UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2008

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-29175

AVANEX CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 94-3285348 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| |

40919 Encyclopedia Circle Fremont, California | | 94538 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (510) 897-4188

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.001 par value

(Title of Class)

The NASDAQ Stock Market LLC

(Name of Each Exchange on Which Registered)

Securities registered pursuant to Section 12(g) of the Act:

Preferred Share Rights (currently attached to and trading only with Common Stock)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of December 31, 2007, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of voting stock held by non-affiliates of the Registrant was approximately $228.9 million based upon the closing price on the Nasdaq Global Market reported for such date. As of August 26, 2008, the Registrant had 15,341,458 outstanding shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement that will be filed with the Commission pursuant to Section 14(a) in connection with the 2008 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. The Proxy Statement will be filed within 120 days of Registrant’s fiscal year ended June 30, 2008.

AVANEX CORPORATION

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2008

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K that are not purely historical are “forward-looking statements” within the meaning of the federal securities laws, including, without limitation, statements regarding our expectations, beliefs, anticipations, commitments, intentions and strategies regarding the future. In some cases you can identify forward-looking statements by terms such as “may,” “could,” “would,” “might,” “will,” “should,” “expect,” “plan,” “intend,” “forecast,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” or the negative of these terms or other comparable terminology. Actual results could differ from those projected in any forward-looking statements for the reasons, among others, detailed in “Risk Factors” in Item 1A. The forward-looking statements are made as of the date of this Form 10-K and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

PART I

Overview

We are a global provider of high-performance, intelligent, photonic products including optical components, modules and subsystems. Our products enable optical communication networks to regenerate, transmit and manage voice, video and data optical signals efficiently. Telecommunication system integrators and their network carrier customers use our products to enhance system performance and increase network speed and capacity. We believe we are one of the largest broad-based suppliers of telecom optical equipment.

In 2003, we acquired all of the outstanding equity of Alcatel Optronics France, a subsidiary of Alcatel, certain assets of the optical components business of Corning Incorporated, and substantially all of the assets of Vitesse’s Optical Components Systems Division. As part of these acquisitions, Alcatel and Corning Incorporated licensed certain intellectual property rights to us. Over the past five years, we have integrated and restructured these assets and have shifted most of our manufacturing operations and portions of our development resources to lower-cost geographic regions. For instance, in March 2005, we announced that we had opened an operations center in Bangkok, Thailand to centralize global manufacturing and operational overhead functions in a lower-cost region. In July 2005, we announced the opening of a development and marketing office in Shanghai, China. In April 2007, we sold ninety percent (90%) of our share capital and voting rights of our wholly-owned subsidiary in France, including our Indium Phosphide (InP) and Gallium Arsenide (GaAs) semiconductor fabs, and our laser, terrestrial pump, submarine pump and Fiber Bragg Grating (FBG) product lines, to 3S Photonics.

In order to expand our transmission product portfolio, in July 2007, we acquired the assets relating to the MSA 300-pin transponder and XFP transceiver businesses of the Commercial Communication Products Division of Essex Corporation, a subsidiary of Northrop Grumman Space and Mission Systems Corporation.

We have one of the broadest optical product portfolio platforms available, with a scalable and efficient global operating model.

We were incorporated in October 1997 as a California corporation, and in January 2000, we were reincorporated as a Delaware corporation. Our principal executive office is located at 40919 Encyclopedia Circle, Fremont, California, 94538. We also maintain facilities in Horseheads, New York; Melbourne, Florida; Shanghai, China; Villebon Sur Yvette, France; San Donato, Italy; and Bangkok, Thailand. Our main telephone number is (510) 897-4188, and our web site address is www.avanex.com. We are not including the information contained in our web site or any other information that may be accessed through our web site as part of, or incorporating it by reference into, this Annual Report on Form 10-K. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports are available, free of charge, through our internet web site, as soon as reasonably practicable, after we electronically file such material with, or furnish it to the Securities and Exchange Commission (SEC).

Avanex and the Avanex logo are registered trademarks of Avanex Corporation. This Annual Report on Form 10-K also includes other trade names, trademarks and service marks of ours and other companies.

1

Recent Events

Following the close of market on August 12, 2008, we effected a fifteen-for-one reverse stock split of our common stock. Accordingly, each fifteen shares of issued and outstanding Avanex common stock and equivalents as of the close of market on August 12, 2008 was converted into one share of common stock, and the reverse stock split was reflected in the trading price of Avanex’s common stock at the opening of market on August 13, 2008. Unless indicated otherwise, all share amounts and per share prices appearing in this Annual Report on Form 10-K reflect the reverse stock split for all periods presented.

On July 7, 2008, Dr. Jo Major, Jr. was terminated from his position as President and Chief Executive Officer of the Company. On July 6, 2008, Dr. Major resigned from the Company’s Board of Directors. Also on July 7, 2008, Marla Sanchez resigned from her position as Senior Vice President and Chief Financial Officer of the Company. On August 25, 2008, Patrick Edsell resigned from his position as Senior Vice President and General Manager.

Industry

Optical technology transfers information in the form of light signals along optical fibers. The light signals are transmitted through fiber optic cable. Beyond lasers, many other optical components and subsystems are utilized within optical networks to generate, clean, amplify, isolate, route, or otherwise enhance light signals.

Over the last several years, the optical components, modules and subsystems industry has experienced a modest increase in business levels, as compared to previous years, because network carriers and cable companies have been deploying new communication networks or have been upgrading the backbone of existing communication networks. The increasing demand for optical solutions is in response to growing bandwidth demand driven by increased transmission of video, voice and data over optical communication networks, and by a need among network carriers to decrease the total cost of ownership of their networks. Certain large telecommunications network carriers have also disclosed that they plan to deploy, and have begun to deploy, new broadband access networks based on fiber optic technologies. These fiber-to-the-premise networks significantly increase the capacity and expand the type of services that can be utilized by residential users.

Products

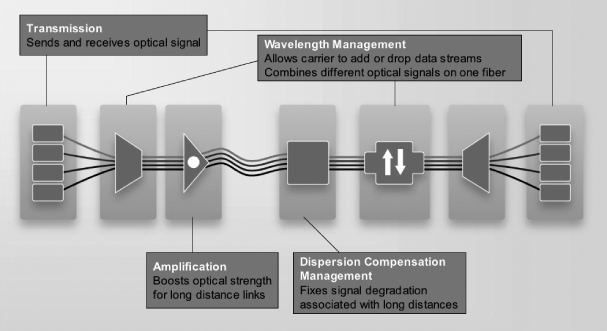

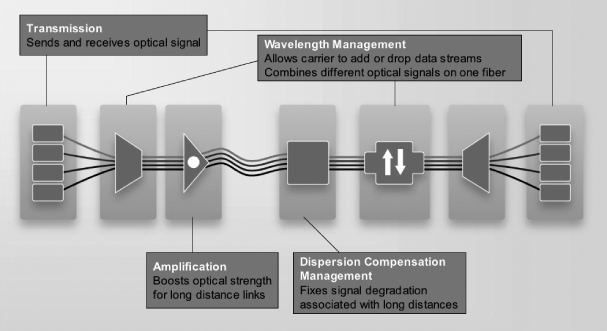

Our product portfolio is comprised of the following product families (depicted visually above):

Amplification—Our Amplification product family includes products that optically amplify transmission signals, including Erbium doped fiber amplifiers.

