UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-21771

West Corporation

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 47-0777362 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| |

| 11808 Miracle Hills Drive, Omaha, Nebraska | | 68154 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (402) 963-1200

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes þ No ¨

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer þ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

At February 14, 2011, 88,016,724.4624 shares of the registrant’s Class A common stock and 9,995,145.5578 shares of the registrant’s Class L common stock were outstanding.

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. These forward-looking statements include estimates regarding:

| | • | | the impact of changes in government regulation and related litigation; |

| | • | | the impact of pending litigation; |

| | • | | the impact of integrating or completing mergers or strategic acquisitions; |

| | • | | the adequacy of our available capital for future capital requirements; |

| | • | | our future contractual obligations; |

| | • | | our capital expenditures; |

| | • | | the cost and reliability of voice and data services; |

| | • | | the cost of labor and turnover rates; |

| | • | | the impact of changes in interest rates; |

| | • | | substantial indebtedness incurred in connection with the 2006 recapitalization and acquisitions; and |

| | • | | the impact of foreign currency fluctuations. |

as well as other statements regarding our future operations, financial condition and prospects, and business strategies.

Forward-looking statements can be identified by the use of words such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “intends,” “continue,” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the risks discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report.

All forward-looking statements included in this report are based on information available to us on the date hereof. We assume no obligation to update any forward-looking statements.

PART I.

Overview

We are a leading provider of technology-driven, voice and data solutions. We offer our clients a broad range of communications and network infrastructure solutions that help them manage or support critical communications. The scale and processing capacity of our proprietary technology platforms, combined with our world-class expertise and processes in managing telephony and human capital, enable us to provide our clients with premium outsourced communications solutions. Our automated service and conferencing solutions are designed to improve our clients’ cost structure and provide reliable, high-quality services. Our solutions also help deliver mission-critical services, such as public safety and emergency communications. We serve Fortune 1000 companies and other clients in a variety of industries, including telecommunications, banking, retail, financial services, technology and healthcare, and have sales and operations in the United States, Canada, Europe, the Middle East, Asia Pacific and Latin America.

1

Since our founding in 1986, we have invested significantly to expand our technology platforms and develop our operational processes to meet the complex communication needs of our clients. We have evolved into a predominantly automated processor of voice and data transactions and a provider of network infrastructure solutions. In 2010, we grew revenue by 0.5% over 2009 to $2,388.2 million and generated $654.7 million in adjusted EBITDA, or 27.4% margins, $60.3 million in net income and $312.8 million in cash flows from operating activities. See “Selected Consolidated Financial Data.”

Investing in technology and developing specialized expertise in the industries we serve are critical components to our strategy of enhancing our services and delivering operational excellence. In 2010, we managed approximately 24.0 billion telephony minutes and over 115 million conference calls, facilitated over 240 million 9-1-1 calls, and delivered over 720 million notification calls and data messages. With approximately 608,000 telephony ports to handle conference calls, alerts and notifications and customer service, we believe our platforms provide scale and flexibility to handle greater transaction volume than our competitors, offer superior service and develop new offerings. These ports include approximately 256,000 Internet Protocol (“IP”) ports, which we believe provide us with the only large-scale proprietary IP-based global conferencing platform deployed and in use today. Our technology-driven platforms allow us to provide a broad range of complementary automated and agent-based service offerings to our diverse client base.

Corporate Information

We are a Delaware corporation that was founded in 1986. On October 24, 2006, we completed a recapitalization (the “recapitalization”) of the company in a transaction sponsored by an investor group led by Thomas H. Lee Partners, L.P. and Quadrangle Group LLC (the “Sponsors”) pursuant to the Agreement and Plan of Merger, dated as of May 31, 2006, between us and Omaha Acquisition Corp., a Delaware corporation formed by the Sponsors for the purpose of our recapitalization. Pursuant to the recapitalization, Omaha Acquisition Corp. was merged with and into West Corporation, with West Corporation continuing as the surviving corporation, and our publicly traded securities were cancelled in exchange for cash.

We financed the recapitalization with equity contributions from the Sponsors and the rollover of a portion of our equity interests held by Gary and Mary West, the founders of West, and certain members of management, along with a senior secured term loan facility, a senior secured revolving credit facility and the private placement of senior notes and senior subordinated notes.

Our principal executive offices are located at 11808 Miracle Hills Drive, Omaha, Nebraska 68154 and our telephone number at that address is (402) 963-1200. Our website address iswww.west.comwhere our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports are available without charge, as soon as reasonably practicable following the time they are filed with or furnished to the SEC. None of the information on our website or any other website identified herein is part of this report. All website addresses in this report are intended to be inactive textual references only.

2

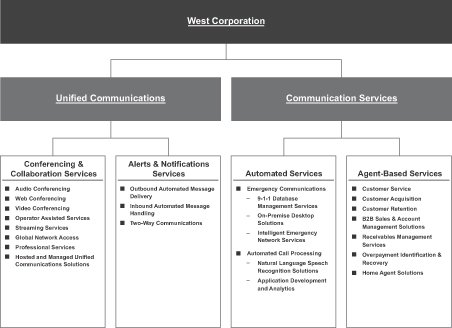

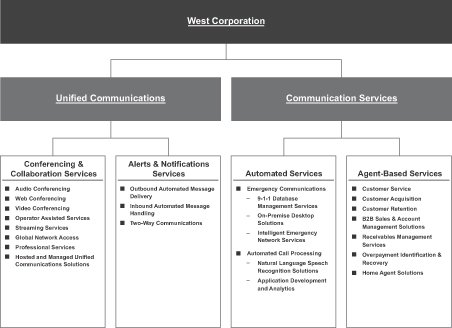

Our Services

We believe we have built our reputation as a best-in-class service provider over the past 24 years by delivering differentiated, high-quality solutions for our clients. Our portfolio of technology-driven, voice and data solutions includes:

Unified Communications

—Conferencing & Collaboration Services.Operating under the InterCall brand, we are the largest conferencing services provider in the world based on conferencing revenue, according to Wainhouse Research, and managed over 115 million conference calls in 2010. We provide our clients with an integrated global suite of meeting replacement services. These include on-demand automated conferencing services, operator-assisted services for complex audio conferences or large events, web conferencing services that allow clients to make presentations and share applications and documents over the Internet, video conferencing applications that allow clients to experience real-time video presentations and conferences and streaming services to connect remote employees and host virtual events. We also provide consulting, project management and implementation of hosted and managed unified communications solutions.

—Alerts & Notifications Services.Our solutions leverage our proprietary technology platforms to allow clients to manage and deliver automated personalized communications quickly and through multiple delivery channels (voice, text messaging, email and fax). For example, we deliver patient notifications, appointment reminders and prescription refill reminders on behalf of our healthcare clients (medical and dental practices, hospitals and pharmacies), provide travelers with flight arrival and departure updates on behalf of our transportation clients and transmit emergency evacuation notices on behalf of municipalities. Our platform also enables two-way communication which allows recipients of a message to respond with relevant information to our clients.

