Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Fiscal Year Ended September 30, 2011 | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File Number 000-27241

KEYNOTE SYSTEMS, INC.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 94-3226488 (I.R.S. Employer Identification No.) | |

777 Mariners Island Blvd, San Mateo, CA (Address of principal executive offices) | 94404 (Zip Code) |

Registrant's telephone number, including area code:

(650) 403-2400

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on Which Registered: | |

|---|---|---|

| Common Stock, $0.001 Par Value Per Share, and the Associated Stock Purchase Rights | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act. YES o NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. YES o NO ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO ý

As of March 31, 2011, the aggregate market value of voting stock held by non-affiliates of the Registrant was $269 million, based on the closing price of a share of Registrant's common stock on March 31, 2011, as reported by the NASDAQ Global Market.

The number of shares of the Registrant's common stock outstanding as of December 7, 2011 was 17,295,680 shares.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III incorporates information by reference to portions of the Registrant's proxy statement for its 2012 annual meeting of stockholders.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2011

| | | Page | ||

|---|---|---|---|---|

PART I | ||||

ITEM 1: | Business | 4 | ||

ITEM 1A: | Risk Factors | 15 | ||

ITEM 1B: | Unresolved Staff Comments | 25 | ||

ITEM 2: | Properties | 25 | ||

ITEM 3: | Legal Proceedings | 25 | ||

ITEM 4: | (Removed and Reserved) | 27 | ||

ITEM 4A: | Executive Officers | 27 | ||

PART II | ||||

ITEM 5: | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 29 | ||

ITEM 6: | Selected Consolidated Financial Data | 32 | ||

ITEM 7: | Management's Discussion and Analysis of Financial Condition and Results of Operations | 33 | ||

ITEM 7A: | Quantitative and Qualitative Disclosures About Market Risk | 53 | ||

ITEM 8: | Financial Statements and Supplementary Data | 55 | ||

ITEM 9: | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 96 | ||

ITEM 9A: | Controls and Procedures | 96 | ||

ITEM 9B: | Other Information | 96 | ||

PART III | ||||

ITEM 10: | Directors, Executive Officers and Corporate Governance | 97 | ||

ITEM 11: | Executive Compensation | 97 | ||

ITEM 12: | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 97 | ||

ITEM 13: | Certain Relationships and Related Transactions, and Director Independence | 97 | ||

ITEM 14: | Principal Accounting Fees and Services | 97 | ||

PART IV | ||||

ITEM 15: | Exhibits, Financial Statement Schedules | 98 | ||

Signatures | 101 | |||

Except for historical information, this annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our anticipated costs and expenses and revenue mix. These forward-looking statements include, among others, statements including the words "expects," "anticipates," "intends," "believes" and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to these differences include, but are not limited to, those discussed in the section entitled "Risk Factors" in Item 1A of Part I of this report, and elsewhere in this report. You should also carefully review the risks described in other documents we file from time to time with the Securities and Exchange Commission, including the quarterly reports on Form 10-Q and current reports on Form 8-K that we may file in fiscal 2012. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this annual report on Form 10-K. Except as required by law, we undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document. No person is authorized to make any forward-looking statements on behalf of Keynote Systems, Inc. other than its authorized officers and then only through its external communications processes. Accordingly, you should not rely on any forward-looking statements regarding Keynote Systems, Inc. from any other sources and we undertake no obligation to correct or clarify any such forward-looking statements, except as required by federal securities law.

The trademarks or registered trademarks of Keynote Systems, Inc. in the United States and other countries include Keynote®, DataPulse®, CustomerScope®, Keynote CE Rankings®, Keynote Customer Experience Rankings®, Perspective®, Keynote Red Alert®, Keynote Traffic Perspective®, Keynote WebEffective®, The Internet Performance Authority®, MyKeynote®, SIGOS®, SITE®, keynote® The Mobile & Internet Performance Authority™, Keynote FlexUse®, DeviceAnywhere®, DemoAnywhere®, DeviceAnywhere Proof Center®, DeviceAnywhere Test Center® and MonitorAnywhere®. All other trademarks are the property of their respective owners.

3

Overview

Keynote Systems, Inc. ("Keynote" or "we") is a leading global provider of Internet and mobile cloud monitoring and testing solutions. We provide cloud-based testing, monitoring and measurement products and services that enable our customers to know how their Web sites, content, and applications perform on nearly any combination of actual browsers, networks and mobile devices. Since our founding in 1995, we have built and optimized a global monitoring network comprised of over 3,000 measurement computers and mobile devices in over 300 locations and 180 metropolitan areas worldwide and execute more than 525 million performance measurements every day. We deliver our products and services primarily through a cloud-based model on a subscription basis to a world-class customer base, representing a broad cross-section of industries.

On October 18, 2011, subsequent to our fiscal year 2011, we closed the acquisition of Mobile Complete, doing business as DeviceAnywhere ("DeviceAnywhere"). DeviceAnywhere developed an enterprise-class, cloud-based mobile application lifecycle management testing and quality assurance platform. DeviceAnywhere offers products and services for testing and monitoring the functionality, usability, performance and availability of mobile applications and Web sites. Mobile developers and enterprises rely on the DeviceAnywhere platform to deliver mobile applications, content and services faster while reducing downtime and testing costs. DeviceAnywhere extends our enterprise mobile cloud product portfolio into the immediately adjacent mobile testing and quality assurance market. Their complementary enterprise mobile cloud solutions enable us to address a wider spectrum of the mobile market by offering enterprises leading solutions in both mobile performance monitoring and mobile testing and quality assurance.

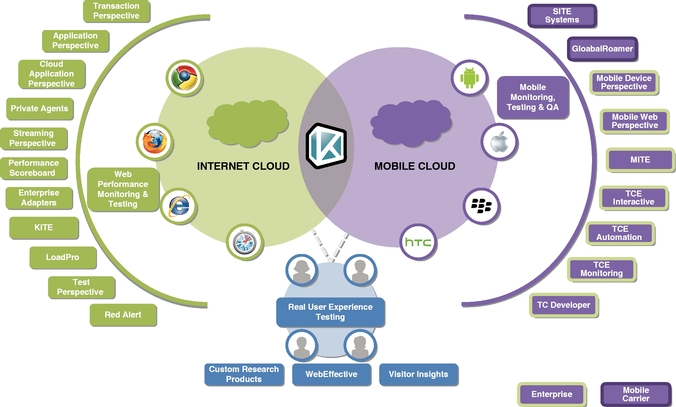

We offer a robust portfolio of Internet and mobile products and services to optimize the end-user customer experience in two broad categories: Internet Cloud ("Internet Cloud") and Mobile Cloud ("Mobile Cloud"). We combine our Internet and Mobile Cloud products and services with our Real User Experience Testing to offer our customers a unique value proposition.

