Investor Presentation July 2020 Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration Statement No. 333-221508 July 29, 2020

Safe Harbor Statement Cautionary Note Regarding Forward-Looking Statements The information contained in this presentation may contain forward-looking statements. When used or incorporated by reference in disclosure documents, the words “believe,” “anticipate,” “estimate,” “expect,” “project,” “target,” “goal” and similar expressions are intended to identify forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These forward-looking statements include but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including but not limited to those set forth below: Operating, legal and regulatory risks; Economic, political and competitive forces impacting various lines of business; Legislative, regulatory and accounting changes; Demand for our financial products and services in our market area; Major catastrophes such as earthquakes, floods or other natural or human disasters and infectious disease outbreaks, including the current coronavirus (COVID-19) pandemic, the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on us and our customers and other constituencies; Volatility in interest rates; Fluctuations in real estate values in our market area; The composition and credit quality of our loan and investment portfolios; Changes in the level and direction of loan delinquencies and charge-offs and changes in estimates of the adequacy of the allowance for credit losses; Our ability to access cost-effective funding; Our ability to continue to implement our business strategies; Our ability to manage market risk, credit risk and operational risk; Timing of revenue and expenditures; Adverse changes in the securities markets; Our ability to enter new markets successfully and capitalize on growth opportunities; Return on investment decisions; System failures or cyber-security breaches of our information technology infrastructure and those of our third-party service providers; Our ability to retain key employees; Other risks and uncertainties, including those occurring in the U.S. and world financial systems; and The risk that our analysis of these risks and forces could be incorrect and/or that the strategies developed to address them could be unsuccessful.

Safe Harbor Statement (cont’d) The COVID-19 pandemic has caused significant economic dislocation in the United States as many state and local governments ordered non-essential businesses to close and residents to shelter in place at home. While jurisdictions in which we operate have gradually allowed the reopening of businesses and other organizations and removed the sheltering restrictions, it is premature to assess whether doing so will result in a meaningful increase in economic activity and the impact of such actions on further COVID-19 cases. Given its ongoing and dynamic nature, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated. As a result of the COVID-19 pandemic and the related adverse local and national economic consequences, our forward-looking statements are subject to the following risks, uncertainties and assumptions: Demand for our products and services may decline; If the economy is unable to substantially and successfully reopen, and high levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase; Collateral for loans, especially real estate, may decline in value; Our allowance for credit losses on loans and leases may increase if borrowers experience financial difficulties; The net worth and liquidity of loan guarantors may decline; A further and sustained decline in our stock price or the occurrence of what management would deem to be a triggering event that could, under certain circumstances, cause management to perform impairment testing on its goodwill or core deposit and customer relationships intangibles that could result in an impairment charge being recorded for that period, that would adversely impact our results of operations and the ability of the Bank to pay dividends to us; As a result of the decline in the Federal Reserve’s target federal funds rate to near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest-bearing liabilities; A material decrease in net income or a net loss over several quarters could result in the elimination of or a decrease in the rate of our quarterly cash dividend; Our wealth management revenues may decline with continuing market turmoil; Our cyber security risks are increased as a result of an increase in the number of employees working remotely; FDIC premiums may increase if the agency experience additional resolution costs; and We face litigation, regulatory enforcement and reputation risk as a result of our participation in the Paycheck Protection Program (PPP) and the risk that the Small Business Administration may not fund some or all PPP loan guaranties. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected or projected. These and other risk factors are more fully described in this presentation and in the Univest Financial Corporation Annual Report on Form 10-K for the year ended December 31, 2019 under the section entitled "Item 1A - Risk Factors," as well as in the Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, and from time to time in other filings made by the Corporation with the SEC. These forward-looking statements speak only at the date of the presentation. The Corporation expressly disclaims any obligation to publicly release any updates or revisions to reflect any change in the Corporation’s expectations with regard to any change in events, conditions or circumstances on which any such statement is based.

Additional Information This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Corporation’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Corporation believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation. The Corporation has filed a registration statement (including a prospectus) (File No. 333-221508) and a preliminary prospectus supplement with the Securities and Exchange Commission (“SEC”) for the offering to which this presentation relates. Before you invest, you should read the prospectus and the preliminary prospectus supplement in that registration statement and the other documents that the Corporation has filed with the SEC for more complete information about the company and the offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, the Corporation, any underwriter or any dealer participating in the offering will arrange to send you copies of the prospectus and the preliminary prospectus supplement relating to the offering if you request it by contacting U.S. Bancorp Investments, Inc. at (877) 558-2607. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on publications and other data obtained from third party sources. While the Corporation believes these third party sources to be reliable as of the date of this presentation, the Corporation has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third party sources. Additional Information and Where to Find It Non-GAAP Financial Measures

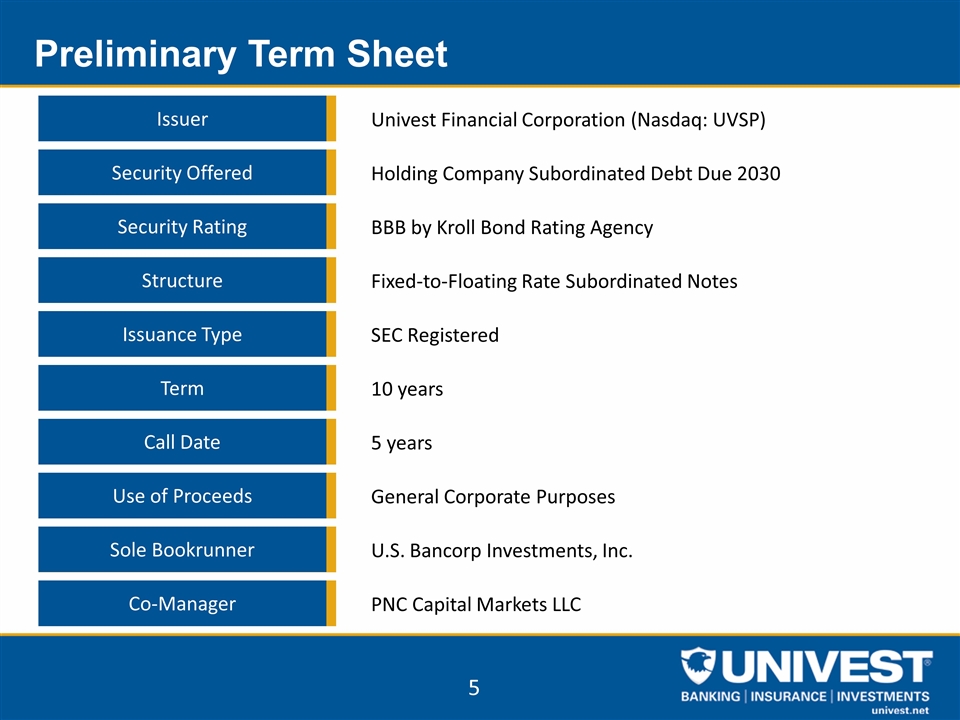

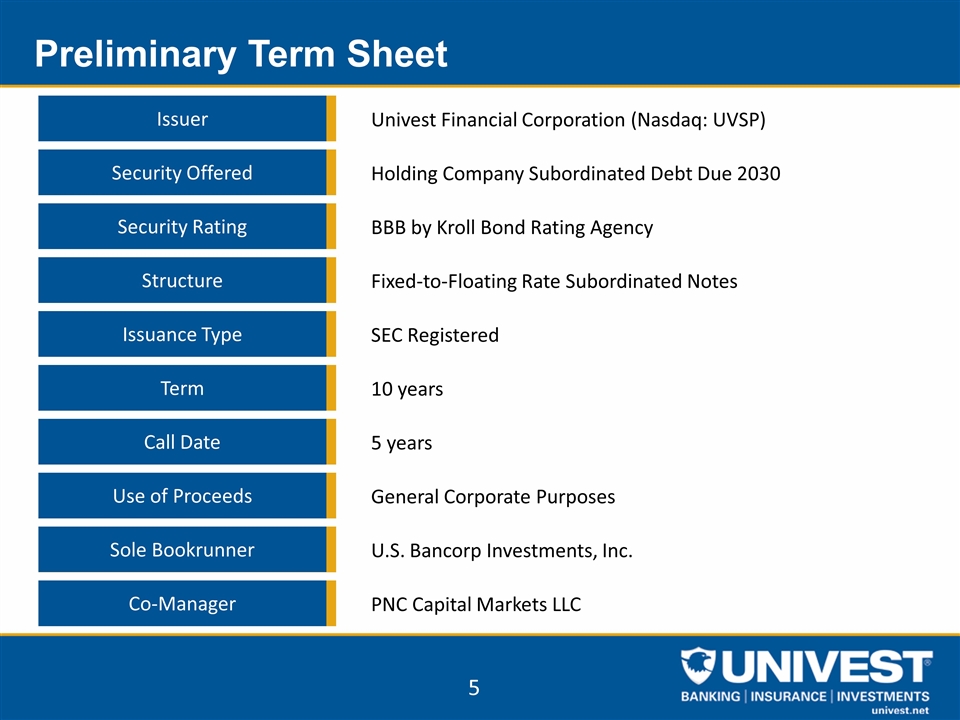

Issuer Univest Financial Corporation (Nasdaq: UVSP) Security Offered Holding Company Subordinated Debt Due 2030 Security Rating BBB by Kroll Bond Rating Agency Structure Fixed-to-Floating Rate Subordinated Notes Issuance Type SEC Registered Term 10 years Call Date 5 years Use of Proceeds General Corporate Purposes Sole Bookrunner U.S. Bancorp Investments, Inc. Co-Manager PNC Capital Markets LLC Preliminary Term Sheet 5

BUSINESS OVERVIEW

Univest Company Overview Headquartered in Souderton, Pennsylvania (Montgomery County) Bank founded in 1876, holding company formed in 1973 Engaged in financial services business, providing full range of banking, insurance and wealth management services Comprehensive financial solutions delivered locally Experienced management team with proven performance track record Physically serving twelve counties in the Southeastern and Central regions of Pennsylvania and three counties in Southern New Jersey Customer base primarily consists of individuals, businesses, municipalities and nonprofit organizations Operating leverage and scale with $6.1 billion of bank assets ($5.6 billion excluding Paycheck Protection Program (“PPP”) loans), $3.6 billion of assets under management and agent for $180 million of underwritten insurance premiums as of 6/30/20 Most recent acquisition was 7/1/16 (Fox Chase Bank with $1.1 billion of assets) Strong organic growth since 7/1/16, primarily driven by Central PA lift-out (Q2 2016)

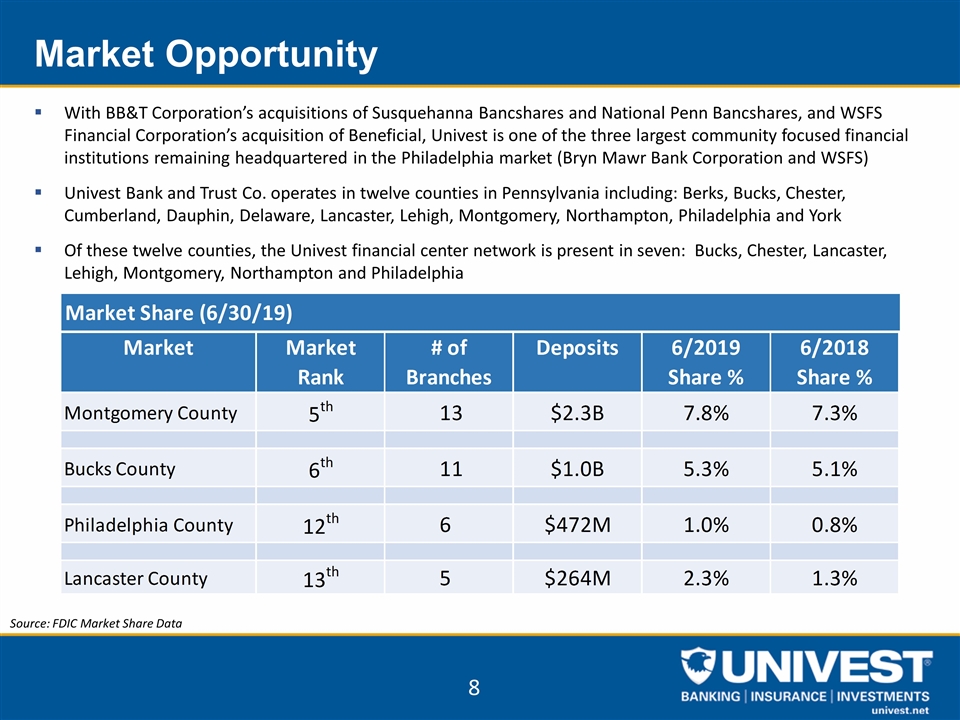

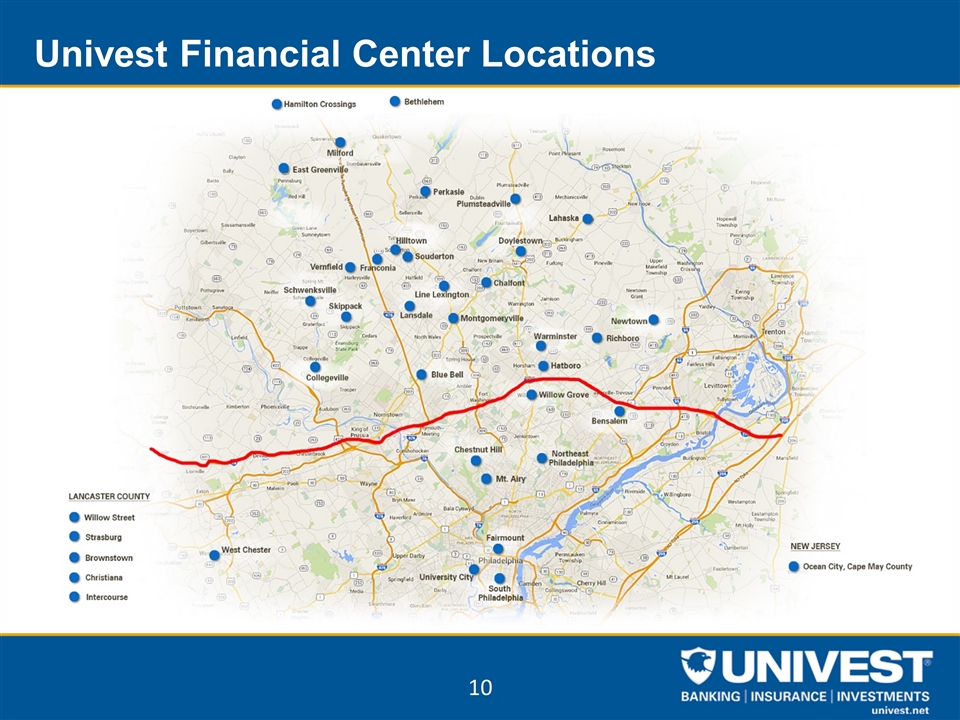

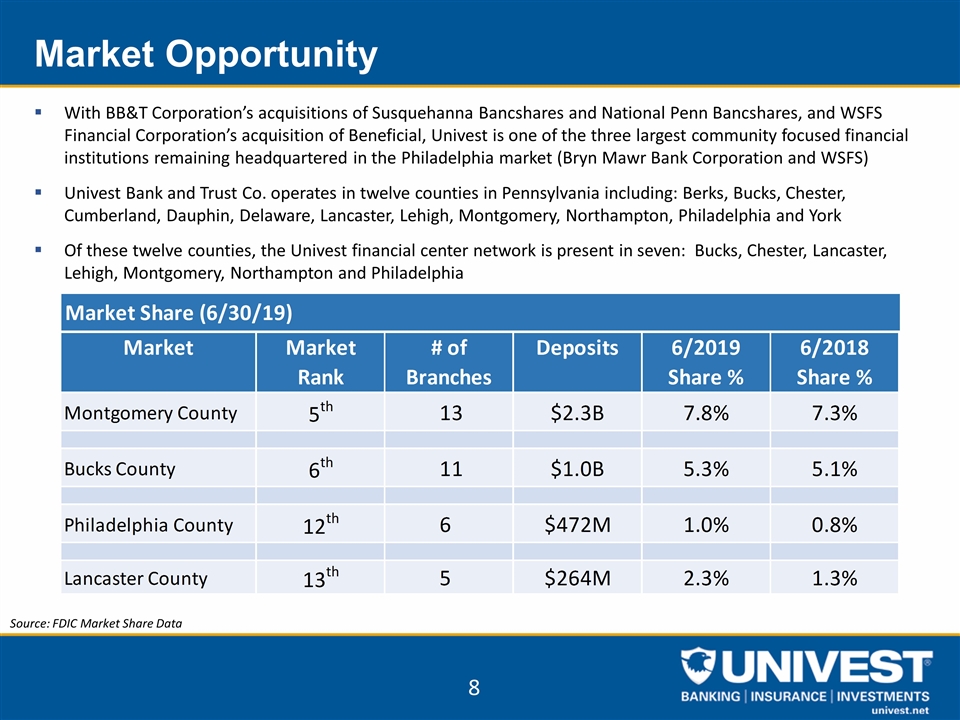

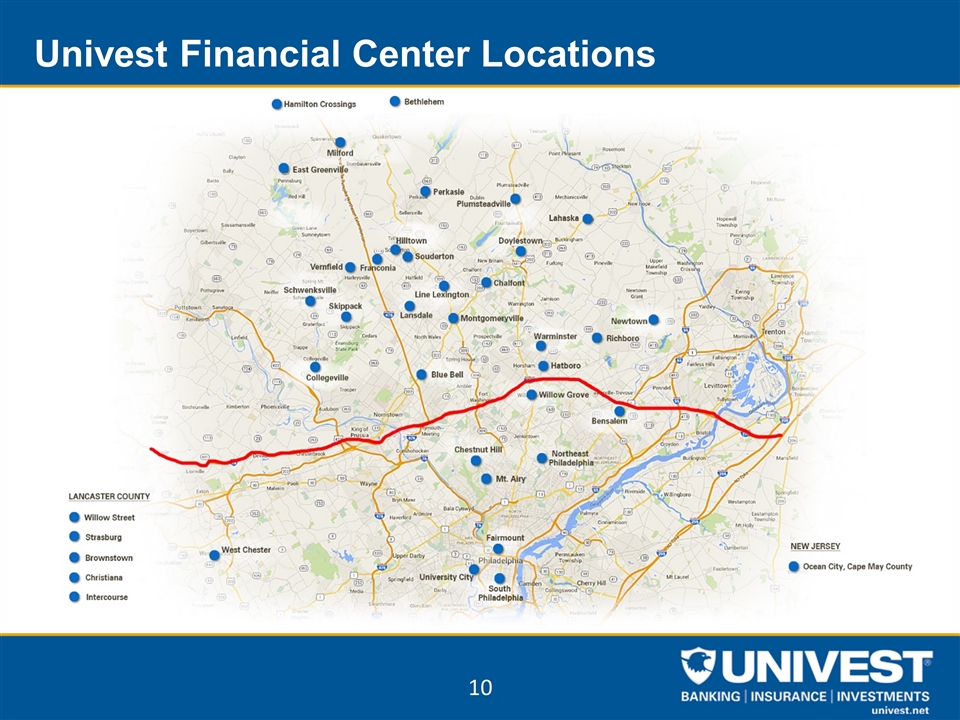

Market Opportunity With BB&T Corporation’s acquisitions of Susquehanna Bancshares and National Penn Bancshares, and WSFS Financial Corporation’s acquisition of Beneficial, Univest is one of the three largest community focused financial institutions remaining headquartered in the Philadelphia market (Bryn Mawr Bank Corporation and WSFS) Univest Bank and Trust Co. operates in twelve counties in Pennsylvania including: Berks, Bucks, Chester, Cumberland, Dauphin, Delaware, Lancaster, Lehigh, Montgomery, Northampton, Philadelphia and York Of these twelve counties, the Univest financial center network is present in seven: Bucks, Chester, Lancaster, Lehigh, Montgomery, Northampton and Philadelphia Source: FDIC Market Share Data