3

Communication Services

—Automated Services

—Emergency Communications Services.We believe we are the largest provider of emergency communications infrastructure systems and services, based on our own estimates of the number of 9-1-1 calls that we and other participants in the industry facilitated. Our solutions are critical in facilitating public safety agencies’ ability to coordinate responses to emergency events. We provide the network database solution that routes emergency calls to the appropriate 9-1-1 centers and allows the appropriate first responders (police, fire and ambulance) to be assigned to those calls. Our clients generally enter into long-term contracts and fund their obligations through monthly charges on users’ local telephone bills. We also provide fully-integrated desktop communications technology solutions to public safety agencies that enable enhanced 9-1-1 call handling.

In 2010, we introduced the Intrado A9-1-1SM Alliance Member Program, a managed services program designed to upgrade the capabilities of 9-1-1 centers by delivering expanded information and new life-saving services across the U.S. The Alliance program creates an open marketplace for companies to significantly improve 9-1-1 by integrating their solutions with Intrado using industry approved open standard interfaces.

—Automated Call Processing.Over the last 21 years we believe we have developed a best-in-class suite of automated voice and data solutions. Our solutions allow our clients to effectively communicate with their customers through inbound and outbound interactive voice response (IVR) applications using natural language speech recognition, automated voice prompts and network-based call routing services. In addition to these front-end customer service applications, we also provide analyses that help our clients improve their automated communications strategy. Our automated services technology platforms serve as the backbone of our telephony management capabilities and our scale and operational flexibility have helped us launch and grow other key services, such as conferencing, alerts and notifications and West at Home.

—Agent-Based Services.We provide our clients with large-scale, agent-based services, including inbound customer care, customer acquisition and retention, business-to-business sales and account management, overpayment identification and recovery services, and collection of receivables on behalf of our clients. We have a flexible model with both on-shore and off-shore capabilities to fit our clients’ needs. We believe that we are known in the industry as a premium provider of these services, and we seek opportunities with clients for whom our services can add value while maintaining attractive margins for us. Our West at Home agent service is a remote call handling model that uses employees who work out of their homes. This service has a distinct advantage over traditional facility-based call center solutions by attracting higher quality agents. This model helps enhance our cost structure and significantly reduces our capital requirements.

Market Opportunity

Over the past 24 years, we have focused on leveraging our strengths in voice and data markets to serve the increasingly complex communications needs of our target client base. The global customer care business process outsourcing (“BPO”) market was estimated to be approximately $62 billion in 2010 with a projected compound annual growth rate (“CAGR”) through 2013 of approximately 7% according to IDC. In this market, we target opportunities where we can operate with a sustained competitive advantage and drive the highest levels of profitability. We have built on our position in this market by investing in emerging service delivery models with attractive end-market growth characteristics, such as West at Home customer care, that provide a higher quality of service to our clients. We believe we are one of the largest providers of this home-based model, having invested in this market early as client adoption began to accelerate.

Our investment strategy has evolved over the years as we have targeted new and complementary markets that not only leverage our depth of expertise in voice and data solutions but also deliver value through less labor intensive areas such as conferencing and collaboration, emergency communications and alerts and notifications services. Consistent with this strategy, we entered the conferencing and collaboration services market with our

4

acquisition of InterCall in 2003. Through organic growth and multiple strategic acquisitions, we have built on our initial success with our InterCall brand to become the leading global provider of conferencing services since 2008 based on revenue, according to Wainhouse Research.

The market for global unified communications services, which includes hosted audio, web and video conferencing as well as hosted and managed unified communication services, was $7.2 billion in 2010 and is expected to grow at a CAGR of 20% through 2014 according to Wainhouse Research. According to Tern Systems, the market for automated message delivery in the U.S. was over $850 million in 2010, and is expected to grow at an annual growth rate of 20% through 2015. We believe this growth is being driven by a number of factors, including increased globalization of business activity, focus on lower costs, increased adoption of conferencing and collaboration services and increasing awareness of the need for rapid communication during emergencies. By leveraging our global sales team and diversified client base, we intend to continue targeting higher growth, underserved markets.

The emergency communications infrastructure services market represents a complementary opportunity that allows us to diversify into end-markets that are less susceptible to downturns in the economy. According to Compass Intelligence, approximately $3.8 billion of government-sponsored funds are estimated to be available for 9-1-1 software, hardware and systems expenditures in 2010 and such funds are expected to grow at a 5.4% CAGR through 2014.

Business Evolution Since the Recapitalization

Over the past several years, we have expanded our capabilities and repositioned our business to meet the growing needs of our clients, addressing attractive new markets with strong demand characteristics and growth profiles. Our evolution during this time frame has resulted in a meaningful shift of our business mix towards a higher growth, higher margin automated processing model. As we continue to increase the level of automated services we provide, we intend to pursue opportunities in markets where we have industry expertise and where clients place a premium on the quality of service provided. Since 2005, we have invested approximately $1.7 billion in strategic acquisitions of value-added service providers, including approximately $850 million since our recapitalization in 2006. We have increased our penetration into higher growth international conferencing markets, strengthened our alerts and notifications services business and established a leadership position in emergency communication infrastructure management services. We have also meaningfully reoriented our business to address the emergence of unified communication products, a fast-growing demand trend. The following summaries further highlight the steps we have taken to improve our business:

—Evolved into a Predominantly Automated Solutions Business.We have continued our evolution into a diversified and automated technology-driven service provider. Our revenue from automated services businesses grew from 37% of total revenue in 2005 to 67.8% in 2010, and our operating income from automated services businesses grew from 53% of total operating income to 95% over the same period.

—Expanded Emergency Communications Services.In early 2006, we acquired Intrado and, in 2008, we acquired HBF Communications and Positron Public Safety Systems to become, we believe, the largest provider of 9-1-1 and emergency communications infrastructure services to telecommunications service providers, government agencies and public safety organizations, based on our own estimates of the number of 9-1-1 calls that we and other participants in the industry facilitated. To complement these acquisitions, we have steadily increased our presence in this market through substantial investments in proprietary systems to develop IP-based emergency communications services capabilities. This business is characterized by long-term client contracts.

—Expanded Conferencing Presence.Through both organic growth and acquisitions, we have been successful in expanding the reach of our conferencing services both domestically and internationally. Our conferencing services volume has grown from approximately 21 million calls in 2006 to over 115 million calls in

5

2010. In addition, we increased our worldwide presence in this market by acquiring Genesys, a global conferencing services provider, in May 2008 and we are now the largest conferencing services provider in the world based on conferencing revenue according to Wainhouse Research.

