UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08839

SPDR® SERIES TRUST

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Shareholders.

| (a) | The Reports to Shareholders are attached herewith. |

Annual Report

December 31, 2023

SPDR® Series Trust - Fixed Income Funds

| SPDR Bloomberg Emerging Markets Local Bond ETF |

| SPDR Bloomberg International Corporate Bond ETF |

| SPDR Bloomberg International Treasury Bond ETF |

| SPDR Bloomberg Short Term International Treasury Bond ETF |

| SPDR FTSE International Government Inflation-Protected Bond ETF |

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus and SAI from the Distributor by calling 1-866-787-2257 or visiting https://www.ssga.com/spdrs. Please read the prospectus carefully before you invest.

TABLE OF CONTENTS

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus and SAI from the Distributor by calling 1-866-787-2257 or visiting https://www.ssga.com/spdrs. Please read the prospectus carefully before you invest.

[This Page Intentionally Left Blank]

Notes to Performance Summaries (Unaudited)

The performance chart of a Fund’s total return at net asset value (“NAV”), the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. A Fund’s per share NAV is the value of one share of a Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of a Fund and the market return is based on the market price per share of a Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of a Fund are listed for trading, as of the time that a Fund’s NAV is calculated. NAV and market returns assume that dividends and capital gain distributions have been reinvested in a Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

The Bloomberg EM Local Currency Government Diversified Index is designed to measure the performance of the fixed-rate local currency sovereign debt of emerging market countries. The index includes government bonds issued by investment grade and non-investment grade countries outside the United States, in local currencies, that have a remaining maturity of one year or more and are rated B3/B-/B- or higher using the middle rating of Moody’s Investors Service, Inc., S&P Global Ratings and Fitch Ratings, Inc. respectively.

The Bloomberg Global Aggregate ex-USD >$1B: Corporate Bond Index is designed to be a broad based measure of the global investment-grade, fixed rate, fixed income corporate markets outside the United States. The index is part of the Bloomberg Global ex-USD Aggregate Bond Index (the “Aggregate Index”). The major components of the Aggregate Index are the Pan-European Aggregate and the Asian Pacific Aggregate Indices. The securities in the index must have a $1 billion USD equivalent market capitalization outstanding and at least 1 year remaining. Securities must be fixed rate, although zero coupon bonds and step-ups are permitted. Additionally, securities must be rated investmen grade (Baa3/BBB-/BBB- or better) using the middle rating from Moody’s Investors Service, Inc., S&P Global Ratings and Fitch Ratings, Inc. after dropping the highest and lowest available ratings. If only two agencies rate a security, then the more conservative (lower) rating will be used. If only one rating agency rates a security, then that one rating will be used. Excluded from the index are subordinated debts, convertible securities, floating-rate notes, fixed-rate perpetuals, warrants, inflation-linked bonds and structured notes. The index is market capitalization weighted and the securities in the index are updated on the last business day of each month.

The Bloomberg Global Treasury ex-US Capped Index is designed to track the fixed-rate local currency sovereign debt of investment grade countries outside the United States. The index includes government bonds issued by investment grade countries outside the United States, in local currencies, that have a remaining maturity of one year or more and are rated investment grade (Baa3/BBB-/BBB-or higher using the middle rating of Moody’s Investors Service, Inc., S&P Global Ratings and Fitch Ratings, Inc. respectively). The index is calculated by Bloomberg Index Services Limited using a modified “market capitalization” methodology. This design ensures that each constituent country within the index is represented in a proportion consistent with its percentage with respect to the total market capitalization of the index. The index is rebalanced on a monthly basis.

The Bloomberg 1-3 Year Global Treasury ex-US Capped Index is designed to measure the performance of fixed-rate local currency sovereign debt of investment grade countries outside the United States that have remaining maturities of one to three years. The index includes government bonds issued by investment grade countries outside the United States, in local currencies, that have remaining maturities of one to three years and are rated investment grade (Baa3/BBB-/BBB- or higher using the middle rating of Moody’s Investors Service, Inc., S&P Global Ratings and Fitch Ratings, Inc. respectively). The securities in the index must be fixed-rate and have certain minimum amounts outstanding, depending upon the currency in which the bonds are denominated. The index is calculated by Bloomberg Index Services Limited using a modified “market capitalization” methodology. This design ensures that each constituent country within the index is represented in a proportion consistent with its percentage with respect to the total market capitalization of the index. Component securities in each constituent country are represented in a proportion consistent with their percentage relative to the other component securities in the constituent country. The securities in the index are updated monthly, on the last business day of each month.

The FTSE International Inflation-Linked Securities Select Index is designed to measure the total return performance of inflation-linked bonds outside the United States with fixed-rate coupon payments that are linked to an inflation index. Inflation-protected public obligations of the inflation-linked government bond markets of developed and emerging market countries, commonly known in the United States as TIPS, are securities issued by such governments that are designed to provide inflation protection to investors. The index includes government debt (direct obligations of the issuer country) but does not include quasi-government debt or corporate debt.

See accompanying notes to financial statements.

1

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

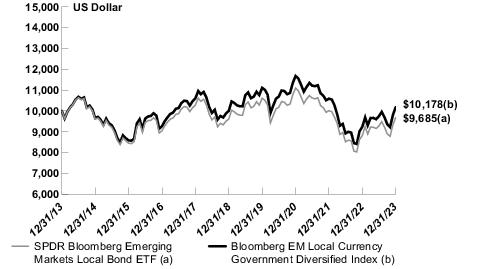

The SPDR Bloomberg Emerging Markets Local Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the fixed-rate local currency sovereign debt of emerging market countries. The Fund’s benchmark is the Bloomberg EM Local Currency Government Diversified Index (the “Index”).

For the 12-month period ended December 31, 2023 (the “Reporting Period”), the total return for the Fund was 9.79%, and the Index was 10.14%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses, cash drag, tax withholdings, and sampling contributed to the difference between the Fund’s performance and that of the index.

Global concerns around heightened inflation, changes in central bank policies, and March’s banking crisis were primary drivers of Fund performance during the Reporting Period. The Fund performed in line with expectations.

Global markets experienced heightened volatility in March after a number of U.S. regional banks as well as Credit Suisse were downgraded by ratings agencies and ultimately either failed or were bought by other large banks. The incident sent shockwaves through global markets as investors feared contagion into other sectors of the global economy. Ultimately, the contagion story did not play out, and market volatility was calmed as early as April.

In order to reign in persistent inflation and overheated economies across the globe, countries’ central banks began an about-face on previous easy monetary policy in 2022, with many embarking on aggressive rate hiking cycles. The European Central bank and Bank of England raised interest rates by a total of 4.50% and 5.00% respectively over the past two years. The hawkish pivot of global central banks roiled sovereign markets and sent yields soaring, leading to negative returns within the sector during the first half of 2023. By the second half of the year, and especially in the fourth quarter, global tightening seemed to finally take effect on cooling inflation, and major central banks paused their rate hiking. With the end of heightened inflation in sight for many economies, markets are now pricing in hikes for 2024. This change in sentiment led to a global bond rally in the fourth quarter, with the Fund posting its strongest returns during the Reporting Period.

The Fund uses forwards to manage currency exposure, particularly when there are flows around month-end, and for currency exposure purposes during market holidays and in the event of challenging liquidity in bond markets.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

2

SPDR Bloomberg Emerging Markets Local Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2023

| | Cumulative Total Return | | Average Annual Total Return |

| | Net

Asset

Value | Market

Value | Bloomberg EM Local Currency Government Diversified Index | | Net

Asset

Value | Market

Value | Bloomberg EM Local Currency Government Diversified Index |

| ONE YEAR | 9.79% | 9.07% | 10.14% | | 9.79% | 9.07% | 10.14% |

| FIVE YEARS | 0.85% | 0.20% | 1.79% | | 0.17% | 0.04% | 0.36% |

| TEN YEARS | (3.15)% | (4.14)% | 1.78% | | (0.32)% | (0.42)% | 0.18% |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg Emerging Markets Local Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.30%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit https://www.ssga.com/spdrs for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

3

SPDR Bloomberg Emerging Markets Local Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2023

| | | |

| | Description | % of Net Assets | |

| | Brazil Letras do Tesouro Nacional

Zero Coupon, 7/1/2026 | 0.9% | |

| | Brazil Notas do Tesouro Nacional

10.00% 1/1/2025 | 0.9 | |

| | Mexico Bonos

5.75% 3/5/2026 | 0.9 | |

| | Mexico Bonos

7.75% 5/29/2031 | 0.9 | |

| | Brazil Letras do Tesouro Nacional

Zero Coupon, 1/1/2026 | 0.8 | |

| | TOTAL | 4.4% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2023

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 97.8% | |

| | Short-Term Investments | 1.9 | |

| | Other Assets in Excess of Liabilities | 0.3 | |

| | TOTAL | 100.0% | |

Top Ten Countries as of December 31, 2023

| | | |

| | Description | % of Total Investments | |

| | South Korea | 12.6% | |

| | China | 12.4 | |

| | Indonesia | 7.3 | |

| | Brazil | 6.8 | |

| | Mexico | 6.7 | |

| | Thailand | 4.6 | |

| | Czech Republic | 4.5 | |

| | Philippines | 4.5 | |

| | South Africa | 4.4 | |

| | Poland | 4.4 | |

| | TOTAL | 68.2% | |

(The Fund's asset allocation and sector breakdown are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

4

SPDR BLOOMBERG INTERNATIONAL CORPORATE BOND ETF

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

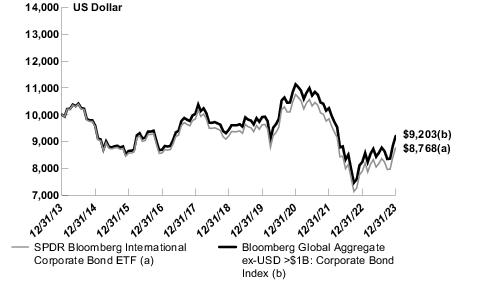

The SPDR Bloomberg International Corporate Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the investment grade corporate sector of the global bond market outside of the united States. The Fund’s benchmark is the Bloomberg Global Aggregate ex-USD >$1B: Corporate Bond Index (the “Index”).