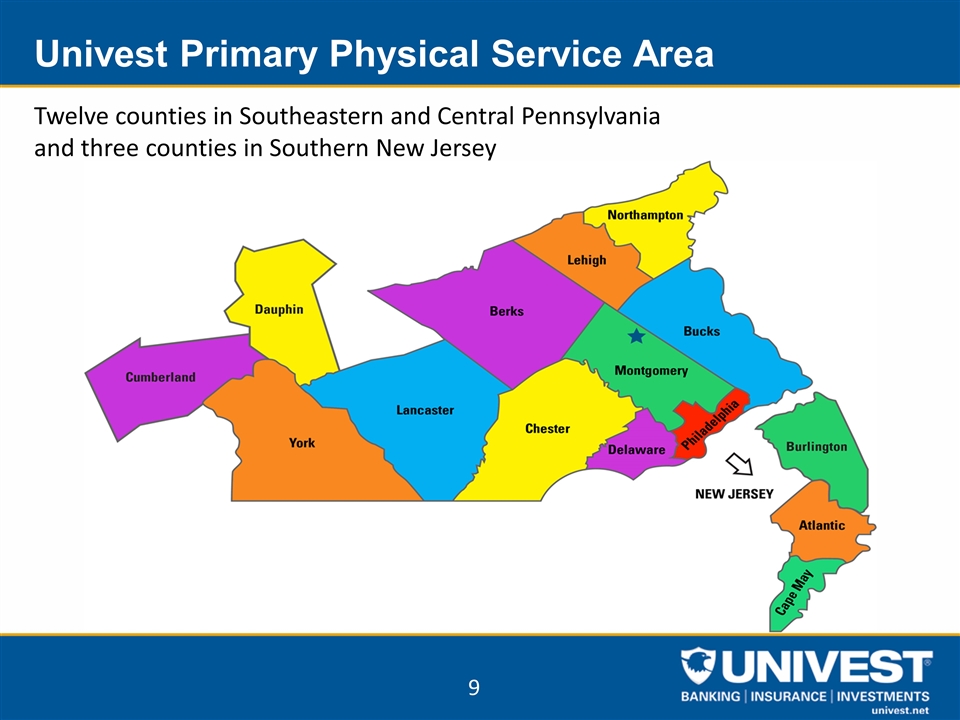

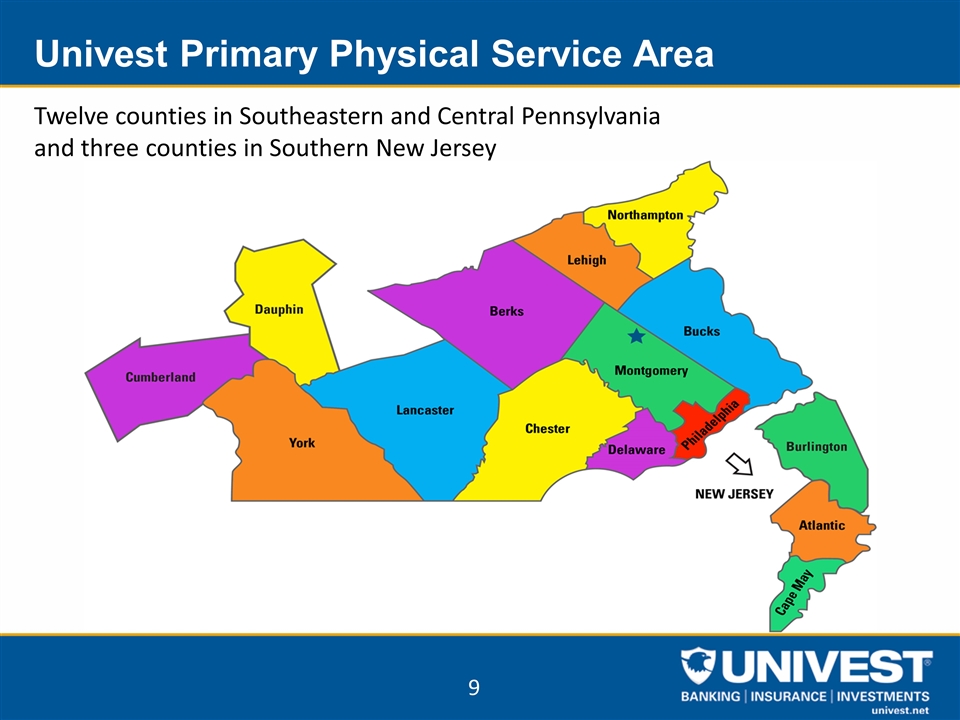

Univest Primary Physical Service Area Twelve counties in Southeastern and Central Pennsylvania and three counties in Southern New Jersey

Univest Financial Center Locations

2020 Strategy 11 Commercial Loan Organic Growth Opportunistic, but disciplined, approach to wealth & insurance acquisitions Continue to take advantage of market dislocation & focus on hiring commercial lenders, including potential team liftouts. - March 2019 – 8 hires, including 5 relationship managers/business developers in Western Lancaster County/York County - April 2019 – 3 relationship managers hired in the Philadelphia suburbs of Southern New Jersey Thoughtfully navigate COVID-19 by working with customers & employees to address evolving needs Multi-prong approach to deposits: Commercial customers Comprehensive Treasury Management offerings Public Funds – Municipalities, Counties & Authorities Retail Promotions & Enhanced Digital Capabilities Brokered Deposits Continued investment in digital, technology infrastructure & customer relationship management tools Cross-sell/Integration of our comprehensive suite of products & services

