Filed by SoftBank Corp.

Pursuant to Rule 425 under the Securities Act of 1933

And deemed filed pursuant to Rule 14a-6

Under the Securities Exchange Act of 1934

Subject Company: Sprint Nextel Corporation

Commission File No.: 001-04721

Selected Portions of 33rd Annual General Meeting of Shareholders Meeting and Related Presentation Materials. The following slides relate to the SoftBank Corp. 33rd Annual General Meeting of Shareholders Meeting held on June 21, 2013. The meeting was conducted in Japanese with simultaneous English translation, and the transcripts filed hereunder are transcribed from the simultaneous English translation. While every effort has been made to provide an accurate translation and transcription, there may be typographical mistakes, inaudible statements, mistranslations of certain statements, errors, omissions or inaccuracies in the transcript. SoftBank believes that none of these inaccuracies is material. The related slides used in 33rd Annual General Meeting of Shareholders Meeting are included as an attachment to this transcript. A replay of the 33rd Annual General Meeting of Shareholders Meeting is accessible through SoftBank’s website atwww.softbank.co.jp/en/.

Cautionary Statement Regarding Forward Looking Statements |

This document includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” “providing guidance” and similar expressions are intended to identify information that is not historical in nature.

This document contains forward-looking statements relating to the proposed transactions between Sprint Nextel Corporation (“Sprint”) and SoftBank Corp. (“SoftBank”) and its group companies, including Starburst II, Inc. (“Starburst II”), and the proposed acquisition by Sprint of Clearwire Corporation (“Clearwire”). All statements, other than historical facts, including, but not limited to: statements regarding the expected timing of the closing of the transactions; the ability of the parties to complete the transactions considering the various closing conditions; the expected benefits of the transactions such as improved operations, enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of SoftBank or Sprint; and any assumptions underlying any of the foregoing, are forward-looking statements. Such statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. You should not place undue reliance on such statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, that (1) there may be a material adverse change of SoftBank; (2) the proposed financing may involve unexpected costs, liabilities or delays or may not be completed on terms acceptable to SoftBank, if at all; and (3) other factors as detailed from time to time in Sprint’s, Starburst II’s and Clearwire’s filings with the Securities and Exchange Commission (“SEC”), including Sprint’s and Clearwire’s Annual Reports on Form 10-K for the year ended December 31, 2012 and Quarterly Reports on Form 10-Q for the quarter ended March 31, 2013, and other factors that are set forth in the proxy statement/prospectus contained in Starburst II’s Registration Statement on Form S-4, which was declared effective by the SEC on May 1, 2013, and in other materials that will be filed by Sprint, Starburst II and Clearwire in connection with the transactions, which will be available on the SEC’s web site (www.sec.gov). There can be no assurance that the transactions will be completed, or if completed, that such transactions will close within the anticipated time period or that the expected benefits of such transactions will be realized.

All forward-looking statements contained in this document and the documents referenced herein are made only as of the date of the document in which they are contained, and none of Sprint, SoftBank or Starburst II undertakes any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

SoftBank Press Conference

June 21, 2013

Presentation by Masayoshi Son, Chairman & CEO, SoftBank Corp.

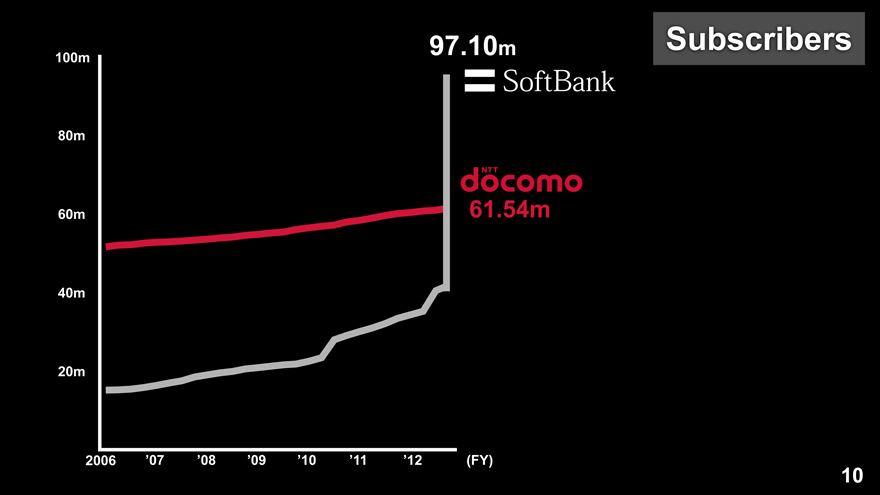

(Slide 10)

| • | In addition to that, if the purchase of Sprint goes well, the number of users is going to be the level by which we will overtake DoCoMo. |

(Slide 11)

| • | There was an issue with regard to connectivity. Well, even with iPhone and the good list of the availability of phones, but the connectivity was poor. But in response to that kind of a complaint, I told on November 20, 2010, by using Twitter, I tweeted that we would overtake DoCoMo, or overachieve the target. |

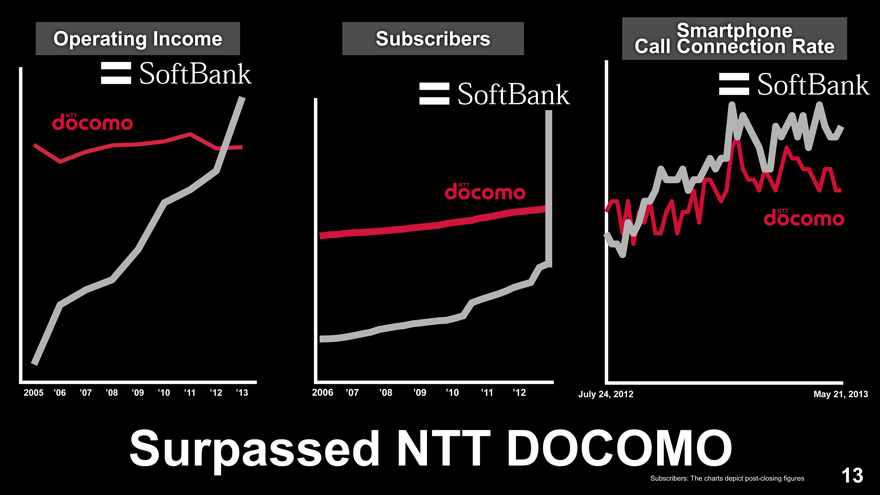

(Slide 12)

| • | Smartphones data connectivity: our connectivity, or connection rate has turned out better than that of DoCoMo. |

(Slide 13)

| • | So these three items – these are the ones I have said and I declared and I dreamed that we would achieve the overtaking of DoCoMo in terms of operating income and data connectivity, and these were the dreams I was talking about 10 years ago. But they have come into reality – all of them. |

(Slide 57)

| • | So let me go to the next biggest question that I received from shareholders, why is SoftBank entering the U.S. market. Let me answer that. |