2

Wavelength Management—Our Wavelength Management platform includes Switching and Routing solutions, Multiplexing and Signal Processing solutions and Micro-Optics and Integrated Modules, including products that optically add and drop transmission signals in both fixed and reconfigurable versions, products that optically multiplex or demultiplex signals based on thin film filters, planar and interleaver technologies, and products that optically attenuate signal power across a single or multiple wavelength bands.

Dispersion Compensation Management—Our Dispersion Compensation product family consists of products that optically compensate for chromatic dispersion and dispersion degradation of transmission signals, including fixed and tunable products based on dispersion compensating fiber and cascaded etalons.

Transmission—Our Transmission product family includes transceivers and transponders. These products transmit and receive optical signals on optical fibers. Our Transmission product family also includes Lithium Niobate Modulators, which are optical devices fabricated from Lithium Niobate and other optical devices that manipulate the phase of magnitude of an optical signal. Their primary function is to transfer information on an optical carrier by modulating the light.

Competition

The optical communications markets are rapidly evolving. We expect these markets to continue to be highly competitive because of the available capacity and easily obtained funding. We believe that our principal competitors in the optical subsystems, modules and components industry include Bookham, Inc., EMCORE Corporation, JDS Uniphase Corporation, Oplink Communications, Inc., Opnext, Inc. and Optium Corporation. We believe we differentiate ourselves from our competitors by offering high levels of customer value through collaborative product design, technology innovation, optical/ mechanical performance, intelligent features for configuration, control and monitoring, multi-function integration and overall customization. The principal competitive factors upon which we compete include breadth of product line, availability, performance, product reliability, innovation and selling price. We believe that we compete favorably with our competitors with respect to the foregoing factors.

Consolidation in the optical systems and components industry in the past has intensified, and future consolidation could further intensify, the competitive pressures that we face. For example, Finisar Corporation and Optium Corporation, and Opnext Inc. and StrataLight Communications, Inc. have recently announced proposed combinations. In addition, Oplink Communications and EMCORE Corporation have expanded their businesses through acquisitions. Significant consolidation has also taken place recently at the carrier level and at our customer level. Recent mergers among our customers include that of ADVA Optical Networking with Movaz Networks Inc., Alcatel with Lucent Technologies Inc., Ericsson AB with Marconi, and the merger of the optical businesses of Marconi Communications and Nokia.

We also face competition from companies that may expand into our industry and introduce additional competitive products. Existing and potential customers are also our potential competitors. These customers may develop or acquire additional competitive products or technologies, which may cause them to reduce or cease their purchases from us. Please see “Risk Factors” in Item 1A of this Annual Report on Form 10-K, including in Section II: “Market and Competitive Risks.”

Research and Development

We believe that research and development is critical to our strategic growth objectives. Our research and development activities are focused on new products that integrate multiple optical functions and that offer intelligent features for configuration, control and monitoring. To accomplish this, our research and development team possesses expertise in the areas of optical components, micro-optic and integrated-optic design, as well as in electronics, firmware, and software. Most of our efforts are directed toward the development of platforms with new revenue potential, but we do continue to invest in current technological platforms to ensure our continued competitiveness in the future.

Our research and development expenses totaled $28.3 million for the fiscal year ended June 30, 2008, $25.2 million for the fiscal year ended June 30, 2007, and $23.5 million for the fiscal year ended June 30, 2006. During

3

fiscal 2008, research and development expenditures increased due to higher prototype parts spending and additional staff in the U.S. and China. During fiscal 2007, research and development expenditures increased as we added staff in China and increased patent-related expenses; however, by the end of fiscal 2007, expenses had decreased to comparable levels with the prior year with the sale of our subsidiary in France. In addition, we have moved significant engineering resources to our Shanghai location to increase the cost effectiveness of our overall research and development activities and to provide support to our third-party contract manufacturers. As of June 30, 2008, we employed 182 people in our research and development groups in Fremont, California; Melbourne, Florida; Horseheads, New York; Villebon Sur Yvette, France; San Donato, Italy; and Shanghai, China.

During fiscal 2006, 2007 and 2008, we saw an increase in the number of customers purchasing integrated subsystem products, as well as an increase in the complexity of such products with existing customers as the demand for more intelligent, efficient and flexible optical fiber networks increases. We continue to invest in such products, as we believe applications for these types of products will become increasingly important in the future. For risks associated with our research and development efforts, please see “Risk Factors” in Item 1A of this Annual Report on Form 10-K, including in Section IV: “Operations and Research and Development Risks.”

Sales and Marketing

We primarily market our products to telecommunications system integrators. Our marketing efforts are centered on the demonstration of, and education about, our products’ performance at trade shows and customer visits. We sell and market our products through a combination of direct sales, distributors and representatives.

As of June 30, 2008, our direct sales organization consisted of directly employed account managers in the United States, Europe and Asia, supported by application engineers and product line managers. We focus our direct sales efforts on service providers and telecommunications systems and optical module manufacturers. The direct sales account managers cover the market on an assigned-account, regional basis and work as a team with systems engineers and product line managers. As of June 30, 2008, our sales and marketing organization consisted of 68 people. We provide customer service directly to our customers.

In order to further our international sales objectives, we have established relationships with distributors and manufacturer’s representatives geographically as needed to support our customers. These distributors and representatives have expertise in distributing complex telecommunications equipment in their markets and provide basic customer service to the end customers they serve.

While we have diversified our customer base, we expect that a substantial proportion of our sales will continue to be concentrated with a limited number of customers. During fiscal 2008, Alcatel-Lucent accounted for 25% of our net revenue and Tellabs accounted for 21% of our net revenue. During fiscal 2007, Alcatel-Lucent accounted for 29% of our net revenue and Tellabs accounted for 17% of our net revenue. During fiscal 2006, Alcatel accounted for 27% of our net revenue and Nortel accounted for 11% of our net revenue.

A summary of certain financial information by geographic location is found in Note 15 in the Notes to Consolidated Financial Statements.

Backlog

We do not believe that backlog as of any particular date is meaningful, as our sales are made primarily pursuant to standard purchase orders for delivery of products. Only a small portion of our orders are non-cancelable, and the dollar amount associated with the non-cancelable portion is not significant.