4

Internet Cloud Products and Services

Our Internet Cloud products and services enable enterprises to monitor key technical performance metrics from the end-user perspective in order to benchmark and improve online application responsiveness and operational support, proactively detect problems that impact end-users, and accelerate the time to respond to and repair performance issues. Our Internet Cloud products and services utilize our global monitoring network and include the following:

Transaction Perspective is our flagship service offering. It provides full visibility into the performance and availability of Web transactions from the end-user perspective. It uses actual Internet Explorer and Firefox browsers to generate real transactions from locations all over the world. Key features include representation of Web transactions on actual Internet Explorer and Firefox browsers, ability to monitor performance of third party components such as ads or video on Web sites and report on specific Web components by server domain or other criteria, Web performance dashboards with real-time smart alerts and comprehensive diagnostics, Flash and Silverlight performance monitoring based on actual browsers and last mile performance, and availability monitoring for access types such as DSL, cable, 3G, and T1/T3.

Application Perspective is a cost-effective, cloud-based Web application monitoring service that measures the response time and availability of Web transactions via a simulated Web browser from multiple geographic locations. It provides root cause monitoring and diagnostics for Web applications and sophisticated trending, alarms and reporting to enable the rapid assessment, diagnosis and repair of performance issues when they occur. Key features include high-frequency operational monitoring and advanced scripting capabilities for monitoring Web services and Application Program Interfaces ("APIs").

Cloud Application Perspective provides portable, on demand, software-based performance monitoring for cloud application services. Cloud Application Perspective can be deployed on a server or PC supporting Windows anywhere in a private cloud to monitor internal applications, first mile performance, or partner applications in a digital value chain.

Private Agents provide a turn-key, managed appliance that can be placed anywhere inside our customers' network or Web cloud application environment. Private Agents provide visibility into the performance of mission critical extranet and intranet applications. Key features include end-to-end view, ability to isolate performance issues, scalability, full integration with our dashboard ("MyKeynote") and self-service configuration.

Streaming Perspective measures, compares and assures the performance of audio and video streams, diagnosing performance problems before they impact the end-user. Key features include support for the latest media players (Flash, Quicktime, Real Media, Silverlight and Windows Media), a Web-based dashboard for all data, multi-purpose stream monitoring, cloud-based delivery and pricing, and Keynote StreamQ technology.

Performance Scoreboard is a customizable dashboard for monitoring Web performance. It helps customers define and manage service level objectives ("SLOs") in complex, multi-location or multi-property businesses. Taking advantage of Keynote's cloud monitoring infrastructure, Performance Scoreboard enables customers to trend the performance of critical transactions relative to industry benchmarks and key competitors. Performance Scoreboard enables customers to track SLOs, quickly identify application and network latency issues, and analyze trends and infrastructure details using cloud-based diagnostic tools.

Enterprise Adapters integrate Keynote's performance measurement data into leading enterprise systems management platforms, such as CA NSM, HP Operations Manager, IBM Tivoli Software, Microsoft SCOM, BMC ProactiveNet Performance Management Software, OPNET APM Software, and Quest Foglight. Enterprise Adapters also integrate with Nagios, the leading open source monitoring platform. Enterprise Adapters transform Keynote performance data and alerts into various formats,

5

including Extensible Markup Language ("XML"), log file, and Simple Network Management Protocol ("SNMP").

Keynote Internet Testing Environment ("KITE") is a free desktop tool for real-time testing, diagnosing and troubleshooting of Web performance issues. KITE can test a single Web page or a multi-page transaction instantly with point-and-click ease and enables easy collaboration between Web developers, quality assurance and operations teams. KITE also provides customers the ability to try our Internet Cloud services before purchasing.

LoadPro is a turnkey, managed Web load testing service utilizing our load testing expertise and proprietary technology. Keynote consultants accurately and dynamically test customers' Web-based applications by driving traffic from multiple points across the globe, thereby quantifying the opportunity cost of performance problems and avoiding over- or under-provisioning of their Web site hardware and software systems. LoadPro utilizes Keynote's global monitoring network and can scale up to one million concurrent users from multiple Internet backbones and countries. Key benefits for our customers include a dedicated cloud-based load testing platform managed by Keynote, no capital expenditures or maintenance costs, and proprietary user behavior profiling and abandonment models that accurately stress test Web sites and applications.

Test Perspective is a cost-effective, cloud-based, self-service load testing service. Customers can take advantage of our global monitoring network of load-generating computers to easily test their Web applications at varying traffic levels. Key benefits include a simplified process, accelerated set up, a unified dashboard and a team friendly user interface.

Red Alert is a self-service, easy-to-use, real-time monitoring service that tests devices connected to the Internet primarily for availability. It can measure availability of any Internet server or other Transmission Control Protocol enabled Internet device, including Web servers, secure Web servers, domain name servers, mail servers, File Transfer Protocol servers and network gateways. Red Alert provides around-the-clock alerts when adverse conditions exceed specified thresholds.

We complement and support our Internet Cloud products and services with a suite of consulting services. Our consulting services provide our customers with a deeper and qualitative perspective on their Web site performance data and benchmarks against other relevant Web sites and user experiences. Our consulting services include:

- •

- Performance Insights deliver a blend of Keynote's Web site monitoring software and custom consulting, tailored to our customers' specific needs. Using Keynote's measurement technology, we measure our customers' business critical applications to provide in-depth analysis of their Web site. Based on this data, our consultants prepare a monthly management report with key performance indicators, as well as monitoring trends and in-depth diagnosis of issues and events.

- •

- Web Site Performance Assessment monitors Web site performance from the end-user's perspective to measure in real time an e-business at the application, transaction, and infrastructure level. Keynote's consultants take this data, analyze it and deliver detailed input on strategies our customers can deploy immediately to improve Web performance.

- •

- Automated Reporting eliminates manual effort required to customize, format and display performance data from our products and services. Automated Reporting e-mails reports, including performance metrics, SLO compliance, competitive intelligence, and industry benchmarking, at requested intervals.

- •

- Custom Competitive Research provides Web site monitoring services with a picture of how a Web site compares to peers and provides actionable recommendations for differentiation from the peer group.

6

Mobile Cloud Products and Services

Keynote provides independent monitoring, testing and quality assurance of mobile content, applications, and services on real devices across multiple mobile operator networks worldwide. Our Mobile Cloud products and services also utilize our global monitoring network to enable carriers, device manufacturers, content portals and developers to test, measure and improve the subscriber experience. Our Mobile Cloud products and services address both mobile operators and enterprises and include the following:

System Integrated Test Environment ("SITE") System is a comprehensive system of test probes and software to test and measure the quality and reliability of mobile networks, mobile applications and content delivery for mobile operators. The SITE system supports network operators and manufacturers as they implement new technologies and protocols, such as GSM, GPRS, EDGE, UMTS, HSDPA and LTE, with no loss of quality. It has a complete interface for protocol layer testing, prepares detailed measurement activity logs for mobile quality tests, and uses SIM multiplexing to ensure the maximum selection for testing across mobile operators around the world. Key features include user behavior modeling, comprehensive core network testing, multiple protocol testing, detailed measurement activity, modular structure and powerful scripting language.

