UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||||

| For the quarterly period ended | March 31, 2024 | |||||||

| ☐ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||||

| For the transition period from to | ||||||||

Commission File Number 0-24429

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 13-3728359 | ||||||||||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||||||||

300 Frank W. Burr Blvd.

Teaneck, New Jersey 07666

(Address of Principal Executive Offices including Zip Code)

Registrant’s telephone number, including area code: (201) 801-0233

N/A

(Former Name, Former Address and Former Fiscal Year,

if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Class A Common Stock, $0.01 par value per share | CTSH | The Nasdaq Stock Market LLC | ||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No: ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☒ | Accelerated filer | ☐ | ||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||||

| Emerging growth company | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of April 26, 2024:

| Class | Number of Shares | |||||||

| Class A Common Stock, par value $0.01 per share | 497,198,868 | |||||||

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

TABLE OF CONTENTS

| Page | ||||||||

| PART I. | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

GLOSSARY

| Defined Term | Definition | |||||||

| 10b5-1 Plan | Trading plan adopted pursuant to Rule 10b5-1 of the Exchange Act | |||||||

| Adjusted Diluted EPS | Adjusted diluted earnings per share | |||||||

| AI | Artificial intelligence | |||||||

| ASC | Accounting Standards Codification | |||||||

| CC | Constant Currency | |||||||

| CE | Continental Europe | |||||||

| CITA | Commissioner of Income Tax (Appeals) in India | |||||||

| CMT | Communications, Media and Technology | |||||||

| CODM | Chief Operating Decision Maker | |||||||

| Credit Agreement | Credit agreement with a commercial bank syndicate dated October 6, 2022 | |||||||

| CTS India | Our principal operating subsidiary in India | |||||||

| DOJ | United States Department of Justice | |||||||

| DSO | Days Sales Outstanding | |||||||

| DTSA | Defend Trade Secrets Act | |||||||

| EPS | Earnings per share | |||||||

| EU | European Union | |||||||

| Exchange Act | Securities Exchange Act of 1934, as amended | |||||||

| FS | Financial Services | |||||||

| GAAP | Generally Accepted Accounting Principles in the United States of America | |||||||

| GenAI | Generative artificial intelligence | |||||||

| HS | Health Sciences | |||||||

| High Court | Madras, India High Court | |||||||

| India Defined Contribution Obligation | Certain statutory defined contribution obligations of employees and employers in India | |||||||

| IRS | Internal Revenue Service | |||||||

| ITAT | Income Tax Appellate Tribunal in India | |||||||

| ITD | Indian Income Tax Department | |||||||

| NA | North America | |||||||

| OECD | Organization for Economic Cooperation and Development | |||||||

| P&R | Products & Resources | |||||||

| RoW | Rest of World | |||||||

| SCI | Supreme Court of India | |||||||

| SEC | United States Securities and Exchange Commission | |||||||

| Second Circuit | United States Court of Appeals for the Second Circuit | |||||||

| SG&A | Selling, general and administrative | |||||||

| Syntel | Syntel Sterling Best Shores Mauritius Ltd. | |||||||

| Tax Reform Act | Tax Cuts and Jobs Act | |||||||

| Term Loan | Unsecured term loan under the Credit Agreement | |||||||

| TriZetto | The TriZetto Group, Inc., now known as Cognizant Technology Software Group, Inc. | |||||||

| UK | United Kingdom | |||||||

| USDC-NJ | United States District Court for the District of New Jersey | |||||||

| USDC-SDNY | United States District Court for the Southern District of New York | |||||||

| Cognizant Technology Solutions | 1 | March 31, 2024 Form 10-Q | ||||||

| Forward Looking Statements | ||||||||||||||

The statements contained in this Quarterly Report on Form 10-Q that are not historical facts are forward-looking statements (within the meaning of Section 21E of the Exchange Act) that involve risks and uncertainties. Such forward-looking statements may be identified by, among other things, the use of forward-looking terminology such as “believe,” “expect,” “may,” “could,” “would,” “plan,” “intend,” “estimate,” “predict,” “potential,” “continue,” “should” or “anticipate” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks and uncertainties. From time to time, we or our representatives have made or may make forward-looking statements, orally or in writing.

Such forward-looking statements may be included in various filings made by us with the SEC, in press releases or in oral statements made by or with the approval of one of our authorized executive officers. These forward-looking statements, such as statements regarding our anticipated future revenues, operating margin, earnings, capital expenditures, impacts to our business, financial results and financial condition as a result of the competitive marketplace for talent and future attrition trends, anticipated effective income tax rate and income tax expense, liquidity, financing strategy, access to capital, capital return strategy, investment strategies, cost management, plans and objectives, including those related to the NextGen program, investment in our business, potential acquisitions, industry trends, client behaviors and trends, the outcome of and costs associated with regulatory and litigation matters, the appropriateness of the accrual related to the India Defined Contribution Obligation and other statements regarding matters that are not historical facts, are based on our current expectations, estimates and projections, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Actual results, performance, achievements and outcomes could differ materially from the results expressed in, or anticipated or implied by, these forward-looking statements. There are a number of important factors that could cause our results to differ materially from those indicated by such forward-looking statements, including:

•economic and geopolitical conditions globally, in particular in the markets in which our clients and operations are concentrated;

•our ability to attract, train and retain skilled employees, including highly skilled technical personnel and personnel with experience in key digital areas and senior management to lead our business globally, at an acceptable cost;

•unexpected terminations of client contracts on short notice or reduced spending by clients for reasons beyond our control;

•challenges related to growing our business organically as well as inorganically through acquisitions, and our ability to achieve our targeted growth rates;

•our ability to successfully implement our NextGen program and the amount of costs, timing of incurring costs, and ultimate benefits of such plans;

•our ability to achieve our profitability goals and maintain our capital return strategy;

•fluctuations in foreign currency exchange rates, or the failure of our hedging strategies to mitigate such fluctuations;

•our ability to meet specified service levels or milestones required by certain of our contracts;

•intense and evolving competition and significant technological advances that our service offerings must keep pace with in the rapidly changing markets we compete in;

•our ability to successfully use AI-based technologies in our client offerings and our own internal operations;

•legal, reputation and financial risks if we fail to protect client and/or our data from security breaches and/or cyber attacks;

•the impact of future pandemics, epidemics or other outbreaks of disease, on our business, results of operations, liquidity and financial condition;

•the impact of climate change on our business;

•our ability to meet ESG expectations and commitments;

•the effectiveness of our risk management, business continuity and disaster recovery plans and the potential that our global delivery capabilities could be impacted;

•restrictions on visas, in particular in the United States, UK and EU, or immigration more generally or increased costs of such visas or the wages we are required to pay employees on visas, which may affect our ability to compete for and provide services to our clients;

•risks related to anti-outsourcing legislation, if adopted, and negative perceptions associated with offshore outsourcing, both of which could impair our ability to serve our clients;

•risks and costs related to complying with numerous and evolving legal and regulatory requirements and client expectations in the many jurisdictions in which we operate;

| Cognizant Technology Solutions | 2 | March 31, 2024 Form 10-Q | ||||||

•potential changes in tax laws, or in their interpretation or enforcement, failure by us to adapt our corporate structure and intercompany arrangements, or adverse outcomes of tax audits, investigations or proceedings;

•potential exposure to litigation and legal claims in the conduct of our business; and

•the factors set forth in "Part I, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023.

You are advised to consult any further disclosures we make on related subjects in the reports we file with the SEC, including this report in the section titled “Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Part I, Item 1. Business” in our Annual Report on Form 10-K for the year ended December 31, 2023. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

| Cognizant Technology Solutions | 3 | March 31, 2024 Form 10-Q | ||||||

PART I. FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements (Unaudited).

