UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

Commission file number 1-12993

ALEXANDRIA REAL ESTATE EQUITIES, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 95-4502084 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

385 East Colorado Boulevard, Suite 299, Pasadena, California 91101

(Address of principal executive offices) (Zip code)

(626) 578-0777

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Common Stock, $.01 par value per share 6.45% Series E Cumulative Redeemable Preferred Stock | Name of Each Exchange on Which Registered New York Stock Exchange New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the shares of Common Stock held by non-affiliates of registrant was approximately $5.5 billion based on the closing price for such shares on the New York Stock Exchange on June 30, 2014.

As of February 13, 2015, 72,033,942 shares of common stock were outstanding.

Documents Incorporated by Reference

Part III of this annual report on Form 10-K incorporates certain information by reference from the registrant’s definitive proxy statement to be filed within 120 days of the end of the fiscal year covered by this annual report on Form 10-K in connection with the registrant’s annual meeting of stockholders to be held on or about May 7, 2015.

INDEX TO FORM 10-K

ALEXANDRIA REAL ESTATE EQUITIES, INC.

| PART I | Page | |

| ITEM 1. | BUSINESS | |

| ITEM 1A. | RISK FACTORS | |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | |

| ITEM 2. | PROPERTIES | |

| ITEM 3. | LEGAL PROCEEDINGS | |

| ITEM 4. | MINE SAFETY DISCLOSURES | |

| PART II | ||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES | |

| ITEM 6. | SELECTED FINANCIAL DATA | |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| ITEM 9A. | CONTROLS AND PROCEDURES | |

| ITEM 9B. | OTHER INFORMATION | |

| PART III | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | |

| ITEM 11. | EXECUTIVE COMPENSATION | |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| PART IV | ||

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

GLOSSARY

Abbreviations or acronyms that may be used in this document:

| ABR | Annualized Base Rent |

| AFFO | Adjusted Funds from Operations |

| ASU | Accounting Standards Update |

| BBA | British Bankers’ Association |

| bps | Basis Points |

| CIP | Construction in Progress |

| EBITDA | Earnings before Interest, Taxes, Depreciation, and Amortization |

| EPS | Earnings per Share |

| FASB | Financial Accounting Standards Board |

| FDIC | Federal Deposit Insurance Corporation |

| FFO | Funds from Operations |

| GAAP | U.S. Generally Accepted Accounting Principles |

| HVAC | Heating, Ventilation, and Air Conditioning |

| IASB | International Accounting Standards Board |

| IFRS | International Financial Reporting Standards |

| IRS | Internal Revenue Service |

| JV | Joint Venture |

| LEED | Leadership in Energy and Environmental Design |

| LIBOR | London Interbank Offered Rate |

| MIT | Massachusetts Institute of Technology |

| NAREIT | National Association of Real Estate Investment Trusts |

| NAV | Net Asset Value |

| NBV | Net Book Value |

| NOI | Net Operating Income |

| NYSE | New York Stock Exchange |

| REIT | Real Estate Investment Trust |

| RSF | Rentable Square Feet/Foot |

| SEC | Securities and Exchange Commission |

| SoMa | South of Market submarket of the San Francisco Bay Area |

| TI | Tenant Improvement |

| U.S. | United States |

| VIE | Variable Interest Entity |

PART I

Certain information and statements included in this annual report on Form 10-K, including, without limitation, statements containing the words “forecast,” “guidance,” “projects,” “estimates,” “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” or “will,” or the negative of these words or similar words, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements involve inherent risks and uncertainties regarding events, conditions, and financial trends that may affect our future plans of operations, business strategy, results of operations, and financial position. A number of important factors could cause actual results to differ materially from those included within or contemplated by the forward-looking statements, including, but not limited to, the description of risks and uncertainties in “Item 1A. Risk Factors” in this annual report on Form 10-K. Additional information regarding risk factors that may affect us is included in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report on Form 10-K. Readers of our annual report on Form 10-K should also read our SEC and other publicly filed documents for further discussion regarding such factors.

As used in this annual report on Form 10-K, references to the “Company,” “Alexandria,” “we,” “us,” and “our” refer to Alexandria Real Estate Equities, Inc. and its consolidated subsidiaries. The following discussion should be read in conjunction with the consolidated financial statements and the accompanying notes appearing elsewhere in this annual report on Form 10-K.

ITEM 1. BUSINESS

Overview

We are a Maryland corporation formed in October 1994, that has elected to be taxed as a REIT for federal income tax purposes. We are a fully integrated, self-administered, and self-managed REIT. We are the largest and leading REIT uniquely focused on collaborative Class A science campuses in urban innovation clusters. Founded in 1994, Alexandria pioneered this niche and has since established a dominant market presence in AAA locations including Greater Boston, the San Francisco Bay Area, New York City, San Diego, Seattle, Maryland, and Research Triangle Park. Alexandria manages its properties through fully integrated regional teams with unparalleled real estate, science, and technology expertise. Alexandria is known for its high-quality and diverse client tenant base. Our client tenants with high credit ratings span the science and technology industries, including renowned academic and medical institutions, multinational pharmaceutical companies, public and private biotechnology entities, U.S. government research agencies, medical device companies, industrial biotech companies, venture capital firms, and science and technology product and service companies. Alexandria has a longstanding and proven track record of developing Class A assets clustered in urban campuses that provide its innovative client tenants with highly dynamic and collaborative ecosystems that enhance their ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity, and success. We believe these advantages result in higher occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset value. We executed our initial public offering in 1997 and received our investment-grade ratings in 2011.

