United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Act of 1934

For the fiscal year ended December 31, 2005

Commission File Number 1-13145

Jones Lang LaSalle Incorporated

(Exact name of registrant as specified in its charter)

Maryland

(State or other jurisdiction of incorporation or organization)

36-4150422

(I.R.S. Employer Identification No.)

200 East Randolph Drive, Chicago, IL | 60601 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 312/782-5800

Securities registered pursuant to Section 12(b) of the Act:

| | Name of each exchange on |

Title of each class | which registered |

| Common Stock ($.01 par value) | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes oNo x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act)

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant as of the close of business on June 30, 2005 was $1,349,753,420.

The number of shares outstanding of the registrant’s common stock (par value $0.01) as of the close of business on February 15, 2006 was 35,523,696, which includes 3,948,935 shares held by a subsidiary of the registrant.

Portions of the Registrant’s Proxy Statement for its 2006 Annual Meeting of Shareholders to be held on May 25, 2006 are incorporated by reference in Part III of this report.

PART I

Company Overview

Jones Lang LaSalle Incorporated (“Jones Lang LaSalle,” which may be referred to as we, us, our, the Company or the Firm) was incorporated in 1997. We are the global leader in real estate services and money management. We serve our clients’ real estate needs locally, regionally and globally in more than 100 markets in 50 countries on five continents, with approximately 22,000 employees, including approximately 11,100 directly reimbursable property maintenance employees. We believe that our combination of local market presence and wholly owned and integrated global reach differentiates our firm from other real estate service providers.

Our full range of services includes: agency leasing; property management; project and development services; valuations; capital markets; buying and selling properties; corporate finance; hotel advisory; space acquisition and disposition (tenant representation); facilities management; strategic consulting; and outsourcing. We provide money management services on a global basis for both public and private assets through LaSalle Investment Management. Our services are enhanced by our integrated global business model, industry-leading research capabilities, client relationship management focus, consistent worldwide service delivery and strong brand.

We have grown by expanding both our client base and the range of our services and products, as well as through a series of strategic acquisitions and mergers. Our extensive global platform and in-depth knowledge of local real estate markets enable us to serve as a single-source provider of solutions for our clients’ full range of real estate needs. We solidified this network of services around the globe through the merger of the businesses of the Jones Lang Wootton companies (“JLW”) (founded in 1783) with those of LaSalle Partners Incorporated (“LaSalle Partners”) (founded in 1968), effective March 11, 1999.

Jones Lang LaSalle History

Prior to our incorporation in Maryland on April 15, 1997 and our initial public offering (the “Offering”) of 4,000,000 shares of common stock on July 22, 1997, Jones Lang LaSalle conducted business as LaSalle Partners Limited Partnership and LaSalle Partners Management Limited Partnership (collectively, the “Predecessor Partnerships”). Immediately prior to the Offering, the general and limited partners of the Predecessor Partnerships contributed all of their partnership interests in the Predecessor Partnerships in exchange for an aggregate of 12,200,000 shares of common stock.

In October 1998, we acquired all of the common stock of the COMPASS group of real estate service companies (collectively referred to as “COMPASS”) from Lend Lease Corporation Limited. The acquisition of COMPASS made us the largest property management services company in the United States and expanded our international presence into Australia and South America.

On March 11, 1999, LaSalle Partners merged its business with that of JLW and changed its name to Jones Lang LaSalle Incorporated. In connection with the merger, we issued 14,300,000 shares of common stock and paid cash consideration of $6.2 million.

On January 3, 2006, Jones Lang LaSalle merged operations with Spaulding & Slye, a privately held real estate services and investment company with offices in Boston and Washington, D.C. Substantially all of Spaulding & Slye’s 500 employees were integrated into the Jones Lang LaSalle organization, significantly increasing the Firm’s New England market presence.

Our Value Model: Performing Consistently and Maximizing Growth

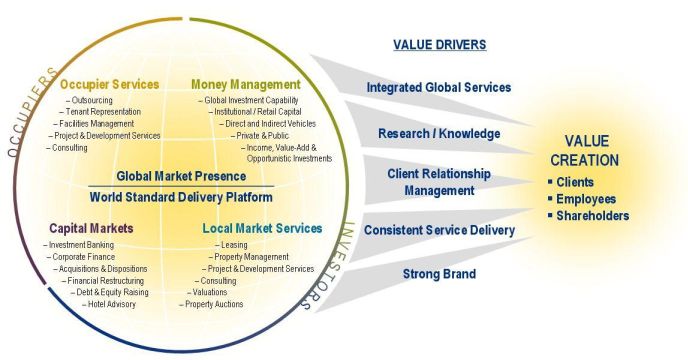

Articulating our range of services and approach to business, our Value Model graphically depicts our stated mission:

To deliver exceptional strategic, fully integrated services and solutions for real estate owners, occupiers and investors worldwide.

The model describes how we serve clients with four broad sets of services:

We believe this combination of services, skills and expertise sets us apart from our competitors. Consultancy practices typically do not share our implementation capability and local market awareness. Investment banking and investment management competitors generally possess neither our local market knowledge nor our real estate service capabilities. Traditional real estate firms lack our financial expertise and operating consistency.

Five key value drivers distinguish our business activities (see “Competitive Advantages” below):

| • | Our integrated global services platform; |

| • | The quality and worldwide reach of our research function; |

| • | Our focus on client relationship management as a means to provide superior client service; |

| • | Our reputation for consistent worldwide service delivery, as measured by our creation of best practices and the skills and experience of our people; and |

| • | The strength of our brand. |

We have designed our business model to create value for our clients, our shareholders and our employees. Based on our established presence in, and intimate knowledge of, real estate and capital markets worldwide, and supported by our investments in thought leadership and technology, we believe that we create value for clients by addressing not only their local, regional and global real estate needs, but also their broader business, strategic, operating and financial goals. We believe that the ability to create and deliver value drives our own ability to grow our business and improve profitability and shareholder value. In doing so, we enable our people to demonstrate their technical competence and advance their careers by taking on new and increased responsibilities as our business expands.

Growth Strategy

To continue to create new value for our clients, shareholders and employees, in early 2005 we identified five strategic priorities for continued growth. We refer to them as the Global Five Priorities, or the “G5.” We have initiated a five-year program designed to invest capital and resources that will maintain and extend our global leadership positions in the G5, which we defined as follows:

G1: Local and Regional Service Operations. Our strength in local and regional markets determines the strength of our global service capabilities. Our financial performance also depends, in great part, on the business we source and execute locally in more than 100 markets around the world.

G2: Global Corporate Solutions. The accelerating trends of globalization and the outsourcing of real estate services by corporate occupiers support our decision to emphasize a truly global Corporate Solutions business to serve their needs comprehensively. This service delivery capability helps us create new client relationships. In addition, current corporate clients are demanding multi-regional capabilities.

