UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 0-31659

NOVATEL WIRELESS, INC.

(exact name of registrant as specified in its charter)

| | |

| Delaware | | 86-0824673 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| |

9645 Scranton Road San Diego, California | | 92121 |

| (Address of Principal Executive Offices) | | (zip code) |

Registrant’s telephone number, including area code: (858) 320-8800

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.001 per share

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-Accelerated filer ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common stock held by non-affiliates of the Registrant, based on the closing price of the Registrant’s common stock on June 29, 2007, as reported by The Nasdaq Global Select Market, was approximately $703,900,689. For the purposes of this calculation, shares owned by officers, directors (and their affiliates) and 5% or greater stockholders, based on Schedule 13G filings, have been excluded. This exclusion is not intended, nor shall it be deemed, to be an admission that such persons are affiliates of the Registrant. The Registrant does not have any non-voting stock issued or outstanding.

The number of shares of the Registrant’s common stock outstanding as of February 25, 2008 was 32,756,554.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for the 2008 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A are incorporated by reference into Part III of this Form 10-K to the extent stated herein.

TABLE OF CONTENTS

i

Forward-Looking Statements

This report contains forward-looking statements based on our current expectations, assumptions, estimates and projections about Novatel Wireless and our industry. These forward-looking statements include, but are not limited to, statements regarding: future demand for access to wireless data and factors affecting that demand; the future growth of wireless wide area networking and factors affecting that growth; changes in commercially adopted wireless transmission standards and technologies; growth in third generation, or 3G, infrastructure spending; the sufficiency of our capital resources; the effect of changes in accounting standards and in aspects of our critical accounting policies; legal developments with respect to intellectual property contained in our products; the utilization of our net operating loss carryforwards; and our general business and strategy, including plans and expectations relating to technology, product development and introduction, strategic relationships, customers, manufacturing, service activities and international expansion. The words “may,” “estimate,” “anticipate,” “believe,” “expect,” “intend,” “plan,” “project,” “will” and similar words and phrases indicating future results are also intended to identify forward-looking statements.

Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated in such forward-looking statements as of the date of this report. You are cautioned not to place undue reliance on these forward looking statements, which reflect management’s analysis only as of the date hereof. You should carefully review and consider the various disclosures in this report regarding factors that could cause actual results to differ materially from anticipated results, including those factors under the caption “Risk Factors” under Item 1A below, and elsewhere in this report. We undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future, except as otherwise required pursuant to our on-going reporting obligations under the Securities Exchange Act of 1934, as amended.

Trademarks

“Novatel Wireless,” the Novatel Wireless logo, “Merlin,” “MobiLink,” “Expedite,” “Ovation” and “Conversa” are trademarks of Novatel Wireless, Inc. Other trademarks, trade names or service marks used in this report are the property of their respective owners.

ii

PART I

Overview

We were incorporated in 1996 under the laws of the State of Delaware. We are a leading provider of wireless broadband access solutions for the worldwide mobile communications market. Our broad range of products includes third generation, or 3G, wireless PC card and ExpressCard modems, embedded modems, Fixed-Mobile Convergence, or FMC, and communications software and solutions for wireless network operators, infrastructure providers, distributors, laptop PC and other original equipment manufacturers, or OEMs, and vertical markets worldwide. Through the integration of our hardware and software, our products are designed to operate on a majority of wireless networks in the world and provide mobile subscribers with secure and convenient high speed access to corporate, public and personal information through the Internet and enterprise networks. We also offer software engineering, integration and design services to our customers to facilitate the use of our products.

Our global end-customer base is comprised of wireless operators, laptop PC and other OEMs, distributors and various companies in other vertical markets. Our current customer base includes wireless operators and other wireless market participants such as AT&T, Hutchison 3G, Optimus, Orange, Sprint PCS, Telefonica, Verizon Wireless, Vodafone and OEM partners such as Dell, Panasonic, Sony, and Toshiba. We have strategic technology, development and marketing relationships with several of these customers.

For the years ended December 31, 2007, 2006 and 2005, revenue recognized from sales of our products was $429.9 million, $218.0 million, and $161.2 million, respectively. For the years ended December 31, 2007 and 2006 revenue recognized from development services was zero. For the year ended December 31, 2005, revenue recognized from development services was $500,000.

Our Products

Our products are designed to operate across 3G networks, including:

| | • | | Code Division Multiple Access, orCDMA, 1xEV-DO is designed to be employed by CDMA operators and provide wireless access speeds comparable to wireline digital subscriber line, or DSL, services. Subscribers can attain wireless access to data at maximum speeds of up to 2.4 megabits per second, or Mbps, on CDMA 1xEV-DO Rev 0 networks and 3.1 Mbps on CDMA 1xEV-DO Rev A networks. |

| | • | | High Speed Downlink Packet Access, orHSDPA, is an enhancement of theUniversal Mobile Telecommunications System,orUMTS,standard which enables packet data transmission in theUMTS downlink with data transmission at maximum speeds of up to 14.4 Mbps.HSDPA can be implemented as an upgrade to currentUMTS infrastructure. WithUMTS, subscribers can attain wireless access to data at maximum speeds of up to 384 kilobits per second, or kbps.UMTS is also referred to as Wideband Code Division Multiple Access, or W-CDMA. |

| | • | | High Speed Uplink Packet Access, orHSUPA, is another release to the evolving 3G standards. HSUPA employs an extremely efficient procedure for sending data on the uplink channel. The theoretical speed for data on the uplink is 5.76Mbps and the downlink will achieve HSDPA theoretical speeds of up to 14.4Mbps. |

1

The following table illustrates our current principal product lines and applications:

| | |

Product | | Applications |

| |

Wireless PC Card and ExpressCard Modems | | |

| |

• Merlin Wireless PC cards and ExpressCards for CDMA 1xEV-DO Rev A • Merlin Wireless ExpressCards for HSDPA and HSUPA | | • Laptop PCs and other platforms supporting PCMCIA and ExpressCard/34/54 interfaces |

| |

Expedite Embedded PCI Express Mini Card Modems | | |

| |

• Expedite PCI Express Mini Card for HSUPA and CDMA 1xEV-DO Rev A | | • Laptops and wireless devices requiring an integrated solution |

| |

Fixed-Mobile Convergence Solutions | | |

| |

• USB modems for CDMA 1xEV-DO Rev A and HSUPA | | • Laptop PCs and other platforms supporting USB interfaces |

