UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 10-Q

_____________________

(Mark One) | ||

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2022

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from ___________ to ___________ |

Commission File Number: 000-29959

_______________

Cassava Sciences, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 91-1911336 | ||

(State or other jurisdiction of | (I.R.S. Employer | ||

incorporation or organization) | Identification Number) |

6801 N. Capital of Texas Highway, Building 1; Suite 300, Austin, TX 78731

(512) 501-2444

(Address, including zip code, of registrant’s principal executive offices and

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

0 | ||||

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, $0.001 par value |

| SAVA |

| Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer þ | Accelerated Filer ¨ | |

Non-accelerated Filer ¨ | Smaller Reporting Company ¨ | |

Emerging Growth Company ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Stock, $0.001 par value | 40,068,890 | ||

Shares Outstanding as of November 4, 2022 |

CASSAVA SCIENCES, INC.

TABLE OF CONTENTS

Page No. | ||||

PART I. | FINANCIAL INFORMATION | |||

Item 1. | Financial Statements | |||

Condensed Consolidated Balance Sheets – September 30, 2022 and December 31, 2021 | 3 | |||

4 | ||||

5 | ||||

Condensed Consolidated Statements of Cash Flows – Nine Months Ended September 30, 2022 and 2021 | 6 | |||

7 | ||||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 | ||

Item 3. | 35 | |||

Item 4. | 35 | |||

PART II. | OTHER INFORMATION | |||

Item 1. | 35 | |||

Item 1A | 36 | |||

Item 2. | 37 | |||

Item 3. | 37 | |||

Item 4. | 37 | |||

Item 5. | 37 | |||

Item 6. | 38 | |||

39 | ||||

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CASSAVA SCIENCES, INC. | |||||

CONDENSED CONSOLIDATED BALANCE SHEETS | |||||

(Unaudited, in thousands, except share and par value data) | |||||

September 30, | December 31, | ||||

2022 | 2021 | ||||

ASSETS | |||||

Current assets: | |||||

Cash and cash equivalents | $ | 174,662 | $ | 233,437 | |

Prepaid expenses and other current assets | 8,610 | 11,045 | |||

Total current assets | 183,272 | 244,482 | |||

Operating lease right-of-use assets | 144 | 210 | |||

Property and equipment, net | 23,130 | 20,616 | |||

Intangible assets, net | 740 | 1,075 | |||

Other assets | — | 399 | |||

Total assets | $ | 207,286 | $ | 266,782 | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||

Current liabilities: | |||||

Accounts payable | $ | 3,534 | $ | 7,126 | |

Accrued development expense | 4,096 | 2,803 | |||

Accrued compensation and benefits | 160 | 1,877 | |||

Operating lease liabilities, current | 102 | 97 | |||

Other current liabilities | 416 | 631 | |||

Total current liabilities | 8,308 | 12,534 | |||

Operating lease liabilities, non-current | 62 | 139 | |||

Other non-current liabilities | 197 | 194 | |||

Total liabilities | 8,567 | 12,867 | |||

Commitments and contingencies (Notes 9, 10 and 11) |

|

| |||

Stockholders' equity: | |||||

Preferred stock, $0.001 par value; 10,000,000 shares authorized, none issued and outstanding | — | — | |||

Common stock, $0.001 par value; 120,000,000 shares authorized; 40,059,514 and 40,016,792 shares issued and outstanding at September 30, 2022 and December 31, 2021, respectively | 40 | 40 | |||

Additional paid-in capital | 463,097 | 461,181 | |||

Accumulated deficit | (264,418) | (207,306) | |||

Total stockholders' equity | 198,719 | 253,915 | |||

Total liabilities and stockholders' equity | $ | 207,286 | $ | 266,782 | |

See accompanying notes to condensed consolidated financial statements.

Enstivity

CASSAVA SCIENCES, INC. | |||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||

(Unaudited, in thousands, except per share data) | |||||||||||||

Three months ended | Nine months ended | ||||||||||||

September 30, | September 30, | ||||||||||||

2022 | 2021 | 2022 | 2021 | ||||||||||

Operating expenses: | |||||||||||||

Research and development, net of grant reimbursement | $ | 18,526 | $ | 8,041 | $ | 50,380 | $ | 14,471 | |||||

General and administrative | 2,819 | 1,712 | 8,703 | 3,953 | |||||||||

Total operating expenses | 21,345 | 9,753 | 59,083 | 18,424 | |||||||||

Operating loss | (21,345) | (9,753) | (59,083) | (18,424) | |||||||||

Interest income | 878 | 15 | 1,223 | 35 | |||||||||

Other income, net | 210 | 176 | 748 | 176 | |||||||||

Net loss | $ | (20,257) | $ | (9,562) | $ | (57,112) | $ | (18,213) | |||||

Net loss per share, basic and diluted | $ | (0.51) | $ | (0.24) | $ | (1.43) | $ | (0.46) | |||||

Shares used in computing net loss per share, basic and diluted | 40,050 | 39,957 | 40,009 | 39,218 | |||||||||

See accompanying notes to condensed consolidated financial statements.

CASSAVA SCIENCES, INC. | |||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY | |||||||||||||

(Unaudited, in thousands, except share data) | |||||||||||||

Total | |||||||||||||

Common stock | Additional | Accumulated | stockholders' | ||||||||||

Shares | Par value | paid-in capital | deficit | equity | |||||||||

Balance at December 31, 2020 | 35,237,987 | $ | 35 | $ | 267,086 | $ | (174,921) | $ | 92,200 | ||||

Stock-based compensation for: | |||||||||||||

Stock options for employees | — | — | 249 | — | 249 | ||||||||

Stock options for non-employees | — | — | 1 | — | 1 | ||||||||

Issuance of common stock pursuant to exercise of stock options | 554,019 | 1 | 691 | — | 692 | ||||||||

Issuance of common stock pursuant to exercise of warrants | 135,015 | — | 1,746 | — | 1,746 | ||||||||

Common stock issued in conjunction with registered direct offering, net of issuance costs | 4,081,633 | 4 | 189,821 | — | 189,825 | ||||||||

Net loss | — | — | — | (3,526) | (3,526) | ||||||||

Balance at March 31, 2021 | 40,008,654 | $ | 40 | $ | 459,594 | $ | (178,447) | $ | 281,187 | ||||

Stock-based compensation for: | |||||||||||||

Stock options for employees | — | — | 410 | — | 410 | ||||||||

Stock options for non-employees | — | — | 5 | — | 5 | ||||||||

Issuance of common stock pursuant to exercise of stock options | 3,240 | — | 3 | — | 3 | ||||||||

Net loss | — | — | — | (5,125) | (5,125) | ||||||||

Balance at June 30, 2021 | 40,011,894 | $ | 40 | $ | 460,012 | $ | (183,572) | $ | 276,480 | ||||

Stock-based compensation for: | |||||||||||||

Stock options for employees | — | — | 548 | — | 548 | ||||||||

Stock options for non-employees | — | — | 24 | — | 24 | ||||||||

Issuance of common stock pursuant to exercise of stock options | 4,898 | — | 75 | — | 75 | ||||||||

Net loss | — | — | — | (9,562) | (9,562) | ||||||||

Balance at September 30, 2021 | 40,016,792 | $ | 40 | $ | 460,659 | $ | (193,134) | $ | 267,565 | ||||

Balance at December 31, 2021 | 40,016,792 | $ | 40 | $ | 461,181 | $ | (207,306) | $ | 253,915 | ||||

Stock-based compensation for: | |||||||||||||

Stock options for employees | — | — | 471 | — | 471 | ||||||||

Stock options for non-employees | — | — | 24 | — | 24 | ||||||||

Issuance of common stock pursuant to exercise of stock options | 14,488 | — | 211 | — | 211 | ||||||||

Net loss | — | — | — | (17,527) | (17,527) | ||||||||

Balance at March 31, 2022 | 40,031,280 | $ | 40 | $ | 461,887 | $ | (224,833) | $ | 237,094 | ||||

Stock-based compensation for: | |||||||||||||

Stock options for employees | — | — | 462 | — | 462 | ||||||||

Stock options for non-employees | — | — | 23 | — | 23 | ||||||||

Issuance of common stock pursuant to exercise of stock options | 66,637 | — | 119 | — | 119 | ||||||||

Net loss | — | — | — | (19,328) | (19,328) | ||||||||

Balance at June 30, 2022 | 40,097,917 | $ | 40 | $ | 462,491 | $ | (244,161) | $ | 218,370 | ||||

Stock-based compensation for: | |||||||||||||

Stock options for employees | — | — | 447 | — | 447 | ||||||||

Stock options for non-employees | — | — | 23 | — | 23 | ||||||||

Expiration of restricted stock Performance Awards | (57,143) | — | — | — | — | ||||||||

Issuance of common stock pursuant to exercise of stock options | 18,740 | — | 136 | — | 136 | ||||||||

Net loss | — | — | — | (20,257) | (20,257) | ||||||||

Balance at September 30, 2022 | 40,059,514 | $ | 40 | $ | 463,097 | $ | (264,418) | $ | 198,719 | ||||

See accompanying notes to condensed consolidated financial statements.

