Registration Statement No. 333-258055

Filed Pursuant to Rule 424(b)(3)

Prospectus

TROIKA MEDIA GROUP, INC.

4,076,362 Shares of Common Stock

This prospectus relates to the sale by selling shareholders (the “Selling Shareholders”) of an aggregate of 4,076,362 shares of common stock, $0.001 par value per share (the “Shares”) acquired by the former members of Redeeem, LLC and their designees pursuant to an Asset Purchase Agreement dated May 21, 2021 with Troika Media Group, Inc. (the “Company,” “TMG,” “we,” “us” or “our”). See “Selling Shareholders.”

The Selling Shareholders have advised us that, subject to the terms and conditions of lock-up agreement entered into with the Company, they will sell the Shares in a number of different ways and at varying prices from time to time in the open market, on the Nasdaq Capital Market, in privately negotiated transactions, at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices or a combination of those methods. See also “Plan of Distribution” on page 88 for more information.

We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of Shares by the Selling Shareholders.

The Selling Shareholders may be deemed “underwriters” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”).

As of July 29, 2021, there were 39,496,588 of our Shares of common stock outstanding, of which approximately 22,591,000 Shares were held by non-affiliates. The 4,076,362 Shares which are being registered for resale by the Selling Shareholders hereunder represent less than 1/3 of the Shares held by non-affiliates as of July 29, 2021.

We will pay the expenses incurred in registering the Shares to which this prospectus relates, including legal and accounting fees. See “Plan of Distribution.”

Our Shares are traded on the Nasdaq Capital Market tier under the symbol “TRKA”. On July 29, 2021, the closing price of our Shares was $2.15 per share.

Investing in our Shares is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered before making a decision to purchase our Shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 30, 2021

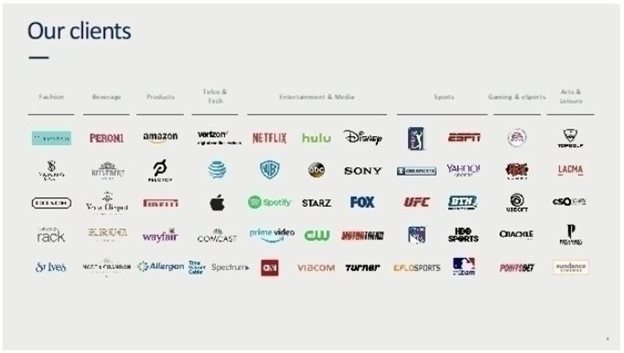

Mission Media Group, our wholly-owned subsidiaries, is a brand experience and communications company with clients in a wide range of industries. Representative current and past clients and client longevity are set forth in the table below:

| 2 |

TABLE OF CONTENTS

|

| Page |

|

|

|

| |

Prospectus Summary |

| 4 |

|

The Offering |

| 9 |

|

Selected Historical Consolidated Financial and Operating Data |

| 9 |

|

Risk Factors |

| 11 |

|

Cautionary Note Regarding Forward-Looking Statements |

| 38 |

|

Use of Proceeds |

| 39 |

|

Capitalization |

| 39 |

|

Market for Registrant’s Common Equity and Related Stockholder Matters |

| 40 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 40 |

|

Business |

| 52 |

|

Management |

| 67 |

|

Executive Compensation |

| 75 |

|

Certain Relationships and Related Person Transactions |

| 83 |

|

Principal Stockholders |

| 85 |

|

Selling Shareholders |

| 87 |

|

Plan of Distribution |

| 88 |

|

Description of Capital Stock |

| 89 |

|

Shares Eligible for Future Sale |

| 94 |

|

Legal Matters |

| 95 |

|

Experts |

| 95 |

|

Where You Can Find Additional Information |

| 95 |

|

Index to Financial Statements |

| 96 |

|

You should rely only on the information contained in this prospectus and the related exhibits in deciding whether to purchase our shares of common stock. Neither we nor any of the underwriters have authorized anyone to provide you with information or to make any representations different from that contained in this prospectus or in any free writing prospectus we have prepared. Neither we nor any of the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication that the information contained in this prospectus is correct as of any time after the date of this prospectus. To the extent that any facts or events arising after the date of this prospectus, individually or in the aggregate, represent a fundamental change in the information presented in this prospectus, this prospectus will be updated to the extent required by law. This prospectus is not an offering to sell securities in any state where the offer or solicitation is not permitted.

We obtained statistical data, market data and other industry data and forecasts used throughout this prospectus from market research, publicly available information and industry publications and third-party research surveys and studies. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. While we believe that these industry publications and third-party research studies and surveys are reliable, we have not independently verified such data and we do not make any representations as to the accuracy of this information. Nevertheless, we are responsible for the accuracy and completeness of the historical information presented in this prospectus, as of the date of the prospectus.

| 3 |

| Table of Contents |

This summary highlights information contained in greater detail elsewhere in this prospectus and may not contain all of the information that may be important to you in making an investment decision. You should read the entire prospectus, including this summary together with the more detailed information, including our financial statements and the related notes, elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in “Risk Factors” beginning on page 11 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Unless otherwise stated or the context requires otherwise, references in this prospectus to “Troika,” the “Company,” “we,” “us” and “our” refer to Troika Media Group, Inc. and its consolidated subsidiaries.

The Company

Overview

Troika Media Group, Inc. (the “Company” “TMG”, “we”, “us” or “our”) is a global marketing services company leveraging data and technology to deliver integrated branding, marketing, media, and analytics solutions to our clients. Our approach is designed to drive business performance and create value in the rapidly evolving consumer-first marketplace. Through our operating units, we offer solutions to clients seeking a holistic approach to meeting their brand strategy, experiential marketing and communications needs. We let data and technology help tell the story.

Our operating units are:

Troika Services, Inc. (Global) - a performance marketing and data intelligence company whose mission is to translate quantifiable metrics into actionable insights and empower businesses to connect with consumers, enhance engagement and optimize brand performance.

Troika Design Group, Inc. (Los Angeles) - a strategic brand consultancy with deep expertise in entertainment, media, sports, and consumer goods and service brands. Troika provides a creative fan-centric approach to integrated brand strategy, creative, research, and technology solutions that builds long-term brand awareness for clients through equity and consumer loyalty.

MissionCulture LLC (New York), Mission-Media Holdings Limited (London) and Mission Media USA Inc. (its non-operating subsidiary) (collectively, known as “Mission”) London-headquartered brand experience and communications companies that specializes in consumer immersion through a cultural lens, via live experiences, brand partnerships, public relations, including social and influencer engagement.

Our corporate offices are in Los Angeles with operations in New York, New Jersey and London. Our global team of approximately 100 employees plus contractors enables us to directly service clients in markets in the U.S. and the U.K. This also provides us with the infrastructure to support accelerated growth by expanding service offerings and reaching clients in new markets.

We have brought together a highly experienced roster of industry leaders and subject matter experts to provide an innovative approach to clients’ new business challenges. We will continue to develop intellectual property expertise in our work and in the businesses that we will seek to acquire, as described below.