G3: Global Capital Markets. Our focus on the further development of our global Capital Markets service delivery capability reflects increasing international cross-border money flows to real estate and the accelerated global marketing of assets that has resulted.

G4: LaSalle Investment Management. With a truly integrated global platform, our LaSalle Investment Management business is already well positioned to serve institutional real estate investors looking for attractive opportunities around the world. Our continued investment in LaSalle’s ability to develop and offer new products quickly, and to extend its portfolio capabilities into promising new markets, is intended to enhance that position.

G5: World-Standard Business Operations. To gain maximum benefit from our other priorities, we must have superior operating and support procedures and processes to serve our clients and support our people. Our goal is to equip our people with the knowledge and risk management tools and other infrastructure resources they need to create sustainable value for our clients.

We committed resources to all G5 priorities during 2005. By continuing to invest in our future based on our view of how our strengths can support the needs of our clients, we intend to further grow our business and to maintain and expand our position as an industry leader in the process.

Business Segments

We report our operations as four business segments. We manage our Investor and Occupier Services (“IOS”) product offerings geographically as (i) Americas, (ii) Europe and (iii) Asia Pacific, and our money management business globally as (iv) LaSalle Investment Management. See “Results of Operations” within Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, as well as Note 7 of Notes to Consolidated Financial Statements, for financial information discussed by segment.

Value Delivery: IOS Americas, Europe and Asia Pacific

To address the needs of real estate owners and occupiers, we provide a full range of integrated property, project management and transaction services locally, regionally and globally through our regional operating segments in the Americas, Europe and Asia Pacific. Services are delivered through the following teams:

Agency Leasing Services executes marketing and leasing programs on behalf of investors, developers, property companies and public bodies to secure tenants and negotiate leases with terms that reflect our clients’ best interests. In 2005, we completed approximately 8,600 agency leasing transactions representing approximately 93 million square feet of space.

Agency leasing fees are typically based on a percentage of the value of the lease revenue commitment for leases consummated.

Property Management Services provides on-site management services to real estate owners for office, industrial, retail and specialty properties. We seek to leverage our market share and buying power to deliver superior service to clients. Our goal is to enhance our clients’ property values through aggressive day-to-day management. We focus on maintaining high levels of occupancy and tenant satisfaction while lowering property operating costs. During 2005, we provided on-site Property Management Services for office, retail, mixed-use and industrial properties totaling approximately 584 million square feet.

Property Management Services typically are provided by an on-site general manager and staff who are supported by regional supervisory teams and central resources in such areas as training, technical and environmental services, accounting, marketing and human resources. Our general managers are responsible for property management activities, client satisfaction and financial results. We do not compensate them with commissions, but rather with a combination of base salary and a performance bonus that is directly linked to results produced for their clients. Increasingly, management agreements provide for incentive compensation relating to operating expense reductions, gross revenue or occupancy objectives or tenant satisfaction levels. Consistent with industry custom, management contract terms typically range from one to three years, but may be canceled at any time following a short notice period, usually 30 to 60 days.

Project and Development Services provides a variety of services—including interior build-out and conversion management, move management and strategic occupancy planning services—to tenants of leased space, owners in self-occupied buildings and owners of real estate investments. Project and Development Services frequently manages relocation and build-out initiatives for clients of our Property Management Services, Integrated Facilities Management and Tenant Representation Services units. Project and Development Services also manages all aspects of development and renovation of commercial projects for our clients. Beginning in 2003, we continued to expand this service to the public sector, particularly to the U.S. military and educational institutions.

Our Project and Development Services business is typically compensated on the basis of negotiated fees. Client contracts are typically multi-year in duration and may govern a number of discrete projects, with individual projects being completed in less than one year.

Valuation Services provides clients with professional valuation services, helping them determine market values for office, retail, industrial and mixed-use properties. Such services may involve valuing a single property or a global portfolio of multiple property types. Valuations, which typically involve commercial property, are completed for a variety of purposes, including acquisitions, dispositions, debt and equity financings, mergers and acquisitions, securities offerings and privatization initiatives. Clients include occupiers, investors and financing sources from the public and private sectors. Our valuation specialists provide services to clients in nearly every developed country. During 2005, we performed more than 22,500 valuations of properties with an aggregate value of approximately $286 billion.

Compensation for valuation services is generally negotiated for each assignment based on its scale and complexity and typically relates in part to the value of the underlying assets.

Capital Markets Services includes institutional property sales and acquisitions, real estate financings, private equity placements, portfolio advisory activities, and corporate finance advice and execution. As more and more real estate assets are marketed internationally, and as a growing number of clients are investing outside their home markets, our Capital Markets Services teams combine local market knowledge with our access to global capital sources to provide clients with superior execution in raising capital for their real estate assets. By researching, developing and introducing innovative new financial products and strategies, Capital Markets Services is integral to the business development efforts of our other businesses. In 2005, we completed institutional property sales and acquisitions, debt financings and equity placements on assets and portfolios valued at approximately $43.5 billion.

Capital Markets Services units are typically compensated on the basis of the value of transactions completed or securities placed. In certain circumstances, we receive retainer fees for portfolio advisory services.

Tenant Representation Services establishes strategic alliances with clients to deliver ongoing assistance to meet their real estate needs, and to help them evaluate and execute transactions to meet their occupancy requirements. We assist clients by defining space requirements, identifying suitable alternatives, recommending appropriate occupancy solutions and negotiating lease and ownership terms with third parties. We help our clients lower real estate costs, minimize real estate occupancy risks, improve occupancy control and flexibility, and create more productive office environments. We employ a multidisciplinary approach to develop occupancy strategies linked to our clients’ core business objectives. In 2005 we completed approximately 3,800 tenant representation transactions involving approximately 53 million square feet.

Compensation for Tenant Representation Services is generally determined on a negotiated fee basis. Fees often reflect performance measures related to targets that we and our clients establish prior to engagement or, in the case of strategic alliances, at annual intervals thereafter. Quantitative and qualitative measurements are used to assess performance relative to these goals, and we are compensated accordingly, with incentive fees awarded for superior performance.

Integrated Facilities Management Services provides comprehensive portfolio and property management services to corporations and institutions that outsource the management of their occupied real estate. Properties under management range from corporate headquarters to industrial complexes. During 2005, Integrated Facilities Management Services managed approximately 319 million square feet of real estate for its clients. Our target clients typically have large portfolios (usually over 1 million square feet) that offer significant opportunities to reduce costs and improve service delivery. The competitive trends of globalization, outsourcing and offshoring are prompting many of these clients to demand consistent service delivery worldwide and a single point of contact from their real estate service providers. Performance measures are generally developed to quantify progress made toward mutually determined goals and objectives. Depending on client needs, Integrated Facilities Management Services units, either alone or partnering with other business units, provide services that include portfolio planning, property management, agency leasing, tenant representation, acquisition, finance, disposition, project management, development management and land advisory services.