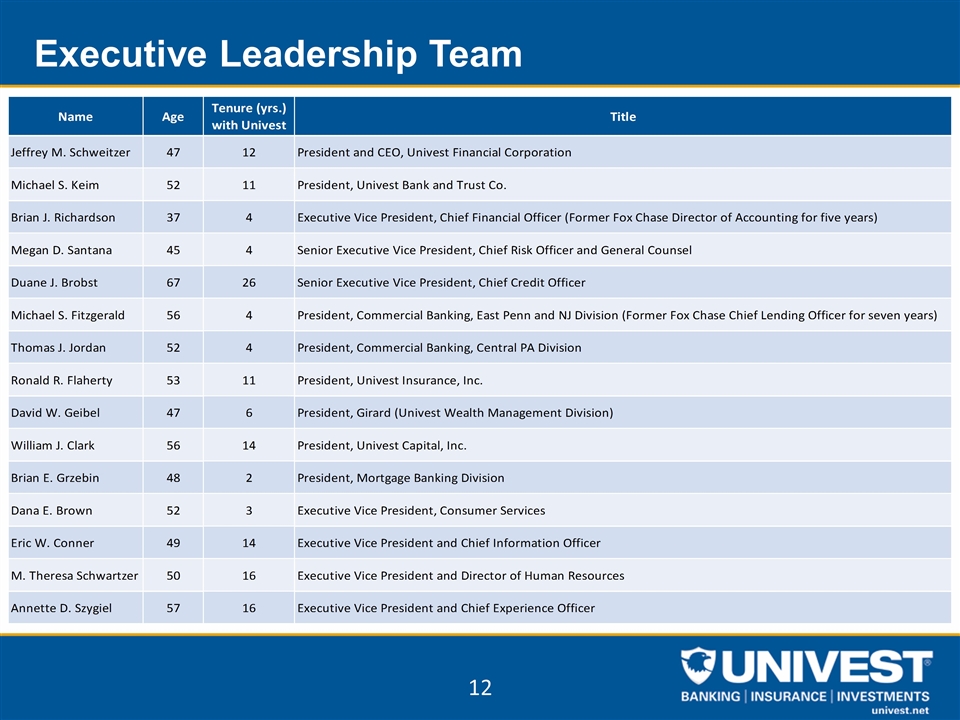

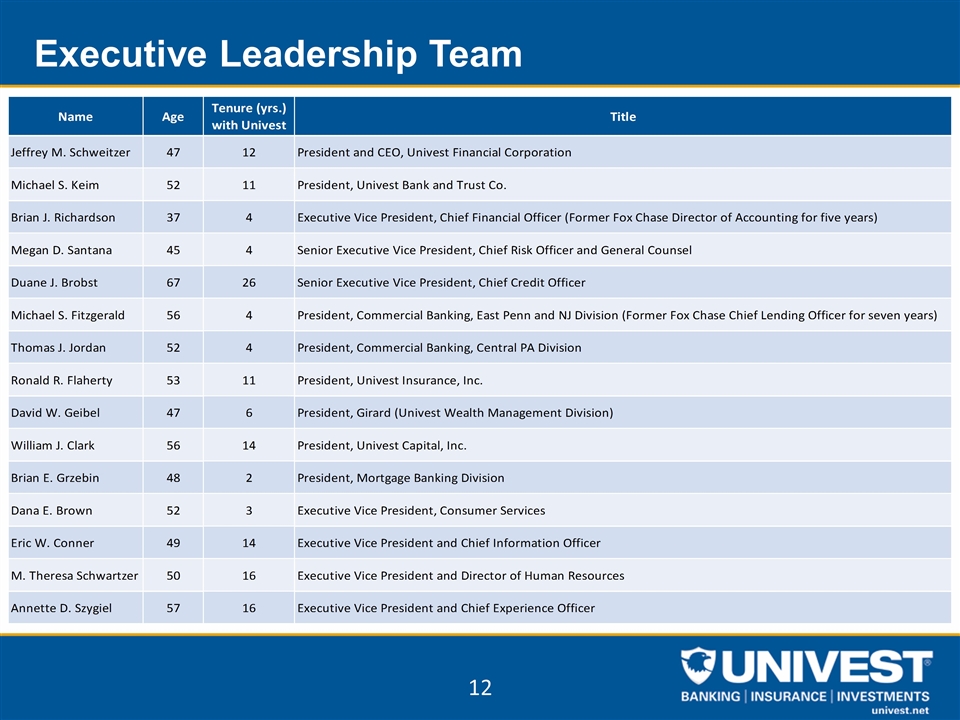

Executive Leadership Team

SUMMARY FINANCIAL HIGHLIGHTS

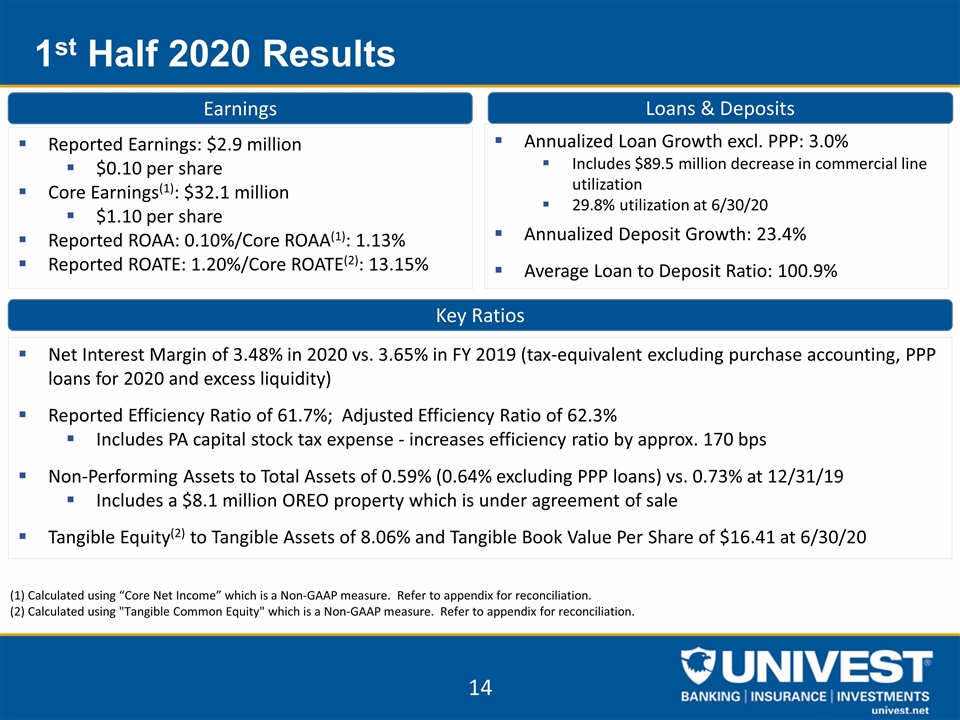

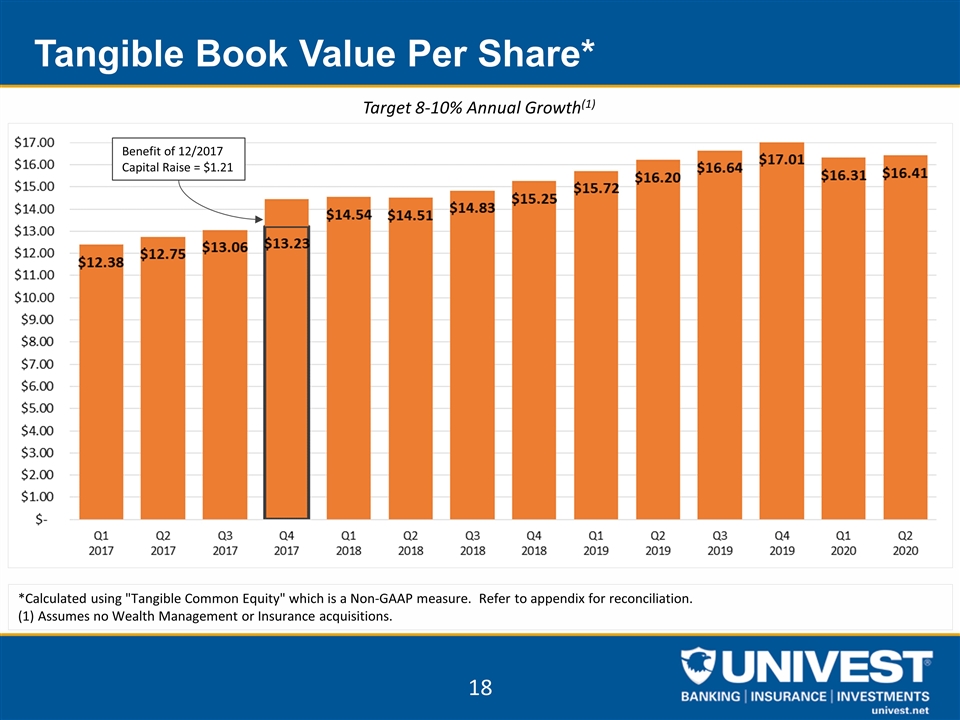

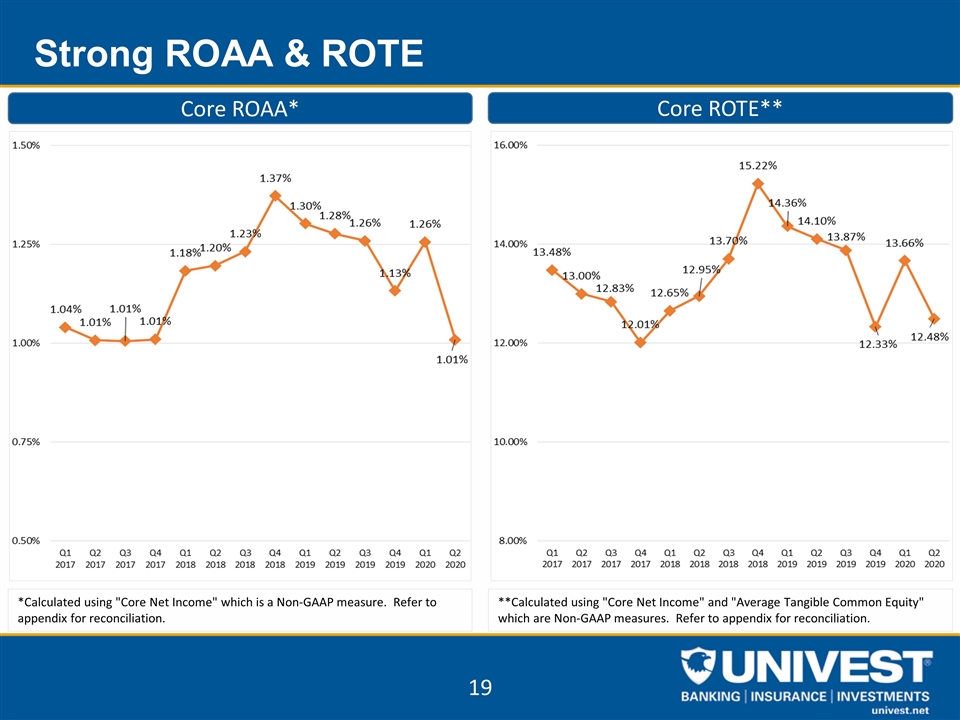

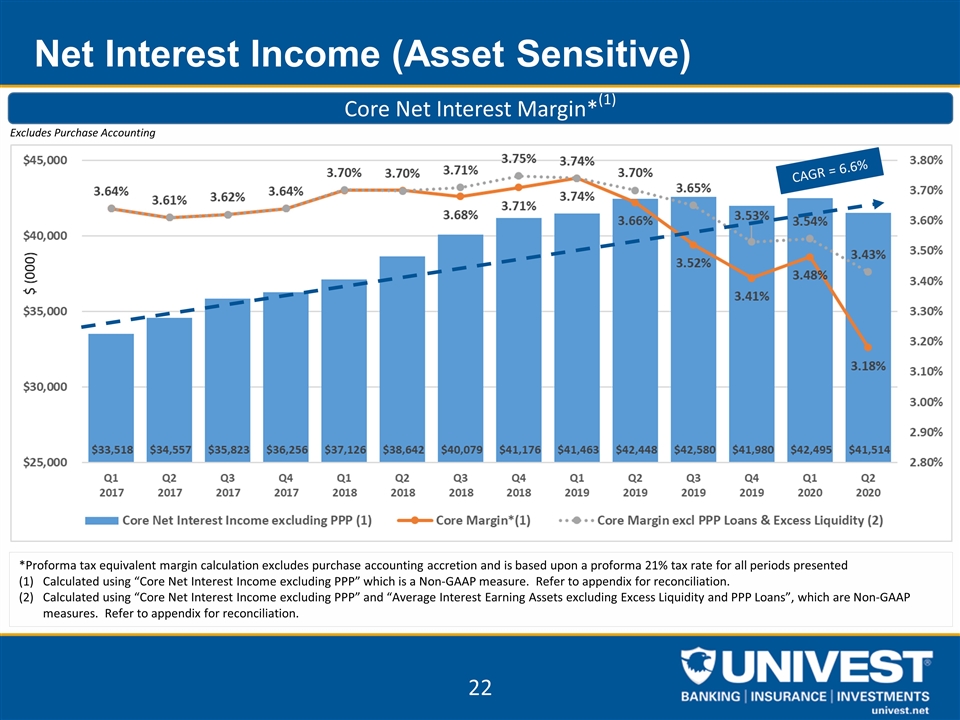

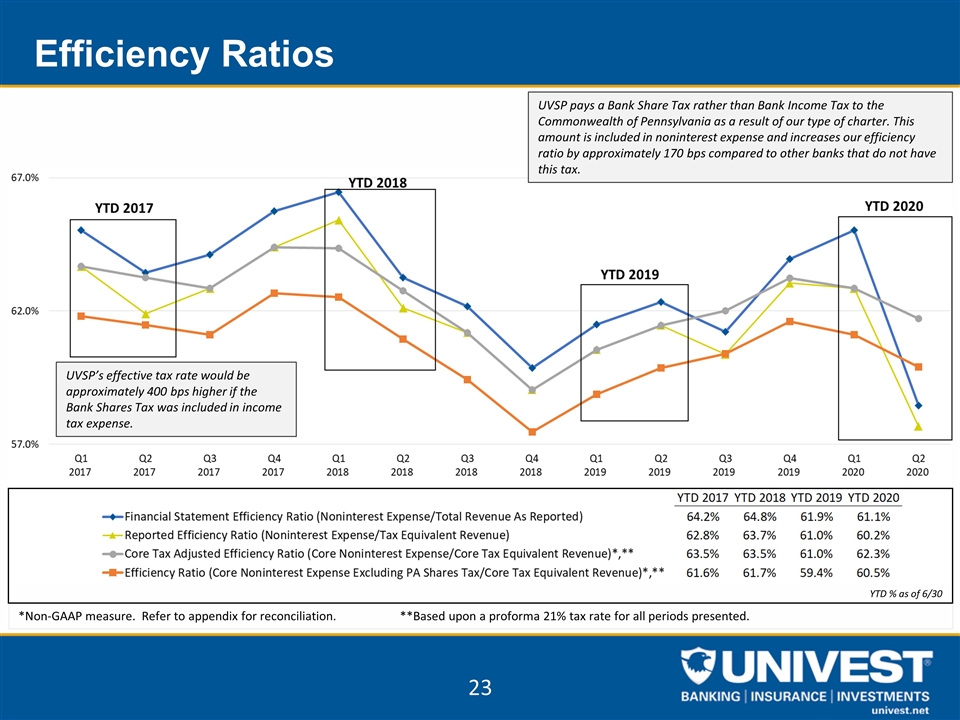

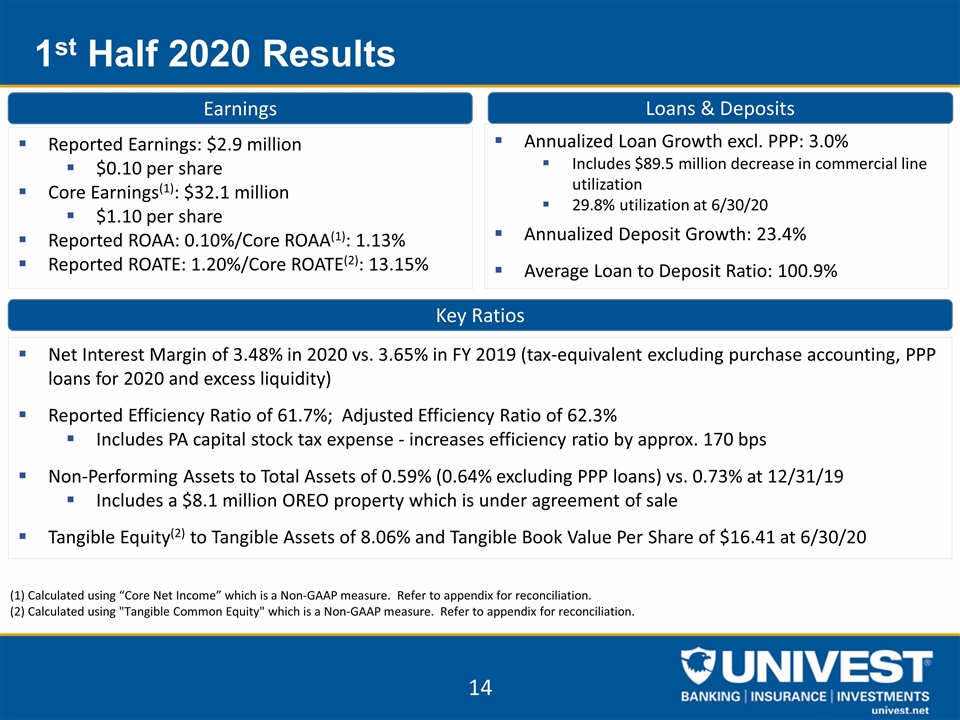

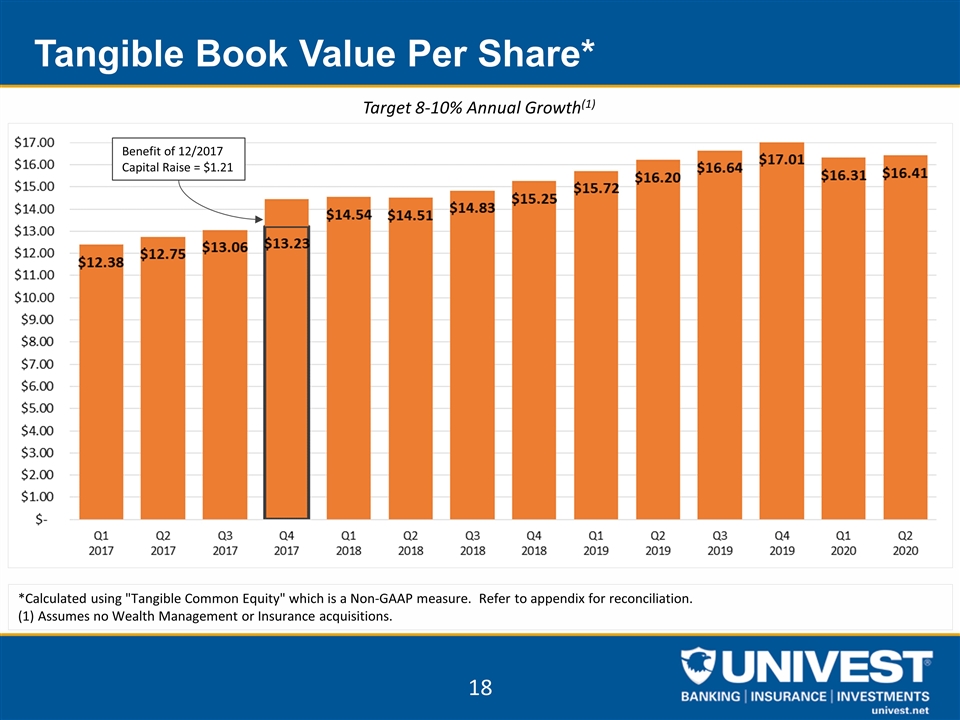

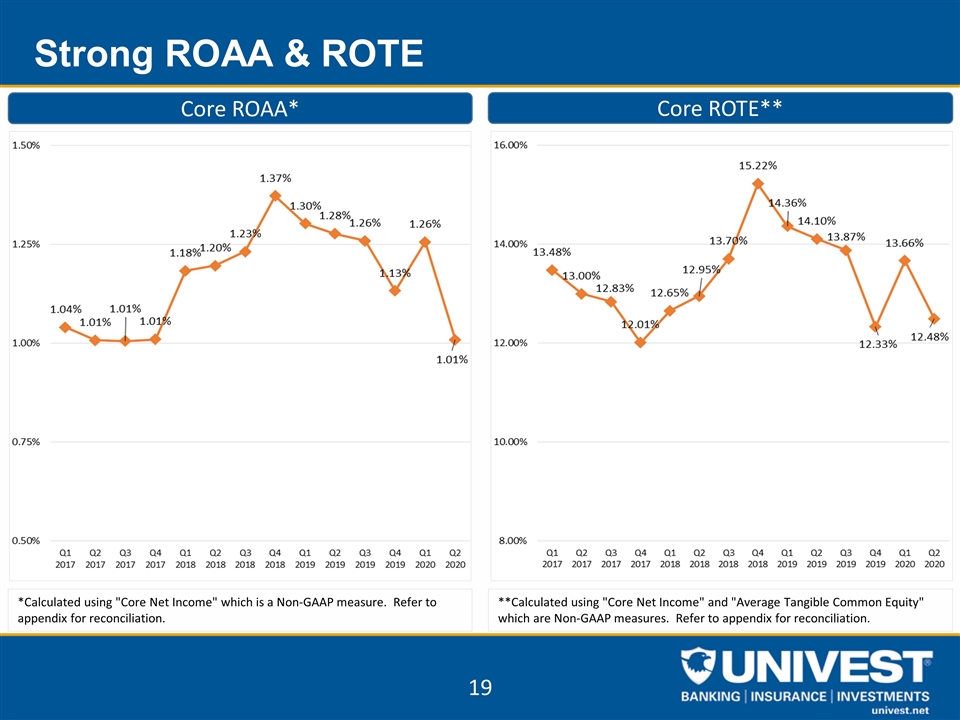

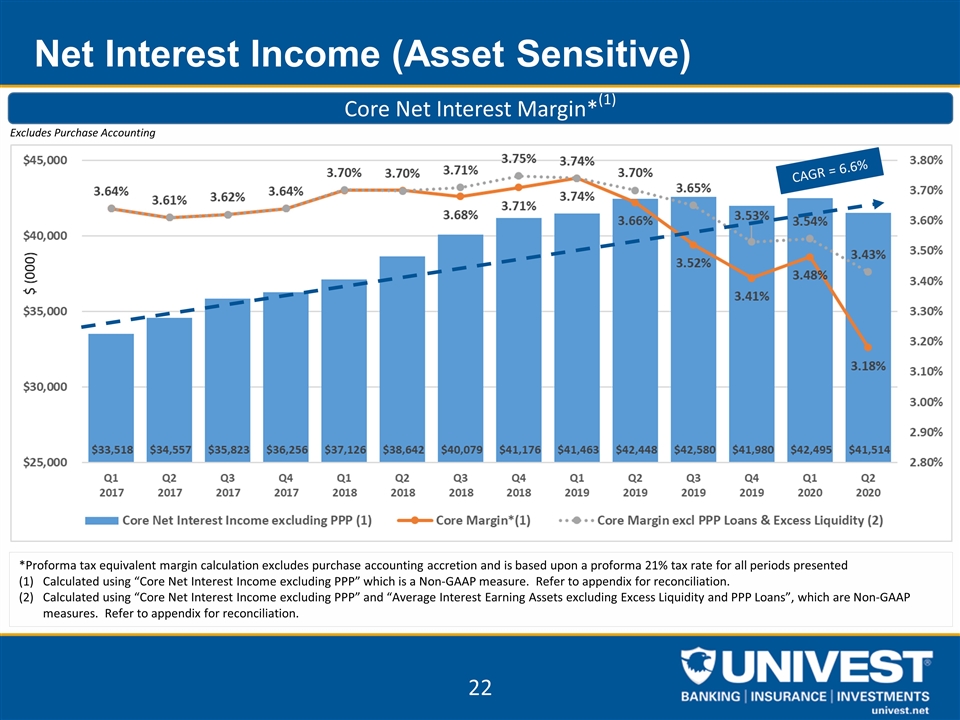

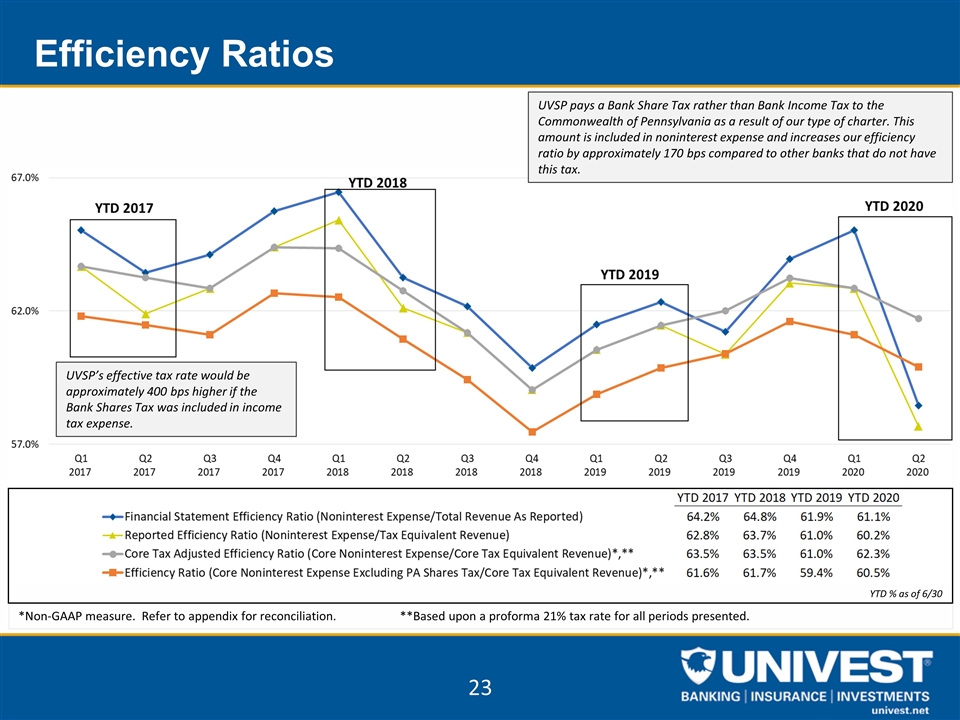

1st Half 2020 Results 14 Earnings Loans & Deposits Reported Earnings: $2.9 million $0.10 per share Core Earnings(1): $32.1 million $1.10 per share Reported ROAA: 0.10%/Core ROAA(1): 1.13% Reported ROATE: 1.20%/Core ROATE(2): 13.15% Annualized Loan Growth excl. PPP: 3.0% Includes $89.5 million decrease in commercial line utilization 29.8% utilization at 6/30/20 Annualized Deposit Growth: 23.4% Average Loan to Deposit Ratio: 100.9% Key Ratios Net Interest Margin of 3.48% in 2020 vs. 3.65% in FY 2019 (tax-equivalent excluding purchase accounting, PPP loans for 2020 and excess liquidity) Reported Efficiency Ratio of 61.7%; Adjusted Efficiency Ratio of 62.3% Includes PA capital stock tax expense - increases efficiency ratio by approx. 170 bps Non-Performing Assets to Total Assets of 0.59% (0.64% excluding PPP loans) vs. 0.73% at 12/31/19 Includes a $8.1 million OREO property which is under agreement of sale Tangible Equity(2) to Tangible Assets of 8.06% and Tangible Book Value Per Share of $16.41 at 6/30/20 (1) Calculated using “Core Net Income” which is a Non-GAAP measure. Refer to appendix for reconciliation. (2) Calculated using "Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation.

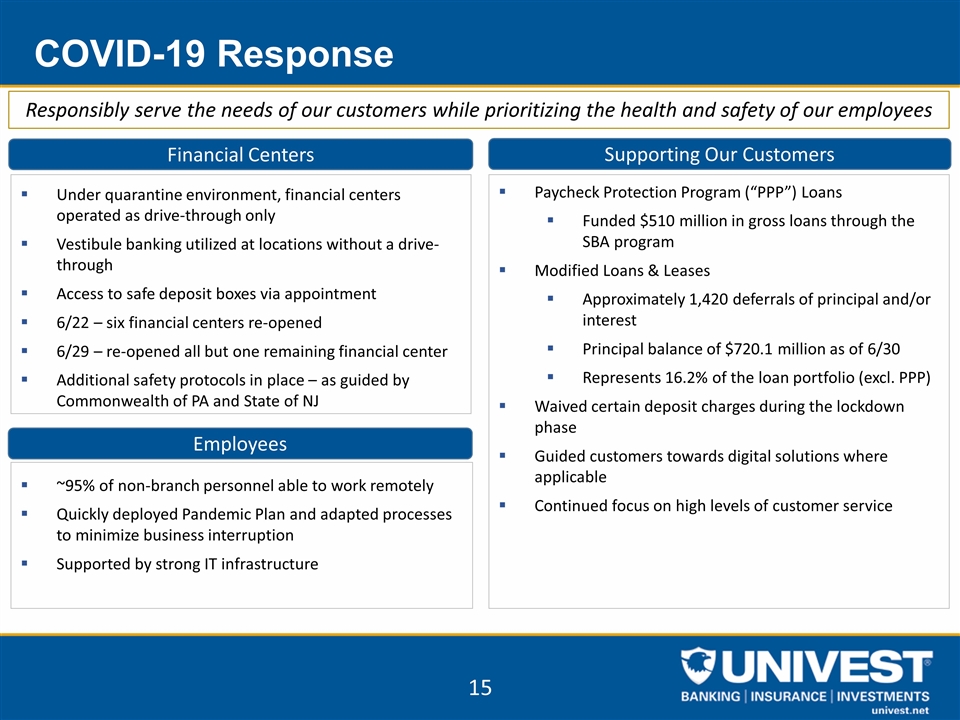

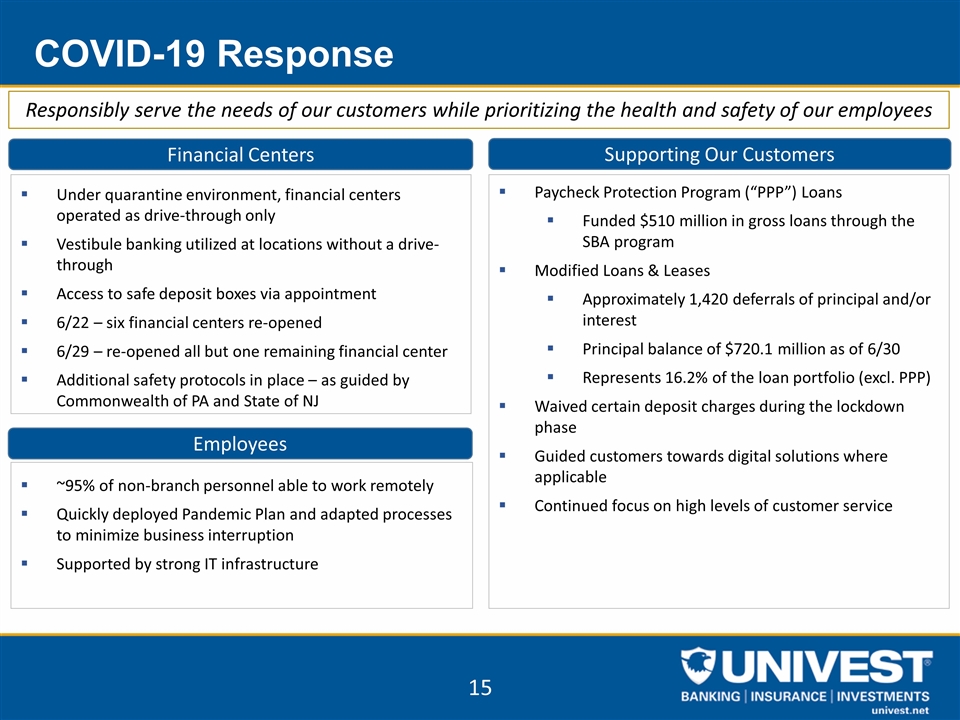

COVID-19 Response Under quarantine environment, financial centers operated as drive-through only Vestibule banking utilized at locations without a drive-through Access to safe deposit boxes via appointment 6/22 – six financial centers re-opened 6/29 – re-opened all but one remaining financial center Additional safety protocols in place – as guided by Commonwealth of PA and State of NJ Responsibly serve the needs of our customers while prioritizing the health and safety of our employees Financial Centers Supporting Our Customers Employees ~95% of non-branch personnel able to work remotely Quickly deployed Pandemic Plan and adapted processes to minimize business interruption Supported by strong IT infrastructure Paycheck Protection Program (“PPP”) Loans Funded $510 million in gross loans through the SBA program Modified Loans & Leases Approximately 1,420 deferrals of principal and/or interest Principal balance of $720.1 million as of 6/30 Represents 16.2% of the loan portfolio (excl. PPP) Waived certain deposit charges during the lockdown phase Guided customers towards digital solutions where applicable Continued focus on high levels of customer service

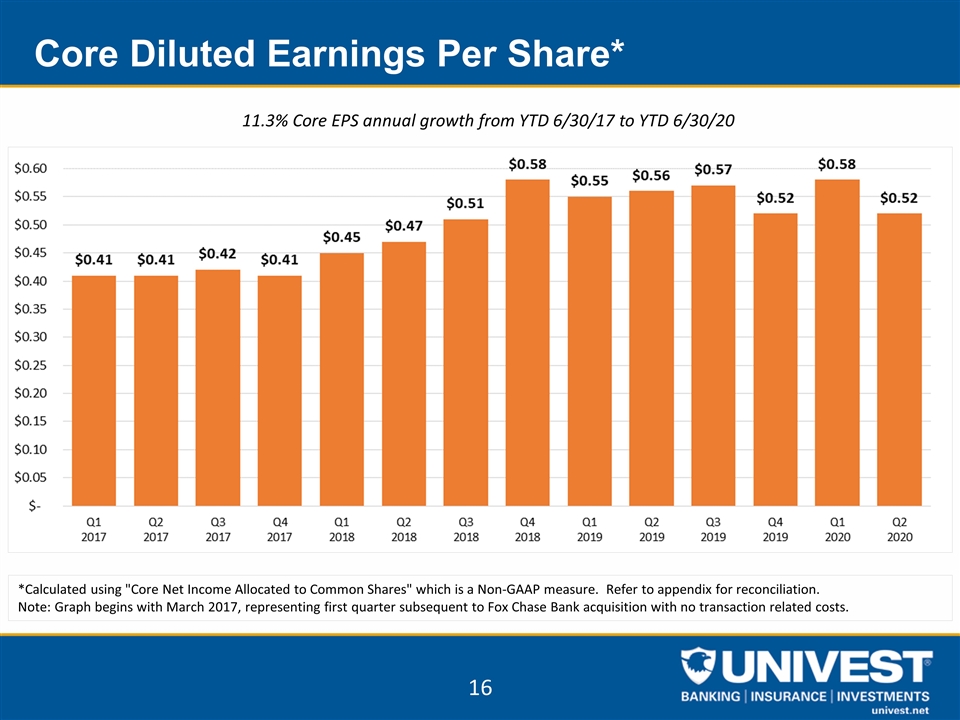

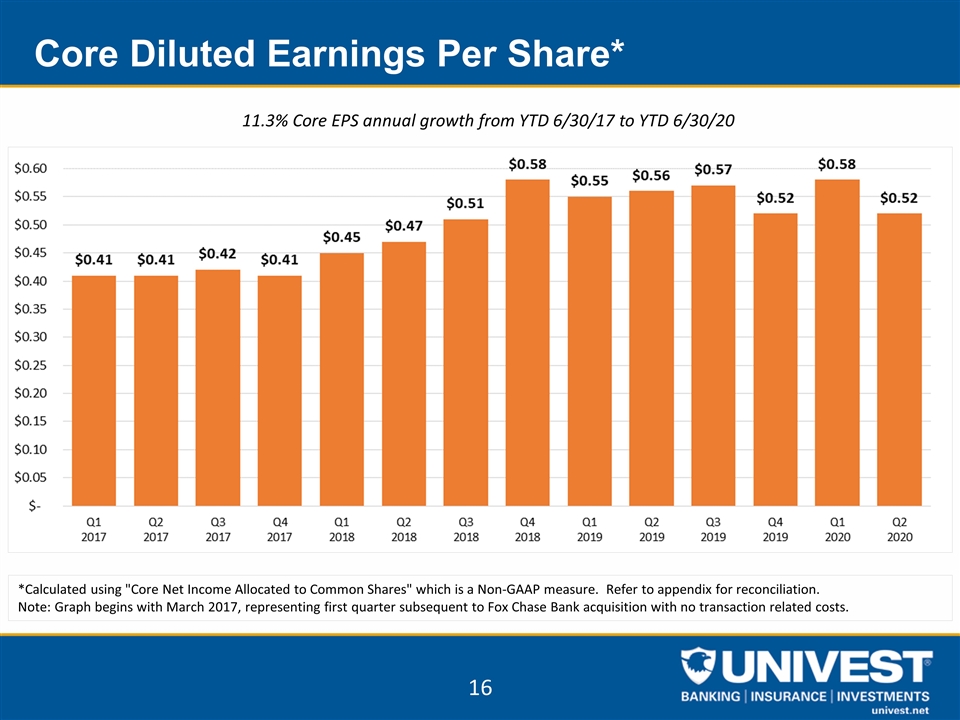

Core Diluted Earnings Per Share* 16 *Calculated using "Core Net Income Allocated to Common Shares" which is a Non-GAAP measure. Refer to appendix for reconciliation. Note: Graph begins with March 2017, representing first quarter subsequent to Fox Chase Bank acquisition with no transaction related costs. 11.3% Core EPS annual growth from YTD 6/30/17 to YTD 6/30/20

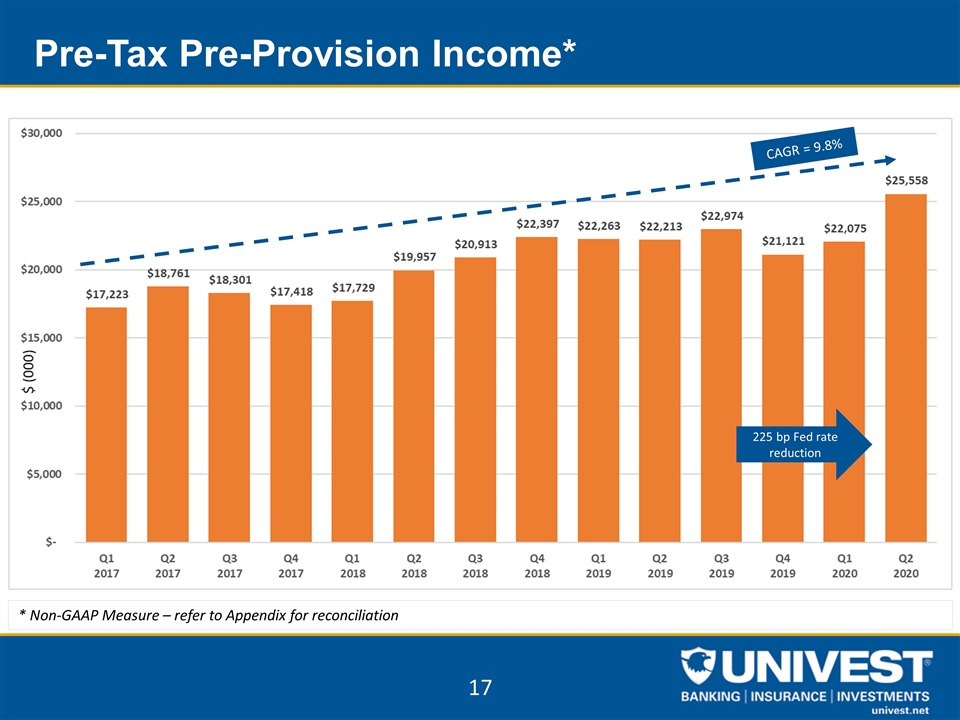

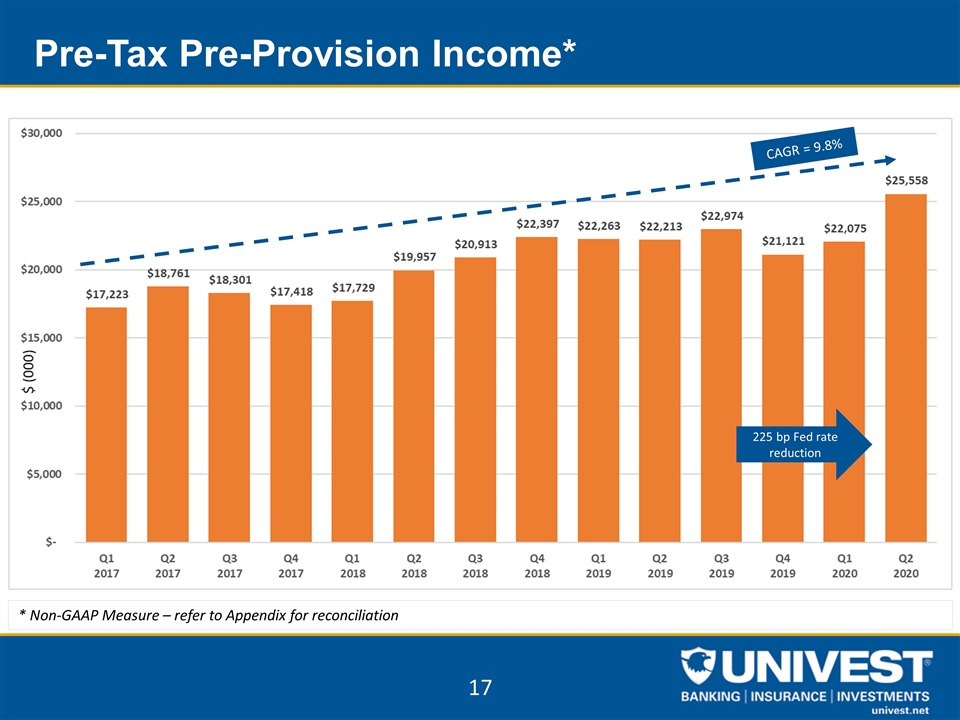

Pre-Tax Pre-Provision Income* 17 * Non-GAAP Measure – refer to Appendix for reconciliation CAGR = 9.8% 225 bp Fed rate reduction