Redeeem Acquisition

On May 21, 2021 Troika Media Group, Inc. (the “Company”), through its wholly owned subsidiary, Troika IO, Inc. (f/k/a “Redeeem Acquisition Corp.”), a California corporation (“Buyer”), entered into an Asset Purchase Agreement (the “APA”) with Redeeem LLC, a California limited liability company (“Seller” or “Redeeem”) and its Manager, Kyle Hill.

Redeeem, founded in 2018 by Kyle Hill, is a peer-to-peer (P2P) exchange that facilitates the purchase, sale and trade of digital goods using bitcoin and other cryptocurrencies. Redeeem allows virtually any company to safely and easily tokenize products, build decentralized apps (dapps) and provide digital services at a fraction of the cost of building blockchain services in-house. Redeeem’s mission and vision is to create a decentralized network of millions of freelancers connected over multiple blockchains.

| 4 |

| Table of Contents |

Most freelance marketplaces are built on Web 2.0 standards that rely on traditional bank rails and store data in centralized data warehouses, making them vulnerable to hacks, seizures, censorships and outages. Many projects are exploring blockchains as a way to improve efficiencies in their supply chain. Web 2.0 marketplaces are social networks and mobile-first and are always on cloud-driven computing. Web 3.0 uses artificial intelligence (AI)-driven services using a decentralized (e.g., blockchain) data architecture with edge computing infrastructure. Currently, there is no specialized framework to build the next standard Web 3.0 marketplace specifically for a global workforce who want to live on the latest decentralized standards. The 3.0 philosophy contrasts 2.0 internet mainly in the way it allows data to be transparent, interconnected, immutable and decentralized from day one to build towards more open standards.

Redeeem believes, based on management’s extensive knowledge of the industry, that it is building one of the first token as a service (TAAS) platforms that helps the legacy Web 2.0 freelance marketplace modernize to Web 3.0 standards without expensive or complicated integrations. The most disruptive Web 3.0 protocol is Bitcoin, the world’s first and most successful implementation of a blockchain. The three areas of disruption the Buyer will focus on in digital currencies are decentralized finance (defi), decentralized apps (dapps) and digital services.

With a fixed supply of 21 million bitcoin tokens, Bitcoin gives people living in hyperinflationary countries in Asia, Africa and Latin America, the ability to protect their financial assets in bitcoins. Nearly half of the “unbanked” population do not have a reliable or efficient access to a bank or financial institution, but with Bitcoin they don’t need centralized bank accounts. Redeeem’s business-to-business (B2B) white-label (for individual clients) platform can be used by founders, entrepreneurs and small business owners to accelerate their business in any industry using blockchain services. Redeeem may explore education services to help educate and onboard customers faster and easier than with manual consulting services.

Redeeem’s experience with NFTs and other forms of crypto assets will augment Troika’s core business by adding additional offerings. An NFT is a unit of data stored on a digital ledger, called a blockchain, that certifies a digital asset to be unique and not interchangeable. NFTs can be used to represent items such as photos, videos, audio, and other types of digital files like wine, gift cards, physical artwork, tickets to live events, and other collectibles. NFTs can also be used to connect artists with collectors without central intermediaries. NFTs can reduce risk in transactions, improve overall transparency, simplify online trading, replace traditional banking operations, and thousands of other creative opportunities. Much of the current market for NFTs is centered around collectibles, such as digital artwork, sports cards, and rarities. One of the most popular NFT marketplaces is undoubtedly NBA TopShot, a marketplace created by Dapper Labs to collect digital “moments” from historical NBA games. The Vancouver-based gaming company Dapper Labs was valued at $7.5 billion in the most recent fundraise in April 2021. Other NFT marketplaces include Axie Infinity, Sorare, CryptoPunks, CryptoKitties, Rarible and OpenSea.

Future Acquisitions

We plan to acquire additional strategic data and technology platforms to further take advantage of our creative solutions business. These proprietary platforms generally possess: market expertise, proprietary technology, leadership and experience within the programmatic ecosystem, coupled with in-house creative teams. Upon the outset of the COVID-19 (a/k/a “coronavirus”) pandemic (“COVID-19”), we were forced to terminate all negotiations with future acquisitions. While COVID-19 has impacted the nation and the world, it has created opportunities for companies despite the unfortunate disruptions and changes in life. Moreover, upon the remission of the international impact associated with COVID-19, we expect to be able to acquire entities distressed by the pandemic upon favorable terms and at a cost savings to us and thereby increase our capabilities in a more cost-effective manner. These entities will likely already be streamlined as a result of measures taken to reduce the impact of COVID-19. We expect that integration and realization of synergies which complement and augment our business will be completed on an expedited basis.

We have not reached any definitive agreement with any acquisition targets, and we cannot assure you that we will consummate any acquisition on favorable terms or at all.

| 5 |

| Table of Contents |

As a part of the TMG family of companies, any future acquisition would be integrated with the Troika Services, Inc. subsidiary to combine the data insights and performance amplification of our creative solutions.

Our Competitive Advantages

Management believes we have the following competitive advantages, which could be augmented to consummate our contemplated acquisitions:

• | Industry Leading Management - Assembled management expertise across all agency disciplines and offerings consisting of established industry leaders, as well as business founders. |

| |

• | Integrated Services - Integrated branding, advertising, data analytics, performance media, research & insights, design, production, content, event marketing, public relations, partnerships and social media. |

| |

• | Category Experience - Entertainment media, sports, fashion, gaming/eSports, consumer goods, telco, healthcare, pharmaceutical, tech, leisure and entertainment. |

| |

• | Results Driven - We believe that we are reinventing how brands drive customer engagement, conversion, loyalty and lifetime value though integrated branding, advertising and performance optimization. |

| |

• | One Stop - Integrated, full-service solutions with our broad talent, skills and experience, provides clients with the confidence in having one organization handling all or the majority of their campaigns and projects. |

Our Market Opportunity

• | Ad spending is shifting to digital.

55% of respondents ages 18-65 in the U.S. bought products online after social media discovery. (Internet Trends 2018, Mary Meeker May 30, 2018)

More than ever, brands need to demonstrate empathy and create emotional connections which empathize and emote. Consumers are eager for uplifting, positive, feel-good advertising and stories during these uncertain times. (Information Resources Inc. June 3, 2020) |

|

|

• | Digital media use increased from 5.6 to 5.9 hours a day for adults from 2016 to 2017. (Internet Trends 2018, Mary Meeker May 30, 2018) |

|

Gaming industry reported the largest increase in consumption and is also expanding the experiences it offers as “eSports” are gaining legitimacy. (Impact of the COVID-19 outbreak on Media & Entertainment Overview of Key Industry Disruptions & Post-Crisis Challenges and Opportunities, May 26th, 2020, Cap Gemini S.A.)

