UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2012 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number: 000-50327

iPass Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 93-1214598 |

(State or Other Jurisdiction

of Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

3800 Bridge Parkway

Redwood Shores, California 94065

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (650) 232-4100

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $0.001 Per Share Par Value | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | x |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock on June 29, 2012, as reported by the NASDAQ Global Select Market on that date: $123,301,469. The determination of affiliate status for the purposes of this calculation is not necessarily a conclusive determination for other purposes. The calculation excludes approximately 8,727,041 shares held by directors, officers and stockholders whose ownership exceeded ten percent of the registrant’s outstanding Common Stock as of June 30, 2012. Exclusion of these shares should not be construed to indicate that such person controls, is controlled by or is under common control with the registrant.

The number of shares outstanding of the Registrant’s Common Stock, $0.001 par value, as of February 28, 2013 was 61,821,210

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement in connection with our 2013 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than April 30, 2013, are incorporated by reference in Part III, Items 10, 11, 12, 13 and 14 of this report on Form 10-K.

iPASS INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2012

TABLE OF CONTENTS

2

Disclosure Regarding Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements regarding future events and our future results that are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “will,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “potential,” variations of such words, and similar expressions are intended to identify forward-looking statements. In addition, any statements which refer to projections of our future financial performance, our anticipated growth and trends in our business, and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Readers are directed to risks and uncertainties identified below, under “Item 1A. Risk Factors” and elsewhere herein, for factors that may cause actual results to be different from those expressed in these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements for any reason.

3

PART I

Overview

iPass is the global Wi-Fi roaming leader for enterprises and telecom service providers and their consumer subscribers. We believe that we are uniquely positioned to take advantage of expanding global demand for Wi-Fi. iPass was incorporated in California in July 1996 and reincorporated in Delaware in June 2000. Our corporate headquarters are located in Redwood Shores, California. We are publicly traded on NASDAQ under symbol IPAS and included in the Russell 2000 and Russell Global Index.

We provide global enterprises and telecommunications carriers with cloud-based mobility management and Wi-Fi connectivity services. Through our proprietary technology platform and global Wi-Fi network, we offer enterprises cross-device, cross-network Internet connectivity services along with cost control, reporting and policy compliance management tools. Based on this same technology platform and our global authentication and settlements infrastructure, we also offer global telecommunications carriers Wi-Fi enablement services allowing them to monetize their Wi-Fi networks and enable data roaming solutions for their subscribers.

Business Highlights

Strategic Mobility Assets

We believe iPass has a unique set of mobility assets that provide us with competitive advantages. We see our three core assets as follows:

Advanced Open Mobile Platform:Our Open Mobile (OM) platform is a cloud-based mobility management platform that securely manages network connectivity and subscribers across a wide variety of computing and mobile devices and provider networks. We believe this scalable subscriber management, billing and reporting platform is unique in the industry and would be time consuming and expensive to replicate. Our Open Mobile platform has the following key characteristics and functionality:

| | • | | An always-on, lightweight software agent that runs on a wide array of devices including smartphone, tablet, and laptops running operating systems such as Android, the iPhone operating system (iOS), Windows and Macintosh. |

| | • | | A cloud-based platform that allows the enterprise to configure and manage its mobility offering by providing in-depth reporting and analytics on mobile usage across the networks and devices used by the enterprise. |

| | • | | Policy enforcement services that enable the enterprise IT organization to have their cost, compliance and security measures enforced across their mobile workforce. |

| | • | | The foundation for an expanded portfolio of mobility services designed to enable enterprise users and carrier customers to connect from any mobile or computing device over a wide range of networks, while providing visibility and control necessary to support the demand of the customer. |

Effective July 1, 2012, we end-of-lifed all versions of our legacy iPassConnect (iPC) platform and began charging extended support fees to customers remaining on our iPC platform.

Integrated Authentication Fabric: We have a global authentication fabric of integrated servers and software that is interconnected withmore than 146 global Wi-Fi network service providers. This infrastructure allows us to provide secure, highly-available and seamless four party global authentication, clearing and settlement of Wi-Fi users for our partners and customers. Our technology architecture is designed to:

| | • | | Integrate with existing enterprise security, directory, and business systems. |

| | • | | Integrate with any Wi-Fi network, whether customer-owned networks or third-party provider networks. |

4

| | • | | Embrace new access methods, devices, and applications. |

| | • | | Facilitate innovation through third-party application development. |

Global Wi-Fi Footprint: We have a Wi-Fi network footprint and supply chain that consists ofmore than 1.2 million commercial Wi-Fi hotspots in over 124 countries globally and across leading Wi-Fi venues, including major airports, convention centers, airplanes, hotels, restaurants, retail and small business locations. Our technology integration across multiple global network providers forms the basis of our network services and we believe creates a unique cost advantage for our customers. We typically contract with network service providers, integrate their networks into our global infrastructure, and monitor their performance to ensure that our customers have a consistent and reliable end user experience.

Key iPass Market Statistics

We believe that iPass has a set of mobility assets at the confluence of the large and rapidly-growing global Wi-Fi market, as evidenced below:

| | • | | 1.4 million: Unique users of iPass’ mobility services platform in 2012. |

| | • | | 15 million: User authentications processed by iPass’ global infrastructure in 2012. |

| | • | | 76,000: iPass hotel, conference venue and global airport hotspots. |

| | • | | 73 million: iPass enabled Wi-Fi sessions in 2012. |

| | • | | 25,000: iPass revenue generating managed network services endpoints in US locations. |

| | • | | 29: iPass connectivity and authentication related patents. |

Business Portfolio

Our business consists of two segments: (i) Mobility Services and (ii) Managed Network Services. Our Mobility Services segment comprises two service offerings: (1) our Open Mobile Enterprise Services, and (2) our Open Mobile Exchange.

Mobility Services

Open Mobile Enterprise Services (“iPass OME” or “OME”): iPass OME delivers enhanced network mobility services, addressing large enterprises’ needs to manage their mobility economics, high speed network connectivity requirements and proliferation of mobile devices, including the “bring-your-own-device” trend. OME has evolved from our Enterprise Mobility Services offerings as we focus on our Open Mobile business and migrate away from our legacy iPC services. OME consists primarily of our network services and platform services, as follows:

Network Services: Our virtual network provides our enterprise and carrier customers access to more than 1.2 million global commercial Wi-Fi hotspots in over 124 countries globally and across leading Wi-Fi venues. Our offerings span multiple geographies and are primarily focused on Wi-Fi access technologies. As such, we continue to wind down our legacy Dial-up and 3G connectivity options as we focus our efforts on the Wi-Fi market.

Platform Services:Our cloud-based Open Mobile Platform enables enterprise users to connect from any mobile device over a wide range of networks. These services allow our customers to effectively manage their mobile workforces by controlling costs, enforcing compliance and ensuring security when workers connect their mobile devices to the Internet and wireless networks. Effective July 1, 2012 we announced the end-of-life of our legacy iPC platform.