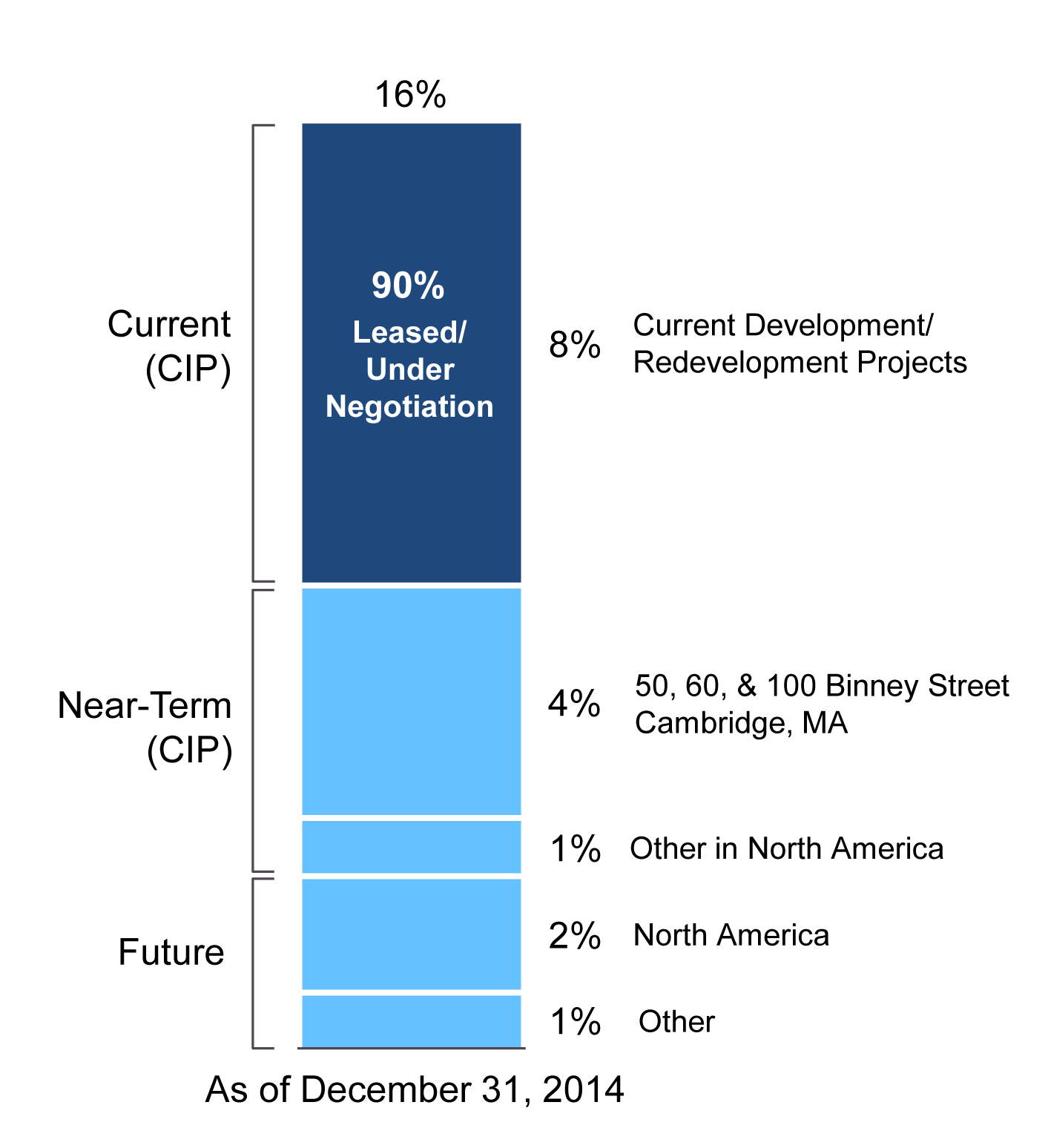

As of December 31, 2014, Alexandria’s total market capitalization was $10.4 billion and its asset base consisted of 31.5 million square feet, including 18.7 million RSF of operating and current value-creation projects, as well as an additional 12.8 million square feet in future ground-up development projects. The occupancy percentage of our operating properties in North America was 97.0% as of December 31, 2014. Our average occupancy rate of operating properties as of December 31 of each year from 2000 to 2014 was 94.8%. Our average occupancy rate of operating and redevelopment properties as of December 31 of each year from 2000 to 2014 was 89.4%. Investment-grade client tenants represented 56% of our total ABR as of December 31, 2014. The comparability of financial data from period to period is affected by the timing of our property acquisition, development, and redevelopment activities.

Business objective and strategies

Our primary business objective is to maximize long-term asset value and shareholder returns based on a multifaceted platform of internal and external growth. A key element of our strategy is our unique focus on Class A assets clustered in urban campuses. These key urban campus locations are characterized by high barriers to entry for new landlords, high barriers to exit for client tenants, and a limited supply of available space. They represent highly desirable locations for tenancy by science and technology entities because of their close proximity to concentrations of specialized skills, knowledge, institutions, and related businesses. Our strategy also includes drawing upon our deep and broad real estate, science, and technology relationships in order to identify and attract new and leading client tenants and to source additional value-creation real estate.

4

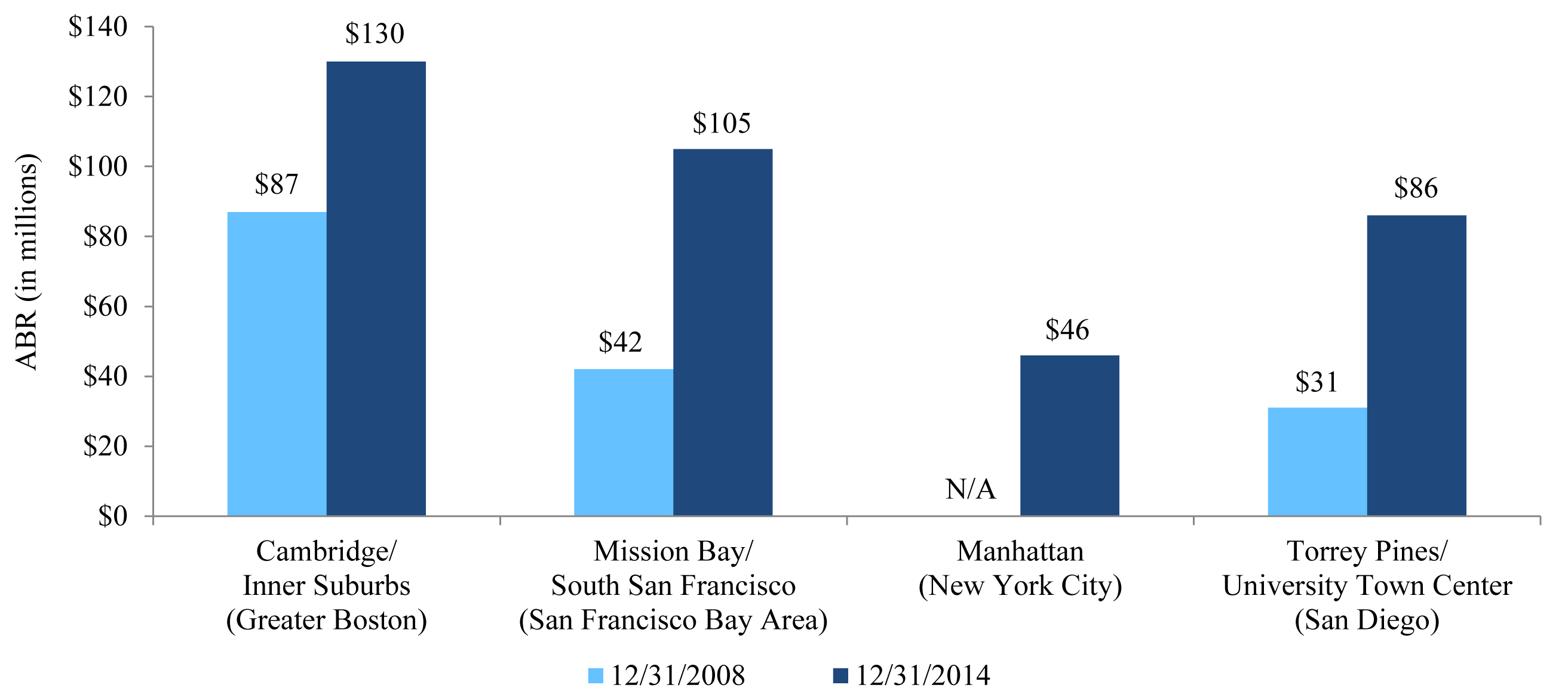

The following chart summarizes the growth of the ABR of our assets in our key cluster submarkets:

|

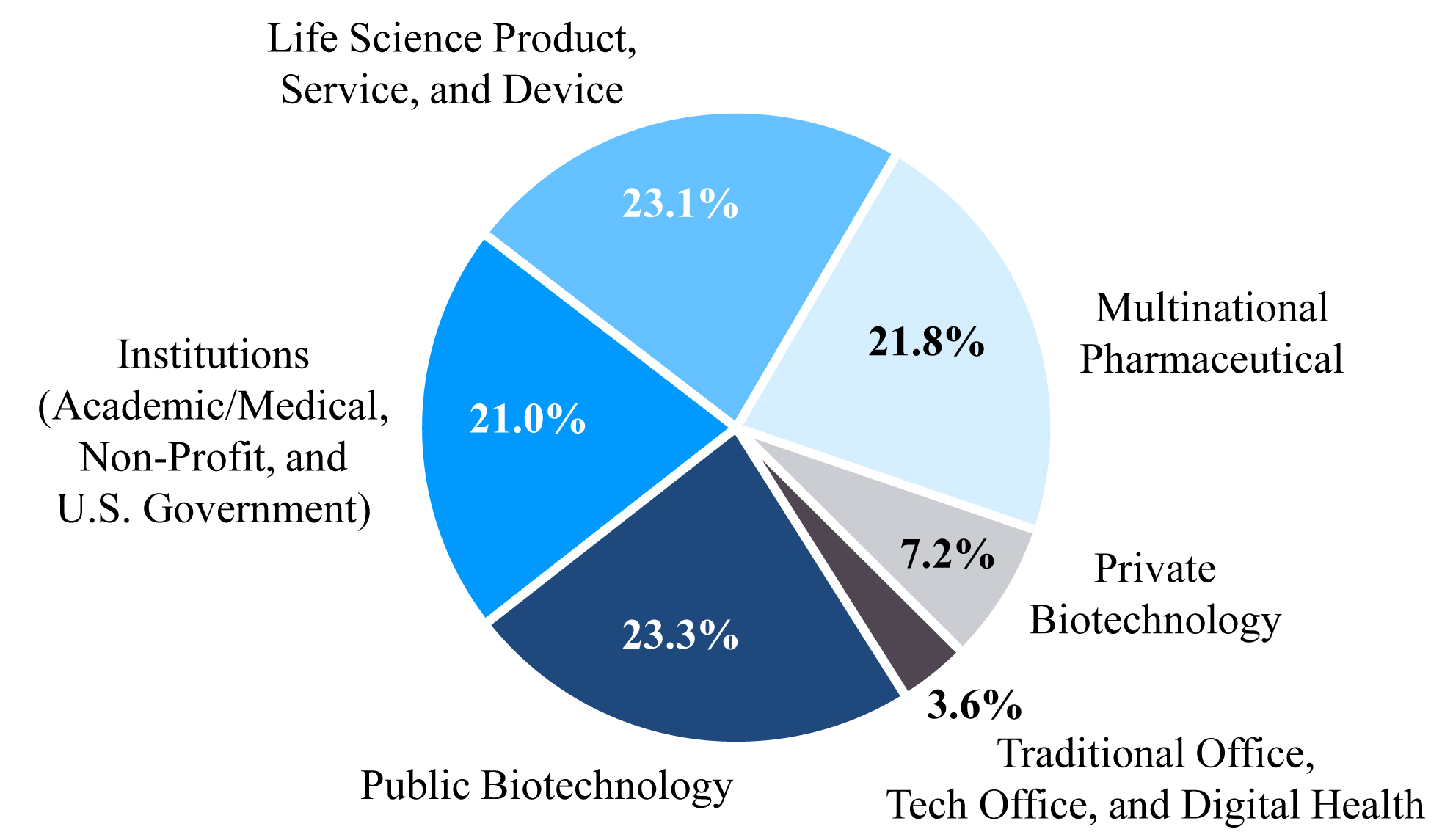

Our client tenant base is broad and diverse within the science and technology industries and reflects our focus on regional, national, and international client tenants with substantial financial and operational resources. For a more detailed description of our properties and client tenants, refer to “Item 2. Properties.” We have an experienced Board of Directors and are led by a senior management team with extensive experience in the real estate, science, and technology industries.

Acquisitions

We seek to identify and acquire high-quality properties in our target cluster markets. Critical evaluation of prospective property acquisitions is an essential component of our acquisition strategy. When evaluating acquisition opportunities, we assess a full range of matters relating to the prospective property or properties, including:

| • | Proximity to centers of innovation and technological advances; |

| • | Location of the property and our strategy in the relevant market; |

| • | Quality of existing and prospective client tenants; |

| • | Condition and capacity of the building infrastructure; |

| • | Quality and generic characteristics of the improvements; |

| • | Physical condition of the structure and common area improvements; |

| • | Opportunities available for leasing vacant space and for re-tenanting or renewing occupied space; |

| • | Availability of and/or ability to add appropriate tenant amenities; |

| • | Availability of land for future ground-up development of new office/laboratory or tech office space; |

| • | Opportunities to redevelop existing space into higher-rent, generic, and reusable office/laboratory or tech office space; |

| • | The property’s unlevered yields and; |

| • | Our ability to increase the property’s long-term financial returns. |

Development

A key component of our business model is our value-creation development projects. Our development strategy is primarily to pursue selective projects with significant pre-leasing where we expect to achieve appropriate investment returns and generally match a source of funds for this use. Our value-creation development projects focus on high-quality, generic, and reusable office/laboratory or tech office space to meet the real estate requirements of our wide range of client tenants.

5

Redevelopment

Another key component of our business model is our value-creation redevelopment of existing office, warehouse, or shell space into high-quality, generic, and reusable office/laboratory or tech office space that can be leased at higher rates. Our redevelopment strategy generally includes significant pre-leasing of certain projects prior to the commencement of redevelopment.

Balance sheet and financial strategy

We seek to maximize balance sheet liquidity and flexibility, cash flows, and cash available for distribution to our stockholders through the ownership, operation, management, and selective acquisition, development, and redevelopment of office/laboratory and tech office properties, as well as management of our balance sheet. In particular, we seek to maximize balance sheet liquidity and flexibility, cash flows, and cash available for distribution by:

| • | Maintaining significant liquidity through borrowing capacity under our unsecured senior line of credit, available commitments under secured construction loans, and cash and cash equivalents; |

| • | Minimizing the amount of near-term debt maturities in a single year; |

| • | Maintaining low to modest leverage; |

| • | Minimizing variable interest rate risk; |

| • | Generating high-quality, strong, and increasing operating cash flows; |

| • | Maintaining geographic diversity in stable-value urban intellectual centers of innovation; |

| • | Renewing existing client tenant space at higher rental rates to the extent possible; |

| • | Minimizing tenant improvement costs; |

| • | Improving investment returns through leasing of vacant space and replacing existing client tenants with new client tenants at higher rental rates; |

| • | Maintaining solid occupancy while also maintaining high lease rental rates; |

| • | Realizing contractual rental rate escalations, which are currently provided for in approximately 94% of our leases (on an RSF basis); |

| • | Implementing effective cost control measures, including negotiating pass-through provisions in client tenant leases for operating expenses and certain capital expenditures; |

| • | Selectively selling real estate assets, including non-income-producing land parcels and non-core/“core-like” operating assets, and investing the proceeds into our highly-leased value-creation development projects; |

| • | Maintaining access to diverse sources of capital; |

| • | Selectively acquiring high-quality office/laboratory and tech office properties in our target urban innovation cluster submarkets at prices that enable us to realize attractive returns; |

| • | Selectively developing properties in our target urban innovation cluster submarkets; and |

| • | Selectively redeveloping existing office, warehouse, or shell space, or newly acquired properties, into generic office/laboratory or tech office space that can be leased at higher rental rates in our target urban innovation cluster submarkets. |

6

| Key Information of Client Tenants | December 31, 2014 | ||

| Total leases | 562 | ||

| Total client tenants | 441 | ||

| Total properties | 193 | ||

| Single-tenant properties | 87 | ||

| Percentage of single-tenant properties | 45 | % | |

| Percentage of aggregate ABR from our three largest client tenants: | |||

| Novartis AG | 6.1 | % | |

| Illumina, Inc. | 4.9 | % | |

| New York University | 3.6 | % | |

| Total percentage of aggregate ABR from our three largest client tenants | 14.6 | % | |

Refer to the section titled “Client Tenants” under Item 2 to this Report for information regarding the investment-grade ratings of our top three largest client tenants (by percentage of aggregate ABR).

Competition

In general, other office/laboratory and tech office properties are located in close proximity to our properties. The amount of rentable space available in any market could have a material effect on our ability to rent space and on the rents that we can earn. In addition, we compete for investment opportunities with other REITs, insurance companies, pension and investment funds, private equity entities, partnerships, developers, investment companies, owners/occupants, and foreign investors. Many of these entities have substantially greater financial resources than we do and may be able to invest more than we can or accept more risk than we are willing to accept. These entities may be less sensitive to risks with respect to the creditworthiness of a client tenant or the geographic concentration of their investments. In addition, as a result of their financial resources, our competitors may offer more free rent concessions, lower rental rates, or higher tenant improvement allowances, in order to attract client tenants. These leasing incentives could hinder our ability to maintain or raise rents and attract or retain client tenants. Competition may also reduce the number of suitable investment opportunities available to us or may increase the bargaining power of property owners seeking to sell. Competition in acquiring existing properties and land, both from institutional capital sources and from other REITs, has been very strong over the past several years. However, we believe we have differentiated ourselves from our competitors, as we are the first publicly traded REIT to focus primarily on the office/laboratory real estate niche; we are the largest owner, manager, and developer of office/laboratory properties in key urban markets; and we have the most important relationships in the life science industry.

Financial information about our operating segment

Refer to Note 2 – “Basis of Presentation and Summary of Significant Accounting Policies,” to our consolidated financial statements for information about our one operating segment.

Regulation

General

Properties in our markets are subject to various laws, ordinances, and regulations, including regulations relating to common areas. We believe we have the necessary permits and approvals to operate each of our properties.