Since the COVID-19 pandemic began, 48% of U.S. consumers have participated in some form of video gaming activity and the global video game market was expected to reach $159 billion in 2020. (2021 outlook for the US telecommunications, media, and entertainment industry, interview with Kevin Westcott, Deloitte Touche Tohmatsu Limited, December 2020)

|

• | Digital advertising is expected to grow as added investments continue to flow to mobile, social and video formats, while focus on print ad spending, such as newspaper and magazine ads, continues to decline. Despite the impact of COVID-19, on-line ad revenue in the first quarter of 2020 revenues grew to $31.4 billion, a 12.0% increase from the prior first quarter period. (Internet Advertising Revenue Report: Full year 2019 results & Q1 2020 revenues. May 2020, Interactive Advertising Bureau) |

|

|

• | In 2016, digital ad spending surpassed TV ad spending for the first time, and digital ad spending is expected to account for roughly half of total media ad spending by 2021. (eMarketer report “US Digital Display Advertising Trends: Eight Developments to Watch for in 2016) |

| 6 |

| Table of Contents |

• | The market for Internet advertising is expanding at over 20% year-on-year (Internet Trends 2017 - Code Conference” - Mary Meeker May 31, 2017 Kleiner Perkins Conference, hereinafter referred to as “Kleiner Perkins Report”).

The challenge for brands is deciding on the mix of “agency” services to in-house –and to do it well. (The Outlook for Data Driven Advertising & Marketing 2020, Jan. 2020, Winterberry Group) |

| |

Half of all advertising spending will be on digital media ad formats by 2019/2020, compared to 46% in 2018. (Washington Post, Hamza Shaban, February 20, 2019) | |

| |

• | Story ads integrate brand stories seamlessly into social environments. 1 in 3 of the most watched Instagram stories are from businesses. A study found that 70% of Instagram and Snapchat users watch stories on both platforms daily. (Brand Disruption 2020: Direct Brands Go Mainstream Direct Brands Initiative Strategic Partners, February 2020, Interactive Advertising Bureau) |

| |

• | A significant driver of digital ad spending, mobile accounted for 70% of total digital ad spending in 2017 and is expected to grow by an average year-over-year rate of 15% between 2018 and 2022. Mobil display, which passed search in 2016 as the most popular digital ad format, has been predicted to continue to show double-digit year-over-year growth between 2018 and 2021. ( US Ad Spending: The eMarketer Forecast for 2017, eMarketer Report published March 15, 2017, hereinafter referred to as “eMarketer Report.”) |

We believe we will be well-positioned to compete due to our numerous advantages:

• | Global end-to-end branding and advertising solution; |

| |

• | Blue-chip clients with long-term relationships with the Company; |

| |

• | Based globally in four major locations, New York, Englewood (New Jersey), Los Angeles and London; |

| |

• | Approximately 100 employees, plus 14 independent contractors; |

| |

• | Capabilities: branding, advertising, data analytics, performance media, research & insights, content, PR, social, partnerships, mobile; and |

| |

• | Diverse Categories: entertainment & media, sports, fashion, gaming/eSports, consumer goods, telco, healthcare, pharmaceutical, tech, leisure and entertainment. |

Our Business Strategy

Management believes, based on its knowledge of the industry at this stage of digital evolution, that the market needs a new breed of a modern agency using an open web-first approach to take the power and control out of the hands of those who operate walled gardens, such as Google, Facebook and Amazon, and put it back into the hands of marketers, where it belongs. Today, the initiatives of such walled gardens are not aligned with a marketer’s success.

Management believes that, holding companies such as GroupM, Publicis, IPG, Dentsu are struggling with baggage, distractions and broken financial models. Our strategy removes value from working media, which is often the most expensive thing a marketer pays for, in automated digital environments and do not help with the walled garden problem.

A modern agency not only has to be fully transparent and laser focused on applying data and technology to put control and leverage back in the hands of the marketer with a cross audience strategy, addressable media planning and activation. We need to have world class personalized creativity, with a financial model that allows us to provide the highest level of expert service and technology without a need to up-sell useless features. This is our plan and our mission.

| 7 |

| Table of Contents |

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties, including those in the section entitled “Risk Factors” and elsewhere in this prospectus. These significant risks include, but are not limited to, the following:

• | our history of losses may harm our ability to obtain additional financing; |

• | our ability to retain our largest clients; |

• | our ability to integrate the combined operations of our previously acquired companies; |

• | our ability to make future acquisitions, and effectively integrate any future combined operations; |

• | general economic conditions in the United States and United Kingdom as a result of the COVID-19 pandemic; |

• | our ability to achieve and maintain profitably; |

• | our ability to sustain or grow our customer base for our current products and provide superior customer service; |

• | our liquidity and working capital requirements, including our cash requirements over the next 12 months; |

• | there is no guarantee any remaining Paycheck Protection Program loans will be forgiven; |

• | our ability to maintain compliance with the ongoing listing requirements for the Nasdaq Capital Market; |

• | compliance with the U.S. and international regulations applicable to our business; |

• | our ability to implement our business strategies and future plans of operations; |

• | expectations regarding the size of our market; |

• | our expectations regarding the future market demand for our services; |

• | compliance with applicable laws and regulatory changes; |

• | our ability to identify, attract and retain qualified personnel and the loss of key personnel; |

• | the limitation of liability and indemnification of our officers and directors; |

• | economic conditions affecting the media industry in which we operate; |

• | economic conditions in the United Kingdom as a result of Brexit; |

• | maintaining our intellectual property rights and any potential litigation involving intellectual property rights; |

• | our ability to anticipate and adapt to a developing market(s) and to technological changes; |

• | acceptance by customers of any new products and services; |

• | a competitive environment characterized by numerous, well-established and well-capitalized competitors; |

• | the ability to develop and upgrade our technology and information systems and keep up with rapidly evolving industry standards; |

• | any interruption in the supply of products and services; |

• | discontinuance of support for our information systems from third party vendors; |

• | significant fluctuations in our quarterly operating results; |

• | the extent, liquidity, volatility and duration of any public trading market for our securities; |

• | the resale of our securities could adversely affect the market price of our common stock and our Warrants and our ability to raise additional equity capital; |

• | we may become subject to “penny stock” rules, which could damage our reputation and the ability of investors to sell their shares; |

• | investors who purchase securities in this offering will experience immediate dilution as a result of this offering and may experience dilution as a result of future issuances by us; and |

• | insiders, including significant stockholders, will continue to have substantial control over the Company. |

Corporate Information

We were incorporated in Nevada in November 2003. Our corporate headquarters are located at 1715 N. Gower St., Los Angeles, California 90028, and our main telephone number is (323) 965-1650. Our website address is www.thetmgrp.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website.

| 8 |

| Table of Contents |

Common Stock Offered | An aggregate of 4,076,362 shares of common stock are registered for resale by the Selling Shareholders, which Shares were issued pursuant to an Asset Purchase Agreement entered into on May 21, 2021 by the former members of Redeeem, LLC.

|

Common Stock Outstanding | 43,572,950 (1)

|

Use of Proceeds | We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares of Common Stock by the Selling Shareholders. See “Use of Proceeds.”

|

Dividend Policy | We have never declared any cash dividends on our shares of Common Stock. We currently intend to retain all available funds and any future earnings for use in financing the growth of our business and do not anticipate paying any cash dividends for the foreseeable future. See “Dividend Policy.”