5

Open Mobile Exchange (“iPass OMX” or “OMX”):iPass OMX service offerings extend and enhance core mobility and internet offerings by integrating our Open Mobile Platform technology and our worldwide Wi-Fi Network, to allow global telecommunications carriers and service providers to seamlessly connect their customers and subscribers to preferred global Wi-Fi networks. Our OMX platform consists of the following three broad service areas:

Roam-in: Roam-in allows Wi-Fi providers to leverage their Wi-Fi network with “visiting” subscribers. Accordingly, by joining the iPass network a Wi-Fi network operator makes their hotspots available to other service providers for commercial purposes.

Roam-out: Roam-out allows carriers and telecommunication service providers to provide their subscribers with global Wi-Fi connectivity. To do so, a carrier provides its subscribers a Wi-Fi roaming service that gives the subscriber access to the iPass global Wi-Fi network.

Wi-Fi Exchange: Exchange is an extensible, carrier-grade platform for Wi-Fi authentication and transaction settlements. Our exchange allows Wi-Fi network operators and service providers who want to develop their own private commercial relationships to access each other’s networks without building and managing the actual interconnect, preferring to leverage the iPass exchange to optimize the interconnect topology and reduce operational complexity.

Managed Network Services (“iPass MNS” or “MNS”)

iPass MNS provides customers with accelerated Wi-Fi and Wide Area Network solutions in the retail, finance, healthcare, and carrier operator space throughout North America. In 2012, we launched a new managed WLAN (Wireless Local Area Network) and Wi-Fi service that expands the MNS platform to enable enterprises, venues, and retailers to deliver an in-store and in-office Wi-Fi experience to their employees and customers. Our primary service offerings in our MNS business include:

Wi-Fi Cloud Connect: Our enterprise managed Wi-Fi offering is based on a controller-less platform that provides fully-managed, secure and compliant Wi-Fi network access for standalone PCs, terminals and handheld devices and tablets without the expense of a dedicated controller infrastructure.

Broadband Connect:Lies at the core of every one of our network solutions, and is designed to offer centralized business-grade high-speed internet services, installation, and ongoing support.

MultiLink Connect and WAN Connect:Upgraded Broadband Connect products that provide a fully managed, Internet-based IP VPN service that delivers reliable availability and scalable high-speed wide area networking through our cloud-based monitoring and management technology platform.

Secure Web Gateway:Secure Web Gateway provides enterprises the flexibility to apply a centrally-managed secure web gateway policy without the expense, concerns and delays attributed to scaling corporate or provider internet egress circuits. Instead, traffic is routed directly from the endpoint to a cloud-based global network of scanning systems optimized to deliver not only enterprise web security policy but also eliminate performance impact to the endpoint, which allows iPass MNS customers to realize maximum bandwidth potential at each endpoint.

Our Strategy

We intend to leverage our unique set of mobility assets across our business portfolio offerings to drive growth in users, customers and Wi-Fi usage with an increasing focus on smartphone and tablet adoption, delivering customer satisfaction via enhanced end user experience (both quality and engagement) across our platform and network. We also intend to lead the consolidation of Wi-Fi global roaming via our OMX business model, as well as scale our MNS business to embrace Wi-Fi as a core competitive offering.

6

Our strategy consists of the following key elements and initiatives specific to our Mobility and MNS service offerings:

Mobility Services Strategy

OME: Our key initiatives to increase Open Mobile platform penetration and Wi-Fi network usage are as follows:

| | • | | Accelerate Adoption of Open Mobile on Smartphones and Tablets: We are focused on accelerating smartphone and tablet user adoption of Open Mobile by simplifying the user activation process and reducing the associated time and cost of customer deployments. We intend to continue to invest in smartphone and tablet operating system development and integration of our end-user experience findings to enhance the usability and to improve reliability of the network connection. |

| | • | | Complete Open Mobile Migration: We are focused on completing the migration of most of our legacy-customer installed base to the OM platform by the end of 2013. We plan on realizing this migration with specific customer-related initiatives to reduce barriers to implementation and deployment in both our enterprise and carrier customers. Our professional services deployment organization is focused on decreasing migration friction and working with enterprise customers and channel partners to drive more timely implementation and deployment of our Open Mobile platform. We fully end-of-lifed our legacy iPC product, effective July 1, 2012, and will continue to encourage customers to migrate to Open Mobile or terminate their legacy services. |

| | • | | Enhance Open Mobile User Experience: We are focused on enhancing the end-user experience on our Open Mobile platform through innovative product features such as auto connect capabilities, network quality assurance benchmarks, hotspot finder upgrades, and direct engagement and feedback from our end-users. |

| | • | | Focus on Large Multi-National Customers: We are focusing our sales efforts on large enterprise customers, in particular, Fortune 1000 companies located in Europe and Asia where we believe our value proposition is the strongest. We believe that the adoption of the Open Mobile platform at large enterprises produces greater network user penetration, resulting in greater frequency-of-use of our mobility platform and increased network usage. |

OMX: We are focused on the following key initiatives in our OMX business:

| | • | | Ramp OMX Revenue Growth: We are focused on growing our OMX revenue by working closely with our existing OMX partners to onboard, develop, and rollout their integrated Wi-Fi roaming offerings. We intend to continue to drive market awareness among carriers to ensure that they proactively and aggressively promote the benefits of our OMX offerings. |

| | • | | Continue to Sign New Carrier Partners: We believe global interest in the value proposition of our OMX offering remains high and we intend to add new carrier and service provider partners as customers for our OMX services. We believe that each new partner added enhances the value and attractiveness of our offering as we create a scalable global solution. |

MNS Strategy

Based on expected demand for our managed Wi-Fi service offerings, we are focused on the following key initiatives in our MNS business:

| | • | | Expand Portfolio of Offerings That Leverage Synergies with Wi-Fi Mobility Expertise: We believe there are significant potential business synergies between our Mobility Services business lines and MNS business that we plan to further leverage by continuing to launch new managed Wi-Fi services offerings while expanding our portfolio of Wi-Fi offerings. |

| | • | | Drive Revenue Growth and Profitability: We intend to drive revenue growth and profitability in our MNS business by: (i) focusing on new customer acquisition and upsell opportunities with existing |

7

| | customers of our managed Wi-Fi service offerings; (ii) investing in new lead generation programs and targeted marketing activities to drive Wi-Fi adoption; and (iii) launching a new MNS brand to embrace the evolution in our Wi-Fi service offerings. |

Geographic Revenue

Mobility service revenue and MNS revenue are derived from the following geographical locations:

| | | | | | | | | | | | |

| | | For the Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

United States | | | | | | | | | | | | |

Mobility Service Revenues | | | 31 | % | | | 37 | % | | | 44 | % |

Managed Network Service Revenues | | | 26 | % | | | 21 | % | | | 18 | % |

International | | | | | | | | | | | | |

Mobility Service Revenues | | | 43 | % | | | 42 | % | | | 38 | % |

Geographic revenues are determined by the location of the customer’s headquarters. No single customer accounted for 10% or more of our revenues.

For further financial information on the Mobility Services and MNS segments, as well as long-lived assets and geographic information, refer to the information contained in Note 15, “Segment and Geographic Information,” in the Notes to the Consolidated Financial Statements included in Item 15. For risks attendant to foreign operations, see the risk entitled “Because a meaningful portion of our business is international, we encounter additional risks, which may impact our revenues and profitability” in “Item 1A. Risk Factors” of this Form 10-K.

