UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-13425

RB Global, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Canada | | 98-0626225 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| Two Westbrook Corporate Center, Suite 500, | | |

| Westchester, Illinois, USA 60154 | | (708) 492-7000 |

| (Address of Principal Executive Offices and Zip Code) | | (Registrant’s Telephone Number, including Area Code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Exchange on Which Registered |

| Common Shares | | RBA | | New York Stock Exchange |

| Common Share Purchase Rights | | N/A | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: Restricted Share Units

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

| | | | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

At June 30, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s common shares held by non-affiliates of the registrant (assuming for these purposes, but without conceding, that all executive officers and directors are "affiliates" of the registrant) was approximately $14,038,147,940. The number of common shares of the registrant outstanding as of January 31, 2025, was 184,748,861.

Documents Incorporated by Reference

Certain portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission (“SEC”) pursuant to Regulation 14A not later than 120 days after the registrant’s fiscal year ended December 31, 2024, in connection with the registrant’s 2025 Annual and Special Meeting of Shareholders, are incorporated herein by reference into Part III of this Annual Report on Form 10-K.

RB GLOBAL, INC.

FORM 10-K

For the year ended December 31, 2024

INDEX

Cautionary Note Regarding Forward-Looking Statements

The information discussed in this Annual Report on Form 10-K of RB Global, Inc. (referred to herein as “RB Global”, the “Company”, “we”, or “us”) includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) and Canadian securities laws. Forward-looking statements are typically identified by such words as “aim”, “anticipate”, “believe”, “could”, “continue”, “estimate”, “expect”, “intend”, “may”, “ongoing”, “plan”, “potential”, “predict”, “will”, “should”, “would”, “could”, “likely”, “generally”, “future”, “long-term”, or the negative of these terms, and similar expressions intended to identify forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. These statements are based on our current expectations and estimates about our business and markets, and may include, among others, statements relating to:

•our future strategy, objectives, targets, projections and performance;

•our ability to drive shareholder value;

•potential growth and market opportunities;

•the level of participation in our auctions and the success of our online marketplaces;

•our ability to grow our businesses, acquire new customers, enhance our sector reach, drive geographic depth, and scale our operations;

•the impact of our initiatives, services, investments, and acquisitions on us and our customers;

•the acquisition or disposition of properties;

•potential future mergers and acquisitions;

•our ability to integrate acquisitions;

•our future capital expenditures and returns on those expenditures;

•our ability to add new business and information solutions, including, among others, our ability to maximize and integrate technology to enhance our existing services and support additional value-added service offerings;

•the supply trend of equipment and vehicles in the market and the anticipated price environment, as well as the resulting effect on our business and Gross Transaction Value (“GTV”);

•our compliance with laws, rules, regulations, and requirements that affect our business;

•effects of various economic, financial, industry, and market conditions or policies, including inflation, the supply and demand for property, equipment, or natural resources;

•the behavior of commercial assets and vehicle pricing;

•the relative percentage of GTV represented by straight commission or underwritten (guarantee and inventory) contracts, and its impact on revenues and profitability;

•our future capital expenditures and returns on those expenditures;

•the effect of any currency exchange and interest rate fluctuations on our results of operations;

•the effect of any tariffs on our results of operations;

•the grant and satisfaction of equity awards pursuant to our compensation plans;

•any future declaration and payment of dividends, including the tax treatment of any such dividends;

•financing available to us from our credit facilities or other sources, our ability to refinance borrowings, and the sufficiency of our working capital to meet our financial needs; and

•our ability to satisfy our present operating requirements and fund future growth through existing working capital, credit facilities and debt.

While we have not described all potential risks related to our business and owning our common shares, the factors discussed in “Part I, Item 1A: Risk Factors” of this Annual Report on Form 10-K for the year ended December 31, 2024 are among those that may affect our performance materially or could cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements. Except as required by applicable securities law and regulations of relevant securities exchanges, we do not intend to update publicly any forward-looking statements, even if our expectations have been affected by new information, future events or other developments. You should consider our forward-looking statements in light of the factors listed or referenced under “Risk Factors” herein.

SUMMARY OF RISK FACTORS

The following is a summary of the principal risks described below in “Part I, Item 1A: Risk Factors” in this Annual Report on Form 10-K. We believe that the risks described in the “Risk Factors” section are material to investors, but other factors not presently known to us or that we currently believe are immaterial may also adversely affect us. The following summary should not be considered an exhaustive summary of the material risks facing us, and it should be read in conjunction with the “Risk Factors” section and the other information contained in this Annual Report on Form 10-K:

Risks Related to Our Business

•Our business and operating results would be adversely affected due to the loss of one or more significant suppliers, a reduction in significant volume from suppliers, an adverse change in our supplier relationships, or a disruption to our supply of damaged, total loss and low-value vehicles.

•Our business and operating results would be adversely affected if we are unable to meet or exceed our buyer customers’ demand and expectations or due to a disruption in demand of damaged, total loss and low-value vehicles.

•Our market position and competitive advantage could be threatened by our competitors and/or disruptive new entrants.

•If our facilities lack the capacity to accept additional vehicles, then our relationships with insurance companies or other vehicle suppliers could be adversely affected.

•We may be unable to keep existing facilities or open new facilities in desirable locations and on favorable terms, which could materially and adversely affect our results of operations.

•Macroeconomic factors, including high fuel prices, high labor costs, inflation and changes in used car prices, may have an adverse effect on our revenues and operating results.

•Reliance on our subhaulers and trucking fleet operations could materially and adversely affect our business and reputation.

•Weather-related and other events beyond our control may adversely impact operations.

•An increase in the number of damaged and total loss vehicles we purchase could adversely affect our profitability.

•A significant change in used-vehicle prices could impact the proceeds and revenue from the sale of damaged and total loss vehicles.

•IAA assumes the settlement risk for vehicles sold through its marketplaces.

•Changes in laws affecting the import and export of damaged and total loss vehicles may have an adverse effect on our business and financial condition.

•We are subject to potential liabilities with respect to IAA’s prior separation from KAR Auction Services, Inc.

•We may not realize the anticipated benefits of, and synergies from, acquisitions and may become responsible for certain liabilities and integration costs as a result.

•Damage to our reputation could harm our business.

•We may incur losses as a result of our guarantee and inventory contracts and advances to consignors.

•The availability and performance of our information technology ("IT") systems and infrastructure is critical to our business and continued growth.

•Consumer behavior is rapidly changing, and if we are unable to successfully adapt to consumer preferences and develop and maintain a relevant and reliable inventory management and multichannel disposition experience for our customers, our financial performance and brand image could be adversely affected.

•We rely on data provided by third parties, the loss of which could limit the functionality of certain of our platforms and disrupt our business.

•Government regulation of the digital landscape is evolving, and unfavorable regulations could substantially harm our business and results of operations.