—Strengthened Alerts and Notifications Business.In 2007, we increased our presence in the high growth, high margin alerts and notifications business through the acquisitions of CenterPost Communications (now known as West Notifications Group Inc.) (“WNG”) and TeleVox Software, Incorporated (“TeleVox”). We now provide automated communication solutions across more industries, including financial services, communications, transportation and pharmacy. TeleVox delivers patient notifications to a diverse base of clients in the medical and dental markets as well as certain other commercial clients such as regional utilities and credit unions.

Our Competitive Strengths

We have developed operational and market expertise to serve the needs of clients who place a premium on the services we provide. We believe the following strengths have helped us to establish a leading competitive position in the markets we serve.

—Proven Business Model Built Over Decades.We have built a strong and stable business model that has delivered a 30.5% revenue CAGR since our inception in 1986. We have helped our clients communicate more effectively with their customers by processing billions of minutes of their voice and data transactions over the past 24 years. As a result of our longstanding history in our markets and significant investment in our businesses, we have accumulated substantial operating and management experience through various economic cycles. As demand for outsourced solutions grows with greater adoption of our technologies and services and the global trend towards business process outsourcing, we believe our long history of delivering results for our clients combined with our scale provide us with a significant competitive advantage.

—Broad Portfolio of Product Offerings with Attractive Value Proposition.Our technology-driven platforms combined with our operational expertise and processes allow us to provide a broad range of complementary automated and agent-based service offerings that help establish deep relationships with our clients. Our ability to efficiently and cost-effectively process high volume, complex transactions for our clients facilitates their critical communications and helps improve their cost structure.

—Scalable Operating Model.We have developed integrated proprietary platforms that we believe form one of the largest multi-carrier, multi-protocol secure managed networks. By allowing us to focus our research and development efforts on new services for multiple transaction types, our highly scalable operating model enables us to enhance our value proposition to clients and achieve greater efficiencies and returns from our infrastructure and invested capital. We also benefit from our ability to use our infrastructure and human capital across our business lines providing for the most efficient and opportunistic use of resources. We believe our shared operating model provides us with highly flexible and capital-efficient operations, which have been a critical factor in driving our performance and financial results.

—Strong, Recurring Client Relationships and Transactions.Many leading corporations look to us to manage their most important communications, voice and data transactions. We help our clients maximize the value of their customer relationships and derive greater value from each transaction that we process. The nature of our deep strategic and operational partnerships with our clients has allowed us to build long-lasting relationships with clients who operate in a broad range of industries, including telecommunications, banking, retail, financial services, technology and healthcare. Our top ten clients in 2010 have an average tenure of over ten years. In 2010, our 100 largest clients represented approximately 57% of our revenue. In addition, our clients often buy multiple services from us, with approximately 46% of our revenue in 2010 coming from clients purchasing multiple service offerings.

6

—Large-Scale, Technology-Driven Platforms.We leverage our strengths in technology, telephony and human capital management to process voice and data transactions for our clients. In 2010, for example, we managed and processed approximately 24.0 billion telephony minutes across our platforms, more than 115 million conference calls, more than 240 million 9-1-1 calls, and delivered over 720 million notification calls and data messages. In addition, with approximately 608,000 telephony ports to handle conference calls, alerts and notifications and customer service, our platforms provide scale and flexibility to handle greater transaction volume than our competitors, offer superior service and develop new offerings. These ports include approximately 256,000 IP ports, which we believe provide us with the only large-scale proprietary IP-based global conferencing platform deployed and in use today.

—Experienced Management Team.Our senior leadership has an average tenure of approximately 12 years with us and has delivered strong results through various market cycles, both as a public and as a private company. As a group, this team has created a culture of superior client service and has been able to achieve a 12.7% revenue CAGR over the past ten years. We also have established a long track record of successfully acquiring and integrating companies to drive growth and margin expansion.

Our Growth Strategy

Our strategy is to identify growing markets where we can deploy our existing assets and expertise to strengthen our competitive position. Our strategy is supported by our commitment to superior client service, operational excellence and technological and market leadership. Key aspects of our strategy include the following:

Drive Revenue and Profit Opportunities

—Expand Relationships with Existing Clients. We are focused on deepening and expanding relationships with our existing clients by delivering value in the form of reduced costs, improved customer relationships and enhanced revenue opportunities. Approximately 46% of our revenue in 2010 came from clients purchasing multiple service offerings from us. As we demonstrate the value that our services provide, often starting with a discrete service, we are frequently able to expand the size and scope of our client relationships.

—Develop New Client Relationships.In addition to expanding and enhancing our existing relationships, we will pursue new client opportunities. We will continue to focus on building long-term client relationships across a wide range of industries and geographies to further diversify our revenue base. We target clients in industries in which we have expertise or other competitive advantages and an ability to deliver a wide range of solutions that have a meaningful impact on their business. For example, our acquisition of Genesys in 2008 combined with our expertise in conferencing and collaboration services has allowed us to penetrate substantial new international markets. By continuing to add long-term client relationships in large and growing markets, we believe we enhance the stability and growth potential of our revenue base.

Enhance Utilization of Deployed Assets

—Continue to Enhance Leading Technology Capabilities.We believe our service offerings are enhanced by our superior technology capabilities and track record of innovation. We have been issued approximately 130 patents and have approximately 220 pending patent applications for technology and processes that we have developed. Many of our advances in technology and new uses for our platforms have been achieved in close partnership with our clients, and we will continue to target technology-driven solutions that enable our clients to realize significant benefits. In addition to strengthening our client relationships, we believe our focus on technology facilitates our ongoing evolution towards a diversified, predominantly automated and technology-driven operating model.

—Continue to Deliver Operational Excellence.We intend to continue to increase productivity and performance for our clients by leveraging our expertise in technology and telephony to efficiently process voice and data transactions. Our ability to provide improvements in processes is an important aspect of our value

7

proposition to clients, and we will continue to leverage our proprietary technology infrastructure and shared services platform to manage higher value transactions and achieve cost savings for our clients and ourselves. In addition, we intend to continue to focus our efforts and expenditures in areas that we believe provide the greatest opportunity for profit enhancement.

Pursue Attractive Markets and Services

—Target Growth Opportunities.We will continue to seek opportunities to expand our capabilities across industries and service offerings. We expect this will occur through a combination of organic growth, as well as strategic partnerships, alliances and acquisitions to expand into new service offerings as well as into new industries. Since 2005, we have invested approximately $1.7 billion in strategic acquisitions. We believe there are acquisition candidates that will enable us to expand our capabilities and markets and intend to continue to evaluate acquisitions in a disciplined manner and pursue those that provide attractive opportunities to enhance our growth and profitability.

Products and Services

Unified Communications

Service Offerings

— Conferencing and Collaboration.