Integrated Facilities Management Services units are compensated on the basis of negotiated fees that are typically structured to include a base fee and performance bonus. We base performance bonus compensation on a quantitative evaluation of progress toward performance measures and regularly scheduled client satisfaction surveys. Integrated Facilities Management Services agreements are typically three to five years in duration, but also are cancelable at any time upon a short notice period, usually 30 to 60 days, as is typical in the industry.

Strategic Consulting Services provides clients with specialized, value-added real estate consulting services and strategies in such areas as mergers and acquisitions, privatization, development and asset strategy, occupier portfolio strategy, organizational strategy and work-process design. Strategic Consulting professionals focus on translating global best practices into local real estate solutions for clients.

Value Delivery: Money Management

Our global money management business, a member of the Jones Lang LaSalle group operated under the name of LaSalle Investment Management, is driven by three priorities:

| • | Developing and executing customized investment strategies that meet the specific investment objectives of each of our clients; |

| • | Providing superior investment performance; and |

| • | Delivering uniformly high levels of services. |

We provide money management services to institutional investors and high-net-worth individuals. We seek to establish and maintain relationships with sophisticated investors who value our global platform and extensive local market knowledge. As of December 31, 2005, LaSalle Investment Management managed approximately $30 billion of public and private real estate assets, making us one of the world’s largest managers of institutional capital invested in real estate assets and securities.

LaSalle Investment Management provides clients with a broad range of real estate investment products and services in the public and private capital markets. We design these products and services to meet the differing strategic, risk/return and liquidity requirements of individual clients. The range of investment alternatives includes private investments in multiple real estate property types (namely office, retail, industrial and residential) either through investment funds that LaSalle Investment Management manages or through single client account relationships (“separate accounts”). We also offer public indirect investments, primarily in publicly traded real estate investment trusts (“REITs”) and other real estate equities.

We believe the success of our money management business comes from our industry-leading research capabilities, innovative investment strategies, global presence, local market knowledge, and strong client focus. We maintain an extensive real estate research department whose dedicated professionals monitor real estate and capital market conditions around the world to enhance current investment decisions and identify future opportunities. In addition to drawing on public sources for information, our research department utilizes the extensive local presence of Jones Lang LaSalle professionals throughout the world to gather and share proprietary insight into local market conditions.

The investment and capital origination activities of our money management business have grown increasingly global. We have invested in direct real estate in 19 countries across the globe, as well as in public real estate companies traded on all major stock exchanges. We expect money management activities, both fund raising and investing, to continue this trend as cross-border capital flows increase.

Private Investments in Real Estate Properties. In serving our money management clients, LaSalle Investment Management is responsible for the acquisition, management, leasing, financing and divestiture of real estate investments across a broad range of real estate property types. LaSalle Investment Management launched its first institutional investment fund in 1979 and currently has a series of commingled investment funds, including nine funds that invest in assets in the Americas, nine funds that invest in assets located in Europe and three funds that invest in assets in Asia Pacific. LaSalle Investment Management also maintains separate account relationships with investors for whom LaSalle Investment Management manages private real estate investments. As of December 31, 2005, LaSalle Investment Management had approximately $25 billion in assets under management in these funds and separate accounts.

Some investors prefer to partner with money managers willing to co-invest their own funds to more closely align the interests of the investor and the investment manager. We believe that our ability to co-invest funds alongside the investments of clients’ funds will continue to be an important factor in maintaining and continually improving our competitive position. Our co-investment strategy will strengthen our ability to continue to raise capital for new investment funds. At December 31, 2005, we had a total of $89 million of investments in, and loans to, co-investments.

We also plan to expand our “merchant banking” activities in appropriate circumstances. This involves our making investments of Firm capital to acquire properties in order to seed investment management funds before they have been offered to clients.

LaSalle Investment Management conducts its operations with teams of professionals dedicated to achieving specific client objectives. We establish investment committees within each region whose members have specialized knowledge applicable to underlying investment strategies. These committees must approve all investment decisions for private market investments. We employ the investment committee approval process for LaSalle Investment Management’s investment funds and for all separate account relationships.

LaSalle Investment Management is generally compensated for money management services for private equity investments based on initial capital invested and managed, with additional fees tied to investment performance above benchmark levels. The terms of contracts vary by the form of investment vehicle involved and the type of service provided. Our investment funds have various life spans, typically ranging between five and ten years. Separate account advisory agreements generally have three-year terms with “at will” termination provisions, and they may include compensation arrangements that are linked to the market value of the assets under management.

Investments in Public Equity. LaSalle Investment Management also offers clients the ability to invest in separate accounts focused on public real estate equity. We invest the capital of these clients principally in publicly traded securities of REITs and property company equities. As of December 31, 2005, LaSalle Investment Management had approximately $5 billion of assets under management in these types of investments. LaSalle Investment Management is typically compensated by securities investment clients on the basis of the market value of assets under management.

Competitive Advantages

We believe that the five value drivers articulated in the Jones Lang LaSalle Value Model create several competitive advantages that have established us as the leader overall in the real estate services and money management business.

Integrated Global Services. By combining a wide range of high-quality, complementary services - and delivering them at consistently high service levels globally - we can develop and implement real estate strategies that meet the increasingly complex and far-reaching needs of our clients. We also believe that we have secured an established business presence in the world’s principal real estate markets, with the result that we can grow revenues without a substantial increase in infrastructure costs. With offices in over 100 markets in 34 countries on five continents, we have in-depth knowledge of local and regional markets and can provide a full range of real estate services around the globe. This geographic coverage positions us to serve our multinational clients and manage investment capital on a global basis. In addition, we anticipate that our additional cross-selling potential across geographies and product lines will continue to develop new revenue sources for multiple business units within Jones Lang LaSalle.

Industry-Leading Research and Knowledge Building. We invest in and rely on comprehensive top-down and bottom-up research to support and guide the development of real estate and investment strategy. Our Global Research Committee oversees and coordinates the activities of approximately 200 research professionals who cover market and economic conditions in approximately 200 metropolitan areas in 35 countries around the world. Research also plays a key role in keeping colleagues throughout the organization attuned to important events and changing conditions in world markets. Dissemination of this information to colleagues is facilitated through our company-wide intranet.

Client Relationship Management. We believe that our ability to deliver superior service to our clients is supported by our ongoing investments in Client Relationship Management and Account Management. Our goal is to provide each client with a single point of contact at our firm, an individual who is answerable to, and accountable for, all the activities we undertake for the client. We believe that we enhance superior client service through best practices in Client Relationship Management, the practice of seeking and acting on regular client feedback, and recognizing each client’s definition of excellence.

Our client-driven focus enables us to develop long-term relationships with real estate investors and occupiers. By developing these relationships, we are able to generate repeat business and create recurring revenue sources. In many cases, we establish strategic alliances with clients whose ongoing service needs mesh with our ability to deliver fully integrated real estate services across multiple business units and office locations. Our relationship focus is supported by an employee compensation system designed to reward client relationship building, teamwork and quality performance, in addition to revenue development.

