See accompanying notes to financial statements.

JAMES ADVANTAGE FUNDS

For the Year Ended June 30, 2009

| | | James Balanced: Golden Rainbow Fund | | | James Small Cap Fund | | | James Market Neutral Fund | | | James Equity Fund | | | James Mid Cap Fund | |

| | | | | | | | | | | | | | | | |

| INVESTMENT INCOME | | | | | | | | | | | | | | | |

| Dividends (Net of withholding taxes | | | | | | | | | | | | | | | |

| of $7,664, $4,784, $3,119, $240 | | | | | | | | | | | | | | | |

| and $488, respectively) | | $ | 5,417,310 | | | $ | 2,119,363 | | | $ | 453,210 | | | $ | 242,711 | | | $ | 87,037 | |

| Interest (Net of foreign taxes of $6,684 | | | | | | | | | | | | | | | | | | | | |

| for James Balanced: Golden | | | | | | | | | | | | | | | | | | | | |

| Rainbow Fund) | | | 9,998,941 | | | | 104,047 | | | | 226,752 | | | | 4,118 | | | | 1,177 | |

| TOTAL INVESTMENT INCOME | | | 15,416,251 | | | | 2,223,410 | | | | 679,962 | | | | 246,829 | | | | 88,214 | |

| | | | | | | | | | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | | | | | | | | | |

| Management fees | | | 4,006,182 | | | | 1,475,821 | | | | 753,836 | | | | 133,538 | | | | 44,224 | |

| 12b-1 distribution and service fees - | | | | | | | | | | | | | | | | | | | | |

| Retail Class | | | 1,353,345 | | | | 297,443 | | | | 112,534 | | | | 28,986 | | | | 11,123 | |

| Dividend expense on securities | | | | | | | | | | | | | | | | | | | | |

| sold short | | | — | | | | — | | | | 145,565 | | | | — | | | | — | |

| Servicing fees | | | 575,000 | | | | — | | | | — | | | | — | | | | — | |

| Professional fees | | | 122,858 | | | | — | | | | — | | | | — | | | | — | |

| Trustees’ fees | | | 7,500 | | | | 11,393 | | | | 11,393 | | | | 11,393 | | | | 11,393 | |

| Registration fees | | | 38,465 | | | | — | | | | — | | | | — | | | | — | |

| Custodian fees and expenses | | | 94,000 | | | | — | | | | — | | | | — | | | | — | |

| Shareholder report printing and mailing | | | 47,000 | | | | — | | | | — | | | | — | | | | — | |

| Postage and supplies | | | 19,084 | | | | — | | | | — | | | | — | | | | — | |

| Compliance fees and expenses | | | 12,000 | | | | — | | | | — | | | | — | | | | — | |

| Other expenses | | | 16,117 | | | | — | | | | — | | | | — | | | | — | |

| TOTAL EXPENSES | | | 6,291,551 | | | | 1,784,657 | | | | 1,023,328 | | | | 173,917 | | | | 66,740 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INVESTMENT | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) | | | 9,124,700 | | | | 438,753 | | | | (343,366 | ) | | | 72,912 | | | | 21,474 | |

| | | | | | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED | | | | | | | | | | | | | | | | | | | | |

| GAINS (LOSSES) ON INVESTMENTS | | | | | | | | | | | | | | | | | | | | |

| Net realized losses from security | | | | | | | | | | | | | | | | | | | | |

| transactions | | | (8,458,231 | ) | | | (31,842,178 | ) | | | (8,083,799 | ) | | | (1,997,929 | ) | | | (1,017,693 | ) |

| Net realized gains on closed | | | | | | | | | | | | | | | | | | | | |

| short positions | | | — | | | | — | | | | 6,371,021 | | | | — | | | | — | |

| Net change in unrealized appreciation/ | | | | | | | | | | | | | | | | | | | | |

| depreciation on investments and | | | | | | | | | | | | | | | | | | | | |

| securities sold short | | | (31,435,278 | ) | | | (18,301,880 | ) | | | (7,016,292 | ) | | | (2,845,949 | ) | | | (915,550 | ) |

| Net change in unrealized appreciation/ | | | | | | | | | | | | | | | | | | | | |

| depreciation on foreign currency | | | | | | | | | | | | | | | | | | | | |

| translation | | | 795,383 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| NET REALIZED AND UNREALIZED | | | | | | | | | | | | | | | | | | | | |

| LOSSES ON INVESTMENTS | | | (39,098,126 | ) | | | (50,144,058 | ) | | | (8,729,070 | ) | | | (4,843,878 | ) | | | (1,933,243 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET DECREASE IN NET ASSETS | | | | | | | | | | | | | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | (29,973,426 | ) | | $ | (49,705,305 | ) | | $ | (9,072,436 | ) | | $ | (4,770,966 | ) | | $ | (1,911,769 | ) |

See accompanying notes to financial statements.

JAMES BALANCED: GOLDEN RAINBOW FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended June 30, 2009 (A) | | | Year Ended June 30, 2008 | |

| | | | | | | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 9,124,700 | | | $ | 8,495,832 | |

| Net realized losses from security and foreign currency transactions | | | (8,458,231 | ) | | | (767,702 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | | | | | | |

| and foreign currency translation | | | (30,639,895 | ) | | | 1,696,416 | |

| Net increase (decrease) in net assets from operations | | | (29,973,426 | ) | | | 9,424,546 | |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Retail Class: | | | | | | | | |

| Dividends from net investment income | | | (9,122,040 | ) | | | (8,538,436 | ) |

| Distributions from net realized gains | | | (30,798 | ) | | | (6,758,977 | ) |

| Institutional Class: | | | | | | | | |

| Dividends from net investment income | | | (952 | ) | | | — | |

| Decrease in net assets from distributions to shareholders | | | (9,153,790 | ) | | | (15,297,413 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Retail Class: | | | | | | | | |

| Proceeds from shares sold | | | 454,813,230 | | | | 225,189,882 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 8,714,151 | | | | 14,632,263 | |

| Payments for shares redeemed | | | (365,723,002 | ) | | | (96,919,708 | ) |

| Net increase in net assets from Retail Class capital share transactions | | | 97,804,379 | | | | 142,902,437 | |

| | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 101,150 | | | | — | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 952 | | | | — | |

| Net increase in net assets from Institutional Class capital share transactions | | | 102,102 | | | | — | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 58,779,265 | | | | 137,029,570 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 478,693,808 | | | | 341,664,238 | |

| End of year | | $ | 537,473,073 | | | $ | 478,693,808 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT LOSS | | $ | (80,686 | ) | | $ | (79,529 | ) |

JAMES BALANCED: GOLDEN RAINBOW FUND

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | | Year Ended June 30, 2009 (A) | | | Year Ended June 30, 2008 | |

| SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | |

| Retail Class: | | | | | | |

| Shares sold | | | 27,570,424 | | | | 12,309,745 | |

| Shares issued in reinvestment of distributions to shareholders | | | 523,588 | | | | 797,396 | |

| Shares redeemed | | | (22,359,235 | ) | | | (5,289,755 | ) |

| Net increase in shares outstanding | | | 5,734,777 | | | | 7,817,386 | |

| Shares outstanding, beginning of year | | | 26,455,856 | | | | 18,638,470 | |

| Shares outstanding, end of year | | | 32,190,633 | | | | 26,455,856 | |

| Institutional Class: | | | | | | | | |

| Shares sold | | | 6,827 | | | | — | |

| Shares issued in reinvestment of distributions to shareholders | | | 59 | | | | — | |

| Net increase in shares outstanding | | | 6,886 | | | | — | |

| Shares outstanding, beginning of period | | | — | | | | — | |

| Shares outstanding, end of period | | | 6,886 | | | | — | |

| (A) | Institutional Class represents the period from commencement of operations (March 2, 2009) through June 30, 2009. |

See accompanying notes to financial statements.

JAMES SMALL CAP FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended June 30, 2009 | | | Year Ended June 30, 2008 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 438,753 | | | $ | 1,029,102 | |

| Net realized losses from security transactions | | | (31,842,178 | ) | | | (26,756,214 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (18,301,880 | ) | | | (28,143,795 | ) |

| Net decrease in net assets from operations | | | (49,705,305 | ) | | | (53,870,907 | ) |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

Dividends from net investment income | | | (438,651 | ) | | | (1,055,734 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 26,334,717 | | | | 72,308,744 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 428,552 | | | | 1,010,437 | |

| Payments for shares redeemed | | | (54,733,126 | ) | | | (167,944,495 | ) |

| Net decrease in net assets from capital share transactions | | | (27,969,857 | ) | | | (94,625,314 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (78,113,813 | ) | | | (149,551,955 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 177,914,856 | | | | 327,466,811 | |

| End of year | | $ | 99,801,043 | | | $ | 177,914,856 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT LOSS | | $ | (2,632 | ) | | $ | (5,685 | ) |

| | | | | | | | | |

| SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 1,814,020 | | | | 3,242,422 | |

| Shares issued in reinvestment of distributions to shareholders | | | 33,618 | | | | 47,255 | |

| Shares redeemed | | | (3,686,285 | ) | | | (7,743,880 | ) |

| Net decrease in shares outstanding | | | (1,838,647 | ) | | | (4,454,203 | ) |

| Shares outstanding, beginning of year | | | 8,879,231 | | | | 13,333,434 | |

| Shares outstanding, end of year | | | 7,040,584 | | | | 8,879,231 | |

See accompanying notes to financial statements.

