UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-11921

E*TRADE Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 94-2844166 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

1271 Avenue of the Americas, 14th Floor, New York, New York 10020

(Address of principal executive offices and Zip Code)

(646) 521-4300

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer x | | | | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of May 2, 2011, there were 279,700,971 shares of common stock outstanding.

E*TRADE FINANCIAL CORPORATION

FORM 10-Q QUARTERLY REPORT

For the Quarter Ended March 31, 2011

TABLE OF CONTENTS

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “E*TRADE” mean E*TRADE Financial Corporation and its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank, Equity Edge, OptionsLink and the Converging Arrows logo are registered trademarks of E*TRADE Financial Corporation in the United States and in other countries.

2

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements involving risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “expect,” “may,” “anticipate,” “intend,” “plan” and similar expressions. Our actual results could differ materially from those discussed in these forward-looking statements, and we caution that we do not undertake to update these statements. Factors that could contribute to our actual results differing from any forward-looking statements include those discussed under Risk Factors, Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report and in our Annual Report on Form 10-K for the year ended December 31, 2010 filed with the Securities and Exchange Commission (“SEC”). The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report. We further caution that there may be risks associated with owning our securities other than those discussed in such filings. Important factors that may cause actual results to differ materially from any forward-looking statements are set forth in Item 1A. Risk Factors in the Annual Report on Form 10-K for the year ended December 31, 2010, and as updated in this report.

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

This information is set forth immediately following Item 3. Quantitative and Qualitative Disclosures about Market Risk.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this document.

GLOSSARY OF TERMS

In analyzing and discussing our business, we utilize certain metrics, ratios and other terms that are defined in the Glossary of Terms, which is located at the end of Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

OVERVIEW

Strategy

Our core business is our trading and investing customer franchise. Building on the strengths of this franchise, our growth strategy is focused on four areas: retail brokerage, corporate services and market making, wealth management, and banking.

| | • | | Our retail brokerage business is our foundation. We believe a focus on these key factors will position us for future growth in this business: growing our sales force with a focus on long-term investing, optimizing our marketing spend, continuing to develop innovative products and services and minimizing account attrition. |

| | • | | Our corporate services and market making businesses enhance our strategy by allowing us to realize additional economic benefit from our retail brokerage business. Our corporate services business is a leading provider of software and services for managing equity compensation plans and is an important source of new retail brokerage accounts. Our market making business allows us to increase the economic benefit on the order flow from the retail brokerage business as well as generate additional revenues through external order flow. |

| | • | | We also plan to expand our wealth management offerings. Our vision is to provide wealth management services that are enabled by innovative technology and supported by guidance from professionals when needed. |

3

| | • | | Our retail brokerage business generates a significant amount of customer cash and we plan to continue to utilize our bank to optimize the value of these customer deposits. |

Our strategy also includes an intense focus on mitigating the credit losses in our legacy loan portfolio and maintaining disciplined expense management. We remain focused on strengthening our overall capital structure and positioning the Company for future growth.

Key Factors Affecting Financial Performance

Our financial performance is affected by a number of factors outside of our control, including:

| | • | | customer demand for financial products and services; |

| | • | | weakness or strength of the residential real estate and credit markets; |

| | • | | performance, volume and volatility of the equity and capital markets; |

| | • | | customer perception of the financial strength of our franchise; |

| | • | | market demand and liquidity in the secondary market for mortgage loans and securities; |

| | • | | market demand and liquidity in the wholesale borrowings market, including securities sold under agreements to repurchase; |

| | • | | our ability to obtain regulatory approval to move capital from our bank to our parent company; and |

| | • | | changes to the rules and regulations governing the financial services industry. |

In addition to the items noted above, our success in the future will depend upon, among other things:

| | • | | continuing our success in the acquisition, growth and retention of trading customers; |

| | • | | our ability to generate meaningful growth in the long-term investing customer group; |

| | • | | our ability to assess and manage credit risk; |

| | • | | our ability to generate capital sufficient to meet our operating needs, particularly a level sufficient to offset loan losses; |

| | • | | our ability to assess and manage interest rate risk; and |

| | • | | disciplined expense control and improved operational efficiency. |

4

Management monitors a number of metrics in evaluating the Company’s performance. The most significant of these are shown in the table and discussed in the text below:

| | | | | | | | | | | | |

| | | As of or For the

Three Months Ended

March 31, | | | Variance | |

| | | 2011 | | | 2010 | | | 2011 vs. 2010 | |

Customer Activity Metrics: | | | | | | | | | | | | |

Daily average revenue trades (“DARTs”) | | | 177,279 | | | | 155,310 | | | | 14 | % |

Average commission per trade | | $ | 11.32 | | | $ | 11.38 | | | | (1 | )% |

Margin receivables (dollars in billions) | | $ | 5.7 | | | $ | 3.8 | | | | 50 | % |

End of period brokerage accounts | | | 2,734,823 | | | | 2,631,977 | | | | 4 | % |

Net new brokerage accounts | | | 50,512 | | | | 1,898 | | | | * | |

Customer assets (dollars in billions) | | $ | 188.9 | | | $ | 158.8 | | | | 19 | % |

Net new brokerage assets (dollars in billions) | | $ | 3.9 | | | $ | 2.2 | | | | * | |

Brokerage related cash (dollars in billions) | | $ | 25.9 | | | $ | 21.8 | | | | 19 | % |

| | | |

Company Financial Metrics: | | | | | | | | | | | | |

Corporate cash (dollars in millions) | | $ | 460.9 | | | $ | 418.4 | | | | 10 | % |

E*TRADE Bank excess risk-based capital (dollars in millions) | | $ | 1,255.0 | | | $ | 945.6 | | | | 33 | % |

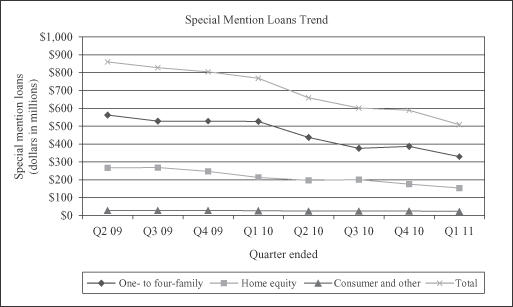

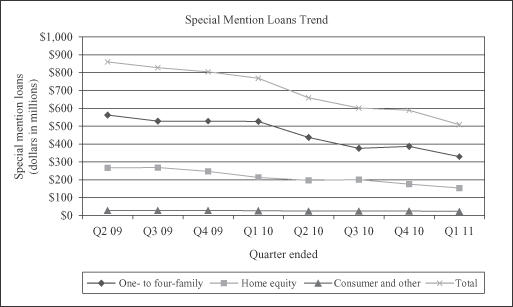

Special mention loan delinquencies (dollars in millions) | | $ | 508.8 | | | $ | 768.6 | | | | (34 | )% |

Allowance for loan losses (dollars in millions) | | $ | 953.6 | | | $ | 1,162.4 | | | | (18 | )% |

Enterprise net interest spread | | | 2.84 | % | | | 2.96 | % | | | (0.12 | )% |

Enterprise interest-earning assets (average in billions) | | $ | 42.7 | | | $ | 42.4 | | | | 1 | % |

| * | | Percentage not meaningful. |

Customer Activity Metrics

| | • | | DARTs are the predominant driver of commissions revenue from our customers. |

| | • | | Average commission per trade is an indicator of changes in our customer mix, product mix and/or product pricing and is impacted by the mix between our customer groups. |

| | • | | Margin receivables represent credit extended to customers and non-customers to finance their purchases of securities by borrowing against securities they currently own. Margin receivables are a key driver of net operating interest income. |

| | • | | End of period brokerage accounts and net new brokerage accounts are indicators of our ability to attract and retain brokerage customers. |

| | • | | Changes in customer assets are an indicator of the value of our relationship with the customer. An increase in customer assets generally indicates that the use of our products and services by existing and new customers is expanding. Changes in this metric are also driven by changes in the valuations of our customers’ underlying securities. |

| | • | | Net new brokerage assets are total inflows to all new and existing brokerage accounts less total outflows from all closed and existing brokerage accounts and are a general indicator of the use of our products and services by existing and new brokerage customers. |

| | • | | Customer cash and deposits, particularly brokerage related cash, are an indicator of a deepening engagement with our customers and are a key driver of net operating interest income. |

Company Financial Metrics

| | • | | Corporate cash is an indicator of the liquidity at the parent company. It is the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. |

