UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2013

OR

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number 1-12993

ALEXANDRIA REAL ESTATE EQUITIES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Maryland | | 95-4502084 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

385 East Colorado Boulevard, Suite 299, Pasadena, California 91101

(Address of principal executive offices) (Zip code)

(626) 578-0777

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of October 31, 2013, 71,627,655 shares of common stock, par value $.01 per share, were outstanding.

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

| |

| Item 1. | FINANCIAL STATEMENTS (UNAUDITED) |

Alexandria Real Estate Equities, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

|

| | | | | | | |

| | September 30, 2013 | | December 31, 2012 |

| Assets | | | |

| Investments in real estate, net | $ | 6,613,761 |

| | $ | 6,424,578 |

|

| Cash and cash equivalents | 53,839 |

| | 140,971 |

|

| Restricted cash | 30,654 |

| | 39,947 |

|

| Tenant receivables | 8,671 |

| | 8,449 |

|

| Deferred rent | 182,909 |

| | 170,396 |

|

| Deferred leasing and financing costs, net | 179,805 |

| | 160,048 |

|

| Investments | 129,163 |

| | 115,048 |

|

| Other assets | 159,567 |

| | 90,679 |

|

| Total assets | $ | 7,358,369 |

| | $ | 7,150,116 |

|

| | | | |

| Liabilities, Noncontrolling Interests, and Equity | | | |

| Secured notes payable | $ | 708,653 |

| | $ | 716,144 |

|

| Unsecured senior notes payable | 1,048,190 |

| | 549,805 |

|

| Unsecured senior line of credit | 14,000 |

| | 566,000 |

|

| Unsecured senior bank term loans | 1,100,000 |

| | 1,350,000 |

|

| Accounts payable, accrued expenses, and tenant security deposits | 452,139 |

| | 423,708 |

|

| Dividends payable | 54,413 |

| | 41,401 |

|

| Total liabilities | 3,377,395 |

| | 3,647,058 |

|

| | | | |

| Commitments and contingencies |

|

| |

|

|

| | | | |

| Redeemable noncontrolling interests | 14,475 |

| | 14,564 |

|

| | | | |

| Alexandria Real Estate Equities, Inc.’s stockholders’ equity: | | | |

| Series D cumulative convertible preferred stock | 250,000 |

| | 250,000 |

|

| Series E cumulative redeemable preferred stock | 130,000 |

| | 130,000 |

|

| Common stock | 711 |

| | 632 |

|

| Additional paid-in capital | 3,578,343 |

| | 3,086,052 |

|

| Accumulated other comprehensive loss | (40,026 | ) | | (24,833 | ) |

| Alexandria’s stockholders’ equity | 3,919,028 |

| | 3,441,851 |

|

| Noncontrolling interests | 47,471 |

| | 46,643 |

|

| Total equity | 3,966,499 |

| | 3,488,494 |

|

| Total liabilities, noncontrolling interests, and equity | $ | 7,358,369 |

| | $ | 7,150,116 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Alexandria Real Estate Equities, Inc.

Consolidated Statements of Income

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2013 | | 2012 | | 2013 | | 2012 |

| Revenues: | | | | | | | |

| Rental | $ | 116,302 |

| | $ | 106,216 |

| | $ | 342,821 |

| | $ | 311,746 |

|

| Tenant recoveries | 38,757 |

| | 34,006 |

| | 110,291 |

| | 97,769 |

|

| Other income | 3,571 |

| | 2,628 |

| | 10,133 |

| | 14,639 |

|

| Total revenues | 158,630 |

| | 142,850 |

| | 463,245 |

| | 424,154 |

|

| | | | | | | | |

| Expenses: | | | | | | | |

| Rental operations | 47,742 |

| | 44,203 |

| | 139,289 |

| | 126,758 |

|

| General and administrative | 11,666 |

| | 12,470 |

| | 35,786 |

| | 35,125 |

|

| Interest | 16,171 |

| | 17,092 |

| | 50,169 |

| | 51,240 |

|

| Depreciation and amortization | 49,102 |

| | 46,584 |

| | 141,747 |

| | 139,111 |

|

| Loss on early extinguishment of debt | 1,432 |

| | — |

| | 1,992 |

| | 2,225 |

|

| Total expenses | 126,113 |

| | 120,349 |

| | 368,983 |

| | 354,459 |

|

| | | | | | | | |

| Income from continuing operations | 32,517 |

| | 22,501 |

| | 94,262 |

| | 69,695 |

|

| | | | | | | | |

| (Loss) income from discontinued operations: | | | | | | | |

| (Loss) income from discontinued operations before impairment of real estate | (64 | ) | | 5,603 |

| | 993 |

| | 14,961 |

|

| Impairment of real estate | — |

| | (9,799 | ) | | — |

| | (9,799 | ) |

| (Loss) income from discontinued operations, net | (64 | ) | | (4,196 | ) | | 993 |

| | 5,162 |

|

| | | | | | | | |

| Gains on sales of land parcels | — |

| | — |

| | 772 |

| | 1,864 |

|

| Net income | 32,453 |

| | 18,305 |

| | 96,027 |

| | 76,721 |

|

| | | | | | | | |

| Net income attributable to noncontrolling interests | 960 |

| | 828 |

| | 2,922 |

| | 2,390 |

|

| Dividends on preferred stock | 6,472 |

| | 6,471 |

| | 19,414 |

| | 20,857 |

|

| Preferred stock redemption charge | — |

| | — |

| | — |

| | 5,978 |

|

| Net income attributable to unvested restricted stock awards | 442 |

| | 360 |

| | 1,187 |

| | 866 |

|

| Net income attributable to Alexandria’s common stockholders | $ | 24,579 |

| | $ | 10,646 |

| | $ | 72,504 |

| | $ | 46,630 |

|

| Earnings per share attributable to Alexandria’s common stockholders – basic and diluted: | | | | | | | |

| Continuing operations | $ | 0.35 |

| | $ | 0.24 |

| | $ | 1.07 |

| | $ | 0.67 |

|

| Discontinued operations, net | — |

| | (0.07 | ) | | 0.01 |

| | 0.08 |

|

| Earnings per share – basic and diluted | $ | 0.35 |

| | $ | 0.17 |

| | $ | 1.08 |

| | $ | 0.75 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Alexandria Real Estate Equities, Inc.

Consolidated Statements of Comprehensive Income

(In thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2013 | | 2012 | | 2013 | | 2012 |

| Net income | $ | 32,453 |

| | $ | 18,305 |

| | $ | 96,027 |

| | $ | 76,721 |

|

| Other comprehensive income: | | | | | | | |

| Unrealized gains (losses) on marketable securities: | | | | | | | |

| Unrealized holding (losses) gains arising during the period | (37 | ) | | 796 |

| | 323 |

| | 1,363 |

|

| Reclassification adjustment for gains included in net income | (250 | ) | | (1,421 | ) | | (480 | ) | | (2,107 | ) |

| Unrealized losses on marketable securities, net | (287 | ) | | (625 | ) | | (157 | ) | | (744 | ) |

| | | | | | | | |

| Unrealized gains (losses) on interest rate swaps: | | | | | | | |

| Unrealized interest rate swap losses arising during the period | (676 | ) | | (2,818 | ) | | (704 | ) | | (9,982 | ) |

| Reclassification adjustment for amortization of interest expense included in net income | 3,904 |

| | 5,956 |

| | 12,046 |

| | 17,626 |

|

| Unrealized gains on interest rate swap agreements, net | 3,228 |

| | 3,138 |

| | 11,342 |

| | 7,644 |

|

| | | | | | | | |

| Foreign currency translation (losses) gains | (3,404 | ) | | 15,104 |

| | (26,461 | ) | | 7,871 |

|

| | | | | | | | |

| Total other comprehensive (loss) income | (463 | ) | | 17,617 |

| | (15,276 | ) | | 14,771 |

|

| Comprehensive income | 31,990 |

| | 35,922 |

| | 80,751 |

| | 91,492 |

|

| Less: comprehensive income attributable to noncontrolling interests | (933 | ) | | (805 | ) | | (2,839 | ) | | (2,379 | ) |

| Comprehensive income attributable to Alexandria’s common stockholders | $ | 31,057 |

| | $ | 35,117 |

| | $ | 77,912 |

| | $ | 89,113 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Alexandria Real Estate Equities, Inc.

