UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

| | |

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR |

| | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number 1-3932

WHIRLPOOL CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | |

| Delaware | | 38-1490038 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | | | |

| 2000 North M-63 | | |

| Benton Harbor, | Michigan | | 49022-2692 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (269) 923-5000

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $1 per share | | WHR | | Chicago Stock Exchange | and | New York Stock Exchange |

| 0.625% Senior Notes due 2020 | | WHR 20 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

|

| | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | ☒ | No | ☐ |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. | Yes | ☐ | No | ☒ |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☒ | No | ☐ |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | ☒ | No | ☐ |

|

| | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | |

| (Check one) | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

| | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes | ☐ | No | ☒ |

The aggregate market value of voting common stock of the registrant held by stockholders not including voting stock held by directors and executive officers of the registrant and certain employee plans of the registrant (the exclusion of such shares shall not be deemed an admission by the registrant that any such person is an affiliate of the registrant) at the close of business on June 28, 2019 (the last business day of the registrant's most recently completed second fiscal quarter) was $8,803,220,412.

On February 7, 2020, the registrant had 62,780,513 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into the Part of the Form 10-K indicated: |

| |

| Document | Part of Form 10-K into which incorporated |

| The registrant's proxy statement for the 2020 annual meeting of stockholders (the "Proxy Statement") | Part III |

WHIRLPOOL CORPORATION

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2019

TABLE OF CONTENTS

|

| | |

| | | PAGE |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| |

| Item 15. | | |

| Item 16. | | |

| | | |

| |

|

| |

Our Company

More than 100 years of delivering value one moment at a time |

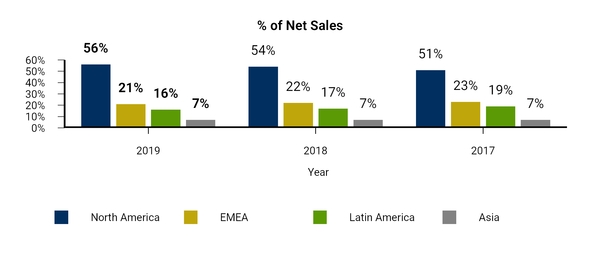

Whirlpool Corporation ("Whirlpool"), the world's leading major home appliance company, was incorporated in 1955 under the laws of Delaware and was founded in 1911. Whirlpool manufactures products in 13 countries and markets products in nearly every country around the world. We have received worldwide recognition for accomplishments in a variety of business and social efforts, including leadership, diversity, innovative product design, business ethics, social responsibility and community involvement. We conduct our business through four operating segments, which we define based on geography. Whirlpool Corporation's operating and reportable segments consist of North America, Europe, Middle East and Africa ("EMEA"), Latin America and Asia. Whirlpool had approximately $20 billion in annual sales and approximately 77,000 employees in 2019.

As used herein, and except where the context otherwise requires, "Whirlpool," "the Company," "we," "us," and "our" refer to Whirlpool Corporation and its consolidated subsidiaries. The world's leading major home appliance company claim is based on most recently available publicly reported annual revenues among leading appliance manufacturers.

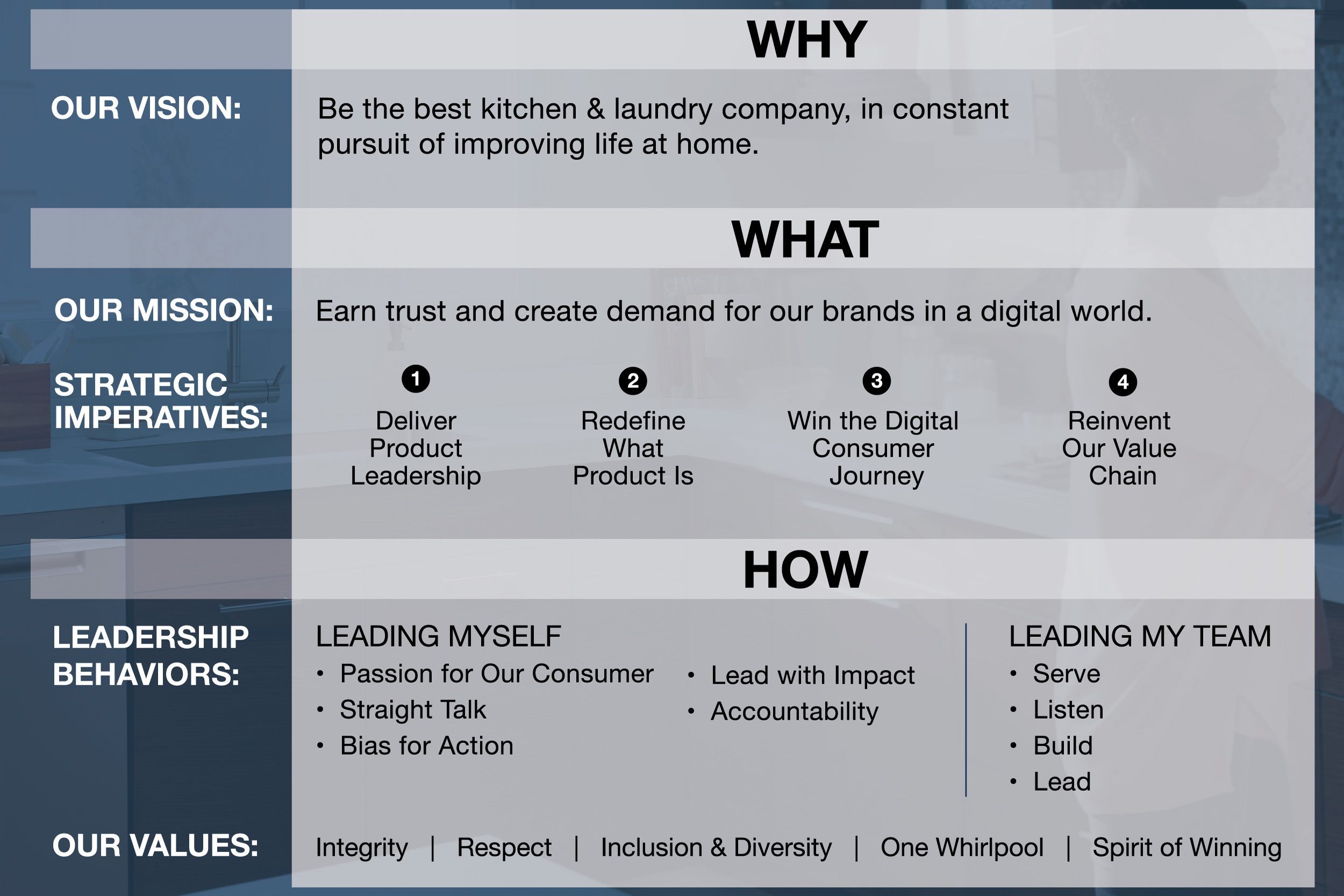

Our Strategic Architecture

Our strategic architecture is the foundational component that drives our shareholder value creation. Below are the key components of our strategic architecture.

Unique Global Position

Whirlpool Corporation is committed to delivering significant, long-term value to both our consumers and our shareholders. For consumers, we deliver value through innovative, high-quality products that solve everyday problems. For our shareholders, we seek to deliver differentiated value through our four strategic pillars: global leading scale, best brand portfolio, proven track record of innovation and best cost position.

|

| | | | | | | | | | | | | | | | | |

| Global Leading Scale | | Best Brand Portfolio | | Proven Track Record of Innovation | | Best Cost Position |

| | | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Global Leading Scale

We are the world's leading major home appliance company.

Our leading position includes a balance of developed countries and emerging markets. As demand recovers in key emerging markets, we believe we are well positioned to benefit and convert this demand into profitable growth.