GlobalRoamer is a cloud-based service offering designed to certify and validate roaming agreements across multiple mobile operators in major geographical regions across the world. By emulating the behavior of real roamers using mobile devices located in networks all over the world, GlobalRoamer allows mobile network operators to verify that all services are available to their roaming customers. With our SIM multiplexing technology, customer SIMs are "virtually" transmitted to remote test stations around the world where real voice, SMS, and data calls are performed. This enables our customers to rapidly test the availability and performance of their roaming services without a single SIM card ever having to be physically shipped to remote test locations. This service offering is based upon a SITE network managed by us and can test over 590 mobile networks in over 170 countries. Key features include improved roaming revenue and service performance, reduced MTTR costs, ad-hoc testing, proactive monitoring, virtual testing, multiple service (SMS, MMS, etc.) certification, global coverage and flexible reporting.

Mobile Device Perspective ("MDP") utilizes our global monitoring network to measure the response time, to measure the availability, and to interactively test the behavior of mobile data services and applications from actual mobile phones located in multiple geographies and connected to different mobile operators' networks. MDP enables wireless operators, mobilized enterprises and mobile content providers to improve the quality of their mobile content, applications, and services, including Web browsing, text messaging, picture messaging, streaming video, and instant messaging, as well as proprietary applications built for smart phone platforms including iOS, Android, Windows Phone 7 and BlackBerry. MDP provides high fidelity measurements that represent the end-user experience while interacting with mobile content, applications and services. Key features include multi-step transaction capabilities, performance dashboard and graphics, collaboration tools, smart alerts, point and click scripting and advanced device control.

Mobile Web Perspective ("MWP") is our cloud-based solution for monitoring and troubleshooting quality and performance issues for mobile Web sites. MWP uses our mobile measurement technology, global monitoring network and extensive device library to provide an accurate and real-time view into the mobile user experience. MWP measures the mobile user experience by using a simulated mobile browser to capture network level details to help customers understand how Web site content is downloaded and rendered on mobile devices. Along with monitoring the performance of mobile content, MWP also benchmarks mobile quality in multiple geographic locations and against competitors. Key features include access to our library of 2,000 emulated mobile devices and 12,000 device profiles, self-service scripting, multiple network options, 50 global measurement locations, performance dashboard, device graphs and reporting.

7

Mobile Internet Testing Environment ("MITE") is an easy-to-use desktop tool for analyzing Web site design using a simulated mobile device. MITE's cloud-based service utilizes our library of over 2,000 emulated mobile devices and 12,000 device profiles to provide an overall verification grade, script success score, download duration, error codes and score, number of resources, actions and content errors, and total bytes sent and received. MITE is offered for free and with more advanced testing capabilities for a fee as MITE Pro. MITE also provides customers the ability to try our Mobile Cloud services before purchasing.

As a result of our acquisition of DeviceAnywhere, we added the following products and services to our Mobile Cloud product portfolio.

Test Center Enterprise Interactive ("TCE Interactive") is a cloud-based lab for testing our customers' internal or external-facing mobile applications and Web sites that is sold on an annual subscription basis. TCE Interactive addresses the challenge of device and platform diversity and optimizes manual testing efforts to save time and expenses for our customers. Key features include easy access to current and popular smart devices, including Android, iOS, BlackBerry, Windows Phone 7 and WebOS handsets and tablets.

Test Center Enterprise Automation ("TCE Automation") is a cloud-based solution that automates the testing of mobile applications and Web sites. Enterprise quality assurance teams can quickly create and automate test scripts to capture, verify and replay real user interactions on real mobile devices. Key features include support for current and popular smart devices, easy to use scripting interface, immediate identification and reporting of mobile application issues and defects and integration with leading testing tools.

Test Center Enterprise Monitoring ("TCE Monitoring") is a cloud-based, enterprise-class platform that enables our customers to monitor the performance and availability of any mobile application or Web site on current and popular smart phones and tablets. TCE Monitoring evaluates the performance and responsiveness of enterprise mobile applications and Web sites from the end-user perspective, using real smart phone and tablets connected to and distributed across live mobile networks. Key features include the ability to monitor across market leading operating systems including Android, iOS, BlackBerry, Windows Phone 7 and WebOS, real time automatic alerts via SMS, e-mail or SNMP, ongoing analysis and advanced device control.

Test Center Developer ("TC Developer") is a cloud-based device laboratory for mobile application developers to conduct interactive manual testing on a per hour rental basis. TC Developer is used by over 1,000 developers to manually test mobile applications by providing online access to current and popular smart phones and tablets on a variety of networks using multiple operating systems. Key features include cloud-based architecture and remote access, comprehensive reporting and a flexible cost model.

We complement and support our Mobile Cloud products and services with a suite of consulting and engineering services. These services include:

- •

- Professional Services to improve operational and business performance.

- •

- Mobile Competitive Monitoring and Analysis to provide a comprehensive view of performance and end-user experience, benchmarked against the competition.

- •

- Mobile Insights to provide comprehensive data from an end-user's perspective, along with detailed analysis and recommendations based on Keynote's collective experience in the mobile market.

8

Real User Experience Testing

To evaluate how users actually interact with a Web site, Keynote has a panel of over 160,000 online users from a cross-section of demographics, languages, and connections options. The panel participates in interactive Web site tests to assess the online user experience. These online tests capture customer attitude and behavior. Keynote's Real User Experience Testing services complement and leverage our Internet and Mobile Cloud products and services to provide additional insights into the end-user Internet and mobile experience. Our suite of products and services enables our customers to perform behavioral and attitudinal analysis, real-world user testing, online surveys, and competitive and market intelligence. Our Real User Experience Testing services include:

WebEffective, our online real user experience testing tool, combines market research, usability labs and Web analytics to provide an in-depth perspective on the Internet and mobile user experience. WebEffective utilizes both the Keynote in-house panel and customer specified panels for conducting in-depth customer experience and usability studies on individual sites or across an entire industry. WebEffective can be used by customers on an assisted self-service basis or via full service engagements delivered by Keynote consultants. Customers can undertake tests by the Keynote Research Panel of over 160,000 panelists, existing customer lists, or real-time interception and polling of site visitors.

Visitor Insights, our online feedback tool, lets customers listen to their customers and convert that conversation into business intelligence. Visitor Insights combines customer satisfaction and Web analytics to provide business intelligence on Internet and mobile end-user attitudes and behavior. Key benefits include actionable reporting, quantitative and qualitative intelligence and support for Web 2.0 and global reach.

Custom Research Products combine our technology and expertise to deliver insights on Internet and mobile end-users' experiences. Custom Research Products include:

- •

- Mobile Web UX (User Experience) Testing assesses the likely performance of a Web site as accessed by iPhone users utilizing proven online research methodologies and Keynote's WebEffective software platform.