Tangible Book Value Per Share* 18 *Calculated using "Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. (1) Assumes no Wealth Management or Insurance acquisitions. Target 8-10% Annual Growth(1) Benefit of 12/2017 Capital Raise = $1.21

Strong ROAA & ROTE 19 *Calculated using "Core Net Income" which is a Non-GAAP measure. Refer to appendix for reconciliation. **Calculated using "Core Net Income" and "Average Tangible Common Equity" which are Non-GAAP measures. Refer to appendix for reconciliation. Core ROAA* Core ROTE**

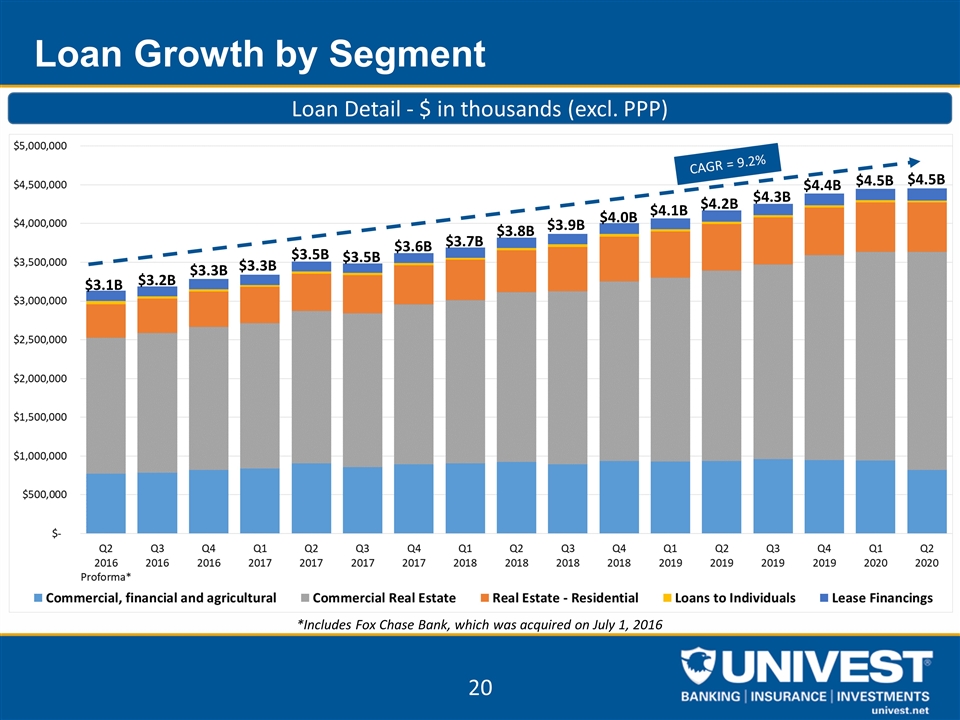

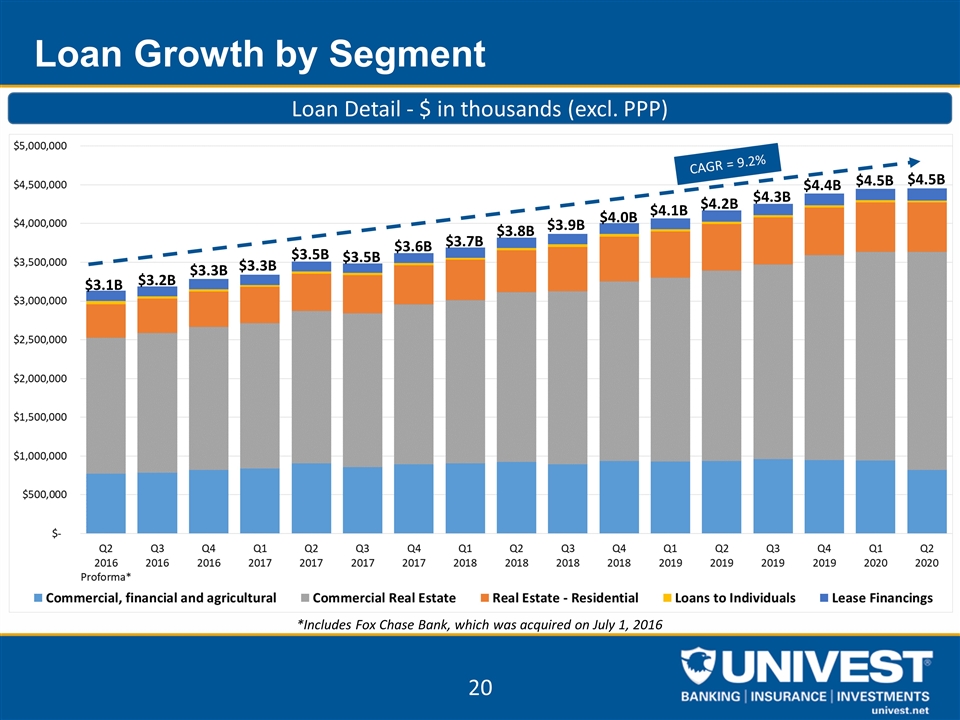

Loan Growth by Segment *Includes Fox Chase Bank, which was acquired on July 1, 2016 CAGR = 9.2% Loan Detail - $ in thousands (excl. PPP) $3.1B $3.2B $3.3B $3.3B $3.5B $3.5B $3.6B $3.7B $3.8B $3.9B $4.0B $4.1B $4.2B $4.3B $4.4B $4.5B $4.5B

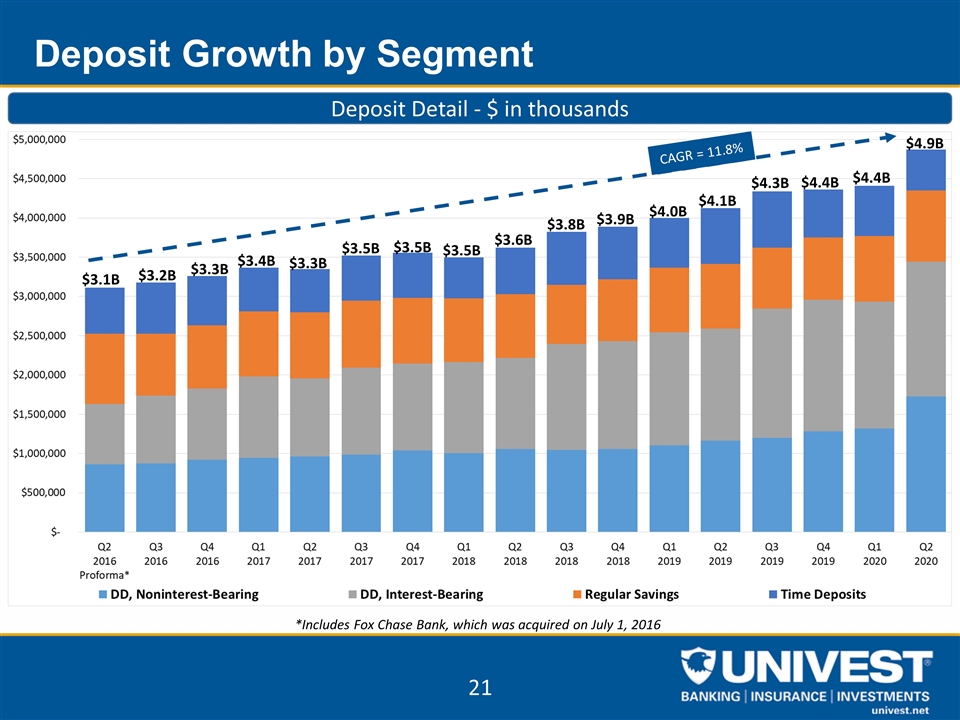

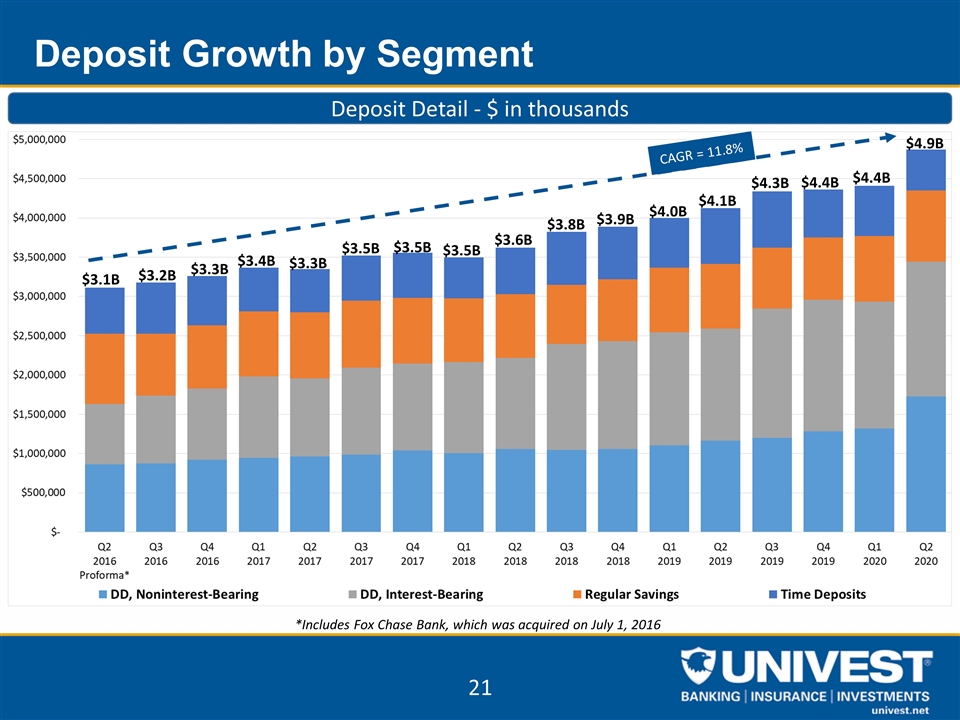

Deposit Growth by Segment *Includes Fox Chase Bank, which was acquired on July 1, 2016 CAGR = 11.8% Deposit Detail - $ in thousands $3.1B $3.2B $3.3B $3.4B $3.3B $3.5B $3.5B $3.5B $3.6B $3.8B $3.9B $4.0B $4.1B $4.3B $4.4B $4.4B $4.9B

22 Net Interest Income (Asset Sensitive) *Proforma tax equivalent margin calculation excludes purchase accounting accretion and is based upon a proforma 21% tax rate for all periods presented Calculated using “Core Net Interest Income excluding PPP” which is a Non-GAAP measure. Refer to appendix for reconciliation. Calculated using “Core Net Interest Income excluding PPP” and “Average Interest Earning Assets excluding Excess Liquidity and PPP Loans”, which are Non-GAAP measures. Refer to appendix for reconciliation. Core Net Interest Margin*(1) Excludes Purchase Accounting CAGR = 6.6%

23 Efficiency Ratios UVSP pays a Bank Share Tax rather than Bank Income Tax to the Commonwealth of Pennsylvania as a result of our type of charter. This amount is included in noninterest expense and increases our efficiency ratio by approximately 170 bps compared to other banks that do not have this tax. UVSP’s effective tax rate would be approximately 400 bps higher if the Bank Shares Tax was included in income tax expense. *Non-GAAP measure. Refer to appendix for reconciliation. **Based upon a proforma 21% tax rate for all periods presented. YTD % as of 6/30

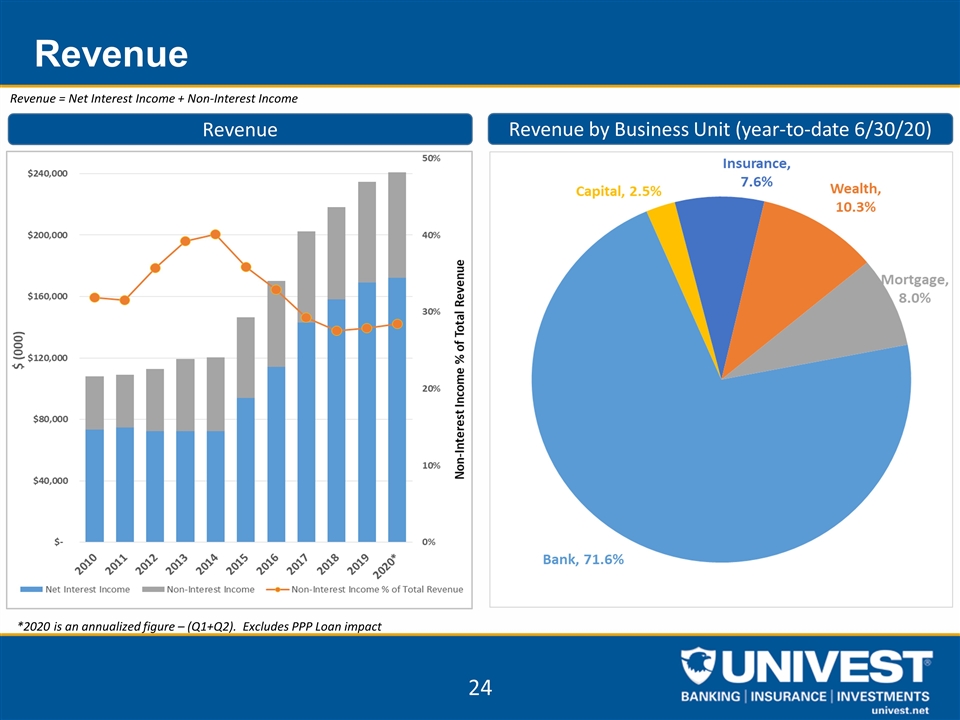

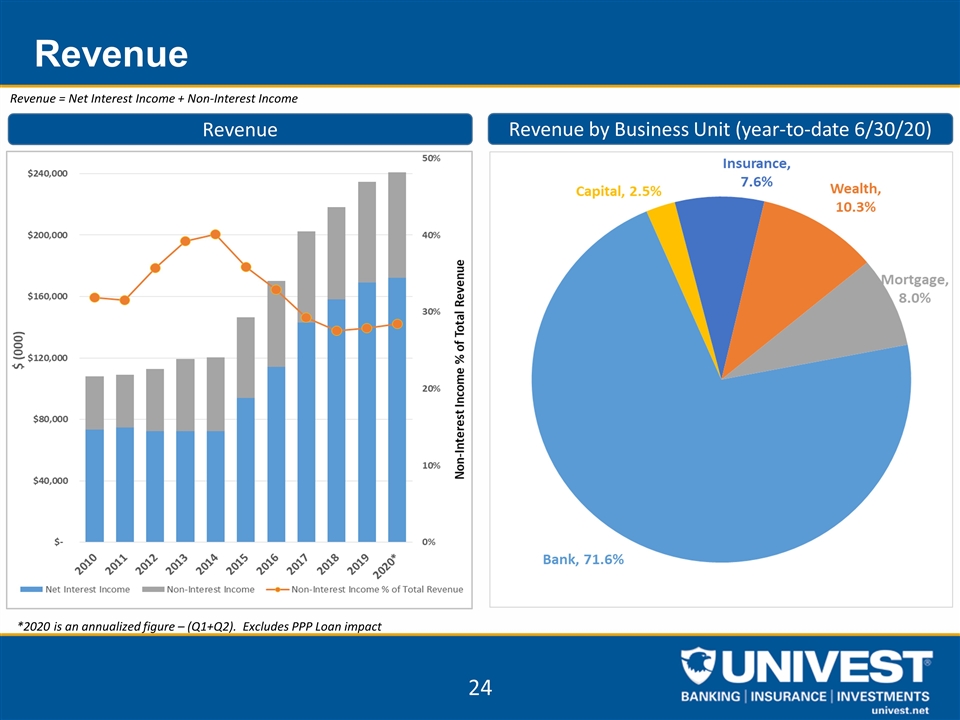

Revenue Revenue Revenue by Business Unit (year-to-date 6/30/20) *2020 is an annualized figure – (Q1+Q2). Excludes PPP Loan impact Revenue = Net Interest Income + Non-Interest Income

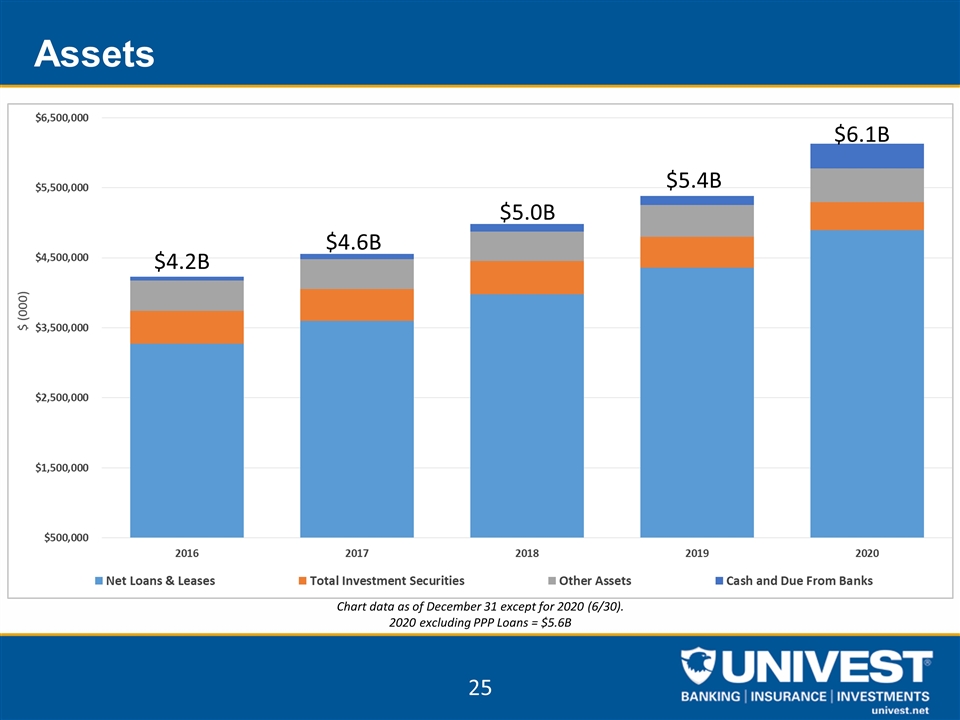

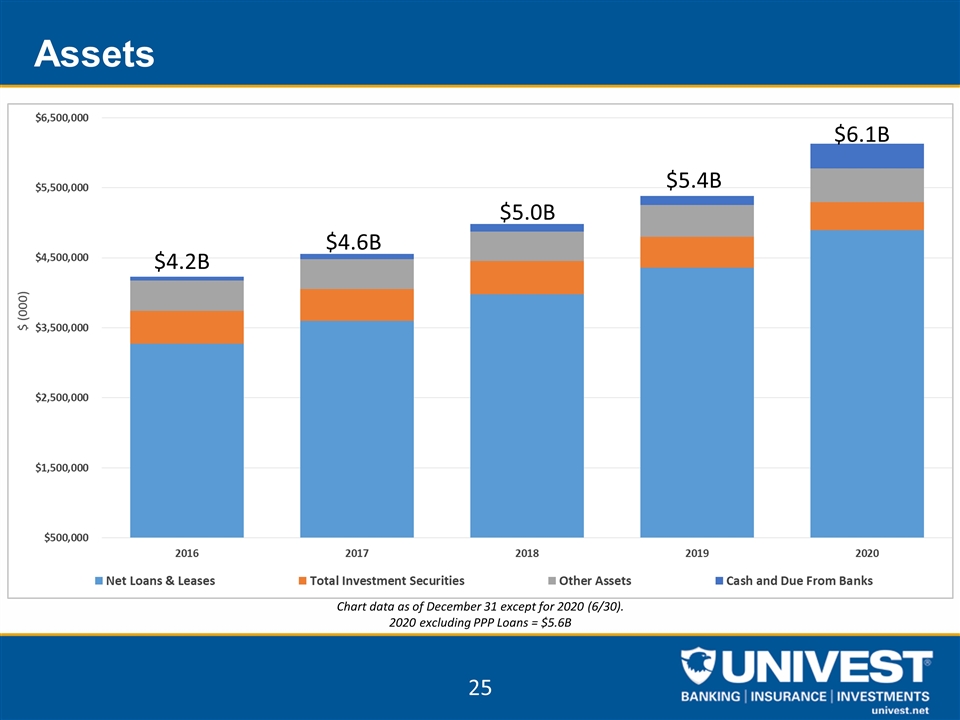

Assets Chart data as of December 31 except for 2020 (6/30). 2020 excluding PPP Loans = $5.6B $4.2B $4.6B $5.0B $5.4B $6.1B