7

Americans with Disabilities Act

Our properties must comply with Title III of the Americans with Disabilities Act of 1990 (the “ADA”), to the extent that such properties are “public accommodations” as defined by the ADA. The ADA may require removal of structural barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. We believe that our properties are in substantial compliance with the ADA and that we will not be required to incur substantial capital expenditures to address the requirements of the ADA. However, noncompliance with the ADA could result in the imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations is an ongoing one, and we will continue to assess our properties and make alterations as appropriate in this respect.

Environmental matters

Under various environmental protection laws, a current or previous owner or operator of real estate may be liable for contamination resulting from the presence or discharge of hazardous or toxic substances at that property, and may be required to investigate and clean up contamination located on or emanating from that property. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of the contaminants, and the liability may be joint and several. Previous owners used some of our properties for industrial and other purposes, so those properties may contain some level of environmental contamination. The presence of contamination or the failure to remediate contamination at our properties may expose us to third-party liability or may materially adversely affect our ability to sell, lease, or develop the real estate or to borrow using the real estate as collateral.

Some of our properties may have asbestos-containing building materials. Environmental laws require that asbestos-containing building materials be properly managed and maintained, and may impose fines and penalties on building owners or operators for failure to comply with these requirements. These laws may also allow third parties to seek recovery from owners or operators for personal injury associated with exposure to asbestos-containing building materials.

In addition, some of our client tenants routinely handle hazardous substances and wastes as part of their operations at our properties. Environmental laws and regulations subject our client tenants, and potentially us, to liability resulting from these activities or from previous uses of those properties. Environmental liabilities could also affect a client tenant’s ability to make rental payments to us. We require our client tenants to comply with these environmental laws and regulations.

Independent environmental consultants have conducted Phase I or similar environmental site assessments on the properties in our portfolio. Site assessments are intended to discover and evaluate information regarding the environmental condition of the surveyed property and surrounding properties, and do not generally include soil samplings, subsurface investigations, or an asbestos survey. To date, these assessments have not revealed any material environmental liability that we believe would have a material adverse effect on our business, assets, or results of operations. Nevertheless, it is possible that the assessments on our properties have not revealed all environmental conditions, liabilities, or compliance concerns, which may have arisen after the review was completed or may arise in the future; and future laws, ordinances, or regulations may impose material additional environmental liability.

Insurance

We carry comprehensive liability, all-risk property, and rental loss insurance with respect to our properties. We select policy specifications and insured limits that we believe to be appropriate given the relative risk of loss, the cost of the coverage, and industry practice. In the opinion of management, the properties in our portfolio are currently adequately insured. In addition, we have obtained earthquake insurance for certain properties located in the vicinity of known active earthquake zones. We also carry environmental insurance and title insurance on our properties. We generally obtain our title insurance policies when we acquire the property, with each policy covering an amount equal to the initial purchase price of each property. Accordingly, any of our title insurance policies may be in an amount less than the current value of the related property.

8

Available information

Copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, including any amendments to the foregoing reports, are available, free of charge, through our corporate website at www.are.com as soon as is reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The current charters of our Board of Directors’ Audit, Compensation, and Nominating & Governance Committees, along with our corporate governance guidelines and Business Integrity Policy and Procedures for Reporting Non-Compliance (the “Business Integrity Policy”), are available on our corporate website. Additionally, any amendments to, and waivers of, our Business Integrity Policy that apply to our Chief Executive Officer and Chief Financial Officer will be available free of charge on our corporate website in accordance with applicable SEC and NYSE requirements. Written requests should be sent to Alexandria Real Estate Equities, Inc., 385 East Colorado Boulevard, Suite 299, Pasadena, California 91101, Attention: Investor Relations. Further, a copy of this annual report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The public may also download these materials from the SEC��s website at www.sec.gov.

Employees

As of December 31, 2014, we had 243 full-time employees. We believe that we have good relations with our employees. We have adopted a Business Integrity Policy that applies to all of our employees. Its receipt and review by each employee is documented and verified annually.

9

ITEM 1A. RISK FACTORS

Forward-looking statements

The following risk factors may adversely affect our overall business, financial condition, results of operations, cash flows, ability to make distributions to our stockholders, access to capital, or the market price of our common stock, as further described in each risk factor below. In addition to the information set forth in this annual report on Form 10-K, one should carefully review and consider the information contained in our other reports and periodic filings that we make with the SEC. Those risk factors could materially affect our overall business, financial condition, results of operations, cash flows, ability to make distributions to our stockholders, access to capital, or the market price of our common stock. The risks that we describe in our public filings are not the only risks that we face. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, also may materially adversely affect our business, financial condition, and results of operations.

Operating factors

We may be unable to identify and complete acquisitions and successfully operate acquired properties.

We continually evaluate the market of available properties and may acquire properties when opportunities exist. Our ability to acquire properties on favorable terms and successfully operate them may be exposed to the following significant risks:

| • | We may be unable to acquire a desired property because of competition from other real estate investors with significant capital, including both publicly traded REITs and institutional investment funds; |

| • | Even if we are able to acquire a desired property, competition from other potential acquirers may significantly increase the purchase price or result in other less favorable terms; |

| • | Even if we enter into agreements for the acquisition of properties, these agreements are subject to customary conditions to closing, including completion of due diligence investigations to our satisfaction; |

| • | We may be unable to finance acquisitions on favorable terms or at all; |

| • | We may spend more than budgeted amounts to make necessary improvements or renovations to acquired properties; |

| • | We may be unable to quickly and efficiently integrate new acquisitions, particularly acquisitions of operating properties or portfolios of properties, into our existing operations, and our results of operations and financial condition could be adversely affected; |

| • | Acquired properties may be subject to reassessment, which may result in higher-than-expected property tax payments; |

| • | Market conditions may result in higher-than-expected vacancy rates and lower-than-expected rental rates; and |

| • | We may acquire properties subject to liabilities and without any recourse, or with only limited recourse, with respect to unknown liabilities such as liabilities for cleanup of undisclosed environmental contamination; claims by client tenants, vendors, or other persons dealing with the former owners of the properties; and claims for indemnification by general partners, directors, officers, and others indemnified by the former owners of the properties. |

The realization of any of the above risks could significantly and adversely affect our ability to meet our financial expectations, our financial condition, results of operations, cash flows, ability to make distributions to our stockholders, and ability to satisfy our debt service obligations, and the market price of our common stock, could be materially adversely affected.

We may suffer economic harm as a result of making unsuccessful acquisitions in new markets.

We may pursue selective acquisitions of properties in markets where we have not previously owned properties. These acquisitions may entail risks in addition to those we face in other acquisitions where we are familiar with the markets, such as the risk of not correctly anticipating conditions or trends in a new market and therefore not being able to generate profit from the acquired property. If this occurs, it could adversely affect our financial position, results of operations, cash flows, ability to make distributions to our stockholders, and ability to satisfy our debt service obligations, and the market price of our common stock.

10

The acquisition of new properties or the development of new properties may give rise to difficulties in predicting revenue potential.

We may continue to acquire additional properties and/or land and may seek to develop our existing land holdings strategically as warranted by market conditions. These acquisitions and developments could fail to perform in accordance with expectations. If we fail to accurately estimate occupancy levels, lease commencement dates, operating costs, or costs of improvements to bring an acquired property or a development property up to the standards established for our intended market position, the performance of the property may be below expectations. Acquired properties may have characteristics or deficiencies affecting their valuation or revenue potential that we have not yet discovered. We cannot assure our stockholders that the performance of properties acquired or developed by us will increase or be maintained under our management.

We may fail to obtain the financial results expected from development or redevelopment projects.