Manufacturing

During fiscal 2007, we completed the transition of most of our manufacturing operations to third party contract manufacturers located in Thailand and China, whose operations are coordinated through our Asian Operations Center in Bangkok, Thailand; however, we continue to manufacture Lithium Niobate chips that are used in our products in San Donato, Italy. As of June 30, 2008, our manufacturing support organization consisted of 241 people.

4

We currently purchase several key components used in our products and equipment from single or limited sources of supply, including Bookham Inc., Corning, Eudyna Devices Inc., JDS Uniphase Corporation and Photop, Inc. These key components include lasers, variable optical attenuators, thin film filters, gain flattening filters, and optical fiber. We also purchase turnkey solutions from OEM manufacturers, such as Browave Corporation, Fabrinet, Optiworks, and Photop Inc. For risks associated with our manufacturing strategy, please see “Risk Factors” in Item 1A of this Annual Report on Form 10-K, including Section IV: “Operations and Research and Development Risks.”

Our United States, Europe and Asia sites are currently TL-9000 certified. We will continue to refine our quality processes to ensure that we maintain our high standards of product quality and customer satisfaction.

Patents and Intellectual Property

As of June 30, 2008, we held approximately 535 U.S. patents and approximately 269 foreign patents (issued and pending), covering a broad range of photonics and optical communications products and technologies. These technologies are incorporated into our products and are covered by patents that expire through April 2026; however, we also have patents that have not been incorporated into our products. In addition, our intellectual property includes trade secrets, trademarks, and copyrights. We do not expect to maintain or enhance our market position primarily through the exercise of our intellectual property rights because the rapid evolution of technology and the wide distribution of patents in our industry preclude such market positioning through intellectual property. We will pursue opportunities to license our intellectual property if we believe that we can be adequately compensated or if there is the potential for a beneficial cross-license agreement.

Our engineering teams have significant expertise in photonic, micro-optic and systems-level design and manufacturing. While we rely on patent, copyright, trade secret and trademark law to protect our technology, we also believe that other factors, such as the technological and creative skills of our personnel, new product developments, frequent product enhancements and reliable product maintenance are essential to establishing and maintaining a technology leadership position.

We generally enter into confidentiality or license agreements with our employees, consultants and corporate partners, and generally control access to and distribution of our proprietary information.

In addition, we have been granted licenses to use other intellectual property, including patents of Alcatel, Corning and various other third parties. For risks associated with our patents and intellectual property, please see “Risk Factors” in Item 1A of this Annual Report on Form 10-K, including Section V: “Intellectual Property and Litigation Risks.”

Employees

As of June 30, 2008, we had 576 employees and consultants comprised of 241 employees in manufacturing support, 182 employees in research and development, 68 employees in sales and marketing, and 85 employees in general and administrative capacities. The work force is located in Canada, China, France, Germany, Italy, Japan, Thailand, the United Kingdom, and the United States.

As of June 30, 2008, some of our employees located in Europe were represented by labor organizations.

We consider our relations with our employees to be good. Our future success depends on our continuing ability to attract, train and retain highly qualified technical, sales and managerial personnel. Please see “Risk Factors” in Item 1A of this Annual Report on Form 10-K, including Section IV: “Operations and Research and Development Risks,” specifically the risk factor entitled “We depend on key personnel to manage our business effectively, and if we are unable to hire, retain or motivate qualified personnel, our ability to sell our products could be harmed.”

5

In addition to the other information contained in this Annual Report on Form 10-K, we have identified the following risks and uncertainties that may have a material adverse affect on our business, financial condition or results of operations. Investors should carefully consider the risks described below before making an investment decision. The risks described below are not the only ones we face. Additional risks not presently known to us or that we currently believe are immaterial may also impair our business operations. Our business could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks and investors may lose all or part of their investment. This section should be read in conjunction with the Condensed Consolidated Financial Statements and Notes thereto, and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in this Form 10-K.

I. Financial and Revenue Risks.

Prior to fiscal 2008, we had a history of negative cash flows and losses, which could return if we do not continue to increase our revenue and/or further reduce our costs.

Prior to fiscal 2008, we experienced operating losses in each quarterly and annual period since our inception in 1997, and we may again incur operating losses for an indeterminate period of time. As of June 30, 2008, we had an accumulated deficit of $700.4 million. For each of our prior fiscal years except for fiscal 2008, we had negative operating cash flow, and we may incur negative operating cash flow in future periods. There can be no assurance that our business will be profitable in the future or that additional losses and negative cash flows from operations will not be incurred, which could have a material adverse affect on our financial condition.

Due to insufficient cash generated from operations in the past, we funded our operations primarily through the sale of equity securities, debt securities, bank borrowings, equipment lease financings, acquisitions and other capital raising transactions. Although we implemented cost reduction programs during the past several years, we continue to have significant fixed expenses, and we expect to continue to incur considerable manufacturing, sales and marketing, product development and administrative expenses.

Our future profitability depends on our ability to maintain or improve gross margin and control operating expenses. If we do not maintain or improve gross margin and control operating expenses, our financial condition and results of operations will be adversely impacted.

During the fiscal years ended June 30, 2008, 2007 and 2006, our gross margin percentage was 31%, 18% and 5%, respectively. Despite our continued efforts to improve our gross margin, there can be no assurance that our gross margin will improve or be maintained in the future.

We have reduced fixed costs through the extensive reliance on third party contract manufacturing and the relocation of most of our manufacturing operations into a central facility in Bangkok, Thailand. We may further reduce fixed costs by relocating certain transactional activities to lower cost regions. We have faced and may face execution issues working with our contract manufacturers, including difficulties managing our supply chain and deliveries to our customers. From a financial viewpoint, should these difficulties occur, we could see negative impacts to revenue, gross margin and inventory levels.

In addition, over our limited operating history, the average selling prices of our existing products have decreased and this trend may continue. However, our overall product mix has shifted toward products with higher levels of integration, typically selling at higher unit prices. Future price decreases may be due to a number of factors, including competitive pricing pressures, rapid technological change and sales discounts. Therefore, to maintain or improve our gross margin, we must develop and introduce new products and product enhancements on a timely basis and reduce our costs of production. Moreover, as our average selling prices decline, we must increase our unit sales volume, or introduce new products, to maintain or increase our total revenues. If our average selling prices decline more rapidly than our costs of production, our gross margin will decline. This would adversely impact our business, financial condition and results of operations. If we are unable to continue to generate positive gross margin, our cash flows from operations would be negatively impacted, and we would be unable to maintain profitability.

6

Our future revenues and operating results are inherently unpredictable, and as a result, we may fail to meet the expectations of securities analysts or investors, which could cause our stock price to decline.