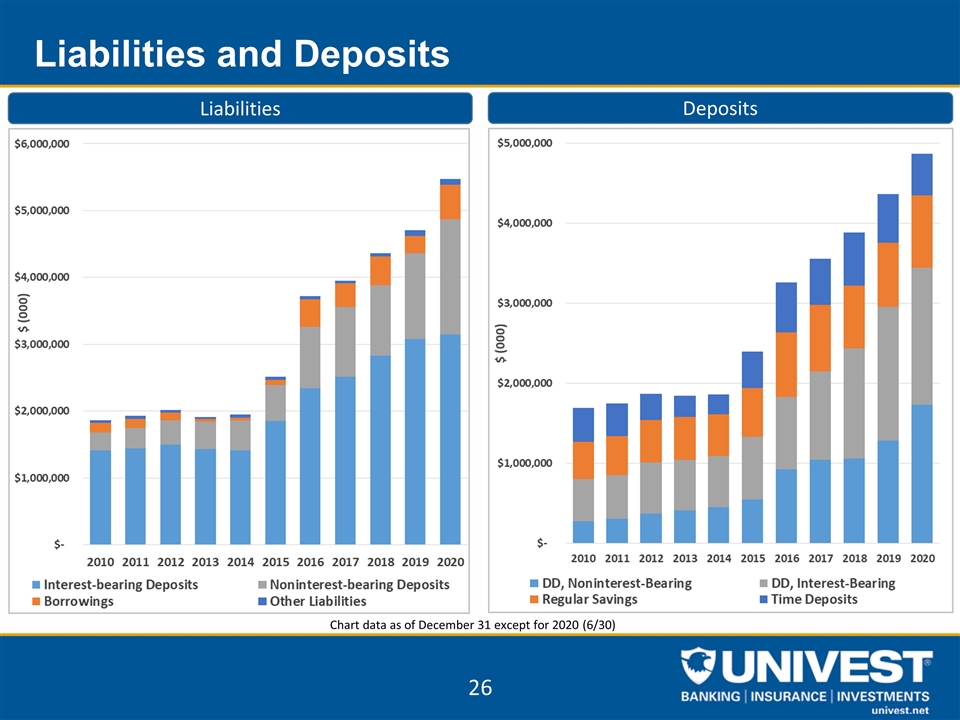

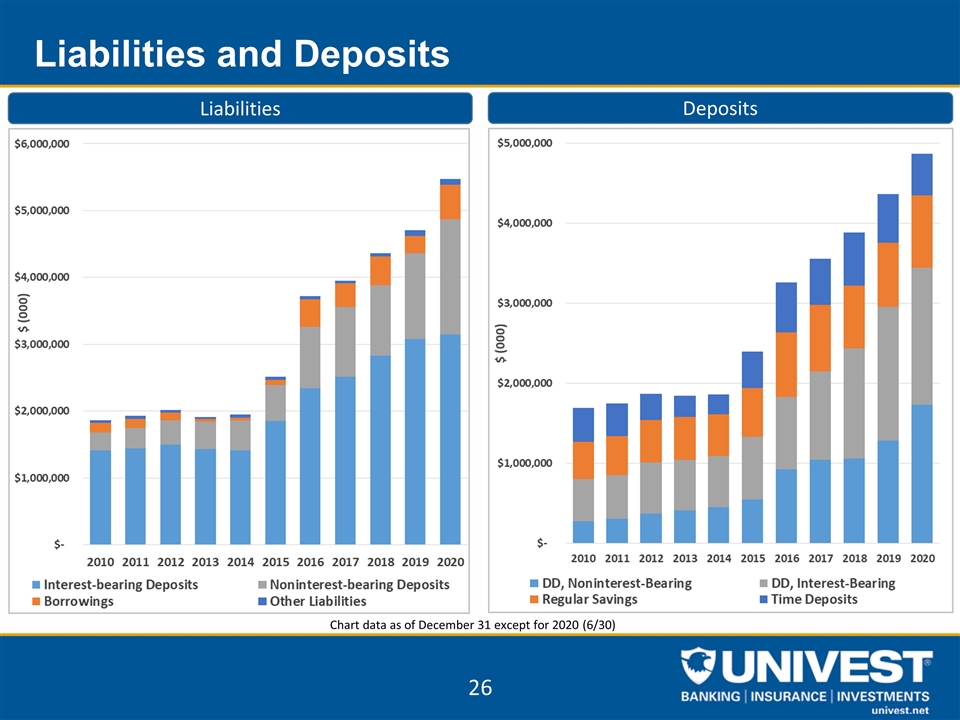

Liabilities and Deposits Chart data as of December 31 except for 2020 (6/30) Liabilities Deposits

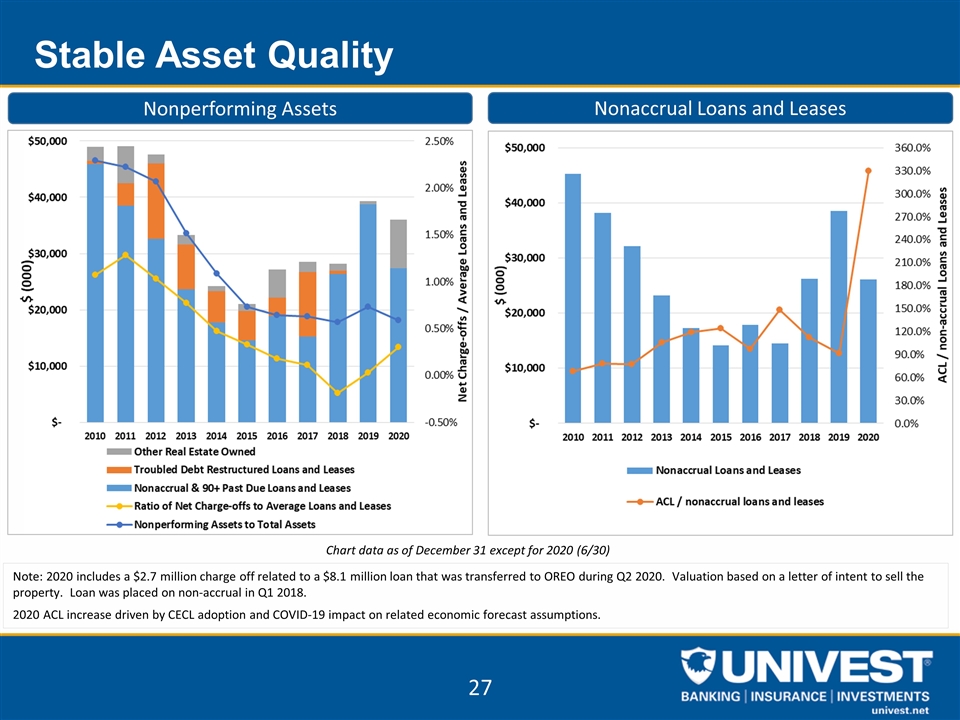

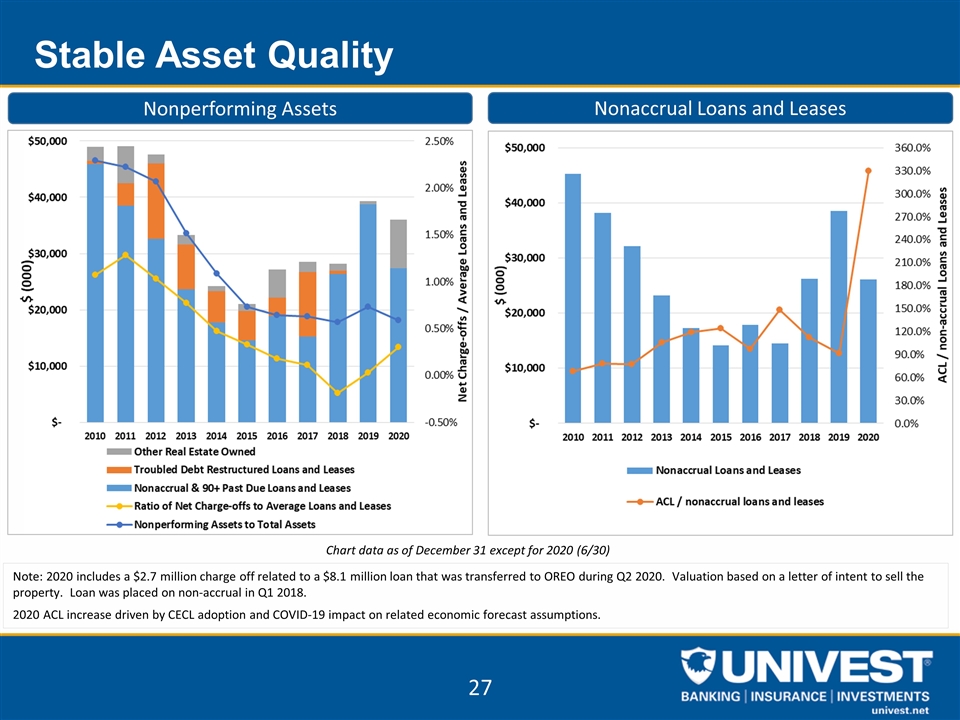

Stable Asset Quality Nonperforming Assets Nonaccrual Loans and Leases Chart data as of December 31 except for 2020 (6/30) Note: 2020 includes a $2.7 million charge off related to a $8.1 million loan that was transferred to OREO during Q2 2020. Valuation based on a letter of intent to sell the property. Loan was placed on non-accrual in Q1 2018. 2020 ACL increase driven by CECL adoption and COVID-19 impact on related economic forecast assumptions.

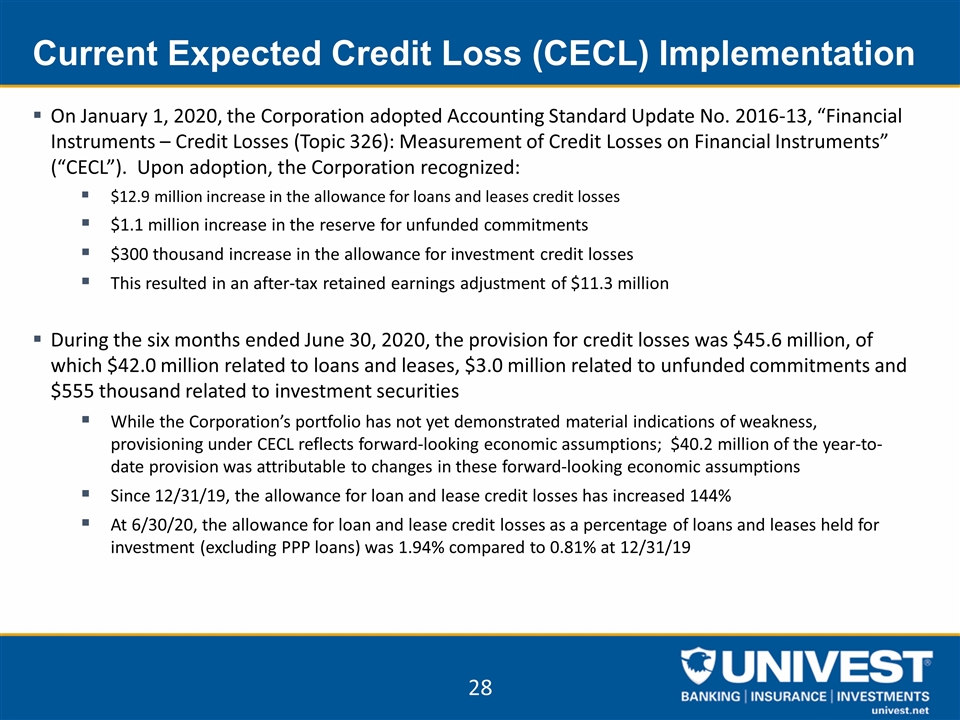

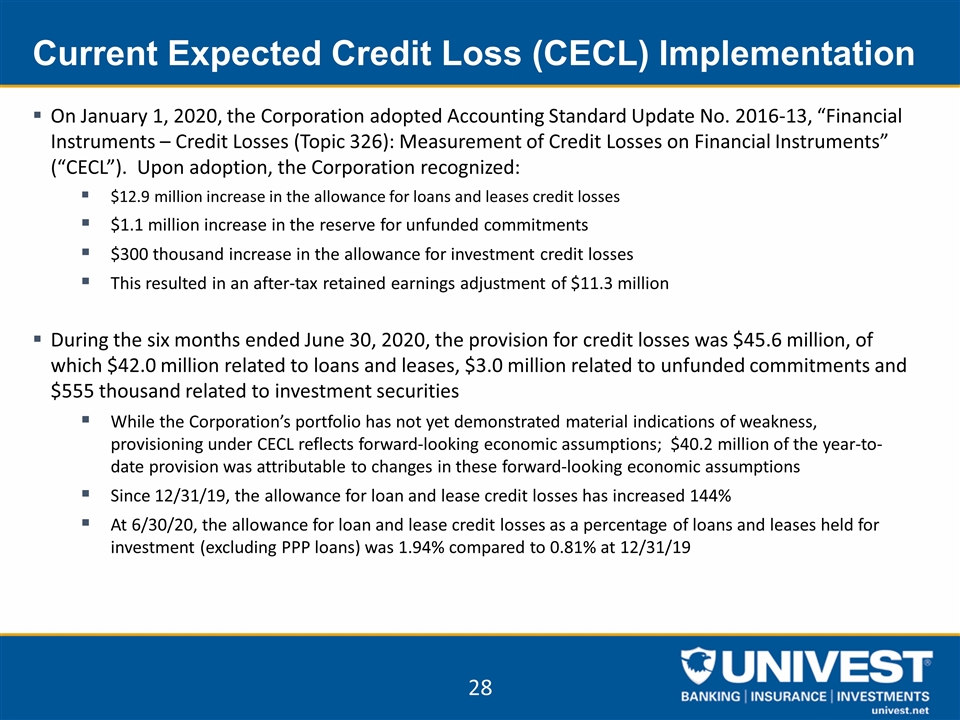

Current Expected Credit Loss (CECL) Implementation On January 1, 2020, the Corporation adopted Accounting Standard Update No. 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“CECL”). Upon adoption, the Corporation recognized: $12.9 million increase in the allowance for loans and leases credit losses $1.1 million increase in the reserve for unfunded commitments $300 thousand increase in the allowance for investment credit losses This resulted in an after-tax retained earnings adjustment of $11.3 million During the six months ended June 30, 2020, the provision for credit losses was $45.6 million, of which $42.0 million related to loans and leases, $3.0 million related to unfunded commitments and $555 thousand related to investment securities While the Corporation’s portfolio has not yet demonstrated material indications of weakness, provisioning under CECL reflects forward-looking economic assumptions; $40.2 million of the year-to-date provision was attributable to changes in these forward-looking economic assumptions Since 12/31/19, the allowance for loan and lease credit losses has increased 144% At 6/30/20, the allowance for loan and lease credit losses as a percentage of loans and leases held for investment (excluding PPP loans) was 1.94% compared to 0.81% at 12/31/19 28

LIQUIDITY AND CAPITAL

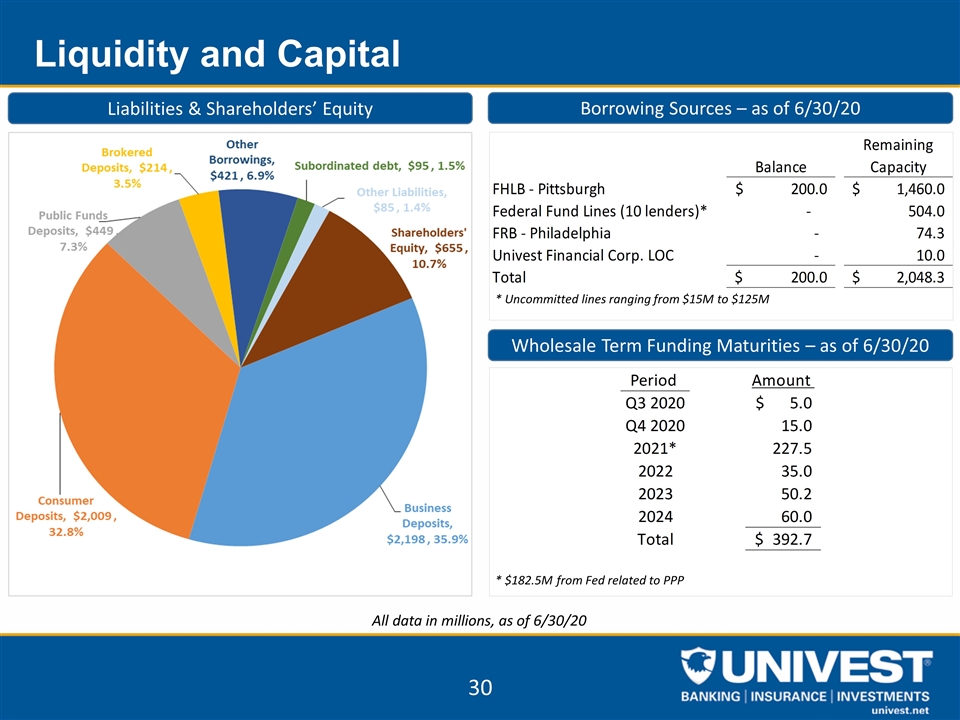

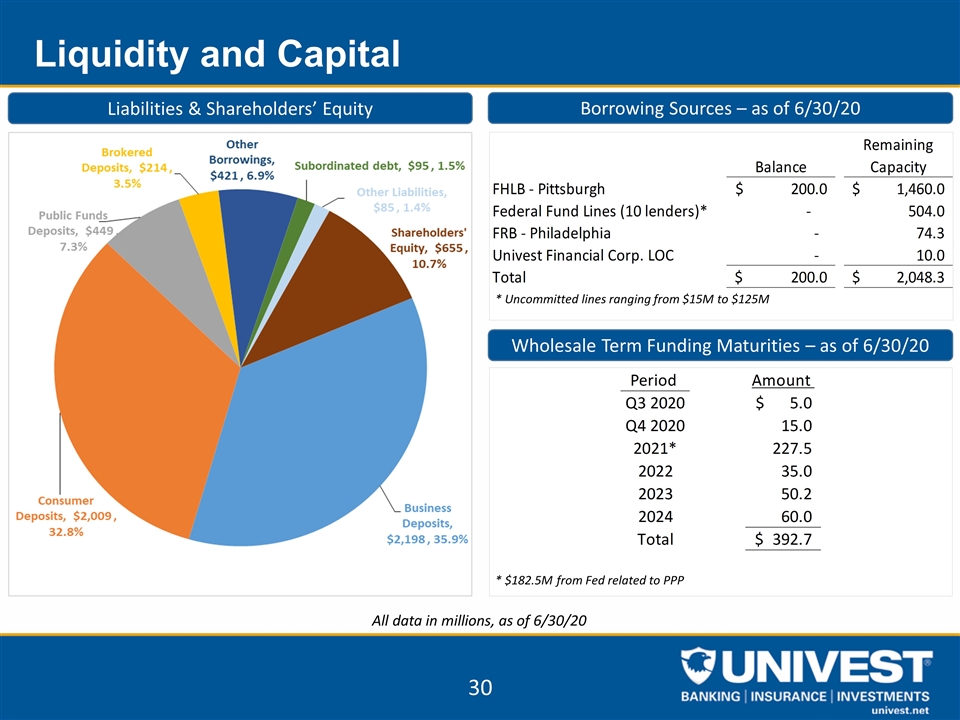

Liquidity and Capital 30 Liabilities & Shareholders’ Equity Borrowing Sources – as of 6/30/20 Wholesale Term Funding Maturities – as of 6/30/20 All data in millions, as of 6/30/20 * $182.5M from Fed related to PPP * Uncommitted lines ranging from $15M to $125M