•If our ability, or the ability of our third party service partners, cloud computing providers or third party data center hosting facilities, to safeguard the reliability, integrity and confidentiality of our and their IT systems is compromised, if unauthorized access is obtained to our systems or customers’, suppliers', counterparties' and employees' confidential information, or if authorized access is blocked or disabled, we may incur material reputational harm, legal exposure, or a negative financial impact.

•Our future expenses may increase significantly and our operations and ability to expand may be limited as a result of licenses, laws and regulations governing auction sites, environmental protection, international trade, tariffs and other matters.

•Losing the services of one or more key personnel or the failure to attract, train and retain personnel could materially affect our business.

•Failure to maintain safe sites could materially affect our business and reputation.

•Income and commodity tax amounts, including tax expense, may be materially different than expected, and there is a trend by global tax collection authorities towards the adoption of more aggressive laws, regulations, interpretations and audit practices.

•Our substantial international operations expose us to additional risks that could harm our business, including foreign exchange rate fluctuations that could harm our results of operations.

•Our business operations may be subject to a number of federal and local laws, rules and regulations governing international trade, including export control regulations.

•Failure to comply with anti-bribery, anti-corruption, and anti-money laundering laws, including the U.S. Foreign Corrupt Practices Act of 1977, as amended, or the FCPA, the Corruption of Foreign Public Officials Act, or the CFPOA, and similar laws associated with our activities outside of the U.S. could subject us to penalties and other adverse consequences.

•We are pursuing a long-term growth strategy that may include acquisitions and developing and enhancing an appropriate sales strategy, which requires upfront investment with no guarantee of long-term returns.

•We are regularly subject to general litigation and other claims, which could have an adverse effect on our business and results of operations.

•Privacy concerns and our compliance with current and evolving domestic or foreign laws and regulations regarding the processing of personal information and other data may increase our costs, impact our marketing efforts, or decrease adoption and use of our products and services, and our failure to comply with those laws and regulations may expose us to liability and reputational harm.

•Our business continuity plan may not operate effectively in the event of a significant interruption of our business.

•Our insurance may be insufficient to cover losses that may occur as a result of our operations.

•Certain global conditions may affect our ability to conduct successful events.

Financial Risks

•Ineffective internal control over financial reporting could result in errors in our financial statements, reduce investor confidence, and adversely impact our stock price.

•We have substantial indebtedness, and the degree to which we are leveraged may materially and adversely affect our business, financial condition and results of operations.

•Our debt instruments have restrictive covenants that could limit our financial flexibility.

Risks Related to Our Intellectual Property

•We may be unable to adequately protect or enforce our intellectual property rights, which could harm our reputation and adversely affect our growth prospects.

Risks Related to Our Industry

•Competition could result in reductions in our future revenues and profitability.

•Decreases in the supply of, demand for, or market values of used equipment, could harm our business.

Risks Related to Our Organization and Governance

•Our articles, by-laws, shareholder rights plan and applicable Canadian provincial and federal law contain provisions that may have the effect of delaying or preventing a change in control.

•U.S. civil liabilities may not be enforceable against us, our directors, or our officers.

•We are governed by the corporate laws of Ontario, Canada, which in some cases have a different effect on shareholders than the corporate laws of Delaware.

PART I

ITEM 1: BUSINESS

Company Overview

RB Global, Inc. and its subsidiaries (collectively referred to as “RB Global”, the “Company”, "our", "us", or “we”) (NYSE & TSX: RBA) is a leading global marketplace that provides value-added insights, services, transaction solutions for buyers and sellers of commercial assets and vehicles worldwide. Through our auction sites in 14 countries and digital platforms, we serve customers and partners in approximately 170 countries across a variety of asset classes, including automotive, commercial transportation, construction, government surplus, lifting and material handling, energy, mining and agriculture.

We primarily facilitate transactions for customers in the automotive and commercial, construction and transportation ("CC&T") sectors. Our customers are primarily automotive insurance companies, as well as end users, dealers, fleet owners, and original equipment manufacturers (“OEMs”) of commercial assets and vehicles. Gross transaction value in our CC&T sector includes equipment needed for earth moving, lift and material handling, as well as vocational and commercial trucks and trailers. Our automotive sector includes all consumer automotive vehicles. The other sector primarily includes assets and equipment in the agricultural, forestry and energy industries, government surplus assets, smaller consumer recreational transportation items and parts sold in our vehicle dismantling business. Each respective sector includes salvage and non-salvage transactions.

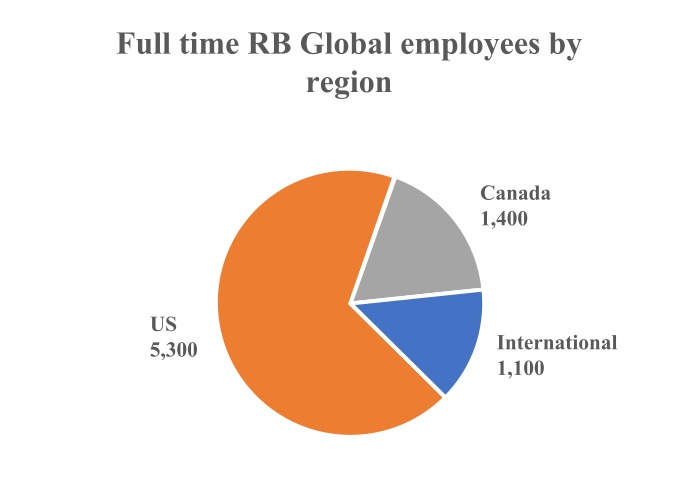

We have a global presence, with operations primarily in the United States, Canada, Australia and across Europe, and employ more than 7,800 full-time employees worldwide, of which approximately 67% are located in the United States.

Macroeconomic Conditions and Industry Trends

Various macroeconomic conditions and trends, such as inflationary pressures and interest rate volatility, impact our business, gross transaction value and operating costs. In addition, our gross transaction value is impacted by the combination of unit volume growth and changes in average selling prices.

Global supply chain disruptions and strong demand for CC&T assets significantly impacted our customers' transaction behavior in recent years. The COVID-19 pandemic initially led to a shortage of new equipment, driving up prices of used assets in our marketplace and extending asset holding periods. This pent-up demand subsequently fueled a surge in transactions in 2023 which normalized in the second half of 2024 creating a challenging comparison for the full year. Our customers and partners continue to experience lower equipment utilization rates, weaker end market demand, a higher interest rate environment, and higher costs to acquire new assets, resulting in delays in replacing or adding assets to their existing asset base. These trends are contributing to a lower need for our customers to transact equipment.

In our automotive sector, the total number of accidents and the number of accidents deemed a total loss influence unit volume growth in the industry. The total number of accidents is a function of the number of vehicles in service and the aggregated number of miles driven. Used automotive prices, the age, and the complexity of the design and technology content of vehicles, in combination with the cost of repair, are some of the factors that influence if a vehicle is deemed a total loss. The current inflation spread between automotive repair and used vehicles is providing a productive environment for a higher number of vehicles deemed a total loss as a percent of total accidents, which is driving industry salvage unit volume growth. Despite these positive trends, we have also seen used automotive prices remain fairly flat year over year, as pricing has normalized following the pandemic.

