Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2011

OR

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number: 0-24081

EVOLVING SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Delaware | | 84-1010843 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

9777 Pyramid Court, Suite 100, Englewood, Colorado | | 80112 |

(Address of principal executive offices) | | (Zip Code) |

(303) 802-1000

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

Common Stock, Par Value $0.001 Per Share | | The Nasdaq Capital Market |

(Title of Class) | | (Name of exchange on which registered) |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | | Accelerated filer o |

| | |

Non-accelerated filer o | | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant, based upon the last sale price of the Common Stock reported on the Nasdaq Capital Market, was approximately $45.3 million as of June 30, 2011.

The number of shares of Common Stock outstanding was 11,221,534 as of March 22, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III (Items 10, 11, 12, 13 and 14) is incorporated by reference to portions of the registrant’s definitive proxy statement for the 2011 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days after the close of the 2011 year.

Table of Contents

EVOLVING SYSTEMS, INC.

Annual Report on Form 10-K

For the year ended December 31, 2011

Table of Contents

Table of Contents

FORWARD-LOOKING STATEMENTS

Except for the historical information contained in this document, this report contains forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995, including estimates, projections, statements relating to our business plans, objectives and expected operating results and assumptions. These forward-looking statements generally are identified by the words “believes,” “goals,” “projects,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” variations of these words and similar expressions. Forward-looking statements are based on current expectations, estimates, projections and assumptions regarding product, services, and customer support revenue; our expectations associated with Evolving Systems India and Evolving Systems U.K., and short- and long-term cash needs, and are subject to risks and uncertainties which may cause our actual results to differ materially from those discussed here. Factors that could cause or contribute to such differences include, but are not limited to those discussed in the sections entitled “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise

PART I

ITEM 1. BUSINESS

INTRODUCTION

Evolving Systems, Inc. is a leading provider of software solutions and services to the wireless, wireline and cable markets. Our customers rely on us to develop, deploy, enhance, maintain and integrate software solutions for a range of Operations Support Systems (“OSS”). Our products support traditional and next generation network technologies, convergent service offerings, and advanced wireless and other broadband networks. We maintain long-standing relationships with many major carriers worldwide. Included among our more than 50 network operator customers are many tier-1 wireless carriers, including two of the world’s largest wireless carriers headquartered outside of North America. We offer software products and solutions in four core areas:

· Service activation solutions used to activate complex bundles of voice, video and data services for traditional and next generation wireless, wireline and cable networks;

· SIM card activation and management solutions that improve the end user experience and dynamically allocate and assign resources to a wireless device when it is first used;

· Connected device solutions used to manage and activate machine-to-machine or M2M devices such as e-readers, smart meters, gaming consoles as well as other SIM-based industry specific devices;

· Billing mediation solutions that support the data collection for service assurance and billing applications.

Our products support traditional and next generation network technologies, convergent service offerings, and advanced wireless and other broadband networks.

We report the operations of our business as two operating segments based on revenue type: license fees and services revenue and customer support revenue. We report geographic information based upon revenue and long-lived assets in the United States, United Kingdom and all other foreign countries as a group. Further information regarding our operating segments and geographical information is contained in Note 11 to our Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

COMPANY BACKGROUND

Founded in 1985, we initially focused on providing custom software development and professional services to telecommunications companies in the United States. In November 2004, we significantly expanded our portfolio of products as a result of the acquisition of Tertio Telecoms Ltd. (“Evolving Systems U.K.”), a supplier of OSS software solutions for service activation and mediation to communication carriers throughout Europe, the Middle East, Africa and Asia. With this acquisition we expanded our markets beyond North America and added a service activation solution, Tertio™, and a billing mediation solution, Evident™, to our product portfolio. The result of this acquisition significantly expanded our product and service capabilities to address a larger portion of our customers’ OSS application needs with a balanced mix of products and product enhancements, as well as services.

On July 1, 2011, we completed an Asset Purchase Agreement (“Purchase Agreement”), with NeuStar, Inc., a Delaware corporation (the “Buyer”). Under the terms of the Purchase Agreement, we agreed to sell our Numbering Solutions Business (the “Numbering Business”) to the Buyer for $39.4 million in cash and the assumption of certain liabilities to the buyer, subject to increase or decrease in accordance with a post-closing working capital adjustment and the assumption of certain liabilities related to the Numbering Business (the “Asset Sale”). The Asset Sale included all of our Local Number Portability (“ LNP”) and Number Management solution products. There was no post-closing working capital adjustment.

1

Table of Contents

As a result of the Asset Sale, our strategy is now focused on service activation as a “pure play” with the majority of our focus on investments concentrating on the wireless markets in the areas of subscriber activation, SIM card management and activation, and connected device activation. We also continue to support our billing mediation product, Evident™.

RECENT DEVELOPMENTS

· The market is moving to add a wide array of connected devices to wireless and broadband networks This represents an opportunity for Evolving Systems to leverage our Dynamic SIM Allocation (“DSA”) technology to provide technical solutions for SIM-based devices such as M2M monitors, e-readers, network connected building management systems, network attached health monitoring systems as well as smart meters and wirelessly connected vending machines. We have announced a new product specifically focused on this market segment named Intelligent M2M Controller (“IMC”).

· The arrival and proliferation of 4G and LTE services. As consumers continue to exhibit an appetite for faster network connections to support devices such as smartphones and tablets, operators are investing to increase the bandwidth of their networks. Often carriers call this offering 4G services. This industry direction should provide opportunities for us with our DSA and service activation solutions.

· Many carriers are focusing increasing attention on improving their end-user experience for their wireless subscribers. Both Tertio™ as well as DSA enable carriers to improve the experience a customer has by providing flexible and powerful “on-device” activation solutions.

INDUSTRY DYNAMICS

The rapid introduction of new technologies such as wireless and broadband services has created a growing market for telecommunications solutions worldwide. This emergence of new technologies in telecommunications networks and end-user devices, consumer electronics, and personal computers, has created an industry that is in the midst of significant change. Carriers not only compete with companies from other industries, such as media and entertainment, but also with companies providing applications and services over the Internet. In such a competitive market, companies are increasingly bundling voice, messaging and data services in order to meet market demand. This bundling of services is just one facet of what is called convergence. In order to facilitate convergence, carriers are implementing a variety of network transformation programs that include: the migration to packet-switching transmission networks based on the Internet protocol (often called all-Internet Protocol (“IP”) networks); the migration to new service creation and delivery platforms that enable the provision of multimedia services over IP-based networks; and the introduction of one or more broadband access networks over existing wired infrastructure, new fiber deployments, cable access networks, and evolved wireless broadband networks including Global System for Mobile Communication (“GSM”)/EDGE, 3G/WCDMA/HSPA, and 4G/Long Term Evolution. Along with the continued development of new technologies, carriers are facing increasing levels of competition due to the varying demand in connection types, subscribers and service usage, as well as pricing declines due to competitive and regulatory pressures. Given the increased competitive climate in the telecommunication market, many carriers are pursuing network expansions in order to provide new value-added services (“VAS”). Carriers are, at the same time, continually looking to reduce operational costs which often leads to the rationalizing of their back office and OSS. This complex and rapidly changing landscape is further affected by the continued consolidation of carriers and their suppliers.