There are significant risks associated with development and redevelopment projects, including the possibility that:

| • | We may not complete development or redevelopment projects on schedule or within budgeted amounts; |

| • | We may be unable to lease development or redevelopment projects on schedule or within budgeted amounts; |

| • | We may expend funds on and devote management’s time to development and redevelopment projects that we may not complete; |

| • | We may abandon development or redevelopment projects after we begin to explore them and as a result we may lose deposits or fail to recover costs already incurred; |

| • | Market and economic conditions deteriorate resulting in lower-than-expected rental rates; |

| • | We may face higher operating costs than we anticipated for development or redevelopment projects, including insurance premiums, utilities, real estate taxes, and costs of complying with changes in government regulations; |

| • | We may face higher requirements for capital improvements than we anticipated for development or redevelopment projects, particularly in older structures; |

| • | We may be unable to proceed with development or redevelopment projects because we cannot obtain debt and/or equity financing on favorable terms or at all; |

| • | We may fail to retain client tenants that have pre-leased our development or redevelopment projects if we do not complete the construction of these properties in a timely manner or to the client tenants’ specifications; |

| • | Client tenants that have pre-leased our development or redevelopment projects file for bankruptcy or become insolvent, adversely affecting the income produced by and the value of our properties; or requiring us to change the scope of the project, potentially resulting in higher construction costs and lower financial returns; |

| • | We may encounter delays, refusals, unforeseen cost increases, and other impairments resulting from third-party litigation or severe weather conditions; |

| • | We may encounter delays or refusals in obtaining all necessary zoning, land use, building, occupancy, and other required government permits and authorizations; and |

| • | Development or redevelopment projects may have defects we do not discover through our inspection processes, including latent defects that may not reveal themselves until many years after we put a property in service. |

The realization of any of the above risks could significantly and adversely affect our ability to meet our financial expectations, financial condition, results of operations, cash flows, ability to make distributions to our stockholders, the market price of our common stock, and our ability to satisfy our debt service obligations could be materially adversely affected.

We could default on leases for land on which some of our properties are located or held for future development.

As of December 31, 2014, we held ground lease obligations that included leases for 28 properties that accounted for approximately 15% of our total number of properties and two land development parcels. Excluding one ground lease related to one operating property that expires in 2036 with a net book value of approximately $10.0 million as of December 31, 2014, our ground lease obligations have remaining lease terms generally ranging from 40 to 100 years, including extension options. If we default under the terms of any particular ground lease, we may lose the ownership rights to the property subject to the lease. Upon expiration of a ground lease and all of its options, we may not be able to renegotiate a new lease on favorable terms, if at all. The loss of the ownership rights to these properties or an increase of rental expense could have a material adverse effect on our financial condition, results of operations, cash flows, and ability to satisfy our debt service obligations and pay distributions to our stockholders, as well as the market price of our common stock.

11

We may not be able to operate properties successfully and profitably.

Our success depends in large part upon our ability to operate our properties successfully. If we are unable to do so, our business could be adversely affected. The ownership and operation of real estate is subject to many risks that may adversely affect our business and our ability to make payments to our stockholders, including the risks that:

| • | Our properties may not perform as we expect; |

| • | We may have to lease space at rates below our expectations; |

| • | We may not be able to obtain financing on acceptable terms; and |

| • | We may underestimate the cost of improvements required to maintain or improve space to meet standards established for the market position intended for that property. |

The realization of any of the above risks could significantly and adversely affect our ability to meet our financial expectations, financial condition, results of operations, cash flows, ability to make distributions to our stockholders, the market price of our common stock, and our ability to satisfy our debt service obligations could be materially adversely affected.

We may experience increased operating costs, which may reduce profitability to the extent that we are unable to pass those costs onto client tenants.

Our properties are subject to increases in operating expenses including insurance, property taxes, utilities, administrative costs, and other costs associated with security, landscaping, and repairs and maintenance of our properties. As of December 31, 2014, approximately 95% of our leases (on an RSF basis) were triple net leases, requiring client tenants to pay substantially all real estate taxes, insurance, utilities, common area, and other operating expenses (including increases thereto) in addition to base rent. However, we cannot be certain that our client tenants will be able to bear the full burden of these higher costs, or that such increased costs will not lead them, or other prospective client tenants, to seek space elsewhere. If operating expenses increase, the availability of other comparable space in the markets we operate in may hinder or limit our ability to increase our rents; if operating expenses increase without a corresponding increase in revenues, our profitability could diminish and limit our ability to make distributions to our stockholders.

The cost of maintaining the quality of our properties may be higher than anticipated, resulting in reduced cash flows and profitability.

If our properties are not as attractive to current and prospective client tenants in terms of rent, services, condition, or location as properties owned by our competitors, we could lose client tenants or suffer lower rental rates. As a result, we may from time to time be required to make significant capital expenditures to maintain the competitiveness of our properties. However, there can be no assurances that any such expenditures would result in higher occupancy or higher rental rates, or deter existing client tenants from relocating to properties owned by our competitors.

Our inability to renew leases or re-lease space on favorable terms as leases expire may significantly affect our business.

Our revenues are derived primarily from rental payments and reimbursement of operating expenses under our leases. If a client tenant experiences a downturn in its business or other types of financial distress, it may be unable to make timely payments under its lease. Also, if our client tenants terminate early or decide not to renew their leases, we may not be able to re-lease the space. Even if client tenants decide to renew or lease space, the terms of renewals or new leases, including the cost of any tenant improvements, concessions, and lease commissions, may be less favorable to us than current lease terms. Consequently, we could generate less cash flow from the affected properties than expected, which could negatively impact our business. We may have to divert cash flow generated by other properties to meet our debt service payments, if any, or to pay other expenses related to owning the affected properties.

The inability of a client tenant to pay us rent could adversely affect our business.

Our revenues are derived primarily from rental payments and reimbursement of operating expenses under our leases. If our client tenants, especially significant client tenants, fail to make rental payments under their leases, our financial condition, cash flows, and ability to make distributions to our stockholders could be adversely affected.

12

The bankruptcy or insolvency of a major client tenant may also adversely affect the income produced by a property. If any of our client tenants becomes a debtor in a case under the U.S. Bankruptcy Code, as amended, we cannot evict that client tenant solely because of its bankruptcy. The bankruptcy court may authorize the client tenant to reject and terminate its lease with us. Our claim against such a client tenant for uncollectible future rent would be subject to a statutory limitation that might be substantially less than the remaining rent actually owed to us under the client tenant’s lease. Any shortfall in rent payments could adversely affect our cash flows and our ability to make distributions to our stockholders.

We could be held liable for damages resulting from our client tenants’ use of hazardous materials.

Many of our client tenants engage in research and development activities that involve controlled use of hazardous materials, chemicals, and biological and radioactive compounds. In the event of contamination or injury from the use of these hazardous materials, we could be held liable for damages that result. This liability could exceed our resources and any recovery available through any applicable insurance coverage, which could adversely affect our ability to make distributions to our stockholders.

Together with our client tenants, we must comply with federal, state, and local laws and regulations governing the use, manufacture, storage, handling, and disposal of hazardous materials and waste products. Failure to comply with these laws and regulations, or changes in them, could adversely affect our business or our client tenants’ businesses and their ability to make rental payments to us.

Our properties may have defects that are unknown to us.

Although we review the physical condition of our properties before they are acquired, and as they are developed and redeveloped, any of our properties may have characteristics or deficiencies unknown to us that could adversely affect the property’s value or revenue potential.

Our properties may contain or develop harmful mold or suffer from other air quality issues, which could lead to liability for adverse health effects and costs to remedy the problem.

When excessive moisture accumulates in buildings or on building materials, mold may grow, particularly if the moisture problem remains undiscovered or is not addressed over a period of time. Some molds may produce airborne toxins or irritants. Indoor air quality issues can also stem from inadequate ventilation, chemical contamination from indoor or outdoor sources, and other biological contaminants such as pollen, viruses, and bacteria. Indoor exposure to airborne toxins or irritants above certain levels may cause a variety of adverse health effects and symptoms, including allergic or other reactions. As a result, the presence of significant mold or other airborne contaminants at any of our properties could require us to undertake a costly remediation program to contain or remove the mold or other airborne contaminants from the affected property or increase indoor ventilation. In addition, the presence of significant mold or other airborne contaminants could expose us to liability from our client tenants, employees of our client tenants, and others if property damage or health concerns arise.

We may not be able to obtain additional capital to further our business objectives.

