Table of Contents

Filed pursuant to rule 424(b)(5)

Registration No. 333-224380

CALCULATION OF REGISTRATION FEE

| ||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (1) | ||

Debt Securities | $750,000,000 | $81,825.00 | ||

| ||||

| ||||

| (1) | The filing fee of $81,825.00 is calculated in accordance with Rule 457(r) of the Securities Act of 1933, as amended. |

Table of Contents

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 20, 2018)

Genesis Energy, L.P.

Genesis Energy Finance Corporation

$750,000,000

8.0% Senior Notes due 2027

The notes will bear interest at the rate of 8.0% per year. Interest on the notes is payable on January 15 and July 15 of each year, commencing on July 15, 2021. The notes will mature on January 15, 2027. We may redeem some or all of the notes at any time before maturity at the prices discussed under the section entitled “Description of Notes—Optional Redemption.”

The notes will be our senior unsecured obligations and will rank equally with all of our other unsubordinated indebtedness from time to time outstanding. Holders of any secured indebtedness will have claims that are senior in right of payment to your claims as holders of the notes, to the extent of the value of the assets securing such indebtedness, in the event of any bankruptcy, liquidation or similar proceeding. At the time of issuance, the notes will be guaranteed on a senior unsecured basis by each of our domestic subsidiaries that is a guarantor under our credit agreement other than Genesis Energy Finance Corporation. The notes will be structurally subordinated to the indebtedness and other liabilities of our non-guarantor subsidiaries. See “Description of Notes.”

The notes will not be listed on any securities exchange. The notes are a new issue of securities with no established trading market.

Investing in the notes involves risks. Read “Risk Factors” beginning on page S-15 of this prospectus supplement, on page 2 of the accompanying base prospectus, on page 32 of our Annual Report on Form 10-K for the year ended December 31, 2019 and on page 51 of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Public Offering Price(1) | Underwriting Discounts | Proceeds to Genesis (before expenses) | ||||||||||

Per Note | 100 | % | 1.5 | % | 98.5 | % | ||||||

Total | $ | 750,000,000 | $ | 11,250,000 | $ | 738,750,000 | ||||||

| (1) | Plus accrued interest from December 17, 2020, if settlement occurs after such date. |

The underwriters expect to deliver the notes in book entry form only, through the facilities of The Depository Trust Company, against payment on or about December 17, 2020.

Joint Book-Running Managers

| RBC CAPITAL MARKETS | WELLS FARGO SECURITIES | SMBC NIKKO | ||

| BNP PARIBAS | BOFA SECURITIES | CITIGROUP | ||

| CAPITAL ONE SECURITIES | SCOTIABANK | BBVA | ||

| FIFTH THIRD SECURITIES | REGIONS SECURITIES LLC | |

Co-manager

Raymond James

December 10, 2020.

Table of Contents

PROSPECTUS SUPPLEMENT

| Page | ||||

| iv | ||||

| S-1 | ||||

| S-15 | ||||

| S-24 | ||||

| S-25 | ||||

| S-27 | ||||

| S-31 | ||||

| S-91 | ||||

| Page | ||||

| S-98 | ||||

| S-102 | ||||

| S-109 | ||||

| S-109 | ||||

| S-110 | ||||

| S-113 | ||||

PROSPECTUS DATED APRIL 20, 2018

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 |

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 26 | ||||

| 27 | ||||

| 27 |

i

Table of Contents

Defeasance, Covenant Defeasance and Satisfaction and Discharge | 28 | |||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 48 | ||||

| 49 | ||||

| 50 |

| 51 | ||||

| 52 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 60 | ||||

| 62 | ||||

| 64 | ||||

| 64 | ||||

| 65 |

We expect that delivery of the notes will be made against payment therefor on or about the closing date specified on the cover page of this prospectus supplement, which will be the fifth business day following the date of this prospectus supplement. This settlement cycle is referred to as “T+5.” Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on any date prior to two business days before delivery will be required, by virtue of the fact that the notes initially will settle T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of notes who wish to trade notes on any date prior to two business days before delivery should consult their own advisor.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus prepared by or on our behalf relating to this offering of notes. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are offering to sell the notes, and seeking offers to buy the notes, only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is accurate as of any date other than the dates shown in these documents or that any information we have incorporated by reference herein is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

None of Genesis Energy, L.P., the underwriters or any of their respective representatives is making any representation to you regarding the legality of an investment in our notes by you under applicable laws. You should consult your own legal, tax and business advisors regarding an

ii

Table of Contents

investment in our notes. Information in this prospectus supplement and the accompanying base prospectus is not legal, tax or business advice to any prospective investor.

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus supplement are based on independent industry publications, government publications or other published independent sources. Although we believe these third-party sources are reliable and that the information is accurate and complete, we have not independently verified the information nor have we ascertained the underlying economic or operational assumptions relied upon therein. In addition, certain of these publications were published before the global COVID-19 pandemic and therefore do not reflect any impact of the COVID-19 pandemic on any specific market or globally.

iii

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of notes. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering of notes. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. If the information about the notes offering varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read “Where You Can Find More Information.”

iv

Table of Contents

This summary highlights information included or incorporated by reference in this prospectus supplement and the accompanying base prospectus. It does not contain all the information that may be important to you or that you may wish to consider before making an investment decision. You should read carefully the entire prospectus supplement, the accompanying base prospectus, the documents incorporated by reference and the other documents to which we refer for a more complete understanding of our business and the terms of this offering, as well as the tax and other considerations that are important to you in making your investment decision. Please read “Risk Factors” beginning on page S-15 of this prospectus supplement, on page 2 of the accompanying base prospectus, on page 32 of our Annual Report on Form 10-K for the year ended December 31, 2019 and on page 51 of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 for information regarding risks you should consider before investing in our notes. Except to the extent otherwise provided, the information contained in this prospectus supplement is as of September 30, 2020.

Unless the context otherwise requires, references in this prospectus supplement to (i)“Genesis Energy, L.P.,” “Genesis,” “we,” “our,” “us” or like terms refer to Genesis Energy, L.P. and its operating subsidiaries, including Genesis Energy Finance Corporation; (ii) “our general partner” refers to Genesis Energy, LLC, the general partner of Genesis; (iii) “Finance Corp.” or “co-issuer” refer to Genesis Energy Finance Corporation; and (iv)“CO2” means carbon dioxide and “NaHS,” which is commonly pronounced as “nash,” means sodium hydrosulfide.

Our Company

We are a growth-oriented master limited partnership formed in Delaware in 1996. Our common units are traded on the New York Stock Exchange, or NYSE, under the ticker symbol “GEL.” We are (i) a provider of an integrated suite of midstream services — primarily transportation, storage, sulfur removal, blending, terminalling and processing — for a large area of Gulf of Mexico and the Gulf Coast region of the crude oil and natural gas industry and (ii) one of the leading producers in the world of natural soda ash.

A core part of our focus is in the midstream sector of the crude oil and natural gas industry in the Gulf of Mexico and the Gulf Coast region of the United States. We provide an integrated suite of services to refiners, crude oil and natural gas producers, and industrial and commercial enterprises and have a diverse portfolio of assets, including pipelines, offshore hub and junction platforms, refinery-related plants, storage tanks and terminals, railcars, rail unloading facilities, barges and other vessels, and trucks.