For the 12-month period ended December 31, 2023 (the “Reporting Period”), the total return for the Fund was 11.13%, and the Index was 11.75%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses, cash drag, the cumulative effect of security misweights, and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

Global concerns around heightened inflation, changes in central bank policies, and the March banking crisis were primary drivers of Fund performance during the Reporting Period. The Fund performed in line with expectations.

Global markets experienced heightened volatility in March after a number of U.S. regional banks as well as Credit Suisse were downgraded by ratings agencies and ultimately either failed or were bought by other large banks. The incident sent shockwaves through global markets as investors feared contagion into other sectors of the global economy and corporate bond performance suffered as investors fled to safe-haven assets. Ultimately, the contagion story did not play out, and market volatility was calmed as early as April.

In order to reign in persistent inflation and overheated economies across the globe, countries’ central banks began an about-face on previous easy monetary policy in 2022, with many embarking on aggressive rate hiking cycles. The European Central bank and Bank of England raised interest rates by a total of 4.50% and 5.00% respectively over the past two years. The hawkish pivot of global central banks roiled sovereign markets and sent yields soaring, leading to negative returns within the sector during the first half of 2023. By the second half of the year, and especially in the fourth quarter, global tightening seemed to finally take effect on cooling inflation, and major central banks paused their rate hiking. With the end of heightened inflation in sight for many economies, markets are now pricing in hikes for 2024. This change in sentiment led to a global bond rally in the fourth quarter, with the Fund posting its strongest returns during the Reporting Period.

The Fund did not invest in derivatives during the Reporting Period.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

5

SPDR Bloomberg International Corporate Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2023

| | Cumulative Total Return | | Average Annual Total Return |

| | Net

Asset

Value | Market

Value | Bloomberg Global Aggregate ex-USD >$1B: Corporate Bond Index | | Net

Asset

Value | Market

Value | Bloomberg Global Aggregate ex-USD >$1B: Corporate Bond Index |

| ONE YEAR | 11.13% | 10.74% | 11.75% | | 11.13% | 10.74% | 11.75% |

| FIVE YEARS | (4.76)% | (4.90)% | (2.46)% | | (0.97)% | (1.00)% | (0.50)% |

| TEN YEARS | (12.32)% | (12.27)% | (7.97)% | | (1.31)% | (1.30)% | (0.83)% |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg International Corporate Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.50%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit https://www.ssga.com/spdrs for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

6

SPDR Bloomberg International Corporate Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2023

| | | |

| | Description | % of Net Assets | |

| | Morgan Stanley

4.66% 3/2/2029 | 0.4% | |

| | Seven & i Holdings Co. Ltd.

0.19% 12/19/2025 | 0.3 | |

| | NTT Finance Corp.

0.84% 6/20/2033 | 0.3 | |

| | NTT Finance Corp.

0.38% 9/20/2030 | 0.3 | |

| | Credit Agricole SA

3.88% 4/20/2031 | 0.3 | |

| | TOTAL | 1.6% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2023

| | | |

| | | % of Net Assets | |

| | Corporate Bonds & Notes | 98.3% | |

| | Short-Term Investments | 4.1 | |

| | Liabilities in Excess of Other Assets | (2.4) | |

| | TOTAL | 100.0% | |

See accompanying notes to financial statements.

7

SPDR BLOOMBERG INTERNATIONAL TREASURY BOND ETF

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

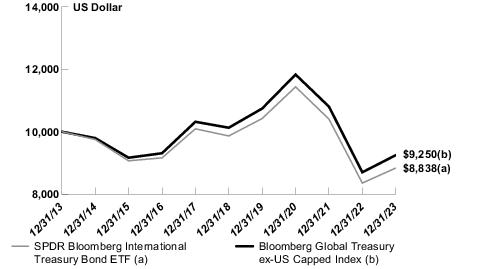

SPDR Bloomberg International Treasury Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the fixed-rate local currency sovereign debt of investment grade countries outside the united States. The Fund’s benchmark is the Bloomberg Global Treasury ex-US Capped Index (the “Index”).

For the 12-month period ended December 31, 2023 (the “Reporting Period”), the total return for the Fund was 5.73%, and the Index was 6.25%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses, cash drag, the cumulative effect of security misweights, and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

Global concerns around heightened inflation and changes in central bank policies were primary drivers of Fund performance during the Reporting Period. The Fund performed in line with expectations.

In order to reign in persistent inflation and overheated economies across the globe, countries’ central banks began an about-face on previous easy monetary policy in 2022, with many embarking on aggressive rate hiking cycles. The European Central bank and Bank of England raised interest rates by a total of 4.50% and 5.00% respectively over the past two years. The hawkish pivot of global central banks roiled sovereign markets and sent yields soaring, leading to negative returns within the sector during the first half of 2023. By the second half of the year, and especially in the fourth quarter, global tightening seemed to finally take effect on cooling inflation, and major central banks paused their rate hiking. With the end of heightened inflation in sight for many economies, markets are now pricing in hikes for 2024. This change in sentiment led to a global bond rally in the fourth quarter, with the Fund posting its strongest returns during the Reporting Period.

The Fund did not invest in derivatives during the Reporting Period.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

8

SPDR Bloomberg International Treasury Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2023

| | Cumulative Total Return | | Average Annual Total Return |

| | Net

Asset

Value | Market

Value | Bloomberg Global Treasury ex-US Capped Index | | Net

Asset

Value | Market

Value | Bloomberg Global Treasury ex-US Capped Index |

| ONE YEAR | 5.73% | 5.10% | 6.25% | | 5.73% | 5.10% | 6.25% |

| FIVE YEARS | (10.41)% | (10.83)% | (8.71)% | | (2.18)% | (2.27)% | (1.81)% |

| TEN YEARS | (11.62)% | (11.93)% | (7.50)% | | (1.23)% | (1.26)% | (0.78)% |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg International Treasury Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.35%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit https://www.ssga.com/spdrs for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

9

SPDR Bloomberg International Treasury Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2023

| | | |

| | Description | % of Net Assets | |

| | China Government Bonds

4.08% 10/22/2048 | 0.4% | |

| | Korea Treasury Bonds

5.50% 3/10/2028 | 0.4 | |

| | Japan Government Ten Year Bonds

0.40% 6/20/2033 | 0.3 | |

| | Japan Government Ten Year Bonds

0.10% 12/20/2030 | 0.3 | |

| | Kingdom of Belgium Government Bonds

5.00% 3/28/2035 | 0.3 | |

| | TOTAL | 1.7% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2023

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 99.1% | |

| | Short-Term Investment | 3.0 | |

| | Liabilities in Excess of Other Assets | (2.1) | |

| | TOTAL | 100.0% | |

Top Ten Countries as of December 31, 2023

| | | |

| | Description | % of Total Investments | |

| | Japan | 22.7% | |

| | France | 4.8 | |

| | United Kingdom | 4.8 | |

| | South Korea | 4.6 | |

| | Australia | 4.5 | |

| | Canada | 4.5 | |

| | China | 4.5 | |

| | Italy | 4.4 | |

| | Germany | 4.4 | |

| | Spain | 4.4 | |

| | TOTAL | 63.6% | |

(The Fund's asset allocation and top ten countries are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

10

SPDR BLOOMBERG SHORT TERM INTERNATIONAL TREASURY BOND ETF

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

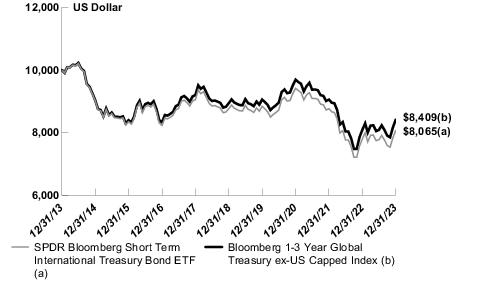

The SPDR Bloomberg Short Term International Treasury Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the short-term (1-3 year remaining maturity) fixed rate, investment grade debt issued by foreign governments of investment grade countries. The Fund’s benchmark is the Bloomberg 1-3 Year Global Treasury ex-US Capped Index (the “Index”).

For the 12-month period ended December 31, 2023 (the “Reporting Period”), the total return for the Fund was 3.49%, and the Index was 4.01%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses, cash drag, the cumulative effect of security misweights, and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

Global concerns around heightened inflation and changes in central bank policies were primary drivers of Fund performance during the Reporting Period. The Fund performed in line with expectations.