OPERATIONS SUPPORT SYSTEMS (“OSS”)

OSS encompasses a broad array of software and systems that perform critical functions for telecommunications carriers, such as service fulfillment, service assurance, and billing. Service fulfillment encompasses ordering, provisioning and activation. Ordering and Customer Relationship Management (“CRM”) systems collect customer information, retrieve current service information, capture and validate new service requests, verify the availability of selected services and transmit completed orders to one or more provisioning OSS. Inventory systems maintain physical and logical views of all the assets a carrier needs to turn up/off/change or add a service. Service assurance systems allow carriers to perform the testing, monitoring and reporting necessary to maintain appropriate network availability and feed operational data to other business systems. Service assurance systems also allow carriers to track and report on service conditions or outages in order to dispatch their large work force for necessary repairs. Carriers use billing systems to collate, manage and report usage information for partner and customer billing. OSS typically operate in a highly available 24x7 environment to support the real-time communication networks that facilitate the carriers’ service offerings.

Traditionally, as carriers have added new services, such as wireless or Internet-based services, they have either developed their own in-house OSS applications or added new OSS applications from product vendors. These additional OSS can be difficult to integrate into the carriers’ operations, as they often utilize heterogeneous elements, making interoperability among the systems technically challenging. These OSS are further constrained by the many incremental changes that have been made in order to accommodate new computing and network technologies and new value-added services, such as texting and broadband services. In addition, carriers have had to adapt their OSS to comply with government or regulatory mandates that in some cases change how systems and processes are required to work. Because of these challenges, carriers have difficulty replacing existing OSS due to the large investment and the complicated interoperability environments in which they operate. As a result, carriers often continue to make incremental modifications to these OSS, in some cases further increasing their complexity and making it more difficult for the

2

Table of Contents

applications to be replaced. However, as packaged OSS software solutions continue to advance, carriers are increasingly looking to replace their legacy OSS environments with OSS software packages designed to meet growing complex processes in the areas of service fulfillment, service assurance and billing.

PRODUCT PORTFOLIO

Dynamic SIM Allocation

In 2007, we announced our DSA solution that offers carriers a new way to provision wireless services by dynamically activating and assigning resources to the wireless device when it is first used. The wireless Subscriber Identity Module (“SIM”) card is central to the provision of wireless access and services for GSM/EDGE and 3G/WCDMA networks and is specified as part of the next generation 4G LTE technologies. These networks represent the most common type of wireless technology used today by wireless operators world-wide. Typically, SIM cards are either pre-provisioned before they are distributed to the retail environment or are provisioned at the point of sale. Pre-provisioning SIM cards require that network resources are allocated well in advance of the SIM card becoming available for sale. This inevitably leads to poor utilization of network resources such as numbers and other critical identifiers. The result is increased network costs and a poor user experience. Provisioning SIM cards at the point of sale overcomes many of these issues but at a high cost, as retail and back-office infrastructure needs to be in place. Our DSA solution offers carriers the user experience and resource efficiency benefits of provisioning at the point of sale without demanding the retail and back-office infrastructure usually required. The solution offers a number of benefits including:

· Improved user experience: Carriers can have various customer care processes, like those for mobile number portability, or replacing lost or stolen SIM cards, that are inefficient and have high operational costs. The solution helps carriers provide more customer self-care for an improved user experience and lower costs.

· Easier to personalize: Prepaid subscribers have traditionally been unable to choose their mobile phone number at time of activation. With our solution, prepaid subscribers can choose their number from a database of available numbers, using just their mobile phone. Furthermore, with our solution, carriers can monetize their number inventory by charging for vanity or golden numbers.

· Improve efficiency and utilization: Carriers can experience a high wastage of SIM cards that are never activated for a revenue-generating subscriber. Our solution reduces the cost of this wastage by removing the need for SIM cards to be pre-provisioned in network databases.

· Ensure availability: Carriers can find it difficult to effectively and reliably manage their SIM inventory, especially when multiple SIM card variants and profiles are needed. The solution helps carriers to ensure new SIM cards and numbers are always available to meet demand.

DSA is an integrated solution comprised of the following components:

· First Use Register — a module that interacts with a subscriber’s initial activation process;

· Task Management — a module that controls the process flow of tasks involved with completing the end user’s activation process.;

· Resource Management — a component that records and controls the management and assignment of specific network inventory elements and resources;

· Menu User — a module that provides carriers with the ability to customize the end user experience on the SIM card. Working with the SIM applet, Menu Server allows the wireless carrier to quickly and easily customize the end user screens on their phones or other devices;

· Mobile Broadband Module — this allows our DSA solution to support activation processes not only by a dialogue on the phone screens but also through a browser. This solution enables carriers to offer a customized experience for subscribers who are activating mobile broadband features for their smart phones or a wide variety of other wirelessly connected devices; and

· Operational Dashboard — a module that assists carriers in the administration, operations and maintenance of the DSA platform. Operational Dashboard offers our customers a flexible and easy-to-use tool that provides important visibility on the performance of DSA as well as a powerful reporting tool.

Service Activation

Our service activation solution, Tertio™, is employed by carriers to activate a new subscriber or to add a new service to an existing subscriber. Our Tertio product provides a flexible operating environment and can be used by carriers to manage their voice, data, and content service needs for both their traditional and broadband IP networks. Our solution is deployed as the service activation engine for over 50 networks around the world including two of the world’s largest wireless carriers.

3

Table of Contents

Tertio is an integrated solution comprised of the following components:

· Tertio Service Composer — a modeling tool that simplifies the creation of new services;

· Tertio Content Connector — a tool used for activation of next-generation services;

· Tertio Activation Designer — a tool that is designed to speed network feature activation;

· Tertio Service Activation — the platform that provides scalability and performance, flexibility and a graphical interface; and

· Tertio Service Verification — a module that allows carriers to verify that the services implemented in the network match those that were in the original service order. By providing this capability, carriers can continually check the accuracy of their order/activation processes.

Our Tertio solution addresses the entire service lifecycle, enabling service providers to better plan, manage and execute the introduction of new services. Tertio allows carriers to introduce new network technologies and eases the burden of integration with existing devices and systems.