Seasonality

We generally experience seasonality in our business due to decreased business travel during the summer, particularly in Europe, and during the year-end holiday season which results in lower usage of our network services. Seasonal trends may cause fluctuations in our business results.

Network Service Providers

We have contractual relationships with approximately 300 telecommunications carriers, internet service providers and other network service providers that enable us to offer our network services around the world. We pay network service providers for access to their network on a usage, session or subscription basis. Most of these contracts have a one or two-year term, after which either party can terminate the contract with notice. The contracts we have entered into with providers are non-exclusive and may contain minimum commitments for the purchase of network access.

Sales and Marketing

Our sales organizations are structured into regional account teams, which include sales management, sales engineers and customer success teams. In our Mobility Services business, we sell our services directly through our global sales force and indirectly through our reseller and carrier partners. In our MNS business, we sell services directly through our sales force in the United States. We maintain sales offices or personnel in a number of cities in the United States as well as in the United Kingdom, India, Australia, Japan, Germany, France, Singapore, and The Netherlands. As of December 31, 2012, our sales organization comprised 55 individuals: 26 in North America, 24 in Europe, Middle East and Africa (“EMEA”) and 5 in Asia Pacific.

Our reseller partners, OEM carriers and carrier partners typically sign a one to two-year agreement with us through which we appoint them as a non-exclusive reseller of our services. Their reseller responsibilities vary

8

and may include actively marketing and selling our services, deploying and supporting customer accounts, and implementing and managing billing for their customers. Our current sales structure allows us to offer our services without incurring the full cost of customer acquisition (sales and marketing) or customer post-sales support. Our reseller partners, OEM carriers and carrier partners typically sell complementary hardware, software, and services, and bundle our services with their core offerings. They may also have a base of existing customers to whom they can efficiently sell our portfolio of services. In many cases our salespeople do support our reseller partners, OEM carriers and carrier partners with closing new business, and our post-sales team may work with them to ensure successful implementation of our services. However, the enterprise or consumer remains the customer of our reseller partners, OEM carriers or carrier partners and has no direct financial relationship with us.

We focus our marketing efforts on establishing a strong corporate reputation in the market, creating awareness and preference for our services and their benefits, educating potential customers, generating new sales opportunities, generating end-user awareness and demand within existing customer accounts and enabling our sales force and channel partners to effectively sell and provide our service offerings. We conduct a variety of marketing programs that may include advertising, promotions, public relations, analyst relations, telemarketing, direct marketing, web and e-mail marketing, collateral and sales tools creation, seminars, events and trade shows, training, co-operative channel marketing, internet marketing and promotions.

Competition

Our approach to addressing the mobility challenges and needs of the enterprise is to provide an integrated platform and suite of value-added services that offer connectivity, reporting and analytics, policy management, and network services. While there are numerous point solution providers that offer varying individual or in some cases combinations of the various mobility services similar to the services we offer, we are not aware of any competitor that provides Wi-Fi global roaming, OM platform or range of services in an integrated offering as we do. Further, we believe that the self-service nature of our platform that allows an enterprise to configure and manage their own custom mobility service is an important and differentiating factor for us.

The mobility market is very fragmented with a variety of competitors, including facilities-based carriers, cloud-based platform operators and mobility management solution providers. We compete based on a number of factors including geographic network coverage, pricing, multiple network technology support, network reliability, quality of service, platform functionality and features, ease of implementation, ease of use and ease of management. We believe we have the largest commercial Wi-Fi network in the world; however, since we don’t own the network, our competitors that own their own Wi-Fi networks can offer lower Wi-Fi pricing than we do.

As we continue to expand our mobility offerings beyond network services to include an integrated platform of mobility services delivered through our cloud-based platform, we may also encounter additional competitors in the marketplace, including mobility management solution providers which offer mobile device management, mobile security, and telecommunication expense management software and services, among other mobility offerings.

With respect to network connectivity and mobility services, we compete with the national telecommunications carriers that provide a suite of services to enterprise customers. In this area, our Wi-Fi offerings also compete directly with 3G and 4G related network connectivity options. To a lesser extent we compete with cloud-based platform operators who may also provide managed services such as VPNs and firewalls, and additional telecommunications services such as local exchange and long distance services, voicemail and DSL services. We do have channel partners that offer these types of services in conjunction with our service, but we do not offer these additional services directly.

With respect to our Managed Network Services, we compete with a variety of providers, including large connectivity providers that own their own networks and have a broad range of network solutions and smaller regional providers.

9

Research and Development

We are committed to continuing to enhance our underlying technology and continuing to innovate and incorporate new technologies and features into our services and network architecture. Our research and development efforts are focused on improving and enhancing our platform and service offerings as well as developing new services, especially for smartphones and tablets. As of December 31, 2012, our research and development organization consisted of 135 employees, approximately 56 in North America, 75 in Asia Pacific, and 4 in EMEA. Our research and development expenses were $13.7 million, $14.4 million and $13.8 million in 2012, 2011 and 2010, respectively.

Intellectual Property

We believe our technology and platform contains valuable intellectual property and we rely on a combination of trademark, copyright, trade secret laws, patents and disclosure restrictions to protect these intellectual property rights. We license third-party technologies that are incorporated into our services. We also enter into confidentiality and proprietary rights agreements with our employees, consultants and other third parties and control access to software, documentation and other proprietary information. We have a patent portfolio, solely related to our Mobility Services business consisting of twenty-three U.S. patents, two Australian patents, one Israeli patent and three European patents (in United Kingdom, Germany and France). Our patents expire between 2016 and 2025. In 2012 we were granted one new U.S. patent. We currently have ten U.S. patent applications pending, and sixteen international patent applications pending (in the same subject areas as the U.S. patent applications). iPass and the iPass logo are registered trademarks. We have also applied for or registered company trademarks in the U.S. and numerous other countries.

Employees

As of December 31, 2012, we had 358 employees of which 211 were located in North America, 108 in Asia Pacific, and 39 in EMEA.

Available Information

We use our website, www.ipass.com, as a routine channel for distribution of important information, including news releases, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act, as amended, as soon as reasonably practicable after they are electronically filed with, or furnished to the U.S. Securities and Exchange Commission (“SEC”). All of these postings and filings are available on our website free of charge. The content on any website referred to in this Form 10-K is not incorporated by reference into this Form 10-K.

10

Our business is subject to a number of risks, many of which are described below. If any of the events described in these risks factors actually occur, our business, financial condition or results of operations could be materially and adversely affected, which would likely have a corresponding impact on the value of our common stock. Further, the risk factors described below could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. These risk factors should be reviewed carefully.

If our Open Mobile Platform does not achieve market acceptance or customer adoption and deployment of our Open Mobile Platform is slow, especially on smartphone and tablet devices, our ability to grow our Mobility Services business could be harmed.