In order to reign in persistent inflation and overheated economies across the globe, countries’ central banks began an about-face on previous easy monetary policy in 2022, with many embarking on aggressive rate hiking cycles. The European Central bank and Bank of England raised interest rates by a total of 4.50% and 5.00% respectively over the past two years. The hawkish pivot of global central banks roiled sovereign markets and sent yields soaring, leading to negative returns within the sector during the first half of 2023. By the second half of the year, and especially in the fourth quarter, global tightening seemed to finally take effect on cooling inflation, and major central banks paused their rate hiking. With the end of heightened inflation in sight for many economies, markets are now pricing in hikes for 2024. This change in sentiment led to a global bond rally in the fourth quarter, with the Fund posting its strongest returns during the Reporting Period.

The Fund did not invest in derivatives during the Reporting Period.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

11

SPDR Bloomberg Short Term International Treasury Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2023

| | Cumulative Total Return | | Average Annual Total Return |

| | Net

Asset

Value | Market

Value | Bloomberg 1-3 Year Global Treasury ex-US Capped Index | | Net

Asset

Value | Market

Value | Bloomberg 1-3 Year Global Treasury ex-US Capped Index |

| ONE YEAR | 3.49% | 2.99% | 4.01% | | 3.49% | 2.99% | 4.01% |

| FIVE YEARS | (7.96)% | (7.79)% | (5.89)% | | (1.64)% | (1.61)% | (1.21)% |

| TEN YEARS | (19.35)% | (19.30)% | (15.91)% | | (2.13)% | (2.12)% | (1.72)% |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg Short Term International Treasury Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.35%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit https://www.ssga.com/spdrs for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

12

SPDR Bloomberg Short Term International Treasury Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2023

| | | |

| | Description | % of Net Assets | |

| | Japan Government Five Year Bonds

0.10% 12/20/2025 | 2.1% | |

| | Japan Government Five Year Bonds

0.10% 3/20/2025 | 2.1 | |

| | Japan Government Five Year Bonds

0.10% 6/20/2025 | 1.5 | |

| | Mexico Bonos

5.75% 3/5/2026 | 1.5 | |

| | Japan Government Ten Year Bonds

0.10% 6/20/2026 | 1.5 | |

| | TOTAL | 8.7% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2023

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 98.9% | |

| | Short-Term Investment | 0.0 * | |

| | Other Assets in Excess of Liabilities | 1.1 | |

| | TOTAL | 100.0% | |

| * | Amount shown represents less than 0.05% of net assets. |

Top Ten Countries as of December 31, 2023

| | | |

| | Description | % of Total Investments | |

| | Japan | 23.5% | |

| | France | 5.3 | |

| | Italy | 4.9 | |

| | South Korea | 4.7 | |

| | Germany | 4.7 | |

| | Canada | 4.6 | |

| | Spain | 4.6 | |

| | United Kingdom | 4.6 | |

| | China | 4.6 | |

| | Australia | 4.5 | |

| | TOTAL | 66.0% | |

(The Fund's asset allocation and top ten countries are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

13

SPDR FTSE INTERNATIONAL GOVERNMENT INFLATION-PROTECTION BOND ETF

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

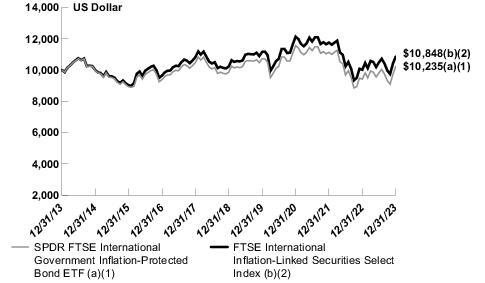

The SPDR FTSE International Government Inflation-Protected Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the inflation protected sector of the global bond market outside the United States. The Fund’s benchmark is the FTSE International Inflation-Linked Securities Select Index (the “Index”).

For the 12-month period ended December 31, 2023 (the “Reporting Period”), the total return for the Fund was 8.74%, and the Index was 9.51%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses, cash drag, tax withholdings, and sampling contributed to the difference between the Fund’s performance and that of the index.

Global concerns around heightened inflation, changes in central bank policies, and the March banking crisis were primary drivers of Fund performance during the Reporting Period. The Fund performed in line with expectations.

Global markets experienced heightened volatility in March after a number of U.S. regional banks as well as Credit Suisse were downgraded by ratings agencies and ultimately either failed or were bought by other large banks. The incident sent shockwaves through global markets as investors feared contagion into other sectors of the global economy. Ultimately, the contagion story did not play out, and market volatility was calmed as early as April.

In order to reign in persistent inflation and overheated economies across the globe, countries’ central banks began an about-face on previous easy monetary policy in 2022, with many embarking on aggressive rate hiking cycles. The European Central bank and Bank of England raised interest rates by a total of 4.50% and 5.00% respectively over the past two years. The hawkish pivot of global central banks roiled sovereign markets and sent yields soaring, leading to negative returns within the sector during the first half of 2023. By the second half of the year, and especially in the fourth quarter, global tightening seemed to finally take effect on cooling inflation, and major central banks paused their rate hiking. With the end of heightened inflation in sight for many economies, markets are now pricing in hikes for 2024. This change in sentiment led to a global bond rally in the fourth quarter, with the Fund posting its strongest returns during the period.

The Fund did not invest in derivatives during the Reporting Period.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

14

SPDR FTSE International Government Inflation-Protected Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2023

| | Cumulative Total Return | | Average Annual Total Return |

| | Net

Asset

Value | Market

Value | FTSE International Inflation-Linked Securities Select Index | | Net

Asset

Value | Market

Value | FTSE International Inflation-Linked Securities Select Index |

| ONE YEAR | 8.74% | 8.83% | 9.51% | | 8.74% | 8.83% | 9.51% |

| FIVE YEARS(1) (2) | 3.84% | 3.73% | 7.33% | | 0.76% | 0.73% | 1.42% |

| TEN YEARS(1) (2) | 2.35% | 2.65% | 8.48% | | 0.23% | 0.26% | 0.82% |

| (1) | Effective February 15, 2016, the Fund changed its benchmark index from the DB Global Government ex-US Inflation-Linked Securities Select Index. The Fund's performance in the tables is based on the Fund's prior investment strategy to track a different benchmark index for periods prior to February 15, 2016. |

| (2) | The FTSE International Inflation-Linked Securities Select Index (formerly, Citi International Inflation-Linked Securities Select Index) inception date is January 15, 2016. Index returns in the line graph below represent the Fund’s prior benchmark index from December 31, 2009 through February 14, 2016 and the FTSE International Inflation-Linked Securities Select Index (formerly, Citi International Inflation-Linked Securities Select Index from February 15, 2016 through December 31, 2023. |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR FTSE International Government Inflation-Protected Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.50%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit https://www.ssga.com/spdrs for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

15

SPDR FTSE International Government Inflation-Protected Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2023

| | | |

| | Description | % of Net Assets | |

| | Spain Government Bonds Inflation-Linked

0.70% 11/30/2033 | 1.8% | |

| | Deutsche Bundesrepublik Bonds Inflation-Linked

0.50% 4/15/2030 | 1.5 | |

| | Turkiye Government Bonds

1.50% 6/18/2025 | 1.5 | |

| | Spain Government Bonds Inflation-Linked

1.00% 11/30/2030 | 1.3 | |

| | Deutsche Bundesrepublik Bonds Inflation-Linked

0.10% 4/15/2026 | 1.3 | |

| | TOTAL | 7.4% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2023

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 99.3% | |

| | Short-Term Investment | 0.0 * | |

| | Other Assets in Excess of Liabilities | 0.7 | |

| | TOTAL | 100.0% | |

| * | Amount shown represents less than 0.05% of net assets. |

Top Ten Countries as of December 31, 2023

| | | |

| | Description | % of Total Investments | |

| | United Kingdom | 18.8% | |

| | Brazil | 8.7 | |

| | France | 7.8 | |

| | Colombia | 4.7 | |

| | Australia | 4.7 | |

| | Mexico | 4.7 | |

| | Italy | 4.7 | |

| | Sweden | 4.7 | |

| | Canada | 4.6 | |

| | Japan | 4.6 | |

| | TOTAL | 68.0% | |

(The Fund's asset allocation and top ten countries are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