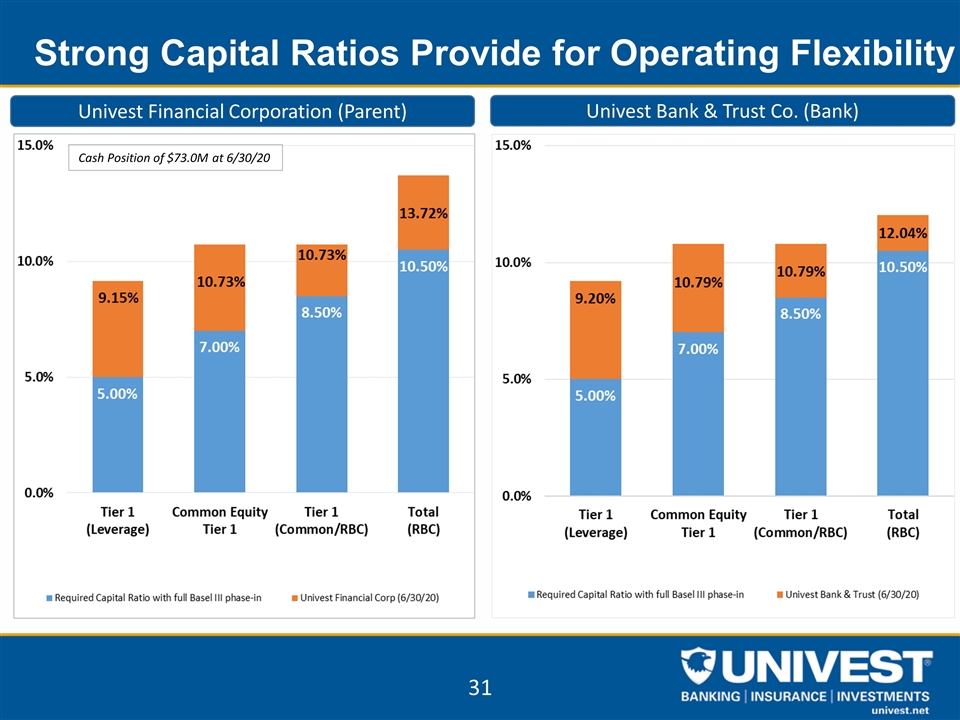

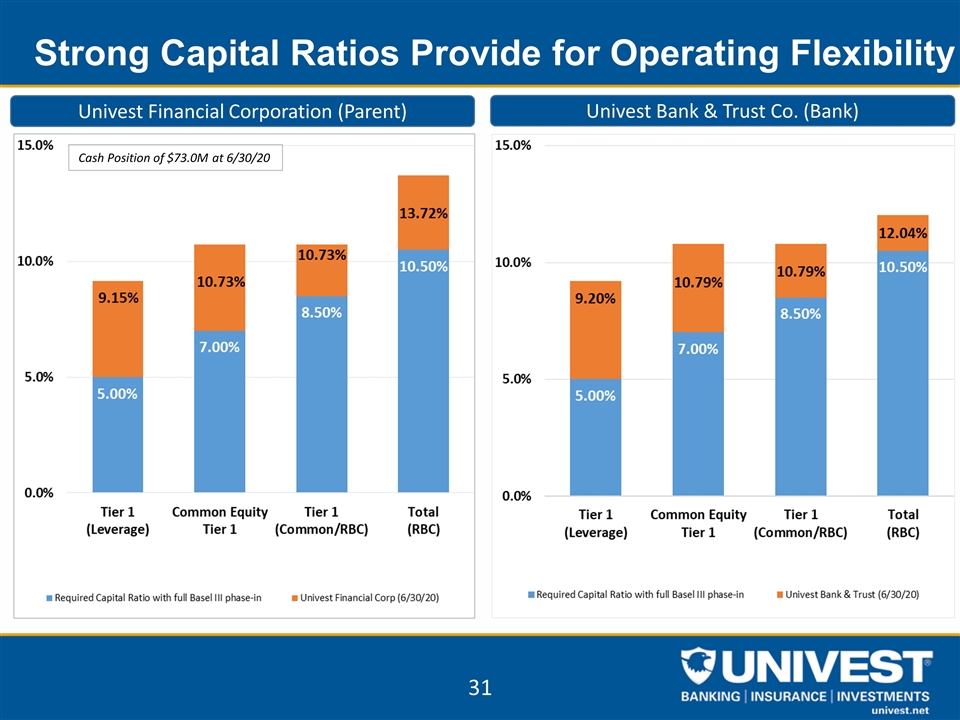

31 Strong Capital Ratios Provide for Operating Flexibility Univest Financial Corporation (Parent) Univest Bank & Trust Co. (Bank) Cash Position of $73.0M at 6/30/20

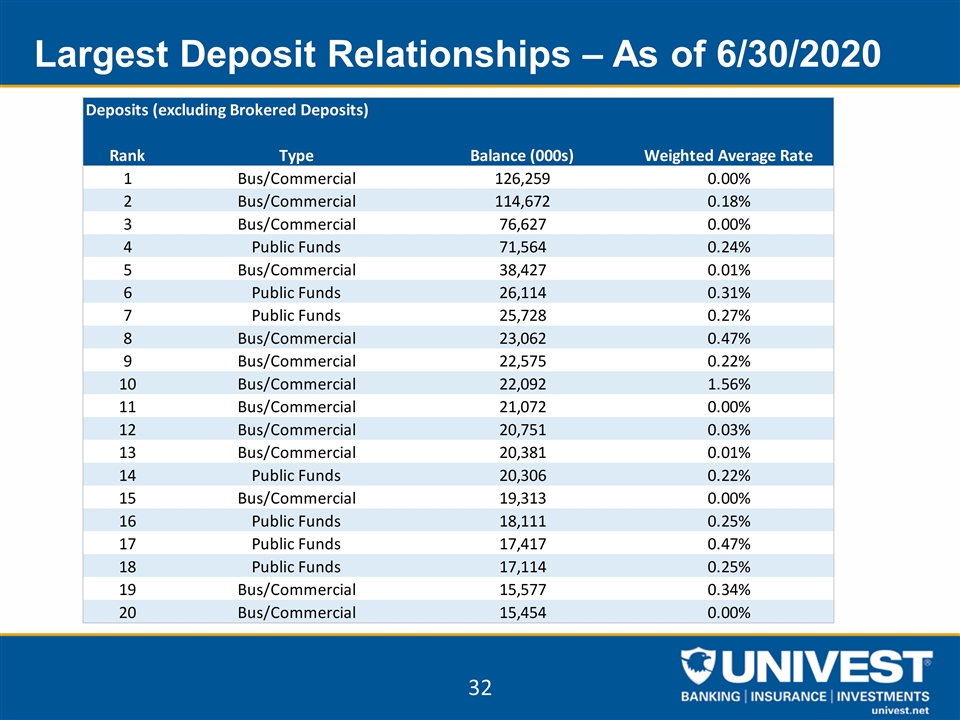

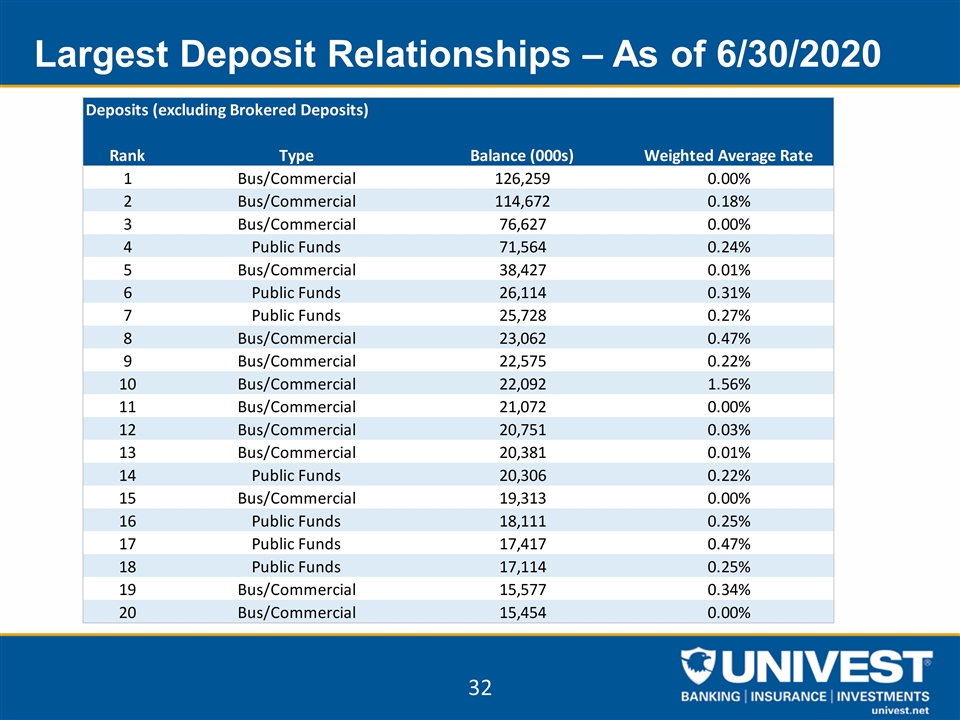

Largest Deposit Relationships – As of 6/30/2020

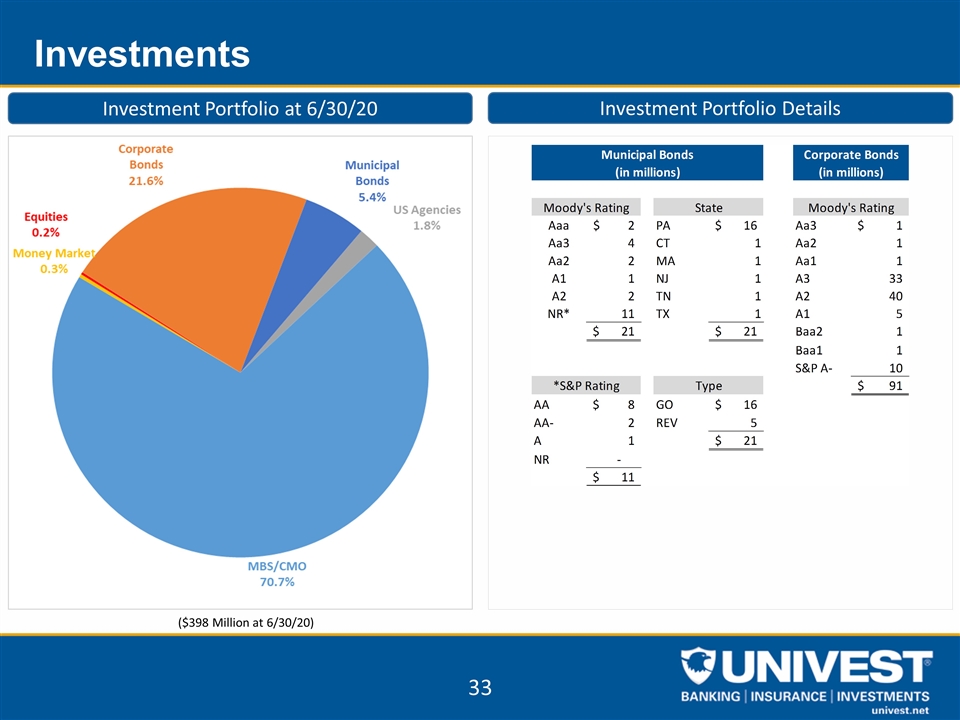

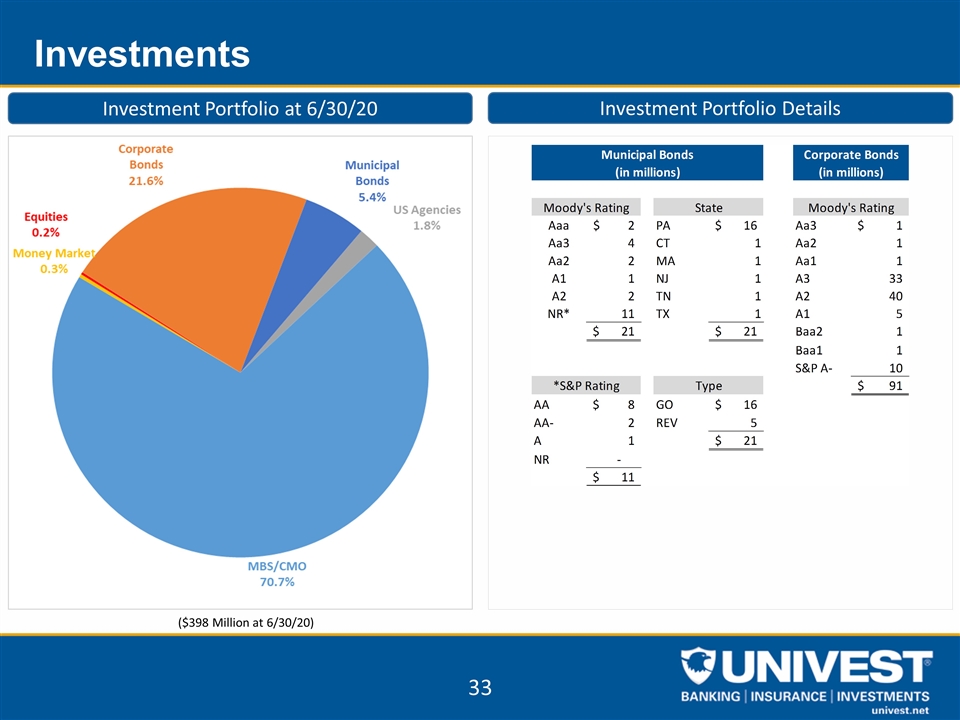

Investments ($398 Million at 6/30/20) Investment Portfolio at 6/30/20 Investment Portfolio Details

LOAN PORTFOLIO DETAIL AND CREDIT OVERVIEW

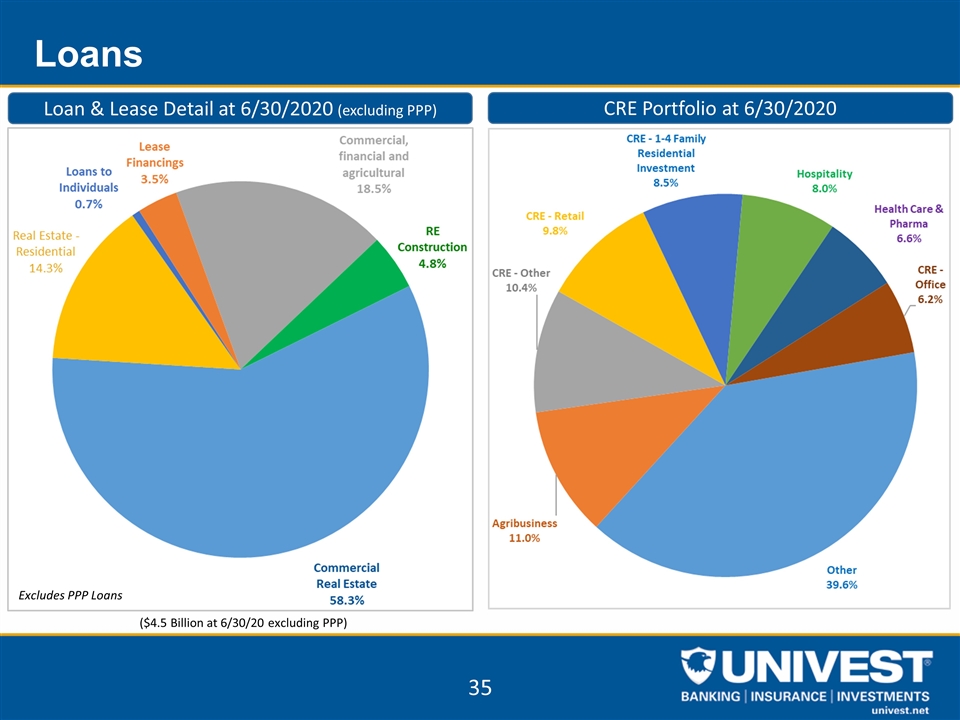

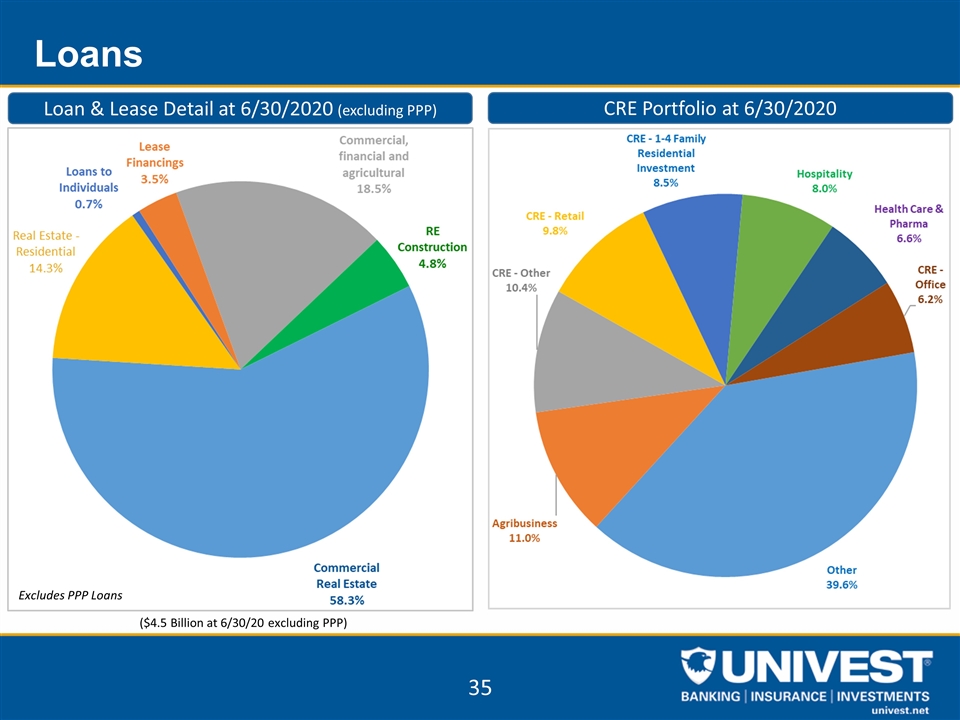

Loans ($4.5 Billion at 6/30/20 excluding PPP) Loan & Lease Detail at 6/30/2020 (excluding PPP) CRE Portfolio at 6/30/2020 Excludes PPP Loans