Our revenues and operating results have fluctuated significantly from quarter-to-quarter in the past, and may continue to fluctuate significantly in the future. Factors that are likely to cause these fluctuations, some of which are outside of our control, include, without limitation, the following:

| | • | | the current economic environment and other developments in the telecommunications industry, including the severe business setbacks of customers or potential customers; |

| | • | | the average margin of the mix of products we sell; |

| | • | | fluctuations in demand for and sales of our products, which will depend upon the speed and magnitude of the transition to an all-optical network, the acceptance of our products in the marketplace, and the general level of spending on infrastructure projects in the telecommunications industry; |

| | • | | cancellations of orders and shipment rescheduling; |

| | • | | changes in product specifications required by customers for existing and future products; |

| | • | | satisfaction of contractual customer acceptance criteria and related revenue recognition issues; |

| | • | | our ability to maintain appropriate manufacturing capacity through our contract manufacturers and materials suppliers, from whom we have no long-term commitments; |

| | • | | the ability of our outsourced manufacturers to timely produce and deliver subcomponents, and possibly complete products in the quantity and of the quality we require; |

| | • | | the current practice of our customers in the telecommunications industry of sporadically placing large orders with short lead times; |

| | • | | our ability to comply with new rules and regulations; |

| | • | | competitive factors, including the introduction of new products and product enhancements by competitors and potential competitors, pricing pressures, and the competitive environment in the markets into which we sell our photonic processing solutions and products, including competitors with substantially greater resources than we have; |

| | • | | our ability to effectively develop, introduce, manufacture, and ship new and enhanced products in a timely manner without defects; |

| | • | | the availability and cost of components for our products; |

| | • | | new product introductions that may result in increased research and development expenses and sales and marketing expenses that are incurred in one quarter, with revenues, if any, that are not recognized until a subsequent quarter; |

| | • | | the unpredictability of customer demand and difficulties in meeting such demand; |

| | • | | revisions to our estimated reserves and allowances, as well as other accounting provisions or charges; |

| | • | | costs associated with, and the outcome of, any litigation to which we are, or may become, a party; and |

| | • | | customer perception of our financial condition and resulting effects on our orders and revenue. |

A high percentage of our expenses, including those related to manufacturing, engineering, sales and marketing, research and development, and general and administrative functions, are fixed in the short term. As a result, if we experience delays in generating and recognizing revenue, our quarterly operating results are likely to be harmed.

Due to these and other factors, we believe that quarter-to-quarter comparisons of our operating results may not be meaningful. Our results for one quarter should not be relied upon as any indication of our future performance. It is possible that in future quarters our operating results may be below the expectations of public market analysts or investors. If this occurs, the price of our common stock would likely decrease.

7

We may not continue to realize the anticipated benefits from our restructuring efforts.

As part of our cost reduction efforts, over the past several years we have implemented various restructuring programs to realign our resources in response to changes in the industry and customer demand. These efforts have included transferring most of our manufacturing operations to lower-cost contract manufacturers and selling our semiconductor fabs and related product lines in France. Our past restructuring programs may have a material effect on our financial position in the future as we pay rent for excess facilities. We may initiate future restructuring actions, which are likely to result in additional expenses that could affect our results of operations or financial position. There can be no assurance that we will realize the benefits we anticipate from our current or future restructuring programs or that such programs will reduce our operating expenses and improve our cost structure.

A lack of effective internal control over financial reporting could result in an inability to report our financial results accurately, which could lead to a loss of investor confidence in our financial reports and have an adverse effect on our stock price.

Effective internal controls are necessary for us to provide reliable financial reports. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed. We have in the past discovered, and may in the future discover, deficiencies, including those considered to be material weaknesses, in our internal controls. For example, as more fully described in Item 9A of this Annual Report on Form 10-K, our management concluded that as of June 30, 2008 we did not maintain effective internal controls over the following:

Controls over the review of journal entries for inventory and taxes related to certain foreign subsidiaries were inadequately designed to prevent or detect a material misstatement of the consolidated financial statements.

Our management determined that these control deficiencies were considered a material weakness that could result in a material misstatement to annual or interim financial statements that would not be prevented or detected. As a result, our management concluded that our internal control over financial reporting was not effective as of June 30, 2008 using the criteria set forth in the Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). We expect the remediation of this material weakness to occur during fiscal year 2009.

A failure to implement and maintain effective internal control over financial reporting, including a failure to implement corrective actions to address the control deficiencies identified above, could result in a material misstatement of our financial statements or otherwise cause us to fail to meet our financial reporting obligations. This, in turn, could result in a loss of investor confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on our business, financial condition, operating results and our stock price, and we could be subject to stockholder litigation.

We incur increased costs as a result of being a public company.

As a public company, we incur significant legal, accounting and other expenses. In addition, the Sarbanes-Oxley Act of 2002, as well as future accounting rules and regulations subsequently implemented by the Securities and Exchange Commission and Nasdaq, have required changes in corporate governance practices of public companies. These rules and regulations have increased our legal and financial compliance costs and have made some activities more time consuming and costly. In addition, we incur additional costs associated with our public company reporting requirements.

Our stock price is highly volatile.

The trading price of our common stock has fluctuated significantly since our initial public offering in February 2000, and is likely to remain volatile in the future. For example, since the beginning of fiscal 2007 through to August 26, 2008, our common stock has closed as low as $6.35 and as high as $34.20 per share. The trading price of our common stock could be subject to wide fluctuations in response to many events or factors, including the following:

| | • | | quarterly variations in our operating results; |

| | • | | significant developments in the businesses of telecommunications companies; |

8

| | • | | changes in financial estimates by securities analysts; |

| | • | | changes in market valuations or financial results of telecommunications-related companies; |

| | • | | announcements by us or our competitors of technology innovations, new products, or significant acquisitions, strategic partnerships or joint ventures; |

| | • | | any deviation from projected growth rates in revenues; |

| | • | | any loss of a major customer or a major customer order; |

| | • | | additions or departures of key management or engineering personnel; |

| | • | | any deviations in our net revenue or in losses from levels expected by securities analysts; |

| | • | | activities of short sellers and risk arbitrageurs; |

| | • | | future sales of our common stock or the availability of additional financing; |

| | • | | volume fluctuations, which are particularly common among highly volatile securities of telecommunications-related companies; and |

| | • | | material weaknesses in internal controls. |

In addition, the stock market has experienced volatility that has particularly affected the market prices of equity securities of many high technology companies, which often has been unrelated or disproportionate to the operating performance of these companies. These broad market fluctuations may adversely affect the market price of our common stock. There is substantial risk that our quarterly results will fluctuate.

Sales of securities by our stockholders or warrantholders could affect the market price of our common stock or have a dilutive effect upon our stockholders.

On October 29, 2007, the Pirelli Group acquired all the shares of our common stock previously held by Alcatel-Lucent. As of August 26, 2008, the Pirelli Group owned shares of our common stock representing approximately 12% of the outstanding shares of our common stock. If the Pirelli Group or our other large stockholders sell substantial amounts of our common stock in the public market, it could cause the market price of our common stock to fall, and could make it more difficult for us to raise capital through public offerings or other sales of our capital stock.