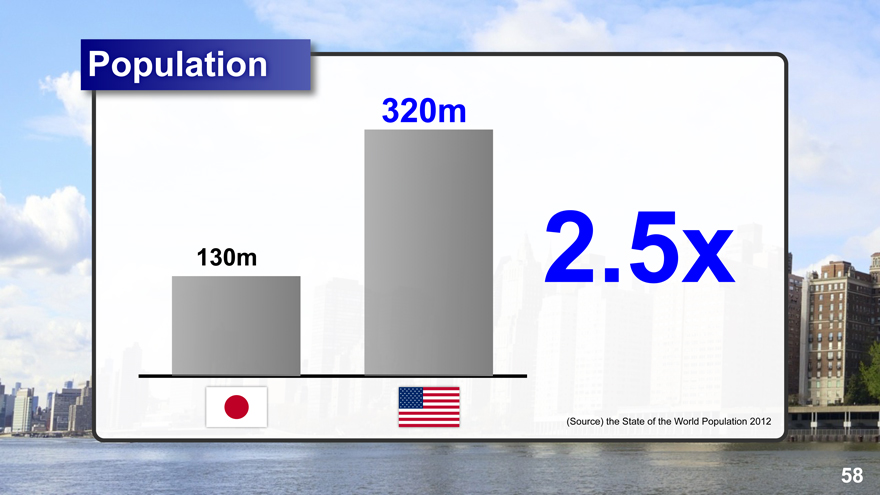

(Slide 58)

| • | In the U.S. market there are 2.5 times the population. |

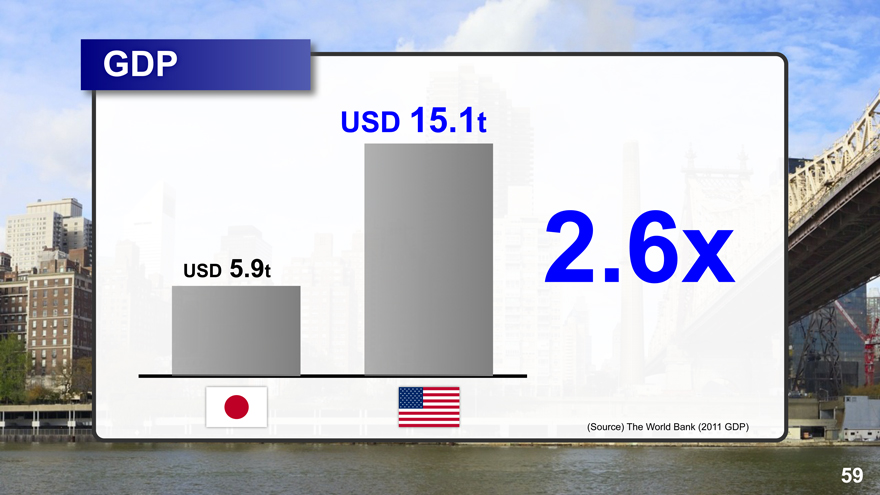

(Slide 59)

| • | In terms of GDP they have 2.6 times. |

1

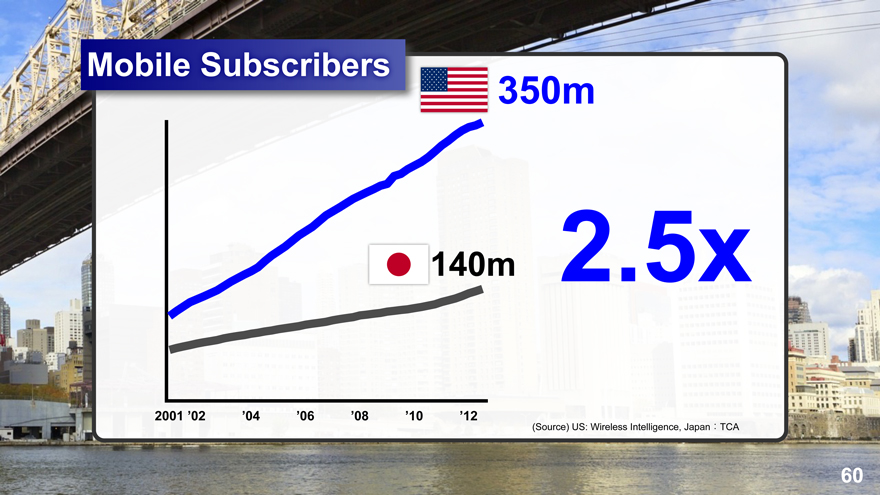

(Slide 60)

| • | Mobile subscribers are 2.5 times. U.S. is one of the richest countries in the world and also the most advanced country. So they are 2.5 times bigger in terms of market compared to Japan and the population growth in Japan may not be seen going forward and I expect rather to decline, so rather than we spend in the domestic market only, but why don’t we challenge to the outside world. That is our challenge that we wanted to make. |

(Slide 61)

| • | And also the reason that we decide to do this step is because we have a common technology which is the smartphone that I mentioned earlier. This is both in the U.S. and Japan the most selling device, in Japan and the U.S., iPhone, Android phones, smartphones. It is exactly the same smartphone, and network technology is also the same, which is LTE. In the past, Japan’s network was kind of isolated from the other countries. Japan’s mobile phone was different, which is the so-called Galapagos mobile phone, having unique advancement in Japan. However, these days, now that we are sharing exactly the same technology and the platform. So the U.S. is a distant country, but at the same time it is a close country as well from that sense. |

(Slide 62)

| • | When I was the age of 16, when I was a school student and made the first step to the United States at that time, so it is almost a second home of mine – and the number three operator, Sprint, is the company that we announced to make a strategic partnership in October 2012. |

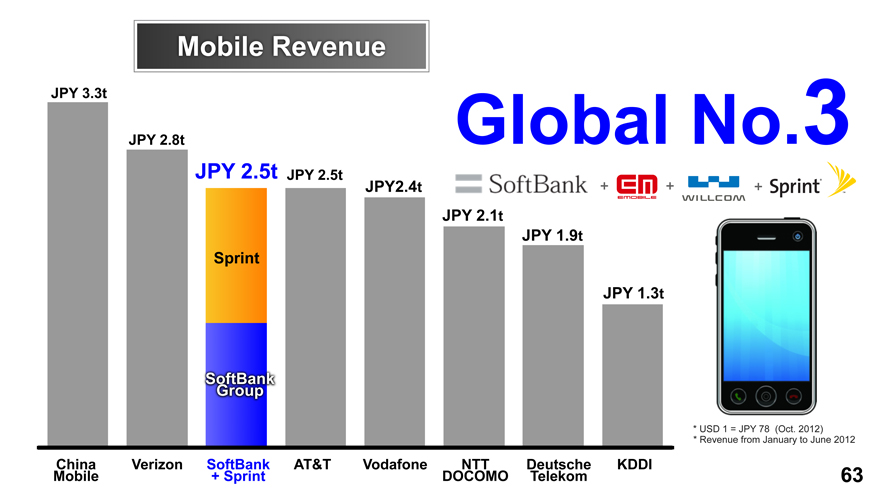

(Slide 63)

| • | Once we can complete this transaction successfully, then we will become global number three in terms of mobile revenue. |