The other core focus of our business is our trona and trona-based exploring, mining, processing, producing, marketing and selling business based in Wyoming (our “Alkali Business”). Our Alkali Business mines and processes trona from which it produces natural soda ash, also known as sodium carbonate (Na2CO3), a basic building block for a number of ubiquitous products, including flat glass, container glass, dry detergent and a variety of chemicals and other industrial products. Our Alkali business has a diverse customer base in the United States, Canada, the European Community, the European Free Trade Area and the South African Customs Union with many long-term relationships. It has been operating for over 70 years and has an estimated remaining reserve life (based on 2019 production) of over 100 years related to the seam currently being mined.

Within our midstream business, we have two distinct, complementary types of operations — (i) our offshore Gulf of Mexico crude oil and natural gas pipeline transportation and handling operations, which focus on providing a suite of services primarily to integrated and large independent energy companies who

S-1

Table of Contents

make intensive capital investments to develop numerous large-reservoir, long-lived crude oil and natural gas properties and (ii) our onshore-based refinery-centric operations located primarily in the Gulf Coast region of the U.S., which focus on providing a suite of services primarily to refiners, which includes our transportation, storage, sulfur removal, and other handling services. Our onshore-based operations occur upstream of, at, and downstream of refinery complexes. Upstream of refineries, we aggregate, purchase, gather and transport crude oil, which we sell to refiners. Within refineries, we provide services to assist in sulfur removal/balancing requirements. Downstream of refineries, we provide transportation services as well as market outlets for finished refined petroleum products and certain refining by-products. In our offshore crude oil and natural gas pipeline transportation and handling operations, we provide services to one of the most active drilling and development regions in the U.S. — the Gulf of Mexico, a producing region representing approximately 16% of the crude oil production in the U.S. in 2019.

Our operations include, among others, the following diversified businesses, each of which is one of the leaders in its market, has a long commercial life and has significant barriers to entry:

| • | one of the largest pipeline networks (based on throughput capacity) in the Deepwater area of the Gulf of Mexico, an area that produced approximately 16% of the oil produced in the U.S. in 2019, |

| • | one of the largest providers of crude oil and petroleum transportation, storage, and other handling services for large, complex refineries in Baton Rouge, Louisiana and Baytown, Texas, both of which have been operational for approximately 100 years, |

| • | one of the leading producers (based on tons produced) of natural soda ash in the world, and |

| • | the largest producer and marketer (based on tons produced), we believe, of NaHS in North and South America. |

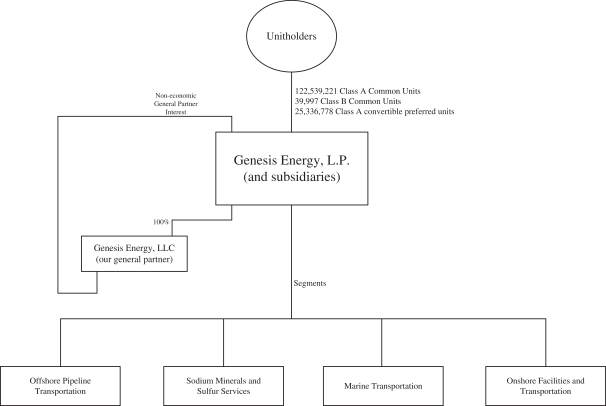

We conduct our operations and own our operating assets through our subsidiaries and joint ventures. Our general partner, Genesis Energy, LLC, a wholly-owned subsidiary that owns a non-economic general partner interest in us, has sole responsibility for conducting our business and managing our operations. Our outstanding common units (including our Class B common units), and our outstanding Class A convertible preferred units, representing limited partner interests, constitute all of the economic equity interests in us.

We currently manage our businesses through four divisions that constitute our reportable segments—offshore pipeline transportation, sodium minerals and sulfur services, onshore facilities and transportation and marine transportation.

Offshore Pipeline Transportation Segment

We conduct our offshore crude oil and natural gas pipeline transportation and handling operations through our offshore pipeline transportation segment, which focuses on providing a suite of services to integrated and large independent energy companies who make intensive capital investments (often in excess of billions of dollars) to develop numerous large-reservoir, long-lived crude oil and natural gas properties in the Gulf of Mexico, primarily offshore Texas, Louisiana, Mississippi and Alabama. This segment provides services to one of the most active drilling and development regions in the U.S. — the Gulf of Mexico, a producing region representing approximately 16% of the crude oil production in the U.S. in 2019. Even though those large-reservoir properties and the related pipelines and other infrastructure needed to develop them are capital intensive, we believe they are generally much less sensitive to short-term commodity price volatility, particularly once a project has been sanctioned. Due to the size and scope of these activities, our customers are predominantly large integrated oil companies and large independent crude oil producers.

S-2

Table of Contents

We own interests in various offshore crude oil and natural gas pipeline systems, platforms and related infrastructure. We own interests in approximately 1,422 miles of crude oil pipelines with an aggregate design capacity of approximately 1,800 MBbls per day, a number of which pipeline systems are substantial and/or strategically located. For example, we own a 64% interest in the Poseidon pipeline system and 100% in the Cameron Highway pipeline system, or CHOPS, which is one of the largest crude oil pipelines (in terms of both length and design capacity) located in the Gulf of Mexico. We also own 100% of the Southeast Keathley Canyon Pipeline Company, LLC, which owns a deepwater pipeline servicing the Lucius, Buckskin and Hadrian North fields in the southern Keathley Canyon area of the Gulf of Mexico.

Our interests in operating offshore natural gas pipeline systems and related infrastructure include approximately 815 miles of pipe with an aggregate design capacity of approximately 2,313 MMcf per day. We also own an interest in four offshore hub platforms, three of which are operational, with aggregate processing capacity of approximately 711 MMcf per day of natural gas and 159 MBbls per day of crude oil.

Our offshore pipelines generate cash flows from fees charged to customers or substantially similar arrangements that otherwise limit our direct exposure to changes in commodity prices. Each of our offshore pipelines currently has significant available capacity (with minimal to no additional capital investment required from us) to accommodate future growth in the fields from which the production is dedicated to that pipeline, including fields that have yet to commence production activities, as well as volumes from non-dedicated fields.

Sodium Minerals and Sulfur Services Segment

Our Alkali Business owns the largest leasehold position of accessible trona ore reserves in the Green River, Wyoming trona patch, a geological formation holding the vast majority of the world’s accessible trona ore reserves. Our Alkali Business holds leases covering approximately 87,000 acres of land, containing an estimated 895 million-short tons of proved and probable reserves of trona ore as of December 31, 2019, representing an estimated remaining reserve life of over 100 years, soda ash production facilities, underground trona ore mines and solution mining operations and related equipment, logistics and other assets.

Our Alkali Business has been mining trona and producing soda ash in the Green River, Wyoming trona patch for over 70 years. All of our Alkali Business’ mining and processing activities are conducted at our “Westvaco” and “Granger” facilities in Wyoming. Utilizing our two facilities near Green River, Wyoming, our Alkali Business involves the mining of trona ore, processing the trona ore into soda ash, also known as sodium carbonate (Na2CO3), and the marketing, selling and distribution of the soda ash and specialty products.