Best Brand Portfolio

We have the best brand portfolio in the industry, including six brands with more than $1 billion in revenue.

We aim to position these desirable brands across many consumer segments. Our sales are led by our global brands, including Whirlpool and KitchenAid. Whirlpool is trusted throughout the world as a brand that delivers innovative care daily. Our KitchenAid brand brings a combination of innovation and design that inspires and fuels the passion of chefs, bakers and kitchen enthusiasts worldwide. These two brands are the backbone of our strategy to offer differentiated products that provide exceptional performance and desirable features while remaining affordable to consumers.

We also have a number of strong regional and local brands, including Maytag, Brastemp, Consul, Hotpoint*, Indesit, and Bauknecht. These brands add to our unmatched depth and breadth of appliance offerings and help us provide products that are tailored to local consumer needs and preferences.

Proven Track Record of Innovation

Whirlpool Corporation has been responsible for a number of first-to-market innovations. These include the first electric wringer washer in 1911, the first residential stand mixer in 1919, the first countertop microwave in 1967 and the first energy and water efficient top-load washer in 1998. We are proud of our legacy of innovation.

While we are proud of that legacy, we are also committed to innovating for a new generation of consumers. Our world-class innovation pipeline has accelerated over the last few years, driven by consistent innovation funding and a

passionate culture of employees focused on bringing new technologies to market. This year, we launched more than 100 new products throughout the world, and we are committed to further accelerating our pace of innovation.

As the shift to digital continues, consumers are beginning to desire connected appliances which fit seamlessly into the larger home ecosystem. We are excited to bring new connected products and technologies to market, including scan-to-cook and remote service diagnostics. Whether developed internally or with one of our many collaborators, we believe these digitally-enabled products and services will increasingly enhance the appliance experience for our consumers.

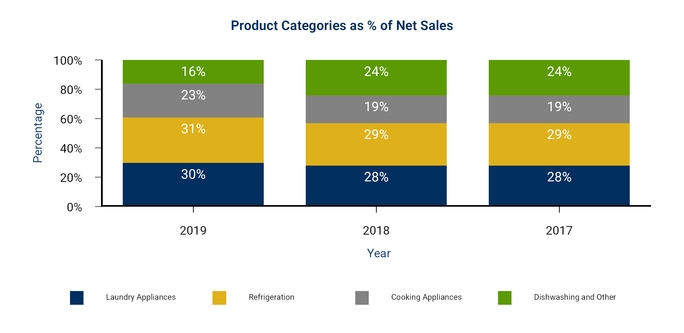

Whirlpool manufactures and markets a full line of major home appliances and related products. Our principal products are laundry appliances, refrigerators and freezers, cooking appliances, dishwashers, mixers and other small domestic appliances. Prior to the divestiture of our Embraco business on July 1, 2019, we also produced compressors for refrigeration systems. The following chart provides the percentage of net sales for each of our product categories which accounted for 10% or more of our consolidated net sales over the last three years:

Best Cost Position

As the number one major appliance manufacturer in the world, we have a cost benefit on everything we do based on scale, and are committed to a relentless focus on cost efficiency. Our global scale enables our local-for-local production model. We are focused on producing as efficiently as possible and at scale throughout the world.

As the global environment continues to change, we believe our strong capabilities for cost takeout allow us to effectively cope with macroeconomic challenges, and we see additional opportunities to further streamline our cost structure. For example, we are on a journey to reduce the complexity of our designs and product platforms. This initiative, among many others, will enable us to utilize increased modular production, improved scale in global procurement, and further streamline our day-to-day manufacturing operations.

We believe our cost position is clearly differentiated in the appliance industry and we are committed to even further improvement, creating strong levels of value for our shareholders, regardless of the external environment.

Value Creation Framework

Our long-term value creation framework is built upon the strong foundation we have in place: our industry-leading brand portfolio and robust product innovation pipeline, supported by our global operating platform and executed by our exceptional employees throughout the world. We measure these value-creation components by focusing on the following key metrics:

|

| | | | | | | | | | |

| | Profitable Growth | | | Margin Expansion | | | Cash Conversion |

| | | | | |

| | Innovation-fueled growth at or above the market | | | Drive cost and price/mix to grow profitability | | | Asset efficiency converts profitable growth to cash |

| | ~3% | | | ~10% | | | 6%+ |

| | Annual Organic Net Sales Growth | | | EBIT Margin

| | | FCF as % of Net Sales |

| | | | | | | | | | | |

Capital Allocation Strategy

We take a balanced approach to capital allocation by focusing on the following key metrics:

|

| |

| Fund the Business | Target |

| Capex / R&D | Capex: ~3% of net sales

R&D: ~3% of net sales |

| Mergers & Acquisitions | Opportunistic M&A with high ROIC threshold |

|

| |

| Return to Shareholders | Target |

| Dividends | ~30% of trailing 12-month ongoing net earnings |

| Share Repurchase | Continue repurchasing at a moderate level |

| Targeted Capital Structure | Maintain strong investment grade rating; Gross Debt/EBITDA of ~2.0 goal |

We remain confident in our ability to effectively manage our business through macroeconomic volatility and expect to continue delivering long-term value for our shareholders.

Regional Business Summary

|

| |

| North America |

• In the United States, we market and distribute major home appliances and small domestic appliances primarily under the Whirlpool, Maytag, KitchenAid, JennAir, Amana, Roper, Admiral, Affresh and Gladiator brand names primarily to retailers, distributors and builders.

• In Canada, we market and distribute major home appliances primarily under the Admiral, Whirlpool, Maytag, JennAir, Amana, Roper, Speed Queen and KitchenAid brand names.

• We sell some products to other manufacturers, distributors, and retailers for resale in North America under those manufacturers' and retailers' respective brand names. |

|

Europe, Middle East and Africa (EMEA) | • In Europe, we market and distribute our major home appliances primarily under the Whirlpool, Hotpoint*, Bauknecht, Indesit, Ignis, Maytag, Laden and Privileg brand names. We also market major home appliances and small domestic appliances under the KitchenAid brand name primarily to retailers and distributors.

• We market and distribute products under the Whirlpool, Bauknecht, Maytag, Indesit, Amana and Ignis brand names to distributors and dealers in Africa and the Middle East; we exited our commercial operations in Turkey in the second quarter of 2019.

• We also marketed and distributed a full line of products under the Whirlpool and KIC brand names in South Africa until we completed the sale of our business and KIC brand in the third quarter of 2019.

• In addition to our operations in Western and Eastern Europe, Turkey and Russia, we have a sales subsidiary in Morocco. |

|

| Latin America | • In Latin America, we produce, market and distribute our major home appliances and small domestic appliances primarily under the Consul, Brastemp, Whirlpool, KitchenAid and Acros brand names primarily to retailers, distributors and directly to consumers.

• We also serve the countries of Bolivia, Paraguay, Uruguay, Venezuela, and certain Caribbean and Central America countries, where we manage appliances sales and distribution through accredited distributors.

• In July 2019, our Latin America operations sold our compressors business to a third party. |

|

| Asia | • In Asia, we have organized the marketing and distribution of our major home appliances and small domestic appliances in multiple countries, primarily including China and India.

• We market and distribute our products in Asia primarily under the Whirlpool, Maytag, KitchenAid, Ariston, Indesit, Bauknecht, Sanyo, Diqua, and Royalstar brand names through a combination of direct sales to appliance retailers and chain stores and through full-service distributors to a large network of retail stores. As our rights to use the Sanyo brand name expired in the fourth quarter of 2019 (with a limited right to sell existing inventories until the second quarter of 2020), we are facilitating brand transition with investment to drive Whirlpool brand awareness in China. |

|

*Whirlpool ownership of the Hotpoint brand in the EMEA and Asia Pacific regions is not affiliated with the Hotpoint brand sold in the Americas.