CASSAVA SCIENCES, INC. | |||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||

(Unaudited, in thousands) | |||||

Nine months ended September 30, | |||||

2022 | 2021 | ||||

Cash flows from operating activities: | |||||

Net loss | $ | (57,112) | $ | (18,213) | |

Adjustments to reconcile net loss to net cash used in operating activities: | |||||

Stock-based compensation | 1,450 | 1,237 | |||

Depreciation | 533 | 131 | |||

Amortization of intangible assets | 379 | 90 | |||

Changes in operating assets and liabilities: | |||||

Prepaid and other assets | 2,790 | (10,102) | |||

Operating lease right-of-use assets and liabilities | (6) | 30 | |||

Accounts payable | (3,592) | 1,434 | |||

Accrued development expense | 1,293 | 2,532 | |||

Accrued compensation and benefits | (1,717) | 43 | |||

Other liabilities | (212) | 609 | |||

Net cash used in operating activities | (56,194) | (22,209) | |||

Cash flows from investing activities: | |||||

Purchase of property and equipment | (3,047) | (22,114) | |||

Net cash used in investing activities | (3,047) | (22,114) | |||

Cash flows from financing activities: | |||||

Proceeds from issuance of common stock upon exercise of stock options | 466 | 1,824 | |||

Proceeds from issuance of common stock upon exercise of common stock warrants | — | 692 | |||

Proceeds from common stock offering, net of issuance costs | — | 189,825 | |||

Net cash provided by financing activities | 466 | 192,341 | |||

Net (decrease) increase in cash and cash equivalents | (58,775) | 148,018 | |||

Cash and cash equivalents at beginning of period | 233,437 | 93,506 | |||

Cash and cash equivalents at end of period | $ | 174,662 | $ | 241,524 | |

See accompanying notes to condensed consolidated financial statements.

Cassava Sciences, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1. General and Liquidity

Cassava Sciences, Inc. and its wholly-owned subsidiary (collectively referred to as the “Company”) discover and develop proprietary pharmaceutical product candidates that may offer significant improvements to patients and healthcare professionals. The Company generally focuses its discovery and product development efforts on disorders of the nervous system.

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and pursuant to the instructions to the Quarterly Report on Form 10-Q and Article 10 of Regulation S-X. All intercompany transactions and balances have been eliminated in consolidation. Accordingly, the condensed consolidated financial statements do not include all of the information and footnotes required by GAAP for complete consolidated financial statements. In the opinion of management of the Company, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation have been included. Operating results for the three and nine months ended September 30, 2022 are not necessarily indicative of the results that may be expected for the year 2022. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

Coronavirus Disease 2019 (COVID-19)

The widespread outbreak of a novel infectious disease called Coronavirus Disease 2019, or COVID-19, and the impact of the omicron and other variants and subvariants of this disease, has not significantly impacted the Company’s operations or financial condition as of November 7, 2022. We believe certain investigational clinical study sites that are involved, or potentially would like to be involved, with our clinical programs may be experiencing lingering, pandemic-related after-effects, such as staffing shortages, operational gaps or other adverse circumstances. Also, this pandemic has created a dynamic and uncertain situation in the national economy. The Company continues to closely monitor the latest information to make timely, informed business decisions and public disclosures regarding the potential impact of pandemic on its operations and financial condition. The scope of pandemic is unprecedented, and its long-term impact on the Company’s operations and financial condition cannot be reasonably estimated at this time.

Liquidity

The Company has incurred significant net losses and negative cash flows since inception, and as a result has an accumulated deficit of $264.4 million at September 30, 2022. The Company expects its cash requirements to be significant in the future. The amount and timing of the Company’s future cash requirements will depend on regulatory and market acceptance of its product candidates and the resources it devotes to researching and developing, formulating, manufacturing, commercializing and supporting its products. The Company may seek additional funding through public or private financing in the future, if such funding is available and on terms acceptable to the Company. There are no assurances that additional financing will be available on favorable terms, or at all. However, management believes that the current working capital position will be sufficient to meet the Company’s working capital needs for at least the next 12 months.

Note 2. Significant Accounting Policies

Use of Estimates

The Company makes estimates and assumptions in preparing its condensed consolidated financial statements in conformity with GAAP. These estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amount of revenue earned and expenses incurred during the reporting period. The Company evaluates its estimates on an ongoing basis, including those estimates related to manufacturing agreements and research collaborations. Actual results could differ from these estimates and assumptions.

Cash and Cash Equivalents and Concentration of Credit Risk

The Company invests in cash and cash equivalents. The Company considers highly liquid financial instruments with original maturities of three months or less to be cash equivalents. Highly liquid investments that are considered cash equivalents include money market accounts and funds, certificates of deposit, and U.S. Treasury securities. The Company maintains its cash and cash equivalents at one financial institution.

Fair Value Measurements

The Company recognizes financial instruments in accordance with the authoritative guidance on fair value measurements and disclosures for financial assets and liabilities. This guidance defines fair value, establishes a framework for measuring fair value in accordance with GAAP, and expands disclosures about fair value measurements. The guidance also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include:

Level 1 includes quoted prices in active markets.

Level 2 includes significant observable inputs, such as quoted prices for identical or similar securities, or other inputs that are observable and can be corroborated by observable market data for similar securities. The Company uses market pricing and other observable market inputs obtained from third-party providers. It uses the bid price to establish fair value where a bid price is available. The Company does not have any financial instruments where the fair value is based on Level 2 inputs.

Level 3 includes unobservable inputs that are supported by little or no market activity. The Company does not have any financial instruments where the fair value is based on Level 3 inputs.

If a financial instrument uses inputs that fall in different levels of the hierarchy, the instrument will be categorized based upon the lowest level of input that is significant to the fair value calculation. The fair value of cash and cash equivalents was based on Level 1 inputs at September 30, 2022 and December 31, 2021.

Business Segments

The Company reports segment information based on how it internally evaluates the operating performance of its business units, or segments. The Company’s operations are confined to one business segment: the development of novel drugs and diagnostics.

Proceeds from Grants

During the three months ended September 30, 2022 and 2021, the Company received reimbursements totaling $0.4 million and $2.0 million pursuant to National Institutes of Health (“NIH”) research grants, respectively. During the nine months ended September 30, 2022 and 2021, the Company received reimbursements totaling $0.9 million and $3.5 million pursuant to NIH research grants, respectively. The Company records the proceeds from these grants as reductions to its research and development expenses.

Stock-based Compensation

The Company recognizes non-cash expense for the fair value of all stock options and other share-based awards. The Company uses the Black-Scholes option valuation model (“Black-Scholes”) to calculate the fair value of stock options, using the single-option award approach and straight-line attribution method. This model requires the input of subjective assumptions including expected stock price volatility, expected life and estimated forfeitures of each award. These assumptions consist of estimates of future market conditions, which are inherently uncertain, and therefore, are subject to management's judgment. For all options granted, it recognizes the resulting fair value as expense on a straight-line basis over the vesting period of each respective stock option, generally four years.