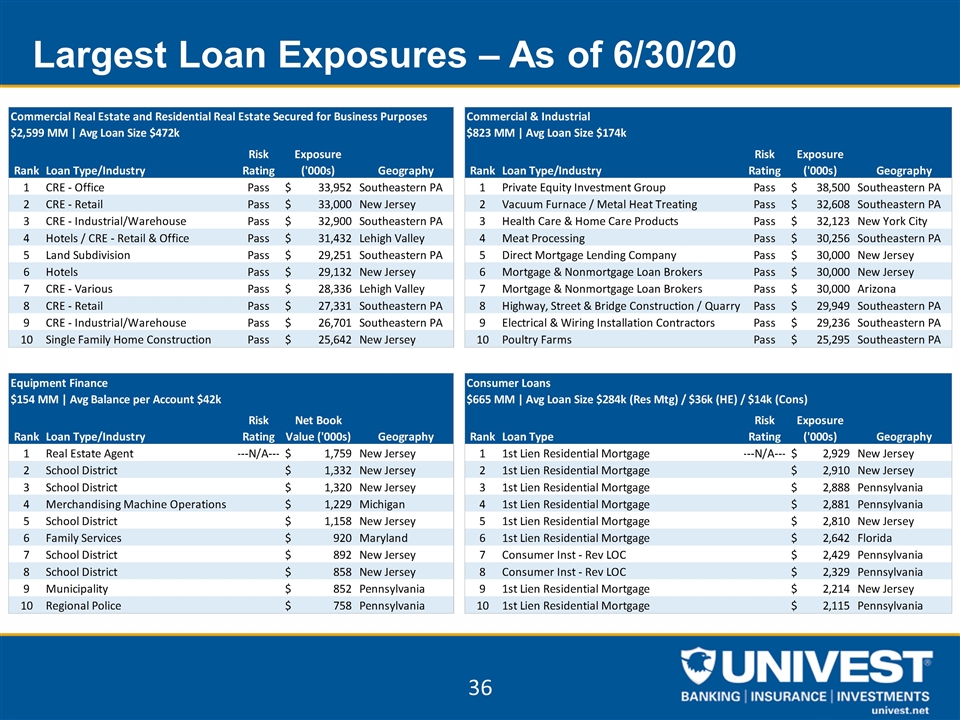

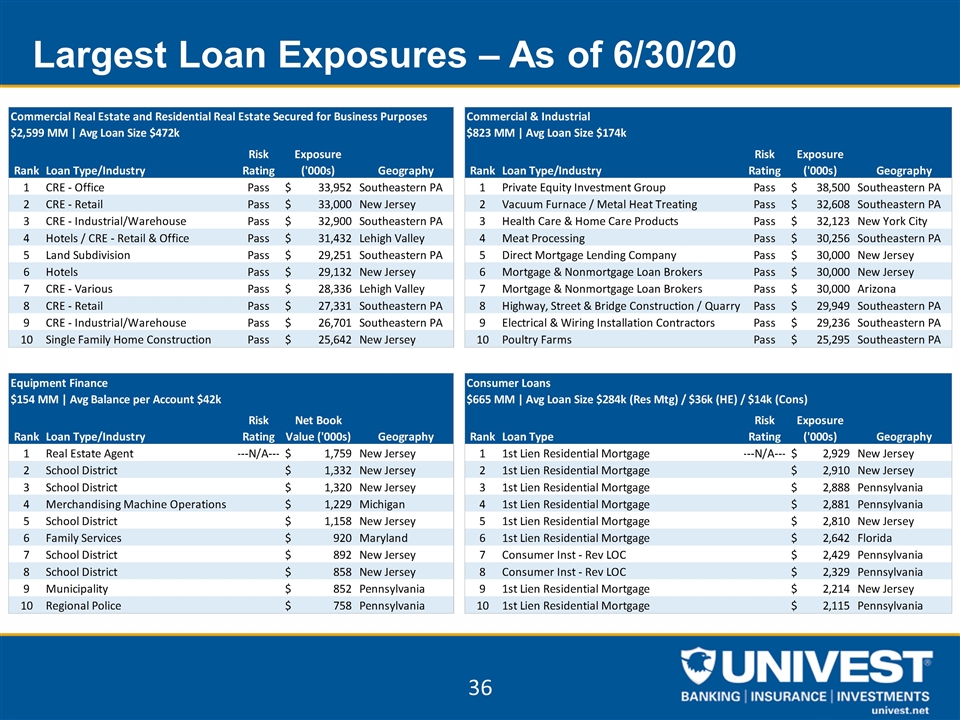

Largest Loan Exposures – As of 6/30/20

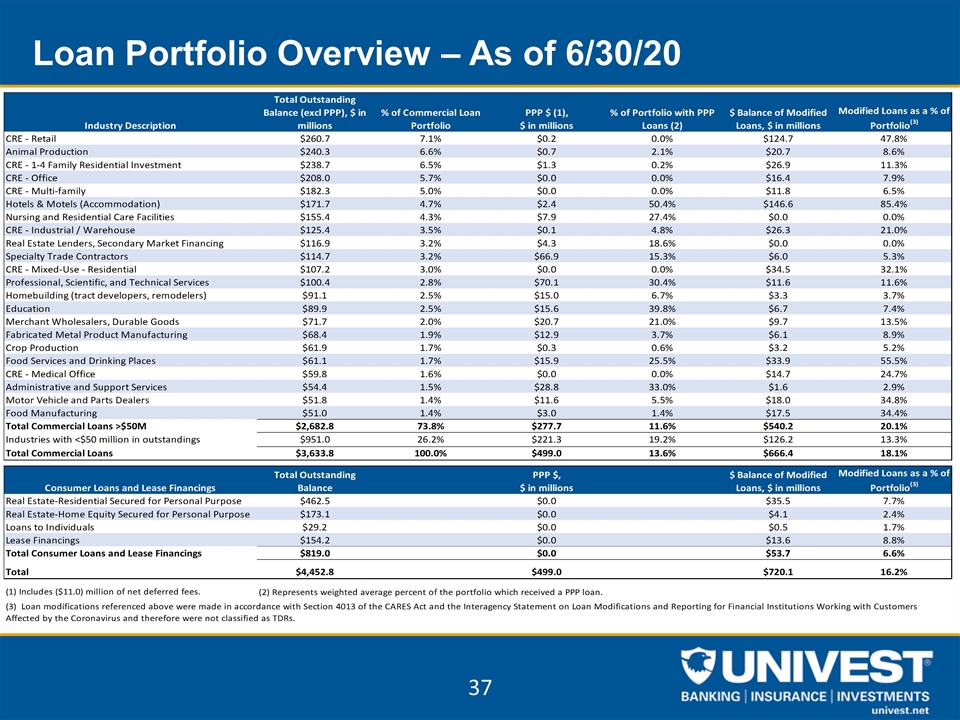

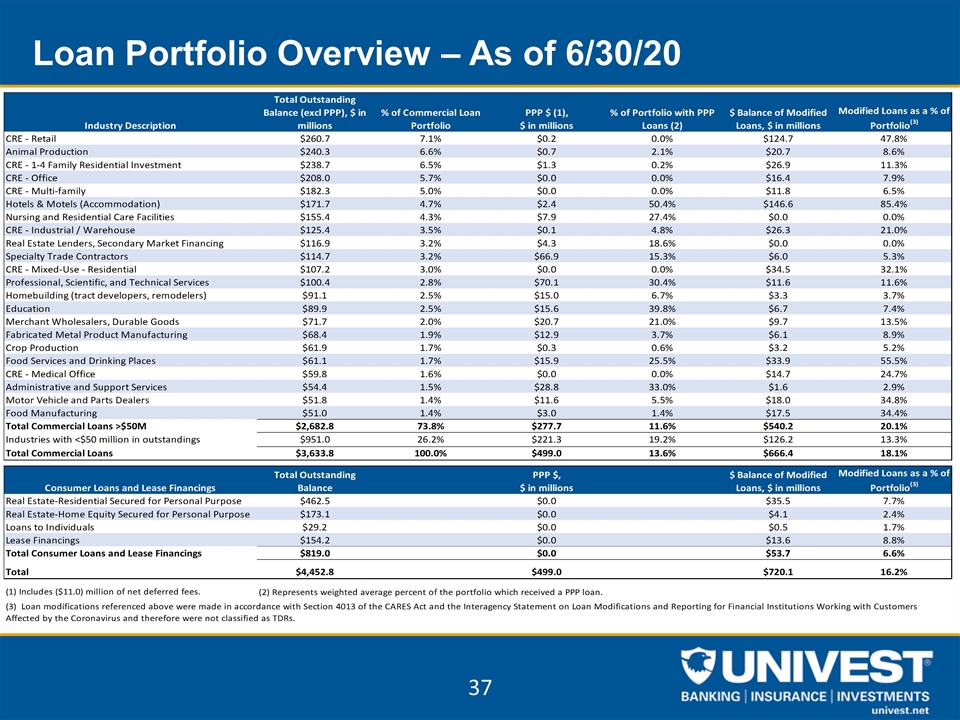

37 Loan Portfolio Overview – As of 6/30/20

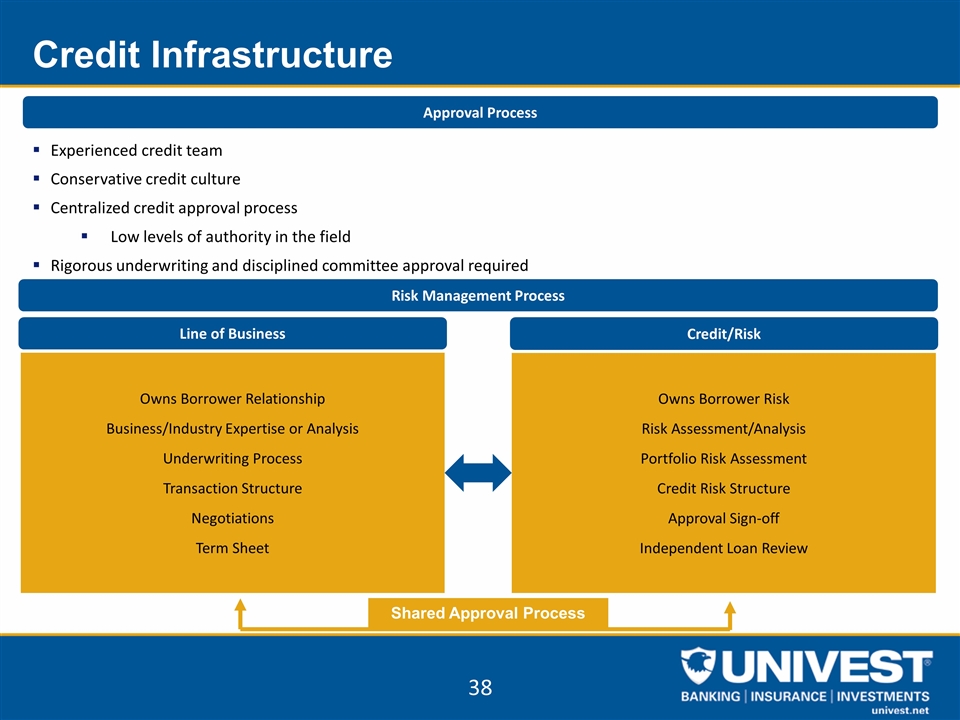

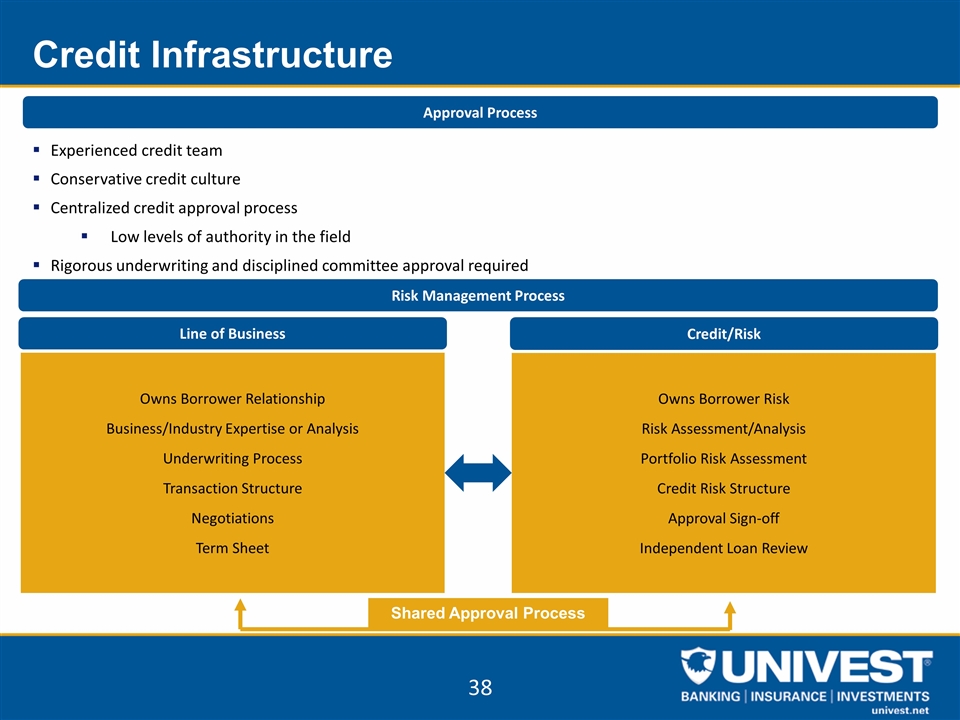

Credit Infrastructure Experienced credit team Conservative credit culture Centralized credit approval process Low levels of authority in the field Rigorous underwriting and disciplined committee approval required Approval Process Risk Management Process Owns Borrower Relationship Business/Industry Expertise or Analysis Underwriting Process Transaction Structure Negotiations Term Sheet Owns Borrower Risk Risk Assessment/Analysis Portfolio Risk Assessment Credit Risk Structure Approval Sign-off Independent Loan Review Shared Approval Process Line of Business Credit/Risk 38

Limited single signature lending authority. Joint signature up to $5.0 MM, then management level loan committee for the largest exposures. Itemized report of all approvals to weekly Officer Loan Committee. Robust independent loan review process. Quarterly review cycle. Credit Officer involvement in all relationships > $1.5MM, exceptions to Officer Loan Committee. Generally, lending is in Pennsylvania, Delaware, New Jersey and Maryland. Management of risk appetite through quarterly reporting to ERM Committee. In-House commercial concentrations levels vs. policy limits, out of market lending report, largest commercial borrowers, regulatory concentrations vs. risk based capital, CRE regulatory guidance report. CRE portfolio trends and market analysis, with stress testing, presented annually to ERM Committee, meeting regulatory expectations for portfolio stress testing. Independent departments for appraisal and environmental report ordering, construction loan disbursement and monitoring and loan grading risk assessments. Chief Risk Officer (Megan Santana) reports directly to the Board of Directors. 39 Credit Overview

BUSINESS UNIT OVERVIEW

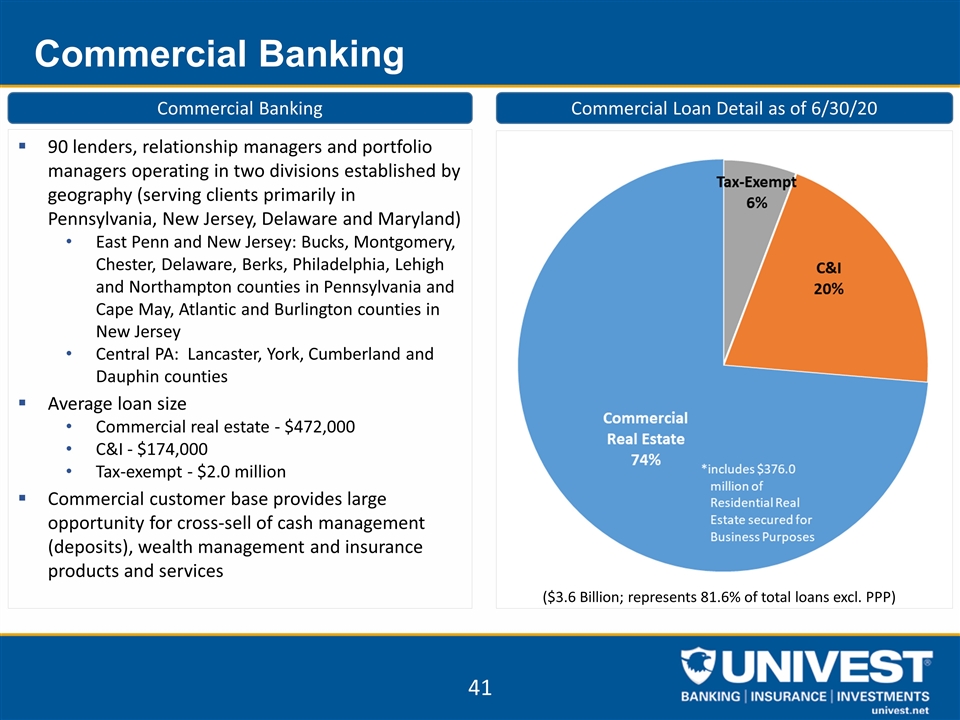

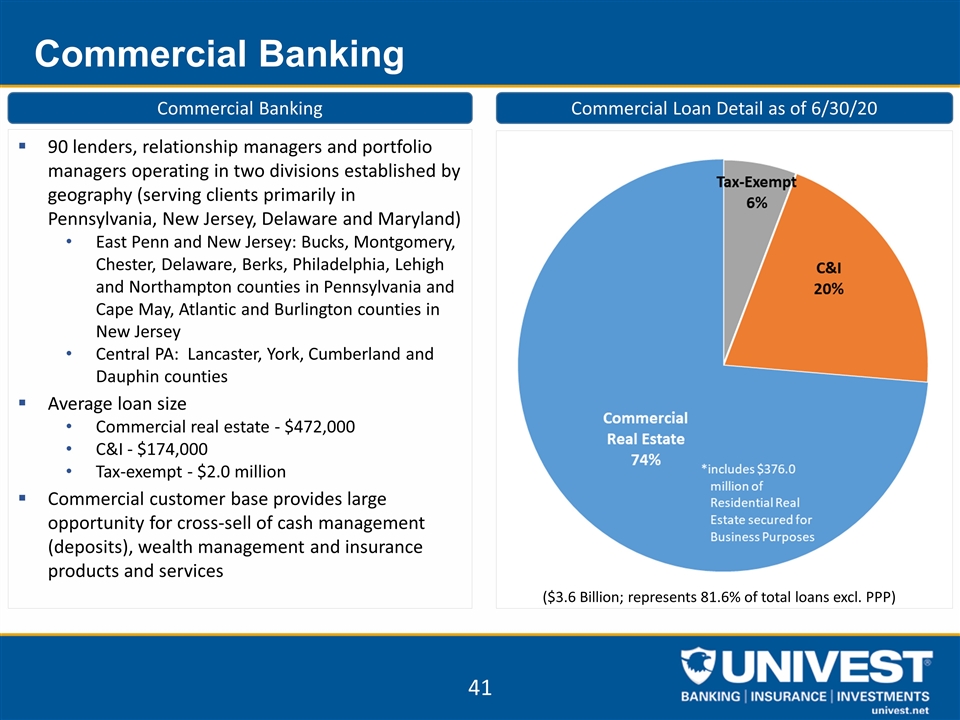

Commercial Banking 90 lenders, relationship managers and portfolio managers operating in two divisions established by geography (serving clients primarily in Pennsylvania, New Jersey, Delaware and Maryland) East Penn and New Jersey: Bucks, Montgomery, Chester, Delaware, Berks, Philadelphia, Lehigh and Northampton counties in Pennsylvania and Cape May, Atlantic and Burlington counties in New Jersey Central PA: Lancaster, York, Cumberland and Dauphin counties Average loan size Commercial real estate - $472,000 C&I - $174,000 Tax-exempt - $2.0 million Commercial customer base provides large opportunity for cross-sell of cash management (deposits), wealth management and insurance products and services ($3.6 Billion; represents 81.6% of total loans excl. PPP) Commercial Loan Detail as of 6/30/20 Commercial Banking

Consumer Banking 39 financial service centers located in Bucks, Chester, Lancaster, Lehigh, Montgomery, Northampton and Philadelphia counties in PA and Ocean City, NJ; also operating 14 retirement centers in Bucks and Montgomery counties Proactively addressed continued reduction in transactional volume by closing fifteen financial centers since September 2015; Reinvesting savings to cover our operating footprint Continued evaluation and optimization of financial center network; and Consolidate historical core market and reinvest in expanded footprint and technology Financial centers staffed by combination of personal bankers and tellers, providing both transaction and consultative services augmented by technology Focused on creating seamless customer experience between in-person and digital Growth strategy focused on obtaining consumer business from commercial customers and their employee base

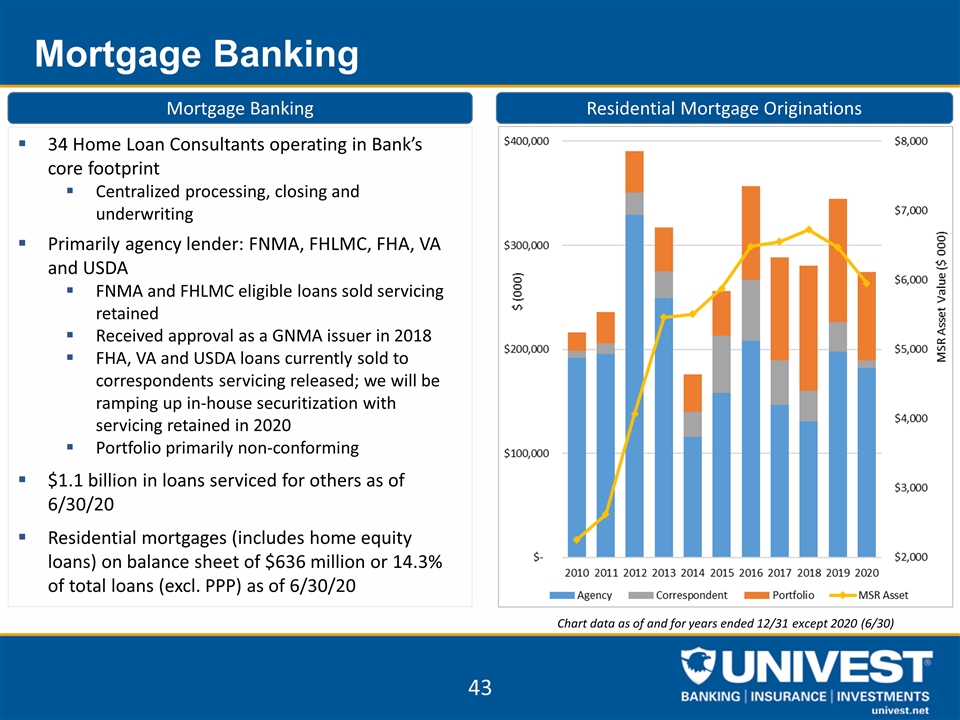

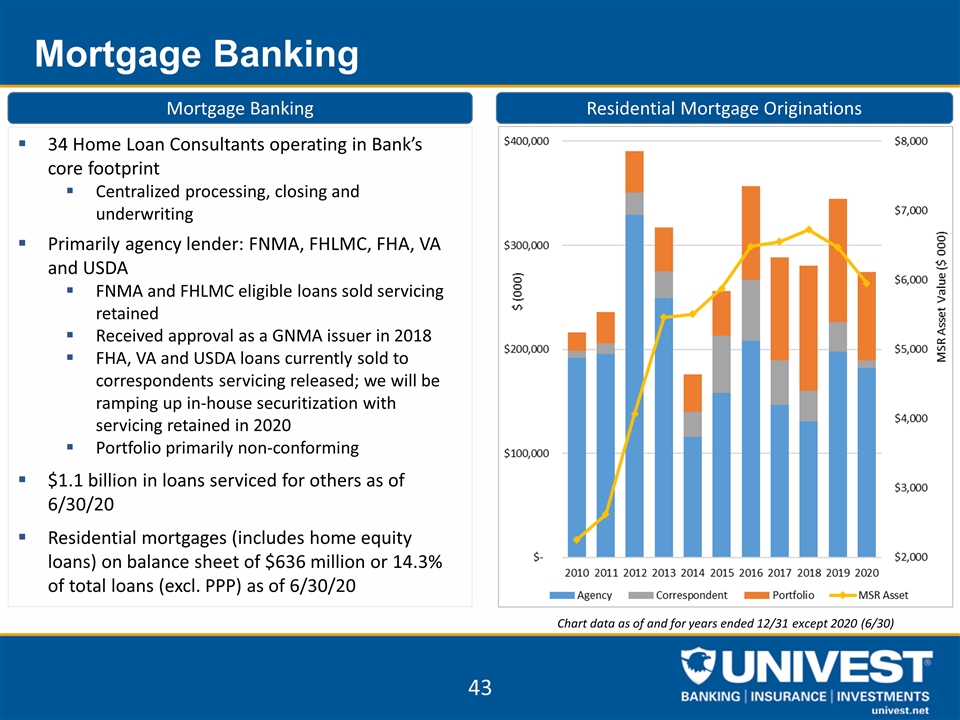

Mortgage Banking 34 Home Loan Consultants operating in Bank’s core footprint Centralized processing, closing and underwriting Primarily agency lender: FNMA, FHLMC, FHA, VA and USDA FNMA and FHLMC eligible loans sold servicing retained Received approval as a GNMA issuer in 2018 FHA, VA and USDA loans currently sold to correspondents servicing released; we will be ramping up in-house securitization with servicing retained in 2020 Portfolio primarily non-conforming $1.1 billion in loans serviced for others as of 6/30/20 Residential mortgages (includes home equity loans) on balance sheet of $636 million or 14.3% of total loans (excl. PPP) as of 6/30/20 Chart data as of and for years ended 12/31 except 2020 (6/30) Residential Mortgage Originations Mortgage Banking