Competition

We encounter different competitors by region, sector, and service across the entire suite of solutions we offer to our partners and customers.

Competition in our CC&T sector for transaction solutions is highly fragmented geographically and by transaction format. We compete for sellers against online and physical auctioneers, brokers, OEMs and equipment dealers offering trade-in services. Some of our customers, including large fleet owners, may seek private sales instead of third-party transaction solutions. The market is constantly evolving and subject to change driven by new and existing competitors and technology-enabled selling solutions for sellers.

In the automotive sector, our sellers are comprised of primarily insurance companies seeking transaction solutions for their damaged or low-value vehicles. We primarily compete with Copart, Inc., as well as with Total Resource Auctions, Inc., a subsidiary of Cox Enterprises, and certain other independent used vehicle auction companies that regularly remarket damaged and total loss vehicles. We have contractual service level agreements and various supply agreements with our sellers, primarily automotive insurance customers.

Our performance against service level agreements and gross returns to drive optimal net returns is critical to our success as we compete.

Competitive Advantages

•Global platform - Our global platform allows us to connect buyers and sellers, offer insights and value-added services for commercial assets and vehicles through our omnichannel marketplace, both digitally and through our auction sites worldwide. We offer unmatched choice and flexibility, tailoring transaction solutions to suit our customers' diverse and changing needs. We also offer our customers a full spectrum of value-added services, such as transportation and logistics, appraisal, inspection, refurbishing, titling, loan payoff, and financial services.

•Trusted customer relationships - Our sales teams act as trusted advisors in their long-standing customer relationships. We take a long-term view, offering clear transparent communication and unparalleled solutions to simplify our customers' experience and cultivate lasting partnerships.

•Data, insights and services - Rich data and analytics are a cornerstone to providing the best customer experience. We invest in data science to deliver asset value predictions, generate user leads, prioritize marketing investments, interpret price trends, and more. Proprietary machine vision technology combined with proprietary algorithmic asset pricing are used internally to set target values and optimize marketplace operations and externally to provide our customers with real-time asset values. In addition, our Rouse Services ("Rouse") and brand is the leading provider of construction equipment rental metrics, benchmarks, and construction equipment valuations to lenders, rental companies, contractors, and dealers. Our business model is built upon an extensive data ecosystem, proprietary analytics, data science techniques, and trusted customer relationships rooted in service and confidentiality.

•Global presence - We achieve exceptional agility with our extensive global network of 311 locations, which enables us to be closer in proximity to our customers. This proximity helps minimize transportation costs and provides our customers with the choice of care, custody, and control of assets.

•Flexibility of yard space and teammates - Teammates working across different businesses and sectors can come together across multiple locations to meet our customers' needs when necessary. Specifically, in a catastrophic event impacting our automotive sector customers, we can increase the speed of our response and avoid incremental operating costs by leveraging all of our teammates and any unused capacity across our global network of locations.

•Global buyer base and demand engine - Our global presence and sophisticated approach to driving buyer demand allows us to generate deep pools of liquidity for transactions, enabling global market pricing for commercial assets and vehicle sellers and helping to deliver the best price realization. We serve customers in approximately 170 countries across a variety of sectors and continuously source and cultivate new buyers around the world.

•Brand - Our well-established brands are well recognized and have a loyal customer base. The Company's marketplace brands include Ritchie Bros., the world's largest auctioneer of commercial assets and vehicles, and IAA, a leading global digital marketplace connecting vehicle buyers and sellers. RB Global's portfolio of brands also includes Rouse, which provides complete end-to-end asset management, data-driven intelligence, and performance benchmarking system, SmartEquip, an innovative technology platform that supports customers' management of the equipment lifecycle and integrates parts procurement with both original equipment manufacturers and dealers and VeriTread, an online marketplace for heavy haul transport.

Growth Strategy

The foundation of our growth strategy is to put our partners and customers first and over-deliver on our commitments. By doing this consistently, along with operational excellence, we expect to solidify our position as their trusted global partner for insights, services, and transaction solutions.

We see significant opportunities to drive transactions and grow our market share by creating a seamless and trusted experience for our sellers and buyers. We have three key areas of strategic focus:

i.Achieve premium price performance for assets transacted across our omnichannel marketplaces while effectively accommodating our partners' liquidity preferences. The key is to manage supply and create deep liquidity pools by expanding our global buyer base through harnessing technology to merchandise assets at scale and provide a diverse and thoughtfully selected range of assets to meet each buyer's unique needs.

ii.Grow our enterprise partner base, which includes insurance companies in our automotive sector and large fleet owners in our CC&T sector. Our partners increasingly rely on our expertise to enhance their profitability by optimizing the lifecycle of the assets they transact through us. The more effectively we can communicate and demonstrate our value upstream from the transaction, the stronger our position will be to earn more transactions from partners and gain market share.

iii.Focus on driving growth with our regional CC&T customers, comprised of small and mid-size businesses that highly value the personalized engagement and relationship with our sales territory managers. By leveraging the expertise of our sales team as trusted advisors, we are confident in our ability to strengthen these existing relationships and build new ones. As we optimize and expand our sales coverage, we are well-positioned to capture additional market share and deliver sustained growth.

We aim to achieve our growth strategy by modernizing our technology capabilities, investing in the development of our teammates, and strategically acquiring businesses and technologies to expand our capabilities and market reach.

Service Offerings

We provide a global marketplace for our partners and customers to buy and sell a variety of asset classes by leveraging our proprietary transaction solutions, services and market insights. The table below outlines the various branded solutions we offer to help our partners and customers more efficiently manage their asset lifecycles and improve on their return on investments.

| | | | | | | | |

| Solution | Brand(s) | Description |

| Transaction Solutions | RB Auction | Onsite and online marketplace for selling and buying used equipment |

| IronPlanet | Online marketplace for selling and buying used equipment |

| Marketplace-E | Online make offer/buy now format |

| GovPlanet | Online marketplace for the sale of government and military assets |

| SalvageSale | Full-service project management and salvage inventory support |

| Ritchie Bros. Private Treaty | Confidential, negotiated sale of large equipment |

| IAA AuctionNow™ | Online auction bidding and buying solution, that features inventory located at physical branches and offsite locations. Available to a global buyer audience |

| IAA Buy Now™ | Online buy now format available between scheduled auctions, leveraging ML based pricing recommendations |

| IAA Custom Bid™ | Bidding tool that provides buyers focused on recycling the ability to set pre-bids in an auction based on vehicle attributes |

| IAA Timed Auctions™ | Timed auction format that allows for competitive bidding and sale prior to a scheduled auction |

| CSAToday® | Online portal that gives sellers the ability to manage their vehicle assets and monitor sales performance |

| Financial Services | Ritchie Bros. Financial Services | Loan origination service that uses a brokerage model to match loan applicants with appropriate financial lending institutions |

| Appraisal Services | Rouse Appraisals | Unbiased, certified appraisal services |