Merlin Wireless PC Card and ExpressCard Modems

OurMerlin Wireless PC Card and ExpressCard modems provide mobile subscribers with secure and convenient high-speed wireless access to data including corporate, public and personal information through the Internet and enterprise networks. Each of ourMerlin Wireless PC Card and ExpressCard modems slides inside standard laptop PCs and other products employing PCMCIA or ExpressCard/34/54 interfaces, respectively. All our modems utilize modem manager software and are compatible with a range of devices including laptop PCs, PDAs, mobile phones, as well as operating systems including Microsoft Windows 98, 2000, Millennium Edition, XP, Vista and Pocket PC. The following is a representative selection of our currentMerlin Wireless PC Card and ExpressCard modems:

| | • | | TheMerlin PC720is a dual band (800/1900 MHz) wireless ExpressCard modem designed to provide mobile broadband connections up to 3.1 Mbps on CDMA 1xEV-DO Rev A networks in North America and is backward compatible to legacy CDMA networks. TheMerlin PC720 incorporates an external flip antenna, maximizing data speed performance and allowing for stronger network signal reception. |

| | • | | TheMerlin X720 ExpressCard provides high-speed connectivity to EV-DO Rev A networks with data speeds up to 3.1 Mbps in North America and is backward compatible to legacy CDMA networks. It has an advanced dual band diversity antenna system design that incorporates an external flip antenna, maximizing data speed performance and allowing for stronger network signal reception. TheMerlin X720 contains A-GPS capability allowing the end-user to retrieve location data from GPS satellites. |

| | • | | TheMerlin XU870 is a tri-band HSDPA/UMTS (850/1900/2100 MHz) and quad-band EDGE/GPRS (850/900/1800/1900 MHz) wireless ExpressCard Modem designed to provide mobile subscribers with high-speed wireless access to data over 3G UMTS/HSDPA networks. TheMerlin XU870 enables mobile broadband connections up to 7.2 Mbps with software upgrade. TheMerlin XU870 operates on networks in North America, Europe and countries around the world in supported bands. |

| | • | | TheMerlin X950DExpressCard is a tri-band HSUPA and quad-band EDGE/GPRS wireless modem designed to be used in both ExpressCard/34 and 54 slots as well as with our adapters in PCMCIA and USB slots. TheX950D enables mobile broadband connections of up to 2.1 Mbps and download speeds up to 7.2 Mbps on HSDPA networks, and contains GPS capability. TheMerlin X950D operates on networks in Europe and countries around the world in supported bands. |

2

Expedite Embedded PCI Express Mini Card Modems for OEMs

OurExpedite Embedded PCI Express Mini Card modems are a form factor specification designed for easy integration into multiple laptop platforms and other wireless devices. EachExpedite Embedded PCI Express Mini Card modemenables wireless high-speed streaming video and audio, secure access to emails with large attachments and other corporate information stored behind firewalls providing reliable connectivity, maximum data throughput and efficient management of device power consumption. The following is a representative selection of our currentExpedite Embedded PCI Express Mini Card modems:

| | • | | TheExpedite EV620 PCI Express Mini Card includes receiver diversity on 800 and 1900 MHz band CDMA2000 1xEV-DO and CDMA2000 1X networks, and enables wireless broadband data access on CDMA 1xEV-DO networks at speeds up to 2.4 Mbps. |

| | • | | TheExpedite E725 PCI Express Mini Card provides dual band (800/1900 MHz) wireless access and is designed to provide mobile broadband connections at speeds up to 3.1 Mbps on CDMA 1xEV-DO Rev A networks. |

| | • | | TheExpedite EU860D PCI Express Mini Card operates globally on 850, 1900, and 2100 MHz bands on HSDPA and UMTS networks with mobile broadband connection speeds up to 3.6 Mbps on the downlink and up to 384 Kbps on the uplink on HSDPA/UMTS capable networks. |

| | • | | TheExpedite EU870D is optimized for Europe and offers diversity, equalizer and operates globally on 850, 1900 and 2100 MHz bands on HSDPA and UMTS networks. TheExpedite EU870D transmits wireless data at speeds up to 3.6 Mbps on the downlink and up to 384 Kbps on the uplink on HSDPA/UMTS networks |

Fixed-Mobile Convergence Solutions

OurOvation USB product line provides wireless connectivity interchangeably to both desktop and other fixed computing devices and to laptop PCs and other portable computing devices. The following is a representative selection of our currentOvation products:

| | • | | TheOvation MCD3000 provides dual band (800/1900 MHz) wireless access and is designed based on the USB standard to provide mobile broadband connections at speeds up to 3.1 Mbps on CDMA 1xEV-DO Rev A networks. TheOvation MCD3000has a dual band diversity antenna system design that incorporates an external flip antenna. |

| | • | | TheOvation MC727 operates on EV-DO Rev A networks (backwards compatible to Rev 0 and 1xRTT) CDMA 800 MHz and CDMA 1900 MHz with connection speeds up to 3.1 Mbps on the downlink and up to 1.8 Mbps on the uplink on EV-DO Rev A capable networks. TheMC727 contains a hot-swappable removable memory via microSD up to 4GB and is GPS capable. |

| | • | | TheOvation MC950D offers both receiver diversity (2100 MHz) and equalizer support with download rates of 7.2 Mbps and upload speeds of up to 2.1 Mbps. TheMC950D is optimized for Europe and Japan, and any territories around the world which support the 2100 MHz band. Software is included on the device so that users don’t need to install drivers from a CD. |

MobiLink Mobile Communications Suite

OurMobiLinkmobile communications software suite, which resides on the mobile subscriber’s computing device, is an object-oriented application that enables a user to gain quick and simple access to advanced connectivity features such as SMS, multimedia messaging and virtual private networking.MobiLinkalso offers video telephony and wireless local area networks, or WLAN management capabilities.MobiLink’sgraphical user interface and underlying functionality are designed to be modular, easily configurable and expandable in order to enable our customers to differentiate their product offerings.MobiLinkis engineered to work with all our wireless modems.

3

Our Strategy

Our objective is to be the leading provider of broadband multimedia (data and voice) solutions for the worldwide mobile communications market. The key elements of our strategy are to:

| | • | | Broaden our Product Offering. We intend to diversify and continue to broaden our product line in the following areas: wireless PC Card and ExpressCard modems, embedded modems, Fixed-Mobile Convergence solutions, and software services and solutions. |

| | • | | Expand Our 3G Wireless PC Card and ExpressCard Modem Offerings Worldwide. We intend to continue expanding our portfolio of 3G wireless PC Card and ExpressCard modem products with leading wireless operators worldwide. We have introduced fourteen 3G products, including EV-DO, HSDPA and HSUPA products and plan to continue to introduce new products aimed at the next generation technologies. |

| | • | | Lead the Embedded Market. From the beginning of 2005 to the end of 2007, we received design wins from six leading laptop manufacturers and additional mass market device manufacturers to embed our 3G products into their product lines. These wins include Dell and Toshiba, two of the world’s largest laptop PC manufacturers. In addition during that period we also received several upgrade orders from existing key customers for our next-generation 3G products. In the future, we will continue to pursue additional opportunities with current OEM partners and with other leading OEM partners as we look to consolidate the largest market share of the embedded market. For some of our OEM partners, we build to order; for others, our technology is embedded in specific wireless SKUs; and for others, our technology is embedded into complete product lines. Most of our customers are addressing world-wide markets and are shipping our EV-DO, HSDPA and HSUPA products. |

| | • | | Capitalize on Our Direct Relationships with Wireless Operators. We intend to continue to capitalize on our direct relationships with wireless operators in order to increase our worldwide market position. In the United States and internationally, we are working closely with wireless operators of EV-DO, UMTS HSDPA and HSUPA wireless networks. |

| | • | | Leverage Strategic Relationships with Wireless Industry Leaders. We believe that strategic relationships with wireless and mobile computing industry leaders are critical to our ability to leverage sales opportunities and ensure that our technology investments address customer needs. Through strategic relationships, we believe that we can increase market penetration and differentiate our products by accessing the resources of others, including access to distribution resources, and dedicated sales and marketing resources and addressing new market opportunities through innovation with our selected partners. We intend to continue the development and leverage of strategic relationships in the industry. |

| | • | | Continue to Target Key Vertical Market Opportunities and Penetrate New Markets. We believe that on-going developments in wireless technologies will create additional vertical market opportunities and more applications for our products. Currently, we market our broadband wireless access solutions to key vertical industry segments by offering innovative products that are intended to increase productivity, reduce costs and create operational efficiencies. |

| | • | | Increase the Value of Our Products. We will continue to add new features and functionality to our products and develop new services and software applications to enhance the overall value and ease of use that our products provide to our customers and end users. |

Customers

Our global end-customer base is comprised of wireless operators, OEMs, distributors and various companies in other vertical markets. Our current customer base includes wireless operators and other wireless market participants such as AT&T, Hutchison 3G, Optimus, Orange, Sprint PCS, Telefonica, Verizon Wireless, Vodafone and OEM partners such as Dell, Panasonic, Sony, and Toshiba. We have strategic technology, development and marketing relationships with several of these customers.

