s three thrift subsidiaries, will be transferred to the OCC; supervision and regulation of savings and loan holding companies, including the Company, will be transferred to the Federal Reserve. Although the Dodd-Frank Act maintains the federal thrift charter, it eliminates certain benefits of the charter and imposes new penalties for failure to comply with the qualified thrift lender test. The Dodd-Frank Act also requires all companies, including savings and loan holding companies that directly or indirectly control an insured depository institution to serve as a source of strength for the institution.

The Dodd-Frank Act also creates a new independent regulatory body, the Consumer Financial Protection Bureau, which has been given broad rulemaking authority to implement the consumer protection laws that apply to banks and thrifts and to prohibit “unfair, deceptive or abusive” acts and practices. For all banks and thrifts with total consolidated assets over $10 billion, including E*TRADE Bank, the Consumer Financial Protection Bureau has exclusive rulemaking and examination, and primary enforcement authority, under federal consumer financial laws and regulations. In addition, the Dodd-Frank Act permits states to adopt consumer protection laws and regulations that are stricter than those regulations promulgated by the Consumer Financial Protection Bureau.

For us, one of the most significant changes under the new law is that savings and loan holding companies such as our Company for the first time will become subject to the same capital and activity requirements as those applicable to bank holding companies. In addition, we will be subject to the same capital requirements as those applied to banks which requirements exclude, on a phase-out basis, all trust preferred securities from Tier 1 capital. While the Dodd-Frank Act provides for a five year phase-in period for these new capital requirements, it requires holding companies like ours, as well as all of our thrift subsidiaries, to be both “well capitalized” and “well managed” in order to be able to engage in certain financial activities such as market making and securities underwriting as soon as the OTS is abolished. We fully expect to meet these capital requirements and to have our Company and its thrift subsidiaries qualify as both “well capitalized” and “well managed” within the applicable phase in periods. However, if we are unable to satisfy these requirements, we could be subject to activity restrictions and other negative regulatory actions. In addition, it is possible that our regulators may impose more stringent capital and other prudential standards on us prior to the end of the five year phase-in period.

The Dodd-Frank Act requires various federal agencies to adopt a broad range of new rules and regulations, the details, substance, and impact of which may not be known for months or years. It is difficult to predict at this time what other specific impacts the Dodd-Frank Act and the yet-to-be-written rules and regulations may have on us. However, given that the legislation is likely to materially change the regulatory environment for the financial services industry in which we operate, we expect at a minimum that our compliance costs will increase.

The OTS may request that we raise additional equity to support E*TRADE Bank or to further reduce debt. If we are unable to do so, we could face negative regulatory actions. Any such actions could have a material negative effect on our business.

In early 2009, the OTS advised us, and we agreed, that we needed to raise additional equity capital for E*TRADE Bank and reduce substantially the amount of our outstanding debt in order to withstand any further deterioration in current credit and market conditions. In furtherance of these objectives, we completed the Debt Exchange, the Public Equity Offering and the At the Market Common Stock Offering in 2009. Pursuant to memoranda of understanding that we and E*TRADE Bank entered into with the OTS, we and E*TRADE Bank are required to submit to the OTS and implement both capital and de-leveraging plans to continue to monitor and address these matters.

14

If we are unable to comply with the terms of our capital plan in the ordinary course of business or are unable to raise any additional cash equity to be contributed as capital to E*TRADE Bank or to further reduce our debt, in each case, as may in the future be required by the OTS, we could face negative regulatory consequences.

If we fail to comply with applicable securities and banking laws, rules and regulations, either domestically or internationally, we could be subject to disciplinary actions, damages, penalties or restrictions that could significantly harm our business.

The SEC, FINRA and other self-regulatory organizations and state securities commissions, among other things, can censure, fine, issue cease-and-desist orders or suspend or expel a broker-dealer or any of its officers or employees. The OTS may take similar action with respect to our banking activities. Similarly, the attorneys general of each state could bring legal action on behalf of the citizens of the various states to ensure compliance with local laws. Regulatory agencies in countries outside of the U.S. have similar authority. The ability to comply with applicable laws and rules is dependent in part on the establishment and maintenance of a reasonable compliance system. The failure to establish and enforce reasonable compliance procedures, even if unintentional, could subject us to significant losses or disciplinary or other actions.

If we do not maintain the capital levels required by regulators, we may be fined or even forced out of business.