The Company has granted share-based awards that vest upon achievement of certain performance criteria (“Performance Awards”). The Company multiplies the number of Performance Awards by the fair value of its common stock on the date of grant to calculate the fair value of each award. It estimates an implicit service period for achieving performance criteria for each award. The Company recognizes the resulting fair value as expense over the implicit

service period when it concludes that achieving the performance criteria is probable. It periodically reviews and updates as appropriate its estimates of implicit service periods and conclusions on achieving the performance criteria. Performance Awards vest and common stock is issued upon achievement of the performance criteria.

Net Loss per Share

The Company computes basic net loss per share on the basis of the weighted-average number of common shares outstanding for the reporting period. Diluted net loss per share is computed on the basis of the weighted-average number of common shares outstanding plus potential dilutive common shares outstanding using the treasury-stock method. Potential dilutive common shares consist of outstanding common stock options. There is no difference between the Company’s net loss and comprehensive loss. The numerators and denominators in the calculation of basic and diluted net loss per share were as follows (in thousands, except net loss per share data):

Three months ended | Nine months ended | ||||||||||

September 30, | September 30, | ||||||||||

2022 | 2021 | 2022 | 2021 | ||||||||

Numerator: | |||||||||||

Net loss | $ | (20,257) | $ | (9,562) | $ | (57,112) | $ | (18,213) | |||

Denominator: | |||||||||||

Shares used in computing net loss per share, basic and diluted | 40,050 | 39,957 | 40,009 | 39,218 | |||||||

Net loss per share, basic and diluted | $ | (0.51) | $ | (0.24) | $ | (1.43) | $ | (0.46) | |||

Dilutive common stock options excluded from net loss per share, diluted | 1,946 | 2,350 | 2,064 | 2,219 | |||||||

The Company excluded common stock options outstanding, along with 57,143 restricted stock awards, from the calculation of net loss per share, diluted, because the effect of including outstanding options and warrants would have been anti-dilutive. The 57,143 restricted stock awards expired during the nine months ended September 30, 2022.

Fair Value of Financial Instruments

Financial instruments include accounts payable and accrued liabilities. The estimated fair value of certain financial instruments may be determined using available market information or other appropriate valuation methodologies. However, considerable judgment is required in interpreting market data to develop estimates of fair value; therefore, the estimates are not necessarily indicative of the amounts that could be realized or would be paid in a current market exchange. The effect of using different market assumptions and/or estimation methodologies may be material to the estimated fair value amounts. The carrying amounts of accounts payable and accrued liabilities are at cost, which approximates fair value due to the short maturity of those instruments.

Research Contract Costs and Accruals

The Company has entered into various research and development contracts with research institutions and other third-party vendors. These agreements are generally cancelable. Related payments are recorded as research and development expenses as incurred. The Company records accruals for estimated ongoing research costs. When evaluating the adequacy of the accrued liabilities, the Company analyzes progress of the studies including the phase or completion of events, invoices received and contracted costs. Significant judgments and estimates are made in determining the accrued balances at the end of any reporting period. Actual results could differ from the Company’s estimates. The Company’s historical accrual estimates have not been materially different from actual costs.

Incentive Bonus Plan

In 2020, the Company established the 2020 Cash Incentive Bonus Plan (the “Plan”) to incentivize Plan participants. Awards under the Plan are accounted for as liability awards under Accounting Standards Codification (ASC) 718 “Stock-based Compensation”. The fair value of each potential Plan award will be determined once a grant date occurs and will be remeasured each reporting period. Compensation expense associated with the Plan will be recognized over the expected achievement period for each Plan award, when a Performance Condition (as defined below) is considered probable of being met. See Note 10 for further discussion of the Plan.

Leases

The Company recognizes assets and liabilities that arise from leases. For operating leases, the Company is required to recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments during the lease term, in the condensed consolidated balance sheets. The Company elected the short-term lease recognition exemption for all leases that qualify. This means, for those leases that qualify, the Company does not recognize right-of-use assets or lease liabilities. As the Company`s leases do not provide an implicit rate, it uses its incremental borrowing rate based on the information available at the commencement date in determining the present value of lease payments. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

Property and equipment

Property and equipment is recorded at cost, net of accumulated depreciation. Depreciation is recorded using the straight-line method over the estimated useful lives of the assets. Owned buildings and related improvements have estimated useful lives of 39 years and approximately 10 years, respectively. Tenant improvements related to leased space are amortized using the straight-line method over the useful lives of the improvements or the remaining term of the corresponding leases, whichever is shorter. The remaining term of the corresponding leases is approximately 1.6 years.

Property and equipment are reviewed for impairment when events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. If property and equipment are considered to be impaired, an impairment loss is recognized.

Intangible assets

Acquired intangible assets are recorded at fair value at the date of acquisition and primarily consist of lease-in-place agreements and leasing commissions. Intangible assets are amortized over the estimated life of the lease-in-place agreements, which is approximately 1.5 years at September 30, 2022.

Intangible assets are reviewed for impairment on an annual basis, and when there is reason to believe that their values have been diminished or impaired. If intangible assets are considered to be impaired, an impairment loss is recognized.

Income Taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax balances are adjusted to reflect tax rates based on currently enacted tax laws, which will be in effect in the years in which the temporary differences are expected to reverse. The Company has accumulated significant deferred tax assets that reflect the tax effects of net operating loss and tax credit carryovers and temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Realization of certain deferred tax assets is dependent upon future earnings. The Company is uncertain about the timing and amount of any future earnings. Accordingly, the Company offsets these deferred tax assets with a valuation allowance.

The Company accounts for uncertain tax positions in accordance with ASC 740, “Income Taxes”, which clarifies the accounting for uncertainty in tax positions. These provisions require recognition of the impact of a tax position in the Company’s condensed consolidated financial statements only if that position is more likely than not of being sustained upon examination by taxing authorities, based on the technical merits of the position. Any interest and penalties related to uncertain tax positions will be reflected as a component of income tax expense.

Note 3. Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets at September 30, 2022 and December 31, 2021 consisted of the following (in thousands):

September 30, | December 31, | ||||

2022 | 2021 | ||||

Prepaid insurance | $ | 1,308 | $ | 662 | |

Contract research organization and other deposits | 7,223 | 10,330 | |||

Other | 79 | 53 | |||

Total prepaid expenses and other current assets | $ | 8,610 | $ | 11,045 | |

Note 4. Real Property Acquisition

On August 4, 2021, the Company completed the all-cash purchase of a two-building office complex in Austin, Texas, a portion of which serves as its corporate headquarters. This property is intended to accommodate the Company’s anticipated growth and expansion of its operations in the coming years. Maintenance, physical facilities, leasing, property management and other key responsibilities related to property ownership are being outsourced to professional real-estate managers. The purchase price of the property was $22.0 million, including transaction costs. The office complex measures approximately 90,000 rentable square feet. At September 30, 2022, the property was over 60% leased. The Company also occupies approximately 25% of the property. The seller was a third party not affiliated with the Company.

The purchase was accounted for as an asset acquisition under ASC 805, Business Combinations. As substantially all of the fair value of the gross assets acquired were concentrated into a single identifiable asset, the Company concluded that the screen was met, and the transaction is considered an asset acquisition rather than an acquisition of a business. Pursuant to the cost accumulation method as prescribed in ASC 805, the cost of the acquisition, including certain transaction costs, is allocated to the assets acquired on the basis of relative fair values. The value of acquired in-place leases was measured as the sum of lost revenues that would be incurred during a prospective lease-up period that would be necessary to achieve occupancy similar to that at the time of acquisition. The value was calculated as the average number of months of lease-up multiplied by the gross monthly market rental rate (base rent plus reimbursements) for each particular suite.