JAMES MARKET NEUTRAL FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended June 30, 2009 | | | Year Ended June 30, 2008 | |

| FROM OPERATIONS | | | | | | |

| Net investment income (loss) | | $ | (343,366 | ) | | $ | 338,664 | |

| Net realized gains (losses) from: | | | | | | | | |

| Security transactions | | | (8,083,799 | ) | | | (1,371,210 | ) |

| Closed short positions | | | 6,371,021 | | | | 2,200,212 | |

| Net change in unrealized appreciation/depreciation on investments | | | (7,016,292 | ) | | | (207,385 | ) |

| Net increase (decrease) in net assets from operations | | | (9,072,436 | ) | | | 960,281 | |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Dividends from net investment income | | | (39,280 | ) | | | (629,826 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 35,152,127 | | | | 19,847,279 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 36,060 | | | | 592,984 | |

| Payments for shares redeemed | | | (43,020,847 | ) | | | (22,008,205 | ) |

| Net decrease in net assets from capital share transactions | | | (7,832,660 | ) | | | (1,567,942 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (16,944,376 | ) | | | (1,237,487 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 50,289,205 | | | | 51,526,692 | |

| End of year | | $ | 33,344,829 | | | $ | 50,289,205 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT INCOME | | $ | 3,090 | | | $ | 1,963 | |

| | | | | | | | | |

| SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 2,985,961 | | | | 1,618,095 | |

| Shares issued in reinvestment of distributions to shareholders | | | 3,082 | | | | 48,663 | |

| Shares redeemed | | | (3,748,604 | ) | | | (1,809,295 | ) |

| Net decrease in shares outstanding | | | (759,561 | ) | | | (142,537 | ) |

| Shares outstanding, beginning of year | | | 4,089,690 | | | | 4,232,227 | |

| Shares outstanding, end of year | | | 3,330,129 | | | | 4,089,690 | |

See accompanying notes to financial statements.

JAMES EQUITY FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended June 30, 2009 | | | Year Ended June 30, 2008 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 72,912 | | | $ | 47,746 | |

| Net realized gains (losses) from security transactions | | | (1,997,929 | ) | | | 2,276,455 | |

| Net change in unrealized appreciation/depreciation on investments | | | (2,845,949 | ) | | | (5,165,551 | ) |

| Net decrease in net assets from operations | | | (4,770,966 | ) | | | (2,841,350 | ) |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Dividends from net investment income | | | (73,673 | ) | | | (60,087 | ) |

| Distributions from net realized gains | | | (1,230,653 | ) | | | — | |

| Decrease in net assets from distributions to shareholders | | | (1,304,326 | ) | | | (60,087 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 3,055,227 | | | | 3,690,993 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 1,296,378 | | | | 59,595 | |

| Payments for shares redeemed | | | (3,580,272 | ) | | | (10,508,250 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | 771,333 | | | | (6,757,662 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (5,303,959 | ) | | | (9,659,099 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 16,213,608 | | | | 25,872,707 | |

| End of year | | $ | 10,909,649 | | | $ | 16,213,608 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT LOSS | | $ | (205 | ) | | $ | — | |

| | | | | | | | | |

| SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 461,696 | | | | 317,675 | |

| Shares issued in reinvestment of distributions to shareholders | | | 236,210 | | | | 5,227 | |

| Shares redeemed | | | (502,065 | ) | | | (922,746 | ) |

| Net increase (decrease) in shares outstanding | | | 195,841 | | | | (599,844 | ) |

| Shares outstanding, beginning of year | | | 1,507,822 | | | | 2,107,666 | |

| Shares outstanding, end of year | | | 1,703,663 | | | | 1,507,822 | |

See accompanying notes to financial statements.

JAMES MID CAP FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended June 30, 2009 | | | Year Ended June 30, 2008 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 21,474 | | | $ | 525 | |

| Net realized losses from security transactions | | | (1,017,693 | ) | | | (288,284 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (915,550 | ) | | | (318,254 | ) |

| Net decrease in net assets from operations | | | (1,911,769 | ) | | | (606,013 | ) |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Dividends from net investment income | | | (21,999 | ) | | | (4,782 | ) |

| Distributions from net realized gains | | | — | | | | (14,003 | ) |

| Decrease in net assets from distributions to shareholders | | | (21,999 | ) | | | (18,785 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 1,257,054 | | | | 1,940,359 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 21,942 | | | | 18,776 | |

| Payments for shares redeemed | | | (908,811 | ) | | | (1,773,538 | ) |

| Net increase in net assets from capital share transactions | | | 370,185 | | | | 185,597 | |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (1,563,583 | ) | | | (439,201 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 6,001,877 | | | | 6,441,078 | |

| End of year | | $ | 4,438,294 | | | $ | 6,001,877 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT INCOME | | $ | (20 | ) | | $ | 525 | |

| | | | | | | | | |

| SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 182,444 | | | | 175,142 | |

| Shares issued in reinvestment of distributions to shareholders | | | 3,373 | | | | 1,700 | |

| Shares redeemed | | | (118,959 | ) | | | (164,564 | ) |

| Net increase in shares outstanding | | | 66,858 | | | | 12,278 | |

| Shares outstanding, beginning of year | | | 562,895 | | | | 550,617 | |

| Shares outstanding, end of year | | | 629,753 | | | | 562,895 | |

See accompanying notes to financial statements. JAMES BALANCED: GOLDEN RAINBOW FUND - RETAIL CLASS

| FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| | | Year Ended June 30, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | |

| Net asset value at beginning of year | | $ | 18.09 | | | $ | 18.33 | | | $ | 17.32 | | | $ | 17.18 | | | $ | 15.28 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.28 | | | | 0.40 | | | | 0.39 | | | | 0.34 | | | | 0.26 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gains (losses) on investments | | | (1.40 | ) | | | 0.11 | | | | 1.34 | | | | 0.75 | | | | 1.95 | |

| Total from investment operations | | | (1.12 | ) | | | 0.51 | | | | 1.73 | | | | 1.09 | | | | 2.21 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.28 | ) | | | (0.40 | ) | | | (0.40 | ) | | | (0.34 | ) | | | (0.26 | ) |

| From net realized gains on investments | | | (0.00 | )(A) | | | (0.35 | ) | | | (0.32 | ) | | | (0.61 | ) | | | (0.05 | ) |

| Total distributions | | | (0.28 | ) | | | (0.75 | ) | | | (0.72 | ) | | | (0.95 | ) | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 16.69 | | | $ | 18.09 | | | $ | 18.33 | | | $ | 17.32 | | | $ | 17.18 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | (6.19 | )% | | | 2.76 | % | | | 10.13 | % | | | 6.48 | % | | | 14.56 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 537,358 | | | $ | 478,694 | | | $ | 341,664 | | | $ | 268,766 | | | $ | 147,605 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | 1.16 | % | | | 1.18 | % | | | 1.18 | % | | | 1.21 | % | | | 1.26 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 1.68 | % | | | 2.20 | % | | | 2.24 | % | | | 2.11 | % | | | 1.70 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 72 | % | | | 53 | % | | | 92 | % | | | 68 | % | | | 36 | % |

| (A) | Amount rounds to less than $0.005. |

See accompanying notes to financial statements.

JAMES BALANCED: GOLDEN RAINBOW FUND -

INSTITUTIONAL CLASS FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout the Period |

| | | Period Ended June 30, | |

| | | 2009(A) | |

| Net asset value at beginning of period | | $ | 14. 80 | |

| | | | | |

| Income from investment operations: | | | | |

| Net investment income | | | 0. 09 | |

| Net realized and unrealized gains on investments | | | 1. 94 | |

| Total from investment operations | | | 2. 03 | |

| | | | | |

| Less distributions: | | | | |

| From net investment income | | | ( 0.14 | ) |

| | | | | |

| Net asset value at end of period | | $ | 16.69 | |

| | | | | |

| Total return | | | 13.75 | %(B) |

| | | | | |

| Net assets at end of period (000’s) | | $ | 115 | |

| | | | | |

| Ratios/Supplemental Data: | | | | |

| Ratio of net expenses to average net assets | | | 0.95 | %(C) |

| | | | | |

| Ratio of net investment in come to average net assets | | | 1.63 | %(C) |

| | | | | |

| Portfolio turnover rate | | | 72 | %(C) |

| (A) | Represents the period from commencement of operations (M arch 2, 2009) through June 30, 2009. |

See accompanying notes to financial statements.

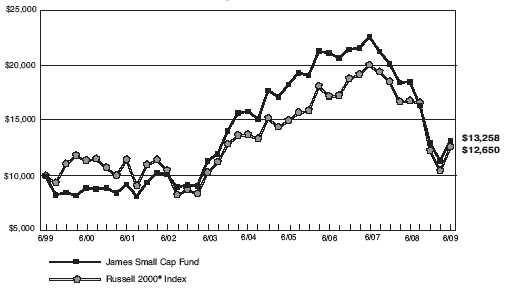

JAMES SMALL CAP FUND

| FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| | | Year Ended June 30, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | |

| Net asset value at beginning of year | | $ | 20.04 | | | $ | 24.56 | | | $ | 23.28 | | | $ | 20.46 | | | $ | 18.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.06 | | | | 0.10 | | | | 0.11 | | | | (0.04 | ) | | | 0.05 | |

| Net realized and unrealized gains (losses) on investments | | | (5.86 | ) | | | (4.52 | ) | | | 1.50 | | | | 3.19 | | | | 2.65 | |

| Total from investment operations | | | (5.80 | ) | | | (4.42 | ) | | | 1.61 | | | | 3.15 | | | | 2.70 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.06 | ) | | | (0.10 | ) | | | (0.11 | ) | | | (0.04 | ) | | | — | |

| From net realized gains on investments | | | — | | | | — | | | | (0.22 | ) | | | (0.30 | ) | | | (1.00 | ) |

| Total distributions | | | (0.06 | ) | | | (0.10 | ) | | | (0.33 | ) | | | (0.34 | ) | | | (1.00 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees (A) | | | — | | | | — | | | | 0.00 | (B) | | | 0.01 | | | | 0.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 14.18 | | | $ | 20.04 | | | $ | 24.56 | | | $ | 23.28 | | | $ | 20.46 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | (28.91 | %) | | | (18.03% | ) | | | 6.97 | % | | | 15.59 | % | | | 15.39 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 99,801 | | | $ | 177,915 | | | $ | 327,467 | | | $ | 170,490 | | | $ | 54,489 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets | | | 0.37 | % | | | 0.42 | % | | | 0.54 | % | | | (0.25 | %) | | | 0.45 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 46 | % | | | 54 | % | | | 104 | % | | | 59 | % | | | 94 | % |

| Amount calculated based on average shares outstanding throughout the period. Effective February 21, 2007, the redemption fee was eliminated. |

| Amount rounds to less than $0.005. |

See accompanying notes to financial statements.