16

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

| FOREIGN GOVERNMENT OBLIGATIONS — 97.8% | | | |

| BRAZIL — 6.8% | | | |

| Brazil Government International Bonds: | | | | | |

8.50%, 1/5/2024

| | BRL | 350,000 | | $ 71,932 |

10.25%, 1/10/2028

| | BRL | 1,000,000 | | 208,097 |

| Brazil Letras do Tesouro Nacional: | | | | | |

Series LTN, Zero Coupon, 10/1/2024

| | BRL | 17,000,000 | | 3,250,980 |

Series LTN, Zero Coupon, 1/1/2025

| | BRL | 58,400,000 | | 10,923,659 |

Series LTN, Zero Coupon, 4/1/2025

| | BRL | 65,000,000 | | 11,912,545 |

Zero Coupon, 7/1/2025

| | BRL | 29,500,000 | | 5,287,032 |

Series LTN, Zero Coupon, 1/1/2026

| | BRL | 93,000,000 | | 15,906,974 |

Series LTN, Zero Coupon, 7/1/2026

| | BRL | 112,000,000 | | 18,279,891 |

Series LTN, Zero Coupon, 7/1/2027

| | BRL | 55,000,000 | | 8,135,530 |

| Brazil Notas do Tesouro Nacional: | | | | | |

Series NTNF, 10.00%, 1/1/2025

| | BRL | 85,950,000 | | 17,706,310 |

Series NTNF, 10.00%, 1/1/2027

| | BRL | 74,875,000 | | 15,477,085 |

Series NTNF, 10.00%, 1/1/2029

| | BRL | 70,890,000 | | 14,551,214 |

Series NTNF, 10.00%, 1/1/2031

| | BRL | 21,000,000 | | 4,273,018 |

Series NTNF, 10.00%, 1/1/2033

| | BRL | 34,300,000 | | 6,930,884 |

| | | | | | 132,915,151 |

| CHILE — 3.5% | | | |

| Bonos de la Tesoreria de la Republica en pesos: | | | | | |

2.30%, 10/1/2028 (a)

| | CLP | 1,535,000,000 | | 1,533,961 |

2.50%, 3/1/2025

| | CLP | 3,730,000,000 | | 4,094,702 |

2.80%, 10/1/2033 (a)

| | CLP | 1,000,000,000 | | 920,120 |

4.50%, 3/1/2026

| | CLP | 5,915,000,000 | | 6,646,806 |

4.70%, 9/1/2030 (a)

| | CLP | 6,990,000,000 | �� | 7,697,231 |

5.00%, 10/1/2028 (a)

| | CLP | 4,600,000,000 | | 5,185,432 |

5.00%, 3/1/2035

| | CLP | 7,875,000,000 | | 8,833,219 |

5.10%, 7/15/2050

| | CLP | 2,970,000,000 | | 3,302,468 |

5.30%, 11/1/2037

| | CLP | 3,500,000,000 | | 4,067,136 |

5.80%, 6/1/2024 (a)

| | CLP | 4,720,000,000 | | 5,372,076 |

5.80%, 10/1/2034

| | CLP | 2,550,000,000 | | 3,068,831 |

6.00%, 4/1/2033 (a)

| | CLP | 3,650,000,000 | | 4,450,277 |

Series 30YR, 6.00%, 1/1/2043

| | CLP | 7,595,000,000 | | 9,416,839 |

| Security Description | | | Principal

Amount | | Value |

7.00%, 5/1/2034 (a)

| | CLP | 2,700,000,000 | | $ 3,544,491 |

| | | | | | 68,133,589 |

| CHINA — 12.3% | | | |

| China Development Bank: | | | | | |

Series 1518, 3.74%, 9/10/2025

| | CNY | 2,000,000 | | 288,951 |

Series 1605, 3.80%, 1/25/2036

| | CNY | 6,500,000 | | 1,003,971 |

Series 1510, 4.21%, 4/13/2025

| | CNY | 9,000,000 | | 1,300,277 |

Series 1805, 4.88%, 2/9/2028

| | CNY | 3,000,000 | | 461,308 |

| China Government Bonds: | | | | | |

1.99%, 4/9/2025

| | CNY | 43,000,000 | | 6,044,537 |

2.00%, 6/15/2025

| | CNY | 25,000,000 | | 3,513,860 |

2.18%, 8/25/2025

| | CNY | 25,000,000 | | 3,523,695 |

2.18%, 8/15/2026

| | CNY | 10,000,000 | | 1,406,024 |

2.22%, 9/25/2025

| | CNY | 5,000,000 | | 705,204 |

2.24%, 5/25/2025

| | CNY | 20,000,000 | | 2,819,761 |

2.26%, 2/24/2025

| | CNY | 23,000,000 | | 3,245,842 |

2.28%, 11/25/2025

| | CNY | 27,000,000 | | 3,810,984 |

2.30%, 5/15/2026

| | CNY | 20,000,000 | | 2,820,352 |

2.33%, 12/15/2025

| | CNY | 20,000,000 | | 2,826,344 |

2.35%, 3/15/2025

| | CNY | 25,000,000 | | 3,530,774 |

2.37%, 1/20/2027

| | CNY | 18,500,000 | | 2,609,474 |

2.39%, 11/15/2026

| | CNY | 20,000,000 | | 2,828,038 |

2.40%, 7/15/2028

| | CNY | 15,000,000 | | 2,115,904 |

2.44%, 10/15/2027

| | CNY | 15,000,000 | | 2,119,911 |

2.46%, 2/15/2026

| | CNY | 40,000,000 | | 5,666,675 |

2.48%, 4/15/2027

| | CNY | 20,000,000 | | 2,829,492 |

2.48%, 9/25/2028

| | CNY | 15,000,000 | | 2,121,696 |

Series 2216, 2.50%, 7/25/2027

| | CNY | 19,000,000 | | 2,689,790 |

2.52%, 8/25/2033

| | CNY | 5,000,000 | | 701,693 |

2.54%, 12/25/2030

| | CNY | 20,000,000 | | 2,820,332 |

Series INBK, 2.55%, 10/15/2028

| | CNY | 15,000,000 | | 2,129,826 |

2.60%, 9/15/2030

| | CNY | 5,000,000 | | 706,884 |

2.60%, 9/1/2032

| | CNY | 20,000,000 | | 2,819,286 |

2.62%, 4/15/2028

| | CNY | 21,000,000 | | 2,989,109 |

2.62%, 9/25/2029

| | CNY | 20,000,000 | | 2,838,278 |

2.62%, 6/25/2030

| | CNY | 25,000,000 | | 3,541,268 |

2.64%, 1/15/2028

| | CNY | 21,000,000 | | 2,988,286 |

2.67%, 5/25/2033

| | CNY | 20,000,000 | | 2,834,198 |

2.67%, 11/25/2033

| | CNY | 20,000,000 | | 2,846,930 |

2.68%, 5/21/2030

| | CNY | 31,000,000 | | 4,401,646 |

2.69%, 8/12/2026

| | CNY | 29,920,000 | | 4,264,112 |

2.69%, 8/15/2032

| | CNY | 30,000,000 | | 4,259,355 |

2.75%, 6/15/2029

| | CNY | 24,000,000 | | 3,429,684 |

2.75%, 2/17/2032

| | CNY | 23,000,000 | | 3,283,115 |

2.76%, 5/15/2032

| | CNY | 15,000,000 | | 2,140,749 |

2.79%, 12/15/2029

| | CNY | 20,000,000 | | 2,859,655 |

2.80%, 3/24/2029

| | CNY | 20,000,000 | | 2,865,646 |

See accompanying notes to financial statements.