- •

- Competitive Intelligence Research provides detailed analysis on competitive Web sites, along with actionable recommendations that could help differentiate a Web site from its competition.

- •

- Brand and Value Proposition Research is a custom engagement that explores the customer's perception of brand in the marketplace, isolating the online experience to uncover how exposure to a Web site impacts brand image—before and after customers interact with a Web site.

- •

- Web Site Design Research provides actionable insights for new Web site prototype and concept ideas, releasing new products or pilot-testing new services before they are put into development.

- •

- Web Site UX (User Experience) Assessment Research provides a clear picture of how customers are actually experiencing a Web site. The research provides insights into how to eliminate obstacles that cause customers to leave a Web site, provides actionable recommendations on how to acquire more customers at a lower cost, and drive sales by creating a user-friendly experience.

- •

- Customer Acquisition Research enables our customers to follow panelists as they seek information and products on the Web, without directing them to a specific Web site. By learning how users navigate the Web and perform transactions, our customers can determine if they are reaching users in the most effective way.

- •

- Continuous Benchmarking Research establishes key metrics to assess the effectiveness of a Web site over an extended period of time. The research enables customers to determine Web site improvements that need to be made and, after implementation, the effect of the improvements.

9

Keynote Global Monitoring Network

Our global monitoring network consists of three primary components: 1) measurement and data collection infrastructure, 2) operations and data centers, and 3) reporting and analysis tools.

Measurement and Data Collection Infrastructure

Our measurements are conducted with Windows-based computers, Linux-based computers and/or popular mobile devices that run our proprietary software to replicate the experience of an Internet or mobile user accessing content, applications, and services through a standard Web browser, mobile browser, or mobile device. We designed our software infrastructure to perform thousands of download measurements concurrently without appreciably affecting the integrity of any single measurement. The measurement computers are co-located at the data center facilities of major telecommunication and Internet access providers with connections to Internet backbone providers and mobile network operators that are selected to be statistically representative of users. At some locations, we employ multiple Internet connections and install equipment racks that can accommodate multiple measurement computers. The hosting arrangements for our measurement computers typically have terms ranging from three months to more than one year.

Our Web measurement computers access a Web site to download Web pages and execute single-page and multi-page transactions, while taking measurements of every component in the process. These computers take measurements continually throughout the day, at intervals as often as three minutes, depending on customer requirements and subscription service level.

Our mobile measurement devices access mobile content, applications, and services and conduct typical mobile activities such as voice, messaging, e-mail and Web browsing while taking measurements of every component in the process. The mobile browsers and mobile devices take measurements continually throughout the day, at intervals as often as 15 minutes, depending on customer requirements and subscription service level.

As of September 30, 2011, we had deployed more than 3,000 measurement computers and mobile devices in over 300 locations and 180 metropolitan areas worldwide. This total includes over 250 mobile devices operating on Android, iOS, BlackBerry, Windows Phone 7 and WebOS. As of September 30, 2011, we had deployed SITE probes in more than 180 cities in major geographical regions across the world to test the quality of customer services when accessed via various roaming arrangements between mobile operators. We continually upgrade and balance our network capacity to meet the needs of our customers.

Operations and Data Centers

Our operations centers, located in San Mateo, California; Plano, Texas; and Nuremberg, Germany, are designed to be scalable to support large numbers of measurement computers and to store, analyze and manage large amounts of data from these computers. Our measurement devices receive instructions from, and return collected data to, our operations centers. The data is stored in large databases that incorporate a proprietary transaction-processing system that we designed to store measurement data efficiently and to deliver measurement data quickly. We also employ proprietary, high-performance application servers that manage the collection of measurement data, the insertion of the data into our databases and the dissemination of this data to our customers in a variety of forms and delivery methods. Our GlobalRoamer infrastructure is managed from Nuremberg, Germany, the headquarters of our Keynote SIGOS subsidiary.

10

Reporting and Analysis Tools

We offer the following tools for reporting and analysis:

- •

- SMS and Email Alerts. Our customers can be notified by email, text message or pager when download times exceed a particular value in specific cities or error counts indicate that a Web site or application is unresponsive.

- •

- Daily Email Reports. Our customers can receive a daily email that summarizes the performance and availability of measured Web sites and applications, with comparisons to industry averages over the same time period.

- •

- Web-Based Analysis. Using their Web browsers and a password, our customers can access our online dashboard, MyKeynote, to retrieve, view and analyze measurement data in multiple formats.

- •

- Data APIs. Our customers can retrieve measurement data through an API, or through bulk file transfers using an industry-standard file-transfer protocol. This allows our customers to incorporate our measurement data within their own custom data-analysis applications.

Customers

As of September 30, 2011, we provided products and services to approximately 2,900 customers of all sizes in 90 countries, representing a broad cross-section of industries including:

• Automotive • Business-to-Business (B2B) • Digital Media/Internet • Financial Services • Government | • Healthcare • Hospitality/Travel • Retail • Technology • Telecommunications |

Sales, Marketing and Customer Support

Sales

We sell our Internet and Mobile Cloud products and services globally through our field sales and telesales organizations. Our Internet and Mobile field sales teams concentrate on selling and servicing our largest customers and consist of direct sales representatives and sales engineers located in 17 metropolitan areas (10 across the United States, 6 in Europe and 1 in Asia Pacific). In addition to our global field sales teams, we have telesales personnel located in Plano, Texas and Bangalore, India. These telesales personnel focus primarily on selling our subscription services and providing telephone and email sales support and customer service. We also market and sell some of our services through our self-service Web site.

In addition, we domestically distribute our services through Web-hosting and Internet service providers who manage e-business Web sites for other companies. These companies sell or bundle our services to their customer base as a value-added service and as a management tool for their customers' Web sites. We also sell to content distribution providers who use our services as a pre-sales tool for their potential customers or in service level agreements with their existing customers. We occasionally market our services through other technology companies on a "lead referred" basis. Internationally, we have direct sales representatives in Germany, the United Kingdom, France, Sweden, the Netherlands, Luxemburg, and Singapore and sell indirectly through reseller partners throughout Europe, the Middle East, Africa and Asia.

Marketing

We maintain an active marketing program designed to demonstrate the breadth and depth of our Internet and Mobile Cloud solutions. We promote our brand through multiple means including the public

11

availability on our Web site of top level details for our e-business performance indices (both page download and transaction), and through our regular reporting and commentary to the media regarding Internet performance-related events.

Our marketing programs include advertising, Internet marketing, trade events, public relations, and other events such as User Conferences and Executive Summits. User Conferences and Executive Summits provide an opportunity for us and our partners to brief chief information officers, chief technology officers, information technology executives and network administrators on emerging solutions, new methodologies and best practices to improve mobile and online business performance.

Customer Support and Maintenance

We provide customer support by email and telephone. Basic support for all our services is available during the business day. For a fee, advanced support is available for our Internet Cloud products through Keynote Diagnostic Services for customers who want analytical or diagnostic support, or who require access 24 hours per day, 7 days per week to Keynote experts to assist them with their questions. We also provide ongoing technical and post-contract support and maintenance for our SITE systems either from our German subsidiary or at a customer's designated location.