Consistent Service Delivery. We believe that our investments in research, technology, people and innovation enable us to develop, share and continually evaluate best practices across our global organization. As a result, we are able to deliver the same consistently high levels of client service and operational excellence substantially wherever our clients’ real estate investment and services needs exist.

Based on our general industry knowledge and specific client feedback, we believe we are recognized as an industry leader in technology. We possess the capability to provide sophisticated information technology systems on a global basis to serve our clients and support our employees. For example, the purpose of OneView SM, our client extranet technology, is to provide clients with detailed and comprehensive insight into their portfolios, the markets in which they operate and the services we provide to them. Delphi SM, our intranet technology, offers our employees easy access to the Firm’s policies and its collective thinking regarding our experience, skills and best practices.

We believe that our investments in research, technology, people and thought leadership position our firm as a leading innovator in our industry. Major research initiatives, such as our “World Winning Cities” program, our offshoring index and our “Global Real Estate Transparency Index,” investigate emerging trends and therefore help us anticipate future conditions and shape new services to benefit our clients. Professionals in our Strategic Consulting practice identify and respond to shifting market and business trends to address changing client needs and opportunities. LaSalle Investment Management relies on our comprehensive investigation of global real estate and capital markets to develop new investment products and services tailored to the specific investment goals and risk/return objectives of our clients. We believe that our commitment to innovation helps us secure and maintain profitable long-term relationships with the clients we target: the world’s leading real estate owners, occupiers and investors.

Strong Brand. Based on our industry knowledge, commissioned marketing surveys, coverage in top-tier business publications and our number of long-standing client relationships, we believe that large corporations and institutional investors and occupiers of real estate generally recognize us as a provider of high-quality, professional real estate and money management services. We believe that the strength of the Jones Lang LaSalle brand and our reputation for excellence in service delivery represent significant advantages when we pursue new business opportunities.

Industry Trends

Increasing Demand for Global Services and Globalization of Capital Flows. Many corporations based in countries around the world have pursued growth opportunities in international markets. Many are striving to control costs by outsourcing or offshoring non-core business activities. Both trends have increased the demand for global real estate services, including facilities management, tenant representation and leasing, and property management services. We believe that this trend will favor real estate service providers with the capability to provide services — and consistently high service levels — in multiple markets around the world. Additionally, real estate capital flows have become increasingly global, as more assets are marketed internationally and as more investors seek real estate investment opportunities beyond their own borders. This trend has created new markets for investment managers equipped to facilitate international real estate capital flows and execute cross-border real estate transactions.

Consolidation. The real estate services industry has experienced significant consolidation in recent years. We believe that as a result of substantial existing infrastructure investments and the ability to spread fixed costs over a broader base of business, it is possible to recognize incrementally higher margins on property management and facilities management assignments as the amount of square footage under management increases.

Large users of commercial real estate services continue to demonstrate a preference for working with single-source service providers able to operate across local, regional and global markets. The ability to offer a full range of services on this scale requires significant corporate infrastructure investment, including information technology and personnel training. Smaller regional and local real estate service firms, with limited resources, are less able to make such investments.

Growth of Outsourcing. In recent years, on a global level, outsourcing of professional real estate services has increased substantially, as corporations have focused corporate resources, including capital, on core competencies. In addition, public and other non-corporate users of real estate, including government agencies and health and educational institutions, have begun to outsource real estate activities as a means of reducing costs. As a result, we believe there are significant growth opportunities for firms like ours that can provide integrated real estate services across many geographic markets.

Alignment of Interests of Investors and Investment Managers. Institutional investors continue to allocate significant portions of their investment capital to real estate, and many investors have shown a desire to commit their capital to investment managers willing to co-invest their own funds in specific real estate investments or real estate funds. In addition, investors are increasingly requiring that fees paid to investment managers be more closely aligned with investment performance. As a result, we believe that investment managers with co-investment capital, such as LaSalle Investment Management, will have an advantage in attracting real estate investment capital. In addition, co-investment may bring the opportunity to provide additional services related to the acquisition, financing, property management, leasing and disposition of such investments.

Employees

With the help of aggressive goal and performance measurements, we attempt to instill in all of our people the commitment to be the best. Our goal is to be the real estate advisor of choice for clients and the employer of choice in our industry. To achieve that, we intend to continue to promote those human resources techniques that will attract, motivate and retain high quality employees. The following table details our respective headcounts at December 31, 2005 and 2004:

| | | 2005 | | 2004 | |

| Professional | | | 9,400 | | | 8,000 | |

| Support | | | 1,500 | | | 1,600 | |

| | | | 10,900 | | | 9,600 | |

| Directly reimbursable property maintenance | | | 11,100 | | | 9,700 | |

| Total Employees | | | 22,000 | | | 19,300 | |

| | | | | | | | |

Directly reimbursable project management employees included as professionals above | | | 3,500 | | | 3,000 | |

The increase in headcount in 2005 was driven by additional or expanded outsourcing engagements, as well as investments in our growing businesses in Asia Pacific, particularly in India and China.

Directly reimbursable project management employees work with clients that have a contracted fee structure comprised of a fixed management fee and a separate component that allows for scheduled reimbursable personnel and other expenses to be billed directly to the client.

Approximately 7,700 and 6,700 of our professional and support staff in 2005 and 2004, respectively, were based in countries other than the United States. Additionally, approximately 7,600 and 6,300 of our directly reimbursable property maintenance workers in 2005 and 2004, respectively, were based in countries other than the United States. Our employees are not members of any labor unions with the exception of approximately 650 of our directly reimbursable property maintenance employees in the United States. We have generally had satisfactory relations with our employees.

Company Web Site, Corporate Governance and Other Available Information

Jones Lang LaSalle’s Web site address is www.joneslanglasalle.com. We make available, free of charge, our Form 10-K, 10-Q and 8-K reports, and our proxy statements, as soon as reasonably practicable after we file them electronically with the U.S. Securities and Exchange Commission (“SEC”). You also may read and copy any document we file with the SEC at its public reference room at 450 Fifth Street, NW, Washington, D.C. 20549. You may call the SEC at 1.800.SEC.0330 for information about its public reference room. The SEC maintains an internet site that contains annual quarterly and current reports, proxy statements and other information that we file electronically with the SEC. The SEC’s internet site is www.sec.gov.

The Company’s Code of Business Ethics, which applies to all employees of the Company, including our Chief Executive Officer, Chief Operating and Financial Officer, Global Controller and the members of our Board of Directors, can also be found on our Web site under Investor Relations/Board of Directors and Corporate Governance. In addition, the Company intends to post any amendment or waiver of the Code of Business Ethics with respect to a member of our Board of Directors or any of the executive officers named in our proxy statement.