We sell our soda ash and specialty products to a diverse customer base directly in the United States, Canada, the European Community, the European Free Trade Area and the South African Customs Union. Our Alkali Business also sells through the American Natural Soda Ash Corporation, or ANSAC, exclusively in all other markets. ANSAC is a nonprofit foreign sales association of which our Alkali Business and two other U.S. soda ash producers are members, whose purpose is to promote export sales of U.S. produced soda ash in conformity with the Webb-Pomerene Act. ANSAC is our Alkali Business’ largest customer.

The global market in which our Alkali Business operates is competitive. Competition is based on a number of factors such as price, favorable logistics and consistent customer service. In North America, primary competition is from other U.S.-based natural soda ash operations: Solvay Chemicals, Ciner

S-3

Table of Contents

Resources, L.P., Tata Chemicals Soda Ash Partners in Wyoming, and Searles Valley Minerals, in California.

Our subsidiaries holding the assets by which we conduct our Alkali Business will not guarantee the notes.

As part of our sulfur services business, we primarily (i) provide sulfur removal services by processing refineries high sulfur (or “sour”) gas streams to remove the sulfur at ten refining operations located mostly in Texas, Louisiana, Arkansas, Oklahoma, Montana and Utah; (ii) operate significant storage and transportation assets in relation to those services; and (iii) sell NaHS and NaOH (also known as caustic soda) to large industrial and commercial companies. Our sulfur removal services footprint also includes NaHS and caustic soda terminals, and we utilize railcars, ships, barges and trucks to transport product. Our sulfur removal services contracts are typically long-term in nature and have an average remaining term of approximately three years. NaHS is a by-product derived from our refinery sulfur removal services process, and it constitutes the sole consideration we receive for these services. A majority of the NaHS we receive is sourced from refineries owned and operated by large companies, including Phillips 66, CITGO, HollyFrontier, Calumet and Ergon. We sell our NaHS to customers in a variety of industries, with the largest customers involved in mining of base metals, primarily copper and molybdenum, and the production of pulp and paper. We believe we are one of the largest producers and marketers of NaHS in North and South America.

Onshore Facilities and Transportation Segment

Our onshore facilities and transportation segment owns and/or leases our increasingly integrated suite of onshore crude oil and refined products infrastructure, including pipelines, trucks, terminals, railcars, and rail unloading facilities. It uses those assets, together with other modes of transportation owned by third parties and us, to service its customers and for its own account. The increasingly integrated nature of our onshore facilities and transportation assets is particularly evident in certain of our more recently completed infrastructure projects in areas such as Louisiana and Texas.

We own four onshore crude oil pipeline systems, with approximately 460 miles of pipe located primarily in Alabama, Florida, Louisiana, Mississippi and Texas that are rate regulated by the Federal Energy Regulatory Commission, or FERC. The rates for certain segments of our Texas onshore pipeline are regulated by the Railroad Commission of Texas. Our onshore pipelines generate cash flows from fees charged to customers. Each of our onshore pipelines has significant available capacity to accommodate potential future growth in volumes.

We own four operational crude oil rail unloading facilities located in Baton Rouge, Louisiana; Raceland, Louisiana; Walnut Hill, Florida; and Natchez, Mississippi which provide synergies to our existing asset footprint. We generally earn a fee for unloading railcars at these facilities. Three of these facilities, our Baton Rouge, Louisiana, Raceland, Louisiana, and Walnut Hill, Florida facilities are directly connected to our existing integrated crude oil pipeline and terminal infrastructure.

In addition to the above, as of December 31, 2019, we had access to a suite of approximately 200 trucks, 300 trailers, 397 railcars, and terminals and tankage with 4.3 million barrels of storage capacity (excluding capacity associated with our common carrier crude oil pipelines) in multiple locations along the Gulf Coast, which we use to service customers and for its own account. Usually, our onshore facilities and transportation segment experiences limited direct commodity price risk because it utilizes back-to-back purchases and sales, matching sale and purchase volumes on a monthly basis. Unsold volumes are hedged with NYMEX derivatives to offset the remaining price risk.

S-4

Table of Contents

Marine Transportation Segment

We own a fleet of 91 barges (82 inland and 9 offshore) with a combined transportation capacity of 3.2 million barrels and 42 push/tow boats (33 inland and 9 offshore). Our marine transportation segment is a provider of transportation services by tank barge primarily for refined petroleum products, including heavy fuel oil and asphalt, as well as crude oil. Refiners accounted for over 80% of our marine transportation volumes for 2019.

We also own the M/T American Phoenix, an ocean going tanker with 330,000 barrels of cargo capacity. The M/T American Phoenix is currently transporting crude oil.

We are a provider of transportation services for our customers and, in almost all cases, do not assume ownership of the products that we transport. Our marine transportation services are conducted under term contracts, some of which have renewal options for customers with whom we have traditionally had long-standing relationships, and spot contracts. For more information regarding our charter arrangements, please refer to the marine transportation segment discussion below. All of our vessels operate under the U.S. flag and are qualified for domestic trade under the Jones Act.

Our Objectives and Strategies

Our primary objective continues to be to generate and grow stable cash flows and deleverage our balance sheet, while never wavering from our commitment to safe and responsible operations. We believe (i) the stable and repeatable cash flows from our four operating segments for the foreseeable future; (ii) new long-term commercial opportunities that will provide significant incremental volumes on our already constructed offshore pipeline transportation assets that require no additional investment from us; and (iii) minimal expected growth capital expenditures in 2020 and for the foreseeable future with the exception of the expansion of our Granger soda ash facility, which can be fully funded externally, together allow us the flexibility to use any excess cash flow from operations to pay down borrowings, and naturally deleverage our balance sheet. These strategies allow us to further enhance our financial flexibility to opportunistically pursue accretive organic projects and acquisitions should they present themselves.

Business Strategy

Our primary business strategy is to provide an integrated suite of services to refiners, crude oil and natural gas producers, and industrial and commercial enterprises. Successfully executing this strategy should enable us to generate and grow stable cash flows.

Within our midstream business, we have two distinct, complementary types of operations: (i) our offshore Gulf of Mexico crude oil and natural gas pipeline transportation and handling operations, which focus on providing a suite of services primarily to integrated and large independent energy companies who make intensive capital investments (often in excess of billions of dollars) to develop numerous large-reservoir, long-lived crude oil and natural gas properties; and (ii) our onshore-based-refinery-centric operations located primarily in the Gulf Coast region of the U.S., which focus on providing a suite of services primarily to refiners, which includes our sulfur removal, transportation, storage, and other handling services. In 2019, refiners were the shippers of approximately 97% of the volumes transported on our onshore crude pipelines, and refiners contract for over 80% of the use of our inland barges, which are used primarily to transport intermediate refined products (not crude oil) between refining complexes. The integrated and large independent energy companies that use our offshore oil pipelines produce oil that is ideally suited for the vast majority of refineries along the Gulf Coast, unlike the lighter crude oil and condensates produced from numerous onshore shale plays.