Development

Our engineering and product management teams work closely with our customers and partners to continually improve and enhance our Internet and Mobile Cloud products and services and our global monitoring network. Our research and development effort takes advantage of a unique global combination of engineers from our Silicon Valley headquarters, engineers from our German subsidiary and engineering and support resources in India. We conduct frequent user meetings and maintain a customer advisory board to provide customers an opportunity to submit ideas and provide feedback on our product roadmap so that we can deliver the innovation and features most desired by our customers. While we internally develop our products and services, we license certain statistical, graphical and database technologies from third parties that are incorporated into our products and services. Development expenditures were $13.2 million, $12.0 million and $12.2 million in fiscal years 2011, 2010 and 2009, respectively. Our expenditures for research and development costs were expensed as incurred.

Competition

The market for our products and services is rapidly evolving. Our competitors vary in size and in the scope and breadth of their products and services. We face competition from companies that offer Internet and mobile software and services with features similar to our products and services such as Compuware (which acquired Gomez), Hewlett-Packard (which acquired Mercury Interactive), Neustar (which acquired Webmetrics) and SmartBear (which acquired AlertSite), and a variety of other Internet and mobile companies that offer a combination of testing, market research and data collection services. Additionally, there are many large and small firms that offer computer network and Internet-related consulting services. Customers could choose to use these companies' products and services or these companies could enhance their products and services to offer all of the features we offer. As we expand the scope of our products and services, we expect to encounter many additional market-specific competitors.

We also could face competition from other companies, which currently do not offer products and services similar to ours, but offer software or services related to Web analytics services, such as Webtrends, Adobe Systems (which acquired Omniture) and IBM (which acquired Coremetrics), and free services that measure Web site availability. In addition, companies that sell systems management software, such as BMC Software, Compuware, CA NSM, HP Software, Quest Software, Attachmate, Precise Software, and IBM's Tivoli Unit, may decide to offer products and services similar to ours. While we have relationships with some of these companies, they could choose to develop products and services similar to ours or to offer our

12

competitors' products and services. We face competition for our mobile services from companies such as Ascom (which acquired Argogroup), JDS Uniphase (which acquired Casabyte), ADECEF and Datamat.

In the future, we intend to expand our product and service offerings and continue to measure and manage the performance of emerging technologies and could face competition from other companies. Some of our existing and future competitors have or may have longer operating histories, larger customer bases, greater brand recognition in similar businesses, and significantly greater financial, marketing, technical and other resources. In addition, some of our competitors may be able to devote greater resources to marketing and promotional campaigns, to adopt more aggressive pricing policies, and to devote substantially more resources to technology and systems development.

Intellectual Property

We are a technology company whose success depends on developing, updating, acquiring and protecting our intellectual property assets.

Our principal intellectual property assets consist of our trademarks, our trade names, our logos, our characters, our design, our trade dress, our service marks, our patents, our patent applications and the proprietary software we developed or acquired to provide our products and services. Trademarks are important to our business because they represent our brand name and we use them in our marketing and promotional activities as well as in the delivery of our products and services. The trademarks or registered trademarks of Keynote Systems, Inc. in the United States and other countries include Keynote®, DataPulse®, CustomerScope®, Keynote CE Rankings®, Keynote Customer Experience Rankings®, Perspective®, Keynote Red Alert®, Keynote Traffic Perspective®, Keynote WebEffective®, The Internet Performance Authority®, MyKeynote®, SIGOS®, SITE®, keynote® The Mobile & Internet Performance Authority™, Keynote FlexUse®, DeviceAnywhere®, DemoAnywhere®, DeviceAnywhere Proof Center®, DeviceAnywhere Test Center® and MonitorAnywhere®. All other trademarks are the property of their respective owners.

We currently have five issued U.S. patents and three U.S. patent applications related to our Internet services. We also have one issued German patent and fifteen German patent applications related to our mobile services. Our patents acquired in the acquisition of DeviceAnywhere include 2 U.S. patents and 5 state patents. It is possible that no patents will be issued from our current pending patent applications and that our issued patents or potential future patents may be found invalid or unenforceable, or otherwise be successfully challenged.

Our proprietary software is an integral part of our Internet and Mobile Cloud products and services and consists of the software we developed or acquired to collect, store, and deliver our measurement data to customers. We also have developed software that we use to provision customers' orders and to bill our customers. The intellectual property we use in our business is important to us. Despite our efforts, we may be unable to prevent others from infringing upon or misappropriating our intellectual property, which could harm our business.

Foreign and Domestic Operations and Geographic Data

The United States represents our largest geographic marketplace. Approximately 49%, 55%, and 55% of our net revenue came from customers in the United States during fiscal years 2011, 2010, and 2009, respectively. Internationally, we have subsidiaries in Germany, the Netherlands, France, Canada and Singapore. Our international operations primarily are transacted in the Euro and, to a lesser extent, the British pound. Our geographic financial information is contained in Note 10 to our consolidated financial statements included in Item 8 of this report on Form 10-K.

13

Employees

As of September 30, 2011, we had a total of 352 employees, of which 207 were based in the United States, 129 were based in Germany and 16 were based in other international locations. None of our employees is represented by a collective bargaining agreement nor have we experienced any work stoppage. In our German subsidiary, our employees are represented by a workers' council which consists of employees who are elected onto the council by their colleagues. We believe that our relationships with our domestic and international employees are good.

About Us

We were incorporated in 1995. Our headquarters is located at 777 Mariners Island Blvd., San Mateo, CA and our telephone number at that location is (650) 403-2400. Our company Web site iswww.keynote.com although information on that Web site shall not be deemed incorporated in this report. Through a link on the Investor Relations section of our Web site, we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports of Form 8-K, and all amendments to those reports filed with the Securities and Exchange Commission ("SEC").

14

Our quarterly financial results are subject to significant fluctuations, and if our future results are below the expectations of investors, the price of our common stock may decline.