JAMES MARKET NEUTRAL FUND

| FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| | | Year Ended June 30, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| Net asset value at beginning of year | | $ | 12.30 | | | $ | 12.17 | | | $ | 12.69 | | | $ | 12.27 | | | $ | 11.02 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.11 | ) | | | 0.11 | | | | 0.40 | | | | 0.17 | | | | 0.01 | |

| Net realized and unrealized gains | | | | | | | | | | | | | | | | | | | | |

| (losses) on investments | | | (2.17 | ) | | | 0.20 | | | | (0.51 | ) | | | 0.42 | | | | 1.23 | |

| Total from investment operations | | | (2.28 | ) | | | 0.31 | | | | (0.11 | ) | | | 0.59 | | | | 1.24 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.01 | ) | | | (0.18 | ) | | | (0.41 | ) | | | (0.18 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees (A) | | | — | | | | — | | | | 0.00 | (B) | | | 0.01 | | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 10.01 | | | $ | 12.30 | | | $ | 12.17 | | | $ | 12.69 | | | $ | 12.27 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | (18.55 | %) | | | 2.60 | % | | | (0.84 | %) | | | 4.94 | % | | | 11.34 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 33,345 | | | $ | 50,289 | | | $ | 51,527 | | | $ | 75,218 | | | $ | 47,303 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets, excluding | | | | | | | | | | | | | | | | | | | | |

| dividends on securities sold short | | | 1.95 | % | | | 1.91 | % | | | 1.94 | % | | | 1.95 | % | | | 1.95 | % |

| Ratio of dividend expense on securities sold short | | | 0.32 | % | | | 0.90 | % | | | 0.32 | % | | | 0.62 | % | | | 0.42 | % |

| Ratio of net expenses to average net assets | | | 2.27 | % | | | 2.81 | % | | | 2.26 | % | | | 2.57 | % | | | 2.37 | % |

| Ratio of net investment income (loss) to average net assets | | | (0.76 | )% | | | 0.74 | % | | | 3.21 | % | | | 1.52 | % | | | 0.11 | % |

Portfolio turnover rate(C) | | | 65 | % | | | 79 | % | | | 57 | % | | | 27 | % | | | 35 | % |

| Amount calculated based on average shares outstanding throughout the period. Effective February 21, 2007, the redemption fee was eliminated. |

| Amount rounds to less than $0.005. |

| Calculation does not include short positions or short transactions. Portfolio turnover rate would be higher if included. |

See accompanying notes to financial statements.

JAMES EQUITY FUND

| FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| | | Year Ended June 30, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| Net asset value at beginning of year | | $ | 10.75 | | | $ | 12.28 | | | $ | 11.04 | | | $ | 8.89 | | | $ | 7.36 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.04 | | | | 0.03 | | | | 0.04 | | | | 0.01 | | | | 0.01 | |

| Net realized and unrealized gains (losses) on investments | | | (3.48 | ) | | | (1.53 | ) | | | 1.24 | | | | 2.16 | | | | 1.53 | |

| Total from investment operations | | | (3.44 | ) | | | (1.50 | ) | | | 1.28 | | | | 2.17 | | | | 1.54 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.04 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.01 | ) | | | (0.01 | ) |

| From net realized gains on investments | | | (0.87 | ) | | | — | | | | — | | | | — | | | | — | |

| From distributions in excess of net investment income | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.91 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.02 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees(A) | | | — | | | | — | | | | 0.00 | (B) | | | 0.00 | (B) | | | 0.00 | (B) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 6.40 | | | $ | 10.75 | | | $ | 12.28 | | | $ | 11.04 | | | $ | 8.89 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | (30.54 | %) | | | (12.20 | %) | | | 11.59 | % | | | 24.45 | % | | | 20.96 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 10,910 | | | $ | 16,214 | | | $ | 25,873 | | | $ | 33,792 | | | $ | 16,833 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 0.63 | % | | | 0.23 | % | | | 0.30 | % | | | 0.06 | % | | | 0.22 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 81 | % | | | 50 | % | | | 58 | % | | | 43 | % | | | 33 | % |

| Amount calculated based on average shares outstanding throughout the period. Effective February 21, 2007, the redemption fee was eliminated. |

| Amount rounds to less than $0.005. |

See accompanying notes to financial statements.

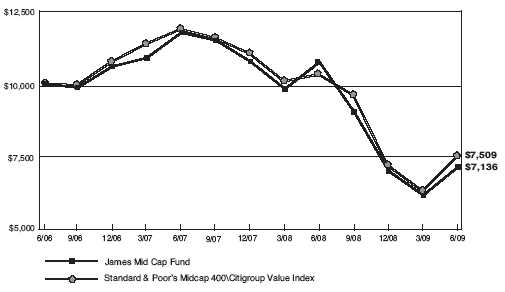

JAMES MID CAP FUND

| FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| | | Year Ended June 30, | |

| | | 2009 | | | 2008 | | | 2007 | |

| Net asset value at beginning of year | | $ | 10.66 | | | $ | 11.70 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | |

| Net investment income | | | 0.03 | | | | 0.00 | (A) | | | 0.04 | |

| Net realized and unrealized gains (losses) on investments | | | (3.61 | ) | | | (1.01 | ) | | | 1.70 | |

| Total from investment operations | | | (3.58 | ) | | | (1.01 | ) | | | 1.74 | |

| | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | |

| From net investment income | | | (0.03 | ) | | | (0.01 | ) | | | — | |

| From net realized gains on investments | | | — | | | | (0.02 | ) | | | (0.04 | ) |

| Total distributions | | | (0.03 | ) | | | (0.03 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | |

Paid-in capital from redemption fees(B) | | | — | | | | — | | | | 0.00 | (A) |

| | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 7.05 | | | $ | 10.66 | | | $ | 11.70 | |

| | | | | | | | | | | | | |

| Total return | | | (33.51 | %) | | | (8.61 | %) | | | 17.41 | % |

| | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 4,438 | | | $ | 6,002 | | | $ | 6,441 | |

| | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | 1.50 | % | | | 1.48 | % | | | 1.49 | % |

| | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 0.48 | % | | | 0.01 | % | | | 0.40 | % |

| | | | | | | | | | | | | |

| Portfolio turnover rate | | | 38 | % | | | 55 | % | | | 53 | % |

| Amount rounds to less than $0.005. |

| Amount calculated based on average shares outstanding throughout the period. Effective February 21, 2007, the redemption fee was eliminated. |

See accompanying notes to financial statements.

JAMES BALANCED: GOLDEN RAINBOW FUND

SCHEDULE OF INVESTMENTS

| Shares | COMMON STOCKS — 40.5% | | Value | |

| | BASIC MATERIALS — 4.5% | | | |

| 5,600 | Agrium, Inc. | | $ | 223,384 | |

| 65,000 | Barrick Gold Corporation | | | 2,180,750 | |

| 10,000 | Celanese Corporation | | | 237,500 | |

| 116,800 | FMC Corporation | | | 5,524,640 | |

| 38,000 | Foster (L.B.) Company - Class A* | | | 1,142,660 | |

| 6,000 | Gold Trust SPDR* | | | 547,080 | |

| 10,000 | iShares Silver Trust | | | 133,800 | |

| 37,000 | Kinross Gold Corporation | | | 671,550 | |

| 97,000 | Newmont Mining Corporation | | | 3,964,390 | |

| 53,000 | Nucor Corporation | | | 2,354,790 | |

| 18,500 | Potash Corporation of Saskatchewan | | | 1,721,425 | |

| 45,000 | PPG Industries, Inc. | | | 1,975,500 | |

| 16,000 | Schnitzer Steel Industries, Inc. - Class A | | | 845,760 | |

| 25,000 | Terra Nitrogen Company, L.P. | | | 2,519,500 | |

| | | | | 24,042,729 | |

| | CONSUMER, CYCLICAL — 6.3% | | | | |

| 70,000 | Best Buy Company, Inc. | | | 2,344,300 | |

| 100,000 | BJ’s Wholesale Club, Inc.* | | | 3,223,000 | |

| 100,000 | Bob Evans Farms, Inc. | | | 2,874,000 | |

| 75,000 | Central Garden & Pet Company* | | | 824,250 | |

| 135,000 | Dollar Tree, Inc.* | | | 5,683,500 | |

| 10,000 | Family Dollar Stores, Inc. | | | 283,000 | |

| 102,000 | McDonald’s Corporation | | | 5,863,980 | |

| 58,000 | Netflix, Inc.* | | | 2,397,720 | |

| 30,000 | NIKE, Inc. - Class B | | | 1,553,400 | |

| 40,000 | The Buckle, Inc. | | | 1,270,800 | |

| 105,000 | The Gymboree Corporation* | | | 3,725,400 | |

| 20,000 | The Home Depot, Inc. | | | 472,600 | |

| 74,000 | Wal-Mart Stores, Inc. | | | 3,584,560 | |

| | | | | 34,100,510 | |

| | CONSUMER, NON-CYCLICAL — 6.0% | | | | |

| 100,000 | Archer-Daniels-Midland Company | | | 2,677,000 | |

| 9,000 | Baxter International, Inc. | | | 476,640 | |

| 90,900 | Darling International, Inc.* | | | 599,940 | |

| 90,000 | Del Monte Foods Company | | | 844,200 | |

| 125,000 | EZCORP, Inc. - Class A* | | | 1,347,500 | |

| 73,000 | Fresh Del Monte Produce, Inc.* | | | 1,186,980 | |

| 11,000 | Hewitt Associates, Inc. - Class A* | | | 327,580 | |

| 42,700 | Ingles Markets, Inc. - Class A | | | 650,748 | |

| 234,700 | Kroger Company | | | 5,175,135 | |

| 154,000 | Merck & Company, Inc. | | | 4,305,840 | |

| 80,000 | PepsiAmericas, Inc. | | | 2,144,800 | |

| 280,000 | Pfizer, Inc. | | | 4,200,000 | |

JAMES BALANCED: GOLDEN RAINBOW FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares | COMMON STOCKS — 40.5% (Continued) | | Value | |