In addition, we have issued warrants to purchase initially up to an aggregate of 665,417 shares of common stock to certain institutional investors that are exercisable through 2011 at exercise prices ranging from $32.18 to $110.85 per share, subject to broad-based anti-dilution provisions, including weighted-average price-based anti-dilution provisions. If these institutional investors exercise the warrants, we will issue shares of our common stock and such issuances may be dilutive to our stockholders. Because the exercise price of the warrants may be adjusted from time to time in accordance with the provisions of the warrants, the number of shares that could actually be issued may be greater than the amount described above. For example, in connection with our March 1, 2007 financing, the holders of the warrants we issued on March 9, 2006 received an antidilution adjustment pursuant to the terms of such warrants resulting in up to 7,815 additional shares being issued upon the exercise of such warrants and the reduction of the exercise price of the warrants from $40.95 per share to $40.30 per share.

We may have difficulty obtaining additional capital.

Our balance of unrestricted cash, cash equivalents, and short-term investments increased from $43.8 million at June 30, 2007 to $55.4 million at June 30, 2008. Except for the past fiscal year, we have not been profitable, and there can be no assurance that our business will remain profitable in the future. A failure to remain profitable would have an adverse affect on our financial condition. It may be difficult for us to raise additional capital. If adequate capital is not available to us as required, or is not available on favorable terms, our business, operating results and financial condition would be adversely affected.

9

II. Market and Competitive Risks.

Market conditions in the telecommunications industry may significantly harm our financial position.

Worldwide economic conditions generally, and market conditions in the telecommunications industry specifically, may significantly harm our financial position. We sell our products primarily to a few large customers in the telecommunications industry. Two customers accounted for an aggregate of 25% and 21% of our net revenue, respectively, for the fiscal year ended June 30, 2008. We expect that the majority of our revenues will continue to depend on sales of our products to a small number of customers. If current customers do not continue to place significant orders, or if they cancel or delay current orders, we may not be able to replace those orders. In addition, any negative developments in the business of existing customers could result in significantly decreased sales to these customers, which could seriously harm our business, operating results and financial condition. We have experienced, and in the future we may experience, losses as a result of the inability to collect accounts receivable, as well as the loss of ongoing business from customers experiencing financial difficulties. If our customers fail to meet their payment obligations, we could experience reduced cash flows and losses in excess of amounts reserved. Because of our reliance on a limited number of customers, any decrease in revenues from, or loss of, one or more of these customers without a corresponding increase in revenues from other customers would harm our business, operating results and financial condition.

Our customers may cancel or delay purchases with little or no advance notice to us.

Our customers typically purchase our products pursuant to individual purchase orders, and only a small portion of our orders is non-cancelable. Accordingly, our customers may cancel, defer or decrease purchases without significant consequence to them and with little or no advance notice. Further, certain of our customers have a tendency to purchase our products near the end of a fiscal quarter. Cancellation or delays of such orders may cause us to fail to achieve that quarter’s financial and operating goals. Decreases in purchases, cancellations of purchase orders, or deferrals of purchases may significantly harm our business, operating results and financial condition, particularly if we are not able to anticipate these events.

We experience intense competition with respect to our products.

We believe that our principal competitors in the optical systems and components industry include Bookham Inc., EMCORE Corporation, JDS Uniphase Corporation, Oplink Communications, Inc., Opnext Inc., and Optium Corporation. We may also face competition from companies that expand into our industry in the future.

A few of our competitors have longer operating histories and significantly greater financial, technical, marketing and other resources than we have. As a result, some of these competitors are able to devote greater resources to the development, promotion, sale, and support of their products. In addition, our competitors that have larger market capitalization or cash reserves are better positioned than we are to acquire other companies in order to gain new technologies or products that may displace our product lines. Consolidation in the optical systems and components industry could intensify the competitive pressures that we face because these consolidated competitors may have longer operating histories and significantly greater financial, technical, marketing and other resources than we have.

Some existing customers and potential customers, as well as, suppliers and potential suppliers, are also our competitors. These customers and suppliers may develop or acquire additional competitive products or technologies in the future, which may cause them to reduce or cease their purchases from us or their supply to us, as the case may be. Further, these customers may reduce or discontinue purchasing our products if they perceive us as a serious competitive threat with regard to sales of products to their customers. Additionally, suppliers may reduce or discontinue selling materials to us if they perceive us as a serious competitive threat with regard to sales of products to their customers. As a result of these factors, we expect that competitive pressures will intensify and may result in price reductions, reduced margins, and loss of market share.

Competition in the optical systems and components industry has contributed to substantial price-driven competition. As a result, sales prices for specific products have decreased over time at varying rates, in some instances significantly. Price pressure is exacerbated by the rapid emergence of new technologies and the evolution of technical standards, which can greatly diminish the value of products relying on older technologies

10

and standards. In addition, the current economic and industry environment in the telecommunications sector has resulted in pressure to reduce prices for our products, and we expect pricing pressure to continue for the foreseeable future, which may adversely affect our operating results. Reduced spending by our customers has caused and may continue to cause increased price competition, resulting in a decline in the prices we charge for our products. If our customers and potential customers continue to constrain their spending, or if the prices we charge continue to decline, our revenues and margins may be adversely affected.

We will lose market share and may not be successful if our customers do not qualify our products to be designed into their products and systems or if our customers significantly delay purchasing our products.

In the telecommunications industry, service providers and optical systems manufacturers often undertake extensive qualification processes prior to placing orders for large quantities of products such as ours, because these products must function as part of a larger system or network. Once they decide to use a particular supplier’s product or component, these potential customers design the product into their system, which is known as a “design-in” win. Suppliers whose products or components are not designed in are unlikely to make sales to that company until the adoption of a future redesigned system at the earliest, which could occur several years after the last design-in win. If we fail to achieve design-in wins in potential customers’ qualification processes, we may lose the opportunity for significant sales to such customers for a significant period of time.

The long sales cycles for sales of our products to customers may cause operating results to vary from quarter to quarter, which could continue to cause volatility in our stock price, and may prevent us from being profitable.

The period of time between our initial contact with certain of our customers and the receipt of an actual purchase order from such customers often spans a time period of six to nine months, or longer. During this time, customers may perform, or require us to perform, extensive and lengthy evaluation and testing of our products and our manufacturing processes before purchasing our products. While our customers are evaluating our products before they place an order with us, we may incur substantial sales and marketing and research and development expenses, expend significant management efforts, increase manufacturing capacity and order long-lead-time supplies. If we increase capacity and order supplies in anticipation of an order that does not materialize, our gross margin will decline, and we will have to carry and write off excess inventory. Even if we receive an order, if we are required to add additional internal manufacturing capacity in order to service the customer’s requirements, such manufacturing capacity may be underutilized in subsequent periods, especially if orders are delayed or cancelled. Either situation could cause our business, results of operations, and financial condition to be below the expectations of public market analysts or investors, which could, in turn, cause the price of our common stock to decline.