Our results of operations could vary significantly from quarter to quarter. If revenue or other financial results fall below ours or investor expectations, we may not be able to increase our revenue or reduce our spending rapidly in response to the shortfall. Other factors that could affect our quarterly operating results include those described below and elsewhere in this report:

- •

- The effect of global economic conditions on customers and partners, including the level of discretionary IT spending;

- •

- Fluctuations in foreign exchange rates;

- •

- The rate of new and renewed subscriptions for our services, particularly large customers;

- •

- The amount and timing of any reductions or increases by our customers in their usage of our products and services;

- •

- Our ability to increase the number of Web sites we measure and the scope of products and services we offer our existing customers in a particular quarter;

- •

- The timing, customer acceptance and service period of orders received during a quarter, especially from new customers;

- •

- Our ability to successfully develop and introduce new products and services;

- •

- Our ability to generate revenues from our DeviceAnywhere acquisition;

- •

- The level of sales of our Mobile Cloud and our recently-acquired DeviceAnywhere products and services and the timing of customer acceptance during the period;

- •

- The timing and amount of engagement services revenue, which is difficult to predict because of its dependence on the number of engagements in any given period, the size of these engagements, and our ability to continue our existing engagements and secure new engagements from customers;

- •

- Disruptions to our global monitoring network infrastructure;

- •

- The timing and amount of operating costs, including unforeseen or unplanned operating expenses, sales and marketing investments, changes in headcount and capital expenditures;

- •

- Seasonal factors, such as with respect to sales of our LoadPro services which are typically higher in our first fiscal quarter due to customers preparing their Web sites for the holiday buying season;

- •

- Future accounting pronouncements and changes in accounting policies;

- •

- The timing and amount, if any, of impairment charges related to potential write down of acquired assets in acquisitions or charges related to the amortization of intangible assets from acquisitions; and

- •

- The cost associated with and the integration of acquisitions, including the DeviceAnywhere acquisition that closed immediately after our year end, or divestures.

Due to these and other factors, we believe that period-to-period comparisons of our results of operations may not be meaningful and should not be relied upon as indicators of our future performance. It is possible that in some future periods, our results of operations may be below the expectations of public-market analysts and investors. If this occurs, the price of our common stock may decline.

15

Our business, operating results and financial condition are susceptible to additional risks associated with international operations.

Our business, financial condition and operating results could be significantly affected by risks associated with international activities, including economic and labor conditions, European economic contagion, political instability, tax laws (including United States taxes on foreign subsidiaries and the negative tax implications related to moving cash from international locations to the United States), and changes in the value of the United States dollar versus foreign currencies. In addition, net revenue from and margins on sales of our products and services in foreign countries could be materially adversely affected by foreign currency exchange rate fluctuations, particularly the Euro as a significant portion of our revenue is denominated in Euros.

Our primary exposure to movements in foreign currency exchange rates relate mainly to non-United States dollar denominated sales in Europe, as well as non-United States dollar denominated cash balances and operating expenses incurred throughout the world. As was the case in recent years, volatility of foreign currencies relative to the United States dollar may adversely affect the United States dollar value of our foreign currency-denominated cash, sales and earnings.

International sales in dollars were approximately 51%, 45% and 45% of our net revenue for the years ended September 30, 2011, 2010 and 2009, respectively. We expect to continue to commit significant resources to our international activities. Conducting international operations subjects us to risks we do not face in the United States. These include:

- •

- Currency exchange rate fluctuations, primarily the Euro;

- •

- Seasonal fluctuations in purchasing patterns;

- •

- Unexpected changes in regulatory requirements;

- •

- Maintaining and servicing measurement computers in distant locations;

- •

- Longer accounts receivable payment cycles and difficulties in collecting accounts receivable;

- •

- Difficulties in managing and staffing international operations;

- •

- Potentially adverse tax consequences, including restrictions on the repatriation of earnings;

- •

- The burdens of complying with a wide variety of foreign laws;

- •

- Difficulties in establishing and enforcing our intellectual property rights in some countries; and

- •

- Political or economic instability, war or terrorism in the countries where we are doing business.

The success of our business depends on maintaining a large customer base, either by customers renewing their subscriptions for our products and services and purchasing additional products and services or by obtaining new customers.

To maintain and grow our revenue, we must maintain or increase the overall size of our customer base, either through maintaining high customer renewal rates, obtaining new customers for our products and services, and/or selling additional products and services to existing customers. Our customers have no obligation to renew our products and services after the contract term and, therefore, they could cease using our products and services at any time. In addition, customers that renew may contract for fewer product and services or at lower prices. Further, our customers may reduce their usage levels of our products and services during the term of their subscription. We cannot project the level of renewal rates or the prices at which customers renew subscriptions. The size of our customer base and prices may decline as a result of a number of factors, including competition, consolidations in the Internet or mobile industries or if a significant number of our customers cease operations.

16

Additionally, sales of our products and services may decline as companies evaluate their technology spending in response to the global economic environment. We have experienced in the past, and may experience in the future, reduced spending, cancellations, and non-renewals by our customers. If we experience reduced renewal rates or if customers renew for a lesser amount of our products and services, or if customers, at any time, reduce the amount of products or services they purchase from us for any reason, our revenue could decline unless we are able to obtain additional customers or sources of revenue, sufficient to replace lost revenue.

If our Mobile Cloud products and services decline, we may not be able to grow our revenue and our results of operations will be harmed.

Revenue from our Mobile Cloud products and services was $49.7 million for the year ended September 30, 2011. Future growth for these products and services could be adversely affected by a number of factors, including, but not limited to, the difficulty in predicting demand; customer acceptance of installed systems; customer acceptance of our new DeviceAnywhere products and services; currency rate fluctuations; global economic conditions; and our ability to successfully compete against current or new competitors in this market. Our business and our operating results could be harmed if we are not able to continue to grow revenue from our Mobile Cloud products and services.

The inability of our products and services to perform properly could result in loss of or delay in revenue, injury to our reputation or other harm to our business.

We offer complex products and services, which may not perform at the level our customers expect. Despite our testing, upgrades to our existing or future products and services may not perform as expected due to unforeseen problems, which could result in loss of or delay in revenue, loss of market share, failure to achieve market acceptance, diversion of development resources, injury to our reputation, increased insurance costs or increased service costs. In addition, we have in the past, and may in the future, acquire, rather than develop internally, some of our products and services.

These problems could also result in tort or warranty claims. Although we attempt to reduce the risk of losses resulting from any claims through warranty disclaimers and liability-limitation clauses in our customer agreements, these contractual provisions may not be enforceable in every instance. Furthermore, although we maintain errors and omissions insurance, this insurance coverage may not be adequate in any particular case. If a court refused to enforce the liability-limiting provisions of our contracts for any reason, or if liabilities arose that were not contractually limited or adequately covered by insurance, we could be required to pay damages.

A disruption to our global monitoring network infrastructure could impair our ability to serve and retain existing customers or attract new customers.

Our operations depend upon our ability to maintain and protect our data centers, which store and distribute all data collected from our global monitoring network. We currently serve our customers from facilities located in San Mateo, California; Plano, Texas; and Nuremburg, Germany. Our primary operations center is located at our corporate headquarters in San Mateo, California. Our primary operations center is susceptible to earthquakes, other natural disasters and possible power outages and our facilities in Texas and Germany are generally susceptible to natural disasters. Natural disasters affecting large geographic areas or that cause severe damage could also negatively impact demand for our products and services from customers. We have occasionally experienced outages in the past and, if we experience outages at our operations centers in the future, we might not be able to promptly receive data from our measurement computers and we might not be able to deliver our products and services to our customers on a timely basis.

17

Although we maintain insurance against fires, earthquakes and general business interruptions, the amount of coverage may not be adequate in any particular case. If our operations centers are damaged, this could disrupt our products and services, which could impair our ability to retain existing customers or attract new customers.