| | CONSUMER, NON-CYCLICAL — 6.0% (Continued) | | | |

| 30,000 | Sara Lee Corporation | | $ | 292,800 | |

| 47,200 | The Brink’s Company | | | 1,370,216 | |

| 7,000 | The Toro Company | | | 209,300 | |

| 125,000 | Tupperware Brands Corporation | | | 3,252,500 | |

| 82,700 | Watson Wyatt Worldwide, Inc. | | | 3,103,731 | |

| | | | | 32,164,910 | |

| | ENERGY — 3.3% | | | | |

| 25,000 | Apache Corporation | | | 1,803,750 | |

| 70,000 | Bolt Technology Corporation* | | | 786,800 | |

| 69,140 | Chevron Corporation | | | 4,580,525 | |

| 54,000 | Devon Energy Corporation | | | 2,943,000 | |

| 64,300 | Exxon Mobil Corporation | | | 4,495,213 | |

| 60,000 | Imperial Oil, Ltd. | | | 2,307,600 | |

| 25,000 | Mariner Energy, Inc.* | | | 293,750 | |

| 20,000 | Valero Energy Corporation | | | 337,800 | |

| | | | | 17,548,438 | |

| | FINANCIAL — 3.8% | | | | |

| 245,000 | American Financial Group, Inc. | | | 5,287,099 | |

| 105,000 | American Physicians Capital, Inc. | | | 4,111,800 | |

| 155,000 | Amerisafe, Inc.* | | | 2,411,800 | |

| 109,346 | AmTrust Financial Services, Inc. | | | 1,246,544 | |

| 33,000 | Annaly Capital Management, Inc. | | | 499,620 | |

| 150 | Euro Currency Trust | | | 21,050 | |

| 16,000 | iShares Dow Jones U.S. Financial Sector Index Fund | | | 681,920 | |

| 57,000 | Knight Capital Group, Inc. - Class A* | | | 971,850 | |

| 250,900 | Rent-A-Center, Inc.* | | | 4,473,547 | |

| 37,000 | Unum Group* | | | 586,820 | |

| 13,750 | W.R. Berkley Corporation | | | 295,213 | |

| | | | | 20,587,263 | |

| | INDUSTRIAL — 5.3% | | | | |

| 102,000 | AGCO Corporation* | | | 2,965,140 | |

| 110,000 | Ampco-Pittsburgh Corporation | | | 2,579,500 | |

| 100,000 | CSX Corporation | | | 3,463,000 | |

| 71,700 | Cummins, Inc. | | | 2,524,557 | |

| 7,000 | Fluor Corporation | | | 359,030 | |

| 243,000 | GrafTech International Ltd.* | | | 2,748,330 | |

| 10,000 | Granite Construction, Inc. | | | 332,800 | |

| 40,000 | Greif, Inc. - Class A | | | 1,768,800 | |

| 60,000 | GulfMark Offshore, Inc.* | | | 1,656,000 | |

| 95,000 | Norfolk Southern Corporation | | | 3,578,650 | |

| 151,700 | Owens-Illinois, Inc.* | | | 4,249,117 | |

| 60,000 | TBS International Ltd. - Class A* | | | 468,600 | |

| 102,000 | The Timken Company | | | 1,742,160 | |

| | | | | 28,435,684 | |

JAMES BALANCED: GOLDEN RAINBOW FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares | COMMON STOCKS — 40.5% (Continued) | | Value | |

| | TECHNOLOGY — 7.0% | | | |

| 100,000 | Arrow Electronics, Inc.* | | $ | 2,124,000 | |

| 10,000 | Avnet, Inc.* | | | 210,300 | |

| 14,000 | Computer Sciences Corporation* | | | 620,200 | |

| 30,000 | Goodrich Corporation | | | 1,499,100 | |

| 170,000 | Hewlett-Packard Company | | | 6,570,500 | |

| 82,000 | International Business Machines Corporation (IBM) | | | 8,562,440 | |

| 48,000 | Lockheed Martin Corporation | | | 3,871,200 | |

| 57,500 | Northrop Grumman Corporation | | | 2,626,600 | |

| 130,000 | Triumph Group, Inc. | | | 5,200,000 | |

| 239,500 | Western Digital Corporation* | | | 6,346,750 | |

| | | | | 37,631,090 | |

| | UTILITIES — 4.3% | | | | |

| 115,000 | American Electric Power Company, Inc. | | | 3,322,350 | |

| 185,000 | AT&T, Inc. | | | 4,595,400 | |

| 180,000 | CenturyTel, Inc. | | | 5,526,000 | |

| 20,000 | DTE Energy Company | | | 640,000 | |

| 41,000 | Edison International | | | 1,289,860 | |

| 10,000 | Energen Corporation | | | 399,000 | |

| 16,700 | FirstEnergy Corporation | | | 647,125 | |

| 80,000 | MDU Resources Group, Inc. | | | 1,517,600 | |

| 60,000 | Sempra Energy | | | 2,977,800 | |

| 62,200 | The Laclede Group, Inc. | | | 2,060,686 | |

| | | | | 22,975,821 | |

| | | | | | |

| | TOTAL COMMON STOCKS | | $ | 217,486,445 | |

| | | | | | |

| Shares | INTERNATIONAL EQUITY EXCHANGE TRADED FUNDS — 0.3% | | Value | |

| 87,000 | iShares MSCI Japan Index Fund | | $ | 820,410 | |

| 14,000 | iShares MSCI South Korea Index Fund | | | 487,060 | |

| 40,000 | iShares MSCI Taiwan Index Fund | | | 403,600 | |

| | | | | | |

| | TOTAL INTERNATIONAL EQUITY EXCHANGE TRADED FUNDS | | $ | 1,711,070 | |

| | | | | | |

| Shares | INTERNATIONAL BOND EXCHANGE TRADED FUNDS — 0.2% | | Value | |

| 15,000 | SPDR Barclays Capital International Treasury Bond ETF | | $ | 819,900 | |

JAMES BALANCED: GOLDEN RAINBOW FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Par Value | U.S. GOVERNMENT & AGENCY BONDS — 43.7% | | Value | |

| $ 877,897 | Government National Mortgage Association, 5.500%, 6/15/23 | | $ | 927,772 | |

| 916,939 | Government National Mortgage Association, 5.000%, 10/15/38 | | | 936,854 | |

| 1,987,474 | Government National Mortgage Association, 4.500%, 2/15/39 | | | 1,988,016 | |

| 3,567,095 | Government National Mortgage Association, 4.000%, 3/20/39 | | | 3,431,818 | |

| 5,000,000 | Government National Mortgage Association, 4.500%, 6/15/39 | | | 5,001,365 | |

| 3,000,000 | Government National Mortgage Association, 4.500%, 7/15/39 | | | 2,994,375 | |

| 500,000 | Tennessee Valley Authority, 5.625%, 1/18/11 | | | 535,091 | |

| 5,000,000 | U.S. Treasury Bills, 10/1/09 | | | 4,997,570 | |

| 5,000,000 | U.S. Treasury Bonds, 4.375%, 2/15/38 | | | 5,049,220 | |

| 16,000,000 | U.S. Treasury Bonds, 3.500%, 2/15/39 | | | 13,835,040 | |

| 5,000,000 | U.S. Treasury Inflation Indexed Note, 1.250%, 4/15/14 † | | | 5,058,013 | |

| 8,750,000 | U.S. Treasury Inflation Indexed Note, 2.500%, 7/15/16 † | | | 9,697,372 | |

| 3,000,000 | U.S. Treasury Inflation Indexed Note, 1.625%, 1/15/18 † | | | 3,023,759 | |

| 15,000,000 | U.S. Treasury Notes, 1.750%, 3/31/10 | | | 15,144,135 | |

| 45,000,000 | U.S. Treasury Notes, 1.250%, 11/30/10 | | | 45,332,100 | |

| 12,500,000 | U.S. Treasury Notes, 4.875%, 2/15/12 | | | 13,632,813 | |

| 23,000,000 | U.S. Treasury Notes, 3.875%, 2/15/13 | | | 24,518,368 | |

| 48,000,000 | U.S. Treasury Notes, 4.625%, 2/15/17 | | | 52,226,255 | |

| 14,400,000 | U.S. Treasury Notes, 3.500%, 2/15/18 | | | 14,470,877 | |

| 13,000,000 | U.S. Treasury Notes, 2.750%, 2/15/19 | | | 12,175,280 | |

| | | | | | |

| | TOTAL U.S. GOVERNMENT & AGENCY BONDS | | $ | 234,976,093 | |

| | | | | | |

| Par Value | CORPORATE BONDS — 3.8% | | Value | |

| $ 500,000 | Anheuser-Busch Companies, Inc., 6.000%, 4/15/11 | | $ | 524,363 | |

| 1,000,000 | Caterpillar, Inc., 7.900%, 12/15/18 | | | 1,153,341 | |

| 1,000,000 | Caterpillar, Inc., 8.250%, 12/15/38 | | | 1,239,064 | |

| 2,500,000 | Citigroup, Inc., 2.875%, 12/9/11 | | | 2,571,725 | |

| 1,500,000 | E.I. Du Pont De Nemours, 5.750%, 3/15/19 | | | 1,583,040 | |

| 2,000,000 | General Electric Capital Corporation, 6.875%, 1/10/39 | | | 1,800,226 | |

| 785,000 | McDonald’s Corporation, 5.700%, 2/1/39 | | | 777,203 | |

| 3,700,000 | Microsoft Corporation, 5.200%, 6/1/39 | | | 3,601,169 | |

| 5,000,000 | U.S. Bancorp, 2.250%, 3/13/12 | | | 5,044,034 | |

| 2,000,000 | Walmart Stores, 5.250%, 9/1/35 | | | 1,906,968 | |

| | | | | | |

| | TOTAL CORPORATE BONDS | | $ | 20,201,133 | |

JAMES BALANCED: GOLDEN RAINBOW FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Par Value | MUNICIPAL BONDS** — 3.5% | | Value | |

| $ 1,000,000 | Adams Co CO SD No 014 Ser 2006 UTGO, 5.000%, 12/1/26 | | $ | 1,026,130 | |

| 1,000,000 | Citrus CA Community College Ser 2007B UTGO, 4.750%, 6/1/31 | | | 935,300 | |

| 1,000,000 | East Baton Rouge LA Swr Community Rev, 5.125%, 2/1/29 | | | 1,015,460 | |

| 1,000,000 | FL St Brd Ed Cap Outlay 2007 Ser D UTGO, 5.000%, 6/1/38 | | | 990,890 | |