5

| | • | | E*TRADE Bank excess risk-based capital is the capital that E*TRADE Bank has in excess of the regulatory minimum to be considered well-capitalized and is an indicator of E*TRADE Bank’s ability to absorb future losses. It is also a potential source of additional corporate cash, as this capital, if requested by us and approved by our regulators, could be sent as a dividend or otherwise distributed to the parent company. |

| | • | | Special mention loan delinquencies are loans 30-89 days past due and are an indicator of the expected trend for charge-offs in future periods as these loans have a greater propensity to migrate into nonaccrual status and ultimately charge-off. |

| | • | | Allowance for loan losses is an estimate of the losses inherent in our loan portfolio as of the balance sheet date and is typically equal to the expected charge-offs in our loan portfolio over the next twelve months as well as the estimated charge-offs, including economic concessions to borrowers, over the estimated remaining life of loans modified in troubled debt restructurings. The general allowance for loan losses also includes a specific qualitative component to account for a variety of economic and operational factors that are not directly considered in the quantitative loss model, including the current level of unemployment and the limited historical charge-off and loss experience on modified loans, but are factors we believe may impact our level of credit losses. |

| | • | | Enterprise interest-earning assets, in conjunction with our enterprise net interest spread, are indicators of our ability to generate net operating interest income. |

Significant Events in the First Quarter of 2011

Enhancement to Our Trading and Investing Products and Services

| | • | | We expanded our offering by introducing unified managed account advisory services to long-term investors seeking professional money management services with an investment of $250,000 or more; |

| | • | | We launched E*TRADE Community, a social networking platform for investors, which leverages social media and provides customers a platform to interact and share ideas and investment strategies with other E*TRADE customers, while being an important channel for us to gather customer feedback; and |

| | • | | We grew our sales force by 12%, which included a nearly 15% increase in our financial consultant team, as we continue to focus on engagement with long-term and retirement investors. |

Conversions of Convertible Debentures

| | • | | During the quarter, $278.9 million of the convertible debentures were converted into 27.0 million shares of common stock; and |

| | • | | On April 29, 2011, Citadel sold 27.5 million shares of the Company’s common stock through a secondary offering. As part of and following the offering, Citadel converted $314.1 million in convertible debentures into 30.4 million shares of common stock. A total of $325.1 million in convertible debentures were converted into 31.4 million shares of common stock during the period April 1, 2011 through May 2, 2011. |

EARNINGS OVERVIEW

We generated net income of $45.2 million for the three months ended March 31, 2011, due primarily to income before income taxes of $184.4 million in the trading and investing segment, which was partially offset by $116.1 million in provision for loan losses reported in the balance sheet management segment. The provision for loan losses has declined 78% from its peak of $517.8 million in the third quarter of 2008 and we expect it to continue to decline in 2011 when compared to 2010, although performance is subject to variability from quarter to quarter.

6

The following sections describe in detail the changes in key operating factors and other changes and events that have affected net revenue, provision for loan losses, operating expense, other income (expense) and income tax expense (benefit).

Revenue

The components of net revenue and the resulting variances are as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months

Ended March 31, | | | Variance | |

| | | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Amount | | | % | |

Net operating interest income | | $ | 309.7 | | | $ | 320.4 | | | $ | (10.7 | ) | | | (3 | )% |

Commissions | | | 124.5 | | | | 113.3 | | | | 11.2 | | | | 10 | % |

Fees and service charges | | | 37.2 | | | | 42.2 | | | | (5.0 | ) | | | (12 | )% |

Principal transactions | | | 29.6 | | | | 26.2 | | | | 3.4 | | | | 13 | % |

Gains on loans and securities, net | | | 32.3 | | | | 29.0 | | | | 3.3 | | | | 11 | % |

Net impairment | | | (6.1 | ) | | | (8.6 | ) | | | 2.5 | | | | (30 | )% |

Other revenues | | | 9.5 | | | | 14.0 | | | | (4.5 | ) | | | (32 | )% |

| | | | | | | | | | | | | | | | |

Total non-interest income | | | 227.0 | | | | 216.1 | | | | 10.9 | | | | 5 | % |

| | | | | | | | | | | | | | | | |

Total net revenue | | $ | 536.7 | | | $ | 536.5 | | | $ | 0.2 | | | | 0 | % |

| | | | | | | | | | | | | | | | |

Total net revenue was $536.7 million for the three months ended March 31, 2011 which was consistent with the same period in 2010, as an increase in commissions was offset by a decline in net operating interest income.

Net Operating Interest Income

Net operating interest income decreased 3% to $309.7 million for the three months ended March 31, 2011 compared to the same period in 2010. Net operating interest income is earned primarily through investing customer cash and deposits in interest-earning assets, which include margin receivables, real estate loans, available-for-sale securities and held-to-maturity securities. The slight decrease in net operating interest income was due primarily to a decrease in the net operating interest spread.

7

The following table presents enterprise average balance sheet data and enterprise income and expense data for our operations, as well as the related net interest spread, yields and rates and has been prepared on the basis required by the SEC’s Industry Guide 3, “Statistical Disclosure by Bank Holding Companies” (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2011 | | | 2010 | |

| | | Average

Balance | | | Operating

Interest

Inc./Exp. | | | Average

Yield/

Cost | | | Average

Balance | | | Operating

Interest

Inc./Exp. | | | Average

Yield/

Cost | |

Enterprise interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Loans(1) | | $ | 15,824.9 | | | $ | 186.3 | | | | 4.71 | % | | $ | 19,928.5 | | | $ | 241.6 | | | | 4.85 | % |

Margin receivables | | | 5,443.3 | | | | 56.3 | | | | 4.19 | % | | | 4,022.2 | | | | 44.7 | | | | 4.51 | % |

Available-for-sale securities | | | 15,752.9 | | | | 111.2 | | | | 2.82 | % | | | 13,720.4 | | | | 109.6 | | | | 3.19 | % |

Held-to-maturity securities | | | 2,518.5 | | | | 20.8 | | | | 3.30 | % | | | — | | | | — | | | | — | |

Cash and equivalents | | | 1,831.1 | | | | 0.9 | | | | 0.21 | % | | | 2,449.3 | | | | 1.4 | | | | 0.23 | % |

Segregated cash and investments | | | 727.2 | | | | 0.2 | | | | 0.13 | % | | | 1,601.0 | | | | 0.9 | | | | 0.24 | % |

Securities borrowed and other | | | 643.8 | | | | 9.8 | | | | 6.16 | % | | | 687.5 | | | | 7.1 | | | | 4.17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total enterprise interest-earning assets | | | 42,741.7 | | | | 385.5 | | | | 3.61 | % | | | 42,408.9 | | | | 405.3 | | | | 3.83 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Non-operating interest-earning and non-interest earning assets(2) | | | 4,473.1 | | | | | | | | | | | | 4,235.2 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 47,214.8 | | | | | | | | | | | $ | 46,644.1 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Enterprise interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Retail deposits | | $ | 25,564.9 | | | | 11.3 | | | | 0.18 | % | | $ | 24,821.5 | | | | 18.5 | | | | 0.30 | % |

Brokered certificates of deposit | | | 70.4 | | | | 0.9 | | | | 5.31 | % | | | 119.8 | | | | 1.5 | | | | 5.04 | % |

Customer payables | | | 5,319.1 | | | | 1.9 | | | | 0.14 | % | | | 5,206.9 | | | | 1.9 | | | | 0.15 | % |

Securities sold under agreements to repurchase | | | 5,885.0 | | | | 38.0 | | | | 2.58 | % | | | 6,372.0 | | | | 34.8 | | | | 2.18 | % |

Federal Home Loan Bank (“FHLB”) advances and other borrowings | | | 2,752.2 | | | | 25.3 | | | | 3.67 | % | | | 2,761.4 | | | | 29.4 | | | | 4.26 | % |

Securities loaned and other | | | 685.0 | | | | 0.3 | | | | 0.20 | % | | | 620.3 | | | | 0.5 | | | | 0.32 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total enterprise interest-bearing liabilities | | | 40,276.6 | | | | 77.7 | | | | 0.77 | % | | | 39,901.9 | | | | 86.6 | | | | 0.87 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Non-operating interest-bearing and non-interest bearing liabilities(3) | | | 2,786.2 | | | | | | | | | | | | 2,934.5 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 43,062.8 | | | | | | | | | | | | 42,836.4 | | | | | | | | | |

Total shareholders’ equity | | | 4,152.0 | | | | | | | | | | | | 3,807.7 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 47,214.8 | | | | | | | | | | | $ | 46,644.1 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Excess of enterprise interest-earning assets over enterprise interest-bearing liabilities/Enterprise net interest income/Spread | | $ | 2,465.1 | | | $ | 307.8 | | | | 2.84 | % | | $ | 2,507.0 | | | $ | 318.7 | | | | 2.96 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Enterprise net interest margin (net yield on enterprise interest-earning assets) | | | | | | | | | | | 2.88 | % | | | | | | | | | | | 3.01 | % |

Ratio of enterprise interest-earning assets to enterprise interest-bearing liabilities | | | | | | | | | | | 106.12 | % | | | | | | | | | | | 106.28 | % |

Return on average: | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | | | | | | | | | | 0.38 | % | | | | | | | | | | | (0.41 | )% |

Total shareholders’ equity | | | | | | | | | | | 4.36 | % | | | | | | | | | | | (5.03 | )% |

Average equity to average total assets | | | | | | | | | | | 8.79 | % | | | | | | | | | | | 8.16 | % |

Reconciliation from enterprise net interest income to net operating interest income (dollars in millions):