The future success of our business will depend in large part on our current and prospective customers’ acceptance of our Open Mobile Platform and enterprise mobility services, as well as the timeliness of our customers’ adoption and deployment of our Open Mobile Platform. Key risks associated with our Open Mobile Platform and services are as follows:

Customer adoption and deployment of our Open Mobile Platform, especially on smartphone and tablet devices, may be slow.We believe that the growth of our business is dependent on the timely adoption and deployment of the Open Mobile Platform by our customers. In particular, smartphone and tablet devices are becoming more relied upon by our customers for their mobile computing needs and may cause our users to stop using laptops while traveling, or to use them less often. We believe it is critical for our business that our services for smartphone and tablet devices achieve market acceptance and that our customers rapidly adopt and deploy our services on smartphone and tablet devices. A material delay in the adoption and deployment of the Open Mobile Platform by our customers, on smartphone and tablet devices in particular, will adversely impact our ability to grow revenues and achieve profitability.

Customer deployment of our Open Mobile Platform may not result in increased use of our services.We believe it is important to the future success of our business that users of our Mobility Services increase their usage of our platform and network services. We believe that the deployment by our customers of our Open Mobile Platform, especially on smartphone and tablet devices, will lead to increased usage of our platform services and correspondingly, our network services, which will lead to an increase in our revenue. However, even if a significant portion of our customers deploy our Open Mobile Platform, there is no guarantee that our customers will use our services more frequently.

Our Open Mobile Platform may not have all functionality desired by our customers.There is risk that we may not release versions of the Open Mobile Platform in a timely manner that contain features that our customers desire and we will need to provide our customers with stable, easy to use, feature-rich and valuable enterprise mobility services related to security, policy control, user activation, authentication and reporting. Further, the Open Mobile Platform may contain technological limitations, bugs or errors that would cause our customers to not adopt or delay the adoption of the Open Mobile Platform. If some or all of these risks associated with our Open Mobile Platform were to occur, market acceptance of the platform may not occur and our business could be harmed.

Customers must be willing to continue to pay for our platform for us to generate meaningful revenues and growth. We believe that it is important that the value proposition of our Open Mobile Platform is accepted by our customers such that they are willing to pay for their users to use our mobility services. If our customers are willing to adopt our Open Mobile Platform but are not willing to pay for the platform, our ability to grow revenues and achieve profitability could be adversely impacted.

11

If our OMX service offerings do not achieve market acceptance our ability to grow our business could be harmed.

Our OMX service offerings were introduced in 2011 and incorporate our Open Mobile Platform, global authentication fabric, and global Wi-Fi network to provide mobile network operators, telecommunication carriers and service provider partners around the world with the infrastructure to offer their customers new mobility services. We have entered into contracts with a number of customers for our OMX services; however, we have not yet received any meaningful revenue from these customers. We have and plan to continue to devote significant resources building our OMX service line of business. If OMX service offerings do not achieve market acceptance and generate meaningful revenue our financial condition may be harmed.

If Global 3G/4G data roaming rates decline precipitously, our ability to grow our business could be harmed.

For our network services to be attractive to our customers, the cost of 3G/4G roaming must be meaningfully greater than the cost of our Wi-Fi network services. Currently, in certain geographies such as Asia, 3G/4G roaming prices are not significantly higher than our rates for Wi-Fi access. In Europe, legislation has been enacted mandating the reduction of wholesale 3G/4G roaming prices. If 3G/4G roaming prices do not remain meaningfully higher than our Wi-Fi network prices then our ability to sell our Mobility Services could be impacted and our business harmed.

Our decision to “End-of-Life” our legacy iPC platform product has and will continue to impact our total revenues.

As of July 1, 2012 our iPC or legacy platform reached end-of-life. While the iPC platform will continue to function for existing customers, we will only provide basic support and only for customers that pay extended support fees. While we believe that the end-of-life of iPC will encourage our customers to migrate to our Open Mobile platform, iPC customers may decide to instead terminate their service with us. If the number of iPC customers who decide to terminate their service with us is greater than expected, our results of operations could be negatively impacted.

If key global Wi-Fi venues offer “no charge” Internet access, our network revenues could be negatively affected.

We derive a significant portion of our network revenue from providing Wi-Fi access in certain key venues (e.g., hotels, airports and cafes). In general, these venues charge their customers for Wi-Fi access. If these venues begin offering Wi-Fi access at no charge, the amount we can charge our customers for Wi-Fi access at these venues will likely decrease or we may not charge our customers for Wi-Fi access at these venues. For example, Starbucks and certain airports in the United States have ceased charging their customers for Wi-Fi access and we have experienced reduced revenues as a result. If this trend continues at other key Wi-Fi venues, our network revenues and overall profitability may be negatively impacted.

If we do not accurately predict network usage for our Flat Rate price plans, our costs could increase without a corresponding increase in network revenue.

A significant number of our customers have purchased our Flat Rate network price plans, and we are signing new customers to this plan. In this plan, our customers pay a flat rate price to access our network services. However, in the majority of situations we continue to pay our providers based on actual network usage. The rate we charge in our Flat Rate price plans is based on statistical predictions of usage across a pool of users within a customer. If actual usage is higher than expected our ability to achieve profitability could be negatively impacted.

12

If demand for mobility services does not grow or grows in ways that do not require use of our services, we may experience a decline in revenues and profitability.

The growth of our business is dependent, in part, upon the increased use of mobility services and our ability to capture a higher proportion of this market. If the demand for mobility services does not continue to grow, or grows in ways that do not require use of our services, then we may not be able to grow our business, or achieve or maintain profitability. Increased usage of our Mobility Services depends on numerous factors, including:

| | • | | Willingness of enterprises to make additional information technology expenditures; |

| | • | | Availability of security services necessary to ensure data privacy over a variety of networks; |

| | • | | Quality, cost and functionality of our services and competing services; |

| | • | | Increased adoption of wireless broadband access methods and our ability to support these new methods; |

| | • | | Proliferation of smartphones, tablets and mobile handheld devices and related applications, and our ability to provide valuable services and support for those devices; |

| | • | | Our ability to partner with mobile network operators and service providers that are willing to stimulate consumer awareness and adoption of our Mobility Services; and |

| | • | | Our ability to timely implement technology changes to our services to meet evolving industry standards for mobile devices, Wi-Fi network access and customer business requirements. |

If we are unable to meet the challenges posed by Wi-Fi access, our ability to profitably grow our business may be impaired.

A substantial portion of the growth of our business has depended, and will continue to depend, in part upon our ability to expand our global Wi-Fi network. Such an expansion may not result in additional revenues to us. Key challenges in expanding our Wi-Fi network include:

The Wi-Fi access market continues to develop at a rapid pace. We derive a significant portion of our revenues from wireless broadband “hotspots,” such as certain airports, hotels and convention centers. The Wi-Fi access market, continues to develop rapidly, in particular: the market for enterprise connectivity services through Wi-Fi is characterized by evolving industry standards and specifications and there is currently no uniform standard for Wi-Fi access. Furthermore, although the use of wireless frequencies generally does not require a license in the United States and abroad, if Wi-Fi frequencies become subject to licensing requirements, or are otherwise restricted, this would substantially impair the growth of Wi-Fi access. Some large telecommunications providers and other stakeholders that pay large sums of money to license other portions of the wireless spectrum may seek to have the Wi-Fi spectrum become subject to licensing restrictions. If the Wi-Fi access market develops in ways that limit access growth, our ability to generate substantial revenues from Wi-Fi access could be harmed.