| 1,000,000 | Friendswood TX ISD Ser 2008 UTGO (Schoolhouse), 5.000%, 2/15/37 | | | 1,004,120 | |

| 3,000,000 | GA St Ser B UTGO, 4.500%, 1/1/29 | | | 3,020,760 | |

| 1,000,000 | Judson TX ISD Ser 2008 UTGO, 5.000%, 2/1/37 | | | 982,330 | |

| 500,000 | Kane & DeKalb Cntys IL Community Unit SD Bldg No 302 | | | | |

| | Ser 2008 UTGO, 5.500%, 2/1/28 | | | 520,400 | |

| 500,000 | Lamar TX Consolidated ISD Ser 2008 UTGO (Schoolhouse), 5.000%, 2/15/38 | | | 502,490 | |

| 1,000,000 | MA St Consolidated Loan Ser 2007C UTGO, 5.250%, 8/1/22 | | | 1,089,560 | |

| 1,000,000 | Marysville MI Pub SD Ser 2007 UTGO, 5.000%, 5/1/32 | | | 989,190 | |

| 125,000 | Mesa AZ IDA Rev Ser A (Discovery Health Systems), 5.625%, 1/1/29 | | | 129,544 | |

| 1,100,000 | Miamisburg OH CSD UTGO, 5.000%, 12/1/33 | | | 1,116,467 | |

| 500,000 | Mt Healthy OH CSD Sch Impt Ser 2008 UTGO, 5.000%, 12/1/26 | | | 515,215 | |

| 550,000 | OH St Higher Ed Cap Fac Ser 2000A UTGO, 5.250%, 2/1/13 | | | 565,444 | |

| 1,000,000 | OH St Univ Gen Rcpts Ser A, 5.000%, 12/1/28 | | | 1,029,490 | |

| 1,000,000 | OH St Ser A, 5.375%, 9/1/28 | | | 1,065,870 | |

| 500,000 | Springboro OH Community CSD Ser 2007 UTGO, 5.250%, 12/1/23 | | | 539,555 | |

| 1,000,000 | Tyler TX ISD UTGO, 5.000%, 2/15/34 | | | 994,330 | |

| 1,000,000 | Will and DuPage Cntys IL Ser 2007 UTGO (Bolingbrook), 5.000%, 1/1/37 | | | 975,190 | |

| | | | | | |

| | TOTAL MUNICIPAL BONDS | | $ | 19,007,735 | |

| | | | | | |

| Par Value | FOREIGN BONDS — 4.3% | | Value | |

| $ 5,000,000 | Australian Government, 5.250%, 3/15/19 | | $ | 3,946,452 | |

| 6,000,000 | Bundesrepublik Deutschland, 3.750%, 1/4/19 | | | 8,700,694 | |

| 6,000,000 | Netherlands Government, 4.000%, 7/15/19 | | | 8,556,156 | |

| 3,000,000 | New Zealand Government, 6.000%, 12/15/17 | | | 1,941,843 | |

| | | | | | |

| | TOTAL FOREIGN BONDS | | $ | 23,145,145 | |

| | | | | | |

| | TOTAL INVESTMENT SECURITIES — 96.3% | | | | |

| | (Cost $505,903,215) | | $ | 517,347,521 | |

| | | | | | |

| | OTHER ASSETS IN EXCESS OF LIABILITIES — 3.7% | | | 20,125,552 | |

| | | | | | |

| | NET ASSETS — 100.0% | | $ | 537,473,073 | |

* Non-income producing security.

** All municipal securities are rated A or higher (Unaudited).

† Represents original purchase par.

CSD – City School District

IDA – Industrial Development Authority

ISD – Independent School District

SD – School District

UTGO – Unlimited Tax General Obligation

| Foreign Bonds Securities Allocation | |

| | | % of total | |

| | | net assets | |

| Asia - Pacific | | | 1.1 | % |

| Europe- Euro | | | 3.2 | % |

| | | | 4.3 | % |

See accompanying notes to financial statements.

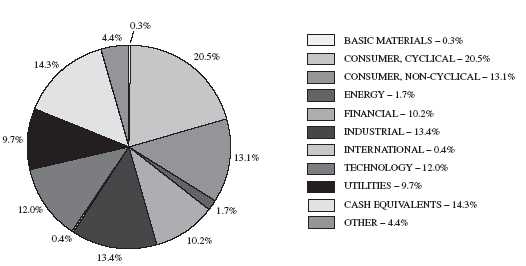

JAMES SMALL CAP FUND

SCHEDULE OF INVESTMENTS

| Shares | COMMON STOCKS — 81.3% | | Value | |

| | BASIC MATERIALS — 0.3% | | | |

| 12,420 | Terra Industries, Inc. | | $ | 300,812 | |

| | CONSUMER, CYCLICAL — 20.5% | | | | |

| 13,420 | Aeropostale, Inc.* | | | 459,903 | |

| 220,003 | Barry (R.G.) Corporation* | | | 1,430,020 | |

| 40,420 | Big Lots, Inc.* | | | 850,033 | |

| 59,820 | BJ’s Wholesale Club, Inc.* | | | 1,927,999 | |

| 16,560 | Bob Evans Farms, Inc. | | | 475,934 | |

| 124,160 | Central Garden & Pet Company* | | | 1,364,518 | |

| 50,048 | Dollar Tree, Inc.* | | | 2,107,021 | |

| 20,875 | DreamWorks Animation SKG, Inc. - Class A* | | | 575,941 | |

| 65,800 | JAKKS Pacific, Inc.* | | | 844,214 | |

| 64,240 | Netflix, Inc.* | | | 2,655,682 | |

| 28,560 | Polaris Industries, Inc. | | | 917,347 | |

| 25,220 | RadioShack Corporation | | | 352,071 | |

| 95,428 | The Buckle, Inc. | | | 3,031,749 | |

| 15,180 | The Children’s Place Retail Stores, Inc.* | | | 401,207 | |

| 62,800 | The Gymboree Corporation* | | | 2,228,144 | |

| 28,100 | The Warnaco Group, Inc.* | | | 910,440 | |

| | | | | 20,532,223 | |

| | CONSUMER, NON-CYCLICAL — 13.5% | | | | |

| 16,240 | AMERIGROUP Corporation* | | | 436,044 | |

| 18,560 | Biovail Corporation | | | 249,632 | |

| 10,300 | Compania Cervecerias Unidas S.A. ADR | | | 360,500 | |

| 221,320 | Del Monte Foods Company | | | 2,075,982 | |

| 76,800 | EZCORP, Inc. - Class A* | | | 827,904 | |

| 102,746 | Fresh Del Monte Produce, Inc.* | | | 1,670,650 | |

| 22,680 | LifePoint Hospitals, Inc.* | | | 595,350 | |

| 85,874 | Lincare Holdings, Inc.* | | | 2,019,756 | |

| 87,420 | Ruddick Corporation | | | 2,048,251 | |

| 119,980 | Tupperware Brands Corporation | | | 3,121,879 | |

| | | | | 13,405,948 | |

| | ENERGY — 1.7% | | | | |

| 28,800 | Magellan Midstream Partners, L.P. | | | 1,001,088 | |

| 13,100 | Sunoco Logistics Partners L.P. | | | 710,282 | |

| | | | | 1,711,370 | |

| | FINANCIAL — 10.2% | | | | |

| 71,880 | American Financial Group, Inc. | | | 1,551,170 | |

| 72,940 | American Physicians Capital, Inc. | | | 2,856,331 | |

| 74,710 | FPIC Insurance Group, Inc.* | | | 2,287,620 | |

| 95,060 | Knight Capital Group, Inc. - Class A* | | | 1,620,773 | |

| 75,880 | Rent-A-Center, Inc.* | | | 1,352,940 | |

| 29,480 | Unum Group* | | | 467,553 | |

| | | | | 10,136,387 | |

JAMES SMALL CAP FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares | COMMON STOCKS — 81.3% (Continued) | | Value | |

| | INDUSTRIAL — 13.4% | | | |

| 97,200 | Applied Industrial Technologies, Inc. | | $ | 1,914,840 | |

| 34,180 | Beacon Roofing Supply, Inc.* | | | 494,243 | |

| 133,000 | Chase Corporation | | | 1,582,700 | |

| 11,820 | Granite Construction, Inc. | | | 393,370 | |

| 32,300 | Greif, Inc. - Class A | | | 1,428,306 | |

| 29,550 | GulfMark Offshore, Inc.* | | | 815,580 | |

| 527,261 | North American Galvanizing & Coatings, Inc.* | | | 3,195,202 | |

| 7,740 | The Black & Decker Corporation | | | 221,828 | |

| 85,800 | Tsakos Energy Navigation Ltd. | | | 1,384,812 | |

| 76,340 | VSE Corporation | | | 1,997,054 | |

| | | | | 13,427,935 | |

| | TECHNOLOGY — 12.0% | | | | |

| 241,898 | CGI Group, Inc. - Class A* | | | 2,145,635 | |

| 144,440 | CIBER, Inc.* | | | 447,764 | |

| 34,440 | CSG Systems International, Inc.* | | | 455,986 | |

| 38,640 | EnerSys* | | | 702,862 | |

| 24,900 | Preformed Line Products Company | | | 1,097,094 | |

| 37,200 | Shanda Interactive Entertainment Ltd. ADR* | | | 1,945,188 | |

| 69,927 | Sybase, Inc.* | | | 2,191,512 | |

| 33,780 | Triumph Group, Inc. | | | 1,351,200 | |

| 64,236 | WESCO International, Inc.* | | | 1,608,469 | |

| | | | | 11,945,710 | |

| | UTILITIES — 9.7% | | | | |

| 96,871 | Atlantic Tele-Network, Inc. | | | 3,806,061 | |

| 78,780 | CenturyTel, Inc. | | | 2,418,546 | |

| 86,860 | El Paso Electric Company* | | | 1,212,566 | |

| 69,539 | WGL Holdings, Inc. | | | 2,226,639 | |

| | | | | 9,663,812 | |

| | | | | | |

| | TOTAL COMMON STOCKS | | $ | 81,124,197 | |

JAMES SMALL CAP FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares/Par | SHORT TERM INVESTMENTS — 14.3% | | Value | |

| 10,000 | First American Treasury Money Market Fund | | $ | 10,000 | |

| $ 3,000,000 | U.S. Treasury Notes, 6.000%, 8/15/09 | | | 3,021,327 | |

| 4,000,000 | U.S. Treasury Notes, 2.125%, 1/31/10 | | | 4,039,844 | |

| 7,000,000 | U.S. Treasury Notes, 4.000%, 4/15/10 | | | 7,194,411 | |

| | TOTAL SHORT TERM INVESTMENTS | | $ | 14,265,582 | |

| | | | | | |

| | TOTAL INVESTMENT SECURITIES — 95.6% | | | | |

| | (Cost $99,633,392) | | $ | 95,389,779 | |

| | | | | | |

| | OTHER ASSETS IN EXCESS OF LIABILITIES — 4.4% | | | 4,411,264 | |

| | | | | | |

| | NET ASSETS — 100.0% | | $ | 99,801,043 | |

* Non-income producing security.