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2011 | | | 2010 | |

Enterprise net interest income | | $ | 307.8 | | | $ | 318.7 | |

Taxable equivalent interest adjustment | | | (0.3 | ) | | | (0.3 | ) |

Customer cash held by third parties and other(4) | | | 2.2 | | | | 2.0 | |

| | | | | | | | |

Net operating interest income | | $ | 309.7 | | | $ | 320.4 | |

| | | | | | | | |

| (1) | | Nonaccrual loans are included in the respective average loan balances. Income on such nonaccrual loans is recognized on a cash basis. |

| (2) | | Non-operating interest-earning and non-interest earning assets consist of property and equipment, net, goodwill, other intangibles, net and other assets that do not generate operating interest income. Some of these assets generate corporate interest income. |

| (3) | | Non-operating interest-bearing and non-interest bearing liabilities consist of corporate debt and other liabilities that do not generate operating interest expense. Some of these liabilities generate corporate interest expense. |

| (4) | | Includes interest earned on average customer assets of $3.6 billion and $3.1 billion for the three months ended March 31, 2011 and 2010, respectively, held by parties outside E*TRADE Financial, including third party money market funds and sweep deposit accounts at unaffiliated financial institutions. |

8

Average enterprise interest-earning assets increased 1% to $42.7 billion for the three months ended March 31, 2011 compared to the same period in 2010. This increase was primarily a result of the increases in average margin receivables and average available-for-sale and held-to-maturity securities, partially offset by decreases in average loans and average cash and equivalents and average segregated cash and investments.

Average enterprise interest-bearing liabilities increased 1% to $40.3 billion for the three months ended March 31, 2011 compared to the same period in 2010. The increase in average enterprise interest-bearing liabilities was primarily due to an increase in average retail deposits, partially offset by a decrease in average securities sold under agreements to repurchase.

Enterprise net interest spread decreased by 12 basis points to 2.84% for the three months ended March 31, 2011 compared to the same period in 2010. This decrease was largely driven by a decrease in loans, combined with a historically low interest rate environment. In the current interest rate environment with historically low levels of interest rates, we expect continued downward pressure on our enterprise net interest spread.

Commissions

Commissions increased 10% to $124.5 million for three months ended March 31, 2011 compared to the same period in 2010. The main factors that affect commissions are DARTs, average commission per trade and the number of trading days during the period. Average commission per trade is impacted by different trade types (e.g. equities, options, fixed income, stock plan, exchange-traded funds, mutual funds and cross border) that can have different commission rates. Accordingly, changes in the mix of trade types will impact average commission per trade.

DART volume increased 14% to 177,279 for the three months ended March 31, 2011 compared the same period in 2010. Option-related DARTs as a percentage of total DARTs represented 19% and 15% of trading volume for the three months ended March 31, 2011 and 2010, respectively. Exchange-traded funds-related DARTs as a percentage of total DARTs represented 8% and 9% of trading volume for the three months ended March 31, 2011 and 2010, respectively.

Average commission per trade decreased 1% to $11.32 for the three months ended March 31, 2011 compared to the same period in 2010. The slight decrease in the average commission per trade was due primarily to the elimination of the $12.99 commission tier and the per share commission applied to market trades larger than 2,000 shares, which did not become effective until the second quarter of 2010, partially offset by an improvement in the product and customer mix when compared to the same period in 2010.

Fees and Service Charges

Fees and service charges decreased 12% to $37.2 million for the three months ended March 31, 2011 compared to the same period in 2010. The decrease was primarily due to the elimination of all account activity fees, which did not become effective until the second quarter of 2010.

Principal Transactions

Principal transactions increased 13% to $29.6 million for the three months ended March 31, 2011 compared to the same period in 2010. Principal transactions are derived from our market making business in which we act as a market maker for our brokerage customers’ orders as well as orders from third party customers. The increase in principal transactions was driven by an increase in the volume of orders in addition to an increase in average revenue earned per share traded when compared to the same period in 2010.

9

Gains on Loans and Securities, Net

Gains on loans and securities, net were $32.3 million and $29.0 million for the three months ended March 31, 2011 and 2010, respectively, as shown in the following table (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Amount | | | % | |

Gains (losses) on loans, net | | $ | 0.0 | | | $ | (0.9 | ) | | $ | 0.9 | | | | * | |

| | | | | | | | | | | | | | | | |

Gains on available-for-sale securities and other investments, net | | | 35.8 | | | | 29.4 | | | | 6.4 | | | | 22 | % |

Gains on trading securities, net | | | 0.6 | | | | 0.7 | | | | (0.1 | ) | | | (12 | )% |

Hedge ineffectiveness | | | (4.1 | ) | | | (0.2 | ) | | | (3.9 | ) | | | * | |

| | | | | | | | | | | | | | | | |

Gains on securities, net | | | 32.3 | | | | 29.9 | | | | 2.4 | | | | 8 | % |

| | | | | | | | | | | | | | | | |

Gains on loans and securities, net | | $ | 32.3 | | | $ | 29.0 | | | $ | 3.3 | | | | 11 | % |

| | | | | | | | | | | | | | | | |

| * | | Percentage not meaningful. |

Net Impairment

We recognized $6.1 million and $8.6 million of net impairment during the three months ended March 31, 2011 and 2010, respectively, on certain securities in the non-agency CMO portfolio due to continued deterioration in the expected credit performance of the underlying loans in those specific securities. The gross other-than-temporary impairment (“OTTI”) and the noncredit portion of OTTI, which was or had been previously recorded through other comprehensive income, are shown in the table below (dollars in millions):

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2011 | | | 2010 | |

Other-than-temporary impairment (“OTTI”) | | $ | (4.9 | ) | | $ | (14.5 | ) |

Less: noncredit portion of OTTI recognized into (out of) other comprehensive income (before tax) | | | (1.2 | ) | | | 5.9 | |

| | | | | | | | |

Net impairment | | $ | (6.1 | ) | | $ | (8.6 | ) |

| | | | | | | | |

Other Revenues

Other revenues decreased 32% to $9.5 million for the three months ended March 31, 2011 compared to the same period in 2010. The decrease was due primarily to the gain on the sale of approximately $1 billion in savings accounts to Discover Financial Services in the first quarter of 2010, which increased other revenues during the three months ended March 31, 2010, and to a decline in the income from the cash surrender value of our bank-owned life insurance when compared to the same period in 2010.

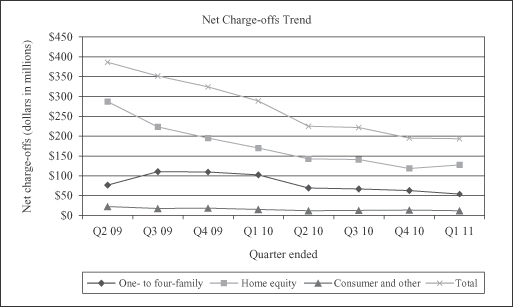

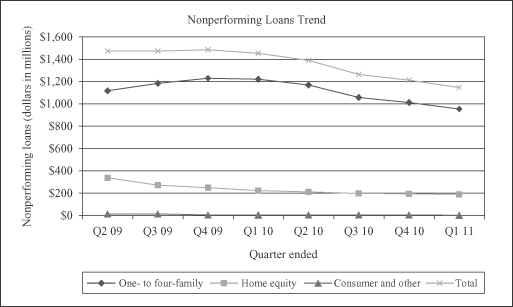

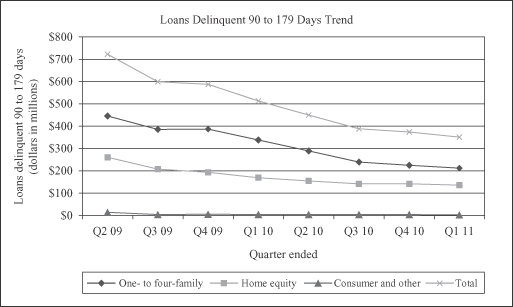

Provision for Loan Losses

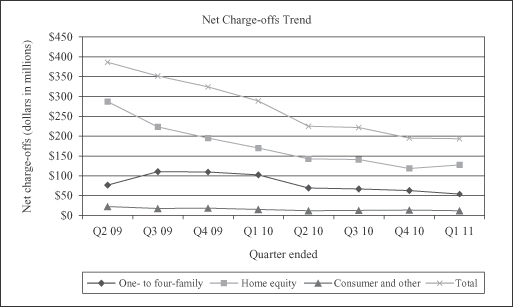

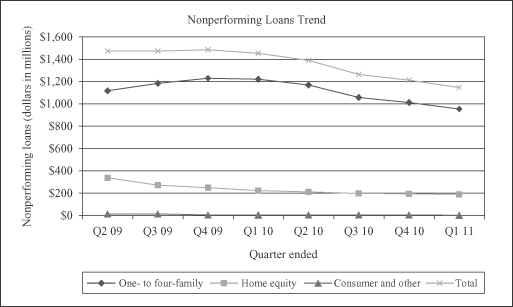

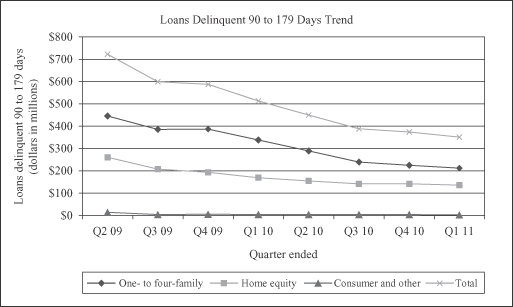

Provision for loan losses decreased 57% to $116.1 million for the three months ended March 31, 2011 compared to the same period in 2010. The decrease in our provision for loan losses was driven primarily by lower levels of at-risk (30-179 days delinquent) loans in our one- to four-family and home equity loan portfolios. We believe the delinquencies in both of these portfolios were caused by several factors, including: significant continued home price depreciation; weak demand for homes and high inventories of unsold homes; significant contraction in the availability of credit; and a general decline in economic growth along with higher levels of unemployment. In addition, the combined impact of home price depreciation and the reduction of available credit

10

made it difficult for borrowers to refinance existing loans. The provision for loan losses has declined 78% from its peak of $517.8 million in the third quarter of 2008 and we expect it to continue to decline in 2011 when compared to 2010, although performance is subject to variability from quarter to quarter.