The SEC, FINRA, OTS and various other regulatory agencies have stringent rules with respect to the maintenance of specific levels of regulatory capital by banks and net capital by securities broker-dealers. E*TRADE Bank is subject to various regulatory capital requirements administered by the OTS, which will soon be administered by the OCC, and E*TRADE Financial Corporation will, for the first time, become subject to specific capital requirements administered by the Federal Reserve. Failure to meet minimum capital requirements can trigger certain mandatory, and possibly additional discretionary actions by regulators that, if undertaken, could harm E*TRADE Bank’s and E*TRADE Financial Corporation’s operations and financial statements.

The Bank must meet specific capital guidelines that involve quantitative measures of E*TRADE Bank’s assets, liabilities and certain off-balance sheet items as calculated under regulatory accounting practices. Quantitative measures established by regulation to ensure capital adequacy require E*TRADE Bank to maintain minimum amounts and ratios of total and Tier 1 capital to risk-weighted assets and of Tier 1 capital to adjusted total assets. To satisfy the capital requirements for a “well capitalized” financial institution, E*TRADE Bank must maintain higher total and Tier 1 capital to risk-weighted assets and Tier 1 capital to adjusted total assets ratios. E*TRADE Bank’s capital amounts and classification are subject to qualitative judgments by the regulators about the strength of components of its capital, risk weightings of assets, off-balance sheet transactions and other factors. Any significant reduction in E*TRADE Bank’s regulatory capital could result in E*TRADE Bank being less than “well capitalized” or “adequately capitalized” under applicable capital rules. A failure of E*TRADE Bank to be “adequately capitalized” which is not cured within time periods specified in the indentures governing our debt securities would constitute a default under our debt securities and likely result in the debt securities becoming immediately due and payable at their full face value.

Similarly, failure to maintain the required net capital by our securities broker-dealers could result in suspension or revocation of registration by the SEC and suspension or expulsion by FINRA, and could ultimately lead to the firm’s liquidation. Net capital is the net worth of a broker or dealer (assets minus liabilities), less deductions for certain types of assets. If such net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited. Such operations may include investing activities, marketing and the financing of customer account balances. Also, our ability to withdraw capital from brokerage subsidiaries could be restricted, which in turn could limit our ability to repay debt and redeem or purchase shares of our outstanding stock.

15

As a non-grandfathered savings and loan holding company, we are subject to regulations that could restrict our ability to take advantage of certain business opportunities.

We are required to file periodic reports with the OTS and are subject to examination by the OTS. The OTS also has certain types of enforcement powers over us, ETB Holdings, Inc. and certain of its subsidiaries, including the ability to issue cease-and-desist orders, force divestiture of E*TRADE Bank and impose civil and monetary penalties for violations of federal banking laws and regulations or for unsafe or unsound banking practices. In addition, under the Gramm-Leach-Bliley Act, our activities are restricted to those that are financial in nature and certain real estate-related activities. We may make merchant banking investments in companies whose activities are not financial in nature if those investments are made for the purpose of appreciation and ultimate resale of the investment and we do not manage or operate the company. Such merchant banking investments may be subject to maximum holding periods and special recordkeeping and risk management requirements. In recent periods, the Company moved its subsidiaries, E*TRADE Clearing LLC and E*TRADE Securities LLC, respectively, to become operating subsidiaries of E*TRADE Bank, resulting in increased regulatory oversight and restrictions on the activities of E*TRADE Clearing LLC and E*TRADE Securities LLC.

We believe all of our existing activities and investments are permissible under the Gramm-Leach-Bliley Act. Even if our existing activities and investments are permissible, we are unable to pursue future activities that are not financial in nature. We are also limited in our ability to invest in other savings and loan holding companies.

In addition, E*TRADE Bank is subject to extensive regulation of its activities and investments, capitalization, community reinvestment, risk management policies and procedures and relationships with affiliated companies. Acquisitions of and mergers with other financial institutions, purchases of deposits and loan portfolios, the establishment of new bank subsidiaries and the commencement of new activities by bank subsidiaries require the prior approval of the OTS, and in some cases the FDIC, which may deny approval or limit the scope of our planned activity. These regulations and conditions could place us at a competitive disadvantage in an environment in which consolidation within the financial services industry is prevalent. Also, these regulations and conditions could affect our ability to realize synergies from future acquisitions, could negatively affect us following the acquisition and could also delay or prevent the development, introduction and marketing of new products and services.