ADR–American Depository Receipts.

See accompanying notes to financial statements.

JAMES MARKET NEUTRAL FUND

SCHEDULE OF INVESTMENTS

| Shares | COMMON STOCKS — 74.8% | | Value | |

| | BASIC MATERIALS — 5.1% | | | |

| 10,100 | FMC Corporation † | | $ | 477,730 | |

| 11,600 | Nucor Corporation † | | | 515,388 | |

| 6,980 | Terra Nitrogen Company, L.P. † | | | 703,444 | |

| | | | | 1,696,562 | |

| | CONSUMER, CYCLICAL — 14.7% | | | | |

| 22,440 | Bob Evans Farms, Inc. † | | | 644,926 | |

| 17,575 | Dollar Tree, Inc.* † | | | 739,908 | |

| 20,400 | McDonald’s Corporation † | | | 1,172,796 | |

| 17,750 | NIKE, Inc. - Class B † | | | 919,095 | |

| 27,060 | The Buckle, Inc. † | | | 859,696 | |

| 16,475 | The Gymboree Corporation* † | | | 584,533 | |

| | | | | 4,920,954 | |

| | CONSUMER, NON-CYCLICAL — 12.1% | | | | |

| 22,500 | Kroger Company † | | | 496,125 | |

| 25,070 | Merck & Company, Inc. † | | | 700,957 | |

| 12,525 | The Brink’s Company † | | | 363,601 | |

| 40,360 | Tupperware Brands Corporation † | | | 1,050,167 | |

| 13,700 | Watson Wyatt Worldwide, Inc. † | | | 514,161 | |

| 20,200 | Wyeth † | | | 916,878 | |

| | | | | 4,041,889 | |

| | ENERGY — 8.7% | | | | |

| 8,500 | Apache Corporation † | | | 613,275 | |

| 25,900 | Bolt Technology Corporation* † | | | 291,116 | |

| 18,330 | Devon Energy Corporation † | | | 998,985 | |

| 14,250 | Exxon Mobil Corporation † | | | 996,218 | |

| | | | | 2,899,594 | |

| | FINANCIAL — 4.1% | | | | |

| 69,400 | AmTrust Financial Services, Inc. † | | | 791,160 | |

| 19,570 | Assurant, Inc. † | | | 471,441 | |

| 8,800 | Hospitality Properties Trust † | | | 104,632 | |

| | | | | 1,367,233 | |

| | INDUSTRIAL — 9.8% | | | | |

| 25,900 | CSX Corporation † | | | 896,917 | |

| 18,600 | Greif, Inc. - Class A † | | | 822,492 | |

| 15,400 | GulfMark Offshore, Inc.* † | | | 425,040 | |

| 39,625 | Owens-Illinois, Inc.* † | | | 1,109,896 | |

| | | | | 3,254,345 | |

JAMES MARKET NEUTRAL FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares | COMMON STOCKS — 74.8% (Continued) | | Value | |

| | TECHNOLOGY — 7.9% | | | |

| 9,000 | Hewlett-Packard Company † | | $ | 347,850 | |

| 6,500 | International Business Machines Corporation (IBM) † | | | 678,730 | |

| 14,190 | Northrop Grumman Corporation † | | | 648,199 | |

| 18,600 | Symantec Corporation* | | | 289,416 | |

| 17,100 | Triumph Group, Inc. † | | | 684,000 | |

| | | | | 2,648,195 | |

| | UTILITIES — 12.4% | | | | |

| 28,275 | American Electric Power Company, Inc. † | | | 816,865 | |

| 29,925 | AT&T, Inc. † | | | 743,337 | |

| 35,930 | MDU Resources Group, Inc. † | | | 681,592 | |

| 16,605 | Sempra Energy † | | | 824,106 | |

| 31,800 | The Laclede Group, Inc. † | | | 1,053,534 | |

| | | | | 4,119,434 | |

| | | | | | |

| | TOTAL COMMON STOCKS | | $ | 24,948,206 | |

| | | | | | |

| | TOTAL INVESTMENT SECURITIES — 74.8% | | | | |

| | (Cost $26,266,892) | | $ | 24,948,206 | |

| | | | | | |

| | SEGREGATED CASH WITH BROKERS— 65.0% | | | 21,687,439 | |

| | | | | | |

| | SECURITIES SOLD SHORT — (70.1)% (Proceeds $27,453,395) | | | (23,383,232 | ) |

| | | | | | |

| | OTHER ASSETS IN EXCESS OF LIABILITIES— 30.3% | | | 10,092,416 | |

| | | | | | |

| | NET ASSETS — 100.0% | | $ | 33,344,829 | |

| * | Non-income producing security. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short aggregating a total market value of $23,781,027. |

See accompanying notes to financial statements.