Operating Expense

The components of operating expense and the resulting variances are as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Amount | | | % | |

Compensation and benefits | | $ | 84.0 | | | $ | 87.2 | | | $ | (3.2 | ) | | | (4 | )% |

Clearing and servicing | | | 39.2 | | | | 39.2 | | | | 0.0 | | | | * | |

Advertising and market development | | | 44.4 | | | | 38.1 | | | | 6.3 | | | | 16 | % |

Professional services | | | 23.5 | | | | 20.3 | | | | 3.2 | | | | 16 | % |

FDIC insurance premiums | | | 20.6 | | | | 19.3 | | | | 1.3 | | | | 6 | % |

Communications | | | 15.6 | | | | 20.5 | | | | (4.9 | ) | | | (24 | )% |

Occupancy and equipment | | | 16.8 | | | | 18.2 | | | | (1.4 | ) | | | (8 | )% |

Depreciation and amortization | | | 22.0 | | | | 20.6 | | | | 1.4 | | | | 7 | % |

Amortization of other intangibles | | | 6.5 | | | | 7.1 | | | | (0.6 | ) | | | (8 | )% |

Facility restructuring and other exit activities | | | 3.5 | | | | 3.4 | | | | 0.1 | | | | 5 | % |

Other operating expenses | | | 21.9 | | | | 21.4 | | | | 0.5 | | | | 3 | % |

| | | | | | | | | | | | | | | | |

Total operating expense | | $ | 298.0 | | | $ | 295.3 | | | $ | 2.7 | | | | 1 | % |

| | | | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

Operating expense increased 1% to $298.0 million for the three months ended March 31, 2011 compared to the same period in 2010. The fluctuation was driven by increases in advertising and market development and professional services, offset by decreases in communications and compensation and benefits expense.

Compensation and Benefits

Compensation and benefits expense decreased 4% to $84.0 million for three months ended March 31, 2011 compared to the same period in 2010. This decrease resulted from lower incentive compensation expense and lower salary expense due to a slight reduction in our employee base compared to the same period in 2010.

Advertising and Market Development

Advertising and market development expense increased 16% to $44.4 million for the three months ended March 31, 2011 compared to the same period in 2010. This fluctuation was due largely to the planned increase in advertising expenditures in our continuing effort to attract new accounts and customer assets during the three months ended March 31, 2011.

Professional Services

Professional services expense increased 16% to $23.5 million for the three months ended March 31, 2011 compared to the same period in 2010. The increase was driven primarily by increased legal expenses compared to the three months ended March 31, 2010.

11

Communications

Communications expense decreased 24% to $15.6 million for the three months ended March 31, 2011 compared to the same period in 2010. The decrease was driven primarily by a decline in vendor service fees as compared to the three months ended March 31, 2010.

Other Income (Expense)

Other income (expense) was an expense of $43.7 million and $39.1 million for three months ended March 31, 2011 and 2010, respectively, as shown in the following table (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Amount | | | % | |

Corporate interest income | | $ | 0.6 | | | $ | 0.0 | | | $ | 0.6 | | | | * | |

Corporate interest expense | | | (43.3 | ) | | | (41.0 | ) | | | (2.3 | ) | | | 5 | % |

Gains on sales of investments, net | | | — | | | | 0.1 | | | | (0.1 | ) | | | * | |

Equity in income (loss) of investments and venture funds | | | (1.0 | ) | | | 1.8 | | | | (2.8 | ) | | | * | |

| | | | | | | | | | | | | | | | |

Total other income (expense) | | $ | (43.7 | ) | | $ | (39.1 | ) | | $ | (4.6 | ) | | | 12 | % |

| | | | | | | | | | | | | | | | |

| * | | Percentage not meaningful. |

Total other income (expense) for the three months ended March 31, 2011 primarily consisted of corporate interest expense resulting from our interest-bearing corporate debt.

Income Tax Expense (Benefit)

Income tax expense was $33.7 million and a benefit of $18.1 million for the three months ended March 31, 2011 and 2010, respectively. Our effective tax rates were 42.7% and (27.4)% for the three months ended March 31, 2011 and 2010, respectively.

Valuation Allowance

We are required to establish a valuation allowance for deferred tax assets and record a charge to income if we determine, based on available evidence at the time the determination is made, that it is more likely than not that some portion or all of the deferred tax assets will not be realized. If we did conclude that a valuation allowance was required, the resulting loss could have a material adverse effect on our results of operations and financial condition.

We do not maintain a valuation allowance against our federal deferred tax assets as of March 31, 2011 as we believe that it is more likely than not that all of these assets will be realized. We continue to maintain a valuation allowance for certain of our state and foreign deferred tax assets as it is more likely than not that they will not be realized.

Tax Ownership Change

During the third quarter of 2009, we exchanged $1.7 billion principal amount of our interest-bearing debt for an equal principal amount of non-interest-bearing convertible debentures. Subsequent to the Debt Exchange, $592.3 million and $128.7 million convertible debentures were converted into 57.2 million and 12.5 million shares of common stock during the third and fourth quarters of 2009, respectively. As a result of these conversions, we believe we experienced a tax ownership change during the third quarter of 2009.

12

As of the date of the 2009 ownership change, we had federal NOLs available to carryforward of approximately $1.4 billion. Section 382 imposes an annual limitation on the amount of post-ownership change taxable income a corporation may offset with pre-ownership change NOLs. We believe the tax ownership change will extend the period of time it will take to fully utilize our pre-ownership change NOLs, but will not limit the total amount of pre-ownership change NOLs we can utilize. Our estimate is that we will be subject to an overall annual limitation on the use of our pre-ownership change NOLs of approximately $194 million. Our overall pre-ownership change NOLs have a statutory carryforward period of 20 years (the majority of which expire in 17 years). As a result, we believe we will be able to fully utilize these NOLs in future periods.

SEGMENT RESULTS REVIEW

We report operating results in two segments: 1) trading and investing; and 2) balance sheet management. Trading and investing includes retail brokerage products and services; investor-focused banking products; market making; and corporate services. Balance sheet management includes the management of asset allocation and credit, liquidity and interest rate risk; loans previously originated or purchased from third parties; and customer cash and deposits. Costs associated with certain functions that are centrally managed are separately reported in a corporate/other category.

Trading and Investing

The following table summarizes trading and investing financial information and key metrics as of and for the three months ended March 31, 2011 and 2010 (dollars in millions, except for key metrics):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Amount | | | % | |

Net operating interest income | | $ | 188.8 | | | $ | 193.6 | | | $ | (4.8 | ) | | | (2 | )% |

Commissions | | | 124.5 | | | | 113.3 | | | | 11.2 | | | | 10 | % |

Fees and service charges | | | 36.1 | | | | 41.2 | | | | (5.1 | ) | | | (12 | )% |

Principal transactions | | | 29.6 | | | | 26.2 | | | | 3.4 | | | | 13 | % |

Other revenues | | | 8.0 | | | | 11.4 | | | | (3.4 | ) | | | (30 | )% |

| | | | | | | | | | | | | | | | |

Total net revenue | | | 387.0 | | | | 385.7 | | | | 1.3 | | | | 0 | % |

Total operating expense | | | 202.6 | | | | 200.0 | | | | 2.6 | | | | 1 | % |

| | | | | | | | | | | | | | | | |

Trading and investing income before income taxes | | $ | 184.4 | | | $ | 185.7 | | | $ | (1.3 | ) | | | (1 | )% |

| | | | | | | | | | | | | | | | |

Key Metrics: | | | | | | | | | | | | | | | | |

DARTs | | | 177,279 | | | | 155,310 | | | | 21,969 | | | | 14 | % |

Average commission per trade | | $ | 11.32 | | | $ | 11.38 | | | $ | (0.06 | ) | | | (1 | )% |

Margin receivables (dollars in billions) | | $ | 5.7 | | | $ | 3.8 | | | $ | 1.9 | | | | 50 | % |

End of period brokerage accounts | | | 2,734,823 | | | | 2,631,977 | | | | 102,846 | | | | 4 | % |

Net new brokerage accounts | | | 50,512 | | | | 1,898 | | | | 48,614 | | | | * | |

Customer assets (dollars in billions) | | $ | 188.9 | | | $ | 158.8 | | | $ | 30.1 | | | | 19 | % |

Net new brokerage assets (dollars in billions) | | $ | 3.9 | | | $ | 2.2 | | | $ | 1.7 | | | | * | |

Brokerage related cash (dollars in billions) | | $ | 25.9 | | | $ | 21.8 | | | $ | 4.1 | | | | 19 | % |

| * | | Percentage not meaningful. |

Our trading and investing segment generates revenue from brokerage and banking relationships with investors and from market making and corporate services activities. This segment generates five main sources of revenue: net operating interest income; commissions; fees and service charges; principal transactions; and other revenues. Other revenues include results from our software and services for managing equity compensation plans from our corporate customers, as we ultimately service retail investors through these corporate relationships.