17

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

2.80%, 3/25/2030

| | CNY | 23,000,000 | | $ 3,289,905 |

2.80%, 11/15/2032

| | CNY | 15,000,000 | | 2,149,493 |

2.85%, 6/4/2027

| | CNY | 30,000,000 | | 4,297,434 |

2.88%, 2/25/2033

| | CNY | 23,000,000 | | 3,319,080 |

2.89%, 11/18/2031

| | CNY | 20,500,000 | | 2,955,877 |

Series 1610, 2.90%, 5/5/2026

| | CNY | 10,000,000 | | 1,432,558 |

2.91%, 10/14/2028

| | CNY | 30,000,000 | | 4,327,343 |

3.00%, 10/15/2053

| | CNY | 10,000,000 | | 1,455,771 |

3.01%, 5/13/2028

| | CNY | 28,000,000 | | 4,049,658 |

3.02%, 10/22/2025

| | CNY | 34,000,000 | | 4,867,685 |

3.02%, 5/27/2031

| | CNY | 36,000,000 | | 5,235,310 |

3.03%, 3/11/2026

| | CNY | 37,000,000 | | 5,312,807 |

Series 1916, 3.12%, 12/5/2026

| | CNY | 27,600,000 | | 3,985,250 |

3.12%, 10/25/2052

| | CNY | 10,000,000 | | 1,466,507 |

Series 1915, 3.13%, 11/21/2029

| | CNY | 28,000,000 | | 4,088,745 |

3.19%, 4/15/2053

| | CNY | 13,000,000 | | 1,954,253 |

Series 1828, 3.22%, 12/6/2025

| | CNY | 7,790,000 | | 1,122,054 |

Series 1907, 3.25%, 6/6/2026

| | CNY | 29,800,000 | | 4,310,078 |

Series 1827, 3.25%, 11/22/2028

| | CNY | 10,000,000 | | 1,471,613 |

3.27%, 11/19/2030

| | CNY | 37,000,000 | | 5,471,818 |

Series 1619, 3.27%, 8/22/2046

| | CNY | 10,000,000 | | 1,495,477 |

3.28%, 12/3/2027

| | CNY | 25,400,000 | | 3,714,414 |

Series 1906, 3.29%, 5/23/2029

| | CNY | 24,600,000 | | 3,625,493 |

3.32%, 4/15/2052

| | CNY | 10,000,000 | | 1,517,092 |

3.39%, 3/16/2050

| | CNY | 24,000,000 | | 3,677,020 |

3.40%, 7/15/2072

| | CNY | 10,000,000 | | 1,582,563 |

Series 1626, 3.48%, 11/21/2066

| | CNY | 6,700,000 | | 1,065,169 |

Series 1710, 3.52%, 5/4/2027

| | CNY | 5,000,000 | | 735,218 |

Series 1608, 3.52%, 4/25/2046

| | CNY | 11,000,000 | | 1,704,680 |

3.53%, 10/18/2051

| | CNY | 10,000,000 | | 1,571,533 |

Series 1819, 3.54%, 8/16/2028

| | CNY | 10,000,000 | | 1,487,331 |

3.72%, 4/12/2051

| | CNY | 14,000,000 | | 2,275,567 |

3.73%, 5/25/2070

| | CNY | 25,000,000 | | 4,241,459 |

Series 1521, 3.74%, 9/22/2035

| | CNY | 7,800,000 | | 1,236,127 |

Series 1525, 3.74%, 10/20/2045

| | CNY | 8,000,000 | | 1,334,949 |

3.76%, 3/22/2071

| | CNY | 21,000,000 | | 3,589,014 |

Series 1705, 3.77%, 2/20/2047

| | CNY | 13,000,000 | | 2,097,867 |

3.81%, 9/14/2050

| | CNY | 24,000,000 | | 3,946,522 |

Series 1910, 3.86%, 7/22/2049

| | CNY | 20,000,000 | | 3,295,793 |

Series 1023, 3.96%, 7/29/2040

| | CNY | 8,000,000 | | 1,324,520 |

| Security Description | | | Principal

Amount | | Value |

Series 1817, 3.97%, 7/23/2048

| | CNY | 10,000,000 | | $ 1,668,798 |

Series 1908, 4.00%, 6/24/2069

| | CNY | 9,000,000 | | 1,607,996 |

Series 1715, 4.05%, 7/24/2047

| | CNY | 10,000,000 | | 1,684,681 |

Series 1003, 4.08%, 3/1/2040

| | CNY | 5,000,000 | | 831,521 |

Series 1824, 4.08%, 10/22/2048

| | CNY | 19,300,000 | | 3,283,701 |

Series 1508, 4.09%, 4/27/2035

| | CNY | 1,000,000 | | 163,904 |

Series 1806, 4.22%, 3/19/2048

| | CNY | 8,000,000 | | 1,385,043 |

Series 1722, 4.28%, 10/23/2047

| | CNY | 3,250,000 | | 566,391 |

Series 1116, 4.50%, 6/23/2041

| | CNY | 11,000,000 | | 1,947,106 |

Series 1417, 4.63%, 8/11/2034

| | CNY | 7,000,000 | | 1,175,413 |

Series 1319, 4.76%, 9/16/2043

| | CNY | 2,000,000 | | 369,623 |

| | | | | | 241,768,140 |

| COLOMBIA — 4.1% | | | |

Colombia Government International Bonds 9.85%, 6/28/2027

| | COP | 115,000,000 | | 27,910 |

| Colombia TES: | | | | | |

Series B, 5.75%, 11/3/2027

| | COP | 20,750,000,000 | | 4,740,791 |

Series B, 6.00%, 4/28/2028

| | COP | 28,015,000,000 | | 6,372,436 |

Series B, 6.25%, 11/26/2025

| | COP | 10,875,000,000 | | 2,662,326 |

Series B, 6.25%, 7/9/2036

| | COP | 5,300,000,000 | | 997,341 |

Series B, 7.00%, 3/26/2031

| | COP | 47,350,000,000 | | 10,539,058 |

Series B, 7.00%, 6/30/2032

| | COP | 34,364,000,000 | | 7,417,444 |

Series B, 7.25%, 10/18/2034

| | COP | 26,825,000,000 | | 5,685,598 |

Series B, 7.25%, 10/26/2050

| | COP | 31,600,000,000 | | 5,917,863 |

Series B, 7.50%, 8/26/2026

| | COP | 49,202,000,000 | | 12,139,203 |

Series B, 7.75%, 9/18/2030

| | COP | 17,800,000,000 | | 4,180,289 |

Series B, 9.25%, 5/28/2042

| | COP | 41,400,000,000 | | 9,700,530 |

Series B, 13.25%, 2/9/2033

| | COP | 29,700,000,000 | | 9,102,252 |

| | | | | | 79,483,041 |

See accompanying notes to financial statements.

18

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

| CZECH REPUBLIC — 4.5% | | | |

| Czech Republic Government Bonds: | | | | | |

Series 135, Zero Coupon, 12/12/2024

| | CZK | 25,000,000 | | $ 1,065,822 |

Series 130, 0.05%, 11/29/2029

| | CZK | 71,750,000 | | 2,588,504 |

Series 100, 0.25%, 2/10/2027

| | CZK | 94,930,000 | | 3,788,348 |

Series 94, 0.95%, 5/15/2030

| | CZK | 199,280,000 | | 7,523,735 |

Series 95, 1.00%, 6/26/2026

| | CZK | 124,530,000 | | 5,161,986 |

Series 121, 1.20%, 3/13/2031

| | CZK | 198,370,000 | | 7,462,751 |

Series 120, 1.25%, 2/14/2025

| | CZK | 140,390,000 | | 6,037,946 |

Series 125, 1.50%, 4/24/2040

| | CZK | 38,660,000 | | 1,238,076 |

Series 138, 1.75%, 6/23/2032

| | CZK | 99,140,000 | | 3,810,859 |

Series 142, 1.95%, 7/30/2037

| | CZK | 45,600,000 | | 1,634,998 |

Series 103, 2.00%, 10/13/2033

| | CZK | 169,350,000 | | 6,494,518 |

Series 89, 2.40%, 9/17/2025

| | CZK | 168,200,000 | | 7,266,972 |

Series 78, 2.50%, 8/25/2028

| | CZK | 204,700,000 | | 8,677,201 |

Series 105, 2.75%, 7/23/2029

| | CZK | 154,350,000 | | 6,552,568 |

Series 145, 3.50%, 5/30/2035

| | CZK | 48,000,000 | | 2,091,850 |

Series 49, 4.20%, 12/4/2036

| | CZK | 92,180,000 | | 4,283,250 |

Series 154, 4.50%, 11/11/2032

| | CZK | 55,000,000 | | 2,585,169 |

Series 53, 4.85%, 11/26/2057

| | CZK | 22,300,000 | | 1,121,506 |

Series 11Y, 4.90%, 4/14/2034

| | CZK | 24,000,000 | | 1,176,397 |

Series 150, 5.00%, 9/30/2030

| | CZK | 69,200,000 | | 3,324,756 |

Series 149, 5.50%, 12/12/2028

| | CZK | 51,000,000 | | 2,471,319 |

Series 153, 5.75%, 3/29/2029

| | CZK | 18,000,000 | | 880,929 |

Series 152, 6.20%, 6/16/2031

| | CZK | 15,000,000 | | 778,403 |

| | | | | | 88,017,863 |

| HUNGARY — 3.7% | | | |

| Hungary Government Bonds: | | | | | |

Series 26/E, 1.50%, 4/22/2026

| | HUF | 1,443,380,000 | | 3,759,402 |

| Security Description | | | Principal

Amount | | Value |

Series 26/F, 1.50%, 8/26/2026

| | HUF | 1,851,000,000 | | $ 4,757,646 |

Series 29/A, 2.00%, 5/23/2029

| | HUF | 608,020,000 | | 1,466,254 |

Series 33/A, 2.25%, 4/20/2033 (b)

| | HUF | 772,070,000 | | 1,685,585 |

Series 34/A, 2.25%, 6/22/2034 (b)

| | HUF | 815,900,000 | | 1,707,232 |

Series 24/C, 2.50%, 10/24/2024

| | HUF | 1,726,200,000 | | 4,808,077 |

Series 26/D, 2.75%, 12/22/2026

| | HUF | 2,403,600,000 | | 6,311,780 |

Series 27/A, 3.00%, 10/27/2027 (b)

| | HUF | 858,170,000 | | 2,258,042 |

Series 30/A, 3.00%, 8/21/2030 (b)

| | HUF | 2,877,500,000 | | 7,125,213 |

Series 38/A, 3.00%, 10/27/2038 (b)

| | HUF | 2,378,160,000 | | 4,795,465 |

Series 41/A, 3.00%, 4/25/2041

| | HUF | 671,300,000 | | 1,287,866 |

Series 31/A, 3.25%, 10/22/2031 (b)

| | HUF | 1,469,870,000 | | 3,611,813 |

Series 28/B, 4.50%, 3/23/2028 (b)

| | HUF | 1,092,400,000 | | 3,002,694 |

4.50%, 5/27/2032

| | HUF | 940,000,000 | | 2,459,443 |

Series 32/A, 4.75%, 11/24/2032

| | HUF | 2,287,700,000 | | 6,088,442 |

Series 25/B, 5.50%, 6/24/2025

| | HUF | 1,567,820,000 | | 4,478,607 |

Series 28/A, 6.75%, 10/22/2028

| | HUF | 3,011,700,000 | | 9,027,623 |

Series 26/H, 9.50%, 10/21/2026

| | HUF | 950,000,000 | | 2,970,188 |

| | | | | | 71,601,372 |

| INDONESIA — 7.3% | | | |

| Indonesia Treasury Bonds: | | | | | |

Series FR90, 5.13%, 4/15/2027

| | IDR | 78,000,000,000 | | 4,870,124 |

Series FR86, 5.50%, 4/15/2026

| | IDR | 70,900,000,000 | | 4,511,638 |

Series FR64, 6.13%, 5/15/2028

| | IDR | 73,750,000,000 | | 4,724,464 |

Series FR88, 6.25%, 6/15/2036

| | IDR | 30,000,000,000 | | 1,890,154 |

Series FR95, 6.38%, 8/15/2028

| | IDR | 20,000,000,000 | | 1,294,512 |

Series FR91, 6.38%, 4/15/2032

| | IDR | 90,000,000,000 | | 5,775,502 |

Series FR93, 6.38%, 7/15/2037

| | IDR | 15,000,000,000 | | 959,603 |

Series FR62, 6.38%, 4/15/2042

| | IDR | 1,700,000,000 | | 107,063 |

Series FR81, 6.50%, 6/15/2025

| | IDR | 62,000,000,000 | | 4,027,242 |

Series FR87, 6.50%, 2/15/2031

| | IDR | 113,700,000,000 | | 7,343,940 |

See accompanying notes to financial statements.