| Inspection Services | Ritchie Bros. Inspections | Truck and heavy equipment inspections |

| IAA Inspection Services® | Remote inspections and appraisals for salvage vehicles |

| Listings Services | Ritchie List, Mascus, Boom & Bucket | Online equipment listing service , B2B dealer portal, and an online fixed price marketplace platform |

| Refurbishing Services | Ritchie Bros. Refurbishing | Repair, paint, and other make-ready services |

| Transportation Services | Ritchie Bros. Logistics

| End-to-end transportation and customs clearance solution for sellers and buyers with shipping needs |

| VeriTread Transport | Online transportation marketplace, connecting shippers and carriers |

| IAA Transport™ | Integrated shipping solution allowing buyers to schedule shipment of vehicles during the checkout process |

| IAA Tow App™ | Mobile dispatch solution that assists the tow network |

| Data Services | Rouse™ | The leading provider of construction equipment market intelligence |

| IAA Vehicle Score™ | A cutting-edge computer vision tool that assesses vehicle damage severity. Our automated Vehicle Score model provides fast and accurate ratings based on photos taken at vehicle check-in, saving time and money |

| IAA Vehicle Value™ | A predictive model that uses machine learning and data mining methods to create an accurate, unbiased vehicle value |

| Parts Services | SmartEquip | Online marketplace connecting equipment owners with parts manufacturers |

| Catastrophe Response Services | Catastrophe (CAT) Services™ | Industry-leading strategic catastrophe response service focused on real estate capacity, operational execution, transportation logistics and vehicle merchandising and selling |

| Title Services | IAA Title Services® | Full suite of title services that facilitate the title documentation, settlement and retrieval process |

| IAA Loan Payoff™ | Service that mitigates the time-consuming process of managing a total loss claim requiring loan payoff and title release |

| DDI Technology | Electronic title and registration services for vehicles dealers and lenders |

Contract options

We offer consignors several contract options to meet their individual needs and sale objectives for selling assets, which include:

•Straight commission contracts, where the consignor receives the gross proceeds from the sale less a pre-negotiated commission rate;

•Fixed fee commission contracts, where the consignor receives the gross proceeds from the sale less a fixed flat fee; and

•Guarantee contracts, where the consignor receives a guaranteed minimum amount plus an additional amount if proceeds exceed a specified level.

We also offer our customers the option to enter into inventory contracts, where we purchase assets before they are resold in the auctions or marketplaces. We may also sell consigned assets or purchased inventory in private sales transactions.

Other value-added services

We also provide a wide array of value-added services to make the process of selling and buying equipment and vehicles convenient for our customers. In addition to the services listed in the table above, we also provide the following value-added services to our customers:

•Title search services, where registries are commercially available, to help ensure equipment sold through RB Global is free and clear of all liens and encumbrances (if we are not able to deliver clear title, we provide a full refund up to the purchase price to the buyer);

•Making equipment available for inspection, testing, and comparison by prospective buyers;

•Displaying high-quality, zoomable photographs of equipment on our website;

•Providing 360-degree video inspection technology to increase buyer confidence in equipment being purchased;

•Providing industry-leading professional equipment inspections and reports;

•Providing free detailed equipment information on our website for most equipment;

•Providing access to commercial transportation companies and customs brokerages through our logistical services, and

•Handling all pre-auction marketing, as well as collection and disbursement of proceeds.

Intellectual Property

We believe our intellectual property has significant value and is an important factor in marketing our organization, services, and website, as well as differentiating us from our competitors. We own or hold the rights to use valuable intellectual property such as trademarks, service marks, domain names and tradenames. We protect our intellectual property in Canada, the U.S., and internationally through federal, provincial, state, and common law rights, including registration of certain trademark and service marks for many of our brands, including our core brands. We also have secured patents for inventions and have registered our domain names.

We rely on contractual restrictions and rights to protect certain of our proprietary rights in products and services. Effective protection of our intellectual property can be expensive to maintain and may require litigation. We must protect our intellectual property rights and other proprietary rights in many jurisdictions throughout the world. In addition, we may, from time to time, be subject to intellectual property claims, including allegations of infringement, which can be costly to defend. For a discussion of the risks involved with intellectual property litigation and enforcement of our intellectual property rights, see the related information in “Part I, Item 1A: Risk Factors” of this Annual Report on Form 10-K.

Environmental, Social & Governance

In 2024, RB Global continued to advance its Environmental, Social and Governance ("ESG") framework, which was developed in 2022 and subsequently aligned with IAA's ESG program in 2023, and which includes the integration of ESG approaches, resources, and capabilities.

Our ESG framework remains instrumental in guiding our actions and driving our ESG progress. We use our framework to establish our goals and performance metrics. As with many areas of the business, we used the post-acquisition integration period to analyze and incorporate best practices of our brands' reporting to shape our combined ESG strategy. As part of our commitment to continuous improvement, we will continue to work closely with our ESG program stakeholders to ensure that our priorities remain aligned with our partners in the industry and the values that we share.

Below is an overview of RB Global's commitment to ESG. Please see our website for our latest sustainability reports and further details on our initiatives and accomplishments.

Environmental

The Company is regulated by federal, state, local jurisdictions, and international environmental laws governing the protection of the environment, health and safety, the use, transport and disposal of hazardous substances and control of emissions including greenhouse gases into the environment. Compliance with these existing laws has not had a material impact on our capital expenditures, earnings or global competitive position. However, climate change initiatives and changing laws and regulations governing the environment may affect the supply of, the demand for, and the market values of equipment in the future.

Our business enables a circular economy of vehicles and equipment. We engage our customers to optimize the use and efficiency of equipment, to re-use, refurbish and recycle before disposition, as extending the life of heavy equipment and vehicles is core to our business model. In turn, we believe this reduces waste and lessens the need to extract natural resources to produce equipment.

In 2024, we continued to take the opportunity to comprehensively evaluate our environmental impact, considering the impacts from the acquisition of IAA. In 2023, to support our reporting and take further meaningful action, we developed a baseline carbon inventory of Scopes 1, 2 and 3 inventory using recognized standards such as the Greenhouse Gas ("GHG") protocol. This enabled us to gain a more complete understanding of our global carbon footprint and identify areas where we can make improvements. With this valuable data, we are well-equipped to establish achievable reduction targets, track our progress, and effectively manage and mitigate our environmental impact.

We continue our commitment to environmental management by ensuring availability of treatment systems to manage wastewater, a recycling system to promote waste management and air filtration systems when necessary.

Social

Human Capital

We employ approximately 7,800 full-time employees and approximately 890 part-time employees worldwide at December 31, 2024. Approximately 5,200 of our full-time employees work at our auction and branch sites to support our operations and solution services and approximately 1,200 full-time employees are focused on sales and solutions for our customers. We also periodically hire contractors as needed to support our auctions, various businesses, and other projects.

Development and Engagement

We believe that our people are our greatest asset and that engaged employees are paramount to the health and success of our business. We invest in a variety of training, development and engagement practices to deliver on our growth agenda and create more leaders.