13

Trading and investing income before income taxes decreased 1% to $184.4 million for the three months ended March 31, 2011 compared to the same period in 2010. We continued to generate new brokerage accounts, ending the quarter with 2.7 million accounts. Our brokerage related cash, which is one of our most profitable sources of funding, increased by $4.1 billion when compared to the same period in 2010.

Trading and investing net operating interest income decreased 2% to $188.8 million for the three months ended March 31, 2011 compared to the same period in 2010. This decrease was driven primarily by a decrease in the net operating interest spread.

Trading and investing commissions increased 10% to $124.5 million for the three months ended March 31, 2011 compared to the same period in 2010. The increase in commissions was primarily the result of an increase in DARTs of 14% to 177,279, partially offset by a slight decrease in the average commission per trade of 1% to $11.32 for the three months ended March 31, 2011 compared to the same period in 2010. The slight decrease in the average commission per trade was due primarily to the elimination of the $12.99 commission tier and the per share commission applied to market trades larger than 2,000 shares, which became effective in the second quarter of 2010, partially offset by an improvement in the product and customer mix when compared to the same period in 2010.

Trading and investing fees and service charges decreased 12% to $36.1 million for the three months ended March 31, 2011 compared to the same period in 2010. The decrease was primarily due to the elimination of all account activity fees, which did not become effective until the second quarter of 2010.

Trading and investing principal transactions increased 13% to $29.6 million for the three months ended March 31, 2011 compared to the same period in 2010. The increase in principal transactions was driven by an increase in the volume of orders in addition to an increase in average revenue earned per share traded for the three months ended March 31, 2011.

Trading and investing operating expense increased 1% to $202.6 million for the three months ended March 31, 2011 compared to the same period in 2010. The increase related primarily to increases in advertising and market development expense and professional services, which were partially offset by a decrease in communications expense.

As of March 31, 2011, we had approximately 2.7 million brokerage accounts, 1.1 million stock plan accounts and 0.5 million banking accounts. For the three months ended March 31, 2011 and 2010, our brokerage products contributed 71% and 68%, respectively, and our banking products, which include sweep products, contributed 29% and 32%, respectively, of total trading and investing net revenue.

14

Balance Sheet Management

The following table summarizes balance sheet management financial information and key metrics as of and for the three months ended March 31, 2011 and 2010 (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Amount | | | % | |

Net operating interest income | | $ | 120.9 | | | $ | 126.7 | | | $ | (5.8 | ) | | | (5 | )% |

Fees and service charges | | | 1.1 | | | | 1.0 | | | | 0.1 | | | | 10 | % |

Gains on loans and securities, net | | | 32.2 | | | | 29.0 | | | | 3.2 | | | | 11 | % |

Net impairment | | | (6.1 | ) | | | (8.6 | ) | | | 2.5 | | | | (30 | )% |

Other revenues | | | 1.5 | | | | 2.6 | | | | (1.1 | ) | | | (41 | )% |

| | | | | | | | | | | | | | | | |

Total net revenue | | | 149.6 | | | | 150.7 | | | | (1.1 | ) | | | (1 | )% |

Provision for loan losses | | | 116.1 | | | | 268.0 | | | | (151.9 | ) | | | (57 | )% |

Total operating expense | | | 53.4 | | | | 51.7 | | | | 1.7 | | | | 3 | % |

| | | | | | | | | | | | | | | | |

Balance sheet management loss before income taxes | | $ | (19.9 | ) | | $ | (169.0 | ) | | $ | 149.1 | | | | (88 | )% |

| | | | | | | | | | | | | | | | |

Key Metrics: | | | | | | | | | | | | | | | | |

Special mention loan delinquencies | | $ | 508.8 | | | $ | 768.6 | | | $ | (259.8 | ) | | | (34 | )% |

Allowance for loan losses | | $ | 953.6 | | | $ | 1,162.4 | | | $ | (208.8 | ) | | | (18 | )% |

Allowance for loan losses as a % of gross loans receivable | | | 6.24 | % | | | 6.09 | % | | | * | | | | 0.15 | % |

| * | | Percentage not meaningful. |

Our balance sheet management segment generates revenue from managing loans previously originated or purchased from third parties as well as our customer cash and deposit relationships to generate additional net operating interest income.

The balance sheet management segment reported a loss of $19.9 million for the three months ended March 31, 2011. The losses in this segment were due primarily to the provision for loan losses of $116.1 million for the three months ended March 31, 2011.

Gains on loans and securities, net were $32.2 million and $29.0 million for the three months ended March 31, 2011 and 2010, respectively. The gains on loans and securities, net for the three months ended March 31, 2011 were due primarily to gains on the sale of certain agency mortgage-backed securities and agency debentures.

We recognized $6.1 million and $8.6 million of net impairment during the three months ended March 31, 2011 and 2010, respectively, on certain securities in the non-agency CMO portfolio due to continued deterioration in the expected credit performance of the underlying loans in those specific securities. The net impairment included gross OTTI of $4.9 million and $14.5 million for the three months ended March 31, 2011 and 2010, respectively. Of the gross OTTI for the three months ended March 31, 2011 and 2010, $(1.2) million and $5.9 million related to the noncredit portion of OTTI, which was recorded through other comprehensive income.

Provision for loan losses decreased 57% to $116.1 million for the three months ended March 31, 2011 compared to the same period in 2010. The decrease in the provision for loan losses was driven primarily by lower levels of at-risk (30-179 days delinquent) loans in our one- to four- family and home equity loan portfolios.

Total balance sheet management operating expense increased 3% to $53.4 million for the three months ended March 31, 2011 compared to the same period in 2010. The increase for the three months ended March 31, 2011 was due to increases in compensation and benefits expense and FDIC insurance premiums, partially offset by a decrease in clearing and servicing expense.

15

Corporate/Other

The following table summarizes corporate/other financial information for the three months ended March 31, 2011 and 2010 (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Amount | | | % | |

Total net revenue | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | | * | |

| | | | | | | | | | | | | | | | |

Compensation and benefits | | | 17.7 | | | | 21.1 | | | | (3.4 | ) | | | (16 | )% |

Professional services | | | 9.5 | | | | 8.3 | | | | 1.2 | | | | 14 | % |

Communications | | | 0.3 | | | | 0.5 | | | | (0.2 | ) | | | (36 | )% |

Occupancy and equipment | | | 1.0 | | | | 0.6 | | | | 0.4 | | | | 54 | % |

Depreciation and amortization | | | 4.7 | | | | 4.9 | | | | (0.2 | ) | | | (2 | )% |

Facility restructuring and other exit activities | | | 3.6 | | | | 3.4 | | | | 0.2 | | | | 5 | % |

Other operating expenses | | | 5.1 | | | | 4.8 | | | | 0.3 | | | | 6 | % |

| | | | | | | | | | | | | | | | |

Total operating expense | | | 41.9 | | | | 43.6 | | | | (1.7 | ) | | | (4 | )% |

| | | | | | | | | | | | | | | | |

Operating loss | | | (41.9 | ) | | | (43.6 | ) | | | 1.7 | | | | (4 | )% |

Total other income (expense) | | | (43.7 | ) | | | (39.1 | ) | | | (4.6 | ) | | | 12 | % |

| | | | | | | | | | | | | | | | |

Corporate/other loss before income taxes | | $ | (85.6 | ) | | $ | (82.7 | ) | | $ | (2.9 | ) | | | 3 | % |

| | | | | | | | | | | | | | | | |

| * | | Percentage not meaningful. |

Our corporate/other category includes costs that are centrally managed, technology related costs incurred to support centrally-managed functions, restructuring and other exit activities, corporate debt and corporate investments.

Our corporate/other loss before income taxes was $85.6 million for the three months ended March 31, 2011, compared to $82.7 million for the same period in 2010. Total other income (expense) primarily consisted of corporate interest expense of $43.3 million resulting from our interest-bearing corporate debt.