The Wi-Fi service provider market is highly fragmented.There are currently many Wi-Fi service providers that provide coverage in only one or a small number of hotspots. We have entered into contractual relationships with numerous Wi-Fi service providers. These contracts generally have an initial term of two years or less. We must continue to develop relationships with many providers on terms commercially acceptable to us in order to provide adequate coverage for our customers’ mobile workers and to expand our Wi-Fi coverage. We may also be required to develop additional technologies in order to integrate new wireless broadband services into our service offering. If we are unable to develop these relationships or technologies, our ability to grow our business could be impaired.

Consolidation of large Wi-Fi service providers may impair our ability to expand network service coverage, negotiate favorable network access terms, and deliver consistent service in our network.The telecommunications industry is rapidly evolving and highly competitive. These factors may cause large Wi-Fi network service providers to consolidate, which would reduce the number of network service providers from which we are able to

13

obtain network access in key locations. If significant consolidation occurs, we will have a smaller number of network service providers to acquire Wi-Fi network access from and we may not be able to provide additional or sufficient redundant access points in some geographic areas, which could diminish our ability to provide broad, reliable, redundant coverage. Further, our ability to negotiate favorable access rates from Wi-Fi network service providers could be impaired, which could increase our network access expenses and harm our operating results.

Wi-Fi service provider actions may restrict our ability to sell our services.Some Wi-Fi network providers restrict our ability to sell access to their networks to our resellers whom they consider competitive with them. This can reduce our revenue by limiting the footprint our partners can make available to their customers.

Significant dependency on key network providers could negatively affect our revenues.

There are certain venues (hotels, airports, cafes, etc.) globally where we depend on key providers for network access in those venues. In addition, in certain geographies we depend on a small number of providers for a large portion of network access. If such a provider were to go out of business, terminate their agreement with us, encounter technical difficulty such that network access was not available to our customers for an extended period of time, it could have a negative impact on our revenues and profitability if we cannot find an alternative provider to enable network access in those venues or geographies.

We face competition in the market for mobility services, which could make it difficult for us to succeed.

While we do not believe there are service providers in the mobility services market that offer a platform or range of services in an integrated offering as we do, we compete with a variety of service providers, including facilities-based carriers, cloud-based platform operators and mobility management solution providers. Some of these providers have substantially greater resources, larger customer bases, longer operating histories and/or greater name recognition than we have. In addition, we face the following challenges:

Many of our competitors can compete on price. Because many of our facilities-based competitors own and operate physical networks they may be able to provide additional hotspot access at little incremental cost to them. As a result, they may offer network access services at a lower cost, and may be willing to discount or subsidize network access services to capture other sources of revenue. In contrast, we have traditionally purchased network access from facilities-based network service providers to enable our network access service and in these cases, may not be able to compete aggressively on price. In addition, new cloud-based platform operators may enter the mobility services market and compete on price. In either case, we may lose business or be forced to lower our prices to compete, which could reduce our revenues.

Many of our competitors offer additional services that we do not, which enables them to bundle these services and compete favorably against us. Some of our competitors provide services that we do not, such as 3G/4G data roaming, local exchange and long distance services, voicemail and digital subscriber line, or DSL, services. Potential customers that desire these services on a bundled basis may choose to subscribe to network access from a competitor that provides these additional services.

Our potential customers may have unrelated business relationships with our competitors and consider those relationships when deciding between our services and those of our competitors. Many of our competitors are large facilities-based carriers that purchase substantial amounts of services or provide other services or goods unrelated to network access services. As a result, if a potential customer is also a supplier to one of our large competitors, or purchases unrelated services or goods from our competitor, the potential customer may be motivated to purchase its network access services from our competitor in order to maintain or enhance its business relationship with that competitor. In addition, our current or potential carrier customers may already have or may consider buying services from mobility management solution providers which may impact our ability to sell our services to those customers as well as drive market prices down for the services that we offer.

14

Users may take advantage of free Wi-Fi networks for Internet and corporate access. Telecommunications providers may offer free Wi-Fi as part of a home broadband or other service contract, which may force down the prices which the market will bear for our services and could reduce our revenues.

We face strong competition in the market for managed network services, which could make it difficult for us to grow.

In the market for managed network services, we compete with a variety of large connectivity service providers, many of whom own their own networks. We see the competition from these larger service providers, which own their own networks, in two primary ways: first in that they can provide a broader range of network options, for example, MPLS (Multiprotocol Label Switching), Frame Relay, Wire line and Wireless Voice, and, second, they can integrate their separate products providing cross-product subsidization. There are also small regional players with a similar model to ours who compete with us. If we are not able to offer competitively priced offerings that are profitable for us, we may have difficulty growing our Managed Network Services business.

If our carrier and channel partners do not successfully market our Mobility Services to their customers, then our ability to grow our revenues could be impaired.

We sell our services directly through our sales force and indirectly through our channel partners, which include telecommunication carriers, systems integrators and value-added resellers. A large percentage of our sales outside the United States are made through our carrier and channel partners. Our business depends on the efforts and the success of these carrier and channel partners in marketing our services to their customers. Our own ability to promote our services directly to our carrier and channel partners’ customers is often limited. Many of our carrier and channel partners may offer services to their customers that may be similar to, or competitive with, our services. Therefore, these channel partners may not actively promote our services. If our channel partners fail to market our services effectively, our ability to grow our revenue could be reduced and our business may be impaired.

Our network revenue and overall profitability may be adversely impacted by material reductions in existing customer and partner minimum commitments.

Our customers and partners that are billed on a usage basis have traditionally entered into contractual provisions that require them to pay the greater of the fees generated from the use of our services or a minimum committed amount over a pre-determined time period. Minimum commitments are negotiated by customers to improve their usage unit pricing, effectively guaranteeing a certain volume to achieve a reduced unit price. Recent global economic conditions in certain cases caused our customers and partners to generate fees from the use of our services that are significantly less than their minimum committed amounts. Consequently this shortfall has caused some partners and customers upon renewal of their contracts with us, to renew with a lower minimum commitment and in some cases with no minimum commitment. Additionally, in some cases partners and customers are requesting a re-evaluation of their minimum commitments on a prospective basis during the term of their existing contract; to maintain these commercial relationships, we have addressed these requests on a contract by contract basis. The reduction or elimination of minimum commitments means that a larger percentage of future revenue will be based on the actual usage of our services and may result in a decrease in our revenues and our ability to achieve profitability could be negatively impacted.

We recently implemented a new enterprise resource planning (ERP) solution. Risks generally associated with the implementation of an ERP system may adversely affect operations and/or the effectiveness of internal controls over financial reporting.

During the first quarter of 2013, we went live with a new ERP system to enhance our operating efficiencies, provide timelier operating and financial information, and scale our infrastructure efficiently in support of our business model. Deployment of ERP systems and related software carry potential risks such as cost overruns, project delays and business interruptions. If we experience a material business interruption as a result of our ERP

15

deployment, it could have a material adverse effect on our business. Additionally, if the ERP system does not operate as intended, it could adversely affect our financial reporting systems, our ability to produce financial reports, or the effectiveness of internal controls over financial reporting.

Our software is complex and may contain errors that could damage our reputation and decrease usage of our services.