JAMES MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT

| Shares | COMMON STOCKS — 69.8% | | Value | |

| | BASIC MATERIALS — 2.8% | | | |

| 21,675 | Aracruz Celulose S.A. ADR | | $ | 321,657 | |

| 14,575 | James River Coal Company | | | 220,520 | |

| 42,376 | MAG Silver Corporation | | | 192,811 | |

| 21,800 | Zoltek Companies, Inc. | | | 211,896 | |

| | | | | 946,884 | |

| | CONSUMER, CYCLICAL — 12.1% | | | | |

| 50,000 | AMR Corporation | | | 201,000 | |

| 13,075 | Cavco Industries, Inc. | | | 331,190 | |

| 37,550 | Centex Corporation | | | 317,673 | |

| 100,175 | Champion Enterprises, Inc. | | | 32,056 | |

| 26,925 | Gaylord Entertainment Company | | | 342,217 | |

| 36,300 | GSI Commerce, Inc. | | | 517,275 | |

| 17,400 | Lamar Advertising Company | | | 265,698 | |

| 33,090 | Las Vegas Sands Corporation | | | 260,087 | |

| 14,875 | MercadoLibre, Inc. | | | 399,840 | |

| 68,650 | Morgans Hotel Group | | | 262,929 | |

| 39,090 | Pulte Homes, Inc. | | | 345,165 | |

| 24,900 | The Ryland Group, Inc. | | | 418,320 | |

| 86,075 | Wendy’s/Arby’s Group, Inc. | | | 344,300 | |

| | | | | 4,037,750 | |

| | CONSUMER, NON-CYCLICAL — 8.7% | | | | |

| 6,680 | AMAG Pharmaceuticals, Inc. | | | 365,196 | |

| 12,175 | Cepheid, Inc. | | | 114,688 | |

| 7,150 | Clinical Data, Inc. | | | 78,793 | |

| 21,200 | comScore, Inc. | | | 282,384 | |

| 37,500 | Elan Corporation plc ADR | | | 238,875 | |

| 28,225 | Eurand NV | | | 366,925 | |

| 26,025 | Hansen Medical, Inc. | | | 128,563 | |

| 22,258 | Insulet Corporation | | | 171,387 | |

| 36,228 | MDS, Inc. | | | 193,458 | |

| 64,870 | Nektar Therapeutics | | | 420,358 | |

| 28,900 | Rigel Pharmaceuticals, Inc. | | | 350,268 | |

| 54,690 | Senomyx, Inc. | | | 115,396 | |

| 15,600 | The Great Atlantic & Pacific Tea Company, Inc. | | | 66,299 | |

| | | | | 2,892,590 | |

| | ENERGY — 1.6% | | | | |

| 25,178 | BPZ Resources, Inc. | | | 123,120 | |

| 38,950 | Clean Energy Fuels Corporation | | | 335,359 | |

| 37,000 | Delta Petroleum Corporation | | | 71,411 | |

| | | | | 529,890 | |

JAMES MARKET NEUTRAL FUND

| SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

| Shares | COMMON STOCKS — 69.8% (Continued) | | Value | |

| | FINANCIAL — 12.1% | | | |

| 34,125 | Boston Private Financial Holdings, Inc. | | $ | 152,880 | |

| 75,000 | CIT Group, Inc. | | | 161,250 | |

| 24,725 | East West Bancorp, Inc. | | | 160,465 | |

| 32,769 | First Horizon National Corporation | | | 393,228 | |

| 8,070 | Forest City Enterprises, Inc. - Class A | | | 53,262 | |

| 13,250 | KBW, Inc. | | | 381,070 | |

| 30,000 | KeyCorp | | | 157,200 | |

| 42,050 | Kingsway Financial Services, Inc. | | | 121,104 | |

| 22,025 | Legg Mason, Inc. | | | 536,969 | |

| 40,975 | MBIA, Inc. | | | 177,422 | |

| 17,500 | PrivateBancorp, Inc. | | | 389,200 | |

| 19,775 | Stewart Information Services Corporation | | | 281,794 | |

| 23,960 | TFS Financial Corporation | | | 254,455 | |

| 14,475 | The St. Joe Company | | | 383,443 | |

| 16,675 | UBS AG ADR | | | 203,602 | |

| 20,000 | Zions Bancorporation | | | 231,200 | |

| | | | | 4,038,544 | |

| | INDUSTRIAL — 4.8% | | | | |

| 14,145 | American Superconductor Corporation | | | 371,306 | |

| 8,600 | Chicago Bridge & Iron Company N.V. ADR | | | 106,640 | |

| 42,325 | Golar LNG Ltd. | | | 361,879 | |

| 35,000 | L-1 Identity Solutions, Inc. | | | 270,900 | |

| 8,350 | Metabolix, Inc. | | | 68,637 | |

| 39,800 | Modine Manufacturing Company | | | 191,040 | |

| 50,925 | Taser International, Inc. | | | 232,218 | |

| | | | | 1,602,620 | |

| | TECHNOLOGY — 25.3% | | | | |

| 47,335 | 3D Systems Corporation | | | 341,285 | |

| 10,200 | Acorda Therapeutics, Inc. | | | 287,538 | |

| 14,185 | Affymax, Inc. | | | 261,430 | |

| 72,550 | Affymetrix, Inc. | | | 430,221 | |

| 28,625 | Amylin Pharmaceuticals, Inc. | | | 386,437 | |

| 109,750 | Arena Pharmaceuticals, Inc. | | | 547,652 | |

| 23,125 | BioMarin Pharmaceutical, Inc. | | | 360,981 | |

| 27,600 | Cavium Networks, Inc. | | | 463,956 | |

| 46,600 | Clearwire Corporation - Class A | | | 257,698 | |

| 8,150 | Cougar Biotechnology, Inc. | | | 350,124 | |

| 12,000 | Crown Castle International Corporation | | | 288,240 | |

| 44,025 | Cypress Bioscience, Inc. | | | 414,715 | |

| 40,000 | Cypress Semiconductor Corporation | | | 368,000 | |

| 16,500 | Electronic Arts, Inc. | | | 358,380 | |

| 78,890 | Micron Technology, Inc. | | | 399,183 | |

| 37,125 | Palm, Inc. | | | 615,161 | |

| 19,320 | Rambus, Inc. | | | 299,267 | |

JAMES MARKET NEUTRAL FUND

| SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

| Shares | COMMON STOCKS — 69.8% (Continued) | | Value | |

| | TECHNOLOGY — 25.3% (Continued) | | | |

| 13,800 | SanDisk Corporation | | $ | 202,723 | |

| 26,900 | SBA Communications Corporation | | | 660,126 | |

| 22,525 | Sequenom, Inc. | | | 88,074 | |

| 17,800 | The Ultimate Software Group, Inc. | | | 431,472 | |

| 20,150 | Vocus, Inc. | | | 398,164 | |

| 9,550 | XenoPort, Inc. | | | 221,274 | |

| | | | | 8,432,101 | |

| | UTILITIES — 2.4% | | | | |

| 21,205 | Cbeyond, Inc. | | | 304,292 | |

| 23,505 | EnerNOC, Inc. | | | 509,353 | |

| | | | | 813,645 | |

| | | | | | |

| | TOTAL COMMON STOCKS SOLD SHORT | | $ | 23,294,024 | |

| | | | | | |

| Shares | INTERNATIONAL EQUITY EXCHANGE TRADED FUNDS — 0.3% | | Value | |

| 4,200 | Powershares Golden Dragon Halter USX China Portfolio | | $ | 89,208 | |

| | | | | | |

| | TOTAL SECURITIES SOLD SHORT — 70.1% (Proceeds $27,453,395) | | $ | 23,383,232 | |

ADR – American Depository Receipts.

PLC – Public Liability Company.

See accompanying notes to financial statements.

JAMES EQUITY FUND

SCHEDULE OF INVESTMENTS

| Shares | COMMON STOCKS — 81.2% | | Value | |

| | BASIC MATERIALS — 4.3% | | | |

| 5,840 | FMC Corporation | | $ | 276,232 | |

| 5,320 | IAMGOLD Corporation | | | 53,838 | |

| 7,380 | Kinross Gold Corporation | | | 133,947 | |

| | | | | 464,017 | |

| | CONSUMER, CYCLICAL — 19.2% | | | | |

| 9,500 | Big Lots, Inc.* | | | 199,785 | |

| 3,500 | BJ’s Wholesale Club, Inc.* | | | 112,805 | |

| 7,440 | Bob Evans Farms, Inc. | | | 213,826 | |

| 20,820 | Central Garden & Pet Company* | | | 228,812 | |

| 5,840 | Dollar Tree, Inc.* | | | 245,864 | |

| 6,760 | Family Dollar Stores, Inc. | | | 191,308 | |

| 7,180 | JAKKS Pacific, Inc.* | | | 92,119 | |

| 5,260 | McDonald’s Corporation | | | 302,397 | |

| 2,420 | Netflix, Inc.* | | | 100,043 | |

| 3,954 | The Buckle, Inc. | | | 125,619 | |

| 8,160 | The Gymboree Corporation* | | | 289,517 | |

| | | | | 2,102,095 | |

| | CONSUMER, NON-CYCLICAL — 11.6% | | | | |

| 1,700 | Archer-Daniels-Midland Company | | | 45,509 | |

| 3,280 | Biovail Corporation | | | 44,116 | |

| 9,500 | ConAgra Foods, Inc. | | | 181,070 | |

| 16,920 | Del Monte Foods Company | | | 158,710 | |

| 1,840 | EZCORP, Inc. - Class A* | | | 19,835 | |

| 3,916 | Kroger Company | | | 86,348 | |

| 3,140 | LifePoint Hospitals, Inc.* | | | 82,425 | |

| 5,220 | Merck & Company, Inc. | | | 145,951 | |

| 9,560 | Pfizer, Inc. | | | 143,400 | |

| 19,820 | Sara Lee Corporation | | | 193,443 | |

| 2,380 | Tupperware Brands Corporation | | | 61,928 | |

| 2,680 | Watson Wyatt Worldwide, Inc. - Class A | | | 100,580 | |

| | | | | 1,263,315 | |

| | ENERGY — 5.4% | | | | |

| 1,410 | Apache Corporation | | | 101,732 | |

| 2,280 | Chevron Corporation | | | 151,050 | |

| 1,580 | Devon Energy Corporation | | | 86,110 | |

| 2,900 | Exxon Mobil Corporation | | | 202,738 | |

| 940 | Sunoco Logistics Partners L.P. | | | 50,967 | |

| | | | | 592,597 | |

JAMES EQUITY FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares | COMMON STOCKS — 81.2% (Continued) | | Value | |

| | FINANCIAL — 10.4% | | | |

| 10,665 | American Financial Group, Inc. | | $ | 230,151 | |

| 6,040 | American Physicians Capital, Inc. | | | 236,526 | |

| 6,700 | Amerisafe, Inc.* | | | 104,252 | |

| 3,640 | Knight Capital Group, Inc. - Class A* | | | 62,062 | |

| 6,240 | Mercer Insurance Group, Inc. | | | 99,216 | |

| 11,160 | Rent-A-Center, Inc.* | | | 198,983 | |

| 12,620 | Unum Group* | | | 200,153 | |

| | | | | 1,131,343 | |

| | INDUSTRIAL — 4.9% | | | | |

| 1,460 | Cooper Industries, Ltd - Class A | | | 45,333 | |

| 3,100 | CSX Corporation | | | 107,353 | |

| 4,580 | Granite Construction, Inc. | | | 152,422 | |

| 3,760 | Greif, Inc. - Class A | | | 166,268 | |

| 1,040 | GulfMark Offshore, Inc.* | | | 28,704 | |

| 1,320 | The Black & Decker Corporation | | | 37,831 | |

| | | | | 537,911 | |

| | TECHNOLOGY — 13.6% | | | | |

| 1,020 | Affiliated Computer Services, Inc. - Class A* | | | 45,308 | |

| 4,400 | Computer Sciences Corporation* | | | 194,920 | |

| 800 | General Dynamics Corporation | | | 44,312 | |

| 2,800 | Goodrich Corporation | | | 139,916 | |

| 6,680 | Hewlett-Packard Company | | | 258,182 | |

| 2,990 | International Business Machines Corporation (IBM) | | | 312,216 | |

| 4,340 | Northrop Grumman Corporation | | | 198,251 | |

| 14,360 | Symantec Corporation* | | | 223,442 | |

| 1,400 | SYNNEX Corporation* | | | 34,986 | |

| 920 | Triumph Group, Inc. | | | 36,800 | |

| | | | | 1,488,333 | |

| | UTILITIES — 11.8% | | | | |

| 8,820 | Alliant Energy Corporation | | | 230,467 | |

| 5,040 | American Electric Power Company, Inc. | | | 145,606 | |

| 9,700 | AT&T, Inc. | | | 240,947 | |

| 7,480 | CenturyTel, Inc. | | | 229,636 | |

| 5,940 | DTE Energy Company | | | 190,080 | |

| 1,580 | Edison International | | | 49,707 | |

| 2,600 | Embarq Corporation | | | 109,356 | |

| 1,800 | Sempra Energy | | | 89,334 | |

| | | | | 1,285,133 | |

| | | | | | |

| | TOTAL COMMON STOCKS | | $ | 8,864,744 | |

JAMES EQUITY FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares | PREFERRED STOCKS — 2.0% | | Value | |

| | FINANCIAL — 0.8% | | | |

| 4,000 | General Electric Capital Corporation, 6.00%, 4/24/47 (4/24/12)** | | $ | 86,920 | |

| | | | | | |

| | UTILITIES — 1.2% | | | | |

| 5,000 | AT&T, Inc., 6.375%, 2/15/56 (2/15/12)** | | | 127,450 | |

| | | | | | |

| | TOTAL PREFERRED STOCKS | | $ | 214,370 | |

| | | | | | |

| Shares/Par | SHORT TERM INVESTMENTS — 14.8% | | Value | |

| 188,722 | First American Treasury Money Market Fund | | $ | 188,722 | |

| $400,000 | U.S. Treasury Notes, 2.125%, 1/31/10 | | | 403,984 | |

| 300,000 | U.S. Treasury Notes, 6.000%, 8/15/09 | | | 302,133 | |

| 700,000 | U.S. Treasury Notes, 4.000%, 4/15/10 | | | 719,441 | |

| | | | | | |

| | TOTAL SHORT TERM INVESTMENTS | | $ | 1,614,280 | |

| | | | | | |

| | TOTAL INVESTMENT SECURITIES — 98.0% | | | | |

| | (Cost $10,873,554) | | $ | 10,693,394 | |

| | | | | | |

| | OTHER ASSETS IN EXCESS OF LIABILITIES — 2.0% | | | 216,255 | |

| | | | | | |

| | NET ASSETS — 100.0% | | $ | 10,909,649 | |

| * | Non-income producing security. |

| ** | Date in parenthesis represents call date. |

See accompanying notes to financial statements.