Operating under the InterCall brand, we are the largest conferencing services provider in the world based on conferencing revenue, according to Wainhouse Research, and managed over 115 million conference calls in 2010. We provide our clients with an integrated global suite of meeting replacement services. These include on-demand automated conferencing services, operator-assisted services for complex audio conferences or large events, web conferencing services that allow clients to make presentations and share applications and documents over the Internet, video conferencing applications that allow clients to experience real-time video presentations and conferences and streaming services to connect remote employees and host virtual events. The conferencing and collaborations business provides six primary services globally:

| | • | | Reservationless Servicesare on-demand automated conferencing services that allow clients to initiate an audio conference at anytime, without the need to make a reservation or rely on an operator. |

| | • | | Operator-Assisted Servicesare pre-scheduled conferences for complex or highly important events. Operator-assisted services are customized to a client’s needs and provide a wide range of scalable features and enhancements, including the ability to record, broadcast, schedule and administer meetings. |

| | • | | Web Conferencing Servicesallow clients to make presentations and share applications and documents over the Internet. These services are offered through our proprietary product, InterCall Unified Meeting, as well as through the resale of Cisco, Microsoft Adobe and IBM products. Web conferencing services are customized to each client’s individual needs and offer the ability to reach a wide audience. |

| | • | | Video Conferencing Servicesallow clients to experience real-time video presentations and conferences. These services are offered through our proprietary products, InterCall Video Conferencing and InterCall Video Managed Services, and can be used for a wide variety of events, including training seminars, sales presentations, product launches and financial reporting calls. |

| | • | | Streaming Services allow clients to connect remote employees and bolster collaboration as well as hosting virtual events such as e-learning, online training and promotional programs. We enhanced our presence in this market with the acquisition of Stream57, LLC on December 31, 2009. |

| | • | | Professional Services offer clients consulting, project management and implementation of hosted and managed unified communications solutions. We expanded our professional services capabilities with the acquisition of the SKT Business Communication Solutions division of the Southern Kansas Telephone Company, Inc. on April 1, 2010. |

8

— Alerts and Notifications.

Our solutions leverage our proprietary technology platforms to allow clients to manage and deliver automated personalized communications quickly and through multiple delivery channels (voice, text messaging, email and fax). For example, we deliver patient notifications, appointment reminders and prescription refill reminders on behalf of our healthcare clients (medical and dental practices, hospitals and pharmacies), provide travelers with flight arrival and departure updates on behalf of our transportation clients and transmit emergency evacuation notices on behalf of municipalities. Our platform also enables two-way communication which allows recipients of a message to respond with relevant information to our clients.

— Professional Services.

We offer expert consulting, design, integration, and implementation of voice, video, messaging, and collaboration systems and services. Specific capabilities and expertise include business value/process assessments, messaging and collaboration applications, training and adoption services, LAN/WAN, virtualization and IP telephony and legacy voice integration, including Session Initiation Protocol based technologies. We greatly enhanced our professional services capabilities in 2010 with the acquisition of SKT Business Communications Solutions.

— Hosted and Managed Unified Communications Services.

Hosted services are offered as partner-hosted or cloud-based in our datacenter and delivered in either multi-tenant or a single-tenant dedicated fashion, both of which are available with or without telephony services. Managed services can be provided from the cloud or on-premise and include 24/7 monitoring, professional services and on-going support. Among other benefits, these hosted and managed Unified Communications solutions reduce the risk of downtime, remove the burden from our customers’ IT staff, and provide a predictable monthly communications spend. These services can be delivered in hosted, managed or hybrid models.

Sales and Marketing

— Conferencing and Collaboration.

For conferencing and collaboration, we maintain a sales force of approximately 800 personnel that are trained to understand and respond to our clients’ needs. We generally pay commissions to sales professionals on both new sales and incremental revenue generated from existing clients.

We manage these sales and marketing efforts through five dedicated channels:

| | • | | National Accounts:Our national accounts meeting consultants sell our services to large, multi-national companies. |

| | • | | Direct Sales:Our direct sales meeting consultants sell our services to mid-market and large enterprises not covered by National Accounts. |

| | • | | International Sales:Our international meeting consultants sell our services internationally. |

| | • | | Internet:We sell our conferencing services on the Internet through InterCall.com and the trade name ConferenceCall.com. We acquire clients using Internet-based search engines to identify potential purchasers of conferencing services through placement of paid advertisements on search pages of major Internet search engine sites. The strength of this marketing program lies in its ability to automatically monitor ad placement on all of the major search engines and ensure optimal positioning on each of these search sites. |

| | • | | Wholesale Sales:We have relationships with traditional resellers, local exchange carriers, interexchange carriers and systems integrators to sell our conferencing services. |

9

— Alerts and Notifications.

For alerts and notifications, we maintain a dedicated sales force of approximately 70 personnel, most of whom are focused on the healthcare, dental and commercial industries. We have a sales strategy that is supported by generating leads from industry trade shows and e-marketing initiatives.

Competition

— Conferencing and Collaboration.The conferencing and collaboration services market is highly competitive. The principal competitive factors in conferencing and collaboration services include, among others, range of service offerings, global capabilities, price and quality of service. Our principal competitors in the conferencing and collaboration industry include AT&T, Verizon, Premiere Global Services, BT Conferencing, NTT, Cisco Systems, Microsoft, IBM and other premise-based solution providers.

— Alerts and Notifications. The alerts and notifications services market is highly competitive and fragmented, characterized by a large number of vertically focused competitors addressing specific industries, including healthcare, travel, education, credit collection and government. The principal competitive factors in alerts and notifications include, among others, industry-specific knowledge and service focus, reliability, scalability, ease of use and price. Competitors in this industry include Varolii, SoundBite Communications, Silverlink Communications and, in the medical and dental markets, PhoneTree, Sesame Communications and Inphonite. We also face competition for clients who implement in-house solutions.

Communication Services

Service Offerings

We believe we are one of the largest providers of outsourced communications services in the United States and we were named the 2010 North American Contact Center Outsourcing Company of the Year by Frost & Sullivan. We provide our clients with a comprehensive portfolio of integrated voice-oriented services through the following channels:

— Automated Services.

| | • | | Emergency Communications Services:We believe we are the largest provider of emergency communications infrastructure systems and services, based on our own estimates of the number of 9-1-1 calls that we and other participants in the industry facilitated. Our solutions are critical in facilitating public safety agencies’ ability to coordinate responses to emergency events. We provide the network database solution that routes emergency calls to the appropriate 9-1-1 centers and allows the appropriate first responders (police, fire and ambulance) to be assigned to those calls. Our clients generally enter into long-term contracts and fund their obligations through monthly charges on users’ local access bills. We also provide fully-integrated desktop communications technology solutions to public safety agencies that enable enhanced 9-1-1 call handling. |

| | • | | Automated Customer Service:Over the last 21 years we believe we have developed a best-in-class suite of automated voice-oriented solutions. Our solutions allow our clients to effectively communicate with their customers through inbound and outbound interactive voice response applications using natural language speech recognition, automated voice prompts and network-based call routing services. In addition to these front-end customer service applications, we also provide analyses that help our clients improve their automated communications strategy. Our automated services technology platforms serve as the backbone of our telephony management capabilities and our scale and operational flexibility have helped us launch and grow other key services, such as conferencing, alerts and notifications and West at Home. |