S-5

Table of Contents

Our Alkali Business is one of the world’s leading producers of natural soda ash. Natural soda ash accounts for approximately 30% of the world’s production of soda ash. We believe the significant cost advantage in the production of natural soda ash over synthetically produced soda ash will remain for the foreseeable future, somewhat mitigating the effects of market specific factors in the soda ash market in which we operate.

We intend to develop our business by:

| • | Identifying and exploiting incremental profit opportunities, including cost synergies, across an increasingly integrated footprint; |

| • | Optimizing our existing assets and creating synergies through additional commercial and operating advancement; |

| • | Leveraging customer relationships across business segments; |

| • | Attracting new customers and expanding our scope of services offered to existing customers; |

| • | Expanding the geographic reach of our businesses; |

| • | Economically expanding our pipeline and terminal operations by utilizing capacity currently available on our existing assets that requires minimal to no additional investment; |

| • | Evaluating internal and third party growth opportunities (including asset and business acquisitions) that leverage our core competencies and strengths and further integrate our businesses; and |

| • | Focusing on health, safety and environmental stewardship. |

Financial Strategy

We believe that preserving financial flexibility is an important factor in our overall strategy and success. Over the long-term, we intend to:

| • | Increase the relative contribution of recurring and throughput-based revenues, emphasizing longer-term contractual arrangements; |

| • | Prudently manage our limited direct commodity price risks; |

| • | Maintain a sound, disciplined capital structure, including our current and forward path to deleveraging, as well as being cash flow neutral or positive in 2020 and the foreseeable future; and |

| • | Create strategic arrangements and share capital costs and risks through joint ventures and strategic alliances. |

Our Competitive Strengths

We believe we are well positioned to execute our strategies and ultimately achieve our objectives due primarily to the following competitive strengths:

| • | Our businesses encompass a balanced, diversified portfolio of customers, operations and assets. We operate four business segments and own and operate assets that enable us to provide a number of services primarily to refiners, crude oil and natural gas producers, and industrial and commercial enterprises that use natural soda ash, NaHS and caustic soda. Our business lines complement each other by allowing us to offer an integrated suite of services to common customers across segments. |

S-6

Table of Contents

Our businesses are primarily focused on (i) providing offshore crude oil and natural gas pipeline transportation and related handling services in the Gulf of Mexico to mostly integrated and large independent energy companies, (ii) producing sodium minerals and sulfur removal and (iii) providing onshore-based refinery-centric crude oil and refined products transportation and handling services. We are not dependent upon any one customer or principal location for our revenues. |

| • | Certain of our businesses are among the leaders in each of their respective markets and each of which has a long commercial life and significant barriers to entry. We operate, among others, diversified businesses, each of which is one of the leaders in its market, has a long commercial life and has significant barriers to entry. We operate one of the largest pipeline networks (based on throughput capacity) in the Deepwater area of the Gulf of Mexico, an area that produced approximately 16% of the oil produced in the U.S. in 2019. We are one of the leading producers (based on tons produced) of natural soda ash in the world. We believe we are the largest producer and marketer (based on tons produced) of NaHS in North and South America. We are one of the largest providers of crude oil and petroleum product transportation, storage and other handling services for large, complex refineries in Baton Rouge, Louisiana and Baytown, Texas, both of which have been operational for approximately 100 years. |

| • | Our offshore Gulf of Mexico crude oil and natural gas pipeline transportation and handling operations are located in a significant producing region with large-reservoir, long-lived crude oil and natural gas properties. We provide a suite of services, primarily to integrated and large independent energy companies who make intensive capital investments to develop numerous large-reservoir, long-lived crude oil and natural gas properties, in one of the most active drilling and development regions in the U.S.-the Gulf of Mexico, a producing region representing approximately 16% of the crude oil production in the U.S. in 2019. |

| • | Our Alkali Business has significant cost advantages over synthetic production methods. Our Alkali Business has significant cost advantages over synthetic production methods, including lower raw material and energy requirements. According to IHS, on average, the cash cost to produce material soda ash has been about half of the cost to produce synthetic soda ash. |

| • | Our expertise and reputation for high performance standards and quality enable us to provide refiners with economic and proven services. Our extensive understanding of the sulfur removal process and crude oil refining can provide us with an advantage when evaluating new opportunities and/or markets. |

| • | Some of our pipeline transportation and related assets are strategically located. Our pipelines are critical to the ongoing operations of our refiner and producer customers. In addition, a majority of our terminals are located in areas that can be accessed by pipeline, truck, rail or barge. Some of our onshore facilities and transportation assets are operationally flexible. Our portfolio of trucks, railcars, barges and terminals affords us flexibility within our existing regional footprint and provides us the capability to enter new markets and expand our customer relationships. |

| • | Our marine transportation assets provide waterborne transportation throughout North America. Our fleet of barges and boats provide service to both inland and offshore customers within a large North American geographic footprint. All of our vessels operate under the U.S. flag and are qualified for U.S. coastwise trade under the Jones Act. |

| • | We have limited direct commodity price risk exposure in our oil and gas and NaHS businesses. The volumes of crude oil, refined products or intermediate feedstocks we purchase are either subject |

S-7

Table of Contents

to back-to-back sales contracts or are hedged with NYMEX derivatives to limit our direct exposure to movements in the price of the commodity, although we cannot completely eliminate commodity price exposure. Our risk management policy requires us to monitor the effectiveness of the hedges to maintain a value at risk of such hedged inventory not in excess of $2.5 million. In addition, our service contracts with refiners allow us to adjust the rates we charge for processing to maintain a balance between NaHS supply and demand. |

| • | We are financially flexible and have significant liquidity. As of September 30, 2020, on an adjusted pro forma basis after giving effect to the application of the net proceeds from the sale of our Free State CO2 pipeline and the repurchase of approximately $56.1 million in aggregate principal amount of certain of our existing notes (as defined below in “— Ownership Structure”), we had $687.3 million available under our $1.7 billion revolving credit agreement, subject to compliance with financial covenants, including up to $172.2 million available under the $200.0 million petroleum products inventory loan sublimit and $98.9 million available for letters of credit. Our inventory borrowing base was $27.8 million at September 30, 2020. |

| • | Our businesses provide relatively consistent consolidated financial performance. Our historically consistent and improving financial performance, combined with our goal of a conservative capital structure over the long term, has allowed us to generate relatively stable and increasing cash flows. |

| • | We have an experienced, knowledgeable and motivated executive management team with a proven track record. Our executive management team has an average of more than 25 years of experience in the midstream sector. Its members have worked in leadership roles at a number of large, successful public companies, including other publicly-traded partnerships. Through their equity interest in us and compensation package (including long term incentive awards based on available cash before reserves, leverage, and safety metrics), our executive management team is incentivized to create value by increasing cash flows. |

Recent Events

Exit from Non-Core Legacy CO2 Pipeline Business

On October 30, 2020, we reached an agreement with a subsidiary of Denbury Inc. to transfer to it the ownership of our remaining CO2 assets, including the Free State CO2 pipeline and the NEJD CO2 pipeline. As a part of such agreement, we will receive total consideration of $92.5 million, of which $22.5 million was paid in the fourth quarter of 2020 upon execution of such agreement, and the remaining $70 million will be paid in equal installments during each quarter of 2021. We will record a loss of approximately $21.5 million in the fourth quarter of 2020 which represents the difference between the proceeds and the net book value of the CO2 assets transferred. This transaction allowed us to exit our non-core CO2 pipeline business.