Risks Relating to Owning Our Stock

We are substantially restricted by the terms of our corporate debt.

The indentures governing our corporate debt contain various covenants and restrictions that limit our ability and certain of our subsidiaries’ ability to, among other things:

| | • | | incur additional indebtedness; |

| | • | | pay dividends or make other distributions; |

| | • | | repurchase or redeem capital stock; |

| | • | | make investments or other restricted payments; |

| | • | | enter into transactions with our shareholders or affiliates; |

| | • | | sell assets or shares of capital stock of our subsidiaries; |

| | • | | receive dividend or other payments from our subsidiaries; and |

| | • | | merge, consolidate or transfer substantially all of our assets. |

16

As a result of the covenants and restrictions contained in the indentures, we are limited in how we conduct our business and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. Each of these series of our corporate debt contains a limitation, subject to important exceptions, on our ability to incur additional debt if our Consolidated Fixed Charge Coverage Ratio (as defined in the relevant indentures) is less than or equal to 2.50 to 1.0. As of December 31, 2010, our Consolidated Fixed Charge Coverage Ratio was 0.95 to 1.0. The terms of any future indebtedness could include more restrictive covenants.

Although these covenants provide substantial flexibility, for example the ability to incur “refinancing indebtedness” and to incur up to $300 million of secured debt under a credit facility, the covenants, among other things, generally limit our ability to incur additional debt even if we were to substantially reduce our existing debt through debt exchange transactions. We could be forced to repay immediately all our outstanding debt securities at their full principal amount if we were to breach these covenants and did not cure the breach within the cure periods (if any) specified in the respective indentures. Further, if we experience a change of control, as defined in the indentures, we could be required to offer to purchase our debt securities at 101% of their principal amount. Under our debt securities a “change of control” would occur if, among other things, a person became the beneficial owner of more than 50% of the total voting power of our voting stock which, with respect to the 2011 Notes, 2013 Notes and 2015 Notes, would need to be coupled with a ratings downgrade before we would be required to offer to purchase those securities.

We cannot assure that we will be able to remain in compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the appropriate parties and/or amend the covenants.

The value of our common stock may be diluted if we need additional funds in the future or engage in debt-for-equity exchanges in the future.

In the future, we may need to raise additional funds via debt and/or equity instruments, which may not be available on favorable terms, if available at all. If adequate funds are not available on acceptable terms, we may be unable to fund our capital needs and our plans for the growth of our business. In addition, if funds are available, the issuance of equity securities could significantly dilute the value of our shares of our common stock and cause the market price of our common stock to fall. We have the ability to issue a significant number of shares of stock in future transactions, which would substantially dilute existing shareholders, without seeking further shareholder approval.

In recent periods, the global financial markets were in turmoil and the equity and credit markets experienced extreme volatility, which caused already weak economic conditions to worsen. Continued turmoil in the global financial markets could further restrict our access to the equity and debt markets.

Citadel is our largest shareholder and debtholder, with approximately 9.9% of our common stock or approximately 27% of our common stock assuming conversion of convertible debentures held by Citadel. Accordingly, Citadel’s interests may conflict with the interests of other shareholders.

Citadel is the largest holder of our common stock, and based upon our review of publicly available information, we believe Citadel owns approximately 9.9% of our outstanding common stock or approximately 27% of our common stock assuming conversion of convertible debentures held by Citadel. Although Citadel is not required to disclose to us the amount of our outstanding debt securities it owns, we believe it owns in the aggregate approximately $590 million of the non-interest-bearing convertible debentures. In addition, Kenneth Griffin, President and CEO of Citadel, joined the Board of Directors on June 8, 2009 pursuant to a director nomination right granted to Citadel in 2007.

Citadel is an independent entity with its own investors and is entitled to act in its own economic interest with respect to its equity and debt investments in E*TRADE. As discussed below, our debt securities contain restrictive covenants. In pursuing its economic interests, Citadel may make decisions with respect to fundamental corporate transactions which may be different than the decisions of investors who own only common shares.

17

Citadel is a substantial holder of our common stock and has not entered into any contractual arrangements to protect the interests of other shareholders.