— Agent-Based Services.We provide our clients with large-scale, agent-based services, including inbound customer care, customer acquisition and retention, business-to-business sales and account management,

10

overpayment identification and recovery services, and receivables management solutions. We have a flexible model with both on-shore and off-shore capabilities to fit our clients’ needs. We believe that we are known in the industry as a premium provider of these services, and we seek opportunities with clients for whom our services can add value while maintaining attractive margins for us. We provide four primary types of services:

| | • | | Customer Service:We provide clients with customized services that are handled by trained agents. In addition to traditional customer care and sales services, we offer our West at Home agent service, a remote call handling model that uses employees who work out of their homes. This service has a distinct advantage over traditional facility-based call center solutions by attracting higher quality agents. This model helps to enhance our cost structure and significantly reduce our capital requirements. |

| | • | | Business-to-Business Services:We provide dedicated outsourced sales and account management services for some of the nation’s leading companies. These services help our clients drive incremental sales, increase market share and strengthen relationships with their customers. Examples of these services include sales, account management, sales support, order management and lead generation. |

| | • | | Overpayment Identification and Recovery:Overpayment identification and recovery includes health insurance claims overpayment identification and the recovery of identified overpaid amounts. Proprietary technology, data modeling and business processes are utilized to identify overpayments and return those funds to our clients. |

| | • | | Receivables Management:Receivables management involves collecting receivables on behalf of our clients. We are focused on specific industries, such as healthcare, financial services, government, utilities and telecommunications. Our recovery strategy is primarily determined by the age of receivables and the extent of previous collection efforts. |

Sales and Marketing

Generally, our Communications Services segment targets growth-oriented clients and selectively pursues those with whom we have the greatest opportunity for long-term success. We maintain approximately 150 sales and marketing personnel dedicated to our Communication Services segment. Their goals are to both maximize our current client relationships and expand our existing client base. To accomplish these goals, we attempt to sell additional services to existing clients and to develop new client relationships. We generally pay commissions to sales professionals on both new sales and incremental revenue generated from existing clients.

Competition

— Emergency Communications.The market for wireline and wireless emergency communications solutions is competitive. The principal competitive factors in wireline and wireless emergency communications are the effectiveness of existing infrastructure, scalability, reliability, ease of use, price, technical features, scope of product offerings, customer service and support, ease of technical migration, useful life of new technology and wireless support. Competitors in the incumbent local exchange carrier and competitive local exchange carrier markets generally include internally developed solutions, and competitors in the wireless market include TeleCommunications Systems. Competition in the public safety desktop market is driven by features functionality, ease of use, price, reliability, upgradability, capital replacement and upgrade policies and customer service and support. Competitors in this market include PlantCML, EmergiTech and 911-Inc.

— Automated Customer Service.The principal competitive factors in the automated customer service market are scalability, flexibility, reliability, speed of implementing client applications and price of services. Competitors in this market are primarily premise-based services.

— Agent-Based Services.The principal competitive factors in the agent-based customer service market include, among others, quality of service, range of service offerings, flexibility and speed of implementing

11

customized solutions to meet clients’ needs, capacity, industry-specific experience, technological expertise and price. In the agent-based customer services market, many clients retain multiple communication services providers, which exposes us to continuous competition in order to remain a preferred vendor. Competitors in the agent-based customer services industry include Convergys, TeleTech, Sykes, NCO, GC Services, Infosys Technologies Limited and Aegis. We also compete with the in-house operations of many of our existing and potential clients.

Our Clients

Our clients vary by business. We have a large and diverse client base for our conferencing and collaboration services, ranging from small businesses to Fortune 100 clients, and operating in a wide range of industries, including telecommunications, banking, retail, financial services, technology and healthcare. Our alerts and notifications business serves a large number of clients, who generally operate in specific industries such as medical and dental or transportation. Traditionally, our emergency communications clients have been incumbent local exchange carriers and competitive local exchange carriers. Our automated customer service and agent-based service businesses serve larger enterprise clients operating in a wide range of industries.

Although we serve many clients, we derive a significant portion of our revenue from relatively few clients. In 2010, our 100 largest clients represented approximately 57% of our revenue, with one client, AT&T, representing approximately 11% of our revenue.

Our Personnel

As of December 31, 2010, we had approximately 33,400 total employees, of which approximately 28,800 were employed in the Communication Services segment (including approximately 8,800 home-based, generally part-time employees), 3,900 were employed in the Unified Communications segment and approximately 700 were employed in corporate support functions. Of the total employees, approximately 7,600 were employed in management, staff and administrative positions, and approximately 4,900 were international employees. Employees of our subsidiaries in France are represented by a local works council. Employees in France and certain other countries are also covered by the terms of industry-specific national collective agreements. Our employees are not represented by any labor organization in the United States. We believe that our relations with our employees and the labor organizations identified above are good.

Our Technology and Systems Development

Technology is critical to our business and we believe the scale and flexibility of our platform is a competitive strength. Our software and hardware systems, as well as our network infrastructure, are designed to offer high-quality, integrated solutions. We have made significant investments in reliable hardware systems and integrated commercially available software when appropriate. We currently have approximately 608,000 telephony ports to handle conference calls, alerts and notifications and customer service. These ports include approximately 256,000 IP ports, which we believe provide us with the only large-scale proprietary IP-based global conferencing platform deployed and in use today. Our technological platforms are designed to handle greater transaction volume than our competitors. Because our technology is client focused, we often rely on proprietary software systems developed internally to customize our services. As of December 31, 2010, we employed a staff of approximately 2,100 professionals in our information technologies department.

We recognize the importance of providing uninterrupted service for our clients. We have invested significant resources to develop, install and maintain facilities and systems that are designed to be highly reliable. Our facilities and systems are designed to maximize system availability and minimize the possibility of a service disruption.

We have network operations centers that operate 24 hours a day, seven days a week and use both internal and external systems to effectively operate our equipment, people and sites. We interface directly with

12

telecommunications providers and have the ability to manage capacity in real time. Our network operations centers monitor the status of elements of our network on a real-time basis. All functions of our network operations centers have the ability to be managed at backup centers.