RB Global continues to invest in employee learning and development. All full-time employees are encouraged to have development plans that focus on career growth. We have curated tools and resources and developed training programs to provide our leaders and employees with the skills to grow successfully. We provide all of our employees access to virtual instructor-led courses, as well as access to a library of over 3,000 online courses and resources.

During 2024, we achieved the following objectives to strengthen the development and engagement of our people:

•We continue to hold quarterly performance conversations to drive performance and ongoing engagement, with a simplified year-end review process to allow for more meaningful conversations about accomplishments, values and opportunities.

•We offer a six-week Leadership Foundations Program to newly promoted and first-time managers, to instill the confidence needed to inspire, delegate, and communicate effectively in their new role.

•We launched a new self-service Mentorship Program to support and encourage employees to learn from connections and meaningful relationships with experienced leaders.

•We continue to support the sales team's expanded sales coverage initiative through our sales bootcamps. In addition, we launched the Master Your Craft training initiative, which provides focused, quick-hit lessons on key sales skills and best practices.

•We continue to strengthen our salvage sale operational training program by integrating analytics and personalized learning paths. Our strategic improvements aim to enhance workforce efficiency, reduce knowledge gaps, and drive growth.

•We strengthened our IAA title training program through a blended learning model with the aim to reduce attrition and enhance knowledge and efficiency within our workforce.

We continuously look for ways to create on-the-job learning opportunities so that our employees feel invested and engaged. Employees are involved in strategic initiatives and in finding ways to better serve our customers, and each other.

Health & Safety

Safety is a top priority at RB Global and core to who we are. Our objective is to keep our people healthy and safe – to send everyone home, every day, the way they came to work. Our global Environmental, Health, Safety and Security ("EHSS") team is focused on creating a unified approach to policies, procedures and best practices with the goal of keeping our teammates and customers safe. The EHSS team is responsible for introducing operational updates to support our commitment to maintaining the highest level of environmental, health and safety standards.

All new employees are required to complete a safety onboarding training that captures our health and safety programs, our policy statement and provides an overview of our global Employee Health and Safety (“EHSS”) policies and expectations. Our 2024 completion rate for the safety onboarding program was 97% (2023: 93%). We also have a risk management process to support our safety orientation programs and our health and safety commitment, which ensures that our employees are exposed to the lowest possible level of risk. Our risk management process begins with an annual review of all incidents from the prior year to identify trends and assess whether we need to address findings through changes in our policies and procedures.

In 2024, all auction sites completed monthly hazard assessments to identify risks and take the necessary corrective actions. In addition, we also require all of our global employees in operations to complete a mandatory annual safety training curriculum.

We measure our Total Recordable Injury Rate (“TRIR”), which is the number of reportable incidences per 100 full-time workers during the year. Our annual TRIR goal is to be lower than the industrial average. TRIR for 2024 was 1.78 (2023: 1.05), which was below the industrial average.

Community Giving

We are committed to support the communities where we live and work. In 2024, we responded to the devastating hurricanes across the United States through donations and sponsorship to local organizations to deliver critical resources such as food, clothing, housing and supplies.

Flexible Workplace

We continue to provide flexible work arrangements - on-site, remote and hybrid - to our people based on the needs of our customers and businesses and encourage opportunities to build engagement and foster connections on-site and within the hybrid world through numerous gatherings and social events across all offices.

Ethical Conduct

We are committed to a culture of excellence. We aim to build a community with strong values of responsibility and integrity, continue to invest in training and development, and to create an open environment where honest communications are the expectation – not the exception. Our Code of Conduct contains guidelines for conducting business with the highest standards of ethical behavior. We also offer the RB Global Ethics Hotline, which is operated by an independent third party and is always available from any location around the world, as a resource through, which anonymous concerns can be raised.

Governance

We believe in doing the right thing for everyone involved in our business and seek to do business with third parties who follow the same core values. This is reflected in our Code of Business Conduct and Ethics, which is delivered through annual training to our

employees and supported by our third-party Ethics Hotline. With the exception of our CEO, our Board of Directors consists of elected independent members.

Oversight of our ESG enterprise strategy is provided by the Nominating and Corporate Governance Committee, while our global ELT provides strategic direction and oversight of ESG across key business functions.

The Role of Technology

Building a modern architecture on which we can scale and grow profitably is a core element of our growth strategy. The role of technology in our business continues to evolve and becomes increasingly important, as our sellers and buyers adopt mobile and online channels to complete their transactions and fulfill their business needs. We continue to invest in technologies to transition to a modern cloud-based architecture, driven by microservices that allow for agility, flexibility and scalability of our solutions. In 2024, we also invested and acquired Boom & Bucket Inc, a digital fixed price marketplace which we can add to our portfolio of selling solutions.

We remain focused on technology enablement to transform the way we leverage technology to drive future profitable growth. We are in the deployment phase of providing our customers a modern unified payment system to process transaction solutions. We are also investing in the development of a new platform to unite our various auction platforms to provide greater stability and simplify our processes for buyers and sellers. Our new platform is designed to provide an updated modern design, improved search functions and navigation capabilities to make it easier for our customers to bid at our auctions and process their transactions. During 2024, we have begun to rollout our digital payments platform and digital checkout system at a select number of auction events and will continue to evaluate, invest and evolve our products and capabilities based on the ongoing needs of our customers and partners.

Our technology capabilities also deliver choices for our customers in the form of multiple channels for buyers and sellers, meeting customers’ asset management needs through information-rich software solutions and leveraging our rich data repository to drive strong sales and improved pricing decisions. We provide our customers with leading tools and capabilities to deliver full life-cycle asset management for used equipment and vehicles.

Revenue Mix

Our revenue is comprised of service revenue and inventory sales revenue. Total service revenue includes revenue by customer type, between revenue earned from buyers or sellers who transact in our live and online auctions, online marketplaces and private brokerages, as well as marketplace services revenue, revenue earned from optional services provided to our customers.

In the third quarter of 2024, we updated our presentation of disaggregated revenue to align to how management evaluates its financial and business performance. The prior year disaggregation of revenue amounts have been recast to conform with current period presentation. We previously disaggregated our revenue by commissions earned from our consignors, buyer fees earned from our buyers in each sale transaction, and presented all other fees earned in the rendering of our services, whether related to auctions, online marketplaces, private brokerage or other services, within marketplace services revenue. As part of our updated presentation, transactional seller revenue now includes commissions, pre-negotiated or fixed, as well as certain auction-related fees earned from sellers to complete the sale of an asset, such as towing to our yards, liens search, title processing and online listing and inspection fees. Transactional buyer revenue now includes buyer transaction fees based on a tiered structure earned from purchasers upon purchase of an asset, as well as other auction-related fees earned from buyers to complete the purchase of an asset, such as title processing, late-pick up, salvage buyer platform registration and other administrative processing charges. Accordingly, certain auction-related fees

were reclassified from marketplace services revenue to transactional seller or transactional buyer revenue. These changes were made in order to align with how management categorize revenues for internal management purposes.