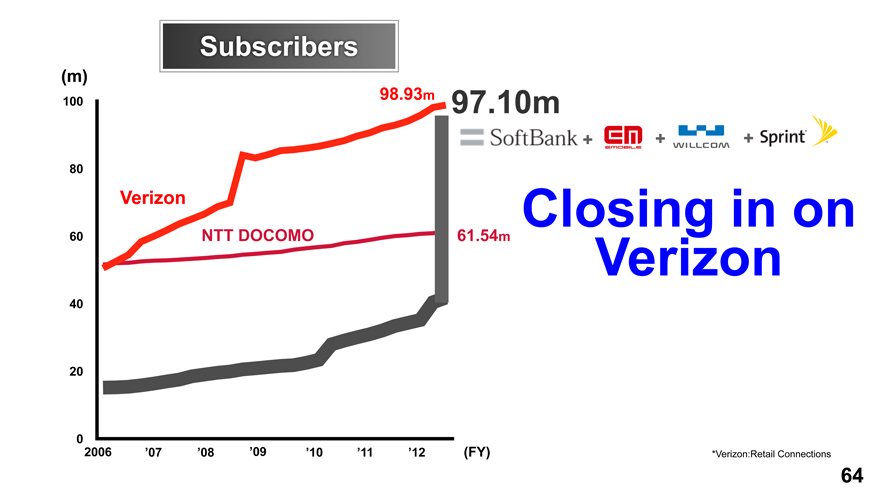

(Slide 64)

| • | In terms of subscribers, as I mentioned earlier, we will exceed DoCoMo, and almost closing in on Verizon, which is the biggest mobile operator in the United States. |

(Slide 65)

| • | Under such circumstances, I would say there will be a question about the status on the transaction. There are several media coverage talking about the negative points on this transaction or the situations on us, and we have received so many questions about the update on the Sprint transaction. |

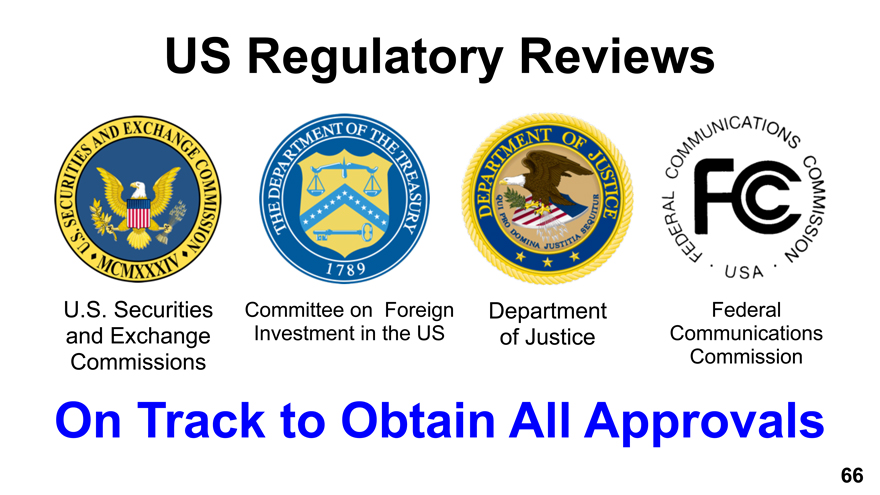

(Slide 66)

| • | So whether we will be able to receive regulatory authorization, and the transaction required four authorizations, and out of the proposed four, three have already been approved. It is an open country, the United States is. It is a very transparent country. From that sense, we are making very firm steps towards those regulatory reviews, and we have obtained three regulatory approvals out of four. The remaining one is the approval from FCC, Federal Communications Commission. The review by |

2

FCC is going forward smoothly and we are confident to be able to receive the approval from this regulatory as well, and we are making good progress so far. Although regulatory approvals goes well, still there is a counterpart or some other third party, which is the company called Dish, coming in to this transaction. Actually, this company, Dish, has proposed a higher offer than us, and they are trying to intervene in the transaction and try to buy this company instead of us. |

(Slide 67)

| • | But on June 18 this week – it seems like a long time ago – every day feels to me like a year, anyway. On 18, Dish announced that they will not make a further proposal to the Sprint special committee. June 18 was the deadline for Dish to offer the revised proposal, but actually Dish didn’t make an upgraded offer. Of course, that is not the end of the process. On June 24 (SIC June 25) the shareholders’ meeting of Sprint will take place, and until then, and without shareholders’ approval, this deal will not be closed. So we should not heave a sigh of relief yet. But there is another hurdle we should clear. Clearwire is the subsidiary of Sprint, and Clearwire owns the spectrum which is crucial for the Sprint business in the United States. Clearwire owns a lot of good frequency bandwidth, and Clearwire is the subsidiary of Sprint, and Sprint is trying to obtain the 49 percent of the shares, but actually Dish made a counterproposal to Clearwire in the form of a tender offer to acquire 25 percent of Clearwire’s shares. So if the tender offer ended with success, even if our deal with Sprint is closed, our business plan with Sprint will not be fully successful. |

(Slide 68)

| • | But there is a new development around Clearwire’s case. Clearwire’s board of directors announced a week ago that they will support Dish’s counterproposal officially, but actually Clearwire’s board of directors changed their recommendation to back Sprint’s offer. That was the official announcement made in the United States. Clearwire also announced that it has decided to discontinue negotiations with Dish. Also, earlier the major shareholders of Clearwire announced that even those who previously supported Dish’s proposal said that they will support Sprint’s proposal, and they agreed on supporting Sprint officially. That is quite a turnaround of event, and the situation is in favor of us right now. |

(Slide 69)

| • | So we believe that we are on track for deal closing in early July 2013, maybe some time next week. Of course, it is too early to heave a sigh of relief. Nothing can be ruled out until the end of the shareholders’ meeting of Sprint, but so far the situation is in favor of us. |

(Slide 70)

| • | There is another commonly asked question from our shareholders which is “Will the US business be successful?” The stake is running high but will our attempts in entering to the United States be successful? |

3

(Slide 71)

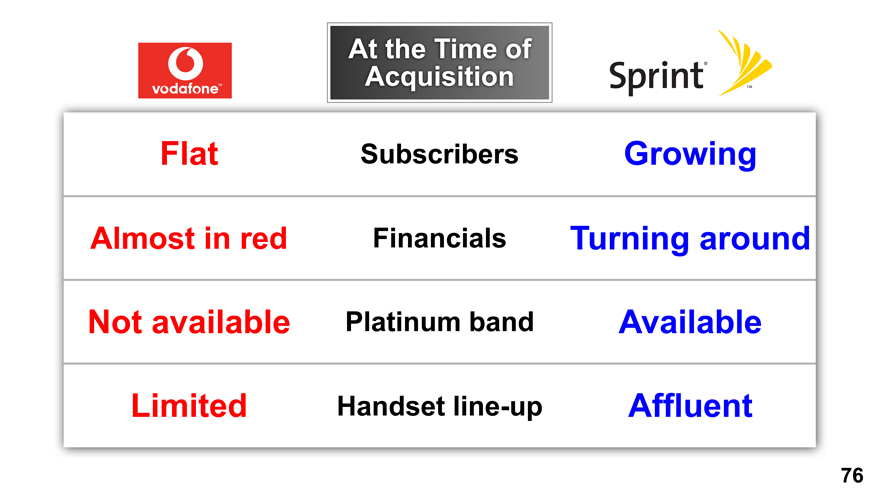

| • | Actually we are confident in our success. Let’s compare the acquisition of Vodafone K.K. and the acquisition of Sprint. We internally discussed that and here is our view. |