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited)

| (in millions, except par values) | March 31, 2024 | December 31, 2023 | |||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 2,231 | $ | 2,621 | |||||||

| Short-term investments | 12 | 14 | |||||||||

| Trade accounts receivable, net | 3,822 | 3,849 | |||||||||

| Other current assets | 1,021 | 1,022 | |||||||||

| Total current assets | 7,086 | 7,506 | |||||||||

| Property and equipment, net | 1,036 | 1,048 | |||||||||

| Operating lease assets, net | 589 | 611 | |||||||||

| Goodwill | 6,393 | 6,085 | |||||||||

| Intangible assets, net | 1,171 | 1,149 | |||||||||

| Deferred income tax assets, net | 993 | 993 | |||||||||

| Long-term investments | 83 | 435 | |||||||||

| Other noncurrent assets | 1,057 | 656 | |||||||||

| Total assets | $ | 18,408 | $ | 18,483 | |||||||

| Liabilities and Stockholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 291 | $ | 337 | |||||||

| Deferred revenue | 449 | 385 | |||||||||

| Short-term debt | 33 | 33 | |||||||||

| Operating lease liabilities | 143 | 153 | |||||||||

| Accrued expenses and other current liabilities | 2,096 | 2,425 | |||||||||

| Total current liabilities | 3,012 | 3,333 | |||||||||

| Deferred revenue, noncurrent | 36 | 42 | |||||||||

| Operating lease liabilities, noncurrent | 503 | 523 | |||||||||

| Deferred income tax liabilities, net | 201 | 226 | |||||||||

| Long-term debt | 598 | 606 | |||||||||

| Long-term income taxes payable | 157 | 157 | |||||||||

| Other noncurrent liabilities | 411 | 369 | |||||||||

| Total liabilities | 4,918 | 5,256 | |||||||||

| Stockholders’ equity: | |||||||||||

Preferred stock, $0.10 par value, 15 shares authorized, none issued | — | — | |||||||||

| Class A common stock, $0.01 par value, 1,000 shares authorized, 497 and 498 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 5 | 5 | |||||||||

| Additional paid-in capital | 20 | 15 | |||||||||

| Retained earnings | 13,621 | 13,301 | |||||||||

| Accumulated other comprehensive income (loss) | (156) | (94) | |||||||||

| Total stockholders’ equity | 13,490 | 13,227 | |||||||||

| Total liabilities and stockholders’ equity | $ | 18,408 | $ | 18,483 | |||||||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

| Cognizant Technology Solutions | 4 | March 31, 2024 Form 10-Q | ||||||

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

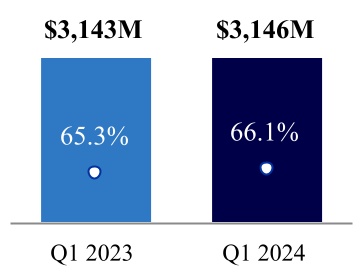

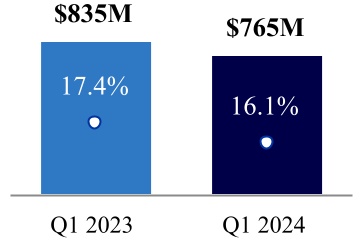

(in millions, except per share data) | Three Months Ended March 31, | ||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

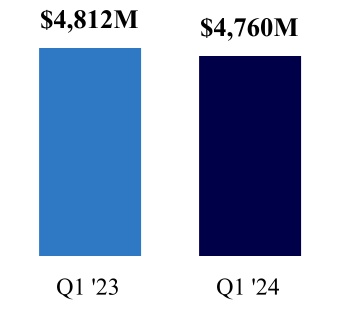

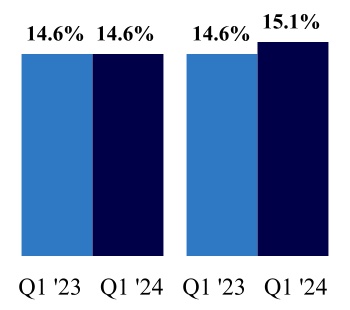

| Revenues | $ | 4,760 | $ | 4,812 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Cost of revenues (exclusive of depreciation and amortization expense shown separately below) | 3,146 | 3,143 | |||||||||||||||||||||

| Selling, general and administrative expenses | 765 | 835 | |||||||||||||||||||||

| Restructuring charges | 23 | — | |||||||||||||||||||||

| Depreciation and amortization expense | 131 | 132 | |||||||||||||||||||||

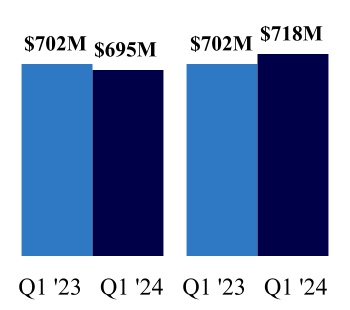

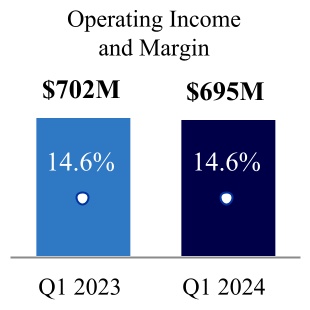

| Income from operations | 695 | 702 | |||||||||||||||||||||

| Other income (expense), net: | |||||||||||||||||||||||

| Interest income | 30 | 30 | |||||||||||||||||||||

| Interest expense | (11) | (9) | |||||||||||||||||||||

| Foreign currency exchange gains (losses), net | 6 | 12 | |||||||||||||||||||||

| Other, net | 2 | 3 | |||||||||||||||||||||

| Total other income (expense), net | 27 | 36 | |||||||||||||||||||||

| Income before provision for income taxes | 722 | 738 | |||||||||||||||||||||

| Provision for income taxes | (179) | (158) | |||||||||||||||||||||

| Income (loss) from equity method investments | 3 | — | |||||||||||||||||||||

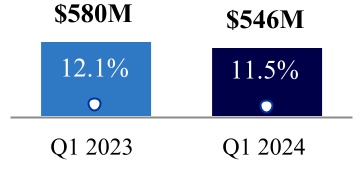

| Net income | $ | 546 | $ | 580 | |||||||||||||||||||

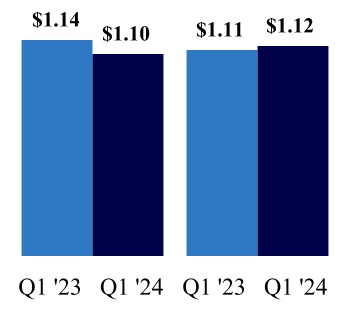

| Basic earnings per share | $ | 1.10 | $ | 1.14 | |||||||||||||||||||

| Diluted earnings per share | $ | 1.10 | $ | 1.14 | |||||||||||||||||||

| Weighted average number of common shares outstanding - Basic | 497 | 509 | |||||||||||||||||||||

| Dilutive effect of shares issuable under stock-based compensation plans | 1 | — | |||||||||||||||||||||

| Weighted average number of common shares outstanding - Diluted | 498 | 509 | |||||||||||||||||||||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

| Cognizant Technology Solutions | 5 | March 31, 2024 Form 10-Q | ||||||

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(in millions) | Three Months Ended March 31, | ||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

| Net income | $ | 546 | $ | 580 | |||||||||||||||||||

| Change in Accumulated other comprehensive income (loss), net of tax: | |||||||||||||||||||||||

| Foreign currency translation adjustments | (73) | 43 | |||||||||||||||||||||

| Unrealized gains and losses on cash flow hedges | 11 | 34 | |||||||||||||||||||||

| Other comprehensive income (loss) | (62) | 77 | |||||||||||||||||||||

| Comprehensive income | $ | 484 | $ | 657 | |||||||||||||||||||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

| Cognizant Technology Solutions | 6 | March 31, 2024 Form 10-Q | ||||||

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

(in millions, except per share data) | Class A Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Total Stockholders' Equity | |||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | 498 | $ | 5 | $ | 15 | $ | 13,301 | $ | (94) | $ | 13,227 | |||||||||||||||||||||||||||

| Net income | — | — | — | 546 | — | 546 | ||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | (62) | (62) | ||||||||||||||||||||||||||||||||

| Common stock issued, stock-based compensation plans | 1 | — | 20 | — | — | 20 | ||||||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | 42 | — | — | 42 | ||||||||||||||||||||||||||||||||

| Repurchases of common stock | (2) | — | (57) | (76) | — | (133) | ||||||||||||||||||||||||||||||||

| Dividends declared, $0.30 per share | — | — | — | (150) | — | (150) | ||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | 497 | $ | 5 | $ | 20 | $ | 13,621 | $ | (156) | $ | 13,490 | |||||||||||||||||||||||||||