19

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

Series FR65, 6.63%, 5/15/2033

| | IDR | 60,000,000,000 | | $ 3,905,124 |

Series 100, 6.63%, 2/15/2034

| | IDR | 5,000,000,000 | | 324,708 |

Series 101, 6.88%, 4/15/2029

| | IDR | 10,000,000,000 | | 658,325 |

Series FR89, 6.88%, 8/15/2051

| | IDR | 30,000,000,000 | | 1,939,664 |

Series FR59, 7.00%, 5/15/2027

| | IDR | 68,000,000,000 | | 4,483,221 |

Series FR82, 7.00%, 9/15/2030

| | IDR | 108,600,000,000 | | 7,199,326 |

Series FR96, 7.00%, 2/15/2033

| | IDR | 45,000,000,000 | | 3,023,917 |

Series FR98, 7.13%, 6/15/2038

| | IDR | 10,000,000,000 | | 678,346 |

Series FR92, 7.13%, 6/15/2042

| | IDR | 70,000,000,000 | | 4,705,644 |

Series FR97, 7.13%, 6/15/2043

| | IDR | 30,000,000,000 | | 2,018,283 |

Series FR84, 7.25%, 2/15/2026

| | IDR | 18,000,000,000 | | 1,184,035 |

Series FR76, 7.38%, 5/15/2048

| | IDR | 41,700,000,000 | | 2,843,302 |

Series FR74, 7.50%, 8/15/2032

| | IDR | 31,300,000,000 | | 2,149,774 |

Series FR80, 7.50%, 6/15/2035

| | IDR | 70,600,000,000 | | 4,882,987 |

Series FR75, 7.50%, 5/15/2038

| | IDR | 46,910,000,000 | | 3,258,321 |

Series FR83, 7.50%, 4/15/2040

| | IDR | 78,500,000,000 | | 5,438,051 |

Series FR78, 8.25%, 5/15/2029

| | IDR | 72,150,000,000 | | 5,044,080 |

Series FR58, 8.25%, 6/15/2032

| | IDR | 3,710,000,000 | | 264,456 |

Series FR72, 8.25%, 5/15/2036

| | IDR | 47,090,000,000 | | 3,443,041 |

Series FR56, 8.38%, 9/15/2026

| | IDR | 84,300,000,000 | | 5,733,079 |

Series FR68, 8.38%, 3/15/2034

| | IDR | 92,700,000,000 | | 6,720,253 |

Series FR79, 8.38%, 4/15/2039

| | IDR | 46,000,000,000 | | 3,432,747 |

Series FR73, 8.75%, 5/15/2031

| | IDR | 39,050,000,000 | | 2,835,075 |

Series FR67, 8.75%, 2/15/2044

| | IDR | 17,050,000,000 | | 1,321,356 |

Series FR71, 9.00%, 3/15/2029

| | IDR | 55,000,000,000 | | 3,945,840 |

Series FR57, 9.50%, 5/15/2041

| | IDR | 1,000,000,000 | | 81,809 |

Series FR45, 9.75%, 5/15/2037

| | IDR | 1,250,000,000 | | 101,652 |

Series FR40, 11.00%, 9/15/2025

| | IDR | 24,000,000,000 | | 1,668,481 |

| Security Description | | | Principal

Amount | | Value |

| Perusahaan Penerbit SBSN Indonesia: | | | | | |

Series PBS, 4.88%, 7/15/2026

| | IDR | 47,000,000,000 | | $ 2,941,083 |

Series PBS, 5.38%, 8/15/2025

| | IDR | 15,000,000,000 | | 955,572 |

Series PBS, 5.88%, 7/15/2028

| | IDR | 2,338,000,000 | | 148,582 |

Series PBS, 6.00%, 1/15/2027

| | IDR | 25,000,000,000 | | 1,593,874 |

Series PBS, 6.13%, 10/15/2025

| | IDR | 33,000,000,000 | | 2,125,984 |

Series PBS, 6.38%, 3/15/2034

| | IDR | 87,522,000,000 | | 5,588,818 |

Series PBS, 6.50%, 6/15/2039

| | IDR | 10,000,000,000 | | 630,913 |

6.63%, 9/15/2029

| | IDR | 10,000,000,000 | | 649,787 |

Series PBS, 6.75%, 6/15/2047

| | IDR | 56,875,000,000 | | 3,670,787 |

Series PBS, 7.75%, 10/15/2046

| | IDR | 23,000,000,000 | | 1,656,005 |

Series PBS, 8.88%, 11/15/2031

| | IDR | 64,200,000,000 | | 4,701,312 |

| | | | | | 143,451,856 |

| ISRAEL — 4.1% | | | |

| Israel Government Bonds - Fixed: | | | | | |

Series 0425, 0.50%, 4/30/2025

| | ILS | 23,300,000 | | 6,189,594 |

Series 0226, 0.50%, 2/27/2026

| | ILS | 36,000,000 | | 9,331,523 |

Series 0330, 1.00%, 3/31/2030

| | ILS | 29,500,000 | | 6,917,418 |

Series 0432, 1.30%, 4/30/2032

| | ILS | 26,000,000 | | 5,943,847 |

Series 0537, 1.50%, 5/31/2037

| | ILS | 26,600,000 | | 5,280,167 |

Series 0825, 1.75%, 8/31/2025

| | ILS | 29,135,000 | | 7,818,742 |

Series 0327, 2.00%, 3/31/2027

| | ILS | 28,250,000 | | 7,449,790 |

Series 0928, 2.25%, 9/28/2028

| | ILS | 32,836,000 | | 8,548,361 |

Series 1152, 2.80%, 11/29/2052

| | ILS | 12,000,000 | | 2,366,993 |

Series 0229, 3.75%, 2/28/2029

| | ILS | 13,600,000 | | 3,882,207 |

Series 0347, 3.75%, 3/31/2047

| | ILS | 28,712,000 | | 7,078,547 |

Series 0142, 5.50%, 1/31/2042

| | ILS | 22,310,000 | | 7,036,566 |

Series 1026, 6.25%, 10/30/2026

| | ILS | 10,025,000 | | 2,974,084 |

| | | | | | 80,817,839 |

See accompanying notes to financial statements.