Our software may contain errors that interrupt network access or have other unintended consequences. If network access is disrupted due to a software error, or if any other unintended negative results occur, such as the loss of billing information, a security breach, unauthorized access to our cloud-based platform or the introduction of a virus by our software onto our customers’ computers or networks, our reputation could be harmed and our business may suffer. Our contracts generally limit our exposure to incidental and consequential damages and to the extent possible; we further limit our exposure by entering into insurance policies that are designed to protect our customers and us from these and other types of losses. If these contract provisions are not enforced or enforceable, or if liabilities arise that are not effectively limited or insured, our operating results and financial condition could be harmed.

Because a meaningful portion of our business is international, we encounter additional risks, which may impact our revenues and profitability.

We generate a substantial portion of our revenues from international customers. Revenues from customers domiciled outside of the United States were approximately 43% of our revenues in 2012, of which approximately 32% and 10% were generated in the EMEA and Asia Pacific regions, respectively. The functional currency of our foreign subsidiaries is the U.S. Dollar and we currently bill nearly all of our services in U.S. Dollars. However, we pay certain expenses in local currencies. During the years ended December 31, 2012, 2011 and 2010, we have not entered into any hedging contracts to manage foreign currency exposure. Our international operations subject our business to specific risks that could negatively impact our business, including:

| | • | | Generally longer payment cycles for foreign customers; |

| | • | | The impact of changes in foreign currency exchange rates on both the attractiveness of our USD-based pricing and our operating results, particularly upon the re-measurement of assets, liabilities, revenues and expenses and the transactional settlement of outstanding local currency liabilities; |

| | • | | High taxes in some foreign jurisdictions; |

| | • | | Difficulty in complying with Internet and data privacy related regulations in foreign jurisdictions; |

| | • | | Difficulty enforcing intellectual property rights and weaker laws protecting these rights; and |

| | • | | Ability to efficiently deploy capital and generate returns in foreign jurisdictions. |

We may be exposed to credit risk, collection risk and payment delinquencies on our accounts receivable.

A substantial majority of our outstanding accounts receivables are not secured. Our standard terms and conditions permit payment within a specified number of days following the receipt of our services. While we have procedures to monitor and limit exposure to credit risk on our receivables, there can be no assurance such procedures will effectively limit our collection risk and avoid losses. In addition, under poor global economic conditions, certain of our customers have faced and may face liquidity concerns and have delayed and may delay or may be unable to satisfy their payment obligations, which may have a material adverse effect on our financial condition and operating results.

Our sales cycles are lengthy and could require us to incur substantial costs that may not result in related revenues.

Our business is characterized by a lengthy sales cycle. Once a contract with a customer is signed there is typically an extended period before the customer or customer’s end-users actually begin to use our services,

16

which is when we begin to realize network revenues. As a result, we may invest a significant amount of time and effort in attempting to secure a customer which may not result in any revenues in the near term. Even if we enter into a contract, we may have incurred substantial sales-related expenses well before we recognize any related revenues. If the expenses associated with sales efforts increase and, we are not successful in our sales efforts, or we are unable to generate associated offsetting revenues in a timely manner, our operating results could be harmed.

Cyber security risks and privacy concerns related to Internet-based services could reduce demand for our services.

The secure transmission of confidential information and mission critical data when using Internet-based services is extremely important to our customers. A key component of our ability to attract and retain customers is the security measures that we have engineered into our network for the authentication of the end-user’s credentials. These measures are designed to protect against unauthorized access to our customers’ networks. Because techniques used to obtain unauthorized access or to sabotage networks change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures against unauthorized access or sabotage. If an actual or perceived breach of network security occurs, that is attributable to our services, the market perception of the effectiveness of our cyber security measures could be harmed resulting in a negative impact to our business.

As part of providing our services, we collect certain information about the users of our service. As such we must comply with evolving laws and regulations regarding the protection and disclosure of such user information. While we have taken steps to comply with applicable privacy laws and regulations and to protect user information, any well-publicized compromises of our users’ data may reduce demand for our services and harm our business.

We rely significantly on information technology to accurately bill our customers and any failure, inadequacy or interruption of that technology could negatively impact our ability to report on our financial performance on a timely basis.

A key component of our ability to attract and retain customers is the timely and accurate furnishing of monthly detail billing records of activity on our network, rated for the agreements in place with both our customers and our suppliers. Our ability to meet these billing requirements, as well as to effectively manage and maintain our books and records and internal reporting requirements, depends significantly on our internal information technology. In January 2013, we migrated to a new enterprise resource planning system to enable us to more efficiently scale these accounting, billing, and reporting requirements. The inability of this new system to operate effectively or to integrate with other systems, or a breach in security of this or related systems could cause delays in billing and reduced efficiency of our operations, or negatively impact our system of internal controls over financial reporting, any of which could require significant capital investments to remediate.

If licenses to third party technologies do not continue to be available to us at a reasonable cost, or at all, our business and operations may be adversely affected.

We license technologies from several software providers that are incorporated into our services. We anticipate that we will continue to license technology from third parties in the future. Licenses to third party technologies may not continue to be available to us at a reasonable cost, or at all. The loss of the right to use these technologies or other technologies that we license could have an adverse effect on our services and increase our costs or cause interruptions, degradations or delays in our services until substitute technologies, if available, are developed or identified, licensed and successfully integrated into our services.

Litigation arising out of intellectual property infringement could be expensive and disrupt our business.

We cannot be certain that our services do not, or will not, infringe upon patents, trademarks, copyrights or other intellectual property rights held by third parties, or that other parties will not assert infringement claims

17

against us. Any claim of infringement of proprietary rights of others, even if ultimately decided in our favor, could result in substantial costs and diversion of our resources. Successful claims against us may result in an injunction or substantial monetary liability, which in either case could significantly impact our results of operations or materially disrupt the conduct of our business. If we are enjoined from using a technology, we will need to obtain a license to use the technology, but licenses to third-party technology may not be available to us at a reasonable cost, or at all.

In order to compete, we must attract and retain key employees, and our failure to do so could harm our results of operations.

In order to compete, we must attract and retain executives, sales representatives, engineers and other key employees. Hiring and retaining qualified executives, sales representatives and engineers are critical to our business, and competition for experienced employees in our industry can be intense. If we experience significant turnover of our executives, sales representatives, engineers and other key employees it will be difficult to achieve our business objectives and could adversely impact our results of operations.

| Item 1B. | Unresolved Staff Comments |

None

We lease approximately 48,000 square feet of space for our headquarters in Redwood Shores, California under a lease that expires in 2015. We also lease sales and support offices in other parts of the Unites States and abroad in EMEA and Asia Pacific. We believe that our principal facility in Redwood Shores, and sales and support offices in other parts of the Unites States and abroad are adequate for our business needs, and we expect that additional facilities will be available in other jurisdictions to the extent we need to add new offices.

Not applicable.

| Item 4. | Mine Safety Disclosures |

Not applicable.