4

Our strong customer relationships provide us with the opportunity to expand our market reach and sales:

| | • | | Wireless Operators and Distributors. By working closely with our wireless operator and distributor customers, we are able to drive demand for our products by combining our expertise in wireless technologies with our customers’ sales and marketing reach over a global subscriber base. Our customers also provide us with important services, including field trial participation, technical support, wireless data marketing and access to additional indirect distribution channels. |

| | • | | OEMs. Our OEM customers integrate our products into devices that they manufacture and sell to end-users through their own direct sales forces and indirect distribution channels. Our products are capable of being integrated into a broad range of devices, including but not limited to laptop PCs, PDAs, M2M devices, and vehicle location devices. We seek to build strong relationships with our OEM partners by working closely with them and providing radio frequency, or RF, design consulting, performance optimization, software integration and customization and application engineering support during the integration of our products. |

Strategic Relationships

We continue to develop and maintain strategic relationships with wireless and computing industry leaders like Dell, QUALCOMM, Sony, Sprint PCS, Verizon Wireless and Vodafone and major software vendors. Through strategic relationships, we have been able to increase market penetration by leveraging the resources of our channel partners, including their access to distribution resources, increased sales opportunities and market opportunities.

Our strategic relationships include technology and marketing relationships with wireless operators, OEM partners that integrate our products into other devices, distributors and leading hardware and software technology providers.

Sales and Marketing

We sell our wireless broadband solutions primarily to wireless operators either directly or through strategic relationships, as well as to OEM partners and distributors located worldwide. Most of our sales to wireless operators and OEM partners are sold directly through our sales force. To a lesser degree, we also use an indirect sales distribution model through the use of select distributors. A significant portion of our revenues comes from a small number of customers. Our revenues from sales to Verizon, Sprint PCS and Dell represented approximately 34.9%, 25.9% and 10.9%, respectively, of our total revenues for the year ended December 31, 2007.

In order to maintain strong sales relationships, we provide co-marketing, trade show support, product training and demo units for merchandising. We are also engaged in a wide variety of activities, such as awareness and lead generation programs as well as product marketing. Other marketing initiatives include public relations, seminars, and co-marketing and co-branding with partners.

We are continuing to drive widespread adoption of our products through increased global marketing activities, expansion of our sales team and distribution networks and continued leverage of our strategic relationships with wireless industry leaders.

We have operations in the United States, Canada and Europe. The amount of our assets in the United States, Canada and Europe as of December 31, 2007 were $288.8 million, $6.3 million, and $1.5 million, respectively. As of December 31, 2006 the amount of our assets in the United States, Canada and Europe were $172.8 million, $18.0 million and $835,000, respectively, and as of December 31, 2005 were $166.5 million, $9.6 million and zero, respectively.

For the years ended December 31, 2007, 2006 and 2005, approximately 25%, 37% and 58%, respectively, of our revenue was derived from international customers. See Note 10 to our Consolidated Financial Statements for

5

further explanation of our revenue based on geography. Our continuing reliance on sales in international markets exposes us to risks attendant to foreign sales. See “Item 1A. Risk Factors—We are subject to the risks of doing business abroad, which could negatively affect our international sales activities and our ability to obtain products from our foreign manufacturers”.

Product Research and Development

Our product development efforts are focused on developing innovative wireless broadband access solutions to address opportunities presented by next generation wireless networks and improving the functionality, design and performance of our products. Our research and development expenses for the years ended December 31, 2007, 2006 and 2005 were $37.6 million, $31.3 million and $20.5 million, respectively. In addition, costs recovered from customer funded development contracts for the years ended December 31, 2007 and 2006 were zero, and for the year ended December 31, 2005 was $200,000, and was included in cost of revenue.

We intend to continue to identify and respond to our customers’ needs by introducing new product designs with an emphasis on supporting cutting edge WAN technology, ease-of-use, performance, size, weight, cost and power consumption.

We manage our products through a structured life cycle process, from identifying initial customer requirements through development and commercial introduction to eventual phase-out. During product development, emphasis is placed on time-to-market, meeting industry standards and customer product specifications, ease of integration, cost reduction, manufacturability, quality and reliability.

Our product development efforts leverage our core expertise in the following key technology areas:

| | • | | Advanced Radio Frequency and Hardware Design. Advanced Radio Frequency, or RF, design is the key technology that determines the performance of wireless devices. We have specialized in 800/900/1800/1900 and 2100 MHz designs for digital cellular, packet data and CDMA technology. Our expertise in RF and baseband technology contributes to the performance, cost advantages and small size of our products. |

| | • | | Miniaturization and System Integration. Small systems integration is the integration of application specific integrated circuits, or ASICs, RF and baseband integrated circuits and packaging technologies. The complete wireless modem is packaged into a module less than half the size of a credit card through the use of advanced integrated circuit designs, embedded software modems and multi-layer RF stripline technologies. We will continue to augment our miniaturization technology, working to further reduce the size and cost of current and future products. |

| | • | | Firmware and Software development. We have specialized in integrating 3G (HSDPA/HSUPA and 1xEV-DO) protocol stacks and customizing the firmware to meet carrier and regulatory requirements. We supply end-to-end WAN modem solutions to our customers including the modem hardware, the customized firmware that runs on the 3G processor and the modem manager application that controls the modem operation. |

Manufacturing and Operations

We have agreements with LG Innotek Co., Ltd, or LG Innotek, a subsidiary of LG Group, located in South Korea, and with Inventec Appliances Corp., or IAC, located in China, for the outsourced manufacturing of our products. Under our manufacturing agreements, LG Innotek and IAC provide us with services including component procurement, product manufacturing, final assembly, testing, quality control, fulfillment and delivery. In addition, we have an agreement with Mobiltron (Europe) Limited, or Mobiltron, for distribution, fulfillment and repair services related to our business in Europe, Middle East, and Africa, or EMEA.

6

We outsource our manufacturing in an effort to:

| | • | | focus on our core competencies; |

| | • | | minimize our capital expenditures and lease obligations; |

| | • | | realize manufacturing economies of scale; |

| | • | | achieve production scalability by adjusting manufacturing volumes to meet changes in demand; and |

| | • | | access best-in-class manufacturing resources. |

We believe that additional assembly line efficiencies are realized due to our product architecture and our commitment to process design. Direct materials for our products consist of custom tooled parts such as printed circuit boards, molded plastic components and fabricated metal components, as well as industry-standard components such as ASICs, RF power amplifiers, flash memory, transistors, integrated circuits, piezo-electric filters, duplexers, inductors, resistors and capacitors. Many of the components used in our products are similar to those used in cellular telephone handsets, helping to reduce our manufacturing costs through the use of standard components.