|

Nasdaq Capital Market symbol for the shares of common stock

| “TRKA”. |

Nasdaq Capital Market symbol for the Warrants

| “TRKAW”. |

Risk Factors | The securities offered by this prospectus are speculative and involve a high degree of risk. Investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page 11 and the other information included in this prospectus. |

_____________

(1) Reflects 39,496,588 shares issued and outstanding as of July 29, 2021 plus the issuance of the 4,076,362 shares offered hereby. The number of shares of our common stock outstanding immediately prior to and following this offering excludes:

· | 3,346,833 shares issuable upon exercise of outstanding employee stock options with an average exercise price of $1.95 per share; and |

· | 7,996,889 shares issuable upon exercise of outstanding warrants with an average exercise price of $2.36, and 5,783,333 shares issuable upon exercise of outstanding public warrants exercisable at $4.98 per share. |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA

The following table presents our summary historical financial data for the periods indicated. The summary historical financial data for the years ended June 30, 2020 and 2019 and the balance sheet data as of June 30, 2020 and 2019 are derived from audited financial statements. The summary historical financial data for the nine (9) months ended March 31, 2021 and 2020, and the balance sheet data as of March 31, 2021 are derived from our unaudited financial statements. The table below gives effect to the 1-for-15 reverse stock split effected on September 24, 2020.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. The following summary and operating data set forth below should be read together with our financial statements, the notes thereto, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the other information contained in this prospectus. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods.

| 9 |

| Table of Contents |

Statement of Operations Data:

|

| Nine Months Ended March 31, |

|

| Years Ended June 30, |

| ||||||||||

|

| 2021 |

|

| 2020 |

|

| 2020 |

|

| 2019 |

| ||||

|

|

|

|

|

|

|

|

|

| |||||||

Project revenues, net |

| $ | 12,437,000 |

|

| $ | 20,759,000 |

|

| $ | 24,613,000 |

|

| $ | 40,791,000 |

|

Cost of revenues |

|

| 6,360,000 |

|

|

| 11,106,000 |

|

|

| 11,636,000 |

|

|

| 23,229,000 |

|

Gross profit |

|

| 6,077,000 |

|

|

| 9,653,000 |

|

|

| 12,977,000 |

|

|

| 17,562,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

| 14,864,000 |

|

|

| 19,483,000 |

|

|

| 24,034,000 |

|

|

| 27,949,000 |

|

Professional fees |

|

| 1,274,000 |

|

|

| 527,000 |

|

|

| 1,028,000 |

|

|

| 1,872,000 |

|

Depreciation expense |

|

| 95,000 |

|

|

| 281,000 |

|

|

| 344,000 |

|

|

| 480,000 |

|

Amortization expense of intangibles |

|

| 1,619,000 |

|

|

| 3,010,000 |

|

|

| 4,002,000 |

|

|

| 4,013,000 |

|

Goodwill impairment expense |

|

| - |

|

|

| 1,387,000 |

|

|

| 1,985,000 |

|

|

| 3,082,000 |

|

Intangible impairment expense |

|

|

|

|

|

|

|

|

|

| 1,867,000 |

|

|

| - |

|

Acquisition costs |

|

|

|

|

|

|

|

|

|

| - |

|

|

| 154,000 |

|

Gain from release of contingent earn out |

|

|

|

|

|

|

|

|

|

| - |

|

|

| (7,571,000 | ) |

Total operating expenses |

|

| 17,852,000 |

|

|

| 24,688,000 |

|

|

| 33,260,000 |

|

|

| 29,979,000 |

|

Loss from operations |

|

| (11,775,000 | ) |

|

| (15,035,000 | ) |

|

| (20,283,000 | ) |

| (12.417,000 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution revenue from stimulus funding |

|

| 2,535,000 |

|

|

| - |

|

|

|

|

|

|

|

|

|

Amortization expense of note payable discount |

|

| (409,000 | ) |

|

| (786,000 | ) |

|

| (1,092,000 | ) |

|

| - |

|

Interest expense |

|

| (35,000 | ) |

|

| (247,000 | ) |

|

| (239,000 | ) |

|

| (186,000 | ) |

Foreign exchange gain |

|

| (48,000 | ) |

|

| 9,000 |

|

|

| 11,000 |

|

|

| (4,000 | ) |

Gain on early termination of operating lease |

|

| - |

|

|

| 170,000 |

|

|

| 164,000 |

|

|

| - |

|

Other income |

|

| 378,000 |

|

|

| 567,000 |

|

|

| 691,000 |

|

|

| 761,000 |

|

Other expenses |

|

| 154,000 |

|

|

| 127,000 |

|

|

| (18,000 | ) |

|

| (659,000 | ) |

Total other income (expense) |

|

| 2,575,000 |

|

|

| (160,000 | ) |

|

| (483,000 | ) |

|

| (88,000 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations before income tax |

|

| (9,200,000 | ) |

|

| (15,195,000 | ) |

|

| (20,766,000 | ) |

|

| (12,505,000 | ) |

Provision for income tax |

|

| (23,000 | ) |

|

| - |

|

|

| - |

|

|

| (64,000 | ) |

Net loss from continuing operations after income tax |

|

|

|

|

|

|

|

|

|

| (20,766,000 | ) |

|

| (12,569,000 | ) |

Net income from discontinued operations |

|

|

|

|

|

|

|

|

|

| 6,319,000 |

|

|

| 6,528,000 |

|

Net loss |

|

| (9,223,000 | ) |

|

| (15,195,000 | ) |

|

| (14,447,000 | ) |

|

| (6,041,000 | ) |

Deemed dividend on preferred stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (820,000 | ) |

Net loss attributable to common stockholders |

|

|

|

|

|

|

|

|

|

| (14,447,000 | ) |

|

| (6,861,000 | ) |

Foreign currency translation adjustment |

|

| (629,000 | ) |

|

| 10,000 |

|

|

| 203,000 |

|

|

| (46,000 | ) |

Comprehensive loss |

|

| (9,852,000 | ) |

|

| (15,185,000 | ) |

|

| (14,244,000 | ) |

|

| (6,907,000 | ) |

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations – basic and diluted |

|

|

|

|

|

|

|

|

|

| (1.35 | ) |

|

| (0.83 | ) |

Discontinued operations – basic |

|

|

|

|

|

|

|

|

|

| 0.41 |

|

|

| 0.43 |

|

Net loss attributable to common stockholders – basic and diluted |

|

|

|

|

|

|

|

|

|

| (0.94 | ) |

|

| (0.45 | ) |

Basic earnings and diluted (loss) per share |

|

|

|

|

|

|

|

|

|

| (14,447,000 | ) |

|

| (6,041,000 | ) |

Continuing operations |

|

| (0.58 | ) |

|

| (0.99 | ) |

|

| - |

|

|

| (820,000 | ) |

Net loss attributable to common stockholders |

|

| (0.58 | ) |

|

| (0.99 | ) |

|

| (14,447,000 | ) |

|

| (6,861,000 | ) |

|

|

|

|

|

|

|

|

|

|

| 203,000 |

|

|

| (46,000 | ) |

Weighted average basic and diluted shares |

|

| 15,874,783 |

|

|

| 15,413,370 |

|

|

| (14,244,000 | ) |

|

| (6,907,000 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations |

|

| - |

|

|

| - |

|

|

| 0.16 |

|

|

| 0.16 |

|

Weighted average basic shares |

|

| - |

|

|

| - |

|

|

| 15,423,655 |

|

|

| 15,211,290 |

|

Weighted average diluted shares |

|

| - |

|

|

| - |

|

|

| 38,736,615 |

|

|

| 42,018,163 |

|

| 10 |

| Table of Contents |

Balance Sheet Data:

|

| As of March 31, |

|

| As of June 30, |

| ||||||

|

| 2021 |

|

| 2020 |

|

| 2019 |

| |||

Total Current Assets |

| $ | 4,815,000 |

|

| $ | 2,691,000 |

|

| $ | 6,090,000 |

|

Total Assets |

|

| 32,960,000 |

|

|

| 33,500,000 |

|

|

| 36,597,000 |

|

Total Current Liabilities |

|

| 21,223,000 |

|

|

| 16,455,000 |

|

|

| 12,443,000 |

|

Total Liabilities |

|

| 30,502,000 |

|

|

| 26,500,000 |

|

|

| 21,774,000 |

|

Preferred Stock |

|

| 61,000 |

|

|

| 61,000 |

|

|

| 60,000 |

|

Common Stock |

|

| 15,000 |

|

|

| 16,000 |

|

|

| 15,000 |

|

Additional Paid-In Capital |

|

| 182,717,000 |

|

|

| 176,262,000 |

|

|

| 169,400,000 |

|

Stock payable |

|

| 156,000 |

|

|

| 1,300,000 |

|

|

| 1,743,000 |

|

Accumulated Deficit |

|

| (180,115,000 | ) |

|

| (170,892,000 | ) |

|

| (156,445,000 | ) |

Other comprehensive (Gain) Loss |

|

| (376,000 | ) |

|

| 253,000 |

|

|

| 50,000 |

|

Total Stockholders’ Equity (deficit) |

|

| 2,458,000 |

|

|

| 7,000,000 |

|

|

| 14,823,000 |

|

Total Liabilities and Stockholders’ Equity |

| $ | 32,960,000 |

|

| $ | 33,500,000 |

|

| $ | 36,597,000 |

|

An investment in our Company is very speculative and involves a very high degree of risk. Accordingly, investors should carefully consider the following risk factors, as well as other information set forth in this report, in making an investment decision with respect to our securities. We have sought to identify what we believe to be all material risks and uncertainties to our business and ownership of our common stock, but we cannot predict whether, or to what extent, any of such risks or uncertainties may be realized nor can we guarantee that we have identified all possible risks and uncertainties that might arise. Additional risks and uncertainties that we do not currently know about or that we currently believe are immaterial may also harm our business operations. If any of these risks or uncertainties occurs, it could have a material adverse effect on our business, financial condition, results of operations and prospects.

Risks Relating to Our Business

We have a history of significant losses from operations in recent years which may continue, and which may harm our ability to obtain financing and continue our operations.

Our consolidated financial statements reflect that we have incurred significant losses since inception, including net losses of $9,223,000, $14,447,000, and $6,041,000 for the nine months ended March 31, 2021 and the years ended June 30, 2020 and 2019, respectively.

As of March 31, 2021, we had an accumulated deficit of $180,115,000 and negative working capital of $16,408,000. We need to improve our ability to achieve business profitability and our ability to generate sufficient cash flow from our operations. We believe that we have sufficient capital from our initial public offering to finance our business operations until we achieve positive cash flows.

| 11 |

| Table of Contents |

Our discontinued operations prior to our entry into a merger agreement with Troika Design Group, Inc. in June 2017 (the “Troika Merger”), our June 2018 acquisition of all of the equity interests (the “Mission Acquisition”) of Mission Culture LLC and Mission-Media Holdings Limited (such entities, collectively, “Mission”) and our May 2021 acquisition of Redeeem caused disruptions to our business, have diluted our stockholders and may harm our business, financial condition or operating results.

The Troika Merger, the Mission Acquisition and the Redeeem Acquisition (collectively, the “Acquisitions”) subjected us to a number of risks, including, but not limited to, the consideration for the Acquisitions and share issuances to our preferred stockholders, resulted in substantial dilution to our existing stockholders. Additional time may be required for the market positions of such acquired companies to improve as planned, particularly as a result of the COVID-19 pandemic. The combined operations of the Company and such entities have placed significant demands on the Company’s management, technical, financial and other resources, as well as the key personnel and other personnel of such acquired companies. As a result of the Acquisitions, we have experienced additional financial and accounting challenges and complexities in areas such as financial reporting. We may assume or be held liable for risks and liabilities as a result of our Acquisitions, some of which we may not have been able to discover during our due diligence or adequately adjust for in our acquisition arrangements, as was the case with the Mission Acquisition. Our ongoing business and management’s attention have been disrupted or diverted by transition or integration issues and the complexity of managing geographically or culturally diverse enterprises. In addition, we may incur one-time write-offs or restructuring charges in connection with any future acquisitions. We may acquire goodwill and other intangible assets that are subject to amortization or impairment tests, which could result in future charges to earnings. We have incurred significant time and expense in connection with litigation arising from the Mission Acquisition. See “Business – Legal Proceedings.”

Our combined operations have only a limited operating history, which makes it difficult to evaluate an investment in our securities.

Our combined operations have only a limited operating history since the Troika Merger in June 2017 upon which our business, financial condition and operating results may be evaluated. As a result of the Acquisitions, as well as any potential acquisitions, we face a number of risks encountered by combined entities, including our ability to:

• | Manage expanding operations, including our ability to service our clients if our customer base grows substantially;

|

• | Attract and retain management and technical personnel;

|

• | Find adequate sources of financing;

|

• | Anticipate and respond to market competition and changes in technologies as they develop and become available;

|

• | Negotiate and maintain favorable rates with our vendors; and

|

• | Retain and expand our customer base at profitable rates. |

We may not be successful in addressing or mitigating these risks and uncertainties, and if we are not successful our business could be significantly and adversely affected.

Expansion of our operations internationally has required significant management attention and resources, involves additional risks and may be unsuccessful.

We have limited experience with operating internationally since June 2018, or providing our services outside of the United States and United Kingdom, and if we choose to expand into further international markets, we would need to adapt to different local cultures, standards and policies. The business model and technology we employ and the merchandise we currently offer may not be successful with consumers outside of the United States or the United Kingdom. Furthermore, to succeed with clients in other international locations, it likely will be necessary to establish satellite offices in foreign markets and hire local employees in those international centers, and we may have to invest in these facilities before proving we can successfully run foreign operations. We may not be successful in expanding into international markets or in generating revenue and/or profits from foreign operations for a variety of reasons, including:

| 12 |

| Table of Contents |

• | localization of our offerings, including translation into foreign languages and adaptation for local practices; |

| |

• | competition from local incumbents that understand the local market and may operate more effectively; |

| |

• | regulatory requirements, taxes, trade laws, trade sanctions and economic embargoes, tariffs, export quotas, customs duties or other trade restrictions or any unexpected changes thereto; |

| |

• | laws and regulations regarding anti-bribery and anti-corruption compliance; |

| |

• | differing labor regulations where labor laws may be more advantageous to employees as compared to the United States and increased labor costs; |

| |

• | more stringent regulations relating to privacy and data security and access to, or use of, commercial and personal information, particularly in Europe; |

| |

• | changes in a specific country’s or region’s political or economic conditions, including those related to COVID-19 and similar matters; |

| |

• | risks resulting from changes in currency exchange rates; and |

| |

• | if we invest substantial time and resources to establish and expand our operations internationally and are unable to do so successfully and in a timely manner, our operating results would suffer. |

Most of our clients may terminate their relationships with us on short notice.