Billing Mediation

Our billing mediation product is Evident™. It enables customers to capture important usage data from the network elements. Billing mediation is the process of collecting network usage data and verifying that usage data is accurate, and is a required pre-condition for generating accurate bills for a carrier’s customers. Billing mediation’s importance lies in its ability to provide a systematic point of reliability and assurance between network consumption and the billing system input. Our Evident product supports convergent voice, data, and content services. Evident™ software enables the accurate management of data, allowing reconciliation of data inputs and outputs. In addition, it provides support for compliance with relevant regulatory, accounting and data integrity requirements. This product also provides service usage data for business intelligence, revenue assurance, and next-generation billing solutions. Our Evident™ solution can be used by wireline, broadband and wireless carriers and provides carrier-grade support in terms of reliability, performance, and scalability.

PROFESSIONAL AND INTEGRATION SERVICES

Our Professional and Integration Services team provides expert consulting services and advice for the design, customization, integration and deployment of our products. The Professional and Integration Services team works closely with the Product Engineering and Development teams so that our products can meet the requirements of our customers as technologies and business requirements continue to evolve. These services cover all aspects of the project lifecycle including system architecture and design, component design, development and customization, system integration and testing, deployment and production support, program and project level management, and domain and product expertise. Our teams work closely with customers and integration partners and have established close, long-term relationships with operators in the Americas, Europe, the Middle East, Africa and Asia Pacific regions.

PRODUCT DEVELOPMENT

We continue to invest in product development (“PD”), particularly for new products and/or for enhancements of existing products. PD is expensed as incurred. For the years ended December 31, 2011, 2010 and 2009, we expensed $2.5 million, $2.5 million and $2.2 million, respectively, in PD costs. The majority of PD investments in 2011 have gone into enhancing our core service activation as well as the further development of our DSA solution.

We focus our product development efforts on identifying specific industry and customer business needs as well as market requirements and then developing solutions that leverage our existing product capabilities. Based upon the identified customer business needs, our product development efforts comprise a combination of design and development of new products or features to enhance our existing products, and design and development of new product functionality as identified in our product “roadmaps.” We build investment plans for our principal product areas and we make other investments in tools and product extensions to accelerate the development, implementation and integration process for customer solutions.

SALES AND MARKETING

Our sales force is primarily a field-based organization structured to focus on specific geographical territories: North America, Europe, Middle East and Africa, Russia and the Commonwealth of Independent States, Asia Pacific, and Central and Latin America. Our sales activities cover both direct sales to the end user customers as well as sales through partners such as Gemalto and Oberthur, who include our products as part of a wider SIM-based solution offering.

The primary objective of our marketing organization is to identify markets for our products and to establish an awareness of our offerings in those markets through a combination of direct marketing, web marketing, and through our participation in shows,

4

Table of Contents

conferences, and industry bodies. The marketing organization also creates electronic and print-based sales collateral to support these activities, as well as maintaining a permanent presence on the web.

Evolving Systems offers a complex product set which lends itself to a high degree of on-site consultative selling with the prospect as part of the sales process. Our sales efforts also cover a large amount of interaction with existing customers where we work to develop incremental revenue streams on existing platforms as well as the introduction of new value propositions. The sales team is responsible for the generation of proactive proposals to prospects, as well as the management and delivery of responses to competitive tenders. This complex, highly involved approach creates a long sales cycle, requiring us to invest a considerable amount of time toward uncertain results.

COMPETITION

The market for telecommunications OSS products is intensely competitive and is subject to rapid technological change, changing industry standards, regulatory developments and consolidation. We face increasing demand for improved product performance, enhanced functionality, rapid integration capabilities as well as pressures to be competitively priced. Our existing and potential competitors include many large domestic and international companies that often have substantially greater financial, technological, marketing, distribution and other resources, larger installed customer bases and longer-standing relationships with telecommunications customers than we do. The market for telecommunications OSS software and services is extremely large. And, we currently hold only a small portion of total market share. Our increased focus on activation as well as our work to establish the Dynamic SIM Allocation market has resulted in our achieving a measurable and reasonable market share in those areas.

Our principal competitors in service activation are Oracle (as a result of its acquisition of Metasolv), Comptel, Intec and Synchronoss Technologies. In mediation, our competitors include CSG Systems and Comptel. For our DSA solution, we believe we hold a significant leadership position in this emerging market segment, however, we are seeing the arrival of competition from Giesecke & Devrient GmbH, Hewlett-Packard Company and Comptel, as well as some other smaller competitors. In addition, some of the network equipment manufacturers’ next generation solutions address some of the benefits provided by DSA.

For all of our products, our ability to compete successfully depends on a wide range of factors. We deliver value by offering quality solutions at a competitive price that are tailored specifically to our customers’ network topography. Once a customer has implemented one of our products, we often receive subsequent orders for enhancements and change requests to add functionality and/or to increase capacity. This follow-on business, and the fact that it is a complicated and expensive process to replace our software, provides an attractive revenue opportunity for us. Furthermore, many of our customer relationships span five years or more. We believe these long-term customer relationships give us a competitive advantage and can be a barrier to entry for our competitors.

SIGNIFICANT CUSTOMERS

For the year ended December 31, 2011, one significant customer (defined as contributing at least 10%) accounted for 10% of revenue from continuing operations. This customer is a large telecommunications operator in Europe. For the years ended December 31, 2010 and 2009, two significant customers accounted for 23% (12% and 11%) and 25% (13% and 12%) of revenue from continuing operations. These customers are large telecommunications operators in Europe and Asia. The loss of any of these customers would have a material adverse effect on our business as a whole.

INTELLECTUAL PROPERTY

We rely on a combination of patents, copyright, trademark and trade secret laws, as well as confidentiality agreements and licensing arrangements, to establish and protect our proprietary rights. We presently have patents pending in the U.S. and other countries on elements of our DSA and IMC products.

BACKLOG

We define backlog as firm non-cancelable sales orders that are anticipated to be delivered and recognized in revenue over the next twelve months. As of December 31, 2011 and 2010, our backlog was approximately $12.6 million and $7.8 million, respectively. Our backlog at December 31, 2011 was comprised of license fees and services of $7.8 million and customer support of $4.8 million compared to license fees and services of $2.8 million and customer support of $5.0 million at December 31, 2010.

EMPLOYEES

As of December 31, 2011, we employed 140 people including 9 in the United States, 56 in the United Kingdom and 75 in Bangalore, India. Of our worldwide staff, 87% are involved in product delivery, development, support and professional services, 7% in sales and marketing, and 6% in general administration.

5

Table of Contents

AVAILABLE INFORMATION

You can find out more information about us at our Internet website located at www.evolving.com. The information on our website is not incorporated into this Annual Report on Form 10-K. Our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K and any amendments to those reports are available free of charge on our Internet website as soon as reasonably practicable after we electronically file such material with the SEC. Additionally, these reports are available at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or on the SEC’s website at www.sec.gov. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

ITEM 1A. RISK FACTORS

Risks Related to Our Business

Impact of Long Sales Cycle; Sales of our products typically require significant review and internal approval processes by our customers over an extended period of time. Interruptions in such process due to economic downturns, consolidations or otherwise could result in the loss of our sale or deferral of revenue into later periods and adversely affect our financial performance.