Competition

Competition in the major home appliance industry is intense, including competitors such as Arcelik, BSH (Bosch), Electrolux, Haier, Kenmore, LG, Mabe, Midea, Panasonic and Samsung, many of which are increasingly expanding beyond their existing manufacturing footprint. The competitive environment includes the impact of a changing retail environment, including the shifting of consumer purchase practices towards e-commerce and other channels. Moreover, our customer base includes large, sophisticated trade customers who have many choices and demand competitive products, services and prices. We believe that we can best compete in the current environment by focusing on introducing new and innovative products, building strong brands, enhancing trade customer and consumer value with our product and service offerings, optimizing our regional footprint and trade distribution channels, increasing productivity, improving quality, lowering costs, and taking other efficiency-enhancing measures.

Seasonality

The Company's quarterly revenues have historically been affected by a variety of seasonal factors, including holiday-driven promotional periods. In each fiscal year, the Company's total revenue and operating margins are typically highest in the third and fourth quarter.

Raw Materials and Purchased Components

We are generally not dependent upon any one source for raw materials or purchased components essential to our business. In areas where a single supplier is used, alternative sources are generally available and can be developed within the normal manufacturing environment. Some supply disruptions and unanticipated costs may be incurred in transitioning to a new supplier if a prior single supplier relationship was abruptly interrupted or terminated. In the event of a disruption, we believe that we will be able to qualify and use alternate materials, sometimes at premium costs, and that such raw materials and components will be available in adequate quantities to meet forecasted production schedules.

Working Capital

In order to support business needs and customer requirements, the Company maintains adequate levels of working capital throughout the year using various inventory management techniques, including demand forecasting and planning. Please see the Financial Condition and Liquidity section of the “Management's Discussion and Analysis” section of this Annual Report on Form 10-K for additional information on our working capital requirements and processes.

Trademarks, Licenses and Patents

We consider the trademarks, copyrights, patents, and trade secrets we own, and the licenses we hold, in the aggregate, to be a valuable asset. Whirlpool is the owner of a number of trademarks in the United States and foreign countries. The most important trademarks to North America are Whirlpool, Maytag, JennAir, KitchenAid and Amana. The most important trademarks to EMEA are Whirlpool, KitchenAid, Bauknecht, Indesit, Hotpoint* and Ignis. The most important trademarks to Latin America are Consul, Brastemp, Whirlpool, KitchenAid and Acros. The most important trademarks to Asia are Whirlpool and Royalstar (which is licensed to us). We receive royalties from licensing our trademarks to third parties to manufacture, sell and service certain products bearing the Whirlpool, Maytag, KitchenAid and Amana brand names. We continually apply for and obtain patents globally. The primary purpose in obtaining patents is to protect our designs, technologies, products and services.

Protection of the Environment

Our manufacturing facilities are subject to numerous laws and regulations designed to protect or enhance the environment, many of which require federal, state, or other governmental licenses and permits with regard to wastewater discharges, air emissions, and hazardous waste management. Our policy is to comply with all such laws and regulations. Where laws and regulations are less restrictive, we have established and are following our own standards, consistent with our commitment to environmental responsibility.

*Whirlpool ownership of the Hotpoint brand in the EMEA and Asia Pacific regions is not affiliated with the Hotpoint brand sold in the Americas.

We believe that we are in compliance, in all material respects, with presently applicable governmental provisions relating to environmental protection in the countries in which we have manufacturing operations. Compliance with these environmental laws and regulations did not have a material effect on capital expenditures, earnings, or our competitive position during 2019 and is not expected to be material in 2020.

The entire major home appliance industry, including Whirlpool, must contend with the adoption of stricter government energy and environmental standards. These standards have been and continue to be phased in over the past several years and include the general phase-out of ozone-depleting chemicals used in refrigeration, and energy and related standards for selected major appliances, regulatory restrictions on the materials content specified for use in our products by some jurisdictions and mandated recycling of our products at the end of their useful lives. Compliance with these various standards, as they become effective, will require some product redesign. However, we believe, based on our understanding of the current state of proposed regulations, that we will be able to develop, manufacture, and market products that comply with these regulations.

Whirlpool participates in environmental assessments and cleanup at a number of locations globally. These include operating and non-operating facilities, previously owned properties and waste sites, including "Superfund" (under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA)) sites. However, based upon our evaluation of the facts and circumstances relating to these sites along with the evaluation of our technical consultants, we do not presently anticipate any material adverse effect on our financial statements arising out of the resolution of these matters or the resolution of any other known governmental proceeding regarding environmental protection matters.

Other Information

For information about the challenges and risks associated with our foreign operations, see "Risk Factors" under Item 1A.

Whirlpool is a major supplier of laundry, refrigeration, cooking and dishwasher home appliances to Lowe's, a North American retailer. Net sales attributable to Lowe's in 2019, 2018 and 2017, were approximately 13%, 12% and 10%, respectively, of our consolidated net sales. Lowe's also represented approximately 14% of our consolidated accounts receivable as of December 31, 2019. The Company did not have any customer with accounts receivable of more than 10% of consolidated accounts receivable as of December 31, 2018. See Note 16 to the Consolidated Financial Statements.

For information on our global restructuring plans, and the impact of these plans on our operating segments, see Note 14 to the Consolidated Financial Statements.

Information About Our Executive Officers

The following table sets forth the names and ages of our executive officers on February 11, 2020, the positions and offices they held on that date, and the year they first became executive officers:

|

| | | | | | |

| Name | | Office | | First Became an Executive Officer | | Age |

| Marc R. Bitzer | | Chairman of the Board, President and Chief Executive Officer | | 2006 | | 55 |

| James W. Peters | | Executive Vice President and Chief Financial Officer | | 2016 | | 50 |

| João C. Brega | | Executive Vice President and President, Whirlpool Latin America | | 2012 | | 56 |

| Joseph T. Liotine | | Executive Vice President and President, Whirlpool North America | | 2014 | | 47 |

| Gilles Morel | | Executive Vice President and President, Whirlpool Europe, Middle East & Africa | | 2019 | | 54 |

| Shengpo (Samuel) Wu | | Executive Vice President and President, Whirlpool Asia | | 2019 | | 53 |

The executive officers named above were elected by our Board of Directors to serve in the office indicated until the first meeting of the Board of Directors following the annual meeting of stockholders in 2020 and until a successor is chosen and qualified or until the executive officer's earlier resignation or removal. Each of our executive officers has held the position set forth in the table above or has served Whirlpool in various executive or administrative capacities for at least the past five years, except for Mr. Wu and Mr. Morel. Prior to joining Whirlpool in February 2017, Mr. Wu for the previous five years served as President and Chief Executive Officer, Asia Pacific, of Osram GmbH, and before

joining Osram in 2012, worked for Honeywell Process Solutions and General Electric in various leadership roles. Prior to joining Whirlpool in April 2019, Mr. Morel served for two years as CEO of Northern and Central Europe for Groupe Savencia. Prior to that, he worked for 27 years at Mars Inc. in various leadership positions, most recently as Regional President, Europe & Eurasia for Mars Chocolate.

Available Information

Financial results and investor information (including Whirlpool's Form 10-K, 10-Q, and 8-K reports) are accessible at Whirlpool's website: investors.whirlpoolcorp.com. Copies of our Form 10-K, 10-Q, and 8-K reports and amendments, if any, are available free of charge through our website on the same day they are filed with, or furnished to, the Securities and Exchange Commission.

We routinely post important information for investors on our website, whirlpoolcorp.com, in the "Investors" section. We also intend to update the Hot Topics Q&A portion of this webpage as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document.