Consolidated Statement of Changes in Stockholders’ Equity and Noncontrolling Interests

(Dollars in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Alexandria Real Estate Equities, Inc.’s Stockholders’ Equity | | | | | | |

| | Series D Cumulative Convertible Preferred Stock | | Series E Cumulative Redeemable Preferred Stock | | Number of Common Shares | | Common Stock | | Additional Paid-In Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Noncontrolling Interests | | Total Equity | | Redeemable Noncontrolling Interests |

| Balance as of December 31, 2012 | $ | 250,000 |

| | $ | 130,000 |

| | 63,244,645 |

| | $ | 632 |

| | $ | 3,086,052 |

| | $ | — |

| | $ | (24,833 | ) | | $ | 46,643 |

| | $ | 3,488,494 |

| | $ | 14,564 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | — |

| | 93,105 |

| | — |

| | 2,118 |

| | 95,223 |

| | 804 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (15,193 | ) | | (83 | ) | | (15,276 | ) | | — |

|

| Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,207 | ) | | (1,207 | ) | | (893 | ) |

| Issuance of common stock | — |

| | — |

| | 7,590,000 |

| | 76 |

| | 534,601 |

| | — |

| | — |

| | — |

| | 534,677 |

| | — |

|

| Issuances pursuant to stock plan | — |

| | — |

| | 246,283 |

| | 3 |

| | 17,387 |

| | — |

| | — |

| | — |

| | 17,390 |

| | — |

|

| Dividends declared on common stock | — |

| | — |

| | — |

| | — |

| | — |

| | (133,388 | ) | | — |

| | — |

| | (133,388 | ) | | — |

|

| Dividends declared on preferred stock | — |

| | — |

| | — |

| | — |

| | — |

| | (19,414 | ) | | — |

| | — |

| | (19,414 | ) | | — |

|

| Distributions in excess of earnings | — |

| | — |

| | — |

| | — |

| | (59,697 | ) | | 59,697 |

| | — |

| | — |

| | — |

| | — |

|

| Balance as of September 30, 2013 | $ | 250,000 |

| | $ | 130,000 |

| | 71,080,928 |

| | $ | 711 |

| | $ | 3,578,343 |

| | $ | — |

| | $ | (40,026 | ) | | $ | 47,471 |

| | $ | 3,966,499 |

| | $ | 14,475 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Alexandria Real Estate Equities, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| | 2013 | | 2012 |

| Operating Activities | | | |

| Net income | $ | 96,027 |

| | $ | 76,721 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 142,677 |

| | 143,933 |

|

| Loss on early extinguishment of debt | 1,992 |

| | 2,225 |

|

| Gain on sale of land parcel | (772 | ) | | (1,864 | ) |

| Loss (gain) on sale of real estate | 121 |

| | (1,564 | ) |

| Non-cash impairment of real estate | — |

| | 9,799 |

|

| Amortization of loan fees and costs | 7,300 |

| | 7,327 |

|

| Amortization of debt premiums/discounts | 383 |

| | 401 |

|

| Amortization of acquired above and below market leases | (2,490 | ) | | (2,356 | ) |

| Deferred rent | (20,007 | ) | | (19,216 | ) |

| Stock compensation expense | 11,541 |

| | 10,412 |

|

| Equity in loss related to investments | — |

| | 26 |

|

| Gain on sales of investments | (4,716 | ) | | (12,316 | ) |

| Loss on sales of investments | 529 |

| | 1,607 |

|

| Changes in operating assets and liabilities: | | | |

| Restricted cash | 1,243 |

| | 441 |

|

| Tenant receivables | (271 | ) | | (2,637 | ) |

| Deferred leasing costs | (37,190 | ) | | (23,597 | ) |

| Other assets | (11,428 | ) | | (3,230 | ) |

| Accounts payable, accrued expenses, and tenant security deposits | 51,437 |

| | 41,378 |

|

| Net cash provided by operating activities | 236,376 |

| | 227,490 |

|

| | | | |

| Investing Activities | | | |

| Proceeds from sale of properties | 101,815 |

| | 36,179 |

|

| Additions to properties | (450,140 | ) | | (406,066 | ) |

| Purchase of properties | (24,537 | ) | | (42,171 | ) |

| Change in restricted cash related to construction projects | 5,711 |

| | (11,453 | ) |

| Distributions from unconsolidated real estate entity | — |

| | 22,250 |

|

| Contributions to unconsolidated real estate entity | (13,881 | ) | | (5,042 | ) |

| Additions to investments | (22,835 | ) | | (21,997 | ) |

| Proceeds from investments | 12,750 |

| | 19,905 |

|

| Net cash used in investing activities | $ | (391,117 | ) | | $ | (408,395 | ) |

Alexandria Real Estate Equities, Inc.

Consolidated Statements of Cash Flows (continued)

(In thousands)

(Unaudited)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| | 2013 | | 2012 |

| Financing Activities | | | |

| Borrowings from secured notes payable | $ | 26,319 |

| | $ | 2,874 |

|

| Repayments of borrowings from secured notes payable | (34,120 | ) | | (8,125 | ) |

| Proceeds from issuance of unsecured senior notes payable | 498,561 |

| | 549,533 |

|

| Principal borrowings from unsecured senior line of credit and unsecured senior bank term loans | 319,000 |

| | 623,147 |

|

| Repayments of borrowings from unsecured senior line of credit | (871,000 | ) | | (580,147 | ) |

| Repayment of unsecured senior bank term loan | (250,000 | ) | | (250,000 | ) |

| Repurchase of unsecured senior convertible notes | (384 | ) | | (84,801 | ) |

| Redemption of Series C Cumulative Redeemable Preferred Stock | — |

| | (129,638 | ) |

| Proceeds from issuance of Series E Cumulative Redeemable Preferred Stock | — |

| | 124,868 |

|

| Change in restricted cash related to financings | 923 |

| | (10,476 | ) |

| Deferred financing costs paid | (16,247 | ) | | (25,301 | ) |

| Proceeds from common stock offerings | 535,686 |

| | 98,443 |

|

| Proceeds from exercise of stock options | — |

| | 155 |

|

| Dividends paid on common stock | (120,367 | ) | | (92,743 | ) |

| Dividends paid on preferred stock | (19,414 | ) | | (21,348 | ) |

| Distributions to redeemable noncontrolling interests | — |

| | (943 | ) |

| Redemption of redeemable noncontrolling interests | — |

| | (150 | ) |

| Contributions by noncontrolling interests | — |

| | 1,626 |

|

| Distributions to noncontrolling interests | (2,100 | ) | | (770 | ) |

| Net cash provided by financing activities | 66,857 |

| | 196,204 |

|

| | | | |

| Effect of foreign exchange rate changes on cash and cash equivalents | 752 |

| | 1,066 |

|

| | | | |

| Net (decrease) increase in cash and cash equivalents | (87,132 | ) | | 16,365 |

|

| Cash and cash equivalents at beginning of period | 140,971 |

| | 78,539 |

|

| Cash and cash equivalents at end of period | $ | 53,839 |

| | $ | 94,904 |

|

| | | | |

| Supplemental Disclosure of Cash Flow Information | | | |

| Cash paid during the period for interest, net of interest capitalized | $ | 34,281 |

| | $ | 30,485 |

|

| | | | |

| Non-Cash Investing Activities | | | |

| Note receivable from sale of real estate | $ | 38,820 |

| | $ | 6,125 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Alexandria Real Estate Equities, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

As used in this quarterly report on Form 10-Q, references to the “Company,” “Alexandria,” “we,” “our,” and “us” refer to Alexandria Real Estate Equities, Inc. and its subsidiaries.