Large communications solutions used for enterprise-wide, mission-critical purposes, involve significant capital expenditures and lengthy implementation plans. Prospective customers typically commit significant resources to the technical evaluation of our products and services and require us to spend substantial time, effort and money providing education regarding our solutions. This evaluation process often results in an extensive and lengthy sales cycle, typically ranging between three and twelve months, making it difficult for us to forecast the timing and magnitude of our contracts. For example, customers’ budgetary constraints and internal acceptance reviews may cause potential customers to delay or forego a purchase. In addition, our TSA and DSA sales opportunities in any given quarter typically include a few high value opportunities. The delay or failure to complete one or more large contracts could materially harm our business, financial condition, results of operations and cash flows and cause our operating results to vary significantly from quarter to quarter and year to year.

Mergers and acquisitions of large communications companies, as well as the formation of new alliances, have resulted in a constantly changing marketplace for our products and services. Purchasing delays and pricing pressures associated with these changes are common. In addition, many of the companies in the communications industry have kept capital expenditures at historically low levels in response to changes in the communications marketplace; some companies have declared bankruptcy, cancelled contracts, delayed payments to their suppliers or delayed additional purchases. The delay or failure to complete one or more large contracts, or the loss of a significant customer, could materially harm our business, financial condition, results of operations, or cash flows, and cause our operating results to vary significantly from quarter to quarter and year to year.

Following the sale of our Numbering Business, we are a smaller, less diversified company that will be more adversely affected by sales fluctuations, limited staff and employee turnover.

Our revenue is smaller following the sale of our Numbering Business in July 2011. Consequently, sales fluctuations could have a greater impact on our revenue and profitability on a quarter-to-quarter basis and a delayed contract could cause our operating results to vary significantly from quarter to quarter. In addition, following the sale of our Numbering Business we reduced our staff and as a smaller company we are heavily reliant on certain key personnel. We may not have sufficient staff to effectively operate our business. In addition, if a key employee were to leave the company it could have a material impact on our business and results of operations as we might not have sufficient depth in our staffing to fill the role that was previously being performed. A delay in filling the vacated position could put a strain on existing personnel or result in a failure to satisfy our contractual obligations or to effectively implement our internal controls, and materially harm our business.

Because our quarterly and annual operating results are difficult to predict and may fluctuate, the market price for our stock may be volatile.

Our operating results have fluctuated significantly in the past and may continue to fluctuate significantly in the future. Fluctuations in operating results may result in volatility of the price of our common stock. These quarterly and annual fluctuations may result from a number of factors, including:

· the size of new contracts and when we are able to recognize the related revenue;

· our rate of progress under our contracts;

· foreign exchange fluctuations;

· budgeting cycles of our customers;

· changes in the terms and rates related to the renewal of support agreements;

6

Table of Contents

· the mix of products and services sold;

· the timing of third-party contractors’ delivery of software and hardware;

· level and timing of expenses for product development and sales, general and administrative expenses;

· changes in our strategy;

· general economic conditions.

Personnel costs are a significant component of our budgeted expense levels and, therefore, our expenses are, to a degree, variable based upon our expectations regarding future revenue. As discussed above, our revenue is difficult to forecast and our sales cycle and the size and timing of significant contracts vary substantially among customers. Accordingly, we may be unable to adjust spending in a timely manner to compensate for any unexpected shortfall in revenue. Any significant shortfall from anticipated levels of demand for our products and services could adversely affect our business, financial condition, results of operations and cash flows.

Based on these factors, we believe our future quarterly and annual operating results may vary significantly from quarter to quarter and year to year. As a result, quarter-to-quarter and year-to-year comparisons of operating results are not necessarily meaningful nor do they indicate what our future performance will be. Furthermore, we believe that in future reporting periods if our operating results fall below the expectations of public market analysts or investors, it is possible that the market price of our common stock could decrease.

Our results of operations could be negatively impacted if we are unable to manage our liquidity.

Our cash forecast indicates that we will have sufficient liquidity to cover anticipated operating costs for at least the next twelve months, but this could be negatively impacted to the extent we are unable to invoice and collect from our customers in a timely manner, or an unexpected adverse event, or combination of events occurs. Therefore, if the timing of cash generated from operations is insufficient to satisfy our liquidity requirements, we may require access to additional funds to support our business objectives through a credit facility or possibly the issuance of additional equity. Additional financing may not be available at all or, if available, may not be obtainable on terms that are favorable to us and not dilutive.

Because our investments are concentrated in the debt securities of a single issuer, adverse events affecting that issuer are likely to have a greater negative impact on us than would occur if our investments were diversified among a larger group of issuers or securities.

Our investment policy requires investments to be rated B- or better. Currently, all of our investments are concentrated in the debt securities of a single issuer, and as a result, adverse events affecting that issuer are likely to have a greater negative impact on us, including a greater risk of loss of our investment, than would occur if our investments were diversified among a larger group of issuers or securities. Any significant future declines in the market values of that issuer’s senior secured debt or common stock, or any significant adverse developments in that issuer’s business, industry, operations or financial condition could materially adversely affect the value of our investment, the issuer’s ability to repay its obligations under the notes, or our financial condition and operating results. Credit ratings and pricing of these investments can be negatively impacted by liquidity, credit deterioration or losses, financial results, or other factors. As a result, the value or liquidity of our long-term investments could decline and result in a material impairment, which could materially adversely affect our financial condition and operating results. If the issuer defaults on its obligations under the notes, the guarantors may be unable to repay the amounts due and the collateral securing the notes may have insufficient value to allow us to obtain a return of our investment in the notes. The senior secured notes are not publicly traded and the issuer has no obligation to register the notes for resale. As a result, we may not be able to resell the notes at a favorable price, or at all, if and when we wish to do so.

The market for our service activation products is mature and we may not be able to successfully develop new products to remain competitive.

The market for our service activation product is mature and we may not be able to successfully identify new product opportunities. If we are unable to identify new product opportunities, sales and profit growth would be adversely affected.

The market for our DSA product is uncertain and we may not be able to generate sufficient demand for our DSA product and new products to grow our business.

We are still in the process of developing customer demand for our DSA product and the market for enhancements to our DSA product and for new products is uncertain; we are still in the early stages of developing customer demand for these products. Our current strategy is heavily reliant on achieving increased sales of our DSA product, enhancements to our DSA product and new products and if we are unable to achieve market acceptance of these products our sales and profit growth would be adversely affected.

7

Table of Contents

If we are unable to properly supervise our software development subsidiary in India, or if political or other uncertainties interfere, we may be unable to satisfactorily perform our customer contracts and our business could be materially harmed.