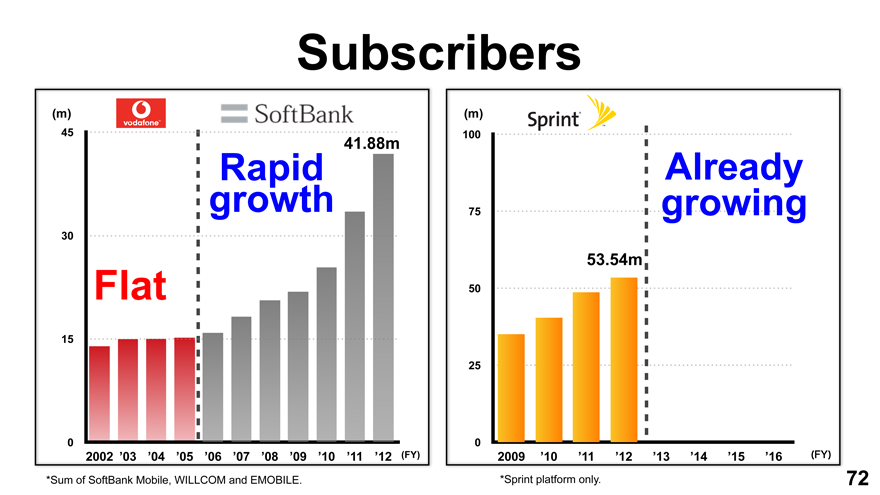

(Slide 72)

| • | The Sprint acquisition will be better than that of Vodafone, probability of success of acquisition of Sprint is better than Vodafone because Vodafone K.K. at that time was struggling to increase the number of subscribers and their operating income kept on falling back then. But once we acquired Vodafone K.K., their mobile business customers started to increase rapidly and we recorded number one net addition for the past five years. The Vodafone K.K.’s net addition share was just 4% but right now the mobile business’ subscriber share is 50%. Now looking at Sprint today, their number of subscribers is increasing year by year, and that trend will be enhanced in the cooperation with SoftBank so it seems that it will be easier for us to help Sprint to further increase their customer base compared to the case of Vodafone K.K. |

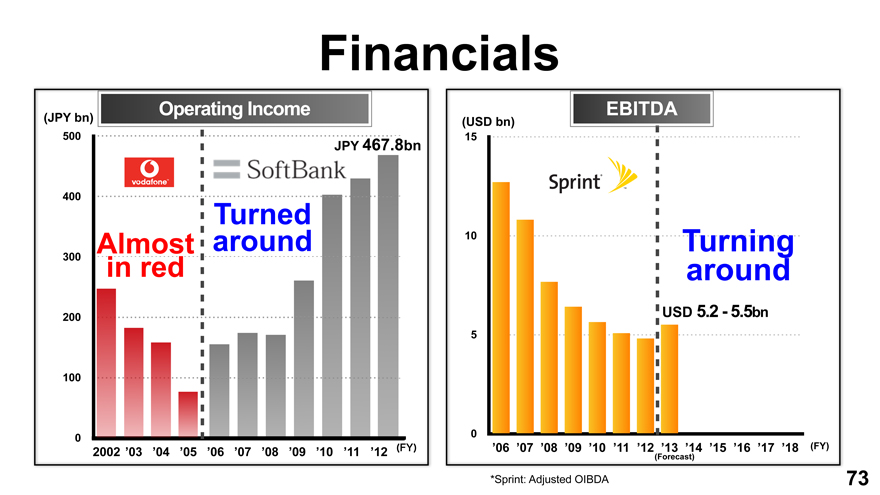

(Slide 73)

| • | Of course the Sprint rival is far bigger than our competitors like DoCoMo, but still, the increased customer base of Sprint could be done. And operating income, the Vodafone K.K.’s operating income kept falling, but Sprint’s operating income already hit the bottom. Let me tell you the analogy of tennis. When the ball bounces up at the highest and if you hit that rising shot, that will be the most effective. The same goes for a company’s performance. If you do something right after the performance hits the bottom, then that could be effective. |

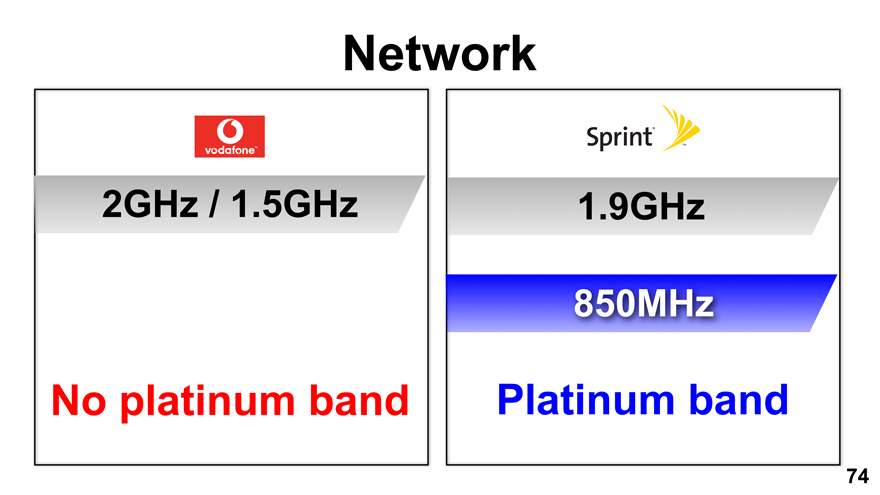

(Slide 74)

| • | Another thing we worked really hard on after Vodafone K.K.’s acquisition was network. It took us six years to acquire platinum band permission, meaning that for six years we had to compete with our competitors without platinum band. From last year, we started platinum band service, after the long last, and we are seeing the positive effect of present platinum band. But in the case of Sprint, the situation is different. Spring already has platinum band which is available for use from next month. From next month they can use platinum band. So we see the rebound in the situation of spectrum of Sprint. |

(Slide 75)

| • | Another thing I would like to emphasize is handset lineup. Under Vodafone K.K., the mobile business has had only a limited number of handsets and back then I felt that if I were the customer of Vodafone K.K., I wouldn’t feel like buying the handsets because the product lineup was limited. But actually, Sprint has a wide variety of product lineup for customers, a totally different situation than Vodafone K.K. |

(Slide 76)

| • | So when we acquired Vodafone K.K., it was like fighting an uphill battle because all the situation relating Vodafone K.K. was not good. Of course the acquisition of Sprint and turning around Sprint is not easy, but we already overcame all the difficulties around Vodafone K.K. so we are confident with the success of Sprint. |