Debt Repurchases

Subsequent to September 30, 2020 and through the date hereof, we repurchased approximately $56.1 million in the aggregate principal amount of certain of our existing notes. See “Capitalization” below.

Our Offices

Our principal executive offices are located at 919 Milam, Suite 2100, Houston, Texas 77002, and the phone number at this address is (713) 860-2500.

S-8

Table of Contents

Concurrent Tender Offer

Concurrently with this offering, we are conducting a cash tender offer (the “Tender Offer”) for any or all of our outstanding $389.6 million aggregate principal amount of our 6.000% senior notes due 2023 (the “2023 notes”), subject to certain conditions. The Tender Offer is scheduled to expire at 5:00 p.m., New York City time, on December 16, 2020, subject to our right to extend the Tender Offer. Assuming all of the outstanding 2023 notes are repurchased by us pursuant to the Tender Offer, the aggregate purchase price for all 2023 notes would be approximately $396.8 million plus accrued and unpaid interest. We intend to use a portion of the net proceeds from this offering to fund the purchase price and accrued and unpaid interest payable with respect to all 2023 notes validly tendered and accepted for payment pursuant to the Tender Offer and the redemption of any 2023 notes that remain outstanding after completion or termination of the Tender Offer.

The Tender Offer is subject to a number of conditions that may be waived or changed. This offering is not conditioned on the closing of the Tender Offer, and we cannot assure you that any holders of 2023 notes will tender their 2023 notes in the Tender Offer, that we will purchase 2023 notes that are so tendered, or that we will redeem the 2023 notes on the terms we describe in this prospectus supplement or at all. In the event that all of the 2023 notes are not tendered in the Tender Offer or the Tender Offer is not consummated, we intend to use a portion of the net proceeds from this offering to redeem any of the 2023 notes that remain outstanding as described below. Pending the potential use of a portion of the net proceeds from this offering to fund the redemption of our 2023 notes and the purchase price and accrued and unpaid interest for all of our 2023 notes validly tendered and accepted for payment in the Tender Offer, we intend to use such net proceeds from this offering to make short-term liquid investments or for the repayment of outstanding borrowings under our revolving credit facility, at our discretion.

This prospectus supplement is not an offer to purchase any of the 2023 notes. The Tender Offer is being made only by and pursuant to the terms of an Offer to Purchase, dated December 10, 2020 and the related letter of transmittal.

To the extent that there are any 2023 notes that remain outstanding following the consummation or termination of the Tender Offer, we intend to call such outstanding 2023 notes for redemption in accordance with the terms and conditions of the indenture governing the 2023 notes. Notwithstanding the foregoing, we have the right but not the obligation to redeem any 2023 notes that remain outstanding after the Tender Offer, and the selection of any particular redemption date is in our discretion. Assuming none of the currently outstanding 2023 notes are repurchased by us pursuant to the Tender Offer, the aggregate redemption price for all of the 2023 notes called for redemption would be approximately $395.5 million, plus accrued and unpaid interest.

This offering is not conditioned on the tender of any of the 2023 notes in the Tender Offer or the closing of any redemption of the 2023 notes, and we cannot assure you that any holders of 2023 notes will tender their 2023 notes in the Tender Offer or that we will redeem the 2023 notes on the terms described in this prospectus supplement or at all. The statements of intent in this prospectus supplement with respect to the redemption of the 2023 notes do not constitute a notice of redemption under the indenture governing the 2023 notes.

RBC Capital Markets, LLC is acting as dealer manager for the Tender Offer, for which it will receive indemnification against certain liabilities and reimbursement of expenses. Additionally, certain of the underwriters or their affiliates are holders of our 2023 notes and, accordingly, may receive a portion of the proceeds of this offering in the Tender Offer or any redemption of the 2023 notes.

S-9

Table of Contents

Ownership Structure

We conduct our operations and own our operating assets through subsidiaries and joint ventures. As is customary with publicly traded limited partnerships, Genesis Energy, LLC, our general partner, is responsible for operating our business, including providing all necessary personnel and other resources.

Genesis Energy, LLC is a holding company with employees, but with no independent assets or operations other than its general partner interest in us and several of our subsidiaries. Our general partner is dependent upon the cash distributions it receives from us to service any obligations it may incur.

Finance Corp., a subsidiary that we formed as a Delaware corporation in November 2006, has no material assets or liabilities, other than liabilities as a co-issuer of the 2023 notes, the 2024 notes, the 2025 notes, the 2026 notes and the 2028 notes (each as defined below in “Description Of Certain Other Indebtedness”) (collectively, our “existing notes”), and as a guarantor of our credit agreement. Its activities are limited to co-issuing our existing notes and the notes offered hereby and engaging in other activities incidental thereto.

Below is a chart depicting our ownership structure as of December 9, 2020.

Finance Corp. will be a co-issuer of the notes and is a co-issuer of our existing notes and a guarantor of our credit agreement. Alkali Holdings Company, LLC (“Alkali Holdings”), Genesis Alkali Holdings, LLC, Genesis Alkali, LLC, Genesis Alkali Wyoming, LP, Independence Hub, LLC, and certain immaterial other consolidated subsidiaries, together with Poseidon Oil Pipeline Company, L.L.C. (“Poseidon”), have been designated as unrestricted subsidiaries under the indentures governing our existing notes and our credit agreement and will be so designated under the indenture for the notes offered hereby. Except for Finance

S-10

Table of Contents

Corp. and our unrestricted subsidiaries, all of our other subsidiaries will be guarantors of the notes offered hereby and are also guarantors of our existing notes and credit agreement. For the nine months ended September 30, 2020, after giving pro forma effect to the sale of the Free State CO2 pipeline and the NEJD CO2 pipeline, Alkali Holdings, Genesis Alkali Holdings, LLC, Genesis Alkali, LLC, Genesis Alkali Wyoming, LP, Independence Hub, LLC and certain immaterial other consolidated subsidiaries (together with Genesis Free State Pipeline, LLC and Genesis NEJD Pipeline, LLC, our “Consolidated Unrestricted Subsidiaries”) (Poseidon, together with the Consolidated Unrestricted Subsidiaries, the “Existing Unrestricted Subsidiaries”) comprised approximately 35% of our consolidated revenues and approximately 13% of our segment margin. Poseidon’s results are not consolidated with our historical consolidated financial statements as we account for Poseidon under the equity method of accounting. On October 30, 2020, we reached an agreement with a subsidiary of Denbury Inc. to transfer to it the ownership of our remaining CO2 assets, including the Free State CO2 pipeline and the NEJD CO2 pipeline, which prior to the transfer had been owned by Genesis Free State Pipeline, LLC and Genesis NEJD Pipeline, LLC, respectively. Please see “Summary — Recent Events.”

The Offering

The following is a brief summary of some of the terms of this offering. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Notes” section of this prospectus supplement contains a more detailed description of the terms and conditions of the notes.