In February 2004, we formed Evolving Systems India, a wholly owned subsidiary of Evolving Systems, Inc. We have experienced a high level of turnover with our Indian development staff as a result of strong competition for technology-based personnel in India. In addition, salary levels in India are steadily increasing, reducing the competitive advantages associated with offshore labor. If we are unable to effectively manage the Evolving Systems India development staff and/or we continue to experience high levels of staff turnover, we may fail to provide quality software in a timely fashion, which could negatively affect our ability to satisfy our customer contracts. Furthermore, political changes and uncertainties in India could negatively impact the business climate there. As a result, we may be unable to satisfactorily perform our customer contracts and our business, financial condition and results of operations could be materially harmed.

We operate a global business that exposes us to additional currency, economic, regulatory and tax risks.

A significant part of our revenue comes from international sales. Our international operations are subject to the risk factors inherent in the conduct of international business, including:

· fluctuations in currency exchange rates;

· compliance with the U.S. Foreign Corrupt Practices Acts and other anti-bribery laws and regulations;

· unexpected changes in regulatory requirements;

· compliance with export regulations, tariffs and other barriers;

· political and economic instability;

· limited intellectual property protection;

· difficulties in staffing and managing foreign operations; and

· potentially adverse tax consequences in connection with repatriating funds.

Approximately half of our revenue is transacted in non- U. S. Dollar denominated currencies (e.g. British Pound Sterling and Euro). As a result, when the U.S. Dollar strengthens, our revenue, when converted to U.S. dollars, is reduced. At the same time, with more than 50% of our operating expenses originating overseas, the strengthening dollar conversely lowers expenses outside of the U.S. Although this has provided some defense against currency fluctuations for our bottom line results, we may not be able to maintain this ratio of revenue to expense in the future. In addition, we may not be able to sustain or increase our international revenue or repatriate cash without incurring substantial risks involving floating currency exchange rates and income tax expenses. Any of the foregoing factors may have a material adverse impact on our international operations and, therefore, our business, financial condition and results of operations.

Changes or challenges to the regulations of the communication industry could hurt the market for our products and services.

Our customers may require, or we may find it necessary or advisable, to modify our products or services to address actual or anticipated changes in regulations affecting our customers. This could materially harm our business, financial condition, results of operations, and cash flows. We are also subject to numerous regulatory requirements of foreign jurisdictions. Any compliance failures or changes in such regulations could, likewise, materially harm our business, financial condition, results of operations and cash flows.

Consolidation in the communications industry may impact our financial performance.

The communications industry has experienced and continues to experience significant consolidation, both in the United States and internationally. These consolidations have caused us to lose customers and may result in fewer potential customers requiring OSS solutions in the future. In addition, combining companies may re-evaluate their OSS solutions and their capital expenditures and may choose a competitive OSS solution used by one of the combining companies. As our customers become larger, they generally have stronger purchasing power, which can result in reduced prices for our products, lower margins on our products and longer sales cycles. All of these factors can have a negative impact on our financial performance, particularly in any fiscal quarter. Because of the uncertainty resulting from these consolidations and the variations in our quarterly operating results, it is extremely difficult for us to forecast our quarterly and annual revenue and we have discontinued providing revenue guidance.

We depend on a limited number of significant customers for a substantial portion of our revenue, and the loss of one or more of these customers could adversely affect our business.

We earn a significant portion of our revenue from a small number of customers in the communications industry. This has been mitigated somewhat by the expansion of our customer base in recent years, but, as noted above, our revenue is smaller following the sale of our Numbering Business and consolidation in the industry continues. The loss of any significant customer, delays in delivery or acceptance of any of our products by a customer, delays in the performance of services for a customer, or delays in

8

Table of Contents

collection of customer receivables could harm our business and operating results to a greater degree than other companies with a broader customer base.

Our products are complex and have a lengthy implementation process; unanticipated difficulties or delays in the customer acceptance process could result in higher costs and delayed payments.

Implementing our solutions can be a relatively complex and lengthy process since we typically customize these solutions for each customer’s unique environment. Often our customers may also require rapid deployment of our software solutions, resulting in pressure on us to meet demanding delivery and implementation schedules. Delays in implementation may result in customer dissatisfaction and/or damage our reputation, which could materially harm our business.

The majority of our existing contracts provide for acceptance testing by the customer, which can be a lengthy process. Unanticipated difficulties or delays in the customer acceptance process could result in higher costs, delayed payments, and deferral of revenue recognition. In addition, if our software contains defects or we otherwise fail to satisfy acceptance criteria within prescribed times, the customer may be entitled to liquidated damages or to cancel its contract and receive a refund of all or a portion of amounts paid or other amounts as damages, which could exceed related contract revenue and which could result in a future charge to earnings. Any failure or delay in achieving final acceptance of our software and services could harm our business, financial condition, results of operations and cash flows.

Many of our products and services are sold on a fixed-price basis. If we incur budget overruns, our margins and results of operations may be materially harmed.

Currently, a large portion of our revenue is from contracts that are on a fixed-price basis. We anticipate that customers will continue to request we provide software and integration services as a total solution on a fixed-price basis. These contracts specify certain obligations and deliverables we must meet regardless of the actual costs we incur. Projects done on a fixed-price basis are subject to budget overruns. On occasion, we have experienced budget overruns, resulting in lower than anticipated margins. We may incur similar budget overruns in the future, including overruns that result in losses on these contracts. If we incur budget overruns, our margins may be harmed, thereby affecting our overall profitability.

Percentage-of-completion accounting used for most of our projects can result in overstated or understated profits or losses.

The revenue for most of our contracts is accounted for on the percentage-of-completion method of accounting. This method of accounting requires us to calculate revenue and profits to be recognized in each reporting period for each project based on our predictions of future outcomes, including our estimates of the total cost to complete the project, project schedule and completion date, the percentage of the project that is completed and the amounts of any probable unapproved change orders. Our failure to accurately estimate these often subjective factors could result in reduced profits or losses for certain contracts.

The industry in which we compete is subject to rapid technological change. If we fail to develop or introduce new, reliable and competitive products in a timely fashion, our business may suffer.

The market for our products and services is subject to rapid technological changes, evolving industry standards, changes in carrier requirements and preferences and frequent new product introductions and enhancements. The introduction of products that incorporate new technologies and the emergence of new industry standards can make existing products obsolete and unmarketable. To compete successfully, we must continue to design, develop and sell enhancements to existing products and new products that provide higher levels of performance and reliability in a timely manner, take advantage of technological advancements and changes in industry standards and respond to new customer requirements. As a result of the complexities inherent in software development, major new product enhancements and new products can require long development and testing periods before they are commercially released and delays in planned delivery dates may occur. We may not be able to successfully identify new product opportunities or achieve market acceptance of new products brought to market. In addition, products developed by others may cause our products to become obsolete or noncompetitive. If we fail to anticipate or respond adequately to changes in technology and customer preferences, or if our products do not perform satisfactorily, or if we have delays in product development, we may lose customers and our sales may deteriorate.

The communications industry is highly competitive and if our products do not satisfy customer demand for performance or price, our customers could purchase products and services from our competitors.