4

(Slide 77)

| • | Moreover, we hit it off with Sprint management. |

(Slide 78)

| • | It has been 9 months since we announced the acquisition of Sprint and every month we have a face-to-face meeting with the Sprint team, and we have weekly video conferences with the Sprint team. |

(Slide 79)

| • | With the video conference system, we see them and exchange information. |

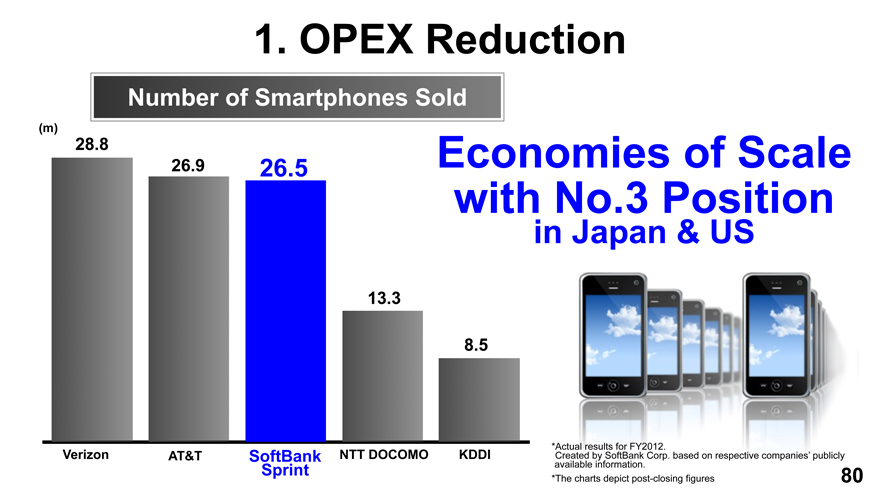

(Slide 80)

| • | Through information exchange, we are sure that we could maximize synergies with Sprint in terms of OPEX reduction and CAPEX efficiency. Why? First of all, OPEX reduction, Sprint has half the number of subscribers compared with their competitors, Verizon and DoCoMo. Because of the small scale, they have difficulty in cost reduction. The same was true with SoftBank before, because of the size of business, SoftBank was struggling in terms of OPEX reduction. But by combining SoftBank and Sprint, the two companies can enjoy the economy of scale in terms of handset procurement. In the past – actually, until then – Sprint purchased half the number of handsets compared with Verizon AT&T and that was the handicap from Sprint’s standpoint, but that handicap will be gone after the SoftBank acquisition of Sprint. So economies of scale give the two companies bigger purchasing power that could lead to OPEX reduction. |

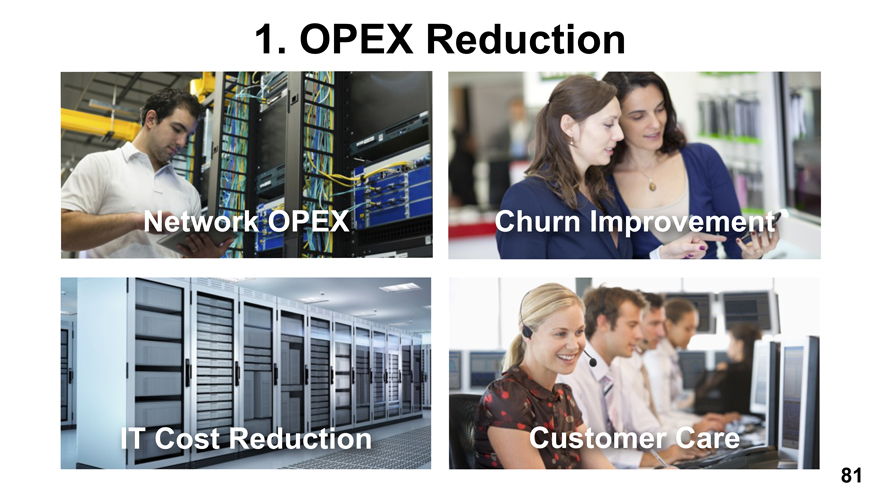

(Slide 81)

| • | So not only the smartphone procurement cost reduction but also network OPEX, churn improvements, IT cost reduction and customer care cost reduction are expected. |

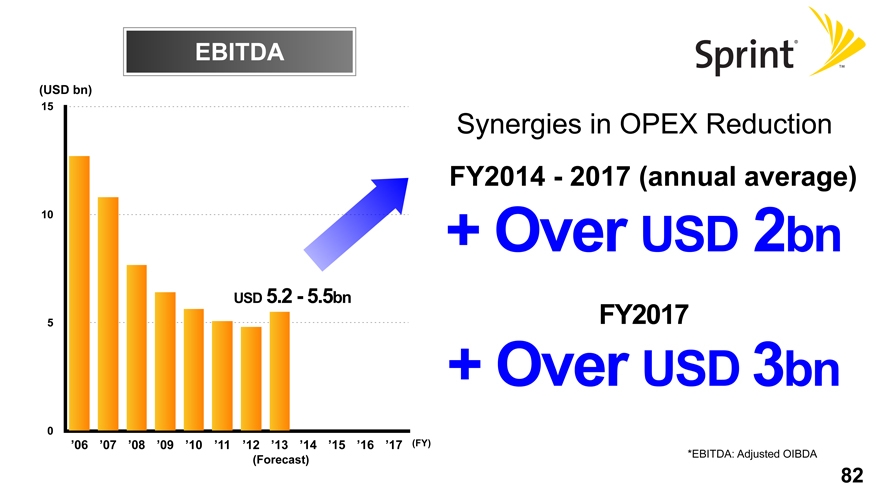

(Slide 82)

| • | So Sprint EBITDA already bottomed out. Not only that but also they would see the better operating income coming from OPEX reduction of 2 billion dollars’ worth. |

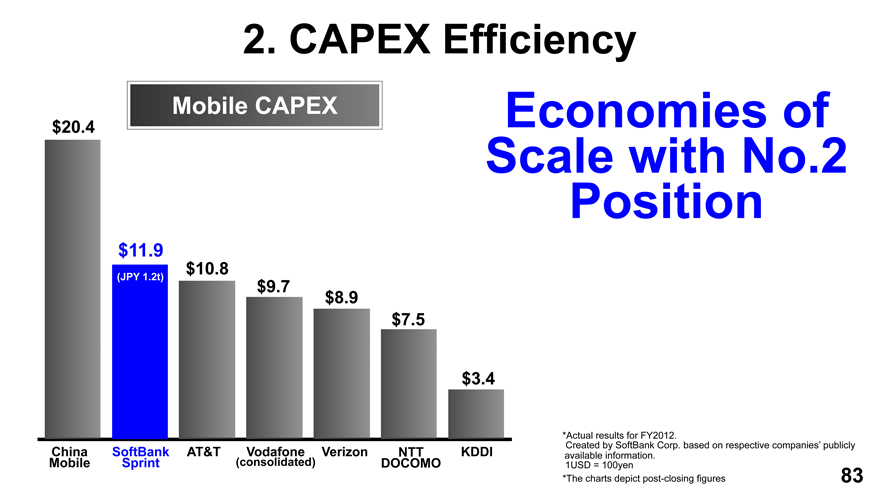

(Slide 83)

| • | And CAPEX efficiency. By combining Sprint and SoftBank, the economy of scale will be bigger than AT&T and Vodafone so the combined company could buy more network equipment from network vendors. In the world, only China mobile spends larger amounts of CAPEX, but excluding Chinese operators, SoftBank-Sprint is the biggest purchaser of network equipment which gives us the bigger purchasing power in terms of network equipment purchasing. |