Our Web site also includes information about our corporate governance. You may access, in addition to other information, the following materials, which we will make available in print to any shareholder who requests them:

| • | Corporate Governance Guidelines |

| • | Charters for our Audit, Compensation, and Nominating and Governance Committees |

| • | Statement of Qualifications for Members of the Board of Directors |

| • | Complaint Procedures for Accounting and Auditing Matters |

| • | Statements of Beneficial Ownership of our Equity Securities by our Directors and Officers |

One of the challenges of a global business such as ours is to be able to determine in a sophisticated manner the enterprise risks that in fact exist and then to determine how best to employ available resources to prevent, mitigate and/or minimize those risks that have the greatest potential (1) to occur and (2) to cause significant damage from an operational, financial or reputational standpoint. An important dynamic that we must also consider and appropriately manage is how much and what types of commercial insurance to obtain and how much potential liability may remain uninsured consistent with the infrastructure that is in place within the organization to identify and properly manage it. While we attempt to approach these issues in an increasingly sophisticated and coordinated manner across the globe, our failure to identify or effectively manage the enterprise risks inherent within our business could result in a material adverse effect on our business, results of operations and/or financial condition.

General economic conditions and real estate market conditions can have a negative impact on our business. We have experienced in past years, and expect in the future to be negatively impacted by, periods of economic slowdown or recession, and corresponding declines in the demand for real estate and related services, within one or more of the markets in which we operate. Each real estate market tends to be cyclical and related to the condition of its corresponding economy as a whole or, at least, to the perceptions of investors and users as to the relevant economic outlook. For example, corporations may be hesitant to expand space or enter into long-term commitments if they are concerned with the economic environment. Corporations that are under financial pressure for any reason, or are attempting to more aggressively manage their expenses, may reduce the size of their workforces and/or seek corresponding reductions in office space and related management services. Negative economic conditions and declines in the demand for real estate and related services in several markets or in significant markets could have a material adverse effect on our business, results of operations and/or financial condition, including as a result of the following factors:

| • | Decline in Leasing Activity |

A general decline in leasing activity can lead to a reduction in fees and commissions for arranging leases, both on behalf of owners and tenants. Additionally, a decline in leasing activity can lead to a reduction in the demand for, and fees earned from, other real estate services, such as Project and Development Services (managing the build-out of space) and Corporate Property Services (managing space occupied by clients).

| • | Decline in Acquisition and Disposition Activity |

A general decline in acquisition and disposition activity can lead to a reduction in fees and commissions for arranging such transactions, as well as in fees and commissions for arranging financing for acquirers.

| • | Decline in Real Estate Investment Activity |

A general decline in real estate investment activity can lead to a reduction in investment management fees on the acquisition of property for clients, as well as in fees and commissions for arranging acquisitions, dispositions and financings.

| • | Decline in the Value and Performance of Real Estate and Rental Rates |

A general decline in the value and performance of real estate and in rental rates can lead to a reduction in investment management fees (the most significant portion of which are generally based upon the performance of investments) and the value of the co-investments we make with our investment management clients or “merchant banking” investments we have made for our own account. Additionally, such declines can lead to a reduction in fees and commissions that are based upon the value of, or revenues produced by, the properties with respect to which services are provided, including fees and commissions for property management and valuations, and for arranging acquisitions, dispositions, leasing and financings.

Concentrations of business with corporate clients increase credit risk and the impact from the loss of certain clients. While our client base remains diversified across industries and geographies, we do value the expansion of business relationships with individual corporate clients and the increased efficiency and economics (both to our clients and our firm) that can result from developing repeat business from the same client and from performing an increasingly broad range of services for the same client. At the same time, having increasingly large and concentrated clients can also lead to greater or more concentrated risks of loss if, among other possibilities, such a client (1) experiences its own financial problems, which can lead to larger individual credit risks, (2) decides to reduce its operations or its real estate facilities, (3) makes a change in its real estate strategy, such as no longer outsourcing its real estate operations, (4) decides to change its providers of real estate services or (5) merges with another corporation or otherwise undergoes a change of control, which may result in new management taking over with a different real estate philosophy or in different relationships with other real estate providers. Additionally, increasingly large clients may, and sometimes do, attempt to leverage the extent of their relationships with us during the course of contract negotiations or in connection with disputes or potential litigation.

The international scope of our operations, and our operations in particular regions and countries, involve a number of risks for our business. The fact that we operate in 50 countries presents risks for our business in a number of ways. If those risks, including the following, associated with the international scope of our operations and our operations in particular regions and countries cannot be or are not successfully managed, our business, operating results and/or financial condition could be materially and adversely affected.

• Difficulties and Costs of Staffing and Managing International Operations; Noncompliance with Policies; Communications and Enforcement of Our Policies and Our Code of Business Ethics; Conflicts of Interest

The coordination and management of international operations poses additional costs and difficulties. We must manage operations in many time zones and that involve people with language and cultural differences. Our success depends on finding and retaining people capable of dealing with these challenges effectively and who will represent the Company with the highest levels of integrity. If we are unable to attract and retain qualified personnel, or successfully plan for succession of employees holding key management positions, our growth may be limited, and our business and operating results could suffer.

Among the challenges we face in retaining our people is maintaining a compensation system that rewards them consistent with local markets and with our profitability, which can be especially difficult where competitors may be attempting to gain market share by hiring our best people at rates of compensation that are well above the market. We have committed resources to effectively coordinate our business activities around the world to meet our clients’ needs, whether they be local, regional or global. We also consistently attempt to enhance the establishment, organization and communication of corporate policies, particularly where we determine that the nature of our business poses the greatest risk of noncompliance. The failure of our people to carry out their responsibilities in accordance with our client contracts, our corporate and operating policies, or our standard operating procedures, or their negligence in doing so, could result in liability to clients or other third parties, which could have a material adverse effect on our business, operating results and/or financial condition.

When addressing staffing in connection with a restructuring of our organization or a downturn in economic conditions or activity, we must take into account the employment laws of the countries in which actions are contemplated, which in some cases can result in significant costs and/or time delays in implementing headcount reductions. Our ability to manage such operational fluctuations and maintain adequate long-term strategies in the face of such developments will be critical to our continued growth and profitability.

The geographic and cultural diversity in our organization makes it more challenging to communicate the importance of adherence to our Code of Business Ethics, to monitor and enforce compliance with its provisions on a worldwide basis, and to ensure local compliance with U.S. laws that apply globally, such as the Foreign Corrupt Practices Act, the Patriot Act and the Sarbanes-Oxley Act of 2002. We have introduced an Ethics Everywhere program to address these challenges and to attempt to maintain a high level of awareness about, and compliance with, our Code of Business Ethics. Breaches of our Code of Business Ethics, particularly by our executive management, could have a material adverse effect on our business, operating results and/or financial condition.

All providers of professional services to clients, including our firm, must manage potential conflicts of interest that may arise, principally where the primary duty of loyalty owed to one client is somehow potentially weakened or compromised by a relationship also maintained with a third party. While the Company has policies in place to identify, disclose and resolve potential conflicts of interest, the failure or inability to do so in a significant situation could have a material adverse effect on our business, operating results and/or financial condition.