18

PART II

| Item 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Price Range of Common Stock

Our common stock is traded on the NASDAQ Global Select Market under the symbol “IPAS”. The following table sets forth the intra-day high and low sale price of our common stock, in each quarterly period presented within the two most recent years, as reported on the NASDAQ Global Select Market:

| | | | | | | | |

| | | Price range | |

| | | High | | | Low | |

Year ended December 31, 2012: | | | | | | | | |

First Quarter | | $ | 2.80 | | | $ | 1.33 | |

Second Quarter | | | 2.70 | | | | 2.07 | |

Third Quarter | | | 2.39 | | | | 1.71 | |

Fourth Quarter | | | 2.21 | | | | 1.65 | |

Year ended December 31, 2011: | | | | | | | | |

First Quarter | | $ | 1.71 | | | $ | 1.25 | |

Second Quarter | | | 1.65 | | | | 1.19 | |

Third Quarter | | | 1.98 | | | | 1.12 | |

Fourth Quarter | | | 1.53 | | | | 1.11 | |

We had 61,821,210 shares of our common stock outstanding as of February 28, 2013, held by 110 holders of record, although there are a significantly larger number of beneficial owners of our common stock.

Dividends

In December 2010 we paid a cash dividend of $0.07 per share, for a total of $4.0 million, to holders of our common stock. We did not pay any other cash dividends on our common stock in 2012, 2011, or 2010. We currently do not expect to pay cash dividends, although the declaration of any future cash dividend is at the discretion of the Board of Directors and will depend on the financial condition, results of operations, capital requirements, business conditions and other factors, as well as a determination that cash dividends are in the best interest of our stockholders.

Unregistered Sales of Equity Securities and Use of Proceeds

The following table sets forth repurchases made in the fourth quarter of the current fiscal year 2012:

| | | | | | | | | | | | | | | | |

Date | | Total

Number of

Shares

Purchased | | | Average

Price Paid

Per Share(3) | | | Total

Number of

Shares (or

units)

Purchased as

Part of

Publicly

Announced

Plans or

Programs | | | Maximum

Number (or

approximate

dollar value)

of Shares (or

units) That

May Yet Be

Purchased

Under the

Plans or

Programs | |

October 9, 2012(1) | | | 15,036 | | | $ | 1.94 | | | | — | | | | — | |

December 10, 2012(2) | | | 33,000 | | | $ | 1.77 | | | | — | | | | — | |

| (1) | Represents the common stock withheld for the purpose of satisfying tax withholding obligations with respect to the vesting of restricted stock awards by certain officers of the company. |

19

| (2) | Represents common stock tendered as consideration for the exercise price of stock options exercised by a director of the Company. |

| (3) | The price per share was equal to the closing market price of our common stock on the date the shares were withheld/tendered. |

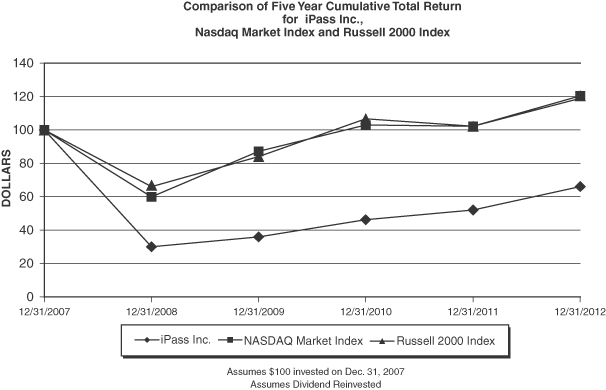

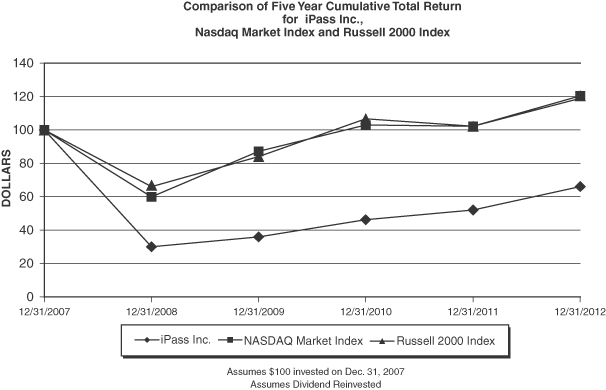

Performance Graph(1)

The performance line graph below compares the cumulative total stockholder return on our common stock with the cumulative total return of the NASDAQ Market Index and the Russell 2000 Index for the five years ended December 31, 2012. The graph and table assumes that $100 was invested on December 31, 2007 in our common stock, the NASDAQ Market Index and the Russell 2000 Index and that all the dividends were reinvested.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12/31/07 | | | 12/31/08 | | | 12/31/09 | | | 12/31/10 | | | 12/31/11 | | | 12/31/12 | |

iPass Inc. | | $ | 100.00 | | | $ | 30.04 | | | $ | 35.77 | | | $ | 45.54 | | | $ | 51.74 | | | $ | 66.67 | |

Russell 2000 Index | | | 100.00 | | | | 66.20 | | | | 84.20 | | | | 106.81 | | | | 102.34 | | | | 119.07 | |

NASDAQ Market Index | | | 100.00 | | | | 60.02 | | | | 87.24 | | | | 103.08 | | | | 102.26 | | | | 120.41 | |

We do not believe that there is any published industry or line of business indices that are directly relevant to our line of business. In addition, we do not believe that we can construct a peer group index as many of the services similar to ours are only a small portion of the business of the companies providing such services. Consequently, in addition to the NASDAQ Market Index, we are comparing our stock price performance to the Russell 2000 Index because we believe that this broad market index provides a reasonable comparison of shareholder returns.

(1) This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of iPass under the 1933 Act or the 1934 Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

20

| Item 6. | Selected Financial Data |

The following table sets forth selected financial data as of and for the last five fiscal years. This selected financial data should be read in conjunction with the consolidated financial statements and related notes included in Item 15 of this report.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (In thousands, except per share data) | |

Statement of Operations Data | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 126,078 | | | $ | 140,761 | | | $ | 156,080 | | | $ | 171,377 | | | $ | 191,368 | |

Total cost of revenues and operating expenses | | | 129,557 | | | | 143,240 | | | | 159,580 | | | | 185,575 | | | | 284,767 | |

Operating loss | | | (3,479 | ) | | | (2,479 | ) | | | (3,500 | ) | | | (14,198 | ) | | | (93,399 | ) |

Net loss | | | (4,378 | ) | | | (3,008 | ) | | | (3,096 | ) | | | (13,492 | ) | | | (91,968 | ) |

Basic and diluted net loss per share | | | (0.07 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.22 | ) | | | (1.50 | ) |

Cash dividends declared per common share | | | — | | | | — | | | | 0.07 | | | | 0.48 | | | | — | |

Total assets | | $ | 60,124 | | | $ | 63,105 | | | $ | 73,982 | | | $ | 89,563 | | | $ | 125,328 | |

Total stockholders’ equity | | | 36,901 | | | | 37,447 | | | | 37,822 | | | | 47,986 | | | | 89,797 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This section is organized as follows:

| | |

| Key Corporate Objectives | | Our overall strategy and goals |

| Significant Trends and Events | | Operating, financial and other material highlights affecting our company |

| Key Operating Metrics | | Discussion of key metrics and measures that we use to evaluate our operating performance |

| Segment Financial Information and Geographic Information | | Discussion of the two segments of our business: Mobility Services and MNS |

Critical Accounting Policies and Estimates | | Accounting policies and estimates that we believe are most important to understanding the assumptions and judgments incorporated in our reported financial results |

| Results of Operations | | An analysis of our financial results comparing the years ended December 31, 2012, December 31, 2011 and December 31, 2010 |

Liquidity and Capital Resources | | An analysis of changes in our balance sheets and cash flows, and discussion of our financial condition and potential sources of liquidity |

Overview

We provide global enterprises and telecommunication carriers with cloud-based mobility management and network connectivity services. For a detailed discussion of our business, see “Item 1. Business.”