The assets acquired are summarized as follows (in thousands):

Land | $ | 3,734 |

Buildings | 15,980 | |

Site improvements | 453 | |

Tenant improvements | 567 | |

Total tangible assets | $ | 20,734 |

Lease-in-place agreements | $ | 1,053 |

Leasing commissions and other | 246 | |

Total intangible assets | $ | 1,299 |

Consideration paid | $ | 22,033 |

The Company records the net income from building operations and leases as other income, net, as leasing is not core to the Company’s operations. Building depreciation and amortization for space not occupied by the Company is included in general and administrative expense. Building depreciation and amortization for space occupied by the Company is allocated between general and administrative expense and research and development expense. Components of other income, net, for the three and nine months ended September 30, 2022 and 2021 were as follows (in thousands):

Three months ended | Nine months ended | |||||||||||

September 30, | September 30, | |||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||

Lease revenue | $ | 620 | $ | 347 | $ | 1,780 | $ | 347 | ||||

Property operating expenses | (410) | (171) | (1,032) | (171) | ||||||||

Other income, net | $ | 210 | $ | 176 | $ | 748 | $ | 176 | ||||

Note 5. Property and equipment

The components of property and equipment, net, as of September 30, 2022 and December 31, 2021 were as follows (in thousands):

September 30, 2022 | December 31, | ||||

Land | $ | 3,734 | $ | 3,734 | |

Buildings | 15,980 | 15,980 | |||

Site improvements | 470 | 470 | |||

Tenant improvements | 3,008 | 567 | |||

Furniture and equipment | 851 | 178 | |||

Construction in progress | 16 | 83 | |||

Gross property and equipment | $ | 24,059 | $ | 21,012 | |

Accumulated depreciation | (929) | (396) | |||

Property and equipment, net | $ | 23,130 | $ | 20,616 | |

Depreciation expense for property and equipment was $181,000 and $121,000 for the three months ended September 30, 2022 and 2021, respectively. Depreciation expense for property and equipment was $533,000 and $131,000 for the nine months ended September 30, 2022 and 2021, respectively.

Note 6. Intangible assets

The components of intangible assets, net, as of September 30, 2022 and December 31, 2021 were as follows (in thousands):

September 30, 2022 | December 31, | ||||

Lease-in-place agreements | $ | 1,053 | $ | 1,053 | |

Leasing commissions and other | 290 | 246 | |||

Gross intangible assets | $ | 1,343 | $ | 1,299 | |

Accumulated amortization | (603) | (224) | |||

Intangible assets, net | $ | 740 | $ | 1,075 | |

Amortization expense for intangible assets was $119,000 and $90,000 for the three months ended September 30, 2022 and 2021, respectively.

Amortization expense for intangible assets was $379,000 and $90,000 for the nine months ended September 30, 2022 and 2021, respectively.

Amortization expense for finite-lived intangible assets as of September 30, 2022 is expected to be as follows (in thousands):

For the year ending December 31, | |||

2022 | 125 | ||

2023 | 444 | ||

2024 | 167 | ||

2025 | 4 | ||

Total amortization | $ | 740 | |

Note 7. Stockholders’ Equity and Stock-Based Compensation Expense

2021 Registered Direct Offering

On February 12, 2021, the Company completed a common stock offering pursuant to which certain investors purchased 4,081,633 shares of common stock at a price of $49.00 per share. Net proceeds of the offering were approximately $189.8 million after deducting offering expenses.

At-the-Market Common Stock Offering

In March 2020, the Company established an at-the-market offering program (“ATM”) to sell, from time to time, shares of Company common stock having an aggregate offering price of up to $100 million in transactions pursuant to a shelf registration statement that was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on May 5, 2020. The Company is obligated to pay a commission of 3.0% of the gross proceeds from the sale of shares of common stock in the offering. The Company is not obligated to sell any shares in the offering.

There were no common stock sales under the ATM during the three and nine months ended September 30, 2022 and 2021.

Common Stock Warrants

In August 2018, the Company issued warrants to purchase up to an aggregate of 9.1 million shares of its common stock in conjunction with an offering of its common stock.

The Company did not receive any proceeds from exercise of common stock warrants during the three and nine months ended September 30, 2022.

The Company did not receive any proceeds from exercise of common stock warrants during the three months ended September 30, 2021. During the nine months ended September 30, 2021, the Company received proceeds of $0.7 million from the exercise of 0.6 million shares pursuant to warrants.

There were no common stock warrants outstanding as of September 30, 2022.

Stock Option and Performance Award Activity in 2022

During the nine months ended September 30, 2022, stock options and unvested Performance Awards outstanding under the Company’s stock option plans changed as follows:

Stock Options | Performance Awards | ||||

Outstanding as of December 31, 2021 | 2,663,727 | 138,055 | |||

Options granted | 4,000 | — | |||

Options exercised | (194,264) | — | |||

Options forfeited/canceled | (22,139) | (130,913) | |||

Outstanding as of September 30, 2022 | 2,451,324 | 7,142 | |||

The weighted average exercise price of options outstanding at September 30, 2022 was $11.03. As outstanding options vest over the current remaining vesting period of 1.7 years, the Company expects to recognize stock-based

compensation expense of $4.9 million. If and when outstanding Performance Awards vest, the Company will recognize stock-based compensation expense of $0.1 million over the implicit service period.

During the three months ended September 30, 2022, there were 18,740 stock options exercised with cash proceeds to the Company totaling $136,000.

During the nine months ended September 30, 2022, there were 194,264 stock options exercised. Of the stock options exercised, 94,399 stock options were net settled in satisfaction of the exercise price, with no cash proceeds received. Cash proceeds to the Company for options not net settled totaled $466,000 during the nine months ended September 30, 2022.

During the nine months ended September 30, 2022, a total of 57,143 shares of restricted stock awards expired as performance criteria related to these Performance Awards were not attained. These shares of restricted stock were returned to the 2008 Equity Incentive Plan, which expired in December 2017, and thus were retired.

Stock-based Compensation Expense in 2022

During the three and nine months ended September 30, 2022 and 2021, the Company’s stock-based compensation expense was as follows (in thousands):

Three months ended | Nine months ended | ||||||||||||

September 30, | September 30, | ||||||||||||

2022 | 2021 | 2022 | 2021 | ||||||||||

Research and development | $ | 399 | $ | 452 | $ | 1,234 | $ | 867 | |||||

General and administrative | 71 | 120 | 216 | 370 | |||||||||

Total stock-based compensation expense | $ | 470 | $ | 572 | $ | 1,450 | $ | 1,237 | |||||

2018 Equity Incentive Plan

The Company’s Board of Directors (the “Board”) or a designated committee of the Board is responsible for administration of the Company’s 2018 Omnibus Incentive Plan, as amended (the “2018 Plan”) and determines the terms and conditions of each option granted, consistent with the terms of the 2018 Plan. The Company’s employees, directors, and consultants are eligible to receive awards under the 2018 Plan, including grants of stock options and Performance Awards. Share-based awards generally expire 10 years from the date of grant. The 2018 Plan, as amended on May 5, 2022, provides for issuance of up to 5,000,000 shares of common stock, par value $0.001 per share, subject to adjustment as provided in the 2018 Plan.

When stock options or Performance Awards are exercised net of the exercise price and taxes, the number of shares of stock issued is reduced by the number of shares equal to the amount of taxes owed by the award recipient and that number of shares are cancelled. The Company then uses its cash to pay tax authorities the amount of statutory taxes owed by and on behalf of the award recipient.

Note 8. Income Taxes

The Company did not provide for income taxes during the three and nine months ended September 30, 2022, because it has projected a net loss for the full year 2022 for which any benefit will be offset by an increase in the valuation allowance. There was also no provision for income taxes for the three and nine months ended September 30, 2021.

Note 9. Commitments

Right-of-use Asset and Liability

The Company has an operating lease for approximately 6,000 square feet of office space in Austin, Texas that expires on April 30, 2024. The Company also had a short-term lease agreement for an additional 3,600 square feet of office space in Austin, Texas that expired on October 31, 2022. Future expected minimum lease payments as of September 30, 2022 are as follows (in thousands):

2022 | 2023 | 2024 | Total future lease payments | Less: imputed interest | Total | |||

Operating leases | $ | 27 | 107 | 36 | 170 | (6) | $ | 164 |

Short-term operating lease | $ | 6 | — | — | 6 | — | $ | 6 |

Rent expense for the three months ended September 30, 2022 and 2021 totaled $41,000 for each period.

Rent expense for the nine months ended September 30, 2022 and 2021 totaled $123,000 and $98,000, respectively.

Cash paid for operating lease liabilities during the three months ended September 30, 2022 and 2021 totaled $42,000 and $41,000, respectively.

Cash paid for operating lease liabilities during the nine months ended September 30, 2022 and 2021 totaled $124,000 and $68,000, respectively.