16

BALANCE SHEET OVERVIEW

The following table sets forth the significant components of the consolidated balance sheet (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | | | | | | | Variance | |

| | | March 31,

2011 | | | December 31,

2010 | | | 2011 vs. 2010 | |

| | | | | Amount | | | % | |

Assets: | | | | | | | | | | | | | | | | |

Cash and equivalents | | $ | 1,864.3 | | | $ | 2,374.3 | | | $ | (510.0 | ) | | | (21 | )% |

Cash and investments required to be segregated under federal or other regulations | | | 319.7 | | | | 609.5 | | | | (289.8 | ) | | | (48 | )% |

Securities(1) | | | 19,588.9 | | | | 17,330.6 | | | | 2,258.3 | | | | 13 | % |

Margin receivables | | | 5,707.7 | | | | 5,120.6 | | | | 587.1 | | | | 11 | % |

Loans, net | | | 14,340.6 | | | | 15,127.4 | | | | (786.8 | ) | | | (5 | )% |

Investment in FHLB stock | | | 164.5 | | | | 164.4 | | | | 0.1 | | | | 0 | % |

Other(2) | | | 5,610.8 | | | | 5,646.2 | | | | (35.4 | ) | | | (1 | )% |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 47,596.5 | | | $ | 46,373.0 | | | $ | 1,223.5 | | | | 3 | % |

| | | | | | | | | | | | | | | | |

Liabilities and shareholders’ equity: | | | | | | | | | | | | | | | | |

Deposits | | $ | 25,971.6 | | | $ | 25,240.3 | | | $ | 731.3 | | | | 3 | % |

Wholesale borrowings(3) | | | 8,594.3 | | | | 8,620.0 | | | | (25.7 | ) | | | (0 | )% |

Customer payables | | | 5,353.5 | | | | 5,020.1 | | | | 333.4 | | | | 7 | % |

Corporate debt | | | 1,868.6 | | | | 2,145.9 | | | | (277.3 | ) | | | (13 | )% |

Other liabilities | | | 1,410.7 | | | | 1,294.3 | | | | 116.4 | | | | 9 | % |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 43,198.7 | | | | 42,320.6 | | | | 878.1 | | | | 2 | % |

Shareholders’ equity | | | 4,397.8 | | | | 4,052.4 | | | | 345.4 | | | | 9 | % |

| | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 47,596.5 | | | $ | 46,373.0 | | | $ | 1,223.5 | | | | 3 | % |

| | | | | | | | | | | | | | | | |

| (1) | | Includes balance sheet line items trading, available-for-sale and held-to-maturity securities. |

| (2) | | Includes balance sheet line items property and equipment, net, goodwill, other intangibles, net and other assets. |

| (3) | | Includes balance sheet line items securities sold under agreements to repurchase and FHLB advances and other borrowings. |

Cash and Investments Required to be Segregated Under Federal or Other Regulations

The level of cash and investments required to be segregated under federal or other regulations, or segregated cash and investments, is driven largely by the amount of customer payables we hold as a liability in excess of the amount of margin receivables we hold as an asset. This difference represents excess customer cash that we are required by our regulators to segregate in a cash account for the exclusive benefit of our brokerage customers. Segregated cash declined by $0.3 billion during the three months ended March 31, 2011. This decline was driven primarily by an increase in margin receivables of $0.6 billion due to organic growth during the three months ended March 31, 2011.

17

Securities

Trading, available-for-sale and held-to-maturity securities are summarized as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | March 31,

2011 | | | December 31,

2010 | | | Variance | |

| | | | | 2011 vs. 2010 | |

| | | | | Amount | | | % | |

Trading securities | | $ | 83.8 | | | $ | 62.2 | | | $ | 21.6 | | | | 35 | % |

| | | | | | | | | | | | | | | | |

Available-for-sale securities: | | | | | | | | | | | | | | | | |

Residential mortgage-backed securities: | | | | | | | | | | | | | | | | |

Agency mortgage-backed securities and CMOs | | $ | 14,598.9 | | | $ | 12,898.1 | | | $ | 1,700.8 | | | | 13 | % |

Non-agency CMOs | | | 387.1 | | | | 395.4 | | | | (8.3 | ) | | | (2 | )% |

| | | | | | | | | | | | | | | | |

Total residential mortgage-backed securities | | | 14,986.0 | | | | 13,293.5 | | | | 1,692.5 | | | | 13 | % |

Investment securities | | | 1,138.0 | | | | 1,512.2 | | | | (374.2 | ) | | | (25 | )% |

| | | | | | | | | | | | | | | | |

Total available-for-sale securities | | $ | 16,124.0 | | | $ | 14,805.7 | | | $ | 1,318.3 | | | | 9 | % |

| | | | | | | | | | | | | | | | |

Held-to-maturity securities: | | | | | | | | | | | | | | | | |

Agency mortgage-backed securities and CMOs | | $ | 2,626.9 | | | $ | 1,928.6 | | | $ | 698.3 | | | | 36 | % |

Investment securities | | | 754.2 | | | | 534.1 | | | | 220.1 | | | | 41 | % |

| | | | | | | | | | | | | | | | |

Total held-to-maturity securities | | $ | 3,381.1 | | | $ | 2,462.7 | | | $ | 918.4 | | | | 37 | % |

| | | | | | | | | | | | | | | | |

Total securities | | $ | 19,588.9 | | | $ | 17,330.6 | | | $ | 2,258.3 | | | | 13 | % |

| | | | | | | | | | | | | | | | |

Securities represented 41% and 37% of total assets at March 31, 2011 and December 31, 2010, respectively. The increase in available-for-sale securities was due primarily to the purchase of $1.7 billion in agency mortgage-backed securities and CMOs, partially offset by the sale or call of agency debentures. The increase in held-to-maturity securities was due primarily to the purchase of $0.7 billion in agency mortgage-backed securities and CMOs.

Loans, Net

Loans, net are summarized as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | | | | | | | Variance | |

| | | March 31,

2011 | | | December 31,

2010 | | | 2011 vs. 2010 | |

| | | | | Amount | | | % | |

Loans held-for-sale | | $ | 4.9 | | | $ | 5.5 | | | $ | (0.6 | ) | | | (12 | )% |

One- to four-family | | | 7,720.6 | | | | 8,170.3 | | | | (449.7 | ) | | | (6 | )% |

Home equity | | | 6,114.7 | | | | 6,410.3 | | | | (295.6 | ) | | | (5 | )% |

Consumer and other | | | 1,334.7 | | | | 1,443.4 | | | | (108.7 | ) | | | (8 | )% |

Unamortized premiums, net | | | 119.3 | | | | 129.1 | | | | (9.8 | ) | | | (8 | )% |

Allowance for loan losses | | | (953.6 | ) | | | (1,031.2 | ) | | | 77.6 | | | | (8 | )% |

| | | | | | | | | | | | | | | | |

Total loans, net | | $ | 14,340.6 | | | $ | 15,127.4 | | | $ | (786.8 | ) | | | (5 | )% |

| | | | | | | | | | | | | | | | |

Loans, net decreased 5% to $14.3 billion at March 31, 2011 from $15.1 billion at December 31, 2010. This decline was due primarily to the strategy of reducing balance sheet risk by allowing the loan portfolio to pay down, which we plan to do for the foreseeable future.

18

Deposits

Deposits are summarized as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | | | | | | | Variance | |

| | | March 31,

2011 | | | December 31,

2010 | | | 2011 vs. 2010 | |

| | | | | Amount | | | % | |

Sweep deposits | | $ | 17,139.9 | | | $ | 16,139.6 | | | $ | 1,000.3 | | | | 6 | % |

Complete savings deposits | | | 6,511.5 | | | | 6,683.6 | | | | (172.1 | ) | | | (3 | )% |

Other money market and savings deposits | | | 1,120.3 | | | | 1,092.9 | | | | 27.4 | | | | 3 | % |

Checking deposits | | | 828.1 | | | | 825.6 | | | | 2.5 | | | | 0 | % |

Certificates of deposit | | | 317.1 | | | | 407.1 | | | | (90.0 | ) | | | (22 | )% |

Brokered certificates of deposit | | | 54.7 | | | | 91.5 | | | | (36.8 | ) | | | (40 | )% |

| | | | | | | | | | | | | | | | |

Total deposits | | $ | 25,971.6 | | | $ | 25,240.3 | | | $ | 731.3 | | | | 3 | % |

| | | | | | | | | | | | | | | | |

Deposits represented 60% of total liabilities at both March 31, 2011 and December 31, 2010. At March 31, 2011, 93% of our customer deposits were covered by FDIC insurance. Deposits generally provide the benefit of lower interest costs compared with wholesale funding alternatives. The increase in deposits of $0.7 billion during the three months ended March 31, 2011 was driven primarily by an increase of $1.0 billion in sweep deposits, partially offset by decreases of $0.2 billion and $0.1 billion in complete savings deposits and certificates of deposit, respectively.