Our operations organization manages our relationships with LG Innotek, IAC and Mobiltron as well as key second tier suppliers. The organization focuses on supply chain management, quality, cost optimization, customer order management and new product introduction.

Intellectual Property

We hold a number of trademarks including Merlin, Expedite, MobiLink, Ovation, and Conversa, each with its accompanying designs, as well as the Novatel Wireless name and logo.

Our wireless broadband access solutions and operations rely on and benefit from our portfolio of intellectual property. We currently own 34 United States patents, two of which are also registered in Canada. In addition, we currently have 29 patent applications pending. From time to time we also seek to have our patents registered in selected foreign jurisdictions. The patents that we currently own expire at various times between 2008 and 2024.

We have licensed software and other intellectual property for use in our products from third-parties, such as QUALCOMM. In the case of QUALCOMM, these licenses allow us to manufacture CDMA, UMTS, HSDPA, HSUPA and EV-DO-based wireless modems and to sell or distribute them worldwide. In connection with such sales, we pay royalties to QUALCOMM. The license from QUALCOMM does not have a specified term and may be terminated by us or by QUALCOMM for cause or upon the occurrence of other specified events. In addition, we may terminate the licenses for any reason upon 60 days prior written notice. We have also granted to QUALCOMM a nontransferable, worldwide, nonexclusive, fully-paid and royalty-free license to use, in connection with wireless communications applications, certain intellectual property of ours that is used in our products which incorporate the CDMA technology licensed to us by QUALCOMM. This license allows QUALCOMM to make, use, sell or dispose of such products and the related components.

Backlog

We do not believe that backlog is a meaningful indicator of our future business prospects due to the many variables, some outside our control, which could cause the actual volume of our product shipments to differ from those that comprise our backlog, and our dependency on evolving wireless network standards. Therefore, we do not believe that backlog information is relevant to an understanding of our overall business.

7

Competition

The market for wireless broadband access solutions is rapidly evolving and highly competitive. It is likely to continue to be significantly affected by the evolution of new wireless technology standards, new product introductions and the market activities of industry participants. We believe the principal competitive factors impacting the market for our products are form factor, time-to-market, features and functionality, performance, quality, brand and price. To maintain and improve our competitive position, we must continue to develop new products, expand our customer base, grow our distribution network and leverage our strategic relationships.

Our wireless communications products currently compete with a variety of devices, including other wireless modems, wireless handsets, wireless handheld computing devices and other wireless devices. Our current and potential competitors include:

| | • | | wireless data modem providers, such as Huawei, Option International, Sierra Wireless, Kyocera, Pantech, Sony-Ericsson, and UTStarcom; and |

| | • | | wireless handset and infrastructure manufacturers, such as Motorola, Nokia, Siemens and Sony-Ericsson. |

We believe that we have advantages over each of our primary competitors due to the technical and engineering design of our products, the broad range of solutions that we offer, the ease-of-use of our products, our ability to adapt our products to specific customer needs and our competitive pricing. As the market for wireless broadband access solutions expands, other entrants may seek to compete with us.

Employees

As of December 31, 2007, we had 301 employees, including 44 in operations, 65 in sales and marketing, 149 in research and development, and 43 in general and administrative functions. We also use the services of consultants and temporary workers from time to time. Our employees are not represented by any collective bargaining unit and we consider our relationship with our employees to be good.

Website Access to SEC Filings

We maintain an Internet website atwww.novatelwireless.com. The information contained on our website or that can be accessed through our website does not constitute a part of this report. We make available, free of charge, through our Internet website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission, or SEC.

8

Before deciding to purchase, hold or sell our common stock, you should carefully consider the risks described below in addition to the other cautionary statements and risks described elsewhere in this Report and in the documents incorporated by reference herein and therein. The risks and uncertainties described below are those that we currently deem to be material, and do not represent all of the risks that we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may in the future become material and impair our business operations. If any of the following risks actually occur, our business could be materially harmed, and our financial condition and results of operations could be materially and adversely affected. As a result, the trading price of our securities could decline, and you might lose all or part of your investment. You should also refer to the other information contained in this Form 10-K, including our financial statements and the related notes.

The market for wireless broadband data access products is highly competitive, and we may be unable to compete effectively.

The market for wireless broadband data access products is highly competitive, and we expect competition to continue to increase and intensify. Many of our competitors or potential competitors have significantly greater financial, technical, operational and marketing resources than we do. These competitors, for example, may be able to respond more rapidly or more effectively than we can to new or emerging technologies, changes in customer requirements, supplier related developments, or a shift in the business landscape. They also may devote greater or more effective resources than we do to the development, promotion, sale, and post- sale support of their respective products and services.

Many of our current or potential competitors have more extensive customer bases and broader customer, supplier and other industry relationships that they can leverage to establish competitive dealings with many of our current and potential customers. Some of these companies also have more established and larger customer support organizations than we do. In addition, these companies may adopt more aggressive pricing policies or offer more attractive terms to customers than they currently do or than we are able to, may bundle their competitive products with broader product offerings and may introduce new products and enhancements. Current and potential competitors might merge or otherwise establish cooperative relationships among themselves or with third parties to enhance their products or market position. As a result, it is possible that new competitors or new or otherwise enhanced relationships among existing competitors may emerge and rapidly acquire significant market share to the detriment of our business.

Our wireless communications products currently compete with a variety of devices, including other wireless modems, wireless handsets, wireless handheld computing devices and other wireless devices. Our current and potential competitors include:

| | • | | wireless data modem providers, such as Huawei, Option, Sierra Wireless, Kyocera, and Sony-Ericsson; and |

| | • | | wireless handset providers, such as Motorola, Nokia, Siemens, and Sony-Ericsson. |

We expect our competitors to continue to improve the features and performance of their current products and to introduce new products, services and technologies. Successful new product introductions or enhancements by our competitors could reduce our sales and the market acceptance of our products, cause intense price competition and make our products obsolete. To remain competitive, we must continue to invest significant resources (financial, human and otherwise) in, among other things, research and development, sales and marketing, and customer support. We cannot be sure that we will have or will continue to have sufficient resources to make these investments or that we will be able to make the technological advances necessary for our products to remain competitive. Increased competition could result in price reductions, fewer or smaller customer orders, reduced margins and loss of our market share. Our failure to compete successfully could seriously harm our business, financial condition and results of operations.

9

Our failure to predict and comply with evolving wireless industry standards, including 3G standards, could hurt our ability to introduce and sell new products.

In our industry, it is critical to our success that we accurately anticipate evolving wireless technology standards and that our products comply with such standards in relevant respects. We are currently focused on engineering and manufacturing products that comply with several different 3G wireless standards. Any failure of our products to comply with any one of these or future applicable standards could prevent or delay their introduction and require costly and time-consuming engineering changes. Additionally, if an insufficient number of wireless operators or subscribers adopt the standards to which we engineer our products, then sales of our new products designed to those standards could be materially harmed.

If we fail to develop and introduce new products successfully, we may lose key customers or product orders and our business could be harmed.