Our primary markets are intensely competitive and we face continuous demand for improved product performance, new product features and reduced prices, as well as intense pressure to accelerate the release of new products and product enhancements. Our existing and potential competitors include many large domestic and international companies, including some competitors that have substantially greater financial, manufacturing, technological, marketing, distribution and other resources, larger installed customer bases and longer-standing relationships with customers than we do. Our principal competitors in activation are Oracle (as a result of its acquisition of Metasolv), Comptel, Intec and Synchronoss Technologies. In mediation, we compete with CSG Systems and Comptel. Our principal competitors in the SIM allocation market include Giesecke & Devrient GmbH, Hewlett-Packard Company and Comptel. Customers also may offer competitive products or services in the future since customers who have purchased solutions

9

Table of Contents

from us are not precluded from competing with us. Many telecommunications companies have large internal development organizations, which develop software solutions and provide services similar to the products and services we provide. We also expect competition may increase in the future from application service providers, existing competitors and from other companies that may enter our existing or future markets with solutions which may be less costly, provide higher performance or additional features or be introduced earlier than our solutions.

We believe that our ability to compete successfully depends on numerous factors, including the quality and price competitiveness of our products and services compared to those of our competitors, the emergence of new industry standards and technical innovations and our ability to respond to those changes. Some of these factors are within our control, and others are not. A variety of potential actions by our competitors, including a reduction of product prices or increased promotion, announcement or accelerated introduction of new or enhanced products, or cooperative relationships among competitors and their strategic partners, could negatively impact the sales of our products and we may have to reduce the prices we charge for our products. Revenue and operating margins may consequently decline. We may not be able to compete successfully with existing or new competitors or to properly identify and address the demands of new markets. This is particularly true in new markets where standards are not yet established. Our failure to adapt to emerging market demands, respond to regulatory and technological changes or compete successfully with existing and new competitors would materially harm our business, financial condition, results of operations and cash flows.

Our business depends largely on our ability to attract and retain talented employees.

Our ability to manage future expansion, if any, effectively will require us to retain our current personnel and attract, train, motivate and manage new employees successfully, to integrate new management and employees into our overall operations and to continue to improve our operations, financial and management systems. We may not be able to retain personnel or to hire additional personnel on a timely basis, if at all. Because of the complexity of our software solutions, a significant time lag exists between the hiring date of technical and sales personnel and the time when they become fully productive. We have at times experienced high employee turnover and difficulty in recruiting and retaining technical personnel. Our failure to retain personnel or to hire qualified personnel on a timely basis could adversely affect our business by impacting our ability to develop new products, to complete our projects and secure new contracts.

Our products are complex and may have errors that are not detected until deployment, and litigation related to warranty and product liability claims could be expensive and could negatively affect our reputation and profitability.

Our agreements with our customers typically contain provisions designed to limit our exposure to potential liability for damages arising out of the use of, or defects in, our products. These limitations, however, tend to vary from customer to customer and it is possible that these limitations of liability provisions may not be effective. We currently have errors and omissions insurance, which, subject to customary deductibles, exclusions and limits, covers claims resulting from failure of our software products or services to perform the function or to serve the purpose intended. To the extent that any successful product liability claim is not covered by this insurance, we may be required to pay for a claim. This could be expensive, particularly since our software products may be used in critical business applications. Defending such a suit, regardless of its merits, could be expensive and require the time and attention of key management personnel, either of which could materially harm our business, financial condition and results of operations. In addition, our business reputation could be harmed by product liability claims, regardless of their merit or the eventual outcome of these claims.

Our measures to protect our proprietary technology and other intellectual property rights may not be adequate and if we fail to protect those rights, our business would be harmed.

Our success and ability to compete are dependent to a significant degree on our proprietary technology. We rely on a combination of patent, copyright, trademark and trade secret laws, as well as confidentiality agreements and licensing arrangements, to establish and protect our proprietary rights. We have patents pending in the U.S. and other countries on elements of our DSA product. In addition, we have registered or filed for registration of certain of our trademarks. Our patent portfolio is relatively small and given the cost of obtaining patent protection, we may choose not to patent certain inventions that later become important. There is also the possibility that a our means of protecting our proprietary right may not be adequate and a third party may copy or otherwise obtain and use our products or technology without authorization or may develop similar technology independently or design around our patents. In addition, the laws of some foreign countries may not adequately protect our proprietary rights.

If our intellectual property protection proves inadequate, we may lose our competitive advantage and our future financial results may suffer.

10

Table of Contents

In the event that we are infringing upon the proprietary rights of others or violating licenses, we may become subject to infringement or other claims that may prevent us from selling certain products and we may incur significant expenses in resolving these claims.

It is also possible that our business activities may infringe upon the proprietary rights of others, or that other parties may assert infringement claims against us. Those claims may involve patent holding companies or other adverse patent owners who have no relevant product revenue of their own, and against whom our own patents may provide little or no deterrence. If we become liable to any third party for infringing its intellectual property rights, we could be required to pay substantial damage awards and to develop non-infringing technology, obtain licenses, or to cease selling the applications that contain the infringing intellectual property. Litigation is subject to inherent uncertainties, and any outcome unfavorable to us could materially harm our business. Furthermore, we do not carry insurance covering infringement claims and we could incur substantial costs in defending against any intellectual property litigation, and these costs could increase significantly if any dispute were to go to trial. Our defense of any litigation, regardless of the merits of the complaint, likely would be time-consuming, costly, and a distraction to our management personnel. Adverse publicity related to any intellectual property litigation also could harm the sale of our products and damage our competitive position.

Certain software developed or used by Evolving Systems, as well as certain software acquired in our acquisition of Evolving Systems U.K., may include so called “open source” software that is made available under an open source software license.

· Such open source software may be made available under licenses, certain of which may impose obligations on us in the event we were to distribute derivative works based on the open source software. Certain licenses impose obligations that could require us to make source code for a derivative work available to the public or license the derivative work under a particular type of open source software license, rather than the license terms we customarily use to protect our software.

· There is little or no legal precedent for interpreting the terms of certain of these open source licenses, including the terms addressing the extent to which software incorporating open source software may be considered a derivative work subject to these licenses. We believe we have complied with our obligations under the various applicable open source licenses. However, if the owner of any open source software were to successfully establish that we had not complied with the terms of an open source license for a particular product that includes such open source software, we may be forced to release the source code for that derivative work to the public or cease distribution of that work.

Disruptions from terrorist activities, geopolitical conditions or military actions may disrupt our business.

The continued threat of terrorism within the U.S. and throughout the world and acts of war may cause significant disruption to commerce throughout the world. Abrupt political changes and armed conflict pose a risk of economic disruption in affected countries, which may increase our operating costs and add uncertainty to the timing and budget for technology investment decisions by our customers. Our business and results of operations could be materially and adversely affected to the extent that such disruptions result in delays or cancellations of customer orders, delays in collecting cash, a general decrease in corporate spending on information technology, or our inability to effectively market, manufacture or ship our products. We are unable to predict whether war, political unrest and the threat of terrorism or the responses thereto will result in any long-term commercial disruptions or if such activities or responses will have any long-term material adverse effect on our business, results of operations, financial condition or cash flows.