Our service revenue is comprised of the following:

•Transactional seller revenue which includes commissions earned from consignors on the sale of consigned assets, as well as other fees earned from consignors to facilitate the sale of an asset such as towing to our yards, liens search, title processing and online listing and inspection fees.

•Transactional buyer revenue which includes transaction fees based on a tiered structure earned from the purchasers of consigned assets and inventory, as well as other fees earned from buyers to complete the purchase of an asset, such as title processing, late pick-up, vehicle buyer platform registration and other administrative processing charges.

•Marketplace services revenue which includes fees earned from various optional services provided to buyers, sellers, or other third-parties, such as transportation, buyer towing, refurbishment, financing, parts procurement, data and appraisal, and other ancillary services.

Inventory sales revenue relates to revenue earned through our inventory contracts and is recognized as the GTV of the assets sold, with the related cost recognized in cost of inventory sold.

Our revenue each period can fluctuate significantly based on the mix of sales arrangements, which is driven by customer preferences. Completed straight commission, fixed commission or guarantee commission contracts result in the commission being recognized as service revenue based on a percentage of gross transaction value or based on a fixed value, while completed inventory contracts result in the full GTV of the assets sold being recorded as inventory sales revenue. As a result, a change in the revenue mix between service revenue and revenue from inventory sales can have a significant impact on our revenue growth percentages.

Governmental Regulations and Environmental Laws

Our operations are subject to a variety of federal, provincial, state and local laws, rules, and regulations throughout the world. Compliance with these regulations and laws requires human level awareness, performance and expertise, and investments in our enterprise management systems to facilitate efficient workflow, data tracking and auditing capabilities to measure compliance. We believe that we are compliant in all material respects with those laws, rules, and regulations that affect our business, and that such compliance does not impose a material impediment on our ability to conduct our business.

We believe that, among other things, laws, rules, and regulations related to the following list of items affect our business:

•Imports and exports of commercial assets. Particularly, there are restrictions in the U.S. and Europe that may affect the ability of equipment owners to transport certain equipment between specified jurisdictions. Also, engine emission standards in some jurisdictions limit the operation of certain trucks and equipment in those regions.

•Development or expansion of auction sites. Such activities depend upon the receipt of required licenses, permits, and other governmental authorizations. We are also subject to various local zoning requirements pertaining to the location of our auction sites, which vary among jurisdictions.

•The use, storage, discharge, and disposal of environmentally sensitive materials. Under such laws, an owner or lessee of, or other person involved in, real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances located on or in, or emanating from, such property, as well as related costs of investigation and property damage. These laws often impose liability without regard to whether the owner or lessee or other person knew of, or was responsible for, the presence of such hazardous or toxic substances.

•Worker health and safety, privacy of customer information, and the use, storage, discharge, and disposal of environmentally sensitive materials.

•The acquisition and sale of totaled and recovered theft vehicles are regulated by state or other local motor vehicle departments in each of the locations in which we operate.

•Some of the transport vehicles used at our marketplaces are regulated by the U.S. Department of Transportation or similar regulatory agencies in the other countries in which we operate.

•In many states and provinces, regulations require that a damaged and total loss vehicle be forever “branded” with a salvage notice in order to notify prospective purchasers of the vehicle’s previous salvage status.

•Some state, provincial and local regulations limit who can purchase damaged and total loss vehicles, as well as determine whether a damaged and total loss vehicle can be sold as rebuildable or must be sold for parts or scrap only.

•We are subject to various local zoning requirements with regard to the location of our auction and storage facilities, which requirements vary from location to location.

•We are indirectly subject to the regulations of the Consumer Financial Protection Act of 2010 due to our vendor relationships with financial institutions.

•We deal with significant amounts of cash in our operations at certain locations and are subject to various reporting and anti-money laundering regulations.

Available Information

We file with the SEC reports on Form 10-K, Form 10-Q, Form 8-K, proxy materials and other filings required under the Exchange Act. Investors may access any materials we file with the SEC through the EDGAR database on the SEC’s website at www.sec.gov.

In addition, investors and others should note that we announce material financial information using our company website (https://rbglobal.com) and investor relations website (https://investor.rbglobal.com), which host our SEC filings, press releases, public conference calls, and webcasts. Information about RB Global, Inc., its business, and its results of operations may also be announced by posts on LinkedIn (https://www.linkedin.com/company/rb-global-inc).

The information that we post on our LinkedIn page could be deemed to be material information. As a result, we encourage investors, the media, and others interested in RB Global, Inc. to review the information that we post on our LinkedIn page.

We are providing these website addresses solely for the information of investors, and the information on or accessible through our websites and social media channel is not incorporated by reference in this Annual Report on Form 10-K.

Also available for investors in the Governance section of our investor relations website are the Code of Business Conduct and Ethics for our directors, officers and employees (“Code of Conduct”), Board Mandate, Audit Committee Charter, Nominating and Corporate Governance Committee Charter, Compensation Committee Charter, Corporate Governance Guidelines, Diversity Policy, Shareholder Engagement Policy, Articles and Bylaws, and Board Chair Role and Description. Additional information related to RB Global, Inc. is also available on SEDAR at www.sedar.com.

As a Business Corporations Act (Ontario) (“OBCA”) company with our principal place of business in Canada, U.S. civil liabilities may not be enforceable against us. Please see “Part I, Item 1A. Risk Factors — U.S. civil liabilities may not be enforceable against us, our directors, or our officers.

ITEM 1A: RISK FACTORS

An investment in our common stock involves a high degree of risk. In addition to the other information included in this Annual Report on Form 10-K, you should carefully consider each of the risks described below before purchasing our common shares. The risk factors set forth below are not the only risks that may affect our business. Our business could also be affected by additional risks not currently known to us or that we currently deem to be immaterial. If any of the following risks actually occur, our business, financial condition and results of operations could materially suffer. As a result, the trading price of our common shares could decline, and you may lose all or part of your investment. Information in this section may be considered “forward-looking statements.” See “Cautionary Note Regarding Forward-Looking Statements” for a discussion of certain qualifications regarding such statements.

Risk Related to Our Business

Our business and operating results would be adversely affected due to the loss of one or more significant suppliers, a reduction in significant volume from suppliers, an adverse change in our supplier relationships, or a disruption to our supply of damaged, total loss and low-value vehicles.

Our business depends on suppliers of damaged, total loss and low-value vehicles. Our vehicle suppliers include insurance companies, used-vehicle dealers, rental car and fleet lease companies, auto lenders and charitable organizations, among others. We have established long-term relationships with virtually all of the major automobile insurance companies. During fiscal 2024, approximately 22% of our consolidated revenues were associated with vehicles supplied by the Company's three largest supplier customers. Our agreements with insurance company suppliers are generally subject to cancellation by either party upon 30 to 90 days’ notice. There can be no assurance that our existing agreements will not be canceled or that we will be able to enter into future agreements on favorable terms with these suppliers. We work to develop strong relationships with our suppliers to better understand their needs. From time to time, however, we may experience the loss of suppliers or a reduction in volume from suppliers, including top vehicle suppliers. If we lose one or more of our significant suppliers, or if one or more of our large suppliers were to significantly reduce volume for any reason or favor competitors or new entrants, we may not be successful in replacing such business and our profitability and operating results could be materially adversely affected.