We rely on a combination of copyright, patent, trademark and trade secret laws, as well as on confidentiality procedures and non-compete agreements, to establish and protect our proprietary rights in each of our segments. We currently own approximately 130 registered patents and approximately 200 registered trademarks including several patents and trademarks that we obtained as part of our past acquisitions. Certain of our patents expired in 2010 and others will expire in 2012. We do not expect these patent expirations to have a material adverse effect on the business. Trademarks continue as long as we actively use the mark. We have approximately 220 pending patent applications pertaining to technology relating to intelligent upselling, transaction processing, call center and agent management, data collection, reporting and verification, conferencing and credit card processing. New patents that are issued have a life of 20 years from the date the patent application is initially filed. We believe the existence of these patents and trademarks, along with our ongoing processes to add additional patents and trademarks to our portfolio, may be a barrier to entry for specific products and services we provide and may also be used for defensive purposes in certain litigation.

Our International Operations

In 2010, revenue attributed to foreign countries exceeded 10% of our consolidated revenue and long-lived assets attributed to foreign countries were approximately 9% of our total consolidated long-lived assets.

Our Unified Communications segment operates out of facilities in the United States and approximately 23 foreign jurisdictions in North America, Europe and Asia.

Our Communication Services segment operates facilities in the United States, Canada, the Philippines, Mexico and Jamaica.

For additional information regarding our domestic and international revenues, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements included herewith.

Government Regulation

Privacy

The Unified Communications and Communications Services segments provide services to healthcare clients that, as providers of healthcare services, are considered “covered entities” under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”). As covered entities, our clients must comply with standards for privacy, transaction and code sets, and data security. Under HIPAA, we are sometimes considered a “business associate,” which requires that we protect the security and privacy of “protected health information” provided to us by our clients. We have implemented HIPAA and Health Information Technology for Economic and Clinical Health Act (“HITECH”) compliance training and awareness programs for our healthcare services employees. We also have undertaken an ongoing process to test data security at all relevant levels. In addition, we have reviewed physical security at all healthcare operation centers and have implemented systems to control access to all work areas.

In addition to healthcare information, our databases contain personal data of our clients’ customers, including credit card and other personal information. Most states as well as the European Union have enacted general privacy legislation requiring notification to consumers in the event of a security breach in or at our systems if the consumers’ personal information may have been compromised as a result of the breach. We have implemented processes and procedures to reduce the risk of security breaches, and have prepared plans to comply with these notification rules should a breach occur.

13

Telecommunications

Our wholly-owned subsidiary, Intrado Inc. and certain of its affiliates (collectively, “Intrado”), are subject to various regulations as a result of their status as a regulated competitive local exchange carrier, and/or an emergency services provider, and/or an inter-exchange carrier, including state utility commissions regulations and Federal Communications Commission (the “FCC”) regulations adopted under the Telecommunications Act of 1996, as amended. Also, under the New and Emerging Technologies 911 Improvement Act of 2008 (NET911 Act, P.L. 11-283, 47 U.S.C. 609) and its attendant FCC regulations (WC Docket No. 08-171, Report and Order dated Oct 21, 2008), Intrado is required to provide access to VoIP (voiceover Internet Protocol) telephony providers certain 9-1-1 and Enhanced, or E9-1-1, elements. Telecommunications providers are also responsible for providing subscriber records to emergency service providers under the Wireless Communications and Public Safety Act of 1999 (P.L. 106-81, 47 U.S.C. 615) and are subject to various federal and state regulations on wireless carriers that provide 9-1-1 or E9-1-1, services, including, but not limited to, regulations imposed by the FCC in C.C. Docket No. 94-102.

The market in which Intrado operates may also be influenced by legislation, regulation, and judicial or administrative determinations which seek to promote a national broadband plan, a nationwide public safety network, next generation services, and/or competition in local telephone markets, including 9-1-1 service as a part of local exchange service, or seek to modify the Universal Service Fee program.

Federal laws regulating the provision of traditional telecommunications services may adversely impact our conferencing business. Historically, we have treated our conferencing business as a provider of unregulated information services, and we have not submitted to FCC regulation or other regulations applicable to providers of traditional telecommunications services. On June 30, 2008 the FCC ordered that stand-alone providers of audio bridging services have a direct Universal Service Fund (“USF”) contribution obligation. The FCC ordered that conferencing providers begin to submit the appropriate forms to the Universal Service Administrative Company (“USAC”) beginning August 1, 2008. The FCC order specifically stated the order would not apply retroactively.

Any changes to these legal requirements, including those caused by the adoption of new laws and regulations or by legal challenges, could have a material adverse effect upon the market for our services and products. In particular, additional delays in implementation of the regulatory requirements imposed by the FCC on VoIP services could have a material adverse effect on our business, financial condition and results of operations.

Debt Collection and Credit Reporting

The receivable management business is regulated both at the federal and state level. The Federal Trade Commission (“FTC”) has the authority to investigate consumer complaints against debt collectors and to recommend enforcement actions and seek monetary penalties. In addition, a new Consumer Financial Protection Bureau (“CFPB”) was formed as part of the recently enacted Dodd-Frank Financial Reform Act. The CFPB has authority to regulate and bring enforcement actions against various types of financial service businesses including collection agencies. Despite the creation of this new agency, none of the enforcement authority was taken from the FTC, meaning that these two government agencies will have dual enforcement authority over the debt collection industry. Unlike the FTC, however, the CFPB has initiated rulemaking authority and new regulations impacting the collection business are likely on the horizon. The Federal Fair Debt Collection Practices Act (“FDCPA”) establishes specific guidelines and procedures that debt collectors must follow in communicating with consumer debtors, including:

| | • | | time, place and manner of communications; |

| | • | | prohibition of harassment or abuse by debt collectors; |

| | • | | restrictions on communications with third parties and specific procedures to be followed when communicating with third parties to obtain a consumer debtor’s location information; |

14

| | • | | notice and disclosure requirements; and |

| | • | | prohibition of unfair or misleading representations by debt collectors. |

Our collection business is also subject to the Fair Credit Reporting Act (“FCRA”), which regulates the consumer credit reporting. Under the FCRA, liability may be imposed on furnishers of data to credit reporting agencies to the extent that adverse credit information reported is false or inaccurate. In addition, the Telephone Consumer Protection Act (“TCPA”) which was originally intended to regulate the telemarketing industry contains certain provisions that also impact the collection industry. Most significantly, the TCPA prohibits the use of automated dialers to call cellular telephones without consent of the consumer and the potential liability for violations of this provision is substantial.

At the state level, most states require that debt collectors be licensed or registered, hold a certificate of authority and/or be bonded. To qualify for such a license or registration, the debt collector may be required to satisfy minimum capital requirements. Due in part to the 2006 recapitalization, we and our debt collection subsidiary have been required to make special arrangements with state regulators to obtain licensure. Failure to comply with license requirements may subject the debt collector to penalties and/or fines. In addition, state licensing authorities, as well as state consumer protection agencies in many cases, have the authority to investigate debtor complaints against debt collectors and to recommend enforcement actions and seek monetary penalties against debt collectors for violations of state or federal laws.