Issuers | Genesis Energy, L.P. and Genesis Energy Finance Corporation. |

| Genesis Energy Finance Corporation, a Delaware corporation, is a subsidiary of Genesis Energy, L.P. that has no material assets or liabilities, other than liabilities as a co-issuer of both the notes and our existing notes, and as a guarantor of our credit agreement. |

Notes Offered | $750,000,000 aggregate principal amount of 8.0% senior notes due 2027. |

Maturity Date | January 15, 2027. |

Interest | Interest on the notes will accrue at a rate of 8.0% per annum. Interest on the notes will be payable semi-annually in cash in arrears on January 15 and July 15 of each year, commencing July 15, 2021. |

Ranking | The notes will be our unsecured senior obligations. Accordingly, they will rank: |

| • | equal in right of payment to all of our existing and future senior unsecured indebtedness, including our existing notes; |

| • | effectively junior in right of payment to all existing and future secured indebtedness, including indebtedness under our revolving credit facility, to the extent of the value of the collateral securing such indebtedness; |

| • | structurally subordinated to all existing and future indebtedness and other liabilities of any non-guarantor subsidiaries; and |

S-11

Table of Contents

| • | senior in right of payment to all existing and future subordinated indebtedness. |

| At September 30, 2020, on an adjusted pro forma basis after giving effect to (i) the application of the net proceeds from the sale of our Free State CO2 pipeline and the repurchase of approximately $56.1 million in aggregate principal amount of certain of our existing notes, and (ii) the application of the net proceeds of this offering as described herein, we would have had approximately $3.3797 billion of total indebtedness (excluding $1.1 million in respect of outstanding letters of credit), approximately $673.0 million of which (excluding $1.1 million in respect of outstanding letters of credit) would be secured indebtedness to which the notes would be effectively junior (to the extent of the value of the collateral securing such indebtedness), and we would have had approximately $1,026.0 million of borrowing capacity available under our $1.7 billion revolving credit facility, subject to compliance with financial covenants, for additional secured borrowings, which would be effectively senior to the notes. As of September 30, 2020, after giving pro forma effect to the sale of the Free State CO2 pipeline and the NEJD CO2 pipeline, the Consolidated Unrestricted Subsidiaries had no outstanding indebtedness, had $137.5 million in outstanding preferred equity, and comprised approximately 35% of our consolidated revenues and approximately 13% of our segment margin for the nine month period then ended. |

Subsidiary Guarantees | Each of our existing subsidiaries, other than Finance Corp. and our unrestricted subsidiaries, will guarantee the notes initially and for so long as each such subsidiary guarantees our revolving credit facility. Not all of our future subsidiaries will have to become guarantors. If we cannot make payments on the notes when they are due, the guarantor subsidiaries, if any, must make them instead. Please see “Description of Notes — Subsidiary Guarantees.” |

| Each guarantee will rank: |

| • | equal in right of payment to all existing and future senior unsecured indebtedness of the guarantor subsidiary, including its guarantee of the existing notes; |

| • | effectively junior in right of payment to all existing and future secured indebtedness of the guarantor subsidiary, including its guarantee of indebtedness under our revolving credit facility, to the extent of the value of the collateral securing such indebtedness; and |

S-12

Table of Contents

| • | senior in right of payment to any future subordinated indebtedness of the guarantor subsidiary. |

| At September 30, 2020, on an adjusted pro forma basis after giving effect to (i) the application of the net proceeds from the sale of our Free State CO2 pipeline and the repurchase of approximately $56.1 million in aggregate principal amount of certain of our existing notes, and (ii) the application of the net proceeds of this offering as described herein, the subsidiary guarantees of the notes would have been effectively junior to $673.0 million of secured indebtedness (to the extent of the value of the collateral securing such indebtedness), all of which would constitute guarantees of indebtedness under our revolving credit facility (excluding $1.1 million in respect of outstanding letters of credit). Please see “Description of Certain Other Indebtedness.” |

| On the issue date, the Existing Unrestricted Subsidiaries will be designated as unrestricted subsidiaries under the indenture governing the notes offered hereby and, accordingly, will not guarantee the notes. |

Use of Proceeds | We intend to use the net proceeds from this offering (i) to fund the purchase price and accrued and unpaid interest for all of our 2023 notes validly tendered and accepted for payment in the Tender Offer, (ii) to fund the redemption price and accrued and unpaid interest for any 2023 notes that remain outstanding after the completion or termination of the Tender Offer and (iii) for general partnership purposes, including repaying a portion of the borrowings outstanding under our revolving credit facility, which had approximately $984.8 million outstanding as of September 30, 2020. Pending the potential use of the net proceeds from this offering as described in (i) and (ii) above, we intend to use such net proceeds from this offering to make short-term liquid investments or for the repayment of outstanding borrowings under our revolving credit agreement, at our discretion. Please see “Use of Proceeds.” |

Optional Redemption | We will have the option to redeem the notes, in whole or in part, at any time on or after January 15, 2024, at the redemption prices described in this prospectus supplement under the heading “Description of Notes — Optional Redemption,” together with any accrued and unpaid interest to, but not including, the date of redemption. In addition, before January 15, 2024, we may redeem all or any part of the notes at the make-whole price set forth under “Description of Notes — Optional Redemption,” plus any accrued and unpaid interest to the date of redemption. In addition, before January 15, 2024, we may, at any time or from time to time, redeem up to 35% of the aggregate principal amount of the notes in an amount not greater than the net proceeds of a |

S-13

Table of Contents

public or private equity offering at a redemption price of 108.0% of the principal amount of the notes, plus any accrued and unpaid interest to the date of redemption, if at least 65% of the aggregate principal amount of the notes issued under the indenture governing the notes remains outstanding immediately after such redemption and the redemption occurs within 120 days of the closing date of such equity offering. |

Change of Control | If we experience certain kinds of changes of control, in certain cases, followed by a rating decline within 60 days, each holder of notes may require us to repurchase all or a portion of its notes for cash at a price equal to 101% of the aggregate principal amount of such notes, plus any accrued and unpaid interest to, but not including, the date of repurchase. |

Certain Covenants | The indenture governing the notes contains covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| • | pay distributions or dividends on, or purchase, redeem or other otherwise acquire, equity interests; |

| • | make certain investments; |

| • | incur additional indebtedness or liens; |

| • | sell certain assets or merge with or into other companies; |

| • | engage in transactions with affiliates; |

| • | enter into sale and leaseback transactions; and |

| • | engage in an unrelated business. |

| These covenants are subject to important exceptions and qualifications. In addition, substantially all of the covenants will be terminated before the notes mature if both of two specified ratings agencies assign the notes an investment grade rating in the future and no events of default exist under the indenture governing the notes. Please see “Description of Notes — Certain Covenants — Covenant Termination.” |

Risk Factors | You should read “Risk Factors” in this prospectus supplement and found in the documents incorporated herein by reference, as well as the other cautionary statements throughout this prospectus supplement, to ensure you understand the risks associated with an investment in the notes. |

Trustee | Regions Bank |

S-14

Table of Contents

An investment in the notes involves risk. We urge you to read and consider carefully the following risks, the risk factors included under the caption “Risk Factors” beginning on page S-15 of this prospectus supplement, on page 2 of the accompanying base prospectus, on page 32 of our Annual Report on Form 10-K for the year ended December 31, 2019 and on page 51 of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which risk factors are incorporated by reference into this prospectus supplement, together with all of the other information included or incorporated by reference into this prospectus supplement, before deciding whether to invest in the notes. If any of these risks were to occur, our business, financial condition or results of operations could be materially and adversely affected. In such case, our ability to meet our obligations under the notes could be materially affected. You could lose all or part of your investment in, or fail to achieve the expected return on, the notes.