We face risks associated with doing business through local partners.

In some countries, because of local customs and regulations or for language reasons, we do business with our customers through local partners who resell our products and services, with or without value-added services. This can cause delays in closing contracts because of the increased complexity of having another party involved in negotiations. In addition, where the local partner provides additional software, hardware and/or services to the end-user customer, our products and services may only be a small portion of the total solution. As a result, payments made to us, as well as conditions surrounding acceptance, may be impacted by factors that are out of our control. There may also be delays in getting payments made by the end-user customer through the reseller. We recently experienced delays in collecting from one of our resellers and this situation may arise again in the future, negatively impacting our cash flows. . Doing business through local partners may also increase our risks under anti-bribery regulations, discussed below.

We face special risks associated with doing business in highly corrupt environments.

Our international business operations include projects in developing countries and countries torn by conflict. To the extent we operate outside the U.S., we are subject to the Foreign Corrupt Practices Act (“FCPA”), which generally prohibits U.S. companies and their intermediaries from paying or offering anything of value to foreign government officials for the purpose of obtaining or keeping business, or otherwise receiving discretionary favorable treatment of any kind. We may also be subject to anti-bribery laws and regulations of the U.K. and other countries. In particular, we may be held liable for actions taken by our local partners and agents, even though such parties are not always subject to our control. Any determination that we have violated the FCPA (whether directly or through acts of others, intentionally or through inadvertence) or other anti-bribery legislation could result in sanctions that could have a material adverse effect on our business. While we have procedures and controls in place to monitor compliance, situations

11

Table of Contents

outside of our control may arise that could potentially put us in violation of the FCPA or other anti-bribery legislation inadvertently and thus negatively impact our business.

Our business and operating results will suffer if our systems or networks are compromised orfail.

Increased sophistication and activities of perpetrators of cyber attacks have resulted in an increase in information security risks in recent years. Our software development and support of our telecommunications customers are increasingly dependent on information technology systems that are complex and vital to continuing operations. A substantial portion of our software development and customer support is provided out of our India facility, which may be subject to increased risk of power loss, telecommunications failure, terrorist attacks and similar events. If we were to experience difficulties maintaining existing systems or implementing new systems, we could incur significant losses due to disruptions in our operations. Additionally, these systems contain valuable proprietary and confidential information and a breach, including cyber security breaches, could result in the disclosure or misuse of this information, damage our reputation, increase our costs and/or cause losses. Although we believe that we have robust information security procedures and other safeguards in place, many of our services do not have fully redundant systems or a formal disaster recovery plan, and we may not have adequate business interruption insurance to compensate us for losses that occur from a system outage. As cyber threats continue to evolve, we may be required to expend additional resources to continue to enhance our information security measures and/or to investigate and remediate any information security vulnerabilities. Any of these consequences would adversely affect our revenue, performance and business prospects.

The trading price of our stock has been subject to wide fluctuations and may continue to experience volatility in the future.

The trading price of our common stock has been subject to wide fluctuations in response to quarterly variations in operating results, announcements of technological innovations or new products by us or our competitors, merger and acquisition activity, changes in financial estimates by securities analysts, the operating and stock price performance of other companies that investors may deem comparable to us, general stock market and economic considerations and other events or factors. This may continue in the future.

In addition, the stock market has experienced volatility that has particularly affected the market prices of stock of many technology companies and often has been unrelated to the operating performance of these companies. These broad market fluctuations may negatively impact the trading price of our common stock. As a result of the foregoing factors, our common stock may not trade at or higher than its current price.

Sales of large blocks of our stock may result in the reduction in the market price of our stock and make it more difficult to raise funds in the future.

If our stockholders sell substantial amounts of our common stock in the public market, the market price of our common stock could fall. The perception among investors that such sales will occur could also produce this effect. We currently have several stockholders who own large percentages of our stock. To the extent we continue to have one or more stockholders who own a large percentage of our stock and those stockholders chose to liquidate their holdings, it may have a dramatic impact on the market price of our stock. These factors also could make it more difficult to raise funds through future offerings of common stock.

We are subject to certain rules and regulations of federal, state and financial market exchange entities, the compliance with which requires substantial amounts of management time and company resources. We identified a material weakness in our financial reporting, and failure to remediate it or any future ineffectiveness of internal controls could adversely affect our business and the price of our common stock.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and NASDAQ, have issued requirements and regulations and are currently developing additional regulations and requirements in response to laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2011. Our compliance with certain of these rules, such as Section 404 of the Sarbanes-Oxley Act, has required and will continue to require the commitment of significant managerial resources. In addition, establishment of effective internal controls is further complicated because we are now a global company with multiple locations and IT systems and a smaller staff following the sale of our Numbering business.

We continue to review our material internal control systems, processes and procedures for compliance with the requirements of Section 404. Such a review resulted in identification of a material weaknesses in our internal controls and a conclusion that our disclosure controls and procedures and internal control over financial reporting were ineffective as of December 31, 2011, as discussed in Section 9A of this Report on Form 10-K. While we are taking steps to remediate the weakness, there is no guarantee that we will not identify additional material weaknesses in our internal controls in the future. Disclosures of material weaknesses in our SEC reports could cause investors to lose confidence in our financial reporting and may negatively affect the price of our stock.

12

Table of Contents

Moreover, effective internal controls are necessary to produce reliable financial reports and to prevent fraud. A material weakness in our internal control over financial reporting could negatively impact our business, results of operations and reputation.

Certain provisions of our charter documents, employment arrangements and Delaware law may discourage, delay or prevent an acquisition of us, even if an acquisition would be beneficial to our stockholders, and may prevent attempts by our stockholders to replace or remove our current management.

On February 11, 2011, our Board of Directors approved an amendment to our stockholders rights agreement (“Poison Pill”) terminating the agreement on March 1, 2011. However, provisions of our amended and restated certificate of incorporation and bylaws, as well as provisions of Delaware law, could continue to make it difficult for a third party to acquire us, even if doing so would benefit our stockholders. In addition, these provisions may frustrate or prevent any attempts by our stockholders to replace or remove our current management by making it more difficult for stockholders to replace members of our board of directors. Because our board of directors is responsible for appointing the members of our management team, these provisions could in turn affect any attempt by our stockholders to replace current members of our management team. These provisions include the following:

· our stockholders cannot take action by written consent; and

· we have advance notice requirements for nominations for election to the Board of Directors or for proposing matters that can be acted upon at stockholder meetings.