(in millions, except per share data) | Class A Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Total Stockholders' Equity | |||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | 509 | $ | 5 | $ | 15 | $ | 12,588 | $ | (299) | $ | 12,309 | |||||||||||||||||||||||||||

| Net income | — | — | — | 580 | — | 580 | ||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | 77 | 77 | ||||||||||||||||||||||||||||||||

| Common stock issued, stock-based compensation plans | 2 | — | 23 | — | — | 23 | ||||||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | 44 | — | — | 44 | ||||||||||||||||||||||||||||||||

| Repurchases of common stock | (4) | — | (60) | (163) | — | (223) | ||||||||||||||||||||||||||||||||

| Dividends declared, $0.29 per share | — | — | — | (149) | — | (149) | ||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | 507 | $ | 5 | $ | 22 | $ | 12,856 | $ | (222) | $ | 12,661 | |||||||||||||||||||||||||||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

| Cognizant Technology Solutions | 7 | March 31, 2024 Form 10-Q | ||||||

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in millions) | For the Three Months Ended March 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | 546 | $ | 580 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 133 | 132 | |||||||||

| Deferred income taxes | (26) | (16) | |||||||||

| Stock-based compensation expense | 42 | 44 | |||||||||

| Other | 32 | 27 | |||||||||

| Changes in assets and liabilities, net of the effect of business combinations: | |||||||||||

| Trade accounts receivable, current | 39 | 89 | |||||||||

| Other current and noncurrent assets | (347) | (17) | |||||||||

| Accounts payable | (47) | (26) | |||||||||

| Deferred revenues, current and noncurrent | 50 | 71 | |||||||||

| Other current and noncurrent liabilities | (327) | (155) | |||||||||

| Net cash provided by operating activities | 95 | 729 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of property and equipment | (79) | (98) | |||||||||

| Proceeds from maturity or sale of available-for-sale investment securities | — | 225 | |||||||||

| Purchases of held-to-maturity investment securities | — | (3) | |||||||||

| Proceeds from maturity of held-to-maturity investment securities | 3 | 15 | |||||||||

| Purchases of other investments | — | (26) | |||||||||

| Proceeds from maturity or sale of other investments | 259 | 81 | |||||||||

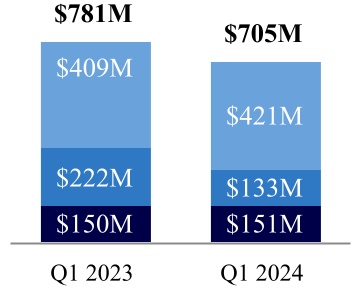

| Payments for business combinations, net of cash acquired | (421) | (409) | |||||||||

| Net cash (used in) investing activities | (238) | (215) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Issuance of common stock under stock-based compensation plans | 20 | 23 | |||||||||

| Repurchases of common stock | (133) | (222) | |||||||||

| Repayment of Term Loan borrowings and earnout and finance lease obligations | (40) | (1) | |||||||||

| Dividends paid | (151) | (150) | |||||||||

| Net cash (used in) financing activities | (304) | (350) | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash and cash equivalents | (39) | — | |||||||||

| (Decrease) increase in cash, cash equivalents and restricted cash and cash equivalents | (486) | 164 | |||||||||

| Cash, cash equivalents and restricted cash and cash equivalents beginning of year | 2,717 | 2,294 | |||||||||

| Cash and cash equivalents, end of period | $ | 2,231 | $ | 2,458 | |||||||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

| Cognizant Technology Solutions | 8 | March 31, 2024 Form 10-Q | ||||||

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Note 1 — Interim Consolidated Financial Statements | ||||||||||||||

The terms “Cognizant,” “we,” “our,” “us” and “the Company” refer to Cognizant Technology Solutions Corporation and its subsidiaries unless the context indicates otherwise. We have prepared the accompanying unaudited consolidated financial statements included herein in accordance with GAAP and the Exchange Act. The accompanying unaudited consolidated financial statements should be read in conjunction with our audited consolidated financial statements (and notes thereto) included in our Annual Report on Form 10-K for the year ended December 31, 2023. In our opinion, all adjustments considered necessary for a fair statement of the accompanying unaudited consolidated financial statements have been included and all adjustments are of a normal and recurring nature. Operating results for the interim periods are not necessarily indicative of results that may be expected to occur for the entire year.

New Accounting Pronouncements

| Date Issued and Topic | Effective Date | Description | Impact | ||||||||

November 2023 Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures | Annual period starting in 2024 and interim periods starting in 2025 Retrospective basis | The standard requires enhanced segment disclosures but does not change the definition of a segment or the guidance for determining a reportable segment. The amendments require disclosure of significant segment expenses regularly provided to the CODM included within segment operating profit or loss and a description of how the CODM utilizes segment operating profit or loss to assess segment performance and allocating resources. The new standard also allows companies to disclose multiple measures of segment profit or loss if those measures are used to allocate resources. | The Company is currently evaluating the impact of the new standard on its disclosures. | ||||||||

December 2023 Income Taxes (Topic 740): Improvements to Income Tax Disclosures | Annual period starting in 2025 Prospective basis although retrospective application is permitted | The standard requires enhanced income tax disclosures primarily related to the income tax rate reconciliation and income taxes paid information. | The Company is currently evaluating the impact of the new standard on its disclosures. | ||||||||

| Cognizant Technology Solutions | 9 | March 31, 2024 Form 10-Q | ||||||

| Note 2 — Revenues and Trade Accounts Receivable | ||||||||||||||

Disaggregation of Revenues

The tables below present disaggregated revenues from contracts with clients by client location, service line and contract type for each of our reportable business segments. We believe this disaggregation best depicts how the nature, amount, timing and uncertainty of revenues and cash flows are affected by industry, market and other economic factors. Our consulting and technology services include consulting, application development, systems integration, quality engineering and assurance services as well as software solutions and related services while our outsourcing services include application maintenance, infrastructure and security as well as business process services. Revenues are attributed to geographic regions based upon client location, which is the client's billing address. Substantially all revenues in the North America region relate to clients in the United States.

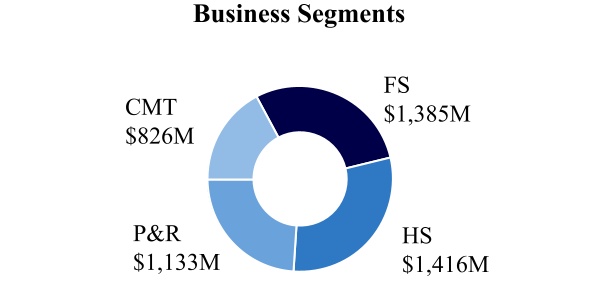

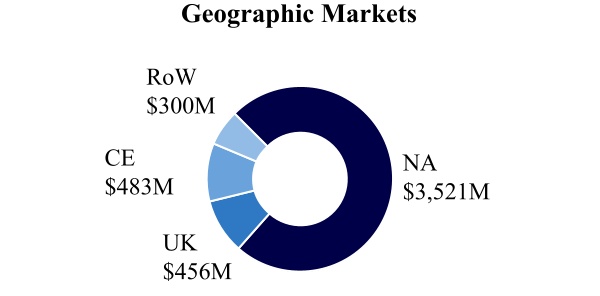

| Three Months Ended March 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Financial Services | Health Sciences | Products and Resources | Communications, Media and Technology | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Geography: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 977 | $ | 1,209 | $ | 773 | $ | 562 | $ | 3,521 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| United Kingdom | 143 | 44 | 131 | 138 | 456 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Continental Europe | 151 | 135 | 145 | 52 | 483 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe - Total | 294 | 179 | 276 | 190 | 939 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rest of World | 114 | 28 | 84 | 74 | 300 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,385 | $ | 1,416 | $ | 1,133 | $ | 826 | $ | 4,760 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service line: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consulting and technology services | $ | 953 | $ | 802 | $ | 736 | $ | 464 | $ | 2,955 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outsourcing services | 432 | 614 | 397 | 362 | 1,805 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,385 | $ | 1,416 | $ | 1,133 | $ | 826 | $ | 4,760 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Type of contract: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time and materials | $ | 783 | $ | 490 | $ | 470 | $ | 467 | $ | 2,210 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed-price | 556 | 670 | 582 | 328 | 2,136 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction or volume-based | 46 | 256 | 81 | 31 | 414 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,385 | $ | 1,416 | $ | 1,133 | $ | 826 | $ | 4,760 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cognizant Technology Solutions | 10 | March 31, 2024 Form 10-Q | ||||||