Risks Relating to the Notes and this Offering

We may be unable to generate sufficient cash to service all of our indebtedness, including the notes, the existing notes and our indebtedness under our credit agreement, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may be unsuccessful.

Our ability to make scheduled payments on, or to refinance, our debt obligations depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness, including the notes offered hereby.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness, including the notes. We cannot assure you that we would be able to take any of these actions, that these actions would be successful and would permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, including our credit agreement, the indentures governing the existing notes, and the indenture governing the notes. In the absence of such cash flows and capital resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Our credit agreement and the indentures governing the existing notes contain, and the indenture governing the notes will contain, restrictions on our ability to dispose of assets. We may be unable to consummate those dispositions or to obtain the proceeds that we could realize from them, and any proceeds may be inadequate to meet any debt service obligations then due. Please see “Description of Certain Other Indebtedness” and “Description of Notes.”

The notes and the related guarantees will be unsecured and effectively junior to our and the guarantors’ existing and future secured indebtedness and to debt of our non-guarantor subsidiaries and joint ventures.

The notes will be our senior unsecured debt and will rank equally in right of payment with all of our other existing and future senior unsecured debt. The notes will be effectively junior to all of our existing and future secured debt (to the extent of the value of the collateral securing that debt) and to the existing and future secured debt of any subsidiaries that guarantee the notes (to the extent of the value of the collateral securing that debt).

The notes will also be structurally subordinated to the existing and future debt of (i) our subsidiaries that do not guarantee the notes, including the Existing Unrestricted Subsidiaries and subsidiaries we

S-15

Table of Contents

designate in the future as “Unrestricted Subsidiaries” as described below under “Description of Notes — Brief Description of the Notes and the Subsidiary Guarantees” and (ii) any joint ventures. Any right that we or our subsidiaries that guarantee the notes have to receive any assets of any of our subsidiaries or joint ventures that do not guarantee the notes upon the liquidation or reorganization of such non-guarantor subsidiaries or joint ventures, and the consequent rights of holders of notes to realize proceeds from the sale of any of those non-guarantor subsidiaries’ or joint ventures’ assets, will be effectively subordinated to the claims of those non-guarantor subsidiaries’ and joint ventures’ creditors, including trade creditors and holders of preferred equity interests of those non-guarantor subsidiaries and joint ventures. As of September 30, 2020, after giving pro forma effect to the sale of the Free State CO2 pipeline and the NEJD CO2 pipeline, the Consolidated Unrestricted Subsidiaries had no outstanding indebtedness, had $137.5 million in outstanding preferred equity, and comprised approximately 35% of our consolidated revenues and approximately 13% of our segment margin for the nine month period then ended.

If we are involved in any dissolution, liquidation or reorganization, holders of our secured debt would be paid before you receive any amounts due under the notes to the extent of the value of the assets securing such debt and creditors of each of our non-guarantor subsidiaries and joint ventures would be paid before you receive any amounts due under the notes from the proceeds of any remaining assets of such non-guarantor subsidiary or joint venture. In that event, you may be unable to recover any principal or interest you are due under the notes. In the event of any dissolution, liquidation or reorganization of our non-guarantor subsidiaries or joint ventures, such non-guarantor subsidiaries or joint ventures will first pay the holders of their debts, holders of preferred equity interests in such non-guarantor subsidiaries or joint ventures and their trade creditors before they will be able to distribute any of their assets to us.

As of September 30, 2020, on an adjusted pro forma basis after giving effect to (i) the application of the net proceeds from the sale of our Free State CO2 pipeline and the repurchase of approximately $56.1 million in aggregate principal amount of certain of our existing notes, and (ii) the application of the net proceeds of this offering as described herein, we would have had approximately $3.3797 billion of total indebtedness, approximately $673.0 million of which (excluding $1.1 million in respect of outstanding letters of credit) would be secured indebtedness to which the notes would be effectively junior (to the extent of the value of the collateral securing such indebtedness), and we would have had approximately $1,026.0 million of borrowing capacity available under our $1.7 billion revolving credit facility, subject to compliance with financial covenants, for additional secured borrowings under our credit agreement, which would be effectively senior to the notes.

Fluctuations in interest rates could adversely affect our business or cause our debt service obligations to increase significantly.

We have exposure to movements in interest rates. The interest rates under our credit agreement are variable. Our results of operations and our cash flows, as well as our access to future capital and our ability to fund our growth strategy, could be adversely affected by significant increases in interest rates. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash available for servicing our indebtedness, including the notes, would decrease.

Our indebtedness could adversely restrict our ability to operate, affect our financial condition and prevent us from complying with our requirements under our debt instruments, including the notes.

As of September 30, 2020, on an adjusted pro forma basis after giving effect to (i) the application of the net proceeds from the sale of our Free State CO2 pipeline and the repurchase of approximately $56.1 million in aggregate principal amount of certain of our existing notes, and (ii) the application of the

S-16

Table of Contents

net proceeds of this offering as described herein, we had approximately $673.0 million outstanding of senior secured indebtedness (excluding $1.1 million in respect of outstanding letters of credit).

We must comply with various affirmative and negative covenants contained in our credit agreement and the indentures governing the existing notes and that will be contained in the indenture governing the notes, some of which may restrict the way in which we would like to conduct our business. Among other things, these covenants limit or will limit our ability to:

| • | incur additional indebtedness or liens; |

| • | make payments in respect of or redeem or acquire any debt or equity issued by us; |

| • | sell assets; |

| • | make loans or investments; |

| • | make guarantees; |

| • | enter into any hedging agreement for speculative purposes; |

| • | acquire or be acquired by other companies; and |

| • | amend some of our contracts. |

The restrictions under our indebtedness may prevent us from engaging in certain transactions which might otherwise be considered beneficial to us and could have other important consequences to noteholders. For example, they could:

| • | increase our vulnerability to general adverse economic and industry conditions; |

| • | limit our ability to make distributions; to fund future working capital, capital expenditures and other general partnership requirements; to engage in future acquisitions, construction or development activities; access capital markets (debt and equity); or to otherwise fully realize the value of our assets and opportunities because of the need to dedicate a substantial portion of our cash flows from operations to payments on our indebtedness or to comply with any restrictive terms of our indebtedness; |

| • | limit our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate; and |

| • | place us at a competitive disadvantage as compared to our competitors that have less debt. |

We may incur additional indebtedness (public or private) in the future under our existing credit agreement, by issuing debt instruments, under new credit agreements, under joint venture credit agreements, under capital leases or synthetic leases, on a project-finance or other basis, or a combination of any of these. If we incur additional indebtedness in the future, it likely would be under our existing credit agreement or under arrangements that may have terms and conditions at least as restrictive as those contained in our existing credit agreement, the indentures governing the existing notes or the indenture governing the notes. Failure to comply with the terms and conditions of any existing or future indebtedness would constitute an event of default. If an event of default occurs, the lenders or noteholders will have the right to accelerate the maturity of such indebtedness and foreclose upon the collateral, if any, securing that indebtedness. In addition, if there is a change of control as described in our credit facility, that would be an event of default unless our creditors agreed otherwise, and such event could limit our ability to fulfill our obligations under our other outstanding debt instruments and to make cash distributions to unitholders which could adversely affect the market price of our securities.