Our transactional clients, which account for the vast majority of our revenue worldwide, typically use our services on an order-by-order project basis rather than under long-term contracts. These clients have no obligation to continue using our services and may stop purchasing from us at any time.

The volume and type of services we provide our clients may vary from year to year and could be reduced if a client were to change its outsourcing or procurement strategy. If a significant number of our transactional clients elect to terminate or not to renew their engagements with us or if the volume of their orders decreases, our business, operating results and financial condition could suffer.

Acquiring new clients and retaining existing clients depends on our ability to avoid and manage conflicts of interest arising from other client relationships.

Our ability to acquire new clients and to retain existing clients may, in some cases, be limited by clients’ perceptions of, or policies concerning, conflicts of interest arising from other client relationships. If we are unable to maintain multiple agencies to manage multiple client relationships and avoid potential conflicts of interests, our business, results of operations and financial position may be adversely affected.

The loss of several of our largest clients could have a material adverse effect on our business, results of operations and financial position.

Clients generally are able to reduce or cancel current or future spending on advertising, marketing and corporate communications projects at any time on short notice for any reason. For the nine months ended March 31, 2021, six (6) customers accounted for 45.1% of our gross revenues. For the fiscal year ended June 30, 2020, six (6) customers accounted for 45.1% of our gross revenues. For the fiscal year ended June 30, 2019, six (6) customers accounted for 44.9% of our gross revenues. A significant reduction in spending on our services by our largest clients, or the loss of several of our largest clients, if not replaced by new clients or an increase in business from existing clients, would adversely affect our revenue and could have a material adverse effect on our business, results of operations and financial position.

| 13 |

| Table of Contents |

Clients periodically review and change their advertising, marketing, branding and corporate communications requirements and relationships. If we are unable to remain competitive or retain key clients, our business, results of operations and financial position may be adversely affected.

We operate in a highly competitive industry. Key competitive considerations for retaining existing clients and winning new clients include our ability to develop solutions that meet client needs in a rapidly changing environment, the quality and effectiveness of our services and our ability to serve clients efficiently, particularly large multinational clients, on a broad geographic basis. Some of our newer services require us to persuade prospective customers, or customers of our existing services, to purchase newer services in substitution of those of a competitor. While many of our client relationships are long-standing, from time to time clients put their advertising, marketing and corporate communications business up for competitive review. The incumbent competitor may have the ability to significantly discount its services or enter into long-term agreements, which would further impede our ability to increase our revenues. We have won and lost accounts as a result of these reviews. To the extent that we are not able to remain competitive or retain key clients, our revenue may be adversely affected, which could have a material adverse effect on our business, results of operations and financial position.

Adverse economic conditions, a reduction in client spending, a deterioration in the credit markets or a delay in client payments could have a material adverse effect on our business, results of operations and financial position.

Economic conditions have a direct impact on our business, results of operations and financial position. Adverse global or regional economic conditions pose a risk that clients may reduce, postpone or cancel spending on advertising, marketing and corporate communications projects. Such actions would reduce the demand for our services and could result in a reduction in revenue, which would adversely affect our business, results of operations and financial position. A contraction in the availability of credit may make it more difficult for us to meet our working capital requirements. In addition, a disruption in the credit markets could adversely affect our clients and could cause them to delay payment for our services or take other actions that would negatively affect our working capital. In such circumstances, we may need to obtain additional financing to fund our day-to-day working capital requirements, which may not be available on favorable terms, or at all. Even if we take action to respond to adverse economic conditions, reductions in revenue and disruptions in the credit markets by aligning our cost structure and more efficiently managing our working capital, such actions may not be effective.

Our financial condition and results of operations for fiscal year 2020 have been adversely affected by COVID-19, and we expect that our financial condition and results of operations for fiscal year 2021 will also be adversely affected.

In December 2019, COVID-19 surfaced in Wuhan, China. The extent to which COVID-19impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others.

We operate servicing domestic and international clients. In the aggregate, revenue from outside of the United States represented 36.2% and 37.7% of our Company’s total revenue for the nine months ended March 31, 2021 and 2020, respectively. Revenue from outside of the United States represented 35.2% and 38.5% of our Company’s total revenue for the last two fiscal years ended June 30, 2020 and 2019, respectively. For some of the services we sell, including experiential and event services provided by our Mission subsidiaries, we have historically provided services that were primarily involved with engagement of consumers in public venues. As a result of COVID-19, wherever we, our suppliers, or our clients operate, we have been adversely affected in our experiential business. Following the early 2020 outbreak of COVID-19, many of clients temporarily halted marketing and advertising activities and normal business operations. The spread of COVID-19 to the United States, our largest market, has raised concerns about the lasting effects of a recession, and has created substantial uncertainty about the expectations for marketing spend in the near term. In addition, not only are our clients impacted, but our vendors are similarly impacted and operating in a reduced manner, further hampering the ability to render services to clients. Due to temporary travel restrictions imposed by various countries in Europe and elsewhere, including the United Kingdom where one of our Mission subsidiaries is based, we have faced delays in our ability to provide services, while visa applications for certain employees have been complicated due to the inability to travel or attend certain face-to-face meetings. Moreover, we have historically relied on in-person selling efforts by our sales executives to secure long-term client contracts. In the short-term, precautionary measures taken by many companies around the world to limit in-person workplace contact in order to reduce the potential for employee exposure to COVID-19 could extend the time required to secure and cause us to lose new client contracts. Additionally, contracted parties may use the current pandemic as reason to invoke so called “force majeure” clauses in order to modify or cancel performance under the applicable agreement. These clauses vary depending on the agreement and will need a case by case review and disputes may arise from such contentions. The extent to which the COVID-19 outbreak continues to impact the Company’s results will depend on future developments that are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact. The Company’s revenue has declined by $16.2 million from $40.8 million to $24.6 million in the fiscal years ended June 30, 2019 and 2020, respectively, and by $8.3 million from $20.8 million to $12.4 million in the nine (9) months ended March 31, 2020 and 2021, respectively. Based on information provided by business unit leaders, the Company believes that approximately $13.0 million or 80.2% of the $16.2 million decrease in revenue in the fiscal year ended June 30, 2020 compared to the fiscal year ended June 30, 2019 is directly attributable to the COVID-19 pandemic. The Company continues to quantify with its business leaders how much of the decline in revenue for the nine months ended March 31, 2021 in comparison to the nine months ended March 31, 2020 was related to the outbreak, however the Company believes that the $8.3 million decrease in revenue is substantially due to the pandemic. If our business continues to be materially adversely affected by the outbreak of COVID-19, it would have a material adverse impact on our operating results and/or financial condition.

| 14 |

| Table of Contents |

We must successfully manage the demand, supply, and operational challenges associated with the actual or perceived effects of a disease outbreak, including epidemics, pandemics, including COVID-19, as described above, or similar widespread public health concerns and associated government responses.