Our ability to acquire, develop, or redevelop properties depends upon our ability to obtain capital. The real estate industry has historically experienced periods of volatile debt and equity capital markets and/or periods of extreme illiquidity. A prolonged period in which we cannot effectively access the public equity or debt markets may result in heavier reliance on alternative financing sources to undertake new investments. An inability to obtain equity or debt capital on acceptable terms could delay or prevent us from acquiring, financing, and completing desirable investments, and could otherwise adversely affect our business. Also, the issuance of additional shares of capital stock or interests in subsidiaries to fund future operations could dilute the ownership of our then-existing stockholders. Even as liquidity returns to the market, debt and equity capital may be more expensive than in prior years.

We may not be able to sell our properties quickly to raise money.

Investments in real estate are relatively illiquid compared to other investments. Accordingly, we may not be able to sell our properties when we desire or at prices acceptable to us in response to changes in economic or other conditions. In addition, the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”) limits our ability to sell properties held for less than two years. These limitations on our ability to sell our properties may adversely affect our cash flows, our ability to repay debt, and our ability to make distributions to our stockholders.

13

Adverse changes in our credit ratings could negatively affect our financing ability.

Our credit ratings may affect the amount of capital we can access, as well as the terms and pricing of any debt we may incur. There can be no assurance that we will be able to maintain our current credit ratings. In the event that our current credit ratings are downgraded or removed, we would most likely incur higher borrowing costs and experience greater difficulty in obtaining additional financing, which would in turn have a material adverse impact on our financial condition, results of operations, cash flows, and liquidity.

We may not be able to refinance our debt and/or our debt may not be assumable.

Due to the high volume of real estate debt financing in recent years, the real estate industry may require more funds to refinance debt maturities than are available from lenders. This potential shortage of available funds from lenders and stricter credit underwriting guidelines may limit our ability to refinance our debt as it matures or may adversely affect our financial condition, our results of operations, our cash flows, our ability to make distributions to our stockholders, and the market price of our common stock.

We may not be able to borrow additional amounts through the issuance of unsecured bonds, under our unsecured senior line of credit, or through unsecured senior bank term loans.

There is no assurance that we will be able to access the unsecured bond market on favorable terms. Our ability to borrow additional amounts through the issuance of unsecured bonds may be negatively impacted by periods of illiquidity in the bond market.

Aggregate unsecured borrowings under our unsecured senior line of credit and unsecured senior bank term loans require compliance with certain financial and non-financial covenants. Borrowings under our unsecured senior line of credit and unsecured senior bank term loans are funded by a group of banks. Our ability to borrow additional amounts under our unsecured senior line of credit and unsecured senior bank term loans may be negatively impacted by a decrease in cash flows from our properties, a default or cross-default under our unsecured senior line of credit and unsecured senior bank term loans, non-compliance with one or more loan covenants, and non-performance or failure of one or more lenders under our unsecured senior line of credit and unsecured senior bank term loans. In addition, we may not be able to refinance or repay outstanding borrowings on our unsecured senior line of credit or unsecured senior bank term loans.

Our inability to borrow additional amounts on an unsecured basis could delay us in or prevent us from acquiring, financing, and completing desirable investments, which could adversely affect our business; and our inability to refinance or repay amounts under our unsecured senior line of credit or unsecured senior bank term loans may adversely affect our cash flows, ability to make distributions to our stockholders, financial condition, and results of operations.

If interest rates rise, our debt service costs will increase and the value of our properties may decrease.

Our unsecured senior line of credit, unsecured senior bank term loans, and certain other borrowings bear interest at variable rates, and we may incur additional variable-rate debt in the future. Increases in market interest rates would increase our interest expense under these debt instruments and would increase the costs of refinancing existing indebtedness or obtaining new debt. Additionally, increases in market interest rates may result in a decrease in the value of our real estate and decrease the market price of our common stock. Accordingly, these increases could adversely affect our financial position and our ability to make distributions to our stockholders.

Failure to hedge effectively against interest rate changes may adversely affect our results of operations.

The interest rate hedge agreements we use to manage some of our exposure to interest rate volatility involve risks, such as the risk that counterparties may fail to honor their obligations under these arrangements. In addition, these arrangements may not be effective in reducing our exposure to changes in interest rates. These risk factors may lead to failure to hedge effectively against changes in interest rates and therefore may adversely affect our results of operations.

14

Our unsecured senior line of credit and unsecured senior bank term loans restrict our ability to engage in some business activities.

Our unsecured senior line of credit and unsecured senior bank term loans contain customary negative covenants and other financial and operating covenants that, among other things:

| • | Restrict our ability to incur additional indebtedness; |

| • | Restrict our ability to make certain investments; |

| • | Restrict our ability to merge with another company; |

| • | Restrict our ability to make distributions to stockholders; |

| • | Require us to maintain financial coverage ratios; and |

| • | Require us to maintain a pool of qualified unencumbered assets. |

Complying with these restrictions may prevent us from engaging in certain profitable activities and constrain our ability to effectively allocate capital. Failure to comply with these restrictions may result in our defaulting on these and other loans which would likely have a negative impact on our operations, financial position, and ability to make distributions to our stockholders.

Our debt service obligations may have adverse consequences on our business operations.

We use debt to finance our operations, including the acquisition, development, and redevelopment of properties. Our use of debt may have adverse consequences, including the following:

| • | Our cash flows from operations may not be sufficient to meet required payments of principal and interest; |

| • | We may be forced to dispose of one or more of our properties, possibly on disadvantageous terms, to make payments on our debt; |

| • | If we default on our debt obligations, the lenders or mortgagees may foreclose on our properties that secure those loans; |

| • | A foreclosure on one of our properties could create taxable income without any accompanying cash proceeds to pay the tax; |

| • | A default under a loan that has cross-default provisions may cause us to automatically default on another loan or interest rate hedge agreement; |

| • | We may not be able to refinance or extend our existing debt; |

| • | The terms of any refinancing or extension may not be as favorable as the terms of our existing debt; |

| • | We may be subject to a significant increase in the variable interest rates on our unsecured senior line of credit, unsecured senior bank term loans, and certain other borrowings, which could adversely impact our cash flows and operations; and |

| • | The terms of our debt obligations may require a reduction in our distributions to stockholders. |

If our revenues are less than our expenses, we may have to borrow additional funds, and we may not be able to make distributions to our stockholders.

If our properties do not generate revenues sufficient to meet our operating expenses, including our debt service obligations and capital expenditures, we may have to borrow additional amounts to cover fixed costs and cash flow needs. This could adversely affect our ability to make distributions to our stockholders. Factors that could adversely affect the revenues we generate from, and the values of, our properties include:

| • | National, local, and worldwide economic conditions; |

| • | Competition from other properties; |

| • | Changes in the science and technology industries; |

| • | Real estate conditions in our target markets; |

| • | Our ability to collect rent payments; |

| • | The availability of financing; |

| • | Changes to the financial and banking industries; |

| • | Changes in interest rate levels; |

| • | Vacancies at our properties and our ability to re-lease space; |

| • | Changes in tax or other regulatory laws; |

| • | The costs of compliance with government regulation; |

| • | The lack of liquidity of real estate investments; and |

| • | Increases in operating costs. |

15

In addition, if a lease at a property is not a triple net lease, we will have greater exposure to increases in expenses associated with operating that property. Significant expenditures, such as mortgage payments, real estate taxes, insurance, and maintenance costs, are generally fixed and do not decrease when revenues at the related property decrease.

If we fail to effectively manage our debt obligations we could become highly leveraged, and our debt service obligations could increase to unsustainable levels.

Our organizational documents do not limit the amount of debt that we may incur. Therefore, if we fail to prudently manage our capital structure, we could become highly leveraged. This would result in an increase in our debt service obligations that could adversely affect our cash flow and our ability to make distributions to our stockholders. Higher leverage could also increase the risk of default on our debt obligations.

Current levels of market volatility are unprecedented.