Based upon our review of publicly available information, we believe Citadel owns approximately 9.9% of our outstanding common stock or approximately 27% of our common stock assuming conversion of convertible debentures held by Citadel. Under the law of Delaware, where the Company is incorporated, this would most likely be sufficient to permit Citadel to influence or cause the election of a substantial number of directors and significantly impact, corporate policy, including decisions to enter into mergers or other extraordinary transactions. The Company and Citadel have not entered into a shareholders agreement or similar contract to restrict these actions, but Citadel will be unable to accomplish these matters for so long as it is subject to certain rules of the OTS regarding rebuttals of control over thrifts and thrift holding companies. If these rules change, or if Citadel receives a waiver or is no longer subject to its rebuttal of control agreement with the OTS or decides to become a thrift holding company, it will be in a position to influence or cause the election of a substantial number of directors and to substantially impact, corporate policy. Further, if Citadel acquires securities representing more than 50% of the total voting power, holders of our debt securities would have the right to require the Company to repurchase all such securities for cash at 101% of their face amount.

The market price of our common stock may continue to be volatile.

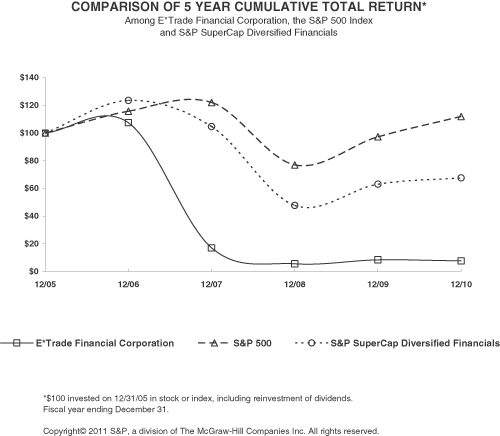

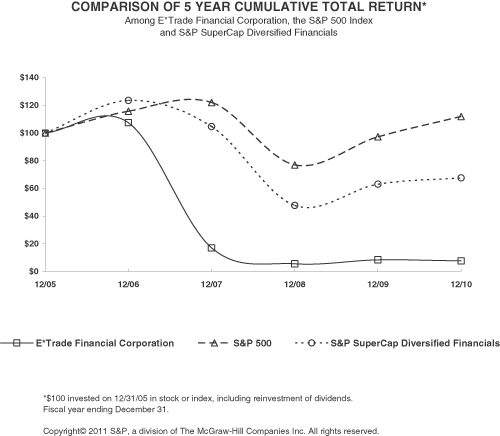

From January 1, 2008 through December 31, 2010, the price per share of our common stock ranged from a low of $5.90 to a high of $54.80. The market price of our common stock has been, and is likely to continue to be, highly volatile and subject to wide fluctuations. In the past, volatility in the market price of a company’s securities has often led to securities class action litigation. Such litigation could result in substantial costs to us and divert our attention and resources, which could harm our business. As discussed in Note 22—Commitments, Contingencies and Other Regulatory Matters of Item 8. Financial Statements and Supplementary Data, we are currently a party to litigation related to the decline in the market price of our stock, and such litigation could occur again in the future. Declines in the market price of our common stock or failure of the market price to increase could also harm our ability to retain key employees, reduce our access to capital, impact our ability to utilize deferred tax assets in the event of another ownership change and otherwise harm our business.

We have various mechanisms in place that may discourage takeover attempts.

Certain provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a third party from acquiring control of us in a merger, acquisition or similar transaction that a shareholder may consider favorable. Such provisions include:

| | • | | authorization for the issuance of “blank check” preferred stock; |

| | • | | provision for a classified Board of Directors with staggered, three-year terms; |

| | • | | the prohibition of cumulative voting in the election of directors; |

| | • | | a super-majority voting requirement to effect business combinations and certain amendments to our certificate of incorporation and bylaws; |

| | • | | limits on the persons who may call special meetings of shareholders; |

| | • | | the prohibition of shareholder action by written consent; and |

| | • | | advance notice requirements for nominations to the Board or for proposing matters that can be acted on by shareholders at shareholder meetings. |

In addition, certain provisions of our stock incentive plans, management retention and employment agreements (including severance payments and stock option acceleration), certain provisions of Delaware law and the requirements under our debt securities to offer to purchase such securities at 101% of their principal amount may also discourage, delay or prevent someone from acquiring or merging with us.

18

We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In addition, the terms of existing or future debt instruments may restrict us from adopting some of these alternatives.