Generally, institutional and dealer suppliers make non-binding long-term commitments with us regarding consignment volumes. Changes in the consignment patterns of our key suppliers could have a material adverse effect on our business and operations. There

are many factors that can adversely affect volume from suppliers, many of which are beyond our control. These factors include, but are not limited to, the following:

•A decrease in the number of vehicles in operation or miles driven;

•Mild weather conditions that cause fewer traffic accidents;

•Reduction of policy writing by insurance providers that would affect the number of claims over a period of time;

•Increases in fuel prices that could lead to a reduction in the miles driven per vehicle, which may reduce the accident rate;

•Changes in vehicle technology, an increase in autonomous vehicles and vehicles equipped with advanced driver-assistance systems (ADAS);

•A decrease in the percentage of claims resulting in a total loss or elimination of automotive collision coverage by consumers;

•Delays or changes in state title processing;

•Government regulations on the standards for producing vehicles; and

•Changes in direct repair procedures that would reduce the number of newer, less damaged total loss vehicles, which tend to have higher salvage values.

Furthermore, in periods when the supply of vehicles from the insurance sector declines, salvage operators have acquired and, in the future, may acquire vehicles on their own. Also, when used vehicle prices are high, used-vehicle dealers may retail more of their trade-in vehicles on their own rather than selling them at auction. If the supply or value of damaged, total loss and low-value vehicles coming to auction declines significantly, our revenues and profitability may be adversely affected.

Our business and operating results would be adversely affected if we are unable to meet or exceed our buyer customers’ demand and expectations or due to a disruption in demand of damaged, total loss and low-value vehicles.

We believe our future success depends in part on our ability to respond to changes in buyer requirements, our ability to meet service level expectations of both buyers and sellers and our ability to meet regulatory requirements for such customers. IAA’s buyer customers include automotive body shops, rebuilders, used car dealers, automotive wholesalers, exporters, dismantlers, recyclers, brokers, and the general public, among others. We work to develop strong relationships and interactive dialogue with our customers to better understand current trends and customer needs. If we are not successful in meeting our customers’ expectations, our customer relationships could be negatively affected and result in a loss of future business, which would adversely affect our operating results and financial condition.

Our market position and competitive advantage could be threatened by our competitors and/or disruptive new entrants.

We face significant competition for the supply of damaged and total loss vehicles and the buyers of those vehicles. IAA’s principal sources of competition historically have come from (1) direct competitors, (2) new entrants, including new vehicle remarketing venues, and (3) existing alternative vehicle remarketing venues, including used-vehicle auctions and certain salvage buyer groups. Due to the increasing use of the Internet and other technology as marketing and distribution channels, we may face increasing competition from online wholesale and retail marketplaces (generally without any meaningful physical presence) and from our own customers, including insurance companies, when they sell directly to end users through such platforms rather than remarket vehicles through our marketplaces. Increased competition could result in price reductions, reduced margins or loss of market share.

Our future success also depends on our ability to respond to evolving industry trends, changes in customer requirements and new technologies. Some of IAA’s competitors may have greater financial and marketing resources than we do, may be able to respond more quickly to evolving industry dynamics and changes in customer requirements, or may be able to devote greater resources to the development, promotion and sale of new or emerging services and technologies. Our ability to successfully grow through investments in the area of emerging opportunities depends on many factors, including advancements in technology, regulatory changes and other factors that are difficult to predict, or that may significantly affect the future of electrification, autonomy, and mobility. If we are unable to compete successfully or to successfully adapt to industry changes, our business, revenues and profitability could be materially adversely affected.

If our facilities lack the capacity to accept additional vehicles, then our relationships with insurance companies or other vehicle suppliers could be adversely affected.

Capacity at our facilities varies from period to period and by region as a result of various factors, including natural disasters. We may not be able to reach agreements to purchase or lease storage facilities in markets where we have limited available capacity, and zoning restrictions or difficulties obtaining use permits may limit our ability to expand our capacity through acquisitions of new land. If we fail to have sufficient capacity at one or more of our facilities, our relationships with insurance companies or other vehicle suppliers could be adversely affected, which could adversely affect our operating results and financial condition.

We may be unable to keep existing facilities or open new facilities in desirable locations and on favorable terms, which could materially and adversely affect our results of operations.

Local land use and zoning regulations, environmental regulations and other regulatory requirements may impact our ability to find

suitable locations and influence the cost of our operations. Most of IAA’s salvage auction vehicle facilities are leased. The termination or expiration of leases at existing facilities may adversely affect us if the renewal terms of those leases are unacceptable to us and we are forced to close the facilities. If we determine to close a location, we may remain obligated under the applicable lease for the remaining lease term and may have to expense the unamortized portion of the right-of-use assets, in part or in full, as an impairment which may have a material impact on our consolidated results of operations and financial position. Also, if we are unable to maintain our existing facilities or open new facilities in desirable locations and on favorable terms, our results of operations could be materially and adversely affected. Further, in an increasing number of markets where we experience significant capacity constraints together with pressing customer demand and a lack of viable alternatives for expansion due to zoning and land use restrictions, we may be required to purchase, lease or occupy industrial sites, which may contain significant environmental impacts.

In addition, some of the facilities on which we operate are impacted by significant recognized environmental concerns and pollution conditions. IAA has incurred, and we may in the future incur, expenditures relating to compliance and risk mitigation efforts, releases of hazardous materials, investigative, remedial or corrective actions, claims by third parties and other environmental issues, and such expenditures, individually or in the aggregate, could be significant. Federal and state environmental authorities are currently investigating IAA’s role in contributing to contamination at the Lower Duwamish Waterway Superfund Site in Seattle, Washington and the role of one of IAA’s subsidiaries in contributing to the Pyrite Canyon Plume in Jurupa Valley, California. Our potential liability at these sites cannot be estimated at this time.

Macroeconomic factors, including high fuel prices, high labor costs, inflation and changes in used car prices, may have an adverse effect on our revenues and operating results.

Macroeconomic factors that affect oil prices and the vehicle and commodity markets can have adverse effects on our revenue and operating results. Significant increases in the cost of fuel, whether due to inflationary pressures or otherwise, could lead to a reduction in miles driven per car and a reduction in accident rates. A material reduction in accident rates, whether due to a reduction in miles driven or other factors, could reduce our vehicle assignment volumes, which in turn, could have a material adverse impact on our revenues. In addition, significant increases in the cost of fuel have resulted and could continue to result in an increase in the prices charged to us by our independent subhaulers and trucking fleet operators. Further, we have recently experienced labor shortages, which have resulted in an increase in associated costs, such as increased overtime to meet demand and increased wages to attract and retain employees. If these conditions or other inflationary pressures continue, our costs for towing and branch labor may continue to rise. To the extent we are unable to pass these costs on to our customers, the increase in prices charged by our independent subhaulers and trucking fleet operators and the increase in labor costs could negatively impact our profitability.