20

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

| MALAYSIA — 4.2% | | | |

| Malaysia Government Bonds: | | | | | |

Series 0220, 2.63%, 4/15/2031

| | MYR | 6,720,000 | | $ 1,350,833 |

Series 0307, 3.50%, 5/31/2027

| | MYR | 8,670,000 | | 1,881,140 |

Series 0223, 3.52%, 4/20/2028

| | MYR | 5,480,000 | | 1,188,975 |

Series 0122, 3.58%, 7/15/2032

| | MYR | 7,080,000 | | 1,511,712 |

Series 0513, 3.73%, 6/15/2028

| | MYR | 5,390,000 | | 1,176,476 |

Series 0519, 3.76%, 5/22/2040

| | MYR | 7,650,000 | | 1,592,433 |

Series 0419, 3.83%, 7/5/2034

| | MYR | 6,110,000 | | 1,320,472 |

Series 0413, 3.84%, 4/15/2033

| | MYR | 7,860,000 | | 1,710,190 |

Series 0118, 3.88%, 3/14/2025

| | MYR | 6,700,000 | | 1,467,421 |

Series 0212, 3.89%, 3/15/2027

| | MYR | 600,000 | | 131,722 |

Series 0219, 3.89%, 8/15/2029

| | MYR | 11,805,000 | | 2,588,977 |

Series 0316, 3.90%, 11/30/2026

| | MYR | 8,605,000 | | 1,892,785 |

Series 0417, 3.90%, 11/16/2027

| | MYR | 5,770,000 | | 1,268,038 |

Series 0119, 3.91%, 7/15/2026

| | MYR | 4,540,000 | | 998,148 |

Series 0115, 3.96%, 9/15/2025

| | MYR | 8,912,000 | | 1,954,998 |

Series 0217, 4.06%, 9/30/2024

| | MYR | 915,000 | | 199,986 |

Series 0120, 4.07%, 6/15/2050

| | MYR | 10,440,000 | | 2,228,955 |

Series 0412, 4.13%, 4/15/2032

| | MYR | 800,000 | | 177,846 |

Series 0415, 4.25%, 5/31/2035

| | MYR | 8,170,000 | | 1,822,218 |

Series 0123, 4.46%, 3/31/2053

| | MYR | 980,000 | | 220,249 |

Series 0322, 4.50%, 4/30/2029

| | MYR | 7,300,000 | | 1,651,870 |

Series 0310, 4.50%, 4/15/2030

| | MYR | 11,000,000 | | 2,495,935 |

Series 0318, 4.64%, 11/7/2033

| | MYR | 10,910,000 | | 2,548,239 |

Series 0222, 4.70%, 10/15/2042

| | MYR | 2,440,000 | | 571,072 |

Series 0216, 4.74%, 3/15/2046

| | MYR | 9,075,000 | | 2,116,605 |

Series 0317, 4.76%, 4/7/2037

| | MYR | 15,375,000 | | 3,605,728 |

4.84%, 7/15/2025

| | MYR | 170,000 | | 37,736 |

| Security Description | | | Principal

Amount | | Value |

Series 0418, 4.89%, 6/8/2038

| | MYR | 7,870,000 | | $ 1,879,157 |

Series 0518, 4.92%, 7/6/2048

| | MYR | 9,860,000 | | 2,369,490 |

Series 0713, 4.94%, 9/30/2043

| | MYR | 5,000,000 | | 1,187,719 |

| Malaysia Government Investment Issue: | | | | | |

Series 0120, 3.42%, 9/30/2027

| | MYR | 9,180,000 | | 1,982,500 |

Series 0121, 3.45%, 7/15/2036

| | MYR | 13,160,000 | | 2,707,924 |

Series 0220, 3.47%, 10/15/2030

| | MYR | 10,460,000 | | 2,228,879 |

Series 123, 3.60%, 7/31/2028

| | MYR | 7,660,000 | | 1,666,925 |

Series 0319, 3.73%, 3/31/2026

| | MYR | 10,800,000 | | 2,358,443 |

Series 0415, 3.99%, 10/15/2025

| | MYR | 8,420,000 | | 1,849,340 |

Series 0316, 4.07%, 9/30/2026

| | MYR | 9,365,000 | | 2,063,948 |

Series 0619, 4.12%, 11/30/2034

| | MYR | 5,000,000 | | 1,109,325 |

Series 0118, 4.13%, 8/15/2025

| | MYR | 5,000,000 | | 1,102,450 |

Series 0119, 4.13%, 7/9/2029

| | MYR | 8,500,000 | | 1,886,279 |

Series 0122, 4.19%, 10/7/2032

| | MYR | 7,000,000 | | 1,560,414 |

Series 0117, 4.26%, 7/26/2027

| | MYR | 4,680,000 | | 1,038,899 |

Series 0223, 4.29%, 8/14/2043

| | MYR | 3,580,000 | | 798,685 |

Series 0218, 4.37%, 10/31/2028

| | MYR | 14,500,000 | | 3,250,304 |

Series 0221, 4.42%, 9/30/2041

| | MYR | 9,280,000 | | 2,090,272 |

Series 0219, 4.47%, 9/15/2039

| | MYR | 8,800,000 | | 2,014,903 |

Series 0513, 4.58%, 8/30/2033

| | MYR | 3,400,000 | | 785,382 |

Series 0519, 4.64%, 11/15/2049

| | MYR | 10,000,000 | | 2,281,262 |

Series 0322, 4.66%, 3/31/2038

| | MYR | 940,000 | | 220,594 |

Series 0617, 4.72%, 6/15/2033

| | MYR | 5,200,000 | | 1,204,623 |

Series 0517, 4.76%, 8/4/2037

| | MYR | 3,300,000 | | 775,094 |

Series 0615, 4.79%, 10/31/2035

| | MYR | 810,000 | | 190,083 |

Series 0417, 4.90%, 5/8/2047

| | MYR | 1,750,000 | | 414,569 |

Series 0222, 5.36%, 5/15/2052

| | MYR | 7,000,000 | | 1,776,263 |

| | | | | | 82,504,485 |

See accompanying notes to financial statements.

21

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

| MEXICO — 6.7% | | | |

| Mexico Bonos: | | | | | |

Series M, 5.00%, 3/6/2025

| | MXN | 53,000,000 | | $ 2,965,302 |

Series M, 5.50%, 3/4/2027

| | MXN | 280,909,300 | | 14,864,663 |

Series M, 5.75%, 3/5/2026

| | MXN | 318,557,200 | | 17,374,154 |

Series M, 7.00%, 9/3/2026

| | MXN | 80,000,000 | | 4,437,238 |

Series M 20, 7.50%, 6/3/2027

| | MXN | 267,660,700 | | 14,963,837 |

Series M, 7.50%, 5/26/2033

| | MXN | 66,760,000 | | 3,570,297 |

Series M, 7.75%, 5/29/2031

| | MXN | 304,716,800 | | 16,776,023 |

Series M, 7.75%, 11/23/2034

| | MXN | 28,508,100 | | 1,537,294 |

Series M, 7.75%, 11/13/2042

| | MXN | 198,089,600 | | 10,289,149 |

Series MS, 8.00%, 5/24/2035

| | MXN | 40,000,000 | | 2,193,432 |

Series M, 8.00%, 11/7/2047

| | MXN | 125,950,800 | | 6,645,653 |

Series M, 8.00%, 7/31/2053

| | MXN | 130,000,000 | | 6,812,324 |

Series M, 8.50%, 3/1/2029

| | MXN | 8,000,000 | | 461,227 |

Series M 20, 8.50%, 5/31/2029

| | MXN | 71,446,300 | | 4,126,921 |

Series M 30, 8.50%, 11/18/2038

| | MXN | 120,130,000 | | 6,764,721 |

Series M 20, 10.00%, 12/5/2024

| | MXN | 146,695,500 | | 8,617,305 |

Series M 30, 10.00%, 11/20/2036

| | MXN | 34,180,000 | | 2,173,799 |

| Mexico Cetes: | | | | | |

Series BI, Zero Coupon, 1/23/2025

| | MXN | 19,000,000 | | 1,002,427 |

Zero Coupon, 3/20/2025

| | MXN | 30,000,000 | | 1,557,037 |

Series BI, Zero Coupon, 5/15/2025

| | MXN | 50,000,000 | | 2,553,769 |

Series BI, Zero Coupon, 7/10/2025

| | MXN | 15,000,000 | | 753,993 |

| | | | | | 130,440,565 |

| PERU — 3.4% | | | |

| Peru Government Bonds: | | | | | |

5.35%, 8/12/2040

| | PEN | 5,500,000 | | 1,270,269 |

5.40%, 8/12/2034

| | PEN | 17,000,000 | | 4,146,175 |

5.70%, 8/12/2024

| | PEN | 5,700,000 | | 1,540,082 |

5.94%, 2/12/2029

| | PEN | 20,725,000 | | 5,597,004 |

6.15%, 8/12/2032

| | PEN | 33,257,000 | | 8,764,998 |

| Security Description | | | Principal

Amount | | Value |

6.35%, 8/12/2028

| | PEN | 38,400,000 | | $ 10,614,893 |

6.71%, 2/12/2055

| | PEN | 3,500,000 | | 934,754 |

6.85%, 2/12/2042

| | PEN | 9,200,000 | | 2,494,752 |

6.90%, 8/12/2037

| | PEN | 54,775,000 | | 14,896,066 |

6.95%, 8/12/2031

| | PEN | 27,420,000 | | 7,642,763 |

7.30%, 8/12/2033

| | PEN | 27,750,000 | | 7,851,432 |

Peru Government International Bonds 6.71%, 2/12/2055

| | PEN | 475,000 | | 126,859 |

| | | | | | 65,880,047 |

| PHILIPPINES — 4.5% | | | |

| Philippines Government Bonds: | | | | | |

Series 1065, 2.88%, 7/9/2030

| | PHP | 153,500,000 | | 2,306,326 |

Series 5-77, 3.38%, 4/8/2026

| | PHP | 270,000,000 | | 4,612,947 |

Series R105, 3.50%, 9/20/2026

| | PHP | 22,000,000 | | 373,690 |

Series 1060, 3.63%, 9/9/2025

| | PHP | 82,000,000 | | 1,426,197 |

Series 7-64, 3.63%, 4/22/2028

| | PHP | 70,000,000 | | 1,153,379 |

Series 2020, 3.63%, 3/21/2033

| | PHP | 43,150,000 | | 648,973 |

Series 7-65, 3.75%, 8/12/2028

| | PHP | 460,000,000 | | 7,599,945 |

Series 1066, 4.00%, 7/22/2031

| | PHP | 227,000,000 | | 3,604,813 |

Series 5-76, 4.25%, 10/17/2024

| | PHP | 50,000,000 | | 890,651 |

Series 3-27, 4.25%, 4/7/2025

| | PHP | 185,000,000 | | 3,270,409 |

Series 2511, 4.63%, 9/9/2040

| | PHP | 156,500,000 | | 2,351,513 |

Series 1061, 4.75%, 5/4/2027

| | PHP | 276,950,000 | | 4,821,677 |

Series 1067, 4.88%, 1/20/2032

| | PHP | 380,000,000 | | 6,353,774 |

Series 2024, 5.13%, 7/15/2041

| | PHP | 20,000,000 | | 317,132 |

Series 3-01, 5.25%, 2/4/2026

| | PHP | 30,000,000 | | 534,388 |

Series 2021, 5.25%, 5/18/2037

| | PHP | 48,800,000 | | 817,069 |

5.75%, 4/12/2025

| | PHP | 114,500,000 | | 2,061,261 |

Series 7-69, 6.00%, 4/27/2030

| | PHP | 50,000,000 | | 905,706 |

Series R251, 6.13%, 10/24/2037

| | PHP | 67,000,000 | | 1,214,771 |

6.25%, 2/14/2026

| | PHP | 105,000,000 | | 1,907,717 |

Series 1063, 6.25%, 3/22/2028

| | PHP | 127,700,000 | | 2,328,663 |

6.38%, 7/27/2030

| | PHP | 150,000,000 | | 2,763,138 |

Series 2022, 6.50%, 2/22/2038

| | PHP | 40,000,000 | | 750,284 |

See accompanying notes to financial statements.