Other Commitments

The Company conducts its product research and development programs through a combination of internal and collaborative programs that include, among others, arrangements with universities, contract research organizations and clinical research sites. The Company has contractual arrangements with these organizations that are cancelable. The Company’s obligations under these contracts are largely based on services performed.

Note 10. 2020 Cash Incentive Bonus Plan

In August 2020, the Board approved the Plan. The Plan was established to promote the long-term success of the Company by creating an “at-risk” cash bonus program that rewards Plan participants with additional cash compensation in lockstep with significant increases in the Company’s market capitalization. The Plan is considered “at-risk” because Plan participants will not receive a cash bonus unless the Company’s market capitalization increases significantly and certain other conditions specified in the Plan are met. Specifically, Plan participants will not be paid any cash bonuses unless (1) the Company completes a merger or acquisition transaction that constitutes a sale of ownership of the Company or its assets (a Merger Transaction) or (2) the Compensation Committee of the Board (the Compensation Committee) determines the Company has sufficient cash on hand, as defined in the Plan. Because of the inherent discretion and uncertainty regarding these requirements, the Company has concluded that a Plan grant date has not occurred as of September 30, 2022.

Plan participants will be paid all earned cash bonuses in the event of a Merger Transaction.

The Company’s market capitalization for purposes of the Plan is determined based on either (1) the closing price of one share of the Company’s common stock on the Nasdaq Capital Market multiplied by the total issued and outstanding shares and options to purchase shares of the Company, or (2) the aggregate consideration payable to security holders of the Company in a Merger Transaction. This constitutes a market condition under applicable accounting guidance.

The Plan triggers a potential cash bonus each time the Company’s market capitalization increases significantly, up to a maximum $5 billion in market capitalization. The Plan specifies 14 incremental amounts between $200 million and $5 billion (each increment, a “Valuation Milestone”). Each Valuation Milestone triggers a potential cash bonus

award in a pre-set amount defined in the Plan. Each Valuation Milestone must be achieved and maintained for no less than 20 consecutive trading days for Plan participants to be eligible for a potential cash bonus award. Approximately 58% of each cash bonus award associated with a Valuation Milestone is subject to adjustment and approval by the Compensation Committee. Any amounts not awarded by the Compensation Committee are no longer available for distribution.

If the Company were to exceed a $5 billion market capitalization for no less than 20 consecutive trading days, all Valuation Milestones would be deemed achieved, in which case cash bonus awards would range from a minimum of $139.1 million up to a hypothetical maximum of $322.3 million. Payment of cash bonuses is deferred until such time as (1) the Company completes a Merger Transaction, or (2) the Compensation Committee determines the Company has sufficient cash on hand to render payment (each, a “Performance Condition”), neither of which may ever occur. Accordingly, there can be no assurance that Plan participants will ever be paid a cash bonus that is awarded under the Plan, even if the Company’s market capitalization increases significantly.

The Plan is accounted for as a liability award. The fair value of each Valuation Milestone award will be determined once a grant date occurs and will be remeasured each reporting period. Compensation expense associated with the Plan will be recognized over the expected achievement period for each of the 14 Valuation Milestones, when a Performance Condition is considered probable of being met.

In October 2020, the Company achieved the first Valuation Milestone. Subsequently, the Compensation Committee approved a potential cash bonus award of $7.3 million in total for all Plan participants, subject to future satisfaction of a Performance Condition.

During the year ended December 31, 2021, the Company achieved 11 additional Valuation Milestones triggering potential Company obligations to all Plan participants from a minimum of $93.7 million up to a hypothetical maximum of $225.0 million, to be determined by the Compensation Committee and contingent upon future satisfaction of a Performance Condition. However, no compensation expense was recorded since no grant date has occurred and no Performance Conditions are considered probable of being met. There is no continuing service requirement for Plan participants once the Compensation Committee approves a cash bonus award.

No Valuation Milestones were achieved during the three and nine months ended September 30, 2022.

No actual cash payments were authorized or made to participants under the Plan through November 7, 2022.

Note 11. Contingencies

Securities Class Actions and Shareholder Derivative Actions

Between August 27, 2021 and October 26, 2021, four putative class action lawsuits were filed alleging violations of the federal securities laws by the Company and certain named officers. The complaints rely on allegations contained in Citizen Petitions submitted to FDA, and allege that various statements made by the defendants regarding simufilam were rendered materially false and misleading. The Citizen Petitions were all subsequently denied by FDA. These actions were filed in the U.S. District Court for the Western District of Texas. The complaints seek unspecified compensatory damages and other relief on behalf of a purported class of purchasers of the Company’s securities. On June 30, 2022, a federal judge consolidated the four class action lawsuits into one case and appointed a lead plaintiff and a lead counsel. Lead plaintiff filed a consolidated amended complaint on August 18, 2022 on behalf of a putative class of purchasers of the Company’s securities between September 14, 2020 and July 26, 2022. Briefing on defendants’ motion to dismiss is scheduled to be completed by January 23, 2023. The Company believes the claims are without merit and intends to defend against these lawsuits vigorously. The Company is unable to estimate the possible loss or range of loss, if any, associated with these lawsuits.

On November 4, 2021, a related shareholder derivative action was filed, purportedly on behalf of the Company, in the U.S. District Court for the Western District of Texas, asserting claims under the U.S. securities laws and state fiduciary duty laws against certain named officers and the members of the Company’s board of directors. This

complaint relies on the allegations made in Citizen Petitions that were submitted to (and subsequently denied by) FDA. The complaint alleges, among other things, that the individual defendants exposed the Company to unspecified damages and securities law liability by causing it to make materially false and misleading statements, in violation of the U.S. securities laws and in breach of their fiduciary duties to the Company. The derivative case seeks, among other things, to recover unspecified compensatory damages on behalf of the Company arising out of the individual defendant’s alleged wrongful conduct. Although the plaintiff in this derivative case does not seek relief against the Company, the Company has certain indemnification obligations to the individual defendants. Since November 4, 2021, three additional shareholder derivative actions were filed alleging substantially similar claims, two in the U.S. District Court for the Western District of Texas, and one in Texas state court (Travis County District Court). All four actions have been stayed pending the resolution of the motions to dismiss in the securities class actions. On July 5, 2022, the three federal court actions were consolidated into a single action.

On August 19, 2022, a shareholder derivative action was filed, purportedly on behalf of the Company, in the Delaware Court of Chancery, asserting claims under state fiduciary duty laws against certain named officers and members of the Company’s board of directors. The complaint alleges, among other things, that the individual defendants breached their fiduciary duties by approving the 2020 Cash Incentive Bonus Plan in August 2020. The complaints seek unspecified compensatory damages and other relief. Although the plaintiff in this derivative case does not seek relief against the Company, the Company has certain indemnification obligations to the individual defendants.

The Company is unable to estimate the possible loss or range of loss, if any, associated with these lawsuits.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This discussion and analysis should be read in conjunction with Cassava Sciences, Inc.’s (the “Company,” “we,” “us,” or “our”) condensed consolidated financial statements and accompanying notes included elsewhere in this Quarterly Report on Form 10-Q. Operating results are not necessarily indicative of results that may occur in future periods.