5

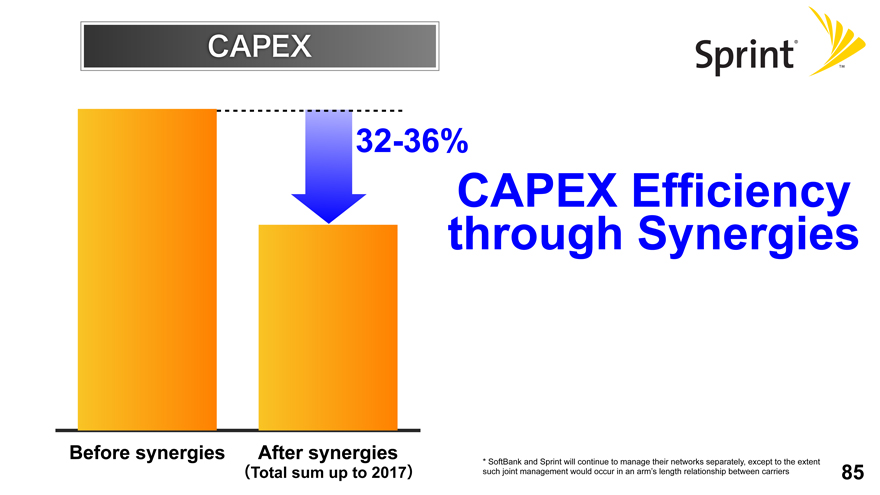

(Slide 84)

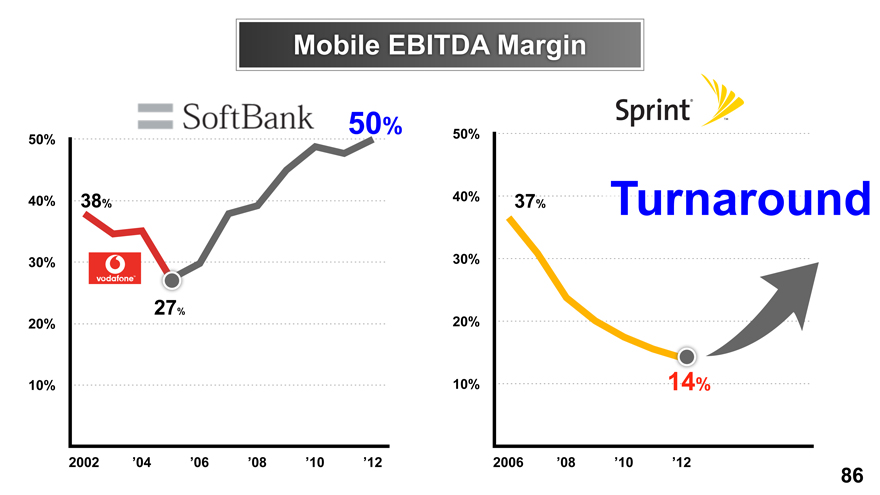

| • | So we could gain the state-of-the-art technology at the lower price. Because of that, Sprint could turn around the mobile EBITDA margin and we are sure about that. |

(Slide 85)

| • | So the current growth trend could continue in SoftBank. |

(Slide 86)

| • | On top of that, we could expect the turnaround and growth trends of Sprint in the United States. |

(Slide 87)

| • | Another common question from shareholders is this: What is the mid- and long-term target? Three years ago in the Annual General Meeting of Shareholders, I announced the next 30-year vision. |

(Slide 88)

| • | Within 30 years from 2010, SoftBank will be listed in the global top-ten market cap. list. That was the vision I announced. |

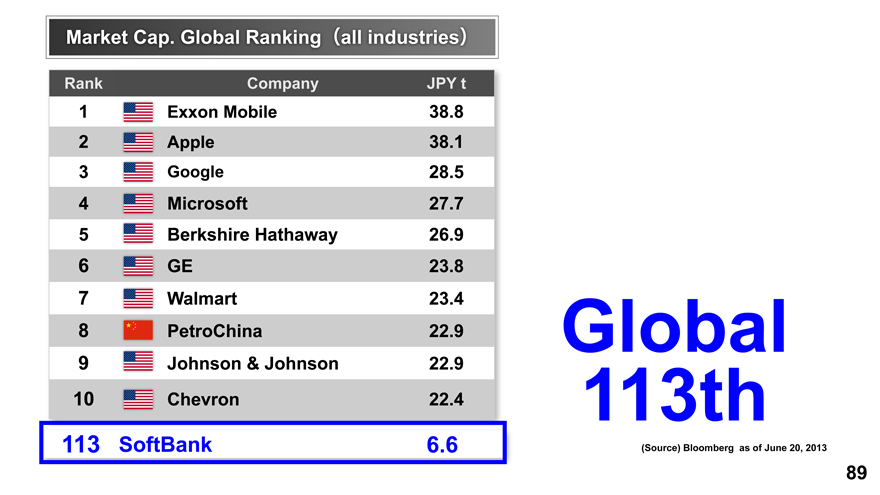

(Slide 89)

| • | And back then three years ago, we were ranked 217th in terms of market cap., but that company aimed to be global top-ten. That was three years ago. But since then, we are ascending the global ranking. Right now we are ranked 113, but we should go further. |

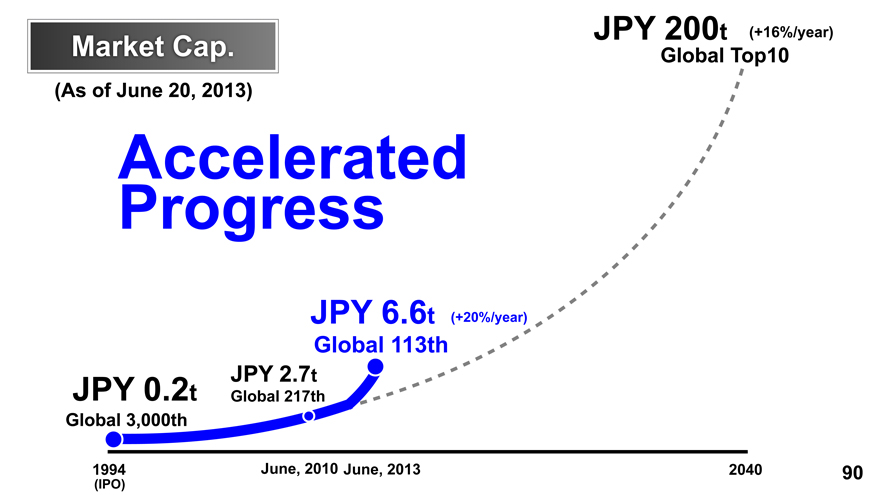

(Slide 90)

| • | Please look at the dotted line. To be global Top10, the market cap. should be 200 trillion yen. But maybe we can accelerate the progress to reach the target, Thank to corporation and support by shareholders, partner companies, and employees. Ahead of our original estimate, we could achieve the target earlier. |