The development of new wireless data products requires technological innovation and can be difficult, lengthy and costly. In addition, wireless operators require that wireless data systems deployed on their networks comply with their own technical and product performance standards, which may differ from the standards our products are required to meet for other operators. This increases the complexity of the product development and customer approval process. In addition, as we introduce new versions of our existing products or new products altogether, our current customers may not require or desire the technological innovations of these products and may not purchase them or might purchase them in smaller quantities than we had expected.

Further, as part of our strategy, we enter into contracts with some customers pursuant to which we develop products for later sale to the customer. Our ability to generate future revenue and operating income under any such contracts depends upon, among other factors, our ability to timely develop products that are suitable for manufacturing and in a cost effective manner and that meet defined product design, technical and performance specifications. Our ability to maximize the benefits of these contracts depends in part on the following:

| | • | | We have priced the products to be sold under these contracts based on our estimated development, production and post-production customer support and warranty costs. If these or other related development, production or support costs are actually higher than our estimated costs, our gross margins and operating margins on the corresponding contracts will be less than anticipated. |

| | • | | If we are unable to commit the necessary engineering, program management and other resources or are otherwise unable to successfully develop products as required by the terms of these contracts, our customers might cancel the related contracts, we may not be entitled to recover any costs that we incurred for research and development, sales and marketing, production and otherwise, and we may be subject to additional costs such as contractual penalties. |

| | • | | If we fail to deliver in a timely manner a product that is suitable for manufacture or if a customer determines that a prototype product we delivered does not meet the agreed-upon specifications, we may be unable to commercially launch the product, we may have to reduce the price we charge for such product if it launches, or we may be required to pay damages to the customer. |

If we are unable to successfully manage these risks or meet required delivery specifications or deadlines in connection with one or more of our key contracts, we may lose key customers or orders and our business could be harmed.

If we fail to develop and maintain strategic relationships, we may not be able to penetrate new markets.

A key element of our business strategy is to penetrate new markets by developing new products through strategic relationships with industry leaders in wireless communications. We are currently investing, and plan to continue to invest, significant resources to develop these relationships. We believe that our success in penetrating new markets for our products will depend, in part, on our ability to develop and maintain these relationships and

10

to cultivate additional or alternative relationships. There can be no assurance, however, that we will be able to develop additional strategic relationships, that existing relationships will survive and successfully achieve their purposes or that the companies with whom we have strategic relationships will not form competing arrangements with others or determine to compete unilaterally with us.

Since we have historically depended, and continue to depend, upon only a small number of our customers for a substantial portion of our revenues, our business could be negatively affected by an adverse change in our dealings with only a few customers.

A significant portion of our revenue comes from a small number of customers. Our top ten customers for the years ended December 31, 2007 and 2006 accounted for approximately 89.2% and 83.3% of our revenue, respectively. Similarly, our revenue could be adversely affected if we are unable to retain the level of business of any of our significant customers or if we are unable to diversify our customer base. We expect that a small number of customers will combine to account for a substantial amount of our revenue for the foreseeable future and any impairment of our relationship with these customers could adversely affect our business.

In addition, a majority of our current customers purchase our products pursuant to contracts that do not require them to purchase any specific minimum quantity of units other than the number of units ordered on an individual purchase order. Such customers have no contractual obligation to continue to purchase our products and if they do not continue to make purchases consistent with their historical purchase levels, our revenue would decline assuming we are unable to remedy this shortfall in full from other existing or new customers.

In light of the limited number of leading wireless operators and OEMs that form our primary customer base, most of whom are already customers, it would be difficult to replace lost revenue resulting from the loss of any significant existing customer or from a material reduction in the volume of business we conduct with any significant existing customer. Consolidation among our customers may further concentrate our business in a limited number of customers and expose us to increased risks relating to dependence on a limited number of customers, which dependence could adversely affect our operating results.

We have had to qualify, and are required to maintain our status, as a supplier for each of our customers. This is a lengthy process that involves the inspection and approval by each customer of our engineering, documentation, manufacturing and quality control procedures before that customer will place volume orders. Attempts to lessen the adverse effect of any loss of, or any material reduction in the volume of business we conduct with, any significant existing customer through the rapid addition of one or more new customers would be difficult because of these qualification requirements. Consequently, our business and operating results could be adversely affected by the loss of, or any material reduction in the volume of business we conduct with, any existing significant customer.

The sale of our products depends on the demand for broadband wireless access to enterprise networks and the Internet.

The markets for broadband wireless access solutions are relatively new and rapidly evolving, both technologically and competitively, and the successful sale of related products and services depends in part on the strength of the demand for wireless access to both enterprise networks and the Internet. At times in the past, market demand for both wireless products and wireless access services for the transmission of data developed at a slower rate than we had anticipated and as a result our product sales did not generate sufficient revenue to cover our corresponding operating costs. The failure of these markets to continue to grow at the rate that we currently anticipate may adversely impact the growth in the demand for our products and our concomitant rate of growth, and as a result, our business, financial condition and results of operations may be harmed.

11

The marketability of our products may suffer if wireless telecommunications operators do not deliver acceptable wireless services.

The success of our business depends, in part, on the capacity, affordability, reliability and prevalence of wireless data networks provided by wireless telecommunications operators and on which our products operate. Currently, various wireless telecommunications operators, either individually or jointly with us, sell our products in connection with the sale of their wireless data services to their customers. Growth in demand for wireless data access may be limited if, for example, wireless telecommunications operators cease or materially curtail operations, fail to offer services that customers consider valuable at acceptable prices, fail to maintain sufficient capacity to meet demand for wireless data access, delay the expansion of their wireless networks and services, fail to offer and maintain reliable wireless network services or fail to market their services effectively. In addition, our future growth depends on the successful deployment of next generation wireless data networks provided by third parties, including those networks for which we are currently developing products. If these next generation networks are not deployed or widely accepted, or if deployment is delayed, there will be no market for the products we are developing to operate on these networks. If any of these events occurs, or if for any other reason the demand for wireless data access fails to grow, sales of our products will decline or remain stagnant and our business could be harmed.

If we do not properly manage the growth of our business, we may experience significant strains on our management and operations and disruptions in our business.

Various risks arise when companies and industries grow quickly. If our business or industry grows too quickly, our ability to meet customer demand in a timely and efficient manner could be challenged beyond our ability to properly respond accordingly. We may also experience development, certification or production delays as we seek to meet increased demand for our products. Our failure to properly manage the growth that we or our industry might experience could negatively impact our ability to execute on our operating plan then in effect and, accordingly, could have an adverse impact on our business, our cash flow and results of operations, and our reputation with our current or potential customers.

We currently rely on third parties to manufacture our products, which exposes us to a number of risks and uncertainties outside our control.

We currently outsource our manufacturing to LG Innotek and Inventec Appliances Corporation. If one of these third-party manufacturers were to experience delays, disruptions, capacity constraints or quality control problems in its manufacturing operations, product shipments to our customers could be delayed or our customers could consequently elect to cancel the underlying product purchase order, which would negatively impact our revenues and our competitive position and reputation. Further, if we are unable to manage successfully our relationship with a manufacturer, the quality and availability of our products may be harmed. None of our third-party manufacturers is obligated to supply us with a specific quantity of products, except as may be provided in a particular purchase order that we may submit to them from time to time and that has been accepted. Therefore, such a third-party manufacturer could under some circumstances decline to accept new purchase orders from us or otherwise reduce its respective business with us. If such a manufacturer stopped manufacturing our products for any reason or reduced manufacturing capacity, we may be unable to replace the lost manufacturing capacity on a timely and comparatively cost effective basis, which would adversely impact our operations. In addition, if a third-party manufacturer were to negatively change the payment and other terms under which it agrees to manufacture for us and we are unable to locate a suitable alternative manufacturer, our manufacturing costs could significantly increase.