In addition, we are subject to the anti-takeover provisions of Section 203 of Delaware General Corporation Law, which prohibit us from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business combination is approved in the prescribed manner. The application of Section 203 and certain provisions of our restated certificate of incorporation may have the effect of delaying or preventing changes in control of our management, which could adversely affect the market price of our common stock by discouraging or preventing takeover attempts that might result in the payment of a premium price to our stockholders.

Our Chief Executive Officer has entered into an employment agreement with us that contains a change in control provision. This agreement generally provides for acceleration on vesting of options, 50% upon a change in control (as defined in such agreement) if the CEO remains employed with the new entity, or 100% in the event the CEO’s employment is terminated. The acceleration of vesting of options upon a change in control may be viewed as an anti-takeover measure and may have the effect of discouraging a merger proposal, tender offer or other attempt to gain control of us.

Our Amended and Restated Stock Option Plan provides for acceleration of vesting under certain circumstances. Upon certain changes in control of us, vesting on some options awarded to directors may be accelerated. In addition, the successor corporation may assume outstanding stock awards or substitute equivalent stock awards. If the successor corporation refuses to do so, such stock awards will become fully vested and exercisable for a period of 15 days after notice from us but the option will terminate if not exercised during that period. As noted above, the acceleration on vesting of options upon a change in control may be viewed as an anti-takeover measure.

General economic factors, domestically and internationally, that impact the communications industry, could negatively affect our revenue and operating results.

Unsettled financial markets, higher interest rates, inflation, levels of unemployment and other economic factors could adversely affect demand for our products and services as consumers and businesses may postpone spending in response to these conditions, negative financial news and declines in income and asset values. Challenging economic and market conditions may also result in:

· difficulty forecasting, budgeting and planning due to limited visibility into the spending plans of current or prospective customers;

· pricing pressure that may adversely affect revenue and gross margin;

· lengthening sales cycles and slowing deployments;

· increased competition for fewer projects and sales opportunities;

· increased risk of charges relating to write off of goodwill and other intangible assets;

· customer and reseller financial difficulty and greater difficulty collecting accounts receivable.

We are unable to predict how long the current economic downturn will last and the magnitude of its effect on our business and results of operations. If these conditions continue, or further weaken, our business and results of operations could be materially adversely affected.

13

Table of Contents

General risk statement

Based on all of the foregoing, we believe it is possible for future revenue, expenses and operating results to vary significantly from quarter to quarter and year to year. As a result, quarter-to-quarter and year-to-year comparisons of operating results are not necessarily meaningful or indicative of future performance. Furthermore, we believe that it is possible that in any given quarter or fiscal year our operating results could differ from the expectations of public market analysts or investors. In such event, or in the event that adverse conditions prevail, or are perceived to prevail, with respect to our business or generally, the market price of our common stock would likely decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We lease office space at various locations which are shown below.

Location | | Square

Footage | | Lease

Expiration | |

Englewood, Colorado (Headquarters) | | 24,305 | | 10/31/12 | |

Bath, England | | 5,100 | | 9/26/15 | |

London, England | | 2,765 | | 3/24/15 | |

Marlow, England | | 130 | | 1/31/12 | |

Bangalore, India | | 12,300 | | 8/18/12 | |

Munich, Germany | | 538 | | 12/31/12 | |

Kuala Lumpur, Malaysia | | 1,042 | | 7/14/12 | |

ITEM 3. LEGAL PROCEEDINGS

We are involved in various legal matters arising in the normal course of business. We do not believe that any such matters will have a material impact on our results of operations and financial position.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

| | For the Years Ended December 31, | |

| | 2011 | | 2010 | |

| | High | | Low | | High | | Low | |

First Quarter | | $ | 8.28 | | $ | 6.89 | | $ | 7.05 | | $ | 6.02 | |

Second Quarter | | $ | 7.87 | | $ | 6.75 | | $ | 7.48 | | $ | 6.72 | |

Third Quarter | | $ | 7.44 | | $ | 6.06 | | $ | 7.64 | | $ | 6.55 | |

Fourth Quarter | | $ | 7.65 | | $ | 6.24 | | $ | 8.35 | | $ | 7.40 | |

As of March 22, 2012, there were approximately 33 holders of record of our common stock.

Dividends

During the first, second and third quarter of 2011, our Board of Directors declared a cash dividend of $.05 per share. During the fourth quarter of 2011, our Board of Directors declared a special cash dividend of $2.00 per share. There can be no guarantee that we will continue to pay dividends. The decision to declare dividends in the future will depend on general business conditions, the impact of such payment on our financial condition and other factors our Board of Directors may consider to be relevant. In addition, we may enter into a credit facility in the future which may require consent of the financial institution issuing the credit facility to declare a dividend. Payment of future dividends can also affect our business as this could reduce our cash reserves to levels that may be inadequate to fund expansions to our business plan or unanticipated contingent liabilities.

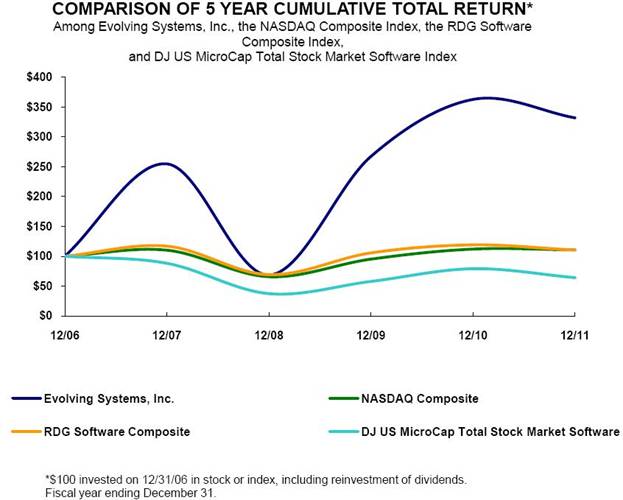

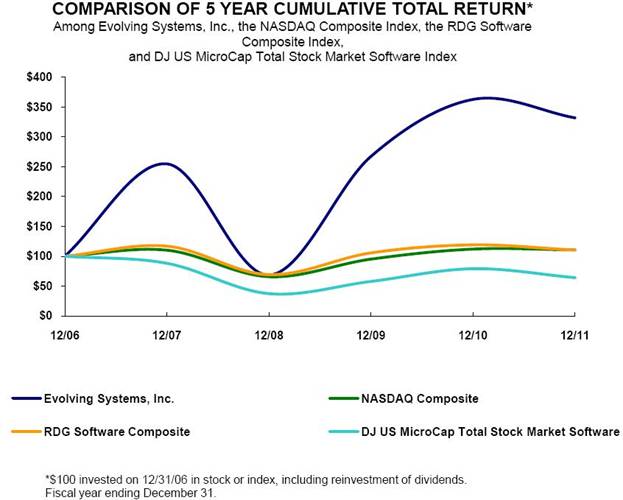

Issuer Purchases of Equity Securities