If the communications industry does not continue to evolve and grow steadily, our business may not succeed.

Future demand for our products is uncertain and unpredictable, and will depend to a great degree on the speed of the widespread adoption of optical networks. If the transition occurs too slowly or ceases altogether, the market for our products and the growth of our business will be significantly limited.

Our future success depends on the continued growth and success of the telecommunications industry, including the continued growth of the Internet as a widely used medium for commerce and communication and the continuing demand for increased bandwidth over communications networks. If the Internet does not continue to expand as a widespread communication medium and commercial marketplace, the need for significantly increased bandwidth across networks and the market for optical transmission products may not develop. As a result, it would be unlikely that our products would achieve commercial success.

The rate at which telecommunications service providers and other optical network users have built new optical networks or installed new systems in their existing optical networks has fluctuated in the past, and these fluctuations may continue in the future. Sales of our components depend on sales of fiber optic telecommunications systems by our systems-level customers, which are shipped in quantity when telecommunications service providers add capacity. Systems manufacturers compete for sales in each capacity

11

deployment. If systems manufacturers that use our products in their systems do not win a contract, their demand for our products will decline, reducing our future revenues. Similarly, a telecommunications service provider’s delay in selecting systems manufacturers for a deployment could delay our shipments and revenues.

III. Acquisition and Divestiture Risks.

Acquisitions, divestitures and other significant transactions may adversely affect our business.

We regularly review acquisition, divestiture and other strategic opportunities that would further our business objectives, complement our existing product offerings, augment our market coverage, secure supplies of critical materials or enhance our technological capabilities. The anticipated benefits of our acquisitions, divestitures and other strategic transactions may not be realized or may be realized more slowly than we expected. Acquisitions, divestitures and other strategic opportunities have resulted in, and in the future could result in, a number of financial consequences, including without limitation:

| | • | | potentially dilutive issuances of equity securities; |

| | • | | reduced cash balances and related interest income; |

| | • | | higher fixed expenses, which require a higher level of revenues to maintain gross margin; |

| | • | | the incurrence of debt and contingent liabilities, including indemnification obligations; |

| | • | | restructuring actions, which could result in charges that have a material effect on our results of operations and our financial position; |

| | • | | loss of customers, suppliers, distributors, licensors or employees of the acquired company; |

| | • | | legal, accounting and advisory fees; |

| | • | | amortization expenses related to intangible assets; and |

| | • | | one-time write-offs of large amounts. |

For example, in connection with our acquisition of the optical components businesses of Alcatel and Corning, we issued shares of our common stock to Alcatel and to Corning representing 28% and 17%, respectively, of the outstanding shares of our common stock on a post-transaction basis. In connection with such acquisitions, we recorded restructuring liabilities at July 31, 2003 with a fair value of $64.1 million relating to workforce reductions, which were included in the purchase price of such acquisitions. Following these acquisitions, we recorded additional significant restructuring liabilities that involved the acquired businesses and resulted in, among other things, a significant reduction in the size of our workforce, consolidation of our facilities and increased reliance on outsourced, third-party manufacturing.

In fiscal 2007, we sold ninety percent (90%) of the shares of Avanex France, the operator of our semiconductor fabs and associated product lines located in Nozay, France. We agreed to indemnify the buyers of Avanex France generally for a period of up to two years in an amount generally not exceeding €5 million for breaches of certain representations, warranties and covenants relating to the condition of the business prior to and at the time of sale. Should any such liabilities or expenses be of a material amount, our finances could be materially and adversely affected. We may experience a shortfall in revenue, lose existing or potential customers or otherwise experience material adverse effects upon our business, results of operation and financial condition.

Additionally, if any potential acquisitions are not completed, we are required to expense the frequently significant legal, accounting, consulting and other costs of pursuing these transactions in the period in which the activity ceases, which could adversely affect our operating results and may not be anticipated. For example, in fiscal 2007, we expensed approximately $2.1 million in diligence and professional fees related to a potential acquisition with which we decided not to proceed further.

Furthermore, our past acquisition and disposition activity has involved, and our future acquisition, disposition and other significant transactions may involve, numerous operational risks, including:

| | • | | difficulties integrating or divesting operations, personnel, technologies, products and the information systems of the acquired or divested companies; |

12

| | • | | diversion of management’s attention from other business concerns; |

| | • | | diversion of resources from our existing businesses, products or technologies; |

| | • | | risks of entering geographic and business markets in which we have no or limited prior experience; and |

| | • | | potential loss of key employees of acquired organizations. |

IV. Operations and Research and Development Risks.

We face various risks related to our manufacturing operations that may adversely affect our business.

We may experience delays, disruptions or quality control problems in our manufacturing operations or the manufacturing operations of our third party manufacturers, and, as a result, product shipments to our customers could be delayed beyond the shipment schedules requested by our customers, which would negatively affect our business, results of operations, and financial condition. In the past, we have experienced disruptions in the manufacture of some of our products due to changes in our manufacturing processes, which resulted in reduced manufacturing yields, delays in the shipment of our products and deferral of revenue recognition. Any disruptions in the future could adversely affect our revenues, gross margin, and results of operations. Changes in our manufacturing processes or those of our third party manufacturers, or the inadvertent use of defective materials by our third party manufacturers or us, could significantly reduce our manufacturing yields and product reliability. Lower than expected manufacturing yields could delay product shipments and further impair our gross margin. These operational issues have included capacity constraints at our contract manufacturers, raw materials shortages, logistics issues, and manufacturing yield issues for some of our new products.

We may need to develop new manufacturing processes and techniques that will involve higher levels of automation, or may need to further relocate certain manufacturing operations to lower cost regions to improve our gross margin and achieve the targeted cost levels of our customers. If we fail to manage this process effectively, or if we experience delays, disruptions or quality control problems in our manufacturing operations, our shipments of products to our customers could be delayed.

We face risks related to our concentration of research and development efforts on a limited number of key industry standards and technologies, and our future success depends on our ability to develop and introduce new and enhanced products successfully that meet the needs of our customers in a timely manner.

In the past, we have concentrated our research and development efforts on a limited number of technologies that we believed had the best growth prospects. If we are unable to develop commercially viable products using these technologies, or these technologies do not become generally accepted, our business will likely suffer.

The markets for our products are characterized by rapid technological change, frequent new product introduction, changes in customer requirements, and evolving industry standards. Our future performance will depend upon the successful development, introduction and market acceptance of new and enhanced products that address these changes. We may not be able to develop the underlying core technologies necessary to create new or enhanced products, or to license or otherwise acquire these technologies from third parties. Product development delays may result from numerous factors, including:

| | • | | changing product specifications and customer requirements; |

| | • | | difficulties in hiring and retaining necessary technical personnel; |

| | • | | difficulties in reallocating engineering resources and overcoming resource limitations; |

| | • | | changing market or competitive product requirements; |

| | • | | unanticipated engineering complexities, and |

| | • | | failure to compete with new product releases by our competitors. |

Our industry has increased its focus on products that transmit voice, video and data traffic over shorter distances and that are offered at lower cost than the products that we offer to our telecommunications customers for transmission of information over longer distances. If we are unable to develop products that meet the requirements of potential customers of these products, our business, results of operations, and financial condition could suffer.