Volatility in salvage car prices could have a material adverse effect on our revenues in future periods.

Adverse economic conditions, including increases in interest rates and lease rates, real estate values and real estate development and construction costs, may increase the costs required to invest in capacity expansion or delay our ability to open new facilities, both of which could have a material impact on our consolidated results of operations and financial position.

Reliance on our subhaulers and trucking fleet operations could materially and adversely affect our business and reputation.

We rely on independent subhaulers and trucking fleet operations to pick up and deliver vehicles to and from our auction facilities. Consistent with the economy generally, we have recently experienced a shortage of towers and haulers, which has resulted in an increase in costs charged to us by towers and subhaulers for these services, and we cannot provide assurances that towers and subhaulers will be available in a timely manner to pick up and deliver vehicles. Failure to pick up and deliver vehicles in a timely manner could harm our brand and reputation, and adversely impact our overall business and results of operations. Further, an increase in fuel cost may lead to increased prices charged by our independent subhaulers and trucking fleet operators, which may significantly increase our cost. We may not be able to pass these costs on to our suppliers or buyers. We are also exposed to risks associated with inclement weather, disruptions in the transportation infrastructure and increase in the price of fuel, any of which could increase our operating costs. If we experience problems or are unable to negotiate or obtain favorable terms with our subhaulers, our results of operations could be materially and adversely affected.

Weather-related and other events beyond our control may adversely impact operations.

Extreme weather or other events, such as hurricanes, tornadoes, earthquakes, forest fires, floods, global pandemics or other health crises, terrorist attacks or war, may adversely affect the overall economic environment, the markets in which we compete, and our operations and profitability. These events, which may increase in frequency and magnitude as a result of climate change, may impact our physical auction facilities, causing a material increase in costs, or delays or cancellation of auction sales, which could have a material adverse impact on our revenues and profitability. In some instances, for example with the severe storm in September 2022 known as “Hurricane Ian”, these events may result in a sharp influx in the available supply of damaged and total loss vehicles and there can be no assurance that our business will have sufficient resources to handle such extreme increases in supply. Our failure to meet our customers’ demands in such situations could negatively affect our relationships with such customers and result in a loss of

future business, which would adversely affect our operating results and financial condition. In addition, revenues generated as a result of the total loss of vehicles associated with such a catastrophe are typically recognized subsequent to the incurrence of incremental costs and such revenues may not be sufficient to offset the costs incurred.

Mild weather conditions tend to result in a decrease in the available supply of damaged and total loss vehicles because traffic accidents decrease, and fewer vehicles are damaged. Accordingly, mild weather can have an adverse effect on our damaged and total loss vehicle inventories, which would be expected to have an adverse effect on our revenue and operating results and related growth rates.

An increase in the number of damaged and total loss vehicles we purchase could adversely affect our profitability.

In certain countries, the salvage market typically operates on a principal basis, in which a vehicle is purchased and then resold, rather than on an agent basis, in which the auction acts as a sales agent for the owner of the vehicle. Operating on a principal basis exposes us to inventory risks, including losses from theft, damage and obsolescence. If we purchase vehicles, the increased costs associated with acquiring the vehicles could have a material adverse effect on our gross profit margin and operating results. Vehicles sold under purchase agreements were approximately 4.1% of IAA’s vehicles sold both domestically and internationally for fiscal year 2024. In addition, when vehicles are purchased, we are subject to changes in vehicle values, such as those caused by changes in commodity prices or changes in used car prices. Decreases in commodity prices, such as steel and platinum, may negatively affect vehicle values and demand at auctions. In addition, declines in used car prices, especially if they occur faster than anticipated, can lead to a significant gap between pre-accident value and sales price.

A significant change in used-vehicle prices could impact the proceeds and revenue from the sale of damaged and total loss vehicles.

The volume of new vehicle production, accuracy of lease residual estimates, interest rate fluctuations, customer demand and changes in regulations, among other things, all potentially affect the pricing of used vehicles. A sustained reduction in used-vehicle pricing could result in lower proceeds from the sale of damaged and total loss vehicles and a related reduction in revenue per vehicle, a potential loss of consignors and decreased profitability. Conversely, when used vehicle prices are high, used-vehicle dealers may retail more of their trade-in vehicles on their own rather than selling them at auction, which could adversely affect our revenues and profitability.

IAA assumes the settlement risk for vehicles sold through its marketplaces.

Typically, following the sale of a vehicle, IAA does not release the vehicle to a buyer until such time as it has received full payment for the vehicle. We may be obligated, however, to remit payment to a seller before receiving payment from a buyer and in those circumstances, we may not have recourse against sellers for any buyer’s failure to satisfy its payment obligations. Because we retain possession of the vehicle, we can resell the vehicle to mitigate any potential losses. Since revenue for most vehicles does not include the gross sales proceeds, failure to collect the receivables in full may result in a net loss up to the amount of gross sales proceeds on a per vehicle basis in addition to any expenses incurred to collect the receivables and to provide the services associated with the vehicle. If we are unable to collect payments on a large number of vehicles and we are unable to resell them and recover our costs, the resulting payment obligations to the seller and decreased fee revenues may have a material adverse effect on our results of operations and financial condition.

Changes in laws affecting the import and export of damaged and total loss vehicles may have an adverse effect on our business and financial condition.

Changes in laws, regulations and treaties that restrict the importation of damaged and total loss vehicles into foreign countries may reduce the demand for damaged and total loss vehicles and impact our ability to maintain or increase IAA’s international buyer base. The adoption of such laws or regulations in other jurisdictions that have the effect of reducing or curtailing our activities abroad could have a material adverse effect on our results of operations and financial condition by reducing the demand for our products and services.

We are subject to potential liabilities with respect to IAA’s prior separation from KAR Auction Services, Inc.

On February 27, 2018, KAR Auction Services, Inc. (“KAR”) announced a plan to pursue the separation and spin-off (the “Separation”) of IAA (its salvage auction services business) into a separate public company. On June 28, 2019, KAR completed the distribution of 100% of the issued and outstanding shares of common stock of IAA to the holders of record of KAR’s common stock on June 18, 2019, on a pro rata basis (the “Distribution”). Under the terms of the Separation and Distribution, each of IAA and KAR is required to indemnify the other party from and with respect to certain liabilities. IAA’s and KAR’s ability to satisfy these indemnities, if called upon to do so, will depend respectively upon our and KAR’s future financial strength. If we are required to indemnify KAR, or if we are not able to collect on indemnification rights from KAR, our financial condition, liquidity or results of operations could be materially and adversely affected.

We may not realize the anticipated benefits of, and synergies from, acquisitions and may become responsible for certain liabilities and integration costs as a result.