This Quarterly Report on Form 10-Q contains certain statements that are considered forward-looking statements within the meaning of the Private Securities Reform Act of 1995. We intend that such statements be protected by the safe harbor created thereby. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Forward-looking statements involve risks and uncertainties and our actual results and the timing of events may differ significantly from the results discussed in the forward-looking statements. Examples of such forward-looking statements include, but are not limited to statements about:

The number of patients with Alzheimer’s disease we expect to enroll in our on-going Phase 3 studies, the enrollment rates for these studies and the length of time to complete our studies, the geographic areas for patient enrollment, and the expected safety profile or treatment benefits of simufilam for people with Alzheimer’s disease;

our reliance on third-party contractors to conduct the clinical trials and make drug supply on a large-scale for our Phase 3 clinical program, or their ability to do so on-time or on-budget;

limitations around the interpretation of improvements in cognition scores observed in interim analyses in our long-term open-label study, as compared to efficacy results from a fully completed, randomized controlled study design;

the ability of clinical scales to assess cognition or health in our trials of Alzheimer’s disease;

announcements or plans regarding any future interim analyses of our open-label study of simufilam and our estimated timeline for doing so;

any significant changes we may make, or anticipate making, to the design of any of our on-going studies of simufilam in patients with Alzheimer’s disease;

our ability to initiate, conduct or analyze additional clinical and non-clinical studies with our product candidates targeted at Alzheimer’s disease and other neurodegenerative diseases;

the interpretation of results from our early clinical studies, such as Phase 1 and Phase 2 studies;

our plans to further develop SavaDx, our investigational blood-based diagnostic, and to evaluate a non-antibody approach for SavaDx;

our ability or willingness to expand therapeutic indications for simufilam outside of Alzheimer’s disease;

the safety, efficacy, or potential therapeutic benefits of our product candidates;

the utility of protection, or the sufficiency, of our intellectual property;

our potential competitors or competitive products;

expected future sources of revenue and capital and increasing cash needs;

our use of a Clinical Research Organization (CRO) to conduct clinical studies of our lead product candidate;

expectations regarding trade secrets, technological innovations, licensing agreements and outsourcing of certain business functions;

our expenses increasing due to increasing inflation or otherwise, or fluctuations in our financial or operating results;

our operating losses, anticipated operating and capital expenditures and legal expenses;

expectations regarding the issuance of shares of common stock to employees pursuant to equity compensation awards, net of employment taxes;

the development and maintenance of our internal information systems and infrastructure;

our need to hire additional personnel and our ability to attract and retain such personnel;

existing regulations and regulatory developments in the United States and other jurisdictions in which we operate;

our plans to expand the size and scope of our operations;

the sufficiency of our current resources to continue to fund our operations;

the accuracy of our estimates regarding expenses, capital requirements, and needs for additional financing;

assumptions and estimates used for our disclosures regarding stock-based compensation;

the expense, timing and outcome of pending or future litigation or other legal proceedings and claims, including U.S. government inquiries;

litigation, claims or other uncertainties that may arise from allegations made against us or our collaborators; and

the long-term impact and lingering after-effects of COVID-19 on our operations and financial condition and those of our vendors and contractors.

Such forward-looking statements and our business involve risks and uncertainties, including, but not limited to the following:

We have a limited operating history in our business targeting Alzheimer’s disease and no products approved for commercial sale.

Research and development of biopharmaceutical products is a highly uncertain undertaking and involves a substantial degree of risk and our business is heavily dependent on the successful development of our product candidates.

We are concentrating a substantial portion of our research and development efforts on the diagnosis and treatment of Alzheimer’s disease, an area of research that has recorded many clinical failures.

We may encounter substantial delays in our clinical trials or may not be able to conduct or complete our clinical trials on the timelines we expect, if at all.

Our clinical trials may fail to demonstrate evidence of the safety and efficacy of our product candidates, which would prevent, delay, or limit the scope of regulatory approval and the commercialization of our product candidates.

We may need to obtain substantial additional financing to complete the development and any commercialization of our product candidates.

We are a small company with no sales force and may not be successful in our efforts to commercialize any product candidates which are approved.

Our CRO and contract manufacturers may fail to perform as anticipated.

We may be unable to protect our intellectual property rights or trade secrets.

We may be subject to third-party claims of intellectual property infringement.

We may not succeed in our maintenance or pursuit of licensing rights or third-party intellectual property necessary for the development of our product candidates.

Enacted or future legislation or regulatory actions may adversely affect our product pricing, or limit the reimbursement we may receive for our products.

A significant breakdown, security breach or interruption affecting our internal computer systems, or those used by our third-party research collaborators, may compromise the confidentiality of our financial or proprietary information, result in material disruptions of our products and operations and adversely affect our reputation.

We may be unsuccessful at hiring and retaining qualified personnel.

We and certain of our directors and executive officers have been named as defendants in lawsuits that could result in substantial costs and divert management’s attention.

Adverse and lingering circumstances caused by disease epidemics or pandemics, such as COVID-19.

Please also refer to the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as such risk factors may be amended, updated or modified periodically in our reports filed with the U.S. Securities and Exchange Commission (the “SEC”) for further information on these and other risks affecting us.

We caution you not to place undue reliance on forward-looking statements because our future results may differ materially from those expressed or implied by them. We do not intend to update any forward-looking statement, whether written or oral, relating to the matters discussed in this Quarterly Report on Form 10-Q, except as required by law.

Our research programs in neurodegeneration benefit from longstanding scientific and financial support from the National Institutes of Health (“NIH”). The contents of this Quarterly Report on Form 10-Q are solely our responsibility and do not necessarily represent any official views of NIH.

Overview

Cassava Sciences, Inc. is a clinical-stage biotechnology company based in Austin, Texas. Our mission is to detect and treat neurodegenerative diseases, such as Alzheimer’s disease. Our novel science is based on stabilizing – but not removing – a critical protein in the brain.

Over the past 10 years, we have combined state-of-the-art technology with new insights in neurobiology to develop novel solutions for Alzheimer’s disease and other neurodegenerative diseases. Our strategy is to leverage our unique scientific/clinical platform to develop a first-in-class program for treating neurodegenerative diseases, such as Alzheimer’s.

We currently have two biopharmaceutical assets under development:

our lead therapeutic product candidate, called simufilam, is a novel treatment for Alzheimer’s disease; and

our lead investigational diagnostic product candidate, called SavaDx, is a novel way to detect the presence of Alzheimer’s disease from a small sample of blood.

Our scientific approach for the treatment of Alzheimer’s disease seeks to simultaneously suppress both neurodegeneration and neuroinflammation. We believe our ability to improve multiple vital functions in the brain represents a new, different and crucial approach to address Alzheimer’s disease.

Our lead therapeutic product candidate, simufilam, is a proprietary small molecule (oral) drug. Simufilam targets an altered form of a protein called filamin A (FLNA) in the Alzheimer’s brain. Published studies have demonstrated that the altered form of FLNA causes neuronal dysfunction, neuronal degeneration and neuroinflammation. We are currently conducting a Phase 3 program with simufilam in patients with mild-to-moderate Alzheimer’s disease dementia.

We believe simufilam improves brain health by reverting altered FLNA back to its native, healthy conformation, thus countering the downstream toxic effects of altered FLNA. We have generated and published experimental and clinical evidence of improved brain health with simufilam. Importantly, simufilam is not dependent on clearing amyloid from the brain. Since simufilam has a unique mechanism of action, we believe its potential therapeutic effects may be additive or synergistic with those of other therapeutic candidates aiming to treat neurodegeneration.

Simufilam has demonstrated a multitude of treatment effects in animal models of disease, including normalizing neurotransmission, decreasing neuroinflammation, suppressing neurodegeneration, and restoring memory and cognition.

Simufilam and SavaDx were both discovered and designed in-house and were characterized by our academic collaborators during research activities that were conducted from approximately 2008 to date. We own exclusive, worldwide rights to these drug assets and related technologies, without royalty obligations to any third party. Our patent protection with respect to simufilam and use of simufilam for Alzheimer’s disease and other neurodegenerative disease currently runs beyond 2033 and includes over six issued patents and related patent filings and applications. In addition, we have patent protection with respect to simufilam for use in treating certain cancers that runs through 2034. We currently have no patents or patent applications in the United States with respect to SavaDx, which we believe is protected in the United States by trade secrets, know-how and other proprietary rights technology.

About Alzheimer’s Disease

Alzheimer’s disease is a progressive neurodegenerative disorder that affects cognition, function and behavior. More than 6 million Americans are estimated to have Alzheimer’s disease and it is predicted that number will increase to more than 13 million people by 2060, according to Alzheimers.gov, a government website managed by the NIH.

Phase 2a Study

In 2019, we completed a small, first-in-patient, clinical-proof-of-concept, open-label Phase 2a study of simufilam in the U.S., with substantial support from the National Institute on Aging (NIA), a division of the NIH. Treatment with simufilam for 28 days significantly improved certain key biomarkers of Alzheimer’s pathology, neurodegeneration and neuroinflammation (p<0.001). Biomarkers effects were seen in all patients in both cerebrospinal fluid (CSF) and plasma.