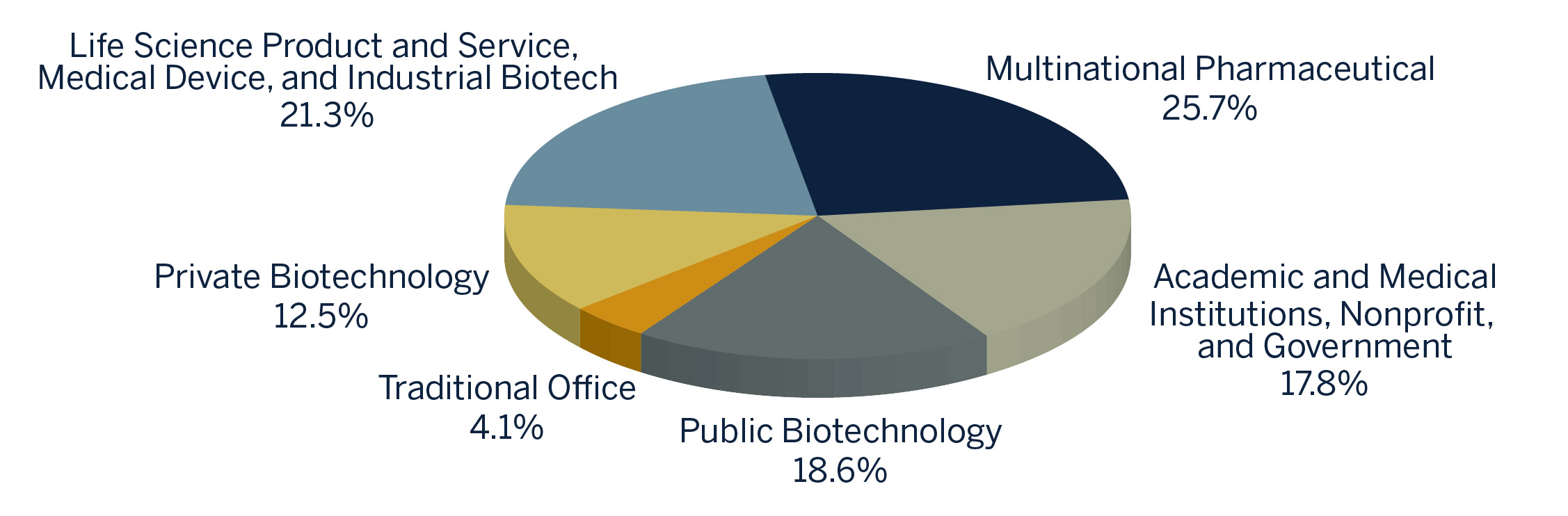

Alexandria Real Estate Equities, Inc. (NYSE: ARE), a self-administered and self-managed investment-grade real estate investment trust (“REIT”), is the largest and leading REIT focused principally on owning, operating, developing, redeveloping, and acquiring high-quality, sustainable real estate for the broad and diverse life science industry. Alexandria’s client tenants span the life science industry, including renowned academic and medical institutions, multinational pharmaceutical companies, public and private biotechnology entities, United States (“U.S.”) government research agencies, medical device companies, industrial biotech companies, venture capital firms, and life science product and service companies. For additional information on Alexandria Real Estate Equities, Inc., please visit www.are.com.

We have prepared the accompanying interim consolidated financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) and in conformity with the rules and regulations of the Securities and Exchange Commission (“SEC”). In our opinion, the interim consolidated financial statements presented herein reflect all adjustments that are necessary to fairly present the interim consolidated financial statements. The results of operations for the interim period are not necessarily indicative of the results that may be expected for the year ending December 31, 2013. These consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in our annual report on Form 10-K for the year ended December 31, 2012.

The accompanying consolidated financial statements include the accounts of Alexandria Real Estate Equities, Inc. and its subsidiaries. All significant intercompany balances and transactions have been eliminated.

We hold interests, together with certain third parties, in companies that we consolidate in our financial statements. We consolidate the companies because we exercise significant control over major decisions by these entities, such as investment activity and changes in financing.

Use of estimates

The preparation of consolidated financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, and equity; the disclosure of contingent assets and liabilities as of the date of the consolidated financial statements; and the amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation.

| |

| 2. | Basis of presentation (continued) |

Investments in real estate, net, and discontinued operations

We recognize assets acquired (including the intangible value of above or below market leases, acquired in-place leases, client tenant relationships, and other intangible assets or liabilities), liabilities assumed, and any noncontrolling interest in an acquired entity at their fair value as of the acquisition date. If there is a bargain fixed rate renewal option for the period beyond the non-cancelable lease term, we evaluate factors such as the business conditions in the industry in which the lessee operates, the economic conditions in the area in which the property is located, and the ability of the lessee to sublease the property during the renewal term, in order to determine the likelihood that the lessee will renew. When we determine there is reasonable assurance that such bargain purchase option will be exercised, we consider its impact in determining the intangible value of such lease and its related amortization period. The value of tangible assets acquired is based upon our estimation of value on an “as if vacant” basis. The value of acquired in-place leases includes the estimated carrying costs during the hypothetical lease-up period and other costs that would have been incurred in the execution of similar leases, considering market conditions at the acquisition date of the acquired in-place lease. We assess the fair value of tangible and intangible assets based on numerous factors, including estimated cash flow projections that utilize appropriate discount and capitalization rates and available market information. Estimates of future cash flows are based on a number of factors, including the historical operating results, known trends, and market/economic conditions that may affect the property. We also recognize the fair values of assets acquired, the liabilities assumed, and any noncontrolling interest in acquisitions of less than a 100% interest when the acquisition constitutes a change in control of the acquired entity. Acquisition-related costs and restructuring costs are expensed as incurred.

The values allocated to land improvements, tenant improvements, equipment, buildings, and building improvements are depreciated on a straight-line basis using an estimated life of 20 years for land improvements, the respective lease term for tenant improvements, the estimated useful life for equipment, and the shorter of the term of the respective ground lease and up to 40 years for buildings and building improvements. The values of acquired above and below market leases are amortized over the lives of the related leases and recognized as either an increase (for below market leases) or a decrease (for above market leases) to rental income. The values of acquired in-place leases are classified in other assets in the accompanying consolidated balance sheets, and amortized over the remaining terms of the related leases.

We are required to capitalize project costs, including predevelopment costs, interest, property taxes, insurance, and other costs directly related and essential to the acquisition, development, redevelopment, or construction of a project. Capitalization of development, redevelopment, and construction costs is required while activities are ongoing to prepare an asset for its intended use. Fluctuations in our development, redevelopment, and construction activities could result in significant changes to total expenses and net income. Costs incurred after a project is substantially complete and ready for its intended use are expensed as incurred. Should development, redevelopment, or construction activity cease, interest, property taxes, insurance, and certain other costs would no longer be eligible for capitalization and would be expensed as incurred. Expenditures for repairs and maintenance are expensed as incurred.

A property is classified as “held for sale” when all of the following criteria for a plan of sale have been met: (1) management, having the authority to approve the action, commits to a plan to sell the property; (2) the property is available for immediate sale in its present condition, subject only to terms that are usual and customary; (3) an active program to locate a buyer and other actions required to complete the plan to sell have been initiated; (4) the sale of the property is probable and is expected to be completed within one year; (5) the property is being actively marketed for sale at a price that is reasonable in relation to its current fair value; and (6) actions necessary to complete the plan of sale indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn. When all of these criteria have been met, the property is classified as “held for sale.” If (1) the operations and cash flows of the property have been or will be eliminated from the ongoing operations; and (2) we will not have any significant continuing involvement in the operations of the property after the sale, then its operations, including any interest expense directly attributable to it, are classified as discontinued operations in our consolidated statements of income, and amounts for all prior periods presented are reclassified from continuing operations to discontinued operations. Depreciation of assets ceases upon designation of a property as “held for sale.”

| |

| 2. | Basis of presentation (continued) |

Impairment of long-lived assets

Long-lived assets to be held and used, including our rental properties, land held for future development, construction in progress, and intangibles, are individually evaluated for impairment when conditions exist that may indicate that the carrying amount of a long-lived asset may not be recoverable. The carrying amount of a long-lived asset to be held and used is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. Impairment indicators or triggering events for long-lived assets to be held and used, including our rental properties, land held for future development, and construction in progress, are assessed by project and include significant fluctuations in estimated net operating income, occupancy changes, significant near-term lease expirations, current and historical operating and/or cash flow losses, construction costs, estimated completion dates, rental rates, and other market factors. We assess the expected undiscounted cash flows based upon numerous factors, including, but not limited to, construction costs, available market information, current and historical operating results, known trends, current market/economic conditions that may affect the property, and our assumptions about the use of the asset, including, if necessary, a probability-weighted approach if multiple outcomes are under consideration. Upon determination that an impairment has occurred, a write-down is recognized to reduce the carrying amount to its estimated fair value. If an impairment loss is not required to be recognized, the recognition of depreciation is adjusted prospectively, as necessary, to reduce the carrying amount of the real estate to its estimated disposition value over the remaining period that the real estate is expected to be held and used. We may adjust depreciation of properties that are expected to be disposed of or redeveloped prior to the end of their useful lives.