| Three Months Ended March 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Financial Services | Health Sciences | Products and Resources | Communications, Media and Technology | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Geography: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 1,033 | $ | 1,248 | $ | 741 | $ | 523 | $ | 3,545 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| United Kingdom | 162 | 37 | 132 | 147 | 478 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Continental Europe | 152 | 124 | 150 | 35 | 461 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe - Total | 314 | 161 | 282 | 182 | 939 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rest of World | 129 | 24 | 95 | 80 | 328 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,476 | $ | 1,433 | $ | 1,118 | $ | 785 | $ | 4,812 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service line: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consulting and technology services | $ | 1,000 | $ | 812 | $ | 732 | $ | 442 | $ | 2,986 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outsourcing services | 476 | 621 | 386 | 343 | 1,826 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,476 | $ | 1,433 | $ | 1,118 | $ | 785 | $ | 4,812 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Type of contract: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time and materials | $ | 861 | $ | 490 | $ | 445 | $ | 464 | $ | 2,260 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed-price | 545 | 650 | 585 | 293 | 2,073 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction or volume-based | 70 | 293 | 88 | 28 | 479 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,476 | $ | 1,433 | $ | 1,118 | $ | 785 | $ | 4,812 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Costs to Fulfill

The following table shows significant movements in the capitalized costs to fulfill for the three months ended March 31:

| (in millions) | 2024 | 2023 | ||||||||||||

| Beginning balance | $ | 245 | $ | 265 | ||||||||||

| Costs capitalized | 14 | 15 | ||||||||||||

| Amortization expense | (24) | (22) | ||||||||||||

| Ending balance | $ | 235 | $ | 258 | ||||||||||

Costs to obtain contracts were immaterial for the periods disclosed.

Contract Balances

The table below shows significant movements in contract assets (current and noncurrent) for the three months ended March 31:

| (in millions) | 2024 | 2023 | ||||||||||||

| Beginning balance | $ | 316 | $ | 326 | ||||||||||

| Revenues recognized during the period but not billed | 248 | 248 | ||||||||||||

| Amounts reclassified to trade accounts receivable | (180) | (223) | ||||||||||||

| Amounts acquired in business combinations | — | 9 | ||||||||||||

| Ending balance | $ | 384 | $ | 360 | ||||||||||

| Cognizant Technology Solutions | 11 | March 31, 2024 Form 10-Q | ||||||

The table below shows significant movements in the deferred revenue balances (current and noncurrent) for the three months ended March 31:

| (in millions) | 2024 | 2023 | ||||||||||||

| Beginning balance | $ | 427 | $ | 417 | ||||||||||

| Amounts billed but not recognized as revenues | 311 | 322 | ||||||||||||

| Revenues recognized related to the beginning balance of deferred revenue | (262) | (251) | ||||||||||||

| Amounts acquired in business combinations | 9 | 13 | ||||||||||||

| Ending balance | $ | 485 | $ | 501 | ||||||||||

Revenues recognized during the three months ended March 31, 2024 for performance obligations satisfied or partially satisfied in previous periods were immaterial.

Remaining Performance Obligations

As of March 31, 2024, the aggregate amount of transaction price allocated to remaining performance obligations was $4,263 million, of which approximately 55% is expected to be recognized as revenues within 2 years and approximately 85% is expected to be recognized as revenues within 5 years. Disclosure is not required for performance obligations that meet any of the following criteria:

(1)contracts with a duration of one year or less as determined under ASC Topic 606: "Revenue from Contracts with Customers",

(2)contracts for which we recognize revenues based on the right to invoice for services performed,

(3)variable consideration allocated entirely to a wholly unsatisfied performance obligation or to a wholly unsatisfied promise to transfer a distinct good or service that forms part of a single performance obligation in accordance with ASC 606-10-25-14(b), for which the criteria in ASC 606-10-32-40 have been met, or

(4)variable consideration in the form of a sales-based or usage-based royalty promised in exchange for a license of intellectual property.

Many of our performance obligations meet one or more of these exemptions and therefore are not included in the remaining performance obligation amount disclosed above.

Trade Accounts Receivable and Allowance for Credit Losses

We calculate expected credit losses for trade accounts receivable based on historical credit loss rates for each aging category as adjusted for the current market conditions and forecasts about future economic conditions. The following table presents the activity in the allowance for credit losses for trade accounts receivable for the three months ended March 31:

| (in millions) | 2024 | 2023 | ||||||||||||

| Beginning balance | $ | 32 | $ | 43 | ||||||||||

Credit loss expense (1) | 1 | 4 | ||||||||||||

| Write-offs charged against the allowance | (3) | (11) | ||||||||||||

| Ending balance | $ | 30 | $ | 36 | ||||||||||

(1)Reported in "Selling, general and administrative expenses" in our unaudited consolidated statements of operations.

| Note 3 — Business Combinations | ||||||||||||||

On January 22, 2024, through the execution of a share purchase agreement, we acquired 100% ownership in Thirdera, an Elite ServiceNow Partner specializing in advisory, implementation and optimization solutions related to the ServiceNow platform.

The acquisition completed during the three months ended March 31, 2024 was not material to our operations. Accordingly, pro forma results have not been presented. We have allocated the purchase price related to this transaction to tangible and intangible assets acquired and liabilities assumed, including goodwill, based on their estimated fair values.

| Cognizant Technology Solutions | 12 | March 31, 2024 Form 10-Q | ||||||

The allocations of preliminary purchase price to the fair value of the aggregate assets acquired and liabilities assumed were as follows:

| (in millions) | Thirdera | Weighted Average Useful Life | |||||||||||||||||||||

| Cash | $ | 8 | |||||||||||||||||||||

| Trade accounts receivable | 22 | ||||||||||||||||||||||

| Other current assets | 10 | ||||||||||||||||||||||

| Property and equipment and other noncurrent assets | 2 | ||||||||||||||||||||||

| Non-deductible goodwill | 178 | ||||||||||||||||||||||

| Tax-deductible goodwill | 167 | ||||||||||||||||||||||

| Customer relationship assets | 73 | 8.0 years | |||||||||||||||||||||

| Other intangible assets | 1 | 1.0 year | |||||||||||||||||||||

| Current liabilities | (29) | ||||||||||||||||||||||

| Noncurrent liabilities | (3) | ||||||||||||||||||||||

| Purchase price | $ | 429 | |||||||||||||||||||||

Goodwill from our acquisition of Thirdera is expected to benefit all of our reportable segments and has been allocated as such. The primary items that generated goodwill are the acquired assembled workforce and synergies between the acquired companies and us, neither of which qualify as identifiable intangible assets. The above allocations are preliminary and will be finalized as soon as practicable within the measurement period, but in no event later than one year following the date of acquisition.

| Note 4 — Restructuring Charges | ||||||||||||||

In the second quarter of 2023, we initiated the NextGen program aimed at simplifying our operating model, optimizing corporate functions and consolidating and realigning office space to reflect the post-pandemic hybrid work environment. We expect the NextGen program to be completed by the end of 2024.

The total costs related to our NextGen program are reported in "Restructuring charges" in our unaudited consolidated statements of operations. We do not allocate these charges to individual segments in internal management reports used by the CODM. Accordingly, such expenses are separately disclosed in our segment reporting as “unallocated costs”. See Note 13.

| Three Months Ended | ||||||||||||||||||||||||||

| (in millions) | March 31, 2024 | |||||||||||||||||||||||||

| Employee separation costs | $ | 8 | ||||||||||||||||||||||||

Facility exit costs (1) | 14 | |||||||||||||||||||||||||

Third party and other costs (2) | 1 | |||||||||||||||||||||||||

| Total restructuring charges | $ | 23 | ||||||||||||||||||||||||

(1)Facility exit costs include lease restructuring of $12 million and related accelerated depreciation charges of $2 million.

(2)Third party and other costs include certain professional services fees directly related to the NextGen program.

We expect to record total costs of approximately $300 million in connection with the NextGen program. For the year ended December 31, 2023, we incurred $229 million of costs in connection with the NextGen program. There were no restructuring charges during the three months ended March 31, 2023.