13

The development of new, technologically advanced products is a complex and uncertain process requiring high levels of innovation and highly skilled engineering and development personnel, as well as the accurate anticipation of technological and market trends. We cannot assure that we will be able to identify, develop, manufacture, market or support new or enhanced products successfully, or on a timely basis. In addition, the introduction of new and enhanced products may cause our customers to defer or cancel orders for existing products. To the extent customers defer or cancel orders for existing products due to the expectation of a new product release, or if there is any delay in the development or introduction of our new products or the enhancements of our products, our business, results of operations, and financial condition would suffer. Further, we cannot assure that our new products will gain market acceptance or that we will be able to respond effectively to competitive products, technological changes or emerging industry standards. Any failure to respond effectively to competitive products, technological change or emerging industry standards would significantly harm our business, results of operations and financial condition.

If we are unable to forecast component and material requirements accurately or if we are unable to commit to deliver sufficient quantities of our products to satisfy customers’ needs, our results of operations will be adversely affected.

Our customers typically require us to commit to delivering certain quantities of our products to them (in guaranteed safety stock, guaranteed capacity or otherwise) without committing themselves to purchase such products, or any quantity of such products. Therefore, wide variations between estimates of our customers’ needs and their actual purchases may result in:

| | • | | a surplus and potential obsolescence of inventory, materials and capacity, if estimates of our customers’ requirements are greater than our customers’ actual need; or |

| | • | | a lack of sufficient products to satisfy our customers’ needs, if estimates of our customers’ requirements are less than our customers’ actual needs. |

We use a rolling six-month to twelve-month demand forecast based on anticipated and historical product orders to determine our component and material requirements. It is very important that we accurately predict both the demand for our products and the lead times required to obtain the necessary components and materials. It is very difficult to develop accurate forecasts of product demand, especially given the current uncertain conditions in the telecommunications industry. Order cancellations and lower order volumes by our customers have in the past created excess inventories. For example, inventory write-offs are primarily the result of our inability to anticipate decreases in demand for certain of our products and variations in product mix ordered by our customers. For the fiscal years ended June 30, 2008 and June 30, 2007, we recorded write-offs of $4.7 million and $12.9 million, respectively, for excess and obsolete inventory. If we fail to accurately predict both the demand for our products and the lead times required to obtain the necessary components and materials in the future, we could incur additional excess and obsolete inventory write-downs. If we underestimate our component and material requirements, we may have inadequate inventory, which could interrupt our manufacturing and delay delivery of our products to our customers. Any of these occurrences would negatively affect our business, results of operations, and financial condition.

Network carriers and telecommunication system integrators historically have required that suppliers commit to provide specified quantities of products over a given period of time. If we are unable to commit to deliver sufficient quantities of our products to satisfy a customer’s anticipated needs, we may lose the opportunity to make significant sales to that customer over a lengthy period of time. In addition, we may be unable to pursue large orders if we do not have sufficient manufacturing capacity to enable us to provide customers with specified quantities of products. We rely heavily upon the capacity and willingness of third party contract manufacturers and materials suppliers to enable us to fulfill our commitments to our customers, but we generally do not have the benefit of long term or other supply or services contracts with our third party contract manufacturers and materials suppliers, who are generally not obligated to adhere to our production schedule. If we cannot deliver sufficient quantities of our products, we may lose business, which could adversely impact our business, results of operations and financial condition.

14

If our customers do not qualify our manufacturing processes, they may not purchase our products and our operating results could suffer.

Certain of our customers will not purchase our products prior to qualification of our manufacturing processes and approval of our quality assurance system. The qualification process determines whether the manufacturing line meets the quality, performance, and reliability standards of our customers. These customers may also require that we, and any manufacturer that we may use, be registered under international quality standards, such as ISO 9001. Our United States, Europe and Asia sites are currently TL-9000 certified. Delays in obtaining customer qualification of our manufacturing processes or approval of our quality assurance system may cause a product to be removed from a long-term supply program and result in significant lost revenue opportunity over the term of that program.

We depend upon a limited number of contract manufacturers and materials suppliers to manufacture and provide a majority of our products, and our dependence on these manufacturers and suppliers may result in product delivery delays, may harm our operations or have an adverse effect upon our business.

We rely on a limited number of outsourced manufacturers and suppliers to manufacture and provide a substantial majority of our components, subassemblies, and finished products. In particular, one contract manufacturer, Fabrinet, currently manufactures products for sale, which constitutes a significant majority of our net revenue. We intend to develop further our relationships with this and with other manufacturers so that they will eventually manufacture many of our high volume key components and subassemblies in the future. The qualification of these independent manufacturers and materials suppliers under quality assurance standards is an expensive and time-consuming process. Our independent manufacturers have a limited history of manufacturing optical subcomponents. Any interruption in the operations of these manufacturers, or any deficiency in the quality or quantity of the subcomponents or products built for us by these manufacturers, could impede our ability to meet our scheduled product deliveries to our customers. Operational issues could result, such as capacity constraints at our contract manufacturers, raw materials shortages, logistics issues, and manufacturing yield issues for some of our new products. As a result, we may lose existing or potential customers.

We have limited experience in working with outsourced manufacturers and suppliers. As a result, we may not be able to manage our relationships with them effectively. If we cannot manage our manufacturing and supplier relationships effectively, or if these manufacturers and suppliers fail to deliver components in a timely manner, we could experience significant delays in product deliveries, which may have an adverse effect on our business and results of operations. Increased reliance on outsourced manufacturing and suppliers, and the ultimate disposition of our manufacturing capacity in the future, may result in impairment expense relating to our long-lived assets in future periods, which would have an adverse impact on our business, financial condition, and results of operations.

Our products may have defects that might not be detected until full deployment of a customer’s network, which could result in a loss of customers and revenue and in damage to our reputation.