This report contains statements referring to Whirlpool that are not historical facts and are considered "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which are intended to take advantage of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, are based on current projections about operations, industry conditions, financial condition and liquidity. Words that identify forward-looking statements include words such as "may," "could," "will," "should," "possible," "plan," "predict," "forecast," "potential," "anticipate," "estimate," "expect," "project," "intend," "believe," "may impact," "on track," and words and terms of similar substance used in connection with any discussion of future operating or financial performance, an acquisition or merger, or our businesses. In addition, any statements that refer to expectations, projections, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Those statements are not guarantees and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results could differ materially and adversely from these forward-looking statements.

We have listed below what we believe to be the most significant strategic, operational, financial, and legal and compliance risks relating to our business.

STRATEGIC RISKS

We face intense competition in the major home appliance industry and failure to successfully compete could negatively affect our business and financial performance.

Each of our operating segments operates in a highly competitive business environment and faces intense competition from a growing number of competitors, many of which have strong consumer brand equity. Several of these competitors, such as those set forth in the Business section of this annual report, are large, well-established companies, ranking among the Global Fortune 150. We also face competition that may be able to quickly adapt to changing consumer preferences, particularly in the connected appliance space. Moreover, our customer base includes large, sophisticated trade customers who have many choices and demand competitive products, services and prices, and which may in the future merge, consolidate, form alliances or further increase their relative purchasing scale. Competition in the global appliance industry is based on a number of factors including selling price, product features and design, consumer taste, performance, innovation, reputation, energy efficiency, service, quality, cost, distribution, and financial incentives, such as promotional funds, sales incentives, volume rebates and terms. Many of our competitors are increasingly expanding beyond their existing manufacturing footprints. Our competitors, especially global competitors with low-cost sources of supply and/or highly protected home countries outside the United States, have aggressively priced their products and/or introduced new products to increase market share and expand into new geographies. Many of our competitors have established and may expand their presence in the rapidly changing retail environment, including the shifting of consumer purchasing practices towards e-commerce

and other channels, and the introduction of direct-to-consumer sales models. If we are unable to successfully compete in this highly competitive environment, our business and financial performance could be negatively affected.

The loss of, or substantial decline in, volume of sales to any of our key trade customers, major buying groups, and/or builders could adversely affect our financial performance.

We sell to a sophisticated customer base of large trade customers, including Lowe's and other large domestic and international trade customers, that have significant leverage as buyers over their suppliers. Most of our products are not sold through long-term contracts, allowing trade customers to change volume among suppliers. As the trade customers continue to become larger through merger, consolidation or organic growth, they may seek to use their position to improve their profitability by various means, including improved efficiency, lower pricing, and increased promotional programs. If we are unable to meet their demand requirements, our volume growth and financial results could be negatively affected. We also continue to pursue direct-to-consumer sales in the U.S. and certain other countries, which may impact our relationships with existing trade customers. The loss or substantial decline in volume of sales to our key trade customers, major buying groups, builders, or any other trade customers to which we sell a significant amount of products, could adversely affect our financial performance. Additionally, the loss of market share or financial difficulties, including bankruptcy and financial restructuring, by these trade customers could have a material adverse effect on our financial statements.

Failure to maintain our reputation and brand image could negatively impact our business.

Our brands have worldwide recognition, and our success depends on our ability to maintain and enhance our brand image and reputation. Maintaining, promoting and growing our brands depends on our marketing efforts, including advertising and consumer campaigns, as well as product innovation. We could be adversely impacted if we fail to achieve any of these objectives or if, whether or not justified, the reputation or image of our company or any of our brands is tarnished or receives negative publicity. In addition, adverse publicity about regulatory or legal action against us, product safety, data privacy breaches or quality issues, or negative association with any one brand could damage our reputation and brand image, undermine our customers' confidence in us and reduce long-term demand for our products, even if the regulatory or legal action is unfounded or not material to our operations.

In addition, our success in maintaining, extending and expanding our brand image depends on our ability to adapt to a rapidly changing media environment, including an ever-increasing reliance on social media and online dissemination of advertising campaigns. Inaccurate or negative posts or comments about us on social networking and other websites that spread rapidly through such forums could seriously damage our reputation and brand image. If we do not maintain, extend and expand our brand image, then our financial statements could be materially and adversely affected.

An inability to effectively execute and manage our business objectives could adversely affect our financial performance.

The highly competitive nature of our industry requires that we effectively execute and manage our business objectives including our global operating platform initiative. Our global operating platform initiative aims to reduce costs, expand margins, drive productivity and quality improvements, accelerate our rate of innovation, generate free cash flow and drive shareholder value. An inability to effectively control costs and drive productivity improvements could affect our profitability. In addition, an inability to provide high-quality, innovative products could adversely affect our ability to maintain or increase our sales, which could negatively affect our revenues and overall financial performance. Additionally, our success is dependent on anticipating and appropriately reacting to changes in customer preferences, including the shifting of consumer purchasing practices towards e-commerce, direct-to-consumer and other channels, and on successful new product development, including in the connected appliance space, and process development and product relaunches in response to such changes. Our future results and our ability to maintain or improve our competitive position will depend on our capacity to gauge the direction of our key product categories and geographic regions and upon our ability to successfully and timely identify, develop, manufacture, market, and sell new or improved products in these changing environments.

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products, services and brands.

We consider our intellectual property rights, including patents, trademarks, copyrights and trade secrets, and the licenses we hold, to be a significant part and valuable aspect of our business. We attempt to protect our intellectual property rights through a combination of patent, trademark, copyright and trade secret laws, as well as licensing agreements and third party nondisclosure and assignment agreements. Our failure to obtain protection for or adequately protect our trademarks, products, new features of our products, or our processes may diminish our competitiveness.

We have applied for intellectual property protection in the United States and other jurisdictions with respect to certain innovations and new products, design patents, product features, and processes. We cannot be assured that the U.S. Patent and Trademark Office or any similar authority in other jurisdictions will approve any of our patent applications. Additionally, the patents we own could be challenged or invalidated, others could design around our patents or the patents may not be of sufficient scope or strength to provide us with any meaningful protection or commercial advantage. Further, the laws of certain foreign countries in which we do business, or contemplate doing business in the future, do not recognize intellectual property rights or protect them to the same extent as United States law. As a result, these factors could weaken our competitive advantage with respect to our products, services, and brands in foreign jurisdictions, which could adversely affect our financial performance.

Moreover, while we do not believe that any of our products infringe on enforceable intellectual property rights of third parties, others may assert intellectual property rights that cover some of our technology, brands, products, or services. Any litigation regarding patents or other intellectual property could be costly and time-consuming and could divert the attention of our management and key personnel from our business operations. Claims of intellectual property infringement might also require us to enter into costly license agreements or modify our products or services. We also may be subject to significant damages, injunctions against development and sale of certain products or services, or limited in the use of our brands.

OPERATIONAL RISKS

We face risks associated with our acquisitions and other investments and risks associated with our increased presence in emerging markets.

From time to time, we make strategic acquisitions or divestitures, investments and participate in joint ventures. For example, we acquired Indesit and a majority interest in Hefei Sanyo in 2014, and we sold our Embraco compressor business in 2019. These transactions, and other transactions that we have entered into or which we may enter into in the future, can involve significant challenges and risks, including that the transaction does not advance our business strategy or fails to produce a satisfactory return on our investment. We may encounter difficulties in integrating acquisitions with our operations, applying our internal control processes to these acquisitions, managing strategic investments, and in overseeing the operations, systems and controls of acquired companies. Integrating acquisitions and carving out divestitures is often costly and may require significant attention from management. Furthermore, we may not realize the degree, or timing, of benefits we anticipate when we first enter into a transaction. While our evaluation of any potential transaction includes business, legal and financial due diligence with the goal of identifying and evaluating the material risks involved, our due diligence reviews may not identify all of the issues necessary to accurately estimate the cost and potential loss contingencies of a particular transaction, including potential exposure to regulatory sanctions resulting from an acquisition target's previous activities or costs associated with any quality issues with an acquisition target's legacy products. In addition, liabilities may be retained by Whirlpool when closing a facility, divesting an entity or selling physical assets, and such liabilities may be material.