Our business has been negatively impacted by the fear of exposure to or actual effects of a disease outbreak, epidemic, pandemic, including COVID-19, as described above, or similar widespread public health concern, such as reduced travel or recommendations or mandates from governmental authorities to avoid large gatherings or to self-quarantine or similar governmental responses. These impacts may include, but are not limited to:

• | Significant reductions in demand or significant volatility in demand for one or more of our services, which may be caused by, among other things: the temporary inability of consumers to purchase our products (or those of our clients) due to illness, quarantine or other travel restrictions, or financial hardship, shifts in demand due to temporary priorities; if prolonged such impacts can further increase the difficulty of planning for operations and may adversely impact our results;

|

• | Inability to meet our clients’ needs and achieve costs targets due to disruptions in our manufacturing and supply arrangements caused by the loss or disruption of essential manufacturing and supply elements such, transportation, workforce, or other products and services used to provide services to our clients;

|

• | Failure of third parties on which we rely, including our suppliers, contract manufacturers, distributors, contractors, commercial banks, joint venture partners and external business partners, to meet their obligations to the Company, or significant disruptions in their ability to do so, which may be caused by their own financial or operational difficulties or governmental disruptions and may adversely impact our operations; or

|

• | Significant changes in the political conditions in markets in which we service, including quarantines, governmental or regulatory actions, closures or other restrictions that limit or close our operating and related facilities, restrict our employees’ ability to travel or perform necessary business functions, or otherwise prevent our third-party partners, suppliers, or customers from sufficiently staffing operations, including operations necessary for our services, which could adversely impact our results. |

Despite our efforts to manage and remedy these impacts to the Company, their ultimate impact also depends on factors beyond our knowledge or control, including the duration and severity of any such outbreak as well as third-party actions taken to contain its spread and mitigate its public health effects be those taken by governments or private enterprise (both voluntary and required).

| 15 |

| Table of Contents |

If any of our key clients fail to pay for our services, our profitability would be negatively impacted.

In general, we take full title and risk of loss for the products we procure from our suppliers. Our obligation to pay our suppliers is not contingent upon receipt of payment from our clients. If any of our key clients fails to pay for our services, our profitability would be negatively impacted.

We may require additional capital to support business growth, and this capital may not be available on acceptable terms or at all.

We may require additional capital to make any future acquisitions subject to various conditions precedent including, but not limited to, satisfactory completion of due diligence, negotiation and execution of a definitive purchase agreement and audit of their financial statements. We intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges, including the need to develop new products or enhance our existing products, enhance our operating infrastructure and acquire complementary businesses and technologies.

We expect to engage in equity and/or debt financings to secure additional funds when necessary. If we raise additional funds through further issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue will be expected to have rights, preferences and privileges superior to those of holders of our common stock. Any debt financing secured by us in the future could include restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. In addition, we may not be able to obtain additional financing on terms favorable to us or at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly limited. We may have to significantly delay, scale back or discontinue the development and/or the commercialization of one or more of our services. Accordingly, any failure to raise adequate capital in a timely manner would be expected to have a material adverse effect on our business, operating results, financial condition and future growth prospects.

We rely on our management team and expect to need additional personnel to grow our business; the loss of one or more senior managers or the inability to attract and retain qualified personnel could harm our business.

Our success and future growth depend to a significant degree on the skills and continued services of our management team, in particular, the services of Robert Machinist, Chief Executive Officer of the Company, Dan Pappalardo, President of Troika Design Group, Inc., Kevin Dundas, CEO of Mission and Kyle Hill, President of Redeeem, which are our three operating subsidiaries. While we have entered into an employment agreement with Messrs. Machinist, Pappalardo and Hill, there can be no assurance that we will be able to retain the services of each of these persons. The loss of one of these persons and/or other members of our management team who have signed employment and consulting agreements would materially adversely affect us. In such an event, we could face substantial difficulty in hiring a qualified successor and could experience a loss in productivity while any successor obtains the necessary training and experience. We do not have key man life insurance policies on members of our management. Our future success also depends on our ability to retain, attract and motivate highly skilled technical, managerial, marketing and customer service personnel, including members of our management team.

Our inability to attract and retain qualified personnel and maintain a highly skilled workforce could have a material adverse effect on our business.

Our employees are our most important assets and our ability to attract and retain key personnel is an important aspect of our competitiveness. If we are unable to attract and retain key personnel, our ability to provide our services in the manner clients have come to expect may be adversely affected, which could harm our reputation and result in a loss of clients, which could have a material adverse effect on our business, results of operations and financial position.

All of our non-executive employees work for us on an at-will basis, subject to applicable law. We plan to hire additional personnel in all areas of our business, particularly for our sales, marketing and technology development areas, both domestically and internationally, which will likely increase our recruiting and hiring costs. Competition for these types of personnel is intense, particularly in the Internet and software industries. As a result, we may be unable to successfully attract or retain qualified personnel. Our inability to retain and attract the necessary personnel could adversely affect our business.

| 16 |

| Table of Contents |

Finally, employee sickness and leaves due to COVID-19 and similar pandemics may result in a drastic reduction in the availability of key employees. Moreover, as we reopen our physical locations, we face dangers associated with our safety measures being ineffective or claims that they were ineffective should employees become ill. Accordingly, we may face claims by employees associated with such matters that would increase our costs or associated litigation expenses.

Misclassification or reclassification of our independent contractors or employees could increase our costs and adversely impact our business.

Our workers are classified as either employees or independent contractors, and if employees, as either exempt from overtime or non-exempt (and therefore overtime eligible). Regulatory authorities and private parties have recently asserted within several industries that some independent contractors should be classified as employees and that some exempt employees, including those in sales-related positions, should be classified as non-exempt based upon the applicable facts and circumstances and their interpretations of existing rules and regulations. If we are found to have misclassified employees as independent contractors or non-exempt employees as exempt, we could face penalties and have additional exposure under federal and state tax, workers’ compensation, unemployment benefits, labor, employment and tort laws, including for prior periods, as well as potential liability for employee overtime and benefits and tax withholdings. Legislative, judicial or regulatory (including tax) authorities could also introduce proposals or assert interpretations of existing rules and regulations that would change the classification of a significant number of independent contractors doing business with us from independent contractor to employee and a significant number of exempt employees to non-exempt. A reclassification in either case could result in a significant increase in employment-related costs such as wages, benefits and taxes. The costs associated with employee classification, including any related regulatory action or litigation, could have a material adverse effect on our results of operations and our financial position.

Our business prospects depend, in part, on our ability to maintain and improve our services as well as to develop new services.