We use a “held for sale” impairment model for our properties classified as “held for sale.” The “held for sale” impairment model is different from the held and used impairment model. Under the “held for sale” impairment model, an impairment loss is recognized if the carrying amount of the long-lived asset classified as “held for sale” exceeds its fair value less cost to sell. Because of these two different models, it is possible for a long-lived asset previously classified as held and used to require the recognition of an impairment charge upon classification as “held for sale.”

Investments

We hold equity investments in certain publicly traded companies and privately held entities primarily involved in the life science industry. All of our investments in actively traded public companies are considered “available for sale” and are reflected in the accompanying consolidated balance sheets at fair value. Fair value has been determined based upon the closing price as of each balance sheet date, with unrealized gains and losses shown as a separate component of comprehensive income. The classification of each investment is determined at the time each investment is made, and such determination is reevaluated at each balance sheet date. The cost of each investment sold is determined by the specific identification method, with net realized gains or losses classified in other income in the accompanying consolidated statements of income. Investments in privately held entities are generally accounted for under the cost method when our interest in the entity is so minor that we have virtually no influence over the entity’s operating and financial policies. Certain investments in privately held entities are accounted for under the equity method when our interest in the entity is not deemed so minor that we have virtually no influence over the entity’s operating and financial policies. Under the equity method of accounting, we recognize our investment initially at cost and adjust the carrying amount of the investment to recognize our share of the earnings or losses of the investee subsequent to the date of our investment. Additionally, we limit our ownership percentage in the voting stock of each individual entity to less than 10%. As of September 30, 2013, and December 31, 2012, our ownership percentage in the voting stock of each individual entity was less than 10%.

Individual investments are evaluated for impairment when changes in conditions may indicate an impairment exists. The factors that we consider in making these assessments include market prices, market conditions, available financing, prospects for favorable or unfavorable clinical trial results, new product initiatives, and new collaborative agreements. If there are no identified events or changes in circumstances that would have an adverse effect on our cost method investments, we do not estimate the investment’s fair value. For all of our investments, if a decline in the fair value of an investment below the carrying value is determined to be other than temporary, such investment is written down to its estimated fair value with a non-cash charge to current earnings.

| |

| 2. | Basis of presentation (continued) |

Income taxes

We are organized and qualify as a REIT pursuant to the Internal Revenue Code of 1986, as amended (the “Code”). Under the Code, a REIT that distributes 100% of its REIT taxable income as a dividend to its shareholders each year and that meets certain other conditions is not subject to federal income taxes, but could be subject to certain state and local taxes. We have distributed 100% or more of our taxable income. Therefore, no provision for federal income taxes is required. We file tax returns, including returns for our subsidiaries, with federal, state, and local jurisdictions, including jurisdictions located in the U.S., Canada, India, China, and other international locations. Our tax returns are subject to examination in various jurisdictions for the calendar years 2008 through 2012.

We recognize tax benefits of uncertain tax positions only if it is more likely than not that the tax position will be sustained, based solely on its technical merits, with the taxing authority having full knowledge of all relevant information. The measurement of a tax benefit for an uncertain tax position that meets the “more likely than not” threshold is based on a cumulative probability model under which the largest amount of tax benefit recognized is the amount with a greater than 50% likelihood of being realized upon ultimate settlement with the taxing authority having full knowledge of all the relevant information. As of September 30, 2013, there were no unrecognized tax benefits. We do not anticipate a significant change to the total amount of unrecognized tax benefits within the next 12 months.

Interest expense and penalties, if any, would be recognized in the first period during which the interest or penalty would begin accruing, according to the provisions of the relevant tax law at the applicable statutory rate of interest. We did not incur tax related interest expense or penalties for the three and nine months ended September 30, 2013.

Interest income

Interest income was approximately $1.2 million and $1.0 million during the three months ended September 30, 2013 and 2012, respectively. Interest income was approximately $3.5 million and $2.5 million during the nine months ended September 30, 2013 and 2012, respectively. Interest income is classified in other income in the accompanying consolidated statements of income.

Recognition of rental income and tenant recoveries

Rental income from leases is recognized on a straight-line basis over the respective lease terms. We classify amounts currently recognized as income, and expected to be received in later years, as an asset in deferred rent in the accompanying consolidated balance sheets. Amounts received currently, but recognized as income in future years, are classified in accounts payable, accrued expenses, and tenant security deposits in the accompanying consolidated balance sheets. We commence recognition of rental income at the date the property is ready for its intended use and the client tenant takes possession of or controls the physical use of the property.

Tenant recoveries related to reimbursement of real estate taxes, insurance, utilities, repairs and maintenance, and other operating expenses are recognized as revenue in the period during which the applicable expenses are incurred.

Tenant receivables consist primarily of amounts due for contractual lease payments, reimbursements of common area maintenance expenses, property taxes, and other expenses recoverable from client tenants. Tenant receivables are expected to be collected within one year. We maintain an allowance for estimated losses that may result from the inability of our client tenants to make payments required under the terms of the lease and for tenant recoveries due. If a client tenant fails to make contractual payments beyond any allowance, we may recognize additional bad debt expense in future periods equal to the amount of uncollectible rent and deferred rent receivables arising from the straight-lining of rent. As of September 30, 2013, and December 31, 2012, we had no allowance for estimated losses.

As of September 30, 2013, approximately 94% of our leases (on a rentable square footage basis) were triple net leases, requiring client tenants to pay substantially all real estate taxes, insurance, utilities, common area expenses, and other operating expenses (including increases thereto) in addition to base rent. Approximately 95% of our leases (on a rentable square footage basis) contained effective annual rent escalations that were either fixed or based on a consumer price index or another index. Additionally, approximately 92% of our leases (on a rentable square footage basis) provided for the recapture of certain capital expenditures.

| |

| 3. | Investments in real estate |

Our investments in real estate, net, consisted of the following as of September 30, 2013, and December 31, 2012 (in thousands):

|

| | | | | | | |

| | September 30, 2013 | | December 31, 2012 |

| Rental properties: | | | |

| Land (related to rental properties) | $ | 542,511 |

| | $ | 522,664 |

|

| Buildings and building improvements | 5,315,447 |

| | 4,933,314 |

|

| Other improvements | 170,078 |

| | 189,793 |

|

| Rental properties | 6,028,036 |

| | 5,645,771 |

|

| Less: accumulated depreciation | (915,494 | ) | | (875,035 | ) |

| Rental properties, net | 5,112,542 |

| | 4,770,736 |

|

| | | | |

| Construction in progress (“CIP”)/current value-creation projects: | | | |

| Active development in North America | 594,973 |

| | 431,578 |

|

| Investment in unconsolidated joint venture | 42,537 |

| (1) | 28,656 |

|

| Active redevelopment in North America | 24,960 |

| | 199,744 |

|

| Active development and redevelopment in Asia | 97,319 |

| | 101,602 |

|

| Generic infrastructure/building improvement projects in North America | 46,227 |

| | 80,599 |

|

| | 806,016 |

| | 842,179 |

|

| Subtotal | 5,918,558 |

| | 5,612,915 |

|

| | | | |

| Land/future value-creation projects: | | | |

| Land undergoing predevelopment activities (CIP) in North America | 351,062 |

| | 433,310 |

|

| Land held for future development in North America | 190,427 |

| | 296,039 |

|

| Land held for future development/undergoing predevelopment activities (CIP) in Asia | 77,274 |

| | 82,314 |

|

| Land subject to sale negotiations | 76,440 |

| | — |

|

| | 695,203 |

| | 811,663 |

|

| Investments in real estate, net | $ | 6,613,761 |

| | $ | 6,424,578 |

|

| |

| (1) | The book value for this unconsolidated joint venture represents our equity investment in the project. |

Investment in unconsolidated real estate entity

We have a 27.5% interest in an unconsolidated joint venture that is currently developing a building totaling 413,536 RSF in the Longwood Medical Area of the Greater Boston market. The project is 37% pre-leased to Dana-Farber Cancer Institute, Inc. Our total investment into this project is approximately$42.5 million as of September 30, 2013. The total project costs are being funded primarily from a $213.2 million non-recourse secured construction loan, of which $75.0 million was drawn and outstanding at September 30, 2013. The loan bears interest at a rate of LIBOR+3.75%, with a floor of 5.25%. This loan has a maturity date of April 1, 2019, assuming the joint venture exercises its two separate one-year options to extend the stated maturity date of April 1, 2017.