Phase 2b Study

In September 2020, we announced final results of a Phase 2b study with simufilam in Alzheimer’s disease. In this clinical study funded by the NIH, Alzheimer’s patients treated with 50 mg or 100 mg of simufilam twice-daily for 28 days showed statistically significant (p<0.05) improvements in CSF biomarkers of disease pathology, neurodegeneration and neuroinflammation, versus Alzheimer’s patients who took placebo. In addition, Alzheimer’s patients treated with simufilam showed improvements in validated tests of episodic memory and spatial working memory, versus patients on placebo. Cognitive improvements correlated most strongly with decreases in levels of P-tau181, a biomarker that suggests brain changes from Alzheimer’s disease.

Open-label Study Strategy

Much of the value of our ongoing open-label study is to gain data to support simufilam’s long-term safety profile in patients.

Clinical data from an open-label study has limitations compared to safety and efficacy data from a fully completed, large, randomized controlled clinical trial. However, we believe there is logic to conducting an open-label study prior to conducting a large, expensive Phase 3 clinical testing program. First, this is a standard clinical method of demonstrating drug safety. Second, we believe that if an experimental drug for Alzheimer’s shows no treatment benefits in a well-designed, long-term open-label study, then there is no chance that drug will succeed in Phase 3 clinical testing. The opposite is not true: encouraging treatment effects in an open-label study is not proof of drug safety or efficacy, nor can encouraging treatment effects predict clinical success in a Phase 3 program.

We believe a well-designed, long-term, open-label study is an exercise in prudent risk-management. Clinical results serve as a tool to help inform and manage the inherent risks and uncertainties of drug development for undertaking a large, expensive Phase 3 clinical testing program.

We also believe the use of interim analyses in our open-label study is a rational approach to inform the design of ongoing, pending, or future clinical studies. An interim analysis is a form of preliminary scientific enquiry that evaluates clinical data before a study is concluded, before patient enrollment has been completed and before data validation procedures are conducted to ensure the final clinical dataset is valid and accurate. Interim, “top-line” and preliminary data from our open-label clinical trial that we announce or publish from time to time are likely to change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final clinical dataset.

Open-label Study Results

In March 2020, we initiated a long-term, open-label study to evaluate simufilam, our lead drug candidate, in patients with Alzheimer’s disease. This study was funded in part by a research grant award from the National Institutes of Health (NIH). The study is intended to monitor the long-term safety and tolerability of simufilam 100 mg twice daily for 12 or more months. Another study objective is to measure changes in cognition and biomarkers. This study uses ADAS-Cog to measure changes in cognition and the Neuropsychiatric Inventory (NPI) to assess dementia-related behavior. Both scales are both standard clinical tools in trials of Alzheimer’s disease.

In September 2021, the open-label study reached its final target enrollment of approximately 200 subjects with mild-to-moderate Alzheimer’s disease. To date, simufilam appears safe and well-tolerated in this study.

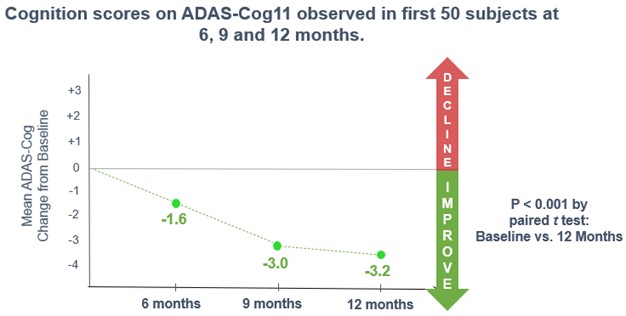

Interim Analysis on 50 Patients at 6 Months. In February 2021, we announced top-line results of a preplanned interim analysis of our open-label study with simufilam. This interim analysis summarized clinical data in the first 50 patients who had completed at least 6 months of drug treatment. Patients’ cognition and behavior scores improved following six months of simufilam treatment, with no safety issues. Six months of simufilam treatment improved cognition scores by 1.6 points on ADAS-Cog11, a 10% mean improvement from baseline to month 6. In these same patients, simufilam also improved dementia-related behavior, such as anxiety, delusions and agitation, by 1.3 points on the Neuropsychiatric Inventory (NPI), a 29% mean improvement from baseline to month 6.

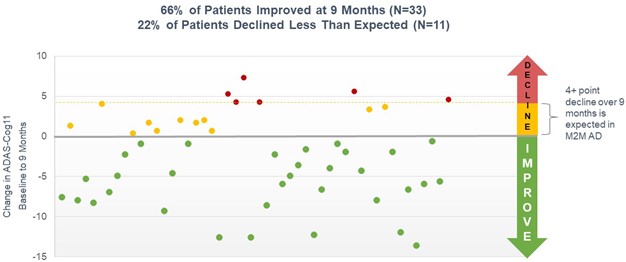

Interim Analysis on 50 Patients at 9 Months. In July 2021, we announced top-line results of a second preplanned interim analysis of our open-label study with simufilam. This interim analysis summarized clinical data on the first 50 patients who had completed at least 9 months of drug treatment. Patients’ cognition and behavior scores improved following nine months of simufilam treatment, with no safety issues. Nine months of simufilam treatment improved cognition scores by 3.0 points on ADAS-Cog11, an 18% mean improvement from baseline to month 9 (p<0.001). Simufilam improved ADAS-Cog scores in 66% of patients at 9 months. An additional 22% of patients declined less than reported in the science literature at 9 months. Cognition outcomes suggest simufilam’s treatment effects were broad-based (Figure 1).

Interim Analysis on 50 Patients at 12 Months. In September 2021, we announced top-line results of a third preplanned interim analysis of our open-label study with simufilam. This interim analysis summarized clinical data on the first 50 patients who had completed at least 12 months of drug treatment. Patients’ cognition and behavior scores both improved following twelve months of simufilam treatment, with no safety issues. Twelve months of simufilam treatment improved cognition scores by 3.2 points on ADAS-Cog11 from baseline to month 12 (p<0.001). Sixty-eight percent (68%) of study subjects improved on ADAS-Cog at 12 months; these study subjects improved an average of 6.8 points (S.D. ± 3.8). An additional 20% of study subjects declined less than 5 points on ADAS-Cog at 12 months; these study subjects declined an average of 2.5 points (S.D. ± 1.3).

Interim Analysis on 100 Patients at 12 Months. In August 2022, we announced results of an interim analysis that was conducted on the first 100 evaluable patients who completed at least 12 months of open-label treatment with simufilam 100 mg twice daily. Top-line results of this interim analysis show that from baseline to month-12:

Drug appears safe and well tolerated.

Overall ADAS-Cog11 scores improved an average of 1.5 points (S.D. ± 6.6; P<0.05)

63% of the 100 patients showed an improvement in ADAS-Cog11 scores, and this group of patients improved an average of 5.6 points (S.D. ± 3.8).

An additional 21% of the 100 patients declined less than 5 points on ADAS-Cog11, and this group of patients declined an average of 2.7 points (S.D. ± 1.4).

We expect to announce top-line data results of our open-label study approximately year-end 2022.

All clinical data from our open-label study are inherently exploratory in nature and, as with all open-label data, should be interpreted with caution. Data results from our open-label study does not constitute, and should not be interpreted as, evidence of therapeutic benefit for simufilam. Any interim data results should not be relied upon as indicative or predictive of full study results.

Figure 1. Individual Patient Changes in ADAS-Cog (N=50) at 9 months

Interim analyses summarize clinical data on the first 50 patients who have completed 6, 9, and 12 months of open-label treatment. Baseline values for cognition for each 50-patient cohort will not be the same at months 6, 9 and 12 because some study participants may drop out of the open-label study in-between interim analyses and dropouts are replaced, such that each interim analysis collects data from the first 50 patients who complete each specified time point.

Figure 2. Changes in ADAS-Cog (N=50) at 6, 9 and 12-month Interim Analyses

The 11-item Alzheimer’s Disease Assessment Scale–Cognitive subscale (ADAS-Cog) was originally developed by the research community to measure cognitive impairment in patients with Alzheimer’s disease. ADAS-Cog is often used in clinical studies of patients with Alzheimer’s because it can help determine incremental improvements or declines in cognition over time.