Our operations systems are also vulnerable to damage from break-ins, computer viruses, unauthorized access, vandalism, fire, floods, earthquakes, power loss, telecommunications failures and similar events. Any outage for any period of time or loss of customer data could cause us to lose customers.

Individuals who attempt to breach our network security, such as hackers, could, if successful, misappropriate proprietary information or cause interruptions in our products and services. We might be required to expend significant capital and resources to protect against, or to alleviate, problems caused by hackers. We may not have a timely remedy against a hacker who is able to breach our network security. In addition to intentional security breaches, the inadvertent transmission of computer viruses could expose us to litigation or to a material risk of loss.

We may face difficulties assimilating, and may incur costs associated with, any future acquisitions.

We have completed several acquisitions in the past and recently closed the acquisition of DeviceAnywhere. As a part of our business strategy, we may seek to acquire or invest in additional businesses, products or technologies that we feel could complement or expand our business, augment our market coverage, enhance our technical capabilities, or may otherwise offer growth opportunities. The recent and future acquisitions could create risks for us, including:

- •

- Difficulties in assimilating acquired personnel, operations and technologies;

- •

- Unanticipated costs associated with the acquisition or incurring of additional unknown liabilities;

- •

- Diversion of management's attention from other business concerns;

- •

- Difficulties in marketing additional services to the acquired companies' customer base or to our customer base;

- •

- Adverse effects on existing business relationships with resellers of products and services, customers and other business partners;

- •

- The need to integrate or enhance the systems of an acquired business;

- •

- Impairment charges related to potential write down of acquired assets in acquisitions;

- •

- Entry in new businesses in which we have little direct experience;

- •

- Difficulties in managing a larger organization with geographically dispersed operations;

- •

- Failure to realize any of the anticipated benefits of the acquisition; and

- •

- Use of substantial portions of our available cash, or dilution in equity if stock is used, to consummate the acquisition and/or operate the acquired business.

A limited number of customers account for a significant portion of our revenue, and the loss of a major customer could harm our operating results.

Our ten largest customers accounted for approximately 30%, 31% and 34% of our net revenue for the years ended September 30, 2011, 2010 and 2009, respectively. We cannot be certain that customers that have accounted for significant revenue in past periods, individually or as a group, will renew, will not cancel or will not reduce the usage of our products and services and, therefore, continue to generate revenue in any future period. In addition, our customers that have monthly renewal arrangements may terminate their contract at any time with little or no penalty. If we lose a major customer or group of customers, our revenue could decline.

18

We have incurred in the past and may, in the future, incur losses, and we may not sustain profitability.

While we were profitable in the fiscal years 2011, 2010 and 2009, we incurred net losses in fiscal 2008 and in other prior fiscal years. As of September 30, 2011, we had an accumulated deficit of $87.1 million. If we are not able to maintain our current revenue levels or increase our revenue, it may be difficult to sustain profitability. In addition, we are required under generally accepted accounting principles to review our goodwill and identifiable intangible assets for impairment when events or circumstances indicate that the carrying value may not be recoverable. As of September 30, 2011, we had $1.7 million of net identifiable intangible assets and $62.5 million of goodwill. Our recent acquisition of DeviceAnywhere will increase the recorded amount of identifiable intangible assets and goodwill. We may in the future incur impairment charges in connection with a write down of goodwill and identifiable intangible assets due to changes in market conditions. In addition, we have deferred tax assets which may not be fully realized, which may contribute to additional losses. As a result of these and other conditions, we may not be able to sustain profitability in the future.

Our investment in sales and marketing may not yield increased customers or revenue.

We have invested and intend to continue investing in our sales and marketing activities to help grow our business, including hiring additional domestic and international sales personnel. Typically, additional sales personnel can take time before they become productive, and our marketing programs may also take time before they yield additional business, if any. We cannot assure you that these efforts will be successful, or that these investments will yield significantly increased revenue in the near or long-term.

Our business could be harmed by adverse economic conditions or reduced spending on information technology.

Our operations and performance depend significantly on worldwide economic conditions, especially the United States and Europe. Uncertainty about current global economic conditions poses a risk as consumers and businesses have reduced and may continue to reduce spending in response to tighter credit, negative financial news and/or declines in income or asset values, which could have a material negative effect on the demand for our products and services. A decrease in consumer demand also could have a variety of negative effects on our customers' demand for our products and services. Other factors that could influence demand include labor and healthcare costs, access to credit, consumer confidence, and other macroeconomic factors affecting spending behavior. These and other economic factors could have a material adverse effect on our financial results, and in certain cases, may reduce our revenue, increase our costs, and lower our gross margin percentage, or require us to recognize impairments of our assets. In addition, real estate values across the United States have been adversely affected by the global economic downturn and tighter credit conditions, and we cannot assure you that the value of our building will not be affected by these conditions.

We must retain qualified personnel in a competitive marketplace, or we may not be able to grow our business.

We may be unable to retain our key employees, namely our management team and experienced engineers, or to attract, assimilate or retain other highly qualified employees. Despite the current unemployment rate, there is substantial competition for highly skilled employees, especially in the San Francisco area. If we fail to attract and retain key employees, our business could be harmed.

If the market does not accept our engagement services, our results of operations could be harmed.

Engagement services revenue represented approximately 10%, 11% and 12% of net revenue for the years ended September 30, 2011, 2010 and 2009, respectively. We will need to successfully market these services in order to maintain or increase engagement services revenue. The market for these services is very competitive. Each engagement typically spans a one month to twelve month period and, therefore, it is more difficult for us to predict the amount of engagement services revenue recognized in any particular

19

quarter. Our business and operating results could be harmed if we cannot maintain or increase our engagement services revenue.

We face competition that could make it difficult for us to acquire and retain customers.

The market for our products and services is rapidly evolving. Our competitors vary in size and in the scope and breadth of their products and services. We face competition from companies that offer Internet and mobile software and services with features similar to our products and services such as Compuware, Hewlett-Packard, Neustar, SmartBear and a variety of other Internet and mobile companies that offer a combination of testing, quality assurance, market research and data collection services. Customers could choose to use these companies' products and services or these companies could enhance their products and services to offer all of the features we offer. As we expand the scope of our products and services, we expect to encounter many additional market-specific competitors.

In addition, there has been a trend toward industry consolidation in our markets for several years. We expect this trend to continue as companies attempt to strengthen or hold their market positions in an evolving industry and as companies are acquired or are unable to continue operations. For example, Compuware acquired Gomez and dynaTrace software, CA Technologies acquired WatchMouse, Hewlett-Packard acquired Mercury Interactive, SmartBear acquired AlertSite and Neustar acquired Webmetrics. We believe that industry consolidation may result in stronger competitors that are better able to compete for customers. This could lead to more variability in operating results and could have a material adverse effect on our business, operating results, and financial condition. Furthermore, rapid consolidation could also lead to fewer customers and partners, with the effect that the loss of a major customer could harm our revenue.