Key Corporate Objectives

We continue our focus of transforming the company from our legacy platform and related network connectivity revenue streams to a Wi-Fi centric business, driven by our Open Mobile platform and leveraging our core assets to deliver mobility solutions to enterprises, carriers, and connectivity service providers. We see the opportunity in smartphones and tablets as a key driver in achieving our growth objectives. We are also

21

focused on continuing to grow our MNS business through both customer additions and new upsell opportunities, especially in the managed Wi-Fi area. Our plan is to continue to expand the strategic value of our business by leveraging our mobility assets across both our businesses to address both large and compelling market opportunities and to execute on key growth initiatives in our businesses. For a detailed discussion regarding our key corporate objectives, see section entitled “Our Strategy” under “Item 1. Business.”

Significant Trends and Events

The following describes significant trends and events that impacted our financial condition, results of operations, and/or the direction of our business in 2012:

Continued Focus on our Open Mobile Enterprise Business

We have continued to show solid progress against two key metrics for our OME business: (i) the number of active Open Mobile Platform users; and (ii) the number of Open Mobile Wi-Fi Network users. During 2012, we steadily increased our percentage of Open Mobile Platform users as a percentage of total platform users from 9% for the fourth quarter of 2011 to 55% for the fourth quarter of 2012. In addition, we grew our percentage of Open Mobile Wi-Fi Network users as a percentage of total Wi-Fi network users from 6% for the fourth quarter of 2011 to 43% for the fourth quarter of 2012. Our Open Mobile growth has been driven by a combination of legacy platform customer migrations, migrated customer user and usage ramps, and new customer acquisition. We continue to release updates to our Open Mobile platform, creating enhanced user experiences on a variety of operating systems. We expect to grow Wi-Fi revenues in the future based on our ability to grow Open Mobile platform and Wi-Fi network users, primarily through the continued focus on the deployment of our Open Mobile platform on smartphone and tablet devices. See “Key Operating Metrics” below for a full discussion of our user metrics.

Ramping Partner Interest in our Open Mobile Exchange Business

We are continuing to develop our OMX business, adding functionality and building-out the network of key partners including mobile operators, telecommunication service providers, and mobile virtual network operators. During 2012, we signed several strategic telecommunication carrier partners across Middle East, North America, South East Asia and Southern Asia. We have signed 23 partners to date, more than doubling our partner relationships in 2012. We believe this early traction positions us to capitalize on the growing carrier and end user consumer demand for Wi-Fi roaming and exchange services. We recognized approximately $0.8 million in OMX revenues in 2012.

Continued Decline in our Legacy Revenues

We define our legacy revenue to include Dial-up and 3G network, our iPC platform, and related platform services, as well as iPC driven network usage, including iPC user driven Wi-Fi, and minimum commit shortfall. With our announcement to fully end-of-life the iPC platform effective July 1, 2012, we experienced anticipated revenue declines in our network, platform, and other legacy revenue streams. Legacy network revenues declined $32.6 million or 38% in 2012, as customers migrated to the Open Mobile platform and as our Dial-up and 3G connectivity solutions continued to be phased out. Legacy platform revenues declined $3.6 million or 27% in 2012 as customers migrated to the Open Mobile platform or terminated their contracts with us. We expect to exit 2013 with our legacy revenue streams representing a smaller percentage of our total company revenue when compared to fiscal 2012.

Key Operating Metrics

Described below are key metrics that we use to evaluate our operating performance and our success in transforming our business and driving future growth.

22

OM Wi-Fi Network Users

OM Wi-Fi Network Users is the number of our platform users each month in a given quarter that paid for Wi-Fi network services from iPass.

OM Platform Active Users

OM Platform Active Users is the number of users who were billed Open Mobile platform fees and who have used or deployed Open Mobile.

The following table summarizes our key operating metrics in relation to the Average Number of Monthly Monetized Users(1) (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | For the Quarter Ended | |

| | | December 31,

2012 | | | September 30,

2012 | | | June 30,

2012 | | | March 31,

2012 | | | December 31,

2011 | |

Open Mobile Users: | | | | | | | | | | | | | | | | | | | | |

Wi-Fi Network Users(2) | | | 35 | | | | 27 | | | | 22 | | | | 12 | | | | 7 | |

Platform Users: | | | | | | | | | | | | | | | | | | | | |

Active | | | 355 | | | | 270 | | | | 176 | | | | 91 | | | | 45 | |

Gross(3) | | | 822 | | | | 689 | | | | 437 | | | | 286 | | | | 207 | |

| | | | | |

Legacy Users: | | | | | | | | | | | | | | | | | | | | |

Wi-Fi Network Users(2) | | | 46 | | | | 54 | | | | 76 | | | | 92 | | | | 107 | |

Other Network Users(4) | | | 28 | | | | 31 | | | | 33 | | | | 35 | | | | 37 | |

Platform Users(5) | | | 286 | | | | 320 | | | | 369 | | | | 450 | | | | 480 | |

| | | | | |

Total Users: | | | | | | | | | | | | | | | | | | | | |

Total Network Users | | | 109 | | | | 112 | | | | 131 | | | | 139 | | | | 151 | |

Open Mobile as a Percentage of Total Wi-Fi Network Users | | | 43 | % | | | 33 | % | | | 22 | % | | | 12 | % | | | 6 | % |

Open Mobile as Percentage of Total Network Users | | | 32 | % | | | 24 | % | | | 17 | % | | | 9 | % | | | 5 | % |

Total Platform Users | | | 641 | | | | 590 | | | | 545 | | | | 541 | | | | 525 | |

Open Mobile as Percentage of Total Platform Users | | | 55 | % | | | 46 | % | | | 32 | % | | | 17 | % | | | 9 | % |

| (1) | We have presented Average Monthly Monetized Users (referred to as “AMMU”) as a metric that we use to track and evaluate the operating performance of our overall Mobility business. The AMMU metric is based on the number of active users of our network and platform services across both our Open Mobile Enterprise offering and legacy iPC offerings. Network users are billed for their use of our Wi-Fi, Dial-up or 3G network services. Platform users are billed for their use of our legacy iPC client or our Open Mobile client. AMMU is defined as the average number of users per month, during a given quarter, for which a fee was billed by us to a customer for such users. |

| (2) | Wi-Fi Network Users represent unique users of Wi-Fi network. |

| (3) | Open Mobile Platform Gross Users is the total number of unique Active and Paying-Undeployed monetized users on the OM platform. |

| (4) | Other Network Users represents unique users of Dial-up and 3G network. |

| (5) | Legacy Platform Users represents unique users of the legacy iPC platform. |

Smartphone and Tablet Users

Smartphone and Tablet Users mean users who have deployed Open Mobile on their smartphone or tablet and used those devices to access Wi-Fi network services from iPass. Our focus is to increase the number of smartphone and tablet adoptions to drive additional Wi-Fi network users and network usage.