Question

| • | Reason for change of the investment amount in Sprint |

Son

| • | I have two reasons for that. For the Sprint existing shareholders – the gap of 3 billion goes to the existing shareholders of Sprint. We changed that way. We need to increase that part. Otherwise, in the battle of proposal offers with DISH, there could be some disadvantages for us. But at the same |

6

time, we didn’t want to increase too much in terms of total amount. That is one reason why. Second of all, as I mentioned in my presentation, 200 billion cost reduction over four years is expected. Every year, for 200 billion over four years is expected as a cost reduction. Last October, that was not yet clear, but in the past nine months I believe that we have been able to see more clearly, and we have an opportunity to be able to reduce there, so that Sprint will be able to turnaround more quickly. In that case, if they would be able to reduce the cost by 200 billion per year, then, even if we decrease from 8 billion to 5 billion, I believe that their business plan still goes well. So we were able to revise that part. That is why we have changed that part, and also, we will be very confident that we have been able to succeed at this. Thank you. |

Question

| • | Other option in case the Sprint transaction does not close |

Son

| • | If the Sprint deal is not closed, actually, I always have Plan B, Plan C, and Plan D. When I make a move, I always have Plan B, Plan C, and Plan D. So if the Sprint deal falls apart, as a Plan B, maybe we could go after T-Mobile. That was what we discussed internally, just to examine the possibility before. But the prospect for the Sprint deal closing is getting better. So for now, I would like to focus our efforts on completing the Sprint deal. So of course, from time to time, we have studied the different options or possibilities. |

Question

| • | Making Clearwire a wholly-owned subsidiary of Sprint |

Son

| • | Of course, we should stay on alert. We should not be off guard. Anything could happen. Actually, we own 51 percent of Clearwire via Sprint, and major shareholders of Clearwire, such as Intel, Comcast and Bright House already have shown the support to Sprint. They said that regardless of the result of voting at the shareholders’ meeting, they will sell their stake in Clearwire to Sprint. This agreement is already in place, but if Dish successfully acquired more than 20 percent of Clearwire through tender offer, then Dish will obtain the right to nominate board members. Not only that, but also Dish raised the conditions or restrictions about the members of independent committees in Clearwire and Sprint. There are a lot of conditions Dish raised along with the tender offer announcement. Once all Dish’s conditions were accepted, that could hamper Sprint’s operation of Clearwire in a negative way, but earlier today, there was an official announcement to the effect that there was an agreement in place which is Clearwire’s board executives and Sprint executives will discontinue negotiations with Dish relating to the takeover bid. Clearwire and Sprint executives agreed that they will push forward the Sprint acquisition of Clearwire, and Clearwire’s special committee changed their recommendation to back the Sprint offer. So that is quite a change of course, and earlier at the Kansas court, the judge ordered to Dish about Dish’s request for nomination of board members or committee related matters – those requests from Dish could be a breach of the agreement signed by Sprint and SoftBank, and Sprint already sued Dish and Clearwire |

7

on the grounds that Dish’s proposal to Clearwire could be a breach of the existing agreement. And then the Kansas court judge said that Dish’s requests are not acceptable. So today is a big day, and today is a good day for me. Dish’s attempt on TOB was made. Even if Dish acquired 25 percent of Clearwire’s stake through a takeover bid, all other requests like the nomination of board members will not be accepted. If so, what is the point of Dish’s attempt of takeover? That could be the way Dish would see the judge’s comment at the Kansas court. So of course nothing can be ruled out, and the situation is still unpredictable, but from our viewpoint, the situation is in favor of us. |

Directors’ Speeches:

Ron Fisher

| • | Good morning, my name is Ron Fisher and I am responsible for the US activities for SoftBank. This last nine months has been an extremely exciting time for us in the United States as we have been preparing for closing the investment in Sprint. I agree with Son-san that we are in a very good position to move forward with the investment in Sprint. We expect a positive vote next week on the 25th and I think we will get a very strong majority vote for moving ahead with investment in Sprint. I also think that with Sprint’s latest agreement with the Clearwire board, that will come to a successful conclusion also over the next couple of weeks. This last nine months we have spent a lot of time between SoftBank and Sprint, getting to know each other, and preparing the plans to help make Sprint an extremely successful company. We now move forward into the implementation phase, and I think that over the next several years, we will create enormous shareholder value. I look forward to working with Son-san and the whole of the Sprint management team in order to make this an outstanding success for SoftBank. Thank you. |

Son

| • | Mr. Ron Fisher is with us for close to 30 years, I believe, and involved in our business managements in several investments in the US including not only Sprint and Clearwire but also Yahoo, Ziff-Davis, COMDEX; all those joint ventures, Microsoft, Cisco, Yahoo; and recently Google, Facebook – so there are several investments and partnerships made with those companies and all negotiations and any investment management are taken care of by Mr. Ron Fisher, and without him we will never be able to make that happen, including Alibaba itself. Mr. Ron Fisher has been more than a great right arm of mine in that area, and the Sprint transaction this time, without him, it never happened. After the completion of the transaction, I will be the chairman, he will be the vice-chair after the transaction completes for this, and he is going to keep taking that role. Thank you very much. |

8

Subscribers |

100m 97.10m

80m = SoftBank

NTT docomo

60m 61.54m

40m

20m

2006 ’07 ’08 ’09 ’10 ’11 ’12 (FY)

10

Operating Income |

= SoftBank

NTT

docomo

2005 ’06 ’07 ’08 ’09 ’10 ’11 ’12 ’13

Subscribers

= SoftBank

NTT

docomo

2006 ’07 ’08 ’09 ’10 ’11 ’12

Smartphone Call Connection Rate

= SoftBank

NTT

docomo

July 24, 2012 May 21, 2013

Surpassed NTT DOCOMO

Subscribers: The charts depict post-closing figures 13

Question 2 |

Why is SoftBank

Entering US Market?

57

Population |

320m

130m 2.5x

(Source) the State of the World Population 2012

58

GDP |

USD 15.1t

USD 5.9t 2.6x

(Source) The World Bank (2011 GDP)

59

Mobile Subscribers |

350m

140m 2.5x

2001 ’02 ’04 ’06 ’08 ’10 ’12

(Source) US: Wireless Intelligence, Japan : TCA

60

Common Technologies |

Smartphone

+

LTE

61

Announcement of

SoftBank / Sprint

Strategic Partnership

in October 2012

62

Mobile Revenue

JPY 3.3t

JPY 2.8t

JPY 2.5t JPY 2.5t

JPY2.4t

JPY 2.1t

JPY 1.9t

JPY 1.3t

Global No.3

=SoftBank + EM EMOBILE + WILLCOM + Sprint

China Mobile Verizon SoftBank + Sprint AT&T Vodafone NTT DOCOMO Deutsche Telekom KDDI

*USD 1 = JPY 78 (Oct. 2012)

*Revenue from January to June 2012

63

Subscribers

(m)

100 98.93m 97.10m

80

Verizon

60 NTT DOCOMO 61.54m

40

20

0

2006 ’07 ’08 ’09 ’10 ’11 ’12(FY)

=SoftBank + EM EMOBILE + WILLCOM + Sprint

Closing in on Verizon

*Verizon:Retail Connections

64

Question 3

Can you Give us

an Update on

Sprint Deal?