The capital and credit markets have experienced volatility for several years. In some cases, the markets have produced downward pressure on stock prices and credit capacity for certain issuers without regard to those issuers’ underlying financial and/or operating strength. If market disruption and volatility worsen, there can be no assurance that we will not experience an adverse effect, which may be material, on our business, financial condition, and results of operations. Disruptions, uncertainty, or volatility in the capital markets may also limit our access to capital from financial institutions on favorable terms, or altogether, and our ability to raise capital through the issuance of equity securities could be adversely affected by causes beyond our control through extraordinary disruptions in the global economy and financial systems or other events.

Failure to meet market expectations for our financial performance would likely adversely affect the market price and volatility of our stock.

Our expected financial results may not be achieved, and actual results may differ materially from our expectations. This may be a result of various factors, including, but not limited to:

| • | The status of the economy; |

| • | The status of capital markets, including availability and cost of capital; |

| • | Changes in financing terms available to us; |

| • | Negative developments in the operating results or financial condition of client tenants, including, but not limited to, their ability to pay rent; |

| • | Our ability to re-lease space at similar rates as vacancies occur; |

| • | Our ability to reinvest sale proceeds in a timely manner at rates similar to the rate at which assets are sold; |

| • | Regulatory approval and market acceptance of the products and technologies of client tenants; |

| • | Liability or contract claims by or against client tenants; |

| • | Unanticipated difficulties and/or expenditures relating to future acquisitions; |

| • | Environmental laws affecting our properties; |

| • | Changes in rules or practices governing our financial reporting; and |

| • | Other legal and operational matters, including REIT qualification and key management personnel recruitment and retention. |

Failure to meet market expectations, particularly with respect to FFO per share, AFFO per share, earnings estimates, operating cash flows, and revenues, would likely result in a decline and/or increased volatility in the market price of our common stock or other outstanding securities.

The price per share of our stock may fluctuate significantly.

The market price per share of our common stock may fluctuate significantly in response to many factors, including, but not limited to:

| • | The availability and cost of debt and/or equity capital; |

| • | The condition of our balance sheet; |

| • | Actual or anticipated capital requirements; |

| • | The condition of the financial and banking industries; |

16

| • | Actual or anticipated variations in our quarterly operating results or dividends; |

| • | The amount and timing of debt maturities and other contractual obligations; |

| • | Changes in our FFO, AFFO, or earnings estimates; |

| • | The publication of research reports about us, the real estate industry, or the science and technology industries; |

| • | The general reputation of REITs and the attractiveness of their equity securities in comparison to other debt or equity securities (including securities issued by other real estate-based companies); |

| • | General stock and bond market conditions, including changes in interest rates on fixed-income securities, that may lead prospective purchasers of our stock to demand a higher annual yield from future dividends; |

| • | Changes in our analyst ratings; |

| • | Changes in our corporate credit rating or credit ratings of our debt or other securities; |

| • | Changes in market valuations of similar companies; |

| • | Adverse market reaction to any additional debt we incur in the future; |

| • | Additions or departures of key management personnel; |

| • | Actions by institutional stockholders; |

| • | Speculation in the press or investment community; |

| • | Terrorist activity adversely affecting the markets in which our securities trade, possibly increasing market volatility and causing the further erosion of business and consumer confidence and spending; |

| • | Government regulatory action and changes in tax laws; |

| • | The realization of any of the other risk factors included in this annual report on Form 10-K; and |

| • | General market and economic conditions. |

Many of the factors listed above are beyond our control. These factors may cause the market price of shares of our common stock to decline, regardless of our financial condition, results of operations, business, or prospects.

Possible future sales of shares of our common stock could adversely affect its market price.

We cannot predict the effect, if any, of future sales of shares of our common stock on the market price of our common stock from time to time. Sales of substantial amounts of capital stock (including the conversion or redemption of preferred stock), or the perception that such sales may occur, could adversely affect prevailing market prices for our common stock. Refer to the section titled “Other Resources and Liquidity Requirements” under the heading “Sources and Uses of Capital” in Item 7 in this Report.

We have reserved a number of shares of common stock for issuance to our directors, officers, and employees pursuant to our Amended and Restated 1997 Stock Award and Incentive Plan (sometimes referred to herein as our equity incentive plan). We have filed a registration statement with respect to the issuance of shares of our common stock pursuant to grants under our equity incentive plan. In addition, any shares issued under our equity incentive plan will be available for sale in the public market from time to time without restriction by persons who are not our “affiliates” (as defined in Rule 144 adopted under the Securities Act). Affiliates will be able to sell shares of our common stock subject to restrictions under Rule 144.

The conversion rights of our convertible preferred stock may be detrimental to holders of common stock.

As of December 31, 2014, we had $237.2 million outstanding of our 7.00% series D cumulative convertible preferred stock (“Series D Convertible Preferred Stock”). Shares of our Series D Convertible Preferred Stock may be converted into shares of our common stock, subject to certain conditions. As of December 31, 2014, the conversion rate for our Series D Convertible Preferred Stock was 0.2480 shares of our common stock per $25.00 liquidation preference, which was equivalent to a conversion price of approximately $100.81 per share of common stock. The conversion rate for our Series D Convertible Preferred Stock is subject to adjustments for certain events, including, but not limited to, certain dividends on our common stock in excess of $0.78 per share per quarter and dividends on our common stock payable in shares of our common stock. In addition, we may, at our option, be able to cause some or all of our Series D Convertible Preferred Stock to be automatically converted if the closing sale price per share of our common stock equals or exceeds 150% of the then-applicable conversion price of our Series D Convertible Preferred Stock for at least 20 trading days in a period of 30 consecutive trading days ending on the trading day immediately prior to our issuance of a press release announcing the exercise of our conversion option. Holders of our Series D Convertible Preferred Stock, at their option, may, at any time and from time to time, convert some or all of their outstanding shares.

17

The conversion of our Series D Convertible Preferred Stock into our common stock would dilute the ownership of our then-existing stockholders, and could adversely affect the market price of our common stock or impair our ability to raise capital through the sale of additional equity securities. Any adjustments that increase the conversion rate of our Series D Convertible Preferred Stock would increase their dilutive effect. Further, the conversion rights by the holders of our Series D Convertible Preferred Stock might be triggered in situations in which we need to conserve our cash reserves, in which event, our election, under certain conditions, to repurchase such Series D Convertible Preferred Stock in lieu of converting it into common stock might adversely affect us and our stockholders.

Our distributions to stockholders may decline at any time.

We may not continue our current level of distributions to our stockholders. Our Board of Directors will determine future distributions based on a number of factors, including:

| • | The amount of cash provided by operating activities available for distribution; |

| • | Our financial condition and capital requirements; |

| • | Any decision to reinvest funds rather than to distribute such funds; |

| • | Our capital expenditures; |

| • | The annual distribution requirements under the REIT provisions of the Internal Revenue Code; |

| • | Restrictions under Maryland law; and |

| • | Other factors our Board of Directors deems relevant. |

A reduction in distributions to stockholders may negatively impact our stock price.

Distributions on our common stock may be made in the form of cash, stock, or a combination of both.

As a REIT, we are required to distribute at least 90% of our taxable income to our stockholders. Typically, we generate cash for distributions through our operations, the disposition of assets, or the incurrence of additional debt. Our Board of Directors may determine in the future to pay dividends on our common stock in cash, shares of our common stock, or a combination of cash and shares of our common stock. For example, we may declare dividends payable in cash or stock at the election of each stockholder, subject to a limit on the aggregate cash that could be paid. Any such dividend would be distributed in a manner intended to count in full toward satisfaction of our annual distribution requirements and to qualify for the dividends paid deduction. While the IRS privately has ruled that such a dividend would so qualify if certain requirements are met, no assurances can be provided that the IRS would not assert a contrary position in the future. Moreover, a reduction in the cash yield on our common stock may negatively impact our stock price.

We have certain ownership interests outside the U.S. that may subject us to risks different from or greater than those associated with our domestic operations.