Because we outsource the manufacture of all of our products, the cost, quality and availability of third-party manufacturing operations are essential to the successful production and sale of our products. Our reliance on third-party manufacturers exposes us to a number of risks which are outside our control, including:

| | • | | unexpected increases in manufacturing costs; |

12

| | • | | interruptions in shipments if a third-party manufacturer is unable to complete production in a timely manner; |

| | • | | inability to control quality of finished products; |

| | • | | inability to control delivery schedules; |

| | • | | inability to control production levels and to meet minimum volume commitments to our customers; |

| | • | | inability to control manufacturing yield; |

| | • | | inability to maintain adequate manufacturing capacity; and |

| | • | | inability to secure adequate volumes of acceptable components, at suitable prices or in a timely manner. |

Although we promote ethical business practices and our operations personnel periodically visit and monitor the operations of our manufacturers, we do not control the manufacturers or their labor practices. If our current manufacturers, or any other third-party manufacturer which we use in the future, violate United States or foreign laws or regulations, we may be subjected to extra duties, significant monetary penalties, adverse publicity, the seizure and forfeiture of products that we are attempting to import or the loss of our import privileges. The effects of these factors could render the conduct of our business in a particular country undesirable or impractical and have a negative impact on our operating results.

We might forecast customer demand incorrectly and order the manufacture of excess or insufficient quantities of particular products.

We have historically placed purchase orders with our manufacturers at least three months prior to the scheduled delivery of the finished goods to our customer. In some instances, due to the length of component lead times, we might need to place manufacturing orders with our contract manufacturers solely on the basis of our receipt of a good-faith but non-binding customer forecast of the quantity and timing of the customer’s expected purchases from us. Accordingly, if the actual number of units that a customer orders from us on the subsequently issued purchase order differs materially from the number of units in respect of which we instructed our manufacturer to procure component parts, we might be unable to obtain in time adequate quantities of components to meet our customers’ binding delivery requirements or, alternatively, we might accumulate excess inventory that we are unable to timely use or resell, if at all. Our operating results and financial condition have been in the past and may in the future be materially adversely affected by our ability to manage our inventory levels and respond to short-term or unexpected shifts in customer demand as to quantities or the customer’s product delivery schedule.

We depend on sole source suppliers for some components used in our products, and therefore the availability and sale of those finished products would be harmed if any of these suppliers is not able to meet our demand and production schedule and alternative suitable components are not available on acceptable terms, if at all.

Our products contain a variety of components, some of which are procured from single suppliers. These components include both tooled parts and industry-standard parts, some of which are also used in cellular telephone handsets. From time to time, certain components used in our products have been in short supply worldwide or their anticipated commercial introduction has been delayed. If there is a shortage of any such components, and we cannot obtain a commercially and technologically suitable substitute or make sufficient and timely design or other product modifications to permit the use of such a substitute, we may not be able to timely deliver sufficient quantities of our products to satisfy our contractual obligations and particular revenue expectations. Moreover, even if we timely locate a substitute part (or locate the originally specified component from a parts broker) and its price materially exceeds our costed bill of materials, then our results of operations would be adversely affected.

13

Others might claim that our products, or components within our products, infringe on their respective intellectual property rights, which may result in substantial costs, diversion of resources and management attention, harm to our reputation or interference with our current or prospective customer relations.

It is possible that other parties might claim that we or our suppliers have violated their respective intellectual property rights. An infringement or misappropriation claim, for example, regardless of the merits or success of the claim, could result in substantial costs to us, diversion of resources and management attention and harm to our reputation. Such claims can be difficult and costly to verify, assess and defend against. A successful infringement claim against us could cause us to be liable for damages and litigation costs. In addition, a finding of infringement on our part (or in some instances, our customer’s reasonable conclusion that abona fide infringement claim is likely to be made) could have other negative consequences, including prohibiting us from further use of the intellectual property, causing us to have to modify our product, if possible, so it does not infringe, or causing us to have to license the intellectual property at issue, thereby incurring licensing fees, some of which could be retroactive. Upon the occurrence of a successful infringement claim, we may also have to develop a non-infringing alternative, which if available could be costly, and delay or prevent sales of our products.

Our business depends on our continued ability to license necessary third-party technology, and we may not be able to license necessary third-party technology or it may be expensive to do so.

We license technology from third parties for the development of our products. We have licensed from third parties, such as QUALCOMM, software, patents and other intellectual property for use in our products and from time to time we may elect or be required to license additional intellectual property. The license from QUALCOMM, for example, does not have a specified term and may be terminated by us or by QUALCOMM for cause or upon the occurrence of other specified events. There can be no assurance that we will be able to maintain our third-party licenses, that such licenses themselves will not be the subject of dispute or adverse litigation, or that additional third-party licenses will be available to us on commercially reasonable terms, if at all. The inability to maintain or obtain third-party licenses required for our products or to develop new products and product enhancements could require us to seek to obtain substitute technology of lower quality or performance standards, if such exists, or at greater cost, which could seriously harm our competitive position, revenue and growth prospects.

We are subject to the risks of doing business abroad, which could negatively affect our international sales activities and our ability to obtain products from our foreign manufacturers.

In addition to our manufacturing activities in Asia, a significant portion of our sales activity takes place in Europe. In addition, a significant portion of our research and development staff is located in Canada. Our international sales accounted for approximately 25% of our revenue for the year ended December 31, 2007 and 37% for the year ended December 31, 2006. Although our experience in marketing, selling, distributing and manufacturing our products and services internationally is limited, we expect to further expand our international sales and marketing activities in the future. Consequently, we are subject to certain risks associated with doing business abroad, including:

| | • | | difficulty in managing widespread sales, research and development operations and post-sales logistics and support; |

��

| | • | | changes in a specific country’s or region’s political or economic conditions, particularly in emerging markets, and changes in diplomatic and trade relationships; |

| | • | | less effective protection of intellectual property and general exposure to different legal standards; |

| | • | | trade protection measures and import or export licensing requirements; |

| | • | | potentially negative consequences from changes in tax laws; |

14

| | • | | increased expenses associated with customizing products for different countries; |

| | • | | unexpected changes in regulatory requirements resulting in unanticipated costs and delays; |

| | • | | longer collection cycles and difficulties in collecting accounts receivable; |

| | • | | international terrorism; |

| | • | | loss or damage to products in transit; and |

| | • | | international dock strikes or other transportation delays. |

Any disruption in our ability to obtain products from our foreign manufacturers or in our ability to conduct international operations and sales could have a material adverse effect on our business, financial condition and results of operations.

To the extent we enter into contracts that are denominated in foreign currencies and do not adequately hedge that exposure, fluctuations in exchange rates between the United States dollar and foreign currencies may affect our operating results.