We do not qualify as the primary beneficiary of the unconsolidated joint venture since we do not have the power to direct the activities of the entity that most significantly impacts its economic performance. The decisions that most significantly impact the entity’s economic performance require both our consent and that of our partners, including all major operating, investing, and financing decisions, as well as decisions involving major expenditures. Consequently, we do not consolidate this joint venture and we account for our investment under the equity method of accounting.

| |

| 3. | Investments in real estate (continued) |

Land undergoing predevelopment activities (additional CIP)

Land undergoing predevelopment activities is classified as construction in progress and is undergoing activities prior to commencement of vertical construction of above-ground building improvements. We generally will not commence ground-up development of any parcels undergoing predevelopment activities without first securing pre-leasing for such space, except when there is significant market demand for high-quality laboratory facilities. If vertical aboveground construction is not initiated at completion of predevelopment activities, the land parcel will be classified as land held for future development. Our objective with predevelopment is to reduce the time it takes to deliver projects to prospective client tenants. Additionally, during predevelopment, we focus on the design of cost effective buildings with generic laboratory and office infrastructure to accommodate single and multi-tenancy. The largest project included in land undergoing predevelopment consists of our 1.2 million developable square feet at the Alexandria Center™ at Kendall Square in East Cambridge, Massachusetts.

We are required to capitalize project costs, including interest, property taxes, insurance, and other costs directly related and essential to the development or construction of a project during periods when activities necessary to prepare an asset for its intended use are in progress. Predevelopment costs generally include the following activities prior to commencement of vertical construction:

| |

| Ÿ | Traditional preconstruction costs including entitlement, design, construction drawings, Building Information Modeling (3-D virtual modeling), budgeting, sustainability and energy optimization reviews, permitting, and planning for all aspects of the project. |

| |

| Ÿ | Site and infrastructure construction costs including belowground site work, utility connections, land grading, drainage, egress and regress access points, foundation, and other costs to prepare the site for vertical construction of aboveground building improvements. For example, site and infrastructure costs for the 1.2 million RSF primarily related to 50 Binney Street and 100 Binney Street of the Alexandria Center™ at Kendall Square are classified as predevelopment prior to commencement of vertical construction. |

Land held for future development

Land held for future development represents real estate we plan to develop in the future, but on which, as of each period presented, no construction or predevelopment activities were ongoing. In such cases, all predevelopment efforts have been advanced to appropriate stages and no further predevelopment activities are ongoing; therefore, interest, property taxes, insurance, and other costs are expensed as incurred.

Real estate asset sales

During the nine months ended September 30, 2013, we sold seven properties for aggregate consideration of $128.6 million, including four properties sold at a total gain of $271 thousand and three properties sold at a total loss of $392 thousand. The net loss on sales is classified in (loss) income from discontinued operations before impairment of real estate in the accompanying consolidated statements of income.

During the nine months ended September 30, 2013, we sold three parcels of land for aggregate consideration of $18.1 million and recognized gains of $772 thousand, which included a gain of $381 thousand on the sale of two parcels in the San Francisco Bay Area market, and a gain of $391 thousand on the sale of one parcel in the Greater NYC market. These gains are classified in gains on sales of land parcels in the accompanying consolidated statements of income.

We hold equity investments in certain publicly traded companies and privately held entities primarily involved in the life science industry. Investments in “available for sale” securities with gross unrealized losses as of September 30, 2013, have each been in a continuous unrealized loss position for less than 12 months. We have the ability and intent to hold these investments for a reasonable period of time sufficient for the recovery of our investment. We believe that these unrealized losses are temporary, and accordingly we have not recognized impairment charges related to “available for sale” securities as of September 30, 2013. As of September 30, 2013, and December 31, 2012, there were no unrealized losses in our investments in privately held entities accounted for under the cost method.

The following table summarizes our investments as of September 30, 2013, and December 31, 2012 (in thousands):

|

| | | | | | | |

| | September 30, 2013 | | December 31, 2012 |

| “Available-for-sale” securities, cost basis | $ | 1,940 |

| | $ | 1,236 |

|

| Gross unrealized gains | 1,708 |

| | 1,561 |

|

| Gross unrealized losses | (392 | ) | | (88 | ) |

| “Available-for-sale” securities, at fair value | 3,256 |

| | 2,709 |

|

| Investments accounted for under cost method | 125,901 |

| | 112,333 |

|

| Investments accounted for under equity method | 6 |

| | 6 |

|

| Total investments | $ | 129,163 |

| | $ | 115,048 |

|

The following table outlines our investment income, which is classified in other income in the accompanying consolidated statements of income for the three and nine months ended September 30, 2013 (in thousands):

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2013 | | 2012 | | 2013 | | 2012 |

| Gross realized gains | $ | 2,050 |

| | $ | 1,190 |

| | $ | 4,716 |

| | $ | 12,316 |

|

| Gross realized losses | — |

| | (518 | ) | | (529 | ) | | (1,607 | ) |

| Equity in loss related to equity method investments | — |

| | — |

| | — |

| | (26 | ) |

| Investment income | $ | 2,050 |

| | $ | 672 |

| | $ | 4,187 |

| | $ | 10,683 |

|

| | | | | | | | |

| Amount of gains reclassified from accumulated other comprehensive income to realized gains, net | $ | 250 |

| | $ | 1,421 |

| | $ | 480 |

| | $ | 2,107 |

|

| |

| 5. | Secured and unsecured senior debt |

The following table summarizes our secured and unsecured senior debts and their respective principal maturities, as of September 30, 2013 (dollars in thousands):

|

| | | | | | | | | | | | | | | | | | | |

| | Fixed Rate/Hedged Variable Rate | | Unhedged Variable Rate | | Total Consolidated | | Percentage of Total | | Weighted Average Interest Rate at End of Period (1) | | Weighted Average Remaining Term (in years) |

| Secured notes payable, net | $ | 589,126 |

| | $ | 119,527 |

| | $ | 708,653 |

| | 24.7 | % | | 5.47 | % | | 2.5 |

| Unsecured senior notes payable, net | 1,048,190 |

| | — |

| | 1,048,190 |

| | 36.5 |

| | 4.29 |

| | 9.1 |

| $1.5 billion unsecured senior line of credit | — |

| | 14,000 |

| | 14,000 |

| | 0.5 |

| | 1.28 |

| | 5.3 |

| 2016 Unsecured Senior Bank Term Loan | 350,000 |

| | 150,000 |

| | 500,000 |

| | 17.4 |

| | 1.70 |

| | 2.8 |

| 2019 Unsecured Senior Bank Term Loan | 600,000 |

| | — |

| | 600,000 |

| | 20.9 |

| | 3.30 |

| | 5.3 |

| Total debt / weighted average | $ | 2,587,316 |

| | $ | 283,527 |

| | $ | 2,870,843 |

| | 100.0 | % | | 3.91 | % | | 5.5 |

| Percentage of total debt | 90 | % | | 10 | % | | 100 | % | | | | | | |

| |

| (1) | Represents the weighted average contractual interest rate as of the end of the period plus the impact of debt premiums/discounts and our interest rate swap agreements. The weighted average interest rate excludes bank fees and amortization of loan fees. |

| |

| 5. | Secured and unsecured senior debt (continued) |

The following table summarizes our outstanding consolidated indebtedness as of September 30, 2013 (dollars in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Stated Rate | | Weighted Average Interest Rate(1) | | Maturity Date(2) | | Remaining for the Period Ending December 31, | | | | |

| Debt | | | | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | Thereafter | | Total |