Changes in our accrued employee separation costs included in "Accrued expenses and other current liabilities" in our consolidated statements of financial position are presented in the table below for the three months ended March 31:

| (in millions) | 2024 | |||||||||||||

| Beginning balance | $ | 42 | ||||||||||||

| Employee separation costs accrued | 8 | |||||||||||||

| Payments made | (21) | |||||||||||||

| Ending balance | $ | 29 | ||||||||||||

| Cognizant Technology Solutions | 13 | March 31, 2024 Form 10-Q | ||||||

| Note 5 — Investments | ||||||||||||||

Our investments were as follows:

| (in millions) | March 31, 2024 | December 31, 2023 | |||||||||

| Short-term investments: | |||||||||||

| Equity investment security | $ | 11 | $ | 11 | |||||||

| Held-to-maturity investment securities | — | 3 | |||||||||

| Time deposits | 1 | — | |||||||||

| Total short-term investments | $ | 12 | $ | 14 | |||||||

| Long-term investments: | |||||||||||

| Other investments | $ | 83 | $ | 80 | |||||||

Restricted time deposits(1) | — | 355 | |||||||||

| Total long-term investments | $ | 83 | $ | 435 | |||||||

(1)As of December 31, 2023 the balance of restricted time deposits contains $96 million of restricted cash equivalents. See Note 8.

Equity Investment Security

Our equity investment security is a U.S. dollar denominated investment in a fixed income mutual fund. Realized and unrealized gains and losses were immaterial for the three months ended March 31, 2024 and 2023.

Held-to-Maturity Investment Securities

As of March 31, 2024, we had no held-to-maturity securities. As of December 31, 2023, the amortized cost and fair value of the held-to-maturity investments were each $3 million. Our held-to-maturity investment securities consisted of an Indian rupee denominated investment in commercial paper, which was in an unrealized loss position but had not been in an unrealized loss position for longer than 12 months.

Other Investments

As of March 31, 2024 and December 31, 2023, we had an equity method investment of $77 million and $74 million, respectively, in the technology sector. Additionally, as of each of March 31, 2024 and December 31, 2023, we had equity securities without a readily determinable fair value of $6 million.

| Note 6 — Accrued Expenses and Other Current Liabilities | ||||||||||||||

Accrued expenses and other current liabilities were as follows:

| (in millions) | March 31, 2024 | December 31, 2023 | |||||||||

| Compensation and benefits | $ | 1,158 | $ | 1,511 | |||||||

| Customer volume and other incentives | 291 | 241 | |||||||||

| Income taxes | 30 | 27 | |||||||||

| Professional fees | 153 | 146 | |||||||||

| Other | 464 | 500 | |||||||||

| Total accrued expenses and other current liabilities | $ | 2,096 | $ | 2,425 | |||||||

| Note 7 — Debt | ||||||||||||||

In 2022, we entered into the Credit Agreement providing for the $650 million Term Loan and a $1,850 million unsecured revolving credit facility, which are each due to mature in October 2027. We are required under the Credit Agreement to make scheduled quarterly principal payments on the Term Loan.

The Credit Agreement requires interest to be paid, at our option, at either the Term Benchmark, Adjusted Daily Simple RFR or the ABR Rate (each as defined in the Credit Agreement), plus, in each case, an Applicable Margin (as defined in the

| Cognizant Technology Solutions | 14 | March 31, 2024 Form 10-Q | ||||||

Credit Agreement). Initially, the Applicable Margin is 0.875% with respect to Term Benchmark loans and RFR loans and 0.00% with respect to ABR loans. Subsequently, the Applicable Margin with respect to Term Benchmark loans and RFR loans will be determined quarterly and may range from 0.75% to 1.125%, depending on our public debt ratings or, if we have not received public debt ratings, from 0.875% to 1.125%, depending on our Leverage Ratio, which is the ratio of indebtedness for borrowed money to Consolidated EBITDA, as defined in the Credit Agreement. Since issuance of the Term Loan, the Term Loan has been a Term Benchmark loan. The Credit Agreement contains customary affirmative and negative covenants as well as a financial covenant. We were in compliance with all debt covenants and representations of the Credit Agreement as of March 31, 2024.

As of December 31, 2023, our India subsidiary had a 15 billion India rupee ($180 million at the December 31, 2023 exchange rate) working capital facility. This facility expired in March 2024. We have never borrowed funds under this facility or any of its predecessor facilities.

Short-term Debt

As of each of March 31, 2024 and December 31, 2023, we had $33 million of short-term debt related to current maturities of our Term Loan.

Long-term Debt

The following table summarizes the long-term debt balances as of:

| (in millions) | March 31, 2024 | December 31, 2023 | |||||||||

| Term Loan | $ | 634 | $ | 642 | |||||||

| Less: | |||||||||||

| Current maturities | (33) | (33) | |||||||||

| Unamortized deferred financing costs | (3) | (3) | |||||||||

| Long-term debt, net of current maturities | $ | 598 | $ | 606 | |||||||

The carrying value of our debt approximated its fair value as of March 31, 2024 and December 31, 2023.

| Note 8 — Income Taxes | ||||||||||||||

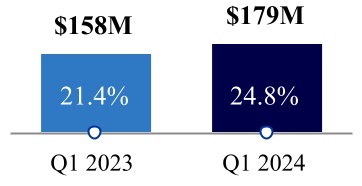

Our effective income tax rates were as follows:

| Three Months Ended March 31, | |||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

| Effective income tax rate | 24.8 | % | 21.4 | % | |||||||||||||||||||

In the first quarter of 2023, we reached an agreement with the IRS, which settled tax years 2017 and 2018, which decreased our effective tax rate in that period.

We are involved in two separate ongoing disputes with the ITD in connection with previously disclosed share repurchase transactions undertaken by CTS India in 2013 and 2016 to repurchase shares from its shareholders (non-Indian Cognizant entities) valued at $523 million and $2.8 billion, respectively.

The 2016 transaction was undertaken pursuant to a plan approved by the High Court in Chennai, India, and resulted in the payment of $135 million in Indian income taxes - an amount we believe includes all the applicable taxes owed for this transaction under Indian law. In March 2018, the ITD asserted that it is owed an additional 33 billion Indian rupees ($396 million at the March 31, 2024 exchange rate) on the 2016 transaction. We deposited 5 billion Indian rupees, representing 15% of the disputed tax amount related to the 2016 transaction, with the ITD. Additionally, certain time deposits of CTS India were placed under lien in favor of the ITD, representing the remainder of the disputed tax amount. As of December 31, 2023, the balance of deposits under lien was 30 billion Indian rupees, including previously earned interest, or $355 million, as presented in "Long-term investments".

In April 2020, we received a formal assessment from the ITD on the 2016 transaction, which is consistent with the ITD's previous assertions. Our appeal was ruled unfavorably by the CITA in March 2022 and by the ITAT in September 2023. We filed an appeal against the order of the ITAT with the High Court. On January 8, 2024, the SCI ruled that, in order to proceed

| Cognizant Technology Solutions | 15 | March 31, 2024 Form 10-Q | ||||||

with the appeal, we must deposit 30 billion Indian rupees ($355 million at the December 31, 2023 exchange rate), representing the time deposits of CTS India under lien, on the condition that, if CTS India prevails at the High Court, the amount deposited will be returned to CTS India, along with interest accrued, within four weeks of the judgment. We made the required deposit in January 2024, and in April 2024, the trial commenced before the High Court.

As of March 31, 2024 and December 31, 2023, the deposit with the ITD was $414 million and $60 million, respectively at March 31, 2024 and December 31, 2023 exchange rates, presented in "Other noncurrent assets". As of December 31, 2023, $96 million of the $355 million in deposits under lien were held in time deposits with a maturity of less than 30 days qualifying as cash equivalent instruments and thus were considered restricted cash equivalents as of December 31, 2023.

The dispute in relation to the 2013 share repurchase transaction is also in litigation. At this time, the ITD has not made specific demands with regards to the 2013 transaction.