A significant amount of our revenues are generated from sales agreements denominated in foreign currencies, and we expect to enter into additional such agreements as we expand our international customer base. As a result, we are exposed to changes in foreign currency exchange rates, and we currently expect the absolute value of this exposure may increase in the future. In particular, fluctuations in the Euro currency may have a material impact on our future operating results and gross margins. We attempt to manage this risk, in part, by minimizing the effects of volatility on cash flows by identifying forecasted transactions exposed to these risks and using foreign exchange forward contracts. Since there is a high correlation between the hedging instruments and the underlying exposures, the gains and losses on these underlying exposures are generally offset by reciprocal changes in the value of the hedging instruments. We use derivative financial instruments as risk management tools and not for trading or speculative purposes. Nevertheless, there can be no assurance that we will not incur foreign currency losses or that foreign exchange forward contracts we may enter into to reduce the risk of such losses will be successful.

Our products may contain errors or defects, which could prevent or decrease their market acceptance and lead to unanticipated costs or other adverse business consequences.

Our products are technologically complex and must meet stringent user requirements. We must develop our hardware and software products quickly to keep pace with the rapidly changing and technologically advanced wireless communications market. Products as sophisticated as ours may contain undetected errors or defects, especially when first introduced or when new models or versions are released. Our products may not be free from errors or defects after commercial shipments have begun, which could result in the rejection of our products, the loss of a customer or the failure to obtain one, damage to our reputation, lost revenue, diverted development resources, increased customer service and support costs, unanticipated warranty claims, and the payment of monetary damages to our customers.

Our quarterly operating results may vary significantly from quarter to quarter and may cause our stock price to fluctuate.

Our future quarterly operating results may fluctuate significantly and may fall short of or exceed the expectations of securities analysts, investors or management. If this occurs, the market price of our stock could fluctuate, in some cases materially. The following factors may cause fluctuations in our operating results:

| | • | | Decreases in revenue or increases in operating expenses. We budget our operating expenses based on anticipated sales, and a significant portion of our sales and marketing, research and development and |

15

| | general and administrative costs are fixed, at least in the short term. If revenue decreases, due to pricing pressures or otherwise, or does not grow as planned and we are unable to reduce our operating costs quickly and sufficiently, our operating results could be materially adversely affected. |

| | • | | Product mix. The product mix of our sales affects profit margins in any given quarter. As our business evolves and the revenue from the product mix of our sales varies from quarter to quarter, our operating results will likely fluctuate in ways that might not be directly proportionate to the fluctuation in revenue. |

| | • | | New product introductions. As we introduce new products, the timing of these introductions within any given quarter will affect our quarterly operating results. We may have difficulty predicting the timing of new product introductions and the market acceptance of these new products. If products and services are introduced earlier or later than anticipated, or if market acceptance is unexpectedly high or low, our quarterly operating results may fluctuate unexpectedly. |

| | • | | Lengthy sales cycle. The length of time between the date of initial contact with a potential customer and the execution of and product delivery under a contract may take several months, or longer, and is subject to delays or interruptions over which we have little or no control. The sale of our products is subject to delays from, among other things, our customers’ budgeting, product testing and vendor approval mechanics, and competitive evaluation processes that typically accompany significant information technology purchasing decisions. As a result, our ability to anticipate the timing and volume of sales to specific customers is limited, and the delay or failure to complete one or more large transactions could cause our operating results to vary significantly from quarter to quarter. |

| | • | | Foreign currency. As noted above, we are exposed to market risk from changes in foreign currency exchange rates. In particular, fluctuations in the Euro currency may have a material impact on our future operating results and gross margins. Our attempts to minimize the effects of volatility in foreign currencies on cash flows may not be successful. |

Due to these and other factors, our results of operations may fluctuate substantially in the future and quarter-to-quarter comparisons may not be reliable indicators of future operating or share price performance.

We may not be able to maintain and expand our business if we are not able to hire, retain and manage additional qualified personnel.

Our success in the future depends in part on the continued contribution of our executive, technical, engineering, sales, marketing, operations and administrative personnel. Recruiting and retaining skilled personnel in the wireless communications industry, including software and hardware engineers, is highly competitive.

Although we may enter into employment agreements with members of our senior management and other key personnel in the future, currently only Peter Leparulo, the Company’s Executive Chairman, is bound by an employment agreement. If we are not able to attract or retain qualified personnel in the future, or if we experience delays in hiring required personnel, particularly qualified engineers, we may not be able to maintain and expand our business.

Any acquisitions we make could disrupt our business and harm our financial condition and results of operations.

As part of our business strategy, we review and intend to continue to review, on an ongoing basis, acquisition opportunities that we believe would be advantageous or complementary to the development of our business. Accordingly, we may acquire businesses, assets, or technologies in the future. If we make any acquisitions, we could take any or all of the following actions, any one of which could adversely affect our business, financial condition, results of operations or share price:

| | • | | issue equity or equity-based securities that would dilute existing stockholders’ percentage ownership; |

16

| | • | | use a substantial portion of our available cash; |

| | • | | incur substantial debt, which may not be available to us on favorable terms and may adversely affect our liquidity; |

| | • | | assume contingent liabilities; and |

| | • | | take substantial charges in connection with acquired assets. |

Acquisitions also entail numerous other risks, including: difficulties in assimilating acquired operations, products, technologies and personnel; unanticipated costs; diversion of management’s attention from other business concerns; adverse effects on existing business relationships with suppliers and customers; risks of entering markets in which we have limited or no prior experience; and potential loss of key employees from either our preexisting business or the acquired organization. We may not be able to successfully integrate any businesses, products, technologies or personnel that we might acquire in the future, and our failure to do so could harm our business and operating results.

Any changes to existing accounting pronouncements or taxation rules or practices may cause adverse fluctuations in our reported results of operations or affect how we conduct our business.

A change in accounting pronouncements or taxation rules or practices can have a significant effect on our reported results and may affect our reporting of transactions completed before the change is effective. New accounting pronouncements, taxation rules and varying interpretations of accounting pronouncements or taxation rules have occurred and may occur in the future. The change to existing rules, future changes, if any, or the need for us to modify a current tax position may adversely affect our reported financial results or the way we conduct our business.

We may not be able to develop products that comply with applicable government regulations.

Our products must comply with government regulations. For example, in the United States, the Federal Communications Commission, or FCC, regulates many aspects of communications devices, including radiation of electromagnetic energy, biological safety and rules for devices to be connected to telephone networks. In addition to the federal government, some states have adopted regulations applicable to our products. Radio frequency devices, which include our modems, must be approved under the above regulations by obtaining equipment authorization from the FCC prior to being offered for sale. Regulatory requirements in Canada, Europe, Asia and other jurisdictions must also be met. Additionally, we cannot anticipate the effect that changes in domestic or foreign government regulations may have on our ability to develop and sell products in the future. Failure to comply with existing or evolving government regulations or to obtain timely regulatory approvals or certificates for our products could materially adversely affect our business, financial condition and results of operations or cash flows.

| Item 1B. | Unresolved Staff Comments |

None

Our principal executive offices are located in San Diego, California where we lease approximately 64,000 square feet under an arrangement that expires in December 2010. In Calgary, Canada, we lease approximately 24,000 square feet for our research and development organization under a lease that expires in September 2012. In Basingstoke, United Kingdom, we lease approximately 4,000 square feet for our European staff under a lease agreement that expires in December 2011. In Shanghai, China, we lease approximately 300 square meters for our Chinese staff under a lease agreement that expires in June 2010. We also lease space in

17

various geographic locations abroad primarily for sales and support personnel or for temporary facilities. We believe that our existing facilities are adequate to meet our current needs and that we can renew our existing leases or obtain alternative space on terms that would not have a material impact on our financial condition.