JAMES MID CAP FUND

SCHEDULE OF INVESTMENTS

| Shares | COMMON STOCKS — 93.2% | | Value | |

| | BASIC MATERIALS — 9.3% | | | |

| 2,500 | FMC Corporation | | $ | 118,250 | |

| 12,500 | IAMGOLD Corporation | | | 126,500 | |

| 3,000 | Kinross Gold Corporation | | | 54,450 | |

| 14,000 | Silver Wheaton Corporation* | | | 115,360 | |

| | | | | 414,560 | |

| | CONSUMER, CYCLICAL — 11.1% | | | | |

| 4,000 | BJ’s Wholesale Club, Inc.* | | | 128,920 | |

| 4,000 | Darden Restaurants, Inc. | | | 131,920 | |

| 5,500 | Dollar Tree, Inc.* | | | 231,550 | |

| | | | | 492,390 | |

| | CONSUMER, NON-CYCLICAL — 19.5% | | | | |

| 5,000 | ConAgra Foods, Inc. | | | 95,300 | |

| 10,000 | Del Monte Foods Company | | | 93,800 | |

| 3,000 | Life Technologies Corporation* | | | 125,160 | |

| 4,000 | LifePoint Hospitals, Inc.* | | | 105,000 | |

| 12,500 | Sara Lee Corporation | | | 122,000 | |

| 6,500 | Tupperware Brands Corporation | | | 169,130 | |

| 4,000 | Watson Wyatt Worldwide, Inc. - Class A | | | 150,120 | |

| | | | | 860,510 | |

| | ENERGY — 7.7% | | | | |

| 10,000 | Frontier Oil Corporation | | | 131,100 | |

| 1,600 | Questar Corporation | | | 49,776 | |

| 3,000 | Sunoco Logistics Partners L.P. | | | 162,660 | |

| | | | | 343,536 | |

| | FINANCIAL — 11.1% | | | | |

| 5,000 | American Financial Group, Inc. | | | 107,900 | |

| 8,200 | Apartment Investment & Management Company - Class A | | | 72,570 | |

| 3,000 | Assurant, Inc. | | | 72,270 | |

| 10,000 | Knight Capital Group, Inc. - Class A* | | | 170,500 | |

| 4,000 | Rent-A-Center, Inc.* | | | 71,320 | |

| | | | | 494,560 | |

| | INDUSTRIAL — 12.0% | | | | |

| 2,500 | AGCO Corporation* | | | 72,675 | |

| 3,500 | Gardner Denver, Inc.* | | | 88,095 | |

| 7,500 | GrafTech International Ltd.* | | | 84,825 | |

| 2,500 | Granite Construction, Inc. | | | 83,200 | |

| 3,000 | Greif, Inc. - Class A | | | 132,660 | |

| 4,000 | The Timken Company | | | 68,320 | |

| | | | | 529,775 | |

JAMES MID CAP FUND

| SCHEDULE OF INVESTMENTS (Continued) |

| Shares | COMMON STOCKS — 93.2% (Continued) | | Value | |

| | TECHNOLOGY — 11.9% | | | |

| 2,000 | Affiliated Computer Services, Inc. - Class A* | | $ | 88,840 | |

| 2,500 | Computer Sciences Corporation* | | | 110,750 | |

| 1,000 | Goodrich Corporation | | | 49,970 | |

| 15,000 | Qwest Communications International, Inc. | | | 62,250 | |

| 3,000 | Teledyne Technologies, Inc.* | | | 98,250 | |

| 4,500 | Western Digital Corporation* | | | 119,250 | |

| | | | | 529,310 | |

| | UTILITIES — 10.6% | | | | |

| 4,000 | CenturyTel, Inc. | | | 122,800 | |

| 3,000 | DTE Energy Company | | | 96,000 | |

| 3,500 | Energen Corporation | | | 139,650 | |

| 6,000 | MDU Resources Group, Inc. | | | 113,820 | |

| | | | | 472,270 | |

| | | | | | |

| | TOTAL COMMON STOCKS | | $ | 4,136,911 | |

| | | | | | |

| Shares | SHORT TERM INVESTMENTS — 0.5% | | Value | |

| 22,166 | First American Treasury Money Market Fund | | $ | 22,166 | |

| | | | | | |

| | TOTAL INVESTMENT SECURITIES — 93.7% | | | | |

| | (Cost $4,698,008) | | $ | 4,159,077 | |

| | | | | | |

| | OTHER ASSETS IN EXCESS OF LIABILITIES — 6.3% | | | 279,217 | |

| | | | | | |

| | NET ASSETS — 100.0% | | $ | 4,438,294 | |

| * | Non-income producing security. |

See accompanying notes to financial statements.

JAMES ADVANTAGE FUNDS

NOTES TO FINANCIAL STATEMENTS

1. General Information and Significant Accounting Policies

James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Market Neutral Fund and James Mid Cap Fund are each a diversified series of James Advantage Funds (the “Trust”), and James Equity Fund is a non-diversified series of the Trust (individually a “Fund,” collectively the “Funds”). The Trust is an open-end management investment company that was organized as an Ohio business trust on August 29, 1997. The Trust is registered under the Investment Company Act of 1940 (the “1940 Act”). James Balanced: Golden Rainbow Fund was originally organized as a series of the Flagship Admiral Funds Inc., a Maryland corporation. On June 26, 1998, pursuant to an Agreement and Plan of Reorganization, James Balanced: Golden Rainbow Fund was restructured through a tax-free reorganization as a series of the Trust. The James Small Cap Fund and James Market Neutral Fund each commenced its public offering of shares on October 2, 1998. The James Equity Fund commenced its public offering of shares on November 1, 1999. The James Mid Cap Fund commenced its public offering of shares on June 30, 2006. Effective March 2, 2009, James Balanced: Golden Rainbow began offering a new class of shares: the Institutional Class. The initial class of shares is now referred to as Retail Class. Each class represents an interest in the same portfolio of investments and has the same rights, but differs primarily in distribution fees and shareholder features. The Retail Class shares are subject to distribution (12b-1) fees but have a lower minimum investment requirement and offer certain shareholder services not available to Institutional Class shareholders. Institutional Class shares are not subject to 12b-1 fees and are available only through investment advisers and bank trust departments that have made arrangements for shares of all of their clients investing in the Fund to be held in an omnibus account (as well as other entities that are approved by management of the Trust).

James Balanced: Golden Rainbow Fund seeks to provide total return through a combination of growth and income and preservation of capital in declining markets. The Fund seeks to achieve its objective by investing primarily in common stocks and/or debt securities that the Fund’s adviser, James Investment Research, Inc. (“James”), believes are undervalued.

James Small Cap Fund seeks to provide long-term capital appreciation. The Fund seeks to achieve its objective by investing primarily in common stocks of small capitalization companies.

James Market Neutral Fund seeks to provide positive returns regardless of the direction of the stock markets. The Fund seeks to achieve its objective by investing in common stocks that James believes are undervalued and more likely to appreciate, and selling short common stocks that James believes are overvalued and more likely to depreciate.

James Equity Fund seeks to provide long-term capital appreciation and outperform the Standard & Poor’s 500 Index (the “S&P 500 Index”). The Fund seeks to achieve its objective by investing primarily in equity securities without regard to the market capitalization of the stock. The Fund often buys stocks in the S&P 500 Index.

James Mid Cap Fund seeks to provide long-term capital appreciation. The Fund seeks to achieve its objective by investing primarily in common stocks of mid capitalization companies.

The following is a summary of significant accounting policies followed by the Funds in preparation of their financial statements, in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

JAMES ADVANTAGE FUNDS

| NOTES TO FINANCIAL STATEMENTS (Continued) |

Share Valuation

The net asset value per share of each Fund, other than the James Balanced: Golden Rainbow Fund, is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The net asset value per share of each class of shares of the James Balanced: Golden Rainbow Fund is calculated daily by dividing the total value of the Fund’s assets attributable to that class, less liabilities attributable to that class, by the number of outstanding shares of that class.

Securities Valuation

The Funds' portfolio securities are valued as of the close of the New York Stock Exchange (“NYSE”) (generally, 4:00 p.m., Eastern time) on each day that the NYSE is open for business, and on any other day on which there is sufficient trading in a Fund’s securities to materially affect the net asset value. Securities that are traded on any exchange are valued at the last quoted sale price. Lacking a last sale price, a security is valued at its last bid price except when, in James’s opinion, the last bid price does not accurately reflect the current value of the security. Securities that are traded on the NASDAQ over-the-counter market are valued at their NASDAQ Official Closing Price (“NOCP”) for all NASDAQ National Market (“NNM”) and NASDAQ Capital Market® securities. When market quotations are not readily available, if an event occurs after the close of the trading market (but before the time as of which a Fund calculates its net asset value) that materially affects a security’s value, when James determines that the market quotation does not accurately reflect the current value or when a restricted security is being valued, that security will be valued at its fair value as determined in good faith in conformity with guidelines adopted by and subject to review of the Board of Trustees. The Funds may use pricing services to determine market value for securities. Debt securities are valued on the basis of valuations provided by dealers or by an independent pricing service that determines valuations based upon market transactions for normal, institutional-size trading units of similar securities. Short-term investments in fixed-income securities with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued by using the amortized cost method of valuation, which the Board has determined will approximate fair value.

For valuation purposes, quotations of foreign securities in a foreign currency are converted to U.S. dollar equivalents at the time of pricing the Funds. In computing the net asset value of the Funds, the values of foreign portfolio securities are generally based upon market quotations which, depending upon the exchange or market, may be last sale price, last bid price, or the average of the last bid and asked prices as of, in each case, the close of the appropriate exchange or another designated time.

The calculation of the share price of the Funds holding foreign securities in its portfolio does not take place contemporaneously with the determination of the values of many of the foreign portfolio securities used in such calculation. Events affecting the values of foreign portfolio securities that occur between the time their prices are determined and the calculation of the Fund’s share price will not be reflected in the calculation unless the Adviser determines, subject to review by the Board of Trustees, that the particular event would materially affect net asset value, in which case an adjustment will be made.

JAMES ADVANTAGE FUNDS

| NOTES TO FINANCIAL STATEMENTS (Continued) |