S-17

Table of Contents

In addition, from time to time, some of our joint ventures may have substantial indebtedness, which will include affirmative and negative covenants and other provisions that limit their freedom to conduct certain operations, events of default, prepayment and other customary terms.

Despite our and our subsidiaries’ current level of indebtedness, we may still be able to incur substantially more debt.

We and our subsidiaries, subject to certain limitations, including those contained in our credit agreement and the indentures governing the existing notes and that will be contained in the indenture governing the notes offered hereby, may be able to incur additional indebtedness in the future by issuing debt instruments, under new credit agreements, under joint venture credit agreements, under capital leases or synthetic leases, on a project-finance or other basis, or a combination of any of these. For example, on an adjusted pro forma basis after giving effect to (i) the application of the net proceeds from the sale of our Free State CO2 pipeline and the repurchase of approximately $56.1 million in aggregate principal amount of certain of our existing notes, and (ii) the application of the net proceeds of this offering as described herein, we expect to be able to borrow approximately an additional $1,026.0 million available on a revolving basis under our $1.7 billion revolving credit facility, subject to compliance with financial covenants. Please see “Description of Certain Other Indebtedness — Revolving Credit Facility and “Capitalization.”

If new debt is added to our current debt levels, the related risks that we and our subsidiaries currently face could intensify. In addition, the incurrence of additional indebtedness could make it more difficult to satisfy our existing financial obligations, including those relating to the notes.

If we incur any additional indebtedness, including trade payables, that ranks equally with the notes, the holders of that debt will be entitled to share ratably with you in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding up of our partnership. This may have the effect of reducing the amount of proceeds paid to you. Please see “Description of Notes” and “Description of Certain Other Indebtedness.”

We may be unable to repurchase the notes upon a change of control.

Upon the occurrence of certain change of control events, in certain cases, followed by a rating decline within 60 days, we would be required to offer to repurchase all or any part of the existing notes and the notes then outstanding for cash at 101% of the principal amount plus accrued and unpaid interest. The source of funds for any repurchase required as a result of any change of control will be our available cash or cash generated from our operations or other sources, including:

| • | borrowings under our credit agreement or other sources; |

| • | sales of assets; or |

| • | sales of equity. |

We cannot assure you that sufficient funds would be available at the time of any change of control to repurchase your notes after first repaying any of our senior debt that may exist at the time. In addition, restrictions under our credit agreement or any future credit facilities will not allow such repurchases. Additionally, a “change of control” (as defined in the indenture governing the notes) will be an event of default under our credit agreement, which would permit the lenders to accelerate the debt outstanding under the credit agreement. Finally, using available cash to fund the potential consequences of a change of control may impair our ability to obtain additional financing in the future, which could have a negative impact on our ability to conduct our business operations.

S-18

Table of Contents

Holders of notes do not have the right to require us to repurchase notes following certain kinds of change of control events unless such a change of control event is followed by a rating decline.

Holders of notes do not have the right to require us to repurchase notes following certain kinds of change of control events unless such a change of control event is followed by a rating decline. Moreover, because the change of control offer provisions of our 2023 notes and 2024 notes do not include a requirement that the change of control event be followed by a rating decline in order to be triggered, we may be obligated to offer to purchase our 2023 notes and 2024 notes, following a change of control event that is not followed by a rating decline, even though holders of notes would not have such right.

The guarantee of a subsidiary could be voided if it constitutes a fraudulent transfer under U.S. bankruptcy or similar state law, which would prevent the holders of the notes from relying on that subsidiary to satisfy claims.

Under U.S. bankruptcy law and comparable provisions of state fraudulent transfer laws, our subsidiary guarantees can be voided, or claims under the guarantee of a subsidiary may be further subordinated to all other debts of that subsidiary guarantor if, among other things, the subsidiary guarantor, at the time it incurred the indebtedness evidenced by its guarantee or, in some states, when payments become due under the guarantee, received less than reasonably equivalent value or fair consideration for the incurrence of the guarantee and:

| • | was insolvent or rendered insolvent by reason of such incurrence; |

| • | was engaged in a business or transaction for which the guarantor’s remaining assets constituted unreasonably small capital; or |

| • | intended to incur, or believed that it would incur, debts beyond its ability to pay those debts as they mature. |

The guarantee of a subsidiary may also be voided, without regard to the above factors, if a court found that the subsidiary guarantor entered into the guarantee with the actual intent to hinder, delay or defraud its creditors.

A court would likely find that a subsidiary guarantor did not receive reasonably equivalent value or fair consideration for its guarantee if that subsidiary guarantor did not substantially benefit directly or indirectly from the issuance of the guarantees. If a court were to void a subsidiary guarantee, you would no longer have a claim against that subsidiary guarantor. Sufficient funds to repay the notes may not be available from other sources, including the remaining subsidiary guarantors, if any. In addition, the court might direct you to repay any amounts that you already received from that subsidiary guarantor.

The measures of insolvency for purposes of fraudulent transfer laws vary depending upon the governing law. Generally, a guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all its assets; |

| • | the present fair saleable value of its assets were less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

Each subsidiary guarantee contains a provision intended to limit the subsidiary guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under its subsidiary

S-19

Table of Contents

guarantee to be a fraudulent transfer. Such provision may not be effective to protect the subsidiary guarantees from being voided under fraudulent transfer law.

Many of the covenants contained in the indenture governing the notes will be terminated if the notes are rated investment grade by both Standard & Poor’s and Moody’s and no default or event of default has occurred and is continuing.

Many of the covenants in the indenture governing the notes will be terminated if the notes are rated investment grade by both Standard & Poor’s and Moody’s provided at such time no event of default has occurred and is continuing. These covenants will include those that restrict, among other things, our ability to pay dividends, incur debt and to enter into certain other transactions. There can be no assurance that the notes will ever be rated investment grade. However, termination of these covenants would allow us to engage in certain transactions that would not have been permitted while these covenants were in force. Please see “Description of Notes — Certain Covenants — Covenant Termination.”

A financial failure by us or our subsidiaries may result in the assets of any or all of those entities becoming subject to the claims of all creditors of those entities.

A financial failure by us or our subsidiaries could affect payment of the notes if a bankruptcy court were to substantively consolidate us and our subsidiaries. If a bankruptcy court substantively consolidated us and our subsidiaries, the assets of each entity would become subject to the claims of creditors of all entities. This would expose holders of notes not only to the usual impairments arising from bankruptcy, but also to potential dilution of the amount ultimately recoverable because of the larger creditor base. Furthermore, forced restructuring of the notes could occur through the “cram-down” provisions of the U.S. bankruptcy code. Under these provisions, the notes could be restructured over your objections as to their general terms, primarily interest rate and maturity.

The interruption of distributions to us from our subsidiaries and joint ventures could affect our ability to make payments on our commitments, including the notes.