In addition to complying with the foregoing federal and state laws, West’s debt collection operations recently entered into a Stipulated Order as part of a settlement agreement that was negotiated with the FTC staff after a lengthy investigation. That Order, once approved by the Commission and the U.S. District Court for the Northern District of Georgia, Atlanta Division, will require us to comply with the FDCPA and the Federal Trade Commission Act, which will not require any procedural changes; however, violations of either law will subject the Company to a contempt action brought by the FTC in addition to the civil penalties available to private litigants. Further, the Order requires that all current employees and any new employee hired over the next five years be provided with a copy of the Order and a short statement regarding their compliance obligations. The Company is also required to maintain certain types of information and data that is subject to audit and inspection by the FTC over periods ranging from three to six years. Finally, the Company is required to include a new disclosure on all written communications to consumers that directs them to call a toll free number if they have a complaint regarding the manner in which their account was handled.

Teleservices

Teleservices sales practices are regulated at both the federal and state level. The TCPA, enacted in 1991, authorized and directed the FCC to regulate the telemarketing industry. The FCC set forth rules to implement the TCPA. These rules, which have been amended over time, currently place restrictions on the methods and timing of telemarketing sales calls as well as certain calling practices utilized in the accounts receivable management business, including:

| | • | | restrictions on calls placed by automatic dialing and announcing devices; |

| | • | | limitations on the use of predictive dialers for outbound calls; |

| | • | | institution of a National “Do-Not-Call” Registry in conjunction with the FTC; |

| | • | | guidelines on maintaining an internal “Do-Not-Call” list and honoring “Do-Not-Call” requests; |

| | • | | requirements for transmitting caller identification information; and |

| | • | | restrictions on facsimile advertising. |

The Federal Telemarketing Consumer Fraud and Abuse Act of 1994 authorized the FTC to issue regulations designed to prevent deceptive and abusive telemarketing acts and practices. The FTC’s Telemarketing Sales Rule

15

(“TSR”) became effective in January 1996 and has been amended over time. The TSR applies to most outbound telemarketing calls to consumers and portions of some inbound telemarketing calls. The TSR generally:

| | • | | prohibits a variety of deceptive, unfair or abusive practices in telemarketing sales; |

| | • | | subjects a portion of inbound calls to additional disclosure requirements; |

| | • | | prohibits the disclosure or receipt, for consideration, of unencrypted consumer account numbers for use in telemarketing; |

| | • | | mandates additional disclosure statements relating to certain products or services, and certain types of offers, especially those involving negative option features; |

| | • | | establishes additional authorization requirements for payment methods that do not have consumer protections comparable to those available under the Electronic Funds Transfer Act or the Truth in Lending Act, or for telemarketing transactions involving pre-acquired account information and free-to-pay conversion offers; |

| | • | | institutes a National “Do-Not-Call” Registry; |

| | • | | provides guidelines on maintaining an internal “Do-Not-Call” list and honoring “Do-Not-Call” requests; |

| | • | | limits the use of predictive dialers for outbound calls; and |

| | • | | restricts the use of pre-recorded message telemarketing calls. |

In addition to the federal regulations, there are numerous state statutes and regulations governing telemarketing activities. These include restrictions on the methods and timing of telemarketing calls as well as disclosures required to be made during telemarketing calls and individual state “Do-Not-Call” registries. Some states also require that telemarketers register in the state before conducting telemarketing business in the state. Such registration can be time consuming and costly. Many states have an exemption for companies which have securities that are listed on a national securities exchange. As a result of the recapitalization in 2006, our securities are no longer listed on a national securities exchange, and we are therefore unable to avail ourselves of the exemption from state telemarketer registration requirements. In addition, employees who are involved in certain industry-specific sales activity, such as activity regarding insurance or mortgage loans, are required to be licensed by various state commissions or regulatory bodies and to comply with regulations enacted by those bodies.

The industries that we serve are also subject to varying degrees of government regulation, including laws and regulations, relating to contracting with the government and data security. We are subject to some of the laws and regulations associated with government contracting as a result of our contracts with our clients and also as a result of contracting directly with the United States government and its agencies.

With respect to marketing scripts, we rely on our clients and their advisors to develop the scripts to be used by us in making consumer solicitation, on behalf of our clients. We generally require our clients to indemnify us against claims and expenses arising with respect to the scripts and products which they provide to us.

We specifically train our marketing representatives to handle calls in an approved manner. While we believe we are in compliance in all material respects with all federal and state telemarketing regulations, compliance with all such requirements is costly and time consuming. In addition, notwithstanding our compliance efforts, any failure on our part to comply with the registration and other legal requirements applicable to companies engaged in telemarketing activities could have an adverse impact on our business. We could become subject to litigation by private parties and governmental bodies, alleging a violation of applicable laws or regulations, which could result in damages, regulatory fines, penalties and possible other relief under such laws and regulations and the accompanying costs and uncertainties of such litigation and enforcement actions.

We discuss the risks associated with governmental regulation in Item 1A. “Risk Factors.”

16

We may not be able to compete successfully in our highly competitive industries, which could adversely affect our business, results of operations and financial condition.

We face significant competition in many of the markets in which we do business and expect that this competition will intensify. The principal competitive factors in our business are range of service offerings, global capabilities and price and quality of services. In addition, we believe there has been an industry trend to move agent-based operations toward offshore sites. This movement could result in excess capacity in the United States, where most of our current capacity exists. The trend toward international expansion by foreign and domestic competitors and continuous technological changes may erode profits by bringing new competitors into our markets and reducing prices. Our competitors’ products, services and pricing practices, as well as the timing and circumstances of the entry of additional competitors into our markets, could adversely affect our business, results of operations and financial condition.

Our Unified Communications segment faces technological advances and consolidation, which have contributed to pricing pressures. Competition in the web and video conferencing services arenas continues to increase as new vendors enter the marketplace and offer a broader range of conferencing solutions through new technologies, including, without limitation, Voice over Internet Protocol, on-premise solutions, private branch exchange (“PBX”) solutions, unified communications solutions and equipment and handset solutions.

Our Communication Services segment’s agent-based business and growth depend in large part on the industry trend toward outsourcing. This trend may not continue, or may continue at a slower pace, as organizations may elect to perform these services themselves. In addition, our Communication Services segment faces risks from technological advances that we may not be able to successfully address. We compete with third-party collection agencies, other financial service companies and credit originators. Some of these companies have substantially greater personnel and financial resources than we do. In addition, companies with greater financial resources than we have may elect in the future to enter the consumer debt collection business.

There are services in each of our business segments that are experiencing pricing declines. If we are unable to offset pricing declines through increased transaction volume and greater efficiency, our business, results of operations and financial condition could be adversely affected.

Increases in the cost of voice and data services or significant interruptions in these services could adversely affect our business, results of operations and financial condition.