We are from time to time party to various legal proceedings arising in the ordinary course of business. Based on evaluation of these matters and discussions with our counsel, we believe that liabilities arising from or sums paid in settlement of these matters will not have a material adverse effect on the consolidated results of our operations or financial condition.

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of our stockholders during the fourth quarter of 2007.

18

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Common Stock Data

Shares of our common stock are quoted and traded on The Nasdaq Global Select Market under the symbol “NVTL.” The following table sets forth, for the periods indicated, the high and low closing sales prices per share of our common stock as reported by The Nasdaq Global Select Market.

| | | | | | |

| | | High | | Low |

2007 | | | | | | |

First quarter | | $ | 17.04 | | $ | 9.75 |

Second quarter | | $ | 26.02 | | $ | 15.99 |

Third quarter | | $ | 28.75 | | $ | 20.83 |

Fourth quarter | | $ | 26.72 | | $ | 15.16 |

| | |

2006 | | | | | | |

First quarter | | $ | 12.96 | | $ | 8.16 |

Second quarter | | $ | 11.46 | | $ | 8.82 |

Third quarter | | $ | 11.96 | | $ | 9.63 |

Fourth quarter | | $ | 9.84 | | $ | 8.14 |

On February 25, 2008 the last reported closing sale price per share of our common stock on The Nasdaq Global Select Market was $11.43.

Number of Stockholders of Record

We have only one class of common stock. As of February 25, 2008 there were approximately 61 holders of record of our common stock. Because many of the shares of our common stock are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders.

Dividends

We have never declared or paid cash dividends on any shares of our capital stock. We currently intend to retain all available funds for use in the operation and development of our business and, therefore, do not anticipate paying any cash dividends in the foreseeable future. Any future determination relating to our dividend policy will be made at the discretion of our board of directors and will depend on a number of factors, including future earnings, capital requirements, financial condition and future prospects and other factors the board of directors may deem relevant.

19

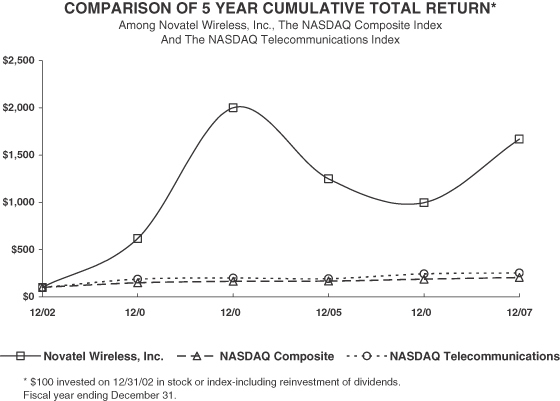

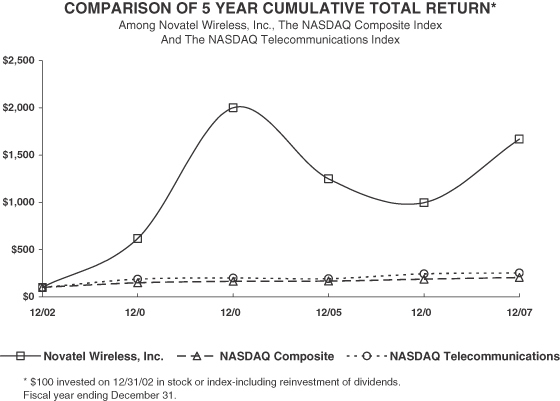

Performance Graph

The following graph compares the cumulative total stockholder return on the Company’s common stock between December 31, 2002 and December 31, 2007 with the cumulative total return of (i) the Nasdaq Stock Market (U.S.) Index (“Nasdaq Index”) and (ii) the Nasdaq Telecommunications Index (the “Nasdaq Telecom Index”), over the same period. This graph assumes the investment of $100.00 on December 31, 2002 in the common stock of the Company, the Nasdaq Index and the Nasdaq Telecom Index and assumes the reinvestment of any dividends. The stockholder return shown on the graph below should not be considered indicative of future stockholder returns and the Company will not make or endorse any predictions as to future stockholder returns.

| | | | | | | | | | | | |

| | | Cummulative Total Return |

| | | 12/02 | | 12/03 | | 12/04 | | 12/05 | | 12/06 | | 12/07 |

Novatel Wireless, Inc. | | 100.00 | | 617.53 | | 2001.03 | | 1248.45 | | 996.91 | | 1670.10 |

NASDAQ Composite | | 100.00 | | 149.75 | | 164.64 | | 168.60 | | 187.83 | | 205.22 |

NASDAQ Telecommunications | | 100.00 | | 188.21 | | 199.04 | | 192.18 | | 244.38 | | 253.12 |

20

| Item 6. | Selected Financial Data |

The following selected financial data should be read in conjunction with our Consolidated Financial Statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this Form 10-K. The selected consolidated statements of operations data presented below for each of the years ended December 31, 2007, 2006, and 2005, and the consolidated balance sheet data at December 31, 2007 and 2006 are derived from our consolidated financial statements that have been included elsewhere in this Form 10-K. The selected consolidated statement of operations data for the years ended December 31, 2004 and 2003 and consolidated balance sheet data at December 31, 2005, 2004, and 2003 are derived from audited consolidated financial statements not included in this Form 10-K.

| | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2007 | | 2006 | | | 2005 | | 2004 | | 2003 | |

| | | (in thousands, except per share data) | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | |

Revenue | | $ | 429,903 | | $ | 217,972 | | | $ | 161,736 | | $ | 103,727 | | $ | 33,815 | |

Cost of revenue | | | 299,062 | | | 162,749 | | | | 115,568 | | | 69,780 | | | 27,942 | |

| | | | | | | | | | | | | | | | | |

Gross margin | | | 130,841 | | | 55,223 | | | | 46,168 | | | 33,947 | | | 5,873 | |

| | | | | | | | | | | | | | | | | |

Operating costs and expenses: | | | | | | | | | | | | | | | | | |

Research and development | | | 37,558 | | | 31,317 | | | | 20,515 | | | 10,625 | | | 6,118 | |

Sales and marketing | | | 20,937 | | | 14,168 | | | | 7,611 | | | 4,739 | | | 2,693 | |

General and administrative | | | 18,899 | | | 16,306 | | | | 7,528 | | | 5,138 | | | 4,068 | |

Restructuring and impairment charges | | | — | | | — | | | | — | | | — | | | 828 | |

| | | | | | | | | | | | | | | | | |

Total operating costs and expenses | | | 77,394 | | | 61,791 | | | | 35,654 | | | 20,502 | | | 13,707 | |

| | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 53,447 | | | (6,568 | ) | | | 10,514 | | | 13,445 | | | (7,834 | ) |

Other income (expense) | | | 6,071 | | | 4,305 | | | | 2,008 | | | 723 | | | (3,804 | ) |

| | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 59,518 | | | (2,263 | ) | | | 12,522 | | | 14,168 | | | (11,638 | ) |

Provision (benefit) for income taxes | | | 20,756 | | | (2,706 | ) | | | 1,406 | | | 349 | | | — | |

| | | | | | | | | | | | | | | | | |

Net income (loss) after income taxes | | | 38,762 | | | 443 | | | | 11,116 | | | 13,819 | | | (11,638 | ) |