| Secured notes payable | | | | | | | | | | | | | | | | | | | | | | |

|

| Greater Boston | | 5.26 | % | | 5.59 |

| % | | 04/01/14 | | $ | 979 |

| | $ | 208,683 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 209,662 |

|

| Suburban Washington, D.C. | | 2.17 | | | 2.17 |

| | | 04/20/14 | (3) | — |

| | 76,000 |

| | — |

| | — |

| | — |

| | — |

| | 76,000 |

|

| San Diego | | 6.05 | | | 4.88 |

| | | 07/01/14 | | 24 |

| | 6,458 |

| | — |

| | — |

| | — |

| | — |

| | 6,482 |

|

| San Diego | | 5.39 | | | 4.00 |

| | | 11/01/14 | | 30 |

| | 7,495 |

| | — |

| | — |

| | — |

| | — |

| | 7,525 |

|

| Seattle | | 6.00 | | | 6.00 |

| | | 11/18/14 | | 60 |

| | 240 |

| | — |

| | — |

| | — |

| | — |

| | 300 |

|

| Suburban Washington, D.C. | | 5.64 | | | 4.50 |

| | | 06/01/15 | | 22 |

| | 138 |

| | 5,788 |

| | — |

| | — |

| | — |

| | 5,948 |

|

| Greater Boston, San Diego, and Greater New York City | | 5.73 | | | 5.73 |

| | | 01/01/16 | | 416 |

| | 1,713 |

| | 1,816 |

| | 75,501 |

| | — |

| | — |

| | 79,446 |

|

| Greater Boston, San Diego, and Greater NYC | | 5.82 | | | 5.82 |

| | | 04/01/16 | | 221 |

| | 931 |

| | 988 |

| | 29,389 |

| | — |

| | — |

| | 31,529 |

|

| San Francisco Bay Area | | 6.35 | | | 6.35 |

| | | 08/01/16 | | 580 |

| | 2,487 |

| | 2,652 |

| | 126,715 |

| | — |

| | — |

| | 132,434 |

|

| San Francisco Bay Area | | L+1.50 | | | 1.69 |

| | | 07/01/15 | (4) | — |

| | — |

| | 43,227 |

| | — |

| | — |

| | — |

| | 43,227 |

|

| San Francisco Bay Area | | L+1.40 | | | 1.59 |

| | | 06/01/16 | (5) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Greater Boston | | L+1.35 | | | 1.54 |

| | | 08/23/17 | (6) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| San Diego, Suburban Washington, D.C., and Seattle | | 7.75 | | | 7.75 |

| | | 04/01/20 | | 345 |

| | 1,453 |

| | 1,570 |

| | 1,696 |

| | 1,832 |

| | 108,469 |

| | 115,365 |

|

| San Francisco Bay Area | | 6.50 | | | 6.50 |

| | | 06/01/37 | | — |

| | 17 |

| | 18 |

| | 19 |

| | 20 |

| | 773 |

| | 847 |

|

| Average/Total | | 5.41 | % | | 5.47 |

| | | | | 2,677 |

| | 305,615 |

| | 56,059 |

| | 233,320 |

| | 1,852 |

| | 109,242 |

| | 708,765 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| $1.5 billion unsecured senior line of credit | | L+1.10 | % | (7) | 1.28 |

| | | 01/03/19 | | — |

| | — |

| | — |

| | — |

| | — |

| | 14,000 |

| | 14,000 |

|

| 2016 Unsecured Senior Bank Term Loan | | L+1.20 | % | | 1.70 |

| | | 07/31/16 | | — |

| | — |

| | — |

| | 500,000 |

| | — |

| | — |

| | 500,000 |

|

| 2019 Unsecured Senior Bank Term Loan | | L+1.20 | % | | 3.30 |

| | | 01/03/19 | | — |

| | — |

| | — |

| | — |

| | — |

| | 600,000 |

| | 600,000 |

|

| Unsecured senior notes payable | | 4.60 | % | | 4.61 |

| | | 04/01/22 | | — |

| | — |

| | — |

| | — |

| | — |

| | 550,000 |

| | 550,000 |

|

| Unsecured senior notes payable | | 3.90 | % | | 3.94 |

| | | 06/15/23 | | — |

| | — |

| | — |

| | — |

| | — |

| | 500,000 |

| | 500,000 |

|

| Average/Subtotal | | | | | 3.91 |

| | | | | 2,677 |

| | 305,615 |

| | 56,059 |

| | 733,320 |

| | 1,852 |

| | 1,773,242 |

| | 2,872,765 |

|

| Unamortized discounts | | | | | — |

| | | | | (146 | ) | | (199 | ) | | (139 | ) | | (177 | ) | | (184 | ) | | (1,077 | ) | | (1,922 | ) |

| Average/Total | | | | | 3.91 |

| % | | | | $ | 2,531 |

| | $ | 305,416 |

| | $ | 55,920 |

| | $ | 733,143 |

| | $ | 1,668 |

| | $ | 1,772,165 |

| | $ | 2,870,843 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Balloon payments | | | | | |

| | | | | $ | — |

| | $ | 297,080 |

| | $ | 48,955 |

| | $ | 730,029 |

| | $ | — |

| | $ | 1,768,352 |

| | $ | 2,844,416 |

|

| Principal amortization | | | | | |

| | | | | 2,531 |

| | 8,336 |

| | 6,965 |

| | 3,114 |

| | 1,668 |

| | 3,813 |

| | 26,427 |

|

| Total consolidated debt | | | | | |

| | | | | $ | 2,531 |

| | $ | 305,416 |

| | $ | 55,920 |

| | $ | 733,143 |

| | $ | 1,668 |

| | $ | 1,772,165 |

| | $ | 2,870,843 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Fixed rate/hedged variable rate debt | | | | | |

| | | | | $ | 2,471 |

| | $ | 229,176 |

| | $ | 12,693 |

| | $ | 583,143 |

| | $ | 1,668 |

| | $ | 1,758,165 |

| | $ | 2,587,316 |

|

| Unhedged variable rate debt | | | | | |

| | | | | 60 |

| | 76,240 |

| | 43,227 |

| | 150,000 |

| | — |

| | 14,000 |

| | 283,527 |

|

| Total consolidated debt | | | | | |

| | | | | $ | 2,531 |

| | $ | 305,416 |

| | $ | 55,920 |

| | $ | 733,143 |

| | $ | 1,668 |

| | $ | 1,772,165 |

| | $ | 2,870,843 |

|

| |

| (1) | Represents the weighted average contractual interest rate as of the end of the period plus the impact of debt premiums/discounts and our interest rate swap agreements. The weighted average interest rate excludes bank fees and amortization of loan fees. |

| |

| (2) | Includes any extension options that we control. |

| |

| (3) | We are having discussions with the lender on an extension of the maturity date. |

| |

| (4) | Secured construction loan with aggregate commitments of $55.0 million. We have two, one-year options to extend the stated maturity date to July 1, 2017, subject to certain conditions. |

| |

| (5) | Secured construction loan with aggregate commitments of $33.0 million. We have two, one-year options to extend the stated maturity date to June 1, 2018, subject to certain conditions. As of September 30, 2013, we had not drawn on the loan. |

| |

| (6) | Secured construction loan with aggregate commitments of $245.4 million. We have a one-year option to extend the stated maturity date to August 23, 2018, subject to certain conditions. As of September 30, 2013, we had not drawn on the loan. |

| |

| (7) | In addition to the stated rate, the line of credit is subject to an annual facility fee of 0.20%. |

| |

| 5. | Secured and unsecured senior debt (continued) |

3.90% Unsecured senior notes payable

In June 2013, we completed a $500.0 million public offering of our unsecured senior notes payable at a stated interest rate of 3.90% (“3.90% Unsecured Senior Notes”). The unsecured senior notes payable were priced at 99.712% of the principal amount with a yield to maturity of 3.94% and are due June 15, 2023. The unsecured senior notes payable are unsecured obligations of the Company and are fully and unconditionally guaranteed by Alexandria Real Estate Equities, L.P., a 100% owned subsidiary of the Company. The unsecured senior notes payable rank equally in right of payment with all other senior unsecured indebtedness. However, the unsecured senior notes payable are effectively subordinated to existing and future mortgages and other secured indebtedness (to the extent of the value of the collateral securing such indebtedness) and to all existing and future preferred equity and liabilities, whether secured or unsecured, of the Company’s subsidiaries, other than Alexandria Real Estate Equities, L.P. We used the net proceeds of this offering initially to prepay $150.0 million of the outstanding principal balance on our unsecured senior bank term loan due in 2016 (“2016 Unsecured Senior Bank Term Loan”), to reduce the outstanding borrowings on our unsecured senior line of credit to zero, and held the remaining proceeds in cash and cash equivalents. As a result of the $150.0 million prepayment, we recognized a loss on early extinguishment of debt related to the write-off of a portion of unamortized loan fees in June 2013, totaling $560 thousand.