The deposits balance is a component of the total customer cash and deposits balance reported as a customer activity metric of $34.7 billion and $33.5 billion at March 31, 2011 and December 31, 2010, respectively. The total customer cash and deposits balance is summarized as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | March 31,

2011 | | | December 31,

2010 | | | Variance | |

| | | | | 2011 vs. 2010 | |

| | | | | Amount | | | % | |

Deposits | | $ | 25,971.6 | | | $ | 25,240.3 | | | $ | 731.3 | | | | 3 | % |

Less: brokered certificates of deposit | | | (54.7 | ) | | | (91.5 | ) | | | 36.8 | | | | (40 | )% |

| | | | | | | | | | | | | | | | |

Retail deposits | | | 25,916.9 | | | | 25,148.8 | | | | 768.1 | | | | 3 | % |

Customer payables | | | 5,353.5 | | | | 5,020.1 | | | | 333.4 | | | | 7 | % |

Customer cash balances held by third parties and other | | | 3,454.1 | | | | 3,363.8 | | | | 90.3 | | | | 3 | % |

| | | | | | | | | | | | | | | | |

Total customer cash and deposits | | $ | 34,724.5 | | | $ | 33,532.7 | | | $ | 1,191.8 | | | | 4 | % |

| | | | | | | | | | | | | | | | |

Wholesale Borrowings

Wholesale borrowings, which consist of securities sold under agreements to repurchase and FHLB advances and other borrowings are summarized as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | March 31,

2011 | | | December 31,

2010 | | | Variance | |

| | | | | 2011 vs. 2010 | |

| | | | | Amount | | | % | |

Securities sold under agreements to repurchase | | $ | 5,866.2 | | | $ | 5,888.3 | | | $ | (22.1 | ) | | | (0 | )% |

| | | | | | | | | | | | | | | | |

FHLB advances | | $ | 2,278.9 | | | $ | 2,284.1 | | | $ | (5.2 | ) | | | (0 | )% |

Subordinated debentures | | | 427.5 | | | | 427.5 | | | | — | | | | 0 | % |

Other | | | 21.7 | | | | 20.1 | | | | 1.6 | | | | 8 | % |

| | | | | | | | | | | | | | | | |

Total FHLB advances and other borrowings | | $ | 2,728.1 | | | $ | 2,731.7 | | | $ | (3.6 | ) | | | (0 | )% |

| | | | | | | | | | | | | | | | |

Total wholesale borrowings | | $ | 8,594.3 | | | $ | 8,620.0 | | | $ | (25.7 | ) | | | (0 | )% |

| | | | | | | | | | | | | | | | |

19

Wholesale borrowings represented 20% of total liabilities at both March 31, 2011 and December 31, 2010. Securities sold under agreements to repurchase and FHLB advances are the primary wholesale funding sources of the Bank. As a result, we expect these balances to fluctuate over time as deposits and interest-earning assets fluctuate.

Corporate Debt

Corporate debt by type is shown as follows (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Face Value | | | Discount | | | Fair Value

Hedge

Adjustment | | | Net | |

March 31, 2011 | | | | | | | | | | | | |

Interest-bearing notes: | | | | | | | | | | | | | | | | |

Senior notes: | | | | | | | | | | | | | | | | |

8% Notes, due 2011 | | $ | 3.6 | | | $ | — | | | $ | — | | | $ | 3.6 | |

7 3/8% Notes, due 2013 | | | 414.7 | | | | (2.2 | ) | | | 13.7 | | | | 426.2 | |

7 7/8% Notes, due 2015 | | | 243.2 | | | | (1.4 | ) | | | 8.8 | | | | 250.6 | |

| | | | | | | | | | | | | | | | |

Total senior notes | | | 661.5 | | | | (3.6 | ) | | | 22.5 | | | | 680.4 | |

12 1/2% Springing lien notes, due 2017 | | | 930.2 | | | | (174.1 | ) | | | 7.0 | | | | 763.1 | |

| | | | | | | | | | | | | | | | |

Total interest-bearing notes | | | 1,591.7 | | | | (177.7 | ) | | | 29.5 | | | | 1,443.5 | |

Non-interest-bearing debt: | | | | | | | | | | | | | | | | |

0% Convertible debentures, due 2019 | | | 425.1 | | | | — | | | | — | | | | 425.1 | |

| | | | | | | | | | | | | | | | |

Total corporate debt | | $ | 2,016.8 | | | $ | (177.7 | ) | | $ | 29.5 | | | $ | 1,868.6 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Face Value | | | Discount | | | Fair Value

Hedge

Adjustment | | | Net | |

December 31, 2010 | | | | | | | | | | | | |

Interest-bearing notes: | | | | | | | | | | | | | | | | |

Senior notes: | | | | | | | | | | | | | | | | |

8% Notes, due 2011 | | $ | 3.6 | | | $ | — | | | $ | — | | | $ | 3.6 | |

7 3/8% Notes, due 2013 | | | 414.7 | | | | (2.5 | ) | | | 15.1 | | | | 427.3 | |

7 7/8% Notes, due 2015 | | | 243.2 | | | | (1.5 | ) | | | 9.3 | | | | 251.0 | |

| | | | | | | | | | | | | | | | |

Total senior notes | | | 661.5 | | | | (4.0 | ) | | | 24.4 | | | | 681.9 | |

12 1/2% Springing lien notes, due 2017 | | | 930.2 | | | | (177.5 | ) | | | 7.3 | | | | 760.0 | |

| | | | | | | | | | | | | | | | |

Total interest-bearing notes | | | 1,591.7 | | | | (181.5 | ) | | | 31.7 | | | | 1,441.9 | |

Non-interest-bearing debt: | | | | | | | | | | | | | | | | |

0% Convertible debentures, due 2019 | | | 704.0 | | | | — | | | | — | | | | 704.0 | |

| | | | | | | | | | | | | | | | |

Total corporate debt | | $ | 2,295.7 | | | $ | (181.5 | ) | | $ | 31.7 | | | $ | 2,145.9 | |

| | | | | | | | | | | | | | | | |

Corporate debt decreased 13% to $1.9 billion at March 31, 2011 from $2.1 billion at December 31, 2010. The decline was due to the conversion of $278.9 million in convertible debentures into 27.0 million shares of common stock during the three months ended March 31, 2011. The remaining face value of the convertible debentures as of March 31, 2011 was $425.1 million.

20

Shareholders’ Equity

The activity in shareholders’ equity during the three months ended March 31, 2011 is summarized as follows (dollars in millions):

| | | | | | | | | | | | |

| | | Common Stock/

Additional Paid-In

Capital | | | Accumulated

Deficit/ Other

Comprehensive Loss | | | Total | |

| | | |

| | | | | | | | | | | | |

Beginning balance, December 31, 2010 | | $ | 6,642.9 | | | $ | (2,590.5 | ) | | $ | 4,052.4 | |

Net income | | | — | | | | 45.2 | | | | 45.2 | |

Conversions of convertible debentures | | | 278.9 | | | | — | | | | 278.9 | |

Net change from available-for-sale securities | | | — | | | | (5.3 | ) | | | (5.3 | ) |

Net change from cash flow hedging instruments | | | — | | | | 23.1 | | | | 23.1 | |

Other(1) | | | 1.5 | | | | 2.0 | | | | 3.5 | |

| | | | | | | | | | | | |

Ending balance, March 31, 2011 | | $ | 6,923.3 | | | $ | (2,525.5 | ) | | $ | 4,397.8 | |

| | | | | | | | | | | | |

| (1) | | Other includes employee share-based compensation accounting and changes in accumulated other comprehensive loss from foreign currency translation. |

Shareholders’ equity increased 9% to $4.4 billion at March 31, 2011 from $4.1 billion at December 31, 2010. This increase was due primarily to the conversion of $278.9 million in convertible debentures into 27.0 million shares of common stock during the three months ended March 31, 2011.

LIQUIDITY AND CAPITAL RESOURCES

We have established liquidity and capital policies to support the successful execution of our business strategies, while ensuring ongoing and sufficient liquidity through the business cycle. These policies are especially important during periods of stress in the financial markets, which have been ongoing since the fourth quarter of 2007 and could continue for some time.

We believe liquidity is of critical importance to the Company and especially important within E*TRADE Bank. The objective of our policies is to ensure that we can meet our corporate and banking liquidity needs under both normal operating conditions and under periods of stress in the financial markets. Our corporate liquidity needs are primarily driven by the amount of principal and interest due on our corporate debt as well as any capital needs at E*TRADE Bank. Our banking liquidity needs are driven primarily by the level and volatility of our customer deposits. Management maintains an extensive set of liquidity sources and monitors certain business trends and market metrics closely in an effort to ensure we have sufficient liquidity and to avoid dependence on other more expensive sources of funding. Management believes the following sources of liquidity are of critical importance in maintaining ample funding for liquidity needs: Corporate cash, Bank cash, deposits and unused FHLB borrowing capacity. Management believes that within deposits, sweep deposits are of particular importance as they are the most stable source of liquidity for E*TRADE Bank when compared to non-sweep deposits. Overall, management believes that these liquidity sources, which we expect to fluctuate in any given period, are more than sufficient to meet our needs for the foreseeable future.