Our growth plans include efforts to increase revenue from emerging markets, including through acquisitions. Local business practices in these countries may not comply with U.S. laws, local laws or other laws applicable to us or our compliance policies, which non-compliant practices may result in increased liability risks. For example, we may incur unanticipated costs, expenses or other liabilities as a result of an acquisition target's violation of applicable laws, such as the U.S. Foreign Corrupt Practices Act (FCPA) or similar worldwide anti-bribery laws in non-U.S. jurisdictions. We may incur unanticipated costs or expenses, including post-closing asset impairment charges, expenses associated with eliminating duplicate facilities, litigation, and other liabilities. In addition, our recent and future acquisitions may increase our exposure to other risks associated with operating internationally, including foreign currency exchange rate fluctuations; political, legal and economic instability; inflation; changes in tax rates and tax laws; and work stoppages and labor relations.

Risks associated with our international operations may decrease our revenues and increase our costs.

For the year ended December 31, 2019, sales outside our North America region represent approximately 44% of our net sales. We expect that international sales will continue to account for a significant percentage of our net sales. Accordingly, we face numerous risks associated with conducting international operations, any of which could negatively affect our financial performance. These risks include the following:

| |

| • | Political, legal, and economic instability and uncertainty |

| |

| • | Foreign currency exchange rate fluctuations |

| |

| • | Changes in foreign tax rules, regulations and other requirements, such as changes in tax rates and statutory and judicial interpretations of tax laws |

| |

| • | Changes in diplomatic and trade relationships, including sanctions resulting from the current political situation in countries in which we do business |

| |

| • | Inflation and/or deflation |

| |

| • | Changes in foreign country regulatory requirements, including data privacy laws |

| |

| • | Various import/export restrictions and disruptions and the availability of required import/export licenses |

| |

| • | Imposition of tariffs and other trade barriers |

| |

| • | Managing widespread operations and enforcing internal policies and procedures such as compliance with U.S. and foreign anti-bribery, anti-corruption regulations and anti-money laundering, such as the FCPA, and antitrust laws |

| |

| • | Labor disputes and work stoppages at our operations and suppliers |

| |

| • | Government price controls |

| |

| • | Trade customer insolvency and the inability to collect accounts receivable |

| |

| • | Limitations on the repatriation or movement of earnings and cash |

As a U.S. corporation, we are subject to the FCPA, which may place us at a competitive disadvantage to foreign companies that are not subject to similar regulations. Additionally, any determination that we have violated the FCPA or other anti-corruption laws could have a material adverse effect on us.

Terrorist attacks, cyber events, armed conflicts, civil unrest, natural disasters, governmental actions and epidemics (including but not limited to the recent coronavirus outbreak originating in China) could affect our domestic and international sales, disrupt our supply chain, and impair our ability to produce and deliver our products. Such events could directly impact our physical facilities or those of our suppliers or customers.

We may be subject to information technology system failures, network disruptions, cybersecurity attacks and breaches in data security, which may materially adversely affect our operations, financial condition and operating results.

We depend on information technology to improve the effectiveness of our operations and to interface with our customers, consumers and employees, as well as to maintain financial accuracy and efficiency. In addition, we collect, store, have access to and otherwise process certain confidential or sensitive data, including proprietary business information, personal data or other information that is subject to privacy and security laws, regulations and/or customer-imposed controls. Our business processes and data sharing across functions, suppliers, and vendors is dependent on information technology integration. The failure of any systems, whether internal or third-party, during normal operation, system upgrades, implementations, or connections, could disrupt our operations by causing transaction errors, processing inefficiencies, delays or cancellation of customer orders, the loss of customers, impediments to the manufacture or shipment of products, other financial and business disruptions, or the loss of or damage to intellectual property and the personally identifiable data of consumers and employees.

In addition, we have outsourced certain information technology support services and administrative functions, such as system application maintenance and certain benefit plan administration functions, to third-party service providers and may outsource other functions in the future to achieve cost savings and efficiencies. If these service providers do not perform effectively, we may not achieve the expected cost savings and may incur additional costs to correct errors made by such service providers. Depending on the function involved, such errors may also lead to business disruption, processing inefficiencies or the loss of or damage to intellectual property and personally identifiable information through system compromise, or harm employee morale.

Our information systems, or those of our third-party service providers, have been in the past and could be in the future impacted by inappropriate or mistaken activity of parties intent on extracting or corrupting information or disrupting business processes. Such unauthorized access could disrupt our business and could result in the loss of assets. Cyber attacks are becoming more sophisticated and include malicious software, attempts to gain unauthorized access to data, and other electronic security breaches that could lead to disruptions in critical systems, unauthorized release of confidential or otherwise protected information, and corruption of data. Our growth in the areas of connected appliances and the "Internet of Things" has increased these risks. These events could impact our customers, consumers, employees, third-parties and reputation and lead to financial losses from remediation actions, loss of business or potential liability or an increase in expense, all of which may have a material adverse effect on our financial statements.

Product-related liability or product recall costs could adversely affect our business and financial performance.

We have been and may be exposed to product-related liabilities, which in some instances may result in product redesigns, product recalls, or other corrective action. In addition, any claim, product recall or other corrective action that results in significant adverse publicity, particularly if those claims or recalls cause customers to question the safety or reliability of our products, may negatively affect our financial statements. We maintain product liability insurance, but it may not be adequate to cover losses related to product liability claims brought against us. Product liability insurance could become more expensive and difficult to maintain and may not be available on commercially reasonable terms, if at all. We may be involved in class action litigation for which we generally have not purchased insurance, and may be involved in certain other product recalls or other litigations or events for which insurance products may have limitations.

We regularly engage in investigations of potential quality and safety issues as part of our ongoing effort to deliver quality products to our customers. We are currently investigating certain potential quality and safety issues globally, and as appropriate, we undertake to effect repair or replacement of appliances in the event that an investigation leads to the conclusion that such action is warranted. Actual costs of these and any future issues depend upon several factors, including the number of consumers who respond to a particular recall, repair and administrative costs, whether the cost of any corrective action is borne by us or the supplier, and, if borne by us, whether we will be successful in recovering our costs from the supplier. The actual costs incurred as a result of these issues and any future issues could have a material adverse effect on our financial statements.

The ability of suppliers to deliver parts, components and manufacturing equipment to our manufacturing facilities, and our ability to manufacture without disruption, could affect our global business performance.

We use a wide range of materials and components in the global production of our products, which come from numerous suppliers around the world. Because not all of our business arrangements provide for guaranteed supply and some key parts may be available only from a single supplier or a limited group of suppliers, we are subject to supply and pricing risk. In addition, certain proprietary component parts used in some of our products are provided by single-source unaffiliated third-party suppliers. We would be unable to obtain these proprietary components for an indeterminate period of time if these single-source suppliers were to cease or interrupt production or otherwise fail to supply these components to us, which could adversely affect our product sales and operating results. Our operations and those of our suppliers are subject to disruption for a variety of reasons, including work stoppages, labor relations, intellectual property claims against suppliers, financial issues such as supplier bankruptcy, information technology failures, and hazards such as fire, earthquakes, flooding, or other natural disasters. Insurance for certain disruptions may not be available, affordable or adequate. Such disruption could interrupt our ability to manufacture certain products. Any significant disruption could negatively impact our financial statements.