We continue to believe we have paid all applicable taxes owed on both the 2016 and the 2013 transactions and we continue to defend our positions with respect to both matters. Accordingly, we have not recorded any reserves for these matters as of March 31, 2024.

| Note 9 — Derivative Financial Instruments | ||||||||||||||

In the normal course of business, we use foreign exchange forward and option contracts to manage foreign currency exchange rate risk. Derivatives may give rise to credit risk from the possible non-performance by counterparties. Credit risk is limited to the fair value of those contracts that are favorable to us. We have limited our credit risk by limiting the amount of credit exposure with any one financial institution and conducting ongoing evaluation of the creditworthiness of the financial institutions with which we do business. In addition, all the assets and liabilities related to the foreign exchange derivative contracts set forth in the below table are subject to master netting arrangements, such as the International Swaps and Derivatives Association Master Agreement, with each individual counterparty. These master netting arrangements generally provide for net settlement of all outstanding contracts with the counterparty in the case of an event of default or a termination event. We have presented all the assets and liabilities related to the foreign exchange derivative contracts, as applicable, on a gross basis, with no offsets, in our unaudited consolidated statements of financial position. There is no financial collateral (including cash collateral) posted or received by us related to the foreign exchange derivative contracts.

The following table provides information on the location and fair values of derivative financial instruments included in our unaudited consolidated statements of financial position as of:

| (in millions) | March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||||

| Designation of Derivatives | Location on Statement of Financial Position | Assets | Liabilities | Assets | Liabilities | |||||||||||||||||||||||||||

| Foreign exchange forward and option contracts – Designated as cash flow hedging instruments | Other current assets | $ | 21 | $ | — | $ | 14 | $ | — | |||||||||||||||||||||||

| Other noncurrent assets | 8 | — | 5 | — | ||||||||||||||||||||||||||||

| Accrued expenses and other current liabilities | — | 1 | — | 5 | ||||||||||||||||||||||||||||

| Other noncurrent liabilities | — | — | — | 1 | ||||||||||||||||||||||||||||

| Total | 29 | 1 | 19 | 6 | ||||||||||||||||||||||||||||

| Foreign exchange forward contracts – Not designated as hedging instruments | Other current assets | 4 | — | 1 | — | |||||||||||||||||||||||||||

| Accrued expenses and other current liabilities | — | 2 | — | 9 | ||||||||||||||||||||||||||||

| Total | 4 | 2 | 1 | 9 | ||||||||||||||||||||||||||||

| Total | $ | 33 | $ | 3 | $ | 20 | $ | 15 | ||||||||||||||||||||||||

| Cognizant Technology Solutions | 16 | March 31, 2024 Form 10-Q | ||||||

Cash Flow Hedges

We have entered into a series of foreign exchange derivative contracts that are designated as cash flow hedges of Indian rupee denominated payments in India. These contracts are intended to partially offset the impact of movement of the Indian rupee against the U.S. dollar on future operating costs and are scheduled to mature each month during the remainder of 2024, 2025 and the first three months of 2026. The changes in fair value of these contracts are initially reported in "Accumulated other comprehensive income (loss)" in our unaudited consolidated statements of financial position and are subsequently reclassified to earnings within "Cost of revenues" and "Selling, general and administrative expenses" in our unaudited consolidated statements of operations in the same period that the forecasted Indian rupee denominated payments are recorded in earnings. As of March 31, 2024, we estimate that $15 million, net of tax, of net gains related to derivatives designated as cash flow hedges reported in "Accumulated other comprehensive income (loss)" in our unaudited consolidated statements of financial position is expected to be reclassified into earnings within the next 12 months.

The notional value of the outstanding contracts by year of maturity was as follows:

| (in millions) | March 31, 2024 | December 31, 2023 | |||||||||

| 2024 | 1,583 | $ | 1,878 | ||||||||

| 2025 | 1,165 | 1,020 | |||||||||

| 2026 | 130 | — | |||||||||

Total notional value of contracts outstanding (1) | $ | 2,878 | $ | 2,898 | |||||||

(1)Includes $50 million and $45 million notional value of option contracts as of March 31, 2024 and December 31, 2023, respectively, with the remaining notional value related to forward contracts.

The following table provides information on the location and amounts of pre-tax gains and losses on our cash flow hedges for the three months ended March 31:

| (in millions) | Change in Derivative Gains and Losses Recognized in Accumulated Other Comprehensive Income (Loss) (effective portion) | Location of Net (Losses) Reclassified from Accumulated Other Comprehensive Income (Loss) into Income (effective portion) | Net (Losses) Reclassified from Accumulated Other Comprehensive Income (Loss) into Income (effective portion) | ||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||

| Foreign exchange forward and option contracts – Designated as cash flow hedging instruments | $ | 15 | $ | 33 | Cost of revenues | $ | — | $ | (11) | ||||||||||||||||||||

| SG&A expenses | — | (1) | |||||||||||||||||||||||||||

| Total | $ | — | $ | (12) | |||||||||||||||||||||||||

The activity related to the change in net unrealized gains and losses on the cash flow hedges included in "Accumulated other comprehensive income (loss)" in our unaudited consolidated statements of stockholders' equity is presented in Note 11.

Other Derivatives

We use foreign exchange forward contracts to provide an economic hedge against balance sheet exposures to certain monetary assets and liabilities denominated in currencies other than the functional currency of our foreign subsidiaries. We entered into foreign exchange forward contracts that are scheduled to mature in the second quarter of 2024. Realized gains or losses and changes in the estimated fair value of these derivative financial instruments are recorded in the caption "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations.

Additional information related to the outstanding foreign exchange forward contracts not designated as hedging instruments was as follows:

| (in millions) | March 31, 2024 | December 31, 2023 | |||||||||||||||||||||

| Notional | Fair Value | Notional | Fair Value | ||||||||||||||||||||

| Contracts outstanding | $ | 1,119 | $ | 2 | $ | 1,317 | $ | (8) | |||||||||||||||

| Cognizant Technology Solutions | 17 | March 31, 2024 Form 10-Q | ||||||

The following table provides information on the location and amounts of realized and unrealized pre-tax gains and losses on the other derivative financial instruments for the three months ended March 31:

| Location of Net Gains (Losses) on Derivative Instruments | Amount of Net Gains (Losses) on Derivative Instruments | ||||||||||||||||||||||||||||

| (in millions) | 2024 | 2023 | |||||||||||||||||||||||||||

| Foreign exchange forward contracts – Not designated as hedging instruments | Foreign currency exchange gains (losses), net | $ | 31 | $ | (10) | ||||||||||||||||||||||||

The related cash flow impacts of all the derivative activities are reflected as cash flows from operating activities.

| Note 10 — Fair Value Measurements | ||||||||||||||

We measure our cash equivalents, certain investments, contingent consideration liabilities and foreign exchange forward and option contracts at fair value. Fair value is the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The fair value hierarchy is based on inputs to valuation techniques that are used to measure fair value that are either observable or unobservable. Observable inputs reflect assumptions market participants would use in pricing an asset or liability based on market data obtained from independent sources while unobservable inputs reflect a reporting entity’s pricing based upon their own market assumptions.

The fair value hierarchy consists of the following three levels:

•Level 1 – Inputs are quoted prices in active markets for identical assets or liabilities.

•Level 2 – Inputs are quoted prices for similar assets or liabilities in an active market, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable and market-corroborated inputs which are derived principally from or corroborated by observable market data.

•Level 3 – Inputs are derived from valuation techniques in which one or more significant inputs or value drivers are unobservable.