Unsecured senior line of credit and unsecured senior bank term loans

On July 26, 2013, we amended our 2016 Unsecured Senior Bank Term Loan to reduce the applicable interest rate margins in respect of the loan thereunder on outstanding borrowings. We extended the maturity of this loan by one month and we expect to repay the loan over the next one to three years. In addition, on August 30, 2013, we amended our $1.5 billion unsecured senior line of credit and our unsecured senior bank term loan due in 2019 (“2019 Unsecured Senior Bank Term Loan”) to reduce the interest rate on outstanding borrowings, extend the maturity dates, and amend certain financial covenants. Also, on August 30, 2013, we amended our 2016 Unsecured Senior Bank Term Loan to conform certain financial covenants to those contained in the amended credit agreement related to our $1.5 billion unsecured senior line of credit and our 2019 Unsecured Senior Bank Term Loan. The maturity dates below reflect any available extension options that we control.

|

| | | | | | | | | | | | | | | | | | |

| | | Balance at 9/30/13 | | Maturity Date | | Applicable Rate | | Facility Fee |

| Facility | | | Prior | | Amended | | Prior | | Amended | | Prior | | Amended |

| 2016 Unsecured Senior Bank Term Loan | | $ | 500 | million | | June 2016 | | July 2016 | | L +1.75% | | L +1.20% | | N/A |

| | N/A |

|

| 2019 Unsecured Senior Bank Term Loan | | $ | 600 | million | | January 2017 | | January 2019 | | L +1.50% | | L +1.20% | | N/A |

| | N/A |

|

| $1.5 billion unsecured senior line of credit | | $ | 14 | million | | April 2017 | | January 2019 | | L +1.20% | | L +1.10% | | 0.25 | % | | 0.20 | % |

On September 30, 2013, we paid down $100 million on our 2016 Unsecured Senior Bank Term Loan to a total outstanding balance of $500 million. During the three months ended September 30, 2013, in conjunction with the refinancing of our unsecured senior bank term loans and the partial repayment of $100 million of our 2016 Unsecured Senior Bank Term Loan, we recognized a loss on early extinguishment of debt totaling $1.4 million, due to the write-off of unamortized loan fees.

Borrowings under the unsecured senior line of credit will bear interest at a “Eurocurrency Rate” or a “Base Rate” specified in the amended unsecured line of credit agreement, plus, in either case, a specified margin (the “Applicable Margin”). The “Eurocurrency Rate” specified in the amended unsecured line of credit agreement is, as applicable, the rate per annum equal to (i) the London interbank offered rate (“LIBOR”) or a successor rate thereto as approved by the administrative agent for loans denominated in a LIBOR quoted currency (i.e., US Dollars, Euro, Sterling, or Yen), (ii) the average annual yield rates applicable to Canadian dollar banker's acceptances for loans denominated in Canadian dollars, (iii) the Bank Bill Swap Reference Bid rate for loans denominated in Australian dollars, or (iv) the rate designated with respect to the applicable alternative currency for loans denominated in a non-LIBOR quoted currency (other than Canadian or Australian dollars). The “Base Rate” specified in the amended unsecured line of credit agreement means for any day a fluctuating rate per annum equal to the highest of (a) the federal funds rate plus 1/2 of 1%, (b) the rate of interest in effect for such day as publicly announced from time to time by Bank of America as its “prime rate,” and (c) the Eurocurrency Rate plus 1.00%. The Applicable Margin for LIBOR borrowings under the unsecured senior line of credit as of September 30, 2013, was 1.10%, which is based on our existing credit rating as set by certain rating agencies. As of September 30, 2013, we had $14 million in borrowings outstanding on our $1.5 billion unsecured senior line of credit. Our unsecured senior line of credit is subject to an annual facility fee of 0.20% based on the aggregate commitments outstanding.

| |

| 5. | Secured and unsecured senior debt (continued) |

In addition, the terms of the unsecured senior line of credit and unsecured senior bank term loan agreements, among other things, limit the ability of the Company, Alexandria Real Estate Equities, L.P., and the Company’s subsidiaries to (i) consummate a merger, or consolidate or sell all or substantially all of the Company’s assets, and (ii) incur certain secured or unsecured indebtedness. Additionally, the terms of the unsecured senior line of credit and unsecured senior bank term loan agreements include a restriction that may limit our ability to pay dividends, including distributions with respect to common stock or other equity interests, during any time a default is continuing, except to enable us to continue to qualify as a REIT for federal income tax purposes. As of September 30, 2013, we were in compliance with all such covenants and there were no limitations pursuant to such covenants.

The following table outlines our interest expense for the three and nine months ended September 30, 2013 and 2012 (in thousands):

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2013 | | 2012 | | 2013 | | 2012 |

| Gross interest | $ | 32,959 |

| | $ | 33,855 |

| | $ | 96,668 |

| | $ | 99,094 |

|

| Capitalized interest | (16,788 | ) | | (16,763 | ) | | (46,499 | ) | | (47,854 | ) |

| Interest expense | $ | 16,171 |

| | $ | 17,092 |

| | $ | 50,169 |

| | $ | 51,240 |

|

Construction loan of unconsolidated joint venture

We have a 27.5% interest in an unconsolidated joint venture that is currently developing a building in the Longwood Medical Area of the Greater Boston market, with the construction costs funded primarily from a non-recourse secured construction loan with aggregate commitments of $213.2 million and an outstanding balance of $75.0 million as of September 30, 2013. See Note 3 for further information.

| |

| 6. | Interest rate swap agreements |

During the nine months ended September 30, 2013 and 2012, our interest rate swap agreements were used primarily to hedge the variable cash flows associated with certain of our existing LIBOR-based variable rate debt, including our unsecured senior line of credit and unsecured senior bank term loans. The ineffective portion of the change in fair value of our interest rate swap agreements is required to be recognized directly in earnings. During the nine months ended September 30, 2013 and 2012, our interest rate swap agreements were 100% effective; because of this, no hedge ineffectiveness was recognized in earnings. The effective portion of changes in the fair values of our interest rate swap agreements that are designated and that qualify as cash flow hedges is classified in accumulated other comprehensive loss. Losses are subsequently reclassified into earnings in the period during which the hedged transactions affect earnings. During the next 12 months, we expect to reclassify approximately $8.5 million in accumulated other comprehensive loss to interest expense as an increase to interest expense.

As of September 30, 2013, and December 31, 2012, the fair values of our interest rate swap agreements were classified in accounts payable, accrued expenses, and tenant security deposits based upon their respective fair values, aggregating a liability balance of approximately $9.3 million and $20.7 million, respectively, which included accrued interest and adjustments for non-performance risk, with the offsetting adjustment reflected as unrealized loss in accumulated other comprehensive loss in total equity. Under our interest rate swap agreements, we have no collateral posting requirements.

We had the following outstanding interest rate swap agreements that were designated as cash flow hedges of interest rate risk as of September 30, 2013 (dollars in thousands):

|

| | | | | | | | | | | | | | | | | |

| | | | | Interest Pay Rate (1) | | Fair Value as of September 30, 2013 | | Notional Amount in Effect as of |

| Effective Date | | Termination Date | | | | September 30, 2013 | | December 31, 2013 |

| December 29, 2006 | | March 31, 2014 | | 4.990 | % | | $ | (1,205 | ) | | $ | 50,000 |

| | $ | 50,000 |

|

| November 30, 2009 | | March 31, 2014 | | 5.015 | % | | (1,817 | ) | | 75,000 |

| | 75,000 |

|

| November 30, 2009 | | March 31, 2014 | | 5.023 | % | | (1,820 | ) | | 75,000 |

| | 75,000 |

|

| December 31, 2012 | | December 31, 2013 | | 0.640 | % | | (291 | ) | | 250,000 |

| | — |

|

| December 31, 2012 | | December 31, 2013 | | 0.640 | % | | (291 | ) | | 250,000 |

| | — |

|

| December 31, 2012 | | December 31, 2013 | | 0.644 | % | | (147 | ) | | 125,000 |

| | — |

|

| December 31, 2012 | | December 31, 2013 | | 0.644 | % | | (147 | ) | | 125,000 |

| | — |

|

| December 31, 2013 | | December 31, 2014 | | 0.977 | % | | (1,802 | ) | | — |

| | 250,000 |

|

| December 31, 2013 | | December 31, 2014 | | 0.976 | % | | (1,799 | ) | | — |

| | 250,000 |

|

| Total | | | | | | $ | (9,319 | ) | | $ | 950,000 |

| | $ | 700,000 |

|

| |

| (1) | In addition to the interest pay rate, borrowings outstanding under our unsecured senior bank term loans include an applicable margin of 1.20% as of September 30, 2013. |

| |

| 7. | Fair value measurements |

We are required to disclose fair value information about all financial instruments, whether or not recognized in the balance sheet, for which it is practicable to estimate fair value. We measure and disclose the estimated fair value of financial assets and liabilities utilizing a fair value hierarchy that distinguishes between data obtained from sources independent of the reporting entity and the reporting entity’s own assumptions about market participant assumptions. This hierarchy consists of three broad levels, as follows: (i) quoted prices in active markets for identical assets or liabilities, (ii) “significant other observable inputs,” and (iii) “significant unobservable inputs.” “Significant other observable inputs” can include quoted prices for similar assets or liabilities in active markets, as well as inputs that are observable for the asset or liability, such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals. “Significant unobservable inputs” are typically based on an entity’s own assumptions, since there is little, if any, related market activity. In instances in which the determination of the fair value measurement is based on inputs from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level of input that is significant to the fair value measurement in its entirety. Our assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability. There were no transfers between the levels in the fair value hierarchy during the three and nine months ended September 30, 2013 and 2012.