Our ability to attract, develop and retain executives and other qualified employees is crucial to our results of operations and future growth.

We depend upon the continued services and performance of our key executives, senior management and skilled personnel, particularly professionals with experience in our business and operations and the home appliance industry. We cannot be sure that any of these individuals will continue to be employed by us. In the case of talent losses, significant time is required to hire, develop and train skilled replacement personnel. An inability to hire, develop, transfer retained knowledge, engage and retain a sufficient number of qualified employees could materially hinder our business by, for example, delaying our ability to bring new products to market or impairing the success of our operations.

A deterioration in labor relations could adversely impact our global business.

As of December 31, 2019, we had approximately 77,000 employees. We are subject to separate collective bargaining agreements with certain labor unions, as well as various other commitments regarding our workforce. We periodically negotiate with certain unions representing our employees and may be subject to work stoppages or may be unable to renew collective bargaining agreements on the same or similar terms, or at all. In addition, our global restructuring activities have in the past and may in the future be received negatively by governments and unions, and may attract negative media attention, which may delay the implementation of such plans. A deterioration in labor relations may have a material adverse effect on our financial statements.

FINANCIAL RISKS

Fluctuations and volatility in the cost of raw materials and purchased components could adversely affect our operating results.

The sources and prices of the primary materials (such as steel, resins, and base metals) used to manufacture our products and components containing those materials are susceptible to significant global and regional price fluctuations due to supply/demand trends, transportation costs, labor costs, government regulations and tariffs, changes in currency exchange rates, price controls, the economic climate, and other unforeseen circumstances. For example, we experienced continued inflation in raw materials and certain manufactured components during 2019, which negatively impacted our operating results. In addition, we enter into commodity swap contracts to hedge the price risk associated with certain commodities purchases. Significant increases in materials costs and other costs now and in the future could have a material adverse effect on our financial statements.

Foreign currency fluctuations may affect our financial performance.

We generate a significant portion of our revenue and incur a significant portion of our expenses in foreign currencies. Changes in the exchange rates of functional currencies of those operations affect the U.S. dollar value of our revenue and earnings from our foreign operations. We use currency forwards, net investment hedges, and options to manage our foreign currency transaction exposures. We cannot completely eliminate our exposure to foreign currency fluctuations, which may adversely affect our financial performance. In addition, because our consolidated financial results are reported in U.S. dollars, if we generate sales or earnings in other currencies, the translation of those results into U.S. dollars can result in a significant increase or decrease in the amount of those sales or earnings. Finally, the amount of legal contingencies related to foreign operations may fluctuate significantly based upon changes in exchange rates and usually cannot be managed with currency forwards, options or other arrangements. Such fluctuations in exchange rates can significantly increase or decrease the amount of any legal contingency related to our foreign operations and make it difficult to assess and manage the potential exposure.

Goodwill and indefinite-lived intangible asset impairment charges may adversely affect our operating results.

We have a substantial amount of goodwill and indefinite-lived intangible assets, primarily trademarks, on our balance sheet. We test the goodwill and intangible assets for impairment on an annual basis and when events occur or circumstances change that indicate that the fair value of the reporting unit or intangible asset may be below its carrying amount. Fair value determinations require considerable judgment and are sensitive to inherent uncertainties and changes in estimates and assumptions regarding revenue growth rates, EBIT margins, capital expenditures, working capital requirements, tax rates, terminal growth rates, discount rates, royalty rates, benefits associated with a taxable transaction and synergies available to market participants. Declines in market conditions, a trend of weaker

than anticipated financial performance for our reporting units or declines in projected revenue for our trademarks, a decline in our share price for a sustained period of time, an increase in the market-based weighted average cost of capital or a decrease in royalty rates, among other factors, are indicators that the carrying value of our goodwill or indefinite-life intangible assets may not be recoverable. We may be required to record a goodwill or intangible asset impairment charge that, if incurred, could have a material adverse effect on our financial statements.

Impairment of long-lived assets may adversely affect our operating results.

Our long-lived asset groups are subject to an impairment assessment when certain triggering events or circumstances indicate that their carrying value may be impaired. If the carrying value exceeds our estimate of future undiscounted cash flows of the operations related to the asset group, an impairment is recorded for the difference between the carrying amount and the fair value of the asset group. The results of these tests for potential impairment may be adversely affected by unfavorable market conditions, our financial performance trends, or an increase in interest rates, among other factors. If as a result of the impairment test we determine that the fair value of any of our long-lived asset groups is less than its carrying amount, we may incur an impairment charge that could have a material adverse effect on our financial statements.

We face inventory valuation risk.

We write down product and component inventories that have become obsolete or do not meet anticipated demand or net realizable value. No assurance can be given that, given the unpredictable pace of product obsolescence and business conditions with trade customers and in general, we will not incur additional inventory related charges. Such charges could negatively affect our financial statements.

We are exposed to risks associated with the uncertain global economy.

The current domestic and international political and economic environment are posing challenges to the industry in which we operate. A number of economic factors, including gross domestic product, availability of consumer credit, interest rates, consumer sentiment and debt levels, retail trends, housing starts, sales of existing homes, the level of mortgage refinancing and defaults, fiscal and credit market uncertainty, and foreign currency exchange rates, currency controls, inflation and deflation, generally affect demand for our products in the U.S. and other countries which we operate.

Economic uncertainty and related factors exacerbate negative trends in business and consumer spending and may cause certain customers to push out, cancel, or refrain from placing orders for our products. Uncertain market conditions, difficulties in obtaining capital, or reduced profitability may also cause some customers to scale back operations, exit markets, merge with other retailers, or file for bankruptcy protection and potentially cease operations, which can also result in lower sales and/or additional inventory. These conditions may similarly affect key suppliers, which could impair their ability to deliver parts and result in delays for our products or added costs. In addition, these conditions may lead to strategic alliances by, or consolidation of, other appliance manufacturers, which could adversely affect our ability to compete effectively.

A decline in economic activity and conditions in certain areas in which we operate have had an adverse effect on our financial condition and results of operations in recent years, and future declines and adverse conditions could have a similar adverse effect. Regional, political and economic instability in countries in which we do business may adversely affect business conditions, disrupt our operations, and have an adverse effect on our financial condition and results of operations. For example, the effect of the UK's exit from the European Union, or Brexit, remains unclear and could adversely impact certain areas of our business, including, but not limited to, an increase in duties and delays in the delivery of products, and adverse impacts to our suppliers and financing institutions.

Uncertainty about future economic and industry conditions also makes it more challenging for us to forecast our operating results, make business decisions, and identify and prioritize the risks that may affect our businesses, sources and uses of cash, financial condition and results of operations. We may be required to implement additional cost reduction efforts, including restructuring activities, which may adversely affect our ability to capitalize on opportunities in a market recovery. In addition, our operations are subject to general credit, liquidity, foreign exchange, market and interest rate risks. Our ability to invest in our businesses, fund strategic acquisitions and refinance maturing debt obligations depends in part on access to the capital markets.

If we do not timely and appropriately adapt to changes resulting from the uncertain macroeconomic environment and industry conditions, or to difficulties in the financial markets, or if we are unable to continue to access the capital markets, our financial statements may be materially and adversely affected.

Significant differences between actual results and estimates of the amount of future funding for our pension plans and postretirement health care benefit programs, and significant changes in funding assumptions or significant increases in funding obligations due to regulatory changes, could adversely affect our financial results.