We believe that our business prospects depend, in part, on our ability to maintain and improve our current services and to develop new services. Our services will have to achieve market acceptance, maintain technological competitiveness and meet an expanding range of customer requirements. We may experience difficulties that could delay or prevent the successful development, introduction or marketing of new services and service enhancements. Additionally, our new services and service enhancements may not achieve market acceptance.

If we do not respond effectively and on a timely basis to rapid technological change, our business could suffer.

Our industry is characterized by rapidly changing technologies, industry standards, customer needs and competition, as well as by frequent new product and service introductions. Our services are integrated with the computer systems of our customers. We must respond to technological changes affecting both our customers and suppliers. We may not be successful in developing and marketing, on a timely and cost-effective basis, new services that respond to technological changes, evolving industry standards or changing customer requirements. Our success depends, in part, on our ability to accomplish all of the following in a timely and cost-effective manner:

• | Effectively using and integrating new technologies; |

| |

• | Continuing to develop our technical expertise; |

| |

• | Developing services that meet changing customer needs; |

| |

• | Advertising and marketing our services; and |

| |

• | Influencing and responding to emerging industry standards and other changes. |

| 17 |

| Table of Contents |

The success of our business depends on the continued growth of digital media as a medium for commerce, content, advertising and communications.

Expansion in the sales of our services depends on the continued acceptance of the digital media as a platform for commerce, content, advertising and communications. The use of the digital media as a medium for commerce, content, advertising and communications could be adversely impacted by delays in the development or adoption of new standards and protocols to handle increased demands of digital media activity, cyber security, reliability, cost, ease-of-use, accessibility and quality-of-service. The performance of the Internet as a medium for commerce, content, advertising and communications has been harmed by viruses, worms, hacking and similar malicious programs, and the Internet has experienced a variety of outages and other delays as a result of damage to portions of its infrastructure. If for any reason digital media does not remain a medium for widespread commerce, content, advertising and communications, the demand for our products would be significantly reduced, which would harm our business.

There is no guarantee that the balance of our Paycheck Protection Program (“PPP”) loan will be forgiven, which would negatively impact our cash flow.

Since 2020, we received approximately $3,397,000 in PPP loan proceeds as part of the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”), which provides economic relief to businesses in response to COVID-19 and under the Small Business Administration (“SBA”) “Economic Injury Disaster Loan” program. The PPP loan and accrued interest are forgivable after 24 weeks as long as we use the PPP loan proceeds for eligible purposes, including payroll, benefits, rent and utilities, and our employee head count remains consistent with our baseline period over the 24-week period after the loan was received. The amount of loan forgiveness will be reduced if we terminate employees or reduce salaries during the 24-week period. The unforgiven portion of the PPP loan is payable over two years at an interest rate of 1%, with a deferral of payments for the first six months. As of March 25, 2021, the Company received notice that approximately $891,000 of PPP loans had been forgiven, with applications for the remaining PPP loan forgiveness pending. While we believe that our use of the loan proceeds will meet the conditions for forgiveness of the remainder of the PPP loan, there is a risk that: (i) the loan will not be forgiven, in whole or in part, (ii) we will take actions that could cause us to be ineligible for forgiveness of the remainder of the loan, or (iii) we may be required to repay the balance upon event of default under the loan or upon a breach of applicable PPP regulations. It is possible that the loan may not be forgiven in full, or that the Company would not be able to deduct the Company expenses it used the PPP Loan for, which could have a negative impact on the Company’s cash flow.

Platform system disruptions could cause delays or interruptions of our services, which could cause us to lose customers or incur additional expenses.

Our success depends on our ability to provide reliable service. Although our network service is designed to minimize the possibility of service disruptions or other outages, our service may be disrupted by problems on our system, such as malfunctions in our software or other facilities, overloading of our network and problems with the systems of competitors with which we interconnect, such as damage to our communications systems and power surges and outages. Any significant disruption in its network could cause it to lose customers and incur additional expenses.

Intellectual property infringement claims are common in the industry and, should such claims be made against us, and if we do not prevail, our business, financial condition and operating results could be harmed.

The Internet, mobile media, software, mass media and technology industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights, domestically or internationally. As we grow and face increasing competition, the probability that one or more third parties will make intellectual property rights claims against us increases. In such cases, our technologies may be found to infringe on the intellectual property rights of others. Additionally, many of our subscription agreements may require us to indemnify our customers for third-party intellectual property infringement claims, which would increase our costs if we have to defend such claims and may require that we pay damages and provide alternative services if there were an adverse ruling in any such claims. Intellectual property claims could harm our relationships with our customers, deter future customers from subscribing to our products or expose us to litigation, which could be expensive and divert considerable attention of our management team from the normal operation of our business. Even if we are not a party to any litigation between a customer and a third party, an adverse outcome in any such litigation could make it more difficult for us to defend against intellectual property claims by the third party in any subsequent litigation in which we are a named party. Any of these results could adversely affect our brand, business and results of operations.

| 18 |

| Table of Contents |

Patent positions in the media industry are uncertain and involve complex legal, scientific and factual questions and often conflicting claims. The industry has in the past been characterized by a substantial amount of litigation and related administrative proceedings regarding patents and intellectual property rights. In addition, established companies have used litigation against smaller companies and new technologies as a means of gaining a competitive advantage.

In addition, we may be required to participate in interference proceedings in the United States Patent and Trademark Office to determine the relative priorities of our inventions and third parties’ inventions. An adverse outcome in an interference proceeding could require us to cease using the technology or to license rights from prevailing third parties.

With respect to any intellectual property rights claim against us or our customers, we may have to pay damages or stop using technology found to be in violation of a third party’s rights. We may have to seek a license for the technology, which may not be available on reasonable terms or at all, may significantly increase our operating expenses or may significantly restrict our business activities in one or more respects. We may also be required to develop alternative non-infringing technology, which could require significant effort and expense. Any of these outcomes could adversely affect our business and results of operations. Even if we prove successful in defending ourselves against such claims, we may incur substantial expenses and the active defense of such claims may divert considerable attention of our management team from the normal operation of our business.

If we are unable to sell additional services to our existing customers or attract new customers, our revenue growth will be adversely affected.

To increase our revenues, we believe we must sell additional services to existing customers and regularly add new customers. If our existing and prospective customers do not perceive our products to be of sufficient value and quality, we may not be able to increase sales to existing customers and attract new customers, or we may have difficulty retaining existing customers, and our operating results will be adversely affected.

Our resources may not be sufficient to manage our intended growth; failure to properly manage potential growth would be detrimental to our business.

We may fail to adequately manage our intended future growth. Most of our administrative, financial and operational functions come from acquired operations. Any growth in our operations will place a significant strain on our resources and increase demands on our management and on our operational and administrative systems, controls and other resources. We cannot assure you that our existing personnel, systems, procedures or controls will be adequate to support our operations in the future or that we will be able to successfully implement appropriate measures consistent with our growth strategy. As part of this growth, we may have to implement new operational and financial systems, procedures and controls to expand, train and manage our employee base, and maintain close coordination among our staff. We cannot guarantee that we will be able to do so.