There are circumstances where the conduct or identity of our clients could cause us reputational damage or financial harm or could lead to our non-compliance with certain laws, as the result of which there could be a material adverse effect on our business, operating results and/or financial condition. An example would be the attempt by a client to “launder” funds through its relationship with us, namely to disguise the illegal source of funds that are put into otherwise legitimate real estate investments. While we continue to attempt to enhance the procedures we use to evaluate our clients before doing business with them and to avoid attempts to launder money or otherwise to exploit their relationship with us, our efforts may not be successful in all situations.

| • | Currency Restrictions and Exchange Rate Fluctuations |

We produce positive flows of cash in various countries and currencies that can be most effectively used to fund operations in other countries or to repay our indebtedness, which is currently primarily denominated in U.S. dollars. We face restrictions in certain countries that limit or prevent the transfer of funds to other countries or the exchange of the local currency to other currencies. We also face risks associated with fluctuations in currency exchange rates that may lead to a decline in the value of the funds produced in certain jurisdictions.

Additionally, although we operate globally, we report our results in U.S. dollars and thus our reported results may be positively or negatively impacted by the strengthening or weakening of currencies against the U.S. dollar. As an example, the euro and the pound sterling, each a currency used in a significant portion of our operations, weakened against the U.S. dollar over the course of 2005. For the year ended December 31, 2005, 28% of our operating income was attributable to operations with U.S. dollars as their functional currency, and 72% was attributable to operations having other functional currencies. In addition to the potential negative impact on reported earnings, fluctuations in currencies relative to the U.S. dollar may make it more difficult to perform period-to-period comparisons of the reported results of operations.

We are authorized to use currency-hedging instruments, including foreign currency forward contracts, purchased currency options and borrowings in foreign currency. There can be no assurance that such hedging will be economically effective. We do not use hedging instruments for speculative purposes.

The following table sets forth the revenues derived from our most significant currencies (based upon 2005 revenues, $ in millions). The euro revenues include our businesses in France, Germany, Italy, Ireland, Spain, Portugal, Holland, Belgium and Luxembourg.

Most Significant Currencies on a Revenue Basis

| | | 2005 | | 2004 | |

| United States Dollar | | $ | 539.9 | | | 421.5 | |

| United Kingdom Pound | | | 281.7 | | | 259.6 | |

| Euro | | | 220.8 | | | 191.4 | |

| Australian Dollar | | | 108.5 | | | 94.9 | |

| Other currencies | | | 239.7 | | | 199.6 | |

Total Revenues | | $ | 1,390.6 | | | 1,167.0 | |

| • | Potentially Adverse Tax Consequences; Changes in Tax Legislation and Tax Rates |

Moving funds between countries can produce adverse tax consequences in the countries from which and to which funds are transferred, as well as in other countries, such as the United States, in which we have operations. Additionally, as our operations are global, we face challenges in effectively gaining a tax benefit for costs incurred in one country that benefit our operations in other countries.

Changes in tax legislation or tax rates may occur in one or more jurisdictions in which we operate that may materially increase the cost of operating our business.

• Burden of Complying with Multiple and Potentially Conflicting Laws and Regulations and Dealing with Changes in Legal and Regulatory Requirements; Licensing; Regulatory and Contractual Liabilities

We face a broad range of legal and regulatory environments in the countries in which we do business. Coordinating our activities to deal with these requirements presents challenges. As an example, in the United Kingdom, the Financial Services Authority (FSA) regulates the conduct of investment businesses and the Royal Institute of Chartered Surveyors (RICS) regulates the profession of Chartered Surveyors, which is the professional qualification required for certain of the services we provide in the United Kingdom, through upholding standards of competence and conduct. As another example, in the United States, various activities of LaSalle Investment Management are regulated by the Securities and Exchange Commisssion (SEC), and as a publicly traded company, we are subject to various corporate governance and other requirements established by statute, pursuant to SEC regulations and under the rules of the New York Stock Exchange. Additionally, changes in legal and regulatory requirements can impact our ability to engage in business in certain jurisdictions or increase the cost of doing so.

The brokerage of real estate sales and leasing transactions requires us to maintain licenses in various jurisdictions in which we operate. If we fail to maintain our licenses or conduct brokerage activities without a license, we may be required to pay fines or return commissions received or have licenses suspended. In addition, because the size and scope of real estate sales transactions have increased significantly during the past several years, both the difficulty of ensuring compliance with the numerous licensing regimes and the possible loss resulting from noncompliance have increased. Furthermore, the laws and regulations applicable to our business, both in the United States and in foreign countries, also may change in ways that materially increase the costs of compliance.

As a licensed real estate service provider in various jurisdictions, we and our licensed employees may be subject to various due diligence, disclosure, standard-of-care, anti-money laundering and other obligations in the jurisdictions in which we operate. Failure to fulfill these obligations could subject us to litigation from parties who purchased, sold or leased properties we brokered or managed. We could become subject to claims by participants in real estate sales or other services claiming that we did not fulfill our obligations as a service provider or broker (including, for example, with respect to conflicts of interests where we are acting, or are perceived to be acting, for two or more clients with potentially contrary interests).

In addition, we may, on behalf of our clients, hire and supervise third-party contractors to provide construction, engineering and various other services for our managed properties. Depending upon the terms of our contracts with clients (which, for example, may place us in the position of a principal rather than an agent), we may be subjected to, or become liable for, claims for construction defects, negligent performance of work or other similar actions by third parties whom we do not control. Adverse outcomes of property management disputes or litigation could negatively impact our business, financial condition and/or results of operations, particularly if we have not limited in our contracts the extent of damages to which we may be liable for the consequences of our actions or if our liabilities exceed the amounts of the commercial third-party insurance that we carry. Moreover, our clients may seek to hold us accountable for the actions of contractors because of our role as property manager even if we have technically disclaimed liability as a legal matter, in which case we may be pressured to participate in a financial settlement for purposes of preserving the client relationship.

| • | Greater Difficulty in Collecting Accounts Receivable in Certain Countries and Regions |

We face challenges to our ability to efficiently and/or effectively collect accounts receivable in certain countries and regions. For example, in Asia, many countries have underdeveloped insolvency laws and clients often are slow to pay. In Europe, clients in some countries, particularly Spain, Italy and France, also tend to delay payments, reflecting a different business culture.

| • | Political and Economic Instability; Terrorist Activities; Health Epidemics |

We operate in 50 countries with varying degrees of political and economic stability. For example, certain Asian, Eastern European and South American countries have experienced serious political and economic instability within the past few years, and such instability will likely continue to arise from time to time in countries in which we have operations. As a result, our ability to operate our business in the ordinary course may be disrupted in one way or another, with corresponding reductions in revenues, increases in expenses or other material adverse effects. In addition, terrorist activities have escalated in recent years and at times have affected cities in which we operate. To the extent that similar terrorist activities continue to occur, they may adversely affect our business because they tend to target the same type of high-profile urban areas in which we do business.