We have five properties in Canada, as well as eight operating properties, one development project, and several land parcels for future development in Asia. Acquisition, development, redevelopment, ownership, and operating activities outside the U.S. involve risks that are different from those we face with respect to our domestic properties and operations. These risks include, but are not limited to:

| • | Adverse effects of changes in exchange rates for foreign currencies; |

| • | Challenges and/or taxation with respect to the repatriation of foreign earnings or repatriation of proceeds from the sale of one or more of our foreign investments; |

| • | Changes in foreign political, regulatory, and economic conditions, including nationally, regionally, and locally; |

| • | Challenges in managing international operations; |

| • | Challenges in hiring or retaining key management personnel; |

| • | Challenges of complying with a wide variety of foreign laws and regulations, including those relating to real estate, corporate governance, operations, taxes, employment, and legal proceedings; |

| • | Differences in lending practices; |

| • | Differences in languages, cultures, and time zones; and |

| • | Changes in applicable laws and regulations in the U.S. that affect foreign operations. |

18

Our foreign investments are subject to taxation in foreign jurisdictions based on local tax laws and regulations, and on existing international tax treaties. We have invested in foreign markets under the assumption that our future earnings in each of those countries will be taxed at the current prevailing income tax rates. There are no guarantees that foreign governments will continue to honor existing tax treaties that we have relied upon for our foreign investments, or that the current income tax rates in those countries will not increase significantly, thus impacting our ability to repatriate our foreign investments and related earnings.

Investments in international markets may also subject us to risks associated with establishing effective controls and procedures to regulate the operations of new offices and to monitor compliance with U.S. laws and regulations, including the Foreign Corrupt Practices Act and similar foreign laws and regulations. The Foreign Corrupt Practices Act and similar applicable anti-corruption laws prohibit individuals and entities from corruptly offering, promising, authorizing, or providing payments or anything of value, directly or indirectly, to government officials in order to obtain, retain, or direct business. Failure to comply with these laws could subject us to civil and criminal penalties that could materially adversely affect our results of operations or the value of our international investments. In addition, if we fail to effectively manage our international operations, our overall financial condition, results of operations, and cash flow, and the market price of our common stock, could be adversely affected.

Further, we may in the future enter into agreements with non-U.S. entities that are governed by the laws of, and are subject to dispute resolution rules of, another country or region. In some cases, such a country or region might not have a forum that provides us an effective or efficient means for resolving disputes that may arise under these agreements.

We are subject to risks and liabilities in connection with properties owned through partnerships, limited liability companies, and joint ventures.

Our organizational documents do not limit the amount of funds that we may invest in non-wholly owned partnerships, limited liability companies, or joint ventures. Partnership, limited liability company, or joint venture investments involve certain risks, including, but not limited to:

| • | Upon bankruptcy of non-wholly owned partnerships, limited liability companies, or joint venture entities, we may become liable for the liabilities of the partnership, limited liability company, or joint venture; |

| • | We may share certain approval rights over major decisions with third parties; |

| • | We may be required to contribute additional capital if our partners fail to fund their share of any required capital contributions; |

| • | Our partners, co-members, or joint ventures might have economic or other business interests or goals that are inconsistent with our business interests or goals and that could affect our ability to lease or re-lease the property, operate the property, or our ability to maintain our qualification as a REIT; |

| • | Our ability to sell the interest on advantageous terms when we so desire may be limited or restricted under the terms of our agreements with our partners; and |

| • | We may not continue to own or operate the interests or assets underlying such relationships or may need to purchase such interests or assets at an above market price to continue ownership. |

We generally seek to maintain control of our partnerships, limited liability companies, and joint ventures in a manner sufficient to permit us to achieve our business objectives. However, we may not be able to do so, and the occurrence of one or more of the events described above could adversely affect our financial condition, results of operations, cash flows, or ability to make distributions to our stockholders, or the market price of our common stock.

External factors may adversely impact the valuation of investments.

We hold equity investments in certain publicly traded companies and privately held entities primarily involved in the science and technology industries. The valuation of these investments is affected by many external factors beyond our control, including, but not limited to, market prices, market conditions, the effect of healthcare reform legislation, prospects for favorable or unfavorable clinical trial results, new product initiatives, the manufacturing and distribution of new products, product safety and efficacy issues, and new collaborative agreements. Unfavorable developments with respect to any of these factors may have an adverse impact on the valuation of our investments.

19

We face risks associated with short-term liquid investments.

From time to time, we may have significant cash balances that we invest in a variety of short-term investments that are intended to preserve principal value and maintain a high degree of liquidity while providing current income. These investments may include (either directly or indirectly) obligations (including certificates of deposit) of banks, money market funds, treasury bank securities, and other short-term securities. Investments in these securities and funds are not insured against loss of principal. Under certain circumstances we may be required to redeem all or part of these securities or funds at less than par value. A decline in the value of our investments or delay or suspension of our right to redeem them may have a material adverse effect on our results of operations or financial condition and our ability to pay our obligations as they become due.

We could incur significant costs due to the financial condition of our insurance carriers.

We insure our properties with insurance companies that we believe have a good rating at the time our policies are put into effect. The financial condition of one or more of the insurance companies that we hold policies with may be negatively impacted, resulting in their inability to pay on future insurance claims. Their inability to pay future claims may have a negative impact on our financial results. In addition, the failure of one or more insurance companies may increase the cost of renewing our insurance policies or increase the cost of insuring additional properties and recently developed or redeveloped properties.

Our insurance may not adequately cover all potential losses.

If we experience a loss at any of our properties that is not covered by insurance, that exceeds our insurance policy limits, or that is subject to a policy deductible, we could lose the capital invested in the affected property and, possibly, future revenues from that property. In addition, we could continue to be obligated on any mortgage indebtedness or other obligations related to the affected properties. We carry comprehensive liability, fire, extended coverage, and rental loss insurance with respect to our properties. We have obtained earthquake insurance for our properties that are located in the vicinity of active earthquake faults. We also carry environmental remediation insurance and have title insurance policies for our properties. We generally obtain our title insurance policies when we acquire the property; each policy covers an amount equal to the initial purchase price of each property. Accordingly, any of our title insurance policies may be in an amount less than the current value of the covered property.

Our client tenants are also required to maintain comprehensive insurance, including liability and casualty insurance that is customarily obtained for similar properties. There are, however, certain types of losses that we and our client tenants do not generally insure against because they are uninsurable or because it is not economical to insure against them. The availability of coverage against certain types of losses, such as from terrorism or toxic mold, has become more limited and, when available, carries a significantly higher cost. We cannot predict whether insurance coverage against terrorism or toxic mold will remain available for our properties because insurance companies may no longer offer coverage against such losses, or such coverage, if offered, may become prohibitively expensive. We have not had material problems with terrorism or toxic mold at any of our properties.

The loss of services of any of our senior officers could adversely affect us.

We depend upon the services and contributions of relatively few senior officers. The loss of services or contributions of any one of them may adversely affect our business, financial condition, and prospects. We use the extensive personal and business relationships that members of our management have developed over time with owners of office/laboratory and tech office properties and with major client tenants in the science and technology industries. We cannot assure our stockholders that our senior officers will remain employed with us.

Competition for skilled personnel could increase labor costs.

We compete with various other companies in attracting and retaining qualified and skilled personnel. We depend on our ability to attract and retain skilled management personnel who are responsible for the day-to-day operations of our company. Competitive pressures may require that we enhance our pay and benefits package to compete effectively for such personnel. We may not be able to offset such additional costs by increasing the rates we charge client tenants. If there is an increase in these costs or if we fail to attract and retain qualified and skilled personnel, our business and operating results could be adversely affected.

20

Failure to maintain effective internal control over financial reporting could have a material adverse effect on our business, results of operations, financial condition, and stock price.

Pursuant to the Sarbanes-Oxley Act of 2002, we are required to provide a report by management on internal control over financial reporting, including management’s assessment of the effectiveness of internal control. Changes to our business will necessitate ongoing changes to our internal control systems and processes. Internal control over financial reporting may not prevent or detect misstatement because of its inherent limitations, including the possibility of human error, the circumvention or overriding of controls, or fraud. Therefore, even effective internal controls can provide only reasonable assurance with respect to the preparation and fair presentation of financial statements. If we fail to maintain the adequacy of our internal controls, including any failure to implement required new or improved controls, or if we experience difficulties in their implementation, our business, results of operations, and financial condition could be materially harmed, and we could fail to meet our reporting obligations and there could be a material adverse effect on our stock price.