Capital is generated primarily through our business operations and our capital market activities. The trading and investing segment has been profitable and a generator of capital for the past seven years and we expect that trend to continue. The balance sheet management segment has generated cumulative losses in prior periods, driven primarily by the provision for loan losses; we believe the provision for loan losses will decline in 2011 as compared to 2010 but is subject to variability from quarter to quarter. The primary business operations of both the trading and investing and balance sheet management segments are contained within E*TRADE Bank; therefore, we believe a key indicator of the capital generated or used in our business operations is the level of

21

regulatory capital in E*TRADE Bank. During the three months ended March 31, 2011, E*TRADE Bank generated an additional $149 million of risk-based capital in excess of the level our regulators define as well-capitalized. The continued generation of additional risk-based capital is a positive indicator that the regulatory capital in E*TRADE Bank is sufficient to meet its operating needs.

Consolidated Cash and Equivalents

The consolidated cash and equivalents balance decreased by $0.5 billion to $1.9 billion for the three months ended March 31, 2011. The majority of this balance is cash held in regulated subsidiaries, primarily the Bank, outlined as follows (dollars in millions):

| | | | | | | | | | | | |

| | | March 31,

2011 | | | December 31,

2010 | | | Variance | |

| | | | | 2011 vs. 2010 | |

Corporate cash | | $ | 460.9 | | | $ | 470.5 | | | $ | (9.6 | ) |

Bank cash | | | 1,330.3 | | | | 1,812.1 | | | | (481.8 | ) |

International brokerage and other cash | | | 73.1 | | | | 91.7 | | | | (18.6 | ) |

| | | | | | | | | | | | |

Total consolidated cash | | $ | 1,864.3 | | | $ | 2,374.3 | | | $ | (510.0 | ) |

| | | | | | | | | | | | |

Corporate cash is the primary source of liquidity at the parent company. We define corporate cash as cash held at the parent company as well as cash held in certain subsidiaries that can distribute cash to the parent company without any regulatory approval. We believe corporate cash is a useful measure of the parent company’s liquidity as it is the primary source of capital above and beyond the capital deployed in our regulated subsidiaries.

Liquidity Available from Subsidiaries

Liquidity available to the Company from its subsidiaries is limited by regulatory requirements. In addition, E*TRADE Bank may not pay dividends to the parent company without approval from the OTS and any loans by E*TRADE Bank to the parent company and its other non-bank subsidiaries are subject to various quantitative, arm’s length, collateralization and other requirements.

We maintain capital in excess of regulatory minimums at our regulated subsidiaries, the most significant of which is E*TRADE Bank. As of March 31, 2011, we held $1.3 billion of risk-based total capital at E*TRADE Bank in excess of the regulatory minimum level required to be considered “well capitalized.” In the current credit environment, we plan to maintain excess risk-based total capital at E*TRADE Bank in order to enhance our ability to absorb credit losses while still maintaining “well capitalized” status. However, events beyond management’s control, such as a continued deterioration in residential real estate and credit markets, could adversely affect future earnings and E*TRADE Bank’s ability to meet its future capital requirements.

The Company’s broker-dealer subsidiaries are subject to capital requirements determined by their respective regulators. At March 31, 2011 and December 31, 2010, all of our brokerage subsidiaries met their minimum net capital requirements. Our broker-dealer subsidiaries had excess net capital of $672.3 million(1) at March 31, 2011, an increase of $23.1 million from December 31, 2010. While we cannot assure that we would obtain regulatory approval in the future to withdraw any of this excess net capital, $488.5 million is available for dividend while still maintaining a capital level above regulatory “early warning” guidelines.

| (1) | | The excess net capital of the broker-dealer subsidiaries at March 31, 2011 included $425.8 million and $184.3 million of excess net capital at E*TRADE Clearing LLC and E*TRADE Securities LLC, respectively, which are subsidiaries of E*TRADE Bank and are also included in the excess risk-based capital of E*TRADE Bank. |

22

Tangible Common Equity

We believe that the tangible common equity to tangible assets ratio is a measure of our capital strength and is additional useful information that supplements the regulatory capital ratios of E*TRADE Bank. The following table shows the calculation of tangible common equity to tangible assets ratio (dollars in millions):

| | | | | | | | | | | | |

| | | March 31,

2011 | | | December 31,

2010 | | | Variance | |

| | | | | 2011 vs. 2010 | |

Total assets | | $ | 47,596.5 | | | $ | 46,373.0 | | | | 3 | % |

Less: Goodwill and other intangibles, net | | | (2,239.7 | ) | | | (2,265.4 | ) | | | (1 | )% |

Add: Deferred tax liability related to goodwill | | | 229.8 | | | | 219.0 | | | | 5 | % |

| | | | | | | | | | | | |

Tangible assets(1) | | $ | 45,586.6 | | | $ | 44,326.6 | | | | 3 | % |

| | | | | | | | | | | | |

Shareholders’ equity | | $ | 4,397.8 | | | $ | 4,052.4 | | | | 9 | % |

Less: Goodwill and other intangibles, net | | | (2,239.7 | ) | | | (2,265.4 | ) | | | (1 | )% |

Add: Deferred tax liability related to goodwill | | | 229.8 | | | | 219.0 | | | | 5 | % |

| | | | | | | | | | | | |

Tangible common equity(2) | | $ | 2,387.9 | | | $ | 2,006.0 | | | | 19 | % |

| | | | | | | | | | | | |

Tangible common equity to tangible assets(3) | | | 5.24 | % | | | 4.53 | % | | | 0.71 | % |

| (1) | | Tangible assets is calculated as total assets less goodwill (net of related deferred tax liability) and other intangible assets and is a non-GAAP measure. |

| (2) | | Tangible common equity is calculated as shareholders’ equity less goodwill (net of related deferred tax liability) and other intangible assets and is a non-GAAP measure. |

| (3) | | Tangible common equity to tangible assets is a non-GAAP measure, the components of which are defined above. |

Financial Regulatory Reform Legislation and Basel III Accords

We believe the majority of the changes in the Dodd-Frank Act will have no material impact on our business. We believe, however, that the implementation of holding company capital requirements is relevant to us as the parent company is not currently subject to capital requirements. These requirements are expected to become effective within the next five years. We have begun to track these ratios internally, using the current capital ratios that apply to bank holding companies, as we plan for this future requirement. During the first quarter of 2011, $278.9 million in convertible debentures were converted into 27.0 million shares of common stock, which improved our holding company ratios. As of March 31, 2011, the parent company Tier I capital to total adjusted assets ratio was approximately 4.4% compared to the minimum ratio required to be “well capitalized” of 5%, and the Tier I capital to risk-weighted assets ratio was approximately 8.5% compared to the minimum ratio required to be “well capitalized” of 6%. As of May 2, 2011, an additional $325.1 million in convertible debentures were converted into 31.4 million shares of common stock. The increase to capital as a result of these additional conversions raised our estimated holding company capital ratios to meet or exceed the “well capitalized” minimums under current bank holding company guidelines. If these conversions had occurred prior to March 31, 2011, the parent company Tier I capital to total adjusted assets ratio would have been approximately 5.2% compared to the minimum ratio required to be “well capitalized” of 5%, and the Tier I capital to risk-weighted assets ratio would have been approximately 9.9% compared to the minimum ratio required to be “well capitalized” of 6%.

The Federal Reserve Bank announced that it expects to issue a notice of proposed rule-making in 2011 that will outline how the Basel III Accords will be implemented for U.S. institutions. We will continue to monitor the ongoing rule-making process to assess both the timing and the impact of the Dodd-Frank Act and Basel III Accords on our business.

Other Sources of Liquidity

We also maintain $350 million in uncommitted financing to meet margin lending needs. At March 31, 2011, there were no outstanding balances and the full $350 million was available.

23

We rely on borrowed funds, from sources such as securities sold under agreements to repurchase and FHLB advances, to provide liquidity for E*TRADE Bank. Our ability to borrow these funds is dependent upon the continued availability of funding in the wholesale borrowings market. At March 31, 2011, E*TRADE Bank had approximately $3.4 billion in additional collateralized borrowing capacity with the FHLB. We also have the ability to generate liquidity in the form of additional deposits by raising the yield on our customer deposit accounts.

Off-Balance Sheet Arrangements

We enter into various off-balance-sheet arrangements in the ordinary course of business, primarily to meet the needs of our customers and to reduce our own exposure to interest rate risk. These arrangements include firm commitments to extend credit and letters of credit. Additionally, we enter into guarantees and other similar arrangements as part of transactions in the ordinary course of business. For additional information on each of these arrangements, see Item 1. Consolidated Financial Statements (Unaudited).

RISK MANAGEMENT

As a financial services company, we are exposed to risks in every component of our business. The identification and management of existing and potential risks are the keys to effective risk management. Our risk management framework, principles and practices support decision-making, improve the success rate for new initiatives and strengthen the organization. Our goal is to balance risks and rewards through effective risk management. Risks cannot be completely eliminated; however, we do believe risks can be identified and managed within the Company’s risk tolerance.

Our businesses expose us to the following four major categories of risk that often overlap:

| | • | | Credit Risk—the risk of loss resulting from adverse changes in the ability or willingness of a borrower or counterparty to meet the agreed-upon terms of their financial obligations. |