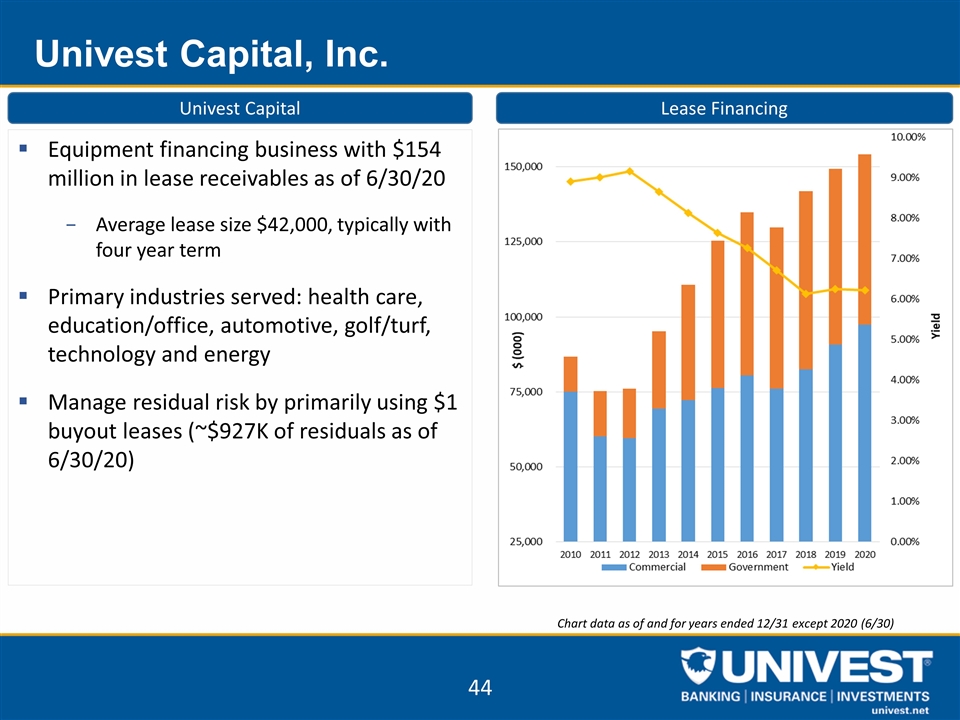

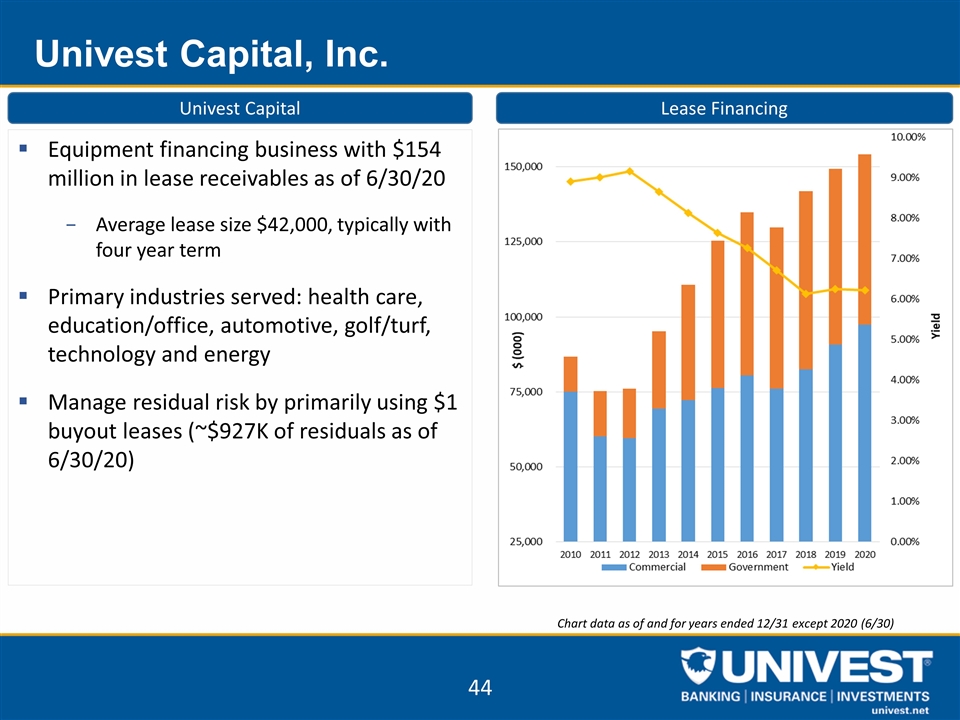

Univest Capital, Inc. Equipment financing business with $154 million in lease receivables as of 6/30/20 Average lease size $42,000, typically with four year term Primary industries served: health care, education/office, automotive, golf/turf, technology and energy Manage residual risk by primarily using $1 buyout leases (~$927K of residuals as of 6/30/20) Lease Financing Univest Capital Chart data as of and for years ended 12/31 except 2020 (6/30)

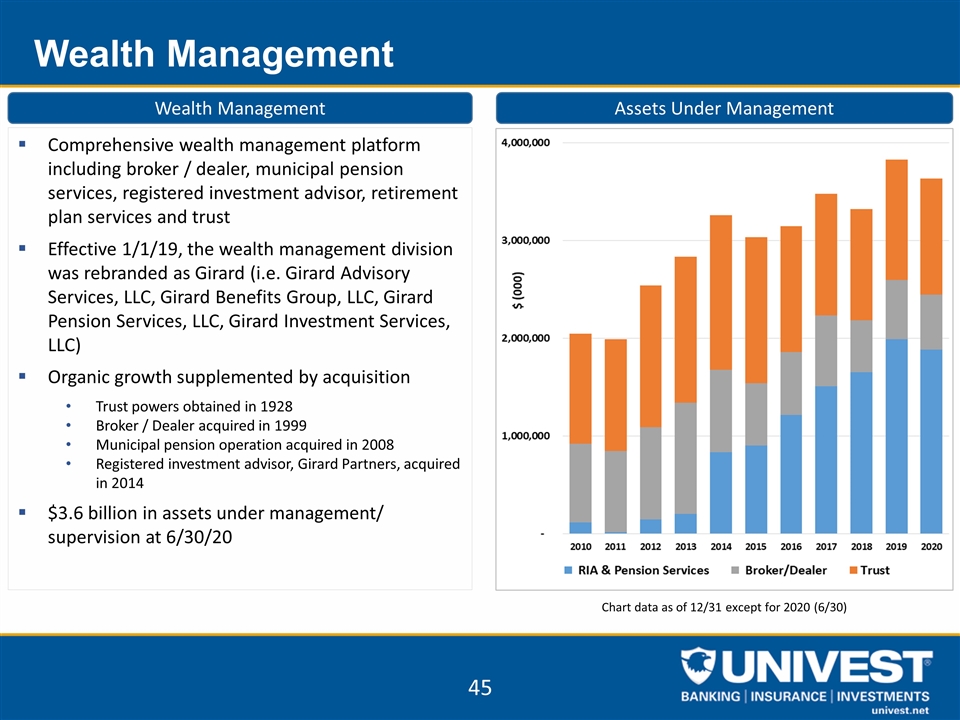

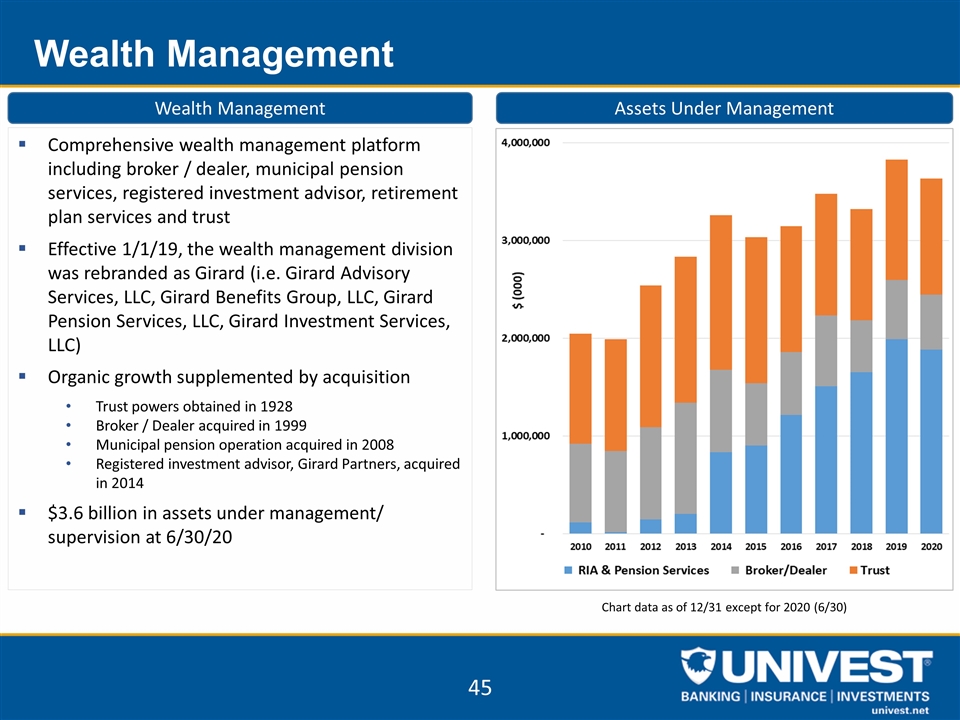

Wealth Management Comprehensive wealth management platform including broker / dealer, municipal pension services, registered investment advisor, retirement plan services and trust Effective 1/1/19, the wealth management division was rebranded as Girard (i.e. Girard Advisory Services, LLC, Girard Benefits Group, LLC, Girard Pension Services, LLC, Girard Investment Services, LLC) Organic growth supplemented by acquisition Trust powers obtained in 1928 Broker / Dealer acquired in 1999 Municipal pension operation acquired in 2008 Registered investment advisor, Girard Partners, acquired in 2014 $3.6 billion in assets under management/ supervision at 6/30/20 Chart data as of 12/31 except for 2020 (6/30) Assets Under Management Wealth Management

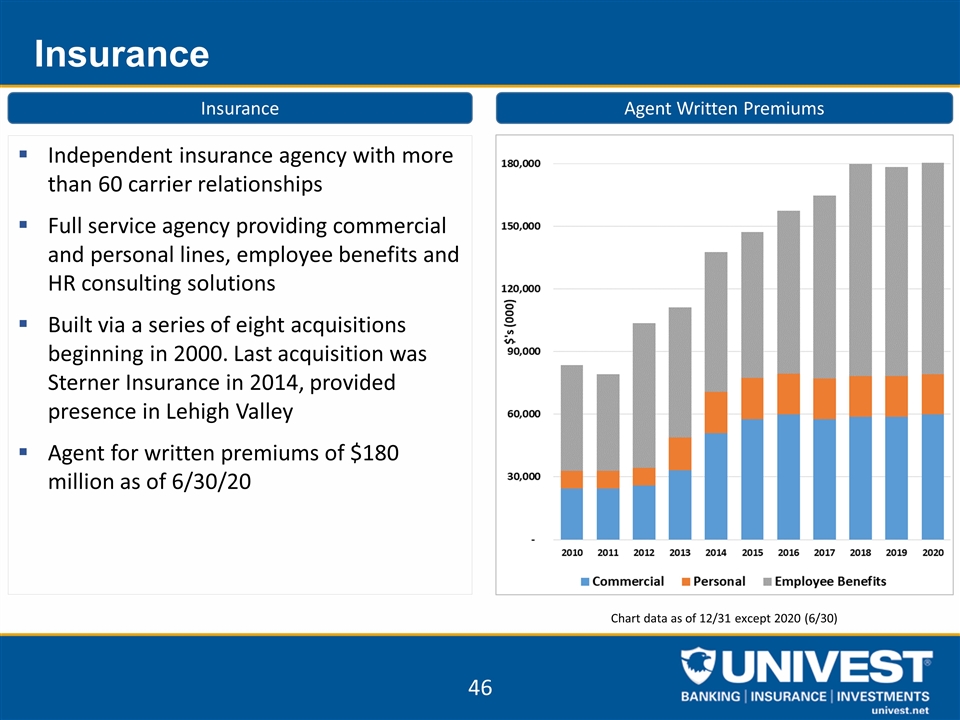

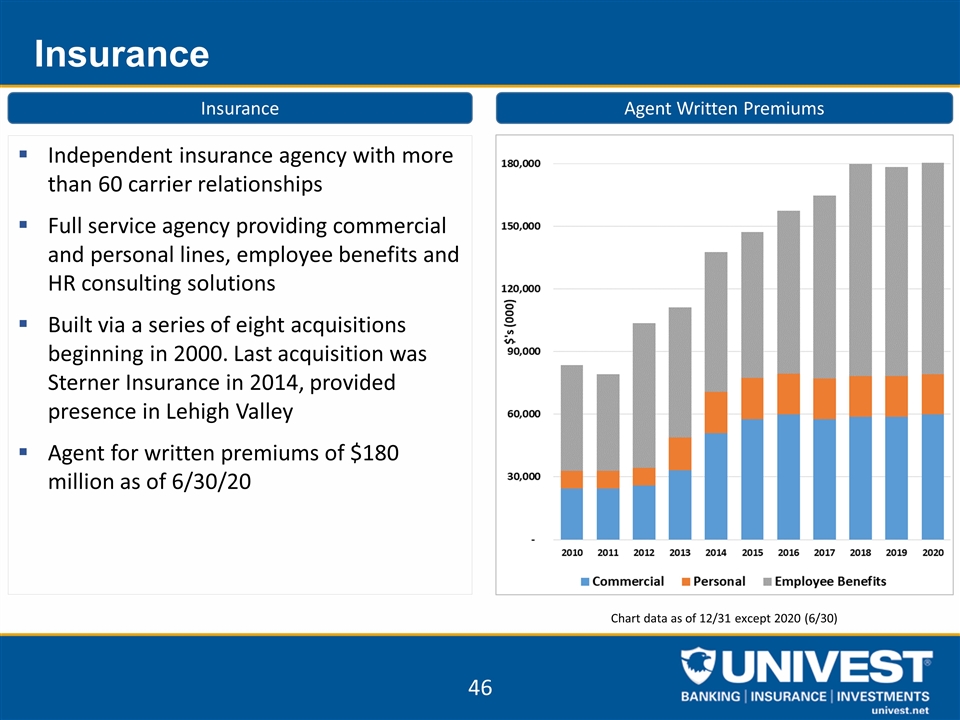

Insurance Independent insurance agency with more than 60 carrier relationships Full service agency providing commercial and personal lines, employee benefits and HR consulting solutions Built via a series of eight acquisitions beginning in 2000. Last acquisition was Sterner Insurance in 2014, provided presence in Lehigh Valley Agent for written premiums of $180 million as of 6/30/20 Chart data as of 12/31 except 2020 (6/30) Agent Written Premiums Insurance

APPENDIX (Non-GAAP Reconciliations)

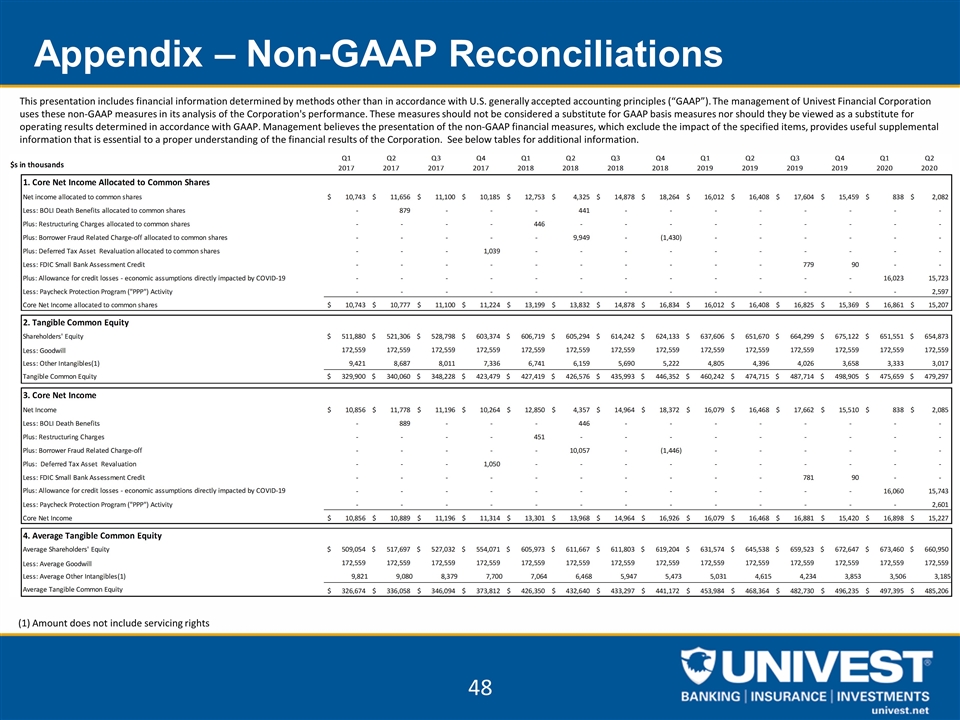

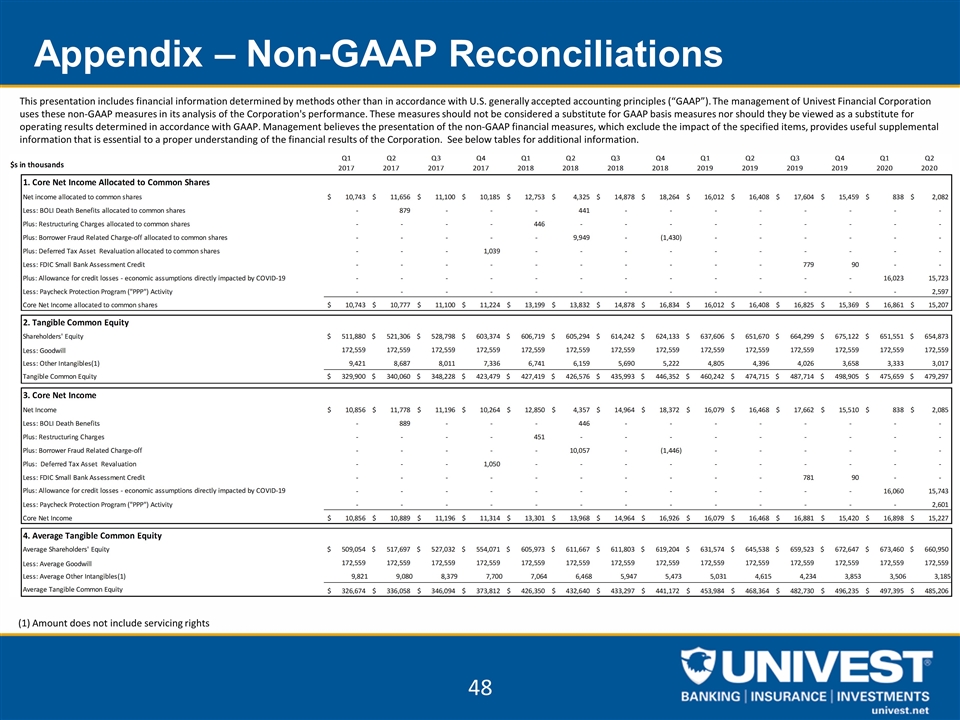

48 Appendix – Non-GAAP Reconciliations (1) Amount does not include servicing rights This presentation includes financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). The management of Univest Financial Corporation uses these non-GAAP measures in its analysis of the Corporation's performance. These measures should not be considered a substitute for GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with GAAP. Management believes the presentation of the non-GAAP financial measures, which exclude the impact of the specified items, provides useful supplemental information that is essential to a proper understanding of the financial results of the Corporation. See below tables for additional information.

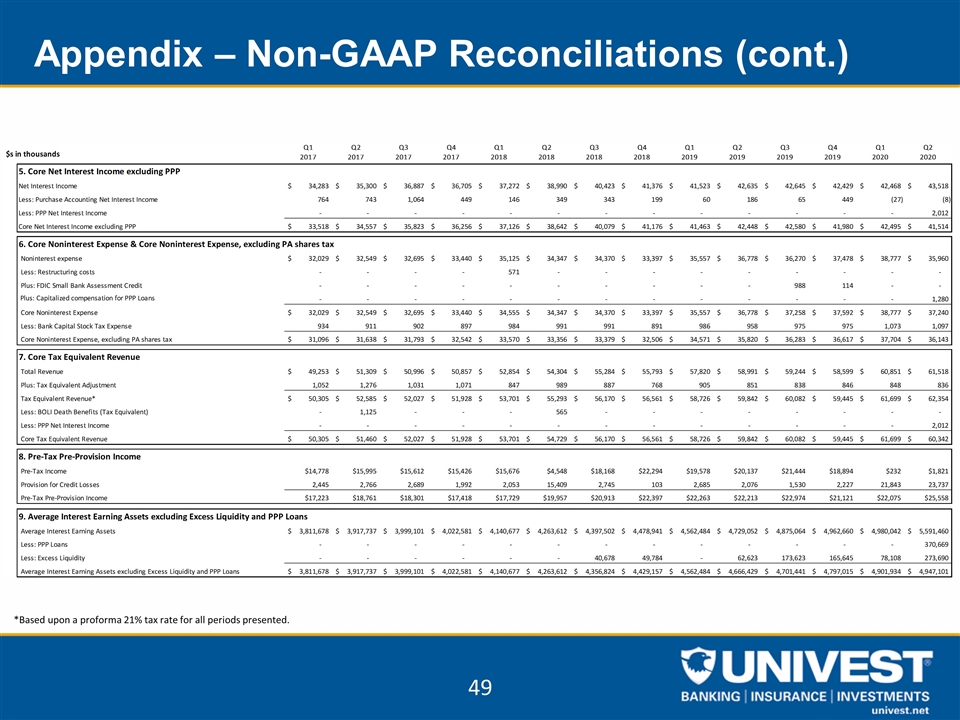

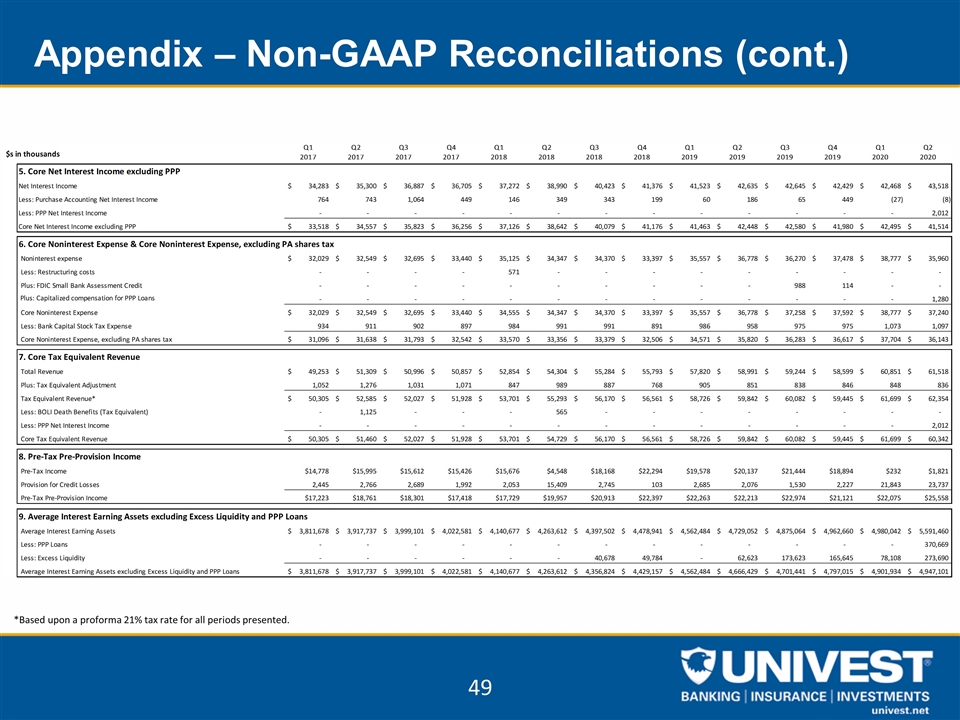

49 Appendix – Non-GAAP Reconciliations (cont.) *Based upon a proforma 21% tax rate for all periods presented.