22

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

Series 1071, 6.63%, 8/17/2033

| | PHP | 250,000,000 | | $ 4,718,317 |

Series 1069, 6.75%, 9/15/2032

| | PHP | 380,000,000 | | 7,203,533 |

Series 2023, 6.75%, 1/24/2039

| | PHP | 52,700,000 | | 1,021,144 |

Series 1064, 6.88%, 1/10/2029

| | PHP | 293,000,000 | | 5,500,984 |

Series 7-68, 7.00%, 10/13/2029

| | PHP | 30,000,000 | | 567,470 |

Series 2017, 8.00%, 7/19/2031

| | PHP | 274,237,338 | | 5,541,703 |

Series 25-7, 8.00%, 9/30/2035

| | PHP | 108,000,000 | | 2,265,713 |

Series 25-8, 8.13%, 12/16/2035

| | PHP | 198,800,000 | | 4,205,872 |

8.13%, 11/24/2042

| | PHP | 95,000,000 | | 2,111,856 |

Series 25-6, 9.25%, 11/5/2034

| | PHP | 30,000,000 | | 675,888 |

Philippines Government International Bonds 6.25%, 1/14/2036

| | PHP | 20,000,000 | | 338,315 |

| | | | | | 87,165,218 |

| POLAND — 4.4% | | | |

| Republic of Poland Government Bonds: | | | | | |

Series 1026, 0.25%, 10/25/2026

| | PLN | 33,173,000 | | 7,413,593 |

Series 0425, 0.75%, 4/25/2025

| | PLN | 14,900,000 | | 3,585,329 |

Series 1030, 1.25%, 10/25/2030

| | PLN | 5,830,000 | | 1,172,544 |

Series 0432, 1.75%, 4/25/2032

| | PLN | 59,700,000 | | 11,798,806 |

Series 0726, 2.50%, 7/25/2026

| | PLN | 39,348,000 | | 9,418,564 |

Series 0727, 2.50%, 7/25/2027

| | PLN | 21,440,000 | | 5,038,341 |

Series 0428, 2.75%, 4/25/2028

| | PLN | 49,770,000 | | 11,601,292 |

Series 1029, 2.75%, 10/25/2029

| | PLN | 17,200,000 | | 3,905,359 |

Series 0725, 3.25%, 7/25/2025

| | PLN | 22,000,000 | | 5,444,777 |

Series 0527, 3.75%, 5/25/2027

| | PLN | 41,625,000 | | 10,196,588 |

Series 0447, 4.00%, 4/25/2047

| | PLN | 400,000 | | 82,904 |

Series 0429, 5.75%, 4/25/2029

| | PLN | 16,750,000 | | 4,398,615 |

Series 1033, 6.00%, 10/25/2033 (b)

| | PLN | 18,610,000 | | 5,017,679 |

Series 728, 7.50%, 7/25/2028

| | PLN | 26,040,000 | | 7,288,384 |

| | | | | | 86,362,775 |

| Security Description | | | Principal

Amount | | Value |

| ROMANIA — 3.8% | | | |

| Romania Government Bonds: | | | | | |

Series 7Y, 2.50%, 10/25/2027

| | RON | 21,100,000 | | $ 4,101,934 |

Series 5Y, 3.25%, 6/24/2026

| | RON | 26,450,000 | | 5,485,161 |

Series 4Y, 3.50%, 11/25/2025

| | RON | 13,600,000 | | 2,882,364 |

Series 5Y, 3.65%, 7/28/2025

| | RON | 16,100,000 | | 3,446,944 |

Series 15Y, 3.65%, 9/24/2031 (b)

| | RON | 12,300,000 | | 2,292,548 |

Series 8Y, 4.15%, 1/26/2028

| | RON | 15,750,000 | | 3,245,588 |

Series 10YR, 4.15%, 10/24/2030

| | RON | 20,930,000 | | 4,111,409 |

Series 5Y, 4.25%, 4/28/2036

| | RON | 16,600,000 | | 3,041,233 |

Series 10Y, 4.75%, 2/24/2025

| | RON | 13,025,000 | | 2,849,843 |

Series 15Y, 4.75%, 10/11/2034

| | RON | 27,900,000 | | 5,452,334 |

Series 7Y, 4.85%, 4/22/2026

| | RON | 15,725,000 | | 3,394,065 |

Series 8Y, 4.85%, 7/25/2029

| | RON | 14,500,000 | | 3,007,421 |

Series 10Y, 5.00%, 2/12/2029

| | RON | 22,185,000 | | 4,653,828 |

Series 15YR, 5.80%, 7/26/2027

| | RON | 17,810,000 | | 3,895,885 |

Series 10Y, 6.70%, 2/25/2032

| | RON | 18,900,000 | | 4,297,383 |

Series 4Y, 7.20%, 5/31/2027

| | RON | 6,000,000 | | 1,368,898 |

Series 10Y, 7.20%, 10/30/2033

| | RON | 5,000,000 | | 1,176,442 |

Series 8Y, 7.35%, 4/28/2031

| | RON | 3,500,000 | | 823,930 |

Series 15Y, 7.90%, 2/24/2038

| | RON | 9,200,000 | | 2,350,601 |

Series 7Y, 8.00%, 4/29/2030

| | RON | 15,800,000 | | 3,811,541 |

Series 10Y, 8.25%, 9/29/2032

| | RON | 15,600,000 | | 3,893,772 |

8.75%, 10/30/2028

| | RON | 21,700,000 | | 5,299,304 |

| | | | | | 74,882,428 |

| SOUTH AFRICA — 4.4% | | | |

| Republic of South Africa Government Bonds: | | | | | |

Series R209, 6.25%, 3/31/2036

| | ZAR | 13,241,000 | | 475,264 |

Series R214, 6.50%, 2/28/2041

| | ZAR | 8,330,000 | | 275,306 |

Series R213, 7.00%, 2/28/2031

| | ZAR | 144,667,000 | | 6,617,303 |

See accompanying notes to financial statements.

23

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2023

| Security Description | | | Principal

Amount | | Value |

Series 2030, 8.00%, 1/31/2030

| | ZAR | 221,125,000 | | $ 11,123,056 |

Series 2032, 8.25%, 3/31/2032

| | ZAR | 175,877,000 | | 8,410,359 |

Series 2037, 8.50%, 1/31/2037

| | ZAR | 178,927,000 | | 7,648,242 |

Series 2044, 8.75%, 1/31/2044

| | ZAR | 187,256,000 | | 7,592,636 |

Series 2048, 8.75%, 2/28/2048

| | ZAR | 256,885,000 | | 10,334,398 |

Series 2035, 8.88%, 2/28/2035

| | ZAR | 240,125,000 | | 11,075,622 |

Series 2040, 9.00%, 1/31/2040

| | ZAR | 210,590,000 | | 9,001,679 |

Series R186, 10.50%, 12/21/2026

| | ZAR | 221,980,000 | | 12,699,137 |

Series 2053, 11.63%, 3/31/2053

| | ZAR | 30,000,000 | | 1,562,793 |

| | | | | | 86,815,795 |

| SOUTH KOREA — 12.5% | | | |

| Korea Treasury Bonds: | | | | | |

Series 2509, 1.13%, 9/10/2025

| | KRW | 8,000,000,000 | | 5,993,515 |

Series 3909, 1.13%, 9/10/2039

| | KRW | 5,450,000,000 | | 3,171,349 |

Series 2603, 1.25%, 3/10/2026

| | KRW | 7,300,000,000 | | 5,435,821 |

Series 2912, 1.38%, 12/10/2029

| | KRW | 10,000,000,000 | | 6,996,115 |

Series 3006, 1.38%, 6/10/2030

| | KRW | 10,000,000,000 | | 6,929,155 |

Series 2503, 1.50%, 3/10/2025

| | KRW | 7,340,000,000 | | 5,578,132 |

Series 01500-2612, 1.50%, 12/10/2026

| | KRW | 4,344,000,000 | | 3,215,344 |

Series 3012, 1.50%, 12/10/2030

| | KRW | 9,500,000,000 | | 6,585,358 |

Series 3609, 1.50%, 9/10/2036

| | KRW | 6,003,000,000 | | 3,842,750 |

Series 4009, 1.50%, 9/10/2040

| | KRW | 6,000,000,000 | | 3,653,838 |

Series 5003, 1.50%, 3/10/2050

| | KRW | 16,730,000,000 | | 9,306,384 |

Series 7009, 1.63%, 9/10/2070

| | KRW | 7,050,000,000 | | 3,587,518 |