We have both funded and unfunded defined benefit pension plans that cover certain employees around the world. We also have unfunded postretirement health care benefit plans for eligible retired employees. The Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code, as amended, govern the funding obligations for our U.S. pension plans, which are our principal pension plans. Our U.S. defined benefit plans were frozen on or before December 31, 2006 for substantially all participants. Since 2007, U.S. employees have been eligible for an enhanced employer contribution under Whirlpool's defined contribution (401(k)) plan.

As of December 31, 2019, our projected benefit obligations under our pension plans and postretirement health and welfare benefit programs exceeded the fair value of plan assets by an aggregate of approximately $0.9 billion, including $0.5 billion of which was attributable to pension plans and $0.4 billion of which was attributable to postretirement health care benefits. Estimates for the amount and timing of the future funding obligations of these pension plans and postretirement health and welfare benefit plans are based on various assumptions, including discount rates, expected long-term rate of return on plan assets, life expectancies and health care cost trend rates. These assumptions are subject to change based on changes in interest rates on high quality bonds, stock and bond market returns, health care cost trend rates and regulatory changes, all of which are largely outside our control. Significant differences in results or significant changes in assumptions may materially affect our postretirement obligations and related future contributions and expenses.

Changes in the method of determining the London Interbank Offered Rate, or LIBOR, or the replacement of LIBOR with an alternative reference rate, may adversely affect our financial condition and results of operations.

Certain of our financial obligations and instruments are or may be made at variable interest rates that use LIBOR (or metrics derived from or related to LIBOR) as a benchmark. On July 27, 2017, the United Kingdom's Financial Conduct Authority announced that it intends to stop persuading or compelling banks to submit LIBOR rates after 2021. It is expected that most, if not all, banks currently reporting information to set LIBOR will stop doing so at such time, which could either cause LIBOR publication to stop immediately or cause LIBOR's regulator to announce the discontinuation of its publication (and, during any such transition period, LIBOR may perform differently than in the past).

These reforms may also result in new methods of calculating LIBOR to be established, or alternative reference rates to be established. For example, in the U.S., a group convened by the Federal Reserve Board and the Federal Reserve Bank of New York, called the Alternative Reference Rate Committee ("ARRC") and comprised of a diverse set of private sector entities, has identified the Secured Overnight Financing Rate (or "SOFR") as its preferred alternative rate for the U.S. LIBOR and the Federal Reserve Bank of New York has begun publishing SOFR daily, and central banks in several other jurisdictions have also announced plans for alternative reference rates for other currencies. The potential consequences of these changes cannot be fully predicted and could have an adverse impact on the market value for LIBOR-linked securities, loans, and other financial obligations or extensions of credit held by or due to us, and could adversely affect our financial statements. Changes in market interest rates may influence our financing costs, returns on financial investments and the valuation of derivative contracts and could reduce our earnings and cash flows. In addition, any transaction process may involve, among other things, increased volatility or illiquidity in markets for instruments that rely on LIBOR, reductions in the value of certain instruments, mismatches between rates in hedging documentation and in the documentation for the underlying obligation being hedged, increased borrowing costs, uncertainty under applicable documentation, and/or difficult and costly consent processes.

LEGAL & COMPLIANCE RISKS

Unfavorable results of legal and regulatory proceedings could materially adversely affect our business and financial condition and performance.

We are subject to a variety of litigation and legal compliance risks relating to, among other things: products; intellectual property rights; income and indirect taxes; environmental matters; corporate matters; commercial matters; credit matters; competition laws; distribution, marketing and trade practice matters; anti–bribery and anti–corruption regulations; energy regulations; data privacy regulations; financial regulations; and employment and benefit matters. For example, we are currently disputing certain income and indirect tax related assessments issued by the Brazilian authorities (see Note 8 and Note 15 to the Consolidated Financial Statements for additional information on these matters). Unfavorable outcomes regarding these assessments could have a material adverse effect on our financial statements in any particular reporting period. Results of legal and regulatory proceedings cannot be predicted with certainty and for some matters, such as class actions, no insurance is cost-effectively available. Regardless of merit, legal and regulatory proceedings may be both time-consuming and disruptive to our operations and could divert the attention of our management and key personnel from our business operations. Such proceedings could also generate significant adverse publicity and have a negative impact on our reputation and brand image, regardless of the existence or amount of liability. We estimate loss contingencies and establish accruals as required by generally accepted accounting principles, based on our assessment of contingencies where liability is deemed probable and reasonably estimable, in light of the facts and circumstances known to us at a particular point in time. Subsequent developments in legal proceedings, volatility in foreign currency exchange rates and other factors may affect our assessment and estimates of the loss contingency recorded and could result in an adverse effect on our results of operations in the period in which a liability would be recognized or cash flows for the period in which amounts would be paid. Actual results may significantly vary from our reserves.

We are subject to, and could be further subject to, governmental investigations or actions by other third parties.

We are subject to various federal, foreign and state laws, including antitrust and product-related laws and regulations, violations of which can involve civil or criminal sanctions. Responding to governmental investigations or other actions may be both time-consuming and disruptive to our operations and could divert the attention of our management and key personnel from our business operations. The impact of these and other investigations and lawsuits could have a material adverse effect on our financial statements.

Changes in the legal and regulatory environment, including data privacy, potential climate regulations and changes in taxes and tariffs, could limit our business activities, increase our operating costs, reduce demand for our products or result in litigation.

The conduct of our businesses, and the production, distribution, sale, advertising, labeling, safety, transportation and use of many of our products, are subject to various laws and regulations administered by federal, state and local governmental agencies in the United States, as well as to foreign laws and regulations administered by government entities and agencies in countries in which we operate. In addition, we operate in an environment in which there are different and potentially conflicting data privacy and data access laws in effect in the various U.S. states and foreign jurisdictions in which we operate and we must understand and comply with each law and standard in each of these jurisdictions while ensuring the data is secure. These laws and regulations may change, sometimes dramatically, as a result of political, economic or social events. Changes in laws, regulations or governmental policy and the related interpretations may alter the environment in which we do business and may impact our results or increase our costs or liabilities.

In addition, we incur and will continue to incur capital and other expenditures to comply with various laws and regulations, especially relating to the protection of the environment, human health and safety, and water and energy efficiency. Climate change regulations at the federal, state or local level or in international jurisdictions could require us to limit emissions, change our manufacturing processes or product offerings, or undertake other costly activities. There is also increased focus by governmental and non-governmental entities on sustainability matters. We have set rigorous science-based targets for greenhouse gas reductions and related sustainability goals, and any failure to achieve our sustainability goals or reduce our impact on the environment, any changes in the scientific or governmental metrics utilized to objectively measure success, or the perception that we have failed to act responsibly regarding climate change could result in negative publicity and adversely affect our business and reputation.

Additionally, we could be subjected to future liabilities, fines or penalties or the suspension of product production for failing to comply with various laws and regulations, including environmental regulations. Cleanup obligations that might arise at any of our manufacturing sites or the imposition of more stringent environmental laws in the future could also adversely affect us.

Additionally, as a global company based in the United States, we are exposed to the impact of U.S. tax changes, especially those that affect the effective corporate income tax rate. In addition, the current domestic and international political environment, including government shutdowns and changes to U.S. policies related to global trade and tariffs, has resulted in uncertainty surrounding the future state of the global economy. The U.S. federal government may propose additional changes to international trade agreements, tariffs, taxes, and other government rules and regulations. These regulatory changes could significantly impact our business and financial performance. For additional information about our consolidated tax provision, see Note 15 to the Consolidated Financial Statements, and for additional information about global trade and tariffs, please see "Other Matters" in the Management's Discussion and Analysis section of this Annual Report on Form 10-K.

|

| |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Our principal executive offices are located in Benton Harbor, Michigan. On December 31, 2019, our principal manufacturing operations were carried on at 36 locations in 13 countries worldwide. We occupied a total of approximately 82.4 million square feet devoted to manufacturing, service, sales and administrative offices, warehouse and distribution space. Over 44.3 million square feet of such space was occupied under lease. Whirlpool properties include facilities which are suitable and adequate for the manufacture and distribution of Whirlpool's products.