The following tables set forth the assets and liabilities that we measure at fair value on a recurring basis by level within the fair value hierarchy as of September 30, 2013, and December 31, 2012 (in thousands):

|

| | | | | | | | | | | | | | | | |

| | | | | September 30, 2013 |

| Description | | Total | | Quoted Prices in Active Markets for Identical Assets | | Significant Other Observable Inputs | | Significant Unobservable Inputs |

| Assets: | | | | | | | | |

| Marketable securities | | $ | 3,256 |

| | $ | 3,256 |

| | $ | — |

| | $ | — |

|

| Liabilities: | | | | | | | | |

| Interest rate swap agreements | | $ | 9,319 |

| | $ | — |

| | $ | 9,319 |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | |

| | | | | December 31, 2012 |

| Description | | Total | | Quoted Prices in Active Markets for Identical Assets | | Significant Other Observable Inputs | | Significant Unobservable Inputs |

| Assets: | | | | | | | | |

| Marketable securities | | $ | 2,709 |

| | $ | 2,709 |

| | $ | — |

| | $ | — |

|

| Liabilities: | | | | | | | | |

| Interest rate swap agreements | | $ | 20,661 |

| | $ | — |

| | $ | 20,661 |

| | $ | — |

|

The carrying amounts of cash and cash equivalents, restricted cash, tenant receivables, other assets, accounts payable, accrued expenses, and tenant security deposits approximate fair value. Our “available-for-sale” securities and our interest rate swap agreements, respectively, have been recognized at fair value. The fair values of our secured notes payable, unsecured senior notes payable, unsecured senior line of credit, and unsecured senior bank term loans were estimated using widely accepted valuation techniques, including discounted cash flow analyses of “significant other observable inputs” such as available market information on discount and borrowing rates with similar terms, maturities, and credit ratings. Because the valuations of our financial instruments are based on these types of estimates, the actual fair value of our financial instruments may differ materially if our estimates do not prove to be accurate. Additionally, the use of different market assumptions or estimation methods may have a material effect on the estimated fair value amounts.

| |

| 7. | Fair value measurements (continued) |

As of September 30, 2013, and December 31, 2012, the book and fair values of our marketable securities, interest rate swap agreements, secured notes payable, unsecured senior notes payable, unsecured senior line of credit, and unsecured senior bank term loans were as follows (in thousands):

|

| | | | | | | | | | | | | | | |

| | September 30, 2013 | | December 31, 2012 |

| | Book Value | | Fair Value | | Book Value | | Fair Value |

| Assets: | | | | | | | |

| Marketable securities | $ | 3,256 |

| | $ | 3,256 |

| | $ | 2,709 |

| | $ | 2,709 |

|

| | | | | | | | |

| Liabilities: | | | | | | | |

| Interest rate swap agreements | $ | 9,319 |

| | $ | 9,319 |

| | $ | 20,661 |

| | $ | 20,661 |

|

| Secured notes payable | $ | 708,653 |

| | $ | 761,047 |

| | $ | 716,144 |

| | $ | 788,455 |

|

| Unsecured senior notes payable | $ | 1,048,190 |

| | $ | 1,028,750 |

| | $ | 549,805 |

| | $ | 593,350 |

|

| Unsecured senior line of credit | $ | 14,000 |

| | $ | 13,738 |

| | $ | 566,000 |

| | $ | 567,196 |

|

| Unsecured senior bank term loans | $ | 1,100,000 |

| | $ | 1,088,322 |

| | $ | 1,350,000 |

| | $ | 1,405,124 |

|

We use income from continuing operations attributable to Alexandria’s common stockholders as the “control number” in determining whether potential common shares are dilutive or antidilutive to earnings per share. Pursuant to the presentation and disclosure literature on gains or losses on sales or disposals by REITs and earnings per share required by the SEC and the Financial Accounting Standards Board, gains or losses on sales or disposals by a REIT that do not qualify as discontinued operations are classified below income from discontinued operations in the consolidated statements of income and included in the numerator for the computation of earnings per share for income from continuing operations.

The land parcels we sold during the nine months ended September 30, 2013 and 2012, did not meet the criteria for classification as discontinued operations because the land parcels did not have significant operations prior to disposition. Accordingly, for the nine months ended September 30, 2013 and 2012, we classified approximately $0.8 million and $1.9 million, respectively, as gain on sales of land parcels below income from discontinued operations, net, in the accompanying consolidated statements of income, and included the gain in income from continuing operations attributable to Alexandria’s common stockholders in the “control number,” or numerator for computation of earnings per share.

We account for unvested restricted stock awards that contain nonforfeitable rights to dividends as participating securities and include these securities in the computation of earnings per share using the two-class method. Our Series D convertible preferred stock (“Series D Convertible Preferred Stock”) is not a participating security, and is not included in the computation of earnings per share using the two-class method. Under the two-class method, we allocate net income after preferred stock dividends, preferred stock redemption charge, and amounts attributable to noncontrolling interests to common stockholders and unvested restricted stock awards based on their respective participation rights to dividends declared (or accumulated) and undistributed earnings. Diluted earnings per share is computed using the weighted average shares of common stock outstanding determined for the basic earnings per share computation plus the effect of any dilutive securities, including the dilutive effect of stock options using the treasury stock method and potential common shares issuable upon conversion of our 8.00% unsecured senior convertible notes (“8.00% Unsecured Senior Convertible Notes”), during the period the notes were outstanding.

| |

| 8. | Earnings per share (continued) |

The table below is a reconciliation of the numerators and denominators of the basic and diluted earnings per share computations for the three and nine months ended September 30, 2013 and 2012 (in thousands, except per share amounts):

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2013 | | 2012 | | 2013 | | 2012 |

| Income from continuing operations | $ | 32,517 |

| | $ | 22,501 |

| | $ | 94,262 |

| | $ | 69,695 |

|

| Gain on sale of land parcel | — |

| | — |

| | 772 |

| | 1,864 |

|

| Net income attributable to noncontrolling interests | (960 | ) | | (828 | ) | | (2,922 | ) | | (2,390 | ) |

| Dividends on preferred stock | (6,472 | ) | | (6,471 | ) | | (19,414 | ) | | (20,857 | ) |

| Preferred stock redemption charge | — |

| | — |

| | — |

| | (5,978 | ) |

| Net income attributable to unvested restricted stock awards | (442 | ) | | (360 | ) | | (1,187 | ) | | (866 | ) |

| Income from continuing operations attributable to Alexandria’s common stockholders – basic and diluted | 24,643 |

| | 14,842 |

| | 71,511 |

| | 41,468 |

|

| (Loss) income from discontinued operations, net | (64 | ) | | (4,196 | ) | | 993 |

| | 5,162 |

|

| Net income attributable to Alexandria’s common stockholders – basic and diluted | $ | 24,579 |

| | $ | 10,646 |

| | $ | 72,504 |

| | $ | 46,630 |

|

| | | | | | | | |

| Weighted average shares of common stock outstanding – basic and diluted | 70,900 |

| | 62,364 |

| | 67,040 |

| | 61,847 |

|

| | | | | | | | |

| Earnings per share attributable to Alexandria’s common stockholders – basic and diluted: | | | | | | | |

| Continuing operations | $ | 0.35 |

| | $ | 0.24 |

| | $ | 1.07 |

| | $ | 0.67 |

|

| Discontinued operations, net | — |

| | (0.07 | ) | | 0.01 |

| | 0.08 |

|

| Earnings per share – basic and diluted | $ | 0.35 |

| | $ | 0.17 |

| | $ | 1.08 |

| | $ | 0.75 |

|