Health epidemics that affect the general conduct of business in one or more urban areas, such as occurred from SARS or may occur from an avian flu outbreak, can also adversely affect the volume of business transactions, real estate markets and the cost of operating real estate, and may therefore adversely affect our results.

Real estate services markets are highly competitive. We provide a broad range of commercial real estate services, and there is significant competition on an international, regional and local level with respect to many of these services and in commercial real estate services generally. Depending on the service, we face competition from other real estate service providers, institutional lenders, insurance companies, investment banking firms, investment managers, accounting firms, technology firms, firms providing outsourcing services and companies bringing their real estate services in-house (any of which may be a global, regional or local firm). Many of our competitors are local or regional firms, which, although substantially smaller in overall size, may be larger in a specific local or regional market. Some of our competitors are expanding the services they offer in an attempt to gain additional business. Some of our competitors may have greater financial, technical and marketing resources, larger customer bases, and more established relationships with their customers and suppliers than we have. Larger or more well-capitalized competitors may be able to respond faster to the need for technological changes, price their services more aggressively, compete more effectively for skilled professionals, finance acquisitions more easily and generally compete more aggressively for market share.

New competitors or alliances among competitors that increase their ability to service clients could emerge and gain market share, develop a lower cost structure, adopt more aggressive pricing policies or provide services that gain greater market acceptance than the services we offer. In order to respond to increased competition and pricing pressure, we may have to lower our prices, which would have an adverse effect on our revenues and profit margins.

We are substantially dependent on long-term client relationships and on revenue received for services under various service agreements. Many of these agreements are cancelable by the client for any reason with as little as 30 to 60 days’ notice, as is typical in the industry. In this competitive market, if we are unable to maintain these relationships or are otherwise unable to retain existing clients and develop new clients, our business, results of operations and financial condition will be materially adversely affected. We must also continue to successfully differentiate the scope and quality of our service and product offerings from those of our competitors in order to maintain the value and premium status of our brand, which is one of our most important assets.

The seasonality of our business exposes us to risks and to volatility in our stock price. Our revenues and profits tend to be significantly higher in the third and fourth quarters of each year than the first two quarters. This is a result of a general focus in the real estate industry on completing or documenting transactions by calendar-year-end and the fact that certain expenses are constant through the year. Historically, we have reported a small loss in the first quarter, a small profit or loss in the second quarter and increasingly larger profit during the third and fourth quarters, excluding the recognition of investment-generated performance fees and co-investment equity gains (both of which can be particularly unpredictable). The seasonality of our business makes it difficult to determine during the course of the year whether plan results will be achieved, and thus to adjust to changes in expectations. Additionally, negative economic or other conditions that arise at a time when they impact performance in the fourth quarter, such as the particular timing of when larger transactions close, may have a more significant impact than if they occurred earlier in the year. To the extent we are not able to identify and adjust for changes in expectations or we are confronted with negative conditions that impact inordinately on the fourth quarter of a year, this could have a material adverse effect on our business, results of operations and/or financial condition. This may in turn lead to volatility in our stock price.

Volatility in LaSalle Investment Management incentive fee revenues. With the growth in assets under management at LaSalle Investment Management, our portfolio is of sufficient size to periodically generate large incentive fees, and in some cases equity gains, that significantly contribute to our earnings and to the changes in earnings from one year to the next. However, volatility in this component of our earnings is inevitable due to the nature of this aspect of our business. In the case of our commingled funds, underlying market conditions, particular decisions regarding the acquisition and disposition of fund assets, and the specifics of the client mandate will determine the timing and size of incentive fees from one fund to another. For separate accounts, where asset management is ongoing, we may also earn incentive fees at periodic agreed-upon measurement dates, and that may be related to performance relative to specified real-estate indices (such as that published by the National Council of Real Estate Investment Fiduciaries (NCREIF)).

While LaSalle Investment Management has focused over the past several years on developing more predictable annuity-type revenues, incentive fees have been, and will continue to be, an important part of our revenues and earnings. As a result, the volatility described above should be expected to continue. For example, in 2005 we recognized, and in 2006 we expect to also recognize, significant incentive fees from a mix of both fund liquidations and separate account performance. We are currently anticipating incentive fees in 2006 to be primarily concentrated in a significant incentive fee from a separate account where we have ongoing portfolio management. This incentive fee is payable only once every four years and will be calculated based on the account’s performance above a real rate of return so long as the account's performance has exceeded a NCREIF - based index.

We may face liability with respect to environmental issues occurring at properties that we manage or in which we invest. Various laws and regulations impose liability on current or previous real property owners or operators for the cost of investigating, cleaning up or removing contamination caused by hazardous or toxic substances at the property. We may face liability under these laws as a result of our role as an on-site property manager. In addition, we may face liability if such laws are applied to expand our limited liability with respect to our co-investments in real estate as discussed below.

Co-investment and merchant banking activities subject us to real estate investment risks and potential liabilities. An important part of our investment strategy includes investing in real estate along with our money management clients. In order to remain competitive with well-capitalized financial services firms, we also make “merchant banking” investments, as the result of which we may use Firm capital to acquire properties before the related investment management funds have been established or investment commitments received from third-party clients. Investing in this manner exposes us to a number of risks that could have a material adverse effect on our business, results of operations and/or financial condition, including as a result of the following risks:

| • | We may lose some or all of the capital that we invest if the investments perform poorly. |

| • | We will have fluctuations in earnings and cash flow as we recognize gains or losses, and receive cash, upon the disposition of investments, the timing of which is geared toward the benefit of our clients. |

| • | We generally hold our investments in real estate through subsidiaries with limited liability; however, in certain circumstances, it is possible that this limited exposure may be expanded in the future based upon, among other things, changes in applicable laws or the application of existing or new laws. To the extent this occurs, our liability could exceed the amount we have invested. |

| • | We make co-investments in real estate in many countries, and this presents risks as described above in "The International Scope of Our Operations, and Our Operations in Particular Regions and Countries, Involve a Number of Risks for Our Business." |

We may have indebtedness with fixed or variable interest rates and certain covenants with which we must comply. At December 31, 2005, we had $44.7 million of indebtedness on a consolidated basis, principally under a revolving credit facility from a syndicate of lenders. We subsequently incurred an additional $150 million of indebtedness as the result of our acquisition of Spaulding & Slye in January 2006. Our average outstanding borrowings under the revolving credit facility were $109 million during 2005, and the effective interest rate on that facility was 3.9%.

Our outstanding borrowings fluctuate during the year primarily due to varying working capital requirements. For example, payment of annual incentive compensation represents a significant working capital requirement commanding increased borrowings in the first half of the year, while the Firm’s seasonal earnings pattern provides more for working capital requirements in the second half of the year.