Standard deviation (“S.D.”) is a measure of how dispersed the data is in relation to the average. A low standard deviation generally shows the data are closely clustered around the average. A high standard deviation generally shows that the data is widely spread.

Historical Rates of Cognitive Decline - Alzheimer’s is a progressive disease. Cognition will always decline over time. Historical controls indicate that in patients with mild-to-moderate Alzheimer’s disease, cognition declines an average of 5.5 points on ADAS-Cog over 12 months amongst study subjects administered placebo in randomized, controlled trials, as reported by the science literature1. As an example of decline in an early Alzheimer’s disease population, in 2020, one of our competitors, Biogen, Inc., reported a 5.2-point decline over 18 months on ADAS-Cog amongst study subjects who were administered placebo in two Phase 3 randomized, controlled trials studies with their proprietary drug, aducanumab2.

_____________________________

1 Disease Progression Meta-analysis Model in Alzheimer’s disease (Ito, et al., Pfizer Global Research), Alzheimer’s & Dementia 6 (2010) 39-53

2 EMERGE and ENGAGE Topline Results (2020), available on-line.

Alzheimer’s is often accompanied by behavior disorders, such as anxiety, agitation or delusions. Such disorders may come and go over time, but they typically emerge or become more frequent as disease progresses. Simufilam reduced dementia-related behavior in the first 50 patients at 12 months of open-label treatment on the Neuropsychiatric Inventory (NPI), a clinical tool used to measure changes in dementia-related behavior.

At baseline, 34% of study subjects had no neuropsychiatric symptoms.

At month 6, 38% of study subjects had no neuropsychiatric symptoms.

At month 9, over 50% of study subjects had no neuropsychiatric symptoms.

At month 12, over 50% of study subjects had no neuropsychiatric symptoms.

Biomarker Analysis. Biomarkers are objective biological data. There are no known placebo effects. A key objective of this study is to measure changes in levels of biomarkers in patients before and after 6 months and 12 months of open-label treatment with simufilam.

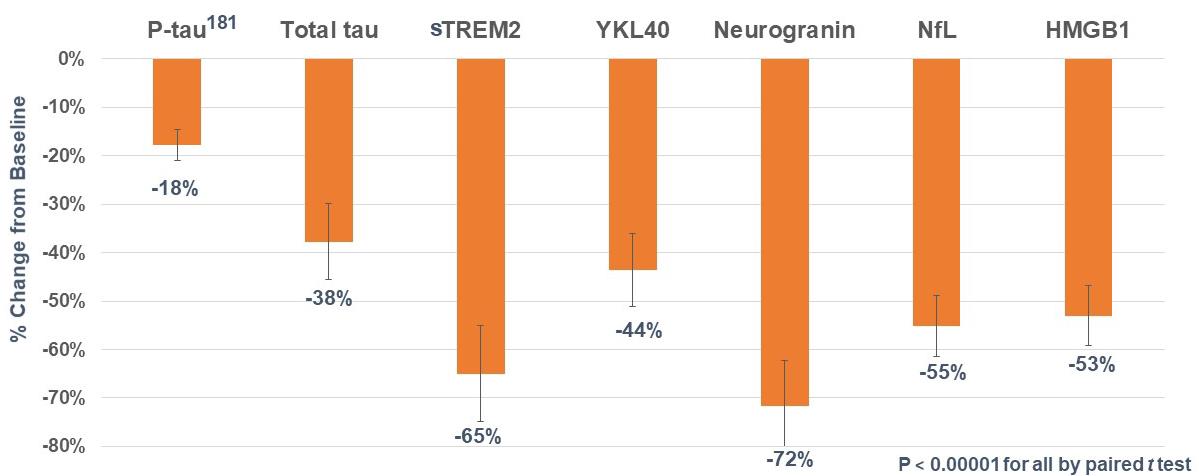

In July 2021, we announced positive biomarker data from our open-label study. Six months of open label treatment with simufilam robustly improved CSF biomarkers in a cohort of 25 patients with mild-to-moderate Alzheimer’s disease. Biomarker data were analyzed from cerebrospinal fluid (CSF) collected from 25 study participants in the open-label study who agreed to undergo a lumbar puncture at baseline and again after 6 months of treatment. CSF bioanalyses were conducted blind by City University of New York (CUNY).

Cerebrospinal fluid (CSF) biomarkers of disease pathology, t-tau and p-tau181, decreased 38% and 18%, respectively (both p<0.00001). CSF biomarkers of neurodegeneration, neurogranin and Nfl, decreased 72% and 55%, respectively (both p<0.00001). CSF biomarkers of neuroinflammation, sTREM2 and YKL-40, decreased 65% and 44% (both p<0.00001). All p-values are baseline vs. 6-month levels by paired t-test. Figure 3.

Core markers of Alzheimer’s pathology are total tau (T-tau), phosphorylated tau (P-tau181), and amyloid beta42 (Aβ42). In Alzheimer’s, tau levels are elevated and Aβ42 is low.

T-tau decreased 38% (p<0.00001)

P-tau181 decreased 18% (p<0.00001)

CSF Aβ42 increased 84% (p<0.00001)

Elevated CSF levels of two proteins, neurogranin (Ng) and neurofilament Light Chain (NfL) indicate neurodegeneration.

Ng decreased 72% (p<0.00001)

NfL decreased 55% (p<0.00001)

Elevated levels of marker YKL-40 indicate neuroinflammation.

YKL-40 decreased 44% (p<0.00001)

sTREM2 is a biomarker of microglia-induced neuroinflammation that has commanded substantial recent attention from researchers for its role in Alzheimer’s and frontotemporal dementia.

sTREM2 decreased 65% (p<0.00001)

HMGB1 protein, is a damage-related protein sometimes called a ‘danger molecule’ because it triggers additional neuroinflammation and loss of neurons.

HMGB1 decreased 53% (p<0.00001)

Figure 3. Significant Decreases in CSF Biomarkers at Month 6

Insert D % Change from Baseline -80% -70% -60% -50% -40% -30% -20% -10% 0% P-tau181 Total tau sTREM2 YKL40 Neurogranin NfL HMGB1 -18% -38% -65% -44% -72% -55% -53% P < 0.0001 for all by paired t test CASSAVA sciences

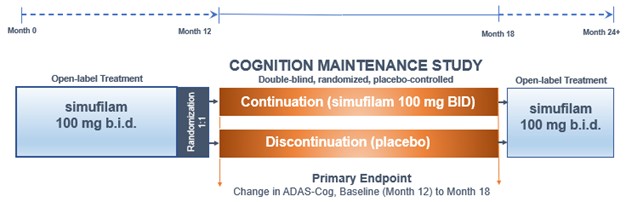

Cognition Maintenance Study (CMS)

In May 2021, we initiated a Cognition Maintenance Study (CMS). This is a double-blind, randomized, placebo-controlled study of simufilam in patients with mild-to-moderate Alzheimer’s disease. Study subjects are randomized (1:1) to simufilam or placebo for six months. To enroll in the CMS, patients must have previously completed 12 months or more of open-label treatment with simufilam. The CMS is designed to evaluate simufilam’s effects on cognition and health outcomes in Alzheimer’s patients who continue with drug treatment versus patients who discontinue drug treatment. Figure 4.

The target enrollment for the CMS is approximately 100 patients or more. As of November 2, 2022, over 65 patients have completed this study. Our goal is to complete patient enrollment for the CMS in Q4 2022 and announce clinical results approximately third-quarter 2023.

Figure 4. Cognition Maintenance Study Design

End-of-Phase 2 (EOP2) Meeting with FDA

In January 2021, we held an End-of-phase 2 (EOP2) meeting for simufilam with the U.S. Food and Drug Administration (FDA). The purpose of this EOP2 meeting was to gain general agreement around key elements of a pivotal Phase 3 program to treat Alzheimer’s disease dementia. FDA attendees included Robert Temple, MD, Deputy Center Director for Clinical Science and Senior Advisor in the Office of New Drugs; Billy Dunn, MD, Director, Office of Neuroscience; Eric Bastings, MD, Director, Division of Neurology, and others.