65

US Regulatory Reviews

U.S. SECURITIES AND EXCHANGE COMMISSION MCMXXXIV

U.S. Securities and Exchange Commissions

THE DEPARTMENT OF THE TREASURY 1789

Committee on Foreign Investment in the US

DEPARTMENT OF JUSTICE

QUI PRO DOMINA JUSTITIA SEQUITUR

Department of Justice

FEDERAL COMMUNICATIONS COMMISSION FCC USA

Federal Communications Commission

On Track to Obtain All Approvals

66

dish

Acquisition Proposal to the Sprint Special Committee

Abandoned

(June 18, 2013)

Big Step Towards Deal Closing

67

Clearwire Board Changed Recommendation

(June 20, 2013)

Support Sprint’s Offer

Discontinued

the negotiation with Dish

Major shareholders support Sprint

68

On Track for Deal Closing

in Early July 2013

=SoftBank

Sprint® TM

69

Question 4

Will the US Business

be Successful?

70

Confident in Success

vodafoneTM < Sprint® TM

71

Subscribers

(m)

vodafoneTM

45

Rapid growth

41.88m

30

Flat

15

0

2002 ’03 ’04

’05

’06 ’07 ’08 ’09 ’10

’11 ’12 (FY)

*Sum of SoftBank Mobile, WILLCOM and EMOBILE.

(m) Sprint TM

100

75

53.54m Already growing

50

25

0

2009 ’10 ’11 ’12 ’13 ’14 ’15 ’16 (FY)

*Sprint platform only.

72

Financials

Operating Income

(JPY bn)

500

400

JPY 467.8bn

vodafoneTM = SoftBank

Almost

300 in red

Turned around

200

100

0

2002 ’03 ’04 ’05 ’06 ’07 ’08 ’09 ’10 ’11 ’12 ‘:

EBITDA

(USD bn)

15

Sprint TM

10

5

0

Turning around

USD 5.2-5.5bn

’06

’07

’08

’09

’10

’11

’12

’13

’14

’15

’16

’17

’18

(FY)

(Forecast)

*Sprint: Adjusted OIBDA

73

Network

vodafoneTM

2GHz / 1.5GHz

No platinum band

Sprint TM

1.9GHz

850MHz

Platinum band

74

Handset Line-up

vodafoneTM

Limited

Sprint®TM

Affluent

75

vodafoneTM

At the Time of Acquisition

Sprint®TM

Flat

Almost in red

Not available

Limited

Subscribers

Financials

Platinum band

Handset line-up

Growing

Turning around

Available

Affluent

76

Moreover,

77

Planning Meetings

78

Maximizing Synergies

1. OPEX reduction

2. CAPEX efficiency

79

1. OPEX Reduction

Number of Smartphones Sold

(m)

28.8

26.9

26.5

13.3

8.5

Verizon AT&T SoftBank Sprint NTT DOCOMO KDDI

Economies of Scale with No.3 Position in Japan & US

*Actual results for FY2012.

Created by SoftBank Corp. based on respective companies’ publicly available information.

*The charts depict post-closing figures

80

1. OPEX Reduction

Network OPEX

IT Cost Reduction

Churn Improvement

Customer Care

81

EBITDA

SPRINT® TM

(USD bn)

15

10

5

0

USD 5.2 - 5.5bn

’06 ’07 ’08 ’09 ’10 ’11 ’12 ’13 ’14 ’15 ’16 ’17 (FY)

(Forecast)

Synergies in OPEX Reduction

FY2014 - 2017 (annual average)

+ Over USD 2bn

FY2017

+ Over USD 3bn

*EBITDA: Adjusted OIBDA

82

2. CAPEX Efficiency

Mobile CAPEX

$20.4

$11.9 (JPY 1.2t)

$10.8

$9.7

$8.9

$7.5

$3.4

China Mobile SoftBank Sprint AT&T Vodafone (consolidated) Verizon NTT DOCOMO KDDI

Economies of Scale with No.2 Position

*Actual results for FY2012.

Created by SoftBank Corp. based on respective companies’ publicly available information.

1USD = 100yen

*The charts depict post-closing figures

83

2. CAPEX Efficiency

Traffic Management

Core Capacity Build

BBU

TDD-LTE Technology

84

CAPEX

SPRINT ® TM

32-36%

CAPEX Efficiency through Synergies

Before synergies

After synergies

Total sum up to 2017

* SoftBank and Sprint will continue to manage their networks separately, except to the extent such joint management would occur in an arm’s length relationship between carriers

85

Mobile EBITDA Margin

SoftBank 50%

50% | ||||||||||

40% | 38% | |||||||||

30% | vodafone | |||||||||

20% | 27% | |||||||||

10% | ||||||||||

2002 | ’04 | ’06 | ’08 | ’10 | ’12 |

Sprint® TM

50% | ||||||||

40% | 37% | |||||||

30% | ||||||||

20% | ||||||||

10% | ||||||||

14% | ||||||||

2006 | ’08 | ’10 | ’12 |

Turnaround

86

Question 5

What is the Mid- and Long-term Target?

87

Announcement of

Next 30-Year Vision in 2010

To be Listed in the Global Top 10 Market Cap.

88

Market Cap. Global Ranking (all industries)

Rank | Company | JPY t | ||

1 | Exxon Mobile | 38.8 | ||

2 | Apple | 38.1 | ||

3 | 28.5 | |||

4 | Microsoft | 27.7 | ||

5 | Berkshire Hathaway | 26.9 | ||

6 | GE | 23.8 | ||

7 | Walmart | 23.4 | ||

8 | PetroChina | 22.9 | ||

9 | Johnson & Johnson | 22.9 | ||

10 | Chevron | 22.4 | ||

113 | SoftBank | 6.6 |

Global

113th

(Source) Bloomberg as of June 20, 2013

89

JPY 200t (+16%/year) | ||

Market Cap. | Global Top10 | |

(As of June 20, 2013) |

Accelerated

Progress

JPY 6.6t | (+20%/year) | |||

Global 113th | ||||

JPY 2.7t | ||||

JPY 0.2t | Global 217th | |||

Global 3,000th |

1994

(IPO)

June, 2010 June, 2013

2040

90

Q&A

= SoftBank

Reason for change of the investment amount in Sprint

Q&A

= SoftBank

Other option in case the Sprint transaction does not close

Q&A

= SoftBank

Making Clearwire a wholly-owned subsidiary of Sprint