The Company's principal manufacturing sites by operating segment were as follows:

|

| | | | |

| Operating Segment | North America | Europe, Middle East and Africa | Latin America | Asia |

| Manufacturing Locations | 10 | 12 | 9 | 5 |

Information regarding legal proceedings can be found in Note 8 to the Consolidated Financial Statements and is incorporated herein by reference.

|

| |

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

|

| |

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Whirlpool's common stock is listed on the New York Stock Exchange and the Chicago Stock Exchange under the ticker symbol WHR. As of February 7, 2020, the number of holders of record of Whirlpool common stock was approximately 8,760.

On July 25, 2017, our Board of Directors authorized an additional share repurchase program of up to $2 billion. For the year ended December 31, 2019, we repurchased 1,043,121 shares at an aggregate purchase price of approximately $148 million under this program. At December 31, 2019, there were approximately $652 million in remaining funds authorized under this program.

Share repurchases are made from time to time on the open market as conditions warrant. These programs do not obligate us to repurchase any of our shares and they have no expiration date.

The following table summarizes repurchases of Whirlpool's common stock in the three months ended December 31, 2019:

|

| | | | | | | | | |

| Period (Millions of dollars, except number and price per share) | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans |

| October 1, 2019 through October 31, 2019 | 35,000 |

| $ | 158.53 | 35,000 |

| $ | 694 |

|

| November 1, 2019 through November 30, 2019 | 184,000 |

| | 149.61 | 184,000 |

| 667 |

|

| December 1, 2019 through December 31, 2019 | 105,700 |

| | 145.38 | 105,700 |

| $ | 652 |

|

| Total | 324,700 |

| $ | 149.19 | 324,700 |

| |

|

| |

| ITEM 6. | SELECTED FINANCIAL DATA |

FIVE-YEAR SELECTED FINANCIAL DATA

|

| | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars, except share and employee data) | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| CONSOLIDATED OPERATIONS | | | | | | | | | | |

| Net sales | | $ | 20,419 |

| | $ | 21,037 |

| | $ | 21,253 |

| | $ | 20,718 |

| | $ | 20,891 |

|

| Restructuring costs | | 188 |

| | 247 |

| | 275 |

| | 173 |

| | 201 |

|

| Impairment of goodwill and other intangibles | | — |

| | 747 |

| | — |

| | — |

| | — |

|

| (Gain) loss on sale and disposal of businesses | | (437 | ) | | — |

| | — |

| | — |

| | — |

|

| Depreciation and amortization | | 587 |

| | 645 |

| | 654 |

| | 655 |

| | 668 |

|

| Operating profit | | 1,571 |

| | 279 |

| | 1,136 |

| | 1,368 |

| | 1,242 |

|

| Earnings (loss) before income taxes | | 1,552 |

| | (21 | ) | | 887 |

| | 1,114 |

| | 1,031 |

|

| Net earnings (loss) | | 1,198 |

| | (159 | ) | | 337 |

| | 928 |

| | 822 |

|

| Net earnings (loss) available to Whirlpool | | 1,184 |

| | (183 | ) | | 350 |

| | 888 |

| | 783 |

|

| Capital expenditures | | 532 |

| | 590 |

| | 684 |

| | 660 |

| | 689 |

|

| Dividends paid | | 305 |

| | 306 |

| | 312 |

| | 294 |

| | 269 |

|

| Repurchase of common stock | | 148 |

| | 1,153 |

| | 750 |

| | 525 |

| | 250 |

|

| CONSOLIDATED FINANCIAL POSITION | | | | | | | | | | |

| Current assets | | $ | 7,398 |

| | $ | 7,898 |

| | $ | 7,930 |

| | $ | 7,339 |

| | $ | 7,325 |

|

| Current liabilities | | 8,369 |

| | 9,678 |

| | 8,505 |

| | 7,662 |

| | 7,744 |

|

| Accounts receivable, inventories and accounts payable, net | | 89 |

| | 256 |

| | 856 |

| | 918 |

| | 746 |

|

| Property, net | | 3,301 |

| | 3,414 |

| | 4,033 |

| | 3,810 |

| | 3,774 |

|

Total assets(1) | | 18,881 |

| | 18,347 |

| | 20,038 |

| | 19,153 |

| | 19,010 |

|

| Long-term debt | | 4,140 |

| | 4,046 |

| | 4,392 |

| | 3,876 |

| | 3,470 |

|

Total debt(2) | | 4,993 |

| | 6,027 |

| | 5,218 |

| | 4,470 |

| | 3,998 |

|

| Whirlpool stockholders' equity | | 3,195 |

| | 2,291 |

| | 4,198 |

| | 4,773 |

| | 4,743 |

|

| PER SHARE DATA | | | | | | | | | | |

| Basic net earnings (loss) available to Whirlpool | | $ | 18.60 |

| | $ | (2.72 | ) | | $ | 4.78 |

| | $ | 11.67 |

| | $ | 9.95 |

|

| Diluted net earnings (loss) available to Whirlpool | | 18.45 |

| | (2.72 | ) | | 4.70 |

| | 11.50 |

| | 9.83 |

|

| Dividends | | 4.75 |

| | 4.55 |

| | 4.30 |

| | 3.90 |

| | 3.45 |

|

Book value(3) | | 49.77 |

| | 34.08 |

| | 56.42 |

| | 61.82 |

| | 59.54 |

|

| Closing Stock Price—NYSE | | 147.53 |

| | 106.87 |

| | 168.64 |

| | 181.77 |

| | 146.87 |

|

| KEY RATIOS | | | | | | | | | | |

| Operating profit margin | | 7.7 | % | | 1.3 | % | | 5.3 | % | | 6.6 | % | | 5.9 | % |

Pre-tax margin(4) | | 7.6 | % | | (0.1 | )% | | 4.2 | % | | 5.4 | % | | 4.9 | % |

Net margin(5) | | 5.8 | % | | (0.9 | )% | | 1.6 | % | | 4.3 | % | | 3.7 | % |

Return on average Whirlpool stockholders' equity(6) | | 43.2 | % | | (5.6 | )% | | 7.8 | % | | 18.7 | % | | 16.3 | % |

Return on average total assets(7) | | 6.4 | % | | (1.0 | )% | | 1.8 | % | | 4.7 | % | | 4.0 | % |

| Current assets to current liabilities | | 0.9 |

| | 0.8 |

| | 0.9 |

| | 1.0 |

| | 0.9 |

|

Total debt as a percent of invested capital(8) | | 54.8 | % | | 65.3 | % | | 50.4 | % | | 43.8 | % | | 41.2 | % |

Price earnings ratio(9) | | 8.0 |

| | (39.3 | ) | | 35.9 |

| | 15.8 |

| | 14.9 |

|

| OTHER DATA | | | | | | | | | | |

| Common shares outstanding (in thousands): | | | | | | | | | | |

| Average number - on a diluted basis | | 64,199 |

| | 67,225 |

| | 74,400 |

| | 77,211 |

| | 79,667 |

|

| Year-end common shares outstanding | | 62,894 |

| | 63,528 |

| | 70,646 |

| | 74,465 |

| | 77,221 |

|

| Year-end number of stockholders | | 8,804 |

| | 9,248 |

| | 9,960 |

| | 10,528 |

| | 10,663 |

|

| Year-end number of employees | | 77,000 |