The following table summarizes the financial assets and (liabilities) measured at fair value on a recurring basis as of March 31, 2024:

| (in millions) | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||

| Cash equivalents: | |||||||||||||||||||||||

| Money market funds | $ | 411 | $ | — | $ | — | $ | 411 | |||||||||||||||

| Time deposits | — | 470 | — | 470 | |||||||||||||||||||

| Short-term investments: | |||||||||||||||||||||||

| Time deposits | — | 1 | — | 1 | |||||||||||||||||||

| Equity investment security | 11 | — | — | 11 | |||||||||||||||||||

| Other current assets: | |||||||||||||||||||||||

| Foreign exchange forward contracts | — | 25 | — | 25 | |||||||||||||||||||

| Other noncurrent assets | |||||||||||||||||||||||

| Foreign exchange forward contracts | — | 8 | — | 8 | |||||||||||||||||||

| Accrued expenses and other current liabilities: | |||||||||||||||||||||||

| Foreign exchange forward contracts | — | (3) | — | (3) | |||||||||||||||||||

| Cognizant Technology Solutions | 18 | March 31, 2024 Form 10-Q | ||||||

The following table summarizes the financial assets and (liabilities) measured at fair value on a recurring basis as of December 31, 2023:

| (in millions) | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||

| Cash equivalents: | |||||||||||||||||||||||

| Money market funds | $ | 327 | $ | — | $ | — | $ | 327 | |||||||||||||||

| Time deposits | — | 834 | — | 834 | |||||||||||||||||||

| Short-term investments: | |||||||||||||||||||||||

| Equity investment security | 11 | — | — | 11 | |||||||||||||||||||

| Other current assets: | |||||||||||||||||||||||

| Foreign exchange forward contracts | — | 15 | — | 15 | |||||||||||||||||||

| Long-term investments: | |||||||||||||||||||||||

Restricted time deposits(1) | — | 355 | — | 355 | |||||||||||||||||||

| Other noncurrent assets: | |||||||||||||||||||||||

| Foreign exchange forward contracts | — | 5 | — | 5 | |||||||||||||||||||

| Accrued expenses and other current liabilities: | |||||||||||||||||||||||

| Foreign exchange forward contracts | — | (14) | — | (14) | |||||||||||||||||||

| Contingent consideration liabilities | — | — | (30) | (30) | |||||||||||||||||||

| Other noncurrent liabilities: | |||||||||||||||||||||||

| Foreign exchange forward contracts | — | (1) | — | (1) | |||||||||||||||||||

The following table summarizes the changes in Level 3 contingent consideration liabilities for the three months ended:

| (in millions) | March 31, 2024 | March 31, 2023 | ||||||||||||

| Beginning balance | $ | 30 | $ | 22 | ||||||||||

| Change in fair value recognized in SG&A expenses | — | 12 | ||||||||||||

| Payments | (30) | — | ||||||||||||

| Ending balance | $ | — | $ | 34 | ||||||||||

We measure the fair value of money market funds based on quoted prices in active markets for identical assets and measure the fair value of our equity investment security based on the published daily net asset value at which investors can freely subscribe to or redeem from the fund. The carrying value of the time deposits approximated fair value as of March 31, 2024 and December 31, 2023.

We estimate the fair value of each foreign exchange forward contract by using a present value of expected cash flows model. This model calculates the difference between the current market forward price and the contracted forward price for each foreign exchange forward contract and applies the difference in the rates to each outstanding contract. The market forward rates include a discount and credit risk factor. We estimate the fair value of each foreign exchange option contract by using a variant of the Black-Scholes model. This model uses present value techniques and reflects the time value and intrinsic value based on observable market rates.

We estimate the fair value of contingent consideration liabilities associated with acquisitions using a variation of the income approach, which utilizes one or more significant inputs that are unobservable. This approach calculates the fair value of such liabilities based on the probability-weighted expected performance of the acquired entity against the target performance metric, discounted to present value when appropriate.

During the three months ended March 31, 2024 and the year ended December 31, 2023, there were no transfers among Level 1, Level 2 or Level 3 financial assets and liabilities.

| Cognizant Technology Solutions | 19 | March 31, 2024 Form 10-Q | ||||||

| Note 11 — Accumulated Other Comprehensive Income (Loss) | ||||||||||||||

Changes in "Accumulated other comprehensive income (loss)" by component were as follows for the three months ended March 31, 2024:

| (in millions) | Before Tax Amount | Tax Effect | Net of Tax Amount | |||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments: | ||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | (109) | $ | 5 | $ | (104) | ||||||||||||||||||||||||||||||||

| Change in foreign currency translation adjustments | (74) | 1 | (73) | |||||||||||||||||||||||||||||||||||

| Ending balance | $ | (183) | $ | 6 | $ | (177) | ||||||||||||||||||||||||||||||||

| Unrealized gains and losses on cash flow hedges: | ||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | 13 | $ | (3) | $ | 10 | ||||||||||||||||||||||||||||||||

| Unrealized gains arising during the period | 15 | (4) | 11 | |||||||||||||||||||||||||||||||||||

| Ending balance | $ | 28 | $ | (7) | $ | 21 | ||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | (96) | $ | 2 | $ | (94) | ||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | (59) | (3) | (62) | |||||||||||||||||||||||||||||||||||

| Ending balance | $ | (155) | $ | (1) | $ | (156) | ||||||||||||||||||||||||||||||||

Changes in "Accumulated other comprehensive income (loss)" by component were as follows for the three months ended March 31, 2023:

| (in millions) | Before Tax Amount | Tax Effect | Net of Tax Amount | |||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments: | ||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | (256) | $ | 8 | $ | (248) | ||||||||||||||||||||||||||||||||

| Change in foreign currency translation adjustments | 41 | 2 | 43 | |||||||||||||||||||||||||||||||||||

| Ending balance | $ | (215) | $ | 10 | $ | (205) | ||||||||||||||||||||||||||||||||

| Unrealized gains and losses on cash flow hedges: | ||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | (68) | $ | 17 | $ | (51) | ||||||||||||||||||||||||||||||||

| Unrealized gains arising during the period | 33 | (8) | 25 | |||||||||||||||||||||||||||||||||||

| Reclassifications of net loss to: | ||||||||||||||||||||||||||||||||||||||

| Cost of revenues | 11 | (3) | 8 | |||||||||||||||||||||||||||||||||||

| SG&A expenses | 1 | — | 1 | |||||||||||||||||||||||||||||||||||

| Net change | 45 | (11) | 34 | |||||||||||||||||||||||||||||||||||

| Ending balance | $ | (23) | $ | 6 | $ | (17) | ||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | (324) | $ | 25 | $ | (299) | ||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | 86 | (9) | 77 | |||||||||||||||||||||||||||||||||||

| Ending balance | $ | (238) | $ | 16 | $ | (222) | ||||||||||||||||||||||||||||||||

| Cognizant Technology Solutions | 20 | March 31, 2024 Form 10-Q | ||||||

| Note 12— Commitments and Contingencies | ||||||||||||||

We are involved in various claims and legal proceedings arising in the ordinary course of business. We accrue a liability when a loss is considered probable and the amount can be reasonably estimated. When a material loss contingency is reasonably possible but not probable, we do not record a liability, but instead disclose the nature and the amount of the claim, and an estimate of the loss or range of loss, if such an estimate can be made. Legal fees are expensed as incurred. While we do not expect that the ultimate resolution of any existing claims and proceedings (other than the specific matters described below, if decided adversely), individually or in the aggregate, will have a material adverse effect on our financial position, an unfavorable outcome in some or all of these proceedings could have a material adverse impact on results of operations or cash flows for a particular period. This assessment is based on our current understanding of relevant facts and circumstances. As such, our view of these matters is subject to inherent uncertainties and may change in the future.

On January 15, 2015, Syntel sued TriZetto and Cognizant in the USDC-SDNY. Syntel’s complaint alleged breach of contract against TriZetto, and tortious interference and misappropriation of trade secrets against Cognizant and TriZetto, stemming from Cognizant’s hiring of certain former Syntel employees. Cognizant and TriZetto countersued on March 23, 2015, for breach of contract, misappropriation of trade secrets and tortious interference, based on Syntel’s misuse of TriZetto confidential information and abandonment of contractual obligations. Cognizant and TriZetto subsequently added federal DTSA and copyright infringement claims for Syntel’s misuse of TriZetto’s proprietary technology. The parties’ claims were narrowed by the court and the case was tried before a jury, which on October 27, 2020 returned a verdict in favor of Cognizant in the amount of $855 million, including $570 million in punitive damages. On April 20, 2021, the USDC-SDNY issued a post-trial order that, among other things, affirmed the jury’s award of $285 million in actual damages, but reduced the award of punitive damages from $570 million to $285 million, thereby reducing the overall damages award from $855 million to $570 million. The USDC-SDNY subsequently issued a final judgment consistent with the April 20th order. On May 26, 2021, Syntel filed a notice of appeal to the Second Circuit, and on June 3, 2021 the USDC-SDNY stayed execution of judgment pending appeal. On May 25, 2023, the Second Circuit issued an opinion affirming in part and vacating in part the judgment of the USDC-SDNY and remanding the case for further proceedings consistent with its opinion. The Second Circuit affirmed the judgment in all respects on liability but vacated the $570 million award that had been based on avoided development costs under the DTSA, and it remanded the case to the USDC-SDNY for further evaluation of damages. On June 23, 2023, the Second Circuit issued its mandate returning the case to the USDC-SDNY. On March 13, 2024, the USDC-SDNY issued a ruling that vacates the alternate compensatory damages awards that were within the scope of the Second Circuit’s remand and awards TriZetto and Cognizant approximately $15 million in attorney’s fees. The USDC-SDNY additionally stayed entry of final judgment to allow the parties time to file any follow-on motions. TriZetto and Cognizant will continue to vigorously pursue our claims against Syntel. We will not record any gain in our financial statements until it becomes realizable.

