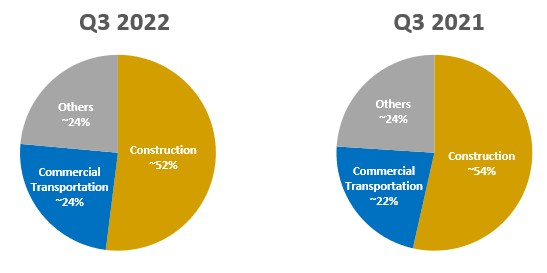

Through our unreserved auctions, online marketplaces, listings, and private brokerage services, we sell a broad range of primarily used commercial and industrial assets as well as government surplus. Construction and commercial transportation assets comprise the majority of the equipment sold by GTV dollar value. Customers selling equipment through our sales channels include end users (such as construction companies), equipment dealers, original equipment manufacturers (“OEMs”) and other equipment owners (such as rental companies). Our customers participate in a variety of sectors, including construction, commercial transportation, agriculture, energy, and natural resources.

We also provide our customers with a wide array of value added services aligned with our growth strategy to create a global marketplace for used equipment services and solutions. Our other services include access to equipment financing, asset appraisals and inspections, online equipment listing, logistical services, and ancillary services such as equipment refurbishment. We offer our customers asset technology solutions to manage the end to end disposition process of their assets and provide market data intelligence to make more accurate and reliable business decisions. Additionally, we offer our customers an innovative technology platform that supports equipment lifecycle management and parts procurement integration with both original equipment manufacturers and dealers, as well as software as a service platform for end-to-end parts procurement and digital catalogs and diagrams.

We operate globally with locations in 12 countries, including the United States, Canada, the Netherlands, Australia, and the United Arab Emirates, and maintain a presence in 48 countries where customers are able to sell from their own yards. In addition, we employ more than 2,700 full-time employees worldwide.

Proposed Acquisition of IAA

On November 7, 2022, we entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with IAA, Ritchie Bros. Holdings Inc., a Washington corporation and a direct and indirect wholly owned subsidiary of the Company (“US Holdings”), Impala Merger Sub I, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings (“Merger Sub 1”), and Impala Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings (“Merger Sub 2”), providing for our acquisition of IAA for total consideration as of the date hereof of approximately $7.3 billion, including the assumption of approximately $1.0 billion of net debt. Upon completion of the acquisition, our stockholders will own approximately 59% of the common shares of the combined company on a fully diluted basis and IAA’s stockholders will own approximately 41%. During the three months and nine months ended September 30, 2022, we incurred a total of $0.9 million and $1.4 million, respectively, in acquisition-related costs related to the proposed acquisition, recognized in selling, general and administrative expenses. If completed, the acquisition of IAA will have a significant impact on our results of operations, financial condition and liquidity. For additional information regarding the proposed acquisition with IAA, see Note 24 to our condensed consolidated financial statements included in Part I – Item I of this report. Unless otherwise specifically noted, the following discussion and analysis of our results of operations and liquidity and capital resources focuses on our existing operations exclusive of the impact of the proposed acquisition of IAA, and any forward-looking statements contained herein do not take into account the impact of such proposed acquisition.

In connection with the proposed Mergers, on November 7, 2022, we entered into (A) a commitment letter (the “Commitment Letter”) with Goldman Sachs Bank USA (acting through such of its affiliates or branches as it deems appropriate, “GS Bank”), Bank of America, N.A. (“BANA”), BofA Securities, Inc. (or any of its designated affiliates, “BofA Securities”, and, together with BANA, “BofA”), Royal Bank of Canada (“Royal Bank”), RBC Capital Markets, LLC (“RBCCM”, and, together with Royal Bank through such of its affiliates and branches as it deems appropriate, “RBC”, and, together with GS Bank and BofA, each, an “Initial Lender”, and collectively, the “Initial Lenders”), pursuant to which the Initial Lenders are committing to provide (i) a backstop senior secured revolving credit facility in an aggregate principal amount of up to $750 million (the “Backstop Revolving Facility”) and (ii) a senior secured 364-day bridge loan facility in an aggregate principal amount of up to $2.8 billion (the “Bridge Loan Facility,” and together with the Backstop Revolving Facility, the “Facilities”) and (B) an engagement letter (the “Engagement Letter”) with Goldman, Sachs & Co. (acting through such of its affiliates or branches as it deems appropriate), BofA Securities and RBCCM (collectively, the “Investment Banks”), pursuant to which the Investment Banks agree, subject to the terms and conditions set forth in the Engagement Letter, to serve as lead arrangers and bookrunners in connection with an amendment to our existing credit facility, a Term Loan A facility, a Term Loan B facility and/or any other loan facilities, credit facilities, commercial bank financings or other bank or institutional facilities, and as lead placement agents for, or lead underwriters or initial purchasers of, any senior secured or unsecured