The terms of our debt contain a number of covenants that could restrict our flexibility to finance future operations or capital needs, or to engage in other business activities that may be in our best interest. The debt covenants limit us in, among other things:

| • | Encumbering or disposing of assets; |

| • | Incurring indebtedness; and |

| • | Engaging in acquisitions. |

In addition, with respect to the revolving credit facility, we must maintain a consolidated net worth of at least $450 million and a leverage ratio not exceeding 3.25 to 1. We must also maintain a minimum interest coverage ratio of 2.5 to 1.

If we are unable to make required payments under the revolving credit facility or if we breach any of the debt covenants, we will be in default under the terms of the revolving credit facility. A default under the facility could cause acceleration of repayment of those amounts as well as defaults under other existing and future debt obligations.

The charter and the amended bylaws of Jones Lang LaSalle and the Maryland general corporate law could delay, defer or prevent a change of control. The charter and bylaws of Jones Lang LaSalle include provisions that may discourage, delay, defer or prevent a takeover attempt that may be in the best interest of Jones Lang LaSalle shareholders and may adversely affect the market price of our common stock.

The charter and bylaws provide for:

| • | The ability of the board of directors to establish one or more classes and series of capital stock including the ability to issue up to 10,000,000 shares of preferred stock, and to determine the price, rights, preferences and privileges of such capital stock without any further shareholder approval; |

| • | A requirement that any shareholder action taken without a meeting be pursuant to unanimous written consent; and |

| • | Certain advance notice procedures for Jones Lang LaSalle shareholders nominating candidates for election to the Jones Lang LaSalle board of directors. |

Under the Maryland General Corporate Law (the “MGCL”), certain “Business Combinations” (including a merger, consolidation, share exchange or, in certain circumstances, an asset transfer or issuance or reclassification of equity securities) between a Maryland corporation and any person who beneficially owns 10% or more of the voting power of the corporation’s shares or an affiliate of the corporation who, at any time within the two-year period prior to the date in question, was the beneficial owner of 10% or more of the voting power of the then-outstanding voting stock of the corporation (an “Interested Shareholder”) or an affiliate of the Interested Shareholder are prohibited for five years after the most recent date on which the Interested Shareholder became an Interested Shareholder. Thereafter, any such Business Combination must be recommended by the board of directors of such corporation and approved by the affirmative vote of at least (1) 80% of the votes entitled to be cast by holders of outstanding voting shares of the corporation and (2) 66 2/3% of the votes entitled to be cast by holders of outstanding voting shares of the corporation other than shares held by the Interested Shareholder with whom the Business Combination is to be effected, unless, among other things, the corporation’s shareholders receive a minimum price (as defined in the MGCL) for their shares and the consideration is received in cash or in the same form as previously paid by the Interested Shareholder for its shares. Pursuant to the MGCL, these provisions also do not apply to Business Combinations approved or exempted by the board of directors of the corporation prior to the time that the Interested Shareholder becomes an Interested Shareholder.

Claims and Investigations; Performance Under Client Contracts; Litigation Management. Substantial legal liability or a significant regulatory action against the Company could have a material adverse financial effect or cause us significant reputational harm, which in turn could seriously harm our business prospects. While we do maintain commercial insurance in an amount we believe is appropriate, we also maintain a significant level of self-insurance for the liabilities we may incur.

We generally provide our services to our clients under contracts, and in certain cases we are subject to regulatory and/or fiduciary obligations (which may relate to, among other matters, the decisions we may make on behalf of a client with respect to managing assets on its behalf or purchasing products or services from third parties or other divisions within our firm). We face legal and reputational risks in the event we do not perform, or are perceived to have not performed, under those contracts or in accordance with those regulations or obligations. The precautions we take to prevent these types of occurrences, which we believe do represent a significant commitment of corporate resources, may nevertheless not be effective in all cases. Unexpected costs or delays could make our client contracts or engagements less profitable than anticipated. Any increased or unexpected costs or unanticipated delays in connection with the performance of these engagements, including delays caused by factors outside our control, could have an adverse effect on profit margins.

In the event that we perform services for clients without executing appropriate contractual documentation, we may be unable to realize our full compensation potential or recognize revenue for accounting purposes, and we may not be able to effectively limit our liability in the event of client disputes.

Because any disputes we have with third parties must generally be adjudicated within the jurisdiction in which the dispute arose, our ability to resolve our disputes successfully depends on the local laws that apply and the operation of the local judicial system, the timeliness, quality and sophistication of which varies widely from one jurisdiction to the next. Our geographic diversity therefore makes it unusually challenging to resolve any such disputes efficiently and/or effectively.

Infrastructure Disruptions. Our ability to conduct a global business may be adversely impacted by disruptions to the infrastructure that supports our businesses and the communities in which they are located. This may include disruptions involving electrical, communications, transportation or other services used by Jones Lang LaSalle or third parties with which we conduct business, or disruptions as the result of natural disasters (such as earthquakes), political instability or terrorist attacks. These disruptions may occur, for example, as a result of events affecting only the buildings in which we operate (such as fires) or such third parties, or as a result of events with a broader impact on the cities where those buildings are located. Nearly all of our employees in our primary locations, including Chicago, London, Singapore and Sydney, work in close proximity to each other in one or more buildings. If a disruption occurs in one location and our employees in that location are unable to communicate with or travel to other locations, our ability to service and interact with our clients may suffer and we may not be able to successfully implement contingency plans that depend on communication or travel.

The infrastructure disruptions described above may also disrupt our ability to manage real estate for clients or may adversely affect the value of real estate investments we make on behalf of clients. The buildings we manage for clients, which include some of the world’s largest office properties and retail malls, are used by numerous people daily, as the result of which fires, floods, defects and natural disasters can result in significant loss of life and, to the extent we are held to have been negligent in connection with our management of the affected properties, we could incur significant financial liabilities and reputational harm.

While we have disaster recovery and crisis management procedures in place, there can be no assurance that they will suffice in any particular situation to avoid a significant loss.

Computer and Information Systems. Our business is highly dependent on our ability to process transactions across numerous and diverse markets in many currencies. If any of our financial, accounting or other data processing, e-mail or electronic information management systems do not operate properly or are disabled (including as the result of computer viruses, problems with the internet or sabotage), we could suffer a disruption of our businesses, liability to clients, loss of client data, regulatory intervention or reputational damage. These systems may fail to operate properly or become disabled as a result of events that are wholly or partially beyond our control, including disruptions of electrical or communications services, disruptions caused by natural disasters, political instability or terrorist attacks, or our inability to occupy one or more of our buildings.

The development of new software systems used to operate one or more aspects of our business, particularly on a customized basis, is complicated and may result in costs that cannot be recuperated in the event of the failure to complete a planned software development. A new software system that has defects may cause reputational issues and client or employee dissatisfaction, with business lost as a result. The acquisition or development of software systems is often dependent to one degree or another on the quality, ability and/or financial stability of one or more third-party vendors, over which we may not have control beyond the rights we negotiate in our contracts.