On February 28, 2019, a ruling of the SCI interpreting the India Defined Contribution Obligation altered historical understandings of the obligation, extending it to cover additional portions of the employee’s income. As a result, the ongoing contributions of our affected employees and the Company were required to be increased. In the first quarter of 2019, we accrued $117 million with respect to prior periods, assuming retroactive application of the SCI’s ruling, in "Selling, general and administrative expenses" in our unaudited consolidated statement of operations. There is significant uncertainty as to how the liability should be calculated as it is impacted by multiple variables, including the period of assessment, the application with respect to certain current and former employees and whether interest and penalties may be assessed. Since the ruling, a variety of trade associations and industry groups have advocated to the Indian government, highlighting the harm to the information technology sector, other industries and job growth in India that would result from a retroactive application of the ruling. It is possible the Indian government will review the matter and there is a substantial question as to whether the Indian government will apply the SCI’s ruling on a retroactive basis. As such, the ultimate amount of our obligation may be materially different from the amount accrued.

On October 31, 2016, November 15, 2016 and November 18, 2016, three putative shareholder derivative complaints were filed in New Jersey Superior Court, Bergen County, naming us, all of our then current directors and certain of our current and former officers at that time as defendants. These actions were consolidated in an order dated January 24, 2017. The complaints assert claims for breach of fiduciary duty, corporate waste, unjust enrichment, abuse of control, mismanagement, and/or insider selling by defendants. On April 26, 2017, the New Jersey Superior Court deferred further proceedings by dismissing the consolidated putative shareholder derivative litigation without prejudice but permitting the parties to file a motion to vacate the dismissal in the future.

On February 22, 2017, April 7, 2017, May 10, 2017 and March 11, 2019, four additional putative shareholder derivative complaints were filed in the USDC-NJ, naming us and certain of our current and former directors and officers at that time as defendants. These actions were consolidated in an order dated May 14, 2019. On August 3, 2020, lead plaintiffs filed a consolidated amended complaint. The consolidated amended complaint asserts claims similar to those in the previously-filed

| Cognizant Technology Solutions | 21 | March 31, 2024 Form 10-Q | ||||||

putative shareholder derivative actions. On February 14, 2022, we and certain of our current and former directors and officers moved to dismiss the consolidated amended complaint. On September 27, 2022, the USDC-NJ granted those motions and dismissed the consolidated amended complaint in its entirety with prejudice. Plaintiffs filed a notice of appeal on October 27, 2022.

On June 1, 2021, an eighth putative shareholder derivative complaint was filed in the USDC-NJ, naming us and certain of our current and former directors and officers at that time as defendants. The complaint asserts claims similar to those in the previously-filed putative shareholder derivative actions. On March 31, 2022, we and certain of our current and former directors and officers moved to dismiss the complaint. On November 30, 2022, the USDC-NJ denied without prejudice those motions. The USDC-NJ ordered the parties to conduct limited discovery related to the issue of whether our board of directors wrongfully refused the plaintiff’s earlier litigation demand and, after the conclusion of such limited discovery, to file targeted motions for summary judgment on the issue of wrongful refusal.

We are presently unable to predict the duration, scope or result of the putative shareholder derivative actions. Although the Company continues to defend the putative shareholder derivative actions vigorously, these lawsuits are subject to inherent uncertainties, the actual cost of such litigation will depend upon many unknown factors and the outcome of the litigation is necessarily uncertain.

We have indemnification and expense advancement obligations pursuant to our bylaws and indemnification agreements with respect to certain current and former members of senior management and the Company’s board of directors. In connection with the matters that were the subject of our previously disclosed internal investigation, the DOJ and SEC investigations and the related litigation, we have received and expect to continue to receive requests under such indemnification agreements and our bylaws to provide funds for legal fees and other expenses. There are no amounts remaining available to us under applicable insurance policies for our ongoing indemnification and advancement obligations with respect to certain of our current and former officers and directors or incremental legal fees and other expenses related to the above matters.

Many of our engagements involve projects that are critical to the operations of our clients’ business and provide benefits that are difficult to quantify. Any failure in a client’s systems or our failure to meet our contractual obligations to our clients, including any breach involving a client’s confidential information or sensitive data, or our obligations under applicable laws or regulations could result in a claim for substantial damages against us, regardless of our responsibility for such failure. Although we attempt to contractually limit our liability for damages arising from negligent acts, errors, mistakes, or omissions in rendering our services, there can be no assurance that the limitations of liability set forth in our contracts will be enforceable in all instances or will otherwise protect us from liability for damages. Although we have general liability insurance coverage, including coverage for errors or omissions, we retain a significant portion of risk through our insurance deductibles and there can be no assurance that such coverage will cover all types of claims, continue to be available on reasonable terms or will be available in sufficient amounts to cover one or more large claims, or that the insurer will not disclaim coverage as to any future claim. The successful assertion of one or more large claims against us that exceed or are not covered by our insurance coverage or changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, could have a material adverse effect on our business, results of operations, financial position and cash flows for a particular period.

In the normal course of business and in conjunction with certain client engagements, we have entered into contractual arrangements through which we may be obligated to indemnify clients or other parties with whom we conduct business with respect to certain matters. These arrangements can include provisions whereby we agree to hold the indemnified party and certain of their affiliated entities harmless with respect to third-party claims related to such matters as our breach of certain representations or covenants, our intellectual property infringement, our gross negligence or willful misconduct or certain other claims made against certain parties. Payments by us under any of these arrangements are generally conditioned on the client making a claim and providing us with full control over the defense and settlement of such claim. It is not possible to determine the maximum potential liability under these indemnification agreements due to the unique facts and circumstances involved in each particular agreement. Historically, we have not made material payments under these indemnification agreements and therefore they have not had a material impact on our operating results, financial position, or cash flows. However, if events arise requiring us to make payment for indemnification claims under our indemnification obligations in contracts we have entered, such payments could have a material adverse effect on our business, results of operations, financial position and cash flows for a particular period.

| Cognizant Technology Solutions | 22 | March 31, 2024 Form 10-Q | ||||||

| Note 13 — Segment Information | ||||||||||||||

We have seven industry-based operating segments, which are aggregated into four reportable business segments:

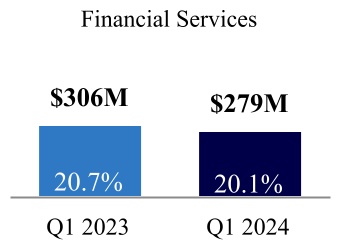

•Financial Services, which consists of the banking and insurance operating segments;

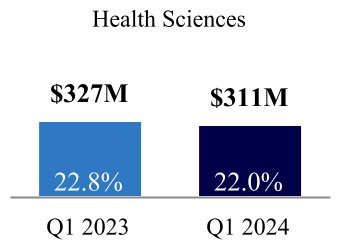

•Health Sciences, which consists of a single operating segment of the same name;

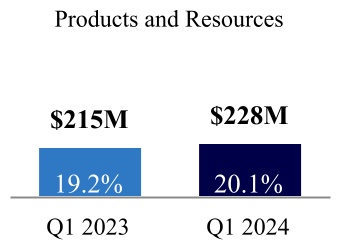

•Products and Resources, which consists of the retail and consumer goods; manufacturing, logistics, energy, and utilities; and travel and hospitality operating segments; and

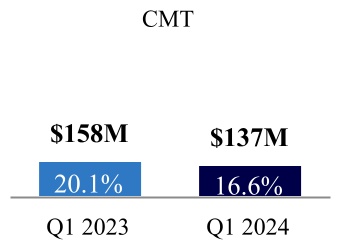

•Communications, Media and Technology, which consists of a single operating segment of the same name.