Our products are designed to be deployed in large and complex optical networks and must be compatible with existing and future components of such networks. Our products can only be fully tested for reliability when deployed in networks for long periods of time. Our products may not operate as expected, and our customers may discover errors, defects, or incompatibilities in our products only after they have been fully deployed and are operating under peak stress conditions. If we are unable to fix errors or other problems, we could experience:

| | • | | loss of customers or customer orders; |

| | • | | loss of or delay in revenues; |

| | • | | loss or damage to our brand and reputation; |

| | • | | inability to attract new customers or achieve market acceptance; |

| | • | | diversion of development resources; |

| | • | | increased service and warranty costs; |

15

| | • | | legal actions by our customers; and |

| | • | | increased insurance costs. |

We may be required to indemnify our customers against certain liabilities arising from defects in our products, which liabilities may also include the following costs and expenses:

| | • | | costs and expenses incurred by our customers or their customers to fix the problems; and |

| | • | | costs and expenses incurred by our customers or their customers to replace our products, or their products which incorporate our products, with other product solutions. |

While we carry insurance policies covering this type of liability, these policies may not provide sufficient protection should a claim be asserted. To date, product defects have not had a material negative effect on our business, results of operations, or financial condition; however, we cannot assure that they will not have a material negative effect on us in the future.

We depend on key personnel to manage our business effectively, and if we are unable to hire, retain, or motivate qualified personnel, our ability to sell our products could be harmed.

Our future success depends, in part, on certain key employees and on our ability to attract and retain highly skilled personnel. In addition, there have been changes in our executive management team, and there can be no assurance that these changes will be successful. The loss of the services of any of our key personnel, the inability to attract or retain qualified personnel, or delays in hiring required personnel, particularly engineering, sales or marketing personnel, may seriously harm our business, results of operations, and financial condition. For example, Dr. Jo Major, our former President and Chief Executive Officer, Marla Sanchez, our former Chief Financial Officer, and Pat Edsell, our former General Manager, recently left the Company. None of our officers or key employees has an employment agreement for a specific term, and these employees may terminate their employment at any time. We do not have key person life insurance policies covering any of our employees. Our ability to continue to attract and retain highly skilled personnel will be a critical factor in determining whether we will be successful in the future. Competition for highly skilled personnel is frequently intense, especially in the San Francisco Bay Area. We may not be successful in attracting, assimilating or retaining qualified personnel to fulfill our current or future needs.

In addition, we have implemented restructuring programs designed to attempt to improve our financial performance. Among other things, we have moved substantially all of our manufacturing operations to lower cost locations. As a result, our headcount in North America and Europe has been substantially reduced and may be reduced further in the future. To date, such actions have not resulted in substantial work stoppages. Decreases in labor productivity, however, whether formalized by a work stoppage or a strike, or by decreased productivity due to morale issues could have an adverse effect on our business and operating results.

We face various risks that could prevent us from successfully manufacturing, marketing and distributing our products internationally.

We have expanded our international operations in Thailand and China, including the expansion of overseas product manufacturing, and we may continue to expand internationally in the future. Further, we have increased international sales and intend to further increase our international sales and the number of our international customers. We have also initiated significant restructuring programs overseas, and may initiate additional restructuring programs overseas in the future. Our international operations have required and will continue to require significant management attention and financial resources. For instance, we have incurred, and may continue to incur, startup costs to open our operations center in Thailand and our research and development office in Shanghai, and may incur costs in transferring operations to Thailand. We currently have limited experience in manufacturing, marketing and distributing our products internationally, particularly from our new operations center in Thailand. In addition, international operations are subject to inherent risks, including, without limitation, the following:

| | • | | greater difficulty in accounts receivable collection and longer collection periods; |

| | • | | difficulties inherent in managing operations and employees in remote foreign operations; |

16

| | • | | import or export licensing and product certification requirements; |

| | • | | tariffs, duties, price controls or other restrictions on foreign currencies or trade barriers imposed by foreign countries; |

| | • | | potential adverse tax consequences; |

| | • | | seasonal reductions in business activity in some parts of the world; |

| | • | | burdens of complying with a wide variety of foreign laws and regulations, particularly with respect to taxes, intellectual property, license requirements, employment matters and environmental requirements; |

| | • | | the impact of recessions in economies outside of the United States; |

| | • | | unexpected changes in regulatory or certification requirements for optical systems or networks; and |

| | • | | political and economic instability, terrorism and war. |

Some of our suppliers and contract manufacturers, including Fabrinet, also have international operations and are subject to the risks described above. Even if we are able to manage the risks of international operations successfully, our business may be materially adversely affected if our suppliers or contract manufacturers are not able to manage these risks successfully.

A portion of our international revenues and expenses are now denominated in foreign currencies. It has not been our recent practice to engage in the hedging of foreign currency transactions to mitigate foreign currency risk. Therefore, fluctuations in the value of foreign currencies could have a negative impact on the profitability of our global operations, which would seriously harm our business, results of operations, and financial condition.

V. Intellectual Property and Litigation Risks.

Current and future litigation against us could be costly and time consuming to defend.

We are subject to legal proceedings and claims that arise in the ordinary course of business. Litigation may result in substantial costs and may divert management’s attention and resources, which may seriously harm our business, results of operations, financial condition and liquidity.

We may be unable to protect our proprietary technology, which could significantly impair our ability to compete.

We rely on a combination of patent, copyright, trademark and trade secret laws, confidentiality agreements and other contractual restrictions on disclosure to protect our intellectual property rights. We also rely on confidentiality agreements with our employees, consultants and corporate partners, and controlled access to and distribution of our technology, documentation and other confidential information. We have numerous patents issued or applied for in the United States and abroad, of which some may be jointly filed or owned with other parties. Further, we license certain intellectual property from third parties, including Alcatel-Lucent and Corning, that is critical to our business, and we also license intellectual property to other parties. We cannot assure that any patent applications or issued patents will protect our proprietary technology effectively, or that any patent applications or patents issued will not be challenged by third parties. Further, we cannot assure that parties from whom we license intellectual property will not violate their agreements with us; that they will not license their intellectual property to third parties; that their patent applications, patents and other intellectual property will protect our technology, products and business; or that their patent applications, patents, and other intellectual property will not be challenged by third parties. For example, Alcatel-Lucent has cross licenses with various third parties, which, when combined with their own intellectual property, may permit these third parties to compete with us. Our intellectual property also consists of trade secrets, requiring more monitoring and control mechanisms to protect. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our products or technology. Monitoring unauthorized use of our products is difficult, and we cannot be certain that the steps we take will prevent misappropriation or unauthorized use of our technology. Further, other parties may independently develop similar or competing technology or design around any patents that may be issued or licensed to us.

17

We use various methods to attempt to protect our intellectual property rights. However, we cannot be certain that these methods will prevent the misappropriation of our intellectual property. In particular, the laws in foreign countries may not protect our proprietary rights as fully as the laws in the United States.

We face risks with regard to third-party intellectual property licenses.

From time to time we may be required to license technology or intellectual property from third parties for our product offerings or to develop new products or product enhancements. We cannot assure that third-party licenses will be available to us on commercially reasonable terms, if at all. The inability to obtain a necessary third-party license required for our product offerings or to develop new products and product enhancements could require us to substitute technology of lower quality or performance standards or of greater cost, either of which could prevent us from operating our business. If we are unable to obtain licenses from third parties if and as necessary, then we may also be subject to litigation to defend against infringement claims from these third parties.