We depend on voice and data services provided by various telecommunications providers. Because of this dependence, any change to the telecommunications market that would disrupt these services or limit our ability to obtain services at favorable rates could adversely affect our business, results of operations and financial condition. While we have entered into long-term contracts with many of our telecommunications providers, there is no obligation for these vendors to renew their contracts with us or to offer the same or lower rates in the future. In addition, these contracts are subject to termination or modification for various reasons outside of our control. An adverse change in the pricing of voice and data services that we are unable to recover through price increases of our services, or any significant interruption in voice or data services, could adversely affect our business, results of operations and financial condition.

Our business depends on our ability to keep pace with our clients’ needs for rapid technological change and systems availability.

Technology is a critical component of our business. We have invested in sophisticated and specialized computer and telephone technology and we anticipate that it will be necessary for us to continue to select, invest in and develop new and enhanced technology on a timely basis in the future in order to remain competitive. Our

17

future success depends in part on our ability to continue to develop technology solutions that keep pace with evolving industry standards and changing client demands. Introduction of new methods and technologies brings corresponding risks associated with effecting change to a complex operating environment and, in the case of adding third party services, results in a dependency on an outside technology provider.

A large portion of our revenue is generated from a limited number of clients, and the loss of one or more key clients would result in the loss of revenue.

Our 100 largest clients represented approximately 57% of our total revenue for the year ended December 31, 2010 with one client, AT&T, accounting for approximately 11% of our total revenue. Subject to advance notice requirements and a specified wind down of purchases, AT&T may terminate certain of its contracts with us with or without cause at any time. If we fail to retain a significant amount of business from AT&T or any of our other significant clients, our business, results of operations and financial condition could be adversely affected. We serve clients and industries that have experienced a significant level of consolidation in recent years. Additional consolidation could occur in which our clients could be acquired by companies that do not use our services. The loss of any significant client would result in a decrease in our revenue and could adversely affect our business, results of operations and financial condition.

Global economic conditions could adversely affect our business, results of operations and financial condition, primarily through disrupting our clients’ businesses.

The uncertain and changing global economic conditions, including disruption of financial markets, could adversely affect our business, results of operations and financial condition, primarily through disrupting our clients’ businesses. Higher rates of unemployment and lower levels of business generally adversely affect the level of demand for certain of our services. In addition, continuation or worsening of general market conditions in the United States economy or other national economies important to our businesses may adversely affect our clients’ level of spending, ability to obtain financing for purchases and ability to make timely payments to us for our services, which could require us to increase our allowance for doubtful accounts, negatively impact our days sales outstanding and adversely affect our results of operations.

Our contracts generally are not exclusive and typically do not provide for revenue commitments.

Contracts for many of our services generally enable our clients to unilaterally terminate the contract or reduce transaction volumes upon written notice and without penalty, in many cases based on our failure to attain certain service performance levels. The terms of these contracts are often also subject to renegotiation at any time. In addition, most of our contracts are not exclusive and do not ensure that we will generate a minimum level of revenue. Many of our clients also retain multiple service providers with whom we must compete. As a result, the profitability of each client program may fluctuate, sometimes significantly, throughout the various stages of a program.

Pending and future litigation may divert management’s time and attention and result in substantial costs of defense, damages or settlement, which could adversely affect our business, results of operations and financial condition.

We face uncertainties related to pending and potential litigation. We may not ultimately prevail or otherwise be able to satisfactorily resolve this litigation. In addition, other material suits by individuals or certified classes, claims, or investigations relating to our business may arise in the future. Furthermore, we generally indemnify our clients against third-party claims asserting intellectual property violations, which may result in litigation. Regardless of the outcome of any of these lawsuits or any future actions, claims or investigations relating to the same or any other subject matter, we may incur substantial defense costs and these actions may cause a diversion of management’s time and attention. Also, we may be required to alter our business practices or pay substantial

18

damages or settlement costs as a result of these proceedings, which could adversely affect our business, results of operations and financial condition. Finally, certain of the outcomes of such litigation may directly affect our business model, and thus our profitability.

We are subject to extensive regulation, which could limit or restrict our activities and impose financial requirements or limitations on the conduct of our business.

The United States Congress, the FCC and the states and foreign jurisdictions where we provide services have promulgated and enacted rules and laws that govern personal privacy, the provision of telecommunication services, telephone solicitations, the collection of consumer debt, the provision of emergency communication services and data privacy. As a result, we may be subject to proceedings alleging violation of these rules and laws in the future. Additional rules and laws may require us to modify our operations or service offerings in order to meet our clients’ service requirements effectively, and these regulations may limit our activities or significantly increase the cost of regulatory compliance.

There are numerous state statutes and regulations governing telemarketing activities that do or may apply to us. For example, some states place restrictions on the methods and timing of telemarketing calls and require that certain mandatory disclosures be made during the course of a telemarketing call. Some states also require that telemarketers register in the state before conducting telemarketing business in the state. Such registration can be time consuming and costly. We specifically train our marketing representatives to handle calls in an approved manner. While we believe we are in compliance in all material respects with all federal and state telemarketing regulations, compliance with all such requirements is costly and time consuming. In addition, notwithstanding our compliance efforts, any failure on our part to comply with the registration and other legal requirements applicable to companies engaged in telemarketing activities could have an adverse impact on our business. We could become subject to litigation by private parties and governmental bodies alleging a violation of applicable laws or regulations, which could result in damages, regulatory fines, penalties and possible other relief under such laws and regulations and the accompanying costs and uncertainties of such litigation and enforcement actions.

Security and privacy breaches of the systems we use to protect personal data could adversely affect our business, results of operations and financial condition.

Our databases contain personal data of our clients’ customers, including credit card and healthcare information. Any security or privacy breach of these databases could expose us to liability, increase our expenses relating to the resolution of these breaches and deter our clients from selecting our services. Migration by our emergency communications business to IP-based communication increases this risk. Our data security procedures may not effectively counter evolving security risks, address the security and privacy concerns of existing or potential clients or be compliant with federal, state, and local laws and regulations in all respects. For our international operations, we are obligated to implement processes and procedures to comply with local data privacy regulations. Any failures in our security and privacy measures could adversely affect our business, financial condition and results of operations.

Our technology and services may infringe upon the intellectual property rights of others. Intellectual property infringement claims would be time consuming and expensive to defend and may result in limitations on our ability to use the intellectual property subject to these claims.

Third parties have asserted in the past and may assert claims against us in the future alleging that we are violating or infringing upon their intellectual property rights. Any claims and any resulting litigation could subject us to significant liability for damages. An adverse determination in any litigation of this type could require us to design around a third party’s patent, license alternative technology from another party or reduce or modify our product and service offerings. In addition, litigation is time-consuming and expensive to defend and could result in the diversion of our time and resources. Any claims from third parties may also result in limitations on our ability to use the intellectual property subject to these claims.

19

We may not be able to adequately protect our proprietary information or technology.