We could also face competition from other companies, which currently do not offer products and services similar to ours, but offer software or services related to Web analytics services, such as Webtrends, Adobe Systems (which acquired Omniture) and IBM (which acquired Coremetrics), and free services that measure Web site availability. In addition, companies that sell systems management software, such as BMC Software, Compuware, CA NSM, HP Software, Quest Software, Attachmate, Precise Software, and IBM's Tivoli Unit, may decide to offer products and services similar to ours. While we have relationships with some of these companies, they could choose to develop products and services similar to ours or to offer our competitors' services. We face competition for our mobile products and services from companies such as Ascom (which acquired Argogroup), JDS Uniphase (which acquired Casabyte), ADECEF and Datamat.

In the future, we intend to expand our product and service offerings and continue to measure, test and manage the performance of emerging technologies which could face competition from other companies. Some of our existing and future competitors have or may have longer operating histories, larger customer bases, greater brand recognition in similar businesses, and significantly greater financial, marketing, technical and other resources. In addition, some of our competitors may be able to devote greater resources to marketing and promotional campaigns, to adopt more aggressive pricing policies, and to devote substantially more resources to technology and systems development.

There are many experienced firms that offer computer network and Internet-related consulting services. These consulting services providers include consulting companies, such as Accenture, as well as consulting divisions of large technology companies, such as IBM. Because this area is very competitive, and we have limited resources dedicated to delivering engagement services, we may not succeed in selling these services.

Increased competition may result in price reductions, increased costs of providing our products and services and loss of market share, any of which could seriously harm our business. We may not be able to compete successfully against our current and future competitors.

20

If we do not continually improve our products and services in response to technological changes, including changes to the Internet and mobile networks, we may encounter difficulties retaining existing customers and attracting new customers.

The ongoing evolution of Internet and mobile networks has led to the development of new technologies and communications protocols, such as Internet telephony, wireless devices, Wi-Fi networks, HSDPA and LTE, as well as increased use of various applications, such as VoIP, mobile applications and video. These developing technologies require us to continually improve the functionality, features and reliability of our products and services, particularly in response to offerings by our competitors. If we do not succeed in developing and marketing new products and services that respond to competitive and technological developments and changing customer needs, we may encounter difficulties retaining existing customers and attracting new customers.

The success of new products and services depends on several factors, including proper definition of the scope and timely completion, introduction and market acceptance. If new Internet, mobile, networking or telecommunication technologies or standards are widely adopted or if other technological changes occur, we may need to expend significant resources to adapt to these developments or we could lose market share or some of our products and services could become obsolete.

The market price of our common stock can be volatile.

The stock market in recent years has experienced significant price and volume fluctuations, and has recently experienced substantial volatility that has affected the market prices of technology companies. These fluctuations have often been unrelated to or disproportionately impacted by the operating performance of these companies. The market for our common stock has been subject to similar fluctuations. Factors such as fluctuations in our operating results, announcements of events affecting other companies in the technology industry, currency fluctuations and general market events and conditions may cause the market price of our common stock to decline. In addition, because of the relatively low trading volume and the fact that we only have approximately 17.3 million shares outstanding at September 30, 2011, our stock price could be more volatile than companies with higher trading volumes and larger numbers of shares available for trading in the public market.

If we do not complement our direct sales force with relationships with other companies to help market our products and services, we may not be able to grow our business.

To increase sales worldwide, we must complement our direct sales force with relationships with other companies to help market and sell our products and services to their customers. We currently have relationships with several Open Application Performance Monitoring ("Open APM") partners and SITE system resellers. Additionally, DeviceAnywhere has reseller partner relationships with third parties to resell its products. If we are unable to maintain our existing marketing, reseller and distribution relationships, or fail to enter into additional relationships, we may have to devote substantially more resources to direct sales and marketing efforts. We would also lose anticipated revenue from customer referrals and other co-marketing benefits.

In the past, we have had to terminate relationships with some of our international resellers, and we may be required to terminate other reseller relationships in the future. As a result, we may have to commit resources to supplement our direct sales effort or to find additional resellers, especially in foreign countries.

Our success will also depend in part on the ability of these companies to help market and sell our products and services. Our existing relationships do not, and any future relationships may not, afford us any exclusive marketing or distribution rights. Therefore, these companies could reduce their commitment to us at any time in the future. Many of these companies have multiple relationships and they may not regard us as significant for their business. In addition, these companies generally may terminate their

21

relationships with us, pursue other relationships with our competitors, or develop or acquire products or services that compete with our services. Even if we succeed in entering into these relationships, they may not result in additional customers or revenue.

Our cash, cash equivalents and short-term investments are managed through various banks around the world and we may realize losses on these.

We maintain our cash, cash equivalents and short-term investments with a number of financial institutions around the world, and our results could vary materially from expectations depending on gains or losses realized on the sale or exchange of investments; impairment charges related to debt securities as well as other investments; and interest rates. The volatility in the financial markets and overall economic conditions increases the risk that the actual amounts realized in the future on our investments could differ significantly from the fair values currently assigned to them.

If the protection of our proprietary technology is inadequate, our competitors may gain access to our technology, and our market share could decline.

Our success is heavily dependent on our ability to create proprietary technology and to protect and enforce our intellectual property rights in that technology, as well as our ability to defend against adverse claims of third parties with respect to our technology and intellectual property. To protect our proprietary technology, we rely primarily on a combination of contractual provisions, confidentiality procedures, trade secrets, copyright and trademark laws, and patents. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products and services or obtain and use information that we regard as proprietary.

The laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the United States. Our means of protecting our proprietary rights may not be adequate and unauthorized third parties, including our competitors, may independently develop similar or superior technology, duplicate or reverse engineer aspects of our products and services, or design around our patented technology or other intellectual property.

There can be no assurance or guarantee that any products, services or technologies that we are presently developing, or will develop in the future, will result in intellectual property that is subject to legal protection under the laws of the United States or a foreign jurisdiction and that produces a competitive advantage for us.

Others might bring infringement claims which could harm our business.

There is significant litigation in the United States involving patents and other intellectual property rights. We could become subject to intellectual property infringement claims as our products and services overlap with competitive offerings. In addition, we are, or could be, subject to other legal proceedings, claims, and litigation arising in the ordinary course of our business. Any of these claims, even if not meritorious, could be expensive and divert management's attention from operating our company. If we become liable to others for infringement of their intellectual property rights, we could be required to pay a substantial damage award, to develop non- infringing technology, obtain a license to use the infringed intellectual property, or cease selling the products and services that contain the infringing intellectual property. We may be unable to develop non-infringing technology or to obtain a license on commercially reasonable terms, or at all.

Our measurement computers and mobile devices are located at sites that we do not own or operate, and it could be difficult for us to maintain or repair them if they do not function properly.

Our measurement computers and mobile devices that we use to provide many of our products and services are located at facilities that are not owned by our customers or us. Instead, these devices are

22